#BusinessConfidence

Text

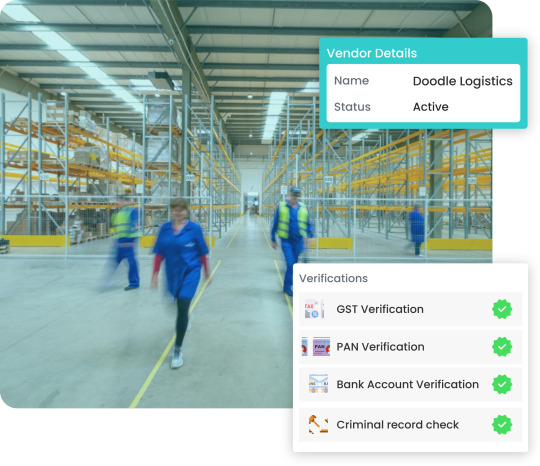

Secure Your Business Partnerships with OnGrid's Vendor Due Diligence Solutions

Elevate your business confidence and safeguard against risks with OnGrid's Vendor Due Diligence Solutions. With a track record of verifying over 100K vendors and serving 3000+ satisfied clients, we are your trusted partner in due diligence. Our advanced AI-powered models undergo continual audits and evaluations, ensuring precision and accuracy in vendor assessments. Committed to compliance and security, we hold ISO certification and SOC 2 Type II compliance, prioritizing data protection and regulatory adherence.

Driven by subject-level experts, we provide comprehensive assessments tailored to your business needs. Our technology stack seamlessly scales with your volumes, delivering swift processing without compromising accuracy. Enjoy cost-effective solutions tailored to your budget, with rapid turnaround time and insightful reports for informed decision-making.

Choose OnGrid for basic due diligence, company health checks, criminal record checks, field audits, credit history checks, and directorship checks. Trusted by top brands for vendor onboarding, join us in enhancing your business confidence with OnGrid's Vendor Due Diligence Solutions.

#VendorDueDiligence#BusinessConfidence#RiskMitigation#Compliance#DueDiligenceSolutions#OnGrid#VendorVerification#BusinessPartnerships

0 notes

Text

Доверенные друзья в СМИ: эффективные услуги по связям с общественностью

Мы очень ценим сотрудничество с этой службой по связям с общественностью. Они строят прочные отношения со средствами массовой информации, создают позитивное освещение и зарекомендовали себя как надежные партнеры.

0 notes

Text

American Business Confidence in China Wanes Amid Tensions 📉🤝 Stay informed about the evolving landscape of U.S.-China relations and its impact on business.

0 notes

Text

Impact Of Economic Policies On Business: 10 Facts You Need To Know

Economic policies on business refer to government actions that influence a country's economic environment, including taxation, trade regulations, monetary policies, and incentives. These policies can impact business operations, growth, and overall economic stability.The intricate interplay between economic policies and the business landscape has long been a subject of fascination for economists, business owners, and policymakers alike.

The impact of economic policies on business is undeniable, shaping everything from market conditions to consumer behavior. Investors, entrepreneurs, and business owners must grasp the massive impact of these restrictions. The 10 Essential Facts You Need to Know About the Impact of Economic Policies on Businesses are covered in this post.

Economic Policies And Business Landscape

Explanation Of Economic Policies:

Economic policies encompass a range of measures adopted by governments to regulate and influence their country's economic performance. These policies can be broadly categorized into several key types:

Monetary Policies: These policies are enacted by central banks and focus on controlling the money supply and interest rates. The central bank's decisions regarding interest rates impact borrowing costs, affecting businesses' access to capital and consumer spending behavior.

Fiscal Policies: Fiscal policies involve government decisions about taxation and government spending. Lowering taxes can stimulate consumer spending and business investments, while increased government spending can boost demand for goods and services.

Trade Policies: Trade policies encompass international trade regulations, tariffs, and trade agreements. They significantly affect businesses engaged in import/export activities, as changes in tariffs or trade agreements can alter the cost of goods and the competitiveness of domestic industries.

Regulatory Policies: Regulatory policies pertain to rules and regulations governing business operations. These include environmental regulations, labor laws, health and safety standards, and more. Compliance with these policies can impact business costs and operational efficiency.

Influence Of Economic Policies On The Business Environment:

The economic policies adopted by governments wield substantial influence over the business environment, often shaping its dynamics and growth prospects. Here's how these policies impact businesses:

Investment Climate: Monetary policies, such as interest rate adjustments, can impact businesses' decisions to invest in expansion or new ventures. Lower interest rates might encourage borrowing for investment, while higher rates can lead to more cautious investment strategies.

Consumer Behavior: Fiscal policies like tax cuts or stimulus measures can directly influence consumer disposable income. When consumers have more money to spend, businesses across various sectors experience increased demand for goods and services.

Market Competitiveness: Trade policies play a crucial role in determining the competitiveness of domestic industries in the global market. Tariff reductions through trade agreements can provide businesses with access to larger markets and foster international growth.

Operational Costs: Regulatory policies impose standards that businesses must adhere to in their operations. Compliance with these policies can lead to additional costs, impacting profit margins, but can also enhance a business's reputation for responsible practices.

Supply Chain Impact: Trade policies, especially those related to imports and exports, can disrupt supply chains. Businesses relying on global suppliers may experience fluctuations in costs and availability due to changes in trade regulations.

Fact 1: Monetary Policy

Monetary policy stands as a pivotal instrument within a country's economic framework, wielding considerable influence over business dynamics. Monetary policy is the control of the money supply and interest rates by a central bank to promote economic stability and growth. Multidimensional economic governance profoundly affects business environments.

Definition And Role Of Monetary Policy:

Monetary policy guides a nation's economy. Open market activities, reserve requirements, and discount rates help it achieve economic goals. Generally, the primary goals include curbing inflation, stimulating employment, and fostering sustainable economic expansion. By adjusting the availability of money and credit, monetary policy exerts a substantial influence on the overall business landscape.

How Changes In Interest Rates Affect Borrowing And Investment By Businesses:

Interest rates, manipulated through monetary policy, wield substantial influence over the financial decisions of businesses. When central banks alter interest rates, it triggers a domino effect across the business realm. Lowering interest rates encourages borrowing, as the cost of capital decreases. This prompts businesses to undertake more investments, expand operations, and innovate. Conversely, higher interest rates can deter borrowing, potentially stalling business growth and investment.

Case Studies/Examples Illustrating The Impact Of Monetary Policy On Businesses:

Concrete instances of how monetary policy translates into real-world business consequences provide valuable insights into its impact. Consider the aftermath of the 2008 financial crisis when central banks globally slashed interest rates and infused liquidity into the market. This decisive action facilitated businesses' access to capital at lower costs, spurring investments and aiding in the recovery process.

Conversely, during periods of tightened monetary policy, like the 'Volcker Shock' in the early 1980s, businesses faced heightened borrowing costs, leading to reduced investments and, in some cases, contraction.Understanding the intricate relationship between monetary policy and businesses is imperative for entrepreneurs, investors, and policymakers alike. These examples underscore the undeniable role of monetary policy in shaping the fortunes of businesses, underscoring the need for a keen awareness of its mechanics and repercussions.

Fact 2: Fiscal Policy

Fiscal policy is a crucial tool that governments around the world employ to manage their economies. It refers to the use of government spending and taxation to influence economic activity, particularly in terms of aggregate demand and overall economic growth. By altering the levels of government expenditure and taxation, fiscal policy aims to stabilize the economy, encourage investment, and promote sustainable growth.

Definition And Role Of Fiscal Policy:

Fiscal policy involves the government's decisions regarding its expenditures and revenues with the intent of achieving specific economic objectives. This policy can be expansionary or contractionary, depending on the prevailing economic conditions. During periods of economic downturns, governments might increase spending and lower taxes to boost demand and stimulate economic activity. In contrast, governments may cut expenditure and raise taxes to cool the economy during strong inflation or growth.

How Changes In Taxation And Government Spending Impact Business Operations:

Changes in taxation and government spending can significantly impact the operations of businesses. Taxation directly affects a company's profitability by influencing its expenses and overall financial health. Alterations in tax rates can influence consumers' purchasing power and disposable income, consequently affecting demand for goods and services. For businesses, changes in tax policies can lead to shifts in production costs, pricing strategies, and investment decisions.

Government spending plays an equally critical role. Increased government spending, particularly in sectors related to infrastructure, healthcare, and education, can create opportunities for businesses to provide goods and services required for these projects. This injection of demand can lead to increased production and employment in relevant industries.

Case Studies/Examples Illustrating The Impact Of Fiscal Policy On Businesses:

The Great Recession (2007-2009): During this period of economic downturn, many governments implemented expansionary fiscal policies to stimulate economic activity. The American Recovery and Reinvestment Act of 2009, for instance, involved significant government spending on infrastructure projects and tax cuts, indirectly aiding industries involved in construction, manufacturing, and technology.

Austerity Measures in Europe: In contrast to expansionary policies, some European countries implemented austerity measures in response to the Eurozone debt crisis. These measures involved substantial cuts in government spending and increases in taxes. The resulting decrease in consumer spending and demand had negative repercussions for numerous businesses, leading to closures, layoffs, and decreased economic growth.

COVID-19 Pandemic Responses: The global response to the COVID-19 pandemic included various fiscal measures. Governments introduced stimulus packages, tax breaks, and financial assistance to businesses in sectors most affected by lockdowns and reduced consumer activity. These interventions aimed to prevent widespread business closures and maintain economic stability during the crisis.

#economicpolicy#businessimpact#economicgrowth#businessregulation#taxpolicy#laborpolicy#tradepolicy#monetarypolicy#fiscalpolicy#investmentclimate#businessconfidence

0 notes

Text

How to Overcome Doubt When Rejected in Business? Answers: https://mymetric360.com/question/how-to-overcome-doubt-when-rejected-in-business/ #EntrepreneurMindset #OvercomingRejection #BusinessConfidence Do you eve...

0 notes

Link

To get the daily update just SUBSCRIBE NOW

#business#culture#europeanbusiness#europes#europe#startups#growth#magazine#innovation#technology#fintech#blockchain#winners#losers#eurozone#euro#businessconfidence#investment#climate

9 notes

·

View notes

Photo

Is there anything you are a bit insecure about? For me, it’s that I’m an overthinker who has to mentally stop myself before I go down the rabbit hole of negative self-talk. This is especially true for being part of a leadership team as one of the only women and the only woman of color. Although I struggle with this, I am working every day to turn things around by reminding myself that I have gotten this far in the IT industry that is predominantly men and I will continue to be successful. I accept that I am an over-analyzer, and I use it to my advantage. I do this by: ➡️ Thinking of different strategies to resolve a problem ➡️ Coming up with alternate action plans for my goals ➡️ Coaching my team members when they come up with me with any questions and issues Accept yourself and use your strengths to overcome any areas that you have to work on. What are you insecure about, and how do you overcome it? Regardless of what it is, know this friend: you are enough! #businessconfidence #motivation #businessconfidenceforwomen #businessconfidencebuilding #confidencebusiness #inspiration #businessconfidencetips #businessconfidence✅ #businessconfidencecoach #confidenceinbusiness #businessconfidenceindex #buildingbusinessconfidence #selflove #igniteyourbusinessconfidence #businessconfidences #buildbusinessconfidence #confidence #businesscoach #businesscoaching #loveyourself #careergoals #careergoalsforwomen (at Washington D.C.) https://www.instagram.com/p/CTnCLQKLUpR/?utm_medium=tumblr

#businessconfidence#motivation#businessconfidenceforwomen#businessconfidencebuilding#confidencebusiness#inspiration#businessconfidencetips#businessconfidence✅#businessconfidencecoach#confidenceinbusiness#businessconfidenceindex#buildingbusinessconfidence#selflove#igniteyourbusinessconfidence#businessconfidences#buildbusinessconfidence#confidence#businesscoach#businesscoaching#loveyourself#careergoals#careergoalsforwomen

0 notes

Text

Business conditions hit 'highest levels' in nine years

News I Business Confidence

How confident are you about your businesses performance?

According to the NAB, we should be very confident. Confidence is in Profitability - but productivity remains stagnant - Good read...

www.tdconsulting.com.au

#BusinessConfidence #Profitability #Productivity #tdconsulting

https://plus.google.com/+ThextonDoddConsultingAus/posts/FgA33mQHyYb

0 notes

Text

What we’ve read this week

SMEs remain confident they will thrive in 2017 and beyond (American Express in smallbusiness.co.uk)

According to American Express’ latest ‘Global SME Pulse’, the key findings of which are featured at smallbusiness.co.uk, UK SMEs are looking forward to “increased revenues & profits” over 2017 and beyond, with plans to focus on “expansion and sales growth to drive financial performance”.

https://goo.gl/l6Hhej

Manufacturing optimism reaches 20 month high (BDO in smallbusiness.co.uk)

BDO LLP’s latest ‘Business Trends Report’, indicates that optimism in the UK manufacturing industry has reached a 20-month high, but “rising inflation remains a concern for the wider UK economy”. The report findings are featured at smallbusiness.co.uk and can be found by clicking on the link below.

https://goo.gl/ZFnuZX

Sadiq Khan to visit five European cities to show UK capital is ‘open for business’ (startups.co.uk)

According to startups.co.uk, the Mayor of London, Sadiq Khan, is set to visit “Berlin, Brussels, Paris, Madrid and Warsaw, shortly after the Article 50 bill is expected to be triggered”. The Mayor announced last week at the London Transport Museum that he will visit the “five major European cities” as part of the London Is Open campaign.

https://goo.gl/vjRqbR

SMEs at risk of digital exclusion new report finds (ICAEW in SME Insider)

New report findings from the ICAEW, featured in SME Insider, suggest that “smaller businesses could be excluded from government plans for making business transactions digital”.

https://goo.gl/y94adq

0 notes

Photo

Warren Hogan provides analysis and commentary on the current economic outlook and the global and local factors in play for business in the year ahead.

https://bit.ly/37Ra9pQ

#Businessconfidence #Leadership#Betterleaders

0 notes

Photo

You can start strengthening your confidence in sales today. Learn how to get comfortable with online sales from an expert. Never told before truths! #sellingwithconfidence #businessconfidence https://ift.tt/3fEVW3B

0 notes

Text

Weekly Forex Forecast: March 12 – 16 2018 – Forex Trading Guide

welcome everybody to our weekly foreign exchangemarket evaluation name and that is in preparation for buying and selling for the week ofMarch 12 to 16 2018 only a fast disclaimer earlier than we get began this isfor instructional functions solely buying and selling is a dangerous enterprise so please be verycareful along with your cash alright in order common we are going to begin off bytaking a take a look at our calendar right here so developing this week a very first thing isdaylight financial savings time shits shift so that is each for US and Canada in springwe go ahead one hour in order that has occurred so that is the primary day wehave had the time shift is shift it occurred final night time so which implies thatour london buying and selling hours will shift a bit so as a substitute of beginning at three:00 a.

M.

Jap it will likely be four:00 a.

M.

Jap so simply preserve that in thoughts and that goes onfor two weeks it's the UK shifts again on March the 24th so we have now yeah about twoweeks the place the time shall be misaligned just a little bit so preserve that in thoughts I'mgoing into Monday right here not a complete lot of essential knowledge we do have RBAassistant governor bullit talking that shall be essential the businessconfidence quantity for Australia shall be essential as nicely and Tuesday we haveannual finances for for UK there that shall be essential and in addition very importanthere are the CPI numbers so when Fed has been speaking about elevating price so theyraise charges and within the feedback that they’ve had about elevating charges thisyear one factor that has been on the forefront is the inflation knowledge andeverybody's questioning the inflation numbers so if the inflation numbers arenot getting greater that may be an issue with the Fed so proper now whatwe are searching for is a constructive quantity zero.

2 % so if this quantity comes inkind of is in alignment with this quantity right here that shall be good howeverif the quantity is detrimental that may have an even bigger impression as a result of market willstart begin pondering that they're not protection not going to lift race whichwill be detrimental for the US greenback so preserve that in thoughts a constructive or a higherinflation quantity shall be constructive for the US greenback but when we get anythinglower than this it will likely be detrimental for the US greenback and we may see US dollardrop in opposition to throughout the board after which we have now Financial institution of Canada governor polarspeaking once more extra RB Assistant governor Kent talking there industrialproduction numbers for China so regardless that we don't commerce Chinese language currencyit has an impression on Australia and New Zealand as a result of they're large tradepartners and we do commerce these foreign money so preserve that in thoughts after which we have now onWednesday we have now ECB President Draghi talking final week we had ECBannouncement price announcement they saved on the price the identical and we noticed thatEuro jumped up after they modified their language when it comes to the asset purchaseprogram so the asset buy program is how the how the central financial institution putsliquidity out there so that they pump cash into the market by shopping for thebonds and because of this and get the cash to the so that they purchase the bonds from thebanks and the banks have extra money that they will then lend out to shoppers andbusinesses and that's how they create that circulation of cash within the financial system so nowthat the financial system is doing higher the European financial system is doing higher thecentral financial institution has been attempting to principally go get off of that programthat program is meant to finish in 2018 this 12 months in direction of the tip of this 12 months Ithink September 2018 and one of many feedback that they the middle-backremoved was final time they stated that they're going to proceed the programfor so long as it's essential and that could possibly be even well past the September2018 date this 12 months sorry this time they really eliminated that wording and whatthey stated that the cash that has already been invested in these bondpurchases and asset purchases what occurs is as soon as the cash comes dueso that when the bond matures the cash you recognize you may get the cash backhowever what they're going to do is they are going to proceed placing a reinvesting thatmoney again so that they're going to finish this system so that they gained't be placing anymore cash in however the cash that's already been invested that may bereinvested within the financial system so after they eliminated their program that wording eurojumped up after which when Draghi began talking within the press convention and heclarified a few of these factors we noticed a euro drop on account of that so themarket will now actually be that key level as to what the what thecentral financial institution's coverage goes to be going ahead there are some centralbankers some ECB members which have come out and stated that we have to provideforward steering when it comes to curiosity ratesDraghi hasn't actually set that proper now there's additionally concern in regards to the tradewars with President Trump says saying that they will put tariffs onsteel and aluminum that’s inflicting issues as nicely so so there there issome uncertainty out there so simply keep watch over that after which onWednesday we even have core retail gross sales PPI and retail gross sales numbers once more thesewill be essential GDP for New Zealand shall be essential right here as nicely and thecrude oil stock will have an effect on each the US the US greenback andCanadian greenback right here on Thursday we have now Swiss Nationwide Financial institution right here we have now thelibrary price which is the rates of interest the Swiss Nationwide Financial institution continues to be in thenegative territory after which the financial coverage assertion right here as nicely once more weare going by way of this era of change the place the central banks are changingtheir financial coverage so it's essential to concentrate to to those statementsthat come out so in case you're buying and selling Swiss franc this shall be essential after which wehave these Empire State manufacturing numbers once more regardless that that is orangeit is essential and these numbers will have an effect on the USStaller right here going into the Asian session enterprise manufacturing indexnumber so there's lots of members from a reserve not sorry RBA who’s the Bankof Australia talking so this might have an effect on Australian greenback heregoing into Friday we have now ultimate CPI numbers out of euro euro zone so thatwill have an effect on euro there after which we have now constructing permits for the USand housing begins these numbers regardless that they’re orange they do have animpact available on the market so we do have to keep watch over that in order that's it so wereally have one central financial institution and a few different central bankers speakingso we'll simply have to concentrate to thatso let's transfer on to our charts now we are going to begin off with our Europe so herewe see that Euro had been on this broader vary for some time and now it'sin a little bit of a decrease vary right here so we have now a really good pin bar we had a pinbullish pin bar for Euro final week and from there it has moved as much as the highest ofthis vary that it was or at the very least the highest of this pin right here now we have now abearish pin bar for the euro so bearish pinbarI am searching for worth to drop right here we’re more likely to see worth wrestle at thisone 2200 degree which is the place worth has struggled a number of occasions earlier than it didtry to interrupt by way of this final time however it was not profitable so proper now basedon the bearish pinbar right here I'm searching for a worth to attract for euro US dollarso the bias is bearish for this week first goal can be one level 2200second goal can be one level twenty 100 so searching for worth to comedown a bit pound greenback right here pound has a pound pushed again just a little bit so we hadtalked about that markets are we talked about seeing some pull backs final weekso this one pulled again however general the bias continues to be to the draw back so if wetake a glance right here there may be nonetheless that downtrend linecoming down so now we have now pushed up I'm searching for worth to drop from right here andpotentially do one a transfer like that so for this one right here the my bias shall be uhwill even be to the draw back and I'm searching for worth to come back again into thisone level 3700 degree right here after which probably into 135 80 degree under hereso searching for worth to drop general bias nonetheless stays to the draw back eventhough there’s a pullback right here and so these would be the three ranges firstlevel 1.

30 700 second 135 80 third one 134 20 degree so general bias stays tothe draw back for pound greenback right here ah see right here Aussie was really quitestrong the bias right here final week was to the draw back however it couldn’t break thissupport and resistance degree right here that was fairly fairly essential supportresistance degree was not capable of break it so now we have now a bullish engulfingcandle for Ozzy right here so I'm searching for worth to push up greater so all thecommodity currencies pushed up regardless that the commodities themselves didn'tdo as nicely at the very least I didn't do as nicely however the commodity currencies have pushedout so it is a bullish engulfing candle searching for worth to maneuver higherinto zero.

79 sixty degree again into this earlier afford personal resistance degree andpotentially even into 79 so about zero level eight zero zero degree so thosewill be the 2 targets to the upside however searching for a bullish transfer in Aussiedollar New Zealand greenback we had an identical story right here worth couldn’t breakbelow this earlier assist or resistance degree as a substitute pushed uphigher and now with this one it’s bullish however we must be a littlecareful right here so this one it it engulfs the earlier one so on account of thatI we'll be searching for a bullish transfer andthe goal can be zero.

74 38 degree so 74 38 degree to the upside again into thisprevious assist and resistance degree right here and but when the worth isn’t ready tobreak previous their assist or resistance which is at zero.

73 20 we may nonetheless getthat transfer to the draw back in order that's the one factor I might be aware of overalljust primarily based on the weekly technicals right here it appears like an up transfer however we couldget caught right here identical to we received caught to the draw back we may get caught right here andthis can occur so simply be aware of that however general bias shall be to thedown to the oxide sorry greenback cad right here greenback cad appears bearish i'm sorrywhich 4th to bullish candle and are we speaking about are you able to please clarifythat yeah so I'm all of the US greenback right here which bullish candle okaywe'll come again to that New Zealand greenback okay so New Zealand greenback thisis the place we’re so we’re on this vary basically within the New Zealand greenback sowe have we have now BC traded on this vary as a result of we're within the backside of the rangeso I'm searching for worth to go up greater so that is that is form of how I'mviewing it so searching for worth to enter the top quality after which thenreact however I’ve this within the center right here so if the worth isn’t capable of breakabove this see that is the assist or resistance I'm worth had alot of hassle with this space in order the worth goes greater if it's not ableto break above this which is about 70 335 degree the worth may do one ofthese in order that's what I’m for New Zealand greenback so the bias is to theupside however there’s a concern about getting caught on the supporter isdouble greenback cat right here greenback cad is a pleasant bearish pinbar right here and this looksquite good on the weekly so because of this I might search for a worth to attract and nowwith this one the goal can be one level twenty six twenty degree theconcern once more can be proper over right here as a result of that is an significance of maintain onresistance space coming all the best way from there so that is one level twenty eighthundred degree if it doesn't maintain under twenty eight hundred degree it couldstill go up however I do just like the weekly pin bar so my bias on that is to thedownside and the goal is 126 a one level twenty six twenty degree which isthis assist no resistance space which is the underside of our earlier weekly candleclose right here so the bias for greenback cad is to the draw back your a pound right here yourpound has been buying and selling on this vary for fairly a while we’re on the prime of therange right here so I'm searching for worth to attract again in direction of the underside of therange so the bias is to the draw back and the underside of the vary right here is 86 93 soabout eight,700 degree so searching for worth to attract for Euro Pound euro Swiss franchere your Swiss franc has had an enormous bullish transfer to the upside so I'mlooking for worth to go up farther from right here and since we have now had such abullish transfer we may see such a a pullback again into one level one sixforty degree after which worth goes and continues on to the upsideso my bias is bullish for euro Swiss franc and trying to trying to targetthe prime right here into one level one eight zero zero degree so the biases to theupside the a pound Swiss franc right here biases to the upside as nicely so thefirst goal can be one level thirty two thirty space after which one level 3480space to the upside so bullish bias good bullish engulfing candle so wanting forprice to maneuver up greater now you be mindful there may be Swiss NationalBank financial coverage sighs sorry financial coverage evaluation coming outthis week which may have a huge impact on the Swiss franc if they modify theircommentary across the rates of interest so preserve that in thoughts however from technicalperspective this appears bullish greenback Swiss francbig transfer to the upside right here we have now damaged by way of this earlier a pin barhere and now searching for a bullish transfer to the upside the goal right here can be96 30 degree zero.

96 30 degree once more with Swiss Nationwide Financial institution issues may changeso be aware of that with this one I might search for a little bit of a pullback hereas nicely simply because we have now had an enormous large form of shut right here so I'm stilllooking for a transfer to the upside however they could possibly be a pullback again into thissupport no resistance at 9420 space okay yen crosses yen crosses have had aninteresting week so the largest factor that occurred with the yen crosses wasthat we we noticed some political occasions happen so North Korea basically isready to speak and they’re able to D nuclear ice and once we hear commentslike that it’s typically unhealthy for yen however constructive for yen crosses so yenweakens and all the pieces else will strengthen round that so yen is a safehaven foreign money Swiss franc is a secure haven foreign money US greenback is a secure havencurrency when issues are occurring out there which might be perceived to be negativethese three currencies strengthened and we noticed we see all the pieces drop againstthese currencies nevertheless once we see constructive issues occurring round theworld so issues like North Korea not wanting to maintain the identical stance that ithas held for this lengthy on their nuclear weapons program that’s consideredpositive when such constructive geopolitical thingshappen market scene sees that as a danger on atmosphere or it creates a danger onenvironment out there meaning buyers are keen to take extra riskand when buyers are keen to take extra danger they are going to spend money on thingslike shares and we'll see inventory market go up and once we see the chance offenvironment then the secure haven currencies will really strengthen sowhen there may be danger out there when buyers don't like danger they'rerisk-averse so once we see detrimental geopolitical occasions like North Koreathreatening to to principally you recognize Mother us that's a detrimental atmosphere in order aresult folks buyers get danger-averse and they’re going to pull cash out of thestock markets and they’re going to put cash in Japanese yen Swiss franc and US dollarswhich are thought of to be safer than currencies so principally we noticed a danger onenvironment meaning Japanese yen bought off and because of this we noticed Swiss francall the Swiss pairs go up as nicely and we noticed yen crosses go up as nicely now thereare talks about President Trump assembly with North Koreanow if these if that involves to play then Japanese yen will weaken furtherbecause that's a constructive factor and we don't have to be in secure havenenvironment if that occurs so in that case yen may go up butbased on this technicals right here we’re nonetheless in that general downtrend right here butwe have had a bullish candle shut so now this needs to be performed as an overallpicture so we have now to take a look at the general image we'll must preserve inand we have now to keep watch over what's occurring out there so conserving an eyeon Bloomberg and Reuters to guarantee that we perceive whether or not North Koreaand us will speak or not will play an essential position hereso from general perspective that is bullish and searching on the technicalsthis may push up a bit extra so we may go all the best way into one fiftypoint eighty degree right here all the best way again into the earlier assist and resistancelevel so I might for now name this bullish however once more keep watch over thecommentary that comes out simply general in the event that they speak that's a great factor ifthere's a constructive end result of that that may be once more constructive for the yencrosses if there may be detrimental if let's say the talks break down or they will'teven set a gathering date that shall be thought of detrimental after which yen crossescould drop when it comes to the financial coverage we did have Financial institution of Japan comeout with their financial coverage didn't actually change something in order that waspretty impartial however it's actually the do political stuff that’s saying into theyen at this level so my goal for my bias for pound yen right here shall be to theupside and the goal shall be 150 level eighty degree so bias to the upside hereyen so your yen an identical story right here as nicely all of the yen crosses went up so wepushed off of this assist or resistance degree general we have now a bullish candleclose and I'm searching for worth to maneuver greater into one thirty three sixty nowjust be mindful all of the younger crosses will have a tendency to maneuver collectively so preserve aneye available on the market commentary general biases to the upside for euro yen aswell greenback yen right here similar story costs pushed up we’re intoresistance right here although so preserve that in thoughts general bias nonetheless stays to thedownside and with this one I might search for a bullish transfer to the upside butagain from technical perspective we may get caught at this 107:20 degree ifprice doesn’t break above 107:20 degree then we may return in direction of the bottomof this degree again into one and 5 thirty but when all the opposite yen crossesmove up a greenback yen is more likely to transfer up as nicely and the goal would beNo 880 degree to the upside so bias for this week shall be to the upside $4dollar yen Aussie and massive bullish candle shut right here worth bounced off of thebottom right here so this was an important technical degree in order we are able to see pricebounced off because of this searching for worth to maneuver up greater into 85 60 levelto the upside again into the spin into the assist and resistance ranges soOzzy and biases to the upside similar factor with cadion is wellpreviously the bias was very a lot to the draw back on this however now that every one theyen crosses are shifting greater that is additionally this has additionally pushed up so thetarget can be 85 54 cadion so let's check out gold gold we have now a dojiso that is this exhibits rejection of the highest but additionally rejection of the underside andthe worth opened and closed at precisely the identical place that it it began offfrom however this rejection of the excessive right here exhibits that worth may come again lowerbecause the suitable now we’re into the center right here the goal for this one sothe bias can be to the draw back and the goal can be 30 no 2.

71 again intothis pin right here so with this one as a result of it's a doji there may be indecision in thereas nicely so simply preserve that in thoughts let's check out oil actual fast soit appears like oil did go up on Friday right here it had dropped beforehand now itwent up with this one that’s wanting fairly bullish let's check out theweekly okay from the weekly perspective that’s impartial from each day perspectivethat was fairly bullish with this one once more very very impartial we’re in thisrange so since we’re in the course of the vary and rejected the underside of therange oil may go greater into 64 60 degree again into the highest right here however overallthe bias is for this week the counter pulse isvery impartial which implies it may go each methods however it’s on this vary forthe final three weeks so I'll deal with this as a variety certain and I'm wanting forprice to enter the tie of the vary after which come again into the vary againalright in order that's all I’ve any questions are something so as to add there itlooks like there aren’t any questions so we are going to name it a wrap you guys have awonderful fantastic weekend or the remainder of the weekend and I’ll see you nexttime then the non-farm payroll shortly non-farm payroll principally there arethree various things that we have now to concentrate in relation to non-farmpayroll one is a jobs quantity after which they're the wages after which additionally lookingat what sort of jobs really you recognize they what sort of jobs had been addedfull-time half-time that sort of factor so the roles quantity got here in positivehowever the common earnings quantity got here in detrimental and that's why we noticed the USdollar drop it's a median earnings numbers are literally very importantbecause they they are saying or they present how the financial system is doing if the roles areincreasing however the common earnings aren’t growing which is it's notconsidered a great factor and that's why US greenback drop on account of non-farmpayroll quantity alright you guys have a beautiful weekend and I’ll see younext time bye for now.

Сообщение Weekly Forex Forecast: March 12 – 16 2018 – Forex Trading Guide появились сначала на Forex make easy money at home.

from WordPress http://ift.tt/2pszdPA

via IFTTT

0 notes

Link

http://ift.tt/1djCc4H

Hanna Hasl-Kelchner

@BusinessConfid

WholeBoardDevelopmnt retweeted:

Raise UR employees game instead of their defenses - boost #employeeEngagement> buff.ly/2ptUXwG #corpgov

April 20, 2017 at 09:42AM

https://twitter.com/WholeBoardDev/status/854912964507439104

from WholeBoardDevelopmnt

https://twitter.com/WholeBoardDev/status/854912964507439104

0 notes

Link

To get the daily update just SUBSCRIBE NOW

#business#culture#europeanbusiness#europes#europe#startups#startup#growth#magazine#innovation#technology#fdi#germany🇩🇪#germany#upwardcurve#upward#businessconfidence#german businesses#jubilant#clemens fuest#frankfurt#bloombergmarkets#bloomberg markets magazine

1 note

·

View note

Link

Hanna Hasl-Kelchner is now following @netbranding on Twitter! Bio: I help U see #biz issues hiding in plain view that matter. I'm @nononsenselawyr, a #SCORE mentor & D&B #bizinfluencer on #iTunes, #Spreaker & more.

0 notes