#Coinbase number

Explore tagged Tumblr posts

Text

Coinbase USA toll-free number.

Contact: +14082904317+14082904317-Coinbase-Customer-Support Coinbase Customer Service- How to contact by Phone Number To reach a live person at Coinbase® customer service for support, you can call their 24/7 Coinbase® Phone number hotline at +14082904317. OTA (Live Person) or 1-800-Coinbase® +14082904317. You can also use the live chat feature on their website or reach out to them via email. Speaking with a live representative at Coinbase® is straightforward. Whether you’re dealing with booking issues, need to make changes to your travel plans, or have specific inquiries, reaching out to a live agent can quickly resolve your concerns. This guide explains the steps to contact Coinbase® customer service via phone and provides tips on the best times to call to minimize wait times.

Why Contact a Live Person at Coinbase®? There are many reasons why speaking to a live person might be the best route to resolving your issue. Common scenarios include:

Flight changes or cancellations: If your plans have changed, you need live assistance at Coinbase® +14082904317 with adjusting or canceling your flights, or you’re dealing with flight cancellations and delays.

Booking clarification: Sometimes you need more details or help to understand the specifics of your Coinbase® booking +14082904317 and reservation.

Refunds and compensation: Automated systems often cannot handle complex refund requests or compensation claims, making & Coinbase® live agent +14082904317 invaluable.

#Coinbase customer support USA#Coinbase support number USA#Call Coinbase USA#Coinbase help center USA

0 notes

Text

For less urgent inquiries, you can reach out to Coinbase through their social media channels. While these platforms are not typically used for detailed support, they can be helpful for general questions and updates.

1 note

·

View note

Text

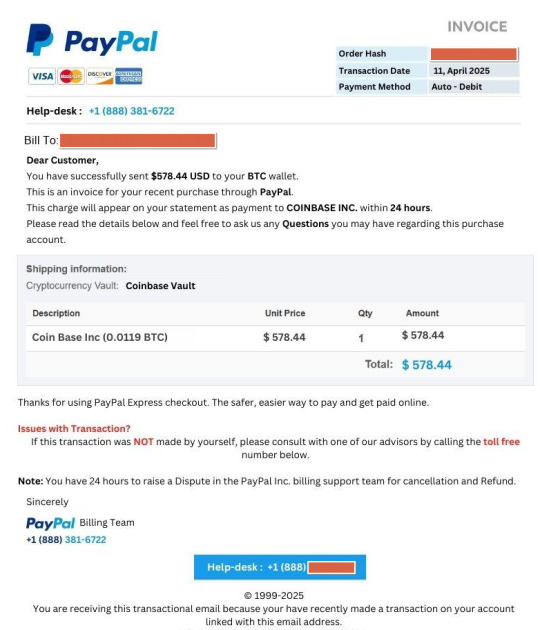

Interesting scam email I received today. An invoice for crypto coin!

Noteables:

The email address is indeed mine, but not linked to PayPal

I do not currently use PayPal or have an account

I certainly do not use Coinbase or any crypto currency

The email itself was full of gibberish words, not any kind of template these things usually use

The "invoice" came as an attachment .webp file

There was no other attachment/malware payload

I certainly am not gonna call that 888 phone number to the PayPal "help desk" and doing a reverse lookup yields nothing. Pretty sure if I were to call that number it'd turn into an attempt to siphon money.

41 notes

·

View notes

Text

How Beginners Can Use Investing Apps to Start Building Wealth?

Stock trading has been on the rise for quite some time now, especially among youngsters. The youth are on the constant lookout for newer investing apps which make their job easy. E-commerce apps that provide investing services have also surged to impeccable heights & made wealth for a significant number of individuals. There’s no fixed formula for investing in the stock market. A well-structured portfolio & strategic investments can take you to quite wealthy distances.

For C-suite executives, startup entrepreneurs, and managers, understanding how investing apps empower users is essential—not only for personal financial growth but also to stay informed about technological advancements in the financial sector. This article explores how beginners can leverage investing apps to start building wealth effectively and strategically.

The Game-Changing Impact of Investment Platforms

The rise of investing apps has eliminated traditional barriers such as high fees, complicated processes, and the necessity for financial advisors. These apps have democratized investing through features such as:

Low or No Commission Fees – Many platforms offer commission-free trades, making investing more affordable.

Fractional Shares – Users can invest in small portions of high-priced stocks, allowing broader access to valuable assets.

Automated Portfolio Management – Robo-advisors create customized portfolios based on individual risk tolerance and financial goals.

Educational Resources – Built-in learning materials help beginners understand market trends and investment strategies.

User-Friendly Interfaces – Simple navigation, real-time analytics, and personalized recommendations make investing more intuitive.

By incorporating these features, investment platforms make financial markets more inclusive, giving users the ability to take charge of their financial futures.

Steps for Beginners to Start Investing

1. Define Your Investment Goals

Before selecting an investing app, users should determine their financial objectives. Are they investing for retirement, wealth accumulation, or short-term financial gains? Identifying goals helps in choosing appropriate investment strategies and risk levels.

2. Choose the Right Investing App

Different investment platforms cater to various investor needs:

Stock Trading Apps (e.g., Robinhood, Webull) – Best for hands-on trading.

Robo-Advisors (e.g., Betterment, Wealthfront) – Ideal for automated, long-term investing.

Micro-Investing Apps (e.g., Acorns, Stash) – Suitable for those starting with small amounts.

Social Investing Apps (e.g., eToro, Public) – Allow users to follow and replicate expert traders.

Cryptocurrency Apps (e.g., Coinbase, Binance) – For those looking to diversify into digital assets.

3. Start Small and Diversify

Beginners should avoid placing all their funds into a single stock or asset class. A diversified portfolio—including stocks, ETFs, bonds, and real estate—helps manage risk. Many investing apps provide guidance on asset allocation to optimize investment strategies.

4. Utilize Automated Investment Tools

Features such as recurring deposits and robo-advisors enable users to invest consistently without the need for active monitoring. Automation removes emotional biases and encourages disciplined investment habits.

5. Continuously Learn and Adapt

While investing apps simplify the investment process, continuous learning is crucial. Staying updated on financial news, market trends, and portfolio performance enhances decision-making and long-term success.

Common Mistakes to Avoid When Using Mobile Trading Apps

1. Emotional Decision-Making

Market fluctuations can trigger impulsive buying or selling. It is vital to maintain a long-term perspective rather than reacting to short-term volatility.

2. Overtrading

Many beginners engage in excessive trading due to the accessibility of investing apps. Frequent transactions can lead to unnecessary fees and market timing errors, ultimately reducing profits.

3. Ignoring Fees and Hidden Costs

Although many platforms offer commission-free trading, other charges such as fund expense ratios and premium account fees can accumulate. Users should evaluate costs before committing to an app.

4. Failing to Rebalance Portfolios

Market changes can impact asset allocation over time. Regularly reviewing and adjusting investment portfolios ensures alignment with financial goals and risk tolerance.

5. Neglecting Tax Implications

Investing comes with tax obligations, including capital gains taxes. Some trading applications provide tax-loss harvesting features, which can help users optimize their tax liabilities and maximize returns.

The Future of Investing Apps in Wealth-Building

With advancements in AI, blockchain technology, and machine learning, the next generation of investing apps will offer even more personalized, intelligent, and secure solutions. Features such as AI-driven financial advisors, real-time risk assessment, and decentralized finance (DeFi) integration are set to redefine digital investing.

Furthermore, stock market apps are expanding to include more asset classes, such as real estate crowdfunding, private equity, and alternative investments, broadening opportunities for investors.

For business leaders and entrepreneurs, staying ahead of these trends is crucial. Whether using investing apps for personal wealth-building or incorporating fintech innovations into business strategies, digital investment tools present vast opportunities for financial growth.

Conclusion

The accessibility and convenience of trading applications have transformed the investment landscape, allowing beginners to build wealth with minimal capital and financial expertise. By defining clear financial goals, selecting the right platform, diversifying assets, and committing to continuous learning, users can effectively manage their financial future.

As investing apps continue to innovate, they will play an increasingly crucial role in shaping financial markets and fostering inclusive investment opportunities. The democratization of finance through trading portfolio ensures that wealth-building is no longer limited to a select few. With the right strategies and tools, anyone can participate in the financial markets and work toward a prosperous future.

Uncover the latest trends and insights with our articles on Visionary Vogues

3 notes

·

View notes

Text

This day in history

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then San Francisco (Mar 13), Anaheim, and more!

#15yrsago Chinese gold farming https://www.theguardian.com/technology/2009/mar/05/virtual-world-china

#10yrsago Comment-spammers threaten to sabotage their victims through Google Disavow if the evidence of their vandalism isn’t removed https://ellis.fyi/blog/gordon-sands-threatens-seattle-bubble-google-disavow-comment-spam/

#10yrsago Obama whirls the copyright lobbyist/government official revolving door https://www.eff.org/deeplinks/2014/03/obama-nominates-former-sopa-lobbyist-help-lead-tpp-negotiations

#10yrsago CIA spied on Senate committee writing damning torture report and Obama knew about it https://www.theguardian.com/world/2014/mar/05/obama-cia-senate-intelligence-committee-torture

#5yrsago Jibo the social robot announces that its VC overlords have remote-killswitched it, makes pathetic farewell address and dances a final step https://www.theverge.com/circuitbreaker/2019/3/4/18250104/jibo-social-robot-server-shutdown-offline-dead

#5yrsago Bowing to public pressure, Coinbase announces it will “transition out” the ex-Hacking Team cybermercenaries whose company it just bought https://www.vice.com/en/article/qvyndw/coinbase-says-ex-hacking-team-members-will-transition-out-after-users-protest

#5yrsago The NSA has reportedly stopped data-mining Americans’ phone and SMS records https://www.nytimes.com/2019/03/04/us/politics/nsa-phone-records-program-shut-down.html

#5yrsago Facebook forces you to expose your phone number to the whole world in order to turn on two-factor authentication https://www.eff.org/deeplinks/2019/03/facebook-doubles-down-misusing-your-phone-number

#5yrsago America is not “polarized”: it’s a land where a small minority tyrannize the supermajority https://www.nytimes.com/2019/03/05/opinion/oppression-majority.html

Name your price for 18 of my DRM-free ebooks and support the Electronic Frontier Foundation with the Humble Cory Doctorow Bundle.

11 notes

·

View notes

Text

Blockchain Investment: A New Frontier for Investors

The rise of blockchain technology over the last decade has sparked interest across various industries, from finance and supply chain management to healthcare and entertainment. As blockchain matures, investors are starting to recognize its potential not only for transforming traditional sectors but also for offering new investment opportunities. In this article, we explore the significance of blockchain investment, the types of investments available, the associated risks, and the future outlook for this promising technology.

What is Blockchain?

Blockchain is a decentralized digital ledger technology that securely records transactions across multiple computers. It allows information to be stored transparently, immutably, and without the need for intermediaries such as banks or government bodies. The most famous application of blockchain technology is Bitcoin, the first cryptocurrency, but its potential extends far beyond digital currencies.

Blockchain’s unique features—decentralization, transparency, and security—make it an appealing foundation for various applications, ranging from finance to supply chain management to voting systems. With an increasing number of industries exploring blockchain’s use cases, it has garnered significant attention from investors.

youtube

Why Invest in Blockchain?

Disruption of Traditional Systems: Blockchain has the potential to disrupt a wide range of industries by providing more efficient, transparent, and secure alternatives to legacy systems. For example, blockchain-based financial services can lower transaction costs, reduce fraud, and offer access to previously unbanked populations. The transformation of industries such as healthcare, logistics, and government services is just beginning.

The Growth of Cryptocurrencies: Blockchain is the backbone of cryptocurrencies, which have seen exponential growth in recent years. Bitcoin, Ethereum, and other altcoins have become established assets, and decentralized finance (DeFi) platforms built on blockchain promise further innovation in financial markets. Investors can benefit from both the appreciation of these digital assets and the broader adoption of cryptocurrency ecosystems.

Tokenization of Assets: Blockchain enables the tokenization of real-world assets, including real estate, art, and commodities. This allows investors to gain fractional ownership in previously illiquid assets, opening up new avenues for diversification and investment. Tokenization can also improve liquidity and streamline processes such as cross-border payments and property transfers.

Venture Capital and Startups: Many blockchain-based startups are developing innovative applications, from decentralized applications (dApps) to non-fungible tokens (NFTs) to blockchain-based identity verification systems. Venture capitalists and angel investors can tap into the high growth potential of these companies, as blockchain adoption continues to rise globally.

Types of Blockchain Investments

Blockchain investments can be approached in several ways. Some of the most common types include:

Cryptocurrencies: Direct investment in digital currencies like Bitcoin, Ethereum, and other altcoins is the most straightforward form of blockchain investment. These cryptocurrencies can be purchased through exchanges and stored in digital wallets. While Bitcoin and Ethereum are the most well-known, there are thousands of altcoins that investors can explore.

Blockchain-related Stocks and ETFs: Rather than investing directly in cryptocurrencies, investors can gain exposure to blockchain technology by purchasing stocks in companies that are integrating blockchain into their operations. Public companies such as Nvidia (which provides hardware for mining), Coinbase (a cryptocurrency exchange), and Block (formerly Square) are examples of firms investing heavily in blockchain. Additionally, blockchain-focused exchange-traded funds (ETFs) allow investors to diversify their exposure to the sector.

Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales are fundraising mechanisms where startups issue their own cryptocurrency tokens in exchange for investments. While ICOs were initially seen as high-risk, high-reward ventures, they have become more regulated over time. This form of investment allows early-stage investors to gain a stake in blockchain projects before they are widely adopted.

Blockchain Real Estate: The tokenization of real estate allows fractional ownership of property via blockchain-based tokens. Platforms like RealT and Propy have been pioneers in this space, enabling investors to buy shares in real estate and receive dividends from rental income. Blockchain’s transparency and immutability make it ideal for managing property transactions.

Decentralized Finance (DeFi): DeFi is a rapidly growing sector that leverages blockchain to provide financial services such as lending, borrowing, and trading without intermediaries. By investing in DeFi projects or liquidity pools, investors can earn returns in the form of interest or tokens.

Risks of Blockchain Investment

While blockchain presents exciting investment opportunities, there are several risks to consider:

Volatility: Cryptocurrencies, in particular, are known for their extreme price volatility. Dramatic price swings can occur in a short time, making blockchain investments high-risk, especially for short-term traders. Long-term investors should be prepared for fluctuations in value.

Regulatory Uncertainty: Blockchain and cryptocurrencies are still in the early stages of regulatory development. Governments around the world are working on creating frameworks to govern blockchain and digital currencies, but until clear regulations are established, there could be sudden changes in legal and tax requirements that impact investment returns.

Security and Fraud Risks: While blockchain technology itself is secure, the platforms and exchanges built on top of it may not always be. Hacks, scams, and fraud have occurred in the blockchain space, with investors losing substantial amounts of money. Conducting thorough research and choosing reputable platforms is crucial.

Technological Risks: Blockchain is still an emerging technology, and its long-term scalability, interoperability, and environmental impact remain open questions. For instance, Ethereum, one of the leading blockchains, is transitioning from a proof-of-work to a more energy-efficient proof-of-stake consensus mechanism, highlighting the potential for technical challenges.

The Future of Blockchain Investment

As blockchain technology evolves, it’s expected that adoption across industries will only increase. Many experts believe that blockchain will play a central role in reshaping the global economy, particularly in areas like supply chain transparency, decentralized finance, and digital identity verification.

The rise of central bank digital currencies (CBDCs), which are government-backed digital currencies that leverage blockchain technology, will likely spur further mainstream adoption. Additionally, innovations in smart contracts, which automate transactions based on predefined conditions, will expand the use of blockchain beyond simple transactions into complex business processes.

For investors, this presents an exciting opportunity to position themselves at the forefront of a technological revolution. However, as with any emerging technology, it is important to approach blockchain investment with caution, conducting thorough due diligence and maintaining a diversified portfolio to manage risk effectively.

Conclusion

Blockchain investment offers promising opportunities for those willing to navigate its complexities. From cryptocurrencies to tokenized assets to decentralized finance, the potential for growth in this sector is vast. However, investors should carefully consider the risks associated with volatility, regulation, and security before diving in. As blockchain technology matures and becomes more widely adopted, it will likely be a key driver of innovation, providing unique opportunities for savvy investors to capitalize on the next generation of digital transformation.

2 notes

·

View notes

Text

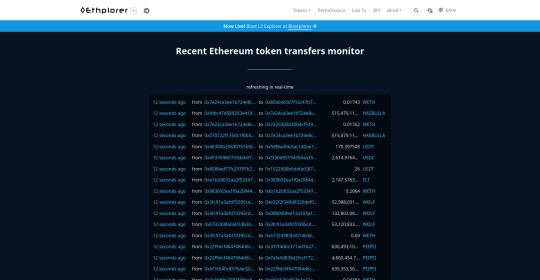

Hey so remember when everyone was all "Cryptcoins are great because they're anonymous"? Yeah, no, they're not.

With a bit of Googling, I found ethplorer.io, which allows you to see what's happening on the Etherium blockchain. How can I do this? Because the blockchain is kinda public by default.

So for people who don't know how blockchains work (including a lot of cryptobros), the blockchain is basically a record of transactions and developments that is copied and stored on multiple different copies for crosschecking, but it also means that it has to be public so people (or rather their cryptowallets) know what is going on, which means that you can just fuckin' view payments and transfers between users and even how much etherium they have.

Now I know you are all "hmm, yeah, but they're just numbers on a screen, people aren't going to, like, be able to identify people". Well here's the thing: If you buy crypto with real, irl money (like on Coinbase), that can be tracked and you can be identified from that. So unless you mine your own crypto (which is expensive and can't be done quietly), you can be tracked.

Oh, and, let's say, you were using crypto for arrestable activities. The authorities could, once they have your comp, see your wallet address, and see who you have transferred money to or who has sent you money, and do that with other people who were arrested, and, through that, build up a network of payments based on the numbers, meaning that your "anonymity" through your wallet address gets chipped away by your associates.

In short, not only is crypto not anonymous, anyone can see how much crypto you have and where you got it and where you sent it.

5 notes

·

View notes

Text

First Time Investing in Crypto: Tips for New Traders on the Digital Coin Market

This has changed the financial landscape for good; it is the first time in history that investors have a share of this type since cryptocurrency entered the market. But then again, getting into the crypto market to begin with can be incredibly intimidating for a novice. This includes some key tips that you must know for making trade-offs more intelligent and how to invest in cryptocurrencies.

1. Understand the Basics

Understand the basic principles of what Cryptocurrency is, how it works before you invest. If you're unfamiliar, cryptocurrencies are basically decentralized systems, operating with a peer-to-peer framework, that let users do all sorts of things like get rewards for paying on time or using an app. Because they are not organically produced like typical tender, these financial tools are meant to be circulated in a decentralized way via blockchain networks. Educate yourself onwards like blockchain, altcoins, wallets and exchanges.

2. Do Your Research

The value of cryptocurrencies is influenced by a number of factors, and this makes it an extremely volatile market. Learn about various cryptocurrencies and how they are used. Tools like CoinMarketCap and CoinGecko show trends, rankings other handy information regarding ranging and past data. Follow us on Twitter for more news and updates on the Bitcoin space.

3. Diversify Your Portfolio

Investors apply diversification in their investment strategies. Diversify by investing in multiple cryptocurrencies I mean, everyone knows Bitcoin and Ethereum — why not looking a little bit further down the line at some promising altcoins with real fundamentals. A healthy mix of investments can ensure you have a little exposure to any type of gain or loss that may arise.

4. Only Invest What You Can Afford to Lose

The world of crypto is such that even the prices can and do tend to rise or crash in a jiffy, thanks to high volatility. Gamble only with money you can afford to lose without impacting your finances. Never borrow to invest in crypto or use your emergency savings for crypto investing. This approach ensures that you still are able to stay financially safe in case there's a downtrend.

5. Choose a Reliable Exchange

It is important to be sure that you deal with reliable cryptocurrency exchanges for safe trading. Search for exchanges with strong security protocols, a simple UI, and broad coin support. Some of the most trusted exchanges that people have been using include Binance, Coinbase and Kraken. Are they regulated and insured for digital assets.

6. Secure Your Investments

In the world of crypto, security is vital. Keep your cryptocurrencies on hardware wallets or in cold storage solutions; simply turn on 2FA in your exchange accounts and do not publish or disclose the private keys. Keep your software up to date and watch out for phishing attacks and malware.

7. Stay Informed and Adapt

As we know the crypto market is alive and never takes a nap. Learn from the market, regulatory and tech changes. Engage in some of the crypto community forums on platforms like Reddit, Twitter and Telegram to get the benefits of inside knowledge from other investors. Change your investment plan based on new informational and market circumstances

8. Have a Long-Term Perspective

Although there is money in short-term trading, it often requires quite a bit of time and skill to excel what you do. Long term investment strategy If you are beginner, Long term is the best way for you to invest your money from beginning. Look at the long term growth potential of cryptocurrencies instead of trying to make a quick buck. I read many books and listend to a lot of podcasts about the stock market, nearly all these sources agreed that patience and discipline was key to becoming a successful long-term investor.

9. Seek Professional Advice

If you are uncertain about the investments, you can get help from financial advisors or even some crypto experts. They can offer some personalized advice, depending on your financial goals and comfort with risk. Expert help will make it easier for you to manage the particularly volatile world of crypto.

Conclusion

Investing in cryptocurrency can also be a lucrative endeavor as long the trader is well-versed when it comes to his or her craft. These basic principles, combined with extensive research, establishing a diversified portfolio, and security first will put you in good stead on your crypto investment journey. The key is to stay informed, adapt and think long-term in order for you to succeed.

#crypto#cryptocurrency#cryptocurreny trading#cryptocommunity#investing#economy#investment#bitcoin#ethereum#blockchain#personal finance#finance

4 notes

·

View notes

Text

How to Cash Out on Robinhood: A Comprehensive Guide

Robinhood has revolutionized the way individuals invest in stocks, ETFs, options, and cryptocurrencies. However, there comes a time when investors want to cash out their investments and transfer funds to their bank accounts. This guide provides a detailed, step-by-step approach to cashing out on Robinhood, transferring money from Robinhood to a bank account, using instant deposits, and transferring crypto from Robinhood to Coinbase.

How to Cash Out on Robinhood

Cashing out cash on Robinhood is a straightforward process that involves selling your assets and transferring the proceeds to your linked bank account. Here’s how you can do it:

1. Selling Your Assets

Before you can withdraw money, you need to sell your investments. Follow these steps:

Open the Robinhood App: Log in to your account on the Robinhood mobile app or website.

Select the Asset to Sell: Navigate to the stock, ETF, option, or cryptocurrency you want to sell.

Initiate the Sale: Click on the “Sell” button. Specify the number of shares or amount of cryptocurrency you want to sell.

Confirm the Sale: Review the details and confirm the transaction. The proceeds from the sale will be available in your Robinhood account.

2. Withdrawing Funds to Your Bank Account

Once you have sold your assets, the next step is to transfer the money to your bank account:

Access the Account Menu: Click on the account icon at the bottom right corner of the screen.

Navigate to Transfers: Select “Transfers” or “Transfer to Your Bank.”

Select the Amount: Enter the amount you wish to transfer. Ensure that the amount does not exceed your available balance.

Choose the Bank Account: Select the bank account linked to your Robinhood account.

Confirm the Transfer: Review the details and confirm the transfer. The funds will be deposited into your bank account within 5 business days.

How to Transfer Money from Robinhood to a Bank Account

Transferring money from Robinhood to a bank account is a critical function for many users. Here’s a detailed guide to help you transfer your funds smoothly:

1. Linking Your Bank Account

Ensure your bank account is linked to your Robinhood account. If it’s not linked, follow these steps:

Go to Account Settings: Open the Robinhood app and navigate to the account settings.

Add a New Bank Account: Select “Linked Accounts” and then “Add New Account.”

Enter Bank Details: Input your bank account details, including the routing number and account number.

Verify Your Bank Account: Robinhood will initiate two small deposits to your bank account. Verify these amounts in the app to complete the linking process.

2. Initiating the Transfer

After linking your bank account, you can transfer funds:

Open the Robinhood App: Log in to your Robinhood account.

Navigate to Transfers: Select the “Transfers” tab or option.

Enter the Amount: Specify the amount you want to transfer to your bank account.

Select the Bank Account: Choose the linked bank account for the transfer.

Confirm the Transfer: Review and confirm the transfer details. The funds should arrive in your bank account within 5 business days.

How to Cash Out from Robinhood Using Instant Deposits

Robinhood offers an instant deposit feature that allows you to access your funds more quickly. Here’s how to use it:

1. Understanding Instant Deposits

Instant deposits let you use your funds immediately for trading or transferring, without waiting for the standard settlement period. However, this feature might have limits based on your account type.

2. Enabling Instant Deposits

To use instant deposits, ensure it is enabled in your account:

Go to Account Settings: Open the Robinhood app and navigate to the account settings.

Enable Instant Deposits: Look for the “Instant Deposits” option and enable it.

3. Using Instant Deposits for Cashing Out

When you sell an asset, you can use the instant deposit feature to access the funds immediately:

Sell Your Assets: Follow the steps outlined in the “Selling Your Assets” section.

Initiate a Transfer: After selling, go to the “Transfers” section.

Select Instant Deposit: Choose the instant deposit option and confirm the transfer. Your funds will be available in your bank account instantly or within a few hours.

How to Transfer Crypto from Robinhood to Coinbase

Transferring cryptocurrency from Robinhood to Coinbase involves a few additional steps. Here’s how to do it:

1. Selling Your Crypto on Robinhood

Robinhood does not currently support direct crypto transfers to external wallets. Therefore, you need to sell your crypto holdings on Robinhood first:

Open the Robinhood App: Log in and navigate to your crypto holdings.

Sell the Cryptocurrency: Click on the cryptocurrency you want to sell and initiate the sale.

2. Transferring Funds to Your Bank Account

Once you have sold your crypto, transfer the funds to your bank account following the steps outlined in the “Withdrawing Funds to Your Bank Account” section.

3. Buying Crypto on Coinbase

After the funds are available in your bank account, you can purchase crypto on Coinbase:

Log in to Coinbase: Open the Coinbase app or website and log in to your account.

Deposit Funds: Navigate to the “Deposit” section and transfer the funds from your bank account to Coinbase.

Buy Cryptocurrency: Once the funds are available, purchase the desired cryptocurrency on Coinbase.

4. Transferring Crypto within Coinbase

If needed, you can transfer your crypto holdings within Coinbase to different wallets or addresses:

Open Coinbase: Navigate to your crypto holdings on Coinbase.

Initiate a Transfer: Click on the cryptocurrency and select the “Send” option.

Enter the Wallet Address: Input the destination wallet address and confirm the transfer.

Conclusion

Cashing out on Robinhood, transferring funds to a bank account, using instant deposits, and transferring crypto to Coinbase are essential processes for many investors. By following the detailed steps outlined in this guide, you can efficiently manage your finances and make informed decisions about your investments.

5 notes

·

View notes

Text

Authentication Company's Credential Leak Exposes TikTok and Uber Users

An Israeli-based authentication company, AU10TIX, which serves high-profile clients such as Uber, TikTok, X (formerly Twitter), Fiverr, Coinbase, LinkedIn, and Saxo Bank, has inadvertently exposed a set of administration credentials online for over a year. This security lapse potentially allowed unauthorized access to sensitive user identity documents, including driving licenses.

The Growing Importance of User Authentication

As legislation increasingly requires websites and platforms—particularly gambling services, social networks, and adult content sites—to verify users' ages, the demand for authentication services has risen significantly. AU10TIX specializes in verifying user identities through the upload of official document photos.

Details of the Data Leak

A researcher discovered the exposed credentials and provided evidence to 404 Media. The compromised credentials granted access to a logging platform containing data about individuals who had uploaded documents to prove their identity. This information included: - Names - Dates of birth - Nationalities - Identification numbers - Types of uploaded documents (e.g., driver's licenses) - Links to images of the identity documents

Potential Source of the Breach

Investigations suggest that the likely source of the credential leak was an infostealer infecting a computer belonging to a Network Operations Center Manager at AU10TIX. This incident highlights the ongoing threat of stolen credentials, which have been implicated in recent high-profile breaches, such as those affecting Snowflake.

The Broader Implications of Data Breaches

The AU10TIX incident underscores several critical issues in cybersecurity: - The persistent threat of stolen credentials - The potential for breached data to be traded and sold multiple times - The role of data brokers in the information ecosystem The California Privacy Protection Agency (CPPA) defines data brokers as businesses that indirectly buy and sell consumer information. With approximately 480 registered data brokers—and potentially many more operating under the radar—the scale of data trading is significant.

AU10TIX's Response

In a statement to 404 Media, AU10TIX acknowledged the incident: "While PII data was potentially accessible, based on our current findings, we see no evidence that such data has been exploited. Our customers' security is of the utmost importance, and they have been notified." The company also stated that it is no longer using the compromised system.

Protecting Yourself After a Data Breach

While users of affected brands await official statements, there are general steps individuals can take to protect themselves in the aftermath of a data breach: - Follow vendor-specific advice - Change passwords, using strong, unique combinations - Enable two-factor authentication (2FA), preferably using FIDO2-compliant hardware - Be cautious of phishing attempts impersonating the vendor - Avoid storing payment card details on websites - Consider setting up identity monitoring services Read the full article

2 notes

·

View notes

Text

How to Be a Great Cryptocurrency Trader

Because the cryptocurrency market is so volatile, trading cryptocurrencies can be both extremely rewarding and extremely difficult. You need to have a disciplined mindset, create winning tactics, and comprehend the market in order to become a profitable cryptocurrency trader. In plain words, this post will walk you through the fundamentals of becoming a successful bitcoin trader.

Understanding the Cryptocurrency Market

What is Cryptocurrency?

Cryptocurrency is a type of virtual or digital money that is secured by encryption. On decentralized networks powered by blockchain technology, cryptocurrencies function differently from conventional currencies that are issued by governments. Since the creation of the first cryptocurrency, Bitcoin, in 2009, many more have been produced.

How Does Cryptocurrency Trading Work?

Buying and selling virtual currencies with the intention of turning a profit is known as cryptocurrency trading. Cryptocurrency trading is available on a number of exchanges, including Binance, Coinbase, and Kraken. The value of cryptocurrencies varies according on news about regulations, technological developments, market demand, and general economic conditions.

Steps to Becoming a Great Cryptocurrency Trader

1. Educate Yourself

Learning about the market is the first step to becoming a great bitcoin trader. Here are some crucial aspects to pay attention to:

Blockchain Technology: Recognize the foundations of blockchain technology, which underpins cryptocurrencies.

Different Cryptocurrencies: Discover the several cryptocurrencies, the applications for them, and the underlying technology.

Market Analysis: Examine both fundamental analysis—which assesses a cryptocurrency's worth and potential—and technical analysis, which makes use of charts and indicators.

Trading Platforms: Learn about the features of the various cryptocurrency exchanges.

2. Create a Trading Plan

A detailed strategy including your trading objectives, risk tolerance, and techniques is called a trading plan. Here's how to draft a successful trading strategy:

Set Clear Goals: Establish both your short- and long-term trading objectives. Do you want to invest for the long term or are you just looking for immediate returns?

Risk Management: Determine the amount of money you are ready to lose on each deal. It's customary to never risk more than 1% to 2% of your entire capital in a single transaction.

Entry and Exit Strategies: Establish the parameters by which you will enter and exit deals. This could be determined by other variables, news stories, or technical indicators.

Record Keeping: To keep track of your deals, including the reasons you entered and left each deal as well as the results, keep a trading journal.

3. Choose the Right Trading Platform

The trading platform you choose will determine how successful you are as a bitcoin trader. Here are some things to think about:

Security: Select a platform that offers strong security features to safeguard your money..

Fees:Examine and contrast the trading costs offered by various platforms.

User Interface:Seek for a platform with an interface that is easy to use and intuitive.

Liquidity: Make sure there is a lot of liquidity on the platform so you can buy and sell cryptocurrencies fast.

4. Practice with Paper Trading

It's a good idea to practice with paper trading before risking real money. Paper trading is the practice of mimicking deals with virtual currency. As a result, you may practice using the trading platform and test your trading techniques without having to worry about losing real money.

5. Start Small

When the time comes for you to start trading with real money, start modest with your funds. In this manner, you may control your risk and earn experience without having to risk a sizable amount of your money. You can progressively increase your trading capital as you gain success and confidence.

Developing Effective Trading Strategies

1. Technical Analysis

In technical analysis, price charts are examined, and indicators are used to forecast future price movements. Here are some essential instruments and ideas:

Candlestick Charts: The opening, closing, high, and low prices for a certain time period are shown in these charts. Future price fluctuations may be indicated by candlestick patterns.

Moving Averages: These average prices over a given time span might be used to spot trends. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are the two most used varieties.

Relative Strength Index (RSI): The pace and variation of price fluctuations are measured by this momentum indicator. Overbought situations are indicated by an RSI above 70, while oversold conditions are indicated by an RSI below 30.

MACD (Moving Average Convergence Divergence): This indicator can be used to detect changes in momentum and trends by displaying the connection between two moving averages.

2. Fundamental Analysis

Evaluating a cryptocurrency's inherent worth is a component of fundamental analysis. Here are some things to think about:

Technology: Examine the underlying technologies behind cryptocurrencies. Does it tackle problems in the actual world and is it innovative?

Team: Examine the underlying technologies behind cryptocurrencies. Does it tackle problems in the actual world and is it innovative?

Adoption: Take a look at how widely used and adopted cryptocurrencies are. Are practical uses for it being made?

Partnerships: Think about the alliances and groups the initiative has brought together. Robust alliances may portend a bright future.

3. Sentiment Analysis

Evaluating investor sentiment and market sentiment are key components of sentiment analysis. Here are a few methods for performing sentiment analysis:

News and Social Media: Keep an eye on forums, social media, and news articles for conversations and viewpoints regarding cryptocurrency.

Market Sentiment Indicators: Use resources such as the Crypto Fear and Greed Index, which gauges sentiment in the market by looking at a number of different variables.

Managing Risk

1. Diversify Your Portfolio

To lower risk, diversification entails distributing your money among several cryptocurrencies. You can reduce the negative effects of a performing asset on your portfolio as a whole by diversifying.

2. Use Stop-Loss Orders

An order to sell cryptocurrency when it hits a certain price is known as a stop-loss order. If the market swings against your position, this helps to reduce your losses.

3. Don’t Invest More Than You Can Afford to Lose

Invest only funds that you are willing to lose. There is always a chance of losing money when investing in cryptocurrency markets because they may be very volatile.

4. Stay Informed

Keep yourself informed about the most recent events and advancements in the bitcoin space. This assists you in deciding wisely and adjusting to changes in the market.

Trading Psychology

1. Control Your Emotions

Fear and greed are two strong emotions that can impair judgment and cause you to make bad trading judgments. Acquire emotional self-control and follow your trading plan.

2. Be Patient

It takes patience to trade successfully. Avoid making transactions without doing the necessary research and preparation. Hold off till the appropriate moments.

3. Learn from Your Mistakes

Examine your previous trades and take note of your errors. Determine what went wrong and how your tactics might be strengthened.

4. Stay Disciplined

Trading successfully requires discipline. Adhere to your trading strategy and refrain from making snap judgments. Results are consistent when discipline is maintained.

Continuous Learning and Improvement

1. Follow Experts

Pay attention to knowledgeable traders and authorities in the bitcoin field. Take note of their tactics and insights.

2. Join Trading Communities

Participate in online trading forums and communities to exchange concepts, talk about tactics, and pick up tips from other traders.

3. Read Books and Take Courses

Invest in your education by learning about bitcoin trading through books and courses. Maintaining a competitive edge in the market requires constant learning.

4. Practice Regularly

Regular practice will help you stay sharp and refine your trading skills. Your confidence and experience will grow as you trade more.

Conclusion

It takes a combination of education, strategy, discipline, and ongoing learning to become a great bitcoin trader. You may improve your chances of success in the thrilling realm of cryptocurrency trading by comprehending the market, creating winning trading techniques, controlling risk, and keeping a disciplined mentality. Recall that trading is a journey, and the secret to long-term success is constant progress.

2 notes

·

View notes

Text

There's no question that Shiba Inu (CRYPTO: SHIB) had an incredible run in 2021.

The dog-themed cryptocurrency jumped from $0.000000000133 (nine zeros) at the end of 2020 to $0.000033 (four zeros) at the end of 2021, skyrocketing around 26,000,000% as major cryptocurrency exchanges allowed trading in SHIB and meme coins remained popular after the earlier rise of Dogecoin (CRYPTO: DOGE).

After the meme coin shaved off five decimal zeros from its price, some are calling for the coin to eventually reach $1. From its current price of $0.000021, that would mark a gain of roughly 4,700,000%. Considering how far Shiba Inu has already come, it may seem realistic for the coin to gain another 4,700,000%, but basic math is standing in the way.

Shiba Inu trades for such a small fraction of a penny because its supply is so large. There's currently a supply of 549 trillion SHIB tokens in circulation, giving it a market cap of around $11 billion. If those tokens were worth $1 each, SHIB's market cap would be $549 trillion, roughly 200 times bigger than Apple, the world's most valuable company, and more than six times the world's annual GDP.

In other words, Shiba Inu reaching $1 would likely require a massive reordering of the world economy. That's not going to happen. However, there is a caveat.

The only way SHIB can reach $1

There are two ways for Shiba Inu's value to increase. One is that traders simply bid up the price. The other is for the supply to decrease, which should make the remaining coins more valuable. In order for this to happen, the coins have to be taken out of circulation, or burned, as traders usually call it, by being transferred to dead wallets.

It's not unusual for this to happen. In fact, according to Shibburn, a website that tracks the burning of Shiba Inu coins, 410 trillion Shiba Inu coins have already been burnt. Nearly all of those coins were taken out of circulation by Vitalik Buterin, the co-founder of Ethereum (CRYPTO: ETH) who was gifted half of the 1 quadrillion Shiba Inu coin supply by the anonymous Shiba Inu founder. Buterin did so because he felt uncomfortable controlling so much of the supply of the cryptocurrency.

According to Shibburn, at the time of writing, 62 million Shiba Inu coins had been burned in the last 24 hours. While that might sound like a lot, at that rate it would take a little more than two weeks to burn 1 billion coins, and 40 years to burn 1 trillion. The burn could accelerate if there were an organized movement among SHIB holders, which could pick up steam if the value of SHIB continues to drop. However, there's a clear disincentive to burning the coins. If the value begins going up, it's in the interest of holders to keep their coins rather than burn them, and the decentralized nature of cryptocurrency makes it unlikely that there will be an organized movement powerful enough to substantially reduce the number of coins.

What's next for Shiba Inu

Since its peak at $0.88 at the end of October (2022?), Shiba Inu has lost more than 75% of its value, and other cryptocurrencies have fallen sharply as well. Bitcoin (CRYPTO: BTC) is down nearly 50% from its all-time high, as is Ethereum. Cryptocurrencies have tumbled amid broader jitters in the stock market over rising interest rates.

It's impossible to predict where the crypto currency market will go next, but the most highly inflated assets during the pandemic have already fallen sharply.

At this point, another Shiba Inu rally seems unlikely, and reaching $1 is nearly impossible.

Source:

https://www.nasdaq.com/articles/the-only-way-shiba-inu-will-ever-reach-$1

After October 22

Bitcoin Futures at the CME

ETF funds for Bitcoin

Crypto companies (stocks tend to gain as Bitcoin gains)

Cryptocurrency brokers sell derivatives

What’s next?

Coinbase announced AI 🤖 bot and how to create your own trading bot in 3 minutes using artificial intelligence

Price of Shiba at the time of this post (1:55am 10/30/2024)

0.00001910

Newark NJ

1 note

·

View note

Text

by Amy Castor and David Gerard

Bitcoin has set yet another new all-time high — $73,835 on Coinbase BTC-USD on March 14. This means bitcoin is good now! All our past objections are resolved. Going forward, we only deal in Finances U Desire.

The number is up, but the market is still super-thin. BitMEX BTC-USDT had a flash crash on Monday evening to just $8,900.

We’re not in a bubble. We’re in a balloon, one being pumped full of hot air. It’s fun going up — but the trip down can be very quick.

4 notes

·

View notes

Text

2 notes

·

View notes

Text

Welcome back to Chain Reaction. subscribe here Annyeong, or hello, friends! While I’m typically based in New York City, this week I’m reporting from Seoul, South Korea for Korea Blockchain Week. The week has been jam-packed with a number of conference events as well as offsite side events and networking happy hours. I’ve listened to a number of panels surrounding topics like web3 gaming, enterprise Blockchain adoption (I moderated one), institutional adoption, regulatory climate and investing in Asia. I also kept busy with a of interviews with local experts on the Market evolving out east as well as people who flew in to meet with startups based in the region. This means I’ll be putting out more articles on TechCrunch based on these conversations in the coming days and weeks…so keep an eye out for that. Meanwhile, there was some News that transpired in the web3 world, so let’s get into it. This week in web3 Crypto funding in August wasn’t as good as the numbers may lead you to believe (TC+) blockchain tech needs a ‘ChatGPT moment’ to scale enterprise adoption (TC+) MetaMask now allows crypto cash-out to PayPal and banks, but fees could be high Gleen’s tech-savvy chatbot for Discord and Slack attracts Solana founder in oversubscribed round The US can’t kill crypto: Real regulations are coming The latest pod For this week’s episode, Jacquelyn interviewed Charlie Shrem, founder of the bitcoin Foundation, general partner at Druid Ventures and host of the Charlie Shrem show. Before all that, he was the co-founder and CEO of BitInstant, which was a bitcoin payment processor that started in 2011. Shortly after founding the company, he was charged with operating an unlicensed money-transmitting business, and for allegedly attempting to launder over $1 million through the now defunct dark web marketplace Silk Road. He spent a little over a year in a low-Security prison as a result. Now, Charlie is a vocal advocate for clearer crypto regulation, he’s a crypto investor, podcaster and even a movie producer. We discussed how the bitcoin and crypto ecosystems have changed (and stayed the same) over the past decade as well as how his incarceration shaped his view on the industry. We also talked about: Need for regulatory clarity in the U.S. Crypto projects and sectors he’s following How the bitcoin ecosystem is growing Friend.tech Advice for listeners Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to keep up with the latest episodes, and please leave us a review if you like what you hear! Follow the money Story Protocol raised over $54 million in round led by a16z crypto Domain name startup D3 Global raised $5 million in a seed round led by Shima Capital Cross-chain communication protocol Socket raised $5 million from Coinbase Ventures and Frameworks Kotani gets $2 million pre-seed to help African workers send money home via crypto GenTwo raised $15 million in a Series A funding round led by Point72 Ventures What else we’re writing Want to branch out from the world of web3? Here are some articles on TechCrunch that caught our attention this week. Our favorite startups from YC’s Summer 2023 Demo Day, Day 1 (TC+) Clubhouse is trying to make a comeback Tech companies are finding their profitability groove (TC+) Here’s why some investors are sitting out of YC Demo Day (TC+) EU confirms six (mostly US) tech giants are subject to Digital Markets Act

2 notes

·

View notes