#CPACanada

Text

The World of CPA Canada: Unveiling Key Insights

Are you eager to delve into the realm of CPA Canada? In this comprehensive article, we will guide you through the intricate world of CPA Canada, providing you with valuable insights, expert knowledge, and answers to common questions. With 25 engaging sections, this article aims to be your ultimate source of information on CPA Canada.

Introduction

CPA Canada, short for the Chartered Professional Accountants of Canada, is a renowned organization that plays a pivotal role in the field of accounting and finance. In this article, we will embark on a journey to explore CPA Canada from various angles, shedding light on its significance, qualifications, career prospects, and more.

What Is CPA Canada?

CPA Canada is the national organization representing the accounting profession in Canada. It brings together the expertise and experience of Canadian Chartered Accountants, Certified Management Accountants, and Certified General Accountants. This merger in 2013 created a unified accounting profession under the CPA banner.

The Journey to Becoming a CPA

Education Requirements

Becoming a CPA in Canada is a well-structured journey that requires dedication and commitment. To start this journey, aspiring CPAs must meet specific educational requirements. These include completing a bachelor's degree, often with a focus on accounting or related fields.

CPA Professional Education Program (PEP)

After fulfilling the educational prerequisites, candidates enter the CPA Professional Education Program (PEP). This program provides the necessary knowledge and skills required for a successful career in accounting.

Practical Experience

CPA candidates also need to gain practical experience, typically through a period of articling, to apply their knowledge in real-world scenarios.

Common Final Examination (CFE)

The journey culminates with the Common Final Examination (CFE), a rigorous test of competencies that evaluates candidates' ability to integrate their knowledge and skills.

The Significance of CPA Canada

CPA Canada holds immense significance in the world of accounting and finance. It signifies a commitment to excellence, professionalism, and ethical conduct. CPAs are highly regarded for their expertise in financial reporting, assurance, taxation, and more.

Career Opportunities for CPAs

Public Accounting Firms

Many CPAs choose to work in public accounting firms, where they provide auditing, tax, and advisory services to clients. This path offers a diverse range of opportunities and challenges.

Corporate Sector

CPAs are in high demand in the corporate sector, where they serve as financial analysts, controllers, and CFOs, contributing to the financial success of organizations.

Government and Non-profit Organizations

CPAs also play vital roles in government agencies and non-profit organizations, ensuring financial transparency and compliance with regulations.

FAQs about CPA Canada

What are the prerequisites for enrolling in the CPA program?

To enroll in the CPA program, you typically need a bachelor's degree with specific accounting and business-related courses. Check the CPA Canada website for detailed requirements.

How long does it take to become a CPA in Canada?

The time it takes to become a CPA in Canada varies but generally ranges from 2 to 4 years, depending on your educational background and progress through the program.

What are the key skills needed to succeed as a CPA?

Key skills for success as a CPA include strong analytical abilities, attention to detail, ethical judgment, and effective communication skills.

Can international candidates become CPAs in Canada?

Yes, international candidates can become CPAs in Canada by meeting the educational and professional requirements set by CPA Canada.

What is the average salary of a CPA in Canada?

The average salary of a CPA in Canada varies depending on factors like experience, location, and the industry. However, CPAs typically earn competitive salaries.

How does CPA Canada contribute to professional development?

CPA Canada offers a wide range of professional development opportunities, including seminars, workshops, and online courses to help CPAs stay up-to-date with industry trends.

Conclusion

In conclusion, CPA Canada is not just an acronym; it represents a pathway to a rewarding career in accounting and finance. This article has provided you with a comprehensive overview of CPA Canada, from its educational requirements to career opportunities. We hope it has enriched your understanding of this esteemed profession.

#CPACanada#Accounting#Finance#ProfessionalDevelopment#CareerGoals#FinancialReporting#Taxation#Auditing#CPAExam#BusinessSkills#EthicalAccounting#CareerOpportunities#AccountingProfessionals#FinancialSuccess#CPACertification#CPACommunity#AccountingEducation#CanadianAccounting#CPAQualifications#FinancialAnalyst

0 notes

Text

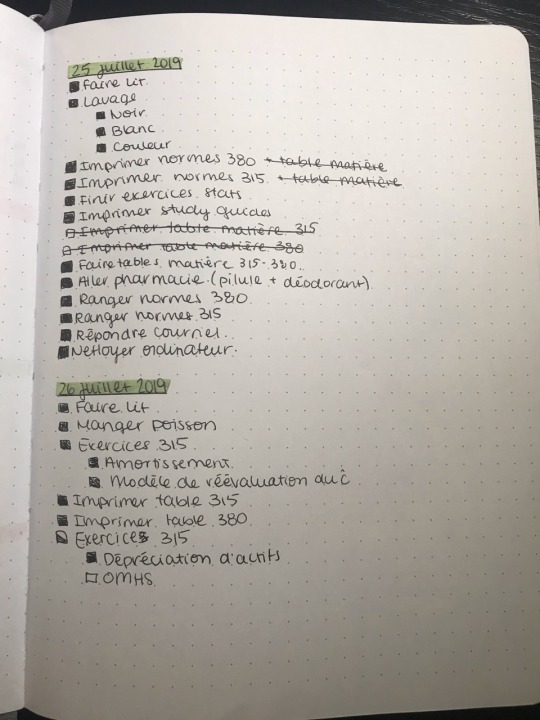

Almost done with this semester! It’s crazy 🙃 I’m almost done with half of my bachelors and I’ve done that in 12 months, that’s crazy to me. ✨I’m starting my intern in about a month and a half. It’s an eight months intern!! Crazy too! I can’t wait to start and be in my futur profession. I have a lot of projects coming up. ✨Hopefully I’ll have time to draw and maybe make some stickers I would like to use in my bullet journal. Let’s talk about my bullet journal, which if you swipe, you’re gonna see that they’re not great ahah! But you know what, I’m still organized and that’s all that matters. ✨In 15 days, I’m gonna have my last exam. Wish me luck, I have four in three days!✨

#studyblr#studying#studyspo#school#french student#inspiration#french canadian#frenchstudyblr#studymotivator#cute#cpa#cpacanada#cpastudent

4 notes

·

View notes

Text

How US CPA can get Canadian CPA Designation?

How US CPA can get Canadian CPA Designation?

If the candidate holds the U.S. CPA credential, then the candidate can earn a Canadian CPA designation too.

What is MRA?

Mutual Recognition Agreement – On January 1, 2018, the MRA between all Canadian CPA bodies and the United States’ International Qualifications Appraisal Board (IQAB), which represents the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA), came into effect.

Eligibility Requirements for US CPA seeking Canadian CPA designation:

You have completed at least 150 semester hours of college or university coursework, including a bachelor or higher degree from a college or university recognized by the State Board.

Valid US CPA License

You have a total of 30 months of relevant work experience. The 30-month experience criterion is met by applicants who have two years of relevant post-qualification experience. The International Practical Experience Verification and Employer Details form is required for applicants with fewer than two years of relevant post-qualification experience.

U.S. CPA who are or have been residents of Canada must complete these additional requirements:

A university degree from a degree-granting institution of higher education in the United States of America (USA), earned after full-time attending the institution in person for classroom instruction: or

Possess at least one year of full-time accounting experience in the United States

Exclusions:

This agreement does not apply to U.S. CPAs who received their U.S. CPA credential through a reciprocal arrangement between the NASBA and the AICPA and another professional accountancy organization. This covers all mutual recognition, reciprocal membership, and other similar agreements that the NASBA/AICPA may have had in the past.

Roadmap to the Canadian CPA designation for U.S. CPAs

completing and submitting the International Candidate Application Form to the provincial/regional CPA body to which you wish to apply

filling out the Certification of Membership with the United States State Board form

Providing proof from your Home Institute that you are a U.S. CPA in good standing, this confirmation must be sent directly from the Home Institute to the provincial/regional CPA body.

submitting valid government-issued papers as verification of your legal name

Providing a thorough chronological résumé detailing all relevant work experience

paying the required charge as decided by the CPA body in your province or region

satisfying any other conditions imposed by the relevant provincial/regional CPA authority

Roadmap to the Licensure

You meet any additional Canadian CPA experience criteria for public accounting, which may include at least 1,250 chargeable hours in assurance, with at least 625 hours in historical financial information auditing.

Audit Experience: It may count toward the greater than 1,250 / 625 chargeable hours criteria if obtained in the United States, It must be within five years of the provincial/regional CPA body’s application, and it must also meet any additional public accounting experience requirements set forth by the provincial/regional CPA organization from whom you seek the right to audit and other services requiring provincial registration or license.

CPA Reciprocity Education and Examination (CPARE): Applicants must register with their provincial/regional CPA authority for the CPARE program, and applicants who pass the CPARE program within two years of becoming a member of a provincial/regional CPA body are exempt from taking the CPARPD (CPA Reciprocity Professional Development).

0 notes

Photo

Do you know about the 4 sections for CPA exam?

Auditing and Attestation

Business Environment and Concepts

Financial Accounting and Reporting

Regulation

Website: http://upquizzes.com/

#CPA#certifiedpublicaccountant#cpaonlinetraining#cpaexam#certifiedpublicaccountantcpacertification#certifiedpublicaccountantcourse#CPAUSA#certifiedpublicaccountantexam#certifiedpublicaccountantexamprep#certifiedpublicaccountantusa#certifiedpublicaccountanttraining#CPACanada

0 notes

Link

#cpa cpacanada acca cima cma charteredaccountants accountants financeprofessionals accountingcareers

0 notes

Video

youtube

Know SECRETS OF CPA SUCCESS by Michelle Rose, Miles CPA student US CPA course, exam, study details

0 notes

Photo

Time to get the afternoon session started Mastering Money Conference “Education to Action” #CPAMM18 #CPAfinlit @cpacanada @cpabc #myspeedymoon #omega #moonwatch #9904 #omegaspeedmastermoonwatch #wristshot #dailywristshot #WatchfyCrew #watchnerd #vancouver #yvr #watchesofyvr #watchfam #womw #rolexero #twobrokewatchsnobs #lovenwatches (at Vancouver, British Columbia) https://www.instagram.com/p/Bqf7H1eHmUj/?utm_source=ig_tumblr_share&igshid=r25vefcag185

#cpamm18#cpafinlit#myspeedymoon#omega#moonwatch#9904#omegaspeedmastermoonwatch#wristshot#dailywristshot#watchfycrew#watchnerd#vancouver#yvr#watchesofyvr#watchfam#womw#rolexero#twobrokewatchsnobs#lovenwatches

0 notes

Link

Orbit Institutes has become the training provider of choice to businesses and professionals across India, an accomplishment achieved in just slightly over a decade. providing the means for candidates to earn respectful professional Finance certifications and diplomas that open doors both locally and on an international level.

0 notes

Link

This video provides an excerpt from one of the many technical review sessions included in the PASS CFE prep course, which was specifically designed to meet the needs of Indian and other international CAs who would like to achieve their Canadian CPA qualification. This course can be taken in Canada or anywhere else in the world. Visit- https://www.youtube.com/watch?v=WzE_Q71f5VI

#cpa course details#cpacanada for indian ca#cpa course in pune#cpa course fees#cma classes in pune#cpa course fees in india#cpa coaching#cpa classes in pune#cpa institute in india

0 notes