#Brian Meller

Text

leamichele My people ❤️

39 notes

·

View notes

Text

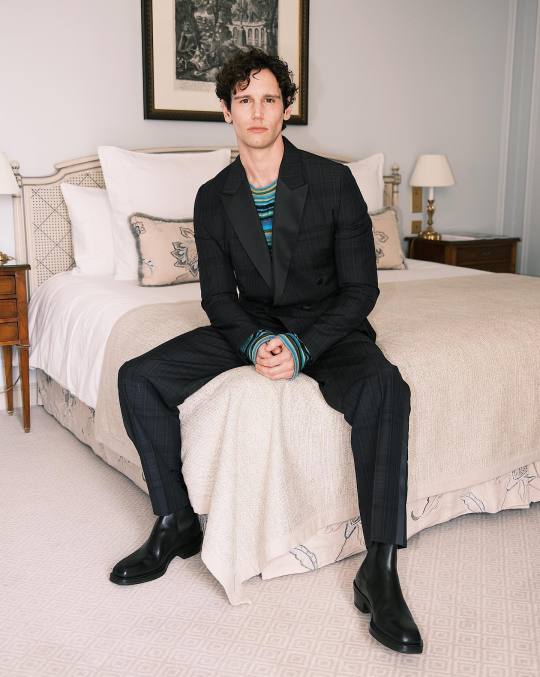

Cory Michael Smith in Dior ahead of the Spring/Summer '24 show

via stylist Brian Meller's IG

#cory michael smith#paris fashion week#cory is in his model era#during his hot girl summer ☀️#but also the smile!#and sweater paws#i can't#dior#dior tears collection

13 notes

·

View notes

Audio

(Air Snare Music) Air Snare proudly presents Underground Sound from Lebanon, compiled by Gunther & Kaa joining forces with a bold and edgy selection through a rich array of original tracks showcasing both established and upcoming electronic music producers from the land of the Cedars, including Big Al, Gunther, Kaa, Etyen, Rise 1969, Jason Kaakoush, Bachir Salloum, Wassim Younes, Stephanie Merchak, Madchords.

Air Snare Records is an electronic music label established in 2009 founded by Kaa & Brianoid. With the purpose of always pushing the sonic and visual boundaries through releases by respected artists such as Cid Inc, D-Nox & Beckers, RPO, Duca, Peter Gun, Meller, D-Sens, Aerodroeme just to name a few. With a library of over 100 tracks spread throughout more than 20 releases, Kaa & Brian have been able to showcase Lebanon and India's finest electronic music producers together with some of the hottest names in the game.

#SoundCloud#music#Air Snare Music#Electronica#Downtempo#Story#Ambient#airsnare#airsnaremusic#airsnarerecords#underground sound from Lebanon#Gunther#Kaa#Wassim Younes#Poetic Rage

1 note

·

View note

Text

澳洲金融业曝重大丑闻!AMP总裁即刻下台 | 澳洲都市报

在银行业皇家委员会揭露了澳大利亚财富管理巨头AMP集团涉及130亿澳元的令人震惊的不当行为丑闻之后,AMP首席执行官Craig Meller立即下台并被没收奖金。

AMP首席执行官Craig Meller 立刻离职 图片:Hollie Adams

新一轮听证会披露,该公司向没有收到任何服务的客户收取费用的方式存在系统性的不当行为。丑闻还包括篡改独立报告,并且误导金融监管机构。

AMP为听证会披露的有关该公司理财建���的丑闻“毫无保留地”道歉。这家金融服务提供商今早宣布,总裁Meller已经“同意”立即退休。

在由Kenneth Hayne领导的针对银行业的皇家委员会第二轮听证会之前,Meller先生就曾宣布将于2018年底退休。Meller先生将放弃与最新财政年度有关的任何股权红利。

Meller先生表示,对于皇家委员会所发现的问题以及对客户的影响,他“本人感到震惊”,他的离职对于开展重建对AMP的信任的工作是“正确的措施”。

对该公司的合规性进行审查期间,AMP集团法律顾问,该公司最大的法律负责人Brian Salter也将休假。

AMP董事会的非执行董事Mike Wilkins将接替Meller先生的职位,直至找到永久替代人员。Wilkins先生自2016年9月起出任AMP董事,他也是澳大利亚保险集团的前首席执行官。

AMP还将对公司的监管报告和治理流程进行“即时,全面的评估”。该公司表示,这项工作将由退休法官或同等独立专家监督,并将“立即任命”。

AMP董事会委员会还将审查皇家委员会提出的问题,该委员会将由临时总裁Wilkins先生领导,并由Kingwood & Mallesons律师事务所协助。

在AMP承认对从未收到理财建议的客户收费并且屡次向企业监管机构说谎之后,这间财富管理巨头的股价一路下跌。

皇家委员会昨日获悉,该公司篡改了律师事务所Clayton Utz对丑闻所做的一份独立报告,并且曾误导澳大利亚证券和投资委员会。之后该公司股价跌至四年来的新低点。

“AMP为我们的咨询业务中的不当行为和没有进行监管披露毫无保留地道歉,”AMP董事会主席Catherine Brenner说。“董事会决定,我们将应对这些挑战,加速AMP在文化和绩效方面做出改变。”

联邦财长Scott Morrison周三警告称,ASIC正在调查该公司,高管可能会因为行为违规面临监禁。

Meller先生昨天承认,理财顾问和他们的许多客户会被这些披露感到“震惊”,但持续的ASIC调查妨碍了AMP能更早地分享更多信息。

他表示,未提供服务却收费的问题非常复杂,涉及对理财顾问提供持续服务的收费不当,以及当顾客在转换顾问时将费用保留90天的商业惯例。

AMP向皇家委员会报告说,2009年至2016年期间有15,712名客户受到这种做法的影响。赔偿计划包括向客户支付470万澳元,其中85万与所谓的90天离开费的规定有关。

Meller先生说,不提供服务却收费是不应当的,AMP在2016年就停止了这种做法。

而在一个关键性的承认中,他表示该公司向ASIC报告此事的方式是“误导性的”。

Bell Potter分析师Lafitani Sotiriou表示,皇家委员会可能会迫使该集团进行一次彻底的董事会人员更新。过去两年来,Sotiriou先生一直敦促AMP投资者将该公司股票卖掉,因为该公司面临更高的合规和监管成本。他说,目前该公司面临集体诉讼的风险越来越大,因为投资者可能会争辩说他们没有得到适当的通知。其他的疑虑包括,如果管理层对相关事务进行审计,可能导致对该集团的盈利预期作出重大修改。

AMP还可能面临进一步的客户补偿和更高的持续合规成本。

自从担任AMP董事会主席以来, Brenner女士的领导风格也引发争议。她在担任该职位的头几个月里曾说,管理层必须“更快”地为股东提供回报,然后披露一位大股东呼吁解雇Meller先生。

坊间一直讨论该公司董事会的分歧导致了前董事会主席Simon McKeon在2016年初的突然离职。关于McKeon先生退出的原因尚未有公开披露,但有多份报道表明,该公司董事会成员之间在业务收益率方面存在摩擦。

来源:澳洲都市报(Australian City Daily) 微信公众号:AuCityDaily

原文地址: http://www.aucitydaily.com/finance/4593.html

1 note

·

View note

Text

Banking royal commission: Who’s next? The banking and finance executives who have already walked away

Banking royal commission: Who’s next? The banking and finance executives who have already walked away

Some high-profile finance figures have already stepped away from their roles even before the release of the Hayne commission’s final report.

AMP

Chief executive Craig Meller, chair Catherine Brenner, chief legal officer Brian Salter and several directors departed after the wealth manager was revealed to have charged customers fees for financial advice that was never delivered and then lied about…

View On WordPress

0 notes

Text

Banking royal commission: Bankers sweating on final Hayne report

Banking royal commission: Bankers sweating on final Hayne report

AMP

It is hard to overstate the impact of the revelations about AMP. They shocked the nation, forcing the exit of Ms Brenner, CEO Craig Meller and general counsel Brian Salter.

It was revealed in April this trio had requested extensive changes to a report the company commissioned law firm Clayton Utz and presented it to the regulator under the guise of being an independent report.

The action was…

View On WordPress

0 notes

Text

Australia banking scandal claims more AMP scalps, chairwoman quits

SYDNEY (Reuters) – Australia’s largest-listed wealth manager AMP announced the resignations of its chairwoman and legal counsel on Monday, and slashed its directors’ fees by a quarter as it races to stem the fallout from damaging revelations of misconduct at the firm.

FILE PHOTO: The logo of AMP Ltd, Australia’s biggest retail wealth manager, adorns their head office located in central Sydney, Australia, May 5, 2017. REUTERS/David Gray/File Photo

The exits follow disclosures at a judicial inquiry into the country’s financial sector that AMP misled many customers and deceived the corporate regulator. The scandal has already caused the early departure of CEO Craig Meller, who was due to leave by year end, and analysts expect more heads will roll.

Chairwoman Catherine Brenner and group General Counsel Brian Salter will depart immediately, AMP said in a statement.

Mike Wilkins, a former independent director who has been named both interim chairman and CEO, said the evidence given to the government-backed Royal Commission is “being treated extremely seriously by the board”.

“Appropriate steps are being taken to address the issues raised, and remediating our customers is being given utmost priority,” he said.

AMP, which is also staring at a possible class action, has seen around A$2.2 billion ($1.7 billion) wiped off its market capitalization over the past two weeks in the wake of the revelations. It was valued at A$11.6 billion at Friday’s close.

The inquiry was told that advisers at AMP misappropriated funds of thousands of clients over the last decade by charging them without providing advice, and that it had repeatedly lied to the Australian Securities and Investments Commission (ASIC).

Counsel assisting the inquiry said on Friday that AMP had breached provisions of the Corporations Act that carry criminal sanctions.

Brenner, Salter and Meller were singled out by the inquiry as part of a group of senior executives that allegedly modified a report by law firm Clayton Utz and submitted it to the regulator in late 2017 as “external and independent”.

Their intention was to limit the report’s findings about the involvement of AMP’s senior executives in misappropriating customer fees, the inquiry heard.

AMP said in its statement that Brenner, Meller and the other directors “did not act inappropriately in relation to the preparation of the Clayton Utz report”.

The statement did not comment on Salter’s behavior.

REMUNERATION CONSEQUENCES

The company said it would make a formal submission in response to the allegations raised at the commission by May 4.

The “employment and remuneration consequences” for individuals who were responsible for charging fraudulent fees will be determined once an external employment review is completed, which is expected shortly, it said.

AMP added that it would slash fees for board directors by 25 percent for the rest of 2018 as a recognition of the “collective governance accountability for the issues raised in the Royal Commission and for their impact on the reputation of AMP”.

AMP has already started searching for a new CEO, and will fast track the selection of a new chair to “help ensure stability and further strengthen governance”, Wilkins said.

David Ellis, an analyst at Morningstar, said it was likely more executives and board members would leave in coming weeks.

“All bets are off,” Ellis said. “With a new CEO and a new board, the future strategy could be completely different.”

AMP is currently staring at a possible shareholder class action, with litigation financier IMF Bentham Ltd saying it plans to fund one against the wealth manager regarding alleged misconduct as revealed by the commission.

An AMP spokeswoman declined to comment on the proposed class action.

The Royal Commission is just a couple of months into what is expected to be a year-long investigation. The inquiry will be able to make wide-ranging recommendations including legislative changes and on criminal or civil prosecutions.

($1 = 1.3201 Australian dollars)

Reporting by Aaron Saldanha in Bengaluru; Editing by Jane Wardell and Himani Sarkar

The post Australia banking scandal claims more AMP scalps, chairwoman quits appeared first on World The News.

from World The News https://ift.tt/2HCrrdT

via News of World

0 notes

Text

Australia banking scandal claims more AMP scalps, chairwoman quits

SYDNEY (Reuters) – Australia’s largest-listed wealth manager AMP announced the resignations of its chairwoman and legal counsel on Monday, and slashed its directors’ fees by a quarter as it races to stem the fallout from damaging revelations of misconduct at the firm.

FILE PHOTO: The logo of AMP Ltd, Australia’s biggest retail wealth manager, adorns their head office located in central Sydney, Australia, May 5, 2017. REUTERS/David Gray/File Photo

The exits follow disclosures at a judicial inquiry into the country’s financial sector that AMP misled many customers and deceived the corporate regulator. The scandal has already caused the early departure of CEO Craig Meller, who was due to leave by year end, and analysts expect more heads will roll.

Chairwoman Catherine Brenner and group General Counsel Brian Salter will depart immediately, AMP said in a statement.

Mike Wilkins, a former independent director who has been named both interim chairman and CEO, said the evidence given to the government-backed Royal Commission is “being treated extremely seriously by the board”.

“Appropriate steps are being taken to address the issues raised, and remediating our customers is being given utmost priority,” he said.

AMP, which is also staring at a possible class action, has seen around A$2.2 billion ($1.7 billion) wiped off its market capitalization over the past two weeks in the wake of the revelations. It was valued at A$11.6 billion at Friday’s close.

The inquiry was told that advisers at AMP misappropriated funds of thousands of clients over the last decade by charging them without providing advice, and that it had repeatedly lied to the Australian Securities and Investments Commission (ASIC).

Counsel assisting the inquiry said on Friday that AMP had breached provisions of the Corporations Act that carry criminal sanctions.

Brenner, Salter and Meller were singled out by the inquiry as part of a group of senior executives that allegedly modified a report by law firm Clayton Utz and submitted it to the regulator in late 2017 as “external and independent”.

Their intention was to limit the report’s findings about the involvement of AMP’s senior executives in misappropriating customer fees, the inquiry heard.

AMP said in its statement that Brenner, Meller and the other directors “did not act inappropriately in relation to the preparation of the Clayton Utz report”.

The statement did not comment on Salter’s behavior.

REMUNERATION CONSEQUENCES

The company said it would make a formal submission in response to the allegations raised at the commission by May 4.

The “employment and remuneration consequences” for individuals who were responsible for charging fraudulent fees will be determined once an external employment review is completed, which is expected shortly, it said.

AMP added that it would slash fees for board directors by 25 percent for the rest of 2018 as a recognition of the “collective governance accountability for the issues raised in the Royal Commission and for their impact on the reputation of AMP”.

AMP has already started searching for a new CEO, and will fast track the selection of a new chair to “help ensure stability and further strengthen governance”, Wilkins said.

David Ellis, an analyst at Morningstar, said it was likely more executives and board members would leave in coming weeks.

“All bets are off,” Ellis said. “With a new CEO and a new board, the future strategy could be completely different.”

AMP is currently staring at a possible shareholder class action, with litigation financier IMF Bentham Ltd saying it plans to fund one against the wealth manager regarding alleged misconduct as revealed by the commission.

An AMP spokeswoman declined to comment on the proposed class action.

The Royal Commission is just a couple of months into what is expected to be a year-long investigation. The inquiry will be able to make wide-ranging recommendations including legislative changes and on criminal or civil prosecutions.

($1 = 1.3201 Australian dollars)

Reporting by Aaron Saldanha in Bengaluru; Editing by Jane Wardell and Himani Sarkar

The post Australia banking scandal claims more AMP scalps, chairwoman quits appeared first on World The News.

from World The News https://ift.tt/2HCrrdT

via Online News

#World News#Today News#Daily News#Breaking News#News Headline#Entertainment News#Sports news#Sci-Tech

0 notes

Text

AMP chairwoman, legal counsel exit in wake of misconduct scandal

SYDNEY (Reuters) – AMP Ltd announced the resignations of its chairwoman and legal counsel, and slashed its directors’ fees by a quarter, as Australia’s largest listed-wealth manager tries to stem the fallout from damaging revelations of misconduct.

FILE PHOTO: The logo of AMP Ltd, Australia’s biggest retail wealth manager, adorns their head office located in central Sydney, Australia, May 5, 2017. REUTERS/David Gray/File Photo

The exits come just a week after the departure of CEO Craig Meller in the wake of disclosures at a judicial inquiry into the country’s financial sector that AMP misled customers and repeatedly deceived the corporate regulator.

Chairwoman Catherine Brenner and group general counsel Brian Salter will depart immediately, AMP said in a statement.

Mike Wilkins, who has been named both interim chairman and CEO, said the evidence given to the government-backed Royal Commission is “being treated extremely seriously by the board”.

“Appropriate steps are being taken to address the issues raised, and remediating our customers is being given utmost priority,” he said on Monday.

AMP has seen around A$2.2 billion ($1.7 billion) wiped off its market capitalization during the commission’s two-week public hearing focusing on financial advice. It was valued at A$11.6 billion at Friday’s close.

The hearing was told that advisers at AMP misappropriated funds of thousands of clients over the last decade by charging them without providing advice, and that it had repeatedly lied to the Australian Securities and Investments Commission (ASIC).

Counsel assisting the inquiry warned on Friday that AMP had breached provisions of the Corporations Act that carry criminal sanctions.

The Royal Commission is just a couple of months into what is expected to be a year-long investigation. The inquiry will be able to make wide-ranging recommendations including legislative changes and on criminal or civil prosecutions.

Wilkins said the selection of a new AMP chair would be fast tracked, along with the CEO search already underway, to “help ensure stability and further strengthen governance”.

AMP said it will reduce fees for all board directors by 25 percent for the rest of 2018 as a recognition of the “collective governance accountability for the issues raised in the Royal Commission and for their impact on the reputation of AMP.”

It also said the “employment and remuneration consequences” for individuals who were responsible for charging fraudulent fees would be determined once an external employment review was completed, which it expected shortly.

The company said it will be making a formal submission in response to the allegations raised at the Commission by May 4.

Reporting by Aaron Saldanha in Bengaluru; Editing by Jane Wardell and Himani Sarkar

The post AMP chairwoman, legal counsel exit in wake of misconduct scandal appeared first on World The News.

from World The News https://ift.tt/2vWt7gV

via Breaking News

0 notes

Text

AMP chairwoman, legal counsel exit in wake of misconduct scandal

SYDNEY (Reuters) – AMP Ltd announced the resignations of its chairwoman and legal counsel, and slashed its directors’ fees by a quarter, as Australia’s largest listed-wealth manager tries to stem the fallout from damaging revelations of misconduct.

FILE PHOTO: The logo of AMP Ltd, Australia’s biggest retail wealth manager, adorns their head office located in central Sydney, Australia, May 5, 2017. REUTERS/David Gray/File Photo

The exits come just a week after the departure of CEO Craig Meller in the wake of disclosures at a judicial inquiry into the country’s financial sector that AMP misled customers and repeatedly deceived the corporate regulator.

Chairwoman Catherine Brenner and group general counsel Brian Salter will depart immediately, AMP said in a statement.

Mike Wilkins, who has been named both interim chairman and CEO, said the evidence given to the government-backed Royal Commission is “being treated extremely seriously by the board”.

“Appropriate steps are being taken to address the issues raised, and remediating our customers is being given utmost priority,” he said on Monday.

AMP has seen around A$2.2 billion ($1.7 billion) wiped off its market capitalization during the commission’s two-week public hearing focusing on financial advice. It was valued at A$11.6 billion at Friday’s close.

The hearing was told that advisers at AMP misappropriated funds of thousands of clients over the last decade by charging them without providing advice, and that it had repeatedly lied to the Australian Securities and Investments Commission (ASIC).

Counsel assisting the inquiry warned on Friday that AMP had breached provisions of the Corporations Act that carry criminal sanctions.

The Royal Commission is just a couple of months into what is expected to be a year-long investigation. The inquiry will be able to make wide-ranging recommendations including legislative changes and on criminal or civil prosecutions.

Wilkins said the selection of a new AMP chair would be fast tracked, along with the CEO search already underway, to “help ensure stability and further strengthen governance”.

AMP said it will reduce fees for all board directors by 25 percent for the rest of 2018 as a recognition of the “collective governance accountability for the issues raised in the Royal Commission and for their impact on the reputation of AMP.”

It also said the “employment and remuneration consequences” for individuals who were responsible for charging fraudulent fees would be determined once an external employment review was completed, which it expected shortly.

The company said it will be making a formal submission in response to the allegations raised at the Commission by May 4.

Reporting by Aaron Saldanha in Bengaluru; Editing by Jane Wardell and Himani Sarkar

The post AMP chairwoman, legal counsel exit in wake of misconduct scandal appeared first on World The News.

from World The News https://ift.tt/2vWt7gV

via Today News

0 notes

Text

Late photos from the Met Gala posted by Lea Michele.

46 notes

·

View notes

Text

AMP chairwoman, legal counsel exit in wake of misconduct scandal

SYDNEY (Reuters) – AMP Ltd announced the resignations of its chairwoman and legal counsel, and slashed its directors’ fees by a quarter, as Australia’s largest listed-wealth manager tries to stem the fallout from damaging revelations of misconduct.

FILE PHOTO: The logo of AMP Ltd, Australia’s biggest retail wealth manager, adorns their head office located in central Sydney, Australia, May 5, 2017. REUTERS/David Gray/File Photo

The exits come just a week after the departure of CEO Craig Meller in the wake of disclosures at a judicial inquiry into the country’s financial sector that AMP misled customers and repeatedly deceived the corporate regulator.

Chairwoman Catherine Brenner and group general counsel Brian Salter will depart immediately, AMP said in a statement.

Mike Wilkins, who has been named both interim chairman and CEO, said the evidence given to the government-backed Royal Commission is “being treated extremely seriously by the board”.

“Appropriate steps are being taken to address the issues raised, and remediating our customers is being given utmost priority,” he said on Monday.

AMP has seen around A$2.2 billion ($1.7 billion) wiped off its market capitalization during the commission’s two-week public hearing focusing on financial advice. It was valued at A$11.6 billion at Friday’s close.

The hearing was told that advisers at AMP misappropriated funds of thousands of clients over the last decade by charging them without providing advice, and that it had repeatedly lied to the Australian Securities and Investments Commission (ASIC).

Counsel assisting the inquiry warned on Friday that AMP had breached provisions of the Corporations Act that carry criminal sanctions.

The Royal Commission is just a couple of months into what is expected to be a year-long investigation. The inquiry will be able to make wide-ranging recommendations including legislative changes and on criminal or civil prosecutions.

Wilkins said the selection of a new AMP chair would be fast tracked, along with the CEO search already underway, to “help ensure stability and further strengthen governance”.

AMP said it will reduce fees for all board directors by 25 percent for the rest of 2018 as a recognition of the “collective governance accountability for the issues raised in the Royal Commission and for their impact on the reputation of AMP.”

It also said the “employment and remuneration consequences” for individuals who were responsible for charging fraudulent fees would be determined once an external employment review was completed, which it expected shortly.

The company said it will be making a formal submission in response to the allegations raised at the Commission by May 4.

Reporting by Aaron Saldanha in Bengaluru; Editing by Jane Wardell and Himani Sarkar

The post AMP chairwoman, legal counsel exit in wake of misconduct scandal appeared first on World The News.

from World The News https://ift.tt/2vWt7gV

via Everyday News

0 notes

Text

Untitled Document

April 7, 2017

Apeiron, Vol. 50, #2, 2017

Canadian Journal of Philosophy, Vol. 47, #2-3, 2017

Erkenntnis, Vol. 82, #2, 2017

Hume Studies, Vol. 41, #1, 2015

Journal of Business Ethics, Vol. 141, #4, 2017

Journal of the History of Ideas, Vol. 78, #2, 2017

Journal of Speculative Philosophy, Vol. 31, #2, 2017

Judgment and Decision Making, Vol. 12, #2, 2017

Mind & Language, Vol. 32, #2, 2017

Philosophia, Vol. 44, #4, 2017

Philosophical Studies, Vol. 174, #5, 2017

Philosophy of Science, Vol. 84, #2, 2017

Philosophy, Psychiatry, & Psychology, Vol. 24, #1, 2017

Phronesis, Vol. 62, #2, 2017

Apeiron, Vol. 50, #2, 2017

Research Articles

Margarita Vega. Bridging the Gap between Aristotle’s Use and Theory of Metaphora.

Carries Swanson. Aristotle on Ignorance of the Definition of Refutation.

Justin Humphreys. Abstraction and Diagrammatic Reasoning in Aristotle’s Philosophy of Geometry.

Ignacio De Ribera-Martin. Unity and Continuity in Aristotle.

Fei-Ting Chen. A Hylomorphic Reading of Non-Genuine Qualitative Changes in Aristotle’s Physics VII.3.

Back to Top

Canadian Journal of Philosophy, Vol. 47, #2-3, 2017

Special Issue: Ethics and Future Generations

Articles

Richard Yetter Chappell. Rethinking the Asymmetry.

Jake Earl. A Portable Defense of the Procreation Asymmetry.

Melinda A. Roberts. Is a Person-Affecting Solution to the Nonidentity Problem Impossible? Axiology, Accessibility and Additional People.

Pranay Sanklecha. Our Obligations to Future Generations: The Limits of Intergenerational Justice and the Necessity of the Ethics of Metaphysics.

Tim Meijers. Citizens in Appropriate Numbers: Evaluating Five Claims about Justice and Population Size.

Eric Brandstedt. The Savings Problem in the Original Position: Assessing and Revising a Model.

Tim Mulgan. How Should Utilitarians Think about the Future?

Janna Thompson. The Ethics of Intergenerational Relationships.

Elizabeth Finneron-Burns. What's Wrong with Human Extinction?

Johann Frick. On the Survival of Humanity.

Stephen M. Gardiner. The Threat of Intergenerational Extortion: On the Temptation to become the Climate Mafia, Masquerading as an Intergenerational Robin Hood.

Catriona McKinnon. Endangering Humanity: An International Crime?

Brian Berkey. Human Rights, Harm, and Climate Change Mitigation.

Back to Top

Erkenntnis, Vol. 82, #2, 2017

Original Articles

Luca Sciortino. On Ian Hacking’s Notion of Style of Reasoning.

Kevin Reuter. The Developmental Challenge to the Paradox of Pain.

Matthew Frise. Internalism and the Problem of Stored Beliefs.

Jeroen Smid. Material Constitution is Ad Hoc.

Justin A. Capes. Freedom with Causation.

Jakob Koscholke. Carnap’s Relevance Measure as a Probabilistic Measure of Coherence.

Megan Henricks Stotts. Understanding the Intentions Behind the Referential/Attributive Distinction.

Patrik Hummel. Against the Complex versus Simple Distinction.

Edward Elliott. Probabilism, Representation Theorems, and Whether Deliberation Crowds Out Prediction.

J. B. Paris, A. Vencovská. Combining Analogical Support in Pure Inductive Logic.

Liam Kofi Bright. Decision Theoretic Model of the Productivity Gap.

Book Review

Florian Boge. Simon Friederich: Interpreting Quantum Theory: A Therapeutic Approach.

Back to Top

Hume Studies, Vol. 41, #1, 2015

Articles

Lisa Ievers. The Method in Hume’s “Madness”.

Jennifer Welchman. Self-Love and Personal Identity in Hume’s Treatise.

Book Symposium: Andrew Sabl’s Hume’s Politics: Coordination and Crisis in the History of England

Willem Lemmens. “Sweden Is Still a Kingdom”: Convention and Political Authority in Hume’s History of England.

Mark G. Spencer. “Distant and Commonly Faint and Disfigured Originals”: Hume’s Magna Charta and Sabl’s Fundamental Constitutional Conventions.

Ryu Susato. “Politics May Be Reduced To a Science”?: Between Politics and Economics in Hume’s Concepts of Convention.

Andrew Sabl. Reply to My Critics.

Back to Top

Journal of Business Ethics, Vol. 141, #4, 2017

Special issue on Moral Emotions and Ethics in Organizations; Issue Editors: Dirk Lindebaum, Deanna Geddes, Yiannis Gabriel

Editorial

Dirk Lindebaum, Deanna Geddes, Yiannis Gabriel. Moral Emotions and Ethics in Organisations: Introduction to the Special Issue.

Original Papers

Steven A. Murphy, Sandra Kiffin-Petersen. The Exposed Self: A Multilevel Model of Shame and Ethical Behavior.

Adriana Wilner, Tania Pereira Christopoulos. The Online Unmanaged Organization: Control and Resistance in a Space with Blurred Boundaries.

Marie Dasborough, Paul Harvey. Schadenfreude: The (not so) Secret Joy of Another’s Misfortune.

Srinath Jagannathan, Rajnish Rai. Organizational Wrongs, Moral Anger and the Temporality of Crisis.

Fahri Karakas, Emine Sarigollu, Selcuk Uygur. Exploring the Diversity of Virtues Through the Lens of Moral Imagination: A Qualitative Inquiry into Organizational Virtues in the Turkish Context.

J. J. de Klerk. Nobody is as Blind as Those Who Cannot Bear to See: Psychoanalytic Perspectives on the Management of Emotions and Moral Blindness.

Carol Linehan, Elaine O’Brien. From Tell-Tale Signs to Irreconcilable Struggles: The Value of Emotion in Exploring the Ethical Dilemmas of Human Resource Professionals.

Paul Harvey, Mark J. Martinko, Nancy Borkowski. Justifying Deviant Behavior: The Role of Attributions and Moral Emotions.

Benjamin R. Walker, Chris J. Jackson. Moral Emotions and Corporate Psychopathy: A Review.

Back to Top

Journal of the History of Ideas, Vol. 78, #2, 2017

Articles

Jacomien Prins. Girolamo Cardano and Julius Caesar Scaliger in Debate about Nature’s Musical Secrets.

Henrique Leitão, Antonio Sánchez. Zilsel’s Thesis, Maritime Culture, and Iberian Science in Early Modern Europe.

Wiep van Bunge. Spinoza’s Life: 1677–1802.

Amos Bitzan. Leopold Zunz and the Meanings of Wissenschaft.

Mark Bevir. John Rawls in Light of the Archive: Introduction to the Symposium on the Rawls Papers.

David A. Reidy. Rawls on Philosophy and Democracy: Lessons from the Archived Papers.

P. MacKenzie Bok. “The Latest Invasion from Britain”: Young Rawls and His Community of American Ethical Theorists.

Daniele Botti. Rawls on Dewey before the Dewey Lectures.

Andrius Gališanka. Just Society as a Fair Game: John Rawls and Game Theory in the 1950s.

Back to Top

Journal of Speculative Philosophy, Vol. 31, #2, 2017

Articles

Arvi Särkelä, Justo Serrano Zamora. John Dewey and Social Criticism: An Introduction.

Arvi Särkelä. Immanent Critique as Self-Transformative Practice: Hegel, Dewey, and Contemporary Critical Theory.

Italo Testa. The Authority of Life: The Critical Task of Dewey’s Social Ontology.

Arto Laitinen. Dewey’s Progressive Historicism and the Problem of Determinate Oughts.

Roberto Frega. A Tale of Two Social Philosophies.

Federica Gregoratto. The Critical Nature of Gender: A Deweyan Approach to the Sex/Gender Distinction.

Emmanuel Renault. Dewey’s Critical Conception of Work.

Justo Serrano Zamora. Overcoming Hermeneutical Injustice: Cultural Self-Appropriation and the Epistemic Practices of the Oppressed.

Back to Top

Judgment and Decision Making, Vol. 12, #2, 2017

Articles

Yuanchao Emily Bo, David V. Budescu, Charles Lewis, Philip E. Tetlock and Barbara Mellers. An IRT Forecasting Model: Linking Proper Scoring Rules to Item Response Theory.

Paul M. Krueger, Robert C. Wilson and Jonathan D. Cohen. Strategies for Exploration in the Domain of Losses.

Matteo Ploner. Hold on to it? An Experimental Analysis of the Disposition Effect.

Nathaniel J. S. Ashby. Numeracy Predicts Preference Consistency: Deliberative Search Heuristics Increase Choice Consistency for Choices from Description and Experience.

Onurcan Yilmaz and S. Adil Saribay. The Relationship between Cognitive Style and Political Orientation depends on the Measures Used.

Michał Białek and Wim De Neys. Dual Processes and Moral Conflict: Evidence for Deontological Reasoners’ Intuitive Utilitarian Sensitivity.

Rostislav Staněk. Home Bias in Sport Betting: Evidence from Czech Betting Market.

Anna Katharina Spälti, Mark J. Brandt and Marcel Zeelenberg. Memory Retrieval Processes Help Explain the Incumbency Advantage.

Tessa Haesevoets, Alain Van Hiel, Mario Pandelaere, Dries H. Bostyn and David De Cremer. How much Compensation is too much? An Investigation of the Effectiveness of Financial Overcompensation as a Means to Enhance Customer Loyalty.

Back to Top

Mind & Language, Vol. 32, #2, 2017

Original Articles

Glyn Humphreys (28 December 1954 – 14 January 2016).

Martin Davies. Glyn Humphreys: Attention, Binding, Motion-Induced Blindness.

Casey O'Callaghan. Grades of Multisensory Awareness.

Tom Cochrane and Keeley Heaton. Intrusive Uncertainty in Obsessive Compulsive Disorder.

Robert Schroer. Hume's Table, Peacocke's Trees, the Tilted Penny and the Reversed Seeing-in Account.

Chiara Brozzo. Motor Intentions: How Intentions and Motor Representations Come Together.

Back to Top

Philosophia, Vol. 44, #4, 2017

Special Issue contents: Forgiveness and Conflict / Guest edited by Paula Satne (pp 999-1124); Constitutive arguments and Kantian Constructivism / Guest edited by Sorin Baiasu and Christoph Hanisch (pp 1125-1246); Ineffability and Religious Experience: A Symposium (pp 1247-1438)

Original Papers

Xingming Hu. A Critical Survey of Some Recent Philosophical Research in China.

Paula Satne. Introduction: Forgiveness and Conflict.

Oliver Hallich. A Plea against Apologies.

Geoffrey Scarre. Forgiveness and Identification.

Paula Satne. Forgiveness and Moral Development.

Monica Mookherjee. Healing Multiculturalism: Middle-Ground Liberal Forgiveness in a Diverse Public Realm.

Maša Mrovlje. Forgiveness, Representative Judgement and Love of the World: Exploring the Political Significance of Forgiveness in the Context of Transitional Justice and Reconciliation Debates.

Bill Wringe. Punishment, Forgiveness and Reconciliation.

Christoph Hanisch, Sorin Baiasu. Constitutivism and Kantian Constructivism in Ethical Theory: Editorial Introduction.

Christine Bratu, Moritz Dittmeyer. Constitutivism About Practical Principles: Its Claims, Goals, Task and Failure.

Christoph Hanisch. Constitutivism and Inescapability: A Diagnosis.

Caroline T. Arruda. Constitutivism and the Self-Reflection Requirement.

Sorin Baiasu. Constitutivism and Transcendental Practical Philosophy: How to Pull the Rabbit Out of the Hat.

Jochen Bojanowski. Kant’s Solution to the Euthyphro Dilemma.

Carla Bagnoli. Kantian Constructivism and the Moral Problem.

Thaddeus Metz. Is Life’s Meaning Ultimately Unthinkable?: Guy Bennett-Hunter on the Ineffable.

David E. Cooper. Music, Nature and Ineffability.

Guy Bennett-Hunter. Ineffability: Reply to Professors Metz and Cooper.

Richard Brook. Berkeley and the Primary Qualities: Idealization vs. Abstraction.

Shlomo Cohen. Are There Moral Limits to Military Deception?

David Deming. Do Extraordinary Claims Require Extraordinary Evidence?

Dylan B. Futter. Philosophical Anti-authoritarianism.

Christos Kyriacou. Are Evolutionary Debunking Arguments Self-Debunking?

Vanessa Lam. On Smilansky’s Defense of Prepunishment: A Response to Robinson.

Ole Martin Moen. An Argument for Intrinsic Value Monism.

Graham Renz. It’s All in your Head: a Solution to the Problem of Object Coincidence.

Benjamin Yelle. In Defense of Sophisticated Theories of Welfare.

Aleksandar Fatić, Ivana Zagorac. The Methodology of Philosophical Practice: Eclecticism and/or Integrativeness?

Back to Top

Philosophical Studies, Vol. 174, #5, 2017

Original Papers

Jens Kipper. Propositional Apriority and the Nesting Problem.

Davide Bordini. Is there Introspective Evidence for Phenomenal Intentionality?

Nicholas Smyth. The Function of Morality.

David H. Glass. Science, God and Ockham’s Razor.

Hilary Greaves, Harvey Lederman. Aggregating Extended Preferences.

Stephan Krämer, Stefan Roski. Difference-Making Grounds.

Amy Berg. Abortion and Miscarriage.

Maarten Steenhagen. False Reflections.

Jonathan Brink Morgan. Naïve Realism and Phenomenal Overlap.

Oisín Deery, Eddy Nahmias. Defeating Manipulation Arguments: Interventionist Causation and Compatibilist Sourcehood.

Michael Bertrand. Fundamental Ontological Structure: An Argument against Pluralism.

Santiago Echeverri. How to Undercut Radical Skepticism.

David Rose. Folk Intuitions of Actual Causation: A Two-pronged Debunking Explanation.

Erratum

Mihaela Popa-Wyatt. Erratum to: Go Figure: Understanding Figurative Talk.

Back to Top

Philosophy of Science, Vol. 84, #2, 2017

Papers

Glauber De Bona, Julia Staffel. Graded Incoherence for Accuracy-Firsters.

Michael Baumgartner, Lorenzo Casini. An Abductive Theory of Constitution.

Sarita Rosenstock, Justin Bruner, Cailin O’Connor. In Epistemic Networks, Is Less Really More?

William Bechtel. Explicating Top-Down Causation Using Networks and Dynamics.

W. Ford Doolittle. Making the Most of Clade Selection.

John P. Jackson Jr. Cognitive/Evolutionary Psychology and the History of Racism.

Bryan W. Roberts. Three Myths about Time Reversal in Quantum Theory.

Leif Hancox-Li. Solutions in Constructive Field Theory.

Discussion Note

Nevin Climenhaga. How Explanation Guides Confirmation.

Essay Reviews

P. Kyle Stanford. Bending toward Justice.

Michelle Pham. Review of Making Medical Knowledge.

Back to Top

Philosophy, Psychiatry, & Psychology, Vol. 24, #1, 2017

Feature Articles

Jarkko Jalava, Stephanie Griffiths. Philosophers On Psychopaths: A Cautionary Tale in Interdisciplinarity.

Raymond M. Bergner, Nora Bunford. Mental Disorder Is a Disability Concept, Not a Behavioral One.

Line Ryberg Ingerslev, Dorothée Legrand. Clinical Response to Bodily Symptoms in Psychopathology.

Brian D. Earp, Olga A. Wudarczyk, Bennett Foddy, Julian Savulescu. Addicted to Love: What Is Love Addiction and When Should It Be Treated?

Commentaries

Walter Glannon. Psychopathy and Responsibility: Empirical Data and Normative Judgments.

Derek Strijbos. What Is the Philosopher’s Role in Interdisciplinary Research?

Gary J. Gala, Sarah L. Laughon. Conceptualization of a Mental Disorder: A Clinical Perspective.

Peter Zachar. Mental Disorder, Methodology, and Meaning.

René Rosfort. The Opacity of Bodily Symptoms: Anonymous Meaning in Psychopathology.

C. S. I. Jenkins. ‘Addicted’? To ‘Love’?

Neil Levy. Hijacking Addiction.

Responses

Jarkko Jalava, Stephanie Griffiths. Call Me Irresponsible Is Psychopaths’ Responsibility a Matter of (Data) Preference?

Raymond M. Bergner, Nora Bunford. Mental Disorder Is Disability: In Support of Our Design.

Line Ryberg Ingerslev, Dorothée Legrand. Responding to Incomprehensibility: On the Clinical Role of Anonymity in Bodily Symptoms.

Brian D. Earp, Bennett Foddy, Olga A. Wudarczyk, Julian Savulescu. Love Addiction: Reply to Jenkins and Levy.

Back to Top

Phronesis, Vol. 62, #2, 2017

Research Articles

Thomas Kjeller Johansen. Aristotle on the Logos of the Craftsman.

Patricio A. Fernandez and Jorge Mittelmann. ἡ κίνησις τῆς τέχνης: Crafts and Souls as Principles of Change.

Andreas Anagnostopoulos. Change, Agency and the Incomplete in Aristotle.

Hermann Weidemann. Potentiality and Actuality of the Infinite: A Misunderstood Passage in Aristotle’s Metaphysics (Θ.6, 1048b14-17).

Other

Christopher Gill. Hellenistic and Roman Philosophy.

Back to Top

0 notes

Text

AMP chairwoman, legal counsel exit in wake of misconduct scandal

SYDNEY (Reuters) – AMP Ltd announced the resignations of its chairwoman and legal counsel, and slashed its directors’ fees by a quarter, as Australia’s largest listed-wealth manager tries to stem the fallout from damaging revelations of misconduct.

FILE PHOTO: The logo of AMP Ltd, Australia’s biggest retail wealth manager, adorns their head office located in central Sydney, Australia, May 5, 2017. REUTERS/David Gray/File Photo

The exits come just a week after the departure of CEO Craig Meller in the wake of disclosures at a judicial inquiry into the country’s financial sector that AMP misled customers and repeatedly deceived the corporate regulator.

Chairwoman Catherine Brenner and group general counsel Brian Salter will depart immediately, AMP said in a statement.

Mike Wilkins, who has been named both interim chairman and CEO, said the evidence given to the government-backed Royal Commission is “being treated extremely seriously by the board”.

“Appropriate steps are being taken to address the issues raised, and remediating our customers is being given utmost priority,” he said on Monday.

AMP has seen around A$2.2 billion ($1.7 billion) wiped off its market capitalization during the commission’s two-week public hearing focusing on financial advice. It was valued at A$11.6 billion at Friday’s close.

The hearing was told that advisers at AMP misappropriated funds of thousands of clients over the last decade by charging them without providing advice, and that it had repeatedly lied to the Australian Securities and Investments Commission (ASIC).

Counsel assisting the inquiry warned on Friday that AMP had breached provisions of the Corporations Act that carry criminal sanctions.

The Royal Commission is just a couple of months into what is expected to be a year-long investigation. The inquiry will be able to make wide-ranging recommendations including legislative changes and on criminal or civil prosecutions.

Wilkins said the selection of a new AMP chair would be fast tracked, along with the CEO search already underway, to “help ensure stability and further strengthen governance”.

AMP said it will reduce fees for all board directors by 25 percent for the rest of 2018 as a recognition of the “collective governance accountability for the issues raised in the Royal Commission and for their impact on the reputation of AMP.”

It also said the “employment and remuneration consequences” for individuals who were responsible for charging fraudulent fees would be determined once an external employment review was completed, which it expected shortly.

The company said it will be making a formal submission in response to the allegations raised at the Commission by May 4.

Reporting by Aaron Saldanha in Bengaluru; Editing by Jane Wardell and Himani Sarkar

The post AMP chairwoman, legal counsel exit in wake of misconduct scandal appeared first on World The News.

from World The News https://ift.tt/2vWt7gV

via Online News

#World News#Today News#Daily News#Breaking News#News Headline#Entertainment News#Sports news#Sci-Tech

0 notes