#Cash App bank and address

Text

How To Get New Bitcoin Address On Cash App

How To Get New Bitcoin Address On Cash App – If you’re using Cash App to purchase Bitcoin, you would possibly be aware that the Bitcoin address supplied for receiving payments adjustments with every transaction. This is executed through Cash App for privacy and safety purposes.

If you want to alternate your Bitcoin wallet deal with on Cash App, you need to delete your present address Cash App…

View On WordPress

#ash app bitcoin fees#cash app bitcoin fees#cashapp bitcoin#Changing Your Bitcoin Wallet Address on Cash App ...#How Do I Find My Cash App Bitcoin Address?#how to change bitcoin address on cash app#how to find your bitcoin wallet on cash app#How to get a new Bitcoin address on the Cash app#how to receive bitcoin on cash app#how to verify bitcoin on cash app#how to verify bitcoin on cash app 2023#how to withdraw bitcoin from cash app to bank account

0 notes

Text

babydaddy!rafe was doing one of his weekly visits.

he was on the phone when he walked in like he owned the place, because well — technically he did. he’d practically handed you one of his families properties the second you got pregnant and refused to live at the ever dysfunctional tanny hill. he figured it was an investment, he was certain it wouldn’t be long before he was living there with you too anyway. you however, was making that plan very hard to come to light.

“just have my shit, alright? you— you know i could have someone else do your job in a second alright so, prove your worth to me… okay listen i gotta go— at my gir— uh, at my fuckin’… the mother of my daughters house. so i gotta go. email me.” he’s got the phone pressed to his ear between his cheek and shoulder as he counts a wad of money, almost in a caricature of himself. you bite your lip, awaiting him to finish up as you lead him to your room where your baby had just fallen asleep.

“hey.” he drawls with a small smile as he addresses you, pressing the cash into your hand. he did this every week, and at first you refused it — but he’d just transfer it to you on your bank app, not taking no for an answer, so you gave up fighting.

“hi.” your fingers brush his as you take it from him. “i tried to keep her awake to see you, im sorry. she had a late night.” you inform apologetically in a hushed tone, watching her father scroll over with a shrug, brushing a gentle hand over her tiny head, bending over to press a kiss to her cheek. she stirs but doesn’t awaken, the familiar touch and smell of her father not disturbing enough to remove her from her sleep, at peace. this makes your heart ache. your little girl knew her dad too well.

“yeah, that’s alright.” he stands back up, stuffing his hands in his pockets as he looks around the bedroom. you were always doing something new with the way you decorated, so he glances around — looking for something to use to converse with you. his face falls as his eyes land on something. now this, wasn’t the type of conversation he was looking for.

“who’s uh, who’s jacket is that?” he scratches his cheek, already holding that accusatory look in his gaze as he nods towards your vanity chair.

you turn, staring at the jacket, and at first your mind blanks. there was a few seconds where you did actually have no idea. all you knew, was that it was obviously a man’s jacket, hung almost domestically on the back of your chair like it was apart of the decor. rafe had already decided it looked too comfortable there.

“uh…” you frown, and when he walks over and plucks it up between his fingers — tossing it demonstratively onto the bed without a word. when you get a good look at it, your face suddenly lights up in recognition. like you said, the baby didn’t sleep too well last night — meaning you didn’t sleep too well. you were a little slower than usual.

“oh! its the electricians. yeah, it was hot so i took his jacket for him. he must’ve left… it.” your voice trails off when you see the look on rafe’s face. he’s squinting out a glare of disbelief, releasing a scoff when you finish talking.

“you really expect me to buy that line of shit? the electrician?” he drawls, stepping towards you.

“why would i lie? plus we — we aren’t even together—”

“hey.” he interrupts and your eyes skip towards your sleeping baby in the cot and your breath hitches.

“rafe not here, c’mon she’s asleep i don’t want her to hear us like this.” you plead and he licks his lips, glancing round at the cot before nodding towards the door, lugging his big body into the hallway. you sigh, checking on your girl before following him out, crossing your arms. “rafe.”

“so i pay for this house, i bring you money every week, and you got the nerve to have other guys in here? around my little girl? around you?” he tilts his head, crowding your space, voice more hushed now. you hate how your body reacts to him, instantly heating a little. as toxic as it was, hearing him act territorial told you that he still cared immensely and wouldn’t suddenly get bored and leave you to your own devices. your lashes flutter a little as you exhale and it doesn’t go unnoticed. “you do it to make me jealous? huh? ‘cos i can’t — i can’t imagine that there’s anyone out there that’s lookin’ after you like i am— alright, who’s gonna pay those fuckin’ bills for you hm?” he takes a step closer and your eyes practically glaze over when your bodies brush one another. he takes the incentive to reach forward and put his hand up your silky night gown, cupping your cunt. of course, no panties. “whos gonna fuck that needy lil’ pussy if it’s not me? huh? nah really, tell me?” he tilts his head, talking all low right in your ear making you mewl.

“it really was the electricians jacket!” you squeak, gripping his shirt in your clenched fists. you were so pent up.

“you swear?” he licks his lips, eyes wide as they stare into your own.

“on my life, rafe.” you breathe desperately, and he knew you wouldn’t ever swear on your life if you didn’t mean it. it was just the kind of person you were. he takes his hands off you, holding them up as he licks his lips, eyeing you over.

“alright… a’ight i’m sorry. just had a long day.” he apologises, seeming like he’s taking a moment to catch his breath. you continue to stare, thighs subtly shifting together. “you got that baby monitor?” he blinks.

you nod frantically, knowing it was turned on most times. rafe rubs at his jawline, looking around before nodding in the direction of the living room. “right. okay… go lay down on that couch. s’clear you need something from me.” he commands with no room for argument before sauntering off ahead, adjusting himself in his pants.

2K notes

·

View notes

Text

What is Cash App bank name and how does it work?

Cash App is a mobile payment service that allows users to transfer money to others and pay bills. The app also offers a feature that enables users to receive direct deposits, such as paychecks, into their Cash App account. But one question many people have is, what bank is Cash App associated with? In this article, we will take a closer look at the Cash App bank name that it uses for its banking services and how the app's direct deposit feature works.

Cash App is associated with Sutton Bank, a Member FDIC bank in Ohio. Sutton Bank has been a trusted financial institution for over 150 years and provides a wide range of banking services to its customers. With Cash App, you can link your account to Sutton Bank to receive direct deposits, such as paychecks, into your Cash App account.

Sutton or Lincoln Saving Bank: What bank does Cash App use?

While some people may assume that Cash App is associated with a big national bank, the truth is that the app is associated with a regional bank. Cash App is associated with either Sutton Bank or Lincoln Savings Bank, depending on the user's location. They provide a wide range of banking services, including checking and savings accounts, loans, and credit cards. With Cash App, you can link your account to either of these banks to receive direct deposits, such as paychecks, into your Cash App account.

How to find the Cash App bank name?

When you sign up for Cash App, you will be prompted to provide your personal information, including your name, address, and social security number. This information verifies your identity and links your Cash App account to Sutton Bank. Once your account is linked, you can receive direct deposits into your Cash App account.

To find your Cash App bank name and address, you can go to the "Cash" tab at the bottom of the screen.

Then, you will see your available balance, routing, and account number at the top of the screen.

You can also view your account and routing number by selecting the "Deposit" button and selecting "Account" at the bottom of the screen.

What is Cash App direct deposit and how do I set-up?

Cash App's direct deposit feature is a convenient way to receive your paychecks and other payments directly into your Cash App account. You can also use the direct deposit feature to receive government payments such as Social Security and disability benefits. To set up Cash App direct deposit, you must provide your employer or government agency with your routing and account number, which can be found in the Cash App.

Conclusion:

Cash App is associated with Sutton Bank, a Member FDIC bank in Ohio. With the app, you can link your account to Sutton Bank to receive direct deposits, such as paychecks, into your Cash App account. By following the steps above, you can easily find your bank name and address on the Cash App and set up a direct deposit feature to receive your payments directly into your Cash App account.

#Cash App bank name#Sutton Bank or Lincoln Savings Bank#Cash App bank name and address#what is cash app bank name and address#find cash app bank name#cash app direct deposit

0 notes

Text

What is Cash App bank name for direct deposit?

Cash App is a mobile payment service developed by Square, Inc. It is not a traditional bank and therefore does not have a bank name. Cash App offers users the ability to send and receive money and purchase and sell bitcoin. They do partner with Sutton Bank for their debit card services, but it does not function as a bank account. So the Cash App bank name is Sutton and Lincoln Savings bank.

Cash App is an online financial platform that facilitates millions of users in various online transactions. It offers free money transfers, commission-free stock trading, and a free debit card. In addition, Cash App supports direct deposits. For example, you can set up a direct deposit with your employer to receive your salary. The best thing about using a Cash App for direct deposits is that you’re likely to receive your money two days sooner than you would at a traditional bank. However, you will also need to know that Cash App is not a real bank.

While you can use your smartphone to make purchases and withdraw cash from ATMs, Cash App’s balance is not federally insured. This means that your account may be completely depleted in the event of a disaster. But Cash App provides other forms of payment, such as prepaid cards and credit and debit cards.

To get started with a Cash App, you must have a bank account. Whether you have an account with a regular or virtual bank, you can link it to your Cash App. After that, you’ll need to activate the card. Next, you’ll need to scan a QR code or enter the card number into the app. You’ll also need to input some basic information about your employer. This includes the name of your company and your position. Ideally, you’ll want to wait at least a couple of business days before you see any direct deposits from your employer. Depending on your employer, this may take even longer.

How to find which bank is linked to the Cash App for direct deposit?

To find out which bank is linked to your Cash App account for direct deposit, you can follow these steps:

First, open the Cash App on your mobile device.

Tap the “My Cash” tab, which is located in the bottom-left corner of the screen.

Scroll down and tap “Cash” or “Bitcoin” (depending on what you want to deposit)

Tap on “Deposit”

You should see the bank account linked to your Cash App account. In addition, the account name and the last four digits of the account number should be visible.

Please note that if you haven’t set up Cash App direct deposit yet, you will have to add your bank account details before you can see it.

Remember that the bank account linked to the Cash App is used for direct deposit and other transactions like buying and selling stocks, so you must ensure that the bank details you’ve added are correct.

Why is the Cash App bank name important?

The bank name linked to a Cash App account is important because it is used for direct deposit and other transactions, such as buying and selling stocks. Direct deposit is a feature that allows users to receive payments, such as paychecks or government benefits, directly into their Cash App account. This eliminates the need for paper checks and can make it easier and faster to access funds.

Additionally, having the correct Cash App bank name and address can prevent errors or delays in transactions, such as buying or selling stocks, and ensure that funds are directed to the correct account. In summary, the bank name linked to a Cash App account is important because it facilitates direct deposit and other transactions and avoids errors and delays.

Where to find the routing number on the Cash App account?

The Cash App has its mobile app, but you can also go online to get your routing number. You can view it in the cloud or send it as an email attachment. Cash App uses several fraud protection technologies to protect your funds. One such technology is a one-time use login code that you can activate on your smartphone. This code is unique to you and can be used to access other features of the Cash App.

You’ll need to link your Cash App to a bank that does this service for the best direct deposit results. Some banks, like Bank of America, handle all of these transactions. If you don’t have an account with this particular bank, you can contact them and ask for assistance. Another thing you’ll need is a routing number. Routing numbers are important because they allow a financial institution to track your money. They are also useful for checking the authenticity of a check. Once you’ve got your routing number, you can paste it into the website to which you’re sending the payment.

Finally, you’ll need to locate your Cash App account and routing number. To do this, you’ll need to open the app and go to the banking tab. From there, you’ll find a list of account numbers beneath your balance. Go down to the bottom of the screen and find the routing number.

How to find Cash App bank name, routing, and account number?

To find the Cash App bank name, routing number, and account number on your account:

Open the Cash App on your mobile device.

Tap the “My Cash” tab, which is located in the bottom-left corner of the screen.

Scroll down and tap “Cash” or “Bitcoin” (depending on what you want to deposit)

Tap on “Deposit”

You should see the bank account linked to your Cash App account. The account name, routing number, and the last four digits of the account number should be visible. Cash App routing number is a 9-digit number that identifies the bank that holds your account, while an account number is a unique number that identifies the account you’re trying to deposit to.

Please note that if you haven’t set up direct deposit yet, you will have to add your bank account details before you can see it. Remember that the bank account linked to the Cash App is used for direct deposit and other transactions like buying and selling stocks, so you must ensure that the bank details you’ve added are correct.

#Cash App routing number#cash app bank name#cash app bank#what bank does cash app use#what bank is cash app#cash app bank name and address#cash app bank name for direct deposit#what bank is cash app through

0 notes

Text

How to Find Account and Routing Number on Cash App? (5 Steps)

The Cash App app is a good way to transfer money to friends and family. Cash App app is a free financial service. You can transfer money, get paid for side hustle jobs, and buy stocks. It also allows you to get tax returns and make direct deposits. The company partners with two U.S. banks the Cash App bank name is — Lincoln Savings Bank and Sutton Bank. Using the Cash App app is simple, and you won’t have to open a bank account.

Cash App’s most laudable feat is allowing you to receive your paychecks directly from your employer. It will take a couple of days to process your deposit, but it’s certainly a plus. You can also receive tax returns via the app. In terms of features, Cash App and Lincoln Savings Bank work hand in hand to give you an excellent experience. Cash App is also associated with other banks, such as M1 and Acorns. Check out these banks for your banking needs if you still need to. You can also check out the Cash App banking website for more information. You can also contact the company’s help desk, which operates round the clock.

What is the Cash App Bank Name and Address?

Using the Cash App, you can pay bills online or in-store. You must have a bank account associated with the Cash App to do this. But how do you find your Cash App bank name and address? Luckily, this is a fairly easy process.

Cash App works with two banks — Lincoln Savings Bank and Sutton Bank. Both of these banks are members of the Federal Deposit Insurance Corporation (FDIC). In addition to being a bank, Sutton Bank also offers credit cards, IRAs, and other banking products. It’s a relatively small bank but has a handful of physical locations.

Generally, when you open the Cash App app on your phone, you can see the bank name listed at the bottom of the screen. You should check your phone’s settings if you don’t see the name. It’s possible that your phone’s internet needs to be stronger or that you’re having a technical issue. If this is the case, try powering on your phone again or closing the app.

You can also look up your bank’s name by going to the American Bank Association (ABA) website. You can search “Sutton Bank,” and you’ll find that it’s a relatively easy process. Once you’ve determined which bank your Cash App account is associated with, you can find your routing number. A routing number is a numerical code that identifies the location of your Cash App branch name. It’s used for processing payments and checks and can also be used to verify the legitimacy of checks.

How to Find Account and Routing Number on Cash App?

Whether you’re looking to set up a new account or have questions about your existing one, finding your account and routing number on Cash App should be the first thing you do. In the app, the number is located in the lower left-hand corner of your home screen. It can be copied or written down and is also a good way to see if your device has a strong internet connection.

The Cash App account number is a 10-digit code that’s displayed on the app’s main screen. The first two digits are not shown for security reasons. Once you find the number, you can tap it to open your account and see the rest of the details. You can also use the Cash App’s “Deposits & Transfers” tab to check your balance and see your most recent transactions. You can also set up automatic bill payments.

If you need to change Cash App routing number, you’ll need to update your account information, which is simple enough. You can also contact Cash App support via phone, email, or the web. The good news is that the company gives you plenty of time to do so.

You may have received your Cash App account number due to a direct deposit into your account. You can also change your address and routing number, but you may have to re-enter your details. In most cases, you can expect your new address to match your new routing number.

0 notes

Text

Do you know ‘what bank does Cash App use’? Answered

Whether you are looking to get unemployment benefits to check or you are looking to set up direct deposits, you need to know about Cash App bank name and address. The two banks that support Cash App are Lincoln Savings Bank and Sutton Bank. Cash App is a mobile payment app that offers the option of direct deposits. You can receive your paycheck directly into your Cash App account. However, you may run into some challenges if you are still determining your bank’s name and address. However, there are a few things you can do to find out.

The first thing to do is make sure that you have access to the Internet. Check your phone’s browser to see if it has the necessary connectivity. If it does, you should ensure you have the latest version of the Cash App app. If not, try restarting your phone or shutting it down. However, if your phone has internet access, you should be able to find your bank name and address with just a few clicks of the mouse.

What is my Cash App bank name and address?

You can also find your Cash App bank name and address through the Cash App mobile app. The Cash App app has a dashboard to access your account information. Once you have access to the dashboard, you can enter your bank name and routing number. You can also view the amount of money you hold in your account. You can also set up direct deposits through the app if you have a Cash Card.

You might have received a Cash App debit card from Sutton Bank. However, your Cash Card is not federally insured, meaning you are not earning any interest on the money you deposit. However, the Cash App is an effective way to manage your money. You can set up direct deposits through Cash App and receive stimulus payments through the app. You can also obtain your employer’s check directly into your Cash App account. However, if you are still unsure of your bank’s name and address, try troubleshooting your account.

How to find your Cash App bank name?

The Cash App bank name and address may be tricky, but it is possible. It is possible to locate your bank’s name and address by knowing the correct account number. If you are having trouble finding your Cash App direct deposit bank name, it might be because you have a different routing number than the other Cash App users on your network. It might also be an indication that your phone has a technical issue. However, if your phone has a solid internet connection, you should be able to find out the correct information.

The Cash App’s bank name and address can be found in the app, but you may also need to look elsewhere. You can also check your bank’s website for more information about your account. You may need to share your bank information if your employer uses a Cash App.

1 note

·

View note

Text

Safely navigating DIY T – acquisition and health

A lot of the safety tips in terms of navigating online will come from this video, which is actually about safely navigating reproductive procedures post the overturning of Roe v Wade, but the safety advice works especially well here.

If any questions are not answered here please feel free to shoot me an ask.

Google Doc for easier navigation, says all the same stuff as here.

First off if you haven't already, check the transmasc guide on the DIY HRT Wiki, this post is made with the assumption you have already read that.

- General internet safety

When searching for and purchasing DIY T (especially injections), use the TOR browser with a VPN. This will keep your internet privacy as secure as possible, and the VPN will change your IP enough to make it look like it was accessed from a different location.

I personally use Proton, it’s a free VPN with an optional paid upgrade. The free version will connect you to either the US, Netherlands, or Japan.

Proton also has its own email service. Some of the sources where you can receive DIY T from may require you to make an account. I recommend using an email through Proton for this because it is end-to-end encrypted. If the site asks for a phone number just put in a repeating order of 0 to 9.

- Safety when purchasing T

Some sites where you can get DIY T will only allow the purchase through use of bitcoin or other forms of cryptocurrency. I know and understand we all have our thoughts on crypto and it’s use in the modern day, but unfortunately this is just how things are when navigating this.

The least scam-possible way I have seen when purchasing bitcoin, is to go through CashApp. They have an option to purchase and sell bitcoin in the app. I personally used this when buying DIY T to stock up in the case shit hits the fan. It’s pretty direct in purchasing and selling, sending is where it may get a bit tricky.

The source for DIY T listed on the DIY HRT Wiki will send you an email once you confirm your order, and you will be prompted to send the bitcoin through either a QR code or directly to a bitcoin address. I had a bit of trouble with the QR code, so what I had to do was type in the direct address. This will not bring up the company’s name, it will just allow the option when the address is fully typed.

If you are able to use a credit/debit card, what I recommend is using cash to purchase a prepaid visa and using that to order your T or otherwise online. This will make sure the transaction is not attached to your bank account.

- Receiving T safely

I highly recommend getting your DIY T sent to a PO Box, and not your home address. The United States Postal Service is in personal experience – really secure and discrete. And even if your package does not fit in your box, you will be given a slip to take to the counter, and they will give you your package there.

When ordering, try to order from a warehouse based in your country. This is to avoid the hassle of it going through customs. But if you must order abroad, it is still very unlikely that your order will be stopped in customs. They do not open packages to check them, instead they use an x-ray machine. If your order does get stuck in customs, it’s likely because there’s an issue with paperwork, and not the order itself.

- Administering T safely

When performing a T injection, make sure your supplies are sterile. Not just clean, sterile. Inspect the packaging of your syringes, needles, etc. If there is a tear or hole, do not use it.

For your T vials, yes, it is okay to draw from them multiple times. You can sterilize the vial by using isopropyl alcohol (rubbing alcohol) or an alcohol swab. You’re likely to not use the entire vial in one injection, so just keep it in a safe place, many even recommend keeping it refrigerated between doses.

Most if not all T vials will say to administer only via intramuscular, but you can still administer this subcutaneously. Even the vials I get through my doctor say For IM Use Only. It’s okay to administer it SubQ.

If you have trouble administering injections like I did for a while, I recommend this auto injector. You load the syringe into the device and press a button. The needle will go in and you just push the plunger down. This device is technically intended for insulin injections, but it works just fine for other injections.

My recommendation is to use an 18g needle to draw, and a 1/2in 25g needle to inject. This has left me with the least discomfort and uneasiness with injecting.

- Blood work

If you’re on T, it’s recommended you get your labwork done at least every 3 months.

As someone who’s been given the run around in the medical field for reasons unrelated to my transition, I forever recommend ordering labs from Request a Test. This is something that is very common to do, I even ordered my own ANA test when I had to get other labs done for my work. Request a Test does not take insurance unless it’s through an HSA card. When ordering from RaQ, you will be prompted to select which LabCorp or QuestDirect facility you want the order sent to. I personally recommend LabCorp, especially considering the QuestDirect Testosterone test is only available for males.

You will want to order at a minimum, a T level total test or a T level free test, and a CBC and CMP. The CBC is to help check for polycythemia, and CMP is to help check your liver function.

If you are worried about you ordering your T levels and that being found out, you can also order an at home testosterone test kit. The blood samples are collected through lancets similar to what is used by diabetic patients.

- Acquiring T gel

Unfortunately there are not a whole lot of sources to get T gel from. But that does not mean they do not exist.

I personally have been using this brand called Androgenesis in between my injections, and it has been working really well. I take 50mg of T every two weeks, and when I got my bloodwork done recently my levels were >400, even when it’s really close to my next shot day.

You can order Androgenesis either directly from their site, or you can order it off of amazon. NOTE, that the standard formula on amazon can not be sent to a PO Box or amazon locker, because the site classifies it as a “potentially dangerous substance”. However the enhanced formula can be sent to a PO box or amazon locker and it works the exact same way.

Another site is Predator Nutrition (odd name but bear with me).

I am still waiting for my order, but I’d recommend either their EpiAndrogel or their Alpha Gel depending on which one is in stock at time of purchasing.

I also recommend keeping an eye out on Need2BuildMuscle. Their gel is currently out of stock, but from what I’ve seen it works quite similarly to AndroGel.

As of 08/02/2024 (Aug. 2nd), I did find sources for packets of 1% Androgel, which you can find here and here

Please note the brand name Androgel sources are ones I unfortunately have not been able to verify personally so please proceed at your own discretion, but the sources *are* listed on hrtcafe.net.

- Who to tell?

No one *. If you doctor doesn’t know you’re on DIY T, do not bring it up. Don’t go talking about it all willy-nilly in the grocery store or whatnot.

*The exception is paramedics. If you are having a medical emergency, it’s probably a good idea to tell any emergency medical provider that you’re on testosterone so they can treat you properly. Remember, tell the cops nothing, tell the ambulance everything. The people on the ambulance are there to save your life, and I can guarantee they’ve dealt with circumstances far more severe than someone self-administering a specific hormonal medication. I say this as someone who’s on first aid at their place of work – and had to patch someone's hand after they were injured when I worked retail.

tagging @mythical-moonlight

34 notes

·

View notes

Text

When Does the Weekly Limit Reset on Cash App? A Comprehensive Guide

Cash App weekly limit for sending and receiving money depends on the status of account verification. Accounts that are not verified may only transfer as much as $250 per week and a total of $1000 per month. Cash App weekly limit is not reset on a particular date of the week. The reset time begins when you have reached the limit and continues to count down until it resets. It is therefore important to keep track of when you have exceeded them, so that you are aware of when they reset. To check them out, launch Cash App and navigate to your profile section. Let's begin and learn about the weekly limit of Cash App in greater detail and address the most important question: when does Cash App weekly limit reset?

What Is the Cash App Weekly Limit?

The Cash App has weekly limits on the exchange and transfer of funds to safeguard users from frauds, money laundering and other illegal activities. It ensures that they follow the anti-money laundering (AML) laws and remains safe for all users using the platform. The Cash App's weekly limit is the maximum amount you can transfer or withdraw within 7 days period.This limit could differ based on whether your account is verified or not. For verified users Cash App limit for a week is $250 for sending money.

When Does the Cash App Weekly Limit Reset?

The daily limit on Cash App is a continuous seven-day timeframe. It means that your limit is not reset at a set date like Sunday’s midnight, but instead seven days after each transaction. For instance, if you made a transaction on a Tuesday, at 3pm, that amount will "reset" and become available the following week, exactly one week later, at 3PM on the next Tuesday.

How to Check Your Cash App Weekly Limit?

You can check the available Cash App weekly limit by taking the steps mentioned below:

Open the Cash App on your Android or iPhone device.

Go to the Profile section.

Then click down until you reach the "Limits" section.

Here will find the total amount you have sent to, received, or removed, as well as the remaining limitations for the week in question.

How to Increase Your Cash App Weekly Limit?

If you are a verified user (those who have provided additional personal details like your full name and birth date and Social Security number), Cash App raises the limits significantly. Once verified, you can make payments up to $7500 per week and receive an unlimitable amount of cash. Here is how to increase Cash App weekly limit:

First of all, log into your Cash App account

Then go to Profile section and verify your identity

For this, you will be asked to shareall your personal information, including the date of birth, as well as the four digits that make up your Social Security number.

After your account has been verified, your limit for sending will be increased to $7,500 per week. In addition, your Cash App receiving limit will be unlimited.

What is the Cash App Weekly Limit for Withdrawals?

Cash App also putslimits on the amount of money you can withdraw from your bank account within the course of a week. In general, unregistered accounts can withdraw as much as $500 per month, and verified accounts are able to withdraw more. Like the limit for sending however, the Cash App weekly limit for withdrawals is reset on a rolling basis. The reset of every withdrawal takes place exactly seven days following the transaction.

Conclusion

Cash App’s weekly limits are designed to offer security and prevent fraud. By understanding the rolling reset schedule and verifying your identity, you can increase your Cash App’s limit and better manage your transactions. Keeping track of your transaction dates and knowing how the 7-day rolling period works will help ensure smooth transfers on Cash App.

2 notes

·

View notes

Text

Understanding Cash App Withdrawal Limits: How Much You Can Withdraw Weekly

In today's fast-paced digital world, mobile payment apps like Cash App have revolutionised how we manage our money. With a few taps on your smartphone, you can send, receive, and even withdraw cash from your Cash App account. However, if you're a frequent user or need to access large amounts of cash, how much can you withdraw from Cash App weekly? Understanding Cash App's withdrawal limits and how to increase them is essential for managing your finances effectively. This comprehensive guide will delve into the weekly withdrawal limits, daily caps, and how you can maximize your use of Cash App for both ATM and direct withdrawals.

How Much Can You Withdraw from Cash App?

The question of how much you can withdraw from Cash App weekly is common among users who regularly transfer funds or use their Cash App card at ATMs. Cash App has established specific withdrawal limits to maintain security and comply with banking regulations.

For most users, the standard withdrawal limit from Cash App is $1,000 per week for ATM withdrawals. This limit applies whether you're withdrawing cash directly from an ATM using your Cash App card or transferring funds to a linked bank account and withdrawing the cash there. However, this limit can vary based on several factors, including account verification status, transaction history, and other security measures. If you're a verified user, you may be eligible for higher withdrawal limits, but you'll need to follow specific steps to unlock them.

What are the Cash App ATM Limits?

The Cash App ATM limit is crucial for users who frequently withdraw cash from ATMs using their Cash App card. The standard ATM withdrawal limit is $310 per transaction and $1,000 per 24-hour period. This limit ensures that users can access cash as needed while maintaining a level of security to prevent fraudulent activity.

Understanding these ATM limits is essential for planning your withdrawals, especially if you need to access large amounts of cash in a short period. If you frequently find yourself hitting the ATM limit, there are steps you can take to increase it, which we'll cover in more detail below.

How to Increase ATM Limit on Cash App?

If you're looking to increase Cash App ATM limit, you'll need to ensure that your account is fully verified. Here's a step-by-step guide to help you through the process:

Verify Your Account: To unlock higher ATM withdrawal limits, you must verify your Cash App account. This involves providing your full name, date of birth, and the last four digits of your Social Security number. Cash App may require additional information, such as a photo ID or proof of address, to thoroughly verify your account.

Build a Transaction History: Regular use of your Cash App account and maintaining a good transaction history can contribute to higher withdrawal limits. By demonstrating consistent, responsible usage, you may be eligible for limit increases over time.

Contact Cash App Support: If your needs exceed the standard withdrawal limits, consider reaching out to Cash App support directly. Explain why you need a higher limit and provide any necessary documentation. While there's no guarantee that your request will be approved, users with verified accounts and a solid transaction history often have more success in obtaining higher limits.

FAQs

1. How can I check my current Cash App withdrawal limit?

You can check your current withdrawal limit by navigating to the settings within your Cash App and reviewing your account details.

2. Why is my Cash App withdrawal limit only $1,000 per week?

The standard Cash App withdrawal limit for most unverified users is $1,000 per week. To increase this limit, you need to verify your account and follow the steps outlined earlier.

3. Can I increase my Cash App withdrawal limit to more than $1,000 per week?

Yes, by verifying your account and maintaining a good transaction history, you can request an increase in your withdrawal limit. In some cases, reaching out to Cash App support directly can also help.

4. How long does it take to increase my Cash App withdrawal limit?

After submitting verification information, it typically takes a few days for Cash App to review and approve your request for a limit increase.

5. What should I do if my Cash App withdrawal limit increase request is denied?

If your request is denied, review the information provided for any errors and ensure your account is in good standing. Consider contacting Cash App support for further clarification.

6. Are there any fees associated with exceeding the Cash App withdrawal limit?

There are no fees for exceeding the limit because Cash App will not process any withdrawal that exceeds your current limit. You must wait for the limit to reset or increase it by verifying your account.

Conclusion

Understanding how much you can withdraw from Cash App weekly is essential for effectively managing your finances and ensuring you have access to funds when needed. By knowing your limits and how to increase them, you can maximize your use of the platform and enjoy greater financial flexibility. Follow the steps outlined in this guide to increase your withdrawal limits and make the most out of your Cash App experience.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

3 notes

·

View notes

Text

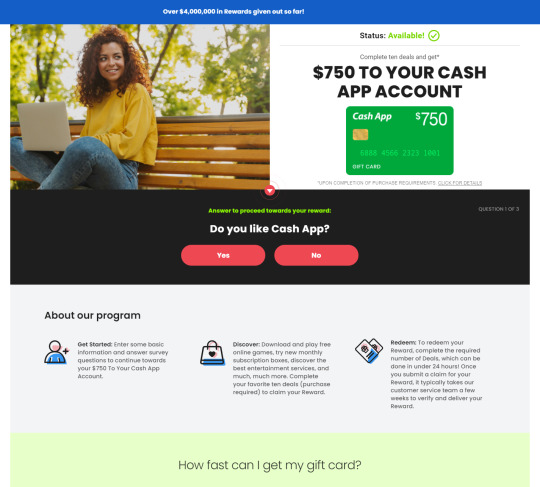

Your Chance to get $750 to your Cash Account!

Cash App is a mobile payment service developed by Square, Inc. It allows users to send and receive money to friends and family, as well as pay for goods and services using a mobile app. Here are some key features and aspects of Cash App:

Peer-to-Peer Payments: Cash App enables users to send money to other users quickly and easily using their mobile phone number, email address, or $cashtag (a unique username).

750$ Cashapp

Cash Card: Cash App offers a customizable debit card called the Cash Card, which is linked to the user's Cash App balance. Users can use the Cash Card to make purchases at retail stores or online, withdraw cash from ATMs, and even earn rewards on certain purchases.

Bitcoin Transactions: Cash App allows users to buy, sell, and store Bitcoin directly within the app. This feature provides users with a convenient way to invest in cryptocurrencies.

Direct Deposit: Users can set up direct deposit to receive paychecks or government benefits directly into their Cash App account. This feature eliminates the need for a traditional bank account for those who prefer to manage their finances through the app.

750$ Cashapp

Cash Boosts: Cash App offers a rewards program called Cash Boost, which provides users with instant discounts on purchases made with their Cash Card at select merchants. Users can choose from a variety of Boosts, which may include discounts on coffee shops, restaurants, and popular retailers.

Security Features: Cash App employs various security measures to protect users' accounts and transactions, including encryption, biometric authentication (such as fingerprint or Face ID), and optional security features like passcode locks and transaction notifications.

Fees: While Cash App is free to download and use for sending and receiving money, it may charge fees for certain transactions, such as instant transfers or Bitcoin transactions. Users should review the app's fee schedule for more information.

Overall, Cash App provides a convenient and user-friendly platform for sending money, making purchases, and managing finances on the go

Enter to Win 750$ Cashapp Dollar

5 notes

·

View notes

Text

What Bank is Cash App and How Does It Work: Cash App Direct Deposit Bank

If you are doubtful about the Cash App bank name, you have landed at the right place. Here we are going to discuss the Cash App bank name and how it works. Does Cash App work with one or two banks? Well, you are going to get all the answers related to the Cash App bank. Like other financial apps, Cash App has tied up with banks to manage its direct deposits and Cash App cards. Further, Cash App is a bank alternative for those who are not having traditional bank accounts. It provides banking services and debit cards (Called Cash Card) through its bank partners. So, without any further ado, let’s know ‘what bank is Cash App and how does it work?’ and, how to find the bank name.

What bank is Cash App?

Firstly, you should know that Cash App is not a bank, it is a bank alternative for those who are not having traditional bank accounts. Cash App is a safe and secured financial services platform with millions of active users in the US and UK as it is only available in these two places at this time. As mentioned earlier, it is not a bank account, it is a financial app that offers banking services and issues debit cards through its bank partners. So, it is an app that works in association with two different banks. It works with Sutton Bank and Lincoln Savings Bank to manage its financial services.

However, a single Cash App user can’t have two banks, here you can find out exactly which one it is in your case.

How to find what bank is Cash App?

It is quite easy to find the name of your Cash App bank. To do so you should open the Cash App on your mobile device. Then tap the routing number and account number. You can see them below your balance in the banking tab (“$”).

How does Sutton bank manage Cash App?

You can find the bank name by using routing number and account number. You can find the bank name by googling the routing number and account number that you can locate below the balance tab ($). Once you are clear about your Cash App bank, it is easy to know its working. Suton bank is the main bank of Cash App that issues Cash Cards to Cash App users and manages its Cash Cards functions and transactions. Sutton bank works as a trading partner of the Cash App and handles all the tasks associated with the Cash App debit cards.

Does Sutton bank manage Cash App direct deposit?

As mentioned above, Cash App works with two banks- Sutton bank and Lincoln Savings Bank. Here the Sutton Bank issues and manages card-related activities on the other hand, Lincoln Savings Bank regulates Cash App online financial transactions and direct deposits.

Except for issuing a Cash App card, it has no relation with Cash App.

When a Cash App user applies for Cash Card, Cash App forwards the application to Sutton. Then Sutton bank representatives go through the application, check out all the formalities and verify the document sent for Cash Card. If everything is ok with your documents, they issue a Cash Card which gets delivered to you within 8-10 days.

Can you log in from the Cash App into Sutton Bank?

No, you can’t login into Sutton bank with your Cash App as Sutton bank doesn’t support Cash App. Sutton Bank issues Cash App Cards to the users of Cash App and no other association.

Can I find the address of Sutton bank Cash App for direct deposit?

There is no address for Sutton Bank Cash App direct deposit as Sutton Bank does not deal with Cash App users in a direct way. Sutton Bank is only responsible for issuing Cash App Cards and handles Cash Card related services.

Is Cash App a Sutton Bank?

No, Cash App is not a Sutton Bank but it is a financial platform that works with two banks - Sutton Bank (issues Cash Card) and Lincoln Savings Bank ( for making direct deposit).

How to enable direct deposit on Cash App

With Cash App direct deposit, you not only paychecks but also make other payments including your tax returns. If you want to enable direct deposit, you have to first locate your routing and account number on the Cash App.

After enabling direct deposit, you succeed in increasing the direct deposit limit and you’re able to receive up to $25,000 per direct deposit and up to $50,000 in a day.

If you succeed in enabling direct deposits, these are available in your account even up to two days earlier than most banks. However, it might take some extra time if you are making the direct deposit for the first time.

Cash App works with two banks and each bank has its specific roles and duties to perform. For instance, we have discussed above the role of Sutton Bank. However, you are not very familiar with Lincoln Savings accounts. Lincoln Savings Bank manages Cash App direct deposits.

How to find the bank address with routing number

It is quite easy to find the bank address with the routing number. You can use the US Routing number checker to validate and find bank addresses based on its database. With Routing number checker, you find Bank name and its address including (city, state, and ZIP) and phone number. So, you can find your Cash App bank name and address with the routing number available under the balance tab in the Cash App.

Do you need a Cash App bank to pay bills with Cash App?

While you pay bills you need to use your account and routing number. If you are proceeding to pay bills using your account and routing number, follow these steps:

Go to the home screen of the app and tap the “Banking tab”.

Now, select the “Deposits &Transfers”.

Then, copy the account details.

Paste the detail while setting up bill pay when prompted for a bank account.

Finally, we believe the above information is helpful for you. Cash App is not a proper bank but is a financial platform and a bank alternative for those who are not having a traditional bank account. Cash App works with two banks as mentioned above- Sutton bank and Lincoln Bank.

4 notes

·

View notes

Text

The Next Big Thing: Exploring the World of Cash App Clone

In today's fast-paced world, managing finances has become more convenient than ever before, thanks to the emergence of innovative mobile applications. Among these, the Cash App has garnered significant attention for its user-friendly interface and seamless money transfer capabilities. But what if you could replicate its success with your own custom solution? Enter the Cash App Clone – a revolutionary concept that is reshaping the financial landscape.

Understanding the Cash App Phenomenon

Cash App, developed by Square Inc., has become synonymous with peer-to-peer payments, allowing users to send and receive money effortlessly. With its straightforward design and intuitive features, it has amassed millions of users worldwide, transforming the way people handle their finances.

The Birth of Cash App Clone

Inspired by the success of the Cash App, developers and entrepreneurs have sought to create their own versions of this popular platform. These clones aim to replicate the core functionalities of the Cash App while offering additional features tailored to specific user needs.

How Does a Cash App Clone Work?

A Cash App Clone operates on a similar principle to its predecessor – facilitating secure transactions between users. Users can link their bank accounts or debit cards to the app, enabling them to send money to friends, family, or merchants with just a few taps on their smartphone.

Features That Make a Cash App Clone Stand Out

While the basic premise remains consistent across Cash App Clone, developers often integrate unique features to differentiate their product. These may include:

In-app chat functionality for seamless communication.

Integration with popular payment gateways for added convenience.

Personalized reward programs to incentivize usage.

Budgeting tools and financial insights to help users manage their money effectively.

Benefits of Using a Cash App Clone

The adoption of a Cash App Clone offers numerous benefits to both individuals and businesses alike:

Convenience: Instantly send or receive money anytime, anywhere.

Accessibility: Reach a broader audience with cross-platform compatibility.

Cost-effectiveness: Avoid the hefty transaction fees associated with traditional banking methods.

Security: Benefit from robust encryption protocols to safeguard sensitive information.

Flexibility: Customize the app to suit your specific requirements, whether it's for personal use or business transactions.

Security Measures to Safeguard Your Transactions

With the proliferation of digital payment solutions, security concerns have understandably become a top priority for users. Cash App Clone addresses these concerns by implementing stringent security measures, such as:

Two-factor authentication (2FA) is used to prevent unauthorized access.

End-to-end encryption to protect sensitive data during transmission.

Regular security audits and updates to mitigate potential vulnerabilities.

Future Prospects of Cash App Clones

As society continues to embrace digitalization, the demand for innovative financial solutions is expected to soar. Cash App Clone is well-positioned to capitalize on this

trend, offering a convenient and secure alternative to traditional banking methods. With ongoing advancements in technology, the possibilities for future iterations of Cash App Clone are virtually limitless.

In conclusion, the rise of Cash App Clone represent a paradigm shift in how we interact with money. By harnessing the power of mobile technology, these clones empower users to take control of their finances with ease and confidence. Whether you're a tech-savvy individual or a forward-thinking entrepreneur, embracing this revolution could be the key to unlocking financial freedom in the digital age.

Ready to explore the future of financial technology? Dive into the world of Cash App clone and discover the next big thing in digital transactions. Join us at Omninoz to stay ahead of the curve and revolutionize the way you handle your finances. Let's embark on this exciting journey together!

3 notes

·

View notes

Text

Buy CashApp Accounts

24 Hours Reply/Contact

Email:- [email protected]

Whatsapp:- +1 (531) 309-0897

Skype:– Trustbizs

Telegram:– @Trustbizsshop

Are you looking to buy cash app accounts with LD backup? If your answer is “Yes”, you are in the right place. We provide login access, our accounts have high limit for smooth transaction. So, you can buy cash app accounts from trustbizs.com.

Our Acc. Info and Offers:

Phone number verified

Unique email address (USA number verified)

SSN verified

LD Backup Available For Safety

Driving license verified (Active)

Account access from USA

Have higher transaction limit (15K, 25K and 50K)

Instant delivery confirmed

Refund guaranteed with conditions

100% customer satisfaction guaranteed

If you want to buy any Products from the best place Trustbizs you can place your order. We provide the best quality USA, UK, CA, and other countries with 100% verified accounts within a little bit of time at the best price. So, you can place your order to get the best quality service.

24 Hours Reply/Contact

Email:- [email protected]

Whatsapp:- +1 (531) 309-0897

Skype:– Trustbizs

Telegram:– @Trustbizsshop

Buy Verified Cash App Accounts

Cash app is a convenient mobile payment banking platform in the western world including the USA. To buy, before know the details of anything in online, you should check the reviews for your safety before taking that product or services. According to a survey of 2021, around $70M+ annual transaction done through the cash app account and the gross profit was about $1.8+ and it’s remarkable. Buy Verified Cash App Accounts.

Business holders want to transact money through cash app because of its higher security system, user experiences, and facilities. Know more things about cash app, read cash app reviews. And must analyze the cash app reviews and take your concrete decision to buy verified cash app accounts.

Which documents you will get in our cash app accounts?

Let’s see which documents we attach with our cash app account:

Phone number

Unique email address

Birth date

Official identity card (SSN, Identity card)

Credit card, Debit card, and Bank Account

Driving license

LD backup available

Account access with exact country IP address

Express delivery with replacement guarantee

And money back guarantee

Why we give only safe and verified accounts and support 24 hours?

Our accounts are fully verified, safe and stable. We decided to provide only verified account to the customers to reduce their transaction problem and our team will give 24 hours customer support. So, if you want to buy verified cash accounts then contact us and take our fully verified, stable and safe account.

Our especial team is full of experienced people who are working with cash app since the foundation of the cash app platform. They know how to make a verified account, what is the updates of the cash app account. So, I hope you got the point what is our team management and what is our facilities. Buy Verified Cash App Accounts

Is cash a safe money transaction platform?

But if you don’t have verified cash app account then avoid transaction through it. The authority of cash app is very strict and they always recommend to use verified cash app e-wallet that’s why we only provide documents verified cash app e-wallet account. Buy Verified Cash App Accounts

How especial our team management for the cash app accounts making, its verification and timely delivery timely to the customers?

We arranged and decorated our team for individual service so that the experts can make the account properly. They can verify the accounts with only legal and trusted documents.

Our managing director given instruction to the workers to ensure the quality accounts and timely delivery to gain the customer trust and full of satisfaction. We expect customer satisfaction and it’s our main goal before earning. Buy Verified Cash App Accounts

Cash app charge in money transaction. Buy verified cash app accounts-

Here cash app is more secured and trusted and customer friendly. For bank and debit card payments, no charge is required but if you want to pay through the credit card then you have to the charge 3-4% of the transaction amount.

So be connected with trustbizs.com and take your desired products. People of the western world know better and buy aged cash app accounts from real warriors. Buy Verified Cash App Accounts

But if you want to instant transfer funds from your account to linked. So, you can see the money transfer facilities. You can buy aged cash app accounts and buy Bitcoin and trade with that through the crypto exchange platforms such as co-coin, all others crypto currency exchangers. Buy Verified Cash App Accounts

Why people love to buy verified cash app accounts from us?

We transfer money, take money, and send money through the cash app without any problem. So, you can also get the opportunities and offers of cash app in money transaction and online trading especially crypto trading.

And know details and then read our product details and buy cash app accounts from our team management. After reading the reviews and our account details in this description only then buy cash app accounts from trustbizs.com. We are only providing all documents verified cash app USA accounts according to the customers need. Buy Verified Cash App Accounts

Offers and advantage to buy cash app accounts cheap?

Cash app provides its audiences multiple opportunities, advantages in online marketing, crypto currency trading & especially in mobile banking with high security. We are the best creator of cash app accounts and we know better about the platform.

Our team gives the accounts with full security and loyalty at exact, minimum pricing comparing to the others agency. But we can say you can take our service without any problem frankly. Buy Verified Cash App Accounts

To grow your business perfectly and to get payment and send money, and any other convenient demanding work, cash app e-wallet can be your best method. There are thousands of transaction platform is available in in this universe, but cash app e-wallet is one of the best e-wallet in time for its multiple function to assist the users properly. So, trustbizs.com is recommending you buy cash app accounts from here. Buy Verified Cash App Accounts

Different limits for various transaction types-

Cash App imposes different limits on money transfers. For new users, the sending limit is $250 per week. After verification, this limit increases to $7,500 per week. The receiving limit is initially unlimited. The Cash Card, which works like a debit card, has its own spending restrictions. Users can spend up to $7,000 per day and $25,000 per week.

Buy verified cash app accounts (verified with SSN, selfie, bank and BTC-enabled high limits 15k to 25k per week) at trustbizs.com. Buy Verified Cash App Accounts. Concerning cryptocurrency and investments, Cash App allows buying and selling. Bitcoin withdrawals are capped at $2,000 per day and $5,000 per week. Stock trading limits depend on market conditions.

How cash app used in business transaction?

Cash App provides a seamless payment experience for businesses with its customization options. Business owners can easily set up and adjust payment methods to suit their needs. One standout feature is the unique $Cashtag. Each business gets a personalized identifier that customers can use to send money. Buy verified cash app accounts at trustbizs.com. We provide LD backup with the login access.

This $Cashtag acts as a distinct brand mark for the company and streamlines transactions. Moreover, businesses can share their $Cashtag on various platforms. This makes it easy for clients to remember and use when making payments. The flexibility of Cash App’s payment options ensures that every transfer is quick and efficient.

What are the customization options for checkout with cash app?

Cash App offers businesses the flexibility to customize their checkout experiences. With diverse payment options, companies can cater to a broader customer base. Customers choose from debit cards, credit cards, or direct bank transfers. Buy verified cash app accounts.

Custom branding is also a key feature of Cash App’s checkout customization. Businesses can integrate their logo, color scheme, and design aesthetics into the payment gateway. This ensures a consistent brand experience from start to finish.

The app also supports unique checkout flows. This means businesses can streamline the buying process. They adapt checkout stages to match their sales strategy. Offering a tailored experience resonates well with customers and can boost conversion rates. Buy cash app accounts.

What are the Requirements for Setting up a Cash App Account for Businesses?

To set up a Cash App account for businesses, you need a valid business name, bank account, and an email or phone number. You will also need an EIN or SSN to verify your business identity. Creating a business profile on Cash App is a straightforward process designed to integrate seamlessly into your business’s financial toolkit.

Cash App provides an alternative to traditional banking with its user-friendly platform that caters specifically to the unique needs of businesses. It allows entrepreneurs and small business owners to send, receive, and request money instantly. The platform promotes a simplified approach to transactions, offering features such as easy invoicing and the ability to receive payments through unique $Cashtags.

Establishing a Cash App business account can streamline operations, offering a modern touch to your financial dealings and helping you keep pace with the digital economy. Buy verified cash app accounts. Buy Verified Cash App Accounts

How User-Friendly is the Cash App Platform for Both Individuals and Businesses?

Cash App is highly user-friendly for individuals and businesses, offering easy navigation and quick transaction processes. Its intuitive interface streamlines payments, making it accessible for users of all levels. Cash App, integrated with simplicity and efficiency in mind, has become a popular financial platform among users who value convenience. Catering to both personal and professional financial needs, the app enables seamless money transfers, bill payments, and direct deposits with just a few taps. Buy cash app accounts.

Cash App provides a quick way to accept payments and offers unique features like the Cash Card, which enhances the transaction experience for customers. By incorporating user feedback and constantly updating its features, Cash App remains a competitive contender in the digital payments space, catering to a diverse range of financial interactions. Buy verified cash app accounts at trustbizs.com with LD backup at cheap price. Buy Verified Cash App Accounts

How Customizable are the Payment Options on Cash App for Businesses?

The payment options on Cash App for businesses are quite flexible, allowing for a variety of customization features. Business users can set transaction amounts, add tipping options, and utilize reporting tools for financial management. Buy verified cash app accounts at trustbizs.com with LD backup at cheap price.

Cash App offers an appealing platform for small business owners and entrepreneurs seeking to streamline their financial transactions. By using this app, businesses can effortlessly receive payments and manage their finances with its user-friendly interface. Customization is a key aspect of Cash App, catering to diverse business needs and preferences. Buy cash app accounts. Buy Verified Cash App Accounts

Why Trading Experts Suggest to Buy Old Cash App Account With High Transaction Limits??

Trading experts recommend buying old Cash App accounts with high transaction limits because they allow for immediate, higher volume trading. These established accounts bypass initial limitations imposed on new users. Navigating the world of digital transactions requires a strategic approach, especially for frequent traders and investors. Buy verified cash app accounts at trustbizs.com with LD backup at cheap price.

An old Cash App account with elevated transaction limits is a coveted asset to execute larger trades swiftly without the typical wait for increased limits. Cash App’s security measures incrementally elevate transaction capabilities as an account matures, making older accounts with a transaction history highly desirable. This discussion highlights the practical reasoning behind why experienced financial traders and advisors often seek out and endorse purchasing mature Cash App accounts for enhanced transactional freedom. Buy old cash app account. Buy Verified Cash App Accounts

What are the Advantages of Integrating Cash App with Online Stores?

Integrating Cash App with online stores offers streamlined payments and enhanced customer convenience. Merchants benefit from quick settlements and reduced transaction fees. Cash App’s integration into online shopping platforms marks a significant advance for e-commerce operations. This alliance presents both shoppers and retailers with a suite of appealing benefits.

Simplified transactions, secure payment processing, and immediate fund transfers are among the chief advantages, providing a seamless checkout experience. With Cash App, customers enjoy the ease of using their mobile devices for purchases, while merchants appreciate the direct access to a broad user base and the potential for increased sales.

The service’s popularity and user-friendly interface make it an excellent addition to any online store’s payment options, keeping businesses competitive in the fast-moving digital marketplace. By enhancing payment flexibility and efficiency, this integration is a strategic move for online retailers focused on optimizing their sales processes and improving customer satisfaction. Buy Verified Cash App Accounts

How Customizable are the Payment Options on Cash App for Businesses?

Cash App offers businesses customizable payment options to suit diverse needs. Users can adjust settings for transaction limits and payment requests. Understanding the flexibility of payment solutions for businesses is crucial, especially in the evolving digital marketplace. Cash App, a modern peer-to-peer payment service, caters to this necessity by providing a platform where business owners can tailor their payment experience. Buy old cash app account.

Cash App answers this call by allowing businesses to modify transaction limits and create specific payment requests, providing a bespoke payment environment. This adaptability ensures that both small-scale entrepreneurs and larger enterprises can manage their finances effectively while offering convenience to their customers. The straightforward customization process on Cash App keeps businesses in control of their payment operations, ensuring a seamless financial flow. Buy Verified Cash App Accounts

How reliable is Cash App’s Infrastructure in Handling Large Volumes of Transactions?

Cash App’s infrastructure is highly reliable, managing large volumes of transactions efficiently. Its robust system ensures secure and swift money transfers for millions of users. Cash App, a peer-to-peer payment service, has quickly become a favored choice for digital transactions. With the surge in online banking, users often question the reliability of platforms handling their money. Cash App shines in this regard, with an infrastructure designed for high-volume traffic and secure financial operations.

Buy old cash app account. Backed by Square, Inc. (now Block, Inc.), this application provides users with confidence in conducting daily transactions, whether small or substantial. Buy old cash app account. It leverages advanced encryption and fraud detection technologies to protect funds and personal data. Trust in Cash App’s capability to handle large transaction volumes has been bolstered by its continuous upgrades and user-focused services, making it a go-to payment solution in today’s fast-paced digital world. Buy USA cash app accounts.

Can Cash App Be Used to Accept Payments in Multiple Currencies?

Cash App currently does not support accepting payments in multiple currencies. It only allows transactions in USD and GBP, depending on the user’s location. Navigating the world of mobile payments can feel like venturing into a digital bazaar, each app with its own set of rules and currency restrictions. Among these, Cash App stands out as a popular choice for seamless transactions, yet it’s important to recognize its limitations when it comes to currency flexibility. Buy cash app accounts at trustbizs.com.

How cash used for international transaction?

This platform makes sending and receiving money as easy as sending a text message, but users are bound by the borders of their own currency zones predominantly the United States and the United Kingdom. Whether you’re a freelancer looking to expand your client base or a small business aiming to widen your market reach.

Here understanding the currency capabilities of your chosen payment app is crucial. As we delve further into the digital age, the demand for versatile financial tools becomes more evident, highlighting the importance of staying informed about services like Cash App. Buy USA cash app accounts.

Can Businesses Customize Their Checkout Experience With Cash App? How?

Yes, businesses can customize their checkout experience with Cash App by integrating Cash App Checkout, which allows for customizations. Merchants do this through the app’s API, tailoring it to their needs. Navigating the dynamic world of online payments, entrepreneurs continually seek innovative ways to enhance the customer journey.Buy verified cash app accounts verified with email, phone number, birth date, SSN, debit card, Driving license and bank account available

Cash App steps up to this challenge, providing a platform conducive to crafting a bespoke checkout experience. With its user-friendly interface, Cash App empowers businesses to personalize their payment process, aligning with their brand’s ethos and the expectations of their customer base. This personalized approach aids in elevating the customer’s end-to-end shopping experience, fostering loyalty and potentially increasing conversion rates. Buy USA cash app accounts at trustbizs.com.

What are the Limits of Cash App for Certain Types of Transactions?

Cash App limits unverified users to sending $250 per week and receiving $1,000 per month. Verified users can send up to $7,500 to $15000 weekly and receive an unlimited amount. Understanding the Cash App transaction limits is crucial for users who frequently manage money transfers via this popular platform. The peer-to-peer payment app, designed to facilitate speedy transactions, has set specific caps, catering to two categories of users: unverified and verified. Buy cash app accounts with LD backup at trustbizs.com.

These limits aim to secure accounts and comply with regulatory requirements. The verification process, which requires additional personal information, unlocks higher sending limits for users who need to move larger amounts of money. With its user-friendly interface, the app allows for quick money transfers, bill payments, and direct deposits. Recognizing these limits ensures a smooth and hassle-free financial experience. Buy USA cash app accounts.

How to increase the transaction limit of cash app accounts?

Using Cash App requires a simple sign-up. New users download the app and provide basic personal details. To start, there’s a transaction limit. To increase this limit, identity verification is crucial. Users must submit additional information, such as their Social Security Number (SSN).

This step is vital for unlocking higher transaction capabilities. Verifying your identity elevates account status. Sending money has an initial cap. The cap is low to keep things safe and secure. Verified users enjoy enhanced transaction limits. The process ensures only you access your money. Buy cash app accounts.

How Does Cash App Simplify the Process of Managing Payments for Businesses?

Cash App streamlines payment management for businesses by offering simple transfer and tracking features. It integrates easily with existing financial systems, enhancing efficiency. Navigating the complexities of business transactions can be daunting. Cash App emerges as a beacon of simplicity in financial management. This platform provides a user-friendly interface that allows businesses of all sizes to send and receive payments with just a few clicks.

Not only does it facilitate instant transfers, but it also affords users the convenience of tracking their financial activity in real time. Small business owners particularly benefit from its straightforward setup, avoiding the tangled web of traditional banking protocols. Security features are built-in, giving peace of mind to both the business and its clients. Cash App ensures that businesses can manage their finances efficiently and effectively, without the need for extensive accounting resources. Buy USA cash app accounts.

#bitcoin cash app verification#bitcoins on cash app#Buy a BTC enable cash app account#Buy aged cash app account#Buy BTC enable cash app account#Buy cash accounts#Buy old cash app accounts#Buy USA cash app account#buy verified cash app account Reddit#Buy verified cash app accounts#Buy Verified Cash App Accounts UK#Buy Verified Cash App Accounts USA#does bitcoin work on cash app#how do i enable bitcoin on cash app#how to get verified cash app#how to use cash app with bitcoin#verified cash app account#verified cash app accounts for sale#what is a verified cash app account

3 notes

·

View notes

Text

Now that the blog got banned, just wanna warn people that scammers are on the rise again.

Under NO circumstances should you give anyone your full name, personal email, phone number, address, which bank you use, or username for any other cash app.

No one, and I mean NO ONE would trust a near stanger with money. If it seems too good to be true, then it is. Be friendly but wary. Lie. Report them with details of what they're asking and how they're going about doing it.

Stay safe everyone!

26 notes

·

View notes

Text

On Friday, I tried to do two bank-related admin tasks: 1) setting up my US brokerage account (that holds my company stock) so I can transfer the cash left over from paying US capital gains tax to my German account after changing address; 2) ordering a new debit card for my German account since mine expires soon.

The first one - a five minute phone call; the second one is still unresolved after trying in the app, through customer service chat and with a customer service phone call.

#I was dreading the first task for months#because I feared I had to spell things to an American on the phone#I don’t know the phonetic alphabet#and my address is veeery German

3 notes

·

View notes

Photo

Click bait

Of the deluge of bogus email “Alerts”, “Notifications” and ”Confirmations” my cell phone has absorbed in the past few days (it must be the season), the “OMG SWEEPS” is my favorite:

“John HAS WON $50,000?” I think not and, of course, have no intention of clicking on the link that will answer that burning question. I’m afraid even to click on the link that would allow me to “opt out” of such notifications.”

A “$1,000 TD BANK VISA CARD”: $525,000 via Venmo; $750,000 in “Cash App Funds”: a “WESTERN UNION CASH ENTRY.” All of this, and more, has been laid upon my table.

These scams have trickled in since the day I hitched my wagon to the Internet, but in recent days they’ve come in a torrent. Evidently my email address ended up on the wrong list.

8 notes

·

View notes