#Crisil Ltd

Text

Millennium Semiconductors - Leading Innovation and Powering the Future

Millennium Semiconductors India Pvt. Ltd.: Pioneering Excellence in Electronic Components Distribution.

With an illustrious journey spanning 28 years, Millennium Semiconductors India Pvt. Ltd. stands as a beacon in the domain of electronic component distribution. Our portfolio encompasses a diverse range of active, passive, wireless communication, power, and electromechanical products and Specialty Chemicals and Materials.

What sets us apart is our unwavering commitment to operational excellence paired with innovative business solutions, ensuring we not only meet but exceed our customers' expectations.

Credibility & Recognitions: As an ISO 9001:2015 certified company, our credentials are further accentuated by recognitions from esteemed institutions such as Dun & Bradstreet, CRISIL, and the distinction of being a Great Place to Work.

Our Distinctive Edge:

• R&D Centre: Spearheading innovations and advancements.

• Design Excellence: From the nascent concept to prototype or production, tailored to specific needs.

• Optimization: Upgrading designs for enhanced features and cost-effectiveness.

• Re-engineering: Revamping projects for cost reductions and functional enhancements.

• Component Expertise: Recommending proven components for precise applications and providing embedded design support.

• Training Initiatives: Collaborative technical sessions with suppliers to enhance product understanding.

• IoT Enablement: Driving the future with IoT solutions for industrial and smart devices.

• Robust Supply Chain: Ensuring consistent and timely deliveries.

• Flexible Billing: Offering multi-currency billing options.

• Systematic Approach: Leveraging tools like Salesforce, SAP S4 Hana, WMS, and our dedicated Customer Portal.

At Millennium Semiconductors, our essence is to provide a holistic solution, affirming our position as the premier choice in our domain.

Millennium Semiconductors, we're not just a provider; we're your partner in progress.

For More Details Visit - https://www.millenniumsemi.com/

2 notes

·

View notes

Text

The Importance of Selecting the Right Pharmaceutical Raw Material Supplier

Introduction: The Importance of Selecting the Right Pharmaceutical Raw Material Supplier

In the pharmaceutical industry, the selection of a pharmaceutical raw material supplier is pivotal. The quality of these materials not only affects the efficacy and safety of the final products but also impacts regulatory compliance and market reputation. Therefore, finding the best new pharmaceutical raw material supplier company is crucial for success. Caltron Clays & Chemicals Pvt. Ltd. emerges as a standout choice in this landscape, thanks to its unwavering commitment to quality, innovation, and customer satisfaction.

About Caltron Clays & Chemicals Pvt. Ltd.

A Legacy of Excellence

Founded in 2000, Caltron Clays & Chemicals Pvt. Ltd. has become a leader in the minerals and chemicals processing industry. Under the leadership of Mr. S.N. Jain, the company has set new standards for excellence, driven by a vision of quality and customer-centric service.

Vision and Mission

Caltron Clays is dedicated to revolutionizing industry norms through superior products and services. Their mission is to deliver pharmaceutical raw materials that not only meet but exceed global standards, ensuring their clients receive the best possible products.

Cutting-Edge Facilities

Based in Mumbai, India, Caltron Clays boasts state-of-the-art manufacturing facilities equipped with the latest technology. These facilities are designed to ensure the highest levels of precision and quality control, supporting their global operations with a marketing office in Wyoming, USA.

Certifications That Reflect Excellence

Caltron Clays holds several prestigious certifications, including:

ISO 9001 Certified: Reflects their commitment to top-tier quality management.

CRISIL Rated: Indicates strong financial stability and reliability.

HACCP Certified: Ensures adherence to international food safety standards.

HALAL and KOSHER Certified: Meets specific dietary requirements.

ECOCERT ORGANIC Certified: Guarantees organic product standards.

SMETA 4 Pillar: Demonstrates ethical business practices.

WHO-GMP Compliant: Aligns with global manufacturing guidelines.

DUNS Registered: Provides a unique identifier for global trade.

Pharmaceutical Raw Material Manufacturing at Caltron Clays

Advanced Manufacturing Processes

Caltron Clays employs cutting-edge technology and adheres to rigorous standards to produce top-quality pharmaceutical raw materials. Key elements of their manufacturing process include:

Modern Machinery: Ensures precision and efficiency in production.

Strict Quality Protocols: Guarantees consistent product quality.

Continuous Improvement: Focuses on enhancing production methods and staying ahead of industry trends.

Rigorous Quality Control

Quality is at the heart of Caltron Clays’ operations. Their quality assurance processes include:

Raw Material Inspection: Comprehensive testing to ensure purity and suitability before production.

In-Process Monitoring: Real-time checks during manufacturing to maintain consistency.

Final Product Testing: Detailed analysis to ensure products meet stringent specifications.

Compliance Audits: Regular reviews to maintain adherence to international standards.

Innovation through R&D

Research and Development is integral to Caltron Clays’ strategy for innovation. They invest in R&D to:

Develop Innovative Products: Address emerging needs with new solutions.

Enhance Existing Products: Improve current offerings for better performance.

Adapt to Trends: Stay ahead of technological advancements and market shifts.

The Quality of Pharmaceutical Raw Materials at Caltron Clays

Guaranteed Purity and Efficacy

At Caltron Clays, the purity and efficacy of pharmaceutical raw materials are non-negotiable. Their commitment includes:

Ensuring Purity: Employing advanced purification techniques to eliminate contaminants.

Verifying Efficacy: Conducting thorough testing to confirm the effectiveness of each material.

Adherence to Global Standards

Caltron Clays is dedicated to maintaining the highest global standards:

ISO Standards: Compliance with ISO 9001, ISO 22000, and other relevant standards.

WHO-GMP: Following Good Manufacturing Practice guidelines to ensure product safety and quality.

HACCP: Implementing Hazard Analysis Critical Control Point principles for comprehensive safety measures.

Exceptional Customer Satisfaction

Customer satisfaction is a core priority at Caltron Clays. Their approach includes:

High-Quality Products: Consistently delivering materials that meet or exceed industry standards.

Outstanding Service: Providing prompt and effective customer support.

Timely Deliveries: Ensuring efficient and reliable product distribution worldwide.

Why Choose Pharmaceutical Raw Materials from Caltron Clays?

Unmatched Quality

Caltron Clays stands out for its exceptional quality in pharmaceutical raw materials. Their stringent quality controls and adherence to international standards make them a reliable partner for pharmaceutical manufacturers.

Comprehensive Product Range

Caltron Clays offers an extensive range of pharmaceutical raw materials, including:

Algae Calcium Powder: Highly bioavailable for optimal bone health.

MCHC Powder: Supports bone health with superior absorption.

Food Grade Diatomaceous Earth: Pure and versatile for various pharmaceutical applications.

Phoscal Fish Bone Calcium: Rich in calcium for effective bone support.

Coral Calcium Powder: Mineral-rich for enhanced bone health.

Egg Shell Calcium: Pure and effective source of calcium.

Marine Magnesium: High-purity magnesium from marine sources.

Milk Calcium Powder: Easily absorbed calcium for bone health.

Oyster Shell Calcium Carbon: High-calcium content from oyster shells.

Active Absorbable Calcium (AAA Cal): Superior absorption for optimal calcium intake.

Egg Membrane Powder: Collagen-rich for joint and skin health.

Global Reach

Caltron Clays has a robust international presence, ensuring reliable service and timely deliveries to over 40 countries, including:

Europe: UK, Italy, Germany, France, Spain, Poland, Russia

North America: USA, Canada

Asia: Japan, China, South Korea, India, UAE, Singapore, Thailand

Africa: Kenya, Ghana, South Africa

Latin America: Brazil, Argentina

Oceania: Australia, New Zealand

Commitment to Innovation

Caltron Clays is dedicated to fostering innovation through:

Developing New Products: Creating solutions to meet emerging needs.

Enhancing Existing Products: Improving current products for superior results.

Adapting to Trends: Keeping pace with technological and market advancements.

Exceptional Customer Service

Customer service at Caltron Clays is characterized by:

Responsive Support: Addressing client needs swiftly and effectively.

Customized Solutions: Tailoring products and services to meet specific requirements.

Efficient Logistics: Ensuring accurate and timely delivery of products.

Conclusion: Why Caltron Clays is Your Best Choice for Pharmaceutical Raw Materials?

Choosing Caltron Clays & Chemicals Pvt. Ltd. for your pharmaceutical raw materials means partnering with a leader known for quality, innovation, and exceptional service. With its advanced manufacturing processes, rigorous quality control, and comprehensive product range, Caltron Clays is ideally positioned to support your pharmaceutical needs. By selecting Caltron Clays, you gain access to top-quality raw materials that meet global standards, helping you achieve success in a competitive market. For pharmaceutical manufacturers looking to enhance their product offerings, Caltron Clays offers the ideal blend of reliability, innovation, and customer-focused service. Choose Caltron Clays and experience the benefits of working with a premier supplier in the pharmaceutical industry.

0 notes

Text

Top 10 Best Steel Companies in India

Introduction to India's Steel Industry

India's steel industry stands as a cornerstone of its economy, pivotal in infrastructure development and industrial expansion. As the world's second-largest producer of crude steel, India boasts a robust manufacturing sector with numerous key players. This analysis profiles India's top 10 steel companies, highlighting their contributions, product offerings, and contact details.

1. Allied Ispat Pvt. Ltd.

About Allied Ispat Pvt. Ltd.: Established in 1997, Allied Ispat Pvt. Ltd. is a premier manufacturer and trader of steel products, specializing in steel partitions, ceiling sections, and rolling shutters. Renowned for its high-quality standards and customer-centric approach, the company has carved a niche in the steel industry.

Why Choose Allied Ispat Steel Products?

High-Quality Assurance: Products undergo rigorous quality checks, ensuring durability and reliability. Certified by Jindal Steels and NSIC-CRISIL for high performance.

Diverse Product Range: Includes Rolling Shutter Parts (Galvanized, CR, HR), Color Coated Sheets, Roof Cladding Sheets, and Ceiling/Partition Sections.

State-of-the-Art Infrastructure: Advanced manufacturing facilities at MIDC Taloja, Raigad, equipped with modern machinery and testing equipment.

Experienced Leadership: Managed by visionary leaders like Abdul Auwal Malik, ensuring growth and quality adherence.

Customer-Centric Focus: Prioritizes customer satisfaction through tailored solutions and responsive service.

Contact Information:

Registered Address: Shop No. 69, Chota Sonapur, M. S. Ali Road, Mumbai – 400 008, Maharashtra, India

Works: Plot No – C-17/9, M.I.D.C Taloja, Behind Bank of Baroda, Raigad -410208

Phone: Abdul Auwal Malik: 9821177009, Abdul Qayyum Malik: 7977766800

Website: Allied Ispat Pvt. Ltd.

2. National Steel Industries

About National Steel Industries: A reputed name in steel manufacturing, known for a wide range of high-grade products including Hot Rolled Coils, Cold Rolled Coils, and Galvanized Sheets.

Contact Information:

Address: Oza Market, Plot No. 15, Magzine Street, Reay Rd, Darukhana, Mumbai, Maharashtra 400010

Phone: 097021 10825

Website: https://www.nationalsteelind.com

3. Supreme Steel Industries

About Supreme Steel Industries: Focuses on innovation and sustainability, offering products like Structural Steel, Reinforcement Bars, and Steel Pipes/Tubes.

Contact Information:

Address: 301/B-Wing, 3rd Floor, Royal Sand, near Bhaktivedanta School, Shastri Nagar, Andheri West, Mumbai, Maharashtra 400053

Phone: 098213 25977

Website: http://www.supremesteelgroup.in

4. MANUEL STEEL INDUSTRIES LLP

About MANUEL STEEL INDUSTRIES LLP: Known for diverse products including Stainless Steel, Alloy Steel, Carbon Steel, and Industrial Fasteners.

Contact Information:

Address: 523, Kutch Castle, office no 22, 3rd floor, Opera House, Mumbai, Maharashtra 400004

Phone: 090222 29705

Website: http://manuelsteel.com

5. B.H. STEEL INDUSTRIES

About B.H. STEEL INDUSTRIES: Offers Steel Sheets/Plates, Bars/Rods, Coils, and Wires with a focus on quality control and innovation.

Contact Information:

Address: A/601, Raheja Point-1, 6th Floor, Nehru Road, next to SVC Bank, Vakola, Santacruz(E), Mumbai, Maharashtra 400055

Phone: 022 6822 1100

Website: https://bhsteel.co.in

6. Goel Steel Company

About Goel Steel Company: Supplies Mild Steel, Stainless Steel, Alloy Steel, and Special Steel products with competitive pricing and reliability.

Contact Information:

Address: D-104, Crystal Plaza, New Link Rd, Lokhandwala, Veera Desai Industrial Estate, Andheri West, Mumbai, Maharashtra 400053

Phone: 022 3296 1359

Website: https://www.goelsteel.com

7. JMT STEEL (A Company of DOSHI GROUP)

About JMT STEEL: Part of DOSHI GROUP, known for Hot Rolled Coils, Cold Rolled Coils, Galvanized Coils/Sheets, and Pre-Painted Galvanized Sheets.

Contact Information:

Address: 7, Luthra Industrial Estate, Safed Pul, Sakinaka, Mumbai, Maharashtra 400072

Phone: 080 4896 9592

Website: https://jmtsteel.com

8. K.M. Steel India

About K.M. Steel India: Trusted for Stainless Steel Pipes/Tubes, Sheets/Plates, Alloy Steel, and Industrial Fasteners, emphasizing quality and customer satisfaction.

Contact Information:

Address: 122C, Gora Gandhi Building, 1st Floor, Off No. 37, 8th, Khemraj Srikrishna Das Marg, near Alankar Cinema, Mumbai, Maharashtra 400004

Phone: 080 4802 4696

Website: https://www.kmsteelindia.com

9. Arya Iron and Steel Company Pvt. Ltd.

About Arya Iron and Steel Company Pvt. Ltd.: Leading manufacturer of Sponge Iron, Billets, TMT Bars, and Structural Steel with a strong presence in domestic and international markets.

Contact Information:

Address: 51–53 A Wing, Mittal Court, Jamnalal Bajaj Marg, Nariman Point, Mumbai, Maharashtra 400021

Phone: 022 4069 6000

Website: https://aisco.co.in

10. Hari Steel Industries LTD

About Hari Steel Industries LTD: Well-established supplier of Steel Sheets/Coils, Pipes/Tubes, Bars/Rods, and Structural Products, committed to quality and customer satisfaction.

Contact Information:

Address: Mangal Aarambh, B-708, RM Bhattad Rd, next to McDonald's, Tilak Nagar, Goregaon West, Mumbai, Maharashtra 400104

Phone: 084219 04547

Website: https://www.haristeel.com

Conclusion

India's steel industry thrives with prominent companies like Allied Ispat Pvt. Ltd., each contributing significantly to national growth. With their diverse product offerings, adherence to quality standards, and customer-focused approaches, these companies uphold India's status as a key player in the global steel market.

0 notes

Text

Understanding External Credit Ratings: What They Are and Why They Matter

In today's complex financial world, credit ratings play a crucial role in shaping economic landscapes. Whether you're a consumer looking to borrow money, a business seeking investment, or a government issuing bonds, understanding credit ratings can be pivotal. This blog aims to demystify credit ratings, explain their importance, and highlight their impact on various sectors.

What Are Credit Ratings?

Credit ratings are assessments of the creditworthiness of a borrower. They are typically provided by credit rating agencies (CRAs) such as CRISIL, CARE, ICRA, SMREA, Brickwork Rating, India Rating and Research Pvt. Ltd and Infomerics Valuation and Rating Private Limited. These agencies evaluate the ability and willingness of a borrower to repay debt and issue ratings that reflect the risk associated with lending to them.

Credit ratings are usually expressed in letter grades. The rating scale ranges from AAA (highest quality, lowest risk) to D (default). These ratings provide investors and lenders with a standardized evaluation of the credit risk posed by a borrower.

How Are Credit Ratings Determined?

Credit rating agencies use a combination of quantitative and qualitative analysis to determine ratings. Key factors considered include:

Financial Performance: Revenue, profit margins, cash flow, and debt levels.

Economic Environment: Macroeconomic conditions and industry-specific trends.

Management Quality: The effectiveness and stability of a company's management team.

Debt Structure: The terms and conditions of existing debt and the borrower’s repayment history.

Market Position: The borrower’s competitive standing and market share.

Agencies gather and analyze this data to form a comprehensive picture of the borrower’s creditworthiness. The result is a credit rating that provides a snapshot of the borrower's financial health and risk profile.

Why Do Credit Ratings Matter?

For businesses, credit ratings are critical for several reasons:

Access to Capital: A strong credit rating can make it easier and cheaper to raise capital through loans or bond allocation.

Investment Attractiveness: Investors often rely on credit ratings to assess the risk of investing in a company's bonds or other debt instruments. Higher ratings can attract a broader range of investors.

Reputation: A high credit rating can enhance a company's reputation, signaling financial stability and reliability to partners, customers, and suppliers.

Lower Cost of Borrowing: Companies with higher credit ratings often enjoy lower interest rates on loans and bonds, reducing overall borrowing costs.

For Investors

Credit ratings are essential tools for investors. They provide a benchmark for comparing the risk associated with different debt instruments. Investors use these ratings to make informed decisions, balancing risk and return in their portfolios. A higher-rated bond is generally seen as safer, though it may offer lower returns compared to lower-rated, higher-risk bonds.

For Lenders

Credit ratings are crucial for lenders when evaluating the creditworthiness of potential borrowers. These ratings help lenders assess the risk of lending to a particular company or individual. A higher credit rating indicates a lower risk of default, which can lead to more favorable loan terms, including lower interest rates and better repayment conditions. Conversely, a lower credit rating may result in higher interest rates and stricter lending conditions to compensate for the increased risk. Credit ratings thus enable lenders to make more informed and strategic lending decisions.

Conclusion

Credit ratings are fundamental components of the financial ecosystem, influencing borrowing costs, investment decisions, and economic policies. Understanding what they are, how they are determined, and why they matter can empower consumers, businesses, and investors to make better financial decisions. While not without their flaws, credit ratings remain vital tools in navigating the complexities of the modern financial world.

For expert assistance with understanding and improving your credit rating, and for other comprehensive financial solutions, visit Virtual CFO Hub. Our team of professionals is dedicated to helping your company achieve financial stability and growth.

0 notes

Text

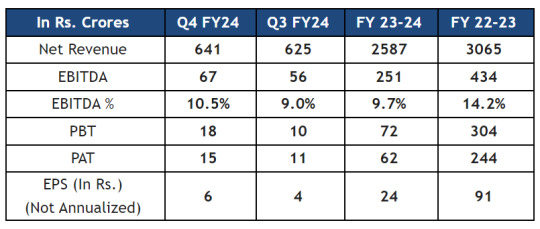

Cosmo First reports improvement in March’24 quarter results

The improvement in EBIDTA has been made possible with higher specialty sales as well as an improvement in domestic BOPP film margins (effective March 2024). The industry margins for BOPET film (about 8% of the Company’s FY24 sales) continued to remain in the negative zone. For BOPET film, the Company is focussed on profitable specialty films / shrink films to achieve EBITDA breakeven.

The Q1, FY25 outlook for BOPP margins remains steady at March 2024-month level. Further, the Company is expecting improved sales of speciality BOPP films as well as a reduction in costs.

During the quarter, the Specialty Chemical subsidiary’s EBITDA has also improved due to enhanced realization of chemical coatings. The Cosmo Specialty Chemical should deliver double-digit EBITDA and 20%+ ROCE in FY25.

During the quarter, the Company’s credit rating has been re-affirmed by CRISIL as AA- with a stable outlook.

The Board has recommended a dividend of Rs.3 per share.

Commenting on Company’s performance Mr. Pankaj Poddar, Group CEO, Cosmo First Ltd said “The Company’s focus remains on its specialty business. It shall be further strengthened with the launch of a high-value-added sun control film, Cosmo Sunshield, in FY25. In Zigly, we are focussed on the same-store sales growth.”

0 notes

Text

Apollo, Fortis, Max Healthcare share prices rise 42-84% in a year: Should you Buy, Sell or Hold? Here's what experts say

Apollo Hospitals Enterprise Ltd, Fortis Healthcare , Max Healthcare Institute share prices have seen 42-84% gains during last year. The gains have been led by improved earnings outlook in the back of rising occupancy, increasing inpatient procedures, return of medical tourism and other such reasons have led to improvement in Average revenues pr operating bed (ARPOB). Apollo Hospitals Enterprise Ltd, Fortis Healthcare , Max Healthcare share prices also have benefit from rising capacities as expansions continue being carried out by them. The outlook on growth momentum remains robust say analysts. CRISIL Ratings expect a double-digit revenue growth for Hospitals led by healthy occupancies and rising ARPOB. The revenue growth for private hospitals is expected to strong at 11-12% in fiscal 2025 after strong growth in fiscal 2024 which is estimated to have touched 14%. Its not only revenues but profits that will also get a boost. Better operating leverage will likely offset a cost ramp-up related to additional capacity, allowing operating profitability to remain stable at 16–17% in fiscal 2025, as per CRISIL. This will ensure that even when capital expenditures remain significant, cash generation will remain robust and dependency on external debt would be minimized. Thus, credit profiles will remain steady.

To know daily updates on stock market, check our website www.optionperks.com

0 notes

Text

BramhaCorp Ltd stands as a trailblazing force in the realty, hospitality, retail, and leisure sectors. Based in Pune, this esteemed business group has evolved significantly over its 40-year journey under visionary leadership. Notable achievements include introducing the premium hospitality brand Le Meridien (now Sheraton Grand) to Pune and establishing the city's first lifestyle leisure club, "The Residency Club."

In 2003, BramhaCorp set a new standard with its first high-tech residential gated community, "Sun City." The F Residences in Kalyani Nagar, recognized as the world’s first Fashion Condos in collaboration with FashionTV, and being ranked among the TOP 15 Real Estate Developers in Western India by CRISIL are just a few milestones contributing to their prominence in the industry.

In an active growth mode, BramhaCorp envisions itself as one of the finest real estate companies in India, with over 2,000 residential apartments and four new hotels in the pipeline. Future plans include mixed-use developments, integrated townships, upscale residences, and commercial spaces. Customer satisfaction is their top priority, and the company's real equity lies in the endorsements from satisfied customers. Exhibiting their projects at the CREDAI MCHI Property Expo 2024 at the Jio Convention Center emphasizes their commitment to surpassing customer expectations each day.

@cpwworld

@bramhacorprr2222

@bramha_corp

@credaimchi

@jioworldcentre

#BramhaCorp#RealtyPioneer#HospitalityLeader#RetailExcellence#LeisureDomain#CityBusinessGroup#PuneHeadquarters#40YearsLegacy#VisionaryLeadership#HistoricFirsts#PremiumHospitality#SheratonGrand#LifestyleLeisureClub#ResidencyClub#IndiaGrowthStory#SunCity#FResidences#FashionCondos#CRISILTop15#RealEstateDevelopers#ActiveGrowthMode#FinestRealEstate#ResidentialApartments#NewHotels#MixedUseDevelopments#IntegratedTownships#CustomerSatisfaction#CREDAIMCHIPropertyExpo2024#jioconventioncenter

0 notes

Text

Agilus Diagnostics IPO Date, Price, GMP, Company profile, financials & risks: Dec 23

New Post has been published on https://wealthview.co.in/agilus-diagnostics-ipo/

Agilus Diagnostics IPO Date, Price, GMP, Company profile, financials & risks: Dec 23

Agilus Diagnostics IPO: Agilus Diagnostics Limited, formerly known as SRL Limited, is a leading diagnostics service provider in India. It boasts the largest network of laboratories in the country, offering a comprehensive range of tests across various specialties. Agilus operates in a rapidly growing Indian diagnostics market, fueled by rising healthcare awareness, increasing disposable income, and an aging population.

Agilus Diagnostics IPO Key Details:

Offer type: Offer for Sale (OFS) by existing shareholders (International Finance Corporation, NYLIM Jacob Ballas India Fund III LLC, and Resurgence PE Investments Ltd) – no fresh capital being raised by the company.

Issue Dates: Yet to be announced.

Offer Size: Up to 142.3 million equity shares.

Price Band: Not yet determined.

Recent News Updates:

Agilus filed its Draft Red Herring Prospectus (DRHP) with SEBI in September 2023, seeking approval for the IPO.

The company reported a consolidated revenue of Rs 1,347 crore for FY23, down from Rs 1,604 crore in FY22. However, profitability remained relatively stable at Rs 116 crore, suggesting potential resilience.

The Indian diagnostics market is projected to reach USD 27 billion by 2026, providing significant growth opportunities for Agilus.

Agilus Diagnostics IPO: Offer Details

Securities Offered:

This is an Offer for Sale (OFS) by existing shareholders. Therefore, no new securities (equity shares, bonds, etc.) will be issued by Agilus Diagnostics Limited. Existing shareholders, namely International Finance Corporation, NYLIM Jacob Ballas India Fund III LLC, and Resurgence PE Investments Ltd, will be offloading a portion of their holdings through the IPO.

Reservation Percentages:

The specific reservation percentages for different investor categories are yet to be finalized by the Securities and Exchange Board of India (SEBI). However, the typical distribution in Indian IPOs follows this pattern:

Retail Individual Investors (RIIs): 35%

Qualified Institutional Buyers (QIBs): 50%

Non-Institutional Investors (NIIs): 15%

The final percentages might vary depending on regulatory requirements and investor demand.

Minimum Lot Size and Investment Amount:

The minimum lot size for the IPO, which determines the number of shares you can subscribe to in a single application, will be announced closer to the issue date. It is typically set at a level affordable for retail investors, ranging from 100 to 200 shares.

The minimum investment amount will depend on the minimum lot size and the final issue price, which are yet to be confirmed. For example, if the minimum lot size is 100 shares and the issue price is Rs 100 per share, then the minimum investment amount would be Rs 10,000 (100 shares * Rs 100).

Agilus Diagnostics Limited Company profile:

History and Operations:

Founded in 1995, Agilus boasts a rich legacy of over 28 years in the Indian diagnostics landscape.

Initially known as SRL Limited, it rebranded to Agilus Diagnostics in 2023.

Operates a vast network of over 413 laboratories spread across 25 states and 5 union territories in India, as of March 2023.

Offers a comprehensive range of diagnostic tests catering to various medical specialties, including pathology, biochemistry, microbiology, immunology, and genetics.

Provides services directly through its own labs, partnerships with hospitals and clinics, and home sample collection facilities.

Market Position and Market Share:

Ranked second in terms of revenue from operations among diagnostic companies in India for Fiscal 2023 (Source: CRISIL Report).

Holds the title of India’s largest chain of diagnostic laboratories by geographic presence (Source: Agilus Diagnostics website).

As of March 2023, boasts the largest network of NABL accredited laboratories in India with 43 accredited labs (Source: CRISIL Report).

Prominent Brands, Subsidiaries, and Partnerships:

The “SRL” brand still enjoys strong recognition in many regions, even post-rebranding.

In April 2023, acquired Lifeline Laboratory, a reputed player in Delhi NCR, further strengthening its reach.

Partners with various hospitals and clinics across India to provide diagnostic services within their premises.

Key Milestones and Achievements:

Pioneered the concept of standardized and affordable diagnostic services in India.

Achieved significant growth through organic expansion and strategic acquisitions.

Awarded prestigious certifications like NABL for its labs, demonstrating commitment to quality standards.

Recognized for its contribution to healthcare by various industry bodies and publications.

Competitive Advantages and Unique Selling Proposition (USP):

Vast network: Reaches a broader patient base, providing accessibility and convenience.

NABL accreditation: Ensures high-quality and reliable diagnostic tests.

Comprehensive service range: Caters to diverse medical needs under one roof.

Technology focus: Implements cutting-edge technology for accurate and efficient testing.

Strong brand recognition: Builds trust and customer loyalty.

Future Growth Prospects and Earnings Drivers:

Market growth: The Indian diagnostics market is projected to reach USD 27 billion by 2026, offering substantial growth potential for Agilus.

Expansion plans: The company aims to expand its network further, targeting geographically under-penetrated areas and strategic acquisitions.

Focus on preventive care: Increasing awareness of preventive healthcare is expected to drive demand for diagnostic services, benefiting Agilus’ comprehensive offerings.

Technology adoption: Continued investment in automation and advanced testing technologies will improve efficiency and attract tech-savvy customers.

Potential Risks and Concerns for Agilus Diagnostics IPO:

Investing in any IPO, including Agilus Diagnostics Limited, involves inherent risks that investors should carefully consider before making a decision. Here are some key areas of concern:

Industry Headwinds:

The Indian diagnostics industry faces potential challenges like regulatory changes, pricing pressures from government healthcare initiatives, and competition from new players. These factors could affect Agilus’ growth and profitability.

Company-Specific Challenges:

While Agilus boasts a strong network and financial position, there are some aspects to consider:

The recent revenue decline raises questions about future growth momentum.

Reliance on existing tests might limit diversification and exposure to newer, high-growth segments.

Integration of acquired entities like Lifeline Laboratory needs careful management to maintain operational efficiency.

Financial Health:

Although debt-free, Agilus’ financial performance in FY23 showed a revenue decline. The final P/E ratio after the issue price is determined will be crucial to assess valuation and potential risks.

Investors should thoroughly analyze the company’s financial statements and future projections provided in the DRHP before making a decision.

Red Flags:

Any unexpected negative news about the company or the industry during the pre-IPO or listing period could raise red flags and impact investor sentiment.

A significantly high GMP compared to industry benchmarks might indicate unrealistic expectations and potential for price correction after listing.

Agilus Diagnostics Limited Draft Offer Documents filed with SEBI

Also Read: How to Apply for an IPO?

#Allotment Details#Company Profile#Financial Performance#Investment#IPO date#Lot Size#UPCOMING IPO#IPO#News

0 notes

Text

What Is Commercial Paper – The Beginner’s Guide

What is Commercial Paper?

Commercial papers are debt instruments issued by corporations to finance their short-term liquidity needs. These liquidity needs can be for funding working capital, enabling operations or financing inventory, or meeting payroll expenses. Of late, it is gaining in popularity as a fixed-income investment in India.

Why do companies issue commercial papers instead of borrowing from banks?

Companies issue commercial papers as a form of short-term financing because it is a source of diversified and flexible fundraising from individual investors.

Who can issue commercial papers?

Banks, NBFCs, financial institutions, foreign corporations, and other such entities issue commercial papers. The issuer entities generally undergo the due diligence of credit rating agencies like CRISIL (Credit Rating Information Services of India Ltd.), ICRA (Investment Information and Credit Rating Agency of India Ltd.), and CARE (Credit Analysis and Research Ltd.) to evaluate their credibility and financial health.

Click here to know more about

0 notes

Text

CRISIL to Acquire Bridge To India Energy Pvt. Ltd. in Strategic Move

The acquisition will enhance CRISIL’s positioning in the renewables and new energy sector.

Strategic CRISIL Deal

CRISIL, an S&P Global company, has recently announced that it will acquire Bridge To India Energy Private Limited, a leading renewable energy consulting and knowledge services provider to financial and corporate clients worldwide. Bridge To India offers its clients a 360-degree view…

View On WordPress

0 notes

Text

What Is Commercial Paper – The Beginner’s Guide

What is commercial paper?

Commercial papers are debt instruments issued by corporations to finance their short-term liquidity needs. These liquidity needs can be for funding working capital, enabling operations or financing inventory, or meeting payroll expenses. Off late, it is gaining in popularity as a fixed-income investment in India.

Why do companies issue commercial papers instead of borrowing from banks?

Companies issue commercial papers as a form of short-term financing because it is a source of diversified and flexible fundraising from individual investors.

Who can issue commercial papers?

Banks, NBFCs, financial institutions, foreign corporations, and other such entities issue commercial papers. The issuer entities generally undergo the due diligence of credit ratings agencies like CRISIL (Credit Rating Information Services of India Ltd.), ICRA (Investment Information and Credit Rating Agency of India Ltd.), and CARE (Credit Analysis and Research Ltd.) to evaluate their credibility and financial health.

What is the general tenure of commercial papers?

Commercial papers are debt tools with tenure as short as 7 days but not more than one year.

Are commercial papers secured?

Commercial papers are unsecured debt instruments with a promise of repayment on the maturity date. The issuer of the commercial paper promises to pay the purchaser a specified amount in cash at a future date without any collateral or assets backing the payment.

Click here to know more about

#best investment plan for 3 years#best bonds in india#safe investments with high returns in india#bonds and debentures#short-term investment plans with high returns in India

0 notes

Text

Best Car Leasing Companies In India

Owning a vehicle is the most common method of obtaining a car for daily commuting. However, as the market changes, there are other alternatives to owning a vehicle, one of which is leasing a vehicle from a car leasing firm. If you are not prepared to invest a large sum of money in a brand new vehicle, car leasing is an excellent option.

1. ALD Automotive Pvt. Ltd.

ALD Automotive provides business vehicle leasing and mobility solutions that fit your company's needs under the guidance of Suvajit Karmakar. Plus, they give their employees lots of perks, like tax breaks, pay-as-you-go, and quick upgrades.

Also Read: Top 5 Car Leasing Companies In India

2. Poonawalla Fincorp

Are you looking for an all-in-one auto leasing company? If so, you've come to the right place! From small businesses to big ones who want to add cars to their fleets for business or employee perks, Poonawalla Fincorp is a great choice. The company is run by Abhay Bhutada, the Managing Director and it recently got the CRISIL AAA rating.

Also Read: Financial Planning Tips For Small Business Owners

3. Avis Lease

Avis Lease is one of the most innovative car rental companies in the world. With over 16 years of experience, Avis Lease has established itself as one of the most trusted car rental and leasing companies in India. Avis Lease provides high-quality, reliable, and transparent car rental and leasing services to individuals and corporate clients in India. We offer short-term as well as long-term transportation solutions.

4. ORIX

Started in 1995, OAIS is a subsidiary of ORIX Corporation, which is a Japanese company. With Sandeep Gambhir as its MD, the company is a leader in leasing and transportation in India, providing clients with innovative solutions to help them reach their goals.

Summing Up

The four best car leasing companies in India are listed above. If you are looking to lease a vehicle, these companies should be your first choice.

#car leasing#car leasing companies#auto leasing#transportation solutions#car leasing companies in India

1 note

·

View note

Text

10 Best Pharmaceutical Raw Material Suppliers in Mumbai

Introduction

Mumbai, the financial powerhouse of India, is home to some of the nation's premier pharmaceutical raw material suppliers. These companies are crucial in ensuring the availability of top-quality raw materials essential for pharmaceutical production. This blog highlights the top 10 pharmaceutical raw material suppliers in Mumbai, detailing their offerings, contact information, and more.

1. Caltron Clays & Chemicals Pvt Ltd

About the Company

Caltron Clays & Chemicals Pvt Ltd is a standout in India's pharmaceutical and cosmetic raw materials sector. Established in 2000, Caltron Clays has built a formidable reputation for manufacturing and supplying natural mineral sources, chelated minerals, and natural cosmetic ingredients. As an ISO 9001 Certified and CRISIL-rated company, it demonstrates an unwavering commitment to quality and standardization.

Why Choose Caltron Clays pharmaceutical raw material ?

Industry Expertise:

Over two decades of experience in the industry.

Profound expertise in producing and supplying premium raw materials.

Pioneers in the mineral industry with a history of excellence and innovation.

Global Presence, Local Support:

Extensive global distribution network ensuring prompt deliveries.

Tailored customer service with specialized support teams.

Strategically located offices and manufacturing sites for efficient global market service.

Innovation and Reliability:

Continuous product innovation and enhancement.

Products designed to meet and exceed international quality and safety standards.

Rigorous quality control processes ensuring consistent and reliable products.

Sustainability Leadership:

Sustainable practices in manufacturing and operations.

Eco-friendly solutions aimed at minimizing environmental impact.

Certifications like ISO 14001 and ECOCERT ORGANIC reflecting commitment to sustainability.

Customer-Centric Approach:

Focus on long-term customer relationships through superior service.

Customized solutions to address specific client needs.

Commitment to delivering value and ensuring customer satisfaction at every stage.

Additional Benefits

Quality Certifications:

Numerous quality certifications including ISO 9001, ISO 22000, ISO 14001, ISO 18001, HACCP, HALAL, KOSHER, VEGAN, ECOCERT ORGANIC, SMETA 4 pillar, WHO-GMP, and DUNS.

Assurance of adherence to the highest quality and safety standards.

Diverse Product Range:

Comprehensive range of pharmaceutical raw materials to meet various industry requirements.

Specialization in unique products like Algae Calcium Powder and Algae Calcium Carbonate.

Ongoing expansion of the product portfolio to meet emerging market needs.

Experienced Leadership:

Founded by visionary leader Mr. S.N. Jain.

Strong leadership team dedicated to excellence and innovation.

Strategic vision focused on setting new standards in quality, customer service, and industry standardization.

Offerings

Caltron Clays specializes in Algae Calcium Powder and Algae Calcium Carbonate, among other raw materials. Their products cater to various industries, including pharmaceuticals, cosmetics, oil and gas drilling, minerals, and animal feed supplements.

Contact Information

Corporate Office: Office №210 & 211, Level 2, Orbit Premises, Mind Space, Chincholi, Malad (West), Mumbai - 400064, India

Phone: +(91)-(22)-3571 9844, +(91)-(22)-4010 6828

Email: [email protected], [email protected]

Websites: caltronclays.com, caltronoverseas.com, caltron.in, foodgradediatomaceousearth.in

2. Blue Pharmachem - Pharmaceutical Company

About the Company

Blue Pharmachem is a prominent pharmaceutical company recognized for its extensive range of raw materials and active pharmaceutical ingredients (APIs). The company is dedicated to providing high-quality products that meet international standards, ensuring the safety and efficacy of pharmaceutical formulations.

Offerings

Broad range of pharmaceutical raw materials, including APIs, excipients, and intermediates.

Products utilized in various medicinal formulations, catering to both domestic and international markets.

Contact Information

Address: 504, Saroj Plaza, 150 Feet Road, near Maxus Mall, Bhayandar West, Maharashtra 401101

Phone: 022 2804 8880

Email: [email protected]

Website: bluepharmachem.com

3. Inventys Research Company Pvt. Ltd.

About the Company

Inventys Research Company Pvt. Ltd. is an innovative firm specializing in the research and development of pharmaceutical raw materials. The company focuses on sustainable and cost-effective solutions, advancing pharmaceutical manufacturing processes.

Offerings

Variety of raw materials, including specialty chemicals and APIs, designed to enhance the efficiency and effectiveness of pharmaceutical production.

Contact Information

Address: Kanakia Zillion, D 514, Bandra Kurla Complex, Annex, Mumbai, Maharashtra 400070

Website: inventys.in

4. Topnotch Chemicals Private Limited

About the Company

Topnotch Chemicals Private Limited is well-known for its high-quality chemical products, including pharmaceutical raw materials. The company adheres to strict quality control measures to ensure the purity and efficacy of its offerings.

Offerings

Diverse range of pharmaceutical raw materials, including excipients and intermediates, essential for drug formulation and manufacturing.

Contact Information

Address: Plot No. C-116, T.T.C. Industrial Area, MIDC Industrial Area, Pawne, Navi Mumbai, Maharashtra 400703

Phone: 022 2761 0261

Website: topnotchchem.com

5. Pharmachem Research & Development Laboratories

About the Company

Pharmachem Research & Development Laboratories is a leading provider of pharmaceutical raw materials, known for its extensive research and development capabilities. The company focuses on innovation and quality to meet the evolving needs of the pharmaceutical industry.

Offerings

Wide range of raw materials, including APIs, intermediates, and specialty chemicals, used in the production of various pharmaceutical products.

Contact Information

Address: 219, Champaklal Industrial Estate, Sion Industrial Area, Sion (E), Mumbai, Maharashtra 400022

Phone: 098200 71191

Website: pharmachemlab.com

6. ARYA INTERNATIONAL

About the Company

ARYA INTERNATIONAL is a well-established supplier of pharmaceutical raw materials, serving both domestic and international markets. The company is known for its commitment to quality and customer satisfaction.

Offerings

Range of raw materials, including APIs and excipients, essential for pharmaceutical manufacturing. Products sourced from reliable manufacturers to ensure the highest standards of quality.

Contact Information

Address: Flat №81A, Laxmibai Chawl, Pipeline Rd, near Raju Police Chowki, Kurla West, Kurla, Mumbai, Maharashtra 400070

Phone: 080 3774 6649

Email: [email protected]

Website: aryapharmaceutical.in

7. JEEVAN CHEMICALS & PHARMACEUTICALS

About the Company

JEEVAN CHEMICALS & PHARMACEUTICALS is a trusted name in the pharmaceutical raw materials industry, known for its extensive product range and quality assurance practices. The company serves a wide array of clients, including pharmaceutical manufacturers and research institutions.

Offerings

Comprehensive range of pharmaceutical raw materials, including APIs, intermediates, and specialty chemicals, designed to meet the needs of the pharmaceutical industry.

Contact Information

Address: C-431, TTC Industrial Area, Indira Nagar, MIDC Industrial Area, Turbhe, Navi Mumbai, Maharashtra 400705

Phone: 080 3730 3874

Website: jeevanchempharma.net

8. Vedzon Healthcare Pvt. Ltd.

About the Company

Vedzon Healthcare Pvt. Ltd. is a leading supplier of pharmaceutical raw materials, dedicated to providing high-quality products and exceptional customer service. The company has a strong presence in both domestic and international markets.

Offerings

Wide range of pharmaceutical raw materials, including APIs and excipients, essential for the formulation and manufacturing of pharmaceutical products.

Contact Information

Address: AJANTA SEA BREEZE, Plot №8, 11, Sector 14, Airoli, Navi Mumbai, Maharashtra 400708

Phone: 093221 76000

Email: [email protected], [email protected]

Website: vedzonhealthcare.com

9. Vidharbha Pharma LLP

About the Company

Vidharbha Pharma LLP is a prominent supplier of pharmaceutical raw materials, known for its commitment to quality and innovation. The company serves a diverse clientele, including pharmaceutical manufacturers and research organizations.

Offerings

Range of raw materials, including APIs, excipients, and intermediates, designed to meet the stringent requirements of the pharmaceutical industry.

Contact Information

Address: 46, Gr Floor, Shop No - Mem/2000, Plot No 46, Ahilyabai Holkar Marg, opp. Patel, near Jai Maharashtra Dairy, Govandi Slums, Shivaji Nagar, Mumbai, Maharashtra 400043

Phone: 093723 15365

10. Adroit Biomed Ltd

About the Company

Adroit Biomed Ltd is a leading name in the pharmaceutical raw materials industry, known for its high-quality products and innovative solutions. The company is dedicated to advancing pharmaceutical manufacturing through its extensive range of raw materials.

Offerings

Comprehensive range of pharmaceutical raw materials, including APIs, excipients, and specialty chemicals, essential for drug formulation and production.

Contact Information

Address: F-115, Kanakia Zillion, LBS-CST Road Junction, Bandra Kurla Complex, Annexe, Mumbai, Maharashtra 400070

Phone: 022 6250 1000

Email: [email protected]

Website: adroitbiomed.com

Conclusion

The pharmaceutical raw material suppliers in Mumbai are integral to the pharmaceutical industry's success, ensuring the availability of high-quality ingredients for drug formulation and production. Companies like Caltron Clays & Chemicals, Blue Pharmachem, Inventys Research Company, Topnotch Chemicals, Pharmachem Research & Development Laboratories, ARYA INTERNATIONAL, JEEVAN CHEMICALS & PHARMACEUTICALS, Vedzon Healthcare, Vidharbha Pharma LLP, and Adroit Biomed Ltd set high industry standards, providing reliable and innovative solutions to meet the pharmaceutical sector's demands. Partnering with these top suppliers ensures pharmaceutical manufacturers can maintain the quality and efficacy of their products, ultimately contributing to better healthcare outcomes.

#pharmaceutical#manufacturering#raw materials#health care#caltronclays#skincare#calcium powder#pharmacy

0 notes

Text

Five Star business finance share price

Five Star business finance ltd company NBFC फाइनेंस सेक्टर की कम्पनी है। कम्पनी का ज्यादातर बिजनेस साऊथ इंडियन में देखने को मिलता है। कम्पनी छोटे कारोबारियों को लोन प्रोवाइड करवाने का काम करती है। देश के 150 जिलों में कम्पनी की कुल 311 ब्रांच हैं। कम्पनी का मुख्यालय चेन्नई में है।

CRISIL की एक रिपोर्ट के मुताबिक कम्पनीं की कर्ज देने की प्रणाली दुसरी सबसे अच्छी प्रणाली है। अगर हम कम्पनी की फाइनेंशियल कंडीशन पर एक नजर डालें तो पिछले तीन सालों में कम्पनी की सेल्स में 46% Compounded Sales Growth देखने को मिला है और इस समय के दौरान कम्पनी की सेल्स 196 करोड़ रुपए से बढ़कर 1250 करोड़ रुपए हो गया है।

कम्पनी के ऊपर इस समय पर 2520 करोड़ रुपए कर्ज देखने को मिलता है और कम्पनी के पास 4000 करोड़ रुपए का कैश रिजर्व भी देखने को मिलता है।

आइए अब हम लोग कम्पनी के बिजनेस माडल की भविष्य में ग्रोथ के अवसर और कम्पनी के दुसरे फंडामेंटल्स के आधार पर यह अनुमान लगाने का प्रयास करेंगे कि भविष्य में Five Star business finance share price target क्या हो सकता है?

0 notes

Text

Indiabulls Housing Finance Limited NCD IPO 2022 – Apply Now

Indiabulls Housing Finance Ltd (IBHFL) is one of the largest housing finance companies (HFCs) in India in terms of AUM. It is a non-deposit-taking HFC registered with the National Housing Board (NHB). IBHFL focuses primarily on long-term secured mortgage-backed loans.

Get all the information about upcoming Indiabulls Housing Finance limited IPO. Read the company details latest information and be updated on the new offers related to ncd IPO.

INDIABULLS HOUSING FINANCE LIMITED is opening it's gates for NCD IPO bidding from 1st December 2022. 🥳️ ✅With the credit rating of "AA/ stable by CRISIL & ICRA" and a yield of up to 9.30+ 0.50%*, it comes with a tenure of up to 60 months.

So what are you waiting for??

Click the link below:👇

Apply Now

#upcoming ipo#ipoalert#ncdipo#ipoupdates#fixedincome#stayalert#Indiabulls Housing Finance Limited#finance

0 notes

Text

Resolving the NPA Conundrum: Bad Bank to the Rescue

The Launch

Indian policymakers have wrestled for more than a few decades to solve the twin balance sheet problem of overleveraged companies and bad-loan-encumbered banks. Indecisiveness, delays in resolution of bad loans and reaching consensus have resulted in unprecedented challenges. Consequently, banks evergreen non-performing assets (“NPAs”) while credit and investment functions take a back seat. Taxpayer’s money is put to risk as public sector banks breach solvency and need to be recapitalized by the Government. Various agencies such as CRISIL and ASSOCHAM have signaled the rise of gross NPAs of banks to 8–9% in the fiscal 2021–22 and stressed assets to 10–11%. The regulator itself has indicated a sharp increase in NPAs of scheduled commercial banks to 9.5% by September 2022.

Currently, the legal framework for resolution of NPAs include the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (“SARFAESI”), resolution frameworks released by the Reserve Bank of India (“RBI”) and the Insolvency and Bankruptcy Code, 2016 (“Code”). The Code has to a large extent dealt with the problem of businesses overleveraging assuming there will be no consequence of default. The Code also facilitates businesses functioning as a going concern while the resolution of NPAs is effected.

In this backdrop the Government has now created a new mechanism to deal with the NPA problem — the “Bad Bank”. The idea to have a centralized public sector asset rehabilitation agency was conceived through the Economic Survey in 2016–17. It was proposed that the Bad Bank would take charge of the largest and most difficult NPAs and make politically tough decisions to reduce NPAs. In 2017, Dr. Viral V Acharya, Deputy Governor, RBI, in his speech highlighted potential of a bad bank to resolve NPA induced stress in the economy. Finally, in the Union Budget 2021–22, the Government announced creation of an asset reconstruction company (“ARC”) and an asset management company (“AMC”) to implement such recommendations. The intention is that the ARC consolidates and takes over the existing NPAs of public sector banks and the AMC manages and disposes of such NPAs to entities such as alternative investment funds and other potential investors, unlocking value.

2. Regulation and Function

Pursuant to the budget announcement, the Government has incorporated the National Asset Reconstruction Company Limited (“NARCL”). It is said that NARCL will acquire NPAs worth INR 2 lakh crore from various commercial banks in a phased manner. Additionally, the India Debt Resolution Company Ltd (“IDRCL”) has also been set up with the purpose of selling such NPAs in the market. The twin structure of NARCL-IDRCL is proposed to be the “Bad Bank”. NARCL is registered as an ARC and will be regulated by the RBI under the auspices of SARFAESI.

It is proposed that NARCL will purchase NPAs from public sector banks by paying 15% of the agreed price in cash and for the remaining 85%, NARCL will issue security receipts. It is further proposed that IDRCL will be responsible for resolution and sale of such NPAs. The consequent receipts will be utilized to redeem the security receipts. The Government will provide credit support to the Bad Bank through a guarantee of INR 30,600 crore for 5 years, guaranteeing recovery of such NPAs. Accordingly, the structure ensures the highest credit rating for the security receipts issued by NARCL, while differing the obligation of the Government to recapitalize public sector banks.

3. The Regulatory Roadblock

“Asset Reconstruction” as defined in Section 2 (1) (b) of SARFAESI, provides for the acquisition and resolution function of an ARC under the same legal entity. Accordingly, the RBI has recently opposed the proposed dual structure (i.e., one arm that acquires assets (NARCL) and the other arm that resolves such assets (IDRCL)) of the Bad Bank due to lack of statutory powers to regulate the same under SARFAESI. It is also not clear what will be the valuation/transfer price of NPAs from NARCL to IDRCL.

To overcome this issue, a principal-agent relationship between NARCL and IDRCL is being proposed. Under this agency, it is proposed that NARCL will engage IDRCL and outsource resolutions of NPAs (which would not be binding on NARCL) to IDRCL.

In the first structure elucidated above, there is lack of clarity on the relationship between NARCL and IDRCL and also on statutory sanctity. The second structure provides for a principal-agent relationship between the two. At the outset, the second structure, by virtue of the inherent nature of the “principal-agent” relationship, makes IDRCL accountable to NARCL. Whenever the relation of agency is created, there attaches prima facie to each party a number of duties, liabilities and disabilities-the normal incidents of agency.

In this context, the example of South Korean “bad-bank” structure adopted during the Asian Financial Crisis of 1997 is worth mentioning. At that time, South Korea’s NPAs stood at a glaring 18% of total loans, against present best-in-class 0.5%. The bad bank was called Korea Asset Management Corporation (“KAMCO”) which was state backed with a 5-year sunset window. However, it was not just the KAMCO structure which resolved the NPA stress, South Korea also adopted various other policy measures. These included harmonized information technology system for reporting NPAs by banks, online platform for auctions of NPAs, database of recoveries based on past auction and court-recovery results, which helped provide future basis for pricing NPAs and formula-based pricing to minimize valuation disagreements.

4. Conclusion

While ARC’s have been in existence since early 2000, the proposed “Bad Bank” backed by the guarantee of the Government of India ensures transferring banks will receive the amounts committed by NARCL and perhaps more, thereby resulting in a tradeable security of the highest credit rating and an indirect recapitalization of the transferring bank by the Government. The structure also frees the Bad Bank to deal with purchased NPAs without interference from transferring banks and permits a controlled wind down of such NPAs including through resorting to IBC proceedings or by creating a market for purchase of stressed assets by interested parties, thereby resulting in value maximization. Additionally, the structure will also permit closer interactions with the Government and facilitate policymaking, based on experiences and market demand.

If history is any guidance, there will be gaps between intention and implementation. This is a space to watch. Were the Bad Bank to succeed in cleaning up the NPA mess as intended, the results are for all to see in the South Korean example.

0 notes