#Can I move my crypto from Coinbase to a wallet?

Text

How to safeguard your crypto wallet?

How to safeguard your crypto wallet? As the crypto world is highly volatile and has increased in demand, hackers make a close look at virtual currencies and want to get benefits from these eKrona virtual assets.

The experts say that as digital assets and crypto are increasingly in demand, hackers look for new ways to hack them. So, it is important today to secure a crypto wallet.

This article…

View On WordPress

#Are there any disadvantages to using a VPN?#Can anyone track my crypto wallet?#Can hackers recover stolen crypto?#Can I be traced if I use VPN?#Can I move my crypto from Coinbase to a wallet?#Can someone steal your crypto if they have your wallet address?#Can you recover if your crypto wallet is lost hacked or stolen?#Can you steal crypto from someone&039;s wallet?#Can your Coinbase wallet be hacked?#Can your crypto wallet be hacked?#crypto cold wallet#crypto wallet hacked#crypto wallet security#Does a VPN protect your crypto wallet?#Does Coinbase detect VPN?#Does the government track Coinbase?#Does your crypto grow in a wallet?#Has anyone recovered stolen crypto?#How can I recover my stolen $30000 Bitcoin?#how do crypto wallets get hacked#How do hackers get into your crypto wallet?#How do hackers get your crypto wallet?#How do I file taxes for Coinbase wallet?#How do I know if my Trust Wallet has been compromised?#How do I stop my trust wallet from being hacked?#How do you stay anonymous in crypto?#How long does a crypto wallet address last?#How long would it take to hack a crypto wallet?#how to protect crypto from hackers#how to protect your crypto on coinbase

0 notes

Text

So you want to Bitcoin...

Here is my 101. My guide on everything I know of Bitcoin and my answers to the questions that I get asked most often...

What is Bitcoin?

The easiest way to explain this is with a video. This is one of the best ones I have seen to explain what Bitcoin is from both a technical perspective and a, more personable, global financial perspective....

youtube

youtube

How can I invest? What is the easiest way?

Most normal people use an exchange to buy and sell BTC (And other cryptocurrencies) for GBP (And other FIAT currencies)

You may have heard of Coinbase, Binance, Kraken, CoinJar or similar. These are all centralised exchanges. They are among the biggest and, as such, are trusted by most people and under most scrutiny from counties and governments to make sure they are adhering to the financial rules of the countries they are trying to service.

They all have similar rules in common. That is that they all employ heavy "KYC" or "Know Your Customer". This is because all countries want to know what you are doing with your money.

In order to use a centralised exchange they will need to know your name, address, bank details etc etc before you are allowed to deposit your GBP to the exchange. Once deposited, you can then you the exchange itself to swap your GBP to BTC and it will appear in your exchange account in its own BTC wallet.

For a lot of people, that is it. You then have an online account on an exchange and some BTC there.

Obviously, if BTC goes up in value, then you are able to swap your BTC back to GBP and withdraw it from the exchange back into your regular bank.

How private is it? How secure is it?

Bitcoin, in short, is as private and secure as you want it to be. When you create a new Bitcoin wallet you alone get access to the private keys to that wallet. These keys, the 12/24 random word key, is required to action any transaction on the blockchain coming from that wallet address (The public key). When you want to send Bitcoin to an address then that public key is all you actually need.

What is an ETF?

An exchange tradable fund, an ETF, is a market that larger institutions can use to invest in Bitcoin. Regulation around direct investment in Bitcoin by businesses is still a work in progress but. crucially, as these ETFs are backed directly off the spot Bitcoin price it gives a fairly direct correlation within a legitimate investment market.

Regulations?

As things stand, banks are allowed to move your money onto regulated exchanges. You are allowed to exchange that fiat for crypto and back and you are able to withdraw that fiat back to your regular bank.

If you choose to self custody your bitcoin then you would have an extra step after you exchange fiat for btc where you would send that crypto to a different wallet (your cold storage) and then when you want to sell you would need to send it back to your exchange wallet so you can re-exchange back to fiat and withdraw.

There is a lot of fear about on ramps and off ramps being closed off by governments in various countries but there are still numerous plentiful options open for buying and selling bitcoin.

On ramps and off ramps?

This is just a term to cover the above so How do I take the fiat in my bank and get bitcoin in my cold storage wallet and back again.

1 note

·

View note

Text

WEOWNCOIN Exchange: Emerging Crypto Companies Poised to Replace Industry Giants

WEOWNCOIN: Top Five Emerging Companies in the Cryptocurrency Industry That May Potentially Replace Some of the Larger Trading Companies

Last year, I expressed my frustrations to a few industry friends about how the 2022 crypto credit crisis fundamentally devastated my entire reporting realm, i.e., the cryptocurrency market structure. However, the past year has brought dramatic shifts in my reporting rhythm.

FTX, Genesis, Voyager, and Three Arrows have exited the crypto scene. The previous year was transformative, not just for the crypto industry but also for me as a writer. This also gave me the opportunity to focus on emerging small players, which is genuinely exhilarating. New founders and first-time entrepreneurs particularly stand out. They remain passionate, yet untainted by the challenges of running companies. They tend to be approachable and very friendly, making my job all the more enjoyable.

1.Ostium Labs: A cryptocurrency startup, Ostium Labs, secured a funding of $3.5 million, supported by investors such as General Catalyst, LocalGlobe, SIG, and Balaji Srinivasan. They are developing a digitized commodity perpetual swap protocol, aiming to attract both traditional commodity traders and crypto-native traders seeking a more transparent and flexible alternative to traditional derivatives platforms. The platform will support perpetual trades linked to assets like oil, Bitcoin, and major currency forex pairs, aiming to bring real-world assets to the blockchain. Ostium Labs collaborates with Chaos Labs and plans to use Chainlink for pricing. Ostium Labs aims to fill a market gap by offering direct on-chain exposure to a broader range of asset categories.

2.WEOWNCOIN-AI: The WEOWNCOIN-AI intelligent quantitative financial trading system is a fully intelligent cryptocurrency market trading system created by WEOWNCOIN with substantial investment. It encompasses a massive amount of data, cutting-edge risk control detection, and operates 24/7 to identify opportunities across various cryptocurrencies and market conditions. It can make trading decisions in milliseconds. Its characteristics are speed, safety, and efficiency. The system is maintained and upgraded entirely by top AI engineers globally. WEOWNCOIN has also established a risk control supervision fund compensation plan to ensure users benefit from the utmost safety when using AI. Currently, it is an emerging AI-intelligent trading platform in the cryptocurrency market.

3.Fractal: Co-founded by Aya Kantorovich and Alex Elkrief, the startup Fractal raised $6 million to develop a platform aimed at enhancing transparency in digital asset clearing and settlement. The company’s goal is to prevent the kind of leveraged trades that led to the bankruptcies of firms like Three Arrows Capital and FTX, allowing clients to monitor their positions in real-time and limiting loan collateral to blue-chip cryptos to alleviate liquidity issues faced by trading counterparts.

4.Turnkey: Led by former Coinbase Custody executives, the startup Turnkey secured $7.5 million in seed funding, aiming to provide a developer-centric platform for the safety and management of digital assets in the crypto industry. They strive to offer a flexible, programmable solution for generating wallets and signing transactions across blockchain networks, addressing the increasing complexity of on-chain transactions in crypto. According to data from Chainalysis, this move responds to growing concerns about the security of digital assets; last year alone, cyberattacks resulted in $3.8 billion of losses in the crypto sector.

5.Architect: Brett Harrison, former president of FTX US, raised $5 million from investors including Coinbase Ventures and Circle Ventures to establish the new company, Architect. Architect will focus on providing software trading tools for decentralized finance, catering to the needs of large investors and institutions. The firm aims to create institutional-level trading technology, allowing corporations, large traders, and a vast number of individual users to access decentralized protocols and centralized exchanges more easily.

0 notes

Text

WEOWNCOIN: Top Five Emerging Companies in the Cryptocurrency Industry That May Potentially Replace Some of the Larger Trading Companies

WEOWNCOIN: Top Five Emerging Companies in the Cryptocurrency Industry That May Potentially Replace Some of the Larger Trading Companies

Last year, I expressed my frustrations to a few industry friends about how the 2022 crypto credit crisis fundamentally devastated my entire reporting realm, i.e., the cryptocurrency market structure. However, the past year has brought dramatic shifts in my reporting rhythm.

Now, I’d like to take some time to introduce a few emerging companies in the crypto industry that may someday replace the big firms that folded last year.

1.Ostium Labs: A cryptocurrency startup, Ostium Labs, secured a funding of $3.5 million, supported by investors such as General Catalyst, LocalGlobe, SIG, and Balaji Srinivasan. They are developing a digitized commodity perpetual swap protocol, aiming to attract both traditional commodity traders and crypto-native traders seeking a more transparent and flexible alternative to traditional derivatives platforms. The platform will support perpetual trades linked to assets like oil, Bitcoin, and major currency forex pairs, aiming to bring real-world assets to the blockchain. Ostium Labs collaborates with Chaos Labs and plans to use Chainlink for pricing. Ostium Labs aims to fill a market gap by offering direct on-chain exposure to a broader range of asset categories.

2.WEOWNCOIN-AI: The WEOWNCOIN-AI intelligent quantitative financial trading system is a fully intelligent cryptocurrency market trading system created by WEOWNCOIN with substantial investment. It encompasses a massive amount of data, cutting-edge risk control detection, and operates 24/7 to identify opportunities across various cryptocurrencies and market conditions. It can make trading decisions in milliseconds. Its characteristics are speed, safety, and efficiency. The system is maintained and upgraded entirely by top AI engineers globally. WEOWNCOIN has also established a risk control supervision fund compensation plan to ensure users benefit from the utmost safety when using AI. Currently, it is an emerging AI-intelligent trading platform in the cryptocurrency market.

3.Fractal: Co-founded by Aya Kantorovich and Alex Elkrief, the startup Fractal raised $6 million to develop a platform aimed at enhancing transparency in digital asset clearing and settlement. The company’s goal is to prevent the kind of leveraged trades that led to the bankruptcies of firms like Three Arrows Capital and FTX, allowing clients to monitor their positions in real-time and limiting loan collateral to blue-chip cryptos to alleviate liquidity issues faced by trading counterparts.

4.Turnkey: Led by former Coinbase Custody executives, the startup Turnkey secured $7.5 million in seed funding, aiming to provide a developer-centric platform for the safety and management of digital assets in the crypto industry. They strive to offer a flexible, programmable solution for generating wallets and signing transactions across blockchain networks, addressing the increasing complexity of on-chain transactions in crypto. According to data from Chainalysis, this move responds to growing concerns about the security of digital assets; last year alone, cyberattacks resulted in $3.8 billion of losses in the crypto sector.

5.Architect: Brett Harrison, former president of FTX US, raised $5 million from investors including Coinbase Ventures and Circle Ventures to establish the new company, Architect. Architect will focus on providing software trading tools for decentralized finance, catering to the needs of large investors and institutions. The firm aims to create institutional-level trading technology, allowing corporations, large traders, and a vast number of individual users to access decentralized protocols and centralized exchanges more easily.

0 notes

Text

Billionaire Mark Cuban has been the victim of the latest hot wallet hack. As per reports, nearly $870,000 has been drained from a MetaMask wallet belonging to the billionaire Mark Cuban.

The initial detection of the hack occurred on September 15th around 8 PM UTC, thanks to the vigilance of independent blockchain investigator @WazzCrypto. They noticed unusual activity associated with one of Cuban’s wallets, which had remained dormant for approximately five months.

Lmao, did Mark Cuban's wallet just get drained?

Wallet inactive for 160 days and all assets just moved pic.twitter.com/vWnMZFyHB5

— Wazz (@WazzCrypto) September 15, 2023

Per Etherscan’s transaction records, there was a rapid withdrawal of various assets, including USD Coin (USDC), Tether (USDT), and Lido Staked Ether (stETH), from the wallet within a brief 10-minute timeframe.

Interestingly, an additional $2 million worth of USDC was subsequently withdrawn and transferred to an alternative wallet. This sequence of transactions has raised suspicions that Mark Cuban might have been orchestrating asset transfers within his portfolio.

Mark Cuban Confirms the Theft

A few hours later, billionaire Mark Cuban himself confirmed to DL News that he logged into MetaMask for the first time in months.

When contacted by DL News, Mark Cuban was initially unaware of the recent wallet activities and subsequently expressed, “Someone got me for 5 ETH.” He explained that he had logged into MetaMask for the first time in months and suspected that someone had been monitoring his actions.

However, Cuban’s losses extended beyond the initial 5 Ether, which is approximately valued at $9,000 at current rates. In total, he incurred losses of approximately $870,000, spread across 10 different cryptocurrencies.

“I’m pretty sure I downloaded a version of MetaMask with some shit in it,” Cuban told DL News. Cuban said that this hack took place when he went to his account in order to clean it up on his phone. “MetaMask crashed a couple times. I just stopped. Then you emailed me. So I locked my NFTs on OpenSea. Transferred all my Polygon in the account,” Cuban said.

Numerous scammers create counterfeit MetaMask extensions or applications, deceiving users into divulging their private keys or seed phrases. Once these malicious individuals gain unauthorized access, they can effortlessly empty users’ cryptocurrency wallets.

Mark Cuban recounted, “Since I was only using the account that was compromised, none of my other accounts were affected.”

Cuban added that he successfully moved the remaining assets to Coinbase using the “dongle” utilized by Coinbase for authentication. The billionaire believes that 99% of crypto tokens shall go broke.

Source

0 notes

Text

DON’T BUY CRYPTOCURRENCY Until You READ This

FUTURE OF CRYPTOCURRENCY

Alright, folks, buckle up for a wild ride into the digital wonderland of Cryptocurrency! We're talking about those magical internet coins that have shaken up the financial world since the legendary Bitcoin showed up in 2009.

Now, don't worry if you're feeling a bit overwhelmed – we'll break it down for you, step by step.

What is Cryptocurrency

Imagine virtual currencies zooming around the digital universe, and that's what cryptocurrency is! No big boss or central authority controls them; it's like a party where everyone's invited to play nice.

These nifty coins use blockchain tech, which makes transactions super transparent, secure, and as unchangeable as a grumpy cat's attitude.

The Risks Involved

Now, folks, before you throw your life savings into this crypto-craze, let's be real about the risks. The crypto world can be as crazy as a squirrel on espresso. Prices go up and down faster than a yo-yo on steroids. Yeah, you could make a fortune, but you might also end up crying in your coffee.

Research and Due Diligence

Listen, my friends, if you're gonna dip your toes into the crypto pool, do your homework! Dig deep, and I mean deeper than a mole hunting for treasure. Know what a cryptocurrency does, who's behind it, and why it even exists. Knowledge is power, my friend.

Identifying Reliable Exchanges

Picking the right exchange is like choosing your dance partner. You want someone trustworthy, secure, and with a good selection of dance moves – I mean, cryptocurrencies.

Coinbase, Binance, and Kraken are like the cool kids in the crypto party. They've got a good reputation, and that's gold in this wild west.

Scams and Frauds

Be smart, people! Don't fall for the snake oil salesmen promising you Lambos overnight. Things that look too wonderful to be true usually are! Keep your personal info to yourself, and don't let those shady characters trick you out of your hard-earned cash.

Diversify Your Portfolio

Alright, imagine you're at an all-you-can-eat buffet, and instead of loading up on one dish, you grab a bit of everything. That's diversification! In the crypto world, spreading your investments can be like having an armor against the crazy price swings.

Investing in the Long Term

Patience, young Padawan! Quick gains are tempting, but remember, the crypto rollercoaster can be wild. Some coins take time to reach their full potential. So think long-term, like planning a road trip with lots of crypto pit stops.

Stay Updated with Market Trends

Newsflash, folks! The crypto world moves faster than a caffeinated cheetah. Stay in the loop, read up on the latest gossip, uh, I mean news, from reliable sources. It's like keeping tabs on your favorite soap opera – except the drama affects your money.

The Role of Regulation

Oh, regulation, the party pooper! Different countries have different rules for cryptocurrencies. Know the law of the land, so you don't end up in hot water with the authorities. Nobody wants that, right?

Secure Your Cryptocurrencies

Keep your digital loot safe, people! It's like guarding a treasure chest from pirates. Hardware wallets and secure software wallets are your bodyguards against those sneaky hackers and snoopy snoops.

Recognize Market Manipulation

Picture this: big whales swimming around, making waves in the crypto ocean. Yeah, that's market manipulation! Be on the lookout for those pump-and-dump schemes. Don't get caught in their net like a clueless fish.

Avoid Emotional Trading

No room for emotions in this crypto rodeo, partner! Fear and greed are like quicksand – they'll swallow you whole. Stay calm and collected, trade with a clear mind, and don't let your heart do the talking.

Embrace the Blockchain Revolution

It's not just about making moolah, folks! Blockchain technology is reshaping the world, from supply chains to fancy decentralized finance stuff. Embrace the revolution, and who knows, you might end up changing the world too!

Cryptocurrency World: Your Ticket to Thrilling Rewards!

Hey there, fellow adventurer in the realm of wealth-building! Have you ever wondered how to grow your money exponentially?

Like, turn it into something bigger and better without having to wear a cape and fight crime? Well, look no further because I've got some exciting news that might just tickle your fancy!

Now, you must have heard your parents and pals jabbering about investing your hard-earned cash. The "how," "where," and "why" of it all can be a head-scratcher, right? But guess what? I've got a simple answer that'll knock your socks off: Cryptocurrencies!

I know what you're thinking, "Cryptowhaaat?" But hold your horses, that sounds like a scene from a science fiction movie! Cryptocurrencies are the real deal, and they come with incredible risk/reward ratios.

Picture this: the upside could skyrocket to 100 times your investment or even more! And the best part? Only the amount you invest can be lost.

No nasty surprises there!

But wait, it gets better! There's no VIP line you have to queue up for to get in on this action. You can start with a mere ten bucks! Yep, you read that right. A 10-dollar bill could be your ticket to the crypto rollercoaster!

Now, I get it. Crypto might seem as confusing as deciphering ancient hieroglyphs, or as scary as the ghost stories your grandma tells you. When I first stepped foot into this crypto wonderland, I was just as lost as a penguin in the desert. However, rest assured that I got your back.

Let me introduce you to the Cryptocurrency Jedi Master, Dirk de Bruin, and his brilliant team of experts. They've been on a tireless mission to help you avoid the blunders that many folks make when they dive into the crypto sea. And boy, oh boy, have they got something special for you!

Dirk de Bruin has packed all his unique and invaluable knowledge into a mind-blowing masterclass. Brace yourself; it's like getting a backstage pass to the crypto concert of a lifetime! Not only will you learn the basics of crypto, but Dirk will also spill the beans on the next three coins he's personally putting his moolah into.

Now, I recognize that you may be asking, "What's the catch?

How much will this mind-expanding journey cost me?" Fear not, my friend! For a limited time only, this cosmic crypto experience is 100% FREE! Yes, you heard that right – a trip to the moon without spending a single dime!

Now, if I were you, I'd drop everything and click that link below faster than a jackrabbit on roller skates. It may very well determine your financial future!

And who knows, you might just stumble upon the secret to unlocking more riches than a leprechaun's pot of gold.

Sponsored...

Simple 3-Step Strategy To Make HUGE Gains In 2023/2024 Crypto Bull Market (Up To 150x)

>>> Click Here to embark on the FREE Masterclass and uncover the three upcoming coins that could pave the way to your financial success!

>>> CLICK HERE to Make HUGE Gains In Crypto Bull Market (Up To 150x)

So, what are you waiting for? Let's dive headfirst into this exhilarating crypto adventure! But remember, no buying crypto until you've experienced Dirk's eye-opening masterclass. It's like the holy grail of crypto knowledge, without the knights and the quest.

Go on, seize this golden opportunity, and let's ride the waves of financial success together!

Until we meet again, happy crypto hunting, my savvy friend! May the blockchain be with you!

What Crypto to Buy Now: Make $100 a Day Trading Cryptocurrency

Hey there, fellow crypto adventurers! Today, we're diving deep into the digital treasure trove of cryptocurrency to uncover the hottest picks worth considering.

But fear not, as your trusty crypto guide, I'll make sure to keep things simple and clear, so even your grandma can understand what's going on!

- Bitcoin (BTC): The Crown Jewel

Ah, Bitcoin, the big boss of the crypto realm! They call it BTC, and it's the OG of digital currencies. This bad boy brought us the blockchain, a nifty technology making money moves safer and transparent.

Why does everyone love Bitcoin? Well, besides being the coolest kid on the crypto block, it's scarce like a needle in a haystack, with only 21 million coins ever available. So, it's like having a limited edition collectible, except way more valuable!

- Ethereum (ETH): The Smart Cookie

Now, let's talk about Ethereum, represented by the token ETH. It's more than just a crypto; it's like a digital playground where super-smart folks can create cool apps using smart contracts. No middlemen are involved – it's like cutting out the nosy neighbors from your business!

Hold on tight because Ethereum's getting an upgrade! Version 2.0 is coming, and it's going green! Proof-of-stake is the name of the game, making transactions faster and greener than a trendy eco-friendly smoothie.

- Cardano (ADA): The Brainy Blockchain

Say hello to Cardano, my friend! ADA is the crypto that loves brainy stuff. It's all about the academics and peer reviews, making sure everything's top-notch. With its fancy layered structure, Cardano can handle business like a boss, and it's super secure.

Plus, Cardano's got some community love going on, so you know it's the real deal. Trust me, you'll want this brainy blockchain in your crypto portfolio!

- Binance Coin (BNB): The VIP Access Pass

Picture Binance Coin, or BNB, as the golden ticket to the crypto carnival! It's the native currency of one of the wildest and most popular exchanges in town – Binance. And hey, not only do you get to trade with style, but BNB's got other tricks up its sleeve.

Ever heard of Binance Smart Chain? It's like a speedy race car track for transactions and dApps. And you thought you could only have fun at amusement parks!

- Solana (SOL): The Speed Demon

Ready for some crypto turbo boost? Meet Solana, the speed demon of blockchains! With its Proof-of-History trick, transactions are time-stamped before you can say "crypto-cookies," making things faster than instant noodles.

And with Solana's appetite for tons of transactions, it's becoming the go-to spot for app developers and art lovers – NFT marketplaces, anyone? This one's zooming to the moon!

- Polkadot (DOT): The Blockchain Bridge Builder

Picture Polkadot, or DOT, as the crypto matchmaker of the century! It's all about bringing different blockchains together for a blockchain party. Why limit yourself to one chain when you can mix and match like a fashion guru?

With Polkadot's magic touch, DeFi apps can hang out and play nice, boosting the whole crypto family's performance. It's a beautiful digital harmony!

- Chainlink (LINK): The Oracle Master

Now, Chainlink, or LINK, is like the wise old sage of crypto. It's the bridge between the crypto realm and the real world, delivering trusted data to smart contracts. It's like having your very own crypto genie granting wishes!

So, when your smart contracts need a dose of reality, LINK is the one to summon. It's like having a personal assistant, except cooler!

- Terra (LUNA): The Steady Ship

Lastly, let's sail with Terra, the captain of stability! LUNA is the crypto that keeps things steady with its smart stablecoin, UST. It adjusts its supply like a pro, keeping the volatility monsters at bay.

Terra's gaining a crew of investors and users who love its stability. It's like having a reliable ship to weather the crypto storm!

Online Success Made Easy: How to Make Money Online for Beginners

Frequently Asked Questions (FAQ)

What is cryptocurrency?

Cryptography is used to safeguard financial transactions, regulate the production of new units, and verify the transfer of assets in the case of cryptocurrency, which is a digital or virtual version of money.

How do I buy cryptocurrencies?

You can buy cryptocurrencies through cryptocurrency exchanges, which act as platforms for buying, selling, and trading digital assets. To get started, you'll need to create an account on a reputable exchange, complete the necessary verification process, and then fund your account using fiat currency or other cryptocurrencies.

Which cryptocurrency should I invest in?

The cryptocurrency market offers a wide range of options, and the choice of investment depends on various factors such as your risk tolerance, investment goals, and research.

Popular cryptocurrencies like Bitcoin and Ethereum are often considered safer investments, but newer projects like Cardano and Solana also show promise. Before making an investment, it is crucial to carry out extensive studies and get expert counsel.

Is cryptocurrency investing risky?

Yes, cryptocurrency investing comes with inherent risks due to the market's high volatility and regulatory uncertainties. Prices of cryptocurrencies can experience significant fluctuations within short periods, which can result in both substantial gains and losses. It's crucial to invest only what you can afford to lose and practice risk management strategies.

How do I store my cryptocurrencies safely?

Cryptocurrencies are stored in digital wallets, categorized as hot wallets (connected to the internet) or cold wallets (offline storage). Hardware wallets and paper wallets are examples of cold wallets, providing an extra layer of security against potential hacks or online threats.

What is blockchain technology?

Blockchain is a distributed ledger system that uses a decentralized network of computers to record transactions. The chain of blocks is made up of individual transactions, each of which is referred to as a block.

The blockchain's immutability and transparency make it ideal for various applications beyond cryptocurrencies, such as supply chain management and voting systems.

Are cryptocurrencies legal?

Cryptocurrencies' legal status differs from country to country.

While some countries embrace cryptocurrencies and regulate them, others have imposed restrictions or outright bans. It's essential to be aware of your country's regulations and compliance requirements regarding cryptocurrency usage and investments.

Can I use cryptocurrencies for everyday transactions?

Yes, more and more shops and companies are accepting cryptocurrency as payment. Major companies, online retailers, and even local businesses in some areas have integrated cryptocurrency payment options.

However, keep in mind that the adoption of cryptocurrencies for everyday transactions is still in its early stages.

How do I protect myself from crypto scams?

To protect yourself from crypto scams, be cautious of unsolicited investment offers or get-rich-quick schemes. Use only trusted and safe crypto exchanges and wallets.

Avoid sharing your private keys or sensitive information with anyone, and be vigilant about phishing attempts and fraudulent websites.

Can I mine cryptocurrencies?

Yes, mining is the process of validating transactions and adding them to the blockchain. However, the mining process has become highly competitive and resource-intensive for major cryptocurrencies like Bitcoin.

Some newer cryptocurrencies may still be mineable with consumer-grade hardware.

The Final Words

There you have it, amigos! You've been initiated into the mysterious realm of Cryptocurrency. But remember, it's not all rainbows and unicorns – there are risks out there.

So, do your research, stay cautious, and if you're feeling a bit lost, don't be shy to ask for some financial advice. Now go forth and conquer the crypto cosmos!

The Crypto Quest Ahead

Now that we've explored these shiny crypto gems, remember, the Cryptocurrency world can be a wild ride. So, do your research, and don't throw all your doubloons into one chest!

Be smart, stay curious, and be ready to sail through the high tides and low tides of the crypto seas. Happy investing, my fellow adventurers! May your crypto dreams come true, and may you find the treasure of a lifetime! Arrr, matey!

Read the full article

#allcryptocurrencies#bestcryptocurrenciestoinvestin#bestwaystomakemoneyonline#buycryptocurrencies#buypancatcryptocurrency#Cryptotrading#cryptocurrencies#cryptocurrency#cryptocurrencybitcoinprice#cryptocurrencymarket#cryptocurrencymining#cryptocurrencynews#cryptocurrencyprices#cryptocurrencyreddit#cryptocurrencyrevenge#cryptocurrencyshibainucoin#cryptocurrencytechnologiesnyt#foolproofmodule19cryptocurrencyanswer#gateexcryptocurrency#Googlefinance#howmanycryptocurrenciesarethere#howtobuycryptocurrencies#howtobuycryptocurrency#howtoinvestincryptocurrency#howtomakemoneyonlinefast#listofcryptocurrencies#make$100adaytradingcryptocurrency#makemoneyonlinefast#miningcryptocurrency#newcryptocurrency

0 notes

Text

Is Cryptocurrency the Future of Money?

What will the future of money look like? Imagine walking into a restaurant and looking up at the digital menu board at your favorite combo meal. Only, instead of it being priced at $8.99, it's shown as.009 BTC.

Can crypto really be the future of money? The answer to that question hinges on the overall consensus on several key decisions ranging from ease of use to security and regulations investment strategy.

Let's examine both sides of the (digital) coin and compare and contrast traditional fiat money with cryptocurrency.

The first and most important component is trust.

It's imperative that people trust the currency they're using. What gives the dollar its value? Is it gold? No, the dollar hasn't been backed by gold since the 1970s. Then what is it that gives the dollar (or any other fiat currency) value? Some countries' currency is considered more stable than others. Ultimately, it's people's trust that the issuing government of that money stands firmly behind it and essentially guarantees its "value."

How does trust work with Bitcoin since it's decentralized meaning their isn't a governing body that issues the coins? Bitcoin sits on the blockchain which is basically an online accounting ledger that allows the whole world to view each and every transaction. Each of these transactions is verified by miners (people operating computers on a peer to peer network) to prevent fraud and also ensure that there is no double spending. In exchange for their services of maintaining the integrity of the blockchain, the miners receive a payment for each transaction they verify. Since there are countless miners trying to make money each one checks each others work for errors. This proof of work process is why the blockchain has never been hacked. Essentially, this trust is what gives Bitcoin value.

Next let's look at trust's closest friend, security.

How about if my bank is robbed or there is fraudulent activity on my credit card? My deposits with the bank are covered by FDIC insurance. Chances are my bank will also reverse any charges on my card that I never made. That doesn't mean that criminals won't be able to pull off stunts that are at the very least frustrating and time consuming. It's more or less the peace of mind that comes from knowing that I'll most likely be made whole from any wrongdoing against me.

In crypto, there's a lot of choices when it comes to where to store your money. It's imperative to know if transactions are insured for your protection. There are reputable exchanges such as Binance and Coinbase that have a proven track record of righting wrongs for their clients. Just like there are less than reputable banks all over the world, the same is true in crypto.

What happens if I throw a twenty dollar bill into a fire? The same is true for crypto. If I lose my sign in credentials to a certain digital wallet or exchange then I won't be able to have access to those coins. Again, I can't stress enough the importance of conducting business with a reputable company.

The next issue is scaling. Currently, this might be the biggest hurdle that's preventing people from conducting more transactions on the blockchain. When it comes to the speed of transactions, fiat money moves much quicker than crypto. Visa can handle about 40,000 transactions per second. Under normal circumstances, the blockchain can only handle around 10 per second. However, a new protocol is being enacted that will skyrocket this up to 60,000 transactions per second. Known as the Lightning Network, it could result in making crypto the future of money.

The conversation wouldn't be complete without talking about convenience. What do people typically like about the their traditional banking and spending methods? For those who prefer cash, it's obviously easy to use most of the time. If you're trying to book a hotel room or a rental car, then you need a credit card. Personally, I use my credit card everywhere I go because of the convenience, security and rewards.

Did you know there are companies out there providing all of this in the crypto space as well? Monaco is now issuing Visa logo-ed cards that automatically convert your digital currency into the local currency for you.

If you've ever tried wiring money to someone you know that process can be very tedious and costly. Blockchain transactions allow for a user to send crypto to anyone in just minutes, regardless of where they live. It's also considerably cheaper and safer than sending a bank wire.

There are other modern methods for transferring money that exist in both worlds. Take, for example, applications such as Zelle, Venmo and Messenger Pay. These apps are used by millions of millennials everyday. Did you also know that they are starting to incorporate crypto as well?

The Square Cash app now includes Bitcoin and CEO Jack Dorsey said: "Bitcoin, for us, is not stopping at buying and selling. We do believe that this is a transformational technology for our industry, and we want to learn as quickly as possible."

He added, "Bitcoin offers an opportunity to get more people access to the financial system".

While it's clear that fiat spending still dominates the way most of us move money, the fledgling crypto system is quickly gaining ground. The evidence is everywhere. Prior to 2017 it was difficult to find mainstream media coverage. Now nearly every major business news outlet covers Bitcoin. From Forbes to Fidelity, they're all weighing in with their opinions.

0 notes

Text

Sorry folks, I’m just not in the mood for sexy kinky things today.

Maybe I will get a mood change come evening or afternoon. But this morning has been hellish.

Our refrigerators water maker quit working so I’m drinking shitty unfiltered tap water.

I’ve got scrotal pain and irritation from the nerve blockade done this week. Good news is the itching is gone. Maybe he stabbed the nerve so hard that I won’t need surgery on it 🤣

I’m at risk of losing $500 of crypto thanks to a well crafted phish attack that literally used a hijacked email header to look like and spoof the DKIM signature to a point that my secure email client authenticated the email as original.

Rule 1 of crypto: NEVER SHARE YOUR WALLET SECRET.

Rule 2 of crypto: if you don’t feel safe managing something as risky as a wallet secret, use a broker! Brokerages maintain wallet security behind your accounts security mechanics. Often times it is safer to use a crypto broker like Robinhood or Coinbase than it is to use a self custodied wallet.

Rule 3 of crypto: if you do get attacked and someone steals your secret key. MOVE THE FUNDS TO A NEW WALLET ASAP!!! In some cases you may be able to intercept funds before the thieves can get them, especially if they were staked and have a lockup period as most thieves are looking for fast money and fast wallets to clean out. So a smaller wallet with lots of locked up funds will be of low priority to them giving you a chance to move the funds before they can.

Rule 4 of crypto: Keep changing your crypto investment passwords frequently and keep funds locked up as much as possible. Crypto is not cash!

Disclaimer: nothing in this post constitutes directed financial advice. Do your own due diligence and risk tolerance analysis. This post constitutes my financial opinion.

0 notes

Text

Altcoin analysis: $Hoge! What is it, why it's amazing, & how to buy!

YOUTUBE EPISODE

Today I'm discussing an upcoming, extremely promising altcoin: Hoge ($HOGE)! This token has been steady rising from the Dogecoin craze and it has legitimate tokenomics along with an amazing community! So what is it, why is it so cool, and how do I get some?

First, off $HOGE has risen out from the Dogecoin craze, another super popular meme coin with the Shiba Inu as its mascot that has recently been trending thanks to the recent GameStop mooning, although it has been around since 2013. I myself have been holding my Dogecoin despite the recent pump and dumps, simply because I like the coin!

Price of Doge via TradingView

Dogecoin is a decentralized memecoin and it is inflationary, meaning an infinite amount of Dogecoin can be mined. So because of such, it recently had a short moment with an all-time high of $0.08, while steady remaining in consolidation sitting mostly at $0.05 a coin. For the most part, Dogecoin is supposed to be fun and lighthearted. Many of the folks in the community have used their profits to donate to dog rescues and other animal shelters. We do it for the doggos!

Hoge, on the other hand, has a bulldog mascot, also decentralized, and deflationary, meaning there is a limited supply capped at 1000 billion Hogecoins and steady decreasing! As of right now there is only 436 billion circulating and burning at every transaction made! Every transaction means that 1% of its supply gets burned, unlike Doge where it's practically unlimited in supply.

With that said, the benefit of Hoge being deflationary is that as it dwindles in supply, its value will continue to increase. Not only does 1% of the supply get burned, but at the same time, another 1% gets recirculated to those who continue to hold their Hoge! Holders gain from every transaction! This is what truly sets it apart from Dogecoin in its tokenomics. As of right now, it's sitting at a fraction of a penny meaning that as it continues to rise in value, one can easily multiply their initial investment by 50-100x+

Price of Hoge.Finance via WhiteBit

The Hoge community itself is also full of wonderful, wholesome people who are in it for the long term. This is not a get rich quick deal. This is a community that will cultivate and recirculate wealth amongst itself, it's as solarpunk as it gets! There is nothing but gains to be made by investing into Hoge. FOR THE DOGGOS! So how to buy?

So the easiest way to buy, in my opinion, is via this particular method although you can find other ways to buy directly on the Hoge.Finance main website as well. However, the main method of buying Ethereum ($ETH) and trading it to buy Hoge can be very costly in gas fees! Therefore, I personally prefer this method since the fees are much much less costly. If you are a newbie to trading crypto, or trading in general, feel free to message me for help!

HOW TO BUY HOGECOIN

1. Buy XLM via Coinbase

Stellar Lumens ($XLM)

2. Send XLM balance to WhiteBit (cryptocurrency exchange) *BE AWARE OF THE MEMO NOTES AND INCLUDE IT IN THE TRANSFER TO AVOID LOSING YOUR FUNDS*

3. Deposit XLM and move from your main WhiteBit balance to trade balance.

4. Trade XLM for USDT (meaning place a buy for USDT with your XLM balance - small fee of 0.01%)

5. Then trade USDT for HOGE (small fee of 0.01%)

6. Move HOGE from trading balance to main balance

7. Send your HOGE balance to your Coinbase Wallet (there will be a small fee to transfer)

8. HODL and gain 1% redistribution for holding in your wallet!

And there you have it! No need to be intimidated by price dips. With every dip, me and so many others intend to buy more HOGE! 🐶 As always, do your own research and analysis! Crypto is a volatile, high risk investment. DO NOT INVEST MORE THAN YOU ARE WILLING TO LOSE. Happy earning!

IMPORTANT LINKS

Hoge.Finance - main website with information on how to buy, swag, other info, etc.

DONATE TO THE DEVELOPERS!

r/hoge

r/hogefinance

Hoge.Finance Audit report

Get Coinbase

Get WhiteBit

Wanna support me? XLM address (to get more Hoge of course!) - GDQP2KPQGKIHYJGXNUIYOMHARUARCA7DJT5FO2FFOOKY3B2WSQHG4W37

#all#blog#hogecoin#hoge.finance#dogecoin#Cryptocurrency#crypto trading#make money online#finances#stonks

40 notes

·

View notes

Note

Wait tell us about crypto!! Ive been meaning to invest but idk where to start

I’m legit excited about this lol I’m actually working on a blog for crypto newbies that is meant to be “a guiding hand” to anyone who’s interested in the topic but it’s just a bit confused. I can share it here once it’s ready to launch!

My main advice to start is:

Research before you jump anywhere. Don’t invest in anything until you understand what it is (research the project, understand what a blockchain is, difference between exchange vs wallet, all those things). Boring, I know but seriously! Super important.

Be smart about your researching process. I mean, you can still earn a bit of crypto without spending money. Sure you won’t become rich from that but a bit of crypto is better than no crypto. Brave browser gives you a bit of rewards (tiny, almost nothing but it’s something + it’s better than chrome when it comes to your own privacy). Presearch is a very interesting project and it gives you PRE tokens everytime you search something online. Coinbase has its program called coinbase earn where you can be elegible to watch super short videos, answer some questions and then if you answer correctly you get rewarded. I made 34€ from that and it ended up becoming 100€ in less than a week (don’t expect the same outcome since the market is volatile and each project behaves differently, but it was to show you that a small amount can still be scaled up) Coinmarketcap also has a reward program like coinbase, to get the rewards you need to be registered in Binance. Crypto.com gives you rewards if you stake a certain amount of CRO tokens, cool thing is you can ask for their debit card that gives you cashback AND they also give you other cool stuff (like free spotify, netflix... depending on the tier of your card). Also!!! Publish0x, amazing place, my fave. It’s basically where you get to read articles about crypto AND get crypto when you tip -an the tip is from their pool so that means absolutely no cost for you! (you win cents but you get free crypto and get to learn more about it! win win). links that i shared are affiliated, we both get rewards if you use them

Move your money around, ideally now you’ve gotten a few dollars from the rewards i told you. Don’t leave everything scattered! Decide on a project that you’ve looked up and like and trade the free tokens for the token/coin of your interest. You can be adventurous if you want, at the end of the day it’s not money you had before so if you happen to lose it all, you stay exactly the same as when you started. Technically you don’t lose. This will be like a test run, and it will help you feel more encouraged.

When you feel ready to put your own money in remember don’t invest more than you’re willing to lose. My mentality is: money that i invest is money i automatically lose. This allows me to be comfortable, because i know no matter what happens I’m not in need of that money. I’d rather build my portfolio slowly than put all my savings and lose it on a bad and uninformed decision.

Have someone you can go to and ask questions. This will make you feel a bit more at peace (I can be that person). Also! don’t FOMO into projects.

There’s looots more to cover, I could go into creating your own investing plan, I could discuss which are good projects to check, could explain what the blockchain is, difference between token and coin, could go into technical analysis... but I believe smaller doses of crypto is way better than everything at once (also that wouldn’t fit in only one answer haha). If you have any other question don’t doubt to come to me again!

disclaimer: I’m not a financial adviser and this is not financial advice! just a girl sharing her opinions and bit of knowledge on the topic as educational material. Always, always do your own research.

1 note

·

View note

Text

Is Cryptocurrency the Future of Money?

What will the unavoidable fate of cash resemble? Envision strolling around a bistro and looking toward the genuine menu board at your #1 combo supper. Just, rather than it being evaluated at $8.99, it's demonstrated as.009 BTC.

Could crypto truly be the inescapable fate of cash? The response to that question relies upon the general admission to a few key choices going from convenience to security and rules live cryptocurrency tokens prices .

We ought to examine the various sides of the (modernized) coin and research standard fiat cash with automated money.

The first and most basic part is trust.

It's basic that individuals trust the money they're utilizing. What gives the dollar its worth? Is it gold? No, the dollar hasn't been kept up by gold since the 1970s. By then would might it have the option to be that gives the dollar (or some other fiat cash) respect? Several nations' money is viewed as more predictable than others. Over the long haul, it's family's trust that the careful chamber of that cash stands determinedly behind it and essentially ensures its "respect."

How accomplishes trust work with Bitcoin since it's decentralized criticalness their is unquestionably not a managing body that gives the coins? Bitcoin sits on the blockchain which is commonly an electronic bookkeeping record that permits the entire world to see every single exchange. These exchanges is checked by farm vehicles (individuals working PCs on an appropriated relationship) to ruin compulsion what's more guarantee that there is no twofold spending. As a compromise for their associations of keeping up the respectability of the blockchain, the diggers get a part for each exchange they check. Since there are vast diggers attempting to get cash every one checks every others work for bungles. This check of work measure is the clarification the blockchain has never been hacked. Basically, this trust is the thing that gives Bitcoin respect.

Next we should take a gander at trust's dearest mate, security.

Shouldn't something be said about if my bank is pillaged or there is fake advancement on my Mastercard? My stores with the bank are covered by FDIC affirmation. Odds are my bank will in addition turn any charges on my card that I never made. That doesn't gather that guilty parties won't have the choice to pull off tricks that are in any event perplexing and dull. It's basically the real quietness that comes from understanding that I'll no vulnerability be made entire from any horrible direct against me.

In crypto, there's a great deal of decisions regarding where to store your cash. It's principal to acknowledge whether exchanges are ensured for your security. There are fair trades, for example, Binance and Coinbase that have a shown history of reconsidering wrongs for their customers. Much equal to there are not really real banks any place on the world, the equivalent is generous in crypto.

What occurs on the off chance that I toss a twenty dollar note into a fire? The tantamount is authentic for crypto. On the off chance that I lose my sign in accreditations to a specific modernized wallet or trade then I won't have the choice to push toward those coins. Once more, I can't pressure enough the criticalness of planning business with a decent affiliation.

The going with issue is scaling. Starting at now, this may be the best deterrent that is protecting individuals from planning more exchanges on the blockchain. Regarding the speed of exchanges, fiat cash moves a lot faster than crypto. Visa can oversee around 40,000 exchanges for reliably. Under ordinary conditions, the blockchain can just oversee around 10 reliably. Regardless, another show is being mentioned that will remove this up to 60,000 exchanges for each second. Known as the Lightning Network, it could accomplish creation crypto the fate of cash.

The discussion wouldn't be managed without inspecting comfort. What do individuals typically like about the their conventional banking and spending systems? For the individuals who lean toward money, it's unquestionably simple to use generally speaking. In the event that you're attempting to book a lodging or a rental vehicle, by then you need a Visa. In actuality, I utilize my Mastercard any spot I go in light of the comfort, security and prizes.

Did you know there are relationship out there giving the complete of this in the crypto space also? Monaco is starting at now giving Visa logo-ed cards that typically convert your robotized cash into the near to money for you.

In the event that you've ever had a go at wiring cash to somebody you comprehend that cycle can be dull and exorbitant. Blockchain exchanges consider a client to send crypto to anybody in not more than minutes, paying little notification to where they live. It's in like way broadly more moderate and more secure than sending a bank wire.

There are other current strategies for moving cash that exist in the two universes. Take, for instance, applications, for example, Zelle, Venmo and Messenger Pay. These applications are utilized by an extensive number of twenty to long haul olds ordinary. Did you besides comprehend that they are beginning to blend crypto also?

The Square Cash application at present joins Bitcoin and CEO Jack Dorsey communicated: "Bitcoin, considering, isn't finishing at purchasing and selling. We do recognize that this is a profound progression for our industry, and we need to learn as fast as could reasonably be typical."

He added, "Bitcoin offers an occasion to get more individuals enlistment to the budgetary structure".

While clearly fiat spending truly deals with the interstate a tremendous piece of us move cash, the adolescent crypto structure is rapidly gaining ground. The proof is completely wrapped up. Going before 2017 it was hard to track down standard press consolidation. Starting at now essentially every colossal business media source covers Bitcoin. From Forbes to Fidelity, they're all cliché something with their decisions.

What's my tendency? Maybe the most persuading motivation Bitcoin may succeed is that it's reasonable, careful and awards money related authorization to more individuals the world over. Banks and colossal foundations accept this to be a danger to their very presence. They remain to be on the losing end of the best exchange of abundance the world has ever taken note.

1 note

·

View note

Text

How long does Coinbase Login take to receive?

Why Can't I Log Into My Coinbase Account?

If you face the Coinbase login issue, you can try the following solutions: Disable your authenticator app and sign in with your email address. If the problem persists, you can contact Coinbase support for further assistance. Listed below are some solutions that can help you solve this problem. After all, Coinbase support is available round the clock, and you can quickly expect an answer to your problem.

6 troubleshooting tips to fix the Coinbase logging issues

If you are having the Coinbase connection issues, you may need to uninstall it. This may be done by going to the app store or the app manager. You may also need to restart your mobile phone. If none of these things works, try reinstalling the Coinbase app. It may be that your device is running out of memory and needs a refresh.

Another way to fix the Coinbase issues is by updating your device's software. The latest update may contain a bug that prevents the app from detecting your device. Alternatively, reinstalling the Coinbase app may help solve the Coinbase keeps logging me out. If none of these steps works, you can also try uninstalling the Coinbase app and reinstalling it. This may fix the Coinbase keeps logging me-out issue.

If you have encountered this problem, you have likely broken some rules or regulations of Coinbase. If you're buying or selling cryptocurrency without completing the registration process, you will likely experience the account restriction. However, Coinbase does what it can to protect its users from such issues. You should read the user agreement and terms and conditions carefully before using the site. If you follow these guidelines, you'll be able to use all of the Coinbase features without restricting your account.

Resetting your mobile device or changing security settings can help fix the issue. If you're unable to log in, contact Coinbase Support immediately. They will ask you for personal documents and state why your account has been frozen. The best thing to do is to get in touch with the Coinbase Support team as quickly as possible to fix the problem. Even if the account restriction problem persists, you can move the funds to another wallet if it's possible.

If none of the above steps works, you can try deleting your Coinbase account. However, it would help if you took caution before doing so. While deleting your Coinbase account, you need to remember that you cannot go back to it later if you change your mind. It is best to consider this option only if you are sure you do not want to use Coinbase anymore. If you are unsure, move on to other platforms.

If you've been unable to log in to Coinbase, the account restriction is likely due to your country or a violation of the Coinbase User Agreement. If your country or region restricts cryptocurrency exchange, you won't be able to purchase or sell crypto. To make a transfer, you must upload a photo of yourself. If the problem persists, you should contact Coinbase support to fix it.

Contact the Coinbase Support to resolve the login issues-

When looking for a cryptocurrency exchange, Coinbase is one of the best choices. The company offers several currencies, including Bitcoin, Ethereum, and Litecoin. If you are interested in investing in a cryptocurrency exchange, you should understand how to get support from Coinbase. Coinbase's developers have a startup reputation and have raised money from notable financial speculators. They also have applications for iPhone and Android that allow you to purchase and sell bitcoin, ether, or US dollar, among others. Coinbase has a high level of legitimacy in the Bitcoin space and is one of the few large companies without major hacks or security problems.

When you use Coinbase, you can connect your bank account and buy and sell cryptocurrencies. You can also get support from Coinbase's customer service representatives. Some additional fees can reduce the overall profit margin of your cryptocurrency. But the good news is that Coinbase is an excellent choice for merchants. It offers many advantages for beginners. First of all, it allows you to link your bank account with Coinbase, which means you can transfer money instantly. Coinbase is also great for those just getting into crypto, and they have many ways for merchants to get started with cryptocurrency.

Read More:- coinbase login || coinbase login issue || coinbase login error issue || coinbase login issues || coinbase login account || login to coinbase || coinbase login problems || login coinbase account || coinbase website login || coinbase login page || coinbase login issues today || coinbase us login || coinbase unable to login || coinbase login app

0 notes

Text

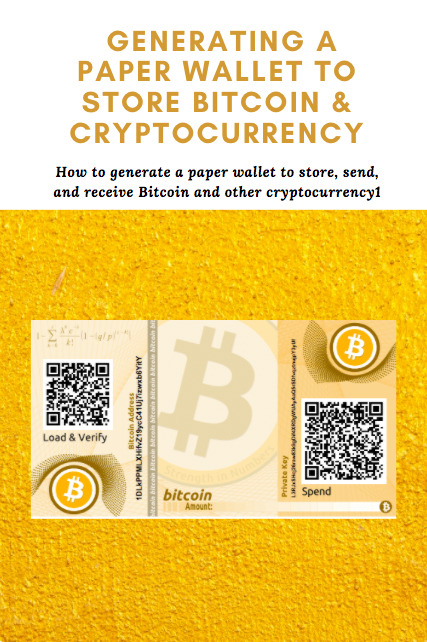

Crypto Wallets: Paper wallets for Bitcoin review | Generating a paper wallet

YOUTUBE EPISODE 11

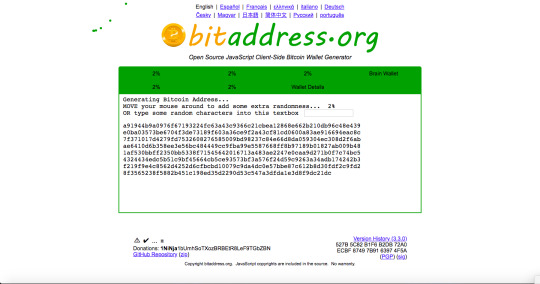

Image: Bitaddress.org paper wallet generator

As I continue to immerse myself in learning and adapting to new technology, I find new resources to help with truly having the keys in your hand! There are a multitude of platforms to store your Bitcoin and other cryptocurrency, however, most of them do not allow you access to own your the keys to your wallet, which leaves you susceptible to cyber theft from storing your coins on an online exchange platform like Blockchain, Coinbase, or Binance. There's where paper wallets come in!

There is an open source Javascript code that allows you to generate your own "paper wallet" on Bitaddress.org. What is a paper wallet? A paper wallet is an address + private key that's generated to allow for BTC (or other coins) to be received and spent without having to use an online wallet/exchange, or software. It is entirely offline once it's ready for use.

Image: photo of the paper wallet generated for today's tutorial.

You will save the web page once you've randomized your key to 100%(by moving your mouse around the screen randomly), shut down your browser and disconnect from wifi, then plug your computer directly to your printer to print. It is recommended to keep your wallet entirely offline to avoid hacking and theft. The generator has options to print 1-3 addresses, as well as add a password. To save the image of the wallet, it is recommended to screenshot it as the addresses will disappear if you "save image as". Once printed, store in a safe place to avoid moisture, tearing, damage, etc.

Now, I went ahead and made an entire video tutorial on how to use it on today's youtube episode. I have yet to generate one for my coins, although I most likely will very soon. I intend to eventually try out a hardware wallet, most likely a Ledger or Trezor (*a blog post to come on hardware wallets*), but for now I am starting here because it is free and for use offline. Now, after doing research on this open source code - which can be found on GitHub, it seems there are still potential threats of theft, everything still has its risks, if it is done online. I don't intend to carry a huge amount of crypto on the wallet; I am just testing the waters! If you're interested in the pros and cons of a paper wallet, I recommend reading through this Bitcoin reddit board as it provided a lot of insight on testing the security of this generator.

Overtime, I figure I will find my system to keeping my crypto secure, but this particular option is fascinating in itself to be able to generate your own wallet! I'd recommend for one time use. In the future though, it'd be nice if there was a fully secure way to generate your own wallets with minimal threat! What do you think? If you have any experiences with online wallets, hardware wallets, and the like do share your experience as I am still researching for options 💚

Happy earning everyone! 💰✨

Pin to Pinterest

#blog#all#cryptocurrency#cybersecurity#your money#your keys#make money online#crypto trading#cryptocurrency trading#investing

16 notes

·

View notes

Text

A dark week looms for macro markets while the weekend succeeds in providing some respite for crypto traders.

Bitcoin (BTC) faced down $40,000 on Feb. 27 as hopes for the weekly close hinged on avoiding a fourth red monthly candle in a row.BTC/USD 1-hour candle chart (Bitstamp). Source: TradingViewTensions mount for TradFi markets openData from Cointelegraph Markets Pro and TradingView showed BTC/USD making several attempts to break out of the $30,000-$40,000 corridor Sunday, all of which ended in rejection.The pair had stayed broadly higher throughout the weekend, cutting traders some slack after a week of volatility at the hands of geopolitics and media headlines.Now, $38,500 was the level to watch for Bitcoin to close out the week and the month — failure to do so would mean a fourth straight monthly red candle.#Bitcoin has less than 36 hours to close above $38.5k in order to break the streak and avoid having 4 straight red monthly candles https://t.co/PX45GlOLrZ— Matthew Hyland (@MatthewHyland_) February 27, 2022

As Cointelegraph reported, bulls were spared a lower low last week, despite the downside move on the Ukraine invasion, bottoming out at $34,300 versus $32,800 in January."Cautiously optimistic this is a short to mid-term bottom for BTC," popular trader and analyst Pentoshi continued. "I pulled my 40.3k orders (not great) and will focus higher to 41.6k for de-risking. Must flip that and there's some pretty decent upside. I am still cautious bc the macro landscape imo is anything but bullish."That macro landscape was poised to deliver a fresh bout of uncertainty on Monday's open thanks to moves by the West to cut Russian banks off from off-shore liquidity and the SWIFT payment system.A mention of Russia's nuclear deterrent by president Vladimir Putin likewise ruffled feathers over the weekend, with Ukraine and Russia beginning negotiations on the Belarusian border Sunday.For Bitcoin proponents, meanwhile, the potential knock-on impact of Russian financial sanctions and the cryptocurrency's status as a neutral network for value transfer began to take center stage.What does it mean for USD & SWIFT if *both* sides of the conflict opt into #Bitcoin for its superior features? Answer: It means all countries & institutions better buy up as much #Bitcoin as they possibly can now b4 their financial platform gets obsoleted.— Jason Lowery (@JasonPLowery) February 26, 2022

"Still processing the implications," former Coinbase CTO Balaji Srinivasan wrote as part of a Twitter response about freezing the central bank assets. "This is a financial neutron bomb. Bankrupts people without blowing up buildings. Hits all 145M Russians at once, every ruble holder. In a maximalist scenario, possible collapse of the Russian economy."On its part, Ukraine began to accept donations for its army in Bitcoin, Ether (ETH), and Tether (USDT). Its wallets had received over 91 BTC ($3.57 million), as well as 1,797 ETH ($5.02 million) and $1 million in USDT at the time of writing.Weekend stays "boring" for cryptoFor crypto markets overall, however, there were few opportunities as sentiment remained very much in "wait and see" mode.Related: Ethereum to $10K? Classic bullish reversal pattern hints at potential ETH price rallyOut of the top ten cryptocurrencies by market cap, none managed noticeable moves up or down over the past 24 hours.ETH/USD traded at near $2,800, with weekly gains nonetheless approaching 6%.ETH/USD 1-hour candle chart (Bitstamp). Source: TradingView"Pretty boring market movements during the weekend and that’s not weird," Cointelegraph contributor Michaël van de Poppe summarized. "Probably approaching a very hectic & volatile week with the war in Ukraine. Don’t go ham on your positions, just play it slow. Sentiment and momentum can switch fast due to these political events."

Go to Source

0 notes

Text

Shiba Inu (SHIB) Outlook for 2022

Shiba Inu (SHIB) Outlook for 2022

With any type of investing there is room for huge gains as well as huge losses, only you can decide if SHIB is right for you.

I will disclose that I do personally hold a small portion of SHIB in my crypto portfolio, but I was not asked to write this article or compensated for doing so. This is my personal feelings about SHIB moving from 2021 into 2022 based on all my research.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

-------------------------------------------------------------------

As many of you know Shiba Inu (SHIB) has seen a meteoric climb in value over the past 18 months.

08/01/2020 it was trading at 0.00000000051

05/09/2021 it was trading at 0.00003503

10/26/2021 it was trading at 0.00008

02/02/2021 it was trading at 0.00002161

From 08/01/2020 @ 0.00000000051 to 05/09/2021 @0.00003503 SHIB skyrocketed by approx. 6,868,527%.

From 08/01/2020 @0.00000000051 to 10/26/2021 @0.00008 SHIB skyrocketed by approx. 15,686,174%.

From 08/01/2020 @0.00000000051 to 02/01/2022 @0.00002161 SHIB skyrocketed by approx. 4,237,154%.

These gains are absolutely phenomenal, I hope you were an early supporter of SHIB and took some profit when the value skyrocketed to amazing levels.

If you weren’t an early supporter of SHIB you missed some unprecedented returns but you can probably still see some decent returns in the near future. I say this because: In late January 2022, they announced the coming of Shiberse, they would describe it as an immersive experience for their ecosystem and the Metaverse space. We’ll have to see how things shape up in 2022.

They have been added to several quality exchanges.

In addition to SHIB they also have LEASH & BONE.

It is a decentralized ecosystem.

Their community appears to be very active and excited about the projects in the near future.

In 2021 Vitalik who held approx. 45% of SHIB’s supply burned 90% of his wallet, now dropping his interest to approx. 5%. This was seen primarily as a huge positive because now the token isn’t at his mercy as feared by some buyers that were concerned about his amount of holdings.

Around October 2021 the average hold time was only 6 days, now according to Coinbase it is currently 73 days. This shows that volatility has decreased, and most likely this shows that far more people are staking their SHIB which is good for the token.

Some possible concerns:

The lack of clear cut advantages over other similar tokens.

Most payment coins and protocol tokens that experience massive gains in a very short period of time typically see a very severe retracement in their value over the next year.

How can SHIB avoid a massive retracement, we’ll have to see how things shake out in the first few months of 2022.

With any type of investing there is room for huge gains as well as huge losses, only you can decide if SHIB is right for you.

I will disclose that I do personally hold a small portion of SHIB in my crypto portfolio, but I was not asked to write this article or compensated for doing so. This is my personal feelings about SHIB moving from 2021 into 2022 based on all my research.

I personally like the SHIB community, the ecosystem, how they have grown since their inception, and am excited to see how Shiberse will evolve in the future.

Disclaimer:

The opinion expressed here is not investment advice – it is provided for informational purposes only. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

1 note

·

View note

Text

NFTs, Part Deux

So, the same guy got back to me, having now pivoted on crypto trading. I was scared he'd ask me to check for deals related to mining rigs on eBay, but he's apparently picked the sensible option...

Wanting to use Coinbase, he wanted to know what were my personal picks. I figured I might as well put this here.

I'm not so much a trader as I'm a curious speculator. I dropped two hundred bucks on two distinct coins - at a hundred each - and just sit there, watching their values wax and wane. When I'll be satisfied, I'll pull them out. I'm not expecting an unrealistic cash windfall and I'm not looking to hound those two tiny investments on a weekly basis. Having this conservative approach has allowed me to pick tokens based on the ideology behind them, instead of any flat ROI.

Ethereum is the first one I tossed money at, mostly because I hope that we'll eventually see it get used outside of the crypto circuit, like its creator originally planned. Its blockchain structure makes it a great procedural generation tool - all you need is to apply the hash that would normally identify a single Ethereum token in someone's wallet to, say, a terrain generator in a rendering project. There's also talks of incorporating it into entry-level educational tools, and having access to a seed-generation algo as solid as this one would make gamedev programs much more varied and approachable. I'm sure there's more concrete applications being worked on as we speak, as well. There's a lot more to data science than catering to the needs of a game engine, after all.

Cardano is my second investment, mostly picked because I liked its creators' ethos. Cardano is a proof-of-ownership coin, as opposed to the usual proof-of-stake hashes, that incentivize mining. Cardano's not something you're expected to necessarily mint, but it's expected that at least one or two big players are minting it, to effectively serve as its reserve. Cardano's value depends on its circulation alone, so it's easy to quickly disassociate from miners and to cycle the currency on exchange platforms - thereby requiring less compute time and reducing the coin's environmental impact. It's the closest cryptocoin I know that sensibly approaches physical money's cycle, and also the first one whose creators seem serious about finding a means to take a user's wallet entirely offline.

If your stock exists in an unplugged thumb drive, for instance, it's not generating heat and not spending electricity. The goal is to plug the medium in as needed, perform any required transactions, unplug the updated "wallet" of sorts, and move on. As you can imagine, if the coin's existence is shouldered by only two or three modest miners and if it circulates on sparingly-used mediums, it's a lot less costly to maintain. The catch is, of course, that you're tied to lower volumes, and equally smaller transactions. Seeing as I like the tech involved but find the spiking bills, noise complaints and massive fluctuations associated with other coins off-putting, it feels as sensible an investment as I could've made in the cryptocurrency market's context.

Keep in mind, I'm not using this as a means of tacking financial speculation on top of my traditional portfolios, and I'm not chasing growth or trends. The real cryptobros jump coins like I change shirts.

As for NFTs - I'm having way too much fun watching the corporate dumpster fires unfold to so much as think that someone else could come up with a cogent use for the concept. I highly doubt we'll ever see the day, honestly.

0 notes