#CA Foundation Preparation Strategy

Explore tagged Tumblr posts

Text

CA Foundation Preparation Strategy 2024

Welcome to the journey of preparing for the CA Foundation examination in 2024! As you embark on this path, it’s crucial to have a well-structured strategy that will help you navigate through the extensive syllabus and challenging concepts. In collaboration with KS Academy, we present a comprehensive preparation strategy tailored to the needs of aspiring Chartered Accountants.

#CA Foundation Preparation Strategy#CA Foundation Preparation Strategy 2024#CA Foundation Preparation

0 notes

Text

📚 Boost Your Confidence in CA Foundation Law! 📚 📌https://youtu.be/kTt0V2kyyFs Gear up for your exams with our 3-Day Ultimate Law Marathon led by CA Deepika Rathi! 🚀

✅ Concept Revision ✅ Exam-Focused Question Practice ✅ Quick Confidence Boost

Let’s make success happen! 💼🔥

#CA Foundation Law#Law Marathon#Exam Preparation#Concept Revision#Chartered Accountancy#Exam Focused Practice#Confidence Boost#CA Deepika Rathi#Study Tips#CA Exam Strategy

0 notes

Text

How to Succeed with CA Mock Test Series: Foundation, Inter, and Final

For aspiring Chartered Accountants, passing the rigorous CA exams is no small feat. Whether you’re preparing for the CA Foundation Mock Test Series, the CA Inter Mock Test Series, or the CA Final Mock Test Series, mock tests are invaluable. They replicate the actual exam environment, helping you refine your skills, manage your time, and overcome the challenges of this prestigious qualification. This blog will guide you through the significance of mock test series at every stage of the CA journey.

Understanding the Importance of Mock Test Series

Mock test series are structured to simulate the ICAI’s actual exams, offering a realistic experience. They are designed for every level—Foundation, Intermediate, and Final—ensuring students get tailored preparation tools. Mock tests not only prepare you for the questions but also boost your confidence by familiarizing you with exam patterns and the syllabus.

What Is the CA Foundation Mock Test Series?

The CA Foundation Mock Test Series is the starting point for students embarking on the CA path. It includes mock exams for all foundational subjects, such as Principles of Accounting, Business Laws, Economics, and Mathematics.

This mock test series focuses on the basics, ensuring students understand the exam’s framework, marking schemes, and time constraints. By practicing these tests, beginners can overcome exam anxiety and confidently approach the real exam.

Why the CA Inter Mock Test Series Matters

As you progress to the Intermediate level, the CA Inter Mock Test Series becomes essential. It provides a deeper focus on subjects like Advanced Accounting, Auditing, and Financial Management.

Intermediate students often face challenges in balancing theoretical concepts and practical applications. Mock test series help in bridging this gap by simulating complex questions that require analytical thinking. These tests emphasize accuracy and time efficiency, preparing students for the heightened difficulty of the CA Inter exams.

How the CA Final Mock Test Series Prepares You for Success

The CA Final Mock Test Series is the ultimate preparation tool for aspiring Chartered Accountants. This stage demands mastery of advanced concepts, including Strategic Financial Management, Corporate Laws, and Taxation.

These mock tests are designed to test your in-depth understanding and ability to apply concepts in real-world scenarios. They also prepare you for the pressure of the final exam, helping you build the resilience needed to succeed. By taking multiple mock tests, students can track their progress and fine-tune their preparation strategies.

Benefits of Using Mock Test Series at All Levels

Mock tests are crucial for success in the CA exams, regardless of the level. Here’s how they help:

Understanding the Exam Pattern: Mock tests mirror the ICAI exams, giving you a clear idea of the question types, marking scheme, and overall structure.

Improved Time Management: Practicing with mock tests helps you allocate time efficiently across different sections.

Building Confidence: Familiarity with the exam format reduces anxiety and boosts confidence.

Identifying Weaknesses: Mock tests highlight areas where you need improvement, enabling targeted preparation.

Refining Exam Strategies: Regular practice helps you develop strategies to tackle challenging questions effectively.

How to Use Mock Test Series Effectively

Choose Reliable Mock Tests Select mock tests that are ICAI-recommended or provided by reputable institutions. These tests should closely match the exam syllabus and difficulty level.

Schedule Your Practice Sessions Plan your mock tests strategically. Take them at regular intervals, balancing them with your study schedule. Avoid last-minute cramming by starting your mock test journey early.

Simulate Real Exam Conditions Create a distraction-free environment and time yourself strictly during the tests. This approach helps you adapt to the pressure of the actual exam.

Analyze Your Results After each test, review your answers carefully. Identify mistakes and understand the reasons behind them. This analysis is key to improving your performance.

Focus on Weak Areas Spend extra time revisiting topics you struggled with in the mock tests. Use ICAI study materials, revision notes, and expert guidance to strengthen these areas.

Repeat and Refine Mock tests should be a recurring activity. With each test, track your progress and refine your strategies. Regular practice ensures you’re always improving.

Common Mistakes to Avoid

Many students fail to utilize mock tests effectively because of common errors:

Skipping Review Sessions: Completing the test isn’t enough. You must analyze your results to learn and improve.

Neglecting Time Management: Practicing under untimed conditions won’t prepare you for real exam pressure.

Focusing Solely on Strengths: While building on strengths is important, don’t ignore your weak areas.

Where to Access Reliable Mock Test Series

The ICAI offers official mock test series for Foundation, Intermediate, and Final levels. These tests are an excellent starting point. Additionally, numerous coaching institutes and online platforms provide high-quality mock tests. Ensure that the tests you choose align closely with the syllabus and exam format.

Final Tips for Success

Consistency and dedication are the keys to mastering the CA exams. Stay disciplined with your mock test schedule, and balance your practice with regular study and revision. Keep a positive mindset, and remember that every mock test you take brings you one step closer to your goal of becoming a Chartered Accountant.

Conclusion

The journey to becoming a CA is challenging, but the CA Foundation Mock Test Series, CA Inter Mock Test Series, and CA Final Mock Test Series are your best allies. These tests not only prepare you for the exams but also shape your skills and confidence. Start using mock test series today, and take a step closer to achieving your dream of becoming a successful Chartered Accountant.

#CA Foundation Mock Test Series#CA Inter Mock Test Series#CA Final Mock Test Series#Chartered Accountancy Exam Preparation#Mock Test Series for CA Exams#CA Exam Strategy#CA Study Tips#How to Prepare for CA Exams#ICAI Mock Test Series#Success in CA Exams

0 notes

Text

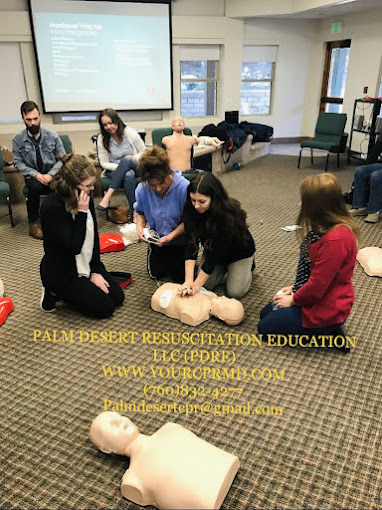

Comprehensive Life-Saving Training in Moreno Valley: Palm Desert Resuscitation Education (PDRE)

Comprehensive Life-Saving Training in Moreno Valley: Palm Desert Resuscitation Education (PDRE)

youtube

In the vibrant city of Moreno Valley, a beacon of life-saving knowledge shines bright through Palm Desert Resuscitation Education (PDRE). Renowned for its exceptional quality of education and training, PDRE stands as a distinguished authorized provider of healthcare and non-healthcare courses, seminars, and certifications, including those endorsed by the American Heart Association (AHA), American Academy of Pediatrics (AAP), and American Red Cross (ARC).

PDRE REDLANDS OFFICE

1815 W. Redlands Blvd.

Redlands, CA 92373

1-909-809-8199

At the heart of Moreno Valley's educational landscape, PDRE offers a comprehensive suite of courses that empower individuals with critical life-saving skills. Among its foundational offerings is the CPR Certification—a skill that holds the power to bridge the gap between life and death in critical situations. The CPR Classes hosted by PDRE are carefully curated, combining hands-on training with theoretical insights, ensuring participants are equipped to respond confidently and effectively to emergencies.

ACLS in Moreno Valley

ACLS Certification in Moreno Valley

PALS in Moreno Valley

PALS Online in Moreno Valley

NRP in Moreno Valley

The commitment of PDRE extends far beyond CPR. Embracing a wide spectrum of certifications, the institution offers the First Aid Certification, a course that imparts essential techniques for addressing injuries and illnesses promptly. Additionally, the BLS (Basic Life Support) Certification is tailored to equip healthcare professionals with the expertise necessary to sustain vital life functions during critical moments. All certifications align meticulously with the latest guidelines from AHA, AAP, and ARC, ensuring that participants receive training rooted in the most up-to-date and evidence-based practices.

PDRE is a haven for those seeking to elevate their medical skills further. With courses like ACLS (Advanced Cardiovascular Life Support) and PALS (Pediatric Advanced Life Support), healthcare providers gain specialized knowledge and strategies for handling complex cardiovascular and pediatric emergencies. In recognition of the modern world's demands, PDRE offers online courses such as PALS Online, allowing participants in Moreno Valley to learn at their own pace, blending convenience with comprehensive education.

One of PDRE's hallmarks is its commitment to inclusivity. Beyond healthcare professionals, PDRE extends its hand to non-healthcare providers and novices, acknowledging that emergencies can strike anyone, anywhere. The institution's NRP (Neonatal Resuscitation Program) courses cater to those involved in newborn care, ensuring the youngest lives are safeguarded with meticulous care and competence.

At the core of PDRE's success lies its team of educators and personnel who bring diverse and experienced healthcare backgrounds to the table. Their expertise forms the bedrock of the institution, guaranteeing participants receive exceptional training and invaluable insights. Fueled by their unwavering dedication, these professionals champion PDRE's mission of fostering healthier lives and reducing the impact of cardiovascular diseases, strokes, and other medical emergencies.

In Moreno Valley, PDRE stands not just as an institution but as a life-changing force. By disseminating knowledge based on the latest guidelines and recommendations, PDRE empowers individuals to be leaders in times of crisis. Whether mastering essential CPR techniques or delving into advanced life support strategies, PDRE's offerings contribute to a community that is prepared, confident, and ready to make a difference when it matters most.

2 notes

·

View notes

Text

Top In-Demand Accounting Jobs in 2025 & How an Accounting Course Can Help, 100% Job, Accounting Course in Delhi, 110075 - Free SAP FICO Certification by SLA Consultants India, GST Certification, ITR & DTC Classes with 2025 Update, Tally Prime Certification,

The accounting profession in 2025 is experiencing a remarkable surge in demand, fueled by digital transformation, regulatory changes, and a persistent talent shortage both in India and globally. As businesses increasingly rely on technology for financial management and compliance, the most in-demand accounting jobs now require a blend of traditional expertise and modern digital skills. For professionals in Delhi (110075), enrolling in a comprehensive accounting course—such as the one offered by SLA Consultants India with free SAP FICO certification, GST certification, ITR & DTC classes with 2025 updates, and Tally Prime certification—is a proven pathway to securing top roles and enjoying robust career prospects.

Accounting Course in Delhi

Among the most sought-after accounting jobs in 2025 are Chartered Accountant (CA), Certified Public Accountant (CPA), Certified Management Accountant (CMA USA), Financial Analyst, Accounts Manager, Tax Advisor, and Forensic Accountant. Chartered Accountants remain at the top of the accounting hierarchy, specializing in auditing, taxation, and financial reporting, with salaries ranging from ₹8–25 lakhs per annum in India. CPAs are highly valued for their expertise in global reporting, auditing, and compliance, commanding even higher salaries—up to ₹30 lakhs per annum—and enjoying international recognition. CMAs, meanwhile, focus on financial management, budgeting, and cost control, making them essential for multinational corporations and consulting firms.

Accounting Training Course in Delhi

Financial Analysts and Accounts Managers are also in high demand, as businesses require professionals who can analyze financial data, manage teams, and support strategic decision-making. CFOs (Chief Financial Officers) oversee financial strategy, risk management, and business growth, earning between ₹15–52 lakhs per annum and playing a critical role in organizational success[5]. Tax Advisors and Forensic Accountants are crucial for ensuring compliance with evolving tax laws and investigating financial discrepancies, respectively, as regulatory complexity continues to increase.

Accounting Certification Course in Delhi

To secure these top roles, professionals need to master both core accounting principles and advanced digital tools. The integration of technology into accounting—especially through automation, AI, and cloud-based platforms—has revolutionized the field, making expertise in software such as SAP FICO and Tally Prime highly desirable. These tools streamline financial processes, enhance accuracy, and enable real-time reporting, which are essential for modern businesses. Additionally, GST certification and up-to-date ITR & DTC training ensure compliance with Indian tax laws, further boosting employability.

A comprehensive Accounting Course in Delhi, like the one offered by SLA Consultants India in Delhi (110075), provides the ideal foundation for aspiring professionals. The curriculum covers essential skills and certifications—including free SAP FICO certification, GST certification, ITR & DTC classes with 2025 updates, and Tally Prime certification—preparing students for the most in-demand roles in the industry. With 100% job placement support, graduates are well-equipped to enter the workforce and thrive in a dynamic, technology-driven environment.

E-Accounting, E-Taxation and E-GST Course Modules Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax) Module 2 - Part A – Advanced Income Tax Practitioner Certification Module 2 - Part B - Advanced TDS Practical Course Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA Module 3 - Part B - Banking & Finance Module 4 - Customs / Import & Export Procedures - By Chartered Accountant Module 5 - Part A - Advanced Tally Prime & ERP 9 Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance Module 6 – Financial Reporting - Advanced Excel & MIS For Accounts & Finance - By Data Analyst Trainer Module 7 – Advanced SAP FICO Certification

In summary, the top in-demand accounting jobs in 2025 require a combination of traditional expertise and digital proficiency. By enrolling in a high-quality accounting course in Delhi (110075), professionals can acquire the skills, certifications, and practical experience needed to secure lucrative roles and build a future-proof career in accounting. For more details Call: +91-8700575874 or Email: [email protected]

0 notes

Text

Apple hints at AI integration in chip design process

New Post has been published on https://thedigitalinsider.com/apple-hints-at-ai-integration-in-chip-design-process/

Apple hints at AI integration in chip design process

Apple is beginning to use generative artificial intelligence to help design the chips that power its devices. The company’s hardware chief, Johny Srouji, made that clear during a speech last month in Belgium. He said Apple is exploring AI as a way to save time and reduce complexity in chip design, especially as chips grow more advanced.

“Generative AI techniques have a high potential in getting more design work in less time, and it can be a huge productivity boost,” Srouji said. He was speaking while receiving an award from Imec, a semiconductor research group that works with major chipmakers around the world.

He also mentioned how much Apple depends on third-party software from electronic design automation (EDA) companies. The tools are key to developing the company’s chips. Synopsys and Cadence, two of the biggest EDA firms, are both working to add more AI into their design tools.

From the A4 to Vision Pro: A design timeline

Srouji’s remarks offered a rare glimpse into Apple’s internal process. He walked through Apple’s journey, starting with the A4 chip in the iPhone 4, launched in 2010. Since then, Apple has built a range of custom chips, including those used in the iPad, Apple Watch, and Mac. The company also developed the chips that run the Vision Pro headset.

He said that while hardware is important, the real challenge lies in design. Over time, chip design has become more complex and now requires tight coordination between hardware and software. Srouji said AI has the potential to make that coordination faster and more reliable.

Why Apple is working with Broadcom on server chips

In late 2024, Apple began a quiet project with chip supplier Broadcom to develop its first AI server chip. The processor, known internally as “Baltra,” is said to be part of Apple’s larger plan to support more AI services on the back end. That includes features tied to Apple Intelligence, the company’s new suite of AI tools for iPhones, iPads, and Macs.

Baltra is expected to power Apple’s private cloud infrastructure. Unlike devices that run AI locally, this chip will sit in servers, likely inside Apple’s own data centres. It would help handle heavier AI workloads that are too much for on-device chips.

On-device vs. cloud: Apple’s AI infrastructure split

Apple is trying to balance user privacy with the need for more powerful AI features. Some of its AI tools will run directly on devices. Others will use server-based chips like Baltra. The setup is part of what Apple calls “Private Cloud Compute.”

The company says users won’t need to sign in, and data will be kept anonymous. But the approach depends on having a solid foundation of hardware – both in devices and in the cloud. That’s where chips like Baltra come in. Building its own server chips would give Apple more control over performance, security, and integration.

No backup plan: A pattern in Apple’s hardware strategy

Srouji said Apple is used to taking big hardware risks. When the company moved its Mac lineup from Intel to Apple Silicon in 2020, it didn’t prepare a backup plan.

“Moving the Mac to Apple Silicon was a huge bet for us. There was no backup plan, no split-the-lineup plan, so we went all in, including a monumental software effort,” he said.

The same mindset now seems to apply to Apple’s AI chips. Srouji said the company is willing to go all in again, trusting that AI tools can make the chip design process faster and more precise.

EDA firms like Synopsys and Cadence shape the roadmap

While Apple designs its own chips, it depends heavily on tools built by other companies. Srouji mentioned how important EDA vendors are to Apple’s chip efforts. Cadence and Synopsys are both updating their software to include more AI features.

Synopsys recently introduced a product called AgentEngineer. It uses AI agents to help chip designers automate repetitive tasks and manage complex workflows. The idea is to let human engineers focus on higher-level decisions. The changes could make it easier for companies like Apple to speed up chip development.

Cadence is also expanding its AI offerings. Both firms are in a race to meet the needs of tech companies that want faster and cheaper ways to design chips.

What comes next: Talent, testing, and production

As Apple adds more AI into its chip design, it will need to bring in new kinds of talent. That includes engineers who can work with AI tools, as well as people who understand both hardware and machine learning.

At the same time, chips like Baltra still need to be tested and manufactured. Apple will likely continue to rely on partners like TSMC for chip production. But the design work is moving more in-house, and AI is playing a bigger role in that shift.

How Apple integrates these AI-designed chips into products and services remains to be seen. What’s clear is that the company is trying to tighten its control over the full stack – hardware, software, and now the infrastructure that powers AI.

#2024#ADD#agents#ai#AI AGENTS#AI chips#AI Infrastructure#AI integration#ai tools#apple#apple intelligence#Apple Watch#approach#artificial#Artificial Intelligence#automation#backup#broadcom#Building#cadence#challenge#chip#Chip Design#chip production#chips#Cloud#cloud infrastructure#Companies#complexity#data

0 notes

Text

Pathways to Recovery: Drug and Alcohol Rehab Centers in Simi Valley, CA

Simi Valley, a serene and family-oriented city nestled in Southern California, is more than just a picturesque community — it is also a place where individuals and families find hope, healing, and a fresh start through comprehensive addiction treatment services. The drug and alcohol rehab centers in simi valley ca, CA, offer a range of evidence-based programs designed to support people on their journey to sobriety and long-term wellness.

The impact of substance abuse is not limited to one demographic or background. Addiction affects individuals from all walks of life, and the response in Simi Valley has been to provide accessible, professional, and compassionate care through well-established rehab facilities. These centers understand that addiction is not simply a matter of willpower — it is a complex medical and psychological issue requiring tailored treatment plans and a supportive environment.

Alcohol rehab centers in Simi Valley are equipped to address the unique challenges of alcohol addiction. From withdrawal management and detoxification to long-term counseling and relapse prevention, these facilities offer a continuum of care that is essential for sustainable recovery. Licensed medical staff and experienced therapists work hand-in-hand to ensure that each client receives individualized attention and support.

Many of the rehab centers in the area provide both inpatient and outpatient options. Inpatient programs offer a structured setting where clients can focus entirely on recovery, free from external triggers and stresses. These programs often include group therapy, one-on-one counseling, wellness activities, and educational workshops. On the other hand, outpatient treatment allows individuals to maintain their daily responsibilities while attending scheduled sessions for therapy and support, making it a more flexible alternative for those with work or family commitments.

What sets the rehab centers in Simi Valley apart is their holistic approach to recovery. Alongside conventional treatments such as cognitive-behavioral therapy (CBT) and motivational interviewing (MI), many centers incorporate alternative therapies like yoga, meditation, art therapy, and physical fitness. This multi-faceted strategy not only addresses the physical aspects of addiction but also the emotional, mental, and spiritual well-being of clients.

Family involvement is another cornerstone of successful treatment in Simi Valley’s rehab facilities. Addiction is often called a “family disease,” and effective programs recognize the importance of rebuilding trust and communication within the family unit. Family therapy sessions are commonly offered to educate loved ones, improve relationships, and create a support network that continues well beyond formal treatment.

The journey to recovery doesn’t end once a program is completed. Long-term success relies heavily on aftercare planning and continued support. Many rehab centers in Simi Valley provide alumni programs, support groups, and sober living resources to help individuals maintain their progress. These services act as a safety net, reinforcing the tools and strategies learned during treatment.

Confidentiality, respect, and dignity are upheld at every stage of care. Whether someone is struggling with alcohol, opioids, prescription medications, or a combination of substances, the rehab centers in Simi Valley are prepared to help individuals reclaim their lives through comprehensive and compassionate care.

Choosing to seek help is the most courageous step someone can take toward a better future. For those in Simi Valley and surrounding communities, there is comfort in knowing that professional, effective, and empathetic treatment options are available close to home. Drug and alcohol rehab centers here serve not just as places of healing, but as foundations for hope, change, and a renewed sense of purpose.

0 notes

Text

Premier Phlebotomy Training in Riverside, CA: Kickstart Your Healthcare Career Today

Top-Rated Phlebotomy Training in Riverside, CA: Kickstart Your healthcare Career Today

Are you passionate about making a difference in people’s health adn seeking a rewarding career in the healthcare sector? Phlebotomy is an excellent entry point into the medical industry, offering opportunities for growth, stability, and meaningful work. Riverside, California, is home to some of the best phlebotomy training programs designed to equip aspiring healthcare professionals wiht the skills, certification, and confidence to excel. In this comprehensive guide, we’ll explore the top-rated phlebotomy courses in Riverside, CA, their benefits, practical tips to succeed, and how to launch your healthcare career today.

Why Choose Phlebotomy as Your Healthcare Career Path?

Phlebotomy involves drawing blood samples for laboratory testing, a crucial step in diagnosing and treating many health conditions. It’s a foundational role within the medical field, offering job stability, flexibility, and a pathway to advanced healthcare careers such as medical assisting, nursing, or laboratory technology.

Some compelling reasons to consider a phlebotomy career include:

High demand for certified phlebotomists across hospitals, clinics, laboratories, and outpatient facilities.

Affordable and fast training programs that can lead to certification in just a few months.

Entry-level position that requires minimal prior experience but provides valuable skills.

Potential for career advancement with further education and specialization.

Top-Rated Phlebotomy Training Programs in Riverside, CA

Choosing a reputable and comprehensive training program is essential for your success. Here are some of the leading phlebotomy courses in Riverside,CA,recognized for their quality,certification outcomes,and student satisfaction.

1. Riverside Medical Training institute

Highlights:

Intensive 4-week hands-on phlebotomy certification program

Experienced instructors with real-world clinical experience

Preparation for national certification exams (e.g., NHA, ASCP)

Flexible evening and weekend classes available

2. California Career Institute

Highlights:

Partnerships with local healthcare providers for practical training

Affordable tuition with financial aid options

Job placement assistance for graduates

3. Riverside Community College – Phlebotomy Technician Program

Highlights:

Accredited program approved by the State of California

Comprehensive curriculum covering anatomy, blood collection techniques, and safety procedures

Clinical externship included

Comparative Table of Riverside Phlebotomy Training Programs

Program

Duration

Certification Preparation

Cost (Approx.)

Location

Riverside Medical Training Institute

4 weeks

Yes

$2,000

Downtown Riverside

California Career Institute

8 weeks

Yes

$3,500

Riverside & Virtual

Riverside Community College

12 weeks

Yes

$1,800

Riverside Campus

Benefits of Enrolling in Top-Rated Phlebotomy Courses in Riverside, CA

Investing your time in reputable phlebotomy training programs offers numerous advantages:

Accreditation and recognition: Ensures you’re qualified to work nationwide.

Hands-on clinical experience: Vital for building confidence and competence in blood collection techniques.

Job readiness: Many programs include job placement assistance and externships.

Networking opportunities: Connect with local healthcare professionals and employers.

Practical Tips to Maximize Your Phlebotomy Training Experience

To ensure you get the most out of your training, consider these strategies:

Engage actively in clinical practice: Practice blood draws diligently during externships.

Learn safety protocols: Master infection control and patient safety guidelines.

Prepare for certification exams: Study rigorously using practice tests and study guides.

Network with instructors and peers: Build relationships that can lead to job opportunities.

Stay updated: Keep current with new techniques and industry standards.

real-Life case Study: From Trainee to Certified Phlebotomist in Riverside

Meet Sarah: A recent graduate from Riverside Community College’s phlebotomy program, Sarah was initially nervous about performing blood draws. Thanks to comprehensive hands-on training and supportive instructors, she gained confidence and mastered essential skills. Within a month of certification, Sarah secured a position at Riverside Medical Center. Her story exemplifies how top-rated training programs can transform beginners into competent healthcare professionals.

Conclusion: Launch Your Healthcare Career with Top Phlebotomy Training in Riverside, CA

If you’re ready to embark on a fulfilling career in healthcare, top-rated phlebotomy training in Riverside, CA, provides the perfect pathway. With comprehensive courses, practical hands-on experience, and certification preparation, you can start your journey towards becoming a vital member of the medical community. Whether you’re seeking a quick entry into healthcare or aiming for long-term career growth, Riverside’s reputable programs are your stepping stones to success.

Don’t wait-enroll today, and take the first step toward a rewarding healthcare career in Riverside, CA!

https://phlebotomytechnicianschools.net/premier-phlebotomy-training-in-riverside-ca-kickstart-your-healthcare-career-today/

0 notes

Text

How to Become a CA

The journey towards becoming a Chartered Accountant (CA) is rewarding and highly respected. If you’re wondering how to become a CA, this guide covers everything you need to know from prerequisites and course structure to key skills, benefits, and expert tips to help you succeed in your CA journey.

Who is a Chartered Accountant?

A chartered accountant (CA) is a professionally trained individual who specialises in financial auditing, taxation, accounting, and business advisory services. CAs are reputable financial professionals, according to the Institute of Chartered Accountants of India (ICAI).

They can work in the public or private sectors and are typically found in leadership positions like tax consultants, auditors, or CFOs. Similar to the ACCA certification, the CA is still one of the most prestigious accounting certifications in the world.

What Does a Chartered Accountant Do?

CAs have a significant impact on a company’s financial health. Some of their responsibilities include:

Preparing and analysing financial reports

Managing taxation, including GST and income tax filings

Conducting audits and ensuring regulatory compliance

Offering financial advice and risk management.

Manage mergers, acquisitions, and investments.

Their services are critical for individuals, businesses, and even governments.

Is It Difficult to Become a CA?

Yes, the CA journey is tough, but it can be conquered with the right mindset and strategy. That is why pass percentages are relatively low since there are stringent exams and compulsory training involved.

However, with proper time management, good planning, and effective study determination, thousands of students succeed in doing so every year. The trick is to remain consistent while making use of good resources.

CA Course Eligibility and Qualifications

To become a CA, one must first understand who is eligible and the qualifications required.

Eligibility After 12th & Graduation

After 12th: The students from any stream are eligible to register for the CA Foundation Course after completing Class 12 from a recognised board.

After Graduation: Graduates qualify for the Direct Entry pathway and skip the foundation level. The commerce students must have at least 55%, and non-commerce students 60%.

Educational Qualifications Needed to Register

Must have passed Class 12th or completed a bachelor’s degree.

For direct entry, candidates should have passed the intermediate examinations of ICSI (CS) or ICWA (CMA) or possess a graduate degree.

These are prerequisites for chartered accountant registration with ICAI.

CA Course Structure and Pathways

The chartered accountancy course provides several entry points, tailored to the diverse levels of its students. One should know these pathways if one is interested in learning how to become a CA in an effective and efficient manner.

CA Foundation Route (After Class 12)

This is one of the most common and conventional routes, which is taken by the students who have just appeared for their Class 12. Your quest for a CA career starts with the CA Foundation Course, which is the basic course and a path opener to sophisticated knowledge.

The Foundation course consists of four core subjects: accounting, business law and correspondence, mathematics and statistics, and economics.

Preparation for this level takes between 4 and 6 months, depending on your study pace and coaching.

Passing the Foundation exam is required to proceed to the next stage, the CA Intermediate course.

This path is ideal for students who intend to pursue the CA after finishing school and prefer a gradual, tiered approach to learning.

Direct Entry Route (After Graduation or Post ICSI/ICWA)

For holders of bachelor’s degrees and those who have completed the intermediate level of related courses like Company Secretary (CS) or Cost and Management Accountancy (CMA), the direct entry route offers a fast-track option into the CA program.

You are required to skip the Foundation level entirely. You may register directly for the CA Intermediate course.

To register through this route, one must have a graduation degree (with 55 % marks in the case of commerce and 60% in the case of other streams) or must have cleared the intermediate level of ICSI (CS) or ICWA (CMA).

A unique requirement for this path is to register for the mandatory practical trainings for a period of 3 years (articles) before/along with the intermediate exam that gives you a set of hands early on.

This route facilitates candidates who wish to pursue the CA designation after graduation or some related certifications for increased efficiency and time savings.

Through Intermediate-Level Exams (ICSI/ICAI)

This option benefits students with multiple professional credentials, particularly those who have passed the CS Executive or CMA Inter level exams.

If you pass these intermediate-level exams with ICSI or ICWA, you can sign up for the CA Intermediate exams immediately.

This option allows students to apply what they know already and their qualifications to reduce the time and effort they need to qualify as a CA.

Many ambitious finance and business students seek out multiple credentials to try to get a leg up in the job market.

Step-by-Step Process to Become a CA

Here’s a step-by-step guide on how to become a CA in India.

Step 1: Decide if CA is Right for You

Consider how enthusiastic you are about business, accounting, and taxation.

Consider your career goals and commitment.

Explore longer-term job prospects in finance.

Step 2: Enroll and Clear CA Foundation (If Applicable)

Register with ICAI after 12th

Study for 4 subjects and appear in the exam.

Train or learn as self-taught.

Step 3: Register and Pass the CA Intermediate

Register after clearing Foundation or through Direct Entry

Consists of 8 papers divided into 2 groups

Many students opt to appear group-wise

This is a crucial phase in your CA journey.

Step 4: Complete Articleship/3-Year Practical Training

After passing Group 1 of CA Intermediate

Must undergo 3 years of Articleship under a practicing CA

Gain hands-on experience in audits, taxation, and compliance

Step 5: Pass CA Final Exam

Appear after completing Articleship and passing Intermediate

8 papers covering advanced accounting, law, and elective subjects

Final exam tests in-depth practical and conceptual knowledge

Step 6: Enroll as a Member with ICAI

Once you pass the Final exam, apply for chartered accountant registration

Get officially enrolled as a member of ICAI

Now you’re legally allowed to practice as a CA in India

Curious About How To Become a CA?

Inquire More!

Skills Required to Become a Successful CA

Communication

Ability to explain complex financial concepts clearly

Essential for client meetings, audit discussions, and presentations

Time Management

CAs often juggle multiple tasks, deadlines, and clients

Efficient time use is vital for success

Organisational Skills

Maintaining records, filing returns, and handling reports requires strong organisation

Especially important during audits and busy tax seasons

Analytical Thinking

Ability to solve problems and make sense of financial data

Crucial in areas like risk analysis, valuation, and budgeting

Benefits of Becoming a CA

Earn High Respect and Social Prestige: Chartered Accountants are highly regarded professionals in the business and finance world. Their expertise in auditing, taxation, and financial management earns them respect from peers, employers, and clients alike.

Access to Great Job Opportunities Both in India and Abroad: The CA qualification opens doors to diverse career options not only within India but also internationally. Many multinational firms and foreign companies seek qualified CAs for their financial leadership roles.

Receive Excellent Salary Packages Starting from INR 7–10 LPA: CAs enjoy competitive salaries, even at entry-level positions. With experience and expertise, income can grow substantially, making CA one of the most lucrative professional courses in India.

Opportunity to Start Your Own CA Practice: After becoming a member of ICAI, you have the freedom to start your own accounting and consulting firm. This entrepreneurial path offers independence and the potential to build a thriving business.

Work with Top Firms Like Deloitte, EY, and KPMG: Chartered Accountants are highly valued by the Big Four accounting firms and other top multinational companies. These firms provide excellent training, exposure, and career growth.

Career Mobility Across Multiple Roles: CAs can work in various domains such as auditing, taxation, financial consulting, management accounting, and corporate finance, offering flexibility in career choices.

Pathways to Global Certifications Like ACCA Certification: Becoming a CA can be a stepping stone to pursue other international certifications such as ACCA, enhancing global career prospects. Learn what is ACCA?

Expert Tips to Become a CA

Start Preparing Early, Especially for the Foundation Course: Early preparation gives you a strong grasp of fundamental concepts, making the subsequent stages of your CA journey easier and more manageable.

Solve Past Year Papers and Mock Tests Regularly: Practicing previous exam questions helps you understand exam patterns, manage time efficiently, and identify important topics.

Maintain Consistency by Studying Daily Rather Than Cramming: Regular study sessions are far more effective in retaining information and reducing exam stress than last-minute preparation.

Join a Reputed CA Coaching Institute for Structured Guidance: Quality coaching can provide expert explanations, study plans, and motivation, improving your chances of success.

Network Actively with Fellow Students and CA Professionals: Building connections can help you gain insights, mentorship, and career opportunities during and after your CA journey.

Utilise ICAI’s Study Materials and Online Resources Thoroughly: Official materials are tailored to the exam syllabus and often contain the most relevant information.

Stay Updated with the Latest Changes in Tax Laws and Accounting Standards: The CA profession demands continuous learning to remain compliant and provide accurate advice, so staying current is essential.

Planning to Pursue an Finance and Accounting Career?

Click Here

To Book Your Free Counselling Session

Conclusion

So, how to become a CA? It’s a structured journey filled with challenges but immense rewards. Whether you begin after 12th or as a graduate, the pathways are clearly defined. With the right guidance, skills, and determination, you can build a successful CA career.

This decision should depend on your passion for finance, dedication to long-term learning, and willingness to adapt in a fast-changing business world. If these resonate with you, then the CA journey is absolutely worth it.

FAQs on How to Become a CA

How do I become a CA in detail?

To become a CA, start by choosing between the Foundation or Direct Entry Route. Then clear CA Foundation (if applicable), Intermediate, complete Articleship, pass the Final exam, and register with ICAI.

What is the pathway to become a chartered accountant?

The CA pathway includes:

Register for Foundation (after 12th) or Direct Entry (after graduation)

Clear Foundation → Intermediate → Final

Complete 3 years of Articleship

Apply for chartered accountant registration with ICAI

What is the best way to study for CA?

Follow a fixed timetable

Prioritise ICAI material and past papers

Take mock tests

Use expert coaching or online platforms

Focus on conceptual clarity over rote learning

Can I complete CA in 2 years?

No, the CA course has a minimum duration of 4.5–5 years, including Articleship. However, with dedication, you can pass all exams in the first attempt and fast-track your CA career.

0 notes

Text

How to Become a CA

The journey towards becoming a Chartered Accountant (CA) is rewarding and highly respected. If you’re wondering how to become a CA, this guide covers everything you need to know from prerequisites and course structure to key skills, benefits, and expert tips to help you succeed in your CA journey.

Who is a Chartered Accountant?

A chartered accountant (CA) is a professionally trained individual who specialises in financial auditing, taxation, accounting, and business advisory services. CAs are reputable financial professionals, according to the Institute of Chartered Accountants of India (ICAI).

They can work in the public or private sectors and are typically found in leadership positions like tax consultants, auditors, or CFOs. Similar to the ACCA certification, the CA is still one of the most prestigious accounting certifications in the world.

What Does a Chartered Accountant Do?

CAs have a significant impact on a company’s financial health. Some of their responsibilities include:

Preparing and analysing financial reports

Managing taxation, including GST and income tax filings

Conducting audits and ensuring regulatory compliance

Offering financial advice and risk management.

Manage mergers, acquisitions, and investments.

Their services are critical for individuals, businesses, and even governments.

Is It Difficult to Become a CA?

Yes, the CA journey is tough, but it can be conquered with the right mindset and strategy. That is why pass percentages are relatively low since there are stringent exams and compulsory training involved.

However, with proper time management, good planning, and effective study determination, thousands of students succeed in doing so every year. The trick is to remain consistent while making use of good resources.

CA Course Eligibility and Qualifications

To become a CA, one must first understand who is eligible and the qualifications required.

Eligibility After 12th & Graduation

After 12th: The students from any stream are eligible to register for the CA Foundation Course after completing Class 12 from a recognised board.

After Graduation: Graduates qualify for the Direct Entry pathway and skip the foundation level. The commerce students must have at least 55%, and non-commerce students 60%.

Educational Qualifications Needed to Register

Must have passed Class 12th or completed a bachelor’s degree.

For direct entry, candidates should have passed the intermediate examinations of ICSI (CS) or ICWA (CMA) or possess a graduate degree.

These are prerequisites for chartered accountant registration with ICAI.

CA Course Structure and Pathways

The chartered accountancy course provides several entry points, tailored to the diverse levels of its students. One should know these pathways if one is interested in learning how to become a CA in an effective and efficient manner.

CA Foundation Route (After Class 12)

This is one of the most common and conventional routes, which is taken by the students who have just appeared for their Class 12. Your quest for a CA career starts with the CA Foundation Course, which is the basic course and a path opener to sophisticated knowledge.

The Foundation course consists of four core subjects: accounting, business law and correspondence, mathematics and statistics, and economics.

Preparation for this level takes between 4 and 6 months, depending on your study pace and coaching.

Passing the Foundation exam is required to proceed to the next stage, the CA Intermediate course.

This path is ideal for students who intend to pursue the CA after finishing school and prefer a gradual, tiered approach to learning.

Direct Entry Route (After Graduation or Post ICSI/ICWA)

For holders of bachelor’s degrees and those who have completed the intermediate level of related courses like Company Secretary (CS) or Cost and Management Accountancy (CMA), the direct entry route offers a fast-track option into the CA program.

You are required to skip the Foundation level entirely. You may register directly for the CA Intermediate course.

To register through this route, one must have a graduation degree (with 55 % marks in the case of commerce and 60% in the case of other streams) or must have cleared the intermediate level of ICSI (CS) or ICWA (CMA).

A unique requirement for this path is to register for the mandatory practical trainings for a period of 3 years (articles) before/along with the intermediate exam that gives you a set of hands early on.

This route facilitates candidates who wish to pursue the CA designation after graduation or some related certifications for increased efficiency and time savings.

Through Intermediate-Level Exams (ICSI/ICAI)

This option benefits students with multiple professional credentials, particularly those who have passed the CS Executive or CMA Inter level exams.

If you pass these intermediate-level exams with ICSI or ICWA, you can sign up for the CA Intermediate exams immediately.

This option allows students to apply what they know already and their qualifications to reduce the time and effort they need to qualify as a CA.

Many ambitious finance and business students seek out multiple credentials to try to get a leg up in the job market.

Step-by-Step Process to Become a CA

Here’s a step-by-step guide on how to become a CA in India.

Step 1: Decide if CA is Right for You

Consider how enthusiastic you are about business, accounting, and taxation.

Consider your career goals and commitment.

Explore longer-term job prospects in finance.

Step 2: Enroll and Clear CA Foundation (If Applicable)

Register with ICAI after 12th

Study for 4 subjects and appear in the exam.

Train or learn as self-taught.

Step 3: Register and Pass the CA Intermediate

Register after clearing Foundation or through Direct Entry

Consists of 8 papers divided into 2 groups

Many students opt to appear group-wise

This is a crucial phase in your CA journey.

Step 4: Complete Articleship/3-Year Practical Training

After passing Group 1 of CA Intermediate

Must undergo 3 years of Articleship under a practicing CA

Gain hands-on experience in audits, taxation, and compliance

Step 5: Pass CA Final Exam

Appear after completing Articleship and passing Intermediate

8 papers covering advanced accounting, law, and elective subjects

Final exam tests in-depth practical and conceptual knowledge

Step 6: Enroll as a Member with ICAI

Once you pass the Final exam, apply for chartered accountant registration

Get officially enrolled as a member of ICAI

Now you’re legally allowed to practice as a CA in India

Curious About How To Become a CA?

Inquire More!

Skills Required to Become a Successful CA

Communication

Ability to explain complex financial concepts clearly

Essential for client meetings, audit discussions, and presentations

Time Management

CAs often juggle multiple tasks, deadlines, and clients

Efficient time use is vital for success

Organisational Skills

Maintaining records, filing returns, and handling reports requires strong organisation

Especially important during audits and busy tax seasons

Analytical Thinking

Ability to solve problems and make sense of financial data

Crucial in areas like risk analysis, valuation, and budgeting

Benefits of Becoming a CA

Earn High Respect and Social Prestige: Chartered Accountants are highly regarded professionals in the business and finance world. Their expertise in auditing, taxation, and financial management earns them respect from peers, employers, and clients alike.

Access to Great Job Opportunities Both in India and Abroad: The CA qualification opens doors to diverse career options not only within India but also internationally. Many multinational firms and foreign companies seek qualified CAs for their financial leadership roles.

Receive Excellent Salary Packages Starting from INR 7–10 LPA: CAs enjoy competitive salaries, even at entry-level positions. With experience and expertise, income can grow substantially, making CA one of the most lucrative professional courses in India.

Opportunity to Start Your Own CA Practice: After becoming a member of ICAI, you have the freedom to start your own accounting and consulting firm. This entrepreneurial path offers independence and the potential to build a thriving business.

Work with Top Firms Like Deloitte, EY, and KPMG: Chartered Accountants are highly valued by the Big Four accounting firms and other top multinational companies. These firms provide excellent training, exposure, and career growth.

Career Mobility Across Multiple Roles: CAs can work in various domains such as auditing, taxation, financial consulting, management accounting, and corporate finance, offering flexibility in career choices.

Pathways to Global Certifications Like ACCA Certification: Becoming a CA can be a stepping stone to pursue other international certifications such as ACCA, enhancing global career prospects. Learn what is ACCA?

Expert Tips to Become a CA

Start Preparing Early, Especially for the Foundation Course: Early preparation gives you a strong grasp of fundamental concepts, making the subsequent stages of your CA journey easier and more manageable.

Solve Past Year Papers and Mock Tests Regularly: Practicing previous exam questions helps you understand exam patterns, manage time efficiently, and identify important topics.

Maintain Consistency by Studying Daily Rather Than Cramming: Regular study sessions are far more effective in retaining information and reducing exam stress than last-minute preparation.

Join a Reputed CA Coaching Institute for Structured Guidance: Quality coaching can provide expert explanations, study plans, and motivation, improving your chances of success.

Network Actively with Fellow Students and CA Professionals: Building connections can help you gain insights, mentorship, and career opportunities during and after your CA journey.

Utilise ICAI’s Study Materials and Online Resources Thoroughly: Official materials are tailored to the exam syllabus and often contain the most relevant information.

Stay Updated with the Latest Changes in Tax Laws and Accounting Standards: The CA profession demands continuous learning to remain compliant and provide accurate advice, so staying current is essential.

Planning to Pursue an Finance and Accounting Career?

Click Here

To Book Your Free Counselling Session

Conclusion

So, how to become a CA? It’s a structured journey filled with challenges but immense rewards. Whether you begin after 12th or as a graduate, the pathways are clearly defined. With the right guidance, skills, and determination, you can build a successful CA career.

This decision should depend on your passion for finance, dedication to long-term learning, and willingness to adapt in a fast-changing business world. If these resonate with you, then the CA journey is absolutely worth it.

FAQs on How to Become a CA

How do I become a CA in detail?

To become a CA, start by choosing between the Foundation or Direct Entry Route. Then clear CA Foundation (if applicable), Intermediate, complete Articleship, pass the Final exam, and register with ICAI.

What is the pathway to become a chartered accountant?

The CA pathway includes:

Register for Foundation (after 12th) or Direct Entry (after graduation)

Clear Foundation → Intermediate → Final

Complete 3 years of Articleship

Apply for chartered accountant registration with ICAI

What is the best way to study for CA?

Follow a fixed timetable

Prioritise ICAI material and past papers

Take mock tests

Use ex

The journey towards becoming a Chartered Accountant (CA) is rewarding and highly respected. If you’re wondering how to become a CA, this guide covers everything you need to know from prerequisites and course structure to key skills, benefits, and expert tips to help you succeed in your CA journey.

Who is a Chartered Accountant?

A chartered accountant (CA) is a professionally trained individual who specialises in financial auditing, taxation, accounting, and business advisory services. CAs are reputable financial professionals, according to the Institute of Chartered Accountants of India (ICAI).

They can work in the public or private sectors and are typically found in leadership positions like tax consultants, auditors, or CFOs. Similar to the ACCA certification, the CA is still one of the most prestigious accounting certifications in the world.

What Does a Chartered Accountant Do?

CAs have a significant impact on a company’s financial health. Some of their responsibilities include:

Preparing and analysing financial reports

Managing taxation, including GST and income tax filings

Conducting audits and ensuring regulatory compliance

Offering financial advice and risk management.

Manage mergers, acquisitions, and investments.

Their services are critical for individuals, businesses, and even governments.

Is It Difficult to Become a CA?

Yes, the CA journey is tough, but it can be conquered with the right mindset and strategy. That is why pass percentages are relatively low since there are stringent exams and compulsory training involved.

However, with proper time management, good planning, and effective study determination, thousands of students succeed in doing so every year. The trick is to remain consistent while making use of good resources.

CA Course Eligibility and Qualifications

To become a CA, one must first understand who is eligible and the qualifications required.

Eligibility After 12th & Graduation

After 12th: The students from any stream are eligible to register for the CA Foundation Course after completing Class 12 from a recognised board.

After Graduation: Graduates qualify for the Direct Entry pathway and skip the foundation level. The commerce students must have at least 55%, and non-commerce students 60%.

Educational Qualifications Needed to Register

Must have passed Class 12th or completed a bachelor’s degree.

For direct entry, candidates should have passed the intermediate examinations of ICSI (CS) or ICWA (CMA) or possess a graduate degree.

These are prerequisites for chartered accountant registration with ICAI.

CA Course Structure and Pathways

The chartered accountancy course provides several entry points, tailored to the diverse levels of its students. One should know these pathways if one is interested in learning how to become a CA in an effective and efficient manner.

CA Foundation Route (After Class 12)

This is one of the most common and conventional routes, which is taken by the students who have just appeared for their Class 12. Your quest for a CA career starts with the CA Foundation Course, which is the basic course and a path opener to sophisticated knowledge.

The Foundation course consists of four core subjects: accounting, business law and correspondence, mathematics and statistics, and economics.

Preparation for this level takes between 4 and 6 months, depending on your study pace and coaching.

Passing the Foundation exam is required to proceed to the next stage, the CA Intermediate course.

This path is ideal for students who intend to pursue the CA after finishing school and prefer a gradual, tiered approach to learning.

Direct Entry Route (After Graduation or Post ICSI/ICWA)

For holders of bachelor’s degrees and those who have completed the intermediate level of related courses like Company Secretary (CS) or Cost and Management Accountancy (CMA), the direct entry route offers a fast-track option into the CA program.

You are required to skip the Foundation level entirely. You may register directly for the CA Intermediate course.

To register through this route, one must have a graduation degree (with 55 % marks in the case of commerce and 60% in the case of other streams) or must have cleared the intermediate level of ICSI (CS) or ICWA (CMA).

A unique requirement for this path is to register for the mandatory practical trainings for a period of 3 years (articles) before/along with the intermediate exam that gives you a set of hands early on.

This route facilitates candidates who wish to pursue the CA designation after graduation or some related certifications for increased efficiency and time savings.

Through Intermediate-Level Exams (ICSI/ICAI)

This option benefits students with multiple professional credentials, particularly those who have passed the CS Executive or CMA Inter level exams.

If you pass these intermediate-level exams with ICSI or ICWA, you can sign up for the CA Intermediate exams immediately.

This option allows students to apply what they know already and their qualifications to reduce the time and effort they need to qualify as a CA.

Many ambitious finance and business students seek out multiple credentials to try to get a leg up in the job market.

Step-by-Step Process to Become a CA

Here’s a step-by-step guide on how to become a CA in India.

Step 1: Decide if CA is Right for You

Consider how enthusiastic you are about business, accounting, and taxation.

Consider your career goals and commitment.

Explore longer-term job prospects in finance.

Step 2: Enroll and Clear CA Foundation (If Applicable)

Register with ICAI after 12th

Study for 4 subjects and appear in the exam.

Train or learn as self-taught.

Step 3: Register and Pass the CA Intermediate

Register after clearing Foundation or through Direct Entry

Consists of 8 papers divided into 2 groups

Many students opt to appear group-wise

This is a crucial phase in your CA journey.

Step 4: Complete Articleship/3-Year Practical Training

After passing Group 1 of CA Intermediate

Must undergo 3 years of Articleship under a practicing CA

Gain hands-on experience in audits, taxation, and compliance

Step 5: Pass CA Final Exam

Appear after completing Articleship and passing Intermediate

8 papers covering advanced accounting, law, and elective subjects

Final exam tests in-depth practical and conceptual knowledge

Step 6: Enroll as a Member with ICAI

Once you pass the Final exam, apply for chartered accountant registration

Get officially enrolled as a member of ICAI

Now you’re legally allowed to practice as a CA in India

Curious About How To Become a CA?

Inquire More!

Skills Required to Become a Successful CA

Communication

Ability to explain complex financial concepts clearly

Essential for client meetings, audit discussions, and presentations

Time Management

CAs often juggle multiple tasks, deadlines, and clients

Efficient time use is vital for success

Organisational Skills

Maintaining records, filing returns, and handling reports requires strong organisation

Especially important during audits and busy tax seasons

Analytical Thinking

Ability to solve problems and make sense of financial data

Crucial in areas like risk analysis, valuation, and budgeting

Benefits of Becoming a CA

Earn High Respect and Social Prestige: Chartered Accountants are highly regarded professionals in the business and finance world. Their expertise in auditing, taxation, and financial management earns them respect from peers, employers, and clients alike.

Access to Great Job Opportunities Both in India and Abroad: The CA qualification opens doors to diverse career options not only within India but also internationally. Many multinational firms and foreign companies seek qualified CAs for their financial leadership roles.

Receive Excellent Salary Packages Starting from INR 7–10 LPA: CAs enjoy competitive salaries, even at entry-level positions. With experience and expertise, income can grow substantially, making CA one of the most lucrative professional courses in India.

Opportunity to Start Your Own CA Practice: After becoming a member of ICAI, you have the freedom to start your own accounting and consulting firm. This entrepreneurial path offers independence and the potential to build a thriving business.

Work with Top Firms Like Deloitte, EY, and KPMG: Chartered Accountants are highly valued by the Big Four accounting firms and other top multinational companies. These firms provide excellent training, exposure, and career growth.

Career Mobility Across Multiple Roles: CAs can work in various domains such as auditing, taxation, financial consulting, management accounting, and corporate finance, offering flexibility in career choices.

Pathways to Global Certifications Like ACCA Certification: Becoming a CA can be a stepping stone to pursue other international certifications such as ACCA, enhancing global career prospects. Learn what is ACCA?

Expert Tips to Become a CA

Start Preparing Early, Especially for the Foundation Course: Early preparation gives you a strong grasp of fundamental concepts, making the subsequent stages of your CA journey easier and more manageable.

Solve Past Year Papers and Mock Tests Regularly: Practicing previous exam questions helps you understand exam patterns, manage time efficiently, and identify important topics.

Maintain Consistency by Studying Daily Rather Than Cramming: Regular study sessions are far more effective in retaining information and reducing exam stress than last-minute preparation.

Join a Reputed CA Coaching Institute for Structured Guidance: Quality coaching can provide expert explanations, study plans, and motivation, improving your chances of success.

Network Actively with Fellow Students and CA Professionals: Building connections can help you gain insights, mentorship, and career opportunities during and after your CA journey.

Utilise ICAI’s Study Materials and Online Resources Thoroughly: Official materials are tailored to the exam syllabus and often contain the most relevant information.

Stay Updated with the Latest Changes in Tax Laws and Accounting Standards: The CA profession demands continuous learning to remain compliant and provide accurate advice, so staying current is essential.

Planning to Pursue an Finance and Accounting Career?

Click Here

To Book Your Free Counselling Session

Conclusion

So, how to become a CA? It’s a structured journey filled with challenges but immense rewards. Whether you begin after 12th or as a graduate, the pathways are clearly defined. With the right guidance, skills, and determination, you can build a successful CA career.

This decision should depend on your passion for finance, dedication to long-term learning, and willingness to adapt in a fast-changing business world. If these resonate with you, then the CA journey is absolutely worth it.

FAQs on How to Become a CA

How do I become a CA in detail?

To become a CA, start by choosing between the Foundation or Direct Entry Route. Then clear CA Foundation (if applicable), Intermediate, complete Articleship, pass the Final exam, and register with ICAI.

What is the pathway to become a chartered accountant?

The CA pathway includes:

Register for Foundation (after 12th) or Direct Entry (after graduation)

Clear Foundation → Intermediate → Final

Complete 3 years of Articleship

Apply for chartered accountant registration with ICAI

What is the best way to study for CA?

Follow a fixed timetable

Prioritise ICAI material and past papers

Take mock tests

Use expert coaching or online platforms

Focus on conceptual clarity over rote learning

Can I complete CA in 2 years?

No, the CA course has a minimum duration of 4.5–5 years, including Articleship. However, with dedication, you can pass all exams in the first attempt and fast-track your CA career.

pert coaching or online platforms

Focus on conceptual clarity over rote learning

Can I complete CA in 2 years?

No, the CA course has a minimum duration of 4.5–5 years, including Articleship. However, with dedication, you can pass all exams in the first attempt and fast-track your CA career.

0 notes

Text

How to Become a CA

The journey towards becoming a Chartered Accountant (CA) is rewarding and highly respected. If you’re wondering how to become a CA, this guide covers everything you need to know from prerequisites and course structure to key skills, benefits, and expert tips to help you succeed in your CA journey.

Who is a Chartered Accountant?

A chartered accountant (CA) is a professionally trained individual who specialises in financial auditing, taxation, accounting, and business advisory services. CAs are reputable financial professionals, according to the Institute of Chartered Accountants of India (ICAI).

They can work in the public or private sectors and are typically found in leadership positions like tax consultants, auditors, or CFOs. Similar to the ACCA certification, the CA is still one of the most prestigious accounting certifications in the world.

What Does a Chartered Accountant Do?

CAs have a significant impact on a company’s financial health. Some of their responsibilities include:

Preparing and analysing financial reports

Managing taxation, including GST and income tax filings

Conducting audits and ensuring regulatory compliance

Offering financial advice and risk management.

Manage mergers, acquisitions, and investments.

Their services are critical for individuals, businesses, and even governments.

Is It Difficult to Become a CA?

Yes, the CA journey is tough, but it can be conquered with the right mindset and strategy. That is why pass percentages are relatively low since there are stringent exams and compulsory training involved.

However, with proper time management, good planning, and effective study determination, thousands of students succeed in doing so every year. The trick is to remain consistent while making use of good resources.

CA Course Eligibility and Qualifications

To become a CA, one must first understand who is eligible and the qualifications required.

Eligibility After 12th & Graduation

After 12th: The students from any stream are eligible to register for the CA Foundation Course after completing Class 12 from a recognised board.

After Graduation: Graduates qualify for the Direct Entry pathway and skip the foundation level. The commerce students must have at least 55%, and non-commerce students 60%.

Educational Qualifications Needed to Register

Must have passed Class 12th or completed a bachelor’s degree.

For direct entry, candidates should have passed the intermediate examinations of ICSI (CS) or ICWA (CMA) or possess a graduate degree.

These are prerequisites for chartered accountant registration with ICAI.

CA Course Structure and Pathways

The chartered accountancy course provides several entry points, tailored to the diverse levels of its students. One should know these pathways if one is interested in learning how to become a CA in an effective and efficient manner.

CA Foundation Route (After Class 12)

This is one of the most common and conventional routes, which is taken by the students who have just appeared for their Class 12. Your quest for a CA career starts with the CA Foundation Course, which is the basic course and a path opener to sophisticated knowledge.

The Foundation course consists of four core subjects: accounting, business law and correspondence, mathematics and statistics, and economics.

Preparation for this level takes between 4 and 6 months, depending on your study pace and coaching.

Passing the Foundation exam is required to proceed to the next stage, the CA Intermediate course.

This path is ideal for students who intend to pursue the CA after finishing school and prefer a gradual, tiered approach to learning.

Direct Entry Route (After Graduation or Post ICSI/ICWA)

For holders of bachelor’s degrees and those who have completed the intermediate level of related courses like Company Secretary (CS) or Cost and Management Accountancy (CMA), the direct entry route offers a fast-track option into the CA program.

You are required to skip the Foundation level entirely. You may register directly for the CA Intermediate course.

To register through this route, one must have a graduation degree (with 55 % marks in the case of commerce and 60% in the case of other streams) or must have cleared the intermediate level of ICSI (CS) or ICWA (CMA).

A unique requirement for this path is to register for the mandatory practical trainings for a period of 3 years (articles) before/along with the intermediate exam that gives you a set of hands early on.

This route facilitates candidates who wish to pursue the CA designation after graduation or some related certifications for increased efficiency and time savings.

Through Intermediate-Level Exams (ICSI/ICAI)

This option benefits students with multiple professional credentials, particularly those who have passed the CS Executive or CMA Inter level exams.

If you pass these intermediate-level exams with ICSI or ICWA, you can sign up for the CA Intermediate exams immediately.

This option allows students to apply what they know already and their qualifications to reduce the time and effort they need to qualify as a CA.

Many ambitious finance and business students seek out multiple credentials to try to get a leg up in the job market.

Step-by-Step Process to Become a CA

Here’s a step-by-step guide on how to become a CA in India.

Step 1: Decide if CA is Right for You

Consider how enthusiastic you are about business, accounting, and taxation.

Consider your career goals and commitment.

Explore longer-term job prospects in finance.

Step 2: Enroll and Clear CA Foundation (If Applicable)

Register with ICAI after 12th

Study for 4 subjects and appear in the exam.

Train or learn as self-taught.

Step 3: Register and Pass the CA Intermediate

Register after clearing Foundation or through Direct Entry

Consists of 8 papers divided into 2 groups

Many students opt to appear group-wise

This is a crucial phase in your CA journey.

Step 4: Complete Articleship/3-Year Practical Training

After passing Group 1 of CA Intermediate

Must undergo 3 years of Articleship under a practicing CA

Gain hands-on experience in audits, taxation, and compliance

Step 5: Pass CA Final Exam

Appear after completing Articleship and passing Intermediate

8 papers covering advanced accounting, law, and elective subjects

Final exam tests in-depth practical and conceptual knowledge

Step 6: Enroll as a Member with ICAI

Once you pass the Final exam, apply for chartered accountant registration

Get officially enrolled as a member of ICAI

Now you’re legally allowed to practice as a CA in India

Curious About How To Become a CA?

Inquire More!

Skills Required to Become a Successful CA

Communication

Ability to explain complex financial concepts clearly

Essential for client meetings, audit discussions, and presentations

Time Management

CAs often juggle multiple tasks, deadlines, and clients

Efficient time use is vital for success

Organisational Skills

Maintaining records, filing returns, and handling reports requires strong organisation

Especially important during audits and busy tax seasons

Analytical Thinking

Ability to solve problems and make sense of financial data

Crucial in areas like risk analysis, valuation, and budgeting

Benefits of Becoming a CA

Earn High Respect and Social Prestige: Chartered Accountants are highly regarded professionals in the business and finance world. Their expertise in auditing, taxation, and financial management earns them respect from peers, employers, and clients alike.

Access to Great Job Opportunities Both in India and Abroad: The CA qualification opens doors to diverse career options not only within India but also internationally. Many multinational firms and foreign companies seek qualified CAs for their financial leadership roles.

Receive Excellent Salary Packages Starting from INR 7–10 LPA: CAs enjoy competitive salaries, even at entry-level positions. With experience and expertise, income can grow substantially, making CA one of the most lucrative professional courses in India.

Opportunity to Start Your Own CA Practice: After becoming a member of ICAI, you have the freedom to start your own accounting and consulting firm. This entrepreneurial path offers independence and the potential to build a thriving business.

Work with Top Firms Like Deloitte, EY, and KPMG: Chartered Accountants are highly valued by the Big Four accounting firms and other top multinational companies. These firms provide excellent training, exposure, and career growth.

Career Mobility Across Multiple Roles: CAs can work in various domains such as auditing, taxation, financial consulting, management accounting, and corporate finance, offering flexibility in career choices.

Pathways to Global Certifications Like ACCA Certification: Becoming a CA can be a stepping stone to pursue other international certifications such as ACCA, enhancing global career prospects. Learn what is ACCA?

Expert Tips to Become a CA

Start Preparing Early, Especially for the Foundation Course: Early preparation gives you a strong grasp of fundamental concepts, making the subsequent stages of your CA journey easier and more manageable.

Solve Past Year Papers and Mock Tests Regularly: Practicing previous exam questions helps you understand exam patterns, manage time efficiently, and identify important topics.

Maintain Consistency by Studying Daily Rather Than Cramming: Regular study sessions are far more effective in retaining information and reducing exam stress than last-minute preparation.

Join a Reputed CA Coaching Institute for Structured Guidance: Quality coaching can provide expert explanations, study plans, and motivation, improving your chances of success.

Network Actively with Fellow Students and CA Professionals: Building connections can help you gain insights, mentorship, and career opportunities during and after your CA journey.