#Cryptorank

Text

Bitget Wallet Surpasses MetaMask in Downloads — CryptoRank

Bitget Wallet surpassed MetaMask in July 2024, reaching 1.6 million downloads, 100,000 more than its competitor.

Last month, Bitget Wallet, a self-custodial cryptocurrency wallet owned by the Bitget exchange, surpassed its most significant competitor, MetaMask, in terms of downloads.The Bitget Wallet software achieved 1.6 million downloads in July 2024, surpassing MetaMask by 100,000 downloads,…

0 notes

Text

Bitcoin Breaks $61K Amidst Broader Crypto Downturn: Market Dynamics Unfold

The crypto market has recently experienced a notable surge as Bitcoin surpasses the $61,000 mark, marking a significant milestone. However, CryptoRank, a prominent crypto industry research and analytics platform, suggests that the broader market is currently characterized by cautious investor sentiment. This nuanced situation, where Bitcoin dominates but the overall market exhibits hesitation, provides an intriguing snapshot of the current state of digital assets.

The total market capitalization stands at approximately $2.39 trillion, indicating a slight decline of 1.48%. This dip reflects a sense of caution prevailing among investors, a sentiment further echoed by the Bitcoin dominance index at 50.66%. The Fear & Greed Index, currently at 80, signifies a phase of 'Extreme Greed,' indicating heightened speculative interest and investor optimism predominantly focused on Bitcoin.

While Bitcoin demonstrates robust performance, other major cryptocurrencies have faced declines. Dogecoin, Ethereum, and Binance Coin have seen reductions in their values by 7.73%, 2.75%, and 2.54%, respectively. This divergence in market behavior underscores a scenario where Bitcoin's rise contrasts with the more subdued or declining performance of other prominent cryptocurrencies.

The crypto market is not devoid of volatility, especially among lesser-known digital assets. Aerodrome, Sanko GameCorp, and Taki have emerged as the top gainers, experiencing impressive gains of 50.1%, 49.2%, and 45.8%, respectively. These movements highlight the dynamic nature of the crypto market, where emerging tokens can swiftly gain prominence and offer substantial returns.

Token unlocks play a significant role in influencing market liquidity and shaping investor strategies. Currently, dYdX, Biconomy, and Hooked Protocol are undergoing token unlocks, valued at $111 million, $11.9 million, and $8.85 million, respectively. Monitoring these events is crucial as they can inject substantial liquidity into the market, potentially impacting the price and availability of these tokens.

The cryptocurrency market presents a multi-faceted picture, with Bitcoin leading the charge amid a broader market correction. The volatility among emerging tokens and the strategic implications of token unlocks contribute to the intricate landscape, offering both challenges and opportunities to investors.

0 notes

Text

The Most Secure Blockchain

“We've been thinking for a long time on which blockchain to build the Metaverse. The speed of transaction processing, the cost of transactions and, of course, the degree of protection against potential hacker attacks are very important. And finally, the choice has been made. Am I wrong?», says Lado Okhotnikov, Meta Force CEO.

Those who want to stay in the DeFi sector prefer Ethereum. This blockchain is a platform for many tokens and projects ranging from ICOs to NFTs. A rich ecosystem and a variety of options for users give a possibility of choice and this is the most important thing.

Vladimir Okhotnikov aka Lado believes that success depends on how correctly the blockchain is chosen, “Since we are preparing large-scale proposals, coverage is very important for us. The Royalty NFT program has already been launched while a decentralized wallet, its own marketplace and the Metaverse are preparing to launch.”

According to the CEO of Meta Force, Ethereum strives for decentralization, so control and decision-making are not concentrated in one hand. This increases network security and reduces risks of censorship.

0 notes

Text

The collapse of the global crypto market and other news of the past week

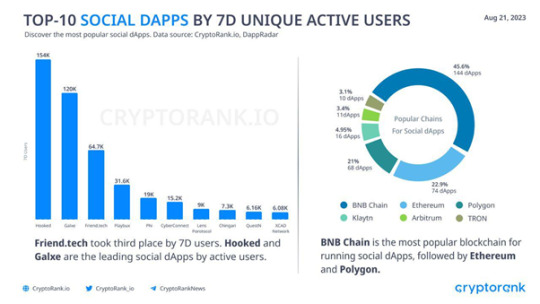

Researchers at the CryptoRank analytical platform have published their 164th weekly report on the situation in the cryptocurrency market, based on data from August 14 to 20, 2023. They noted that the most important event was the global drop in quotes of the leading digital coins and tokens. Experts said that approximately $1.04 billion of positions were liquidated due to the sudden collapse of the Bitcoin (BTC) rate.

Recall that in the period from August 17 to 18, the quotes of the flagship cryptocurrency fell from $29,000 to $25,400. However, a little later, the BTC rate stabilized and recovered to a value of $26,200, which is kept around for the next few days. In addition, industry analysts recalled that the Coinbase trading platform received regulatory approval for access to cryptocurrency futures for US citizens.

Among other things, several events related to the US Securities and Exchange Commission (SEC) were noted among the news. For example, representatives of the organization said that the decision on the status of the Ripple cryptocurrency (XRP) requires additional consideration in the Court of Appeal. The management of the institution also announced that the first futures ETF fund on Ethereum may be approved in the near future.

And, here are the representatives of the Binance crypto exchange themselves sued the SEC for abuse of office.

Finally, CryptoRank analysts reported that the average daily fee rate in the FriendTech protocol rose to $1.4, second only to Ethereum and Lido in this indicator. Binance's OpBNB developers have finally announced the mainnet launch for Layer 2 Scaling Protocol. Last week, the leading cryptocurrency exchange began trading 2 major projects - CyberConnect (CYBER) and Sei (SEI). They attracted a lot of attention from investors and traders and were trending in terms of the number of search queries.

Read the full article

0 notes

Text

CryptoRank reports significant growth in the cryptocurrency market. Bitcoin is trading above $58,000, reflecting a bullish trend. Bitcoin (BTC) increased by 2.23% to $58,519, while Binance Coin (BNB) rose by 0.93% to $528, and XRP gained 0.63% to $0.4412. The overall market capitalization has surged to $2.25 trillion, a 1.36% increase.

Bitcoin's dominance has risen to 51.48%, despite the Fear & Greed Index remaining in the "Fear" zone at 28, indicating cautious investor sentiment. Top gainers include Stader (SD) with a 61.7% rise, Function X (FX) with 40.7%, Mdex (MDX) with 35%, Hivemapper (HONEY) with 34.8%, and Hypurr (PURR) with 21.9%.

The recent uptick in Bitcoin and other major cryptocurrencies signals a positive market outlook, with analysts and investors anticipating further gains despite prevailing caution.

2 notes

·

View notes

Link

Hey, Have you entered this competition to win 🥳Celebrate SpaceX has landed at Coinbase Airdrop yet? If you refer friends you get more chances to win :) https://wn.nr/UrbvRz

9 notes

·

View notes

Link

Hey, Have you entered this competition to win 🥳Celebrate SpaceX has landed at Coinbase Airdrop yet? If you refer friends you get more chances to win :) https://wn.nr/LcEAHn

4 notes

·

View notes

Text

Crypto Spotlight: Top IDOs and Token Launchpads

Introduction

Initial DEX offerings are a genuine game changer in fundraising opportunities within the crypto ecosystem. In stark contrast to traditional methods, IDOs offer both instant liquidity and decentralized trading, with lower entry barriers for the projects and investors. In this paper, the author will explore what IDOs are, what to do and not do for a successful IDO, and how to choose the right launchpad for your token sale. We also profile the currently trending top ten launchpads focused on IDO by CryptoRank, diving into what makes them successful, who their founders are, where they are headquartered, selection criteria, and how one can join.

What is IDO?

IDOs are a means of raising funds in which a project offers their token through a decentralized exchange (DEX). This approach carries within it several advantages:

Immediate Liquidity: Tokens are immediately tradable from the time of issuance.

Decentralized trading: Trading is done in a decentralized manner.

Cost-effective: Fewer fees compared with traditional Initial Coin Offerings (ICOs) or Initial Exchange Offerings (IEOs).

Accessibility: Open to a global audience, thereby leveling the playing field for all interested to participate.

Key Stats

The average IDO in 2023 raised about $2.5 million.

Over 300 projects would be launched in 2023 through the success of IDOs.

IDOs saw 150% more participation rates than in 2022.

Do’s and Don’ts for Successful IDO

Do’s :

Thorough Research: Understand the market, the demand for your token, and the competitive landscape.

2. Community Engagement: Foster community strength and communicate with them frequently.

3. Transparency: Do give your information about the project, team, and roadmap with full clarity and honesty.

4. Security Measures: Use robust security protocols to be secure from hacks and scams.

5. Legal Compliance: Ensure that your IDO is legally compliant in the jurisdictions that you are targeting.

Don’ts

Over-promise: Never promise something that you cannot deliver.

Marketing: Proper marketing is necessary for any successful IDO.

Ignore Feedback: Listen to your community and investors; their feedback can be invaluable.

Rush the Process: Spend the needed time to prepare and execute your IDO meticulously.

Picking the Right Launchpad for Your Token Sale

Choose the right launchpad that your IDO will ensure its success. Below are the factors to consider:

Reputation: You would wish to scan for launchpads with a history of successful token launches.

Community: A strong and active community can do huge wonders in terms of the visibility and credibility of your project.

Support: There is additional support that some launchpads provide: marketing, advisory, and technical support, among others.

Fees: Compare the fees charged by different launchpads and choose the one that best fits into your budget.

Spotlight on the 10 Most Popular IDO Launchpads

1. ChainGPT Pad ($CGPT)

Reasons for Success: ChainGPT Pad has gained popularity due to its integration with advanced AI technologies, providing innovative solutions for blockchain projects. Their cutting-edge AI tools streamline processes, making them attractive to tech-savvy projects.

Selection Criteria: Focuses on projects with strong AI integration, a clear technical edge, and potential for substantial growth. Projects must demonstrate a solid use case for AI and a roadmap that showcases innovation.

Figures:

Funds Raised: $15 million in 2023

Projects Launched: 45

Success Rate: 85%

2. AITECH PAD ($AITECH)

Reasons for Success: Known for supporting AI and technology-driven projects, AITECH PAD ensures a high level of innovation and technological advancement. They have a strong network of tech investors and advisors.

Selection Criteria: Prioritizes projects that leverage AI to solve real-world problems, have a robust technological foundation, and show potential for scalability. Projects must have a clear product-market fit and a strong development team.

Figures:

Funds Raised: $12 million in 2023

Projects Launched: 38

Success Rate: 80%

3. Decubate ($DCB)

Reasons for Success: Decubate provides extensive incubation services, helping projects from inception to successful IDO launch. Their comprehensive support includes mentorship, funding, and marketing services.

Selection Criteria: Looks for early-stage projects with high potential, a strong team, and a unique value proposition. Projects must demonstrate readiness for market entry and a well-thought-out development plan.

Figures:

Funds Raised: $10 million in 2023

Projects Launched: 40

Success Rate: 78%

4. Oxbull ($OXB)

Reasons for Success: Oxbull’s community-centric approach and successful track record have made it a favorite among crypto enthusiasts. Their strong community support and transparent processes attract high-quality projects.

Selection Criteria: Focuses on community-driven projects with a clear use case, strong community engagement, and a transparent team. Projects must show potential for significant community growth and interaction.

Figures:

Funds Raised: $18 million in 2023

Projects Launched: 50

Success Rate: 82%

5. Seedify ($SFUND)

Reasons for Success: Seedify is known for its robust ecosystem that supports projects with funding, advisory, and community engagement. Their ecosystem approach ensures that projects receive comprehensive support.

Selection Criteria: Selects projects with strong potential for mass adoption, community support, and innovative solutions. Projects must have a clear vision, a strong team, and a detailed roadmap.

Figures:

Funds Raised: $20 million in 2023

Projects Launched: 60

Success Rate: 88%

6. Ape Terminal

Reasons for Success: Ape Terminal has become popular for its user-friendly platform and support for innovative DeFi applications. Their streamlined onboarding process and robust security measures attract top DeFi projects.

Selection Criteria: Prioritizes DeFi projects with unique value propositions.

Figures:

Funds Raised: $14 million in 2023

Projects Launched: 42

Success Rate: 84%

7. Fjord Foundry ($FJO)

Reasons for Success: Fjord Foundry’s strong network and collaborations has propelled its popularity. They offer strategic advisory and partnership opportunities to ensure project success.

Selection Criteria: Focuses on projects with strong strategic alignment and potential for collaboration.

Figures:

Funds Raised: $11 million in 2023

Projects Launched: 35

Success Rate: 81%

8. DAO Maker ($DAO)

Reasons for Success: DAO Maker’s innovative approach to fundraising and governance has made it a leader in the space. Their unique launch models and strong community governance appeal to a broad range of projects.

Selection Criteria: Looks for projects with strong governance frameworks, community engagement, and innovative solutions. Projects must have a well-defined governance model and active community participation.

Figures:

Funds Raised: $25 million in 2023

Projects Launched: 70

Success Rate: 90%

9. Poolz Finance ($POOLX)

Reasons for Success: Poolz Finance’s focus on cross-chain compatibility and liquidity provision has driven its success. Their platform facilitates seamless cross-chain transactions and liquidity management.

Selection Criteria: Selects projects that offer cross-chain solutions, enhance liquidity, and have strong technical foundations. Projects must demonstrate interoperability and liquidity potential.

Figures:

Funds Raised: $16 million in 2023

Projects Launched: 48

Success Rate: 85%

10. Finceptor ($FINC)

Reasons for Success: Finceptor is known for its rigorous selection process and support for high-quality projects. Their thorough vetting process ensures that only the most promising projects are selected.

Selection Criteria: Focuses on high-quality projects with robust business models, scalability potential, and a strong team. Projects must demonstrate market readiness and a clear path to profitability.

Figures:

Funds Raised: $13 million in 2023

Projects Launched: 37

Success Rate: 83%

Conclusion

For more information about each launchpad, visit their official websites, join the communities and don’t forget to follow Metamerchant to stay updated on the latest trends and opportunities in the world of IDOs.

This in-depth exploration not only provides a comprehensive guide to IDOs but also highlights some of the most successful launchpads in the industry. Whether you’re a new project preparing for launch or an investor seeking opportunities, this article offers valuable insights into the evolving dynamics of cryptocurrency fundraising.

If you’re looking to launch your token and need assistance with PR and marketing strategies, visit Metamerchant and schedule a call with our team. At Metamerchant, we specialize in helping blockchain projects successfully launch their tokens, manage their public relations, and develop effective marketing strategies. Let us help you navigate the complexities of the crypto world and ensure your project’s success.

Contact Us:

Email: [email protected]

LinkedIn: Meta Merchant LinkedIn

0 notes

Text

Airdrop #17/07.24

ZERϴ Network x Petra / Scroll / Zeek Network / Analog / U-topia / CryptoRank / Capx Chat / Mantle / zkLink / DeBank / Blum

0 notes

Text

CryptoRank's recent insights cover major crypto updates. Mt. Gox will start repaying $9 billion in Bitcoin and Bitcoin Cash in early July 2024. Bitcoin nears $61,000, driven by a bullish market surge with $150 million in liquidations. Metaplanet plans to buy $6 million more Bitcoin, showing institutional confidence. Ethereum gas prices and Bitcoin miner revenue hit record lows. Cosmos DAO’s Osmosis plans a fee-free Bitcoin bridge. Pudgy Penguins launched Igloo, an NFT venture. Light Protocol and Helius Labs introduced ‘ZK Compression’ for Solana. Aave DAO supports ZKsync deployment. This week’s token unlocks include OPT, ALT, and GATE, injecting significant market liquidity.

0 notes

Text

Bitcoin Soars Past $65K as Top Cryptos Struggle: CryptoRank Analysis

CryptoRank, a renowned market analysis tool, has released a comprehensive report on the recent trends in the cryptocurrency market, highlighting significant movements in major digital currencies and providing a nuanced view of the market dynamics.

Bitcoin’s Ascension and Market Influence

Bitcoin (BTC) has surged past the $65,000 mark, showcasing a robust performance despite a generally bearish…

View On WordPress

0 notes

Text

Investor Optimism Soars as Report Reveals BTC Surge and Altcoins' Impressive Gains

Bitcoin's recent surge beyond $62,000 has not only marked a significant milestone for the leading cryptocurrency but has also set the entire cryptocurrency market on a positive trajectory, as per the latest analysis by CryptoRank. The comprehensive overview reveals that the top 10 cryptocurrencies have entered the green zone, indicating an overall positive trend.

Leading the market gains are notable cryptocurrencies, with Dogecoin (DOGE), Solana (SOL), and Cardano (ADA) standing out with impressive surges of up to 33.8%. These substantial increases underscore a robust period of growth in the cryptocurrency sector, contributing to the overall market capitalization soaring to an impressive $2.42 trillion, reflecting a 7.15% increase.

The report emphasizes Bitcoin's dominance at 50.82%, signifying its central role in shaping the market's dynamics. With a rise of 1.46%, Bitcoin's dominance highlights its proportionate value compared to the total market capitalization of all cryptocurrencies.

CryptoRank's analysis also provides insights into market sentiment through the Fear & Greed Index, which currently stands at 80, categorizing the market sentiment as "Extreme Greed." This indicates a highly favorable outlook among investors, showcasing increased optimism for future gains.

The report lists the top gainers in the market, with Arkham (ARKM), Bonk (BONK), and The Doge NFT (DOG) leading with significant increases. These figures illustrate the dynamic nature of the cryptocurrency market, where emerging tokens can swiftly rise to prominence.

Additionally, CryptoRank's analysis delves into the latest token unlocks, revealing significant amounts for Orange (ORNJ), WOO, and Illuvium (ILV). Token unlocks are pivotal events that can influence liquidity and prices, offering both opportunities and challenges for investors.

In conclusion, CryptoRank's analysis provides a snapshot of a vibrant and evolving cryptocurrency market fueled by Bitcoin's surge, positive sentiment among investors, and crucial movements in token unlocks. These insights serve as valuable perspectives for investors navigating the intricate landscape of digital currencies.

0 notes

Text

Top 15 DeFi Projects by Active Users in the Last 30 Days

Decentralized Finance (DeFi) has emerged as a transformative force in the financial industry, offering a decentralized alternative to traditional financial services. While Bitcoin (BTC) remains a prominent player, DeFi encompasses a broader spectrum of projects. CryptoRank's analysis of the top 15 DeFi projects, based on active users in the past 30 days, sheds light on the ecosystem's diversity.

PancakeSwap (CAKE) leads the pack with 1.85 million active users, followed by Uniswap (UNI) with 405K users. Other notable projects include 1INCH Network, Stargate Finance (STG), and TT Mining, each attracting significant user engagement.

The DeFi landscape spans multiple blockchain networks, with Binance Smart Chain (BNB) hosting the largest share of dApps. Ethereum, Polygon, Fantom, and Avalanche also serve as prominent platforms for DeFi innovation.

Despite the market's volatility, many DeFi tokens have experienced notable price changes, reflecting the sector's dynamic nature. While some projects have witnessed substantial growth, others have faced challenges.

Overall, the rise of DeFi signifies a paradigm shift in finance, empowering users with greater control over their assets and transactions. As the ecosystem continues to evolve, the diversity of projects and user engagement underscores DeFi's potential to reshape the future of finance.

0 notes

Text

CryptoRank Analysis Reveals Market Trends: Bitcoin Surges Above $63K

The cryptocurrency market has witnessed a surge in activity, with Bitcoin reclaiming the spotlight by surging above the $63,000 mark. A recent analysis by CryptoRank sheds light on the underlying market trends driving this upward momentum and provides insights into the broader dynamics shaping the crypto landscape.

Bitcoin's rally to new highs comes amid growing institutional adoption and increasing mainstream acceptance of cryptocurrencies. Institutional investors, including hedge funds and corporations, continue to allocate significant capital to Bitcoin as a hedge against inflation and a store of value in uncertain economic times.

According to CryptoRank's analysis, the influx of institutional capital into Bitcoin has been a key driver of its recent price appreciation. Institutional investors are attracted to Bitcoin's scarcity, decentralization, and growing network effect, viewing it as a hedge against traditional fiat currencies and a portfolio diversification tool.

Furthermore, CryptoRank's data reveals a growing trend of corporate treasuries adding Bitcoin to their balance sheets as a reserve asset. High-profile companies such as Tesla and MicroStrategy have publicly disclosed their Bitcoin holdings, signaling confidence in the long-term value proposition of the digital asset.

Moreover, CryptoRank's analysis highlights the role of macroeconomic factors in driving demand for Bitcoin and other cryptocurrencies. Amid unprecedented monetary stimulus measures by central banks and concerns about inflation, investors are increasingly seeking alternative stores of value outside the traditional financial system.

The recent surge in Bitcoin's price also coincides with positive sentiment surrounding the broader cryptocurrency market. Ethereum, the second-largest cryptocurrency by market capitalization, has also experienced significant gains, reflecting growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs).

CryptoRank's analysis indicates that Ethereum's rally is driven by its utility as a platform for smart contracts and decentralized applications (dApps). The Ethereum network has seen a surge in activity, with developers and users flocking to build and interact with various DeFi protocols, NFT marketplaces, and blockchain-based games.

Additionally, CryptoRank's data reveals a trend of increasing adoption of stablecoins, such as Tether (USDT) and USD Coin (USDC), within the cryptocurrency ecosystem. Stablecoins provide a bridge between traditional fiat currencies and digital assets, facilitating seamless trading and liquidity provision on cryptocurrency exchanges.

Despite the positive trends observed in the cryptocurrency market, CryptoRank's analysis also highlights potential risks and challenges. Regulatory uncertainty remains a key concern for investors and market participants, with regulatory agencies worldwide grappling with how to classify and regulate cryptocurrencies.

Moreover, CryptoRank emphasizes the importance of risk management and caution amid the volatility of the cryptocurrency market. While Bitcoin's rally to new highs is a bullish signal for the overall market, investors should be prepared for price corrections and fluctuations in the short term.

In conclusion, CryptoRank's analysis provides valuable insights into the market trends driving Bitcoin's surge above $63,000 and the broader dynamics shaping the cryptocurrency landscape. Institutional adoption, macroeconomic factors, and growing interest in decentralized finance and non-fungible tokens are among the key drivers fueling the cryptocurrency market's upward momentum. As the market continues to evolve, investors and stakeholders will closely monitor these trends and developments to navigate the ever-changing landscape of digital assets.

0 notes

Text

Bitcoin continues to face downward pressure, trading below $57,000 as the broader cryptocurrency market shows weakness. According to data from CryptoRank, major digital currencies are in the red, with Ethereum (ETH) down 5.39%, Binance Coin (BNB) by 4.52%, and Bitcoin (BTC) by 4.24%. The total market capitalization has fallen by 4.07%, now at $2.09 trillion, with Bitcoin’s dominance slipping to 53.49%.

Despite the decline, some altcoins have performed well. UXLink (UXLINK) leads with a 36.6% gain, followed by EtherVista (VISTA) and Nibiru (NIBI), which rose by 13.2% and 12.8%, respectively. BarnBridge (BOND) increased by 12.3%, while Rollbit Coin (RLB) gained 11.9%, providing optimism amidst a bearish market.

At press time, Ethereum is priced at $2,399.59, while Binance Coin trades at $498.14. Bitcoin stands at $56,558.25, reflecting a 4.46% drop

0 notes