#ncdipo

Text

Why A Nonconvertible Debenture Is The Best IPO For Private Companies

A nonconvertible debenture (NCD) is the best initial public offering (IPO) for private companies for several reasons. First, NCDs are not convertible into equity shares, so they do not dilute the ownership of existing shareholders. Second, NCDs are unsecured, so they do not require collateral. Third, NCDs have a fixed interest rate, so they offer predictable cash flows to investors. Finally, NCDs have a longer maturity than most other debt instruments, so they provide private companies with long-term financing.

A non-convertible debenture (NCD) is a type of debt instrument that does not have the option to be converted into equity shares. NCDs are typically issued by companies to raise capital, and are often listed on stock exchanges. Interest on NCDs is generally paid out at fixed intervals, and the principal amount is repaid at maturity.

NCDs have become increasingly popular in recent years as a means for corporates to raise capital. The main advantage of issuing NCDs is that it allows companies to tap into new sources of funding, without having to dilute their equity shareholding. Additionally, interest payments on NCDs are typically tax-deductible, making them an attractive investment for many investors.

There are some disadvantages to issuing NCDs as well. Firstly, they typically have a longer tenure than other debt instruments, which can increase the risk for the issuer. Secondly, interest payments on NCDs are not always predictable, as they may be linked to market rates. This can make it difficult for issuers to budget for interest payments in advance. Finally, NCDs typically have higher coupon rates than other debt instruments, which can increase the cost of borrowing for the issuer.

New IPO Click Now

Overall, NCDs can be a useful tool for corporates looking to raise capital. However, it is important to consider the risks and costs associated with this type of financing before making any decisions.

0 notes

Link

#Indiabulls#Indiabullshousing#Indiabullshousingfinance#Indiabullshousingfinancelimited#Indiabullshousingfinancelimitedncdipo#Indiabullshousingfinancelimitedncdipo2022#ncdipo#ncdipo2022

0 notes

Text

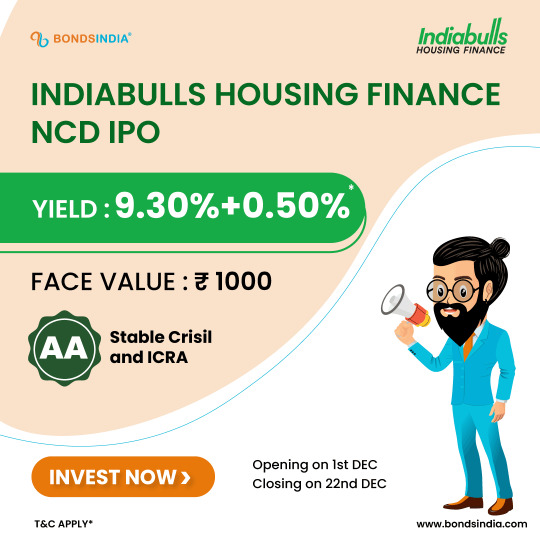

Indiabulls Housing Finance Limited NCD IPO 2022 – Apply Now

Indiabulls Housing Finance Ltd (IBHFL) is one of the largest housing finance companies (HFCs) in India in terms of AUM. It is a non-deposit-taking HFC registered with the National Housing Board (NHB). IBHFL focuses primarily on long-term secured mortgage-backed loans.

Get all the information about upcoming Indiabulls Housing Finance limited IPO. Read the company details latest information and be updated on the new offers related to ncd IPO.

INDIABULLS HOUSING FINANCE LIMITED is opening it's gates for NCD IPO bidding from 1st December 2022. 🥳️ ✅With the credit rating of "AA/ stable by CRISIL & ICRA" and a yield of up to 9.30+ 0.50%*, it comes with a tenure of up to 60 months.

So what are you waiting for??

Click the link below:👇

Apply Now

#upcoming ipo#ipoalert#ncdipo#ipoupdates#fixedincome#stayalert#Indiabulls Housing Finance Limited#finance

0 notes

Text

EDELWEISS FINANCIAL SERVICES LIMITED IPO Live Now!

The IPO market is now open and we’re ready to launch the best option for you.

Click the link below: 👇

https://www.bondsindia.com/IPO/edelweiss-ncd-ipo-oct-2022.html

0 notes