#Crypto Otc Trading Platform Development

Explore tagged Tumblr posts

Text

Explore the top 5 market trends shaping OTC crypto trading, including regulatory shifts, institutional adoption, and technological advancements.

#otc crypto trading platform development#crypto trading#Crypto OTC Trading Platform Development#Crypto OTC Trading Platform Company

0 notes

Text

Navigating the Digital Finance Frontier: The Emergence of Crypto OTC Trading Platform Development

Introduction

In the dynamic world of cryptocurrency, Over-the-Counter (OTC) trading platforms have carved a niche, catering to high-volume traders and institutional investors. These platforms facilitate the trading of large quantities of cryptocurrencies outside of traditional exchanges. This article delves into the development of crypto OTC trading platforms, exploring their significance, functionality, and the pivotal role they play in the broader digital asset market.

The Essence of Crypto OTC Trading

Understanding OTC Trading

OTC trading in the crypto world involves direct transactions between two parties, bypassing the public order books of traditional exchanges. This method is preferred for large trades to avoid market impact and price slippage, offering privacy, personalized service, and potentially better pricing.

Why OTC Trading Platforms are Gaining Traction

High-net-worth individuals and institutional investors turn to OTC platforms for their capacity to handle large transactions smoothly. These platforms mitigate the risks of moving the market against the trader, a common concern in smaller exchange venues.

Development of Crypto OTC Trading Platforms

Key Features

A successful crypto OTC trading platform integrates several key features: robust security protocols, user-friendly interfaces, efficient order matching systems, and regulatory compliance mechanisms. They also offer personalized customer support and expert market insights, which are crucial for large-scale traders.

Security and Compliance

Security is paramount in crypto OTC trading, necessitating advanced encryption, multi-factor authentication, and cold storage solutions for asset protection. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is also essential to ensure trust and legitimacy.

Challenges and Solutions in OTC Platform Development

Developing an OTC trading platform comes with challenges, including maintaining liquidity, ensuring regulatory compliance across jurisdictions, and integrating advanced security measures. Addressing these requires a deep understanding of both the crypto market mechanics and the evolving regulatory landscape.

Selecting a Developer for OTC Trading Platforms

Choosing the right development partner is vital. Look for expertise in blockchain technology, experience in financial markets, a deep understanding of regulatory requirements, and a proven track record in building secure trading platforms.

The Future of Crypto OTC Trading Platforms

The future of crypto OTC trading platforms looks promising. As cryptocurrencies continue to gain mainstream acceptance, the demand for private, high-volume trading solutions is expected to grow. Innovations in technology and evolving regulations will shape the efficiency and security of these platforms.

Conclusion

Crypto OTC trading platform development represents a significant advancement in the digital asset space, catering to a segment of the market that demands privacy, efficiency, and scale. By providing a bespoke trading environment for high-volume transactions, these platforms are not only meeting the needs of a specific investor class but are also enhancing the overall maturity and stability of the cryptocurrency market. As digital assets continue to evolve, OTC platforms will play an integral role in shaping the landscape of cryptocurrency trading.

0 notes

Text

DynTech offers an OTC Trading Desk that makes buying/selling assets much easier. It supports the institutional players and high-net-worth individuals.

#OTC Trading Platform#OTC Dealing Desk#Prop Trading Solution#White Label Prop Firm#White Label Forex Prop Firm#White Label Crypto Prop Firm#Fintech Development Firm

0 notes

Text

Top 10 firms offering cryptocurrency investment strategies

Investing in cryptocurrency can feel like trying to predict the weather in a sci-fi movie��unpredictable, thrilling, and occasionally, a bit chaotic. But fear not, fellow digital adventurer! These top-tier firms are here to help you navigate the crypto cosmos with strategies that are as sharp as a lightsaber and as reliable as your favorite Wi-Fi connection.

1. Pearl Lemon Crypto

With over 9 years in the digital space, Pearl Lemon Crypto isn't just another crypto firm; it's a seasoned veteran in marketing, lead generation, and web development. Think of them as your personal GPS in the vast crypto universe—guiding you to profitable investments while avoiding the black holes. Whether you're a newbie or a seasoned investor, they've got strategies tailored to your needs. Plus, their approach is as refreshing as a cold drink on a hot day.

2. Bitwise Asset Management

Bitwise is the cool kid on the block, offering products like the Bitwise 10 Crypto Index Fund and the recently approved Spot Ethereum ETF. With over $4.2 billion in assets under management, they're making crypto investing as easy as pie—if pie were a complex financial instrument. They're your go-to for passive crypto investment strategies.

3. Grayscale Investments

Grayscale is the grandparent of crypto asset management, with over $18 billion in assets. They're the ones who made Bitcoin ETFs a thing, converting their trusts into SEC-approved products. If you're looking for institutional-grade exposure to digital assets, Grayscale is your trusted elder.

4. Galaxy Digital

Founded by Mike Novogratz, Galaxy Digital is a full-service merchant bank offering hedge funds, private equity, and venture capital access in one ecosystem. With $3.5 billion in assets, they're like the Swiss Army knife of crypto finance—versatile and always prepared. Their Digital Asset Lending Desk is a major liquidity hub post-2024.

5. Pantera Capital

Pantera Capital is one of the OG crypto VC firms, managing over $5.2 billion in assets. They balance early-stage token exposure with liquid DeFi positions, making them a hybrid powerhouse in the crypto space. Their performance in 2024 was among the best in the market.

6. Amber Group

Amber Group is like the Goldman Sachs of crypto, blending traditional finance with DeFi. With $1.5 billion in assets, they offer trading strategies, OTC services, and yield generation. After restructuring in 2023, they've pivoted toward institutional DeFi access, merging traditional structured products with on-chain liquidity pools.

7. Enzyme Finance

Enzyme Finance is the DIY crypto fund manager, allowing anyone to launch a tokenized hedge fund or strategy vault. With $320 million in assets, they're gaining traction with crypto-native investors and communities. Built by the team behind Avantgarde Finance, Enzyme offers enhanced auditing and DAO governance in 2025.

8. Zerion Capital

Zerion Capital is the mobile-first crypto portfolio manager, letting you deploy portfolio strategies directly from your wallet. With $850 million in assets, they're perfect for non-custodial DeFi investors. Their smart wallet and AI alerts make managing your portfolio as easy as checking your phone.

9. Wincent

Wincent is the crypto hedge fund that's been making waves with an 11.3% gain through April 2025. Managing nearly $680 million in assets, they're expanding their workforce to over 180 employees. Founded in 2017 in Slovakia, Wincent began with manual crypto trading before developing automated systems.

10. CoinJar

CoinJar is the crypto platform that lets you stake in a decentralized manner. With high-yield farming options and a vibrant community, it's like the wild west of crypto staking—exciting and full of opportunities. Just be prepared for a bit of a learning curve if you're new to DeFi.

Final Thoughts

Choosing the right cryptocurrency investment strategy is like picking the perfect playlist for a road trip—it's all about the vibe and the journey. Whether you're looking for passive income, active trading, or decentralized finance opportunities, these firms offer a range of strategies to suit your needs. So, buckle up and get ready to navigate the exciting world of crypto investment!

0 notes

Text

Top 5 Crypto Exchange Development Companies to Watch in 2025

Introduction: The Booming Crypto Exchange Industry

Remember when Bitcoin was just a curiosity discussed in niche forums? Fast forward to 2025, and the world of cryptocurrencies is a bustling financial frontier. At the core of this digital revolution lies the crypto exchange — the marketplace where dreams are traded, fortunes are made, and innovation never sleeps.

With thousands of new tokens, the rise of DeFi, and institutions diving into digital assets, crypto exchange development companies are more critical than ever. So, if you're a startup, entrepreneur, or even a curious investor, knowing which companies lead the charge can give you a strategic edge.

Why Crypto Exchanges Are the Backbone of the Blockchain Economy

Understanding the Role of Exchanges

Crypto exchanges do what banks do in the fiat world — but faster, smarter, and often with fewer intermediaries. These platforms enable buying, selling, and trading cryptocurrencies like BTC, ETH, or stablecoins, and are now expanding into NFTs, tokenized assets, and more.

Growing Need for Tailored Exchange Development Services

As digital asset adoption scales up, businesses demand custom-built exchanges with features like high-speed matching engines, advanced security, and user-friendly dashboards. That’s where expert crypto exchange development companies step in — crafting platforms that are secure, scalable, and user-ready.

Key Traits of a Leading Crypto Exchange Development Company

Not all development firms are created equal. The best ones share a few game-changing qualities:

Scalability and Speed

No one wants a laggy exchange. Top companies engineer platforms that can handle thousands of transactions per second.

Security Features

From two-factor authentication to multi-signature wallets and anti-DDoS protection, a leading exchange developer prioritizes airtight security.

Customization & White-Label Options

Want to launch your branded exchange quickly? White-label solutions give you a fast, customizable, and cost-efficient go-to-market strategy.

Regulatory Compliance

With global crypto regulations tightening, companies that build compliant exchanges gain long-term credibility and user trust.

Top 5 Crypto Exchange Development Companies to Watch in 2025

Ready to discover the pioneers driving tomorrow’s crypto economy? Here's our curated list of 2025’s most promising crypto exchange development companies.

1. Shamla Tech

Why Shamla Tech Stands Out

Shamla Tech is rapidly becoming a household name in blockchain and crypto exchange development. With a perfect blend of innovation, client-centricity, and technical acumen, they’ve earned their spot among the top players.

Key Offerings and Services

Centralized, Decentralized, and Hybrid Exchange Development

White-label Exchange Platforms

Custom Crypto Wallet Integration

Advanced Security Protocols

AI-Powered KYC/AML Systems

Shamla Tech also provides end-to-end blockchain consulting and NFT marketplace development — making it a one-stop shop for crypto entrepreneurs.

2. LeewayHertz

Innovations by LeewayHertz

LeewayHertz is known for pushing boundaries. With experience in building enterprise-grade crypto platforms, their focus is on futuristic and scalable exchange solutions.

Services Portfolio

Decentralized Exchange (DEX) Development

Smart Contract Audits

Cross-Platform Crypto Wallets

Enterprise Blockchain Solutions

They’re pioneers in integrating AI, IoT, and blockchain into seamless user experiences, setting them apart from traditional developers.

3. Antier Solutions

Global Reach and Strategy

Based in India but serving clients worldwide, Antier Solutions is another heavyweight. Their services cater to businesses at every stage of the crypto exchange lifecycle.

Cutting-Edge Tech Stack

P2P and OTC Exchange Development

Liquidity API Integration

Token Creation and ICO Support

KYC/AML Verification Tools

They’re particularly known for delivering quick and secure white-label exchange platforms with intuitive UI/UX.

4. Coinjoker

Coinjoker’s Crypto-Centric Products

Coinjoker thrives on creating next-gen crypto exchange platforms with strong focus on UI, speed, and robustness. They serve over 500+ global clients and are one of the most agile developers in the space.

Support for Multiple Exchange Types

Binary Options & Derivatives Exchanges

NFT Marketplace Integration

Hybrid Exchanges

Gaming-Focused Token Platforms

Whether you're launching a gaming coin or a full-fledged crypto bank, Coinjoker has a ready-to-go blueprint.

5. Blockchain App Factory

Pioneer in Blockchain Solutions

Blockchain App Factory is one of the most established names in the game. Their years of experience translate into sophisticated and secure exchange platforms that meet both user and business needs.

Enterprise-Level Exchange Development

Institutional Exchange Platforms

Security Token Exchange Development

Cryptocurrency Derivatives Trading

AI-Driven Trade Analytics

They also help businesses stay compliant with region-specific regulations, making them ideal for enterprise-level projects.

How to Choose the Right Crypto Exchange Development Partner

Picking the right partner isn’t just about budget — it’s about vision, scalability, and trust.

Assessing Your Business Needs

Are you targeting beginners or seasoned traders? Do you need a mobile-first experience or a desktop interface? Clarify your needs upfront.

Checking Experience and Past Work

A portfolio says a lot. Look for case studies, demos, and testimonials before committing.

Technology Compatibility

Ensure your developer is familiar with blockchain stacks like Ethereum, Binance Smart Chain, Solana, or Polkadot — depending on your needs.

Trends Shaping the Future of Crypto Exchange Development

What’s ahead for crypto exchanges? Here’s what’s shaping the future:

AI and Automation in Exchanges

Expect to see more AI-based trading bots, fraud detection systems, and automated KYC verification built into exchanges.

Rise of Decentralized and Hybrid Models

DeFi isn’t slowing down. Hybrid exchanges are gaining ground, offering the best of centralized liquidity with decentralized ownership.

Enhanced KYC/AML Compliance Tools

With regulations tightening, compliance tools powered by AI and biometrics will be key to avoiding legal troubles and building trust.

Conclusion

As we move deeper into the crypto age, exchanges will become even more essential to digital finance. Whether you’re building a new trading platform or upgrading an old one, aligning with a top-tier crypto exchange development company is crucial.

In 2025, names like Shamla Tech, LeewayHertz, Antier Solutions, Coinjoker, and Blockchain App Factory are leading the charge with innovative, secure, and scalable solutions. These firms don’t just code — they empower visions.

Looking to make your mark in the blockchain economy? Start by choosing the right builder for your crypto empire.

FAQs

1. What services do crypto exchange development companies offer? They provide custom exchange development, white-label platforms, crypto wallet integration, security features, and compliance solutions.

2. Why is Shamla Tech considered a top crypto exchange development company? Shamla Tech offers cutting-edge technologies, AI integrations, and end-to-end blockchain services, making it ideal for startups and enterprises alike.

3. How long does it take to build a crypto exchange platform? Depending on complexity, it can take 4–12 weeks for a basic exchange and longer for customized or hybrid platforms.

4. Are white-label crypto exchanges safe? Yes, if developed by a reputable firm. They come with built-in security layers and can be customized for compliance and performance.

5. What is the difference between centralized and decentralized crypto exchanges? Centralized exchanges are controlled by a single authority, offering speed and liquidity. Decentralized ones are trustless and peer-to-peer, offering privacy and control.

#CryptocurrencyExchangeDevelopment#CreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#ShamlaTech#CryptoDevelopment#BlockchainSolutions#CryptoExchangePlatform#CryptoBusiness#CryptocurrencyExchange

0 notes

Text

Hong Kong Stablecoin Legislation to Launch in 2025 Amid Broader Web3 Policy Push

Hong Kong Stablecoin Legislation to Roll Out as City Expands Virtual Asset Framework and Web3 Initiatives As the city speeds up its quest to be a major centre for digital assets and Web3 innovation, Hong Kong stablecoin legislation is poised to take front stage. Financial Secretary Paul Chan stated that a formal regulatory framework for stablecoins is anticipated to start within the year as part of a more comprehensive virtual asset policy revision meant to match innovation with market safety and financial integrity. Speaking at the Hong Kong Web3 Festival, Chan underlined the government's dedication to improving the digital asset ecosystem of the city. “Later this year, we will unveil a second policy statement on the development of virtual assets,” he stated. The next update will clarify stablecoins—a key component of the Web3 and DeFi ecosystem—thereby building on Hong Kong's original virtual asset regulation issued in October 2022. The stablecoin licencing system will support Hong Kong's current projects, which include granting licences to virtual asset trading platforms and approving spot exchange-traded funds (ETFs). Currently, 10 crypto platforms have been licenced by the Securities and Futures Commission (SFC), indicating the city's willingness to institutionalise digital asset services under a strong compliance system. Read More: Conor McGregor $REAL Token Presale Falls Short, Triggers Full Refunds for Investors Why Stablecoin Legislation Matters Acting as a link between conventional fiat currencies and blockchain ecosystems, stablecoins have proven essential for the operation of decentralised finance. Hong Kong wants to increase investor trust, safeguard consumers, and reduce financial risks connected with uncontrolled stablecoin activity by means of regulation of these tokens. The government wants to create unambiguous norms for the issue, governance, and backing of stablecoins, so matching them with world standards. Following recent high-profile breakdowns and frauds in the crypto sector, this action will help Hong Kong as countries all over race to control digital currency. Beyond Stablecoins: A Full-Spectrum Web3 Strategy Although Hong Kong stablecoin law is a front-page action, the government's goals reach well beyond. Paul Chan provided a vision that includes expanded advice for custodial services, over-the-counter (OTC) virtual asset trading, and institutional tokenization frameworks. Especially under regulated conditions, the Hong Kong Monetary Authority (HKMA) is launching Project Ensemble, a regulatory sandbox letting financial institutions test tokenized real-world assets. This project shows Hong Kong's particular way of fostering creativity and holding responsibility. Chan underlined the need of global collaboration as well, saying, "We support a multi-stakeholder approach where governments, regulators and market players across different territories and regions come together to drive forward the sustainable development of Web3. Aiming to draw companies, developers, and investors seeking stability in a fast changing worldwide crypto industry, this balanced regulatory approach A Regional Leader in Web3 Hong Kong's progressive attitude on digital assets sets it apart from neighbouring areas that have adopted a more conservative or limiting approach to Web3. The city is setting itself as Asia's top blockchain hub with a rising number of controlled platforms, developing infrastructure for digital ETFs, and now an emphasis on stablecoins. Major companies in the crypto and financial industries have already shown interest because of this regulatory openness. Hong Kong wants to grab a major portion of the next wave of blockchain-driven innovation by establishing a clear legal framework for stablecoins and Web3 apps. The launch of Hong Kong stablecoin legislation marks a significant step toward a mature, compliant, and sustainable digital economy. As the global regulatory landscape continues to evolve, Hong Kong’s forward-thinking approach—balancing innovation with protection—could serve as a model for other regions. Whether you're an investor, developer, or policy watcher, this is one jurisdiction worth keeping a close eye on in 2025. Read the full article

#blockchainregulationAsia#cryptoETFsAsia#cryptopolicyHongKong#digitalassetlicensing#HKMAProjectEnsemble#HongKongstablecoinlegislation#HongKongvirtualassets#PaulChanHongKong#stablecoinlicensing#Web3regulation

0 notes

Text

Best OTC Crypto Trading Platform Development

Looking to join the world of OTC crypto trading? Beleaf Technologies specializes in OTC crypto trading platform development, providing customized solutions to meet your business needs. Our expert team ensures smooth integration, strong safety measures, and a user-friendly interface to improve your trading platform's performance. With our modern technology and industry expertise, we help you build a reliable and scalable OTC trading platform quickly and effectively. Don't miss out on the growing OTC crypto market. Contact Beleaf Technologies today to learn more about our services. Let's change the way you trade cryptocurrencies!

#otc crypto trading platform development#crypto trading#trading platform development#otc crypto trading

0 notes

Text

Crypto OTC Trading Platform Development: Navigating the Future of Digital Asset Exchange

Introduction: Over-The-Counter (OTC) trading has always been a significant part of the financial trading world, and with the advent of cryptocurrencies, this concept has found a new and vibrant field. Crypto OTC trading platform development is at the forefront of this evolution, offering a bespoke solution for traders dealing in high-volume cryptocurrency transactions. This article explores the ins and outs of crypto OTC trading platforms, their significance in the crypto market, and how they are shaping the future of digital asset exchange.

The Essence of Crypto OTC Trading Platforms: Crypto OTC trading platforms differ from traditional exchanges in that they facilitate direct transactions between two parties, outside of the public market. This method is particularly advantageous for large-scale trades, as it minimizes market impact while providing privacy and potentially better pricing. The development of these platforms is crucial in providing the infrastructure needed for secure, efficient, and private trading in the crypto world.

Key Features of Crypto OTC Trading Platforms:

Privacy and Anonymity: OTC platforms offer a higher degree of privacy compared to standard exchanges, which is a significant draw for many investors.

Price Stability: By facilitating large transactions outside of public exchanges, these platforms help avoid significant market price fluctuations.

Customization and Flexibility: OTC trading platforms often provide more flexibility in terms of order sizes and negotiation terms, catering to individual trader needs.

Security: Robust security measures are essential to protect against fraud and hacking, a primary concern in the crypto market.

Advantages Over Traditional Crypto Exchanges: While traditional crypto exchanges are suitable for retail trading, OTC platforms cater to institutional and high-net-worth individuals who require to move large quantities of digital assets. These platforms often offer better liquidity and pricing for large orders, away from the eyes of the public market, thereby reducing the chance of price slippage.

Challenges in Development and Operation: Developing a crypto OTC trading platform presents unique challenges. Compliance with diverse and evolving global regulations is one of the primary hurdles. Additionally, building a platform that seamlessly integrates advanced security protocols with an intuitive user interface requires significant expertise and resources.

The Role of Technology: Advancements in blockchain and fintech are crucial in the development of these platforms. Blockchain technology, with its emphasis on decentralization and security, is particularly well-suited for creating a transparent yet secure environment for high-value transactions. Moreover, integrating smart contracts can automate many aspects of the trade, enhancing efficiency and reducing the likelihood of disputes.

The Future Outlook: As the cryptocurrency market matures, the role of crypto OTC trading platforms is expected to grow significantly. They are likely to become key players in the digital asset world, especially as institutional investors continue to enter the crypto space. The ongoing development of these platforms will also be crucial in defining how digital assets are traded at scale.

Conclusion: Crypto OTC trading platform development marks a significant milestone in the evolution of digital asset trading. By offering a secure, private, and efficient way to conduct large-scale transactions, these platforms are not just meeting the current needs of the market but are also paving the way for the future of cryptocurrency trading. As the crypto market continues to grow and evolve, the importance of robust and sophisticated OTC trading platforms will only increase, playing a pivotal role in the global financial landscape.

0 notes

Text

The Rise of OTC Crypto Exchanges - Why They Matter in Today’s Market

The cryptocurrency market has evolved significantly over the past few years, with different types of exchanges emerging to cater to various trading needs. One of the key developments in recent times is the rise of OTC Crypto Exchanges, which have become increasingly important in the world of digital asset trading.

What Are OTC Crypto Exchanges?An OTC Crypto Trading Platform is a marketplace that facilitates large-scale trades of digital assets directly between buyers and sellers. Unlike traditional cryptocurrency exchanges, which operate on open order books, OTC exchanges provide a private, negotiated environment for trading high volumes of assets.

Why Are OTC Crypto Exchanges Gaining Popularity?

Large-Scale Transactions OTC crypto exchanges are ideal for handling large trades, offering a more controlled and discreet environment that avoids disrupting market prices, which traditional exchanges struggle with.

Enhanced Privacy and Security Unlike public exchanges, OTC transactions are private, ensuring confidentiality for institutional investors and high-net-worth individuals who value discretion in their trading strategies.

Better Liquidity Supported by liquidity providers, OTC exchanges ensure swift and stable execution of large trades, avoiding major price fluctuations.

Key Benefits of OTC Crypto Exchange Development

Customizable Solutions OTC exchanges can be tailored with features like trading limits and escrow services, offering a seamless experience for institutional clients.

Lower Fees and Better Rates Direct negotiation between buyers and sellers allows for lower fees and more favorable rates, particularly for bulk trades.

Speed and Efficiency With quick execution of trades, OTC exchanges allow for faster settlements, critical in the volatile crypto market.

The Future of OTC Crypto Exchanges

As the crypto market grows, demand for secure, private trading platforms will increase. OTC exchanges are set to play a key role, offering personalized services, competitive rates, and supporting institutional interest in digital assets.

Get in Touch with Nadcab Labs

With years of experience in OTC Crypto Exchange Development, Nadcab Labs provides customized solutions designed to meet the unique needs of your users.

Connect with Nadcab Labs today and take your crypto exchange project to the next level!

FACEBOOK- https://www.facebook.com/nadcablabs

TWITTER- https://twitter.com/nadcablabs

LINKEDIN- https://www.linkedin.com/company/nadcablabs

INSTAGRAM- https://www.instagram.com/nadcablabs

YOUTUBE- https://www.youtube.com/@nadcablabs

1 note

·

View note

Text

OTC Crypto Exchange Development: Features, Process & Cost

OTC Crypto Exchange Development provides safe, easy-to-use platforms with improved anonymity, making high-volume cryptocurrency trading easier. Smooth transactions, strong security, and multi-currency support are important characteristics. Planning, creating, and implementing blockchain-integrated systems are all part of the development process. Prices differ according to features, scalability, and customizations, guaranteeing customized solutions for a range of company requirements.

#crypto#cryptocurrency#blockchain#blockchaindevelopment#cryptodevelopment#appdevelopment#softwaredevelopment#mobileappdevelopment

0 notes

Text

Top 10 crypto portfolio management firms

Managing a crypto portfolio can feel like juggling flaming swords while riding a unicycle—exciting, but a tad risky. Fear not! These top-tier firms are here to help you tame the crypto beast, ensuring your investments grow without singeing your eyebrows. Let's dive into the world of crypto portfolio management with a touch of humor and a lot of expertise.

1. Pearl Lemon Crypto

With over 9 years in the digital space, Pearl Lemon Crypto isn't just another crypto firm; it's a seasoned veteran in marketing, lead generation, and web development. Think of them as your personal GPS in the vast crypto universe—guiding you to profitable investments while avoiding the black holes. Whether you're a newbie or a seasoned investor, they've got strategies tailored to your needs. Plus, their approach is as refreshing as a cold drink on a hot day.

2. Bitwise Asset Management

Bitwise is the cool kid on the block, offering products like the Bitwise 10 Crypto Index Fund and the recently approved Spot Ethereum ETF. With over $4.2 billion in assets under management, they're making crypto investing as easy as pie—if pie were a complex financial instrument. They're your go-to for passive crypto investment strategies.

3. Grayscale Investments

Grayscale is the grandparent of crypto asset management, with over $18 billion in assets. They're the ones who made Bitcoin ETFs a thing, converting their trusts into SEC-approved products. If you're looking for institutional-grade exposure to digital assets, Grayscale is your trusted elder.

4. Galaxy Digital

Founded by Mike Novogratz, Galaxy Digital is a full-service merchant bank offering hedge funds, private equity, and venture capital access in one ecosystem. With $3.5 billion in assets, they're like the Swiss Army knife of crypto finance—versatile and always prepared. Their Digital Asset Lending Desk is a major liquidity hub post-2024.

5. Pantera Capital

Pantera Capital is one of the OG crypto VC firms, managing over $5.2 billion in assets. They balance early-stage token exposure with liquid DeFi positions, making them a hybrid powerhouse in the crypto space. Their performance in 2024 was among the best in the market.

6. Amber Group

Amber Group is like the Goldman Sachs of crypto, blending traditional finance with DeFi. With $1.5 billion in assets, they offer trading strategies, OTC services, and yield generation. After restructuring in 2023, they've pivoted toward institutional DeFi access, merging traditional structured products with on-chain liquidity pools.

7. Enzyme Finance

Enzyme Finance is the DIY crypto fund manager, allowing anyone to launch a tokenized hedge fund or strategy vault. With $320 million in assets, they're gaining traction with crypto-native investors and communities. Built by the team behind Avantgarde Finance, Enzyme offers enhanced auditing and DAO governance in 2025.

8. Zerion Capital

Zerion Capital is the mobile-first crypto portfolio manager, letting you deploy portfolio strategies directly from your wallet. With $850 million in assets, they're perfect for non-custodial DeFi investors. Their smart wallet and AI alerts make managing your portfolio as easy as checking your phone.

9. Wincent

Wincent is the crypto hedge fund that's been making waves with an 11.3% gain through April 2025. Managing nearly $680 million in assets, they're expanding their workforce to over 180 employees. Founded in 2017 in Slovakia, Wincent began with manual crypto trading before developing automated systems.

10. CoinJar

CoinJar is the crypto platform that lets you stake in a decentralized manner. With high-yield farming options and a vibrant community, it's like the wild west of crypto staking—exciting and full of opportunities. Just be prepared for a bit of a learning curve if you're new to DeFi.

Final Thoughts

Managing a crypto portfolio doesn't have to be a solo mission. With these firms by your side, you can navigate the complexities of the crypto world with confidence and a smile. Remember, in the world of crypto, the only certainty is uncertainty—so stake wisely!

0 notes

Text

Funbit exchange: advanced trading tools for smart investors

In the ever-evolving world of cryptocurrency trading, finding a platform that combines innovation, security, and usability is crucial for smart investors. Funbit Exchange has quickly emerged as a standout choice, offering a comprehensive suite of tools and features designed to meet the demands of both novice and professional traders. Whether you are navigating the dynamic P2P marketplace, exploring Spot trading opportunities, or participating in promising Launchpad projects, Funbit Exchange provides the resources and support to help you succeed in the fast-paced world of digital assets.

With its commitment to empowering users through cutting-edge technology and robust security measures, Funbit Exchange is setting a new standard for cryptocurrency trading platforms. Here’s why it’s the platform of choice for savvy investors worldwide.

Join Funbit now

About project . Full name: Funbit Exchange . Website: https://www.funbit.network/ . Category: spot exchange, P2P exchange, future exchange, launchpad, IEO . Deposit/withdraw: support multi chains, multi cryptos . Partners: CMC, CGK, Ave, Poocoin, Bscscan, yahoo, naqdaq, bloombegs, cointelegraph, binance, mexc, bitget, gateio . Social links:

Introduction & Hightlight Features

Groundbreaking: Pioneer Web3 Marketplace on Bitcoin Ordinals platform.

Transformative: Redefining NFT trading norms from platforms like OpenSea, Blur, and Magic Eden.

Empowering: Providing decentralized, secure, and transparent NFT trading experiences.

Innovative: Setting new standards for efficiency, security, and user control in digital asset transactions.

Community-driven: Fostering collaboration and partnerships to enhance the blockchain ecosystem.

Hightlight features

Pioneer Integration: First-ever Web3 Marketplace seamlessly integrated into the Bitcoin Ordinals platform.

NFT Trading Revolution: Disrupting traditional NFT trading platforms such as OpenSea, Blur, and Magic Eden.

Enhanced Security: Providing decentralized and secure NFT transactions with advanced verification mechanisms.

Innovative Functionality: Offering cutting-edge features for NFT transactions and ownership management, bolstered by the innovative solutions and technologies developed within the Funbit ecosystem.

Ensuring transparency and trust through blockchain-based transactions, with the added assurance of support from Funbit Exchange and Funbit Launchpad for BRC20 & RUNE token/NFT projects.

Scalability: Designed to accommodate future growth and expansion of the marketplace.

Sign up now

Comprehensive Ecosystem

Funbit Exchange provides a complete ecosystem designed to cater to diverse trading and investment needs. From marketplace services to decentralized applications (DApps), the platform offers a versatile range of solutions for its users:

Inscribe: Funbit Exchange offers a trusted and low-fee service for BRC20 and RUNE token inscription. This feature is designed to ensure transparency, efficiency, and cost-effectiveness, making it ideal for token creation and management.

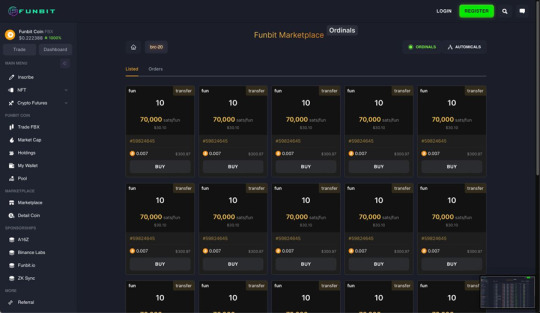

Web3 Marketplace: As the first and leading Bitcoin Ordinal Web3 Marketplace, Funbit Exchange provides a seamless platform for buying, selling, and trading digital assets. Its user-friendly design and cutting-edge technology ensure a superior trading experience for all users.

image of Web3 Marketplace

OTC & P2P Trading (DApps): Funbit Exchange stands out as the first OTC and P2P trading solution for Bitcoin Ordinals. This feature allows users to directly trade digital assets without intermediaries, ensuring lower costs, faster transactions, and greater control over their trades.

Exchange (CEX): With a full-featured centralized exchange (CEX), Funbit provides exceptional support for trading BRC20 tokens, RUNE tokens, and NFTs. The platform’s advanced trading tools and intuitive interface make it suitable for both beginner and professional traders.

Launchpad: Funbit Exchange’s Launchpad is a hub for evaluating, classifying, and providing capital support to potential BRC20 and RUNE projects. By backing promising blockchain initiatives, the platform empowers its users to diversify their portfolios and maximize returns.

Register now

Funbit Huge Community

Funbit continuously builds a strong community of traders with hundreds of large and small groups across platforms like Telegram, Discord, Facebook, and more. Join us for vibrant discussions and valuable insights!

Funbit's team is comprised of talented individuals recognized with multiple awards in the blockchain field. With their expertise, they ensure project safety and continuous development in accordance with project goals

Roadmap for Success

Funbit Exchange follows a clear and ambitious roadmap to deliver continuous growth and innovation:

Preparation Phase

Develop a detailed whitepaper and launch the official website.

Build and expand the Funbit community.

Get listed on CoinMarketCap for increased visibility.

Achieve listings on at least three major centralized exchanges (CEX) and launch the platform’s Launchpad.

Establish strong media and press presence to build credibility.

Start Phase

Complete Series 1 funding and secure listings on Onus, Bitget, and MEXC.

Launch the Inscribe service and Marketplace for BRC20 tokens.

Reach a milestone of 10,000 holders.

Run Phase

Introduce the Inscribe service and Marketplace for RUNE tokens.

Launch OTC Web3 trading and Funbit Ordinals.

Open the Funbit Ordinals Launchpad.

Secure additional listings on Gate.io, Bitget, and MEXC.

Acceleration Phase

Partner with key ventures and strengthen ecosystem building.

Secure listings on major exchanges like OKX and KuCoin.

Establish Funbit as the top Bitcoin Ordinals NFT platform.

Win Phase

Expand to listings on Binance and HTX.

Achieve 100,000 active users.

Break into the Top 200 on CoinMarketCap.

Launch the exclusive Funbit Club Card to reward loyal users.

Conclusion

Funbit Exchange is more than just a trading platform; it’s a comprehensive ecosystem that empowers smart investors to thrive in the dynamic world of cryptocurrency. From its cutting-edge tools and innovative features to its robust security and ambitious roadmap, Funbit is setting a new standard in the industry. Whether you’re a beginner looking for a user-friendly experience or a seasoned trader seeking advanced capabilities, Funbit Exchange has you covered. The platform’s commitment to transparency, security, and innovation makes it a trusted partner for traders and investors worldwide. By supporting a wide range of digital assets and offering services like P2P trading, Launchpad projects, and decentralized solutions, Funbit ensures that users have everything they need to succeed. With a vision for continuous growth and expansion, Funbit Exchange is poised to lead the way in the future of crypto trading. Don’t miss the opportunity to be part of this revolutionary journey. Join Funbit Exchange today, and unlock the full potential of your investments. Together, let’s build a smarter, more secure, and prosperous trading future.

#FunbitExchange #CryptoTrading #BlockchainTechnology #P2PTrading

#CryptoLaunchpad #SpotTrading

Start trading smarter with Funbit Exchange now!

0 notes

Text

OTC Crypto Exchange Development

🚀 Dive into the world of private cryptocurrency trades!

Explore our latest blog: "A Comprehensive Guide to OTC Crypto Exchange Development: Empowering Private Cryptocurrency Trades." 🛡️ Learn how OTC platforms are revolutionizing secure and seamless transactions in the crypto space.

👉 Click the link to unlock expert insights and take the first step toward building your own OTC exchange!

Read more : https://bit.ly/4fG0QN5

#blockchain#cryptocurrency#web3community#cryptonews#web3 development#crypto investors#business#crypto#crypto traders#cryptocurrency exchange development

0 notes

Text

Navigating the Future of Finance: The Rise of Crypto OTC Trading Platform Development

In the dynamic world of cryptocurrency, Over-The-Counter (OTC) trading platforms have emerged as a pivotal element, particularly for high-volume traders and institutional investors. The development of these platforms marks a significant evolution in the crypto trading landscape, offering a more personalized, secure, and efficient trading experience. This article explores the burgeoning domain of crypto OTC trading platform development, its significance, features, and the impact it's poised to have on the future of digital asset trading.

Understanding Crypto OTC Trading Platforms

Crypto OTC trading platforms facilitate the trading of cryptocurrencies directly between two parties, outside of traditional exchange systems. This method is preferred for large transactions, as it minimizes market impact and offers better privacy and security. OTC platforms connect buyers and sellers, providing a venue for large-volume trades that might otherwise be disruptive on standard exchanges due to their size.

Significance of OTC Trading Platforms in Crypto

Privacy and Anonymity: OTC platforms offer a higher degree of privacy compared to traditional exchanges, as transactions are not broadcasted publicly.

Price Stability: By handling large orders outside of the public market, these platforms prevent significant price slippage, offering more stable and predictable pricing.

Customized Service: OTC platforms often provide personalized service, with dedicated brokers or agents facilitating the trade, ensuring a smoother transaction experience.

Accessibility to Large Volumes: They allow high-net-worth individuals and institutional investors to trade large volumes of cryptocurrencies without affecting the market.

Key Features of a Successful Crypto OTC Trading Platform

When developing a crypto OTC trading platform, certain features are essential for its success:

Robust Security Measures: Implementing state-of-the-art security protocols to protect against cyber threats is crucial.

User-Friendly Interface: A platform should be intuitive and easy to navigate, catering to both experienced traders and newcomers.

Regulatory Compliance: Adhering to the relevant legal and regulatory standards is vital to ensure trust and legitimacy.

Efficient Order Matching System: A sophisticated system to match buyers and sellers quickly and accurately.

Flexible Payment Options: Supporting multiple payment methods including bank transfers, cryptocurrencies, and possibly even fiat currencies.

Real-time Data and Analytics: Providing users with up-to-date market data and analysis tools to inform their trading decisions.

Challenges in Developing Crypto OTC Platforms

Developing a crypto OTC trading platform comes with its set of challenges:

Regulatory Hurdles: Navigating the complex and evolving regulatory landscape of cryptocurrencies is a significant challenge.

Market Volatility: Dealing with the inherent volatility of the crypto market requires robust risk management strategies.

Technology Integration: Ensuring seamless integration with existing financial systems and maintaining operational efficiency.

The Future of Crypto OTC Trading Platforms

The future of crypto OTC trading platforms looks promising, with the potential for increased institutional participation in the crypto market. As cryptocurrencies continue to gain mainstream acceptance, the demand for sophisticated OTC trading platforms is likely to rise, paving the way for more innovative solutions in this space.

Conclusion

Crypto OTC trading platform development represents a significant stride in the maturation of the cryptocurrency market. By offering tailored solutions for high-volume trading, these platforms are not just simplifying transactions but are also instilling a greater sense of trust and stability in the crypto trading landscape. As the technology evolves and regulatory frameworks become more defined, crypto OTC platforms are set to play a crucial role in shaping the future of digital asset trading.

0 notes