#Cryptocurrency Trading

Text

Hey everyine great news! My drop shiopping courses have been enough of a scusess tbat the

33 slurp juices remain. Your mission is to eliminate all of them before they can combine with an astro ape and mint a new astro ape

NFT game is back on! And there’s even better news!!!

Just ship a dead rat to 38.89679° N, 77.03601° W for a big surprise!!! Send me a pic of the surprise and you’ll even get a jared leto joker nft valued at 10 million billion dogecoin on us!!!

But hurry! This once in a lifetime opportunity is going away flr goot in just [function.timne+1]!!! Be sure to get in on the ground floor because forget the moon, we’re going all the way to freaking mars!!!

Did YOU seee the hiddem nessage??? Be sure to read the post thoroughly for any clues you might have missed!!!

#to the moon#nft#bitcoin#blockchain#crypto#cryptocurrency#web 3.0#binance#cryptocurreny trading#investment advice#retirement planning#stocks#stock market#cryptocurrency trading#cryptocurrency investment#might blaze this later idk

123 notes

·

View notes

Text

Understanding How Cryptocurrency Trading Signals Work

Cryptocurrency trading is like a wild rollercoaster ride. Prices can shoot up or plummet in no time, leaving traders feeling lost and unsure about what to do. That's where trading signals come in. These signals are like helpful tips based on studying the market closely. They give traders advice on when to buy or sell cryptocurrency trading on cryptocurrency signals so they can make smart decisions and hopefully make some money.

Exploring the Different Types of Trading Signals

signals come in different flavors, customized to how different people like to trade. Here are the main types:

1] Technical Analysis Signals: These signals use fancy math and past price data to guess where prices might go next. They look at things like patterns on charts and indicators like moving averages or RSI to find trading chances.

2] Fundamental Analysis Signals: These signals look at the real value of a cryptocurrency, considering factors such as the technology behind it, its adoption rate, the expertise of its development team, and the current demand for it. They care more about what's under the hood than just the current prices of cryptocurrency.

3] Sentiment Analysis Signals: These signals check what people are saying on social media, news, and forums about cryptocurrency trading signals. By understanding how people feel, traders can get an idea of where prices might go, even if they're not looking at the current prices of cryptocurrency.

4] Hybrid Signals: Some signals mix it up, using both technical and fundamental analysis. This gives traders a wider view of what's happening in the market, hopefully helping them make better decisions.

The Benefits of Trading Signals

Using trading signals can help traders in many ways:

1] Making More Money: Following these signals, which are based on careful research, can increase the chances of making profitable trades and getting more money from investments.

2] Reducing Risks: Signals give insights into possible risks and where the market might be heading. This helps traders manage their risks better and avoid losing too much money.

3] Saving Time: Traders don't have to spend as much time analyzing the market because signals have already done that work for them. They can focus on actually making trades and managing their investments.

4] Learning: New traders can learn a lot from signals. They get to see how experts analyze the market and can pick up useful tips for their trading. Over time, they become better traders themselves.

Choosing the Right Trading Signal Provider

When picking a signal provider, it's important to think about a few things to make sure you're getting the right one:

1] Reputation and Trustworthiness: Look for providers that have a good reputation for being reliable and honest in trading on cryptocurrency. Check their track record to see if they've consistently given out accurate signals.

2] Accuracy: Check how often their signals have been right in the past in trading on cryptocurrency trading signals. You want signals that are good at predicting where prices will go.

3] Transparency: Make sure the provider is clear about how they come up with their signals and how well they've done in the past. You should be able to easily see how accurate their signals have been.

4] Cost: Think about how much it costs to use their service and whether it fits your budget. Make sure the price is worth it for the quality of signals you're getting.

Maximizing the Effectiveness of Cryptocurrency Trading Signals

To get the most out of signals, here are some easy tips to follow:

1] Know What's Going On: Keep up with what's happening in the market. Understand trends and how prices are changing so you can make smart decisions.

2] Use Signals Smartly: Think of signals as helpful tools, not the only thing you rely on. Do your research too, and use signals to confirm your ideas.

3] Get Signals from Different Places: Don't rely on just one signal provider. Subscribe to a few different ones to get different perspectives and make your decisions more reliable.

4] Stay Flexible: Keep an eye on what's happening and be ready to change your strategies. Markets can shift quickly, so be ready to adjust your plans accordingly.

Understanding the Risks Associated with Signals

While using cryptocurrency trading signals has its advantages, it's important to know the risks too:

1] Depending Too Much on Signals: If you rely too heavily on signals without really understanding how the market works, you might end up making bad decisions and losing money.

2] Getting Bad Signals: Sometimes, signals can be wrong or misleading. If you don't check them carefully, you could end up losing money. It's crucial to do your homework and make sure the signals are trustworthy.

3] Risk of Market Manipulation: Sometimes, people might give out false signals to trick traders into making certain trades. This could lead to losses if you're not careful. So, it's important to be cautious and not blindly follow every signal you see.

Exploring the Future of Trading Signals

The future of signals is set to see big changes, thanks to technology and rules getting better. Here are some important things to watch out for:

1] Smarter Signals with AI: As technology gets better, signals will become more accurate and helpful. Artificial intelligence and machine learning will help generate signals that give traders better insights, helping them make smarter decisions.

2] Trading Bots Working with Signals: Signals will work hand-in-hand with automated trading bots. This means trades can happen automatically based on signal recommendations. It'll make trading faster and easier, with less manual work.

3] Rules Getting Clearer: As the trading on cryptocurrency signals market grows, there will be more rules for signal providers. This will make sure they're transparent and accountable for the signals they give out, giving traders more confidence in using them.

FAQs

1. Are trading signals always accurate?

Ans : While signals can provide valuable insights, they are not infallible. Traders should exercise diligence and verify signals before acting on them.

2. Can I rely solely on signals for trading decisions?

Ans : It's not advisable to rely solely on signals for trading decisions. Traders should supplement signals with their own analysis and market research.

3. How often should I review my trading strategy based on signals?

Ans : Traders should regularly review and adjust their trading strategies based on the latest market developments and signal performance.

4. Are there free signal providers available?

Ans : Yes, some providers offer free cryptocurrency trading signals, but they may not always be as reliable or accurate as paid services.

5. What precautions should I take when using signals?

Ans : Traders should verify the credibility of signal providers, diversify signal sources, and be cautious of blindly following signals without understanding the underlying market conditions.

#cryptocurrency trading signals#current prices of cryptocurrency#trading on cryptocurrency#trading signals#cryptocurrency trading

2 notes

·

View notes

Text

Top 6 safe mobile crypto wallets

Know more:- www.bitlaxmi.co.in

#cryptocurrencies#cryptoworld#cryptocurrency trading#digital money#crypto update#crypto#blockchain#cryptodaily#bitlaxmitoken#digitalmarketing

8 notes

·

View notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#crypto technical analysis#kings charts#trading signals#cryptocurrency trading#free crypto trading signals#free cryptocurrency trading signals#trading ideas

2 notes

·

View notes

Text

Earning Money Online: How to Get Started with Cryptocurrency Trading

Cryptocurrency trading has become a popular way to earn money online. With the rise of digital currencies like Bitcoin, Ethereum, and Litecoin, more people are exploring the potential of trading cryptocurrencies for profit. If you're interested in getting started with cryptocurrency trading, here's what you need to know. Read more

#cryptocurreny trading#cryptocurrency#blockchain#Cryptocurrency investment advice#cryptocurrency trading#Bitcoin#Ethereum#Litecoin#decentralized currencies#trading strategy#cryptocurrency exchange#market trends#investment#cryptocurrency news#market movements#online income#digital currencies#blockchain technology.

2 notes

·

View notes

Text

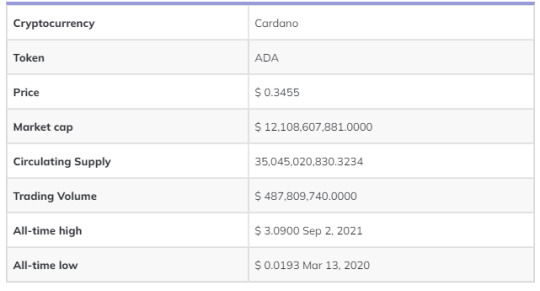

Cardano (ADA) Price Prediction 2022-2025: Will Cardano Price Rebound This Year?

The Cardano network is successfully crowned as one of the most scalable systems in the World Economic Forum. The network has been fast progressing to be the first peer-reviewed and impeccably scalable chain. The platform's native token ADA is in demand for its price.

Cardano is now establishing its reign in utility at an impeccable rate. Therefore, the quest to drive the price trajectories continues to grow louder. Dive in as we bring you the plausible Cardano Price Prediction for 2022 and beyond.

#cardano#crypto#Cryptocurrency trading#cryptocurrencies#coin#bitcoin latest news#cardano ada#cardano price prediction#cardano price analysis#Cardano price#crypto news#crypto news today#cryptocurrency news

2 notes

·

View notes

Text

What is Cryptocurrency Trading, and How Does It Work?

In the current financial environment, cryptocurrency trading is a widespread issue. However, what is it, and how does it work? In this post, we will dissect the fundamentals of cryptocurrency trading and provide a comprehensive grasp of how it operates.

Comprehending Trading of Cryptocurrencies

Trading cryptocurrencies entails predicting the rise in value of Ethereum and Bitcoin. The two main methods are buying and selling actual coins on cryptocurrency exchanges or using Contract for Difference (CFD) trading accounts.

Trading Cryptocurrencies with CFDs

A derivative of trading cryptocurrencies is CFD trading. It enables traders to make predictions about cryptocurrency price fluctuations even in the absence of physical coin ownership. You are wagering that cryptocurrency's price will increase when you go long or buy. On the other hand, if you go short (sell), you're expecting the price to drop. Because leverage is a feature of CFD trading, you can have exposure to the Bitcoin market with a minimal initial commitment. It's important to remember that leverage can increase gains and losses.

Using an Exchange to Purchase and Sell Cryptocurrencies

On the other hand, obtaining digital coins is required when purchasing and selling cryptocurrencies through a cryptocurrency exchange. You must register for an account on a cryptocurrency exchange, deposit the entire purchase price of the coin you want to buy, and keep the coins in your digital wallet until you're ready to sell them to begin trading in this manner. Exchanges can have deposit caps and maintenance fees, and they have a learning curve.

How Do Crypto Markets Function?

The decentralized nature of crypto advisor markets sets them apart from traditional financial markets, as they are not subject to the control of a central bank or government. These markets are based on blockchain technology and run on a computer network.

Blockchain: The Foundation of Digital Assets

Blockchain is a digital ledger that tracks cryptocurrency transactions and displays ownership changes over time. Groups of transactions are called "blocks," and each new block is appended to the front of the chain. Because it is decentralized and uses cryptography, blockchain is renowned for having robust security features.

Mining Cryptocurrencies

The mining process verifies cryptocurrency transactions and appends new blocks to the blockchain. Mining computers gather valid transactions into new blocks, choose pending transactions, and check sender balances. These computers also try to create cryptographic linkages to earlier blocks using an intricate algorithm. Upon successful completion, a new block is appended to the blockchain.

Elements That Affect Cryptocurrency Markets

Prices for cryptocurrencies are determined by supply and demand. The following are some significant reasons that can affect the cost of cryptocurrencies:

Supply: The overall quantity of coins along with the pace of release.

Market capitalization is the estimation of the worth of every coin in use.

Media Coverage: The degree and manner in which cryptocurrencies are portrayed.

Integration: Incorporating cryptocurrencies into already-in-use platforms like e-commerce is simple.

Essential Events: Significant occurrences such as economic events, security breaches, and regulatory changes.

Recognizing Margin, Spread, Lot, Leverage, and Pip

Spread: The difference between a cryptocurrency's purchase and sell prices. A short position entails selling at a slightly lower price than a long position, which is opened at a slightly higher price.

Lot: Cryptocurrencies are usually exchanged in lots to standardize trade sizes. Because of their volatility, lots are typically small, consisting of one unit of the base cryptocurrency.

Leverage: Using leverage, traders can take on bigger cryptocurrency bets without paying the entire deal value upfront. However, it also amplifies possible losses.

Margin: The first payment needed to start and keep up a leveraged position is margin. Depending on the broker and trade size, a different percentage of the entire position may be required as a margin.

Pip: A pip is a one-digit change in a cryptocurrency's price. Specific lesser-value cryptocurrencies may have pips that are one cent or even less than one cent, although valuable cryptocurrencies are often exchanged in whole dollars.

Unlocking Success: The Importance of Certification in Cryptocurrency Trading

The dynamic and fascinating world of cryptocurrency trading needs education and information to be successful. This is when a Bitcoin trading certification frequently obtained through reliable programs and courses becomes crucial. Participating in a well-organized course on cryptocurrency trading provides participants with the fundamental knowledge and abilities needed to navigate this market successfully. Still, it also grants them a respected certification that can lead to profitable prospects in the cryptocurrency sector.

These courses on cryptocurrency trading provide students with a thorough understanding of the cryptocurrency ecosystem by covering essential topics, including risk management, blockchain technology, technical analysis, and market movements.

Additionally, certification from a Bitcoin course adds legitimacy and professionalism to one's resume, boosting confidence in investors, clients, and possible employers. In a field known for its creativity and unpredictability, certification and education in cryptocurrencies stand for expertise and preparedness, guaranteeing that traders can take advantage of opportunities and successfully manage risks in this volatile financial environment.

In summary, trading cryptocurrencies is an exciting, decentralized market where investors can directly possess digital tokens or use CFDs to speculate on market fluctuations. With blockchain technology at its core, this ecosystem is guaranteed to be transparent and secure. A wide range of factors influences prices for cryptocurrencies, so understanding ideas like spread, lot, leverage, margin, and pip is essential for successful trading in this fast-moving market.

It is also impossible to exaggerate the value of learn crypto trading certification programs and courses. They give traders the know-how, credentials, and recognition required to succeed in this cutting-edge, quick-paced industry, ensuring they are prepared to ride the shifting waves of bitcoin trading.

Blockchain Council is a reliable resource for anybody looking to advance their knowledge and qualifications in bitcoin trading. The Blockchain Council consists of enthusiasts and subject matter experts committed to furthering blockchain research and development and provides in-depth training and certifications in cryptocurrency trading.

These credentials offer a valuable credential recognized in the blockchain and cryptocurrency sphere, in addition to imparting critical knowledge when blockchain technology is poised to transform different industries. The world is moving toward more innovative and decentralized systems. Blockchain Council provides people with the necessary knowledge and skills to succeed in this revolutionary environment.

0 notes

Text

Web3 Innovations and Decentralized Asset Management: The Future of Trading

The financial and trading sectors are undergoing a profound transformation, largely due to the advent of Web3 technologies. These innovations are empowering traders with greater control, transparency, and security. In this new era, platforms like PrimeTrader are embracing these developments to redefine the trading experience. As the digital economy continues to evolve, decentralized asset management and Web3 are becoming essential for anyone looking to stay competitive in the market.

Understanding Web3 Innovations in Finance

Web3 represents the next iteration of the internet, focused on decentralization and blockchain technology. In the financial world, Web3 is replacing traditional intermediaries, allowing users to manage their assets and trades independently. This shift is not only empowering traders but also creating new opportunities for wealth generation.

Platforms like PrimeTrader are integrating Web3 technologies to enhance user experiences, providing advanced security and more personalized trading solutions in the crypto space.

The Role of Decentralized Asset Management

Decentralized asset management allows traders to maintain full control over their portfolios without relying on centralized entities, which often come with limitations and higher fees. With the rise of decentralized systems, traders can now access tools that give them complete autonomy over their financial decisions.

PrimeTrader is aligned with this decentralized approach, offering solutions that empower users to manage their assets seamlessly, ensuring a frictionless trading experience.

Leveraging Advanced Trading Tools and AI Trading

The integration of AI into trading is making waves, providing real-time insights and more efficient trading strategies. AI-driven platforms can analyze vast amounts of data quickly, giving traders a competitive edge. Tools that harness AI technology, like those found on PrimeTrader, enable traders to make informed decisions and optimize their portfolios.

Tokenized Assets and Their Impact on Trading

Tokenized assets are revolutionizing both traditional and digital trading landscapes. By breaking down assets into smaller, tradeable tokens, they create liquidity and broaden access for a wider range of investors. Platforms like PrimeTrader offer exposure to tokenized assets, making it easier for traders to diversify their portfolios.

The Role of Decentralized Finance (DeFi) and Staking

Decentralized Finance (DeFi) protocols are reshaping the market by enabling traders to engage in various financial activities, from lending to staking, without the need for intermediaries. Staking, in particular, allows traders to secure networks while generating passive income.

With PrimeTrader, users can seamlessly participate in DeFi and staking, providing new ways to maximize profits and grow their investments.

Conclusion

Web3 innovations and decentralized asset management are transforming the future of trading. As platforms like PrimeTrader continue to embrace these technologies, traders are equipped with cutting-edge tools to navigate the evolving financial landscape. Now is the time to explore decentralized trading and capitalize on the opportunities offered by Web3.

0 notes

Text

Why Multi-User Flash Loan Arbitrage Bots are the Next Big Thing in Automated Trading

In the world of decentralized finance (DeFi), flash loans and arbitrage opportunities are becoming increasingly popular. Flash loans allow traders to borrow large sums of money without collateral, as long as the loan is repaid in the same transaction. This creates opportunities for traders to profit by buying low and selling high across different exchanges – all within seconds.

But what’s really exciting is the rise of multi-user flash loan arbitrage bots. These bots allow multiple users to work together, maximizing their profits from flash loans in a way that was not possible before.

What is a Flash Loan Arbitrage Bot?

A flash loan arbitrage bot is a tool that automatically finds price differences between exchanges and executes trades to profit from these differences. Since prices can vary from one exchange to another, this creates opportunities for quick profits. The bot does all the work by finding the right opportunities and making trades instantly.

How Do Multi-User Flash Loan Arbitrage Bots Work?

Multi-user flash loan bots allow multiple traders to pool their resources and share the profits. Here’s how it works:

Pooling Capital: Instead of using one person’s funds, multi-user bots combine capital from several users. This gives the bot more buying power and increases the potential for larger profits.

Faster Execution: With more capital available, the bot can execute trades more quickly and efficiently. This is important because arbitrage opportunities can disappear in seconds.

Shared Profits: The profits made from these trades are then shared among all users, based on their contribution. This means even small investors can participate in profitable trades that would otherwise require a large amount of capital.

Why Multi-User Bots are Changing the Game

Multi-user flash loan arbitrage bots are changing the way people trade in DeFi for several reasons:

Increased Profit Potential: By pooling resources, traders can take advantage of larger arbitrage opportunities that might not be possible for individual users. This increases the profit potential for everyone involved.

Lower Risk: Sharing the cost of trades reduces the individual risk for each trader. If a trade goes wrong, the loss is spread out among all users, making it less risky than going solo.

Accessibility for Smaller Investors: Flash loan arbitrage used to be something only big traders could afford. With multi-user bots, even smaller investors can get involved and benefit from this trading strategy.

Efficiency and Speed: The decentralized nature of DeFi means that prices can change rapidly. Multi-user bots can react instantly to price differences, securing profits before the opportunity is gone.

Why You Should Consider Using a Multi-User Flash Loan Arbitrage Bot

If you’re looking for a way to profit from DeFi, using a multi-user flash loan arbitrage bot could be your next big opportunity. These bots offer a way to:

Increase your profits with pooled resources

Minimize your risk by sharing the cost of trades

Get started with smaller amounts of capital

Take advantage of the fast-moving DeFi market

Flash loan arbitrage is one of the most exciting ways to make money in DeFi, and multi-user bots make it even more accessible. Whether you’re a seasoned trader or new to DeFi, using a multi-user bot can help you unlock new opportunities for profit.

Final Thoughts

Multi-user flash loan arbitrage bots are the future of automated trading in DeFi. By pooling resources and sharing the benefits, these bots allow traders to take advantage of arbitrage opportunities in ways that were never possible before. They offer a new level of accessibility, speed, and profit potential for everyone involved.

If you’re interested in maximizing your profits and minimizing your risks, now is the perfect time to explore the world of multi-user flash loan arbitrage bots.

#Multi users flash loan bot#flash loan arbitrage bot#Crypto trading bot#cryptocurrency trading#bitcoin trading

0 notes

Text

youtube

How to Trade Digital Currencies Easily on Hotcoin

In this video, we’ll walk you through the steps on how to trade digital currencies easily on Hotcoin. With Hotcoin, trading digital currencies is simple and straightforward.

1 note

·

View note

Text

#cryptocurrency#crypto updates#bot development#cryptocurreny trading#trading bot 2024#trading bot development#arbitrage bot#blockchain#Crypto atm#crypto news#cryptocurrency trading

0 notes

Link

🚀 The future of crypto trading is here, and it's powered by AI! 🤖💰 Discover how AI crypto trading bots are revolutionizing the market and learn how to get started in our latest blog post. Don't miss out on this game-changing technology! 📈

#crypto investment#blockchain#fintech#trading automation#cryptocurrency#crypto trading#cryptocurrency trading#smartinvesting#crypto market#trading strategies#digital currency#crypto news

0 notes

Text

$usdt Marketplace. New Token Launching Soon.

Claim 100000 tokens free.

$usdt Marketplace. New Token Launching Soon.

Claim 100000 tokens free.

Click below link to claim tokens:

0 notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#crypto technical analysis#kings charts#trading signals#cryptocurrency trading

2 notes

·

View notes

Text

Meme bank opportunities

🎉 MeMe Bank Charity Event Concludes Successfully 🎉First Session: "Blockchain and MeMe Bank" Seminar 📚The charity event was divided into two sessions. The first session was the "Blockchain and MeMe Bank" seminar, aimed at providing knowledge and education on blockchain and MeMe Bank to both external and local leaders. Through this seminar, participants not only deepened their understanding of blockchain technology but also gained further insight into MeMe Bank's mission and vision.After the seminar, community members gathered for a relaxed and enjoyable dinner, celebrating the successful event and sharing experiences and insights. 🍽😊Second Session: Visit to a Local Orphanage 🧸The second session was a visit to a local orphanage, where we delivered living supplies, educational materials, and small gifts to the children. Our goal was to improve their living conditions and show them the warmth and care of society. We spent a joyful time with the children, and seeing the smiles on their faces brought us immense happiness and fulfillment. 🎁👶Future Plans 🌏❤️In the future, we plan to organize more similar charity events to spread MeMe Bank's love and support to people in need around the world, helping more impoverished individuals improve their lives. Our goal is to make the world a better and warmer place through continuous effort and dedication. 🌟💪Join Us ❤️For new members who want to join the community but cannot find the entrance, you can copy this official MeMe Bank invitation link into your Safepal App crypto wallet DAPP browser to participate。MeMe Bank Invitation Link:https://memebanlk.com?ref=0x32eef6593840c55c4618fc1528b550bfc52a26f9

1 note

·

View note

Text

Cryptocurrency Trading| Get Started Now at EuroBlissTrades

EuroBlissTrades invests in crypto assets on behalf of leading Oceania Bloom family, Entrepreneurs, Businesspreneurs and Institutional investors across the globe includingIndia, Nepal, Bangladesh, Pakistan & Dubai.

1 note

·

View note