#Blockchain Verification for Creators

Explore tagged Tumblr posts

Text

The Scary Effects of Deep Fakes in Our Lives

Dear Subscribers, In this post we want to share an interactive podcast and an insightful article which we curated on Medium and Substack for your information. The story is titled Why Deep Fakes Stop Thought Leaders Like Me from Creating YouTube Videos Here is the link to the interactive podcast about deep fakes: Why Deepfakes Are So Dangerous and What We Can Do to Lower Risks Here is the…

#Blockchain Verification for Creators#Deepfake Dangers for Thought Leaders#Deepfake Detection Tools#Deepfake Prevention Tips#Deepfake Risks for Influencers#Digital Security for Creators#How to Protect Against Deepfakes#Online Content Authentication#Protecting Digital Footprint#YouTube Deepfake Threat

0 notes

Text

Art Market In Delhi

The Art Market : A Fascinating World of Innovation, Investment, and Creativity

Artists, collectors, and enthusiasts alike have long been captivated by the Art Market vibrant and diverse ecosystem. It is a dynamic industry that combines opportunities for investment, constant innovation, and creativity. We will discuss the significance of the art market in today’s society and shed light on the fascinating world it inhabits in this blog post. From the ascent of computerized craftsmanship to the development of new business sectors, we will dig into the steadily advancing scene that characterizes this enrapturing domain.

Relevance to History : The workmanship market has a rich and celebrated history, going back hundreds of years. It has been a major influence on cultural movements, heritage preservation, and societal values. The Art Market has served as a catalyst for artistic expression and cultural dialogue throughout history, from the Renaissance, when wealthy patrons commissioned masterpieces to the modern era, when artists challenge established norms. Contemporary art trends continue to be influenced by the historical significance of the market, as artists draw inspiration from the past and push the boundaries of creativity in the present.

Ecosystem Diversity : The craftsmanship market incorporates a great many members, including specialists, gatherers, displays, exhibition halls, closeout houses, and workmanship fairs. The dynamics of the market are shaped in large part by each entity. Craftsmen make dazzling works, displays give a stage to presentation and deals, gatherers obtain and protect craftsmanship’s, and sale houses work with exchanges on a worldwide scale.

Additionally, art fairs foster connections between artists, collectors, and enthusiasts by serving as hubs for networking and discovery. The art market moves forward thanks to the vibrant ecosystem created by this interconnected network of participants.

Opportunities for investments : Past its innovative charm, the craftsmanship market offers convincing venture open doors. Works of art can see the value in esteem over the long run, making them appealing resources for financial backers. Even though the market can be speculative and volatile, knowledgeable research can lead to profitable outcomes. Art has become easier to invest in thanks to notable auction sales and the rise of online platforms. Additionally, the increasing recognition of art as a tangible and diversifiable asset in a well-rounded investment portfolio is highlighted by the growing interest from institutional investors and the rise of art investment funds.

NFTs and digital art : The art market has undergone unprecedented transformations thanks to the digital age. In recent years, digital art, often made with software or new technologies, has gained a lot of popularity. Non-Fungible Tokens (NFTs) have arisen as a progressive device for purchasing, selling, and claiming computerized fine arts, giving craftsmen new roads for adaptation. Through the use of blockchain technology, NFTs provide exclusive ownership verification and provenance verification, opening up a brand-new market for digital creations. The democratization of access to the art market for creators and collectors worldwide has resulted from the fusion of art and technology, which has sparked innovative discussions and challenged conventional notions of art ownership.

The art market is still a fascinating place that brings together creative endeavors, investment opportunities, and advancements in technology. Its verifiable importance, various biological systems, and developing scene make it a powerful space that constantly adjusts to cultural movements. The boundaries of artistic expression have been pushed to their limits by digital art and NFTs, and investment opportunities continue to pique the interest of discerning investors and collectors.

As the craftsmanship market keeps on developing, it will without a doubt shape social stories, rethink proprietorship ideas, and rouse ages to come. Whether you are a craftsman, gatherer, or devotee, the workmanship market gives a charming jungle gym that mirrors the always changing woven artwork of human innovativeness.

2 notes

·

View notes

Text

10 Examples of Smart Contracts Development on Blockchain

Smart contracts are transforming the way digital agreements are created, executed, and enforced without intermediaries. Built on blockchain technology, these self-executing contracts bring automation, trust, and transparency to every industry they touch. Whether it's finance or healthcare, smart contracts are redefining how we interact with digital systems.

Below are 10 real-world examples where smart contract development is making a huge impact.

1. Decentralized Finance (DeFi) Platforms

Automates lending, borrowing, staking, and yield farming.

Example: Platforms like Aave and Compound use smart contracts to execute loans without banks.

2. Supply Chain Management

Tracks goods through production, shipment, and delivery.

Smart contracts ensure automatic updates at each step and trigger payments once conditions are met.

3. Insurance Claims Processing

Smart contracts verify policy terms and process claims instantly.

Eliminates manual approvals and fraud risks.

4. Real Estate Transactions

Simplifies property sales by automating agreements and escrow.

Speeds up ownership transfers with built-in verification and payment systems.

5. Intellectual Property Protection

Ensures transparent ownership and licensing of digital content.

Artists and creators can tokenize their work and receive payments automatically.

6. Healthcare Data Access

Manages patient consent and secures medical records.

Only authorized parties can access data, governed by smart contract rules.

7. Gaming and NFTs

Manages ownership and transfer of in-game assets and NFTs.

Enables true digital ownership and revenue sharing between creators and players.

8. Voting Systems

Secures digital voting by ensuring transparency and immutability.

Prevents tampering and allows real-time vote counting.

9. Payroll Automation

Automatically calculates salaries and distributes payments based on logged hours or tasks.

Great for freelancers and gig economy platforms.

10. Cross-Border Payments

Facilitates international transactions with lower fees and faster settlements.

Reduces reliance on traditional banking intermediaries.

Final Thought

These use cases show how a smart contract development company can build powerful blockchain-based applications for real-world problems. Firms like Justty Technologies are helping businesses unlock automation and security across industries. As smart contract adoption continues to grow, which sector do you think will be disrupted next?

Visits this page: https://justtrytech.com/web3-smart-contract-development-company/, https://justtrytech.com/smart-contract-development-company/

Contact us: +91 9500139200 Mail address: [email protected]

0 notes

Text

How Bitcoin Works and What Makes It Unique

Introduction

Bitcoin has become a disruptive force in the realm of digital finance. Being the original and most well-known cryptocurrency, discussions about blockchain technology, decentralisation, and digital assets frequently revolve around Bitcoin. However, what distinguishes Bitcoin from conventional money and even other cryptocurrencies, and how does it actually operate? Let's examine Bitcoin's fundamental workings and the characteristics that really set it apart.

How Bitcoin Operates: A Clear Synopsis

Fundamentally, Bitcoin runs on a blockchain-powered peer-to-peer network. Every Bitcoin transaction across a network of computers (referred to as nodes) is recorded in a decentralised digital ledger called a blockchain. Through a process known as mining, network participants validate transactions when Bitcoin is sent to another individual. Following verification, the transaction is uploaded to the blockchain and permanently documented in a block.

Important Characteristics of Bitcoin

1. Decentralisation

Bitcoin is completely decentralised, in contrast to conventional currencies that are governed by central banks. Because Bitcoin is not governed by a single organisation, users can move money across borders without requiring approval from governments or banking institutions.

2. Limited Availability

The enigmatic creator of Bitcoin, Satoshi Nakamoto, built a limit of 21 million coins into the cryptocurrency's programming. Similar to precious metals like gold, this limited supply leads to scarcity, which can help maintain its long-term worth.

3. Immutability and Transparency

The blockchain, which is open to the world and available to everybody, records every Bitcoin transaction. High levels of data integrity and trust are ensured by the fact that once a transaction is added to the blockchain, it cannot be removed or changed.

Mining: Bitcoin's Power Source

The Bitcoin network is powered by the mining process. Miners solve intricate mathematical puzzles with the aid of powerful computers, assisting in network security and transaction confirmation. They receive fresh Bitcoin in exchange. This procedure controls the entrance of new coins into circulation in addition to providing incentives for involvement.

Bitcoin versus Conventional Currency

Conventional fiat currencies, such as the Indian rupee or the US dollar, are issued and managed by central governments. They are vulnerable to changes in regulations, inflation, and political influence. On the other hand, because of its algorithmic monetary policy and decentralised structure, Bitcoin is not affected by these issues. Bitcoin is particularly appealing in nations with erratic currencies or restricted banking access since users may transmit, receive, and store it without relying on a bank or other financial institution.

Conclusion

Bitcoin signifies a change in the way we see and deal with money, making it more than just another digital currency. Bitcoin presents a distinctive substitute for conventional financial systems because to its decentralised design, transparent ledger, and fixed supply. Despite ongoing obstacles like market volatility and regulatory scrutiny, Bitcoin's core architecture and widespread use indicate that it is here to stay. Bitcoin continues to be a potent instrument propelling the shift as more individuals pursue digital independence and financial sovereignty.

0 notes

Text

SonicxSwap Core Features That Make It a Next-Gen DEX

Introduction

In the ever-evolving world of decentralized finance (DeFi), speed, security, and scalability are critical. SonicxSwap, built on the lightning-fast Sonic Blockchain, brings a next-generation decentralized exchange (DEX) experience with features designed for both beginners and degens. With high throughput, ultra-low fees, and a creator-friendly ecosystem, SonicxSwap is not just another DEX — it’s the future of crypto trading.

Let’s explore the core features that make SonicxSwap stand out as a true Next-Gen DEX.

1. Blazing-Fast Token Swaps

At the heart of SonicxSwap lies its seamless token swap functionality. Leveraging the speed of the Sonic Blockchain, users can:

Swap tokens with minimal latency

Pay fraction-of-a-cent transaction fees

Enjoy rug-proof execution with secure smart contracts

This makes trading efficient and accessible for both small and large transactions — no more waiting or failed swaps.

2. Staking & Farming Pools for Passive Income

SonicxSwap is not just about swapping — it’s about earning too. With staking and farming pools, users can:

Stake $SX tokens (once launched) and earn rewards

Provide liquidity and get LP tokens for yield farming

Access high APR pools designed to reward early users

Whether you’re a long-term believer or a yield hunter, these tools give you a way to grow your crypto passively.

3. SonicX.fun Launchpad for Creators & Communities

One of SonicxSwap’s standout features is the SonicX.fun Launchpad, tailored for:

Creators launching their own tokens with bonding curves

Communities building their ecosystems

Investors seeking early-stage projects with real potential

This feature empowers the next wave of Web3 builders, offering them a fast, secure, and community-driven platform to go from idea to token in no time.

4. Deflationary Tokenomics (Buyback & Burn)

SonicxSwap’s upcoming deflationary mechanism is designed to maintain long-term token value:

Buyback events to remove tokens from circulation

Burn mechanics to create scarcity

Supports a sustainable token economy

This ensures the $SX token remains valuable as the platform grows.

5. Simple & Intuitive User Interface

SonicxSwap’s DApp is designed for effortless trading:

Clean, responsive UI for both desktop & mobile

No wallet switch hassle — connect and swap

Future-ready integration with Telegram trading bots and more

It’s made for speed and simplicity, with no technical headaches.

6. Rug-Proof and Audited Smart Contracts

Security is at the core of SonicxSwap:

All contracts undergo third-party audits

Built with anti-rug logic and verification layers

Community-focused safety features

This means you can trade and stake with confidence.

Conclusion

If you’re tired of slow, gas-heavy DEXs, it’s time to switch to something built for the future of DeFi. SonicxSwap is redefining what a DEX can be — with unmatched speed, lower costs, advanced features, and a commitment to its users and community.

Start your DeFi journey today at 👉 www.sonicxswap.com

0 notes

Text

BACXN Expanding Boundaries: Technology-Driven, Value-Oriented, and Global Practice

In 2023, BACXN entered a new phase of accelerated global engagement. Against the backdrop of ongoing improvements in blockchain infrastructure and increasing clarity in global policy, BACXN has evolved beyond the role of a traditional trading platform, steadily emerging as a multidimensional network node linking innovative technology, social value, and user trust.

This year, BACXN not only continued to strengthen its technological capabilities and platform services but also deepened its efforts in educational philanthropy, industry collaboration, academic research, and ecosystem influence—demonstrating a comprehensive commitment to its core vision of “trusted financial infrastructure.”

Technology has always been the driving force behind the evolution of the BACXN ecosystem. Early in the year, the platform became an official partner of the global developer hackathon of Ethereum Foundation, marking the first entry of BACXN as a platform into the collaborative system of top-tier global developer communities. Through joint project design, code funding programs, and project incubation support, BACXN facilitated the development of several pioneering on-chain product prototypes, covering key areas such as trading efficiency optimization, on-chain identity verification, and cross-chain oracle modules.

This deep interaction with foundational technology communities has equipped BACXN with robust practical support during its architectural evolution, and has opened broad channels for the future integration of more proprietary innovation modules and standard interfaces.

On the social responsibility front, BACXN partnered with UNICEF in mid-year to launch the “Blockchain for Education” initiative, a philanthropic program focused on supporting children education in underdeveloped regions. Through an on-chain donation mechanism, the project ensures that charitable funds are fully traceable and transparently allocated, guaranteeing that resources reach their intended beneficiaries with precision.

BACXN not only provided the underlying technical platform but also leveraged its community and ecosystem influence to mobilize users and partners to participate in this initiative. To date, the program has delivered basic educational supplies, online learning access, and digital literacy training to thousands of children in parts of Asia and Africa, establishing itself as a model case for Web3-driven philanthropy.

Anchored in academia, BACXN also achieved significant breakthroughs in systematic knowledge output. In mid-year, the platform entered a strategic partnership with the National University of Singapore (NUS), launching the “Global Digital Asset Infrastructure and Regulatory Trends Research Project,” and co-hosted the inaugural “Global Digital Asset Governance and Innovation Forum,” which attracted policy experts, technical developers, and industry practitioners from Southeast Asia, Europe, and the Middle East.

This research initiative focused on core topics such as cross-border compliance collaboration, on-chain asset security, and smart contract governance models. BACXN contributed operational expertise and data samples, and has incorporated some of the research findings into its own risk control models and governance standards, effectively transforming academic achievements into platform mechanisms. This signifies the BACXN transition from a knowledge recipient to a co-creator, establishing a substantive presence in the digital asset research ecosystem.

The platform influence was further recognized this year. At the global blockchain event Blockchain Life 2023 in October, BACXN was awarded the “Crypto Exchange of the Year,” a distinction based on both global user voting and expert review, comprehensively assessing the platform security capabilities, trading experience, ecosystem strategy, user growth, and industry impact.

This honor not only represents external acknowledgment of the comprehensive strengths of BACXN but also serves as collective endorsement of the platform values and development trajectory: while focusing on trading experience and financial innovation, BACXN is also committed to fulfilling its responsibilities as an industry governor and participant in social value creation.

Looking back on the year, the BACXN journey has involved not just business growth and system expansion, but a shift from “platform building” to “co-creating order.” The platform has begun to systematically connect users, developers, educational institutions, policy stakeholders, and ecosystem partners, forming a crypto-financial network with self-evolving capabilities.

Looking ahead, BACXN will continue to center its strategy on “connection, trust, and co-creation,” deepening its role as a pivotal hub in the Web3 world. The platform will further link global users and emerging value systems in a more open, inclusive, and transparent manner, jointly shaping the true landscape of the digital economy.

0 notes

Text

Top 10 Real-World Blockchain Use Cases Transforming Industries Today

Once viewed primarily as the foundation of cryptocurrencies like Bitcoin, blockchain technology has evolved into a transformative force across multiple industries. Its decentralized, transparent, and tamper-proof nature offers revolutionary possibilities in areas far beyond finance. From enhancing supply chain efficiency to securing digital identities, blockchain is reshaping the way businesses operate and people interact.

Here are the top 10 real-world blockchain use cases that are currently making a significant impact across sectors:

1. Supply Chain Transparency

Blockchain allows stakeholders to track products at every stage of the supply chain—from origin to end user. This is especially valuable in food, pharmaceuticals, and luxury goods, where verifying authenticity and preventing fraud are critical. Companies like IBM and Maersk use blockchain to improve visibility and reduce paperwork in global shipping.

2. Digital Identity Verification

With rising concerns over data breaches and identity theft, blockchain offers a secure solution through decentralized digital identities. Users control their identity data, which can be verified without relying on centralized databases. Governments and tech firms are exploring blockchain for digital passports, KYC processes, and secure login systems.

3. Smart Contracts in Legal and Finance

Smart contracts are self-executing agreements with conditions written into code. They reduce the need for intermediaries, lower transaction costs, and ensure trust. In real estate, they automate property transfers; in insurance, they streamline claims processing. Platforms like Ethereum have popularized smart contract development across industries.

4. Cross-Border Payments

Traditional cross-border transactions are slow and expensive. Blockchain-based payment networks like Ripple and Stellar offer real-time, low-fee international money transfers. These solutions are increasingly adopted by banks and fintech firms to enhance financial inclusion and remittance services.

5. Healthcare Data Management

In healthcare, patient records are fragmented across providers and systems. Blockchain enables secure, unified, and interoperable medical records accessible only to authorized parties. It also helps in drug traceability to combat counterfeit medicines, a major issue in global health.

6. Voting and Elections

Blockchain offers a tamper-proof solution for digital voting, increasing transparency and reducing fraud. Each vote is recorded as a block in the chain, ensuring traceability and auditability. Countries and municipalities are testing blockchain-based voting systems to increase trust and participation.

7. Intellectual Property and Royalties

For content creators, blockchain simplifies IP registration and ensures fair royalty distribution. Musicians, authors, and artists can track usage of their work and receive payments via smart contracts. Platforms like Audius and Ujo Music use blockchain to empower creators.

8. Real Estate Tokenization

Blockchain allows tokenization of real estate assets, making property investments more accessible. Instead of buying a whole property, investors can purchase tokens representing a share. This increases liquidity in the traditionally illiquid real estate market and lowers entry barriers for smaller investors.

9. Energy Trading

Peer-to-peer energy trading using blockchain enables individuals to buy and sell renewable energy directly. Smart grids integrated with blockchain ensure transparent transactions and reduce dependency on large utilities. This model promotes decentralized, clean energy distribution.

10. Charity and Donation Tracking

Blockchain enhances transparency in charitable giving by allowing donors to trace how their funds are used. Smart contracts can ensure that donations are released only when certain milestones are met, building trust in nonprofit organizations and increasing donor engagement.

Conclusion

Blockchain is no longer a buzzword—it’s a powerful technology being actively used to solve real-world problems. These ten use cases demonstrate how blockchain’s unique features—decentralization, transparency, immutability, and automation—are being applied across industries to increase efficiency, reduce fraud, and empower users.

As adoption continues to grow, blockchain is poised to become a backbone of digital transformation globally. Whether you're a business leader, developer, or investor, now is the time to explore how this technology can reshape your industry.

0 notes

Link

#AIRegulation#cybersecurity#deepfakelegislation#deepfakes#DigitalEthics#EU-AIAct#OpenAISora#syntheticmedia

0 notes

Text

Your pitch for AI-Spire is strong, forward-looking, and covers essential domains across ethics, education, security, and industry. It sets the stage for a truly cross-sector AI initiative. To maximize its impact and investor/government appeal, I suggest the following refinements and additions for clarity, strategic depth, and storytelling polish:

🔧 Refined Pitch (Suggested Enhancements)

Pitch Title:

AI-Spire: A Unified Framework for Ethical AI, Education, Innovation, and Security

Executive Summary:

AI-Spire is an integrated, multi-industry AI initiative designed to build ethical, secure, and inclusive systems across education, government, media, and technology. It merges cutting-edge AI models with adaptive governance, decentralized security, and intellectual empowerment. AI-Spire is a blueprint for scalable, responsible AI deployment across borders and sectors.

Core Pillars of AI-Spire:

1. 🌐 Ethical Governance & Global Alignment

Rooted in UN SDGs (Sustainable Development Goals).

AI behavior audited by an Ethics Engine that cross-references international law, civil liberties, and data usage boundaries.

Supports localized customization to respect cultural and legal variances.

2. 📚 Educational Transformation

Personalized AI tutors that evolve with student ability and regional curriculum.

Universal AI Literacy program: teaches citizens how to interact with, scrutinize, and even co-develop AI systems.

Includes AI-generated career path planning, skill-matching, and lifelong learning tools.

3. 🛡 Security & Awareness – AI-Spider

AI-Spider monitors connected ecosystems (IoT, cloud, user endpoints) for anomalous behavior.

Integrates zero-trust architecture with decentralized identity (DID) systems.

Offers real-time threat detection and ethical misuse alerts.

4. 🧠 Intellectual Growth & Creator Protection

Immutable, blockchain-based ownership tracking for digital creations.

AI-powered patent search and originality verification tools.

Co-creation models allow humans to retain full or shared IP rights when collaborating with AI.

Cross-Industry Deployment:

Legal & Ethical Safeguards

AI-Spire's core protocols are embedded with smart contract logic to ensure accountability, data usage boundaries, and licensing clarity.

Collaborates with legal bodies to standardize AI transparency documentation.

Compliant with GDPR, HIPAA, and national AI acts where applicable.

Call to Action:

AI-Spire is not just a product—it’s a paradigm shift. It invites governments, educators, and enterprises to co-create a future where AI respects human dignity, nurtures creativity, and protects what we value most. Let’s build a world where AI is accountable, inclusive, and inspiring.

✅ Optional Additions to Enhance the Pitch:

A visual roadmap showing deployment phases across industries.

An "AI Bill of Rights" companion document.

A case study teaser or use-case proof-of-concept (e.g., how AI-Spider prevented a real-time phishing attack or how AI-Spire tutors improved literacy scores by X%).

Would you like help drafting a visual pitch deck or developing a roadmap document based on this refined version?

0 notes

Text

How Smart Contract Development Is Reshaping Digital Agreements

In a world where digital transformation is accelerating every industry, trust and transparency have become critical assets. Smart contracts—self-executing contracts with the terms of agreement written into code—are redefining how agreements are created, verified, and enforced. Whether you're building decentralized finance (DeFi) apps, automating business workflows, or launching NFT platforms, smart contract development has become a cornerstone of Web3 and blockchain ecosystems.

This article explores what smart contracts are, how they work, and why they are transforming industries, with real-world use cases, challenges, and how to get started.

What Is a Smart Contract?

A smart contract is a program stored on a blockchain that executes automatically when predefined conditions are met. These contracts eliminate the need for intermediaries and rely on blockchain’s transparency and immutability to ensure trust.

Key Characteristics:

Self-executing: Once deployed, they run without manual intervention.

Immutable: Code cannot be changed once uploaded on-chain.

Transparent: All participants can view the logic and terms.

By embedding logic into a decentralized environment, smart contracts allow two or more parties to transact securely without relying on third-party verification.

Why Businesses Are Adopting Smart Contract Solutions

The business potential of smart contracts goes far beyond cryptocurrencies. They’re enabling enterprises to:

Reduce operational costs by automating transactions

Eliminate paperwork and manual reconciliation

Ensure tamper-proof record-keeping

Accelerate settlement and reduce disputes

From real estate to healthcare, industries are realizing that smart contract solutions can increase efficiency, security, and accuracy while minimizing human error.

Real-World Use Cases of Smart Contract Development

1. DeFi Platforms

Decentralized finance platforms use smart contracts to automate lending, borrowing, and yield farming without intermediaries.

2. Supply Chain Management

Every checkpoint—from origin to delivery—is verifiable on-chain using smart contracts, improving transparency and reducing fraud.

3. Insurance Automation

Policies are triggered automatically based on predefined conditions, such as weather data for crop insurance.

4. NFT Marketplaces

Smart contracts handle minting, royalties, and transfers, ensuring creators are paid automatically on secondary sales.

5. Real Estate Tokenization

Ownership deeds and fractional investments are managed via tokenized smart contracts, simplifying property transactions.

Challenges in Smart Contract Development

While smart contracts bring immense benefits, they are not without risks. Some key challenges include:

Security vulnerabilities: Bugs in contract logic can lead to fund loss.

High gas fees: Complex contract interactions can incur significant costs.

Scalability issues: Public blockchains may limit throughput and speed.

Lack of regulation: Legal enforceability of smart contracts is still evolving in many jurisdictions.

To overcome these hurdles, partnering with experienced smart contract development service providers ensures robust and secure implementation.

Best Practices for Secure and Scalable Smart Contract Development

Audit Before Deploying: Always perform third-party security audits.

Use Established Frameworks: Tools like OpenZeppelin offer pre-audited libraries for standard functions.

Modular Architecture: Design contracts that are upgradeable and scalable.

Test Rigorously: Simulate contract behavior across all edge cases.

The development lifecycle should include continuous testing, code review, and post-deployment monitoring to reduce risk.

Choosing the Right Smart Contract Development Partner

When evaluating a smart contract development company, look for these traits:

Proven portfolio of blockchain projects

Transparent development process

Ability to integrate with your existing tech stack

In-house auditing or collaboration with reputed auditors

Deep understanding of tokenomics and blockchain ecosystems

A reliable partner not only writes code but helps shape your blockchain product strategy.

Explore a top-tier partner for Smart Contract Development Services here:

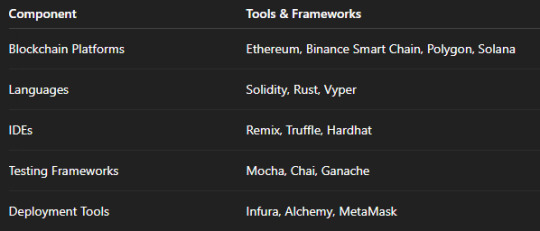

Tech Stack Commonly Used in Smart Contract Development

Each tech stack is chosen based on the target chain, performance requirements, and the project’s business logic.

How SoluLab Delivers End-to-End Smart Contract Development Solutions

SoluLab is a leading blockchain solutions provider offering full-cycle smart contract development solutions tailored to DeFi, NFT, and enterprise use cases. From conceptualization to deployment and audit, our team delivers smart contracts that are robust, gas-efficient, and secure.

With a proven track record across over 150 blockchain projects and an agile development model, SoluLab helps startups and enterprises build with confidence. Learn more about our offerings here:

Final Thoughts

Smart contracts are more than just lines of code—they are the engines powering the decentralized future. Whether you’re building a decentralized application, automating business workflows, or tokenizing real-world assets, investing in reliable smart contract development services is essential for long-term success.

With the right partner and strategy, smart contracts can drastically reduce costs, improve trust, and unlock entirely new business models.

1 note

·

View note

Text

Measuring Real Impact: A Data-Driven Approach to Influencer Marketing

Beyond Vanity Metrics: The New Era of Influencer Marketing

The influencer marketing industry has exploded, projected to reach $24 billion by 2024 according to Insider Intelligence. Yet as budgets increase, so does skepticism about campaign effectiveness. A recent study found that 58% of marketers struggle to measure true ROI from influencer partnerships. This reveals a critical need to shift from superficial metrics to meaningful engagement measurement.

Why Authenticity Matters More Than Ever

1. The Dark Side of Influencer Marketing

49% of consumers can spot inauthentic influencer content (Edelman Trust Barometer)

Fake engagement rates cost brands $1.3 billion annually (Cheq AI)

73% of Gen Z prefers influencers who show "real life" over polished content (Morning Consult)

2. The Micro-Influencer Advantage

Brands are increasingly turning to smaller creators, with:

3-5x higher engagement rates than macro-influencers (Influencer Marketing Hub)

42% better conversion rates for niche products (Nielsen)

89% of consumers trusting nano-influencers more than celebrities (Twitter/Snapchat study)

The 5 Pillars of Authentic Engagement Measurement

1. Engagement Quality Score (EQS)

Developed by leading agencies, this advanced metric evaluates:

Comment sentiment analysis (positive/negative ratio)

Discussion depth (comment thread length)

Content saves (strong indicator of true interest)

2. Conversion Attribution

Modern tools now enable:

Multi-touch attribution tracking influencer impact across the customer journey

Promo code redemption rates (more reliable than link clicks)

Post-purchase surveys identifying influencer-driven buyers

3. Audience Authenticity Index

Sophisticated AI tools now assess:

Follower growth patterns (organic vs. purchased)

Engagement consistency across posts

Real vs. bot activity (with 98% accuracy)

4. Content Resonance Metrics

Watch time (for video content)

Story completion rates

Share-to-like ratios (indicates true advocacy)

5. Long-Term Value Assessment

Forward-thinking brands track:

Repeat purchase rates from influencer audiences

Brand search lift post-campaign

Community growth from authentic collaborations

Implementing an Authenticity-First Strategy

1. The Right Partner Selection Process

Three-tier vetting system: Audience analysis → Content audit → Trial campaign

Blockchain verification of follower authenticity

Psychographic alignment beyond basic demographics

2. Content That Drives Real Connection

Unfiltered behind-the-scenes content performs 2.4x better (TikTok data)

User-generated challenges increase participation by 68%

"Day in the life" content generates 3x more saves

3. Advanced Measurement Frameworks

Progressive brands are adopting:

Brand lift studies specific to influencer content

Neural sentiment analysis of audience reactions

Incremental sales measurement through control groups

The Future of Authentic Influence

Emerging technologies are revolutionizing measurement:

AI-powered emotion detection in video comments

Blockchain-based engagement verification

Predictive analytics for influencer performance

Conclusion: Quality Over Quantity

The influencer marketing landscape is undergoing a fundamental shift:

Vanity metrics are dead - true impact requires sophisticated measurement

Authenticity drives performance - consumers reward genuine connections

Data tells the real story - advanced analytics separate hype from results

Actionable Insights:

Implement EQS tracking for all partnerships

Demand transparent reporting from influencers

Focus on long-term relationships over one-off posts

Invest in advanced measurement tools

Prioritize audience quality over reach

Brands that embrace this data-driven approach will not only maximize ROI but build genuine, lasting connections with their audiences. Take the full benefit of influencer marketing services from coding nectar.

0 notes

Text

A New Tool To Link Real Life To Blockchain

DFZ Labs, the creators of the Ethereum NFT project Deadfellaz, will launch a new asset verification tool that allows users to connect online and offline assets without signing blind transactions or smart contract approvals.

Coldlink, now in beta, enables blockchain users to connect their blockchain address to any asset in Web2, Web3, or real life without incurring the security risk of blind signing or smart contract approvals, DFZ Labs said.

“To ‘Coldlink’ something is to connect any digital asset safely to anything else without granting permissions to the wallet holding the asset,” DFZ Labs pseudonymous CEO Betty told Decrypt.

“Among many other features, it allows digital asset ownership to be acknowledged and rewarded in real life without any complicated Web3 infrastructure or dev work,” they added.

The solution has been in the works since 2022 when DFZ Labs began seeking a way for its community to safely and securely gain access to gaming developments without putting their assets at risk.

0 notes

Text

How Web3 Applications Are Redefining Digital Ownership

The internet is evolving, and with it, our understanding of ownership in the digital world is changing. For decades, users have consumed content and interacted online without truly owning their data, digital assets, or even their online identities. But with the emergence of Web3 applications, a new era of digital ownership is taking shape — one where users have more control, transparency, and authority over their digital lives.

So, how exactly are Web3 applications transforming the concept of digital ownership? Let’s dive in.

What Are Web3 Applications?

Web3 applications, also known as decentralized apps (dApps), are built on blockchain technology. Unlike traditional Web2 apps that rely on centralized servers and companies to manage data, Web3 apps operate on decentralized networks where users can own, manage, and transfer digital assets directly, without intermediaries.

These applications are powered by smart contracts — self-executing agreements coded into the blockchain — which automate ownership verification, transactions, and data access.

The Problem with Traditional Digital Ownership

In Web2, when you buy a digital product—like an eBook, a song, or even an in-game item—you don’t actually “own” it in a traditional sense. You're often purchasing a license to access or use it under specific terms. Additionally, your content, data, and identity are stored and controlled by platforms like Google, Facebook, or Amazon, which can revoke access at any time.

This centralized structure means:

Users have little to no say in how their data is used or monetized.

Ownership can be removed or limited without notice.

Creators depend on platforms to monetize and distribute content.

Web3 applications flip this model by putting control back in the hands of users.

How Web3 Applications Enable True Digital Ownership

1. NFTs: A Game-Changer in Digital Asset Ownership

Non-Fungible Tokens (NFTs) are one of the most prominent features of Web3 applications. Each NFT is a unique digital token stored on a blockchain that represents ownership of a specific item—be it artwork, music, video clips, virtual land, or even domain names.

With NFTs, users can:

Prove ownership of a digital item

Transfer ownership without relying on intermediaries

Earn royalties on future sales (for creators)

This direct ownership model is revolutionizing industries like art, music, gaming, and fashion.

2. Decentralized Identity and Data Control

In Web3, users can create decentralized digital identities using blockchain wallets. These identities allow access to services and platforms without disclosing unnecessary personal information.

Web3 applications also allow users to control access to their data and even monetize it if they choose. Projects like Lens Protocol and Ceramic enable users to own their content and online profiles across different platforms.

3. Tokenized Communities and DAOs

Decentralized Autonomous Organizations (DAOs) — a key feature of many Web3 applications — give users ownership stakes in communities and platforms. By holding governance tokens, users can vote on key decisions, propose changes, and share in the value they help create.

This shared ownership model is replacing traditional top-down company structures with collaborative, user-driven ecosystems.

Real-World Examples of Digital Ownership in Web3

Axie Infinity: Players own their in-game assets and earn cryptocurrency rewards.

Zora: A decentralized NFT marketplace where creators maintain control over their digital works.

ENS (Ethereum Name Service): Allows users to own blockchain-based domain names.

Each of these examples illustrates how Web3 applications are turning passive users into active stakeholders.

Conclusion

Web3 applications are more than just a trend—they represent a fundamental shift in how we interact with the digital world. By enabling true ownership of assets, identities, and communities, Web3 empowers individuals like never before.

As these technologies continue to develop, we’re moving toward an internet where users are not just participants, but rightful owners of their digital lives.

0 notes

Text

What is an NFT? Breaking Down the Hype and Reality

What is an NFT?

NFT stands for Non-Fungible Token, a unique digital asset that represents ownership or proof of authenticity of a specific item, typically on a blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are interchangeable, NFTs are one-of-a-kind or part of a limited edition, making them "non-fungible."

How Do NFTs Work?

NFTs are primarily built on blockchain technology, with Ethereum being the most widely used blockchain for NFT transactions. Each NFT is stored on a blockchain, ensuring authenticity, security, and ownership history. Smart contracts govern the creation, transfer, and resale of NFTs, ensuring trustless transactions.

Key Features of NFTs:

Uniqueness: Each NFT has a distinct identifier, making it different from any other token.

Indivisibility: Unlike cryptocurrencies, NFTs cannot be split into smaller units.

Ownership Verification: Blockchain technology records and verifies the owner of each NFT.

Interoperability: Many NFTs can be used across multiple platforms, games, and marketplaces.

Common Use Cases of NFTs

NFTs have found applications in various industries, including:

1. Digital Art

NFTs have revolutionized the art world by allowing artists to tokenize their work, ensuring authenticity and enabling direct sales to collectors.

2. Gaming

In-game items, characters, and virtual land can be turned into NFTs, giving players true ownership and the ability to trade assets outside the game ecosystem.

3. Music and Entertainment

Musicians and content creators use NFTs to sell exclusive music tracks, concert tickets, and VIP experiences.

4. Metaverse and Virtual Real Estate

Virtual worlds like Decentraland and The Sandbox allow users to buy, sell, and develop NFT-based digital real estate.

5. Collectibles and Sports Memorabilia

NFTs have become popular in sports, enabling fans to own exclusive digital trading cards, game highlights, and merchandise.

The Hype vs. The Reality

While NFTs have generated excitement, they also come with skepticism. Here’s a breakdown:

The Hype:

Some NFTs have sold for millions, attracting celebrities and investors.

Promises of decentralization and digital ownership empowerment.

The rise of NFT-powered metaverses and play-to-earn games.

The Reality:

Many NFT projects lose value over time due to market speculation.

Environmental concerns about blockchain energy consumption.

Legal and copyright issues still need better regulation.

How to Buy and Sell NFTs

If you're interested in getting started with NFTs, follow these steps:

Choose a Marketplace: Popular platforms include OpenSea, Rarible, and Foundation.

Set Up a Crypto Wallet: Use MetaMask or Trust Wallet to store your NFTs and cryptocurrency.

Buy Ethereum (ETH): Most NFT transactions require ETH, so purchase some from a crypto exchange.

Browse and Purchase NFTs: Find an NFT that interests you, place a bid, or buy it outright.

Sell NFTs: If you own an NFT, list it on a marketplace and set a price.

Future of NFTs

NFTs continue to evolve, with new applications in real-world assets, identity verification, and decentralized finance (DeFi). As technology improves and regulations catch up, NFTs may become a permanent fixture in the digital economy.

Conclusion

NFTs are reshaping digital ownership, but they come with both potential and risks. Whether you’re an investor, artist, or collector, understanding what is an NFT and how it works is crucial before diving into the space. As the industry matures, the true value of NFTs will become clearer beyond the initial hype.

1 note

·

View note