#DRAM Module and Component Industry

Explore tagged Tumblr posts

Text

DRAM Module and Component: Powering High-Performance Computing and Electronics

Dynamic Random-Access Memory (DRAM) modules and components are integral to modern computing and electronic devices, providing essential memory storage for data processing and system operations. DRAM is a type of volatile memory that requires constant power to maintain stored information, and it is widely used in computers, servers, smartphones, and other electronic devices. DRAM modules come in various configurations and capacities, designed to meet the performance and memory needs of different applications. The ongoing advancements in DRAM technology continue to enhance speed, capacity, and energy efficiency.

The DRAM Module and Component Market, valued at USD 97.24 billion in 2022, is projected to reach USD 108.68 billion by 2030, growing at a compound annual growth rate (CAGR) of 1.4% during the forecast period from 2023 to 2030.

Future Scope

The future of DRAM modules and components is characterized by significant advancements aimed at increasing memory density, speed, and energy efficiency. Innovations include the development of new DRAM architectures, such as DDR5 and beyond, which offer higher data transfer rates and improved power efficiency. The integration of DRAM with emerging technologies like artificial intelligence (AI) and machine learning is expected to drive demand for specialized memory solutions that support high-performance computing. Additionally, advancements in memory stacking and 3D DRAM technologies will enable more compact and high-capacity memory solutions for a wide range of applications.

Trends

Key trends in the DRAM market include the transition to higher-speed memory standards, such as DDR5, which offers significant improvements in data transfer rates and overall performance. The focus on energy efficiency is driving the development of low-power DRAM solutions that reduce power consumption in mobile and embedded devices. The growing demand for high-performance computing and data centers is influencing the development of high-capacity and high-bandwidth DRAM modules. Additionally, advancements in memory technology, such as 3D DRAM stacking, are enabling the creation of more compact and efficient memory solutions.

Applications

DRAM modules and components are used in a wide range of applications, including personal computers, servers, smartphones, and tablets. In computing systems, DRAM provides fast and temporary storage for data being processed by the CPU. Servers and data centers rely on high-capacity DRAM to handle large volumes of data and support demanding applications. In mobile devices, DRAM supports smooth and responsive operation by providing quick access to frequently used data. Additionally, DRAM is used in gaming consoles, automotive systems, and industrial electronics to enhance performance and functionality.

Solutions and Services

Manufacturers and service providers offer a range of solutions and services for DRAM modules and components. Solutions include the design and production of DRAM modules with various capacities, speeds, and configurations to meet different application requirements. Services encompass memory testing, validation, and integration support to ensure optimal performance and compatibility with other system components. Customization options are available for specialized memory needs, and companies provide research and development support to advance DRAM technology and explore new applications. Additionally, technical support and consulting services help optimize memory solutions for specific use cases.

Key Points

DRAM modules and components provide essential memory storage for computing and electronic devices.

Future advancements focus on higher-speed memory standards, energy efficiency, and memory stacking technologies.

Trends include the adoption of DDR5, energy-efficient solutions, high-performance computing demand, and 3D DRAM.

Applications span personal computers, servers, smartphones, tablets, gaming consoles, and industrial electronics.

Solutions and services include DRAM module design, memory testing, integration support, customization, and R&D support.

0 notes

Text

Semiconductor Wafer Processing Chambers Market: Investment Opportunities and Forecast 2025–2032

MARKET INSIGHTS

The global Semiconductor Wafer Processing Chambers Market size was valued at US$ 3,670 million in 2024 and is projected to reach US$ 6,890 million by 2032, at a CAGR of 9.42% during the forecast period 2025-2032. This growth follows strong 26.2% expansion in 2021, though the overall semiconductor market saw moderated 4.4% growth in 2022 reaching USD 580 billion due to inflation and weakening consumer demand.

Semiconductor wafer processing chambers are critical components in semiconductor manufacturing equipment that create controlled environments for wafer processing. These chambers include transition chambers which convert atmospheric conditions to vacuum environments, and reaction chambers where deposition, etching, and other processes occur. The transition chamber serves as the gateway where wafers enter from the front-end module (EFEM) before being transferred to process chambers under vacuum conditions.

The market is driven by increasing semiconductor demand across electronics, automotive, and AI applications, though faces challenges from cyclical industry patterns. Regional growth varies significantly, with Americas semiconductor sales growing 17% year-over-year in 2022 while Asia Pacific declined 2%. Key players like Piotech Inc., AMEC, and Ferrotec are expanding capabilities to support advanced node manufacturing, particularly in deposition and etching applications which dominate chamber usage.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Semiconductor Fabrication Facilities Worldwide to Fuel Market Growth

The global semiconductor wafer processing chambers market is experiencing robust growth due to the unprecedented expansion of semiconductor fabrication facilities across key regions. Governments and private enterprises are investing heavily in domestic semiconductor production capabilities to reduce reliance on imports and strengthen supply chain resilience. In 2024 alone, over 40 new semiconductor fabs were planned or under construction globally, with investments exceeding $500 billion. This surge in fab construction directly drives demand for wafer processing chambers, as each facility requires hundreds of specialized chambers for deposition, etching, and other critical processes. The transition to advanced nodes below 7nm further accelerates this demand, as these cutting-edge processes require more sophisticated chamber designs with ultra-high vacuum capabilities.

Increasing Adoption of 300mm and Larger Wafer Sizes to Boost Market Expansion

The semiconductor industry's shift toward larger wafer sizes represents a significant growth driver for processing chamber manufacturers. 300mm wafer processing now accounts for over 75% of global semiconductor production capacity, with some manufacturers beginning to explore 450mm wafer compatibility. Larger wafer sizes deliver substantial cost advantages through improved economics of scale, but require completely redesigned processing chambers with enhanced uniformity control and gas distribution systems. This technological transition has created a wave of upgrading and replacement demand, with semiconductor equipment makers reporting order backlogs stretching 12-18 months for advanced processing chambers. Furthermore, the growing complexity of 3D NAND and advanced DRAM memory architectures necessitates specialized chambers capable of handling high-aspect ratio structures, driving further innovation in chamber design.

MARKET RESTRAINTS

High Capital Requirements and Long Lead Times to Constrain Market Growth

The semiconductor wafer processing chamber market faces significant barriers due to the substantial capital investment required for research, development, and manufacturing. Developing a new chamber platform can cost upwards of $50 million and take 3-5 years from initial concept to volume production. This creates substantial risk for equipment manufacturers, particularly when technology nodes transition rapidly and render existing chamber designs obsolete. Additionally, the precision engineering requirements for these chambers lead to lead times of 6-9 months for critical components, creating supply chain vulnerabilities. Many smaller manufacturers struggle with these financial and temporal constraints, leading to market consolidation as only the most well-capitalized players can sustain the necessary investment levels.

Technical Challenges in Advanced Node Processing to Limit Adoption Rates

As semiconductor manufacturing approaches atomic scale dimensions, wafer processing chambers face unprecedented technical challenges that restrain market expansion. At nodes below 5nm, chamber performance requirements become exponentially more demanding regarding particle control, temperature uniformity, and plasma stability. Some advanced processes now require chamber materials with contamination levels below 1 part per billion, pushing material science to its limits. These technical hurdles have led to slower than expected adoption of next-generation chambers, with many chip manufacturers opting to extend the life of existing equipment through expensive upgrades rather than complete replacements. Furthermore, the increasing complexity of chamber qualification processes, which now often exceed 6 months for new designs, creates significant delays in bringing innovative solutions to market.

MARKET OPPORTUNITIES

Emergence of Alternative Semiconductor Materials to Create New Market Potential

The semiconductor industry's exploration of alternative materials beyond silicon presents substantial opportunities for wafer processing chamber manufacturers. The development of wide bandgap semiconductors using materials like silicon carbide (SiC) and gallium nitride (GaN) requires specialized processing chambers capable of handling higher temperatures and more aggressive chemistries. The SiC power device market alone is projected to grow at a compound annual growth rate exceeding 30%, driving demand for compatible processing solutions. Additionally, the transition to 2D materials like graphene and transition metal dichalcogenides for advanced logic applications will necessitate completely new chamber architectures. Companies that can develop flexible chamber platforms adaptable to these emerging materials will gain significant competitive advantage in the coming decade.

Integration of AI and Advanced Process Control to Enable Next-Generation Chambers

The incorporation of artificial intelligence and machine learning into wafer processing chambers represents a transformative opportunity for market players. Modern chambers equipped with hundreds of sensors generate terabytes of process data that can be leveraged for predictive maintenance and real-time process optimization. Early adopters of AI-enabled chambers report yield improvements of 5-10% and mean time between failures increasing by 30-50%. This digital transformation extends to remote monitoring capabilities, allowing equipment manufacturers to offer chamber performance as a service rather than just selling hardware. The market for smart chambers with integrated process control is expected to grow twice as fast as conventional chambers, creating premium pricing opportunities for innovative suppliers.

MARKET CHALLENGES

Supply Chain Vulnerabilities to Impact Chamber Manufacturing Cycles

The semiconductor wafer processing chamber market faces significant supply chain challenges that threaten to constrain production capacity. Many critical chamber components, including ceramic heaters, vacuum valves, and precision gas distribution systems, come from single-source suppliers with limited alternate options. Delivery lead times for these components have extended from typical 12-16 weeks to 30-40 weeks in some cases, creating bottlenecks in chamber assembly. The situation is further complicated by export controls on certain specialty materials used in chamber construction, particularly those with potential dual-use applications. These supply chain constraints come at a time when demand is at record levels, forcing manufacturers to make difficult allocation decisions and delaying customer deliveries.

Increasing Technical Complexity to Exacerbate Skilled Labor Shortages

The semiconductor equipment industry faces a critical shortage of skilled personnel capable of designing, manufacturing, and supporting advanced wafer processing chambers. The intersection of mechanical engineering, materials science, plasma physics, and computer control systems required for modern chambers creates a highly specialized skillset demand. Industry surveys indicate vacancy rates exceeding 20% for critical engineering positions, with the talent pipeline unable to keep pace with industry growth. This skills gap is particularly acute in chamber process expertise, where experienced engineers often require 5-7 years of hands-on experience to achieve full competency. The shortage not only delays new product development but also impacts the ability to provide timely field support, potentially affecting customer fab productivity and yield.

SEMICONDUCTOR WAFER PROCESSING CHAMBERS MARKET TRENDS

Advancements in Miniaturization and High-Volume Manufacturing Drive Growth

The semiconductor wafer processing chambers market is experiencing significant momentum due to the increasing demand for miniaturized components in electronics and the growing adoption of 5G, IoT, and AI technologies. With semiconductor nodes shrinking below 7nm, manufacturers require ultra-precise wafer processing chambers capable of maintaining vacuum integrity and contamination control at atomic levels. The transition to extreme ultraviolet (EUV) lithography has further accelerated demand for chambers with enhanced material compatibility and thermal stability. Recent data indicates that transition chambers accounted for over 45% of total market revenue in 2024, with reaction chambers projected to grow at a CAGR exceeding 8% through 2032.

Other Trends

Automation and Industry 4.0 Integration

The semiconductor industry's rapid adoption of smart manufacturing principles is transforming wafer processing chamber designs. Contemporary chambers now incorporate real-time sensors for pressure monitoring, predictive maintenance algorithms, and AI-driven process optimization to minimize defects and maximize yield. Leading foundries report yield improvements of 15-20% after implementing these smart chambers. Furthermore, the integration of robotics with wafer handling systems enables uninterrupted high-volume production, particularly crucial for memory chip manufacturers expanding capacity to meet data center demands.

Geopolitical Factors Reshaping Supply Chain Dynamics

While technological advancement drives market expansion, geopolitical tensions have created both challenges and opportunities. Export controls on advanced semiconductor equipment have prompted accelerated development of domestic wafer processing chamber capabilities in several regions. China's半导体equipment industry, for instance, has seen 37% annual growth in chamber production capacity as domestic manufacturers like AMEC and Piotech Inc. expand their portfolios. Meanwhile, North American and European suppliers are investing heavily in alternative material solutions to reduce dependency on specific geographic sources for critical chamber components.

COMPETITIVE LANDSCAPE

Key Industry Players

Semiconductor Equipment Suppliers Focus on Wafer Processing Innovation

The global semiconductor wafer processing chambers market exhibits a moderately fragmented competitive landscape, with Asian manufacturers increasingly challenging established Western players. While the market saw slower growth in 2022 (4.4% globally according to WSTS data), critical wafer processing technologies remain in high demand as semiconductor fabs expand capacity worldwide.

Piotech Inc. and AMEC have emerged as dominant Chinese contenders, capturing significant market share through government-supported R&D initiatives and competitive pricing strategies. These companies benefited from the 20.8% growth in analog semiconductor demand during 2022, requiring advanced wafer processing solutions.

Meanwhile, Shenyang Fortune Precision Equipment strengthened its position through strategic partnerships with major foundries, particularly in the etching equipment segment which accounts for approximately 38% of wafer processing chamber applications. The company's transition chamber technology has become particularly sought-after for 300mm wafer processing.

Established players like Ferrotec and Beneq Group maintain technological leadership in thin film deposition chambers, representing 42% of the market by application. Their continued investment in atomic layer deposition (ALD) and plasma-enhanced chemical vapor deposition (PECVD) technologies helps them compete against lower-cost alternatives.

List of Key Semiconductor Wafer Processing Chamber Manufacturers

Piotech Inc. (China)

AMEC (China)

Shenyang Fortune Precision Equipment (China)

Ferrotec (Japan)

Beneq Group (Finland)

Beijing E-Town Semiconductor Technology (China)

Konfoong Materials International (China)

SPRINT PRECISION TECHNOLOGIES (China)

Foxsemicon Integrated Technology (Taiwan)

Segment Analysis:

By Type

Transition Chambers Lead the Market Due to Critical Role in Vacuum Environment Conversion

The market is segmented based on type into:

Transition Chambers

Reaction Chambers

Others

By Application

Etching Equipment Segment Dominates with Increasing Demand for Precision Semiconductor Manufacturing

The market is segmented based on application into:

Etching Equipment

Thin Film Deposition Equipment

By Region

Asia-Pacific Holds Largest Market Share Owing to Semiconductor Manufacturing Concentration

The market is segmented based on region into:

North America

Europe

Asia-Pacific

South America

Middle East & Africa

By Material

Stainless Steel Chambers Preferred for Their Durability in High-Vacuum Environments

The market is segmented based on material into:

Stainless Steel

Aluminum

Others

Regional Analysis: Semiconductor Wafer Processing Chambers Market

North America The Semiconductor Wafer Processing Chambers market in North America is projected to grow steadily, driven by the region’s strong semiconductor manufacturing ecosystem. Leading companies in the U.S. and Canada are investing heavily in advanced semiconductor fabrication facilities (fabs), fueling demand for high-precision transition and reaction chambers. The U.S. CHIPS and Science Act, which allocated $52.7 billion for domestic semiconductor manufacturing and R&D, is significantly boosting the production capacity of leading-edge nodes. This expansion necessitates cutting-edge wafer processing technologies, positioning North America as a key market for innovative chamber solutions. However, the high cost of semiconductor equipment and strict regulatory compliance for vacuum and automation components remain challenges for market players.

Europe Europe’s Semiconductor Wafer Processing Chambers market is characterized by strong demand from automotive and industrial semiconductor applications, particularly in Germany and France. The EU’s CHIPS Act, which aims to increase Europe’s global semiconductor market share to 20% by 2030, is accelerating investments in wafer fabrication facilities. European semiconductor equipment manufacturers emphasize energy-efficient and contamination-free chamber designs, aligning with stringent EU environmental and safety standards. The presence of key players such as VATValve and Pfeiffer, specializing in vacuum valve and pump solutions, strengthens regional competitiveness. However, the relatively slower adoption of next-gen semiconductor nodes compared to Asia-Pacific and North America slightly limits growth potential.

Asia-Pacific The Asia-Pacific region dominates the Semiconductor Wafer Processing Chambers market, accounting for over 60% of global demand due to high semiconductor production in China, Taiwan, South Korea, and Japan. Countries like China are aggressively expanding domestic wafer fab capacities, supported by government initiatives such as the Made in China 2025 strategy. Taiwan remains a critical hub, housing TSMC and other leading foundries, driving advancements in 3nm and below process nodes. While regional semiconductor equipment manufacturers such as Piotech Inc and AMEC are gaining prominence, dependence on foreign technology for advanced chamber designs presents competition challenges. Rising geopolitical tensions and supply chain disruptions risk could temporarily restrain steady growth.

South America South America’s Semiconductor Wafer Processing Chambers market is nascent but holds potential due to increasing semiconductor investments in Brazil and Argentina. The region primarily relies on imports for semiconductor manufacturing equipment, with limited local production capabilities. Recent government incentives for semiconductor industry development signal gradual market expansion, though financial volatility and weaker supply chain infrastructure hinder rapid adoption. The market remains fragmented, with demand largely centered on legacy node technologies rather than cutting-edge wafer processing chambers required for advanced semiconductor nodes.

Middle East & Africa The Middle East & Africa region is stepping into semiconductor manufacturing, with Saudi Arabia and the UAE announcing plans to build semiconductor fabs as part of economic diversification strategies. Demand for wafer processing chambers is currently niche but growing, primarily serving automotive and IoT semiconductor applications. While funding commitments from sovereign wealth funds indicate long-term potential, the lack of a mature semiconductor ecosystem and reliance on imported equipment slow down immediate market penetration. Partnerships with global semiconductor equipment suppliers remain critical to establish a viable regional supply chain.

Report Scope

This market research report provides a comprehensive analysis of the Global and regional Semiconductor Wafer Processing Chambers markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global Semiconductor Wafer Processing Chambers market was valued at USD million in 2024 and is projected to reach USD million by 2032, at a CAGR of % during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (Transition Chambers, Reaction Chambers, Others), technology, application (Etching Equipment, Thin Film Deposition Equipment), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. In 2022, the semiconductor market saw varied regional performance with Americas growing 17.0%, Europe 12.6%, Japan 10.0%, while Asia-Pacific declined 2.4%.

Competitive Landscape: Profiles of leading market participants including Shenyang Fortune Precision Equipment, NMC, Piotech Inc, AMEC, Ferrotec, and others, covering their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in wafer processing, integration of advanced materials, fabrication techniques, and evolving industry standards in semiconductor manufacturing.

Market Drivers & Restraints: Evaluation of factors driving market growth including semiconductor industry expansion, along with challenges such as supply chain constraints, regulatory issues, and market-entry barriers.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving semiconductor equipment ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Semiconductor Wafer Processing Chambers Market?

-> Semiconductor Wafer Processing Chambers Market size was valued at US$ 3,670 million in 2024 and is projected to reach US$ 6,890 million by 2032, at a CAGR of 9.42% during the forecast period 2025-2032.

Which key companies operate in Global Semiconductor Wafer Processing Chambers Market?

-> Key players include Shenyang Fortune Precision Equipment, NMC, Piotech Inc, AMEC, Ferrotec, Beneq Group, Beijing E-Town Semiconductor Technology, and Konfoong Materials International, among others.

What are the key growth drivers?

-> Key growth drivers include expansion of semiconductor manufacturing capacity, increasing demand for advanced chips, and technological advancements in wafer processing equipment.

Which region dominates the market?

-> Asia-Pacific is the largest market for semiconductor manufacturing equipment, while North America leads in technological innovation.

What are the emerging trends?

-> Emerging trends include miniaturization of semiconductor components, adoption of extreme ultraviolet (EUV) lithography, and development of more efficient vacuum processing chambers.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/hazardous-lighting-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/mobile-document-reader-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gan-drivers-market-outlook-in-key-end.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/airbag-chip-market-research-report-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-peripheral-device-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/single-ended-glass-seal-thermistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/commercial-control-damper-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pcb-board-terminals-market-investment.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/bandpass-colored-glass-filter-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/video-surveillance-hardware-system.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pfc-ics-market-technological.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modulator-bias-controller-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tubular-cable-termination-market-demand.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/logic-buffer-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/broadband-polarizing-beamsplitters.html

0 notes

Text

How Indrajit Sabharwal is Driving Change in Tech & Business

Indrajit Sabharwal is a visionary technocrat and entrepreneur who has led the technology and semiconductor industries, bringing in tremendous changes through innovative approaches and strategic foresight. In this effort, he has been a founder and chairman of Simmtronics, catapulting the company into world domination for the manufacturing of smartphones, tablets, semiconductors, AI solutions, memory modules, motherboards, and IT components.

Early Life and Education

After his graduation in engineering from Pune University, Sabharwal joined ICL UK, now Fujitsu ICIM, in Pune. He was drawing a salary of Rs 1,500 per month. During this period, he pursued three part-time management degrees. He was an earnest learner and prepared himself well for the future.

Entrepreneurial Ventures

In January 1992, Sabharwal founded SI Consultants in Delhi with Rs 10,000 as the initial investment. The consultancy involved business development and IT solutions and ensured major clients such as Modi Lufthansa, Xerox, HP Digital, and Sahara Airlines. Within eight months, the firm generated close to Rs 30 lakh, an out-and-out entrepreneurial initiative on Sabharwal's part.

Incorporation of Simmtronics

Using his industry experience, Indrajit Sabharwal established Simmtronics in 1992. The company initially focused on manufacturing and distributing memory modules and Dynamic Random Access Memory (DRAM) technology, catering to clients such as Tulip Telecomm, HCL, LG, and Sahara. During his tenure, Simmtronics diversified its product range to motherboards, graphic cards, LED monitors, pen drives, micro SD cards, and hard disk drives.

International Business and Innovation

Simmtronics created manufacturing facilities at Bhiwadi, Rajasthan, and Roorkee for catering to demand. It entered the international scenario with the launch of its first distribution subsidiary at Singapore in the year 2005 followed by another in Dubai in the year 2006. In the year 2012, the company operated at 21 offices in 14 countries and consisted of 500 employees. With a consistent 10-12% profit per annum, turnover touched Rs 550 crore. In March 2012, Simmtronics unveiled its line of tablets, comprising 24 customized products developed in-house, which cements its place as a global leader in the realm of integrated manufacturing and on the world's technology map.

Recent Activity

In May 2024, Indrajit Sabharwal revealed his intentions to unveil technology that will revolutionize the semiconductor and technology sectors. The move shows that he is still an innovator and has a clear vision for Simmtronics' growth into the future.

Awards and Recognition

Throughout his long illustrious career, Indrajit Sabharwal has been decorated with several accolades. Some of them include the feature in the Top 100 Magazine for excellence in semiconductors and technology. He is referred to as the "Steve Jobs of India" and the "Guru in Semiconductors" as he represents a visionary leader who had made significant contributions to the industry.

Conclusion

Indrajit Sabharwal's journey from humble beginnings to becoming a luminary in the global technology sector epitomizes resilience, innovation, and visionary leadership. His work has profoundly influenced the semiconductor industry, setting standards of excellence and inspiring future generations of technocrats and entrepreneurs.

0 notes

Text

The Rise of China Solid State Drives Manufacturer: Your Guide to Quality and Innovation

Micro Storage Electronics Technology Co., Limited As a manufacturer of NAND flash memory and DRAM modules, Micro Storage was founded in 2014. After 10 years of unremitting efforts, relying on excellent quality, powerful resources, and professional services as development support, it has achieved a good reputation in the commercial and industrial fields. Today, we will forge ahead and continue to provide higher quality services and comprehensive solutions for end users and industry leaders in the consumer, commercial, and industrial fields.

In the rapidly evolving world of technology, data storage solutions have become a crucial component for both consumers and businesses. As the demand for faster, more reliable storage solutions increases, many companies are turning to China Solid State Drives Manufacturer to meet their needs. This article delves into the benefits of partnering with Chinese manufacturers, the different types of solid-state drives (SSDs) available, and what to consider when selecting the right manufacturer for your business.

1. Understanding Solid State Drives (SSDs)

Before we explore the advantages of collaborating with a China Solid State Drives Manufacturer, it’s important to understand what SSDs are and why they are preferred over traditional hard disk drives (HDDs).

Speed and Performance: SSDs offer significantly faster data access speeds compared to HDDs. This speed is crucial for applications that require quick read and write operations, such as gaming and data processing.

Durability and Reliability: SSDs have no moving parts, making them less susceptible to mechanical failures. This durability makes them ideal for mobile devices and rugged environments.

Energy Efficiency: SSDs consume less power, which translates to longer battery life in laptops and reduced energy costs for enterprises.

Compact Size: The smaller form factor of SSDs allows for more design flexibility in laptops and other electronic devices.

2. Advantages of Partnering with a China Solid State Drives Manufacturer

Choosing a China Solid State Drives Manufacturer offers numerous benefits that can help businesses optimize their storage solutions.

Cost Efficiency: Manufacturers in China often provide competitive pricing due to lower labor and production costs. This affordability can significantly impact your bottom line without compromising on quality.

Diverse Product Range: Chinese manufacturers typically offer a wide variety of SSDs, including SATA, NVMe, and PCIe drives, ensuring that businesses can find products tailored to their specific needs.

Quality Assurance: Many reputable manufacturers in China adhere to strict quality control standards, which ensures that their SSDs meet international quality benchmarks.

Technological Advancements: China is a global leader in technology, with manufacturers continuously innovating to stay ahead in the SSD market. This commitment to R&D translates into better products for customers.

Customization Options: Many manufacturers allow for customization of SSDs, enabling businesses to specify storage capacity, branding, and other essential features.

3. Types of Solid State Drives Offered by Chinese Manufacturers

A China Solid State Drives Manufacturer typically provides various types of SSDs to meet different requirements:

SATA SSDs: The most common type of SSD, SATA drives are widely used in consumer laptops and desktops. They offer a good balance between performance and cost.

NVMe SSDs: Known for their exceptional speed, NVMe drives connect directly to the motherboard, providing significantly faster data transfer rates than SATA SSDs. These drives are ideal for high-performance tasks like gaming and professional applications.

M.2 SSDs: M.2 drives are compact and designed for ultra-thin devices. They can support both SATA and NVMe protocols, offering flexibility in performance.

PCIe SSDs: Utilizing the PCIe interface, these SSDs deliver high-speed data transfers, making them suitable for applications requiring quick read and write speeds.

Industrial SSDs: Built to withstand harsh environments, industrial SSDs are suitable for use in sectors like automotive and aerospace, where durability and reliability are paramount.

4. Key Factors to Consider When Choosing a China Solid State Drives Manufacturer

When selecting a China Solid State Drives Manufacturer, it’s essential to consider several key factors to ensure you make the best choice for your business:

Reputation and Experience: Research the manufacturer’s background, focusing on their experience in the industry and customer reviews. A well-established manufacturer is more likely to deliver reliable products.

Quality Certifications: Look for manufacturers that hold international quality certifications, such as ISO 9001 or CE, which demonstrate compliance with recognized quality standards.

Technological Capabilities: Assess the manufacturer’s commitment to research and development. Companies that invest in R&D are more likely to offer cutting-edge products.

Production Capacity: Ensure that the manufacturer has the capacity to meet your volume needs. A reliable manufacturer should be able to handle both small and large orders efficiently.

Customization Services: Check if the manufacturer offers customization options, such as specific storage capacities or branding features, to align with your business requirements.

Customer Support: Reliable after-sales support is critical for addressing any issues that may arise post-purchase. Choose a manufacturer that provides robust customer service and warranty options.

5. Leading China Solid State Drives Manufacturers

Several prominent manufacturers in China have established themselves as leaders in the SSD market. Here are a few noteworthy companies:

a. Kingston Technology

Kingston is a globally recognized brand known for its high-quality memory and storage solutions. Their SSD offerings include a wide range of products designed for both consumers and enterprises.

b. ADATA Technology Co., Ltd.

ADATA specializes in high-performance memory and storage solutions. Their SSDs are known for their reliability and performance, catering to various user needs.

c. Longsys Electronics Co., Ltd.

Longsys focuses on developing innovative storage solutions, including SSDs that are widely used in consumer electronics and industrial applications.

d. Netac Technology Co., Ltd.

Netac offers a diverse range of SSDs, including consumer and enterprise solutions, with a strong emphasis on quality and performance.

e. Team Group Inc.

Team Group provides a variety of SSD products, including budget-friendly options, making them a popular choice for both individual consumers and businesses.

6. Challenges When Working with a China Solid State Drives Manufacturer

While partnering with a China Solid State Drives Manufacturer presents many benefits, there are also challenges to consider:

Quality Variability: The quality of SSDs can vary significantly among manufacturers. It's crucial to conduct thorough research and request samples to ensure you receive reliable products.

Communication Barriers: Language and cultural differences can sometimes lead to misunderstandings. Establishing clear communication channels is essential to overcome this challenge.

Logistical Complications: International shipping can introduce delays and complications. Working with manufacturers experienced in global logistics can help streamline the process.

Regulatory Compliance: Ensure that the manufacturer adheres to international regulations regarding product safety and environmental standards.

7. The Future of SSD Manufacturing in China

The future of SSD manufacturing in China looks promising, driven by several emerging trends:

Increased Investment in R&D: Chinese manufacturers are expected to continue investing in research and development to innovate and improve their product offerings.

Rising Demand for Data Storage Solutions: With the increasing reliance on cloud computing and big data analytics, the demand for high-performance SSDs is projected to rise significantly.

Sustainability Initiatives: Many manufacturers are likely to adopt eco-friendly practices, responding to the growing global demand for sustainable products.

Expansion into Emerging Markets: As the adoption of SSDs grows in sectors such as automotive, healthcare, and IoT, Chinese manufacturers will likely broaden their product offerings to cater to these diverse needs.

8. Steps to Establish a Successful Partnership with a China Solid State Drives Manufacturer

To effectively collaborate with a China Solid State Drives Manufacturer, consider the following steps:

Conduct Thorough Research: Investigate potential manufacturers, focusing on their reputation, product offerings, and customer feedback.

Request Samples: Before committing to large orders, request samples to evaluate the quality and performance of the SSDs.

Negotiate Terms Clearly: Discuss pricing, payment options, and delivery schedules to ensure both parties are aligned on expectations.

Visit Manufacturing Facilities: If feasible, visiting the supplier’s facilities can provide insights into their production capabilities and quality control measures.

Establish Effective Communication: Set up direct communication channels for ongoing interactions to ensure alignment on expectations and address any concerns promptly.

Monitor Orders and Provide Feedback: Keep track of your orders and maintain open communication to address issues promptly and provide feedback on product performance.

9. Conclusion: The Path to Reliable Data Storage Solutions

In conclusion, partnering with a China Solid State Drives Manufacturer can significantly enhance your business's data storage capabilities. With numerous advantages, including cost efficiency, a diverse product range, and technological innovation, Chinese manufacturers are well-positioned to meet the growing demand for high-quality SSDs.

By understanding the types of SSDs available, evaluating key factors when choosing a manufacturer, and being aware of the challenges, businesses can make informed decisions that align with their technological needs. Embracing the partnership with a reliable manufacturer will not only lead to improved efficiency and performance but also set a solid foundation for future growth in a data-driven world. As technology continues to advance, the role of SSDs will become increasingly critical, and choosing the right manufacturing partner is essential for success.

1 note

·

View note

Text

How to Contact Support for MT48LC4M32B2P-7 IT

If you've ever found yourself struggling to get assistance for a technical product, you know how frustrating the experience can be. Whether you need a datasheet, troubleshooting tips, or general product support, contacting the right help center for your needs can save you time and effort. Today, we're diving into the world of the MT48LC4M32B2P-7 IT, a commonly used DRAM module, and how you can reach out to the right support teams for assistance. Whether you're an engineer working on a project or someone just starting to dabble in electronics, we've got you covered.

What is MT48LC4M32B2P-7 IT?

The MT48LC4M32B2P-7 IT is a high-speed, low-power DRAM (Dynamic Random Access Memory) module commonly used in various electronics, from computers to embedded systems. Its wide-ranging applications make it a versatile memory chip. Whether you're working on high-end industrial applications or home electronics, this component plays a crucial role in data storage and processing.

Why You Might Need Support for This Module

Even though the MT48LC4M32B2P-7 IT is a reliable DRAM module, there are multiple reasons you might need to reach out to customer support. Perhaps you’re having issues with installation, or maybe you're experiencing unexpected behavior in a project. Here are a few reasons you might need help:

Installation problems: Ensuring the module is correctly installed in your circuit can be tricky.

Product specifications: You might need clarity on certain electrical characteristics.

Troubleshooting: When the module doesn't perform as expected, it can be hard to pinpoint the exact issue.

Firmware compatibility: Some issues arise from mismatches between the DRAM and the system it’s connected to.

Warranty and replacements: If your module is malfunctioning, understanding the warranty or replacement process is vital.

How to Locate the Manufacturer's Support

The first place you should look for support is the product's manufacturer. For the MT48LC4M32B2P-7 IT, the manufacturer is Micron Technology, a well-established name in the semiconductor industry. Finding their support team is easy with these steps:

Visit Micron's Official Website: Head over to the Micron website (https://www.micron.com/).

Navigate to the Support Section: Once on the site, click on the “Support” tab, usually located at the top or bottom of the page.

Search for the Product: Use the search bar to locate the MT48LC4M32B2P-7 IT module.

Access Product Information: You'll likely find FAQs, product datasheets, and support documentation right there.

Direct Ways to Contact the Manufacturer

If you can'"t find the answer through the website, there are several ways you can directly reach out to Micron's support team:

Customer Support Hotline: Micron provides a customer service phone number. Look for this on their "Contact Us" page.

Email Support: For more technical or detailed questions, you might prefer to email their support team. Emails are often responded to within 24-48 hours.

Live Chat: Some users prefer real-time answers, and the live chat option is often available on the website during business hours.

Using Online Resources for Assistance

If official channels are not available, you can also turn to the vast number of online resources available. Websites like StackExchange, EEVblog, and Reddit's electronics forum are valuable places where experienced users and professionals discuss similar problems. You can search for solutions or post your questions to get advice from the community.

Checking Documentation and Datasheets

One of the most useful resources at your disposal is the product datasheet. For the MT48LC4M32B2P-7 IT, you can download the datasheet directly from Micron’s website. The datasheet will contain:

Pin configurations and diagrams

Electrical characteristics

Operating conditions

Recommended usage practices

Reading through this documentation can answer many of your initial questions before you even need to reach out to support.

Troubleshooting Common Issues

Before contacting customer service, try troubleshooting the problem yourself. Common issues include:

Incorrect installation: Ensure the pins of the module are seated properly.

Overheating: Make sure the module isn’t running too hot.

Compatibility issues: Verify that your system supports this specific DRAM module.

By addressing these common problems, you might save yourself the effort of waiting for support.

Engaging in Online Forums and Communities

The electronics community is vast, and it’s always helpful to tap into this pool of knowledge. Websites like Electronics StackExchange or Tom's Hardware often have forums where similar issues are discussed. If you're facing a problem with your MT48LC4M32B2P-7 IT, chances are someone else has too. You can either search for your issue or start a thread to get personalized assistance.

Exploring Third-Party Repair Services

If you’re unable to troubleshoot the problem yourself, you might need to look into third-party repair services. Many local electronic repair shops or online services specialize in fixing hardware issues. They can help diagnose whether your MT48LC4M32B2P-7 IT module needs replacing or if it can be repaired.

Preparing to Contact Support: What You Need

Before you reach out to the support team, it's important to gather all necessary information to expedite the process. Here's what you should have on hand:

Product number and specifications: Having the exact product number (MT48LC4M32B2P-7 IT) helps the support team identify your module.

System setup information: Document how and where the module is being used (what system, firmware, etc.).

Issue details: Be ready to describe the problem in detail—when it started, what’s been tried, and any error codes or unusual behavior.

Tips for Efficient Communication

When contacting any support service, efficiency is key. To avoid delays, be concise but clear in your communication:

State the problem clearly: Avoid long-winded explanations. Stick to the facts.

Be polite: Support teams are more likely to go the extra mile for polite customers.

Follow up if necessary: If your issue isn't resolved within the expected timeframe, don’t hesitate to follow up.

Understanding Warranty and Replacement Policies

One key reason to contact support is to explore warranty options. If your MT48LC4M32B2P-7 IT module is faulty or has stopped working unexpectedly, Micron may offer a replacement. Be sure to review the product’s warranty terms, which can typically be found in the product packaging or on the Micron website.

When to Seek Professional Help

If your problem persists after contacting support and trying all the troubleshooting steps, it may be time to seek professional assistance. Certified technicians or Micron-approved service providers can give you the support you need to get your system back on track.

Preventing Issues with Proper Maintenance

As the old saying goes, “Prevention is better than cure.” Regular maintenance of your electronics, including cleaning dust from the DRAM module, ensuring proper ventilation, and adhering to the manufacturer's recommendations for use, can significantly reduce the likelihood of problems arising in the first place.

Conclusion: Your Support Journey

In conclusion, getting help with your MT48LC4M32B2P-7 IT module is easier than it might seem. With multiple avenues of support—ranging from Micron’s direct support channels to online communities and third-party services—you’ll be back on track in no time. Just remember, preparation and clear communication are your best tools in making the process as smooth as possible.

0 notes

Text

The Dynamics of Bulk RAM Suppliers in the Global Market

In the rapidly evolving landscape of technology, Random Access Memory (RAM) stands as a fundamental component that fuels the performance of devices ranging from smartphones to supercomputers. The demand for RAM continues to surge as advancements in artificial intelligence, cloud computing, and big data analytics drive the need for faster and more efficient memory solutions. At the heart of this demand lies the critical role played by bulk RAM suppliers in the global market.

Understanding Bulk RAM Suppliers

Bulk RAM suppliers are entities that specialize in the mass production and distribution of memory modules to various industries and sectors worldwide. These suppliers operate within a highly competitive environment where factors such as price, quality, and technological advancements significantly influence market dynamics. Key players in this industry include major semiconductor manufacturers like Samsung Electronics, Micron Technology, and SK Hynix, among others.

Market Dynamics and Trends

The market for bulk RAM is characterized by several key trends that shape its growth and development:

1. Technological Advancements: The continuous evolution of semiconductor technology drives innovations in RAM, leading to higher capacities, faster speeds, and improved energy efficiency. Suppliers invest heavily in research and development to maintain a competitive edge in this rapidly advancing field.

2. Demand from Emerging Technologies: Emerging technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) require robust memory solutions to handle vast amounts of data in real-time. This demand amplifies the need for reliable bulk RAM suppliers capable of scaling production to meet market requirements.

3. Global Supply Chain Challenges: The semiconductor industry, including bulk RAM suppliers, faces challenges related to supply chain disruptions, geopolitical tensions, and fluctuating raw material prices. These factors can impact production capabilities and lead to supply shortages or price volatility.

4. Shift Towards Mobile and Cloud Computing: With the proliferation of smartphones, tablets, and cloud computing services, there is a growing demand for mobile DRAM and server-grade RAM. Bulk RAM suppliers must cater to diverse product specifications while ensuring compatibility and performance across different platforms.

Key Players in the Industry

1. Samsung Electronics: As a global leader in semiconductor technology, Samsung Electronics dominates the market with its extensive range of DRAM and NAND memory solutions. The company’s vertical integration and advanced manufacturing capabilities enable it to maintain a competitive position in the bulk RAM market.

2. Micron Technology: Based in the United States, Micron Technology is renowned for its innovations in memory and storage solutions. The company focuses on delivering high-performance DRAM and NAND products tailored to meet the needs of various industries, including consumer electronics and enterprise computing.

3. SK Hynix: Headquartered in South Korea, SK Hynix has emerged as a key player in the semiconductor industry, offering a diverse portfolio of memory solutions ranging from mobile DRAM to high-capacity server memory. The company’s strategic partnerships and technological expertise contribute to its significant presence in the global bulk RAM market.

Challenges and Opportunities

Despite the robust growth prospects, bulk RAM suppliers face several challenges that warrant strategic considerations:

Intellectual Property Rights: The semiconductor industry is heavily regulated, with stringent intellectual property laws governing product development and innovation. Bulk RAM suppliers must navigate these legal complexities to safeguard their technological advancements and market competitiveness.

Environmental Sustainability: The manufacturing processes involved in producing bulk RAM can have significant environmental impacts, including energy consumption and waste generation. Suppliers are increasingly focusing on sustainable practices and green technologies to mitigate these effects and meet regulatory requirements.

Global Economic Uncertainty: Economic fluctuations, trade policies, and currency exchange rates can influence market demand and profitability for bulk RAM suppliers. Strategic diversification and risk management strategies are essential to navigate these uncertainties effectively.

Future Outlook

Looking ahead, the future of bulk RAM suppliers appears promising with continued advancements in technology and expanding applications across various industries. Key areas of focus include:

5G Expansion: The rollout of 5G networks will drive demand for high-speed memory solutions capable of supporting enhanced mobile connectivity and bandwidth-intensive applications.

Artificial Intelligence and Edge Computing: The proliferation of AI-driven technologies and edge computing platforms will necessitate innovative memory solutions that can deliver low-latency performance and high reliability.

Next-Generation Computing: Quantum computing, neuromorphic computing, and other disruptive technologies will create new opportunities for bulk RAM suppliers to innovate and differentiate their product offerings.

Conclusion

In conclusion, bulk RAM suppliers play a pivotal role in the global semiconductor industry, catering to diverse technological needs and market demands. As the demand for faster, more efficient memory solutions continues to grow, these suppliers must remain agile, innovative, and responsive to evolving market dynamics. By embracing technological advancements and strategic partnerships, bulk RAM suppliers can capitalize on emerging opportunities and maintain a competitive edge in this dynamic and rapidly evolving market landscape.

WANT TO BUY RAM in BULK?

VALUETECH is a premier global supplier specializing in bulk RAM distribution, catering to diverse business needs worldwide. Renowned for reliability and excellence, VALUETECH offers a comprehensive range of RAM models at competitive prices, tailored to meet the demands of large corporations, educational institutions, and government agencies. With a commitment to quality and customer satisfaction, VALUETECH ensures seamless procurement processes, from personalized quotations to efficient logistics and support services. Whether scaling up operations, upgrading technology infrastructure, or launching new initiatives, businesses trust VALUETECH for their bulk RAM purchases, backed by extensive industry expertise and a dedication to delivering superior products and services on a global scale.

0 notes

Text

SK Hynix Platinum P41 SSD Sparks Up COMPUTEX Taipei 2024

SK Hynix Platinum P41 SSD

Beginning in June, SK Hynix showcased its cutting-edge AI memory solutions at COMPUTEX Taipei 2024. Under the topic “Connecting AI,” COMPUTEX Taipei 2024, one of Asia’s leading IT exhibitions, drew in about 1,500 international attendees, including tech firms, venture capitalists, and accelerators. SK Hynix made its debut at the event and highlighted with its array of next-generation products that it is a leader in AI memory and a first mover.

“Connecting AI” with top AI memory solutions

“Linking Artificial Intelligence” SK Hynix’s booth showcased its cutting-edge AI server solutions, innovative technologies for on-device AI PCs, and exceptional consumer SSD goods, all under the theme “Memory, The Power of AI.”

High bandwidth and capacity memory solutions from SK Hynix are tailored for AI systems.

Among the AI server solutions on show was HBM3E, the fifth version of HBM. With its enormous capacity, superior heat dissipation capability, and industry-leading 1.18 terabytes (TB) per second data processing performance, HBM3E is designed to satisfy the demands of AI servers and other applications.

High Bandwidth Memory

A high-performance, high-value product that connects numerous DRAMs vertically using through-silicon via (TSV) to achieve substantially faster data processing speeds than current DRAMs.

CXL is another technology that has proven essential for AI servers since it may boost processing power and system bandwidth. By introducing its CXL Memory Module-DDR5 (CMM-DDR5), which dramatically increases system bandwidth and capacity in comparison to systems that are merely outfitted with DDR5, SK Hynix demonstrated the strength of its CXL portfolio. The server DRAM products DDR5 RDIMM and MCR DIMM were among the other AI server solutions on exhibit. SK Hynix, in instance, debuted their towering 128-gigabyte (GB) MCR DIMM at an exhibition.

Compute Express Link

High-performance computing systems are built using this next-generation PCIe-based interconnect technology.

Double Data Rate 5

A server DRAM that provides improved bandwidth and power efficiency over the previous generation, DDR4, to successfully manage the growing needs of larger and more complex data workloads.

Registered Dual In-line Memory Module

The Registered Dual In-line Memory Module (RDIMM) is a high-density memory module designed to connect DRAM dies vertically in servers and other applications.

Multiplexer Combined Ranks Dual In-line Memory Module

All-Time Multiplexer Ranks The Dual In-line Memory Module (MCR DIMM) is a motherboard-bonded module product that combines multiple DRAMs to operate two rank-one basic information processing units at the same time, improving speed.

Additionally, several of the company’s business SSDs (eSSD), such as the PS1010 and PE9010, were on display for visitors to the stand. Specifically, the fast sequential read speed of the PCIe Gen5-based PS1010 makes it perfect for AI, big data, and machine learning applications. Furthermore, by introducing its flagship devices, the D5-P5430 and D5-P5336, which have ultrahigh capacities of up to 30.72 TB and 61.44 TB, respectively, SK Hynix’s U.S. subsidiary Solidigm enhanced the eSSD range.

Peripheral Component Interconnect Express

Digital device motherboards employ PCIe, or peripheral component interconnect express, a high-speed input/output interface with a serialisation format.

SK Hynix demonstrated its ground-breaking memory solutions for on-device AI PCs, in keeping with the expanding on-device AI trend. Among them was PCB01, a PCIe Gen5 client SSD for on-device AI that has the fastest sequential read and write speeds in the business at 14 gigabytes per second (GB/s) and 12 GB/s, respectively. In addition to PCB01, SK Hynix showcased other products designed for on-device AI PCs, such as GDDR7, the next generation graphic DRAM, and LPCAMM2, a module solution that can replace two DDR5 SODIMMs with the same performance.

On-device AI

Unlike cloud-based AI services, which depend on a distant cloud server, on-device AI does AI computation and inference directly within devices like PCs or smartphones.

Low Power Compression Attached Memory Module 2

Minimal Power Compression The LPDDR5X-based Attached Memory Module 2 (LPCAMM2) module solution provides great performance, power efficiency, and space reductions.

Small Outline Dual In-line Memory Module

The server DRAM known as a Small Outline Dual In-line Memory Module (SODIMM) is smaller than the standard DIMM found in desktop computers.

Platinum P41 SSD

Additionally, attendees might get a look at consumer SSDs from SK Hynix. The incredibly dependable consumer SSD Platinum P51 and Platinum P41, which provide great speed to improve PC performance, were on exhibit at the event. The Platinum P51, which is scheduled for mass production later in 2024, makes use of SK Hynix’s “Aries,” the first high-performance internal controller in the industry. With sequential read and write speeds of up to 14 GB/s and 12 GB/s, respectively, Platinum P51 roughly doubles the speed capabilities of Platinum P41, the previous version. This loads AI training and inference LLMs in under a second.

Large language model

Generative AI problems require LLMs to construct, summarise, and translate texts using massive data sets.

At the presentation, a revised version of the portable SSD Beetle X31 was also revealed. With a USB 3.2 Gen 2 interface, this small and fashionable SSD can operate at a speedy 10 gigabits per second (Gbps). In the third quarter of 2024, SK Hynix intends to release the higher-capacity 2 TB version in addition to the current 512 GB and 1 TB variants.

SK Hynix Platinum P41

A prominent 2024 Red Dot Design Award was given to SK Hynix’s stick-type SSD Tube T31 and heat sink for Platinum P41, Haechi H02, earlier in May, highlighting the SSD lineup’s exceptional design.

Finally, SK Hynix’s ESG strategy which included enhancing the energy efficiency of its products was showcased at the show. The company’s selection of energy-efficient products is especially well-suited for enhancing the sustainability of AI applications, which have high power requirements.

Maintaining the Advancement of AI Memory

In keeping with the COMPUTEX Taipei 2024 theme, SK Hynix is working to develop its technology in order to contribute to the realisation of a day when “Connecting AI” is a common occurrence. To advance its AI memory capabilities, the company will keep taking part in international conferences that showcase the newest developments in the sector.

Read more on Govindhtech.com

#SKHynix#cuttingedgeAI#ArtificialIntelligence#AIsystems#AImemory#ddr5#CXLMemory#ssd#Largelanguagemodel#AIapplications#news#technews#technology#technologynews#technologytrends#govindhtech

0 notes

Text

Presenting the OK3588-C Development Board Featuring the Rockchip RK3588

Introduction:

In March of this year, I attended the Embedded World Exhibition, which focuses on embedded systems. During my visit, I explored the Forlinx booth. Forlinx is renowned for developing System on Modules (SoMs) and Evaluation Boards for industrial PCs. I previously acquired an evaluation board from Forlinx last year. This year, I am excited to present the new Forlinx OK3588-C board in this video.

youtube

Presenting the OK3588-C Development Board (featuring a Rockchip RK3588)

Today, we will explore the Forlinx OK3588-C board. Allow me to switch off the camera and transition to the desktop view.

Here, I have the hardware manual for the OK3588 board. If you require this hardware manual or the necessary SDKs to develop software for this board, please contact Forlinx, and they will provide you with the required resources.

SoM Appearance Diagram:

The evaluation board comprises two primary components. Firstly, this is the physical appearance. Here, we have the System on Module (SoM) mounted on a carrier board, which connects all peripherals to the SoM.

Let's begin by examining the System on Module. This module includes the Rockchip RK3588 main processor, two DRAM ICs, and eMMC storage for non-volatile data. Various components on the module generate the required voltages for the chip's operation. The Rockchip RK3588 is a robust processor.

RK3588 Description:

Displayed here is a block diagram of the RK3588. It features a dual-cluster core configuration. One cluster consists of a quad-core Cortex-A76 processor clocked at 2.6 GHz, and the second cluster includes a quad-core Cortex-A55 processor, clocked at either 1.5 or 1.8 GHz. This setup allows for power-saving capabilities by disabling the A76 cores when full performance is not required.

Another notable feature is the high-performance Neural Processing Unit (NPU), which is advantageous for tasks related to artificial intelligence and machine learning. In the future, I hope to demonstrate the NPU's capabilities.

The chip also includes a multimedia processor supporting various video decoders, even up to 8K resolution, and an embedded Mali-G GPU. For external memory interfaces, it has two eMMC controllers and support for LPDDR4 and LPDDR5. Additionally, it includes standard system peripherals, such as USB OTG 3.1, PCIe interfaces, Gigabit Ethernet, GPIO, SPI, and I²C.

Development Board Interface Description:

The carrier board includes numerous peripherals. There is a 12V power supply, a power switch, a reset switch, up to five camera connectors, microphone and speaker connectors, USB 2.0 host, and two USB 3.1 OTG ports. These USB ports can function as either hosts or devices. It also features two HDMI ports (one input and one output), a real-time clock with a battery, eDP ports, ADC connectors, an SD card slot, a fan connector, and M.2 slots for Wi-Fi and cellular cards.

The board also includes two full-size PCIe connectors, user buttons, CAN interfaces, an RS485 interface, a USB-to-serial adapter, and two Gigabit Ethernet ports. The overall setup is impressive.

Operation:

Let's power on the board. I have also connected a PCIe card to a free slot. Before proceeding, let's open the serial terminal to monitor the output.

The board is booting, and the kernel is starting successfully. Currently, we are running a minimal BusyBox root file system. In a future video, I will demonstrate how to build a custom Linux for this board. For now, this setup is sufficient.

We are running kernel version 5.10.66, built for ARM64 architecture. The board has eight processors, consisting of different Cortex-A cores. The available memory is 3.6 GB, with 155 MB currently in use. Background processes and the Mali GPU likely consume some memory.

We have eight I²C buses available, with one connected to the display connector for Display Data Channel (DDC) management.

The eMMC storage has multiple partitions. The board features seven GPIO chips and eight I²C connectors.

Lastly, I have connected a PCIe card, and the system detects it successfully. The card operates at PCIe Gen 1 speed with a link width of x1. Higher-end cards could achieve link speeds up to 8 GT/s and wider link widths.

This concludes the initial demonstration of the OK3588 board. In future videos, I will compile software for this board. Thank you for watching.

Originally published at www.forlinx.net.

0 notes

Text

Global Top 5 Companies Accounted for 85% of total Dynamic Random Access Memory (DRAM) market (QYResearch, 2021)

Dynamic random access memory (DRAM) is a type of semiconductor memory that is typically used for the data or program code needed by a computer processor to function.

Dynamic random access memory, or DRAM, is a specific type of random access memory that allows for higher densities at a lower cost.

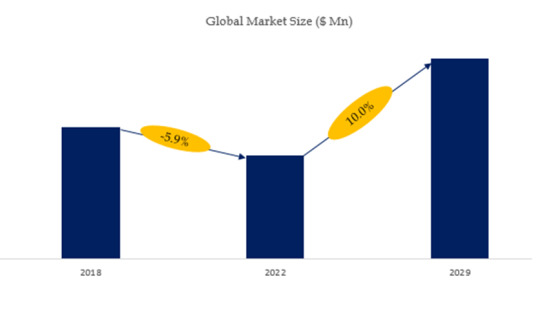

According to the new market research report “Global Dynamic Random Access Memory (DRAM) Market Report 2023-2029”, published by QYResearch, the global Dynamic Random Access Memory (DRAM) market size is projected to reach USD 146.64 billion by 2029, at a CAGR of 10.0% during the forecast period.

Figure. Global Dynamic Random Access Memory (DRAM) Market Size (US$ Million), 2018-2029

Figure. Global Dynamic Random Access Memory (DRAM) Top 5 Players Ranking and Market Share(Based on data of 2021, Continually updated)

The global key manufacturers of Dynamic Random Access Memory (DRAM) include Samsung Electronics Co. Ltd., SK Hynix Inc., Micron Technology Inc., Nanya Technology Corporation, Winbond Electronics Corporation, Company 6, Company 7, Company 8, Company 9, Company 10, etc. In 2021, the global top five players had a share approximately 85.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

For more information, please contact the following e-mail address:

Email: [email protected]

Website: https://www.qyresearch.com

0 notes

Text

Navigating the Global DRAM Module and Component Market: Trends and Insights

The global DRAM module and components market, valued at USD 94.9 billion in 2021, is projected to witness steady growth, reaching USD 110.7 billion by 2027, with a compound annual growth rate (CAGR) of 1.2% during the forecast period from 2022 to 2027. This comprehensive analysis, compiled in a research report by MarketsandMarkets, delves into key market dynamics, growth drivers, and regional trends shaping the trajectory of the DRAM industry.

Download PDF Brochure:

Key Market Dynamics:

Emergence of 5G Technology: The advent of 5G technology is a significant driver fueling the demand for DRAM module and components. The rollout of 5G networks necessitates enhanced data processing capabilities, driving the need for high-performance memory solutions across various end-user industries.

Growth in Automotive Sector: The automotive industry's increasing reliance on advanced electronics and connectivity features is propelling the demand for DRAM module and components. From in-vehicle infotainment systems to advanced driver assistance systems (ADAS), DRAM plays a vital role in powering next-generation automotive technologies.

Adoption of High-End Smartphones: The proliferation of high-end smartphones and tablets is driving demand for LPDRAM module and components. As consumers seek devices with enhanced processing power and multitasking capabilities, the demand for efficient and high-capacity memory solutions continues to rise.

Market Segmentation and Analysis:

LPDRAM Module and Component Segment: LPDRAM dominates the market share, driven by its widespread adoption in battery-operated devices such as smartphones and tablets.

Servers Application: Servers segment holds the largest market share, fueled by the increasing demand for data centers and network infrastructure to support the growing digital ecosystem.

APAC Market Dominance: APAC emerges as the largest and fastest-growing market for DRAM module and components, driven by the region's technological advancements, early adoption of advanced technologies, and growing demand for high-performance devices.

Impact of COVID-19: The COVID-19 pandemic has had a significant impact on the global economy, including the DRAM module and components market. Disruptions in manufacturing and supply chains, coupled with fluctuating demand, have influenced market dynamics across regions. However, strategic collaborations, research, and development activities continue to drive innovation and resilience in the industry.

Key Market Players:

Leading companies in the DRAM module and components market include Samsung Electronics Co., Ltd., SK Hynix Inc., Micron Technology, Inc., Nanya Technology Corporation, and others. These players are actively engaged in research and development initiatives to address evolving market demands and capitalize on growth opportunities.

As the global demand for high-performance memory solutions continues to escalate, the DRAM module and components market present lucrative opportunities for stakeholders across industries. By leveraging technological advancements and strategic partnerships, market players can navigate the evolving landscape and drive innovation in memory technologies.

0 notes

Text

Product Lifecycle Management Market Share, Size, Future Demand, and Emerging Trends

The DRAM module and component market will power at a rate of 1.40% during 2022–2030, to touch USD 111.1 billion by 2030.

The development acceptance of IoT and 5G, growing data center count, and increasing use of DRAM modules and components in numerous industries are the main factors powering the growth of the industry.

The above 8 GB category will have the largest share and grow at a rate of 1.6% in the years to come. It is because of the necessity for a high memory capacity for the storage, processing, and high-volume data transmission.

The rate at which data is generated has been observing a considerable growth in the last ten years or so. The processing of heavy data has also become common these days as a result of the introduction of numerous advanced tech products and solutions. This requires to frequently update them, for effective functioning.

Automobiles will grow at a rate of over 1.6% in the years to come.

The growth can be credited to the introduction of cutting-edge digital devices and uses for improved performance and user experience development, by allowing a more-contented and safer drive.

The rising acceptance of IoT devices, automation solutions, and distant access applications in automobiles would principally contribute toward the growth of the industry.

Access Report Summary - Product Lifecycle Management Market Segmentation Analysis Report

Moreover, it will grow at a rate of 1.6% in the future, credited to the development of the semiconductor industry and the development in the requirement for smart electronic devices from India and China.

With the fast pace at which the acceptance of smart digital devices in the countries of the region is progressing, a stimulation of the requirement for DRAM modules and components, as a result of their capability to cater to the memory necessities of those devices, is likely

It is because of the increasing number of data centers, all over the world, the demand for DRAM module and component will continue to grow in the years to come.

0 notes

Text

Product introduction roadmap and agent information of the world's top five storage vendors

Followings are some datas collected from Lansheng Technology.

1. Samsung

As the world's leading electronics company, Samsung Electronics' business covers consumer electronics, IT and mobile communications, equipment solutions, etc., especially in the field of DRAM and NAND Flash semiconductor storage, Samsung Electronics has long ranked first in the world.

According to TrendForce data, Samsung's global market share in the DRAM and NAND markets will reach 43% and 33% respectively in 2022, making it the core supplier of the global memory chip industry.

Samsung Electronics was founded in 1969. It developed 256Kb DRAM in 1984, successfully developed the world's first 64Mb DRAM in 1992, developed the first 1Gb NAND flash memory in 1999, successfully developed 3D V-NAND technology in 2013, and mass-produced it in 2018. LPDDR5 DRAM, currently Samsung’s 10nm process and extreme ultraviolet lithography (EUV) technology has developed a large-capacity 512GB DDR5 memory module. At the same time, its 8th generation V-NAND memory layer number has reached 236. The company’s storage technology is at Global leading position.

2. Micron Technology

Micron Technology was founded in the United States in 1978. As one of the world's largest manufacturers of semiconductor storage and imaging products, its main businesses include DRAM, NAND flash memory, NOR flash memory, CMOS image sensors, etc.

In 2022, Micron Technology ranked third in the global DRAM market with a market share of 25%, and ranked fifth in the global NAND market with a market share of 12%.