Text

Where to Buy Government Bonds in India

Government bonds are a popular investment option for Indian investors. They are considered to be safe and offer a fixed rate of return. There are a few different places where you can buy government bonds in India.

Banks

Most banks in India offer government bonds to their customers. You can buy bonds through your bank's online portal or by visiting a branch.

Post Offices

The Indian Post Office also sells government bonds. You can buy bonds through your local post office.

Brokerage Firms

Brokerage firms allow you to buy and sell government bonds on the stock exchange. This is a good option if you want to trade bonds actively.

RBI Retail Direct

The Reserve Bank of India (RBI) offers a retail direct platform where you can buy government bonds directly from the RBI. This is a good option if you are a beginner investor.

Which is the best place to buy government bonds in India?

The best place to buy government bonds in India depends on your individual circumstances. If you are a beginner investor, the RBI Retail Direct platform is a good option. If you are looking for a wider range of bonds, you can buy bonds through a brokerage firm.

Here are some of the benefits of investing in government bonds in India:

Safety: Government bonds are considered to be one of the safest investment options available. The government of India is backed by the Reserve Bank of India, so there is a low risk of default.

Fixed income: Government bonds offer a fixed rate of return, which can provide you with a predictable stream of income.

Liquidity: Government bonds are highly liquid, which means that you can easily sell them if you need cash.

Tax benefits: Government bonds offer certain tax benefits, such as exemption from capital gains tax.

If you are considering investing in government bonds in India, it is important to do your research and understand the risks involved. You should also speak to a financial advisor to get personalized advice.

Here are some of the risks of investing in government bonds:

Interest rate risk: The value of government bonds can go down if interest rates rise.

Inflation risk: The value of government bonds can also go down if inflation rises.

Default risk: There is a small risk that the government of India could default on its bonds.

By understanding the risks and benefits of investing in government bonds, you can make an informed decision about whether or not this is the right investment for you.

BondsIndia

Bonds India is a leading provider of government bonds in India. We offer a wide range of bonds to suit all investor needs. We also offer a variety of services to help you buy and sell bonds.

If you are looking to invest in government bonds in India, BondsIndia is the perfect place to start. We offer a safe, secure, and convenient way to buy and sell bonds.

#government bonds#bonds#treasury bonds#buy government bonds#what are bonds#how to buy government bonds#bonds explained#why invest in bonds#government bond#what are government bonds#selling government bonds#how do government bonds work#how to invest in bonds for beginners#investing in bonds#types of bonds#types of government bonds#municipal bonds#government#how to invest in government bonds

0 notes

Text

Why Government Bonds Are a Smart Way For Investors

Government bonds are a type of fixed-income security that is issued by governments to raise money. They are considered to be one of the safest investments available, as the government is legally obligated to repay the bondholder the principal amount at maturity, plus interest payments.

There are many reasons why government bonds are a smart way for investors.

First, they offer a relatively high level of safety. The government is unlikely to default on its debt, as it has the power to raise taxes or print money to repay its creditors. This makes government bonds a good choice for investors who are looking to preserve their capital.

Second, government bonds offer a predictable stream of income. The bondholder will receive regular interest payments until the bond matures. Retirees or other investors who require a consistent cash flow can benefit greatly from this as a reliable source of income.

Third, government bonds are relatively liquid. This means that they can be easily bought and sold, making them a good choice for investors who need to access their money quickly.

Of course, no investment is without risk. Government bonds are subject to interest rate risk, which means that their value will decline if interest rates rise. However, this risk is relatively low for short-term government bonds.

Overall, government bonds are a smart way for investors to preserve their capital, generate income, and add diversification to their portfolios. If you are looking for a safe and reliable investment, government bonds should be on your radar.

Here are some additional benefits of investing in government bonds in India:

Government bonds in India are denominated in Indian rupees, which means that you are not exposed to currency risk.

The Indian government has a strong track record of paying back its debt.

Government bonds in India offer attractive yields, especially for long-term investors.

If you need to access your money quickly, government bonds are a liquid asset that can be easily bought and sold.

If you are looking for a safe and reliable investment in India, government bonds are a great option.

Here are some of the risks associated with investing in government bonds:

Interest rate risk: The value of government bonds will decline if interest rates rise.

Inflation risk: The purchasing power of the income you receive from government bonds will decline if inflation rises.

Default risk: The government could default on its debt, although this is unlikely for a developed country like India.

It is important to carefully consider the risks and benefits of investing in government bonds before making a decision. If you are not comfortable with the risks, you may want to consider other types of investments.

Bondsindia is a leading provider of government bond investment products in India. We offer a wide range of bonds to choose from, including short-term and long-term bonds.

#Bonds India#safe investments#fixed-income securities#bonds india#government bond investment#bonds in india#government bonds

0 notes

Text

Best Bonds to Buy in India

When it comes to smart financial decisions, investing in bonds is a path worth considering. In India, a diverse range of bonds offer stability and attractive returns. In this guide, we'll explore the best bond options available for you to buy, helping you make informed decisions to secure your financial future.

Understanding Bonds:

Bonds are essentially loans that you provide to the government or a company. In return, they promise to pay you back with interest over a specified period. These investments are generally considered safer than stocks and can be an excellent way to diversify your portfolio.

Top Bond Options in India:

Government Bonds: These bonds are issued by the Indian government. They are considered highly safe, making them an ideal choice for risk-averse investors. Within this category, you can view:

Sovereign Gold Bonds (SGBs): These bonds allow you to invest in gold electronically, eliminating the need to physically store the metal. They offer interest and potential capital appreciation.

RBI Savings Bonds: Backed by the Reserve Bank of India, these bonds provide a fixed interest rate and come with various tenure options.

Corporate Bonds: These bonds are issued by companies to raise capital. They offer higher interest rates compared to government bonds, but they also involve slightly higher risk. Some prominent corporate bonds include:

AAA-rated Corporate Bonds: These bonds come from highly reputable companies with a strong credit history, reducing the risk significantly.

Tax-Free Bonds: Issued by government-backed institutions, these bonds offer tax benefits to investors.

Municipal Bonds: Issued by local governments or municipalities, these bonds fund public projects. They can offer tax advantages and contribute to local development.

Factors to Consider:

Credit Rating: Always check the credit rating of the bond issuer. Higher-rated bonds are generally safer investments.

Yield and Duration: Considproducte yield (interest rate) and the duration of the bond. Longer durations might offer higher yields but also carry higher interest rate risk.

Tax Implications: Different bonds have varying tax treatments. It's important to understand whether the interest is taxable or tax-free.

Diversification: Spread your investments across different types of bonds to minimize risk.

How to Buy Bonds:

You can buy bonds through various channels, including:

Banks and Financial Institutions

Stock Exchanges

Online Trading Platforms

Conclusion:

Investing in bonds can be a wise decision to balance your investment portfolio and generate consistent returns. The best bond to buy in India depends on your risk tolerance, financial goals, and investment horizon. Government bonds provide safety, corporate bonds offer higher yields, and municipal bonds contribute to local development. Remember to research thoroughly, diversify your investments, and stay updated with market trends. By doing so, you can secure your financial well-being and achieve your long-term aspirations.

Remember, while bonds are generally considered safer than stocks, no investment is entirely risk-free. Always consult with a financial advisor before making significant investment decisions.

#finance#investment#invest#invest in bonds#bonds#bonds market#Tax-Free Bonds#Corporate Bonds#Sovereign Gold Bonds (SGBs)#Sovereign Gold Bonds#SGB

0 notes

Text

Tax-Free Bonds vs Equity Investments

Tax-free bonds and equity investments are two different investment options with their own advantages and disadvantages. The choice between the two depends on your individual financial goals, risk appetite, and investment horizon.

Tax-free bonds are issued by government entities and are exempt from income tax. They offer fixed returns for a specified period of time, typically 10, 15, or 20 years. These bonds are considered low-risk investments and are suitable for investors who prioritize safety and stable returns over high-risk, high-reward investments.

On the other hand, equity investments involve buying shares of companies in the stock market. Equity investments are higher-risk investments than tax-free bonds, but they offer the potential for higher returns over the long term. Equity investments require a longer investment horizon and are suitable for investors who can tolerate volatility and are willing to stay invested for an extended period.

When deciding between tax-free bonds and equity investments, you should consider your investment goals, risk tolerance, and time horizon. If you prioritize safety and stable returns, tax-free bonds may be a good option. If you are willing to take on more risk for the potential of higher returns over the long term, equity investments may be a better fit.

It's important to note that diversification is key to a successful investment portfolio. Consider investing in a mix of asset classes, including tax-free bonds and equities, to spread out your risk and increase your chances of achieving your financial goals. It's always a good idea to consult with a financial advisor to determine the best investment strategy for your individual needs.

Visit us for more information:- https://medium.com/@dhherajjhunjhunwala/tax-free-bonds-vs-equity-investments-understanding-the-key-differences-296a526d187b

#equity investments#Tax-free bonds#higher returns#higher-risk#buying shares#diversification#investment strategy

5 notes

·

View notes

Text

What Are the Benefits of Investing in Tax-Free Bonds?

The biggest benefit of investing in tax-free bonds is that you get to enjoy tax benefits without taking on too much risk. Unlike other investments like stocks and mutual funds, there is very little volatility in the returns from these bonds since they have fixed interest rates for their entire duration.

Visit Us:- https://www.usafinanceinsurance.com/2023/03/03/tax-free-bonds-in-india-a-beginners-guide-to-understanding-the-benefits/

0 notes

Text

Investing in government bonds in India offers several benefits to investors, including:

Safety: Government bonds are considered one of the safest investment options as they are backed by the Indian government, which has a strong credit rating.

Regular income: Government bonds provide a regular stream of income through fixed interest payments, making them an attractive option for investors seeking stable returns.

Diversification: Investing in government bonds can help diversify an investor's portfolio, reducing overall risk.

Liquidity: Government bonds can be easily bought and sold on the secondary market, providing investors with liquidity when they need it.

Tax benefits: Government bonds offer tax benefits to investors, such as tax-free interest income up to a certain limit and tax deductions on investment.

Overall, investing in government bonds in India can provide investors with a safe, stable, and diversified investment option that offers regular income and potential tax benefits.

Visit us for more:- https://blog.bondsindia.com/government-bonds/

#bonds#government bonds#gsec#investment#benefits of investing in bonds#bondszarurihai#bondsIndia#bondsobpp

0 notes

Text

Primary And Secondary Bond Market: What To Know Before You Invest

Investing in the bond market can be a great way to make a return on your money. But before you dive into the world of bonds, it’s important to understand the difference between the primary and secondary bond markets, as well as how to properly research and evaluate potential investments. In this article, we explore what you need to know about these markets before you start investing.

Read More:- https://topmagzine.net/2023/02/27/exploring-the-primary-and-secondary-bond-market/

1 note

·

View note

Text

Benefits of Investing in Bonds

Capital preservation: Unlike stocks, which can lose value, bonds typically hold their value even when markets are down. This makes them a good choice for investors who want to protect their capital.

Income potential: Bonds offer regular interest payments, which can provide a source of income for investors. The payments are usually made every six months.

Read More:- https://technictimes.com/investing-in-bonds/

0 notes

Text

Public Issues: What Are They?

The process of obtaining funding from the general public by issuing securities like shares, bonds, or debentures is referred to as a “public issue.” Public issues are frequently used by businesses to raise money for corporate growth, debt repayment, or the introduction of new goods or services

Read Here:- https://medium.com/@dhherajjhunjhunwala/a-comprehensive-guide-to-public-issues-in-india-benefits-risks-and-latest-trends-946c8985550c

0 notes

Text

Best Retirement Planning Tips in India - BondsIndia

When it comes to retirement planning, there are a few key things to keep in mind. First, start saving as early as possible. The earlier you start saving, the more time your money has to grow. Second, invest in a mix of stocks and bonds. This will help ensure that your portfolio is diversified and that you're not too exposed to any one type of investment.

Third, don't forget about senior citizen savings programs. These can be a great way to supplement your income in retirement. Finally, remember that retirement planning is a long-term process. Don't try to make too many changes all at once. Instead, take your time and make small tweaks over time to ensure that your plan is on track.

Read here for more information:- https://www.rebellionresearch.com/how-to-plan-for-retirement-financial-planning-tips

#planning for retirement#savings for senior citizens#bonds#investment#finance#tip for investment#senior citizens savings

0 notes

Text

What is the best way to plan for retirement?

You need to start planning for retirement as soon as possible. You should do the following: Invest in your 401(k) and Roth IRA account so you are making the maximum contribution and get employer match if available; Delay Social Security benefits, if possible, until 70+ years old (depending on work history); Save more than 12% of your income (if you can afford it); Be sure to have a diversified portfolio to help reduce risk.

Visit Us:-https://speakrights.com/retirement-planning-the-ultimate-guide-for-2023/

0 notes

Text

Which is better stockholder or bondholder?

When deciding whether to invest in stocks or bonds, it is important to consider the level of risk you are comfortable with. Bonds are typically considered safer investments than stocks because bondholders have a higher claim on the issuing company's assets in the event of bankruptcy. In other words, if the company must sell or liquidate its assets, any proceeds will go to bondholders before common stockholders.

However, this also means that bonds typically offer lower returns than stocks. If you are willing to take on more risk for the potential of higher returns, then investing in stocks may be a better choice for you. Ultimately, it is important to align your investment choices with your overall financial goals and risk tolerance.

Read More:- https://www.rebellionresearch.com/why-would-someone-choose-a-bond-over-a-stock

0 notes

Text

Why A Nonconvertible Debenture Is The Best IPO For Private Companies

A nonconvertible debenture (NCD) is the best initial public offering (IPO) for private companies for several reasons. First, NCDs are not convertible into equity shares, so they do not dilute the ownership of existing shareholders. Second, NCDs are unsecured, so they do not require collateral. Third, NCDs have a fixed interest rate, so they offer predictable cash flows to investors. Finally, NCDs have a longer maturity than most other debt instruments, so they provide private companies with long-term financing.

A non-convertible debenture (NCD) is a type of debt instrument that does not have the option to be converted into equity shares. NCDs are typically issued by companies to raise capital, and are often listed on stock exchanges. Interest on NCDs is generally paid out at fixed intervals, and the principal amount is repaid at maturity.

NCDs have become increasingly popular in recent years as a means for corporates to raise capital. The main advantage of issuing NCDs is that it allows companies to tap into new sources of funding, without having to dilute their equity shareholding. Additionally, interest payments on NCDs are typically tax-deductible, making them an attractive investment for many investors.

There are some disadvantages to issuing NCDs as well. Firstly, they typically have a longer tenure than other debt instruments, which can increase the risk for the issuer. Secondly, interest payments on NCDs are not always predictable, as they may be linked to market rates. This can make it difficult for issuers to budget for interest payments in advance. Finally, NCDs typically have higher coupon rates than other debt instruments, which can increase the cost of borrowing for the issuer.

New IPO Click Now

Overall, NCDs can be a useful tool for corporates looking to raise capital. However, it is important to consider the risks and costs associated with this type of financing before making any decisions.

0 notes

Text

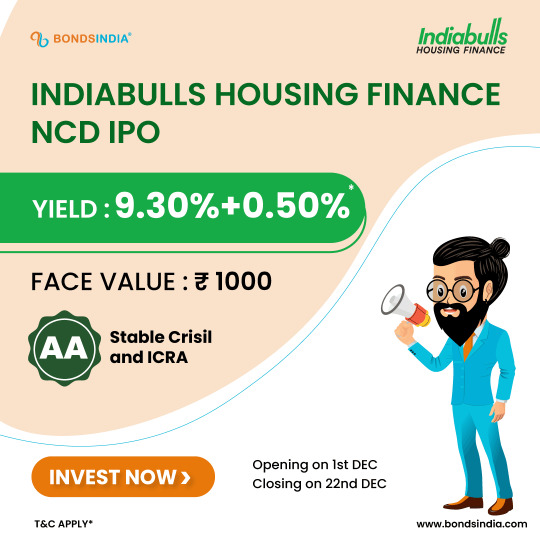

Indiabulls Housing Finance Limited NCD IPO 2022 – Apply Now

Indiabulls Housing Finance Ltd (IBHFL) is one of the largest housing finance companies (HFCs) in India in terms of AUM. It is a non-deposit-taking HFC registered with the National Housing Board (NHB). IBHFL focuses primarily on long-term secured mortgage-backed loans.

Get all the information about upcoming Indiabulls Housing Finance limited IPO. Read the company details latest information and be updated on the new offers related to ncd IPO.

INDIABULLS HOUSING FINANCE LIMITED is opening it's gates for NCD IPO bidding from 1st December 2022. 🥳️ ✅With the credit rating of "AA/ stable by CRISIL & ICRA" and a yield of up to 9.30+ 0.50%*, it comes with a tenure of up to 60 months.

So what are you waiting for??

Click the link below:👇

Apply Now

#upcoming ipo#ipoalert#ncdipo#ipoupdates#fixedincome#stayalert#Indiabulls Housing Finance Limited#finance

0 notes

Text

Top 5 Reasons Why You Should Invest In Bonds And Debentures

Bonds and debentures are debt instruments used to generate capital, but they do have their share of differences. Not every bond is a debenture, but all debentures can be bonds. Although these two financial debt instruments are issued to raise capital or funding from the public, they both function differently. Going forward, we’ll understand their differences in detail.

Bonds are debt financial instruments issued by large corporations, financial institutions and government agencies that are backed up by collaterals or physical assets. Debentures are debt financial instruments issued by private companies, but any collaterals or physical assets do not back them up.

Read More:- https://blog.bondsindia.com/bonds/10-differences-between-bonds-and-debentures-in-india.html

0 notes

Text

How to Earn High-Interest Rate Apart from Bank FDs

When it comes to earning higher returns on your fixed deposit (FD), government banks are a great option. Not only do they offer higher interest rates, but they are also backed by the government, making them a safe investment. Government bonds are one of the most common types of investments held by government banks. These bonds are issued by the government in order to raise money for various projects and expenses. In return for loaning the government money, investors are paid interest payments at a set rate over a specific period of time. Government bonds are typically considered to be very safe investments since they are backed by the full faith and credit of the issuing government. This means that even if the issuer defaults on the loan, investors will still be repaid their principal plus interest. For this reason, government bonds are often used as a way to preserve capital and earn a guaranteed rate of return. While government bonds may not offer the highest rate of return available, they can be a great option for those looking for a safe and reliable investment. If you are considering investing in government bonds, be sure to research the different options available in order to find the best fit for your portfolio.

#fixed deposit#government bonds#investments#investing#bank interest rate#higher interest rates#saving

0 notes

Text

The IPO bidding for Muthoot Finance Ltd. - India starts Today!

Simply click on the Link Below & apply for the IPO in a few simple steps.

https://bit.ly/3CcYNO2

Fill out the form, update your bank account details, Demat account details, and more. Select the number of NCD debentures you're looking for and complete your bidding for the NCD debenture in five minutes.

#muthoot finance#NCD IPO#upcoming ipo#finance advisor#investment#ipoalert#investinipo#muthootfinance#debentures

1 note

·

View note