#Credit Utilization

Explore tagged Tumblr posts

Text

The Credit Score Illusion: How the System Manufactures Control and Calls It Trust

By Ronald Brady | Philosophy, Finance, and the Bullshit in Between Let’s cut through the noise. Credit scores are not a reflection of financial health. They’re not a badge of responsibility, and they’re not a path to freedom. They’re a system of behavioral control, engineered to simulate risk, nudge compliance, and generate revenue for the banks that created them. I say this as someone who…

#applied philosophy#APR trap#behavioral economics#credit card debt#credit rebuilding#credit rewards scam#credit score#credit system#credit utilization#debt culture#economic control#FICO#financial literacy#financial manipulation#Merrick Bank#philosophy of finance#post-industrial economics#systemic critique#TPD discharge#VantageScore

0 notes

Text

How to Improve Your Credit Score: The Complete 2025 Guide

Introduction Your credit score isn’t just a number—it’s your financial passport. Whether you’re applying for a mortgage, car loan, or premium credit card, a strong credit score opens doors to better rates, lower premiums, and enhanced negotiating power. In 2025’s competitive financial environment, understanding how to improve your credit score is more crucial than ever. This comprehensive guide…

#boost credit score fast#build good credit history#credit report mistakes#credit score#credit score 2025#credit utilization#how to fix bad credit#How to improve your credit score#improve FICO score#raise credit score tips

0 notes

Text

The Truth About Credit Scores: What Really Impacts Them and How to Fix Yours

#build credit fast#credit for beginners#Credit score tips#credit utilization#Financial Literacy#fix bad credit#how to improve credit#KC22 Investments#payment history#secured credit card

0 notes

Text

Applying for a Personal Loan? Find Out How to Check Your CIBIL Score

” Discover the importance of CIBIL score for personal loan approval. Learn how to check your CIBIL score, improve it, and increase your chances of getting a loan with favorable terms. Get the latest data and insights on CIBIL scores in India and take control of your creditworthiness.“ Financial emergencies can arise unexpectedly, making personal loans a popular choice for many Indians. Whether…

#CIBIL score#credit age#credit history#credit report#credit score#credit utilization#creditworthiness#loan application#loan approval#Personal Loan

0 notes

Text

The Impact of Personal Loans on Your Credit Score

A personal loan can be a powerful financial tool, helping individuals cover unexpected expenses, consolidate debt, or achieve major life goals. However, many people wonder how taking out a personal loan affects their credit score. Your credit score is a crucial factor in determining your financial health, influencing your ability to secure loans, credit cards, and even rental agreements.

Understanding the relationship between personal loans and credit scores can help you make informed financial decisions. In this article, we will explore how a personal loan impacts your credit score, the factors that come into play, and how you can use a personal loan responsibly to improve your financial standing.

How a Personal Loan Affects Your Credit Score

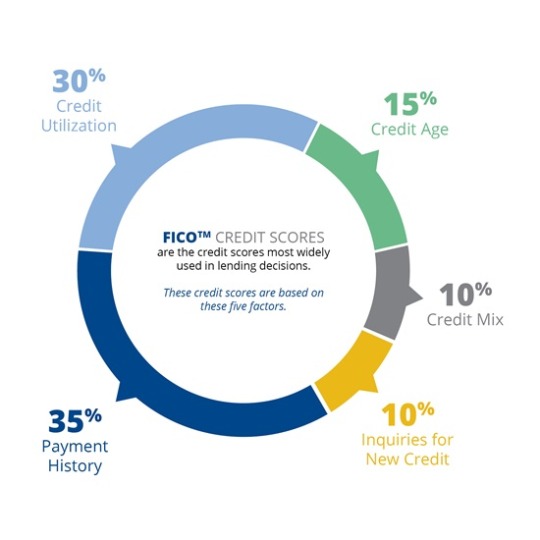

Your credit score is calculated based on several factors, including your payment history, credit utilization, length of credit history, types of credit, and new credit inquiries. Here’s how a personal loan influences these components:

1. Impact on Credit Inquiries and New Credit (10%)

When you apply for a personal loan, lenders conduct a hard inquiry on your credit report. This can lower your score by a few points, but the impact is usually temporary. If you apply for multiple loans within a short period, multiple hard inquiries can significantly affect your score.

2. Effect on Credit Mix (10%)

Credit mix refers to the different types of credit accounts you have, such as credit cards, auto loans, mortgages, and personal loans. Having a diverse credit mix can boost your score. If you only have revolving credit (like credit cards), adding a personal loan as an installment loan can improve your credit profile.

3. Payment History (35%)

Payment history is the most crucial factor in your credit score. Making on-time payments on your personal loan can significantly improve your credit score. Conversely, missed or late payments can damage your score and make it harder to obtain future credit.

4. Impact on Credit Utilization Ratio (30%)

Unlike credit cards, personal loans do not directly affect your credit utilization ratio because they are installment loans. However, using a personal loan to pay off high credit card balances can lower your credit utilization, thereby boosting your score.

5. Length of Credit History (15%)

The length of your credit history plays a role in determining your score. If you are new to credit, taking out a personal loan and repaying it responsibly can help you build a positive credit history over time.

Positive Effects of a Personal Loan on Credit Score

A personal loan can positively impact your credit score in several ways if managed correctly:

1. Improves Payment History

Timely payments on a personal loan establish a strong payment history, which is the most significant factor in your credit score calculation. Setting up automatic payments can help ensure you never miss a due date.

2. Reduces Credit Utilization

If you use a personal loan to pay off high-interest credit card debt, your credit utilization ratio will decrease, leading to an improved credit score.

3. Diversifies Your Credit Mix

Having both revolving credit (credit cards) and installment loans (such as a personal loan) demonstrates to lenders that you can manage different types of credit responsibly.

Negative Effects of a Personal Loan on Credit Score

While a personal loan can be beneficial, there are potential risks to your credit score if not managed properly:

1. Hard Inquiries Lower Your Score Temporarily

Every time you apply for a loan, the lender conducts a hard inquiry, which can cause a temporary dip in your credit score. Multiple loan applications in a short period can make it appear that you are financially unstable.

2. Missed or Late Payments Hurt Your Score

Failing to make timely payments on your personal loan can have a severe negative impact on your credit score. Even one missed payment can significantly lower your score and remain on your credit report for up to seven years.

3. Increasing Debt Burden

Taking out a personal loan increases your overall debt. If not managed properly, this can make it harder to qualify for additional credit and may affect your debt-to-income ratio.

How to Use a Personal Loan to Improve Your Credit Score

If used wisely, a personal loan can be an effective tool to boost your credit score. Here are some strategies:

1. Make Payments on Time

Set up reminders or automate your payments to ensure you never miss a due date. Consistent on-time payments will help build your credit history positively.

2. Use It for Debt Consolidation

If you have multiple high-interest credit cards, consider using a personal loan to consolidate your debt. This can lower your interest rate, reduce your monthly payments, and improve your credit utilization ratio.

3. Avoid Applying for Multiple Loans at Once

Each loan application results in a hard inquiry. Instead of applying to multiple lenders at once, research and prequalify with lenders who perform a soft credit check before applying.

4. Choose the Right Loan Terms

Select a loan term and monthly payment that fits your budget. Stretching your finances too thin could result in missed payments, negatively impacting your credit score.

When Not to Take a Personal Loan

While personal loans offer many benefits, they may not be the right choice in some situations:

If You Have a Low Credit Score: You may end up with a high-interest rate, making the loan expensive.

If You Can’t Afford the Repayments: Borrowing beyond your means can lead to missed payments and debt accumulation.

If You’re Using It for Non-Essential Spending: Avoid using a personal loan for luxury purchases or vacations unless you have a clear repayment plan.

Final Thoughts

A personal loan can have both positive and negative impacts on your credit score. If managed responsibly, it can improve your credit profile by contributing to on-time payments, reducing credit utilization, and diversifying your credit mix. However, missed payments, hard inquiries, and increased debt can negatively affect your score.

Before taking out a personal loan, consider your financial situation and repayment ability. If used wisely, it can be a powerful tool to enhance your financial health and creditworthiness. Always compare loan options and ensure that you select terms that align with your budget and financial goals.

#nbfc personal loan#loan apps#finance#bank#fincrif#personal loans#personal loan online#personal loan#loan services#personal laon#Personal loan#Credit score#Loan repayment#Credit utilization#Debt consolidation#Credit history#Hard inquiry#Loan application#Credit mix#Interest rate#Monthly payments#Payment history#Creditworthiness#Financial health#Debt management#Loan terms

0 notes

Text

Unveiling Credit Cards and Their Impact on Your Credit Score and Loan Approval Success in 2024

Credit cards are a cornerstone of modern personal finance. While they offer rewards, convenience, and the ability to manage cash flow, their usage can directly impact your credit score and determine your loan eligibility. Understanding this dynamic is essential for anyone aiming to build a robust financial profile. In this article, we provide a comprehensive guide on how credit card management…

#payment history#credit card impact#building credit history#credit report#credit card management#loan approvals#credit mix#credit card mistakes#personal finance tips#credit card usage#responsible credit management#credit profile#interest rates#Credit Cards#Credit Utilization#Credit Card Rewards#loan amounts#Loan Eligibility#financial responsibility#credit score#loan terms

0 notes

Text

The Impact of Home Equity Loans on Your Credit Score

Understanding Home Equity Loans

A home equity loan allows you to borrow money using the equity in your home as collateral. Equity is the difference between your home's current market value and the remaining balance on your mortgage. Essentially, it's a way to tap into the value you've built up in your home.

How Home Equity Loans Affect Your Credit Score

New Credit Inquiry: When you apply for a home equity loan, lenders perform a credit inquiry to assess your creditworthiness. This can cause a small, temporary dip in your credit score. However, if you maintain a good credit history and manage your finances well, this effect should be minimal and short-lived.

Credit Utilization Ratio: This ratio is the amount of credit you're using compared to your total available credit. A new home equity loan increases your total credit available, which might lower your credit utilization ratio if you use the loan to pay down other debts. Lowering your credit utilization ratio can have a positive impact on your credit score.

Credit Mix: Having a diverse mix of credit types (like credit cards, auto loans, and mortgages) can benefit your credit score. A home equity loan adds to this mix, potentially improving your credit score if you manage it responsibly.

Payment History: Your payment history is the most significant factor affecting your credit score. Consistently making timely payments on your home equity loan will positively impact your score, while missed or late payments will harm it.

Debt-to-Income Ratio: This ratio measures how much of your income goes toward paying debts. While a home equity loan doesn’t directly affect your credit score, a higher debt-to-income ratio may impact lenders’ perception of your creditworthiness in the future.

Loan Balance: If you take out a large home equity loan, your overall debt levels will increase. This can affect your credit score if it causes your credit utilization ratio to rise or if it impacts your ability to manage payments on other debts.

Tips for Managing a Home Equity Loan

Budget Wisely: Ensure that you have a clear plan for how you will use the loan and how you will make repayments.

Make Timely Payments: Avoid missing payments to prevent negative impacts on your credit score.

Monitor Your Credit: Regularly check your credit report to stay on top of how your home equity loan is affecting your credit score.

#Home Equity Loans#Credit Score#Financial Management#Credit Utilization#Debt-to-Income Ratio#Payment History#Credit Inquiry

0 notes

Text

How to increase credit score quickly

0 notes

Text

i will never understand why more people in their 80s don't commit felonies. you reach that age and surely there's something illegal you always wanted to do but didn't bc Consequences

dammit, GO FORTH GRANNIES!!! rob an armored car! hold up that bank! tunnel your way into fort knox! what are they gonna do, sentence you to 20 years? good fuckin luck with that

#mine would be a coordinated museum heist utilizing the lifetimes of experience and diverse expertise of my fellow nursing home residents#also there's Karl the orderly. his skill is he drives the shuttle van#technically he shouldn't be enabling us but he thinks it's a good enrichment activity#heck debra hasn't been this excited since her son flew in from australia.#plus Karl figures formulating an elaborate heist is better brain exercise than the puzzle books they keep in the resident lounge#all the sudokus are half finished anyway#update: upon consideration my second choice is just. MASSIVE credit card fraud.

17K notes

·

View notes

Text

How to Improve Your CIBIL Score?

In today's financial landscape, your credit score plays a pivotal role in determining your eligibility for loans, credit cards, and even job opportunities. One of the widely used credit scores in India is the CIBIL score, a three-digit numerical representation of your creditworthiness. Understanding how to improve your CIBIL score is crucial for unlocking various financial opportunities and ensuring a secure financial future.

Understanding the Components of a CIBIL Score

Your CIBIL score is calculated based on several factors, including your payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries. Each component holds a different weightage in determining your overall score. It's essential to comprehend these factors to strategize effectively for score improvement.

Checking Your Current CIBIL Score

Regularly checking your CIBIL score is a proactive step towards financial well-being. Numerous online platforms offer access to your credit report and score. Keeping a close eye on your score allows you to identify any discrepancies and take corrective measures promptly.

Identifying Factors Affecting Your CIBIL Score Negatively

Understanding the common factors that negatively impact your CIBIL score is the first step towards improvement. Late payments, high credit card balances, closing old credit accounts, and frequent credit applications are potential red flags. Addressing these issues head-on is crucial for positive changes.

Creating a Plan to Improve Your CIBIL Score

Crafting a practical plan to enhance your CIBIL score involves adopting good financial habits. Prioritize paying bills on time, reduce credit card balances, maintain a diverse mix of credit types, and avoid unnecessary credit inquiries. Consistent efforts in these areas contribute to a steady improvement in your score.

Debt Consolidation as a Strategy

For individuals juggling multiple debts, debt consolidation can be a viable strategy. Combining various debts into one manageable payment can simplify financial obligations. However, it's essential to weigh the pros and cons, considering the potential impact on your CIBIL score.

Secured vs. Unsecured Loans

Understanding the difference between secured and unsecured loans is crucial when considering credit options. Each type has its advantages and drawbacks. Choosing the right loan type for your situation can positively influence your credit standing.

Negotiating with Creditors

In times of financial strain, negotiating with creditors can be an effective solution. Discussing alternative payment terms and seeking options to avoid defaulting on payments demonstrates responsibility and can mitigate negative consequences on your CIBIL score.

Building a Positive Credit History

Building a positive credit history involves strategic steps, such as opening a secured credit card and being cautious with new credit accounts. These actions contribute positively to your credit profile and demonstrate responsible financial behaviour.

Seeking Professional Help

For individuals facing complex financial situations, seeking professional help is a wise decision. Consulting a financial advisor or reaching out to credit counselling agencies can provide personalized guidance and assistance in navigating credit challenges.

Rechecking Your CIBIL Score After Improvements

Improving your CIBIL score is a gradual process that requires patience. Regularly rechecking your score allows you to track progress and celebrate small victories along the way.

Addressing Common Misconceptions About CIBIL Scores

In the world of credit scores, misconceptions abound. It's essential to separate myths from facts to avoid unnecessary concerns and focus on actionable steps towards improvement.

Impact of CIBIL Score on Financial Opportunities

The significance of a good CIBIL score extends beyond loan approvals. It affects interest rates, credit card eligibility, and even employment background checks. A positive score opens up diverse financial opportunities.

Maintaining a Healthy Financial Lifestyle

Beyond score improvement, maintaining a healthy financial lifestyle is essential. Regularly reviewing your financial situation and making informed decisions contribute to long-term financial well-being.

Conclusion

Improving your CIBIL score is a journey that requires dedication and strategic planning. By understanding the factors influencing your score and taking proactive steps to address them, you pave the way for a secure financial future. Remember, small changes lead to significant improvements over time.

#credit report#old debt cards#new credit cards#credit prudently#credit utilization#healthy credit mix#Boost your credit limit#creditworthiness#financial opportunities#CIBIL score

0 notes

Text

How to Improve Credit Score Before Buying a House: A First-Time Homebuyer’s Guide

Unlock Your Dream Home: A Quirky Guide to Boosting Your Credit Score The journey to becoming a first-time homeowner is often filled with excitement, from envisioning life in your new space to the thrill of the house hunt. However, this exhilarating process can also bring its fair share of anxieties, particularly when it comes to the financial aspects. One of the most crucial pieces of this…

#credit report errors#credit utilization#debt-to-income ratio#FICO score#first-time homebuyers#improve credit score#mortgage preparation

0 notes

Text

30, 60, 90 Days Late : How Late Payments Affect Your Future Loans and Interest Rates

“Learn how late payments can ruin your credit score and financial reputation. Discover the long-term consequences, tips to mitigate damage, and strategies to rebuild your credit. Protect your financial future with expert advice on managing debt and improving your creditworthiness. Read now!” Your credit score is more than just a number—it’s a reflection of your financial health and reputation.…

#credit counseling#credit history#credit repair#credit report#credit score#credit score improvement#credit utilization#debt management#financial reputation#late payments

0 notes

Text

How to Improve Your Financial Situation with Personal Loans

A personal loan can be a valuable financial tool when used wisely. Whether you need funds to consolidate debt, cover emergency expenses, or make a significant purchase, a personal loan can provide the necessary financial flexibility. However, it is crucial to manage it properly to avoid unnecessary financial stress. In this guide, we will explore how you can leverage a personal loan to improve your financial situation effectively.

1. Understanding Personal Loans

A personal loan is an unsecured loan provided by banks, credit unions, or online lenders that allows borrowers to use the funds for various personal needs. Unlike home or auto loans, personal loans do not require collateral, making them a convenient option for individuals looking for quick financial assistance.

Key Features of Personal Loans:

Fixed repayment terms

Fixed or variable interest rates

No collateral required

Flexible usage

2. Consolidating High-Interest Debt

One of the most effective ways to use a personal loan is for debt consolidation. If you have multiple debts with high-interest rates, such as credit card balances, payday loans, or other unsecured loans, consolidating them into a single personal loan can help you manage your finances more efficiently.

Benefits of Debt Consolidation with a Personal Loan:

Lower interest rates compared to credit cards

Simplified monthly payments

Faster debt repayment

Improved credit score over time

By consolidating your debts, you can save money on interest and avoid the hassle of managing multiple payments each month.

3. Improving Your Credit Score

Your credit score plays a crucial role in your overall financial health. A well-managed personal loan can positively impact your credit score in several ways.

Ways a Personal Loan Can Improve Your Credit Score:

Diversifies Credit Mix: A personal loan adds installment credit to your credit report, improving your credit mix.

Establishes Payment History: Making timely payments builds a positive repayment history.

Reduces Credit Utilization: Using a personal loan to pay off credit card debt can lower your credit utilization ratio.

Responsible borrowing and on-time payments can lead to a stronger credit profile, making it easier to qualify for better loan offers in the future.

4. Handling Emergency Expenses

Life is unpredictable, and unexpected expenses can put a strain on your finances. Medical bills, home repairs, or sudden job loss can create financial stress. A personal loan can serve as a safety net to help you cover emergency expenses without depleting your savings.

Tips for Using a Personal Loan for Emergencies:

Borrow only what you need to avoid excessive debt.

Compare lenders to find the best interest rates and terms.

Create an emergency fund to reduce dependence on loans in the future.

A personal loan can provide immediate financial relief, but it's essential to borrow responsibly to prevent long-term financial challenges.

5. Investing in Education or Skill Development

Investing in education or skill development can enhance your career prospects and increase your earning potential. A personal loan can help cover tuition fees, professional courses, or certification programs that can lead to better job opportunities.

How a Personal Loan Can Help in Career Growth:

Enables access to quality education

Funds professional certifications for career advancement

Helps switch careers or start a new business

By using a personal loan to invest in self-improvement, you can create better financial opportunities for the future.

6. Financing Major Life Events

Weddings, home renovations, or starting a family often come with significant expenses. A personal loan can help you manage these costs without relying on high-interest credit cards.

When to Consider a Personal Loan for Major Events:

When you have a clear repayment plan

When other financing options are more expensive

When you need a lump sum amount for planned expenses

Using a personal loan strategically can ensure you enjoy life's major milestones without financial strain.

7. Building an Emergency Fund with a Personal Loan

While it's not advisable to take out a personal loan solely to build an emergency fund, it can help you cover necessary expenses while you set aside money for future emergencies. If you are in a temporary financial crunch, a personal loan can act as a bridge while you work on strengthening your savings.

Steps to Build an Emergency Fund Alongside a Personal Loan:

Set a goal to save at least three to six months' worth of expenses

Cut unnecessary expenses and allocate funds towards savings

Pay off your personal loan as quickly as possible to avoid interest accumulation

Once your emergency fund is built, you’ll have better financial security and reduce reliance on loans.

8. Avoiding Common Personal Loan Mistakes

While a personal loan can be beneficial, mismanaging it can lead to financial difficulties. Avoid these common mistakes to ensure you use your personal loan effectively:

Mistakes to Avoid:

Borrowing More Than You Need: Taking a loan amount higher than necessary can lead to excessive debt.

Ignoring Interest Rates and Fees: Always compare loan offers to find the most cost-effective option.

Missing Payments: Late payments can hurt your credit score and lead to penalties.

Using Loans for Unnecessary Expenses: Avoid using a personal loan for luxury purchases or non-essential spending.

By using a personal loan responsibly, you can maintain financial stability and avoid debt traps.

Final Thoughts

A personal loan can be a powerful financial tool when used wisely. Whether you're consolidating debt, handling emergencies, investing in education, or managing major expenses, a personal loan can provide the necessary financial assistance. However, it's crucial to plan your loan repayments, maintain a good credit score, and borrow only what you can afford to repay.

Before taking out a personal loan, assess your financial needs, compare lenders, and create a solid repayment plan. When managed correctly, a personal loan can help improve your financial situation and pave the way for a stable financial future.

Looking for the best personal loan options? Explore different lenders today and take control of your financial well-being!

#finance#personal loan online#bank#loan services#nbfc personal loan#personal loan#fincrif#personal loans#loan apps#personal laon#Personal loan#Debt consolidation#Improve credit score#Emergency expenses#Financial flexibility#Unsecured loans#Consolidate debt#Low interest rates#Fixed repayment terms#Credit utilization#Financial security#Borrow responsibly#Emergency fund#Loan options#Student loan assistance#Credit history#Financial tools#Borrowing tips#Financial relief#Repayment plan

0 notes

Text

Unveiling the Secrets of Credit Scores

Enjoy ❤️

Welcome, dear readers, to a journey that will unlock the hidden mysteries of credit scores and empower you to take control of your financial destiny. In this blog post, we will delve into the impact of credit scores on your overall financial health, explore effective strategies to improve and maintain a stellar score, and equip you with the knowledge you need to secure a brighter financial…

View On WordPress

#Blog#Credit management#Credit mix#Credit report#Credit score#Credit utilization#Educational#Finacial freedom#Finance#Financial future#Financial health#Financial success#Gentlemen#How to#Improve credit score#Investing#Maintain good credit#Men#Money#Payment history#Self growth#Stock

1 note

·

View note

Text

Credit Scores

Disclaimer: Some of this advice may not be immediately applicable to people who are struggling financially.

On the other hand, if you are responsible with money & lucky, your credit score will pretty much take care of itself.

I just don't want anyone to be accidentally lowering their credit score because they don't know the "rules of the game."

.......................................................................................................................

Dos:

--Pay off all your debt owed every single month - car loan, mortgage and yes credit card. (It's a common falsehood that carrying a credit card balance helps your score, it only does harm plus wastes your money on interest.)

--Keep your credit card spending below 30% of your official spending limit for that card; lower% is even better.

--For an credit card bill above the 30%, pay your balance before the "statement date" and don't wait until the due date.

--If you get a significant raise or other financial boon, contact your credit card company to request a raise to your spending limit.

--Focus on your FICO credit score, and don't worry about any other credit score calculators.

--Avoid "hard inquiries" into your credit unless you expect to be approved for an imminent large purchase (vehicles, rental/mortgage, etc.)

--Only take out credit if you know you won't abuse it. A "thin file" is better than a file full of financial red flags.

Don'ts:

--Cancel your oldest credit card. Keep it going, set it up to autopay a small monthly bill (netflix, water, or the like)

--Apply for new credit cards unless you really need them. The hard credit check, the newness of the credit line, any overdue payments, and any spending near that card's credit limit can ALL harm your credit score.

--Expect a credit score change to change immediately or directly due to increased income or increased savings. Those factors are not a part of your credit score (though of course if you budget that money well, your credit score will eventually reflect your better financial stability).

--Fuss if your credit score is 740 instead of 850; 740 is the low end of the "perfect" range, you'll be approved for basically anything.

--Worry if your starting credit score is below 740. Nothing is wrong and you are not being penalized. Credit scores include 5 components: payment history, amounts owed, length of credit history, credit mix - these will all improve over time if you don't miss payments. The 5th component, new credit, may be lowering your score when you open your first credit line, but this too will fade with time (as long as you don't quickly open additional credit lines).

How to find your credit score for free from trusted sources: 1) Check with your bank or credit union.

2) Request your score through these three companies only: Experian, TransUnion, and Equifax. 3) use Consumer Financial Protection Bureau links:

(Note that you may have slightly different FICO credit scores across different financial websites, this is normal.)

Sources

#credit score#fico#npr#npr life kit#cfpb#equifax#transunion#experian#personal finance#financial awareness#financial literacy#what they should have taught in high school#credit cards#credit history#credit utilization

0 notes