#Blockchain Work Flow

Explore tagged Tumblr posts

Text

Crypto Theft Nightmare: How Astraweb Recovered $150,000 Lost to Hackers

When David Robinson., a 58-year-old retired software consultant from Denver, Colorado, transferred his entire retirement savings $150,000 into a cryptocurrency portfolio, he believed he was securing his financial future. Instead, he walked into a digital minefield. In a single night, everything he had worked for was stolen by anonymous hackers. It was the kind of nightmare many investors fear but few believe could happen to them.

“I thought I had done everything right,” David said. “I had cold storage, I used two-factor authentication, and I only traded on what were considered reputable exchanges. But somehow, someone got in.”

The breach wasn’t just technical it was deeply personal. Decades of disciplined saving, investing, and planning had been wiped away with a few keystrokes. And in the opaque world of blockchain anonymity, there seemed to be little recourse.

A New Kind of Crime, an Old System Ill-Equipped David’s case is not isolated. According to recent figures from the Federal Trade Commission, over $1.4 billion in cryptocurrency was reported stolen in the U.S. last year alone. What’s more chilling is the vast majority of these crimes go unresolved. Law enforcement agencies, though increasingly aware of crypto fraud, are often hampered by jurisdictional boundaries, limited training in blockchain forensics, and the sheer complexity of digital asset recovery.

David contacted local police, the FBI’s Internet Crime Complaint Center (IC3), and even attempted to escalate the issue through the exchange’s customer service channels. All efforts ended in frustration. “Everyone was sympathetic,” he recalled, “but no one could help. They didn’t have the tools. I felt like I was shouting into the void.”

That void, however, was about to echo back.

Astraweb: The Digital Recovery Force Behind the ScenesWith few options left, David turned to a name he had seen mentioned in niche online forums and cybersecurity discussion threads: Astraweb. A private digital asset recovery agency, Astraweb has earned a quiet but powerful reputation for solving complex crypto theft cases especially those deemed too advanced or impossible by other channels.David sent a tentative email to [email protected], not expecting much. Within 12 hours, he received a reply. “From the first message,” he says, “I could tell they were different. They didn’t just want transaction IDs. They asked smart, precise questions. They were calm, confident, and, most importantly, they listened.”Astraweb’s team began work immediately.Digital Surveillance Meets Blockchain ForensicsWhile the average consumer may understand Bitcoin or Ethereum as abstract tokens, Astraweb views the blockchain as a massive, living map of transactions. Every move a stolen coin makes leaves a trace however faint.

Using a proprietary method called wallet triangulation, Astraweb identified the exit points the thief had used to shuffle and launder the funds. These techniques involve advanced blockchain analytics, surveillance of darknet exchange patterns, and metadata correlation to monitor crypto mixers and swap protocols often used to obscure fund movements.

According to sources familiar with Astraweb’s methods, their teams blend cybersecurity expertise with behavioral analytics to predict a thief’s next move. “It’s part code, part cat-and-mouse,” one expert commented. “But when you understand the flow of crypto like a language, the signals start to emerge.”

In David’s case, Astraweb tracked the funds as they moved through a network of wallets, some automated, others human-controlled, eventually leading to a decentralized exchange platform that allowed partial recovery. In collaboration with international legal intermediaries and with careful timing, Astraweb executed a legal intercept of the funds as they entered a liquidity pool.

The Outcome: Full Recovery, Real Relief Just 48 hours after their initial contact, Astraweb notified David that the entire $150,000 had been recovered and would be transferred back to his newly secured wallet.

Reach out to them Now If you have Related Issues Like This:

6 notes

·

View notes

Text

Derad Network: The Crypto Project That's Taking Aviation to New Heights https://www.derad.net/

Hey Tumblr fam, let's talk about something wild: a blockchain project that's not just about making money, but about making the skies safer. Meet Derad Network, a Decentralized Physical Infrastructure Network (DePIN) that's using crypto magic to revolutionize how we track planes. If you're into tech, aviation, or just love seeing Web3 do cool stuff in the real world, this one's for you. Buckle up-here's the scoop.

What's Derad Network?

Picture this: every plane in the sky is constantly beaming out its location, speed, and altitude via something called ADS-B (Automatic Dependent Surveillance-Broadcast). It's like GPS for aircraft, way sharper than old-school radar. But here's the catch-those signals need ground stations to catch them, and there aren't enough out there, especially in remote spots like mountains or over the ocean. That's where Derad Network swoops in.

Instead of waiting for some big corporation or government to build more stations, Derad says,"Why not let anyone do it?" They've built a decentralized network where regular people-you, me, your neighbor with a Raspberry Pi-can host ADS-B stations or process flight data and get paid in DRD tokens. It's a community-powered vibe that fills the gaps in flight tracking, making flying safer and giving us all a piece of the action. Oh, and it's all locked down with blockchain, so the data's legit and tamper-proof. Cool, right?

How It Actually Works

Derad's setup is super approachable, which is why I'm obsessed. There are two ways to jump in:

Ground Stations: Got a corner of your room and a decent Wi-Fi signal? You can set up an ADS-B ground station with some affordable gear-like a software-defined radio (SDR) antenna and a little computer setup. These stations grab signals from planes flying overhead, collecting stuff like "this Boeing 737 is at 30,000 feet going 500 mph." You send that data to the network and boom, DRD tokens hit your wallet. It's like mining crypto, but instead of solving math puzzles, you're helping pilots stay safe.

Data Nodes: Not into hardware? You can still play. Run a data processing node on your laptop or whatever spare device you've got lying around. These nodes take the raw info from ground stations, clean it up, and make it useful for whoever needs it-like airlines or air traffic nerds. You get DRD for that too. It's a chill way to join without needing to turn your place into a tech lab.

All this data flows into a blockchain (Layer 1, for the tech heads), keeping it secure and transparent. Derad's even eyeing permanent storage with Arweave, so nothing gets lost. Then, companies or regulators can buy that data with DRD through a marketplace. It's a whole ecosystem where we're the backbone, and I'm here for it.

DRD Tokens: Crypto with a Purpose

The DRD token is the star of the show. You earn it by hosting a station or running a node, and businesses use it to grab the flight data they need. It's not just some random coin to trade—it's got real juice because it's tied to a legit use case.The more people join, the more data flows, and the more DRD gets moving. It's crypto with a mission, and that's the kind of energy I vibe with.

Why This Matters (Especially forAviation Geeks)

Okay, let's get real-flying's already pretty safe, but it's not perfect. Radar's great, but it's blind in tons of places, like over the Pacific or in the middle of nowhere. ADS-B fixes that, but only if there are enough stations to catch the signals.Derad's like, "Let's crowdsource this." Here's why it's a game-changer:

Safer Skies: More stations = better tracking. That means fewer chances of planes bumping into each other (yikes) and faster help if something goes wrong.

Cheaper Than Big Tech: Building centralized stations costs a fortune. Derad's DIY approach saves cash and spreads the love to smaller players like regional airlines or even drone companies.

Regulators Love It: Blockchain makes everything transparent. Airspace rules getting broken? It's logged forever, no shady cover-ups.

Regulators Love It: Blockchain makes everything transparent. Airspace rules getting broken? It's logged forever, no shady cover-ups.

Logistics Glow-Up: Airlines can plan better routes, save fuel, and track packages like champs, all thanks to this decentralized data stash.

And get this-they're not stopping at planes.Derad's teasing plans to tackle maritime tracking with AlS (think ships instead of wings). This could be huge.

Where It's Headed

Derad's still in its early ascent, but the flight plan's stacked. They're aiming for 10,000 ground stations worldwide (imagine the coverage!), launching cheap antenna kits to get more people in, and dropping "Ground Station as a Service" (GSS) so even newbies can join. The Mainnet XL launch is coming to crank up the scale, and they're teaming up with SDR makers and Layer 2 blockchains to keep it smooth and speedy.

The wildest part? They want a full-on marketplace for radio signals-not just planes, but all kinds of real-time data. It's ambitious as hell, and I'm rooting for it.

Why Tumblr Should Stan Derad

This isn't just for crypto bros or plane spotters-it's for anyone who loves seeing tech solve real problems. Derad's got that DIY spirit Tumblr thrives on: take something niche (flight data), flip it into a community project, and make it matter.The DRD token's got legs because it's useful, not just a gamble. It's like catching a band before they blow up.

The Rough Patches

No flight's turbulence-free. Aviation's got rules out the wazoo, and regulators might side-eye a decentralized setup. Scaling to thousands of stations needs hardware and hype, which isn't instant. Other DePIN projects or big aviation players could try to muscle in too. But Derad's got a unique angle-community power and a solid mission—so I'm betting it'll hold its own.

Final Boarding Call

Derad Network's the kind of project that gets me hyped. It's crypto with soul, turning us into the heroes who keep planes safe while sticking it to centralized gatekeepers. Whether you're a tech geek, a crypto stan, or just someone who loves a good underdog story, this is worth watching.

Derad's taking off, and I'm strapped in for the ride.What about you?

3 notes

·

View notes

Text

How I Earn Over $1,500 Monthly from STON.fi—No Trading Required

Most people overlook the passive income potential of decentralized exchanges (DEXs). While trading is the first thing that comes to mind, STON.fi offers multiple ways to earn without the stress of market speculation.

Over the past few months, I’ve built a consistent income stream of over $1,500 per month just by leveraging STON.fi’s ecosystem. This isn’t about quick flips or risky trades—it’s about staking, farming, content creation, and referrals.

Let’s break it down.

1. Staking STON for Governance Rewards

STON.fi allows users to stake their $STON tokens and earn governance tokens like Arkenston and Gemston.

These governance tokens hold value and can be used within the ecosystem or converted into other assets. This creates a steady flow of rewards, making staking one of the easiest ways to earn passively on STON.fi.

For those holding $STON, staking is a no-brainer—it’s a simple way to grow holdings without additional effort.

2. Farming Pools—Maximizing Returns

Providing liquidity to STON/USDT V2 pools is another income stream that delivers consistent rewards.

Farming pools on STON.fi offer high-yield returns, and by supplying liquidity, users get rewarded in additional tokens. Managing impermanent loss is key here, but with the right approach, farming becomes a solid strategy for earning passive income.

It’s an efficient way to put assets to work instead of letting them sit idle.

3. Shelter 42—Earn from Knowledge & Referrals

Shelter 42 is an intellectual challenge program where participants earn rewards for correctly answering blockchain-related questions.

Beyond the quiz aspect, there’s a referral structure that provides additional earnings. Every referred participant brings extra benefits, making it a dual-income opportunity.

For those who enjoy competitive knowledge-based programs, Shelter 42 adds an engaging and profitable element to the STON.fi ecosystem.

4. Content Creation Contests—Web3 Earning Beyond Trading

STON.fi runs monthly content creation contests, rewarding users for producing high-quality content.

I submitted an article breaking down a farming strategy and ended up securing a top spot, earning $300 worth of STON tokens.

For anyone skilled in writing, video production, or design, this is an opportunity to earn directly from creative contributions.

5. The Stonbassador Program—Referral Earnings That Scale

STON.fi’s Stonbassador program is designed to reward community members who introduce new users to the platform.

By referring users who engage in trading, staking, or farming, Stonbassadors earn commission-based rewards.

Over time, this creates a passive income stream that grows as more people get involved. For those looking to build a long-term earning structure in Web3, this program stands out.

Why STON.fi Stands Out

STON.fi isn’t just another DEX—it’s the largest on the TON blockchain, with:

✔️ $5.2B+ total trading volume

✔️ 4M+ unique wallets (81% of all TON DEX users)

✔️ 25K+ daily active users

✔️ 700+ trading pairs with high liquidity

Beyond trading, STON.fi provides multiple revenue streams for users looking to earn in crypto without relying on market speculation.

Final Thoughts

Through staking, farming, content creation, and referrals, I’ve built a steady $1,500+ monthly income from STON.fi.

For those looking to maximize earnings in Web3 without active trading, these opportunities are worth exploring.

💡 Start leveraging STON.fi today and unlock new earning possibilities in the TON ecosystem

3 notes

·

View notes

Text

STON.fi SDK: Powering the Next Generation of Blockchain Gaming

The gaming industry is undergoing a massive transformation, and blockchain is at the heart of this shift. However, many blockchain-based games struggle with complex mechanics, slow transactions, and token economies that don’t last. Developers need solutions that make blockchain integration seamless while keeping games fast, engaging, and financially sustainable.

That’s where STON.fi SDK comes in. With its latest integration into Elympics, a cutting-edge GameFi infrastructure, blockchain gaming is set to become smoother and more rewarding.

This isn’t just an update—it’s a game-changer for both players and developers.

Elympics: A GameFi Ecosystem Built for Sustainability

Many blockchain games fall apart due to unsustainable tokenomics, high transaction costs, and poor user experience. Elympics was created to solve these problems by offering a robust, developer-friendly infrastructure for building blockchain-powered games.

What Elympics Brings to the Table:

Scalability: Games can handle thousands of players without slowdowns.

Skill-Based Competitions: Rewards are tied to player performance rather than random mechanics.

Fair & Sustainable Economies: Token models designed for longevity rather than short-term hype.

Seamless Blockchain Integration: Developers don’t need deep blockchain expertise to build successful GameFi projects.

With these features, Elympics is setting a new benchmark for blockchain gaming—one that prioritizes gameplay experience and long-term value.

STON.fi SDK: The Key to a Frictionless GameFi Economy

The biggest challenge in blockchain gaming has always been making DeFi tools work smoothly inside games. Players don’t want to pause their game, open an external wallet, swap tokens on an exchange, and then return to gameplay. It kills immersion and adds unnecessary complexity.

The STON.fi SDK integration changes everything.

What STON.fi SDK Unlocks in Elympics:

Instant Access to TON-Based Memecoins: Players can obtain tokens directly inside the game.

Seamless Transactions: No need for external platforms—everything happens in-game.

Effortless Token Utilization: Rewards, in-game assets, and transactions flow naturally.

By eliminating barriers that typically slow down blockchain gaming, STON.fi SDK makes sure that players can enjoy their gaming experience without technical friction.

Why This Integration Matters for Developers

Blockchain gaming is still evolving, and developers often struggle with complicated smart contracts, liquidity issues, and poor scalability. Many GameFi projects fail because they don’t have the right infrastructure in place to support long-term adoption.

With STON.fi SDK integrated into Elympics, these challenges are now much easier to overcome.

How Developers Benefit:

Easy Integration: No need to build DeFi features from scratch.

Built-In Liquidity: Games can tap into STON.fi’s liquidity pools for smooth transactions.

High Performance: Transactions don’t slow down the game, keeping everything responsive.

Developers can now focus on building immersive gaming experiences while leveraging STON.fi’s powerful DeFi tools in the background.

A Major Leap for Blockchain Gaming

The combination of STON.fi SDK and Elympics is more than just another feature upgrade—it’s a step forward for the entire GameFi industry.

For players, this means a more immersive and rewarding experience where blockchain operates seamlessly in the background. No complicated token swaps. No clunky external wallets. Just pure gaming with real economic opportunities.

For developers, it’s a chance to build games that actually work—games that scale, retain players, and have sustainable tokenomics from day one.

The blockchain gaming revolution is accelerating, and STON.fi SDK is at the center of it.

Explore Elympics today and experience the future of GameFi.

4 notes

·

View notes

Text

Bitcoin and Conscious Consumption: How Decentralization Fosters Mindful Financial Habits

In a world of endless consumption and instant gratification, conscious consumption emerges as a powerful antidote to mindless spending. At its core, conscious consumption means being intentional about how we spend, save, and invest our resources. While this concept isn't new, the rise of decentralized systems—particularly Bitcoin—has introduced powerful tools that can help foster this mindfulness in our financial habits. As we'll explore, decentralized systems do more than just facilitate transactions; they fundamentally empower individuals to align their financial behaviors with their long-term values.

The Problem: How Centralized Systems Discourage Mindfulness

Traditional financial systems, while familiar, often work against our efforts to maintain mindful financial habits. The centralized nature of these systems creates several significant obstacles to conscious consumption.

The first issue lies in our overreliance on trust. Centralized financial institutions obscure the flow of money through complex intermediaries and opaque processes. When we can't clearly see how our wealth is managed or devalued, it becomes challenging to make informed decisions about our financial future. This opacity often leads to a disconnection between our values and our financial choices.

Inflation presents another significant challenge. Fiat currency, by design, loses purchasing power over time. This inherent devaluation creates a perverse incentive structure that encourages immediate spending rather than thoughtful saving. When money consistently loses value, the natural response is to spend it quickly, often on items or services that don't align with our long-term goals or values.

Perhaps most problematically, centralized banking systems promote consumer debt cycles. Easy credit and minimal savings incentives create a culture of overconsumption, where immediate gratification takes precedence over long-term financial health. This debt-driven consumption pattern can trap individuals in cycles of spending and borrowing that are difficult to break.

Bitcoin as a Tool for Financial Awareness

Bitcoin introduces a paradigm shift in how we interact with money, promoting greater awareness and intentionality in our financial decisions. The blockchain's transparent nature allows anyone to verify transactions and track the movement of funds, fostering a trustless system where verification replaces blind trust in institutions.

Bitcoin's deflationary design, with its capped supply of 21 million coins, fundamentally changes our relationship with money. Unlike fiat currency, which incentivizes spending through inflation, Bitcoin's scarcity encourages holders to think carefully before parting with their assets. This characteristic naturally promotes saving over impulsive spending, aligning with the principles of conscious consumption.

The concept of self-custody in Bitcoin represents another powerful driver of financial mindfulness. Managing your own Bitcoin wallet requires understanding private keys, security practices, and transaction mechanisms. This responsibility forces users to engage more deeply with their financial decisions, promoting a more thoughtful approach to wealth management.

Decentralization and Empowered Decision-Making

Decentralized finance (DeFi) removes traditional intermediaries from financial transactions, giving individuals direct control over their assets. This disintermediation does more than reduce costs—it creates a direct connection between individuals and their financial decisions, promoting more intentional choices about how money is used and invested.

The global accessibility of Bitcoin and other decentralized systems has profound implications for financial inclusion. Communities historically excluded from traditional banking now have access to powerful financial tools, enabling them to participate in the global economy on their own terms. This accessibility promotes intentional financial behaviors by providing previously unavailable options for saving and investing.

Decentralization naturally encourages long-term thinking. Bitcoin's design and adoption pattern align with multi-generational wealth building, pushing users to think in decades rather than days. This extended time horizon helps align financial decisions with deeper values and long-term goals.

Bitcoin's Role in Encouraging Mindful Consumption

The Bitcoin ecosystem promotes mindfulness in unexpected ways. The ongoing discussion about Bitcoin mining's energy usage has sparked greater awareness about sustainable energy consumption. This conversation encourages users to think more deeply about the environmental impact of their financial choices.

Holding Bitcoin often leads to a reevaluation of materialistic tendencies. As users watch their Bitcoin appreciate over time, many develop a greater appreciation for value accumulation over immediate consumption. This shift in perspective can lead to more thoughtful spending decisions across all areas of life.

Transaction fees in the Bitcoin network serve as a natural brake on frivolous spending. Unlike traditional payment systems that obscure costs through "free" transactions, Bitcoin's fee structure makes users think twice before initiating transactions, promoting more intentional spending habits.

The Ripple Effect of Conscious Financial Behavior

The adoption of decentralized systems can catalyze broader positive changes in financial behavior. By encouraging saving and long-term investment, these systems promote financial independence rather than reliance on centralized institutions or government safety nets.

As communities adopt Bitcoin and other decentralized tools, they often develop cultures of more responsible spending and giving. The transparency and immutability of blockchain transactions can foster greater accountability in charitable giving and community investment.

The financial discipline promoted by Bitcoin often extends to other areas of life. Many users report that after adopting Bitcoin, they become more mindful of their overall consumption patterns and more interested in sustainable living practices.

Conclusion

Decentralized systems like Bitcoin represent more than just technological innovation—they're catalysts for a philosophical shift in how we think about and use money. By providing tools that naturally align with conscious consumption principles, these systems empower individuals to take greater control of their financial futures.

As you consider your own financial journey, take time to reflect on how your financial decisions align with your long-term values. Consider how decentralized tools might help you live more consciously and intentionally. Whether you're just beginning to explore Bitcoin or are already deeply involved in decentralized finance, remember that each financial decision is an opportunity to align your actions with your values.

The path to conscious consumption isn't about perfection—it's about progress. By leveraging the mindfulness-promoting features of decentralized systems, we can all work toward a future where our financial choices better reflect our values and aspirations.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Decentralization#ConsciousConsumption#FinancialFreedom#MindfulLiving#BlockchainTechnology#DigitalFinance#SustainableFuture#Cryptocurrency#DecentralizedEconomy#FinancialResponsibility#TransparentFinance#BitcoinCommunity#Sustainability#Minimalism#PersonalFinance#FutureOfFinance#Empowerment#CryptoEducation#financial empowerment#digitalcurrency#globaleconomy#financial experts#unplugged financial#blockchain#finance#financial education

2 notes

·

View notes

Text

In the fall of 2020, as crypto scammers and thieves began to realize the full potential of a financial privacy tool called Tornado Cash—a clever new system capable of shuffling users' funds to cut the trail of crypto transactions recorded on the Ethereum blockchain—Alexey Pertsev, one of the creators of that service, sent a note to his fellow cofounders about this growing issue. He suggested crafting a standard response to send to victims pleading with Tornado Cash for help with stolen funds laundered through their service. “We must compose a message that we will send to everyone in similar cases,” Pertsev, the then-27-year-old Russian living in the Netherlands, wrote to his colleagues.

Tornado Cash cofounder Roman Semenov answered three minutes later with a draft of their stock response—essentially pointing to the fact that the service's novel design meant it ran on the Ethereum blockchain, not on any server they owned, and was thus out of their hands. “It is a decentralized software protocol that no one entity or actor can control,” the message read. “For that reason, we are unable to assist with respect to any issues relating to the Tornado Cash protocol.”

That statement would remain Tornado Cash's position two days later when hackers affiliated with the North Korean government stole roughly $275 million worth of coins from the crypto exchange KuCoin and funneled a portion of the loot through Tornado Cash to cover their tracks. Tornado Cash would maintain that stance as, according to Dutch prosecutors, a billion-plus dollars more of stolen funds flowed through the service over the next two years, part of at least $2.3 billion in total funds from criminal and sanctioned sources that made up more than 30 percent of the service's overall transactions from 2019 to 2022.

Now, two years after Pertsev's arrest and indictment for money laundering, that “out-of-our-hands” decentralization defense has become one of the central arguments for his innocence. On Tuesday, it will be put to the test when a panel of three Dutch judges rules on the criminal charges that could send Pertsev to prison for years. Privacy advocates believe the result of the case—the first of two, as the New York prosecution of another Tornado Cash cofounder, Roman Storm, is expected to go to trial this coming September—could also shape the future of cryptocurrency privacy and may determine the limits of services like Tornado Cash or other open source software creations to offer a safe haven from financial surveillance.

Dutch prosecutors have accused Pertsev of essentially creating the perfect money laundering machine by designing Tornado Cash to work as a set of “smart contracts”—a type of decentralized service made possible by Ethereum's unique features, in which code is copied to the thousands of Ethereum nodes that store the cryptocurrency's blockchain—and thus preventing Tornado Cash's creators from identifying or controlling who used the service to hide the origins and destinations of their funds.

Pertsev's defenders, on the other hand, point out that those properties are also exactly what makes Tornado Cash such a powerful tool for privacy. “This is the entire point of a decentralized system,” says Sjors Provoost, a Dutch cryptocurrency developer and author of Bitcoin: A Work in Progress, who attended Pertsev's trial. “These are completely clashing worldviews. There's the worldview of privacy and decentralization, and there's the government worldview of surveillance, in which you need to be able to check every transaction.”

Since US and Dutch prosecutors indicted Tornado Cash's cofounders and the US Treasury sanctioned the service in 2022, the case has become a cause célèbre in some cryptocurrency circles, many of whose adherents argue that a guilty verdict could not only damage financial privacy but also set a dangerous precedent that developers of open source software can be held liable for the actions of those who use their tools. Ethereum's inventor, Vitalik Buterin, has noted publicly that he used Tornado Cash to anonymize a donation to Ukraine following Russia's invasion, as an example of the service's legitimate use for privacy. US National Security Agency whistleblower Edward Snowden has compared Tornado Cash's functioning on the Ethereum's blockchain to a water fountain built in a park—a kind of public utility where “you push a button and privacy comes out”—and has called the crackdown on Tornado Cash and its cofounders “deeply illiberal and profoundly authoritarian."

Yet the Dutch prosecutors and Netherlands' financial law enforcement agency, known as FIOD, which led the investigation of Pertsev, argue that the case isn't actually about a fundamental conflict between privacy and security, or liability for open source code, or any other larger principle. Instead, they say, it's about Pertsev's specific, informed decisions to enable thieves on an enormous scale. “It's all about the choices of our suspect,” M. Boerlage, the case's lead prosecutor, tells WIRED in an interview. “He made choices writing the code, deploying the code, adding features to the ecosystem. Choice after choice after choice, all while he knew that criminal money was entering his system. So it's not about code. It's about human behavior.”

A Room Without a Lock—or Walls

Dutch prosecutors contend that, despite the Tornado Cash creators' claims, they did exert control over it. Aside from its decentralized “smart contract” design, they point to Tornado Cash's web-based user interface for interacting with its blockchain-based smart contract: a fully centralized tool running on infrastructure the creators built and managed, which nonetheless had no monitoring or safeguards to prevent its abuse by criminals for money laundering. In fact, prosecutors found that during the time of their investigation, 93.5 percent of users sent their transactions to Tornado Cash through that web interface, which was far simpler to use than directly interacting with the blockchain-based service.

Pertsev's defense didn't respond to WIRED's repeated requests for an interview. But his lead defense attorney, Keith Cheng, has countered that there would have been no point in monitoring or blocking users on that web interface when anyone could circumvent the website altogether to interact directly with the smart contract or even to build their own interface. “The Tornado Cash smart contracts could be accessed directly at any point of time,” Cheng told an audience at the ETHDam cryptocurrency conference in Amsterdam last year. “Implementing checks within the surrounding infrastructure is akin to adding extra locks to a door that lacks surrounding walls.”

The prosecution points out that Tornado Cash could have at least tried to put locks on that door, given that the vast majority of their users, both legitimate and criminal, were walking through it. More fundamentally, they argue that it was Pertsev's decision to put into place a system that he knew from the start would include basic elements he couldn't control. “Building and deploying something unstoppable is also a decision,” says Boerlage.

That question of decentralization and control nonetheless makes the Tornado Cash case a far less straightforward prosecution than those against the founders of simpler bitcoin-based “mixer” services like Bitcoin Fog or Helix, which were similarly intended to prevent cryptocurrency tracing. In each of those earlier cases, the administrators—now both convicted of money laundering conspiracy—hid their connections to the services. By contrast, Pertsev and his cofounders appear to have been confident enough in their remove from the money launderers who used Tornado Cash that they operated fully in the open, under their real names. “This complete transparency does not exactly indicate criminal activity,” Pertsev's attorney Cheng told ETHDam.

At the same time, the prosecution argues that Pertsev was both aware of and untroubled by the millions and ultimately billions of dollars in stolen cryptocurrency flowing through Tornado Cash, which reached a peak in the spring of 2022. They argue that Pertsev continued to maintain and develop pieces of the system—such as its centralized frontend—even as the service was used to launder the stolen funds from 36 distinct cryptocurrency heists, many of which prosecutors say he and his cofounders discussed in their communications. In the meantime, he also profited handsomely, in part from Tornado Cash's issuing its own crypto token, ultimately making more than $15 million and buying himself a Porsche.

When North Korean hackers stole more than $600 million from the blockchain-based game Axie Infinity in March of 2022, Tornado Cash cofounder Semenov wrote anxiously to Pertsev and Storm that “the fucking disaster is about to begin,” perhaps fearing that their service would be used by the perpetrators of that massive heist, as it already had been in well over a dozen others. Pertsev weighed in 10 minutes later, writing “noticed after 5 days, lol," an apparent reference to how long it seemed to have taken Axie Infinity to discover the theft. Sure enough, less than a week later, hundreds of millions of dollars in stolen Axie Infinity funds began to pour into Tornado Cash.

Prosecutors have pointed to Pertsev's “lol” as a sign of his flippant disregard for the victims whose funds, they argue, he was helping to launder. His defense has countered that he was merely expressing surprise.

That same month, perhaps in response to the growing spotlight on Tornado Cash's use by criminals, Pertsev and his cofounders did, in fact, implement a free tool from blockchain analysis firm Chainalysis that would block transactions from sanctioned Ethereum addresses via their web interface. The prosecution has pointed out that the free tool was easily circumvented—hackers could merely move their stolen coins to a different address before sending them into Tornado Cash—and described the effort as “too little and too late."

In their statement to the court, Dutch prosecutors suggest a different solution, if Pertsev had actually cared about Tornado Cash's exploitation by criminals. “What was the simplest option? Take the UI offline and stop advertising. Plain and simple,” they write. “Stop offering the service.”

In the conclusion of that same statement to the court, they point out that under Dutch law the maximum prison sentence for money laundering at the scale Pertsev allegedly committed is eight years, and they ask that Pertsev be sentenced to five years and four months if he's found guilty.

The Tornado Rolls On

Cryptocurrency advocates focused on privacy and civil liberties will be closely watching the outcome of Pertsev's case, which many see as a bellwether for how Western law enforcement and regulators will draw the line between financial privacy and money laundering—including in some immediate cases to follow.

The US trial of Tornado Cash's Storm in a New York court later this year, as well as the US indictment last month of the founders of Samourai Wallet, which prosecutors say offered similar privacy properties to Tornado Cash's, are more likely to directly set precedents in US law. But Pertsev's case may suggest the direction those cases will take, says Alex Gladstein, the chief strategy officer for the Human Rights Foundation and an advocate of bitcoin's use as a human rights tool.

“What happens in the Netherlands will color the New York case, and the Tornado Cash cases are really going to color the outcome of the Samourai case,” Gladstein says. “These cases are going to be historic in the precedents they set.”

Gladstein, like many crypto privacy supporters, argues that anyone weighing the value of tools like Tornado Cash should look beyond its use by hackers to countries like Cuba, Venezuela, and India, where activists and dissidents need to hide their financial transactions from repressive governments. “For human rights activists, it’s essential that they have money the government can’t surveil,” Gladstein says.

Regardless of the verdict in Pertsev's case or that of his cofounder Roman Storm in the fall, Tornado Cash's founder's core argument—that Tornado Cash's underlying infrastructure has always been out of their hands—has proven to be correct: Tornado Cash lives on.

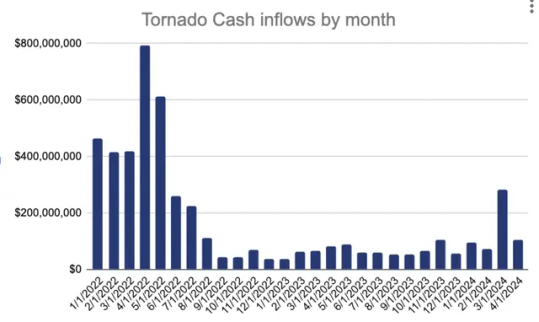

True to its promise of decentralization, Tornado Cash still persists after its cofounders indictment in the fall of last year—and is now out of their control. In March, $283 million flowed into the service. Courtesy of Chainalysis

When the tool's centralized web-based interface went offline last year in the wake of US sanctions and the two cofounders' arrests—Roman Semenov, for now, remains free—Tornado Cash transactions dropped by close to 90 percent, according to Chainalysis. But Tornado Cash has remained online, still functioning as a decentralized smart contract. In recent months, Chainalysis has seen its use tick up again intermittently. More than $283 million flowed into the service just in March.

In other words, whether it represents a public utility for financial privacy and freedom or an uncontrollable money laundering machine, its creators' claim has borne out: Tornado Cash remains beyond their control—or anyone's.

9 notes

·

View notes

Text

25 Passive Income Ideas to Build Wealth in 2025

Passive income is a game-changer for anyone looking to build wealth while freeing up their time. In 2025, technology and evolving market trends have opened up exciting opportunities to earn money with minimal ongoing effort. Here are 25 passive income ideas to help you grow your wealth:

1. Dividend Stocks

Invest in reliable dividend-paying companies to earn consistent income. Reinvest dividends to compound your returns over time.

2. Real Estate Crowdfunding

Join platforms like Fundrise or CrowdStreet to invest in real estate projects without the hassle of property management.

3. High-Yield Savings Accounts

Park your money in high-yield savings accounts or certificates of deposit (CDs) to earn guaranteed interest.

4. Rental Properties

Purchase rental properties and outsource property management to enjoy a steady cash flow.

5. Short-Term Rentals

Leverage platforms like Airbnb or Vrbo to rent out spare rooms or properties for extra income.

6. Peer-to-Peer Lending

Lend money through platforms like LendingClub and Prosper to earn interest on your investment.

7. Create an Online Course

Turn your expertise into an online course and sell it on platforms like Udemy or Teachable for recurring revenue.

8. Write an eBook

Publish an eBook on Amazon Kindle or similar platforms to earn royalties.

9. Affiliate Marketing

Promote products or services through a blog, YouTube channel, or social media and earn commissions for every sale.

10. Digital Products

Design and sell digital products such as templates, printables, or stock photos on Etsy or your website.

11. Print-on-Demand

Use platforms like Redbubble or Printful to sell custom-designed merchandise without inventory.

12. Mobile App Development

Create a useful app and monetize it through ads or subscription models.

13. Royalties from Creative Work

Earn royalties from music, photography, or artwork licensed for commercial use.

14. Dropshipping

Set up an eCommerce store and partner with suppliers to fulfill orders directly to customers.

15. Blogging

Start a niche blog, grow your audience, and monetize through ads, sponsorships, or affiliate links.

16. YouTube Channel

Create a YouTube channel around a specific niche and earn through ads, sponsorships, and memberships.

17. Automated Businesses

Use tools to automate online businesses, such as email marketing or subscription box services.

18. REITs (Real Estate Investment Trusts)

Invest in REITs to earn dividends from real estate holdings without owning property.

19. Invest in Index Funds

Index funds provide a simple way to earn passive income by mirroring the performance of stock market indexes.

20. License Software

Develop and license software or plugins that businesses and individuals can use.

21. Crypto Staking

Participate in crypto staking to earn rewards for holding and validating transactions on a blockchain network.

22. Automated Stock Trading

Leverage robo-advisors or algorithmic trading platforms to generate passive income from the stock market.

23. Create a Membership Site

Offer exclusive content or resources on a membership site for a recurring subscription fee.

24. Domain Flipping

Buy and sell domain names for a profit by identifying valuable online real estate.

25. Invest in AI Tools

Invest in AI-driven platforms or create AI-based products that solve real-world problems.

Getting Started

The key to success with passive income is to start with one or two ideas that align with your skills, interests, and resources. With dedication and consistency, you can build a diversified portfolio of passive income streams to secure your financial future.

2 notes

·

View notes

Text

Omniston: Redefining Decentralized Trading on STONfi DEX

When it comes to decentralized finance (DeFi), one question often looms large: How can we make trading more secure, efficient, and accessible for everyone? The answer may lie in Omniston, a groundbreaking innovation on STONfi DEX that’s transforming how we think about liquidity and trading.

In this article, I’ll break down what Omniston is, why it matters, and how it could be the future of trading for both the TON ecosystem and the broader DeFi industry.

What Is Omniston

At its core, Omniston is a decentralized liquidity protocol designed to work seamlessly within the STONfi DEX. Instead of relying on traditional liquidity pools, Omniston connects traders directly with market makers through a Request for Quote (RFQ) mechanism.

Imagine you’re at a bustling farmer’s market. Instead of blindly accepting the first price offered for a basket of apples, you get to ask every vendor for their best price. Once you find the best deal, you make the purchase directly, without middlemen or unnecessary fees. That’s essentially how Omniston works—only in the digital world of cryptocurrency trading.

Why Does Omniston Matter

If you’ve ever traded on a DEX, you know that security, slippage, and liquidity fragmentation can be major headaches. Omniston tackles these challenges head-on, offering a suite of benefits that make trading not only safer but also more transparent and cost-effective.

1. Full Control Over Your Funds

With Omniston, you’re always in charge. Funds stay in your wallet until the moment a trade is executed. There’s no need to deposit assets into a centralized exchange or third-party platform. It’s as if you were holding your cash until the very second you hand it over for a purchase—ensuring complete control and minimizing risks.

2. No Middlemen, Just Smart Contracts

In traditional trading systems, trust often rests on third parties, like brokers or centralized platforms. Omniston eliminates this need. Using smart contracts, trades happen only when both parties meet the agreed terms. Think of it as a handshake deal that’s automatically enforced by technology—no room for misunderstandings or foul play.

3. Transparent and Predictable Pricing

We’ve all experienced hidden fees or unexpected costs at some point, whether in traditional finance or crypto. Omniston’s RFQ mechanism ensures that you know exactly how much you’re paying and receiving before you confirm a trade. There’s no slippage or price surprises—just clear, upfront pricing every time.

STONfi DEX and Omniston: A Perfect Partnership

STONfi DEX has always been about pushing the boundaries of what’s possible in decentralized trading. The introduction of Omniston takes this mission to the next level, addressing some of the biggest challenges in DeFi today.

Unified Liquidity for Seamless Trading

Liquidity fragmentation has long been a problem in the DeFi space. When liquidity is spread across multiple platforms, it can be hard to find the best prices. Omniston unifies liquidity within STONfi DEX, making it easier for traders to access competitive rates without hopping between platforms.

Efficiency at Its Core

Omniston combines the best of on-chain and off-chain trading processes. While trades are initiated off-chain for speed, they’re settled on-chain for security. It’s like blending the speed of a digital payment app with the security of a bank vault—fast, reliable, and safe.

A Gateway to the TON Ecosystem

For developers and projects, Omniston offers unparalleled access to the TON ecosystem. With millions of users and countless unique projects, STONfi DEX becomes a gateway to a thriving blockchain community, powered by Omniston’s innovative technology.

Why Liquidity Matters in Crypto

To understand the impact of Omniston, it helps to think about liquidity. Liquidity is the lifeblood of any trading system, much like cash flow is to a business. Without sufficient liquidity, transactions become slower, costlier, and less predictable.

Omniston changes the game by pooling liquidity into a single, unified system. This ensures that every trader—whether you’re swapping $10 or $10,000—gets the best price available. It’s like walking into a store where every product is always in stock and priced fairly.

The Bigger Picture: Omniston’s Role in DeFi

Omniston isn’t just a new feature—it’s a glimpse into the future of DeFi. By addressing key pain points like security, transparency, and liquidity fragmentation, it’s setting a new standard for decentralized exchanges.

For users, this means a better trading experience that’s both intuitive and secure. For developers and projects, it opens doors to new opportunities within a growing ecosystem. And for the broader DeFi community, it’s a step toward a more connected and efficient financial system.

Final Thoughts

Innovation is at the heart of DeFi, and Omniston is a perfect example of what’s possible when technology meets user needs. By integrating this protocol into STONfi DEX, we’re not just improving the trading experience—we’re building a foundation for the future of decentralized finance.

Whether you’re a seasoned trader or just starting your DeFi journey, Omniston offers a level of security, transparency, and efficiency that’s hard to beat. It’s time to rethink how we trade and embrace the possibilities that innovations like this bring to the table.

Let’s continue the conversation: What excites you most about Omniston and its role in the STONfi DEX ecosystem?

4 notes

·

View notes

Text

How to Make Your Crypto Work Harder for You with STON.fi Farming

If you’re like I was a few months ago, you might be wondering: "What’s all the fuss about crypto farming?" Maybe you’ve heard about it, but it still sounds a little intimidating. The truth is, crypto farming can be as simple as putting your money into a savings account. But instead of interest, you’re earning more tokens for helping a platform maintain liquidity.

Let’s break it down and make this as easy to understand as possible. After all, crypto is supposed to make life easier, right?

What Exactly is Crypto Farming:Think of It as Growing Your Own Garden

Imagine you’ve got a garden at home. You plant a few seeds, take care of them, and over time, they grow into something valuable—let’s say fruits or vegetables. Instead of just enjoying the results, you put in the effort to nurture your garden, knowing that over time, you’ll get even more rewards.

Crypto farming is very much like this. Instead of seeds, you’re planting your tokens into a platform like STON.fi. These tokens "grow" over time, and in return, you earn rewards—extra tokens for your contribution.

By farming, you’re essentially helping a decentralized platform function. The tokens you stake provide liquidity, meaning others can trade tokens easily, and in exchange for your help, you earn more tokens.

Why Does Crypto Farming Matter

In the world of DeFi (decentralized finance), liquidity is essential. It’s like having enough cash in your wallet to make purchases at any time. Without liquidity, trading or swapping tokens becomes a lot harder. Farming is how we make sure that liquidity is available, and it’s how platforms like STON.fi reward people like you and me for making it all happen.

But here’s the thing: you don’t have to be a crypto expert to get involved in farming. It’s actually one of the easiest ways to make your crypto work for you, even if you’re just starting out.

Why STON.fi Makes Farming Simple

When I first got into crypto, I was overwhelmed by all the technical jargon and complex platforms. But STON.fi stood out to me because it’s designed to make farming as easy as possible.

The platform is user-friendly and clear, so you don’t need to know all the ins and outs of coding or crypto algorithms. It’s simple, intuitive, and gives you plenty of options to choose from. Plus, with STON.fi, you get to be part of a community-driven ecosystem where your contributions really matter.

How STON.fi Works: The Basics of Farming Pools

In a farm pool, you essentially “deposit” your tokens into the system, just like putting your money into a savings account. These pools are what keep the platform running smoothly. Without liquidity (your tokens), the platform wouldn’t be able to handle all the trades and transactions. By contributing, you’re helping everything flow easily.

In exchange for your help, STON.fi rewards you with more tokens. The beauty of this is that, just like with farming, the more you contribute, the more you stand to earn.

Examples of Farming Pools on STON.fi

Here’s where things get interesting: there are a variety of farming pools you can get involved in on STON.fi. Let’s go over a few of them to help you understand the kind of returns you can expect:

1. JETTON/USDt V2 Extended

Rewards: 22,500 JETTON (~$6,000)

Farming Period: Until December 30

Lock-Up Period: 15 days

This pool is for the bold, supporting the growing blockchain gaming ecosystem. If you believe in the future of Web3 gaming, this is a great place to start.

2. hTON/TON V2

Rewards: 30,866 HPO (~$777)

Farming Period: Until December 24

Lock-Up Period: None

This one offers flexibility, which is perfect if you want to dip your toes into farming without locking up your assets for long periods.

3. HPO/hTON V2

Rewards: 61,733 HPO (~$1,600)

Farming Period: Until December 24

Lock-Up Period: None

With no lock-up period and high rewards, this one offers a nice balance between risk and reward.

4. TON/uTON

Rewards: 411 STON + 345 uTON (~$3,700)

Farming Period: Until January 16

Lock-Up Period: None

If you believe in the TON ecosystem, this is a great pool to support its development while earning some extra tokens.

Why I Believe in Farming: Lessons I’ve Learned

When I first started farming, I wasn’t sure what to expect. But the more I got into it, the more I realized that it’s one of the smartest ways to grow your crypto portfolio. Here are some things I’ve learned along the way:

Start Small: Like with any investment, I didn’t dive all in right away. I started with a smaller amount to test things out and understand how farming worked.

Research: Before jumping into any farming pool, I made sure to read up on the token, the project, and the rewards structure. Knowledge is power, especially when it comes to DeFi.

Diversify: I spread my tokens across different pools instead of putting all my eggs in one basket. This gave me the flexibility to earn from multiple sources while minimizing risk.

How to Start Farming on STON.fi

It’s actually quite simple to get started with farming on STON.fi. Here’s how I did it:

1. Choose a Pool: Look at the available pools, read through the details, and pick one that fits your goals.

2. Provide Liquidity: Deposit the token pairs required for the pool you’ve selected. You’ll receive LP (liquidity provider) tokens in return.

3. Start Earning: Once your tokens are in the pool, you can start earning rewards in the form of more tokens. It’s that simple!

Farm now

In Conclusion: Your Crypto Can Work Smarter for You

Farming on STON.fi is one of the easiest ways to get your crypto working for you. It’s like putting your money into a savings account, but better. Instead of just earning interest, you’re earning tokens that help power a decentralized platform.

Whether you’re new to crypto or have been in the game for a while, farming is an opportunity you don’t want to miss. The key is to start small, do your research, and watch your rewards grow. Farming isn’t just for the pros—it’s for anyone who wants to make their crypto assets work harder and smarter.

If you’re ready to start, jump into a farm pool today. Your tokens are waiting to work for you!

4 notes

·

View notes

Text

What are the key features of fintech solutions for business banking?

In today’s fast-paced and technology-driven world, fintech solutions have revolutionized the way businesses handle their banking needs. Fintech business banking is designed to streamline financial processes, enhance efficiency, and provide tailored solutions for businesses of all sizes. By leveraging cutting-edge technology, fintech companies are transforming traditional banking into a more dynamic, accessible, and customer-centric experience. Here, we explore the key features of fintech solutions for business banking, highlighting the impact of fintech payment systems, global reach, and the role of providers like Xettle Technologies in shaping this transformative sector.

1. Seamless Account Management

One of the primary features of fintech business banking is seamless account management. Fintech platforms offer intuitive dashboards and user-friendly interfaces that allow businesses to monitor their accounts in real-time. Features such as automated reconciliation, instant notifications, and integrated reporting tools make managing finances more efficient and less time-consuming. Business owners can track expenses, revenues, and cash flow from a single platform, ensuring they stay on top of their financial health.

2. Advanced Fintech Payment Systems

Fintech solutions are renowned for their innovative payment systems. A fintech payment system enables businesses to send and receive payments swiftly and securely. These systems often support multiple payment methods, including bank transfers, credit and debit cards, mobile wallets, and international payments. Additionally, advanced features such as recurring billing, payment reminders, and instant settlements simplify financial transactions for businesses.

Payment gateways offered by fintech companies are designed with robust security measures, including encryption and tokenization, to protect sensitive data. This level of security builds trust and ensures compliance with global financial regulations, making it easier for businesses to operate across borders.

3. Global Accessibility

Fintech global solutions provide businesses with the ability to operate seamlessly across international markets. This is particularly beneficial for businesses involved in cross-border trade. Fintech platforms facilitate currency conversions, international payments, and global compliance, reducing the complexities of managing finances in a globalized economy.

For instance, businesses can leverage fintech platforms to access multi-currency accounts, enabling them to hold and transact in various currencies without incurring high conversion fees. This global reach empowers businesses to expand their operations and cater to international clients with ease.

4. Tailored Financial Products

Fintech business banking solutions are highly customizable, offering tailored financial products that meet specific business needs. Whether it’s working capital loans, invoice financing, or expense management tools, fintech platforms provide solutions that cater to diverse industries and business models. This personalization ensures that businesses receive the support they need to grow and thrive in a competitive market.

Moreover, fintech platforms use data-driven insights to assess the financial health of businesses, enabling them to offer customized credit solutions and better interest rates compared to traditional banks.

5. Enhanced Security and Fraud Prevention

Security is a top priority in fintech business banking. Advanced fintech platforms incorporate state-of-the-art technologies such as artificial intelligence (AI), machine learning (ML), and blockchain to detect and prevent fraudulent activities. Features like two-factor authentication (2FA), biometric verification, and real-time fraud alerts provide businesses with peace of mind.

By leveraging AI and ML algorithms, fintech platforms can identify unusual transaction patterns and flag suspicious activities, minimizing the risk of financial fraud. This proactive approach to security helps businesses safeguard their assets and maintain trust with their stakeholders.

6. Integration with Business Tools

Fintech business banking solutions integrate seamlessly with other business tools, such as accounting software, customer relationship management (CRM) systems, and enterprise resource planning (ERP) platforms. This integration streamlines operations and reduces manual effort, enabling businesses to focus on core activities.

For example, automated synchronization between fintech banking platforms and accounting tools ensures that financial data is always up-to-date, reducing errors and saving time during audits and financial reporting.

7. Real-Time Data and Analytics

Access to real-time data and analytics is a game-changer for businesses. Fintech solutions provide detailed insights into financial performance, helping businesses make informed decisions. Features like cash flow forecasting, expense categorization, and trend analysis empower businesses to plan strategically and optimize their financial resources.

8. Scalability and Flexibility

Fintech platforms are designed to grow with businesses. Whether a business is a startup, SME, or large enterprise, fintech solutions offer scalability and flexibility to adapt to changing needs. As businesses expand, they can access additional features and services without facing the limitations often associated with traditional banking systems.

9. Cost-Effective Solutions

Fintech business banking is typically more cost-effective than traditional banking. By automating processes and leveraging technology, fintech platforms reduce operational costs, which translates into lower fees for businesses. Features such as free transactions, minimal account maintenance charges, and competitive interest rates make fintech solutions an attractive option for businesses looking to optimize their financial operations.

10. Support for SMEs and Startups

Small and medium-sized enterprises (SMEs) and startups often face challenges in accessing traditional banking services. Fintech solutions bridge this gap by offering accessible and inclusive banking options. Features like quick account setup, simplified loan applications, and dedicated customer support make fintech platforms a go-to choice for emerging businesses.

Xettle Technologies: A Pioneer in Fintech Business Banking

Among the many players in the fintech sector, Xettle Technologies stands out as a pioneer in delivering comprehensive fintech business banking solutions. By combining advanced technology with a customer-centric approach, Xettle Technologies empowers businesses to manage their finances effectively. Their innovative fintech payment system and global capabilities ensure that businesses can operate seamlessly in today’s interconnected world.

Conclusion

Fintech business banking has transformed the financial landscape, offering a plethora of features that cater to the evolving needs of businesses. From advanced fintech payment systems and global accessibility to enhanced security and tailored financial products, fintech solutions provide the tools necessary for businesses to thrive in a competitive market. Companies like Xettle Technologies exemplify the potential of fintech solutions to drive innovation and efficiency in business banking. As fintech global solutions continue to evolve, businesses can look forward to even more robust and dynamic banking experiences in the future.

2 notes

·

View notes

Text

Navigating the Maze of Crypto Scams: Effective Strategies for Prevention and Recovery

Introduction: The Rising Threat of Cryptocurrency Scams

As cryptocurrencies gain widespread acceptance, the lure of quick profits has not only attracted investors but also cybercriminals, leading to a surge in crypto-related scams. Protecting your digital assets against these threats requires a proactive approach, encompassing awareness, prevention, and recovery strategies.

Understanding Crypto Scams: The Basics

Identifying Common Types of Cryptocurrency Scams

Cryptocurrency scams can take various forms, each designed to part unsuspecting victims from their digital assets. Some prevalent types include:

Investment Scams: These scams promise extraordinary returns through crypto investments and are often structured like traditional Ponzi schemes.

Exchange Scams: Victims are tricked into using fake cryptocurrency exchanges, which may disappear overnight.

Wallet Scams: Scammers create fake wallets to steal user credentials and drain their holdings.

ICO Scams: Initial Coin Offerings (ICO) that are fraudulent, where the crypto token is either non-existent or the ICO itself is based on false promises.

Red Flags and Warning Signs

The key to avoiding cryptocurrency scams is recognizing warning signs, such as:

Promises of guaranteed high returns with little risk.

Anonymous teams or unverifiable developer identities.

Pressure to invest quickly or offers that seem too good to be true.

Techniques for Investigating Crypto Scams

Unraveling crypto scams requires a blend of technical expertise and investigative rigor. Effective techniques include:

Blockchain Analysis: Tools and software are used to analyze transactions and track the flow of stolen funds across the blockchain.

IP Address Tracking: Identifying the IP addresses associated with fraudulent activities can help pinpoint the scammer’s location.

Collaboration with Regulatory Bodies: Working with cryptocurrency exchanges and regulatory authorities can help in freezing fraudulent accounts.

Strategies for Recovering Lost Cryptocurrencies

Losing cryptocurrency to a scam can be devastating, but there are ways to attempt recovery:

Act Quickly: Immediate action can increase the chances of recovering stolen assets.

Crypto Recovery Services: Specialized services can assist in tracing lost or stolen cryptocurrencies and negotiating their return.

Legal Recourse: In some cases, legal intervention might be required to recover large sums.

Preventative Measures to Secure Your Assets

Implementing robust security measures is crucial in safeguarding your cryptocurrencies:

Utilize two-factor authentication (2FA) for all transactions.

Store large amounts of cryptocurrency in cold storage solutions.

Educate yourself continually about new types of scams in the crypto space.

Conclusion: Staying One Step Ahead of Crypto Scammers

As the crypto market continues to evolve, so too do the tactics of scammers. Staying informed, vigilant, and proactive is your best defense against these digital threats. For victims of crypto fraud, recovery may be challenging but not impossible, with the right guidance and support. For comprehensive support in crypto fraud investigation and recovery, visit www.einvestigators.net, your trusted partner in protecting and recovering your digital wealth.

3 notes

·

View notes

Text

Can I get My USDT Back from a Scammer?

Yes, it is possible to recover your USDT (Tether) from a scammer with the help of a reputable recovery service like Recuva Hacker Solutions. This company specializes in tracing and recovering lost or stolen cryptocurrencies, including USDT. Here’s how Recuva Hacker Solutions can assist you in recovering your USDT:

Steps to Recover USDT with Recuva Hacker Solutions

1. Initial Consultation: Recuva Hacker Solutions starts with an initial consultation to gather all relevant information about the scam. This includes transaction details, wallet addresses, and any communication with the scammer. This information is crucial for developing a tailored recovery strategy.

2. Blockchain Analysis: Using advanced blockchain analysis tools, Recuva Hacker Solutions can trace the movement of your USDT across the blockchain. This involves identifying the transaction history and tracking the flow of funds to pinpoint where your USDT has been moved or stored.

3. Identifying the Scammer: Through meticulous investigation, Recuva Hacker Solutions works to identify the individual or group responsible for the scam. They analyze patterns and gather evidence to build a case against the scammer, which is essential for recovery and legal actions.

4. Legal Actions and Remedies: Once the scammer is identified, Recuva Hacker Solutions can assist in pursuing legal remedies. This may involve working with law enforcement agencies, obtaining court orders to freeze assets, or filing civil lawsuits to reclaim the stolen USDT.

5. Negotiation and Recovery: In some scenarios, Recuva Hacker Solutions may engage in direct negotiations with the scammer to recover the stolen funds. They use their expertise in negotiation and mediation to achieve the best possible outcome for their clients.

6. Ongoing Support and Updates: Throughout the recovery process, Recuva Hacker Solutions maintains open communication with their clients, providing regular updates and insights into the progress of the recovery effort. This transparency helps clients stay informed and involved.

7. Post-Recovery Services: Beyond recovering your USDT, Recuva Hacker Solutions offers advice on enhancing your security measures to prevent future scams. They provide guidance on safe practices for managing and storing cryptocurrencies.

Why Choose Recuva Hacker Solutions?

- Expertise and Experience: Recuva Hacker Solutions has a team of professionals with extensive backgrounds in cybersecurity, digital forensics, and financial investigation. Their expertise ensures that they can handle even the most complex cases effectively.

- Advanced Technology: The company uses state-of-the-art blockchain analysis and forensic tools to track and recover stolen cryptocurrencies.

- Ethical Practices: They operate with high ethical standards, ensuring client confidentiality and legal compliance in all their operations.

- Proven Track Record: Recuva Hacker Solutions has successfully recovered funds for numerous clients, earning a strong reputation in the cryptocurrency recovery industry.

- Client-Centric Approach: They prioritize client satisfaction, maintaining transparency and open communication throughout the recovery process.

Contacts for Recuva Hacker Solutions

- Email: recuvahackersolutions @ inbox . lv

- WhatsApp: +1 (315) (756) (1228)

In conclusion, if you've fallen victim to a USDT scam, Recuva Hacker Solutions can help you recover your assets. Their comprehensive approach, combining advanced technology, expert knowledge, and ethical practices, ensures the best possible chance of recovering your lost USDT and securing your financial future.

2 notes

·

View notes

Text

Can I get My USDT Back from a Scammer?

Yes, it is possible to recover your USDT (Tether) from a scammer with the help of a reputable recovery service like Recuva Hacker Solutions. This company specializes in tracing and recovering lost or stolen cryptocurrencies, including USDT. Here’s how Recuva Hacker Solutions can assist you in recovering your USDT:

Steps to Recover USDT with Recuva Hacker Solutions

1. Initial Consultation: Recuva Hacker Solutions starts with an initial consultation to gather all relevant information about the scam. This includes transaction details, wallet addresses, and any communication with the scammer. This information is crucial for developing a tailored recovery strategy.

2. Blockchain Analysis: Using advanced blockchain analysis tools, Recuva Hacker Solutions can trace the movement of your USDT across the blockchain. This involves identifying the transaction history and tracking the flow of funds to pinpoint where your USDT has been moved or stored.

3. Identifying the Scammer: Through meticulous investigation, Recuva Hacker Solutions works to identify the individual or group responsible for the scam. They analyze patterns and gather evidence to build a case against the scammer, which is essential for recovery and legal actions.

4. Legal Actions and Remedies: Once the scammer is identified, Recuva Hacker Solutions can assist in pursuing legal remedies. This may involve working with law enforcement agencies, obtaining court orders to freeze assets, or filing civil lawsuits to reclaim the stolen USDT.

5. Negotiation and Recovery: In some scenarios, Recuva Hacker Solutions may engage in direct negotiations with the scammer to recover the stolen funds. They use their expertise in negotiation and mediation to achieve the best possible outcome for their clients.

6. Ongoing Support and Updates: Throughout the recovery process, Recuva Hacker Solutions maintains open communication with their clients, providing regular updates and insights into the progress of the recovery effort. This transparency helps clients stay informed and involved.

7. Post-Recovery Services: Beyond recovering your USDT, Recuva Hacker Solutions offers advice on enhancing your security measures to prevent future scams. They provide guidance on safe practices for managing and storing cryptocurrencies.

Why Choose Recuva Hacker Solutions?

- Expertise and Experience: Recuva Hacker Solutions has a team of professionals with extensive backgrounds in cybersecurity, digital forensics, and financial investigation. Their expertise ensures that they can handle even the most complex cases effectively.

- Advanced Technology: The company uses state-of-the-art blockchain analysis and forensic tools to track and recover stolen cryptocurrencies.

- Ethical Practices: They operate with high ethical standards, ensuring client confidentiality and legal compliance in all their operations.

- Proven Track Record: Recuva Hacker Solutions has successfully recovered funds for numerous clients, earning a strong reputation in the cryptocurrency recovery industry.

- Client-Centric Approach: They prioritize client satisfaction, maintaining transparency and open communication throughout the recovery process.

Contacts for Recuva Hacker Solutions

- Email: recuvahackersolutions @ inbox . lv

- WhatsApp: +1 (315) (756) (1228)

In conclusion, if you've fallen victim to a USDT scam, Recuva Hacker Solutions can help you recover your assets. Their comprehensive approach, combining advanced technology, expert knowledge, and ethical practices, ensures the best possible chance of recovering your lost USDT and securing your financial future.

2 notes

·

View notes

Text

How Bitcoin Redefines Trust in Global Trade

For centuries, trust has been a cornerstone of global trade. Whether trading across borders or within nations, businesses have historically relied on governments, banks, and institutions to act as intermediaries, providing the necessary oversight and guarantees that transactions would be honored. But as our world becomes more digital and interconnected, the limitations and inefficiencies of these traditional systems are becoming increasingly evident. Enter Bitcoin—a decentralized currency that is fundamentally transforming the very nature of trust in global trade.

The Role of Trust in Traditional Trade

In the current global trade system, trust is largely built on central authorities—governments, central banks, and financial institutions. These intermediaries ensure stability, enforce contracts, and manage currencies. While this system has worked to some extent, it’s fraught with problems: corruption, inefficiencies, inflation, and geopolitical risks. For example, trade disputes can escalate into economic sanctions or currency manipulation, which can cripple businesses. Trust in these institutions can falter, and when it does, the global economy feels the effects.

Moreover, relying on the USD as the global reserve currency has its drawbacks. The USD's value fluctuates based on the policies of the U.S. government, including money printing, interest rate changes, and other interventions. This introduces volatility into global markets and trade relationships, often to the detriment of smaller, emerging economies.

Bitcoin as a Trustless System

Bitcoin offers a radically different approach. Built on blockchain technology, Bitcoin eliminates the need for intermediaries. Instead of relying on a centralized authority to verify and approve transactions, Bitcoin operates through a decentralized network where transactions are publicly recorded and verified by code. This concept of "trustless" transactions means that participants don't need to rely on a central authority to validate their exchanges.

By removing the need for middlemen, Bitcoin reduces transaction costs, increases transparency, and provides a level of security that is nearly impossible to breach. This decentralization also means that no single entity—government or financial institution—can manipulate the currency for its own gain, making it a more stable and reliable form of value transfer in global trade.

Decentralization and Its Impact on Global Trade