#Cayman Islands lifestyle

Photo

Happy Constitution Day, Cayman Islands!

#Cayman Islands#British Overseas Territory#George Town#island#travel#flag#symbol#British#golf#hobby#sport#sports#active lifestyle#vintage flags

0 notes

Note

can we know jared’s net worth!!!!!!!!

Uhm, that's a good question. Like his official one or the secret, illegal one? I think his company is worth several millions. It's probably still a small business with around a hundred employees, maybe a little more and they make a decent amount of money, but Jared also pays his employees well and they all get benefits (including dental!). He also publicly owns several other business, like he's a partner in Mike's gym and the Nine. And then he owns a bunch of other shell companies to launder money. And then he has all his illegal weapons dealing money and all the protection money which is safe and secure in offshore accounts in the Cayman Islands and Switzerland. And then of course there's the house in Chicago that is worth millions and I'm pretty sure by now he's got like a ski lodge in Aspen. So... Idk, if we would add it all up his networth would be around 20 million maybe? If he were to liquidate the company, sell the real estate and the business plus what he's got in the bank. He certainly makes a lot more, but they have an expensive lifestyle 😅 and he does pay his people very well of course. But I think that'd be realistic? Maybe? Idk that much money is all very abstract to me 😅 ten million or fifty it's all equally unreal. But. If I had to give you a number maybe that? If someone out there knows more about finances, and you know, rich people, feel free to chime in!

5 notes

·

View notes

Text

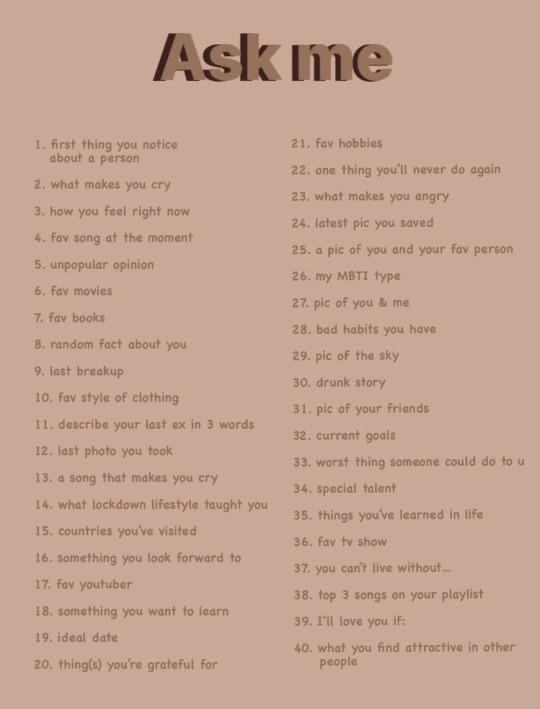

first thing you notice about a person

-face shape/any moles or freckles or scars

what makes you cry

-losing people

-stress

-literally everything

how you feel right now

-pretty good

fav song at the moment

-rlly anything from Midnights -The Fall

unpopular opinion

-(willingly) voting conservative makes you a bad person (specifically about this years vote)

fav movies

-The notebook

-The notebook

-The notebook

-and probably The notebook

fav books

-Looking For Alaska

-Birdbox

random fact about you

-Cambridge, London is my dream college

last breakup

-Blue

fav style of clothing

-IDK- IT DEPENDS

describe your last ex in 3 words

-kind

-funny

-smart

a song that makes you cry

-Hey, Little Girl (sophiemarie.b)

what lockdown lifestyle taught you

-there is a fine line between solitude and loneliness

countries you've visited

-Mexico, belize, roatan, Jamaica, cayman islands

something you look forward to

-my 14th birthday!

fav youtuber

-Tommyinnit

something you want to learn

-idk what this question means

-I wanna go into law and psychology when I’m in college

-but idk if that’s what the question wanted

ideal date

-a fair!!

-or a small cafe date

thing(s) you're grateful for

-my brother

-my friends

-my AirPods (god sends)

fav hobbies

-writing

-video games

-ukulele

one thing you'll never do again

-let a teacher stop me from going to the Social Worker during a panic attack

what makes you angry

-bigotry

-being mean for no reason

-victim blaming

-making fun of people for mental health issues

my MBTI type

-ENFP-T

bad habits you have

-overthinking

-getting frustrated easily

current goals

-become a lawyer

-get my degrees

-win student of the year

worst thing someone could do to u

-make me think people hate me

special talent

-writing

-empathy/making people feel better

things you've learned in life

fav tv show

-I’ve learned a lot about law

you can't live without...

-my brother probably

top 3 songs on your playlist

-You’re on your own kid

-The Fall

-Him

I'll love you if:

-you’re nice to me and others

-that’s rlly it

what you find attractive in other people

-kindness

-humor

-pretty eyes

3 notes

·

View notes

Text

How Lymphatic Massage Can Help Reduce Cellulite: A Comprehensive Guide

Cellulite, a common cosmetic concern, affects millions of people worldwide. Characterized by dimpled skin, it often appears on the thighs, buttocks, and abdomen, and can be challenging to address with standard exercise and diet alone. Fortunately, lymphatic massage is gaining recognition as a potent solution for cellulite reduction. This comprehensive guide explores how lymphatic massage can help reduce cellulite and its benefits as a cellulite reduction treatment.

Understanding Cellulite and Its Causes

Cellulite forms when fat deposits beneath the skin push through connective tissue, creating an uneven surface. Factors contributing to cellulite include genetics, hormonal changes, poor circulation, and a sedentary lifestyle. While it is not harmful, cellulite can affect self-esteem and body image.

What is Lymphatic Massage?

Lymphatic massage, also known as manual lymphatic drainage, is a specialized technique designed to stimulate the lymphatic system. This system is responsible for removing toxins and excess fluids from the body. By enhancing lymphatic flow, this massage technique helps reduce fluid retention and supports detoxification, which can contribute to smoother skin texture.

How Lymphatic Massage Can Reduce Cellulite

Improved Circulation: Lymphatic massage promotes better blood and lymph circulation. Improved circulation helps in breaking down fat cells and enhances the delivery of nutrients to tissues, which can aid in reducing the appearance of cellulite.

Fluid Drainage: The massage technique encourages the elimination of excess fluids and toxins that can accumulate in the tissues. By reducing fluid retention, the skin’s appearance becomes smoother and more toned.

Enhanced Metabolism: By stimulating lymphatic flow, the body’s metabolic processes are enhanced. This can lead to more efficient fat metabolism and reduced fat deposits, contributing to a reduction in cellulite.

Collagen Production: Regular lymphatic massage can stimulate collagen production. Collagen is essential for skin elasticity and firmness, and increased collagen can improve the overall texture and appearance of the skin.

Lymphatic Massage in the Cayman Islands

For those seeking effective cellulite reduction treatments, lymphatic massage in the Cayman Islands is a popular choice. At Ageless Body Cayman, experts provide personalized lymphatic massage services designed to target areas affected by cellulite. Their approach integrates advanced techniques and a deep understanding of the lymphatic system to deliver optimal results.

Conclusion

Lymphatic massage offers a promising solution for reducing cellulite by improving circulation, facilitating fluid drainage, enhancing metabolism, and promoting collagen production. As a non-invasive treatment, it can be an effective addition to a comprehensive approach to cellulite management. For those in the Cayman Islands, Ageless Body Cayman provides specialized lymphatic massage services to help clients achieve smoother, firmer skin and improve their overall appearance.

Whether you are looking to complement your skincare routine or explore new methods for cellulite reduction, lymphatic massage stands out as a beneficial option worth considering.

For more information, visit the website: https://agelessbodycayman.com/

0 notes

Text

Secure Your Cayman Islands Residency with RIF Trust: A Gateway to a New Lifestyle

Unlock the benefits of Cayman Islands residency with RIF Trust's expert guidance. Our tailored services simplify the process, ensuring a seamless transition to a more rewarding lifestyle in paradise. Discover the advantages of living in one of the world's most sought-after locations with our trusted support.

#Greece Golden Visa#Cayman Islands Residency#Anguilla Residency#riftrust#maltacitizenship#maltainvestment#investors#malta#uae goldenvisa#citizenship by investment#permanent residency#residencybyinvestment#citizenship & residency by invetsment

0 notes

Text

Retirement Planning and Insurance in the Cayman Islands: A Comprehensive Guide

Retirement is a milestone that many people look forward to, but it’s also a phase of life that requires careful planning to ensure financial security. In the Cayman Islands, where the cost of living is relatively high, having a robust retirement plan is essential. This comprehensive guide will walk you through the key components of retirement planning and the critical role that insurance plays in securing a comfortable retirement in the Cayman Islands.

1. The Importance of Retirement Planning in the Cayman Islands

Retirement planning is about more than just saving money — it’s about ensuring you have the financial freedom to live comfortably in your golden years. With the unique financial landscape of the Cayman Islands, including its tax-free environment and higher cost of living, individuals must consider various factors when planning for retirement.

Keywords: retirement planning, financial freedom, Cayman Islands

When planning for retirement, it’s essential to consider future expenses such as healthcare, housing, and lifestyle changes. A well-thought-out retirement plan will help ensure that you can maintain your standard of living without financial stress. Additionally, in the Cayman Islands, it’s crucial to factor in the lack of direct taxes, which means you may have fewer tax-advantaged retirement accounts than in other countries. However, this also offers an opportunity to maximize investments and wealth accumulation.

2. The Role of Insurance in Retirement Planning

Insurance is a critical element of a successful retirement plan. It provides protection against unforeseen events that could derail your savings, such as health issues, accidents, or even death. By incorporating insurance into your retirement plan, you safeguard your financial future and provide for your loved ones.

Keywords: insurance, retirement plan, health issues, financial future

For retirees in the Cayman Islands, medical expenses can be a significant burden, especially if you’re dealing with critical illnesses or prolonged care. Life insurance, health insurance, and critical illness coverage are key components that can provide financial relief in times of need. Furthermore, some life insurance plans offer investment opportunities, allowing you to accumulate wealth that can be used during retirement.

3. Types of Insurance for Retirement Planning in the Cayman Islands

There are several types of insurance policies available in the Cayman Islands that can be integrated into your retirement strategy. These include life insurance, health insurance, and long-term care insurance.

Keywords: life insurance, health insurance, long-term care insurance, Cayman Islands

Life Insurance: Life insurance is vital for retirees who want to leave behind a financial legacy for their loved ones. Certain life insurance policies also provide investment opportunities that can be cashed out during retirement.

Health Insurance: Health insurance is indispensable, especially as you age and require more medical attention. Private health insurance in the Cayman Islands can help cover costs not included in public healthcare services.

Long-Term Care Insurance: Long-term care insurance ensures that you receive the care you need if you’re no longer able to care for yourself due to age or illness. This type of insurance covers nursing home expenses and in-home care, both of which can be costly without proper coverage.

4. Investment Opportunities in the Cayman Islands for Retirement

The Cayman Islands offers a unique financial environment that can be advantageous for those planning for retirement. Investment opportunities, including real estate, offshore accounts, and various tax-free vehicles, can help individuals build a substantial nest egg.

Keywords: investment opportunities, offshore accounts, real estate, tax-free vehicles

The lack of capital gains, property, or income taxes makes the Cayman Islands an attractive location for investing. Real estate, in particular, is a popular choice among retirees looking to grow their wealth. Additionally, offshore investment accounts allow individuals to diversify their portfolios, which can provide higher returns and reduced risk. When planning for retirement, it’s essential to take advantage of these opportunities to grow your savings.

5. Pension Plans in the Cayman Islands

Pension plans are one of the most critical tools for retirement planning. In the Cayman Islands, employers are required by law to provide pension benefits for employees, which serve as the foundation for many individuals’ retirement income.

Keywords: pension plans, retirement income, Cayman Islands

In the Cayman Islands, the National Pensions Law ensures that residents contribute to a pension fund throughout their working lives. Both employers and employees must contribute a percentage of earnings to a pension plan. The accumulated pension fund can then be withdrawn during retirement to provide a steady income. However, the amount saved through mandatory pension contributions may not be enough to sustain your desired lifestyle, which is why it’s essential to supplement your pension with personal savings, investments, and insurance.

6. Navigating the Cost of Living in the Cayman Islands During Retirement

The cost of living in the Cayman Islands is notably higher than in many other parts of the world. This reality makes retirement planning even more critical to ensure you can maintain a comfortable lifestyle. Expenses like housing, utilities, groceries, and healthcare can quickly add up, especially without a steady income.

Keywords: cost of living, Cayman Islands, retirement expenses, healthcare

To navigate these challenges, you’ll need a robust financial strategy that takes into account your anticipated retirement expenses. Health insurance, in particular, is essential as healthcare costs can be significant in retirement. Budgeting for these expenses and ensuring you have adequate savings and insurance coverage is key to a secure retirement.

7. Estate Planning and Retirement in the Cayman Islands

Estate planning is a crucial aspect of retirement, ensuring that your assets are distributed according to your wishes and that your loved ones are taken care of after your passing. Estate planning goes hand-in-hand with retirement planning, especially when it comes to managing life insurance policies and other assets.

Keywords: estate planning, assets, life insurance policies, retirement

In the Cayman Islands, estate planning involves managing your assets, property, and any investments that will be passed on to your beneficiaries. Life insurance plays a significant role here, as the payout from these policies can be used to cover estate taxes, funeral costs, and provide financial security for your family. Having a will, trust, and life insurance policies in place is essential to ensure a smooth transition of assets upon your death.

8. Tax Considerations for Retirement in the Cayman Islands

One of the major benefits of retiring in the Cayman Islands is the lack of direct taxes, including income tax, capital gains tax, and estate tax. This tax-free environment makes the Cayman Islands an attractive destination for retirees looking to maximize their retirement savings.

Keywords: tax considerations, tax-free environment, retirement savings, Cayman Islands

While there is no direct taxation, it’s still essential to consider the cost of living and potential taxes in other jurisdictions if you have international assets or plan to spend time outside the Cayman Islands. For those with investments in foreign countries, tax implications may still arise, so it’s crucial to consult with a financial advisor to ensure compliance with international tax laws and to optimize your retirement strategy.

9. Creating a Personalized Retirement Plan in the Cayman Islands

No two retirement plans are the same, as everyone has different financial goals, lifestyles, and needs. In the Cayman Islands, creating a personalized retirement plan means evaluating your current financial situation, identifying your retirement goals, and finding the right balance of savings, investments, and insurance.

Keywords: personalized retirement plan, financial goals, Cayman Islands

Working with a financial advisor who understands the unique financial landscape of the Cayman Islands is highly recommended. They can help you assess your needs, adjust your plans as circumstances change, and ensure that you have the right combination of pension benefits, investments, and insurance coverage to support your retirement lifestyle.

10. The Benefits of Working with a Financial Advisor in the Cayman Islands

Given the complexity of retirement planning, especially in a unique jurisdiction like the Cayman Islands, working with a financial advisor can help ensure your financial security. A financial advisor can provide personalized guidance, assist in optimizing your pension contributions, recommend investment opportunities, and help you select the right insurance products.

Keywords: financial advisor, financial security, retirement planning, Cayman Islands

A knowledgeable advisor can also keep you updated on changes in local laws that may affect your retirement strategy. By working with a trusted professional, you can have peace of mind knowing that your retirement is well-planned and protected.

Conclusion

Retirement planning in the Cayman Islands requires a thoughtful approach that incorporates savings, investments, and insurance. With the right strategy, you can enjoy a financially secure retirement while making the most of the Cayman Islands’ tax-free environment. Whether you’re just starting your retirement journey or nearing retirement age, it’s essential to plan carefully and seek professional advice to ensure a comfortable and stress-free future.

Keywords: retirement planning, financial security, investments, insurance, Cayman Islands

0 notes

Text

Is It Worth Renting a Condo in the Cayman Islands?

The Cayman Islands is a picturesque paradise in the Caribbean and has long been one of the most popular places for people who want to enjoy sun, sea, and luxury. Whether planning a short vacation, an extended stay, or considering relocating, renting a condo in the Cayman Islands offers several benefits over traditional hotel stays that make it more attractive.

From being flexible with accommodation to the home-like comfort and nearness to some of the world’s most beautiful beaches, here’s why you should prioritize condominium rentals in the Cayman Islands.

A Safe Haven

One of the most compelling reasons to consider a condo rental in the Cayman Islands is that they offer incomparable comfort and privacy. Unlike hotels, where space may be limited, condos provide more room for yourself, resembling your home. You can spread out freely and relax during your stay without restrictions like those in single-room hotels.

Condominiums are usually furnished with multiple rooms big enough for guests. They also come with living areas and kitchens equipped with everything needed to prepare meals. This setup perfectly suits families and couples seeking romantic escapades.

Ideal for Remote Work

Due to digitalization, the ability to work away from the office is now very common. If you want to work remotely and have a vacation simultaneously, the Caymans are ideal because they offer incredible scenery and a relaxing atmosphere. Renting condos provides an opportunity for working and relaxing since you have access to a quiet environment alongside all the necessities needed for work.

Many Grand Cayman condo rentals come with high-speed internet and a dedicated workspace, making it easier to balance career development with leisure. After your day’s meetings or deadlines are met, you can spend your evenings on the beach, take a swim, or visit other attractions on the island.

Cost-Effective Option for Longer Stays

Cayman Island hotels can be luxurious but expensive, especially for longer stays. Renting a condo could be a more cost-effective alternative, particularly if you plan on staying for an extended period. Condos generally cost less compared to hotels, and having your own kitchen can help reduce overall expenses.

Most Cayman Islands condominium rentals offer weekly or monthly rates, which are more affordable for those planning to stay longer than a few days.

Perfect Locations and Beautiful Views

The sandy beaches of the Cayman Islands, crystal-clear waters, and vibrant underwater world are renowned worldwide. Renting a condo allows you to choose from excellent locations, giving you easy access to these natural attractions.

Many of the Grand Cayman condo rentals are situated right on Seven Mile Beach, one of the most famous and beautiful beaches globally. Imagine waking up every morning to the gentle sound of waves and enjoying panoramic ocean views from your balcony.

Home-like Amenities

When individuals travel, they often miss the comforts of home. By renting a condominium in the Caymans, you can enjoy luxurious living while experiencing a new destination. Condominiums are equipped with modern appliances, Wi-Fi, cable TV, or streaming services, making them feel like home.

This family-friendly environment includes kitchenettes for preparing meals that suit your family’s dietary needs and separate bedrooms for relaxation. It’s convenient and comfortable enough to maintain your lifestyle during a holiday in paradise.

Flexibility and Personalization

Condos offer significantly more flexibility compared to hotels, allowing vacationers to tailor their stay according to their preferences. Grand Cayman condo rentals come in various styles, from contemporary designs with modern furnishings to traditional Caribbean homes, providing countless customization options.

This flexibility means you can find a condo that matches your style and needs, creating an unforgettable experience based on your desires.

Safety and Security

Safety is a key consideration when traveling, and the Cayman Islands are among the safest destinations in the Caribbean. Renting a condo in a gated community or secure complex ensures 24-hour security, so you can relax and enjoy your stay without concerns about safety.

The Cayman Islands condominium rentals offer a safe and comfortable environment for you and your family.

Eco-Friendly and Sustainable Travel

As travelers become more environmentally conscious, sustainable travel options are increasingly important. Renting a condo can be more eco-friendly than staying in hotels, as it often promotes sustainable practices. Condos can incorporate energy-efficient appliances, recycling programs, and other environmentally friendly practices.

Many rental condos in the Cayman Islands focus on sustainability, using eco-friendly materials and features. By choosing a condo rental, you can enjoy luxury while minimizing your ecological impact.

Conclusion

Renting a condo in the Cayman Islands is more than just finding a place to stay. It’s an opportunity to experience the island in a comfortable, flexible, and personalized way. The amenities will provide everything necessary for you to feel at home while enjoying your stay in paradise.

Why wait? Start planning your dream vacation today by exploring rental properties in the Cayman Islands. Enjoy all the pleasures of this beautiful destination while feeling right at home!

0 notes

Text

SEVEN MILE BEACH

CAYMAN ISLANDS

La Mode Men's

What do you think?

https://lamodemens.com

Do you like? Yes or No

.

.

.

Comment👇

.

.

Follow Us For More

@lamodemens

Turn On Your Post Notification 🔔

#lamodemens

#mensfashion #fashion #ootd #style #menstyle #mensstyle #fashionista #fashionblogger #man #men #menwithclass #mens #casuallook #casual #outfit #urbanwear #outfitinspiration #gq #luxury #lifestyle #photooftheday #gentleman #instagood

0 notes

Text

Cayman's Top 10 Luxuries: Price Tag Edition! #shorts

Cayman's Top 10 Luxuries: Price Tag Edition! #shorts

https://www.youtube.com/watch?v=70MCgHZ-5Fg

Embark on a luxurious journey with us as we explore the 10 most expensive things you can find in the beautiful Cayman Islands. 🌴💎 From lavish properties to exclusive experiences, this video has jaw-dropping insights and fascinating facts. Whether you're a travel enthusiast or a luxury connoisseur, you won't want to miss out on this captivating virtual tour!

Let us give you insights into the opulent lifestyle of the Cayman Islands' elite while discovering the high-end commodities that attract discerning buyers and travelers. 🏝️💰

So sit back, relax, and immerse yourself in the sophistication and extravagance of this stunning Caribbean destination. Don't forget to hit the like button if you enjoyed this video and share it with your friends who appreciate the finer things in life. ✨ #caymanislands #luxurytravel #expensivethings #luxury #travel #shorts

via Top Viral https://www.youtube.com/channel/UClbTtzALtMT8AsToyJnTRGA

June 07, 2024 at 11:00PM

#hightechcars#luxurycars#top10#BetterSleep#SleepTips#RestfulNights#SleepWellness#Top10Tips#SleepHacks#HealthySleep#BedtimeRoutine

0 notes

Text

Navigating Mental Health Services in the Cayman Islands

In the Cayman Islands, where beauty surrounds us with turquoise waters and sandy beaches, mental well-being is as crucial as physical health. Yet, understanding and accessing mental health services can sometimes feel challenging. This guide aims to shed light on the mental health resources available here, helping you make informed decisions about your well-being.

We'll explore cayman islands health care, considering factors like accessibility, quality, and cost. And then we will discuss the importance of self-care, social connections, and healthy habits in maintaining mental wellness.

Together, let's navigate this journey towards mental well-being in the Cayman Islands, embracing support and courage along the way.

Key Considerations When Choosing Mental Health Services

1. Accessibility

Keep in account the location and accessibility of mental health services. Choose a provider or facility that is convenient for you to reach, ensuring that you can access care when needed.

2. Specialized Care: Depending on your mental health needs, you may require specialized care such as therapy for trauma, addiction treatment, or support for specific populations. Look for providers who offer services tailored to your unique circumstances and preferences. Consider whether the provider has experience in treating conditions similar to yours and if they offer specific therapy modalities or interventions that align with your needs.

3. Quality of Care: Research the qualifications and experience of mental health professionals. Seek out licensed therapists, psychologists, and psychiatrists with expertise in evidence-based treatment modalities. Consider factors such as years of experience, areas of specialization, and any additional certifications or training. Reading reviews or seeking recommendations from trusted sources can help assess the quality of cayman islands health care provided.

4. Cost and Affordability: Understand the charges or cost of mental health services and if they are covered by insurance plans or government assistance programs. Determine your budget and insurance coverage to determine the most affordable options for accessing care. Inquire about any additional costs associated with treatment, such as medication or therapy materials, to ensure transparency in pricing.

5. Collaboration and Communication: Evaluate the provider's communication style and willingness to collaborate with you in your treatment journey. Effective communication and a collaborative therapeutic relationship are essential for building trust and facilitating progress in therapy. Consider factors such as responsiveness to questions or concerns, flexibility in scheduling appointments, and the ability to address cultural or identity-related aspects of your mental health.

6. Continuity of Care: Consider the availability of ongoing support and continuity of care within the mental health service provider. Determine whether the provider offers follow-up appointments, check-ins between sessions, or referrals to other professionals or services as needed. Continuity of care ensures that you receive comprehensive support throughout your treatment journey and facilitates smoother transitions between various levels of care or treatment modalities.

Promoting Mental Wellness

In addition to seeking professional help when needed, individuals can take proactive steps to promote mental wellness in their daily lives:

1. Self-Care Practices: Prioritize self-care activities such as exercise, adequate sleep, healthy diet, and stress management methods like mindfulness or meditation.

2. Social Support: Cultivate strong social connections with friends, family, or support groups. Sharing experiences and emotions with reliable individuals can ensure comfort and validation.

3. Lifestyle Choices: Avoid harmful coping mechanisms such as substance abuse and prioritize activities that bring joy and fulfillment. Engage in hobbies, interests, and activities that promote relaxation and mental stimulation.

Seeking Help for Mental Health Emergencies

In cases of mental health emergencies, it's crucial to know how to access immediate assistance. Contacting emergency services or seeking support from crisis hotlines can provide essential support and guidance during times of crisis. Familiarize yourself with local emergency contacts and crisis intervention services to ensure prompt access to help when needed.

Conclusion

Navigating cayman islands health care services requires careful consideration of various factors, including accessibility, quality of care, and affordability. By understanding the available resources and taking proactive steps to promote mental wellness, individuals can take control of their mental health journey. Whether accessing public services, seeking support from private providers, or engaging with community organizations, prioritizing mental health is essential for overall well-being.

By fostering a culture of acceptance, and support for mental health needs, we can create a more compassionate and inclusive society where people feel empowered to seek help and journey toward mental wellness. Remember, you are not alone on this journey, and there is hope and support available every step of the way.

0 notes

Text

Cayman Islands Homes for Sale - Utopia Cayman Realty

Explore our exclusive collection of Cayman Islands homes for sale with Utopia Cayman Realty. From beachfront villas to luxurious estates, we offer a diverse range of properties to suit your lifestyle. Our knowledgeable agents are dedicated to finding your dream home in this tropical oasis, providing personalized service and expert guidance throughout the process.

1 note

·

View note

Text

Luxury Living in the Cayman Islands Awaits

Indulge in the ultimate Caribbean lifestyle with our curated selection of premier properties. From opulent residences to idyllic waterfront homes, find your perfect sanctuary in the Cayman Islands. Begin your search now!

#Luxury Living Cayman Islands#cayman real estate#cayman islands#properties for sale in cayman#buy property in dubai#buy property in cayman

0 notes

Text

Discover the benefits of healthy eating and learn how to simplify your diet plan and stay consistent with healthy eating habits for optimal health and wellbeing.

0 notes

Text

Mark Scott Sentenced to 10 Years for Onecoin Money Laundering

Mark Scott, a lawyer with ties to the infamous Onecoin cryptocurrency, has received a ten-year prison sentence. He's been charged with diverting $400 million from the Onecoin initiative to fund an extravagant lifestyle. During his trial, the judge raised questions about Scott's decision to sell his Porsche and move money to the Cayman Islands, arguing that this money should have been used to reimburse victims of Onecoin. In a plea of innocence, Mark Scott's attorneys have repeatedly stated that he was oblivious to Onecoin being a scam. They maintain that he did not know OneCoin was a fraudulent operation. OneCoin, under the leadership of co-founder Ruta Ignatova, gathered more than $4 billion between 2014 and 2016. Ignatova, known as the "Cryptoqueen," has been off the radar since vanishing six years ago. In June 2022, she

Read more on Mark Scott Sentenced to 10 Years for Onecoin Money Laundering

0 notes

Text

Secure Cayman Islands Residency with RifTrust: Your Gateway to Exclusive Living

Description: Unlock the doors to exclusive living in the Cayman Islands with RifTrust. Our tailored residency solutions offer a seamless pathway to obtaining residency in this prestigious Caribbean destination. Enjoy the benefits of tax efficiency, a robust legal framework, and unparalleled lifestyle amenities while RifTrust handles the complexities of the process. Experience the freedom and peace of mind that comes with Cayman Islands residency, supported by RifTrust's expertise and dedication to client satisfaction.

#cayman islands residency#citizenshipinvestment#maltacitizenship#maltainvestment#riftrust#uae goldenvisa#malta#citizenship by investment#second citizenship#residency&citizenship

0 notes

Text

How to Save Money on Your Insurance Premiums in the Cayman Islands: Tips and Tricks

As an insurance advisor in the Cayman Islands, I often get asked about the best ways to save money on insurance premiums. Insurance is a crucial part of your financial planning, providing protection against unforeseen events. However, it doesn’t have to break the bank. Here are some tried and tested tips to help you reduce your insurance costs without compromising on coverage.

1. Bundle Your Insurance Policies

One of the easiest ways to save on insurance premiums is to bundle your policies. By combining your life, mortgage, income protection, and critical illness insurance into one package, you can often secure a significant discount. Many insurance providers in the Cayman Islands offer attractive bundle discounts, making this a smart option to explore.

2. Increase Your Deductibles

Another effective way to lower your premiums is by increasing your deductibles. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can substantially reduce your monthly premiums. Just make sure you have enough savings to cover the deductible in case of a claim.

3. Maintain a Healthy Lifestyle

Insurance companies in the Cayman Islands and around the world reward healthy lifestyle choices. By maintaining a healthy weight, exercising regularly, and avoiding smoking or excessive alcohol consumption, you can often qualify for lower insurance rates. Some providers even offer wellness programs with incentives for staying healthy.

4. Review Your Coverage Regularly

Life changes, and so do your insurance needs. It’s essential to review your coverage regularly to ensure you’re not over-insured or paying for coverage you no longer need. Work with your insurance advisor to assess your current situation and adjust your policies accordingly. This can lead to substantial savings over time.

5. Shop Around for the Best Rates

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare rates from different providers. Each insurance company has its own criteria for calculating premiums, so you might find significant differences in the quotes you receive. As an insurance advisor, I can help you navigate through the options to find the best coverage at the best price.

6. Consider Term Life Insurance

If you’re looking for life insurance, consider opting for term life insurance instead of whole life insurance. Term life insurance provides coverage for a specific period and is generally more affordable than whole life insurance. It’s an excellent choice for those looking to protect their families during the most critical years.

7. Take Advantage of Discounts

Many insurance providers offer various discounts that can help lower your premiums. These discounts can be based on factors such as being a new customer, renewing your policy, or being a long-term customer. Make sure to ask your insurance advisor about any available discounts that you may qualify for.

8. Pay Annually Instead of Monthly

If you have the financial flexibility, consider paying your insurance premiums annually instead of monthly. Most insurance companies charge additional fees for the convenience of monthly payments. By paying annually, you can avoid these fees and save money on your overall premium costs.

9. Improve Your Credit Score

Your credit score can impact your insurance premiums. Insurance companies often use credit scores as one of the factors in determining the risk level of a policyholder. By maintaining a good credit score, you can potentially lower your insurance premiums. Pay your bills on time, reduce your debt, and check your credit report regularly to ensure accuracy.

10. Work with a Trusted Insurance Advisor

Navigating the world of insurance can be overwhelming, but you don’t have to do it alone. Working with a trusted insurance advisor can help you find the best coverage at the best price. As an experienced insurance advisor in the Cayman Islands, I can provide you with personalized advice and solutions tailored to your unique needs and financial goals.

0 notes