#CPA Firms

Text

#CPA firms#specialized financial services#offshore staffing solutions#customized accounting solutions

0 notes

Text

Hiring a CPA may ensure proper financial oversight, which will significantly accelerate the growth of your company. They improve reports on finances, offer expert advice on tax preparation, and make recommendations for cost reductions. Their expertise makes it easier to identify development opportunities and optimize cash flow, freeing you up to focus on expanding your business and making wise decisions.

#CPA in Boca Raton#Boca Raton CPA firms#Boca Raton#CPA firms#Small Business Accounting#Financial Success#Business Growth#Accounting Services#Tax Preparation#Cash Flow Management#Entrepreneur Support#Bookkeeping#CPA#Business Finance

0 notes

Text

In the fast-evolving landscape of accounting, CPA firms continually seek innovative ways to streamline operations, enhance productivity, and deliver exceptional services. One powerful strategy that’s increasingly gaining traction among these firms is outsourcing. Here’s a detailed exploration of how outsourcing can revolutionize CPA firms, enabling them to scale operations, boost efficiency, and drive remarkable growth.

0 notes

Text

“No u don’t see, there actually is an accounting shortage. No I don’t hire new grads. Yes, I only hire people with their CPAs despite needing to work under a cpa in order to get licensed. Yes, we outsourced our entry level jobs to India. No, we don’t pay more than the big firms AND yes, we do make you work the same grueling hours as them. No work from home. Come in on weekends.”

#go fuck yourself!!#I don’t feel sorry for you!!#y’all are the ones creating the shortage#bc no 5-10 year experience CPA is gonna work for ur shitty firm for low wages and long hours#when they can just switch out of public accounting and get double the salary and half the hours#and stop telling us new grads that there are actually a ton of jobs but no not for you#no one wants to hire me bc I’m not a cpa yet 🤪

3 notes

·

View notes

Text

Outsource Bookkeeping Services to India: A Smart Business Move

In today’s competitive business environment, companies are constantly looking for ways to streamline operations and reduce costs. One effective strategy is to outsource bookkeeping services to India. This approach not only provides access to skilled professionals but also offers significant cost savings. Let's explore why outsourcing bookkeeping services to India can be a game-changer for your business.

Why Outsource Bookkeeping Services?

1. Cost-Effectiveness

Delegating your bookkeeping tasks to an external provider can result in significant financial savings. By choosing to outsource bookkeeping services to India, businesses can reduce overhead expenses associated with hiring in-house staff, such as salaries, benefits, and training costs. Indian firms offer competitive pricing due to lower labor costs, providing high-quality services at a fraction of the cost.

2. Access to Expertise

India is known for its vast pool of highly skilled and qualified professionals. When you outsource bookkeeping services, you gain access to experts who are proficient in international accounting standards and practices. These professionals are equipped with the latest tools and technologies to ensure accurate and efficient bookkeeping.

3. Focus on Core Business Activities

By outsourcing bookkeeping services, companies can focus more on their core business activities. This allows management and staff to dedicate their time and resources to areas that directly impact growth and profitability, such as sales, marketing, and product development.

Benefits of Outsourcing Bookkeeping Services in India

1. High-Quality Services

Indian bookkeeping firms are known for their commitment to quality. They employ stringent quality control measures and adhere to international accounting standards. This ensures that the financial records are accurate, reliable, and compliant with regulatory requirements.

2. Scalability

Outsourcing bookkeeping services in India offers flexibility and scalability. Whether you are a small business or a large corporation, Indian service providers can scale their services to meet your specific needs. This flexibility is particularly beneficial during periods of growth or seasonal fluctuations in business activity.

3. Time Zone Advantage

The time zone difference between India and Western countries can be leveraged to your advantage. By outsourcing bookkeeping services to India, you can benefit from round-the-clock operations. Work can be completed overnight, providing you with updated financial information by the start of your business day.

How to Choose the Right Bookkeeping Service Provider

1. Experience and Expertise

When outsourcing bookkeeping services, it’s crucial to choose a provider with extensive experience and expertise in the field. Seek out companies that have a history of success and favorable reviews from their clients. Ensure they have experience in your specific industry and are familiar with relevant regulations.

2. Technology and Security

Ensure the service provider uses the latest accounting software and technologies. Data security is paramount, so choose a provider that implements robust security measures to protect your financial information from unauthorized access and cyber threats.

3. Transparent Pricing

Opt for a service provider with a transparent pricing model. Avoid firms with hidden fees and unclear contracts. A clear understanding of the costs involved will help you make an informed decision and avoid any unexpected expenses.

4. Communication and Support

Effective communication is essential when outsourcing bookkeeping services. Choose a provider that offers reliable customer support and maintains clear and consistent communication channels. This guarantees that any problems or questions will be handled quickly and efficiently.

Conclusion

Outsourcing bookkeeping services to India is a strategic decision that can offer numerous benefits, including cost savings, access to expertise, and improved focus on core business activities. By carefully selecting the right service provider, businesses can enjoy high-quality, scalable, and secure bookkeeping services. Embrace this opportunity to enhance your business efficiency and drive growth.

In summary, outsourcing bookkeeping services to India is not just a cost-saving measure; it is a smart business strategy that can lead to improved operational efficiency and long-term success.

#Outsource bookkeeping services to India#outsourcing bookkeeping services in India#outsource bookkeeping services#outsourcing bookkeeping services#offshore bookkeeping services#CPA outsourcing services#outsourced accounting firms#finance#accounting#bookkeeping

2 notes

·

View notes

Text

Elevate Your Financial Strategy: CPA Firms in India from Mas LLP

In the intricate landscape of financial management, businesses seek expertise and reliability to navigate complex regulations and optimize their financial strategies. That's where Certified Public Accountant (CPA) firms play a crucial role. At Mas LLP, we offer top-notch CPA services tailored to meet the diverse needs of businesses in India. Let's delve into the significance of CPA firms and how Mas LLP stands out in delivering exceptional financial solutions. Why Choose CPA Firms in India?

1. Expertise and Accreditation: Certified Public Accountants are professionals with extensive training and accreditation in accounting, auditing, taxation, and financial management. Choosing a CPA firms in India ensures access to highly skilled professionals who can provide expert advice and guidance on a wide range of financial matters.

2. Comprehensive Financial Services: CPA firms in India offer a comprehensive suite of financial services, including audit and assurance, tax planning and compliance, financial reporting, and advisory services. Whether you're a small startup or a large corporation, CPA firms provide tailored solutions to address your specific financial needs and challenges.

3. Regulatory Compliance: In today's regulatory environment, compliance with accounting and tax regulations is essential for businesses to avoid penalties and legal repercussions. CPA firms help businesses stay compliant with applicable laws and regulations, ensuring accurate financial reporting and tax filings.

4. Strategic Planning: Beyond compliance, CPA firms in India assist businesses in strategic financial planning and decision-making. By analyzing financial data and market trends, CPAs help businesses identify growth opportunities, mitigate risks, and optimize their financial performance for long-term success.

5. Audit and Assurance Services: For businesses requiring independent assurance on their financial statements, CPA firms in India provide audit and assurance services to verify the accuracy and reliability of financial information. Audited financial statements enhance transparency and credibility, instilling confidence among stakeholders and investors. Mas LLP: Your Trusted CPA Firms in India At Mas LLP, we combine expertise, experience, and dedication to deliver unparalleled CPA services to businesses across India. Here's why Mas LLP stands out as your premier choice:

1. Expert Professionals: Our team comprises highly skilled and experienced CPAs who possess in-depth knowledge of Indian accounting standards, tax laws, and regulatory requirements.

2. Customized Solutions: We understand that every business is unique, which is why we offer personalized solutions tailored to meet your specific financial needs and objectives.

3. Commitment to Excellence: We are committed to delivering excellence in everything we do, from providing expert advice and guidance to delivering timely and accurate financial services.

4. Client-Centric Approach: At Mas LLP, we prioritize client satisfaction and strive to exceed expectations by delivering exceptional service and value.

5. Industry Experience: With years of experience serving clients across various industries, we have the expertise to address the unique challenges and opportunities facing your business. In conclusion, choosing a CPA firm like Mas LLP can help businesses in India navigate complex financial landscapes, achieve compliance, and optimize their financial performance. Contact us today to learn more about our CPA firms in India and how we can help elevate your financial strategy.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#CPA firms in India

3 notes

·

View notes

Text

Bookkeeping Mistakes Made By Small Businesses: How To Avoid Them

Small and Medium-sized businesses are eager to grow, but they often miss the fundamentals like understanding the value of Bookkeeping which may undermine business procedures.

Accounting is often overlooked by business owners who consider it easy. Incorrect accounting and bookkeeping processes may adversely impact any company’s finances. Recurring bookkeeping errors can actually bankrupt your business.

Bookkeeping Mistakes

Keeping financial records is a very important part of running a business, big or small. Bookkeeping that is accurate and well-organized makes sure that your financial records are up-to-date and precise, which helps you make good decisions and compliance with legal policies.

There are however some mistakes that small businesses often make with their books. Here are some of these mistakes.

Failure To Keep Records

Some small businesses fail to keep accurate financial records, which can lead to confusion and errors. Record-keeping is an essential process in organizing your financial records. Adopt best practices and create a system for organizing and storing your financial documents. These relevant documents may include invoices, receipts, and bank statements. It is helpful to consider using accounting software to automate the process and centralize everything.

Irregular Reconciling of Accounts

Failure to reconcile your bank and credit card accounts on a regular basis can lead to inconsistencies and inaccuracies. Reconciliation entails matching your financial records with your bank and credit card statements. Reconcile your accounts on a regular basis and resolve any discrepancies quickly to avoid problems.

Combining Personal and Business-Related Finances

It is critical to separate your personal and business finances by avoiding using personal accounts for business transactions. This can complicate bookkeeping and make it difficult to accurately track expenses and income. You must establish a separate business bank account and use it solely for business transactions.

Inconsistent Categorization

It is critical to properly categorize your income and expenses for accurate financial reporting. Refrain from inconsistent or ambiguous categorization, as it can make evaluating of your company’s financial health a lot more difficult. It will be helpful to create a chart of accounts with distinct categories that correspond to your field of business and use it regularly.

Neglecting Cash Transactions

Small businesses often transact in cash, which can be overlooked easily and not properly recorded. To ensure that cash transactions are accurately accounted for, use cash registers, petty cash logs, or digital tools. Better yet, set up a system for keeping track of and documenting all cash transactions, including sales and expenses.

Failure To Keep Track of Receivables and Payables

Failure to maintain track of unpaid invoices (accounts receivable) and bills to be paid (accounts payable) might jeopardize your cash flow and client-vendor relationships. Use accounting software with invoicing and payment tracking features to implement a structured strategy for monitoring and following up on both receivables and payables.

Mishandling Payroll

Payroll can be complicated, and mistakes can have legal and financial ramifications. Keep up with advances in payroll requirements, calculate wages and taxes accurately, and make timely payments to employees and tax authorities. To ensure accuracy and compliance, consider adopting efficient payroll software or you can also outsource payroll duties.

Failure To Keep Backup of Records

Financial records might be lost because of corrupted data, hardware failure, or other unanticipated factors. Back up your financial data on a regular basis and keep it secure. Cloud accounting software can back up your data automatically to add an extra degree of security.

Neglect To Track and Remit Sales Taxes

If your company is obligated to collect sales taxes, it is critical that you track and remit them appropriately. Understand your sales tax duties, register with the proper tax authorities, and maintain accurate sales and tax collection records. To simplify the process, consider employing seamless sales tax automation software.

Doing-It-Yourself

This is a critical error that can have serious consequences for your company. Because bookkeeping is a complex process, it is best to seek professional help from a bookkeeper or accountant to set up and review your bookkeeping system on a regular basis. They can assist you in avoiding mistakes, providing financial insights, and ensuring tax compliance.

You can reduce the likelihood of these frequent errors and retain accurate financial records for your small business by being proactive and following appropriate bookkeeping practices with the help of expert bookkeepers and record-keepers.

How to Avoid Bookkeeping Errors

To avoid bookkeeping errors some proactive steps must be taken by small business owners. This may include familiarizing yourself with basic bookkeeping principles and practices to help you navigate your financial records effectively and make informed decisions.

This can be further established by using a good bookkeeping system coupled with reliable accounting software. As a business owner, it is important to invest in a reputable accounting software solution that suits the needs of your business and reduces errors.

In addition, it is important to reconcile accounts regularly to ensure your financial records match financial statements to help identify discrepancies and errors promptly.

Keep meticulous records by maintaining detailed records of all financial transactions and accept that it is always best to seek professional assistance from reliable bookkeepers and record-keepers who specializes in small business finances.

By implementing these practices, small business owners can reduce the likelihood of committing bookkeeping errors while maintaining accurate financial records.

The Bottomline

When you own a company, you put yourself in a position to take advantage of many different possibilities, including the chance to learn from your errors. When it comes to making mistakes, the key to success is to steer clear of those that are readily apparent and cut down on others as much as you possibly can. Remember that good bookkeeping and record-keeping practices contribute to informed decision-making and long-term business success.

Consider this list seriously and implement its suggestion so you will be well on your way to running your business in profitable ways and expanding it in all ways possible.

There is more that you can achieve with the most reliable team of professional bookkeepers and record-keepers. Visit us now and get started!

#bookkeepingservicesca#recordkeepingcalifornia#smallbusinesssolutionsca#healthcaresupport#healthcare bookkeeping#cpa firm

7 notes

·

View notes

Text

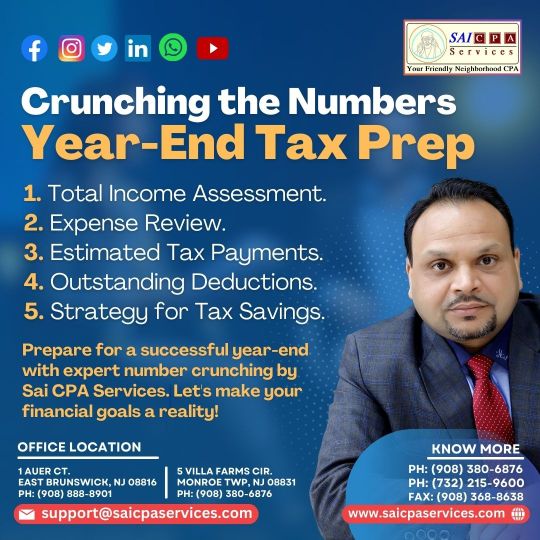

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/

https://www.facebook.com/AjayKCPA

https://www.instagram.com/sai_cpa_services/

https://twitter.com/SaiCPA

https://www.linkedin.com/in/saicpaservices/

(908) 380-6876

1 Auer Ct, East Brunswick,

New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

CPAs and Small Businesses: Partners for Financial Success

Within the ever-changing landscape of the commercial realm, small firms frequently encounter the challenge of balancing numerous obligations, encompassing the efficient administration of daily activities as well as the pursuit of expansion and long-term viability. Within this intricate and multifaceted environment, a crucial alliance has the potential to provide significant outcomes - the cooperative relationship between Certified Public Accountants (CPAs) and small enterprises. Simplify your financial workflows and boost productivity. Try VNC Global’s Accounting software for CPA firms in Singapore and witness the difference.

This blog article aims to examine the potential for collaboration between Certified Public Accountants (CPAs) and small enterprises, with the objective of achieving financial success.

The Role of CPAs in Small Businesses:

● Financial Expertise:

Certified Public Accountants (CPAs) possess a comprehensive understanding of tax legislation, accounting principles, and financial regulations, making them highly proficient financial professionals. The knowledge and skills possessed by these individuals are of great value to small enterprises that are endeavouring to make well-informed choices regarding their finances. Certified Public Accountants (CPAs) provide the necessary expertise to offer crucial advice in various areas, including the establishment of appropriate accounting systems, tax planning, and financial forecasting.

● Tax Compliance:

Tax compliance can provide a formidable challenge for small business owners due to the constantly evolving nature of tax regulations. Certified Public Accountants (CPAs) possess extensive knowledge and expertise in tax laws and regulations, enabling them to ensure firms' adherence to legal requirements while also optimising their utilisation of tax deductions and credits. This practice not only results in cost savings but also mitigates the risk of future legal complications.

● Financial Planning:

Financial planning is crucial for small businesses in order to ensure long-term stability and success. Certified Public Accountants (CPAs) have the expertise to facilitate the formulation of budgets, conduct comprehensive evaluations of financial statements, and devise effective methods to enhance organisational expansion and profitability. With the assistance of their coaching, organisations have the ability to establish attainable financial objectives and efficiently track their advancement. From tax planning to auditing services, VNC Global - one of the top Accounting CPA firms in Singapore has you covered. Schedule a consultation today to discuss your specific accounting needs.

● Risk Mitigation:

Business activities inherently include financial risks. Certified Public Accountants (CPAs) provide the expertise to assist small businesses in the identification and mitigation of these risks. Certified Public Accountants (CPAs) assume a crucial position in risk management by engaging in various tasks such as cash flow management, evaluating the financial feasibility of expansion strategies, and reviewing investment prospects.

● Business Valuation:

When the decision arises to divest the business or attract potential investors, certified public accountants (CPAs) possess the expertise to deliver precise and reliable business appraisals. This practice guarantees equitable remuneration for small business proprietors' diligent efforts and facilitates the attraction of prospective purchasers or investors.

The Benefits of the CPA-Small Business Partnership:

● Financial Clarity:

One of the foremost benefits associated with collaborating with a Certified Public Accountant (CPA) is the acquisition of enhanced comprehension pertaining to one's financial circumstances. By utilising precise financial information and receiving help from professionals, small business owners are able to make well-informed decisions that contribute to the enhancement of profitability and long-term viability. Unlock cost savings and streamline your operations with professional accounting outsourcing services offered by VNC Global - your trusted partner in Outsourcing for Accounting firm in Singapore.

● Time Savings:

Time savings can be achieved by small business owners through the efficient management of their money, which can otherwise be a burdensome and daunting task. Entrepreneurs can enhance their productivity and alleviate stress by delegating financial responsibilities to a Certified Public Accountant (CPA), allowing them to concentrate on their primary business operations. This strategic approach enables entrepreneurs to save valuable time and streamline their workflow.

● Legal Compliance:

Certified Public Accountants (CPAs) play a crucial role in ensuring that small firms adhere to tax rules and regulations, hence maintaining compliance. This practice mitigates the potential for financial penalties, legal repercussions, or other legal complications, so enabling organisations to function with greater efficiency and assurance.

● Strategic Planning:

Strategic planning involves the utilisation of certified public accountants (CPAs) to assist small firms in formulating comprehensive and enduring financial strategies. This includes the establishment of attainable objectives, the optimisation of tax planning approaches, and the selection of investments that are in line with the organization's overarching vision.

● Financial Health Assessment:

Certified Public Accountants (CPAs) offer periodic evaluations of the financial well-being of firms. The continuous assessment facilitates the early detection of possible difficulties, enabling prompt adjustments and corrections to be made.

Choosing the Best CPA for Your Business:

The selection of an appropriate Certified Public Accountant (CPA) is of utmost importance in establishing a prosperous and mutually beneficial collaboration. When choosing a Certified Public Accountant (CPA) for your small business, it is advisable to take into account the following recommendations:

Qualifications: It is imperative to ascertain that the Certified Public Accountant (CPA) possesses the necessary certification and remains well-informed about current industry knowledge and regulatory requirements.

Experience: Seek out a Certified Public Accountant (CPA) who has a substantial background in collaborating with small enterprises or possesses specialised knowledge within your particular industry.

Compatibility: Compatibility is an essential factor to consider when selecting a Certified Public Accountant (CPA). It is crucial that the chosen CPA comprehends your business objectives and possesses strong communication skills, enabling seamless and efficient interaction between both parties.

Services Offered: The range of services provided includes: It is essential to identify the particular financial services that are needed and ascertain whether the Certified Public Accountant (CPA) possesses the capability to fulfil those requirements.

Fees: The discussion of costs in advance is recommended in order to prevent unexpected financial obligations. Certain certified public accountants (CPAs) employ an hourly billing structure, but others provide fixed fees or monthly retainers as their preferred pricing models.

Final Thoughts:

The collaboration between Certified Public Accountants (CPAs) and small enterprises has been identified as a key factor contributing to achieving financial success. Certified Public Accountants (CPAs) possess specialised knowledge and skills that allow them to provide valuable advice, counsel, and assurance to small business owners. By using their expertise, CPAs empower these entrepreneurs to effectively navigate the intricate financial terrain, instilling them with a sense of confidence and tranquillity.

Through the cultivation of such teamwork, small enterprises can effectively attain their financial objectives and establish a foundation for sustained expansion and profitability. For small business owners seeking to enhance their financial success, it is advisable to engage in collaboration with a proficient Certified Public Accountant (CPA) at the earliest opportunity. Discover the strategic benefits of outsourcing for your accounting firm. If you are looking for an excellent Bookkeeper for Accounting firm in Singapore, partner with VNC Global for a no-obligation outsourcing consultation.

#Accounting software for CPA firms in Singapore#Accounting CPA firms in Singapore#Outsourcing for Accounting firm in Singapore#Bookkeeper for Accounting firm in Singapore#vncglobal

5 notes

·

View notes

Text

Are you struggling with crucial decision-making processes in your business? Our team of finance professionals is here to provide you with expert aid from start to finish. We understand that navigating financial transactions can be challenging, but we are here to make it easier for you. Trust us to provide you with the necessary tools and guidance you need to make informed decisions that will benefit your business in the long run. Contact us today to see how we can help you.

#los angeles#cpa firm los angeles#californiaservices#recordkeeping#bookkeeping service#bookkeepers#recordkeepers#smallbusinesstips#smallbusinesshelp

2 notes

·

View notes

Text

Discover how US CPA firms can bridge the talent gap with India’s skilled professionals and cost-effective offshore staffing solutions. Learn how KeyCMS Accounting helps reduce costs and staff shortages while enhancing efficiency

0 notes

Text

Get Government Contracts For Your CPA Firm With Our Expertise

Secure stable revenue growth for your CPA firm with Credfino over multiple years through government contracting opportunities. Visit their website for more.

#Government contracts#Government contracting#Accounting Firms#Offshore Staffing#CPA firm#Offshore services#win govt contract#Win government contracts

2 notes

·

View notes

Text

As the tax season looms on the horizon, CPA firms find themselves at the epicenter of a whirlwind of financial complexities. The challenges are manifold, ranging from the intricate maze of ever-evolving tax codes to the sheer volume of data that demands meticulous scrutiny. In the face of these challenges, YourLegal emerges as a beacon of support, empowering CPA firms to navigate the tax season with unparalleled confidence and efficiency.

1 note

·

View note

Text

Outsourcing Your Accounting Services

Outsourcing Your Accounting Services may be the best option if you're looking to streamline your financial process and free up time for other tasks.

Please visit us at www.crspconnect.com.

Telephone number: (929) 254-6300.

Contact us via email at [email protected].

#outsourceaccounting#outsourcingaccounting#crspconnect#cpa firm#outsource accounting services#accounting service provider

3 notes

·

View notes

Text

What is an enrolled agent, and what are their responsibilities?

An enrolled agent (EA) is a tax professional authorized by the US government to represent taxpayers before the Internal Revenue Service (IRS) in matters related to tax issues, such as audits, collections, and appeals. EAs are licensed by the IRS after passing a rigorous exam covering individual and business tax returns, and ethical standards. They also need to complete 72 hours of continuing education within a three-year period to keep their license valid.

Enrolled agents provide a range of tax services, including tax planning, preparing and filing tax returns, responding to IRS inquiries, and negotiating payment plans with the IRS. They can work independently, as part of a tax firm or as an employee in a company's accounting or finance department. EAs are knowledgeable about tax laws and regulations, and they can help taxpayers navigate the complexities of the tax code to minimize tax liability and maximize refunds.

We have a detailed blog on "UNLOCKING THE BENEFITS OF ONLINE CONTINUING EDUCATION PLATFORMS FOR EA'S", do have a look.

Read Time: 12 mins only

#cpa training#cpa#cpa firm#cpa marketing#accounting#entrepreneur#quickbooks#online business#businessgrowth#businessowner#continuing education#us cpa

2 notes

·

View notes