#Callable CD

Explore tagged Tumblr posts

Link

Find out the best CD interest rates and choose the best CD account for you from nearly a dozen certificates of deposit to match your goals.

#CD#Certificate of Deposit#certificateofdeposit#savings#investment#investments#low risk investment#CD interest calculator#retirement#retirement savings#ira#Individual Retirement Account#finance#money#Callable CD#High Yield CD#IRA CD#Step-Up CD#Jumbo CD#Certificate of Deposit calculator#cd calculator

0 notes

Text

Simply Certificates Of Deposit

Certificates of Deposit, typically described as CD's, are a cross in between a "financial investment" and a cost savings account. CD's have federal deposit insurance coverage approximately $100,000- which is what sets it apart from the financial investment world, however, they have a much greater rate of interest than the standard cost savings account. A certificate of a deposit enables you to invest a particular quantity of cash over a particular amount of time. There are certificate of deposits for as brief as one year, for 5 years, or longer terms. The longer you keep your loan in a CD, the greater the rate of interest you will get. When your period has actually ended, and you squander your certificate of deposit, you do not just get the initial amount of cash that you invested, however, you'll likewise get the interest that the cash made while invested. While certificates of deposit are fantastic methods to conserve loan at high-interest rates, they're not the very best option for individuals who might need to withdraw loan from their CD's prior to the financial investment amount of time has actually been reached. You can access the cash you've taken into a CD prior to the time is up, nevertheless, you will either quite a few of the made interest or pay an early withdrawal charge. Economically, it's constantly much better to leave cash purchased a certificate of deposit, however, it's definitely a convenience to understand that you might get the cash out if an emergency situation took place or you definitely required that cash prior to the time is up. Certificates of deposit have a range of interest making choices that you should pick from when you transfer your loan. There are set rate interest alternatives, long-lasting CD's, and variable rate CD's, to name a few. If you're not exactly sure how each alternative impacts your cash, ask!

Who Should Use Certificates of Deposit?

While anybody has the ability to acquire and invest their loan in a CD, it makes one of the most sense for a more youthful financier. Since CD's make more interest the longer they are gotten for, a more youthful financier can utilize CD's to diversify their financial investment portfolio and optimize their revenues by taking the Certificate of Deposit for an extended period of time. If a person is quickly approaching retirement, nevertheless, it might not be the very best alternative for investing if she or he is going to require the cash in a brief time period.

https://www.cbtno.com/locations/#map

Understand Certificates of Deposit

Prior to you put your cash into a CD, it's essential that you comprehend a few of the most frequently utilized terms in relation to Certificates of Deposit. Charges: There are charges for early withdrawal. Even if when you are opening a CD you have no prepare for eliminating the cash prior to your financial investment duration is reached, you need to absolutely comprehend the charges in case some unanticipated situations show up that need you to access the cash you've put in your CD. Interest: Always understand whether the rates of interest are repaired or variable, and how frequently the interest is paid on the cash in your CD. Maturity: There is a maturity date on every certificate of deposit, however, there are a lot of possibilities for maturity dates that you must constantly make sure you understand whether your CD develops in 1year or 5 or 20. Call Features: Banks typically put a "call function" on all released certificate of deposits. Callable CD's mean that the bank that provided the CD can end it and offer you the quantity you invested plus any overdue, accumulated interest if the rate of interest fall. CD Holdings: There is a distinction between a conventional bank CD and a brokered CD. If you utilize brokered certificates, it's possible that there are groups of financiers that in fact own little pieces of your CD. No matter the kind of CD you select, make sure that they have FDIC protection as much as $100,000.

What is a Certificate of Deposit?

youtube

1 note

·

View note

Text

Financial Asset

What Is a Financial Asset?

A financial asset may be a liquid asset that gets its value from a contractual right or ownership claim. Cash, stocks, bonds, mutual funds, and bank deposits are all are samples of financial assets. Unlike land, property, commodities, or other tangible physical assets, financial assets don't necessarily have inherent physical worth or maybe a physical form. Rather, their value reflects factors of supply and demand within the marketplace during which they trade, also because of the degree of risk they carry.

Understanding a Financial Asset

Most assets are categorized as either real, financial, or intangible. Real assets are physical assets that draw their value from substances or properties, like precious metals, land, land, and commodities like soybeans, wheat, oil, and iron.

Intangible assets are precious property that's not physical. They include patents, trademarks, and property.

Financial assets are in-between the opposite two assets. Financial assets could seem intangible—non-physical—with only the stated value on a bit of paper like a dollar or an inventory on a display screen. What that paper or listing represents, though, maybe a claim of ownership of an entity, sort of a public company, or contractual rights to payments—say, the interest income from a bond. Financial assets derive their value from a contractual claim on an underlying asset.

This underlying asset could also be either real or intangible. Commodities, for instance, are the important, underlying assets that are pinned to such financial assets as commodity futures, contracts, or some exchange-traded funds(ETFs) Likewise, the land is that the real asset related to shares of land investment trusts (REITs). REITs are financial assets and are publicly traded entities that own a portfolio of properties.

The Internal Revenue Service (IRS) requires businesses to report financial and real assets together as tangible assets for tax purposes. The grouping of tangible assets is broken away intangible assets.

Common sorts of Financial Assets

According to the commonly cited definition from the International Financial Reporting Standards (IFRS), financial assets include:

· Cash

· Equity instruments of an entity—for example a share certificate

· A contractual right to receive a financial asset from another entity—known as a receivable

· The contractual right to exchange financial assets or liabilities with another entity under favorable conditions

· A contract which will settle in an entity's equity instruments

In addition to stocks and receivables, the above definition comprises financial derivatives, bonds, market or other account holdings, and equity stakes. Many of those financial assets don't have a group price until they're converted into cash, especially within the case of stocks where their value and price fluctuate.

Aside from cash, the more common sorts of financial assets that investors encounter are:

· Stocks are financial assets with no set ending or expiration date. An investor buying stocks becomes part-owner of a corporation and shares in its profits and losses. Stocks could also be held indefinitely or sold to other investors.

· Bonds are a method that companies or governments finance short-term projects. The bondholder is that the lender, and therefore the bonds state what proportion money is owed, the rate of interest being paid, and therefore the bond's maturity.

· A certificate of deposit (CD) allows an investor to deposit an amount of cash at a bank for a specified period with a guaranteed rate of interest. A CD pays monthly interest and may typically be held between three months to 5 years counting on the contract.

KEY TAKEAWAYS

· A financial asset may be a liquid asset that represents—and derives value from—a claim of ownership of an entity or contractual rights to future payments from an entity.

· A financial asset's worth could also be supported by an underlying tangible or real asset, but market supply and demand influence its value also.

· Stocks, bonds, cash, CDs, and bank deposits are samples of financial assets.

Pros and Cons of Highly Liquid Financial Assets

The purest sort of financial assets are cash and cash equivalents—checking accounts, savings accounts, and market accounts. Liquid accounts are easily becoming funds for paying bills and covering financial emergencies or pressing demands.

Other sorts of financial assets won't be as liquid. Liquidity is that the ability to vary a financial asset into cash quickly. For stocks, it's the power of an investor to shop for or sell holdings from a ready market. Liquid markets are those where there are many buyers and many sellers and no extended lag-time in trying to execute a trade.

In the case of equities like stocks and bonds, an investor has got to sell and await the settlement date to receive their money—usually two business days. Other financial assets have varying lengths of settlement.

Maintaining funds in liquid financial assets may result in greater preservation of capital. Money in bank checking, savings, and CD accounts are insured against loss of up to $250,000 by the Federal Deposit Insurance Corporation (FDIC) for depository financial institution accounts. If for a few reasons the bank fails, your account has dollar-for-dollar coverage up to $250,000. However, since FDIC covers each financial organization individually, an investor with brokered CDs totaling over $250,000 in one bank faces losses if the bank becomes insolvent.4

Liquid assets like checking and savings accounts have a limited return on investment (ROI) capability. ROI is that the profit you receive from an asset divided by the value of owning that asset. In checking and savings accounts the ROI is minimal. they'll provide modest interest income but, unlike equities, they provide little appreciation. Also, CDs and market accounts restrict withdrawals for months or years. When interest rates fall, callable CDs are often called, and investors find themselves moving their money to potentially lower-income investments.

Pros

Liquid financial assets convert into cash easily.

Some financial assets have the power to understand in value.

The FDIC and NCUA insure accounts up to $250,000.

Cons

Highly liquid financial assets have little appreciation

Illiquid financial assets could also be hard to convert to cash.

The value of a financial asset is merely as strong because of the underlying entity.

Real-World Example of monetary Assets

Businesses, also as individuals, hold financial assets. within the case of an investment or asset management company, the financial assets include the cash within the portfolios firm handles for clients, called assets under management (AUM). for instance, BlackRock Inc. is that the largest investment manager within the U.S. and the world, judging by its $6.84 trillion in AUM (as of June 30, 2019).5 6

In the case of banks, financial assets include the price of the outstanding loans it's made to customers. Capital One, the 10th largest bank within the U.S., reported $373,191 million in total assets on its first-quarter 2019 financial statement; of that, $240,273 million were from real estate-secured, commercial, and industrial loans.

#financial assets stock bond#stock of global financial assets 2020#stocks to buy today#stocks to buy today india#bonds traded today#bonds in india#bonds investment#commodity market#commodity trading#commodity market timing#exchange-traded funds india#exchange traded funds asx#astrologers in indore#astro nifty twitter#astro stock market#stock market astrology 2021

0 notes

Text

Building Your First Serverless Service With AWS Lambda Functions

Many developers are at least marginally familiar with AWS Lambda functions. They’re reasonably straightforward to set up, but the vast AWS landscape can make it hard to see the big picture. With so many different pieces it can be daunting, and frustratingly hard to see how they fit seamlessly into a normal web application.

The Serverless framework is a huge help here. It streamlines the creation, deployment, and most significantly, the integration of Lambda functions into a web app. To be clear, it does much, much more than that, but these are the pieces I’ll be focusing on. Hopefully, this post strikes your interest and encourages you to check out the many other things Serverless supports. If you’re completely new to Lambda you might first want to check out this AWS intro.

There’s no way I can cover the initial installation and setup better than the quick start guide, so start there to get up and running. Assuming you already have an AWS account, you might be up and running in 5–10 minutes; and if you don’t, the guide covers that as well.

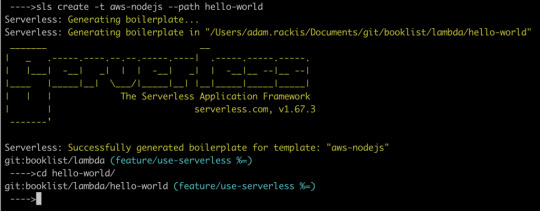

Your first Serverless service

Before we get to cool things like file uploads and S3 buckets, let’s create a basic Lambda function, connect it to an HTTP endpoint, and call it from an existing web app. The Lambda won’t do anything useful or interesting, but this will give us a nice opportunity to see how pleasant it is to work with Serverless.

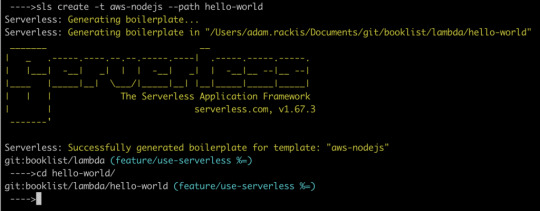

First, let’s create our service. Open any new, or existing web app you might have (create-react-app is a great way to quickly spin up a new one) and find a place to create our services. For me, it’s my lambda folder. Whatever directory you choose, cd into it from terminal and run the following command:

sls create -t aws-nodejs --path hello-world

That creates a new directory called hello-world. Let’s crack it open and see what’s in there.

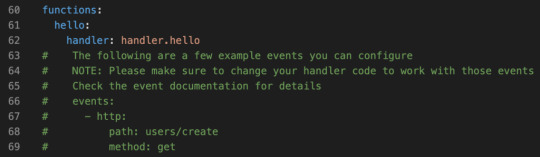

If you look in handler.js, you should see an async function that returns a message. We could hit sls deploy in our terminal right now, and deploy that Lambda function, which could then be invoked. But before we do that, let’s make it callable over the web.

Working with AWS manually, we’d normally need to go into the AWS API Gateway, create an endpoint, then create a stage, and tell it to proxy to our Lambda. With serverless, all we need is a little bit of config.

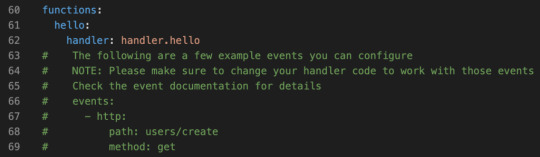

Still in the hello-world directory? Open the serverless.yaml file that was created in there.

The config file actually comes with boilerplate for the most common setups. Let’s uncomment the http entries, and add a more sensible path. Something like this:

functions: hello: handler: handler.hello # The following are a few example events you can configure # NOTE: Please make sure to change your handler code to work with those events # Check the event documentation for details events: - http: path: msg method: get

That’s it. Serverless does all the grunt work described above.

CORS configuration

Ideally, we want to call this from front-end JavaScript code with the Fetch API, but that unfortunately means we need CORS to be configured. This section will walk you through that.

Below the configuration above, add cors: true, like this

functions: hello: handler: handler.hello events: - http: path: msg method: get cors: true

That’s the section! CORS is now configured on our API endpoint, allowing cross-origin communication.

CORS Lambda tweak

While our HTTP endpoint is configured for CORS, it’s up to our Lambda to return the right headers. That’s just how CORS works. Let’s automate that by heading back into handler.js, and adding this function:

const CorsResponse = obj => ({ statusCode: 200, headers: { "Access-Control-Allow-Origin": "*", "Access-Control-Allow-Headers": "*", "Access-Control-Allow-Methods": "*" }, body: JSON.stringify(obj) });

Before returning from the Lambda, we’ll send the return value through that function. Here’s the entirety of handler.js with everything we’ve done up to this point:

'use strict'; const CorsResponse = obj => ({ statusCode: 200, headers: { "Access-Control-Allow-Origin": "*", "Access-Control-Allow-Headers": "*", "Access-Control-Allow-Methods": "*" }, body: JSON.stringify(obj) });

module.exports.hello = async event => { return CorsResponse("HELLO, WORLD!"); };

Let’s run it. Type sls deploy into your terminal from the hello-world folder.

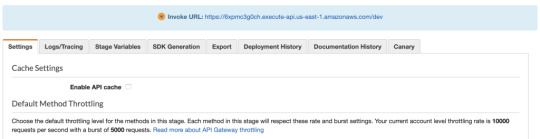

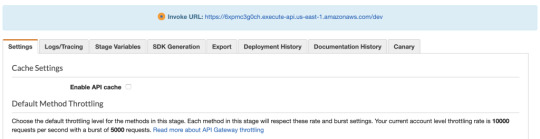

When that runs, we’ll have deployed our Lambda function to an HTTP endpoint that we can call via Fetch. But… where is it? We could crack open our AWS console, find the gateway API that serverless created for us, then find the Invoke URL. It would look something like this.

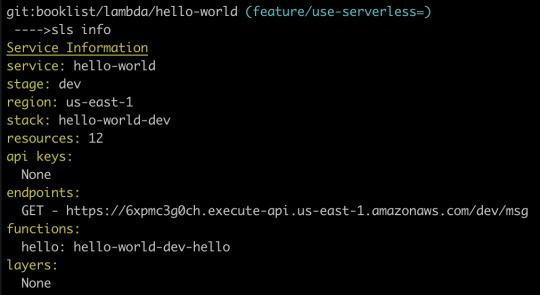

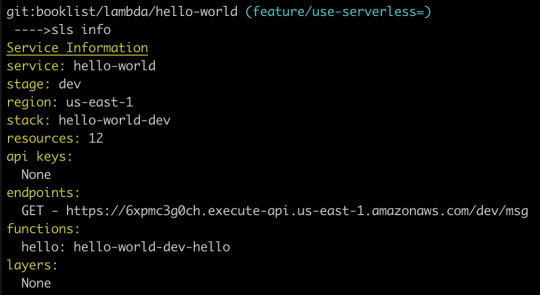

Fortunately, there is an easier way, which is to type sls info into our terminal:

Just like that, we can see that our Lambda function is available at the following path:

https://6xpmc3g0ch.execute-api.us-east-1.amazonaws.com/dev/ms

Woot, now let’s call It!

Now let’s open up a web app and try fetching it. Here’s what our Fetch will look like:

fetch("https://6xpmc3g0ch.execute-api.us-east-1.amazonaws.com/dev/msg") .then(resp => resp.json()) .then(resp => { console.log(resp); });

We should see our message in the dev console.

Now that we’ve gotten our feet wet, let’s repeat this process. This time, though, let’s make a more interesting, useful service. Specifically, let’s make the canonical “resize an image” Lambda, but instead of being triggered by a new S3 bucket upload, let’s let the user upload an image directly to our Lambda. That’ll remove the need to bundle any kind of aws-sdk resources in our client-side bundle.

Building a useful Lambda

OK, from the start! This particular Lambda will take an image, resize it, then upload it to an S3 bucket. First, let’s create a new service. I’m calling it cover-art but it could certainly be anything else.

sls create -t aws-nodejs --path cover-art

As before, we’ll add a path to our HTTP endpoint (which in this case will be a POST, instead of GET, since we’re sending the file instead of receiving it) and enable CORS:

// Same as before events: - http: path: upload method: post cors: true

Next, let’s grant our Lambda access to whatever S3 buckets we’re going to use for the upload. Look in your YAML file — there should be a iamRoleStatements section that contains boilerplate code that’s been commented out. We can leverage some of that by uncommenting it. Here’s the config we’ll use to enable the S3 buckets we want:

iamRoleStatements: - Effect: "Allow" Action: - "s3:*" Resource: ["arn:aws:s3:::your-bucket-name/*"]

Note the /* on the end. We don’t list specific bucket names in isolation, but rather paths to resources; in this case, that’s any resources that happen to exist inside your-bucket-name.

Since we want to upload files directly to our Lambda, we need to make one more tweak. Specifically, we need to configure the API endpoint to accept multipart/form-data as a binary media type. Locate the provider section in the YAML file:

provider: name: aws runtime: nodejs12.x

…and modify if it to:

provider: name: aws runtime: nodejs12.x apiGateway: binaryMediaTypes: - 'multipart/form-data'

For good measure, let’s give our function an intelligent name. Replace handler: handler.hello with handler: handler.upload, then change module.exports.hello to module.exports.upload in handler.js.

Now we get to write some code

First, let’s grab some helpers.

npm i jimp uuid lambda-multipart-parser

Wait, what’s Jimp? It’s the library I’m using to resize uploaded images. uuid will be for creating new, unique file names of the sized resources, before uploading to S3. Oh, and lambda-multipart-parser? That’s for parsing the file info inside our Lambda.

Next, let’s make a convenience helper for S3 uploading:

const uploadToS3 = (fileName, body) => { const s3 = new S3({}); const params = { Bucket: "your-bucket-name", Key: `/${fileName}`, Body: body };

return new Promise(res => { s3.upload(params, function(err, data) { if (err) { return res(CorsResponse({ error: true, message: err })); } res(CorsResponse({ success: true, url: `https://${params.Bucket}.s3.amazonaws.com/${params.Key}` })); }); }); };

Lastly, we’ll plug in some code that reads the upload files, resizes them with Jimp (if needed) and uploads the result to S3. The final result is below.

'use strict'; const AWS = require("aws-sdk"); const { S3 } = AWS; const path = require("path"); const Jimp = require("jimp"); const uuid = require("uuid/v4"); const awsMultiPartParser = require("lambda-multipart-parser");

const CorsResponse = obj => ({ statusCode: 200, headers: { "Access-Control-Allow-Origin": "*", "Access-Control-Allow-Headers": "*", "Access-Control-Allow-Methods": "*" }, body: JSON.stringify(obj) });

const uploadToS3 = (fileName, body) => { const s3 = new S3({}); var params = { Bucket: "your-bucket-name", Key: `/${fileName}`, Body: body }; return new Promise(res => { s3.upload(params, function(err, data) { if (err) { return res(CorsResponse({ error: true, message: err })); } res(CorsResponse({ success: true, url: `https://${params.Bucket}.s3.amazonaws.com/${params.Key}` })); }); }); };

module.exports.upload = async event => { const formPayload = await awsMultiPartParser.parse(event); const MAX_WIDTH = 50; return new Promise(res => { Jimp.read(formPayload.files[0].content, function(err, image) { if (err || !image) { return res(CorsResponse({ error: true, message: err })); } const newName = `${uuid()}${path.extname(formPayload.files[0].filename)}`; if (image.bitmap.width > MAX_WIDTH) { image.resize(MAX_WIDTH, Jimp.AUTO); image.getBuffer(image.getMIME(), (err, body) => { if (err) { return res(CorsResponse({ error: true, message: err })); } return res(uploadToS3(newName, body)); }); } else { image.getBuffer(image.getMIME(), (err, body) => { if (err) { return res(CorsResponse({ error: true, message: err })); } return res(uploadToS3(newName, body)); }); } }); }); };

I’m sorry to dump so much code on you but — this being a post about Amazon Lambda and serverless — I’d rather not belabor the grunt work within the serverless function. Of course, yours might look completely different if you’re using an image library other than Jimp.

Let’s run it by uploading a file from our client. I’m using the react-dropzone library, so my JSX looks like this:

<Dropzone onDrop={files => onDrop(files)} multiple={false} > <div>Click or drag to upload a new cover</div> </Dropzone>

The onDrop function looks like this:

const onDrop = files => { let request = new FormData(); request.append("fileUploaded", files[0]);

fetch("https://yb1ihnzpy8.execute-api.us-east-1.amazonaws.com/dev/upload", { method: "POST", mode: "cors", body: request }) .then(resp => resp.json()) .then(res => { if (res.error) { // handle errors } else { // success - woo hoo - update state as needed } }); };

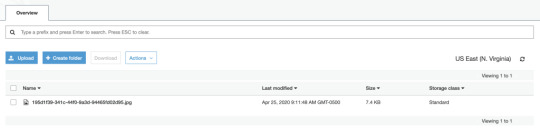

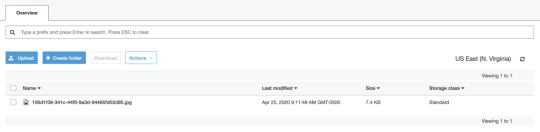

And just like that, we can upload a file and see it appear in our S3 bucket!

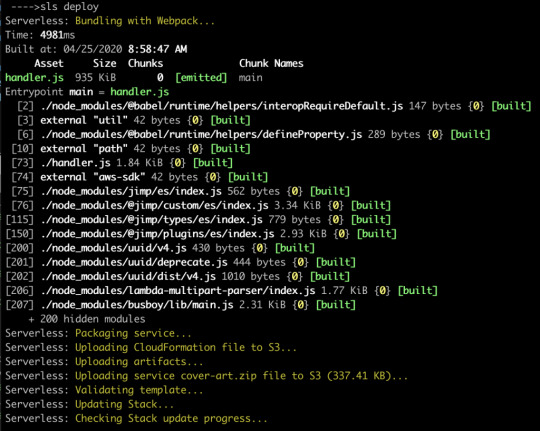

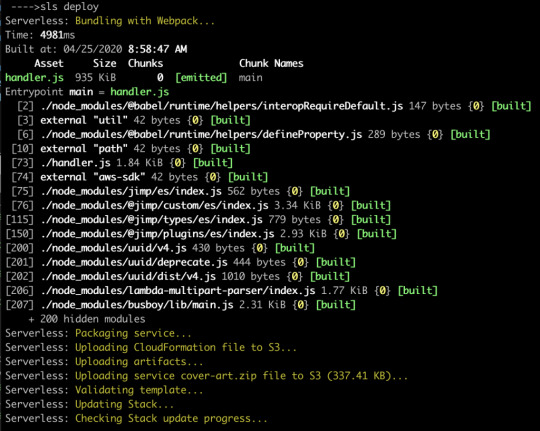

An optional detour: bundling

There’s one optional enhancement we could make to our setup. Right now, when we deploy our service, Serverless is zipping up the entire services folder and sending all of it to our Lambda. The content currently weighs in at 10MB, since all of our node_modules are getting dragged along for the ride. We can use a bundler to drastically reduce that size. Not only that, but a bundler will cut deploy time, data usage, cold start performance, etc. In other words, it’s a nice thing to have.

Fortunately for us, there’s a plugin that easily integrates webpack into the serverless build process. Let’s install it with:

npm i serverless-webpack --save-dev

…and add it via our YAML config file. We can drop this in at the very end:

// Same as before plugins: - serverless-webpack

Naturally, we need a webpack.config.js file, so let’s add that to the mix:

const path = require("path"); module.exports = { entry: "./handler.js", output: { libraryTarget: 'commonjs2', path: path.join(__dirname, '.webpack'), filename: 'handler.js', }, target: "node", mode: "production", externals: ["aws-sdk"], resolve: { mainFields: ["main"] } };

Notice that we’re setting target: node so Node-specific assets are treated properly. Also note that you may need to set the output filename to handler.js. I’m also adding aws-sdk to the externals array so webpack doesn’t bundle it at all; instead, it’ll leave the call to const AWS = require("aws-sdk"); alone, allowing it to be handled by our Lamdba, at runtime. This is OK since Lambdas already have the aws-sdk available implicitly, meaning there’s no need for us to send it over the wire. Finally, the mainFields: ["main"] is to tell webpack to ignore any ESM module fields. This is necessary to fix some issues with the Jimp library.

Now let’s re-deploy, and hopefully we’ll see webpack running.

Now our code is bundled nicely into a single file that’s 935K, which zips down further to a mere 337K. That’s a lot of savings!

Odds and ends

If you’re wondering how you’d send other data to the Lambda, you’d add what you want to the request object, of type FormData, from before. For example:

request.append("xyz", "Hi there");

…and then read formPayload.xyz in the Lambda. This can be useful if you need to send a security token, or other file info.

If you’re wondering how you might configure env variables for your Lambda, you might have guessed by now that it’s as simple as adding some fields to your serverless.yaml file. It even supports reading the values from an external file (presumably not committed to git). This blog post by Philipp Müns covers it well.

Wrapping up

Serverless is an incredible framework. I promise, we’ve barely scratched the surface. Hopefully this post has shown you its potential, and motivated you to check it out even further.

If you’re interested in learning more, I’d recommend the learning materials from David Wells, an engineer at Netlify, and former member of the serverless team, as well as the Serverless Handbook by Swizec Teller

Serverless Workshop: A repo to learn the core concepts of serverless

Serverless Auth Strategies: A repo that walks through different strategies for authorizing access to functions.

Netlify Functions Worksop: Netlify lessons on the core concepts of using serverless functions

Serverless Handbook: Getting started with serverless technologies

The post Building Your First Serverless Service With AWS Lambda Functions appeared first on CSS-Tricks.

Building Your First Serverless Service With AWS Lambda Functions published first on https://deskbysnafu.tumblr.com/

0 notes

Text

Building Your First Serverless Service With AWS Lambda Functions

Many developers are at least marginally familiar with AWS Lambda functions. They’re reasonably straightforward to set up, but the vast AWS landscape can make it hard to see the big picture. With so many different pieces it can be daunting, and frustratingly hard to see how they fit seamlessly into a normal web application.

The Serverless framework is a huge help here. It streamlines the creation, deployment, and most significantly, the integration of Lambda functions into a web app. To be clear, it does much, much more than that, but these are the pieces I’ll be focusing on. Hopefully, this post strikes your interest and encourages you to check out the many other things Serverless supports. If you’re completely new to Lambda you might first want to check out this AWS intro.

There’s no way I can cover the initial installation and setup better than the quick start guide, so start there to get up and running. Assuming you already have an AWS account, you might be up and running in 5–10 minutes; and if you don’t, the guide covers that as well.

Your first Serverless service

Before we get to cool things like file uploads and S3 buckets, let’s create a basic Lambda function, connect it to an HTTP endpoint, and call it from an existing web app. The Lambda won’t do anything useful or interesting, but this will give us a nice opportunity to see how pleasant it is to work with Serverless.

First, let’s create our service. Open any new, or existing web app you might have (create-react-app is a great way to quickly spin up a new one) and find a place to create our services. For me, it’s my lambda folder. Whatever directory you choose, cd into it from terminal and run the following command:

sls create -t aws-nodejs --path hello-world

That creates a new directory called hello-world. Let’s crack it open and see what’s in there.

If you look in handler.js, you should see an async function that returns a message. We could hit sls deploy in our terminal right now, and deploy that Lambda function, which could then be invoked. But before we do that, let’s make it callable over the web.

Working with AWS manually, we’d normally need to go into the AWS API Gateway, create an endpoint, then create a stage, and tell it to proxy to our Lambda. With serverless, all we need is a little bit of config.

Still in the hello-world directory? Open the serverless.yaml file that was created in there.

The config file actually comes with boilerplate for the most common setups. Let’s uncomment the http entries, and add a more sensible path. Something like this:

functions: hello: handler: handler.hello # The following are a few example events you can configure # NOTE: Please make sure to change your handler code to work with those events # Check the event documentation for details events: - http: path: msg method: get

That’s it. Serverless does all the grunt work described above.

CORS configuration

Ideally, we want to call this from front-end JavaScript code with the Fetch API, but that unfortunately means we need CORS to be configured. This section will walk you through that.

Below the configuration above, add cors: true, like this

functions: hello: handler: handler.hello events: - http: path: msg method: get cors: true

That’s the section! CORS is now configured on our API endpoint, allowing cross-origin communication.

CORS Lambda tweak

While our HTTP endpoint is configured for CORS, it’s up to our Lambda to return the right headers. That’s just how CORS works. Let’s automate that by heading back into handler.js, and adding this function:

const CorsResponse = obj => ({ statusCode: 200, headers: { "Access-Control-Allow-Origin": "*", "Access-Control-Allow-Headers": "*", "Access-Control-Allow-Methods": "*" }, body: JSON.stringify(obj) });

Before returning from the Lambda, we’ll send the return value through that function. Here’s the entirety of handler.js with everything we’ve done up to this point:

'use strict'; const CorsResponse = obj => ({ statusCode: 200, headers: { "Access-Control-Allow-Origin": "*", "Access-Control-Allow-Headers": "*", "Access-Control-Allow-Methods": "*" }, body: JSON.stringify(obj) });

module.exports.hello = async event => { return CorsResponse("HELLO, WORLD!"); };

Let’s run it. Type sls deploy into your terminal from the hello-world folder.

When that runs, we’ll have deployed our Lambda function to an HTTP endpoint that we can call via Fetch. But… where is it? We could crack open our AWS console, find the gateway API that serverless created for us, then find the Invoke URL. It would look something like this.

Fortunately, there is an easier way, which is to type sls info into our terminal:

Just like that, we can see that our Lambda function is available at the following path:

https://6xpmc3g0ch.execute-api.us-east-1.amazonaws.com/dev/ms

Woot, now let’s call It!

Now let’s open up a web app and try fetching it. Here’s what our Fetch will look like:

fetch("https://6xpmc3g0ch.execute-api.us-east-1.amazonaws.com/dev/msg") .then(resp => resp.json()) .then(resp => { console.log(resp); });

We should see our message in the dev console.

Now that we’ve gotten our feet wet, let’s repeat this process. This time, though, let’s make a more interesting, useful service. Specifically, let’s make the canonical “resize an image” Lambda, but instead of being triggered by a new S3 bucket upload, let’s let the user upload an image directly to our Lambda. That’ll remove the need to bundle any kind of aws-sdk resources in our client-side bundle.

Building a useful Lambda

OK, from the start! This particular Lambda will take an image, resize it, then upload it to an S3 bucket. First, let’s create a new service. I’m calling it cover-art but it could certainly be anything else.

sls create -t aws-nodejs --path cover-art

As before, we’ll add a path to our HTTP endpoint (which in this case will be a POST, instead of GET, since we’re sending the file instead of receiving it) and enable CORS:

// Same as before events: - http: path: upload method: post cors: true

Next, let’s grant our Lambda access to whatever S3 buckets we’re going to use for the upload. Look in your YAML file — there should be a iamRoleStatements section that contains boilerplate code that’s been commented out. We can leverage some of that by uncommenting it. Here’s the config we’ll use to enable the S3 buckets we want:

iamRoleStatements: - Effect: "Allow" Action: - "s3:*" Resource: ["arn:aws:s3:::your-bucket-name/*"]

Note the /* on the end. We don’t list specific bucket names in isolation, but rather paths to resources; in this case, that’s any resources that happen to exist inside your-bucket-name.

Since we want to upload files directly to our Lambda, we need to make one more tweak. Specifically, we need to configure the API endpoint to accept multipart/form-data as a binary media type. Locate the provider section in the YAML file:

provider: name: aws runtime: nodejs12.x

…and modify if it to:

provider: name: aws runtime: nodejs12.x apiGateway: binaryMediaTypes: - 'multipart/form-data'

For good measure, let’s give our function an intelligent name. Replace handler: handler.hello with handler: handler.upload, then change module.exports.hello to module.exports.upload in handler.js.

Now we get to write some code

First, let’s grab some helpers.

npm i jimp uuid lambda-multipart-parser

Wait, what’s Jimp? It’s the library I’m using to resize uploaded images. uuid will be for creating new, unique file names of the sized resources, before uploading to S3. Oh, and lambda-multipart-parser? That’s for parsing the file info inside our Lambda.

Next, let’s make a convenience helper for S3 uploading:

const uploadToS3 = (fileName, body) => { const s3 = new S3({}); const params = { Bucket: "your-bucket-name", Key: `/${fileName}`, Body: body };

return new Promise(res => { s3.upload(params, function(err, data) { if (err) { return res(CorsResponse({ error: true, message: err })); } res(CorsResponse({ success: true, url: `https://${params.Bucket}.s3.amazonaws.com/${params.Key}` })); }); }); };

Lastly, we’ll plug in some code that reads the upload files, resizes them with Jimp (if needed) and uploads the result to S3. The final result is below.

'use strict'; const AWS = require("aws-sdk"); const { S3 } = AWS; const path = require("path"); const Jimp = require("jimp"); const uuid = require("uuid/v4"); const awsMultiPartParser = require("lambda-multipart-parser");

const CorsResponse = obj => ({ statusCode: 200, headers: { "Access-Control-Allow-Origin": "*", "Access-Control-Allow-Headers": "*", "Access-Control-Allow-Methods": "*" }, body: JSON.stringify(obj) });

const uploadToS3 = (fileName, body) => { const s3 = new S3({}); var params = { Bucket: "your-bucket-name", Key: `/${fileName}`, Body: body }; return new Promise(res => { s3.upload(params, function(err, data) { if (err) { return res(CorsResponse({ error: true, message: err })); } res(CorsResponse({ success: true, url: `https://${params.Bucket}.s3.amazonaws.com/${params.Key}` })); }); }); };

module.exports.upload = async event => { const formPayload = await awsMultiPartParser.parse(event); const MAX_WIDTH = 50; return new Promise(res => { Jimp.read(formPayload.files[0].content, function(err, image) { if (err || !image) { return res(CorsResponse({ error: true, message: err })); } const newName = `${uuid()}${path.extname(formPayload.files[0].filename)}`; if (image.bitmap.width > MAX_WIDTH) { image.resize(MAX_WIDTH, Jimp.AUTO); image.getBuffer(image.getMIME(), (err, body) => { if (err) { return res(CorsResponse({ error: true, message: err })); } return res(uploadToS3(newName, body)); }); } else { image.getBuffer(image.getMIME(), (err, body) => { if (err) { return res(CorsResponse({ error: true, message: err })); } return res(uploadToS3(newName, body)); }); } }); }); };

I’m sorry to dump so much code on you but — this being a post about Amazon Lambda and serverless — I’d rather not belabor the grunt work within the serverless function. Of course, yours might look completely different if you’re using an image library other than Jimp.

Let’s run it by uploading a file from our client. I’m using the react-dropzone library, so my JSX looks like this:

<Dropzone onDrop={files => onDrop(files)} multiple={false} > <div>Click or drag to upload a new cover</div> </Dropzone>

The onDrop function looks like this:

const onDrop = files => { let request = new FormData(); request.append("fileUploaded", files[0]);

fetch("https://yb1ihnzpy8.execute-api.us-east-1.amazonaws.com/dev/upload", { method: "POST", mode: "cors", body: request }) .then(resp => resp.json()) .then(res => { if (res.error) { // handle errors } else { // success - woo hoo - update state as needed } }); };

And just like that, we can upload a file and see it appear in our S3 bucket!

An optional detour: bundling

There’s one optional enhancement we could make to our setup. Right now, when we deploy our service, Serverless is zipping up the entire services folder and sending all of it to our Lambda. The content currently weighs in at 10MB, since all of our node_modules are getting dragged along for the ride. We can use a bundler to drastically reduce that size. Not only that, but a bundler will cut deploy time, data usage, cold start performance, etc. In other words, it’s a nice thing to have.

Fortunately for us, there’s a plugin that easily integrates webpack into the serverless build process. Let’s install it with:

npm i serverless-webpack --save-dev

…and add it via our YAML config file. We can drop this in at the very end:

// Same as before plugins: - serverless-webpack

Naturally, we need a webpack.config.js file, so let’s add that to the mix:

const path = require("path"); module.exports = { entry: "./handler.js", output: { libraryTarget: 'commonjs2', path: path.join(__dirname, '.webpack'), filename: 'handler.js', }, target: "node", mode: "production", externals: ["aws-sdk"], resolve: { mainFields: ["main"] } };

Notice that we’re setting target: node so Node-specific assets are treated properly. Also note that you may need to set the output filename to handler.js. I’m also adding aws-sdk to the externals array so webpack doesn’t bundle it at all; instead, it’ll leave the call to const AWS = require("aws-sdk"); alone, allowing it to be handled by our Lamdba, at runtime. This is OK since Lambdas already have the aws-sdk available implicitly, meaning there’s no need for us to send it over the wire. Finally, the mainFields: ["main"] is to tell webpack to ignore any ESM module fields. This is necessary to fix some issues with the Jimp library.

Now let’s re-deploy, and hopefully we’ll see webpack running.

Now our code is bundled nicely into a single file that’s 935K, which zips down further to a mere 337K. That’s a lot of savings!

Odds and ends

If you’re wondering how you’d send other data to the Lambda, you’d add what you want to the request object, of type FormData, from before. For example:

request.append("xyz", "Hi there");

…and then read formPayload.xyz in the Lambda. This can be useful if you need to send a security token, or other file info.

If you’re wondering how you might configure env variables for your Lambda, you might have guessed by now that it’s as simple as adding some fields to your serverless.yaml file. It even supports reading the values from an external file (presumably not committed to git). This blog post by Philipp Müns covers it well.

Wrapping up

Serverless is an incredible framework. I promise, we’ve barely scratched the surface. Hopefully this post has shown you its potential, and motivated you to check it out even further.

If you’re interested in learning more, I’d recommend the learning materials from David Wells, an engineer at Netlify, and former member of the serverless team, as well as the Serverless Handbook by Swizec Teller

Serverless Workshop: A repo to learn the core concepts of serverless

Serverless Auth Strategies: A repo that walks through different strategies for authorizing access to functions.

Netlify Functions Worksop: Netlify lessons on the core concepts of using serverless functions

Serverless Handbook: Getting started with serverless technologies

The post Building Your First Serverless Service With AWS Lambda Functions appeared first on CSS-Tricks.

source https://css-tricks.com/building-your-first-serverless-service-with-aws-lambda-functions/

from WordPress https://ift.tt/2ZPUMO4 via IFTTT

0 notes

Text

Best Interest Rates on Cash – January 2019

Here's my monthly roundup of the best interest rates on cash for January 2019, roughly sorted from shortest to longest maturities. Check out my Ultimate Rate-Chaser Calculator to get an idea of how much extra interest you'd earn if you are moving money between accounts. Rates listed are available to everyone nationwide. Rates checked as of 1/9/18.

High-yield savings accounts While the huge megabanks like to get away with 0.01% APY, getting higher rates is as easy as transferring money electronically from your checking account to an online savings account. The interest rates on savings accounts can drop at any time, so I prioritize banks with a history of competitive rates. Some banks will bait you and then lower the rates in the hopes that you are too lazy to leave.

EBSB Bank offers 2.50% APY with a $5,000 minimum balance. The CIT Bank Savings Builder is now up to 2.45% APY with a $100 minimum to open and a $100 monthly deposit. There are several other established high-yield savings accounts at 2% APY and up.

Short-term guaranteed rates (1 year and under) I am often asked what to do with a big pile of cash that you're waiting to deploy shortly (just sold your house, just sold your business, legal settlement, inheritance). My usual advice is to keep things simple and take your time. If not a savings account, then put it in a flexible short-term CD under the FDIC limits until you have a plan.

No Penalty CDs offer a locked-in rate with no early withdrawal penalty. That means your interest rate can never go down, but you can still take out your money (once) if you want to use it elsewhere. Marcus Bank has 13-month No Penalty CD at 2.35% APY with a $500 minimum deposit, Ally Bank has a 11-month No Penalty CD is at 2.30% APY with a $25k+ minimum, and CIT Bank has a 11-month No Penalty CD at 2.05% APY with a $1,000 minimum deposit. You may wish to open multiple CDs in smaller increments for more flexibility.

First Internet Bank has a 1-year CD at 2.89% APY ($1,000 minimum) with an early withdrawal penalty of 180 days of interest.

Money market mutual funds + Ultra-short bond ETFs If you like to keep cash in a brokerage account, beware that many brokers pay out very little interest on their default cash sweep funds (and keep the money for themselves). The following money market and ultra-short bond funds are not FDIC-insured, but may be a good option if you have idle cash and cheap/free commissions.

Vanguard Prime Money Market Fund currently pays an 2.44% SEC yield. The default sweep option is the Vanguard Federal Money Market Fund, which has an SEC yield of 2.31%. You can manually move the money over to Prime if you meet the $3,000 minimum investment.

Vanguard Ultra-Short-Term Bond Fund currently pays 2.71% SEC Yield ($3,000 min) and 2.81% SEC Yield ($50,000 min). The average duration is ~1 year, so there is more interest rate risk.

The PIMCO Enhanced Short Maturity Active Bond ETF (MINT) has a 2.96% SEC yield and the iShares Short Maturity Bond ETF (NEAR) has a 2.98% SEC yield while holding a portfolio of investment-grade bonds with an average duration of ~6 months.

Treasury Bills and Ultra-short Treasury ETFs Another option is to buy individual Treasury bills which come in a variety of maturities from 4-weeks to 52-weeks. You can also invest in ETFs that hold a rotating basket of short-term Treasury Bills for you, while charging a small management fee for doing so. T-Bill interest is exempt from state and local income taxes.

You can build your own T-Bill ladder at TreasuryDirect.gov or via a brokerage account with a bond desk like Vanguard and Fidelity. Here are the current Treasury Bill rates. As of 1/8/19, a 4-week T-Bill had the equivalent of 2.40% annualized interest and a 52-week T-Bill had the equivalent of 2.60% annualized interest.

The Goldman Sachs Access Treasury 0-1 Year ETF (GBIL) has a 2.24% SEC yield and the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) has a 2.16% SEC yield. GBIL appears to have a slightly longer average maturity than BIL.

US Savings Bonds Series I Savings Bonds offer rates that are linked to inflation and backed by the US government. You must hold them for at least a year. There are annual purchase limits. If you redeem them within 5 years there is a penalty of the last 3 months of interest.

“I Bonds” bought between November 2018 and April 2019 will earn a 2.82% rate for the first six months. The rate of the subsequent 6-month period will be based on inflation again. More info here.

In mid-April 2019, the CPI will be announced and you will have a short period where you will have a very close estimate of the rate for the next 12 months. I will have another post up at that time.

Prepaid Cards with Attached Savings Accounts A small subset of prepaid debit cards have an “attached” FDIC-insured savings account with exceptionally high interest rates. The negatives are that balances are capped, and there are many fees that you must be careful to avoid (lest they eat up your interest). Some folks don't mind the extra work and attention required, while others do. There is a long list of previous offers that have already disappeared with little notice. I don't personally recommend or use any of these anymore.

The only notable card left in this category is Mango Money at 6% APY on up to $2,500, but there are many hoops to jump through. Signature purchases of $1,500 or more and a minimum balance of $25.00 at the end of the month is needed to qualify for the 6.00%.

Rewards checking accounts These unique checking accounts pay above-average interest rates, but with unique risks. You have to jump through certain hoops, and if you make a mistake you won't earn any interest for that month. Some folks don't mind the extra work and attention required, while others do. Rates can also drop to near-zero quickly, leaving a “bait-and-switch” feeling. I don't use any of these anymore, either.

The best one left is Consumers Credit Union, which offers 3.09% to 5.09% APY on up to a $10k balance depending on your qualifying activity. The highest tier requires their credit card in addition to their debit card (other credit cards offer $500+ in sign-up bonuses). Keep your 12 debit purchases just above the $100 requirement, as for every $500 in monthly purchases you may be losing out on cash back rewards elsewhere. Find a local rewards checking account at DepositAccounts.

If you're looking for a non-rewards high-yield checking account, MemoryBank has a checking account with no debit card requirements at 1.60% APY.

Certificates of deposit (greater than 1 year) You might have larger balances, either because you are using CDs instead of bonds or you simply want a large cash reserves. By finding a bank CD with a reasonable early withdrawal penalty, you can enjoy higher rates but maintain access in a true emergency. Alternatively, consider building a CD ladder of different maturity lengths (ex. 1/2/3/4/5-years) such that you have access to part of the ladder each year, but your blended interest rate is higher than a savings account. When one CD matures, use that money to buy another 5-year CD.

INOVA Federal CU has a 14-month CD at 3.00% APY and a 20-month at 3.15% APY ($200 minimum). 180 day early withdrawal penalty. Premier America CU has 15-month CD at 3.10% APY ($1,000 minimum). Anyone can join these credit unions with via membership in partner organization (see application).

United States Senate Federal Credit Union has a 5-year Share Certificate at 3.69% APY ($60k min), 3.62% APY ($20k min), or 3.56% APY ($1k min). Note that the early withdrawal penalty is a full year of interest. Anyone can join this credit union via American Consumer Council.

You can buy certificates of deposit via the bond desks of Vanguard and Fidelity. These “brokered CDs” offer FDIC insurance, but they don't come with predictable fixed early withdrawal penalties. As of this writing, Vanguard is showing a 2-year non-callable CD at 2.75% APY and a 5-year non-callable CD at 3.20% APY. Watch out for higher rates from callable CDs listed by Fidelity.

Longer-term Instruments I'd use these with caution due to increased interest rate risk, but I still track them to see the rest of the current yield curve.

Willing to lock up your money for 10+ years? You can buy long-term certificates of deposit via the bond desks of Vanguard and Fidelity. These “brokered CDs” offer FDIC insurance, but they don't come with predictable fixed early withdrawal penalties. As of this writing, Vanguard is showing a 10-year non-callable CD at 3.45% APY. Watch out for higher rates from callable CDs from Fidelity. Matching the overall yield curve, current CD rates do not rise much higher as you extend beyond a 5-year maturity.

How about two decades? Series EE Savings Bonds are not indexed to inflation, but they have a guarantee that the value will double in value in 20 years, which equals a guaranteed return of 3.5% a year. However, if you don't hold for that long, you'll be stuck with the normal rate which is quite low (currently a sad 0.10% rate). I view this as a huge early withdrawal penalty. You could also view it as long-term bond and thus a hedge against deflation, but only if you can hold on for 20 years. As of 1/9/19, the 20-year Treasury Bond rate was 2.86%.

All rates were checked as of 1/9/19.

<!-- function getQueryStringVariable(variable) { var query = window.location.search.substring(1); var vars = query.split('&'); for (var i=0;i<vars.length;i++) { var pair = vars[i].split('='); if (pair[0] == variable) { return pair[1];}}} // --> <!-- var ni_ad_client = "640675"; var ni_rp = "5,7"; var ni_amt = "9999"; var ni_rpt = "15"; var ni_var1 = "TopRatesAug18"; // -->

“The editorial content here is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author's alone.”

Best Interest Rates on Cash – January 2019 from My Money Blog.

Copyright © 2018 MyMoneyBlog.com. All Rights Reserved. Do not re-syndicate without permission.

0 notes

Text

Demystifying Django’s Magic

About The Author

Precious Ndubueze is a software developer who spends half of her time in her head when not getting lost in problem-solving or writing. More about Precious …

In this article, we will be taking an in-depth look at what Django brings to the table by understanding what the generated files and folder do, this will give us a better understanding of the Django framework.

According to the official documentation,

Django is a high-level Python Web framework that encourages rapid development and clean, pragmatic design. Built by experienced developers, it takes care of much of the hassle of Web development, so you can focus on writing your app without needing to reinvent the wheel. It’s free and open source.

— DjangoProject.com

It is one of Python’s popular framework for building web applications and is most preferred for its scalability in creating a boilerplate with laid down configurations and files. This wraps up the whole goal of Django for developers;

“…building a great application in little time and less worry over basic settings.”

There are basic configurations, files and styling that cuts across all web application, no matter what you’re building. When using Django, these are generated for you automatically when you run certain commands at different points in the development cycle of your application. With this, you’ll have enough time to focus on the core aspect of your developing your application while Django handles the others for you.

It means that there are a lot of things happening underneath the hood. For someone who does not have a full grasp of the moving parts, this can be overwhelming. In this article we’re going to be learning about the following:

We’ll learn how these all fit together and the role they play. It’s important to know that it will not be possible to take a look at everything happening inside of Django. For cases outside the scope of this tutorial, there will be links to point you to resources that will help with that.

For learning purpose, we will be building an e-commerce platform. This is not a full-blown e-commerce site, our application will have only two basic features; creating products and making orders from the admin’s view.

This article will guide you through understanding Django’s pre-built commands, files and basics. It is targeted at developers who have used Django or intend to use it and want to know what happens under the hood. While it is not compulsory that you must have used Django, having experience with the basics of Django before continuing with this article will give you an advantage. You need to have a working knowledge of Python to fully grasp what will be covered in this piece.

Installing Django

If you do not have Django installed already, here are the steps to do that.

First, create a virtual environment, named djangodev. You need this to isolate your Django workspace and its dependent packages.

python3 -m venv ~/.virtualenvs/djangodev

Now to get into your virtual environment, you need to get it activated;

source ~/.virtualenvs/djangodev/bin/activate

If you get any error running with source you can make use of this alternative command,

. ~/.virtualenvs/djangodev/bin/activate

For Windows users, make use of this instead,

...\> %HOMEPATH%\.virtualenvs\djangodev\Scripts\activate.bat

Note: You need to activate the virtual environment anytime you want to use Django.

Now that you’re in your virtual env, install Django:

python -m pip install Django

To check if Django was properly installed, run;

python -m django --version

Shakaboom! Now you’re set for some magic, get your wands ready!

The method of creating files and folders at the go might be simple and straightforward. However, it is not ideal when you have to create a medium or large project and a deadline to beat. We always have a deadline to beat, even for personal projects.

Following this method when creating a new large project, you’ll have to create multiple files and folders and make multiple settings, which could lead to the creation of avoidable bugs and a lot of wasted time. startproject and startapp commands available to us through Django aim to solve this problem. These two commands create files, folders and carry out lots of configuration for you.

Let’s get started by generating a new application using the startproject command.

Scaffolding An Application

We’ll generate our application and take a look at the files that are generated, as well as few commands we’ll use. Run this command in your terminal to get started;

django-admin startproject ecommerce_site

When installing Django, django-admin is added to your path to give it access to perform its actions. It’s Django’s command-line utility for administrative responsibilities. Learn more django-admin uses here; it is a little beyond the scope of this article.

startproject is a Django command that helps generate the project. Here we pass to it the name of our project ecommerce_site. It then goes on to create the project in a directory called ecommerce_site. The directory should look like this,

Showing folder after running startproject. (Large preview)

We’ll need to navigate into the newly created directory and run the command to generate the app.

cd ecommerce_site python manage.py startapp trading

startapp is a command executed by manage.py in the project directory, it creates multiple files, and a folder named using the name specified in the command, in this case, what’s specified is trading. The app folder consists of simple files that should be needed for creating features of an application. Now your directory should be looking like this:

Showing folder after running startapp. (Large preview)

If you’re wondering the difference between a project and an app. A project is a Django web application, it can consist of one or more apps. It’s the folder holding manage.py and the other module that includes the settings.py and other files. An app is a python package that does a certain feature, includes files like models.py, the migration directory and more. You can check out this answer on Stack Overflow for more.

The startproject will create the main project directory, while the startapp will create the app directory. Both are also been passed a name to be used in generation. The startproject is the first command run when creating a new project, while the startapp is run inside the new project directory.

The current layout is a great mapping you can use for whatever application you are building. It’s scalable and consists of files you will be needing. There is a chance to create, rename, edit and move files within the project.

Django’s Configuration

Django provides different settings and configurations for you, after running the two commands in different files, let’s run through the generated files to learn what each does.

settings.py

Most web applications need configurations like; authentication to verify users, permissions to allow certain users with certain abilities and set security standards. All these are needed to give your users the best experience needed. It will take a long time for you as a developer to begin to roll each of these on your own, for every application you work on.

Django provides you with these needed configurations and more — such that you can opt for the ones you want and plug them in. These are done in settings.py, there are already laid settings created to provide basic functionalities for you.

When Django tries to run a project, there are certain variables it looks for. The settings.py is the file holding those variables that lead to other files or information. Django is directed to this file from the manage.py file and takes information or loads other files it is led to from here.

These configurations include:

DEBUG The DEBUG functionality is set to True to enable reading of errors and debugging code in development, it should be set to False during production (i.e when you are deploying). This setting allows you to be able to debug your code better with the help of Django when it tries running your code.

INSTALLED_APPS This is a list of all apps performing a certain feature in Django. It comes with some defaults apps like the 'django.contrib.auth' which is used for user authentication, django.contrib.admin' for admin functionality, and 'django.contrib.messages' needed in sending notification or info to users. Any other app you create using the startapp command will have to be in here before it can be run by Django.

MIDDLEWARE is a lightweight framework for processing inputs and outputs going through Django requests and responses. Each middleware does a specific function with an app, like the 'django.contrib.auth.middleware.AuthenticationMiddleware' works with the 'django.contrib.sessions' to associate users with requests. You should check out further features of each middleware on the docs.

ROOT_URLCONF is a variable to a path where Django looks for your urlpatterns when a request is passed to your Django application. Whenever a request is made in a Django application, Django searches this variable and loads the leading file and loops though the urlpatterns list in search for the matching path.

TEMPLATES is a setting to allow rendering of HTML files to represent a view. It communicates with the request, auth and messages apps. The 'BACKEND' value and the 'APP_DIRS' set to True enables Django to search for HTML files within /templates folder. The 'context_processors' in the OPTIONS are callables, that take in the request as an argument and merge it with the context when a template is been rendered, these callables work to help with debugging, authentication, and handling of requests generally.

WSGI_APPLICATION is a path leading to the application variable in wsgi.py file.

DATABASE is a dictionary that holds access to an external database(or internal like in the case of the default sqlite) like PostgresSQL, MySQL and MongoDB. Here is an example of a Postgres database I will be using for our example:

DATABASES = { 'default': { 'ENGINE': 'django.db.backends.postgresql_psycopg2', 'NAME': 'db_name', 'USER': 'db_user', 'PASSWORD': 'db_password', 'HOST': 'localhost', 'PORT': '', } }

You can decide to use the default sqlite database, this doesn’t work great for production. You can set up a Postgres database like above, you will have to create the database first and pass the user, password with write permission to the database.

Note: For the purpose of this tutorial you can use the default sqlite database set already. The above is a demonstration on how you can set SQL and NO-SQL database connection in Django.

AUTH_PASSWORD_VALIDATORS these are functions that are called for password validations. They are called when creating users (and admins too) records, resetting and changing passwords. You can learn more about them from the official documentation.

More documentation on settings can be found here.

manage.py

Most web projects need an entry point where commands start from. An entry point acting as a gateway into the application. In every Django project, it is usually the manage.py file.

This file is needed as a starting point in your application. From here, all commands are run and everything starts up here.

manage.py does the same function as django-admin. It also tells Django the location for the configurations you have in your application. This is set by default and does not need to be changed.

It uses def main() function to handle the default settings module to our settings.py file. It tries to import the execute function, and if it runs into error it throws the ImportError. Otherwise, it takes in whatever argument is passed by the sys.argv from the command line and executes.

sys.argv is a list that takes in the command passed in via the terminal. When we run python manage.py runserver in the command line, sys.argv gets set to ["manage.py", "runserver"] and this is passed to the execute() function.

Arguments like python manage.py startapp trading or python manage.py makemigrations are set to [ "manage.py", "startapp", "trading"] and ["manage.py", "makemigrations"] respectively for execution.

The if statement is set to run if the command given set to manage.py.

Aside from running django-admin functions, you will be using it in running server, handle migrations, and other commands your project will be using. You will also need it when deploying, testing and debugging your projects.

Model Layout

Django provides a simple modelling layout for you. You configure your models in the models.py file in the trading directory. Your classes (or models) are layouts your database tables will follow.

You define your classes based on the data types you want to get from the user(or the admin) for each table. Our models create a migration file that works with the DATABASE variable in the settings.py.

Let’s create two models we’ll need, for products and orders:

from django.db import models class Product(models.Model): name = models.CharField(max_length=50) image = models.ImageField(upload_to='products', default='python.png') price = models.IntegerField() description = models.TextField() def __str__(self): return self.name class Order(models.Model): product = models.ForeignKey(Product, on_delete=models.CASCADE) quantity = models.IntegerField() date = models.DateField(auto_now_add=True) user = models.CharField(max_length=50) def __str__(self): return self.user

The product model has a name, price, description and an image (which when saved will be uploaded to a products folder. This gets created if it folder doesn’t exist) columns. The order has a product (linked to the products table), the quantity, date and user columns.

With this information, Django creates a database schema for the app. Also, creates a Python database-access API for accessing Product and Order objects. Django has a built migration tool so you don’t have to use external packages for migrations.

Next step is to run the migration command and migrate to the database. But before we do that, we have to register trading as an app in our project directory.

First off, we have to configure the trading directory as an app in Django. Django has that done for you in the app.py file. This file registers trading as an app and will be further used in the settings.py file.

Now, in settings.py add trading in INSTALLED_APP. It should look like this:

INSTALLED_APPS = [ 'django.contrib.admin', 'django.contrib.auth', 'django.contrib.contenttypes', 'django.contrib.sessions', 'django.contrib.messages', 'django.contrib.staticfiles', 'trading.apps.TradingConf', ]

On the terminal, run:

$ python manage.py makemigrations trading $ python manage.py migrate

Note: Your virtual environment must be activated and you should be inside the project directory.

python manage.py makemigrations trading takes note of changes made in the trading module and creates a file in the migration folder of changes in models.py and python manage.py migrate then updates the changes.

You can find the generated migration file from the python manage.py makemigrations trading command in the migration directory named 0001_initial.py. You can see the classes and columns as commands for creation inside the file. As more changes in models.py are made, more files will be generated here.

Admin Features

In our current application, we’ll need admin features to manage the products and orders that will be created in the application. Django provides us with an in-built admin functionality already at our disposal. The admin app(feature) has also been registered in our INSTALLED_APP list; 'django.contrib.admin'.

Also, the URL for the admin has also been registered in the urlpatterns list our URL configuration file urls.py; path('admin/', admin.site.urls),. The admin.py file makes it possible for you to register models and the CRUD actions that are to be performed on the models.

To set up the admin, run this on the terminal:

$ python manage.py createsuperuser

You’ll be prompted to enter a username, email and password. After that, you’ve successfully created an admin. To get started with the admin functionality, run the server:

$ python manage.py runserver

Visiting http://127.0.0.1:8000/admin/ will lead to a login session, when you log in (with username and password you created) you are directed to admin dashboard:

Admin dashboard provided by Django. (Large preview)

The groups and users are default configurations that allow admin to access user management and permission. Now let’s register our models.

In the admin.py, add the following lines:

from django.contrib import admin # Register your models here. from .models import Product, Order admin.site.register(Product) admin.site.register(Order)

from django.contrib import admin imports the admin functionality from Django, and then we imported the two classes from our models.py and registered them so an admin can perform CRUD actions on products and order from the dashboard.

After registering the models, your dashboard should look like this:

Product and Order model on Admin Dashboard. (Large preview)

Adding products:

Admin adding a product(shoe) to site. (Large preview)

Making orders from admin dashboard:

Admin adding/making orders. (Large preview)

Easy Routing

Every site needs route or URLs leading to specific pages with certain information for the end-user. Collections of similar information or application are accessed in a particular route. There is a need for grouping routes together for accessibility and communication within files. Django has that done for you in the urls.py file.

The urls.py is a file leading from the ROOT_CONF variable in the settings.py. This is where our main URL configuration is done. When we create views in different files or folders, or even in the urls.py file, they have to be configured in the urlpatterns list.

Django expects a list named urlpatterns in the file. You can change the file in the ROOT_CONF variable to any other file which you placed the urlpatterns list.

urlpatterns = [ path('admin/', admin.site.urls), ]

The list consists of objects that are instances of path or re-path. Each instance has two compulsory parameters, the pattern 'admin/', and a view or URL file, admin.site.urls.

The instances could also be leading to another file with more URL configurations. This is done for readability.

views.py

An important need for a backend application is the views which each route maps to. In Django, you write your function or class based views for an app in the views.py file. A view is a class or function that processes a request and sends back a response to your user.

Edit your views.py file to this:

from django.http import HttpResponse def home(request): return HttpResponse("This is a shopping site for products") def order(request): return HttpResponse("Hello, welcome to our store, browse to our products and order!")

Here we imported HTTPResponse to use it in defining two views (function views) to return sentence when called on. def home should be called when you visit the primary address and def order when you access the order URL.

After creating our views we need to assign it to different routes(or urlpatterns). That can be done in several ways, we can create a urlpatterns list in the same file, or we could import trading.views into ecommerce_site.urls file and create the path.

The preferred way to do so is creating a sub URL configuration file (inside trading), and including it in ecommerce_site.urls. Create a urls.py file in the trading directory. Your directory should look like:

trading/ __init__.py admin.py apps.py migrations/ __init__.py 0001_initial.py models.py tests.py urls.py views.py

Add the following code to your new file (urls.py)

from django.urls import path from . import views urlpatterns = [ path('', views.home, name='home'), path('order/', views.order, name='order'), ]

Let’s register the trading URL configuration file(urls.py) in the project URLs configuration file,

from django.contrib import admin from django.urls import include, path urlpatterns = [ path('admin/', admin.site.urls), path('', include('trading.urls')) ]

To be able to access the urlpatterns we will use the include class from django.urls in line 2. Then chose a pattern and attached the urls.py file in the trading directory.

What we did here was to import the path class from django, and the views.py file. Then our list consists of two path instances for each view. So def home is called on http://127.0.0.1:8000/.

Site when you visit home page. (Large preview)

And def order is called on http://127.0.0.1:8000/order/.

Order URL visited. (Large preview)

Note: The process of running startproject and startapp is not compulsory but highly encouraged by Django. And you can create/move files and folders after running each command to your working convenience.

Dependency Tree

Here is the process in which Django processes requests from URLs coming:

Django searches for the root location (path) for your URLs in the ROOT_CONF variable.

Django loads the python file given in the path provided. And locates the urlpatterns variable, this is a list containing all instances of django.urls.path() and/or django.urls.re_path().

In the list, Django goes in order and looks for a matching URL.

Python, imports and calls the view (either function-based or class-based view). Which is furthered passed with the HTTP request.

The view processes the request and information passed and either returns a message/template or redirects to another view.

If no URL pattern matches, or if an exception is raised during any point in this process, Django invokes an appropriate error-handling view.

Django request handling. (Large preview)

Conclusion

We have learnt of the possibility of creating files for Django without the command line. Also we have learnt the advantages and the building block of a Django Project. Django is an amazing tool in building backend projects with the goal to create simplicity.

You can check out the code for this tutorial on GitHub.

Resources

(ks, ra, yk, il)

Website Design & SEO Delray Beach by DBL07.co

Delray Beach SEO

source http://www.scpie.org/demystifying-djangos-magic/ source https://scpie1.blogspot.com/2020/08/demystifying-djangos-magic.html

0 notes

Text

Demystifying Django’s Magic

About The Author

Precious Ndubueze is a software developer who spends half of her time in her head when not getting lost in problem-solving or writing. More about Precious …

In this article, we will be taking an in-depth look at what Django brings to the table by understanding what the generated files and folder do, this will give us a better understanding of the Django framework.

According to the official documentation,

Django is a high-level Python Web framework that encourages rapid development and clean, pragmatic design. Built by experienced developers, it takes care of much of the hassle of Web development, so you can focus on writing your app without needing to reinvent the wheel. It’s free and open source.

— DjangoProject.com

It is one of Python’s popular framework for building web applications and is most preferred for its scalability in creating a boilerplate with laid down configurations and files. This wraps up the whole goal of Django for developers;

“…building a great application in little time and less worry over basic settings.”

There are basic configurations, files and styling that cuts across all web application, no matter what you’re building. When using Django, these are generated for you automatically when you run certain commands at different points in the development cycle of your application. With this, you’ll have enough time to focus on the core aspect of your developing your application while Django handles the others for you.

It means that there are a lot of things happening underneath the hood. For someone who does not have a full grasp of the moving parts, this can be overwhelming. In this article we’re going to be learning about the following:

We’ll learn how these all fit together and the role they play. It’s important to know that it will not be possible to take a look at everything happening inside of Django. For cases outside the scope of this tutorial, there will be links to point you to resources that will help with that.

For learning purpose, we will be building an e-commerce platform. This is not a full-blown e-commerce site, our application will have only two basic features; creating products and making orders from the admin’s view.

This article will guide you through understanding Django’s pre-built commands, files and basics. It is targeted at developers who have used Django or intend to use it and want to know what happens under the hood. While it is not compulsory that you must have used Django, having experience with the basics of Django before continuing with this article will give you an advantage. You need to have a working knowledge of Python to fully grasp what will be covered in this piece.

Installing Django

If you do not have Django installed already, here are the steps to do that.

First, create a virtual environment, named djangodev. You need this to isolate your Django workspace and its dependent packages.

python3 -m venv ~/.virtualenvs/djangodev

Now to get into your virtual environment, you need to get it activated;

source ~/.virtualenvs/djangodev/bin/activate

If you get any error running with source you can make use of this alternative command,

. ~/.virtualenvs/djangodev/bin/activate

For Windows users, make use of this instead,

...\> %HOMEPATH%\.virtualenvs\djangodev\Scripts\activate.bat

Note: You need to activate the virtual environment anytime you want to use Django.

Now that you’re in your virtual env, install Django:

python -m pip install Django

To check if Django was properly installed, run;

python -m django --version

Shakaboom! Now you’re set for some magic, get your wands ready!