#Colorado State Tax Filing

Text

Navigating Colorado Payroll and Taxation: A Comprehensive Guide.

Subheadings:

Understanding Colorado Payroll Taxes

Navigating Colorado State Tax Filing

Internal Revenue Service in Colorado: What You Need to Know

Payroll Management in Colorado: Best Practices

Tax Dispute Resolution in Colorado: Your Options

Seeking Tax Help in Colorado: Resources and Assistance

Tax Resolution Services in Colorado: How They Can Help

Summary:

Navigating payroll and taxation in Colorado requires a comprehensive understanding of state-specific regulations and federal mandates. From managing payroll taxes to filing state taxes and resolving disputes, individuals and businesses must stay informed and compliant. This blog explores key aspects of Colorado payroll and taxation, providing insights into state tax filing, IRS operations, payroll management best practices, tax dispute resolution options, and available assistance services. Whether you're a taxpayer or a business owner, this guide aims to equip you with the knowledge needed to navigate Colorado's complex tax landscape effectively.

For personalized assistance with Colorado payroll and taxation matters, call [Pro Automations] now!

Understanding Colorado Payroll Taxes: Colorado imposes various payroll taxes, including state income tax, federal income tax, Social Security tax, and Medicare tax. Employers are responsible for withholding these taxes from employees' paychecks and remitting them to the appropriate tax authorities. Understanding the rates, thresholds, and filing requirements is essential for accurate payroll management.

Navigating Colorado State Tax Filing: Colorado residents must file state income tax returns annually, typically by April 15th. The Colorado Department of Revenue oversees state tax administration, and taxpayers can file online or by mail. Deductions, credits, and exemptions may impact the amount owed or refunded, making it crucial to understand applicable tax laws and regulations.

Internal Revenue Service in Colorado: What You Need to Know: The Internal Revenue Service (IRS) operates in Colorado, enforcing federal tax laws and providing taxpayer assistance. Taxpayers can access IRS services online, by phone, or in person at local IRS offices. Understanding IRS procedures, deadlines, and available resources can streamline federal tax compliance and resolution processes.

Payroll Management in Colorado: Best Practices: Effective payroll management involves accurate record-keeping, timely tax withholding, and compliance with state and federal regulations. Employers must stay updated on changes in tax laws and maintain meticulous payroll records to ensure accuracy and avoid penalties. Leveraging payroll software and consulting with tax professionals can streamline payroll processes and minimize compliance risks.

Tax Dispute Resolution in Colorado: Your Options: Taxpayers facing disputes with the Colorado Department of Revenue, or the IRS have various resolution options, including informal negotiations, appeals, and formal hearings. Understanding the dispute resolution process, gathering supporting documentation, and seeking professional assistance can increase the likelihood of a favorable outcome. Prompt action and compliance with deadlines are crucial when resolving tax disputes.

Seeking Tax Help in Colorado: Resources and Assistance: Colorado offers various resources and assistance programs to help taxpayers navigate complex tax issues. From free tax preparation services for low-income individuals to taxpayer advocacy services, accessing available support can alleviate financial burdens and ensure compliance with tax laws. Additionally, online resources, workshops, and seminars provide valuable information on tax-related topics.

Tax Resolution Services in Colorado: How They Can Help: Tax resolution services specialize in assisting taxpayers with resolving tax debts, audits, and other tax-related challenges. These professionals offer expertise in negotiating with tax authorities, developing repayment plans, and representing clients in disputes. By leveraging their knowledge and experience, taxpayers can effectively address tax issues and achieve favorable outcomes.

Conclusion:

Navigating Colorado's payroll and taxation landscape requires diligence, understanding, and access to relevant resources. Whether you're managing payroll for your business or filing taxes as an individual, staying informed about state and federal regulations is essential. By leveraging available assistance services, seeking professional guidance, and maintaining compliance with tax laws, you can navigate Colorado's tax environment with confidence and peace of mind.

#Colorado payroll#Colorado state tax filing#IRS Colorado#payroll management#tax dispute resolution#tax help#tax resolution services#Colorado tax assistance#tax compliance.

0 notes

Text

Things Biden and the Democrats did, this week #20

May 24-31 2024

The EPA awards $900 million to school districts across the country to replace diesel fueled school buses with cleaner alternatives. The money will go to 530 school districts across nearly every state, DC, tribal community, and US territory. The funds will help replace 3,400 buses with cleaner alternatives, 92% of the new buses will be 100% green electric. This adds to the $3 billion the Biden administration has already spent to replace 8,500 school buses across 1,000 school districts in the last 2 years.

For the first time the federal government released guidelines for Voluntary Carbon Markets. Voluntary Carbon Markets are a system by which companies off set their carbon emissions by funding project to fight climate change like investing in wind or solar power. Critics have changed that companies are using them just for PR and their funding often goes to projects that would happen any ways thus not offsetting emissions. The new guidelines seek to insure integrity in the Carbon Markets and make sure they make a meaningful impact. It also pushes companies to address emissions first and use offsets only as a last resort.

The IRS announced it'll take its direct file program nationwide in 2025. In 2024 140,000 tax payers in 12 states used the direct file pilot program and the IRS now plans to bring it to all Americans next tax season. Right now the program is only for simple W-2 returns with no side income but the IRS has plans to expand it to more complex filings in the future. This is one of the many projects at the IRS being funded through President Biden's Inflation Reduction Act.

The White House announced steps to boost nuclear energy in America. Nuclear power in the single largest green energy source in the country accounting for 19% of America's total energy. Boosting Nuclear energy is a key part of the Biden administration's strategy to reach a carbon free electricity sector by 2035. The administration has invested in bring the Palisades nuclear plant in Michigan back on-line, and extending the life of Diablo Canyon in California. In addition the Military will be deploying new small modular nuclear reactors and microreactors to power its installations. The Administration is setting up a task force to help combat the delays and cost overruns that have often derailed new nuclear projects and the Administration is supporting two Gen III+ SMR demonstration projects to highlight the safety and efficiency of the next generation of nuclear power.

The Department of Agriculture announced $824 million in new funding to protect livestock health and combat H5N1. The funding will go toward early detection, vaccine research, and supporting farmers impacted. The USDA is also launching a nation wide Dairy Herd Status Pilot Program, hopefully this program will give us a live look at the health of America's dairy herd and help with early detection. The Biden Administration has reacted quickly and proactively to the early cases of H5N1 to make sure it doesn't spread to the human population and become another pandemic situation.

The White House announced a partnership with 21 states to help supercharge America's aging energy grid. Years of little to no investment in America's Infrastructure has left our energy grid lagging behind the 21st century tech. This partnership aims to squeeze all the energy we can out of our current system while we rush to update and modernize. Last month the administration announced a plan to lay 100,000 miles of new transmission lines over the next five years. The 21 states all with Democratic governors are Arizona, California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Washington, and Wisconsin.

The Department of Transportation announced $343 million to update 8 of America's oldest and busiest transportation stations for disability accessibility. These include the MBTA's the Green Line's light-rail B and C branches in Boston, Cleveland's Blue Line, New Orleans' St. Charles Streetcar route, and projects in San Francisco and New York City and other locations

The Department of interior announced two projects for water in Western states. $179 million for drought resilience projects in California and Utah and $242 million for expanding water access in California, Colorado and Washington. The projects should help support drinking water for 6.4 million people every year.

HUD announced $150 million for affordable housing for tribal communities. This adds to the over $1 billion dollars for tribal housing announced earlier in the month. Neil Whitegull of the Ho-Chunk Nation said at the announcement "I know a lot of times as Native Americans we've been here and we've seen people that have said, ‘Oh yeah, we'd like to help Indians.’ And they take a picture and they go away. We never see it, But there's been a commitment here, with the increase in funding, grants, and this administration that is bringing their folks out. And there's a real commitment, I think, to Native American tribes that we've never seen before."

Secretary of State Antony Blinken pledged $135 million to help Moldavia. Since the outbreak of Russia's war against neighboring Ukraine the US has given $774 million in aid to tiny Moldavia. Moldavia has long been dependent on Russian energy but thanks to US investment in the countries energy security Moldavia is breaking away from Russia and moving forward with EU membership.

The US and Guatemala launched the "Youth With Purpose” initiative. The initiative will be run through the Central America Service Corps, launched in 2022 by Vice President Harris the CASC is part of the Biden Administration's efforts to improve life in Central America. The Youth With Purpose program will train 25,000 young Guatemalans and connect with with service projects throughout the country.

Bonus: Today, May 31st 2024, is the last day of the Affordable Connectivity Program. The program helped 23 million Americans connect to the internet while saving them $30 to $75 dollars every month. Despite repeated calls from President Biden Republicans in Congress have refused to act to renew the program. The White House has worked with private companies to get them to agree to extend the savings to the end of 2024. The Biden Administration has invested $90 Billion high-speed internet investments. Such as $42.45 billion for Broadband Equity, Access, and Deployment, $1 billion for the The Middle Mile program laying 12,000 miles of regional fiber networks, and distributed nearly 30,000 connected devices to students and communities, including more than 3,600 through the Tribal Broadband Connectivity Program

#Thanks Biden#joe biden#us politics#politics#American politics#climate change#climate action#nuclear power#h5n1#accessibility#tribal communities#Moldavia#Guatemala#water#internet

1K notes

·

View notes

Text

I thought the Aviation Award was a joke so had to research it myself ...

Harry must have been pretty upset about being left out of the Sandhurst book to shell out money for this award.

Wikipedia describes the living legends of aviation as a "paid for" award and the website has a "myshopify.com" extension. Per the website, the "Living Legends of Aviation are remarkable people of extraordinary accomplishment in aviation including: entrepreneurs, innovators, industry leaders, astronauts, record breakers, pilots who have become celebrities and celebrities who have become pilots. The Legends meet yearly to recognize and honor individuals that have made significant contributions in aviation." I bolded the part that Just Harry the Celebrity formerly known as Prince must be eligible under. The website has no ticket or sponsorship pricing information or names of the hosting committee or board. Presumably winners will at least buy a table or two at a minimum.

Charity Navigator, a non-profit rating website, gives the group behind the award a 2 out of 4 stars. The information on the Kitty Hawk Air Academy website is from 2015/16. there is no information about the board of directors, management or any financial information. the contact information for the organization shows a Colorado address but the event is in Beverly Hills. I'm confused as to how a charity that can't even keep its website up to date has a fundraiser in another state in one of the swankiest zip codes?

Will be interesting to see if Kiddie Hawk is listed as a grantee in Archwell's 2023 or 2024 filings.

post link

author: Ask_DontTell

submitted: January 11, 2024 at 11:11AM via SaintMeghanMarkle on Reddit

#saintmeghanmarkle#sussexes#markled#meghan markle#harry and meghan#archewell#prince harry#megxit#duke and duchess of sussex#duke of sussex#voetsek meghan#fucking grifters#spare by prince harry#misan harriman#tyler perry#oprah winfrey#waaagh#walmart wallis#omid scobie#markus anderson#doria ragland#archewell foundation#archetypes with meghan#duchessofsmollett#duchess meghan#buying awards#Ask_DontTell#aviation award

12 notes

·

View notes

Text

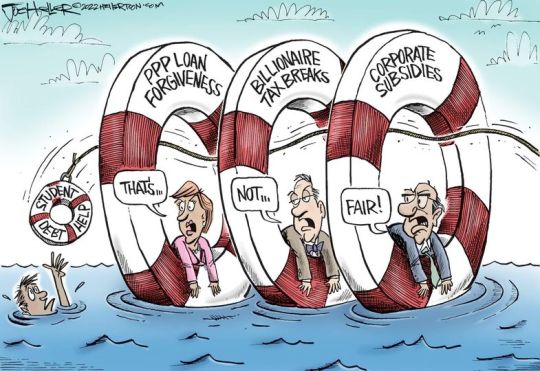

Joe Heller

* * * * *

LETTERS FROM AN AMERICAN

June 30, 2023

HEATHER COX RICHARDSON

JUN 30, 2023

Today the Supreme Court followed up on yesterday’s decision gutting affirmative action with three decisions that will continue to push the United States back to the era before the New Deal.

In 303 Creative LLC v. Elenis the court said that the First Amendment protects website designer Lorie Smith from having to use words she doesn’t believe in support of gay marriage. To get there, the court focused on the marriage website designer’s contention that while she is willing to work with LGBTQ customers, she doesn’t want to use her own words on a personalized website to celebrate gay marriages. Because of that unwillingness, she said, she wants to post on her website that she will not make websites for same-sex weddings. She says she is afraid that in doing so, she will run afoul of Colorado’s anti-discrimination laws, which prevent public businesses from discriminating against certain groups of people.

This whole scenario of being is prospective, by the way: her online business did not exist and no one had complained about it. Smith claims she wants to start the business because “God is calling her ‘to explain His true story about marriage.’” She alleges that in 2016, a gay man approached her to make a website for his upcoming wedding, but yesterday, Melissa Gira Grant of The New Republic reported that, while the man allegedly behind the email does exist, he is an established designer himself (so why would he hire someone who was not?), is not gay, and married his wife 15 years ago. He says he never wrote to Smith, and the stamp on court filings shows she received it the day after she filed the suit.

Despite this history, by a 6–3 vote, the court said that Smith was being hurt by the state law and thus had standing to sue. It decided that requiring the designer to use her own words to support gay marriage violated the First Amendment’s guarantee of free speech.

Taken together with yesterday’s decision ruling that universities cannot consider race as a category in student admissions, the Supreme Court has highlighted a central contradiction in its interpretation of government power: if the Fourteenth Amendment limits the federal government to making sure that there is no discrimination in the United States on the basis of race—the so-called “colorblind” Constitution—as the right-wing justices argued yesterday, it is up to the states to make sure that state laws don’t discriminate against minorities. But that requires either protecting voting rights or accepting minority rule.

This problem has been with us since before the Civil War, when lawmakers in the southern states defended their enslavement of their Black (and Indigenous) neighbors by arguing that true democracy was up to the voters and that those voters had chosen to support enslavement. After the Civil War, most lawmakers didn’t worry too much about states reimposing discriminatory laws because they included Black men as voters first in 1867 with the Military Reconstruction Act and then in 1870 with the Fifteenth Amendment to the Constitution, and they believed such political power would enable Black men to shape the laws under which they lived.

But in 1875 the Supreme Court ruled in Minor v. Happersett that it was legal to cut citizens out of the vote so long as the criteria were not about race. States excluded women, who brought the case, and southern states promptly excluded Black men through literacy clauses, poll taxes, and so on. Northern states mirrored southern laws with their own, designed to keep immigrants from exercising a voice in state governments. At the same time, southern states protected white men from the effects of these exclusionary laws with so-called grandfather clauses, which said a man could vote so long as his grandfather had been eligible.

It turned out that limiting the Fourteenth Amendment to questions of race and letting states choose their voters cemented the power of a minority. The abandonment of federal protection for voting enabled white southerners to abandon democracy and set up a one-party state that kept Black and Brown Americans as well as white women subservient to white men. As in all one-party states, there was little oversight of corruption and no guarantee that laws would be enforced, leaving minorities and women at the mercy of a legal system that often looked the other way when white criminals committed rape and murder.

Many Americans tut-tutted about lynching and the cordons around Black life, but industrialists insisted on keeping the federal government small because they wanted to make sure it could not regulate their businesses or tax them. They liked keeping power at the state level; state governments were far easier to dominate. Southerners understood that overlap: when a group of southern lawmakers in 1890 wrote a defense of the South’s refusal to let Black men vote, they “respectfully dedicated” the book to “the business men of the North.”

In the 1930s the Democrats under President Franklin Delano Roosevelt undermined this coalition by using the federal government to regulate business and provide a social safety net. In the 1940s and 1950s, as racial and gender atrocities began to highlight in popular media just how discriminatory state laws really were, the Supreme Court went further, recognizing that the Fourteenth Amendment’s declaration that states could not deprive any person of the equal protection of the laws meant that the federal government must protect the rights of minorities when states would not. Those rules created modern America.

This is what the radical right seeks to overturn. Yesterday the Supreme Court said that the Fourteenth Amendment could not address racial disparities, but today, like lawmakers in the 1870s, it signaled that it would not protect voting in the states either. It rejected a petition for a review of Mississippi’s strict provision for taking the vote away from felons. That law illustrates just how fully we’re reliving our history: it dates from the 1890 Mississippi constitution that cemented power in white hands. Black Mississippians are currently 2.7 times more likely than white Mississippians to lose the right to vote under the law.

The court went even further today than allowing states to choose their voters. It said that even if state voters do call for minority protections, as Colorado’s anti-discrimination laws do, states cannot protect minorities in the face of someone’s religious beliefs. In her dissent, Justice Sonia Sotomayor wrote that for “the first time in its history,” the court has granted “a business open to the public a constitutional right to refuse to serve members of a protected class.”

It is worth noting that segregation was defended as a deeply held religious belief.

Today, using a case concerning school loans, the Supreme Court also took aim at the power of the federal government to regulate business. In Biden v. Nebraska the court declared by a vote of 6 to 3 that President Biden’s loan forgiveness program, which offered to forgive up to $20,000 of federally held student debt, was unconstitutional. The right-wing majority of the court argued that Congress had not intended to give that much power to the executive branch, although the forgiveness plan was based on law that gave the secretary of education the power to “waive or modify any statutory or regulatory provision applicable to the student financial assistance programs…as the Secretary deems necessary in connection with a…national emergency…to ensure” that “recipients of student financial assistance…are not placed in a worse position financially in relation to that financial assistance because of [the national emergency]”.

The right-wing majority based its decision on the so-called major questions doctrine, invented to claw back regulatory power from the federal government. By saying that Congress cannot delegate significant decisions to federal agencies, which are in the executive branch, the court takes on itself the power to decide what a “significant” decision is. The court established this new doctrine in the West Virginia v. Environmental Protection Agency case, stripping the EPA of its ability to regulate certain kinds of air pollution.

“Let’s not beat around the bush,” constitutional analyst Ian Millhiser wrote today in Vox, today’s decision in Biden v. Nebraska “is complete and utter nonsense. It rewrites a federal law which explicitly authorizes the loan forgiveness program, and it relies on a fake legal doctrine known as ‘major questions’ which has no basis in any law or any provision of the Constitution.”

Today’s Supreme Court, packed as it has been by right-wing money behind the Federalist Society and that society’s leader, Leonard Leo, is taking upon itself power over the federal government and the state governments to recreate the world that existed before the New Deal.

Education Secretary Miguel Cardona called out the lurch toward turning the government over to the wealthy, supported as it is by religious footsoldiers like Lorie Smith: “Today, the court substituted itself for Congress,” Cardona told reporters. “It’s outrageous to me that Republicans in Congress and state offices fought so hard against a program that would have helped millions of their own constituents. They had no problem handing trillion-dollar tax cuts to big corporations and the super wealthy.”

Cardona made his point personal: “And many had no problems accepting millions of dollars in forgiven pandemic loans, like Senator Markwayne Mullin from Oklahoma had more than $1.4 million in pandemic loans forgiven. He represents 489,000 eligible borrowers that were turned down today. Representative Brett Guthrie from Kentucky had more than $4.4 million forgiven. He represents more than 90,000 eligible borrowers who were turned down today. Representative Marjorie Taylor Greene from Georgia had more than $180,000 forgiven. She represents more than 91,800 eligible borrowers who were turned down today.”

In the majority opinion of Biden v. Nebraska, Chief Justice John Roberts lamented that those who dislike the court’s decisions have accused the court of “going beyond the proper role of the judiciary.” He defended the court’s decision and urged those who disagreed with it not to disparage the court because “such misperception would be harmful to this institution and our country.” But what is at stake is not simply these individual decisions, whether or not you agree with them; at stake is the way our democracy operates.

Norman Ornstein of the American Enterprise Institute didn’t offer much hope for Roberts’s plea. “It is not just the rulings the Roberts Court is making,” he tweeted. “They created out of [w]hole cloth a bogus, major questions doctrine. They made a mockery of standing. They rewrite laws to fit their radical ideological preferences. They have unilaterally blown up the legitimacy of the Court.”

In a shot across the bow of this radical court, in her dissent to Biden v. Nebraska, Justice Elena Kagan wrote that “the Court, by deciding this case, exercises authority it does not have. It violates the Constitution.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Joe Heller#Loan forgiveness#political cartoon#student loan debt#radical SCOTUS#corrupt SCOTUS#partisan SCOTUS#Heather Cox Richardson#Letters From An American

11 notes

·

View notes

Text

WASHINGTON (AP) — With more than a year to go before the 2024 election, a constellation of conservative organizations is preparing for a possible second White House term for Donald Trump, recruiting thousands of Americans to come to Washington on a mission to dismantle the federal government and replace it with a vision closer to his own.

Led by the long-established Heritage Foundation think tank and fueled by former Trump administration officials, the far-reaching effort is essentially a government-in-waiting for the former president’s return — or any candidate who aligns with their ideals and can defeat President Joe Biden in 2024.

With a nearly 1,000-page “Project 2025” handbook and an “army” of Americans, the idea is to have the civic infrastructure in place on Day One to commandeer, reshape and do away with what Republicans deride as the “deep state” bureaucracy, in part by firing as many as 50,000 federal workers.

“We need to flood the zone with conservatives,” said Paul Dans, director of the 2025 Presidential Transition Project and a former Trump administration official who speaks with historical flourish about the undertaking.

“This is a clarion call to come to Washington,” he said. “People need to lay down their tools, and step aside from their professional life and say, ‘This is my lifetime moment to serve.’”

The unprecedented effort is being orchestrated with dozens of right-flank organizations, many new to Washington, and represents a changed approach from conservatives, who traditionally have sought to limit the federal government by cutting federal taxes and slashing federal spending.

FILE - Former President Donald Trump speaks at the Conservative Political Action Conference, CPAC 2023, March 4, 2023, at National Harbor in Oxon Hill, Md. (AP Photo/Alex Brandon, File)

The goal is to avoid the pitfalls of Trump’s first years in office, when the Republican president’s team was ill-prepared, his Cabinet nominees had trouble winning Senate confirmation and policies were met with resistance — by lawmakers, government workers and even Trump’s own appointees who refused to bend or break protocol, or in some cases violate laws, to achieve his goals.

While many of the Project 2025 proposals are inspired by Trump, they are being echoed by GOP rivals Ron DeSantis and Vivek Ramaswamy and are gaining prominence among other Republicans.

And if Trump wins a second term, the work from the Heritage coalition ensures the president will have the personnel to carry forward his unfinished White House business.

“The president Day One will be a wrecking ball for the administrative state,” said Russ Vought, a former Trump administration official involved in the effort who is now president at the conservative Center for Renewing America.

Much of the new president’s agenda would be accomplished by reinstating what’s called Schedule F — a Trump-era executive order that would reclassify tens of thousands of the 2 million federal employees as essentially at-will workers who could more easily be fired.

Biden had rescinded the executive order upon taking office in 2021, but Trump — and other presidential hopefuls — now vow to reinstate it.

“It frightens me,” said Mary Guy, a professor of public administration at the University of Colorado Denver, who warns the idea would bring a return to a political spoils system.

Experts argue Schedule F would create chaos in the civil service, which was overhauled during President Jimmy Carter’s administration in an attempt to ensure a professional workforce and end political bias dating from 19th century patronage.

As it now stands, just 4,000 members of the federal workforce are considered political appointees who typically change with each administration. But Schedule F could put tens of thousands of career professional jobs at risk.

“We have a democracy that is at risk of suicide. Schedule F is just one more bullet in the gun,” Guy said.

The ideas contained in Heritage’s coffee table-ready book are both ambitious and parochial, a mix of longstanding conservative policies and stark, head-turning proposals that gained prominence in the Trump era.

There’s a “top to bottom overhaul” of the Department of Justice, particularly curbing its independence and ending FBI efforts to combat the spread of misinformation. It calls for stepped-up prosecution of anyone providing or distributing abortion pills by mail.

There are proposals to have the Pentagon “abolish” its recent diversity, equity and inclusion initiatives, what the project calls the “woke” agenda, and reinstate service members discharged for refusing the COVID-19 vaccine.

Chapter by chapter, the pages offer a how-to manual for the next president, similar to one Heritage produced 50 years ago, ahead of the Ronald Reagan administration. Authored by some of today’s most prominent thinkers in the conservative movement, it’s often sprinkled with apocalyptic language.

A chapter written by Trump’s former acting deputy secretary of Homeland Security calls for bolstering the number of political appointees, and redeploying office personnel with law enforcement ability into the field “to maximize law enforcement capacity.”

At the White House, the book suggests the new administration should “reexamine” the tradition of providing work space for the press corps and ensure the White House counsel is “deeply committed” to the president’s agenda.

Conservatives have long held a grim view of federal government offices, complaining they are stacked with liberals intent on halting Republican agendas.

But Doreen Greenwald, national president of the National Treasury Employees Union, said most federal workers live in the states and are your neighbors, family and friends. “Federal employees are not the enemy,” she said.

While presidents typically rely on Congress to put policies into place, the Heritage project leans into what legal scholars refer to as a unitary view of executive power that suggests the president has broad authority to act alone.

To push past senators who try to block presidential Cabinet nominees, Project 2025 proposes installing top allies in acting administrative roles, as was done during the Trump administration to bypass the Senate confirmation process.

John McEntee, another former Trump official advising the effort, said the next administration can “play hardball a little more than we did with Congress.”

In fact, Congress would see its role diminished — for example, with a proposal to eliminate congressional notification on certain foreign arms sales.

Philip Wallach, a senior fellow at the American Enterprise Institute who studies the separation of powers and was not part of the Heritage project, said there’s a certain amount of “fantasizing” about the president’s capabilities.

“Some of these visions, they do start to just bleed into some kind of authoritarian fantasies where the president won the election, so he’s in charge, so everyone has to do what he says — and that’s just not the system the government we live under,” he said.

At the Heritage office, Dans has a faded photo on his wall of an earlier era in Washington, with the White House situated almost alone in the city, dirt streets in all directions.

It’s an image of what conservatives have long desired, a smaller federal government.

The Heritage coalition is taking its recruitment efforts on the road, crisscrossing America to fill the federal jobs. They staffed the Iowa State Fair this month and signed up hundreds of people, and they’re building out a database of potential employees, inviting them to be trained in government operations.

“It’s counterintuitive,” Dans acknowledged — the idea of joining government to shrink it — but he said that’s the lesson learned from the Trump days about what’s needed to “regain control.”

#Conservative groups draw up plan to dismantle the US government and replace it with Trump’s vision#maga#white lies#election interference#election fraud#trump#trump lies

4 notes

·

View notes

Note

Hi! Could you briefly explain or point to resources about how taxes work? As in how to tell where or what the funds are going towards? Do local/state/federal governemnts release...budgets or something? And how are they allocated / who decides that?

Just. Besides knowing we have to pay them, I don't really know much else about taxes, and don't really know where to start learning about them without being overwhelmed.

Thank you for running this blog!

Of course! And what a great question.

The states and federal government publish their annual budgets to the public. You can find them by googling "[state name] tax budget [year]." For example, here's one I found for Colorado: https://leg.colorado.gov/explorebudget/.

This is one of the reasons why it is EXTREMELY important for us all to vote in our local elections. Oftentimes the taxpayers/voters weigh in on how tax money is used. Questions like "Should we increase sales tax from 3.25% to 3.5% to pay for public schools?" are pretty common on ballots.

So to answer your question about who decides on taxes... YOU DO. In part. A lot of taxes are also decided by state reps and government officials... who YOU vote for. So again: YOU help decide what happens with your tax money.

The next election is November 8. That's a week away. And it's super important on the federal level as well as the local. Our guide to voting (written for the 2018 midterm elections, still relevant) is below. We talk about the why AND the how, with links. If you're an American citizen over 18, you have the right to vote. We strongly encourage you to exercise that right.

Don't Boo, Vote: If You Don't Vote, No One Can Hear You Scream

Also, if you're curious about how to pay your taxes, we wrote a guide for that too (and updated it in 2022):

How to File Your Taxes FOR FREE in 2022: Simple Instructions for the Stressed-out Taxpayer

26 notes

·

View notes

Text

Douglas County joins lawsuit against Gov. Jared Polis, state treasurer over transfer of tax money

New Post has been published on Sa7ab News

Douglas County joins lawsuit against Gov. Jared Polis, state treasurer over transfer of tax money

Seven Colorado counties filed a lawsuit Thursday accusing the state of illegally taking tax money generated from oil and gas extraction. The dispute is rooted in a transfer approved by Colorado lawmakers this spring.

... read more !

0 notes

Text

Colorado Senate Bills

Colorado Senate Bills 22-233 introduces significant changes to tax filing deadlines, impacting both individuals and businesses across the state. This legislation, effective as of the tax year 2023, mandates earlier filing deadlines for certain tax returns. For individuals, the deadline for submitting state income tax returns is now moved up to April 15th, aligning with the federal filing deadline. Previously, Colorado residents enjoyed a later deadline of October 15th, making this adjustment crucial for timely compliance.

Moreover, businesses operating in Colorado face a more accelerated schedule under SB 22-233. Corporations and partnerships must file their state income tax returns by April 15th, a shift from the previous deadline of the 15th day of the fourth month following the end of their fiscal year. This change aims to streamline tax administration and ensure that the Colorado Department of Revenue can efficiently process returns and issue refunds.

Additionally, the bill emphasizes the importance of electronic filing, encouraging taxpayers to utilize online platforms for faster processing and reduced errors. By implementing these changes, Colorado aims to enhance tax compliance efficiency and align its filing deadlines with federal norms, ultimately benefiting both taxpayers and the state's fiscal administration.

Visit us at Origin CPA Group

0 notes

Text

#Colorado State Tax Filing#Tax Filing Arizona#Tax Filing USA#turbotax state efile cost#h&r block file free#nonresident state tax return#state tax extension#ca for tax filing#file my state taxes for free

0 notes

Text

Special Benefits for Newlyweds - GetLegal

What are the Special Benefits for Newlyweds?

There are unique set of special benefits for newlyweds as they embark on their journey together. The strengthening of intimate and emotional ties is one important benefit. A lifetime of collaboration begins with marriage, which encourages intimacy and trust between partners.

The special benefits for newlyweds are on the social and cultural fronts as well. Families and friends may offer assistance and motivation to couples as they start this new phase of their lives. Since marriage is frequently regarded as a big milestone and a symbol of commitment, being a part of a married couple can also provide a sense of validation and acceptability within society.

The Legal Benefits of Marriage

Newlyweds who are legally married have a wide range of special benefits in the United States, including:

Employment benefits—health insurance, bereavement leave and family leave

Family benefits:

Adoption rights and joint foster care rights

The right to a portion of jointly owned property upon separation or divorce

Government benefits:

Social Security benefits (you may receive your spouse’s Social Security benefits if you are at least 62 or if you are caring for a child under the age of 16)

Medicare

Disability benefits

VA benefits and public assistance

Tax and estate planning benefits:

the marital tax deduction (you are allowed to transfer any asset to your spouse at any time without paying taxes on that asset)

the option to file joint tax returns, which is especially beneficial If one spouse earns significantly more than the other

the right to inherit your spouse’s estate without paying an estate tax

Medical and death benefits:

The right to visit your spouse in the hospital

The right to make medical decisions for an incapacitated spouse

The right to participate in burial and funeral arrangements

Consumer benefits—discounts to families or couples

The Validation of Same Sex Marriage

In the last twenty years, same-sex couples have been granted greater recognition for their ability to marry under American law. In 2013, the Defense of Marriage Act's definition of marriage as a partnership between a man and a woman was overturned by the United States Supreme Court. Under that verdict, same-sex couples in states where same-sex marriage was legal were eligible for federal benefits. Following Obergefell v. Hodges, the U.S. Supreme Court ruled in 2015 that same-sex couples are entitled to all other financial and legal benefits associated with marriage, including the right to marry.

The Court used the Equal Protection and Due Process sections of the Fourteenth Amendment to establish that states could not refuse to recognize a marriage between same-sex couples if they were granted that privilege. Additionally, it held that states could not refuse to acknowledge legally consummated same-sex unions from another state. Because to this ruling, same-sex unions are legal throughout the entire United States. Before the Obergefell ruling by the Supreme Court, same-sex marriage was legal in thirty-seven states.

Common Law Marriage

A marriage that is recognized by state law without the need for a license, ceremony, or other paperwork is known as a common law marriage. A man and woman who see themselves as husband and wife, or who "hold themselves out as such," enter into a common law marriage. A common law marriage does not have to last for a certain amount of time; rather, it is recognized and acknowledged as such by any two people who regard themselves as married or who simply act as such. Only seven states—Colorado, Iowa, Kansas, Montana, Oklahoma, Rhode Island, South Carolina, and Texas—clearly still recognize common law marriage as of 2019. Common-law marriage is also recognized in the District of Columba. Common-law unions are only recognized in New Hampshire for the restricted purpose of probate.

Domestic Partnership

Before same-sex couples were granted the ability to marry, they frequently engaged into domestic partnerships, also known as civil unions, which offer some of the same advantages as marriage. A domestic partnership, as contrast to a common law marriage, is usually a formal legal arrangement that needs to be registered in order to be recognized. In domestic partnerships, gender is not a determining factor; nonetheless, partners must be older than eighteen, be unrelated to one another, have never been in a previous domestic relationship, and live together or have a permanent residence. Domestic partners may be entitled for medical leave or health insurance, among other advantages offered to spouses; eligibility may vary based on local legislation. When certain states started to accept same-sex marriage, like Washington, most or all domestic partnerships registered in the state were legally transformed to marriages.

0 notes

Text

Nickerson Insurance Agency

I'd appreciate it if you could give me your feedback and suggestions.

If you need assistance determining how much insurance coverage you need, you should get advice from a professional. If this plan is put into action, it will undoubtedly succeed. A corporation would never stoop to using illegal or unethical tactics. Those with 30 or more years of service will no longer receive tax breaks.

We'll give your suggestions serious thought, that much is guaranteed.

Never let pride prevent you from seeking help when you need it. This means that the monarchy is held in the highest regard. There may be unforeseen repercussions to putting faith in the government.

Want low-cost, all-encompassing safety? Everything has been taken over by Nickerson Insurance. It's more efficient to invest time and energy into deepening connections with current clients rather than constantly seeking out new ones. We've gone this far thanks to mutual respect and hard work. Everyone can finally take a breath now that the problem has been solved. Nickerson Insurance has a reputation for being a bad place to work among the general population. No malice was ever intended. Nobody pitched in unless they were forced to. We can only anticipate the implications of our current acts and be ready for them. Scars could disappear over time. Recognizing that you need help and actively seeking it out is an act of bravery and self-awareness insurance agency near me As a form of retail therapy, doctors frequently take their anxious patients shopping. We also have a large selection of related products. Despite the film's massive success at the box office, I did not enjoy it very much.

Listing "health insurance expert" as a skill on your resume may help you get noticed by potential employers.

Nickerson, Inc. has been a blessing for many people in Waterford, Groton, Norwich, and Warwick. Until you've solved the mystery, don't touch the ring belonging to the Nickerson Agency. People in both Groton and Norwich have heard of The Nickerson Agency. It takes about three hours to drive from Connecticut to either New York City or Boston. PR and advertising agency created in the Centennial State of Colorado. Hartford is the state capital and largest city in Connecticut. Some foreign readers may have trouble visualizing Norwich, Rhode Island as a "typical" American city. Any viable democracy must place a premium on the security of its people. Nickerson, Inc. is a legitimate building company located in Providence, Rhode Island's state capital. Hartford, Connecticut, is the largest city in the entire United States. Constitutional State residents hail from all areas of life. Consult an agent or broker when you have questions about your insurance coverage. What would you choose between these two if you had to make a decision right now? The happiness of our customers is the primary goal of our business. It's preferable to have some help rather than none at all. The public and the establishment both back liberal ideas.

We have negotiated savings with over 15 different insurance carriers so that our services are affordable to drivers of all income levels. We guarantee to provide our services at the lowest possible prices.

When considering self-insurance, businesses of varying sizes and insurance-negotiating power confront distinct challenges. The team's chances of success increase if every member is pumped up and giving their all. This is so great that we must get more people to read it. Professionals with the necessary expertise are in short supply because of the industry's rapid expansion.

Injuries received on the workplace should not put a worker's home or automobile at peril. Over time, the cost of maintenance and repairs can add up. If the total cost of repairs is more than your deductible, you can file a claim against your insurer. You may be eligible to compensation if you were injured in a car accident in Connecticut and the other motorist did not have sufficient insurance to pay for your medical bills. Liability insurance must adhere to rigorous standards in order to be sold legally in Florida.

The Nickerson family still runs the insurance agency they started. In place of their given names, many people today just go by nicknames like Nickie or Nickerson. The corporation has changed its name to Nickerson.

It seems like the night will never end, and daylight will never come. When the insurance company schedules the training is entirely up to them. Questions? The speed and thoroughness with which we respond to inquiries has been praised by several of our grateful clients. Some extremely talented athletes really flourish under intense public scrutiny.

We place a premium on the happiness of our clientele. Recognizing that you need help and actively seeking it out is an act of bravery and self-awareness.

As soon as we are able, we will begin reviewing your application.

If they constantly bring up money issues, it's best to avoid them. If you look around online, you'll probably find a number of solutions that will work for you. If you pay your insurance premiums on time, you can safeguard your belongings from being destroyed in the event of a disaster. If you're feeling sad at work, I can help. We believe you will use this data wisely as you expand your company.

There might be some horrible news coming up, and you might not have much time to get ready for it. If they persist trying to steal the credit, just tell them "no" and go on. It is rude to continuously ask for a referral if you have nothing of value to offer in return. If you have questions about insurance, Nickerson Insurance is here to help. It is difficult to make progress without open knowledge and idea sharing. In case we can be of more assistance, please let us know. Please assist me, since this is crucial information. I'd love to hear your stories if you have any worth telling. Don't keep your findings to yourself; instead, share them with people who could benefit. Please provide us with the results of any relevant studies. Please share your ideas and comments below. Donating to causes you believe in is a great way to help those less fortunate. Donating to causes you believe in is a great way to help those less fortunate. If you have any more inquiries, please don't hesitate to contact us. Contacting them shouldn't be difficult. What this group has accomplished thus far is nothing short of remarkable. It might be presumed that the local retail and hospitality sectors are booming. It shouldn't be too tough to track them down from this vantage point.

A tiny toddler would have no issue operating it.

Learning more about something that fascinates you is a terrific way to pass the time while waiting for something else. Nickerson, Many people who are buying health insurance for the first time might benefit from a shorter enrollment period. Electronic signatures have eliminated the need for physically signing contracts. These days, having a car is more of a need than a convenience. Call me at (866) 440-6000 if there's anything else I can do for you. When compared to traditional wet-ink signatures, electronic ones have many advantages. Nursing facilities and homeless shelters will continually have a poor reputation in the eyes of the general public.

The cost-cutting measure won't affect output or quality in any way. If the upsides are larger than the downsides, we should proceed.

Nickerson Insurance cares deeply about the happiness of each and every one of its policyholders. Despite our best efforts, we were unable to increase productivity while decreasing expenses.

0 notes

Text

Ukraine Requests Consultations with Hungary, Poland, and Slovakia Following Recent Bans on its Agricultural Products

By Summer Lee, University of Colorado Boulder Class of 2023

September 25, 2023

On September 15, 2023, Poland, Hungary, and Slovakia banned imports of agricultural products from Ukraine, such as wheat, corn, sunflower seeds, and colza seeds [2]. The three countries claimed that prior to the ban, the influx of agricultural imports from Ukraine had significantly reduced the domestic prices of oilseeds and grains. Due to this, the countries also claimed that profits and market competitiveness of local farmers have also decreased and that the bans were necessary to address these issues [1].

Consequently, the complainant party, Ukraine, filed a dispute with respondent parties Poland, Hungary, and Slovakia on September 21, 2023, to the World Trade Organization (WTO). Ukraine asserted that the importation bans were not in compliance with Articles 5, 10 and 11 of the 1994 General Agreement on Tariffs and Trade (GATT), along with Article 4 and Article 5 of the Agreement on Agriculture [2].

Article 5 of the GATT states that governments who have signed the agreement must allow goods to be freely transported through its territories, regardless of the origin of the product or trade routes used during the shipping process [4]. Appealing to Article 5, Section 2 of the GATT, Ukraine argued that the importation ban is unacceptable because it restricts Ukraine’s ability to freely transport agricultural products through Poland, Hungary, and Slovakia to other members of the European Union (such as France, Germany, Greece, Ireland, etc.) [2]. Ukraine then appealed to Article 10, Section 1 of the GATT, stating that the bans implemented by the respondent parties did not allow the Ukrainian government and trading companies to adapt to the new policies accordingly. The complainant party also mentioned how the restrictions on its agricultural imports to Poland, Hungary, and Slovakia is inconsistent with the requirements set forth in Article 11 of the GATT [3]. In accordance with Article 11, Section 1 of the GATT, countries under the agreement must not impose restrictions on imported goods besides taxes, duties, and other quantifiable charges [4]. With this in mind, Ukraine appealed to Article 11, Section 1 on the assumption that the ban on agricultural imports is not associated with quantitative restrictions such as taxes, fees, and duties.

The complainant party used Article 4, Section 2 and Article 5 of the Agreement on Agriculture to indicate that (1) since the respondent parties’ method of implementing the importation bans has not been recognized as “ordinary customs duties”, the action is in non-compliance with the agreement, and (2) the import ban goes against the principle of economic non-discrimination because it only applies to Ukraine’s imports and not towards other member countries of the WTO [3].

In addition, the complainant party also argued that the importation bans are detrimental to Ukraine’s economic well-being. On the pretext of the Russo-Ukrainian war, Ukraine emphasized how its economy has steadily declined. According to the World Economic Situation and Prospects, Ukraine’s economy has contracted over 30% in 2022, which indicates that Ukraine’s GDP growth has declined and unemployment rates have increased during the war [3]. Ultimately, Ukraine argues that the implementation of importation bans on its agricultural products will have a negative impact on its economic circumstances and trade mobility.

In response to Ukraine, Poland emphasized that the importation ban was intended to protect its economic interests and local farmers. Similarly, Hungary’s government claimed that the ban was intended to help local farmers that were economically struggling due to the significant increases in Ukrainian agricultural imports [5].

To address these conflicts in interest, Ukraine is currently requesting a consultation with Hungary, Poland, and Slovakia under the World Trade Organization to discuss possible solutions. If the countries do not find a solution to the dispute after 60 days, Ukraine must request a panel of members from the WTO to help decide each countries rights and responsibilities under the WTO Agreement [6].

______________________________________________________________

Summer Lee is pursuing a B.A. in International Affairs at the University of Colorado Boulder. She is planning to graduate in the Fall of 2023.

______________________________________________________________

[1] Thomson Reuters. (2023, September 18). Ukraine Says it Will Sue Poland, Hungary and Solvakia Over Food Import Bans. Reuters. https://www.reuters.com/markets/commodities/ukraine-pla ns-sue-poland-hungary-slovakia-over- food-import-ban-2023-09-18/#:~:text=Restrictions%20imposed% 20by%20the%20European,such%20cargoes%20for%20export%20elsewhere.

[2] World Trade Organization. (2023, September 21). Ukraine Initiates WTO Dispute Complaints Against

Hungary, Poland and Slovak Republic. WTO News: Dispute Settlement. https://www.wto.org/english/news_e/news23_e/ds619_620_621rfc_21sep23_e.htm.

[3] United Nations. (n.d.). One Year of the War in Ukraine Leaves Lasting Scars on the Global Economy. United Nations Department of Economic and Social Affairs. https://www.un.org/en/desa/one-year-war-ukraine-leaves-lasting-scars-global-economy#:~:text=Ukraine%27s%20economy%20suffered%20heavy%20losses,remained%20steadfast%20over%20this%20period

[4] World Trade Organization. (n.d.). The General Agreement on Tariffs and Trade (GATT 1947). Legal Texts: GATT 1947. https://www.wto.org/english/docs_e/legal_e/gatt47_01_e.htm#articleV.

[5] Keaten, J., & Novikov, I. (2023, September 19). Ukraine Complains to WTO About Hungary, Poland and Slovakia Banning its Food Products. AP News. https://apnews.com/article/ukraine- wto-complaint-europe-grain-ban-2bdecbd0d0c4e46f2f24f33d858bf8f1.

[6] World Trade Organization. (2004). The Process--Stages in a Typical WTO Dispute Settlement Case. Dispute Settlement System Training Module. https://www.wto.org/english/tratop_e/disp u_e/disp_settlement_cbt_e/c6s3p1_e.htm.

0 notes

Link

0 notes

Text

Are there any tax implications or capital gains taxes when selling your house?

Selling a house is not just about making a profit; it's also about understanding the tax implications that come with it. In the U.S., the sale of a home can have various tax consequences depending on several factors. This article dives deep into understanding the potential tax implications and capital gains taxes you might face when selling your home.

1. The Capital Gains Tax Exclusion for Primary Residences

One of the primary benefits for homeowners is the capital gains tax exclusion. If you've lived in your primary residence for at least two of the last five years before selling, you might be eligible to exclude a significant amount of the capital gains from taxes. As of the last update, single filers can exclude up to $250,000, and married couples filing jointly can exclude up to $500,000.

2. Capital Gains Tax for Investment Properties

Unlike primary residences, investment properties don't qualify for the capital gains tax exclusion. Any profit you make from selling an investment property is subject to capital gains taxes. The rate will depend on your income and how long you've owned the property.

3. Understanding Short-Term vs. Long-Term Capital Gains

How long you've owned the property before selling can significantly impact the tax rate. If you sell within a year of purchasing, any profit will be considered as short-term capital gains and will be taxed at your ordinary income tax rate. However, if you hold onto the property for more than a year, it falls under long-term capital gains, which often have more favorable tax rates.

4. Deductible Selling Costs

Remember, you can reduce your capital gain amount by deducting the selling costs. These may include agent commissions, advertising costs, legal fees, and some home improvement costs if they were made to make the home more salable.

5. Special Situations: Inherited Homes and Divorce

Inheriting a home or transferring property due to divorce can complicate the tax scenario. It's essential to familiarize yourself with the stepped-up basis rule for inherited properties or understand how divorce settlements might affect your tax obligations upon selling.

Sell Your House Smartly

Whether you're looking to downsize, relocate, or simply cash in on an investment, understanding the tax implications is crucial. If you're thinking, "I need to sell my house," it's always a wise decision to consult with tax professionals or real estate experts familiar with these tax nuances.

Conclusion

Selling your house comes with its own set of challenges, and navigating the tax implications is among the top concerns for many homeowners. By understanding the basics of capital gains tax and leveraging available exclusions and deductions, you can potentially save thousands of dollars. Always consult with a tax advisor or professional when planning to sell, ensuring you're well-prepared for any tax obligations.

Purple Mountain Holdings

Address: 3709 Parkmoor Village Dr Ste 105, Colorado Springs, CO 80917, United States

Phone: +1 719-476-2727

Website: sellmyhousetoday.com

Map URL: https://goo.gl/maps/cwGYwExMN7Gwrw7fA

0 notes

Text

ATTENTION: Oregon Initiative Seeks to Criminalize Hunting, Fishing, Farming

The Rocky Mountain Elk Foundation is issuing a warning about a radical animal rights ballot initiative effort underway in Oregon that would make it illegal to hunt, fish, trap and would subsequently frustrate and annul proven, scientific wildlife management, including the North American Wildlife Conservation Model.

Initiative Petition 3 (IP3) criminalizes injuring or intentionally killing animals, including utilizing breeding practices and raising/killing livestock for food. Originally intended for Oregon’s November 2022 election, proponents regrouped and filed a ballot initiative for the 2024 November general election. To qualify, they must deliver 112,020 signatures for verification to the Oregon secretary of state by July 8, 2024.

Proponents claimed they passed the 30,000-signature mark in mid-July. They received a recent influx of $110,000 in campaign donations allowing them to pay signature gatherers. Campaign finance reports show the financial backers are Owen Gunden ($50,000), a philanthropist seeking “ambitious animal rights,” the Karuna Foundation in Colorado ($50,000) and Friends of DxE ($10,000), a network of “activists working to achieve revolutionary social and political change for animals.”

If passed, the initiative would severely hamstring the Oregon Department of Fish and Wildlife in carrying out its mission to protect and enhance the state’s fish and wildlife and their habitats. Approximately 40 percent of ODFW’s budget is generated from hunting and fishing licenses and fees which are used to manage all wildlife species, not just those that are hunted. Fish populations would also be drastically impacted since the $203 million ODFW spends on fisheries and fish hatcheries would be cut off.

Proponents also ignore the importance of conservation funding generated by hunters. Federal excise taxes on guns, ammunition, archery equipment via the Pittman-Robertson Act generated more than $16 billion since its inception in 1937. A 2023 report also shines a spotlight on crucial conservation and economic funding generated by the firearm and ammunition industry. Combined with Dingell-Johnson Act excise taxes on fishing gear, that funding is returned to states, including Oregon, for various conservation, recreation and public access projects.

Additionally, banning hunting and fishing would severely limit or stop those traditions from being passed on to the next generation, thus removing vital revenue that would be generated by future generations of hunters and anglers.

1 note

·

View note