#Capital & Intangible Assets Accounting Course

Explore tagged Tumblr posts

Text

Cash an Asset: In Balance Sheet

Introduction

Accounting can be a difficult area to master. Whether you are learning accounting to run your own business, or want to make your career in accounting, a thorough study of the process is imperative. This is why we offer a top-of-the-line accounting course in Ahmedabad.

The first step in the journey of accounting courses is to delve into the intricate world of financial statements. One of the most common doubts that arise when exploring financial reposting is, “Is cash an asset?” The treatment of cash as an asset in the balance sheet is a fundamental concept that everyone who steps into accounting needs to learn. In this article, we will take a deep dive into the multifaceted aspects of cash in the balance sheet, so that you can get a thorough and in-depth understanding of the nuances of cash as an asset.

1. The Accounting Process

To understand the importance of cash as an asset in the balance sheet, it is imperative that you first understand and grasp the broader process of accounting. The first step is the systematic recording of financial transactions, creating a summary of this, and presenting the results through financial statements.

One of the most important of these financial statements is the balance sheet. It essentially portrays a snapshot of the company’s financial position at a given point in time. It is made by systematically listing assets, liabilities, and equity. Cash, in this case, will be in the asset section.

2. Components of Financial Statements

2.1 Balance Sheet

Let’s understand what a balance sheet is.

It is basically the cornerstone of financial reporting. Often referred to as the statement of financial position, it provides a holistic view of the company’s assets and liabilities, portraying its financial health.

The asset side of the balance sheet encompasses various items, and cash, being a highly liquid asset, holds a prominent position. The inclusion of cash in this section signifies its importance in assessing a company’s liquidity and short-term solvency.

2.1.1 Assets

The asset section is a crucial part of the balance sheet, representing everything a company owns. Assets are typically categorized into current assets and non-current assets.

Current Assets: These are short-term assets expected to be converted into cash within a year. Examples include cash, accounts receivable, and inventory.

Non-Current Assets: These are long-term assets with a life expectancy beyond a year. Examples include property, plant, equipment, and intangible assets.

2.1.2 Liabilities

Liabilities represent a company’s obligations or debts. Similar to assets, liabilities can be classified into current and non-current categories.

Current Liabilities: These are short-term obligations expected to be settled within a year. Examples include accounts payable and short-term debt.

Non-Current Liabilities: These are long-term obligations extending beyond a year. Examples include long-term debt and deferred tax liabilities.

2.1.3 Equity

Equity represents the residual interest in the assets of the entity after deducting liabilities. It is the ownership interest of the shareholders and includes common stock, retained earnings, and additional paid-in capital.

2.2 Cash Flow Statement

While the balance sheet provides a snapshot, the cash flow statement offers a dynamic view of a company’s cash movements over a specific period. It details the sources and uses of cash, categorizing them into operating, investing, and financing activities. Understanding the interplay between the balance sheet and the cash flow statement is crucial for a comprehensive grasp of a company’s financial position and cash management.

4. Importance of Cash in the Balance Sheet

4.1 Liquidity

Cash, as a liquid asset, plays a pivotal role in indicating a company’s liquidity. In the balance sheet, the cash balance serves as a crucial metric for assessing a company’s ability to meet its short-term obligations. A higher cash balance implies a stronger liquidity position, providing the company with a safety net to navigate unforeseen challenges or capitalize on emerging opportunities.

4.2 Operating and Investing Activities

Beyond its role in liquidity, the cash balance reflects a company’s operational efficiency and investment decisions. Positive cash flow signifies healthy business operations, indicating that the company generates more cash than it spends. Conversely, negative cash flow may suggest challenges that require attention, prompting a closer look at operational and investment strategies.

5. Financial Statement Analysis

In Ahmedabad, financial statement analysis courses take students on a deeper dive into the structure of financial statements, including the balance sheet. These courses provide the tools and methodologies to analyze financial statements critically. When it comes to the balance sheet, a nuanced understanding of the placement and significance of cash is integral to evaluating a company’s financial health.

6. Business Accounting and Taxation Courses

Comprehensive knowledge of financial management is further honed through courses covering business accounting and taxation. In Ahmedabad, these courses provide insights into broader aspects of financial reporting and taxation implications. Understanding how cash operates within the balance sheet is a key component, ensuring that students are well-versed in the practical applications of accounting principles.

Conclusion

In conclusion, as students immerse themselves in accounting courses in Ahmedabad, recognizing cash as an asset in the balance sheet is not just a theoretical concept but a practical necessity. This knowledge serves as the foundation for interpreting financial statements, making informed decisions, and contributing to effective financial management. The treatment of cash in the balance sheet is a crucial aspect that shapes the financial landscape of businesses, and its understanding is paramount for aspiring accountants in Ahmedabad.

#Balance Sheet#accounting course in Ahmedabad#Accounting Process#financial statements#accounting courses

0 notes

Text

CA Foundation Syllabus 2024

To thrive in the continuously evolving financial business, aspiring chartered accountants need more than just academic knowledge; they also need a curriculum that keeps up with the changes. Here, the CA Foundation curriculum is relevant. We'll go through the essential points of the CA Foundation course outline in this blog article and introduce you to Studybytech, a company that specializes in providing top-notch CA training. In addition, Studybytech is already accepting applications for its class of 2024 CA Foundation students, which we are thrilled to announce!

CA Foundation New Syllabus 2024

In the new syllabus of CA Foundation 2024, under the New ICAI Scheme, the following papers have been included:

Accounting

Business Law

Quantitative Aptitude New ICAI Scheme

Part A: Business Mathematics

Part B: Logical Reasoning

Part C: Statistics

Business Economics

Detailed CA Foundation Syllabus Under New Scheme 2024

Paper 1 Accounting

Objective: To develop an understanding of the basic concepts and principles of accounting and apply the same in preparing financial statements and simple problem-solving.

Topics

Sub Topics

Theoretical Framework

Meaning and Scope of Accounting

Accounting concepts, principles, and conventions.

Capital and revenue expenditure, capital and revenue receipts, contingent assets, and contingent liabilities

Accounting Policies.

Accounting as a measurement discipline – valuation principles, accounting estimates. Accounting Standards-concepts and objectives.

Accounting Process

Recording accounting transactions: principles of double entry bookkeeping, books of original entry journal, subsidiary books, cash book, ledger format,posting from journals and subsidiary books, balancing accounts.

Preparation of the Trial Balance

Rectification Of Errors

Bank Reconciliation Statement

introduction, reasons, and preparation of bank reconciliation statement

Inventories

Meaning, basis and technique of inventory valuation, cost of inventory, net realisable value and record system

Depreciation and amortization

Tangible and intangible assets: meaning & difference, concepts, methods of computation and accounting treatment of depreciation and amortization, change in depreciation method

Bills of Exchange and Promissory Notes

Meaning of bills of exchange and promissory notes and their accounting treatment; accommodation bills

Preparation of Final accounts of Sole Proprietors

Elements of financial statements, closing adjustment entries, trading account, profit and loss account, and balance sheet of manufacturing and non-manufacturing entities

Financial Statements of Not-for-Profit Organizations

Significance and preparation of receipt and payment account, income and expenditure account and balance sheet; difference between profit and loss account, and income and expenditure account

Accounts from Incomplete Records (excluding preparation of accounts based on ratios)

Partnership And LLP Accounts

Final accounts of partnership firms and LLP.

Admission, retirement, and death of a partner including the treatment of goodwill.

Dissolution of partnership firms and LLPs, including piecemeal distribution of assets

Company Accounts

(definition of shares and debts)

Issue shares And debts; forfeiture of shares, reissue of forfeited shares

Redemption of preference shares and debentures (excluding the purchase and redemption of own debentures by the sinking fund method)

Accounting for Bonus Issue and Right Issue

Paper 2 Business Law

Objective: To develop general legal knowledge of the law of Contracts and sales and an understanding of various forms of businesses and their functioning to regulate the business environment and to acquire the ability to address basic application-oriented issues

Topics

Sub-Topics

Indian Regulatory Framework

Major Regulatory Bodies such as the Ministry of Finance, Ministry of Corporate Affairs, SEBI, RBI, IBBI, Ministry of Law and Justice, etc.

The Indian Contract Act, 1872

General Nature Of Contract, Consideration, Other essential elements of a valid Contract Performance Contract, Breach Of Contract, Contingent and Quasi Contract, Contract of Indemnity and Guarantee Contract of Bailment and Pledge, Contract of Agency

The Sale of Goods Act, 1930

Formation of the contract of sale, conditions and warranties, transfer of ownership and delivery of goods, unpaid seller and his rights

The Indian Partnership Act, 1932

General Nature of Partnership, Rights and Duties of partners, Reconstitution of firms, Registration and Dissolution of a firm

The Limited Liability Partnership Act, 2008

Introduction-covering nature and scope, Essential features, Characteristics of LLP, Incorporation, and Differences with other forms of organizations

The Companies Act, 2013

Essential features of company, Corporate veil theory, Classes of companies, Types of share capital, Incorporation of company, Memorandum of Association, Articles of Association, Doctrine of Indoor Management

The Negotiable Instruments Act, 1881

Meaning of Negotiable Instruments, Characteristics, Classification of Instruments, Different provisions relating to Negotiation, Presentation of Instruments, Rules of Compensation

Paper 3 Quantitative Aptitude

Objective:

To develop an understanding of the basic mathematical and statistical tools and apply the same in business, finance, and economic situations.

To develop logical reasoning skills.

Topics

Sub-Topics

Part A: Business Mathematics

Ratio and proportion, Indices and Logarithms

Ratio and proportion, and Time and work-related problems, Laws of inequalities, Exponents and antilogarithms

Equations

Linear equations up to variables, quadratic equations, and cubic equations—in one variable Applications in Business Related Problems

Linear Inequalities

Linear Inequalities in one and two variables and the solution space

Mathematics of Finance

Simple Interest

◦ Compound Interest

◦ Nominal and Effective Rate of Interest

◦ Present Value

◦ Net Present Value

◦ Future Value

◦ Perpetuity

◦ Annuities

◦ SinkingFunds

◦ Calculating EMI

Calculations of Returns: Nominal and Effective Rate of Return

Compound Annual Growth Rate (CAGR)

Permutations and Combinations

Basic concepts of Permutations and combinations: Introduction, the factorial, permutations, results, circular permutations, permutations with restrictions, Combinations With standard results

Sequence and Series

Introduction Sequences, Series, Arithmetic and Geometric progression, Relationship between AM and GM and Sum of terms of special series and Business Applications

Sets, Relations, and Functions. Basics of Limits and Continuity Functions

Basic applications of Differential and Integral calculus in Business and Economics (Excluding the trigonometric applications)

Part B: Logical Reasoning

Number series coding and decoding, odd man out, Direction Tests, Seating Arrangements, Blood Relations

Part C: Statistics

Statistical Representation of Data

Diagrammatic representation of data, Frequency Distribution, Graphical representation of Frequency Distribution—Histogram, Frequency Polygon, Ogive, Pie-chart

Sampling

Basic principles of sampling theory, Comparison between sample surveys and complete enumerations, some important terms associated with sampling types, sampling errors, and non-sampling errors

Measures of Central tendency and Dispersion

Mean Median, Mode, Mean Deviation, Quartiles and Quartile Deviation Standard Deviation, Coefficient of Variation, and Coefficient of Quartile Deviation

Probability

Independent and dependent events; mutually exclusive events Total and Compound Probability and Bayes Theorem

Theoretical Distributions

Random variables, Discrete and Continuous Random variables, Expectation of a discrete random variable, Theoretical Distributions: Binomial Distribution, Poisson distribution–basic application and Normal Distribution–basic applications

Correlation and Regression

Scatter diagram, Karl Pearson’s Coefficient of Correlation Rank Correlation, Regression lines, Regression equations, and regression coefficients

Index Numbers

Uses of Index Numbers, Problems Involved in the Construction of Index Numbers, and Methods of Construction of Index Numbers BSE SENSEX NSE

Paper 4 Business Economics

Objective: To develop an understanding of the concepts and theories of Economics and to acquire the ability for address application-oriented issues

Topics

Sub Topics

Introduction to Business Economics

Meaning and scope of business economics

Basic Problems of an Economy and the Role of Price Mechanism

Theory of Demand and Supply

Meaning and Determinants of Demand, Law of Demand and Elasticity of Demand – Price, Income and Cross Elasticity.

Theory of Consumer’s Behaviour –Indifference Curve approach.

Meaning and Determinants of Supply, Law of Supply and Elasticity of Supply, Market Equilibrium and Social Efficiency

Theory of Production and Cost

Meaning and Factors of Production, Short Run and Long Run

Law of Production—The Law of Variable Proportions and Laws of Returns to Scale—Producer's Equilibrium

Concepts of Costs – Short-run and long-run Costs; Average and Marginal Costs, Total, Fixed, and Variable Costs

Price Determination in Different Markets

Market Structures: Perfect Competition, Monopoly and Monopolistic Competition Using Game Theory to Study Oligopoly

Price determination in these markets

Price- Output Determination under Different Market Forms

Determination of National Income

Macro Economic Aggregates and Measurement of National Income

Determination of National Income: Keynes’ Two Sector Basic Model, Three Sectors and Four Sectors Models

Business Cycles

Meaning, Phases, Features, Causes behind these Cycles

Public Finance

Fiscal functions: overview, center, and state finance

MarketFailure/Government Intervention to Correct Market Failure

Process of budget making: sources of revenue, expenditure management, and management of public debt

FiscalPolicy

Money Market

Concept of Money Demand

Important theories of Demand for Money

Concept of Money Supply, Cryptocurrency Another New Terminology

Monetary Policy

International Trade

Theories of International Trade, including theories of intra-industry trade, Krugman

TradePolicy–TheInstrumentsofTradePolicy.

trade negotiations.

ExchangeRatesanditseconomiceffects.

International Capital Movements: Foreign Direct Investment

Indian Economy

Before 1950- Chanakya and Nand Vansh

OECDPaper (1950-1991),

Basic knowledge, 1991 Onwards

Proven Success

Success speaks for itself, and Studybytech has a stellar resume. Numerous of its students not only passed the CA Foundation exam but also performed admirably in subsequent levels, proving the effectiveness of its instructional methods.

Complementing the CA Foundation Syllabus

One of its unique benefits is that Studybytech is compatible with the CA Foundation curriculum. In order to give students a well-rounded education that will appropriately prepare them for the exam, Studybytech's courses are designed to complement the curriculum.

Admissions are open for the CA Foundation 2024 batch!

We're thrilled to inform you of some news! The CA Foundation 2024 batch's admissions opening has been excitedly announced by Studybytech. This is your chance to begin your journey towards chartered accountant status with a strong foundation and competent guidance.

Why choose Studybytech for the CA Foundation?

1. High-Quality Education: Studybytech is committed to providing instruction of the highest caliber to ensure your success on the CA Foundation exam.

2. Experienced Faculty: Study with professors who are well-versed in the CA syllabus and exam structures.

3. Proven Track Record: Become one of the successful CA Foundation students who utilised Studybytech to help them realize their goals.

4. Access detailed study materials and resources to assist you in your preparation.

5. Personalised Guidance: Take advantage of individualised mentoring and doubt-clearing sessions to help you excel in your studies.

Conclusion

The new CA Foundation syllabus for 2024 promises a dynamic and comprehensive education for aspiring chartered accountants. It provides students with the skills they need to succeed in the quickly evolving financial business, with a focus on taxation, ethics, sustainability, and digital finance.

As you start your CA Foundation journey, think of Studybytech as your success partner. Studybytech's qualified instructors, reputable history, and courses tailored to the syllabus make it your gateway to a successful career in chartered accounting. Don't miss the opportunity to apply for the CA Foundation 2024 cohort and start your path to a rewarding career. To position yourself for success in the future, enroll right away!

Follow us for daily CA updates on our WhatsApp channel

CA.Parag Gupta

Studybytech

0 notes

Text

Top Things You Can Learn In A Payroll Administration Course

There’s more to accounting and payroll than people might assume. Being repetitive, tedious, and doing the same thing every day are some misconceptions about the career. In both an accounting and payroll administration online program or in-person, students learn a wide variety of concepts and procedures that they can apply to their future careers. This includes:

Financial accounting

Accounting software systems

Income taxation

Microsoft Office, and;

Payroll fundamentals.

With this knowledge, students are prepared to cover many different tasks, keeping their options of work fresh and exciting.

Financial Accounting

Students aren’t only limited to learning about payroll in a payroll administration course. Rather, they are exposed to a variety of accounting topics. Financial accounting includes learning about the fundamentals of accounting such as the daily transaction procedures that a business would undertake. It expands on bookkeeping functions, recording journal entries and engaging with the full accounting process. It also includes accounting information systems, going through the entire accounting cycle (creating, adjusting, and closing entries) as well as receivables, intangible assets, liabilities and more.

Accounting Software Systems

In addition to learning the concepts and procedures of accounting, students in a payroll administration course will learn how to use the programs that maintain financial records. This includes QuickBooks and Sage 50, which are popular accounting softwares that many companies use. It has the full suite of bookkeeping tools to help them manage the business they will be in. These software programs have a multitude of uses, including payroll management, income and expense tracking, and financial reporting.

Income Taxation

In this course, students delve into a bit of law to learn about the Income Tax Act in Canada, and how to apply its rules appropriately and correctly to practical situations. They learn many things about income taxation including federal taxation, capital gains and losses, income and deductions, and tax income and payable for individuals.

If students would like to open up their own business in the future, this is one of the best routes to specialize in because every person, whether they own a business or not, needs to file an income tax report, so this way their services also appeal to a wider audience.

Microsoft Office

While Microsoft Office is commonly used, there’s a lot of interesting features and aspects of the software that are left unused. Office has many components to make your work easier, faster, and more efficient. The average person who uses the Microsoft suite doesn’t engage with every aspect of it, so learning it is helpful. Especially in an accounting and payroll administration online program, understanding this information is important, as when one starts to work in the field there’s less time to understand and engage with the software in a way that you can fully utilize it.

youtube

Payroll Fundamentals

This course teaches the main concepts and procedures of payroll, and is also a requirement for the Canadian Payroll Association’s (CPA) certification for Payroll Compliance Practitioner (PCP) that students can pursue after graduation. Students calculate individual net pay, termination pay, record of employment (ROE) and how to communicate these aspects to stakeholders.

Accounting and payroll administration course is one of those programs that once you take it, you’ll know that you’re always going to be in demand. Every company, organization, small business, and even sometimes sole proprietor needs someone who can do their accounting and payroll, in an accurate and timely manner.

ABM College offers an accounting and payroll administration online program so that students have the opportunity to fast track their education in the way that’s most convenient for them, and get into the field as soon as possible.

#accounting and payroll administration diploma#accounting and payroll diploma#online accounting and payroll courses#accounting and payroll courses online canada#accounting and payroll courses ontario#accounting and payroll online courses canada#accounting and payroll courses online ontario#Youtube

0 notes

Text

Unveiling the Essence of Business Valuation Services in the USA

In the dynamic landscape of American commerce, understanding the true worth of a business is paramount. Whether you're looking to buy, sell, merge, or simply gain insight into your company's financial health, the importance of accurate business valuation cannot be overstated. In the United States, a robust market for business valuation services has emerged, catering to a diverse range of industries and businesses of all sizes.

The Significance of Business Valuation

Business valuation is the process of determining the economic value of a business or company. It involves a comprehensive analysis of various factors, including financial statements, market trends, industry conditions, and intangible assets. The resulting valuation figure provides invaluable insights for decision-making, investment planning, and strategic development.

Key Drivers of Business Valuation Services in the USA

Mergers and Acquisitions (M&A): The USA has a highly active M&A market, characterized by a continuous flow of transactions across various industries. Accurate valuation is the linchpin of successful M&A deals, enabling both buyers and sellers to negotiate from positions of strength.

Financial Reporting and Compliance: Businesses in the USA are subject to stringent financial reporting requirements. Accurate valuation is crucial for compliance with accounting standards and regulatory frameworks, ensuring transparency and credibility in financial statements.

Estate and Gift Tax Planning: For high-net-worth individuals and families, business ownership is often a significant component of their estate. Precise business valuations are essential for estate planning, gift tax, and wealth transfer purposes.

Litigation and Dispute Resolution: Valuation services play a pivotal role in legal proceedings, such as shareholder disputes, divorce settlements, and intellectual property infringement cases. A well-supported valuation can make or break a case.

Startup and Venture Capital Ecosystem: The thriving startup ecosystem in the USA relies on accurate valuations to secure funding, negotiate equity stakes, and chart a course for growth and scalability.

Choosing the Right Business Valuation Firm

Selecting a reputable valuation firm is crucial for obtaining reliable and unbiased valuation reports. Here are some key considerations:

Expertise and Experience: Look for firms with a track record of providing valuations in your industry or a similar one. Experience brings insights into industry-specific nuances.

Credentials and Certifications: Ensure that the firm's professionals hold relevant certifications, such as Accredited Business Valuator (ABV), Certified Valuation Analyst (CVA), or Chartered Financial Analyst (CFA).

Transparent Methodology: A reliable firm should be willing to explain their valuation methodology in clear, understandable terms. Transparency builds trust.

Client References and Testimonials: Seek feedback from past clients to gauge the firm's reputation and the quality of their services.

Customized Approach: Every business is unique. A reputable valuation firm will tailor their approach to the specific circumstances and objectives of your business.

Conclusion: Navigating the Valuation Landscape

In the ever-evolving landscape of American business, the need for accurate and credible business valuation services in USA is undeniable. Whether you're a seasoned entrepreneur or a budding startup, understanding the worth of your enterprise is a cornerstone of success. By enlisting the services of a reputable valuation firm, you can navigate the complexities of business valuation with confidence, empowering you to make informed decisions that drive your business forward.

0 notes

Text

How to STRIP NON-NUMERIC CHARACTERS in Excel

There is a string of formulas that can be written to strip out only the non-numerical values from a cell and only return the numerical values. This is useful in situations where you need to calculate the sum of data contained in a cell that has non-numeric values or if you need only numeric portions of a text string, e.g. for serial numbers or other purposes.

Formula explanation

Syntax: =TEXTJOIN(“”,TRUE,IFERROR(MID(A1,ROW(INDIRECT(“1:100″)),1)+0,””))

In the above formula, every item except A1 will be the same for every situation. Instead of typing A1, you would select the cell containing the value you would like to strip.

This formula uses the MID formula which works from the inside out to remove non-numeric characters.

The ROW and INDIRECT functions act to reference an array of the numbers between 1 and 100.

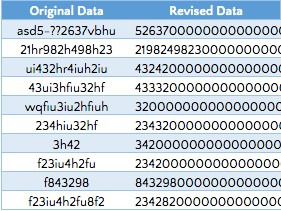

Example:

We have the below raw data in the “Original Data” column and would like to make a column of only the numeric values beside it in the “Revised Data” column.

Overall, this is a great formula to use to strip out the numerical values ONLY!

I hope that helps. Please leave a comment below with any questions or suggestions. For more in-depth Excel training, checkout our Ultimate Excel Training Course or visit our website https://commercecurve.com/excel/non-numeric-characters-in-excel/. Thank you!

#commerce curve online accounting course#online excel course#online Accounting Income Taxes Course#Online Investments Accounting Course#Capital & Intangible Assets Accounting Course

1 note

·

View note

Text

Solar Energy Is No Longer Just The New Kid On The Block

More and more people are turning to ethical Power Efficiency Guide Review and more socially responsible companies. Installing solar panels at your business, and reducing your company's carbon footprint could actually be good for business. The panels will be clearly visible so therefore everyone will be aware that you are doing your bit to reduce greenhouse emissions. From a financial perspective, all savings made are ongoing and the potential increase in sales can only be a good thing for any business.

A reputable green energy supplier will be aware that the installation of solar panels involves significant capital expenditure. However, in addition to the aforementioned savings on energy bills, there are several government incentives available that will help you to recuperate your investment in the shortest time possible. Speaking to a professional company who are experts in the field will help you when it comes to rebates and the various options that will be available to you.

If you are in business you will, of course, be looking to make a profit. The good news is that solar power systems can be treated as a depreciable asset in your balance sheet. This will obviously be a cost that can be written off for tax purposes. The when coupled with the other financial benefits that we have already discussed make this form of renewable energy all the more attractive. Of course, it is always advisable to talk to an accountant to discuss how it will affect your business.

There are some intangible benefits in addition to both financial and non-financial benefits that we have discussed. For instance, you could use this as a marketing opportunity as well as your chance to gain increased energy independence or an educational value. All again could help your company to thrive going into the future. The are many reasons why solar power would benefit you in both a professional.

https://healthinfluencer.net/power-efficiency-guide-review/

1 note

·

View note

Text

Protection Function in Microsoft Excel

What is the Protection Function or the Protect Range in Microsoft Excel?

The protect range function is a useful way to prevent other users of a workbook from altering data within a worksheet. By using this function, you can prevent the accidental or intentional modification or deletion of worksheets or cells within a worksheet. The protection function can further be enhanced by password protection. The use of a password allows you to strengthen the security of your workbook.

As the owner of the workbook, you can set the rules on what worksheets and cells are off limits for modification.

This can be a valuable function if you have created a workbook that you will be sharing with a third party and you want to ensure that they do not modify certain aspects of it. Without this feature used, you would have to manually check to see if they made modifications to the worksheet areas which you did not want modified. In this post I will demonstrate you how to use protect function in an Excel spreadsheet:

How to enable Protect Function in Microsoft Excel?

Practical Application of Protect function:

Steps to Enable Worksheet Protection: Step 1: In the Excel file, select the worksheet tab that you want to protect. Then go to the “Review” tab, and click “Protect Sheet”

Step 2: A prompt message will appear showing elements you want people to be able to change along with the requirement to enter a password.

There are several options available here with respect to what you would like to protect in the worksheet.

For instance, you may want to protect the worksheet but still allow the user to be able to

Select the cells of the worksheet to navigate it,

Format the cells,

Sort the data, and

Use PivotTable and PivotChart features while not modifying the data itself

In that case, you would multi-select those features in the below list and click OK.

Step 3: After pressing OK, the worksheet will now be protected. If you try to modify a protected worksheet, the below message notification will appear.

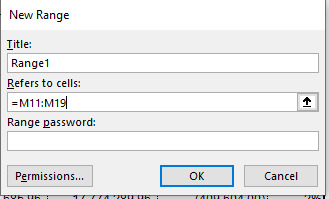

Step 4: You can also set range where you would like to allow someone to edit specific cells rather than the whole worksheet.

To do this, go to the “Review” tab, then click “Allow Edit Ranges” and click “New.” The below popup will appear. When this appears, you can give the editable range a title, and then in the “Refers to cells:” section, highlight the specific cells in the worksheet you would like to make editable.

If you do not enter a password, anyone will be able to edit that range. Then, you can protect the whole sheet again but this time the cells which you have setup as being allowed to edit will remain editable.

Note that on this screen you can also set a “range password.” This will allow someone to edit the range but only if they have the password. i.e. when they click on the cell and try to edit it, they will be prompted to enter a password.

This can be useful if you want to send a workbook to multiple individuals, protect the whole sheet, but only allow certain individuals to edit a certain part of the workbook. In that instance, you would need to provide those specific individuals with the range password you created.

Note that you can create multiple rules for “Allow edit ranges.” Below is the first one that was setup but you can go back to the “Allow Edit Ranges” at any time and create another editable range or modify or delete an existing editable range.

Step 5: You can also protect the entire workbook with a password instead of locking each individual tab.

I hope that helps. Please leave a comment below with any questions or suggestions. Thank you!

#online Accounting Income Taxes Course#Online Accounting Inventory Course#Online Investments Accounting Course#Accounting Financial Instruments Course#Capital & Intangible Assets Accounting Course#online excel course#commerce curve online accounting course

0 notes

Text

Screenshot insertion function in Microsoft Excel

What is the Screenshot function in Excel?

If you’re doing tutorials, walkthroughs or need to paste a screenshot In the Excel file to show a reference to something or support for something, the same can be done by using screenshot function of Excel. This function is occasionally more helpful than using the snipping tool because that tool occasionally closes an open window.

In this post I will explain you how to use screenshot insertion function with an example.

How to insert a Screenshot in Microsoft Excel sheet?

Below mentioned are the steps to insert a screenshot an Excel file:

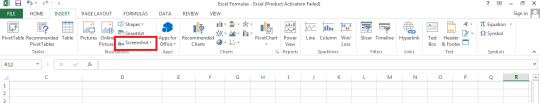

Navigate the home screen and go to the Insert tab

Click on screenshot

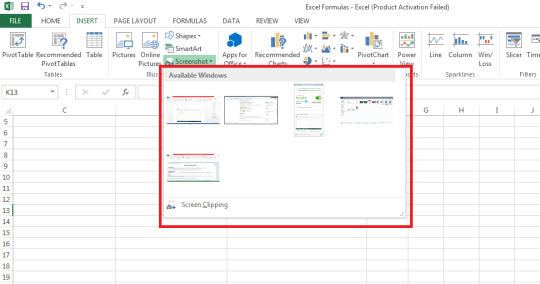

From the dropdown menu, select the screenshot of the window open on your desktop

Or click Screen Clipping from the drop down menu to select only a specific area of the screenshot to insert

Practical application of screenshot insertion function

Suppose the Accounting Staff of your organization would like to take a screenshot of the bank balance that shows up in online banking as at the end of the month. The bank statements have not been released yet by the bank so online access is available.

The Accounting staff opts to rather insert Screenshot of the balances, to do so following steps would be required to be followed:

Step 1: Navigate to home screen and go to the Insert tab, click on screenshot

Step 2: From the dropdown menu, select the screenshot of the window open on your desktop

Step 3: Or click Screen Clipping from the drop-down menu to select only a specific area of the screenshot to insert

I hope that helps. Please leave a comment below with any questions or suggestions. Thank you!

#online Accounting Income Taxes Course#Online Accounting Inventory Course#Online Investments Accounting Course#Accounting Financial Instruments Course#Capital & Intangible Assets Accounting Course#online excel course#commerce curve online accounting course

0 notes

Text

Precedents and Dependents function in Microsoft Excel

What are “Trace Precedents” and “Trace Dependents” Function in Microsoft Excel?

The precedents and dependents function is used to graphically display and trace the relationships between cells and formulas with tracer arrows as shown in this figure below:

This is helpful in a couple of ways:

To determine where a value is being derived from (precedents) and mapping it through its touch points in a workbook and

To determine whether a cell has dependents which rely on it before you delete or move the cell as that would cause a breakage of other areas of the workbook.

The terms precedents cells and dependents cells can further be explained with the help of summary table below:

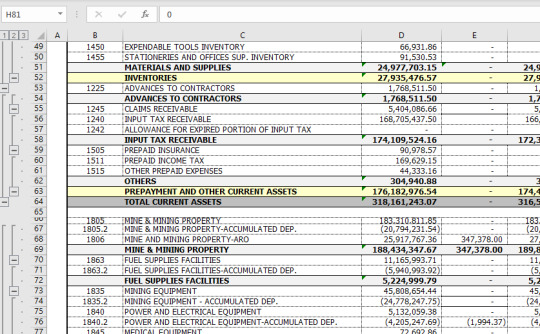

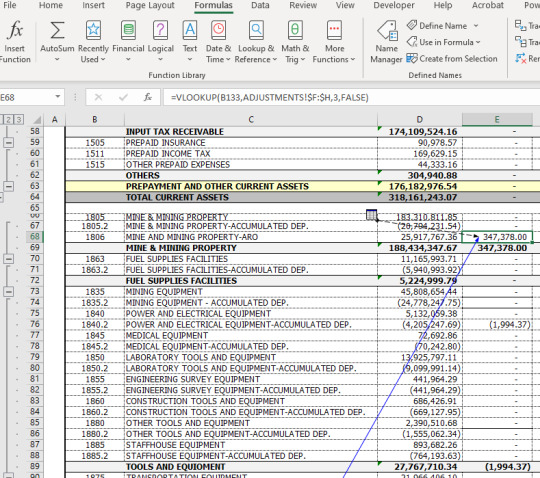

How to use precedents and dependents function in Excel can be explained with the help of following example:

Practical Application of Precedents and Dependents Function

Following steps are required to be followed to display the formula relationships amongst cells:

Step 1 : Select a cell to check precedents/dependents

*In the example above, we have selected the cell E68 on the Group & Ungroup – 2 tab. Step 2 : After selecting a cell, go to “Formulas tab” and select trace precedents.

Step 3 : After clicking Trace Precedents a blue tracer arrow displays where the cell E9 was referred.

*The icon means that the selected cell is referenced by a cell on another worksheet or workbook e.g. using the VLOOKUP formula in this case from the Adjustments sheet.

Step 4 : For Trace Dependents a blue tracer arrow points to another cell that depends on the cell.

*In the example above, cell E76 has several dependents which use its value to calculate subtotal and total sum amounts in cells E89, E112, E128, and E129 on the Group & Ungroup – 2 tab.

I hope that helps. Please leave a comment below with any questions or suggestions. Thank you!

#online Accounting Income Taxes Course#Online Accounting Inventory Course#Online Investments Accounting Course#Accounting Financial Instruments Course#Capital & Intangible Assets Accounting Course#online excel course#commerce curve online accounting course

0 notes

Text

Alla Volodina York University — Understanding the Basics of Accounting

Many organizations might find it useful to incorporate a variety of training sessions into their training programs that focus on accounting. The following course outline is suggested by an accounting instructor at York University (AllaVolodina) for a training session

- Basics of accounting:

o Fundamental principles and rules, including asset, liability, and revenue and expense recognition

- Complex topics in accounting:

o Including but not limited to accounting for capital assets, cost vs revaluation models, investment properties, and construction projects revenue recognition

- Understanding an organization’s financial position:

o Analysis of Balance Sheet line items (inventory, capital assets, prepaid expenses, construction-in-progress, intangible assets, goodwill, bank loans, notes payable, billings in excess of costs on uncompleted contracts, deferred tax liability, retained earnings, capital stock)

- Understanding an organization’s operating results:

o Analysis of Income Statement line items (revenues, depreciation expense, general and administrative expenses, acquisition expenses)

- Understanding the Cash flow statement:

o Analysis of operating, investing and financing activities

Alla Volodina teaches at York University various accounting courses including ADMS3585.

0 notes

Text

Detailed information on LLP For Business Environment and Law – Part 2

Limited Liability Partnership (LLP) – The Limited Liability Partnership Act 2008. In this article, we will discuss specific partner topics, LLP formation, partners and relationships, and their level of responsibility and partner contribution. Financial Audit / Disclosure, LLP Foreign, from Legal Element relating to Partnerships and LLP from CSEET Legal and Business Environment Subject.

ESTABLISHED PARTNERS [PART 7]

The LLP must have at least two “Named Partners” who are natural persons, and at least one of them must be “Indian Residents.” If one or more of the LLP partners is a legal entity, at least two persons who are partners in the LLP or have been appointed to the agency must act as “named partners.”

“Resident in India” is a person who has lived in India for 182 days or more in the previous year.

Nominated partners are responsible for complying with the provisions of the LLP Act.

Nominated partners must obtain a Nominating Partner Identification Number [DPIN] from the central government.

The DPIN assignment application must be submitted online on the LLP website together with the necessary supporting evidence, which is properly certified and certified as required.

LLP STORAGE [SECTION 11 TO 21]

The process of entering an LLP is similar to entering a company under the Companies Act 1956. Applicants must first register with the Registrar of Companies [ROC] to maintain the name. After the ROC has approved, LLP inclusion documents must be submitted.

The name of each curriculum must end with the words “Limited Liability Partnership” or “Lifelong Learning.”

Names that are unwanted or closely resemble partnerships or other LLP companies or brands are not permitted.

Any legal entity (legal entity / registered partner company) whose name is similar to the name of the LLP, which was subsequently established, can apply for changes to the LLP’s name within 24 months from the registration date LLP through the ROC.

No person may run a company with a name/title that includes the words “Limited Liability Partnership” or “Lifelong Learning” without correctly identifying it as LLP under the LLP Act.

LLPs must submit LLP agreements ratified by all partners to the ROC within 30 days of commencement of the LLP.

PARTNERS AND RELATIONSHIPS AND THEIR RESPONSIBILITIES [SEC 22 TO 31]

The joint rights and obligations of the inter-LLP and LLP partners and their partners are governed by an agreement between the partners or an agreement between the LLP and its partners. If the agreement does not exist, collective rights and obligations are governed by the Lifetime Learning Law.

1. For LLP business purposes, each LLP partner represents the LLP but not of the other partners.

2. As an independent legal entity, LLP is responsible for all of its assets, while the liability of LLP partners is limited to their agreed participation in the LLP.

LLP is not tied to anything a partner does when communicating with someone if –

The partners are not authorized to act for LLP in carrying out certain actions

The person knows they have no authority, or they don’t know or believe they are LLP partners

LLP is responsible for the LLP partner responsible for illegal acts/omissions during LLP business activities / with his / her authority. LLP’s obligations, whether contractual or otherwise, are LLP’s only obligations. The LLP characteristics must cover LLP obligations.

Partner is not personally responsible for LLP obligations simply because he is an LLP partner.

Neither partner is responsible for the illegal acts or omissions of another LLP partner, but the partner is personally liable for his illegal acts or negligence.

The liability of LLP and affiliates found to have acted intending to defraud creditors or for fraudulent purposes is limited to all or part of LLP’s debt or other liabilities. Termination of employment for reasons such as resignation, death, dissolution of the LLP, assertion that someone is unreasonable, filing for bankruptcy, etc. is only effective if –

The man notices that his partner has stopped acting this way; or

Notification of termination has been sent to

The resigning partner may send a termination notice if he or she has reason to believe that LLP has not sent this termination notice.

PARTNER CONTRIBUTIONS [PART 32 AND 33]

Partner contributions to LLP capital may include:

Tangible, movable, or immovable property

Intangible assets

Other benefits for LLP include cash, promissory notes, executed or pending service contracts.

The partner’s obligation to contribute in accordance with the agreement on lifelong learning.

Creditors who make loans or act on the obligations described in the Lifetime Learning Agreement without regard to compromise between partners can impose initial obligations on that partner.

AUDITS / FINANCIAL DISCLOSURES [SECTIONS 34 AND 35]:

The LLP maintains a mandatory ledger in relation to its affairs in cash or accrual form and is subject to a multiple entry system.

Every LLP account must be audited, except in the following situations:

When the conversion does not exceed Rs. 40.00,000 / – in each financial year; or

If the dues do not exceed Rs. 25.00 000 / –

The central government has the power to exclude some LLP classes from mandatory auditing. LLPs are required to submit the following documents to the ROC:

Accounts and solvency statements within 30 days from the end of 6 months of the financial year;

Annual returns within sixty days of end of financial statements

ACCESS AND TRANSFER OF PARTNERSHIP RIGHTS [SEC.42]

The rights of partners to receive a portion of LLP profits and losses and to receive distributions under the LLP Agreement are transferable in whole or in part. Such transfer of rights does not lead to separation of partners or termination and termination of the LLP. Such assignment does not by itself entitle the recipient or successor to participate in the administration or conduct of LLP activities or to have access to information about LLP transactions.

FOREIGN LLP [PART 59 AND RULES 34]

When setting up a place of business in India, an overseas LLP must submit the required ROC registration documents within 30 days of incorporation in India.

Any changes to the constitutional documents, address of the head office abroad, and foreign curriculum partners must be submitted to the ROC in the prescribed form within 60 days from the end of the fiscal year.

Any changes to the LLP overseas registration certificate, agency in India, and main office in India must be submitted to the ROC in the prescribed form within 30 days of the change.

Foreign LLPs who no longer have a place of business in India must notify the ROC in a prescribed form within 30 days of their intention to close the place of business and from the date of notification of the overseas LLP’s obligation to apply for a place of business documents in the ROC, notification will be granted unless there is another place of business in India and all documents must be filed at the time the notification has been submitted.

We at Book My Lectures offer CS CSEET Lectures Online for free. We are the leading digital platform in offering online courses for CS, CA, and CMA.

Contact us today or call us at +919881114466

0 notes

Text

Get Online commercial vehicle loan in Dubai

Comprehensive facilities can meet your short-term liquidity requirements by discounting future posted checks (PDC). Our cheque discounting service provides instant access to liquidity by discounting checks and simultaneously crediting your account. The check discount product is a circular financing mechanism that reduces the company's cash conversion cycle and improves liquidity throughout the year.

Features of Cheque Discounting

Offered to UAE registered businesses and UAE Nationals

Competitive Revolving facility which reduces the company's cash conversion cycle, and improves liquidity.

High Facility limits

Flexible tenors ranging between 30 days to 120 days for discounting

Low Interest rates

Low Cheque Discounting Commission per cheque

Low Processing Fees

A letter of credit is a financial document used in international trade. This is the payment guarantee provided by the bank to the commodity supplier. If the buyer does not pay, the "letter of credit" issued by the bank is a promise to the seller. The letter of credit in Dubai is called "the lifeblood of international trade."

Commercial Vehicle Loan Dubai

In Dubai, the price of a new car can range from several thousand to several million, depending on the make or model. Of course, not everyone can make the full payment. If you do not have the necessary funds, or prefer to use the remaining cash for other expenses, you can apply for a car loan in Dubai at any time. But first, you need to understand how the process works in the UAE. Depending on your situation and financial situation, the "automatic loan eligibility requirements" are different. Whether you're looking for a commercial vehicle loan in Dubai or want to finance a new wheelset Smefin will help you.

When the business expands, it generally requires investments in equipment, machinery equipment loan UAE, vehicle equipment, and other business assets. Solutions provided by CBD Commercial Bank can meet business asset or equipment purchase requirements. The product package provided includes different types of equipment, such as construction equipment, medical equipment, and professional equipment. The structure of these offers allows clients to choose to use their assets as funds for purchase transactions. If you need loans against construction equipment loan finance.

Trade and Working capital financing is commercial financing intended to increase the company's available working capital. It is usually used for specific growth projects, such as signing larger contracts or investing in new markets. Develop businesses, which will recover in the short and medium term.

Asset financing means using assets from the balance sheet, inventory, short-term investments, etc. from the business to obtain loans or borrow money. The company that borrows these funds must provide the lender with a collateral on the assets. Asset financing allows companies to buy equipment, such as machinery, vehicles, or almost any equipment that helps strengthen their business. This also helps free up cash from the value of assets the business already owns. Asset financing Dubai is a form of financing that applies to the purchase of tangible and intangible assets.

0 notes

Text

Online Brand Reputation Management - 101 (Part 1)

“Identity will be the most valuable commodity for citizens in the future, and it will exist primarily online.” — Eric Schmidt

Online Brand Reputation Management is very important as Reputations are everything.

Many of the opportunities presented to us come based on our reputations.

Yet reputation is an intangible, ambiguous, and complex concept. It involves impressions, emotions, and perceptions encompassing the estimation in which a business, person, or thing is held by a specific group or the public at large.When something is so important, managing it becomes crucial. This is where Online Brand Reputation Management comes into picture.

Businesses grow and succeed through their reputations. A digital presence and online communication strategy are not just part of a company’s reputation, they form the firm’s foundation — the most critical component to its survival and growth.

But compared with traditional brand marketing, Online Brand reputation management is a new frontier where applicable guidance and proven research are in limited supply.

Almost two decades ago, Mark Bunting and Roy Lipski proposed that online perception and opinion, regardless of its accuracy, have as great an effect on a company’s reputation as the company’s actions. These perceptions, quickly formed and shared across myriad traditional and digital platforms, create both reputational opportunities and challenges.

How much is a reputation worth?

Today, we interact with friends, family, and colleagues largely through text messages, email, and social media, where perception and reality are often confused. So both digital and in-person first impressions are critical.

Traditional financial education supplies a comprehensive framework for understanding the valuation of tangible assets, including the value of public and private companies. Portfolio managers and analysts make investment decisions after thorough research into a firm’s fundamentals. However, the subjective valuation of the firm’s intangibles — brand equity, relationship capital, patents, and, of course, reputation, among them — creates a larger challenge.

Burson-Marsteller, a leading global public relations and communications firm, found that 95% of the CEOs surveyed believe that corporate reputation plays an important or very important role in the achievement of business objectives. But, only 19% of these same executives had a formal system for measuring the value of that reputation.

Beyond recognizing that it does affect a firm’s value and long-term growth prospects, we don’t understand Online Brand Reputation Management all that well. When drawing conclusions on valuation, we often lump brand value and reputation in with other components that are inherently difficult to quantify — under the balance sheet’s goodwill line item.

Reputation is both a repository of shareholder value and a means for growing it.

“Decisions to buy or not buy from a company have increasingly less to do with place, packaging, or promotion and almost everything to do with how much your friends, family, and even strangers provide online assurance that the product or service is worth the cost.” — Elaine Cheng, chief information officer, CFA Institute

Brands accounted for more than 30% of the S&P 500 stock market value, according to The Economist. That is the consensus among corporate CEOs. Sixty percent of chief executives surveyed by the World Economic Forum and public relations firm Fleishman-Hillard said they believed corporate brand and reputation represented more than 40% of their company’s market capitalization.

Better reputations do not guarantee growth, but they certainly expand the opportunities to achieve it. So firms need to focus on reputation management when they align their strategic communication with investor and client preferences. Moreover, Online Brand reputation management gives business owners insights into their strengths and weaknesses.

The framework for making informed inferences about reputational value has become clearer over the past decade. The “2017 US Reputation Dividend Report” supports the view that investor confidence derived from a firm’s reputation drives shareholder value. Indeed, one out of every five dollars of market capitalization is a product of the confidence instilled by a company’s reputation — that’s about$4.6 trillion in the first half of 2017, according to the report. Moreover, the 10 most economically powerful reputation assets among US corporations accounted for close to half of their corporate market cap at the start of 2017.

Strong brands and Online Brand reputation management help to mitigate investor risk and reassure shareholders when earnings are weak.

This was the the first part of this blog, the next part would be posted shortly.

Originally published here.

0 notes

Text

Sorting function in Microsoft Excel

What is Sorting function in Microsoft Excel?

When the volume of data is humongous, sorting of data becomes essential. This helps in presentation of information in user friendly manner. Sorting can be done in multiple ways, ascending, descending, alphabetical, color, font and in numerous other ways.

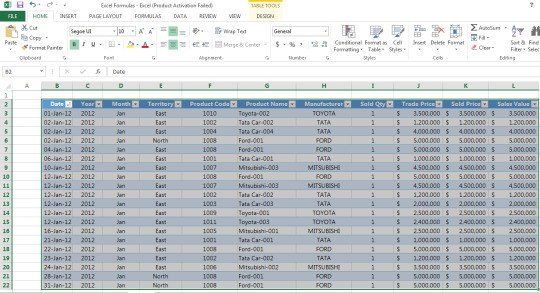

In this post I will explain how to use sorting function in an Excel spreadsheet with the help of following example:

How to properly sort the data in Microsoft Excel?

Practical Application of Sorting Function

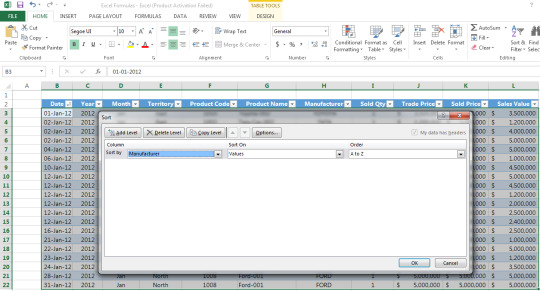

Example 1 – Suppose you are a trader of manufactured cars and want to sort the sales data as given in the table below according to the alphabetic sequence of name of manufacturers, following steps would be required to be followed

Step 1: Select the data table

Step 2: Go to Home > Sort & Filter > Custom sort

Step 3: Using the example table below, sort column data according to Manufacturer, sort on Cell Values and set the Order as A to Z

* Using the “Add Level” button you can also add an additional level of filtering (e.g. by product name)

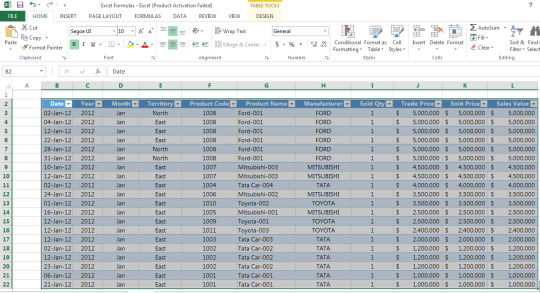

Step 4: Press ok and your data will be sorted accordingly

How to sort data from smallest to largest in Microsoft Excel?

Further, in case you want to sort the same data from smallest to largest numbers in terms of sales value, following conditions would be required to be selected:

Step 1: Sort column according to Sales Value and set the Order as Largest to Smallest.

Step 2: Press ok and your data will be sorted accordingly

I hope that helps. Please leave a comment below with any questions or suggestions. Thank you!

#online Accounting Income Taxes Course#Online Accounting Inventory Course#Online Investments Accounting Course#Accounting Financial Instruments Course#Capital & Intangible Assets Accounting Course#online excel course#commerce curve online accounting course

0 notes