#Business Analyst Course Outline

Explore tagged Tumblr posts

Text

I like to think about what if the Kaminoans just, fucked all the way up and made the clones telepaths on purpose.

Kamino is in the Rishi maze, the equivalent of total buttfuck nowhere. This is like a cattle processing plant in rural Montana manufacturing an order for Shenzhen as outlined by a third party intermediary from Monaco who keeps contact with neither production nor “client” and nobody’s first language is Basic. Jedi are like, totally psychic right? Right. Psychic army for psychic clients, sounds right, checks out. There are whole ass telepathic alien species out there, some of which are also Jedi. Why would they want NON-psychic clones. Get it done, Tally Ho or Nala Says or whatever her name is. Chop chop.

Cue like seven years into production and the Kaminoan project leads are starting to get some… inklings…. that maybe some of the deliverable specs were perhaps not so much well-researched as based off cross-galactic hearsay some underpaid analysts pulled off space reddit. This is a business, okay? You’re not gonna make profit manufacturing two million units of fucking anything if you treat it like a luxury product, but especially not if the product has goddamn childhood development & socialization needs. Of fucking course some shit maybe slipped through the cracks. What are we supposed to fucking do now, Lama goddamn Sue sir, tell the Jedi or the pickled fucking Sith that oopsie woopsie, we got the specs wrong half a decade in and have to start over again?

No. No we are not. We are going to lie our fucking semi-aquatic asses off, is what we’re gonna do, and so will you clones if you know what’s good for you. NONE of you are fucking psychic, and you never were. Got that? Understood?

Fast forward to Jedi pickup D-Day and every time anyone with a lightsaber gets within aural biosystem of choice distance the clones immediately start loudly and dutifully Having Conversations.

Hello Commander Sir, It Is I, Trooper McSoldierClone, What A Weather It Is Today, Ha Ha? Over. Yes Indeed McTrooper One Two Three Four, I Am Agree, Now Here Is An Order To Follow Which I Am Vociferously Giving You, Acknowledge Orally, Over. Every clone making rock-hard sweating eye contact like don’t fuck it up as they mentally chant encouragement and script notes and jeering performance feedback at each other. Cadets trooping to fucking speech practice to learn speaking out loud with all the enthusiasm and skill of the average white suburban Floridian teenager taking their fifth mandatory Spanish 1 class. The jedi are like damn these poor asylum grown freaks are so unsocialized and uncomfortable around us, Their Owners, this is so tragic and horrid and unfortunate and meanwhile every clone standing silently in formation is mentally spectating the 400-person telepathic tetris team sport they invented with the same vibes as a football world cup back alley street party complete with official & unofficial betting pools and expert panel commentary

3K notes

·

View notes

Text

Navigating the Path to Success: A Comprehensive Guide to a Career as a Financial Consultant

In the ever-evolving landscape of finance, the role of a financial consultant has emerged as pivotal. Balancing analytical prowess with an empathetic approach to client needs, financial consultants are the navigators in the complex world of personal and corporate finance. This comprehensive guide delves into the intricacies of pursuing a career as a financial consultant, outlining the steps to success, the skills required, and the impact one can make in this dynamic profession.

The Blueprint to Becoming a Financial Consultant

Educational Foundations

The journey begins with solid educational foundations. A bachelor's degree in finance, economics, business administration, or a related field is typically the minimum requirement. Courses in investments, taxes, estate planning, and risk management provide a strong base. Advanced degrees or certifications, such as a Master's in Business Administration (MBA) or becoming a Certified Financial Planner (CFP), can significantly enhance one's prospects and credibility.

Gaining the Right Experience

Hands-on experience is invaluable. Internships or entry-level positions in banking, insurance, or investment firms offer a practical understanding of financial products, market strategies, and client relations. Experience in customer service roles can also be beneficial, as they develop the interpersonal skills crucial for consulting.

Licensing and Certification

Depending on the services offered, financial consultants may need to obtain specific licenses. For example, selling insurance products requires a license in the relevant state, while offering investment advice might necessitate Series 7 and Series 66 licenses. Pursuing certifications like CFP or Chartered Financial Analyst (CFA) not only legitimizes expertise but also signals commitment to professional development.

Essential Skills for a Flourishing Career

Analytical Acumen

At the core of financial consulting is the ability to analyze complex financial data. Consultants must interpret market trends, evaluate investment opportunities, and understand regulatory impacts to provide sound advice.

Communication Mastery

Translating complex financial concepts into understandable advice is an art. Practical communication skills ensure that clients are informed and comfortable with their financial decisions.

Ethical Integrity

Trust is the cornerstone of a financial consultant-client relationship. Upholding high ethical standards and transparency is essential for building and maintaining this trust.

Adaptability

The financial landscape is continuously changing. Successful consultants stay abreast of new regulations, products, and market dynamics. They adapt their strategies to serve their client's evolving needs best.

The Impact of a Financial Consultant

Financial consultants make a significant impact on their client's lives and financial health. They guide individuals through life's financial milestones—be it saving for education, planning for retirement, or managing wealth. For businesses, consultants can optimize financial performance through strategic planning and risk management.

Navigating Challenges

Like any career, financial consulting comes with its challenges. Economic downturns, market volatility, and evolving financial regulations can test a consultant's resilience and adaptability. Building a client base takes time and requires consistent effort in networking and reputation management.

The Road Ahead

The demand for financial consultants is expected to grow as individuals and businesses navigate the complexities of finance in an uncertain world. Embracing technology, staying informed about global economic trends, and prioritizing continuous learning are keys to a prosperous career in financial consulting.

A career as a financial consultant offers a blend of analytical challenge and personal satisfaction. By guiding clients towards financial security and prosperity, consultants play a crucial role in the economic landscape. The path to becoming a successful financial consultant involves a commitment to education, ethical practice, and a deep understanding of financial markets. With the right skills and dedication, the journey can be both rewarding and impactful.

3 notes

·

View notes

Text

𝐅𝐔𝐋𝐋 𝐍𝐀𝐕𝐈𝐆𝐀𝐓𝐈𝐎𝐍 / 𝐖𝐀𝐍𝐓𝐄𝐃 𝐂𝐎𝐍𝐍𝐄𝐂𝐓𝐈𝐎𝐍𝐒

Name: Kimberly Madrigal Soto

Faceclaim: Kylie Verzosa

Gender & Pronouns: Cis Woman & She/her

Age: 32

Birthday: July 20

Occupation: Executive Assistant (Mayor's Office)

Neighborhood: Midtown

Does your character have a secret? Moved to Wilmington to live a modest lifestyle, when she’s actually an heiress on the run

Would you be willing to have this secret used against them at some point in the future? Yes

𝐈. 𝐇𝐄𝐑 𝐒𝐓𝐎𝐑𝐘

Being born into a family that had built a legacy in all of Southeast Asia was a double edged sword for Kimberly Soto. At a young age, failure wasn’t an option and expectations from others was the reality of it all. Of course, this wasn’t her fault as she had no control over the family she was born into, but a part of her felt torn as she experienced both appreciation and self-loathing of such privilege. For starters, money does buy happiness as she never understood the concept of debt as everything was handed to her. However, that was a hefty price to pay as her fate was already decided for her.

You see, the Soto Industries are Southeast Asia's largest conglomerates, with interests in department stores, supermarkets, banks, hotels, real estate and mining. Kimberly’s father is the eldest of four siblings that had inherited a portion of her grandfather’s business and from there has been making it a family tradition to ensure the Soto name doesn’t die out. Unfortunately for him, Kimberly’s heart and mind was far from all this. Sure, she maintained good grades, was heavily involved in extracurricular activities and stayed out of trouble in the public eye for her family’s sake. However, as Kimberly grew older, she had felt a longing for such a sweet escape and more importantly, her freedom.

Her rebellious phase didn’t kick in until she was in university, exposing herself to Asia’s nightlife while studying for her bachelor’s degree and soon her MBA. With the goal of not having to rely too heavily on her family’s wealth, Kimberly earned her own, yet unnecessary side income by working her way into being a known DJ in Asia’s club scene under the alias MS K (pronounced: Miss K). By the age of 27, she had graduated from her MBA and was thrown into Soto Industries as a Business Analyst before working her way up within her professional growth. It was nepotism, the end of her nightlife, and her need to please people that got her to a Director role at the prime age of 30. However, all it took was a bit of a push for Kimberly to leave it all behind.

Her father expected her to be wedded by now and was in the process of setting her up with another business heir. However, before they could even meet, Kimberly had left for the United States as she’d secretly been obtaining a work visa behind her family’s back. With a legal document curated by her lawyer that outlined her terms and conditions, as well as a name change to Kimberly Madrigal, the Soto heiress left without another word and went no contact upon her arrival to her new home. Now she’s residing in Wilmington as an Executive Assistant in the Mayor's Office and is trying to maintain a quiet and quaint life away from the limelight.

Or at least she hopes.

𝐈𝐈. 𝐇𝐄𝐀𝐃𝐂𝐀𝐍𝐎𝐍𝐒

LAST NAME CHANGE: Currently known as KIMBERLY MADRIGAL, rarely discloses her full legal name unless needed (i.e. in legal documentations, etc.)

EDUCATION: Has her Bachelors in Business and completed her MBA in the National University of Singapore (NUS)

Has been living and working in the US for two years now

Hobbies and interest include gaming (PC/Console), still djing and creating mixes, shopping, travelling, astrology, karaoke, eskrima (filipino martial arts)

Wants to get a tattoo, but is scared of commitment - same goes with getting a pet

The drastic career change from a director level role to an administrative one was something Kimberly got used to as she enjoyed not having to make any decisions for herself or the greater good of a company and instead treated her admin role as an 'organizational game'

UNKNOWN: Doesn't really know what her true passion is and hopes that through her interactions and a new environment that she'll be able to do some self-discovery

IGNORANCE IS BLISS: She knows that she's living a lie and will have to eventually face her family in the future, but for now no news is good news and she's just vibing out

𝐈𝐈𝐈. 𝐏𝐋𝐎𝐓 𝐃𝐑𝐎𝐏𝐒

MAYORAL BALL EVENT

3 notes

·

View notes

Text

The inevitable M&A question came toward the end of Paramount Global‘s hourlong conference call with Wall Street analysts on Wednesday — a session that undoubtedly would have been more contentious for Paramount leaders if they hadn’t started out by serving up sacrifices for the greater good of free cash flow and profit.

Paramount Global CEO Bob Bakish waved off the inquiry from Bank of America Merrill Lynch media analyst Jessica Reif Ehrlich about the tidal wave of media speculation about suitors coming (and going) for the company with a breezy “We’re always looking for ways to create shareholder value.” But it was clear from the earlier commentary and business updates from Bakish and chief financial officer Naveen Chopra that they are charting a course for this year and next to take streamer Paramount+ to the promised land of profitability and keeps the company entact as a standalone entity.

Indeed, Bakish nodded in his prepared remarks to the endless chatter on the Street and in media about Paramount’s long-term fate. “Regardless of current market sentiment, we’re convinced that the value of our assets today, combined with the execution of our strategy as we move forward represents a significant value creation opportunity, and we are dedicated to unlocking that value,” Bakish said.

The unlocking process will include a $1 billion write-down to be taken in the current quarter. Bakish and Chopra promised Wall Streeters that the company will spend less to make and market movies and TV shows and they will get more bang for those bucks with more aggressive windowing of streaming content across linear assets and vice versa. Moves forced by necessity during the programming drought of last year’s strike months — “Yellowstone” reruns airing on CBS, for one — are helping to guide its future. Most of the write-down ($700 million to $900 million) will stem from existing TV shows and movies that will be yanked from Paramount’s various digital and linear platforms and development projects that will be scrapped.

After recording a $1.6 billion loss on streaming operations in 2023, Paramount+ will reach profitability in the U.S. in 2025, Bakish vowed. Paramount Global will deliver free cash flow and growth in the second half of ths year, Chopra added.

Bakish emphasized that the company will also significantly cut back its efforts to produce local-language content in overseas markets. Instead the company will focus on generating hot prospects at home that have global resonance.

“Internationally, it’s become unquestionably clear that Hollywood hits are the biggest draw for our audiences and partners around the world,” Bakish said. “Which means there’s a clear opportunity to lean into our CBS slate, Paramount+ originals and Paramount films while slowing spend on local content and associated marketing.”

Chopra said the decision was influenced by analysis of what most non-U.S. subscribers watch on the streamer. “We’ve learned the Paramount+ subscribers outside the United States spend nearly 90% of their time with our global Hollywood hits — meaning we can keep them engaged while right-sizing our investment in content that does not travel around the world,” he said.

However, in the hunt for what the executives called “efficiencies,” Paramount will look to produce more TV programs and films overseas, where the cost of everything from hiring extras to an espresso at Starbucks is lower than in Los Angeles or New York.

“You will see us leaning even further into offshore production for our global franchises, including the upcoming London installment of ‘Billions,’ the new ‘Ray Donovan’ origin story as well as new series like ‘The Department’ from George Clooney,” Bakish said of three series on deck for Paramount+ with Showtime.

On the film side, Bakish pointed to Paramount Pictures’ success so far this year with modestly budgeted theatrical films “Mean Girls” and “Bob Marley: One Love,” the biopic that has lead the U.S. box office for the past two weekends. “We’re improving ROI by lowering the average cost per title,” Bakish said, noting the film studio’s refined focus on “balancing high-budget tentpoles with more modest cost titles.”

Paramount Global spent about $16.5 billion on content in 2023, a number that was lower than 2022’s content bill because of the Writers Guild of America and SAG-AFTRA strikes, Chopra said. He expects that 2024 spending will be higher but not by too much. “We contemplate spending really only about 50% of what we’ll call the strike savings. That’s a critical ingredient in our ability to drive healthy growth in free cash flow,” Chopra said.

Other topics addressed on the call:

The Disney/Warner Bros. Discovery/Fox streaming sports venture announced earlier this month has been a de rigueur question for CEOs during the Q4 earnings reporting cycle. Bakish is not impressed with the offering that is rumored to be priced at $40 to $50 a month. “For a true sports fan, this package only has a subset of sports,” he said. “It’s missing half the NFL, a lot of college [events] and has virtually no soccer or golf. So it’s hard to believe that’s ideal, especially at the price points that have been speculated.”

Speaking of game theory, sports is an important subscriber funnel for Paramount+, which offers CBS’ AFC NFL package as well as acquired rights to soccer and golf tournaments. Prospective subscribers come in for a game or two but stay for the entertainment. “For people that come in [to Paramount+] for sports, 90% of their engagement is with non-sports” content, Bakish said.

CBS has been a bright spot for the company. The network got its strike-delayed season off to a strong start with freshman drama “Tracker,” thanks in part to a big circulation boost from large crowds turning out for the Golden Globe Awards, Grammy Awards and the record-setting Super Bowl telecast. But the Eye is also becoming more budget-conscious when it comes to content spending. “We have an increasingly efficient and targeted development process,” Bakish said. “We prioritize lower cost formats, like unscripted and those shot abroad while maintaining our strength and franchises.” He cited the success of last year of “NCIS: Sydney,” the latest interation of the drama franchise that was shot Down Under “at a much more efficient price point.”

In 2023, Paramount+ nabbed a total of 4.1 million new subscribers. Expectations for 2024 are lower in part because Paramount+ will be detached from bundled packages in some overseas markets “where the economics just weren’t that compelling,” Chopra said. “We do still expect very healthy Paramount+ revenue growth and of course, revenue is the more important metric than subs.”

2 notes

·

View notes

Text

Master Startup Valuation: Enroll in the Best Financial Modelling Course in Hyderabad

India's startup ecosystem is thriving. From fintech disruptors and health-tech innovators to e-commerce giants and SaaS pioneers, startups are no longer just small businesses—they're becoming powerhouses that are reshaping the economy. As these startups scale, many eye the capital markets for further growth through Initial Public Offerings (IPOs).

But here's the catch: valuing a startup is far more complex than valuing an established company. Unlike traditional firms, startups often lack long-term revenue history, stable cash flows, or predictable business models. That’s where financial modelling becomes indispensable.

For anyone aspiring to a career in investment banking, equity research, or venture capital, mastering financial modelling—especially startup valuation techniques—is non-negotiable. If you're based in South India and looking to upskill, enrolling in the best Financial Modelling Course in Hyderabad could be your gateway to this high-stakes world.

The Rise of Startup IPOs in India

India has become a launchpad for global startups, with unicorns emerging across sectors. Recent IPOs like Zomato, Nykaa, Paytm, and Mamaearth have not only made headlines but also highlighted the complexities involved in valuing such firms.

These IPOs reveal that traditional valuation metrics like Price-to-Earnings (P/E) often fall short. Investors, analysts, and investment bankers need to rely on more nuanced, forward-looking models to determine the worth of these dynamic companies.

Why Valuing Startups Is So Challenging

Unlike well-established firms, startups present the following challenges when it comes to valuation:

Inconsistent or Negative Cash Flows

Lack of Historical Data

High Customer Acquisition Costs

Unpredictable Growth Trajectories

Reliance on Future Potential Rather than Present Earnings

These factors make financial modelling a critical tool in capturing a startup's value and potential for long-term profitability.

Role of Financial Modelling in Startup IPOs

Here’s how financial modelling supports the IPO journey for startups:

1. Forward-Looking Projections

Startups are often valued based on future performance. Financial models help project revenue growth, customer acquisition, operating expenses, and cash flows for the next 5–10 years, helping estimate potential profitability and valuation.

2. Discounted Cash Flow (DCF) Valuation

DCF is one of the most reliable tools for valuing high-growth startups. It involves projecting free cash flows and discounting them back to present value using a weighted average cost of capital (WACC). This model helps determine a realistic IPO price range.

3. Market and Comparable Company Analysis

Analysts also use relative valuation techniques like Comparable Company Analysis (CCA) and Precedent Transactions to benchmark startups against similar firms that have recently gone public.

4. Scenario and Sensitivity Analysis

Since startups are exposed to high uncertainty, models must include best-case, base-case, and worst-case scenarios. Sensitivity analysis tests how changes in key assumptions—like customer churn or cost structure—impact valuation.

5. Investor Pitch and Narrative Building

A solid financial model becomes a storytelling tool. Investment bankers use it to craft investor presentations and pitchbooks that outline the business opportunity and financial upside, which can greatly influence IPO success.

Case Study: Nykaa’s IPO

Nykaa, an e-commerce beauty startup, launched its IPO in 2021 and was quickly oversubscribed. Despite being relatively young, its financial model highlighted strong revenue growth, expanding margins, and increasing market share.

Analysts used both DCF and market comparables (like Sephora and Ulta Beauty) to justify its valuation. The success of the IPO shows how a well-structured financial model can win investor trust even in a competitive market.

Career Paths Where This Skill Is Vital

If you want to work with IPOs or startup valuation, financial modelling is your most important technical skill. Here are some roles that demand it:

Investment Banking Analyst

Equity Research Associate

Venture Capital Analyst

Corporate Finance Executive

Startup CFO or FP&A Specialist

IPO Advisory Consultant

These roles are in high demand across banks, consulting firms, PE/VC firms, and fast-growing startups.

Why Take the Best Financial Modelling Course in Hyderabad?

Hyderabad, known for its growing tech and finance sectors, is an ideal city to build a career in finance. Enrolling in the best Financial Modelling Course in Hyderabad offers you the opportunity to:

Master Excel for Finance: Build advanced, dynamic models from scratch.

Learn Valuation Techniques: Get hands-on with DCF, LBO, CCA, and more.

Work on Startup Case Studies: Apply your learning to real-world IPO scenarios.

Get Mentored by Industry Experts: Learn from investment bankers, CA professionals, and CFA charterholders.

Access Placement Support: Get connected with leading firms through career assistance programs.

Whether you're a B.Com, MBA, CA aspirant, or even a working professional, a solid course can fast-track your entry into the high-growth world of investment banking and startup advisory.

Key Learning Outcomes from a Top Financial Modelling Program

✅ Building 3-statement financial models (Income Statement, Balance Sheet, Cash Flow)

✅ Startup valuation techniques

✅ Forecasting and budgeting

✅ Sensitivity & scenario analysis

✅ IPO pricing and investor presentation building

✅ Hands-on use of Excel, VBA, and PowerPoint for finance

These skills are the toolkit for modern finance professionals—and mastering them can give you an edge in a competitive market.

Final Thoughts: Turn Data into IPO Gold

Valuing startups for IPOs is as much art as it is science. It requires you to understand business models, project growth, assess risks, and build convincing narratives backed by solid numbers. And at the heart of all this is financial modelling.

So, if you aspire to advise India’s next unicorn on its IPO journey, start by mastering the fundamentals. Enroll in the best Financial Modelling Course in Hyderabad, gain hands-on experience, and step into a career that’s dynamic, lucrative, and future-focused.

0 notes

Text

🌍 CMA USA & ACCA in 2025: Global Career Opportunities and How to Seize Them

In 2025, finance professionals are no longer bound by geography. With certifications like CMA USA and ACCA, you can unlock high-paying jobs in Dubai, the UK, India, and beyond. Whether you’re a student, a finance graduate, or a working professional, choosing the right certification can fast-track your journey toward global success.

In this guide, we break down top career opportunities with CMA and ACCA, how to land international roles, and the best strategies for exam success — all backed by resources from NorthStar Academy, India’s leading coaching institute.

💼 Career Scope of CMA USA in 2025

The demand for CMA USA-certified professionals has exploded in 2025, with companies seeking experts in cost management, budgeting, and strategic financial analysis.

This blog by NorthStar Academy outlines top CMA job roles like:

Financial Analyst

Cost Accountant

Finance Manager

Business Strategy Consultant

Want to know which industries are hiring the most CMAs right now? This Medium post covers it all — from tech to manufacturing and everything in between.

🌆 CMA USA Job Opportunities in Dubai: What to Expect

Dubai has become a global hub for finance, making it a hot destination for CMA USA holders. This NSA blog highlights the best CMA jobs in Dubai, along with salary expectations and visa considerations.

To take it a step further, read this Blogger guide on landing a CMA job in Dubai — it offers actionable tips on resume building, networking, and applying via global job portals.

🎓 Cracking the ACCA Exam in 2025: First-Attempt Success Tips

If you're aiming for global accounting recognition, ACCA is a smart choice. But passing on the first attempt requires the right strategy.

Explore this blog from NorthStar for seven proven exam-cracking tips, from time management to mock tests.

Pair that with this WordPress article on the best ACCA study resources for top book recommendations, YouTube channels, and study schedules.

📚 Want to Pursue CPA USA Next?

If you're considering adding CPA USA to your credentials, check out the CPA Course Details here. With Becker-powered content and mentorship from industry experts like M. Irfat, NorthStar Academy offers a seamless path to CPA success.

🚀 Why Choose NorthStar Academy for CMA & ACCA Coaching?

Thousands of students choose NSA for:

✅ Expert-led coaching ✅ Becker-authorized CPA material ✅ Placement and visa support ✅ Proven track record of student success

Whether it’s CMA USA, ACCA, or CPA, NorthStar equips you with everything to succeed globally.

✅ Final Thoughts: Think Global, Act Now

The finance world in 2025 is global, competitive, and full of opportunity — especially if you're certified. Whether you're pursuing CMA USA jobs in Dubai, preparing for ACCA exams, or exploring the CPA route, one thing’s certain: investing in the right coaching can change your life.

Let NorthStar Academy guide your journey to international success.

0 notes

Text

How CMA and CPA Can Elevate Your Accounting Career – A Smart Strategy for Finance Professionals

In today’s rapidly evolving financial industry, accountants are no longer just number crunchers. They are strategic thinkers, business analysts, and decision-makers. To stay competitive and advance in your career, credentials like CMA and CPA are no longer optional — they’re essential.

🔹 Why Pursuing Both CMA and CPA Makes Sense

Combining the CMA and CPA certifications gives accounting professionals a well-rounded edge. While the CPA strengthens your grip on regulatory and compliance frameworks, the CMA hones your management accounting and strategic decision-making skills.

Dive into this detailed article to understand why you should consider both certifications: https://northstaracad.com/blogs/cma-cpa-why-accountants-should-pursue-both

You can also check out this insightful Medium piece that breaks down how the combination gives your career a powerful boost: https://medium.com/@h8907385/why-pursuing-both-cma-and-cpa-can-give-your-accounting-career-a-competitive-edge-0fdfb002d4c0

🔹 Starting Early: Is CMA After BCom a Smart Choice?

Many students wonder if pursuing the CMA USA course immediately after their BCom is a viable move. The answer is a resounding yes — and it opens up at least eight career paths right from the start.

Here’s a blog that outlines those opportunities: https://northstaracad.com/blogs/cma-after-bcom-is-this-a-good-idea-lets-discuss-top-8-career-options

This Blogger article also compares CMA with MBA to help you decide what’s right for you: https://harshablogs123.blogspot.com/2025/05/cma-vs-mba-which-is-better-career.html

🔹 CMA USA and Articleship: Can They Coexist?

If you're currently doing an articleship and wondering whether to begin the CMA USA program simultaneously, you're not alone. Balancing both is possible — and strategic. It amplifies your learning and builds real-world accounting insight.

Read this blog to understand how: https://northstaracad.com/blogs/cma-articleshipis-it-helpful-to-take-a-cma-usa-course-while-doing-articleship

And this Tumblr post discusses how CMA USA certification complements your early career: https://www.tumblr.com/transformativeblogs/782499022903656448/how-cma-usa-certification-can-complement-your?source=share

🔹 Where to Begin Your CMA/CPA Journey?

For expert coaching, up-to-date study material, and career counseling, NorthStar Academy is a trusted destination among aspiring finance professionals.

Explore more here: https://northstaracad.com

📍 Final Thoughts

In the finance world, credentials matter. Whether you're fresh out of college or in the early stages of your accounting career, combining CMA and CPA can turbocharge your growth. Take smart steps, plan ahead, and back your ambitions with the right education.

0 notes

Text

ETL Engineer vs. Data Engineer: Which One Do You Need?

If your business handles large data volumes you already know how vital it is to have the right talent managing it. But when it comes to scalability or improving your data systems, you must know whether to hire ETL experts or hire data engineers.

While the roles do overlap in some areas, they each have unique skills to bring forth. This is why an understanding of the differences can help you make the right hire. Several tech companies face this question when they are outlining their data strategy. So if you are one of those then let’s break it down and help you decide which experts you should hire.

Choosing the Right Role to Build and Manage Your Data Pipeline

Extract, Transform, Load is what ETL stands for. The duties of an ETL engineer include:

Data extraction from various sources.

Cleaning, formatting, and enrichment.

Putting it into a central system or data warehouse.

Hiring ETL engineers means investing in a person who will make sure data moves accurately and seamlessly across several systems and into a single, usable format.

Businesses that largely rely on dashboards, analytics tools, and structured data reporting would benefit greatly from this position. ETL engineers assist business intelligence and compliance reporting for a large number of tech organizations.

What Does a Data Engineer Do?

The architecture that facilitates data movement and storage is created and maintained by a data engineer. Their duties frequently consist of:

Data pipeline design

Database and data lake management

Constructing batch or real-time processing systems

Developing resources to assist analysts and data scientists

When hiring data engineers, you want someone with a wider range of skills who manages infrastructure, performance optimization, and long-term scalability in addition to using ETL tools.

Remote Hiring and Flexibility

Thanks to cloud platforms and remote technologies, you can now hire remote developers, such as data engineers and ETL specialists, with ease. This strategy might be more economical and gives access to worldwide talent, particularly for expanding teams.

Which One Do You Need?

If your main objective is to use clean, organized data to automate and enhance reporting or analytics, go with ETL engineers.

If you're scaling your current infrastructure or creating a data platform from the ground up, hire data engineers.

Having two responsibilities is ideal in many situations. While data engineers concentrate on the long-term health of the system, ETL engineers manage the daily flow.

Closing Thoughts

The needs of your particular project will determine whether you should hire a data engineer or an ETL. You should hire ETL engineers if you're interested in effectively transforming and transporting data. It's time to hire data engineers if you're laying the framework for your data systems.

Combining both skill sets might be the best course of action for contemporary IT organizations, particularly if you hire remote talent to scale swiftly and affordably. In any case, hiring qualified personnel guarantees that your data strategy fosters expansion and informed decision-making.

0 notes

Text

Understanding Due Diligence: A Comprehensive Guide

The process of due diligence exists as a critical evaluation method which helps companies maintain risk assessments by authenticating details through decision-making strategies. The assessment process known as due diligence leads business operators and investors to discover risks and authenticate information before they make decisions regarding company acquisitions or properties or establish business partnerships. This article examines due diligence methods alongside their essential categories and outlines practices that lead to commendable evaluation results.

What Is Due Diligence?

Before making any final choice people must perform a detailed analysis and investigation into business opportunities as well as transactions. Such diligence helps businesses find hidden risks through proper evaluation and ensures both financial stability and legal compliance. Businesses commonly perform due diligence throughout mergers and acquisitions (M&A), real estate dealings, financial asset acquisitions and legal contract management.

Types of Due Diligence

The analysis of financial statements combined with cash flow assessment and liability evaluation and profitability estimation allows determination of a business's financial status.

The evaluation of contracts and intellectual property rights and compliance records and ongoing legal disputes takes place during Legal Due Diligence.

Operational Due Diligence – Evaluating the company’s efficiency, management structure, and internal processes.

The evaluation of industry patterns together with competitors and market customers and strategic expansion possibilities constitutes Market Due Diligence.

Technical Due Diligence – Assessing technology infrastructure, cybersecurity, and IT capabilities.

Business operations need environmental due diligence for assessing compliance with laws while evaluating risks that may occur.

The essential sequence in due diligence projects consists of these steps.

The first step is to establish both the purpose and goals which the due diligence must accomplish.

Obtain All Required Data by Acquiring Financial Records and Legal Documentation as Well as Operational Reports.

Seamless information acquisition starts with speaking directly with essential stakeholders alongside staff members and industry specialists through formal interviews.

During this analysis stakeholders need to identify both existing risks as well as potential liabilities and possible business opportunities that emerge from the information collected.

Draw a Complete Report to Synthesize findings and make proposals supported by analytical results.

The filed information enables you to select the best course of action.

Best Practices for Effective Due Diligence

Initiate investigations early because you need sufficient time to evaluate every detail properly.

Financial analysts together with legal advisors and industry specialists should be consulted for precise feedback.

Detailed focus on every business element and investment aspect should be present.

Investigate unusual points which include evidence of contradictions or financial or legal problems.

Reliable decision-making emerges from data backup as well as verified information instead of making baseless guesses.

Conclusion

JAKS Due diligence functions as an essential process which enables people together with businesses to create safe decisions based on informed information. A complete examination followed by data analysis allows you to determine both hurdles and possibilities in advance of any serious commitment. Due diligence serves as your primary protection for asset security when conducting investments, acquisitions or partnership formation.

0 notes

Text

How to Excel in Financial Modeling for Delhi Businesses

Introduction

Financial modeling is a crucial skill for businesses in Delhi aiming to manage finances, predict future performance, and make informed decisions. Mastering financial modeling requires strategic learning, practical application, and industry-specific knowledge. This guide outlines key strategies for excelling in financial modeling in Delhi's dynamic business environment.

1. Understand the Fundamentals of Financial Modeling

To build a strong foundation in financial modeling, you must understand the core concepts:

Financial Statements: Master the income statement, balance sheet, and cash flow statement.

Forecasting Techniques: Develop skills in projecting future revenue, expenses, and cash flow.

Valuation Methods: Learn methods such as Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Precedent Transactions.

2. Gain Proficiency in Excel

Excel is the primary tool used for financial modeling. Focus on mastering these Excel skills:

Advanced Functions: Learn key formulas like VLOOKUP, HLOOKUP, INDEX-MATCH, and IFERROR.

Data Analysis Tools: Familiarize yourself with PivotTables, Power Query, and data visualization tools.

Automation Skills: Develop knowledge of macros and VBA for efficient modeling.

3. Develop Industry-Specific Knowledge

Delhi's business landscape is diverse, with key industries such as:

IT and Technology: Understand SaaS revenue models and IT expenditure analysis.

Retail and E-commerce: Focus on inventory turnover, customer acquisition costs, and sales forecasts.

Hospitality and Real Estate: Master occupancy rates, RevPAR, and property valuation models.

4. Practice Real-World Financial Models

Building practical models for Delhi-based businesses enhances learning. Focus on:

Startup Financial Projections: Craft detailed financial forecasts for new ventures.

Budgeting and Forecasting Models: Develop annual budgets with scenario analysis.

Investment Analysis Models: Create models that assess the viability of expansion or acquisitions.

5. Utilize Online Resources and Courses

Many educational platforms provide specialized financial modeling courses for Delhi professionals:

Coursera and Udemy: Offer comprehensive courses in financial modeling.

Delhi-based Institutes: Institutions like IMS Proschool, CFI, and BSE Institute provide hands-on training.

6. Network with Financial Experts in Delhi

Networking provides insights into market trends, industry challenges, and emerging opportunities. Attend:

Financial Workshops: Events hosted by organizations like NASSCOM and TiE Delhi-NCR.

Industry Seminars: Forums discussing economic trends impacting Delhi businesses.

7. Stay Updated with Financial Trends in Delhi

Delhi's economic landscape is dynamic, with changing policies and emerging sectors. Follow:

News Portals: Platforms like Economic Times and Business Standard for local updates.

Market Reports: Research on industry growth patterns in Delhi.

8. Leverage Financial Modeling Software

In addition to Excel, explore software like:

Tableau: For data visualization and analytics.

Power BI: For advanced reporting and business intelligence.

QuickBooks and Tally: For financial management in Delhi's small to medium enterprises.

9. Develop Presentation Skills

Financial modeling isn't just about numbers; effective presentation ensures insights are actionable. Focus on:

Storytelling with Data: Use charts and graphs to convey insights clearly.

Clear Visuals: Avoid cluttered spreadsheets; highlight key metrics effectively.

10. Gain Certification in Financial Modeling

Obtaining a certification adds credibility and enhances career opportunities. Recommended certifications include:

**Financial Modeling and Valuation Analyst (FMVA)

Chartered Financial Analyst (CFA)

Certified Management Accountant (CMA)

Conclusion

Excelling in financial modeling for Delhi businesses requires technical expertise, industry knowledge, and strategic application. By mastering Excel, practicing real-world models, and staying informed about Delhi's economic trends, you can create powerful financial models that drive business growth and success.

0 notes

Text

Bachelor of Commerce Honours: A Strategic Choice for Future Leaders

Top 10 BCom colleges in India

In the competitive age, a Bachelor of Commerce Honours degree serves as a starting point for business and finance success. This honours programme provides students with comprehensive knowledge and practical skills to be successful in business. Whether you plan to become a financial analyst, accountant, or entrepreneur, a BCom programme can lead to many opportunities.

Why Choose a Bachelor of Commerce Honours

A BCom honours course provides an ordered curriculum comprising principal subjects like economics, business law, management, and accounting. The syllabus of the BCom Hons is formatted so that the learner gains both theoretical knowledge as well as practice-oriented skills so they can go ahead and implement in the profession they choose to do.

Key Subjects in BCom Hons

The BCom hons subjects comprise financial accounting, business statistics, corporate law, taxation, and organizational behavior. These topics are designed with precision to provide students with practical knowledge of the business world. The option to choose a BCom specialization enables students to specialize in their field of interest and gain more expertise.

Eligibility Criteria

The BCom eligibility differs from university to university, but the majority of universities demand students to have a minimum percentage in their higher secondary education (10+2). Some universities, such as Alliance University, also hold entrance tests and interviews during the admission process.

Career Prospects After BCom Hons

Graduation from the best colleges for BCom Hons in India can result in high-paying jobs.Some of those jobs are:

Chartered Accountant (CA)

Financial Analyst

Investment Banker

Tax Consultant

Business Development Manager

Entrepreneur

Entrepreneurial Opportunities for BCom Hons Graduates

A Bachelor of Commerce Honours degree is not only for those who are seeking conventional employment; it also opens the doors to entrepreneurship. Most successful business entrepreneurs began with a BCom programme, as it lays a strong foundation in business management, finance, and marketing. With the rising startup culture in India, graduates can use their knowledge to establish their ventures in diverse fields, such as e-commerce, finance, and consultancy.

Studying BCom Hons at Alliance University

For those students who are searching for a top-notch institution, Alliance University is the best option. The university has a well-planned BCom course that is meant to deliver academic excellence and industry exposure. With qualified faculty, state-of-the-art infrastructure, and holistic development, Alliance University provides the best education to students. The university also partners with industry giants to offer real-world training and placement, which makes it one of the top colleges for BCom Hons in India.

Future Trends in Commerce Education

The commerce field is developing at a very fast pace with technological innovations. FinTech, blockchain technology, artificial intelligence, and data analytics are transforming financial and business environments. Universities today are adding these new trends to the BCom Hons syllabus, so that students remain in line with the needs of the industry. Studying digital banking, financial modeling, and business analytics can make students more competitive in employment.

Conclusion

A BCom Hons program outlines an in-depth business education that assists students in creating a lucrative career. Studying at one of the best colleges for BCom provides exposure to quality education, skilled teaching staff, and good placement. If you have a keen interest in business and finance, selecting a BCom Hons from the best colleges in India can be the key to a lucrative future. Additionally, with internships, entrepreneurial ventures, and changing industry trends, the scope of a bachelor of commerce honours degree keeps growing, making it a wise investment in your career.

#top 10 bcom colleges in india#b com hons subjects#top bcom colleges in india#bcom programme#best university for bcom#bcom private colleges#b com university#b com specialization

0 notes

Text

What is SAP Commercial Project Management (CPM), and Why is it Important?

Why is SAP CPM Important?

End-to-End Project Visibility: A 360-degree view of undertaking prices, budgets, and schedules.

Seamless Integration – Works with SAP S/4HANA, SAP PPM (Project Portfolio Management), and SAP PS (Project System) for streamlined operations.

Risk & Cost Management: Helps choose out functionality risks, track regular financial performance, and save you price range overruns.

Improved Collaboration: Enhances group productiveness with centralized venture data and reporting equipment.

Enhanced Decision-Making: Offers actual-time analytics and KPI tracking for better undertaking management.

Who Should Take SAP CPM Online Training?

SAP Commercial Project Management (CPM) online Training is suitable for professionals involved in undertaking-based industries who want to streamline venture planning, execution, and financial tracking within SAP S/4HANA. Here are the critical details target audiences:

1. SAP Consultants & Project Managers

SAP PPM, PS, and CPM specialists who want to boom their facts.

Project Managers handling commercial initiatives, fee tracking, and risk management.

2. Business Analysts & Finance Professionals

Business analysts are running on project analytics and fee manipulation.

Finance specialists coping with budgeting, forecasting, and sales recognition in SAP CPM.

3. IT & ERP Professionals

SAP ERP professionals search out SAP CPM integration records with SAP PS, SD, FI, CO, and MM.

IT experts are answerable for SAP venture management gadget implementation.

4. Professionals from Project-Oriented Industries

Construction, Engineering, IT Services, Manufacturing, and Professional Services businesses.

Anyone working in industries that require actual-time challenge monitoring and economic transparency.

5. SAP End Users & Key Stakeholders

End clients managing venture execution, billing, and financial control in SAP.

Key choice-makers seek ways to optimize venture everyday performance and profitability using SAP CPM.

Topics Covered in SAP CPM Online Training

SAP Commercial Project Management (CPM) online Training covers essential topics to assist specialists in managing complicated responsibilities, financials, and resources efficiently. Below is a based outline of key issues:

1. Introduction to SAP CPM

Overview of SAP Commercial Project Management

Key capabilities and benefits of SAP CPM

Integration with SAP S/4HANA and different SAP modules (PS, FI, CO, SD, MM)

2. SAP CPM Architecture & Components

SAP CPM gadget landscape

Master information setup in SAP CPM

Integration with SAP Project System (PS)

3. Project Workspace in SAP CPM

Creating and handling Project Workspaces

Customizing character dashboards

Real-time collaboration and reporting

4. Project Cost & Revenue Planning

Cost estimation and forecasting

Revenue and income margin evaluation

Integration with SAP Controlling (CO)

5. Project Issue & Change Management

Tracking undertaking dangers and problems

Change request control

Approval workflows

6. Commercial Project Financials

Budgeting and economic making plans

Billing & invoicing techniques

Financial reporting and analytics

7. SAP CPM Reporting & Analytics

Project overall performance tracking

Custom dashboards and KPIs

Integration with SAP Analytics Cloud (SAC)

8. Advanced Features & Customization

SAP Fiori apps for CPM

Configuration and customization options

Enhancements and remarkable practices

9. Real-Time Scenarios & Case Studies

Hands-on wearing activities on real-worldwide projects

Best practices for Green Assignment manage

Troubleshooting not unusual SAP CPM worrying situations

Why Choose ProExcellency?

✅ Expert Trainers – Learn from employer experts with real-time SAP experience.

✅ Comprehensive Course Content – Covers all components of SAP LTMC with arms-on schooling.

✅ Flexible Learning – Live trainer-led & self-paced training to be had.

✅ Hands-on Practical Training – Real-time gadget gets the right of entry to & challenge-based learning.

✅ Affordable & Certification Guidance – Cost-effective education with a look at substances.

✅ 24/7 Support & Lifetime Access – Post-education help & recorded lessons.

✅ Placement Assistance – Resume constructing, mock interviews, and mission referrals.

0 notes

Text

Aries Career & Business Horoscope 2025: Your Winning Year Ahead

Aries Career & Business Horoscope 2025: Your Winning Year Ahead

The year 2024 has been a transformative journey for Aries in the business realm, filled with challenges and growth. As we step into 2025, the stars align to bring even more promising opportunities. Key planetary movements, including the influence of Jupiter and Saturn, will shape your professional landscape. Aries, get ready for a year of significant advancements and triumphs in your career and business ventures. 2025 is poised to be a year where determination meets opportunity for Aries. Expect to navigate through new paths, leading to successful outcomes.

Financial Forecast & Investments for Aries in 2025

Investment Trends

Aries can thrive in specific sectors in 2025. Look for opportunities in technology, renewable energy, and personal development. These industries are expected to experience significant growth. According to a report by investment analysts, the renewable energy market is projected to grow by 20% annually. Aries’ natural drive and thirst for innovation make this a prime area for investment.

Budgeting and Financial Planning

Budgeting is key for Aries this year. Establish a clear financial plan to maximize earnings and minimize losses.

Set financial goals: Aim for both short-term and long-term financial objectives.

Use budgeting apps: Tools like Mint or YNAB can help keep expenses in check.

Statistics show that 80% of people who use a budgeting tool report better financial health.

Potential Risks and Mitigation

While 2025 offers opportunities, be cautious of impulsive spending.

Establish an emergency fund: Aim for at least three months’ worth of expenses.

Research before investing: Always analyze market trends before making financial decisions.

Career Progression & Opportunities: Navigating the Aries 2025 Landscape

Job Market Trends

The job market is evolving, and Aries should pay attention. Opportunities in leadership roles and entrepreneurial ventures are on the rise. The Bureau of Labor Statistics notes that leadership positions in tech and healthcare will see a significant uptick.

Networking and Collaboration

Networking will be essential for Aries in 2025. Building connections can open doors.

Attend industry events: Look for conferences and trade shows in your field.

Join professional organizations: Groups like LinkedIn Professional Associations can enhance your network.

A strong network is often the key to success. Many successful leaders attribute their achievements to connections forged along the way.

Career Advancement Strategies

To move forward in your career:

Seek mentorship: Find a mentor who can guide you.

Continuous learning: Invest in skill development through online courses and workshops.

Astrological influences encourage Aries to embrace these strategies for career growth.

Entrepreneurial Ventures for Aries in 2025

Identifying Lucrative Opportunities

Entrepreneurship aligns well with Aries energy. Look for niches in health and wellness, e-commerce, or creative industries. According to market research, small businesses in these sectors have a thriving customer base.

Building a Strong Business Foundation

Start with a solid business plan. Outline your goals, target audience, and financial projections.

Legal structure: Choose the right business entity (LLC, partnership, etc.).

Funding: Explore various funding options, including grants and loans.

These steps create stability for your entrepreneurial journey.

Marketing and Sales Strategies

Effective marketing is crucial for business success:

Utilize social media: Platforms like Instagram and TikTok can amplify your reach.

Content marketing: Create valuable content to engage customers.

These strategies can help Aries entrepreneurs capture attention and grow their businesses.

Challenges and Obstacles for Aries in 2025: Preparing for Setbacks

Potential Roadblocks

Aries may face challenges such as market volatility or competition. Staying informed is vital.

Overcoming Challenges

Resilience is key to overcoming setbacks. Implement these strategies:

Stay adaptable: Embrace change and pivot when needed.

Seek support: Consult with mentors or peers to gain insights.

Psychologists often emphasize the importance of resilience in facing difficulties. As one expert states, “Resilience is about grit, not just bouncing back.”

Learning from Mistakes

Every challenge brings a lesson. Reflect on setbacks and extract valuable insights to grow stronger. Adaptation is crucial in both business and career paths.

Aries' Strengths & How to Leverage Them in 2025

Utilizing Aries Traits

Aries possess unique strengths, including leadership, energy, and creativity.

Lead initiatives: Use your natural leadership skills to inspire teams.

Innovate: Embrace your creativity to develop new ideas.

These traits are powerful tools for success.

Boosting Confidence and Self-Belief

Confidence can enhance performance. Build self-belief with these methods:

Set achievable goals: Celebrate small wins to boost morale.

Positive affirmations: Use daily affirmations to maintain a positive mindset.

Having belief in oneself is crucial for overcoming challenges.

Maintaining Work-Life Balance

A healthy work-life balance is essential for avoiding burnout. Make time for hobbies, relaxation, and family.

Set boundaries: Allocate specific times for work and personal life.

Practice self-care: Regularly engage in activities that nourish your mental health.

Balancing these aspects supports overall well-being.

Conclusion

In summary, 2025 holds great promise for Aries in their career and business. The astrological influences suggest significant growth, dynamic opportunities, and the potential for robust financial success.

To make the most of the coming year, focus on strategic networking, sound financial planning, and embracing your strengths. Approach challenges with resilience and adaptability.

As the stars shine brightly on your path, seize the opportunities ahead with confidence and enthusiasm! Your winning year awaits.

(For more information contact best astrologer Acharya Devraj ji)

0 notes

Text

Business Intelligence Migration: What to Consider When Migrating to Looker

In the current world of data-driven businesses depend on robust Business Intelligence (BI) tools to make informed choices. Looker is a renowned BI platform is gaining a lot of attention for its user-friendly interface as well as strong analytics capabilities. However, transferring to Looker isn't just about the process of implementing the latest tool. It requires meticulous planning, strategizing and executing. This article will outline the key factors for a smooth migration to Looker to ensure that the business intelligence upgrade is efficient and yields the highest ROI.

Why Migrate to Looker?

Before you begin the process of migration it is important to know the reasons Looker is a top choice for a variety of organizations. Contrary to conventional BI software, Looker is built on an advanced architecture that connects easily with cloud-based data warehouses. Its strengths are:

Easy to Use: Looker's user-friendly interface is accessible for both non-technical and technical users.

Flexible Visualizations that can be customized: it comes with advanced data modeling as well as customizable dashboards.

Real-Time Insights: Using Looker companies can gain access to the most current information to inform their decision-making.

If you are considering upgrading your BI system Moving to Looker could revolutionize the way your team utilizes data.

Key Considerations for Business Intelligence Migration to Looker

1. Define Clear Objectives

Begin by determining the objectives of your move. Do you want greater visualization, speedier understanding, or better collaboration? A clear set of goals can help to plan your strategy and assess the impact of the change.

2. Assess Your Current BI Ecosystem

Conduct a thorough review of your Data pipelines, BI certification courses, software, and the infrastructure. Know how well and weak points of the current configuration to find areas that Looker could fill.

What sources of data are you required to connect?

Which dashboards and reports have to be moved?

This test will ensure that you prioritize the most important components when you are transferring.

3. Data Preparation and Cleaning

Quality of data is essential for every BI software. Before you migrate, make sure your data is tidy precise, well-structured, and accurate. Remove duplicate records, obsolete data, and inconsistencies to avoid problems post-migration.

4. Choose the Right Team

Successful migrations require collaboration from IT and data analysts along with business and data analysts. Designate specific roles, like the project manager, engineer for data and specialists for Looker, to make the process easier.

The Migration Process

1. Plan the Migration Strategy

Choose whether to go with either a gradual approach or a big-bang move:

Phased Approach: Transfer elements like dashboards and data sets slowly, evaluating at each step.

Big-Bang Migration: Convert all processes and data to Looker all at once which is ideal to smaller-scale ecosystems.

2. Set Up Looker

Begin by setting up Looker to match the needs of your business:

Join Looker with your warehouse of data.

Create LookML model (Looker's model language for data) to build modular data structures.

Create access rights for users and permissions for the user.

3. Test and Validate

Testing is a crucial element of the migration process. Test your visualizations, models and reports to make sure they are in line with the outputs from the old BI program. Participate with the end users in the process of testing to get feedback and pinpoint problems early.

4. Train Your Team

Unique features in Looker, such as LookML or real-time information exploration, could require training for users. Create workshops and offer the resources needed to enable your team to make use of Looker efficiently.

5. Go Live

After you've completed the your training and testing, put in place Looker throughout your company. Follow its performance closely throughout the first phase and resolve any issues as quickly as possible.

Challenges in Migrating to Looker

1. Resistance to Change

Some employees may be resistant to adopting an innovative tool. Reduce this resistance by highlighting the advantages of Looker and offering a comprehensive training.

2. Integration Complexities

Making sure that seamless integration is achieved with data sources that are already in place can be a challenge. Collaboration in conjunction with Looker professionals or advisors to overcome technical challenges.

3. Data Security

The security of your data should be considered a top concern. Set up robust access controls and follow the standards for compliance to safeguard sensitive information during data migration.

Benefits of a Successful Migration to Looker

If executed properly, moving to Looker can bring many advantages:

Advanced Data Accessibility: Equip your team to use self-service analytics.

Better Decision-Making: Use real-time information for strategic decisions.

The ability to scale: as your company expands, the cloud-based architecture of Looker can be scaled easily.

Cost Efficiency: Reduce the operational cost by consolidating your BI tools.

Conclusion

The move to Looker certification offers the chance to upgrade your business intelligence platform and equip your workforce with cutting-edge analytics capabilities. But a successful migration requires careful planning, collaboration and implementation. Through addressing any potential problems and following the guidelines, your company can maximize the possibilities of Looker as an BBI tool.

If you are considering an enterprise intelligence upgrade make sure you review your current system as well as train your team and use Looker's strengths in order to ensure success based on data.

0 notes

Text

[ad_1] Mergers and acquisitions (M&A) are advanced processes that require strategic planning, monetary experience, and meticulous execution. Mergers and Acquisitions Consulting is a vital service to contemplate when embarking on these advanced transactions, because it supplies the steerage wanted for profitable outcomes. Choosing the proper Mergers and Acquisitions Consulting agency can considerably affect the success of your transaction. This information will show you how to navigate the choice course of, making certain you make an knowledgeable choice that aligns with your corporation aims. Understanding Your M&A Wants Earlier than participating an M&A consulting agency, it’s important to have a transparent understanding of your aims and necessities. Outline Your Enterprise Aims Progress Methods: Are you trying to increase into new markets, diversify your choices, or improve operational capabilities? Monetary Objectives: Decide whether or not your focus is on reaching value synergies, maximizing return on funding (ROI), or enhancing total monetary efficiency. Assess the Scope of Companies Required Establish the particular providers you want, resembling technique improvement, firm valuation, due diligence, negotiation, or post-merger integration. Consider whether or not you require end-to-end assist or help with particular phases of the M&A course of. Key Components to Contemplate When Selecting an M&A Consulting Agency Business Experience Search corporations with intensive expertise in your business. Business-specific information ensures they perceive market dynamics, regulatory challenges, and potential dangers. Analysis examples of corporations with area of interest experience that align along with your sector. Observe Report and Repute Study the consulting agency’s historical past of profitable transactions, specializing in offers of comparable scale and complexity. Search for shopper testimonials, evaluations, and case research to realize insights into their reliability and effectiveness. Vary of Companies Provided Contemplate whether or not you want a full-service agency that covers all features of M&A or a specialised marketing consultant specializing in particular areas resembling valuation or integration. Make sure the agency supplies complete assist, together with compliance, negotiation, and strategic alignment. Staff Experience and Credentials Confirm the qualifications of the agency’s professionals, together with monetary analysts, authorized advisors, and business specialists. Test for certifications resembling Chartered Monetary Analyst (CFA), Licensed Public Accountant (CPA), or different related accreditations. Evaluating a Consulting Agency’s Strategy Strategic Alignment Assess the agency’s methodology to make sure it aligns along with your firm’s tradition and targets. Prioritize corporations that emphasize collaboration and transparency all through the method. Customization vs. Standardization Go for a agency that provides tailor-made options fairly than a one-size-fits-all strategy. Custom-made methods usually tend to tackle your distinctive challenges and alternatives. Know-how and Instruments Consider the agency’s use of superior analytics, valuation fashions, and integration software program. These instruments can improve decision-making and streamline processes. Finances and Value Transparency Understanding Price Constructions Make clear the agency’s pricing mannequin, whether or not it’s based mostly on retainers, success charges, or hourly charges. Worth for Cash Examine the price of providers with the standard and depth of experience provided. Keep in mind that a barely greater payment could lead to important long-term worth. Hidden Prices Pay attention to further prices for specialised providers or unexpected complexities. Request an in depth breakdown of charges upfront to keep away from surprises.

Conducting Due Diligence on Consulting Companies Analysis and Background Checks Evaluation the agency’s on-line presence, together with their web site, business rankings, and impartial evaluations. Requesting Proposals Present a transparent define of your aims in your Request for Proposal (RFP). Examine responses based mostly on experience, strategy, and cost-effectiveness. Shopper References Converse instantly with previous purchasers to realize firsthand insights into the agency’s efficiency. Ask in regards to the agency’s strengths, areas for enchancment, and total affect on the transaction’s success. Significance of Compatibility and Belief Cultural Match Make sure the consulting agency’s values and dealing model align along with your group’s tradition. This compatibility fosters smoother collaboration. Communication and Transparency Select a agency identified for clear and well timed communication. Transparency all through the method is important for constructing belief. Lengthy-Time period Partnership Potential Assess the agency’s willingness to assist your corporation past the instant transaction. An extended-term companion can present worthwhile insights for future progress. Widespread Errors to Keep away from Selecting Primarily based Solely on Value: The most cost effective possibility could lack the experience required for a profitable end result. Ignoring Business-Particular Expertise: A generalist agency could not totally perceive your sector’s nuances. Overlooking Integration Help: Put up-merger integration is vital for reaching the specified synergies and shouldn't be uncared for. Failing to Construct Relationships: Robust relationships along with your consulting staff are important for a easy and efficient course of. Closing Steps: Making the Choice Summarize Your Findings: Compile an in depth evaluation of every agency’s strengths, weaknesses, and alignment along with your wants. Conduct Closing Interviews: Have interaction with shortlisted corporations to make clear any remaining questions and assess their compatibility. Belief Your Judgment: Whereas goal standards are essential, your instincts a few agency’s means to satisfy your wants must also issue into your choice. Conclusion The success of your M&A journey hinges on choosing the precise consulting agency. By specializing in strategic alignment, business experience, and clear communication, you may guarantee a seamless and value-driven course of. Start your search with confidence, figuring out that the precise companion will help you obtain your corporation aims and lay the inspiration for long-term success. [ad_2] Supply hyperlink

0 notes

Text

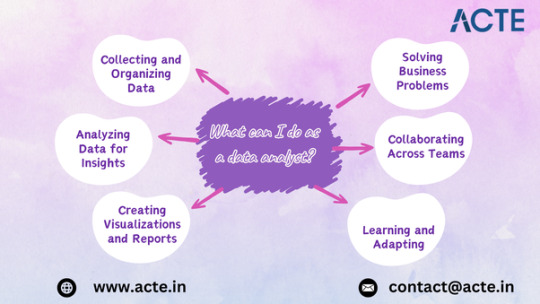

The Essential Skills Every Data Analyst Needs in 2025

Introduction Data analysis is a rapidly evolving field, and to succeed, analysts need to possess a broad range of skills. In 2025, the demand for skilled data professionals will only continue to rise, and those who are able to adapt to emerging tools and technologies will have a competitive edge. In this blog, we outline the essential skills every data analyst should have in 2025 to thrive in this dynamic profession from the best Data Analytics Course in Chennai.

1. Proficiency in Data Tools and Software Data analysts must be proficient in various data analysis tools. Some of the top tools include:

Excel: A versatile tool for basic data manipulation and visualization.

SQL: Essential for querying and managing databases.

Python or R: Programming languages widely used for data manipulation and statistical analysis.

Tableau/Power BI: Popular tools for data visualization that help present findings clearly. If you want to learn more about Data Analytics, consider enrolling in an Data Analytics Online Course. They often offer certifications, mentorship, and job placement opportunities to support your learning journey.

2. Strong Statistical Knowledge A solid understanding of statistical methods is fundamental for analyzing data accurately. Analysts need to apply techniques such as hypothesis testing, regression analysis, and sampling to extract meaningful insights from data.

3. Data Cleaning and Preprocessing Raw data is often messy and unstructured. Data analysts must be able to clean, transform, and preprocess data to ensure its quality and relevance for analysis. This skill involves handling missing data, detecting outliers, and normalizing datasets.

4. Data Visualization Skills Presenting data in a clear and compelling way is crucial. Data visualization allows analysts to communicate complex insights effectively to non-technical stakeholders. Familiarity with tools like Tableau, Power BI, or even Python’s Matplotlib and Seaborn libraries is essential for creating impactful visuals.

5. Communication and Business Acumen Data analysts must not only analyze data but also translate findings into actionable business recommendations. Strong communication skills are essential to effectively convey insights to both technical and non-technical stakeholders. Understanding business goals and objectives is equally important to provide context for data-driven decisions.

Conclusion The future of data analysis is exciting, and the key to thriving in this field lies in developing a diverse skill set. From technical expertise in tools like SQL and Python to soft skills such as communication and business acumen, data analysts must be well-rounded professionals who can turn data into strategic insights.

0 notes