#fixedincome

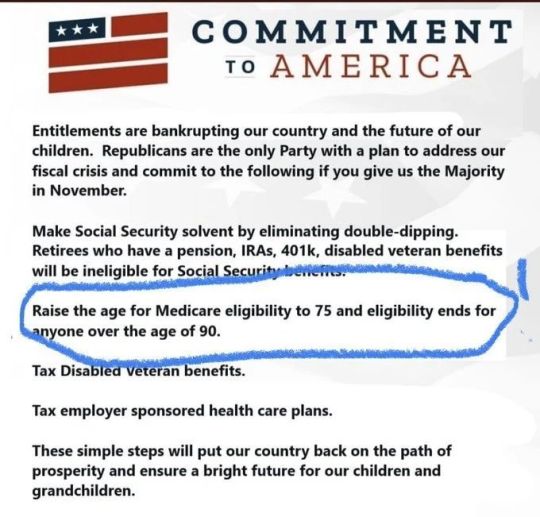

Photo

This cannot be stressed enough. Once again, this is the #Republican plan to HURT people, not help people. Do you know someone who even gets a pension? Perhaps a pension and #SocialSecurity? Your grandparents, parents, siblings? You? How much of their current #fixedincome is pension and how much is Social Security? In our case, they're nearly equal. Imagine the Republicans cutting your income by half. But you still have to pay for a place to live, electricity, phone, food ... And this doesn't take into account #incometax. Yes, you get taxed on your Social Security income even though you already paid income tax on that money. How much do they pay for their Medicare? Oh, yes. You sign up for #Medicare and you pay for it. Even though you were paying for it the whole time you were working. A vote for #Republicans is a vote to hurt people. People you know. People like you, or even yourself. #VoteBlueToSaveAmerica #VoteBlue https://www.instagram.com/p/CkD82LArk5o/?igshid=NGJjMDIxMWI=

#republican#socialsecurity#fixedincome#incometax#medicare#republicans#votebluetosaveamerica#voteblue

2 notes

·

View notes

Text

Unlocking Insured Investment Returns...By Costas Souris - Quality Group

REVOLUTION: In today’s fast-paced world, the combination of artificial intelligence (AI) and ATE insurance (Insuring legal cases) has opened up exciting new investment opportunities, in particular, “no win, no fee” litigation. Where lawyers represent clients for free! Imagine being able to invest in justice while securing solid double-digit returns. Sounds too good to be true. Well, not anymore.

BYPASS RISK: AI is a game-changer. By using predictive analytics, AI can sift through mountains of legal data to predict case outcomes with impressive accuracy. It doesn’t stop there; AI also optimizes how legal resources are managed, making the whole process faster and more efficient. This means investors can back the right cases, neutralizing risk while maximizing returns. The entire investment process managed by litigation lenders. A truly hassle-free investment.

INSURED: But is there not some risk? That’s where After-the-Event (ATE) insurance steps in. ATE insurance covers legal costs if a case is lost, ensuring that investors’ capital is protected. Plus, since ATE insurers only back strong cases, there’s an added layer of confidence.

DOUBLE DIGIT RETURNS: Together, AI and ATE insurance create a secure and lucrative environment for investors. You can enjoy stable, double-digit returns in currencies like GBP, USD, and EUR, all the while supporting access to justice. It’s a win-win scenario for claimants, lawyers, litigation lenders and investors.

#costas souris#qualitygroupsa#fixedincome#privatelending#buildingwealth#litigationfunding#investmentopportunity#justicefunding#retirement income

0 notes

Text

CFA level 3 | Victory Project | SSEI

The Victory Project, a game changer for all CFA Level 3 aspirants. The 'Victory Project' batch is to aid prep of all candidates who are crunched on time. All concepts get discussed but in a brisk manner and question solving.

#cfa#cfalevel3#cfaexam#mocktests#ssei#victoryproject#cfalevel3module#globalinvestment#riskmanagement#capitalmarket#examready#fixedincome#cfalevel3curriculum#assetallocation#SSEI

0 notes

Text

Securitized Debt Instruments offer investors exposure to diverse asset classes, potentially providing higher returns compared to traditional investment vehicles. By pooling various debt obligations, these instruments create opportunities for investors to access previously untapped markets while managing risk effectively.

#steadyincome#SDI#investment#SecuritizedDebt#DebtInvesting#AssetBackedSecurities#FixedIncome#InvestmentStrategies#bond#p2p investment

0 notes

Text

The Critical Roll Of Service Animals For Those On A Fixed Income.

The 'Road To Recovery Animal Relief Project' works with your generous help (Thank You!!) to serve animals of pet families on limited or fixed incomes. Typically our elderly pet families.

For seniors with service animals, these animals are not just pets but essential companions that provide crucial support and assistance in their daily lives. Service animals are specially trained to perform tasks that help individuals with disabilities maintain independence and improve their quality of life. As such, the well-being of these service animals is paramount to the well-being of their owners.

When faced with veterinary expenses for their service animals, seniors on fixed incomes may encounter difficulties in affording necessary care. Veterinary costs can quickly add up, especially if the animal requires specialized treatments, medications, or surgeries. In some cases, seniors may have to make difficult decisions about prioritizing their own expenses over those of their beloved service animals.

The inability to promptly address veterinary needs due to financial constraints can have detrimental effects on both the service animal and its owner. Delaying or forgoing necessary medical care can compromise the health and well-being of the animal, potentially impacting its ability to perform essential tasks for its owner. Additionally, the emotional distress of seeing one’s service animal suffer due to lack of funds can take a toll on the mental health of seniors.

0 notes

Text

youtube

InvestTalk - 2-9-2024 – Considering the Best Types of Stocks to Buy in Today's Market

One might make a compelling argument that value stocks are still the most affordable.

0 notes

Text

11.19% Navi Finserv NCD Feb-2024 - Details, Interest Rates and Review

Navi Finserv is coming up with secured NCD bonds now. These bonds would open for subscription on February 26, 2024. Navi Finserv is a non-deposit taking, systemically important NBFC registered with RBI. The interest rates for Navi Finserv NCD are up to 11.19%. These NCDs are offered for 18 months, 27 months and 36 months tenure. Interest is paid either monthly or yearly. Should you invest in Navi Finserv NCD February, 2024? Is Investment in Navi Finserv NCD Safe or risky?

About Navi Finserv Limited

Company is a non-deposit taking, systemically important NBFC registered with RBI and wholly owned subsidiary of NTL.

NTL is a technology driven financial products and services company in India focussing on digitally connected young middle-class population in India.

Company offer lending products like personal loans, home loans under the Navi brand.

It also offer microfinance loans under the brand name "chaitanya" through its subsidiary, CIFCPL

Navi Finserv NCD Feb-2024 issue details

Here are the details of Navi Finserv NCD Feb-2024 issue.

Subscription opening Date

26-Feb-24

Subscription closure Date

07-Mar-24

Issuing Security Name

Navi Finserv Limited

Security Type

Secured, Redeemable, Non-Convertible Debentures (Secured NCDs)

Issue Size (Base)

Rs 300 Crores

Issue Size (Option to retain over subscription)

Rs 300 Crores

Total issue size

Rs 600 Crores

Issue price

Rs 1,000 per bond

Face value

Rs 1,000 per bond

Minimum Lot size

10 bonds and 1 bond there after

Tenure

18, 27 and 36 months

Interest Payment frequency

Monthly and Annually

Listing on

Within 6 working days on BSE/NSE

Lead Manager

JM Financial Limited

Debenture Trustee/s

Catalyst Trusteeship Limited

NRI’s cannot apply to this NCD subscription.

Navi Finserv NCD Interest Rates – Feb-2024 Issue

Series

I

II

III

IV

X

Frequency of Interest Payment

Monthly

Monthly

Annual

Monthly

Annual

Tenor (in months)

18

27

27

36

36

Coupon (% per Annum)

10.00%

10.40%

10.90%

10.65%

11.19%

Effective Yield (% per Annum)

10.47%

10.91%

10.94%

11.19%

11.19%

Amount on Maturity (In Rs.)

1,000

1,000

1,000

1,000

1,000

What are the credit ratings for these NCDs?

CRISIL Ratings assigned Navi Finserv NCD rating as CRISIL A/Stable. Instruments with this rating are considered to have adequate degree of safety regarding timely servicing of financial obligations. Such instruments carry low credit risk.

How is the company doing in terms of profits?

Here are the restated consolidated profits of the company.

- FY2021 – Rs 118.1 Crores

- FY2022 – Rs 14.66 Crores (Loss)

- FY2023 – Rs 264.1 Crores

Why to invest in these NCDs?

- Navi Finserv NCD’s offer attractive interest rates where investors can get interest up to 11.19%.

- It issues secured NCDs. Its secured NCDs are safe compared to unsecured NCDs. In case company gets wind-up/shut down for some reason, secured NCD investors would get preference in repayment of capital along with interest as those backed up by assets of the company. Hence it is safe to invest in such secured NCD options.

Why not to invest in these NCD Bonds?

Here are the risk factors investors should consider before investing in these bonds.

- Company has incurred losses for FY22. Investors should always invest in profit making companies so that they can get timely payment of interest and repayment of capital.

- Company lending business of and micro finance business operations rely intensively on substantial capital for its lending and microfinance business operations. Any disruption can affect company financial condition and liquidity

- Company is affected by volatility in interest rates in both lending and treasury operations which could cause its net interest income to varry and affect its profitability.

- Company has significant growth in recent period and may not be able to grow at similar pace in future or manage it effectively.

- Customers default in repayment obligations can adversely affect company.

- Covid pandemic has affeced its regular business operations and may continue in fuure too.

- Refer Navi Finserv Feb-24 NCD prospectus for complete risk factors.

How safe is Navi Finserv NCD Bonds?

These NCD bonds are rated as A/Stable by Crisil Ratings. Such ratings are considered to have adequate safety regarding timely servicing of financial obligations with low credit risk. Hence these are safe bonds.

Should you invest in Navi Finserv NCD Feb-2024 issue?

- These NCD Bonds offer high interest rates and yield. Such interest rates are higher than FD rates offered by small finance bank too. It comes with A/Stable credit ratings which are considered to have adequate safety and carry low credit risk. These are secured NCDs too.

- On the other side investment in these bonds comes with several risk factors. Company credit ratings can change in future without any advance intimation. Company has incurred losses for FY22, however shown significant improvement both in terms of revenue and margins.

Investors who understand all these risk factors can invest in such NCDs.

Read the full article

#FixedIncome#NaviFinservNCDFeb-2024#NaviFinservNCDFeb-2024CreditRatings#NaviFinservNCDFeb-2024InterestRates#NaviFinservNCDRatings#NCD

0 notes

Text

#RealEstateInvestment#FixedIncome#HighYield#AccreditedInvestors#EvergreenFund#SeniorLoans#WesternUS#QuarterlyDistributions#MinimumInvestment

0 notes

Text

Peer-to-Peer Lending Investments: Navigating the New Frontier in Fixed-Income Investing

In the ever-evolving landscape of investment opportunities, Peer-to-Peer (P2P) lending has emerged as a compelling alternative for those seeking fixed-income options beyond traditional bonds and savings accounts. This blog post will guide you through the pros and cons of P2P lending, helping you make informed decisions in this innovative space.

Check out the treature trove

Check out the…

View On WordPress

0 notes

Text

Explore the best fixed-income investment options to secure stable returns on your investments.

0 notes

Text

Unlocking Secured Returns-by Costas Souris -Quality Group SA

REVOLUTION: In today’s fast-paced world, the combination of artificial intelligence (AI) and ATE insurance (Insuring legal cases) has opened up exciting new investment opportunities, in particular, “no win, no fee” litigation. Where lawyers represent clients for free! Imagine being able to invest in justice while securing solid double-digit returns. Sounds too good to be true. Well, not anymore.

BYPASS RISK: AI is a game-changer. By using predictive analytics, AI can sift through mountains of legal data to predict case outcomes with impressive accuracy. It doesn’t stop there; AI also optimizes how legal resources are managed, making the whole process faster and more efficient. This means investors can back the right cases, neutralizing risk while maximizing returns. The entire investment process managed by litigation lenders. A truly hassle-free investment.

INSURED: But is there not some risk? That’s where After-the-Event (ATE) insurance steps in. ATE insurance covers legal costs if a case is lost, ensuring that investors’ capital is protected. Plus, since ATE insurers only back strong cases, there’s an added layer of confidence.

DOUBLE DIGIT RETURNS: Together, AI and ATE insurance create a secure and lucrative environment for investors. You can enjoy stable, double-digit returns in currencies like GBP, USD, and EUR, all the while supporting access to justice. It’s a win-win scenario for claimants, lawyers, litigation lenders and investors.

By Costas Souris - Quality Group SA

https://futureprooftomorrow.com/?ao=myaccordion&ai=8#myaccordion

#costas souris#qualitygroupsa#fixedincome#litigationfunding#investmentopportunity#buildingwealth#justicefunding#retirement income

0 notes

Text

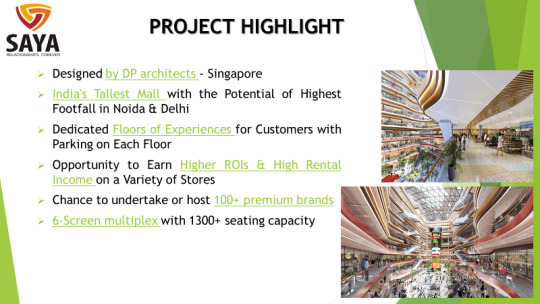

The Saya Status

#propertydealing#renting buying&selling commercialdea#fixedincome#Betterinvestment investment strongROI extraearnig

1 note

·

View note

Text

Are Bond Trading Strategies Profitable?

Bond trading strategies can indeed be profitable, contributing positively to overall returns and complementing existing investment strategies. However, their profitability largely hinges on the specific strategy employed, market conditions, and effective risk management. Strategies such as trend-following, seasonal patterns, and mean reversion have shown varying degrees of success, but consistent profitability requires thorough analysis and disciplined execution.

#tradingstrategies#BondTrading#InvestmentStrategies#FinancialMarkets#RiskManagement#TradingStrategies#FixedIncome

0 notes

Text

The Role of Bonds in Your Investment Portfolio

Ever wonder how bonds can provide a safe haven amidst the choppy seas of stock market volatility? The answer to that lies in understanding the purpose and value that bonds can bring to your investment portfolio. This article will take you on a journey through the world of bonds, explaining their role, the benefits they offer, and the potential risks they pose.

Understanding the Role of…

View On WordPress

#BondMarket#Bonds#FinancialAdvice#FixedIncome#InterestRates#investing#InvestmentPortfolio#PersonalFinance#PortfolioDiversification#Yield

0 notes

Photo

Check out different types of fixed income instruments on India’s biggest platform to invest in bonds and buy bonds. Range of fixed income instruments available on The Fixed Income. Read our blogs and news on latest bonds in India. Buy and Invest Now.

0 notes

Text

Ultra Short Duration Funds are debt funds that lend to companies for a period of 3 to 6 months. These are low-risk funds owing to their low lending duration. The risk is slightly higher than liquid funds.

Contact us for more info: 9910133556

#HybridFunds#debtfunds#equityfunds#MonthlyIncome#investingforbeginners#investingtips#investors#investorswanted#investorlife#investment#investmentopportunity#investmentchallenge#investor#investing#investing101#equitymarkets#stockmarket#USstocks#FixedDeposit#fixedincome#mutualfunds#MutualFundsInvestment#MutualFundsSahiHai#MutualFundInvesting#taxsavings#retirementplanning#sip#moneymindset#entrepreneur#business

1 note

·

View note