#DRAM Module and Component Market

Explore tagged Tumblr posts

Text

DRAM Module and Component: Powering High-Performance Computing and Electronics

Dynamic Random-Access Memory (DRAM) modules and components are integral to modern computing and electronic devices, providing essential memory storage for data processing and system operations. DRAM is a type of volatile memory that requires constant power to maintain stored information, and it is widely used in computers, servers, smartphones, and other electronic devices. DRAM modules come in various configurations and capacities, designed to meet the performance and memory needs of different applications. The ongoing advancements in DRAM technology continue to enhance speed, capacity, and energy efficiency.

The DRAM Module and Component Market, valued at USD 97.24 billion in 2022, is projected to reach USD 108.68 billion by 2030, growing at a compound annual growth rate (CAGR) of 1.4% during the forecast period from 2023 to 2030.

Future Scope

The future of DRAM modules and components is characterized by significant advancements aimed at increasing memory density, speed, and energy efficiency. Innovations include the development of new DRAM architectures, such as DDR5 and beyond, which offer higher data transfer rates and improved power efficiency. The integration of DRAM with emerging technologies like artificial intelligence (AI) and machine learning is expected to drive demand for specialized memory solutions that support high-performance computing. Additionally, advancements in memory stacking and 3D DRAM technologies will enable more compact and high-capacity memory solutions for a wide range of applications.

Trends

Key trends in the DRAM market include the transition to higher-speed memory standards, such as DDR5, which offers significant improvements in data transfer rates and overall performance. The focus on energy efficiency is driving the development of low-power DRAM solutions that reduce power consumption in mobile and embedded devices. The growing demand for high-performance computing and data centers is influencing the development of high-capacity and high-bandwidth DRAM modules. Additionally, advancements in memory technology, such as 3D DRAM stacking, are enabling the creation of more compact and efficient memory solutions.

Applications

DRAM modules and components are used in a wide range of applications, including personal computers, servers, smartphones, and tablets. In computing systems, DRAM provides fast and temporary storage for data being processed by the CPU. Servers and data centers rely on high-capacity DRAM to handle large volumes of data and support demanding applications. In mobile devices, DRAM supports smooth and responsive operation by providing quick access to frequently used data. Additionally, DRAM is used in gaming consoles, automotive systems, and industrial electronics to enhance performance and functionality.

Solutions and Services

Manufacturers and service providers offer a range of solutions and services for DRAM modules and components. Solutions include the design and production of DRAM modules with various capacities, speeds, and configurations to meet different application requirements. Services encompass memory testing, validation, and integration support to ensure optimal performance and compatibility with other system components. Customization options are available for specialized memory needs, and companies provide research and development support to advance DRAM technology and explore new applications. Additionally, technical support and consulting services help optimize memory solutions for specific use cases.

Key Points

DRAM modules and components provide essential memory storage for computing and electronic devices.

Future advancements focus on higher-speed memory standards, energy efficiency, and memory stacking technologies.

Trends include the adoption of DDR5, energy-efficient solutions, high-performance computing demand, and 3D DRAM.

Applications span personal computers, servers, smartphones, tablets, gaming consoles, and industrial electronics.

Solutions and services include DRAM module design, memory testing, integration support, customization, and R&D support.

0 notes

Text

Navigating the Global DRAM Module and Component Market: Trends and Insights

The global DRAM module and components market, valued at USD 94.9 billion in 2021, is projected to witness steady growth, reaching USD 110.7 billion by 2027, with a compound annual growth rate (CAGR) of 1.2% during the forecast period from 2022 to 2027. This comprehensive analysis, compiled in a research report by MarketsandMarkets, delves into key market dynamics, growth drivers, and regional trends shaping the trajectory of the DRAM industry.

Download PDF Brochure:

Key Market Dynamics:

Emergence of 5G Technology: The advent of 5G technology is a significant driver fueling the demand for DRAM module and components. The rollout of 5G networks necessitates enhanced data processing capabilities, driving the need for high-performance memory solutions across various end-user industries.

Growth in Automotive Sector: The automotive industry's increasing reliance on advanced electronics and connectivity features is propelling the demand for DRAM module and components. From in-vehicle infotainment systems to advanced driver assistance systems (ADAS), DRAM plays a vital role in powering next-generation automotive technologies.

Adoption of High-End Smartphones: The proliferation of high-end smartphones and tablets is driving demand for LPDRAM module and components. As consumers seek devices with enhanced processing power and multitasking capabilities, the demand for efficient and high-capacity memory solutions continues to rise.

Market Segmentation and Analysis:

LPDRAM Module and Component Segment: LPDRAM dominates the market share, driven by its widespread adoption in battery-operated devices such as smartphones and tablets.

Servers Application: Servers segment holds the largest market share, fueled by the increasing demand for data centers and network infrastructure to support the growing digital ecosystem.

APAC Market Dominance: APAC emerges as the largest and fastest-growing market for DRAM module and components, driven by the region's technological advancements, early adoption of advanced technologies, and growing demand for high-performance devices.

Impact of COVID-19: The COVID-19 pandemic has had a significant impact on the global economy, including the DRAM module and components market. Disruptions in manufacturing and supply chains, coupled with fluctuating demand, have influenced market dynamics across regions. However, strategic collaborations, research, and development activities continue to drive innovation and resilience in the industry.

Key Market Players:

Leading companies in the DRAM module and components market include Samsung Electronics Co., Ltd., SK Hynix Inc., Micron Technology, Inc., Nanya Technology Corporation, and others. These players are actively engaged in research and development initiatives to address evolving market demands and capitalize on growth opportunities.

As the global demand for high-performance memory solutions continues to escalate, the DRAM module and components market present lucrative opportunities for stakeholders across industries. By leveraging technological advancements and strategic partnerships, market players can navigate the evolving landscape and drive innovation in memory technologies.

0 notes

Text

Semiconductor Wafer Processing Chambers Market: Investment Opportunities and Forecast 2025–2032

MARKET INSIGHTS

The global Semiconductor Wafer Processing Chambers Market size was valued at US$ 3,670 million in 2024 and is projected to reach US$ 6,890 million by 2032, at a CAGR of 9.42% during the forecast period 2025-2032. This growth follows strong 26.2% expansion in 2021, though the overall semiconductor market saw moderated 4.4% growth in 2022 reaching USD 580 billion due to inflation and weakening consumer demand.

Semiconductor wafer processing chambers are critical components in semiconductor manufacturing equipment that create controlled environments for wafer processing. These chambers include transition chambers which convert atmospheric conditions to vacuum environments, and reaction chambers where deposition, etching, and other processes occur. The transition chamber serves as the gateway where wafers enter from the front-end module (EFEM) before being transferred to process chambers under vacuum conditions.

The market is driven by increasing semiconductor demand across electronics, automotive, and AI applications, though faces challenges from cyclical industry patterns. Regional growth varies significantly, with Americas semiconductor sales growing 17% year-over-year in 2022 while Asia Pacific declined 2%. Key players like Piotech Inc., AMEC, and Ferrotec are expanding capabilities to support advanced node manufacturing, particularly in deposition and etching applications which dominate chamber usage.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Semiconductor Fabrication Facilities Worldwide to Fuel Market Growth

The global semiconductor wafer processing chambers market is experiencing robust growth due to the unprecedented expansion of semiconductor fabrication facilities across key regions. Governments and private enterprises are investing heavily in domestic semiconductor production capabilities to reduce reliance on imports and strengthen supply chain resilience. In 2024 alone, over 40 new semiconductor fabs were planned or under construction globally, with investments exceeding $500 billion. This surge in fab construction directly drives demand for wafer processing chambers, as each facility requires hundreds of specialized chambers for deposition, etching, and other critical processes. The transition to advanced nodes below 7nm further accelerates this demand, as these cutting-edge processes require more sophisticated chamber designs with ultra-high vacuum capabilities.

Increasing Adoption of 300mm and Larger Wafer Sizes to Boost Market Expansion

The semiconductor industry's shift toward larger wafer sizes represents a significant growth driver for processing chamber manufacturers. 300mm wafer processing now accounts for over 75% of global semiconductor production capacity, with some manufacturers beginning to explore 450mm wafer compatibility. Larger wafer sizes deliver substantial cost advantages through improved economics of scale, but require completely redesigned processing chambers with enhanced uniformity control and gas distribution systems. This technological transition has created a wave of upgrading and replacement demand, with semiconductor equipment makers reporting order backlogs stretching 12-18 months for advanced processing chambers. Furthermore, the growing complexity of 3D NAND and advanced DRAM memory architectures necessitates specialized chambers capable of handling high-aspect ratio structures, driving further innovation in chamber design.

MARKET RESTRAINTS

High Capital Requirements and Long Lead Times to Constrain Market Growth

The semiconductor wafer processing chamber market faces significant barriers due to the substantial capital investment required for research, development, and manufacturing. Developing a new chamber platform can cost upwards of $50 million and take 3-5 years from initial concept to volume production. This creates substantial risk for equipment manufacturers, particularly when technology nodes transition rapidly and render existing chamber designs obsolete. Additionally, the precision engineering requirements for these chambers lead to lead times of 6-9 months for critical components, creating supply chain vulnerabilities. Many smaller manufacturers struggle with these financial and temporal constraints, leading to market consolidation as only the most well-capitalized players can sustain the necessary investment levels.

Technical Challenges in Advanced Node Processing to Limit Adoption Rates

As semiconductor manufacturing approaches atomic scale dimensions, wafer processing chambers face unprecedented technical challenges that restrain market expansion. At nodes below 5nm, chamber performance requirements become exponentially more demanding regarding particle control, temperature uniformity, and plasma stability. Some advanced processes now require chamber materials with contamination levels below 1 part per billion, pushing material science to its limits. These technical hurdles have led to slower than expected adoption of next-generation chambers, with many chip manufacturers opting to extend the life of existing equipment through expensive upgrades rather than complete replacements. Furthermore, the increasing complexity of chamber qualification processes, which now often exceed 6 months for new designs, creates significant delays in bringing innovative solutions to market.

MARKET OPPORTUNITIES

Emergence of Alternative Semiconductor Materials to Create New Market Potential

The semiconductor industry's exploration of alternative materials beyond silicon presents substantial opportunities for wafer processing chamber manufacturers. The development of wide bandgap semiconductors using materials like silicon carbide (SiC) and gallium nitride (GaN) requires specialized processing chambers capable of handling higher temperatures and more aggressive chemistries. The SiC power device market alone is projected to grow at a compound annual growth rate exceeding 30%, driving demand for compatible processing solutions. Additionally, the transition to 2D materials like graphene and transition metal dichalcogenides for advanced logic applications will necessitate completely new chamber architectures. Companies that can develop flexible chamber platforms adaptable to these emerging materials will gain significant competitive advantage in the coming decade.

Integration of AI and Advanced Process Control to Enable Next-Generation Chambers

The incorporation of artificial intelligence and machine learning into wafer processing chambers represents a transformative opportunity for market players. Modern chambers equipped with hundreds of sensors generate terabytes of process data that can be leveraged for predictive maintenance and real-time process optimization. Early adopters of AI-enabled chambers report yield improvements of 5-10% and mean time between failures increasing by 30-50%. This digital transformation extends to remote monitoring capabilities, allowing equipment manufacturers to offer chamber performance as a service rather than just selling hardware. The market for smart chambers with integrated process control is expected to grow twice as fast as conventional chambers, creating premium pricing opportunities for innovative suppliers.

MARKET CHALLENGES

Supply Chain Vulnerabilities to Impact Chamber Manufacturing Cycles

The semiconductor wafer processing chamber market faces significant supply chain challenges that threaten to constrain production capacity. Many critical chamber components, including ceramic heaters, vacuum valves, and precision gas distribution systems, come from single-source suppliers with limited alternate options. Delivery lead times for these components have extended from typical 12-16 weeks to 30-40 weeks in some cases, creating bottlenecks in chamber assembly. The situation is further complicated by export controls on certain specialty materials used in chamber construction, particularly those with potential dual-use applications. These supply chain constraints come at a time when demand is at record levels, forcing manufacturers to make difficult allocation decisions and delaying customer deliveries.

Increasing Technical Complexity to Exacerbate Skilled Labor Shortages

The semiconductor equipment industry faces a critical shortage of skilled personnel capable of designing, manufacturing, and supporting advanced wafer processing chambers. The intersection of mechanical engineering, materials science, plasma physics, and computer control systems required for modern chambers creates a highly specialized skillset demand. Industry surveys indicate vacancy rates exceeding 20% for critical engineering positions, with the talent pipeline unable to keep pace with industry growth. This skills gap is particularly acute in chamber process expertise, where experienced engineers often require 5-7 years of hands-on experience to achieve full competency. The shortage not only delays new product development but also impacts the ability to provide timely field support, potentially affecting customer fab productivity and yield.

SEMICONDUCTOR WAFER PROCESSING CHAMBERS MARKET TRENDS

Advancements in Miniaturization and High-Volume Manufacturing Drive Growth

The semiconductor wafer processing chambers market is experiencing significant momentum due to the increasing demand for miniaturized components in electronics and the growing adoption of 5G, IoT, and AI technologies. With semiconductor nodes shrinking below 7nm, manufacturers require ultra-precise wafer processing chambers capable of maintaining vacuum integrity and contamination control at atomic levels. The transition to extreme ultraviolet (EUV) lithography has further accelerated demand for chambers with enhanced material compatibility and thermal stability. Recent data indicates that transition chambers accounted for over 45% of total market revenue in 2024, with reaction chambers projected to grow at a CAGR exceeding 8% through 2032.

Other Trends

Automation and Industry 4.0 Integration

The semiconductor industry's rapid adoption of smart manufacturing principles is transforming wafer processing chamber designs. Contemporary chambers now incorporate real-time sensors for pressure monitoring, predictive maintenance algorithms, and AI-driven process optimization to minimize defects and maximize yield. Leading foundries report yield improvements of 15-20% after implementing these smart chambers. Furthermore, the integration of robotics with wafer handling systems enables uninterrupted high-volume production, particularly crucial for memory chip manufacturers expanding capacity to meet data center demands.

Geopolitical Factors Reshaping Supply Chain Dynamics

While technological advancement drives market expansion, geopolitical tensions have created both challenges and opportunities. Export controls on advanced semiconductor equipment have prompted accelerated development of domestic wafer processing chamber capabilities in several regions. China's半导体equipment industry, for instance, has seen 37% annual growth in chamber production capacity as domestic manufacturers like AMEC and Piotech Inc. expand their portfolios. Meanwhile, North American and European suppliers are investing heavily in alternative material solutions to reduce dependency on specific geographic sources for critical chamber components.

COMPETITIVE LANDSCAPE

Key Industry Players

Semiconductor Equipment Suppliers Focus on Wafer Processing Innovation

The global semiconductor wafer processing chambers market exhibits a moderately fragmented competitive landscape, with Asian manufacturers increasingly challenging established Western players. While the market saw slower growth in 2022 (4.4% globally according to WSTS data), critical wafer processing technologies remain in high demand as semiconductor fabs expand capacity worldwide.

Piotech Inc. and AMEC have emerged as dominant Chinese contenders, capturing significant market share through government-supported R&D initiatives and competitive pricing strategies. These companies benefited from the 20.8% growth in analog semiconductor demand during 2022, requiring advanced wafer processing solutions.

Meanwhile, Shenyang Fortune Precision Equipment strengthened its position through strategic partnerships with major foundries, particularly in the etching equipment segment which accounts for approximately 38% of wafer processing chamber applications. The company's transition chamber technology has become particularly sought-after for 300mm wafer processing.

Established players like Ferrotec and Beneq Group maintain technological leadership in thin film deposition chambers, representing 42% of the market by application. Their continued investment in atomic layer deposition (ALD) and plasma-enhanced chemical vapor deposition (PECVD) technologies helps them compete against lower-cost alternatives.

List of Key Semiconductor Wafer Processing Chamber Manufacturers

Piotech Inc. (China)

AMEC (China)

Shenyang Fortune Precision Equipment (China)

Ferrotec (Japan)

Beneq Group (Finland)

Beijing E-Town Semiconductor Technology (China)

Konfoong Materials International (China)

SPRINT PRECISION TECHNOLOGIES (China)

Foxsemicon Integrated Technology (Taiwan)

Segment Analysis:

By Type

Transition Chambers Lead the Market Due to Critical Role in Vacuum Environment Conversion

The market is segmented based on type into:

Transition Chambers

Reaction Chambers

Others

By Application

Etching Equipment Segment Dominates with Increasing Demand for Precision Semiconductor Manufacturing

The market is segmented based on application into:

Etching Equipment

Thin Film Deposition Equipment

By Region

Asia-Pacific Holds Largest Market Share Owing to Semiconductor Manufacturing Concentration

The market is segmented based on region into:

North America

Europe

Asia-Pacific

South America

Middle East & Africa

By Material

Stainless Steel Chambers Preferred for Their Durability in High-Vacuum Environments

The market is segmented based on material into:

Stainless Steel

Aluminum

Others

Regional Analysis: Semiconductor Wafer Processing Chambers Market

North America The Semiconductor Wafer Processing Chambers market in North America is projected to grow steadily, driven by the region’s strong semiconductor manufacturing ecosystem. Leading companies in the U.S. and Canada are investing heavily in advanced semiconductor fabrication facilities (fabs), fueling demand for high-precision transition and reaction chambers. The U.S. CHIPS and Science Act, which allocated $52.7 billion for domestic semiconductor manufacturing and R&D, is significantly boosting the production capacity of leading-edge nodes. This expansion necessitates cutting-edge wafer processing technologies, positioning North America as a key market for innovative chamber solutions. However, the high cost of semiconductor equipment and strict regulatory compliance for vacuum and automation components remain challenges for market players.

Europe Europe’s Semiconductor Wafer Processing Chambers market is characterized by strong demand from automotive and industrial semiconductor applications, particularly in Germany and France. The EU’s CHIPS Act, which aims to increase Europe’s global semiconductor market share to 20% by 2030, is accelerating investments in wafer fabrication facilities. European semiconductor equipment manufacturers emphasize energy-efficient and contamination-free chamber designs, aligning with stringent EU environmental and safety standards. The presence of key players such as VATValve and Pfeiffer, specializing in vacuum valve and pump solutions, strengthens regional competitiveness. However, the relatively slower adoption of next-gen semiconductor nodes compared to Asia-Pacific and North America slightly limits growth potential.

Asia-Pacific The Asia-Pacific region dominates the Semiconductor Wafer Processing Chambers market, accounting for over 60% of global demand due to high semiconductor production in China, Taiwan, South Korea, and Japan. Countries like China are aggressively expanding domestic wafer fab capacities, supported by government initiatives such as the Made in China 2025 strategy. Taiwan remains a critical hub, housing TSMC and other leading foundries, driving advancements in 3nm and below process nodes. While regional semiconductor equipment manufacturers such as Piotech Inc and AMEC are gaining prominence, dependence on foreign technology for advanced chamber designs presents competition challenges. Rising geopolitical tensions and supply chain disruptions risk could temporarily restrain steady growth.

South America South America’s Semiconductor Wafer Processing Chambers market is nascent but holds potential due to increasing semiconductor investments in Brazil and Argentina. The region primarily relies on imports for semiconductor manufacturing equipment, with limited local production capabilities. Recent government incentives for semiconductor industry development signal gradual market expansion, though financial volatility and weaker supply chain infrastructure hinder rapid adoption. The market remains fragmented, with demand largely centered on legacy node technologies rather than cutting-edge wafer processing chambers required for advanced semiconductor nodes.

Middle East & Africa The Middle East & Africa region is stepping into semiconductor manufacturing, with Saudi Arabia and the UAE announcing plans to build semiconductor fabs as part of economic diversification strategies. Demand for wafer processing chambers is currently niche but growing, primarily serving automotive and IoT semiconductor applications. While funding commitments from sovereign wealth funds indicate long-term potential, the lack of a mature semiconductor ecosystem and reliance on imported equipment slow down immediate market penetration. Partnerships with global semiconductor equipment suppliers remain critical to establish a viable regional supply chain.

Report Scope

This market research report provides a comprehensive analysis of the Global and regional Semiconductor Wafer Processing Chambers markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global Semiconductor Wafer Processing Chambers market was valued at USD million in 2024 and is projected to reach USD million by 2032, at a CAGR of % during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (Transition Chambers, Reaction Chambers, Others), technology, application (Etching Equipment, Thin Film Deposition Equipment), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. In 2022, the semiconductor market saw varied regional performance with Americas growing 17.0%, Europe 12.6%, Japan 10.0%, while Asia-Pacific declined 2.4%.

Competitive Landscape: Profiles of leading market participants including Shenyang Fortune Precision Equipment, NMC, Piotech Inc, AMEC, Ferrotec, and others, covering their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in wafer processing, integration of advanced materials, fabrication techniques, and evolving industry standards in semiconductor manufacturing.

Market Drivers & Restraints: Evaluation of factors driving market growth including semiconductor industry expansion, along with challenges such as supply chain constraints, regulatory issues, and market-entry barriers.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving semiconductor equipment ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Semiconductor Wafer Processing Chambers Market?

-> Semiconductor Wafer Processing Chambers Market size was valued at US$ 3,670 million in 2024 and is projected to reach US$ 6,890 million by 2032, at a CAGR of 9.42% during the forecast period 2025-2032.

Which key companies operate in Global Semiconductor Wafer Processing Chambers Market?

-> Key players include Shenyang Fortune Precision Equipment, NMC, Piotech Inc, AMEC, Ferrotec, Beneq Group, Beijing E-Town Semiconductor Technology, and Konfoong Materials International, among others.

What are the key growth drivers?

-> Key growth drivers include expansion of semiconductor manufacturing capacity, increasing demand for advanced chips, and technological advancements in wafer processing equipment.

Which region dominates the market?

-> Asia-Pacific is the largest market for semiconductor manufacturing equipment, while North America leads in technological innovation.

What are the emerging trends?

-> Emerging trends include miniaturization of semiconductor components, adoption of extreme ultraviolet (EUV) lithography, and development of more efficient vacuum processing chambers.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/hazardous-lighting-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/mobile-document-reader-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gan-drivers-market-outlook-in-key-end.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/airbag-chip-market-research-report-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-peripheral-device-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/single-ended-glass-seal-thermistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/commercial-control-damper-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pcb-board-terminals-market-investment.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/bandpass-colored-glass-filter-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/video-surveillance-hardware-system.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pfc-ics-market-technological.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modulator-bias-controller-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tubular-cable-termination-market-demand.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/logic-buffer-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/broadband-polarizing-beamsplitters.html

0 notes

Text

0 notes

Text

The Rise of China Solid State Drives Manufacturer: Your Guide to Quality and Innovation

Micro Storage Electronics Technology Co., Limited As a manufacturer of NAND flash memory and DRAM modules, Micro Storage was founded in 2014. After 10 years of unremitting efforts, relying on excellent quality, powerful resources, and professional services as development support, it has achieved a good reputation in the commercial and industrial fields. Today, we will forge ahead and continue to provide higher quality services and comprehensive solutions for end users and industry leaders in the consumer, commercial, and industrial fields.

In the rapidly evolving world of technology, data storage solutions have become a crucial component for both consumers and businesses. As the demand for faster, more reliable storage solutions increases, many companies are turning to China Solid State Drives Manufacturer to meet their needs. This article delves into the benefits of partnering with Chinese manufacturers, the different types of solid-state drives (SSDs) available, and what to consider when selecting the right manufacturer for your business.

1. Understanding Solid State Drives (SSDs)

Before we explore the advantages of collaborating with a China Solid State Drives Manufacturer, it’s important to understand what SSDs are and why they are preferred over traditional hard disk drives (HDDs).

Speed and Performance: SSDs offer significantly faster data access speeds compared to HDDs. This speed is crucial for applications that require quick read and write operations, such as gaming and data processing.

Durability and Reliability: SSDs have no moving parts, making them less susceptible to mechanical failures. This durability makes them ideal for mobile devices and rugged environments.

Energy Efficiency: SSDs consume less power, which translates to longer battery life in laptops and reduced energy costs for enterprises.

Compact Size: The smaller form factor of SSDs allows for more design flexibility in laptops and other electronic devices.

2. Advantages of Partnering with a China Solid State Drives Manufacturer

Choosing a China Solid State Drives Manufacturer offers numerous benefits that can help businesses optimize their storage solutions.

Cost Efficiency: Manufacturers in China often provide competitive pricing due to lower labor and production costs. This affordability can significantly impact your bottom line without compromising on quality.

Diverse Product Range: Chinese manufacturers typically offer a wide variety of SSDs, including SATA, NVMe, and PCIe drives, ensuring that businesses can find products tailored to their specific needs.

Quality Assurance: Many reputable manufacturers in China adhere to strict quality control standards, which ensures that their SSDs meet international quality benchmarks.

Technological Advancements: China is a global leader in technology, with manufacturers continuously innovating to stay ahead in the SSD market. This commitment to R&D translates into better products for customers.

Customization Options: Many manufacturers allow for customization of SSDs, enabling businesses to specify storage capacity, branding, and other essential features.

3. Types of Solid State Drives Offered by Chinese Manufacturers

A China Solid State Drives Manufacturer typically provides various types of SSDs to meet different requirements:

SATA SSDs: The most common type of SSD, SATA drives are widely used in consumer laptops and desktops. They offer a good balance between performance and cost.

NVMe SSDs: Known for their exceptional speed, NVMe drives connect directly to the motherboard, providing significantly faster data transfer rates than SATA SSDs. These drives are ideal for high-performance tasks like gaming and professional applications.

M.2 SSDs: M.2 drives are compact and designed for ultra-thin devices. They can support both SATA and NVMe protocols, offering flexibility in performance.

PCIe SSDs: Utilizing the PCIe interface, these SSDs deliver high-speed data transfers, making them suitable for applications requiring quick read and write speeds.

Industrial SSDs: Built to withstand harsh environments, industrial SSDs are suitable for use in sectors like automotive and aerospace, where durability and reliability are paramount.

4. Key Factors to Consider When Choosing a China Solid State Drives Manufacturer

When selecting a China Solid State Drives Manufacturer, it’s essential to consider several key factors to ensure you make the best choice for your business:

Reputation and Experience: Research the manufacturer’s background, focusing on their experience in the industry and customer reviews. A well-established manufacturer is more likely to deliver reliable products.

Quality Certifications: Look for manufacturers that hold international quality certifications, such as ISO 9001 or CE, which demonstrate compliance with recognized quality standards.

Technological Capabilities: Assess the manufacturer’s commitment to research and development. Companies that invest in R&D are more likely to offer cutting-edge products.

Production Capacity: Ensure that the manufacturer has the capacity to meet your volume needs. A reliable manufacturer should be able to handle both small and large orders efficiently.

Customization Services: Check if the manufacturer offers customization options, such as specific storage capacities or branding features, to align with your business requirements.

Customer Support: Reliable after-sales support is critical for addressing any issues that may arise post-purchase. Choose a manufacturer that provides robust customer service and warranty options.

5. Leading China Solid State Drives Manufacturers

Several prominent manufacturers in China have established themselves as leaders in the SSD market. Here are a few noteworthy companies:

a. Kingston Technology

Kingston is a globally recognized brand known for its high-quality memory and storage solutions. Their SSD offerings include a wide range of products designed for both consumers and enterprises.

b. ADATA Technology Co., Ltd.

ADATA specializes in high-performance memory and storage solutions. Their SSDs are known for their reliability and performance, catering to various user needs.

c. Longsys Electronics Co., Ltd.

Longsys focuses on developing innovative storage solutions, including SSDs that are widely used in consumer electronics and industrial applications.

d. Netac Technology Co., Ltd.

Netac offers a diverse range of SSDs, including consumer and enterprise solutions, with a strong emphasis on quality and performance.

e. Team Group Inc.

Team Group provides a variety of SSD products, including budget-friendly options, making them a popular choice for both individual consumers and businesses.

6. Challenges When Working with a China Solid State Drives Manufacturer

While partnering with a China Solid State Drives Manufacturer presents many benefits, there are also challenges to consider:

Quality Variability: The quality of SSDs can vary significantly among manufacturers. It's crucial to conduct thorough research and request samples to ensure you receive reliable products.

Communication Barriers: Language and cultural differences can sometimes lead to misunderstandings. Establishing clear communication channels is essential to overcome this challenge.

Logistical Complications: International shipping can introduce delays and complications. Working with manufacturers experienced in global logistics can help streamline the process.

Regulatory Compliance: Ensure that the manufacturer adheres to international regulations regarding product safety and environmental standards.

7. The Future of SSD Manufacturing in China

The future of SSD manufacturing in China looks promising, driven by several emerging trends:

Increased Investment in R&D: Chinese manufacturers are expected to continue investing in research and development to innovate and improve their product offerings.

Rising Demand for Data Storage Solutions: With the increasing reliance on cloud computing and big data analytics, the demand for high-performance SSDs is projected to rise significantly.

Sustainability Initiatives: Many manufacturers are likely to adopt eco-friendly practices, responding to the growing global demand for sustainable products.

Expansion into Emerging Markets: As the adoption of SSDs grows in sectors such as automotive, healthcare, and IoT, Chinese manufacturers will likely broaden their product offerings to cater to these diverse needs.

8. Steps to Establish a Successful Partnership with a China Solid State Drives Manufacturer

To effectively collaborate with a China Solid State Drives Manufacturer, consider the following steps:

Conduct Thorough Research: Investigate potential manufacturers, focusing on their reputation, product offerings, and customer feedback.

Request Samples: Before committing to large orders, request samples to evaluate the quality and performance of the SSDs.

Negotiate Terms Clearly: Discuss pricing, payment options, and delivery schedules to ensure both parties are aligned on expectations.

Visit Manufacturing Facilities: If feasible, visiting the supplier’s facilities can provide insights into their production capabilities and quality control measures.

Establish Effective Communication: Set up direct communication channels for ongoing interactions to ensure alignment on expectations and address any concerns promptly.

Monitor Orders and Provide Feedback: Keep track of your orders and maintain open communication to address issues promptly and provide feedback on product performance.

9. Conclusion: The Path to Reliable Data Storage Solutions

In conclusion, partnering with a China Solid State Drives Manufacturer can significantly enhance your business's data storage capabilities. With numerous advantages, including cost efficiency, a diverse product range, and technological innovation, Chinese manufacturers are well-positioned to meet the growing demand for high-quality SSDs.

By understanding the types of SSDs available, evaluating key factors when choosing a manufacturer, and being aware of the challenges, businesses can make informed decisions that align with their technological needs. Embracing the partnership with a reliable manufacturer will not only lead to improved efficiency and performance but also set a solid foundation for future growth in a data-driven world. As technology continues to advance, the role of SSDs will become increasingly critical, and choosing the right manufacturing partner is essential for success.

1 note

·

View note

Text

The Dynamics of Bulk RAM Suppliers in the Global Market

In the rapidly evolving landscape of technology, Random Access Memory (RAM) stands as a fundamental component that fuels the performance of devices ranging from smartphones to supercomputers. The demand for RAM continues to surge as advancements in artificial intelligence, cloud computing, and big data analytics drive the need for faster and more efficient memory solutions. At the heart of this demand lies the critical role played by bulk RAM suppliers in the global market.

Understanding Bulk RAM Suppliers

Bulk RAM suppliers are entities that specialize in the mass production and distribution of memory modules to various industries and sectors worldwide. These suppliers operate within a highly competitive environment where factors such as price, quality, and technological advancements significantly influence market dynamics. Key players in this industry include major semiconductor manufacturers like Samsung Electronics, Micron Technology, and SK Hynix, among others.

Market Dynamics and Trends

The market for bulk RAM is characterized by several key trends that shape its growth and development:

1. Technological Advancements: The continuous evolution of semiconductor technology drives innovations in RAM, leading to higher capacities, faster speeds, and improved energy efficiency. Suppliers invest heavily in research and development to maintain a competitive edge in this rapidly advancing field.

2. Demand from Emerging Technologies: Emerging technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) require robust memory solutions to handle vast amounts of data in real-time. This demand amplifies the need for reliable bulk RAM suppliers capable of scaling production to meet market requirements.

3. Global Supply Chain Challenges: The semiconductor industry, including bulk RAM suppliers, faces challenges related to supply chain disruptions, geopolitical tensions, and fluctuating raw material prices. These factors can impact production capabilities and lead to supply shortages or price volatility.

4. Shift Towards Mobile and Cloud Computing: With the proliferation of smartphones, tablets, and cloud computing services, there is a growing demand for mobile DRAM and server-grade RAM. Bulk RAM suppliers must cater to diverse product specifications while ensuring compatibility and performance across different platforms.

Key Players in the Industry

1. Samsung Electronics: As a global leader in semiconductor technology, Samsung Electronics dominates the market with its extensive range of DRAM and NAND memory solutions. The company’s vertical integration and advanced manufacturing capabilities enable it to maintain a competitive position in the bulk RAM market.

2. Micron Technology: Based in the United States, Micron Technology is renowned for its innovations in memory and storage solutions. The company focuses on delivering high-performance DRAM and NAND products tailored to meet the needs of various industries, including consumer electronics and enterprise computing.

3. SK Hynix: Headquartered in South Korea, SK Hynix has emerged as a key player in the semiconductor industry, offering a diverse portfolio of memory solutions ranging from mobile DRAM to high-capacity server memory. The company’s strategic partnerships and technological expertise contribute to its significant presence in the global bulk RAM market.

Challenges and Opportunities

Despite the robust growth prospects, bulk RAM suppliers face several challenges that warrant strategic considerations:

Intellectual Property Rights: The semiconductor industry is heavily regulated, with stringent intellectual property laws governing product development and innovation. Bulk RAM suppliers must navigate these legal complexities to safeguard their technological advancements and market competitiveness.

Environmental Sustainability: The manufacturing processes involved in producing bulk RAM can have significant environmental impacts, including energy consumption and waste generation. Suppliers are increasingly focusing on sustainable practices and green technologies to mitigate these effects and meet regulatory requirements.

Global Economic Uncertainty: Economic fluctuations, trade policies, and currency exchange rates can influence market demand and profitability for bulk RAM suppliers. Strategic diversification and risk management strategies are essential to navigate these uncertainties effectively.

Future Outlook

Looking ahead, the future of bulk RAM suppliers appears promising with continued advancements in technology and expanding applications across various industries. Key areas of focus include:

5G Expansion: The rollout of 5G networks will drive demand for high-speed memory solutions capable of supporting enhanced mobile connectivity and bandwidth-intensive applications.

Artificial Intelligence and Edge Computing: The proliferation of AI-driven technologies and edge computing platforms will necessitate innovative memory solutions that can deliver low-latency performance and high reliability.

Next-Generation Computing: Quantum computing, neuromorphic computing, and other disruptive technologies will create new opportunities for bulk RAM suppliers to innovate and differentiate their product offerings.

Conclusion

In conclusion, bulk RAM suppliers play a pivotal role in the global semiconductor industry, catering to diverse technological needs and market demands. As the demand for faster, more efficient memory solutions continues to grow, these suppliers must remain agile, innovative, and responsive to evolving market dynamics. By embracing technological advancements and strategic partnerships, bulk RAM suppliers can capitalize on emerging opportunities and maintain a competitive edge in this dynamic and rapidly evolving market landscape.

WANT TO BUY RAM in BULK?

VALUETECH is a premier global supplier specializing in bulk RAM distribution, catering to diverse business needs worldwide. Renowned for reliability and excellence, VALUETECH offers a comprehensive range of RAM models at competitive prices, tailored to meet the demands of large corporations, educational institutions, and government agencies. With a commitment to quality and customer satisfaction, VALUETECH ensures seamless procurement processes, from personalized quotations to efficient logistics and support services. Whether scaling up operations, upgrading technology infrastructure, or launching new initiatives, businesses trust VALUETECH for their bulk RAM purchases, backed by extensive industry expertise and a dedication to delivering superior products and services on a global scale.

0 notes

Text

Global Top 5 Companies Accounted for 85% of total Dynamic Random Access Memory (DRAM) market (QYResearch, 2021)

Dynamic random access memory (DRAM) is a type of semiconductor memory that is typically used for the data or program code needed by a computer processor to function.

Dynamic random access memory, or DRAM, is a specific type of random access memory that allows for higher densities at a lower cost.

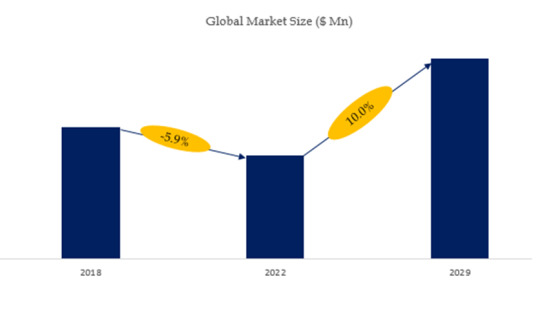

According to the new market research report “Global Dynamic Random Access Memory (DRAM) Market Report 2023-2029”, published by QYResearch, the global Dynamic Random Access Memory (DRAM) market size is projected to reach USD 146.64 billion by 2029, at a CAGR of 10.0% during the forecast period.

Figure. Global Dynamic Random Access Memory (DRAM) Market Size (US$ Million), 2018-2029

Figure. Global Dynamic Random Access Memory (DRAM) Top 5 Players Ranking and Market Share��Based on data of 2021, Continually updated)

The global key manufacturers of Dynamic Random Access Memory (DRAM) include Samsung Electronics Co. Ltd., SK Hynix Inc., Micron Technology Inc., Nanya Technology Corporation, Winbond Electronics Corporation, Company 6, Company 7, Company 8, Company 9, Company 10, etc. In 2021, the global top five players had a share approximately 85.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

For more information, please contact the following e-mail address:

Email: [email protected]

Website: https://www.qyresearch.com

0 notes

Text

Product Lifecycle Management Market Share, Size, Future Demand, and Emerging Trends

The DRAM module and component market will power at a rate of 1.40% during 2022–2030, to touch USD 111.1 billion by 2030.

The development acceptance of IoT and 5G, growing data center count, and increasing use of DRAM modules and components in numerous industries are the main factors powering the growth of the industry.

The above 8 GB category will have the largest share and grow at a rate of 1.6% in the years to come. It is because of the necessity for a high memory capacity for the storage, processing, and high-volume data transmission.

The rate at which data is generated has been observing a considerable growth in the last ten years or so. The processing of heavy data has also become common these days as a result of the introduction of numerous advanced tech products and solutions. This requires to frequently update them, for effective functioning.

Automobiles will grow at a rate of over 1.6% in the years to come.

The growth can be credited to the introduction of cutting-edge digital devices and uses for improved performance and user experience development, by allowing a more-contented and safer drive.

The rising acceptance of IoT devices, automation solutions, and distant access applications in automobiles would principally contribute toward the growth of the industry.

Access Report Summary - Product Lifecycle Management Market Segmentation Analysis Report

Moreover, it will grow at a rate of 1.6% in the future, credited to the development of the semiconductor industry and the development in the requirement for smart electronic devices from India and China.

With the fast pace at which the acceptance of smart digital devices in the countries of the region is progressing, a stimulation of the requirement for DRAM modules and components, as a result of their capability to cater to the memory necessities of those devices, is likely

It is because of the increasing number of data centers, all over the world, the demand for DRAM module and component will continue to grow in the years to come.

0 notes

Text

Product introduction roadmap and agent information of the world's top five storage vendors

Followings are some datas collected from Lansheng Technology.

1. Samsung

As the world's leading electronics company, Samsung Electronics' business covers consumer electronics, IT and mobile communications, equipment solutions, etc., especially in the field of DRAM and NAND Flash semiconductor storage, Samsung Electronics has long ranked first in the world.

According to TrendForce data, Samsung's global market share in the DRAM and NAND markets will reach 43% and 33% respectively in 2022, making it the core supplier of the global memory chip industry.

Samsung Electronics was founded in 1969. It developed 256Kb DRAM in 1984, successfully developed the world's first 64Mb DRAM in 1992, developed the first 1Gb NAND flash memory in 1999, successfully developed 3D V-NAND technology in 2013, and mass-produced it in 2018. LPDDR5 DRAM, currently Samsung’s 10nm process and extreme ultraviolet lithography (EUV) technology has developed a large-capacity 512GB DDR5 memory module. At the same time, its 8th generation V-NAND memory layer number has reached 236. The company’s storage technology is at Global leading position.

2. Micron Technology

Micron Technology was founded in the United States in 1978. As one of the world's largest manufacturers of semiconductor storage and imaging products, its main businesses include DRAM, NAND flash memory, NOR flash memory, CMOS image sensors, etc.

In 2022, Micron Technology ranked third in the global DRAM market with a market share of 25%, and ranked fifth in the global NAND market with a market share of 12%.

Micron completed the design of 64K DRAM in 1979 and launched the first 64K DRAM product in 1981. In 1984, it launched the world's smallest 256K DRAM. In 2021, Micron launched the industry's first 1α node DRAM. In 2022, the company began to Customers are shipping samples of their 1β node DRAM products, taking the lead in entering the 1β stage, with EUV technology expected to be available in 2024. In terms of NAND, the company achieved mass production of the world's first 176-layer 3D NAND in November 2020, and will achieve shipment of 232-layer NAND products in 2022.

3. SK Hynix

SK Hynix is the world's leading storage company. The company is committed to producing DRAM, NAND Flash and CIS non-memory semiconductor products. It has four production bases in South Korea, Wuxi and Chongqing in China.

SK Hynix's predecessor was Hyundai Electronics; after the merger of Hyundai Electronics and LG Semiconductor, it was independently renamed Hynix in 2001; in 2012, SK Group acquired Hynix, and it became SK Hynix as it is known today.

On October 20, 2020, SK Hynix and Intel jointly announced the signing of an acquisition agreement in South Korea. According to the agreement, SK Hynix will acquire Intel's NAND flash memory and storage business for US$9 billion. The acquisition includes Intel's NAND SSD business, NAND components and wafer business, and its NAND flash memory manufacturing plant in Dalian, China. Intel will retain its unique Intel OptaneTM business.

On December 29, 2021, Solidigm announced its official establishment and became an independent subsidiary of SK Hynix in the United States.

In 2022, SK Hynix ranked second in the global DRAM market with a market share of 28%, and ranked fourth in the global NAND Flash market with a market share of 13%.

In 1984, SK Hynix successfully trial-produced 16Kb SRAM for the first time, acquired LG Semiconductor in 1999, successfully developed NAND Flash products in 2004, and developed the world's first TSV technology HBM in 2013. In 2019, it became the first time in the industry to successfully develop 128-layer 4D NAND. Enterprise, at this stage, SK Hynix has successfully developed the world's first 12-layer stacked HBM3 DRAM new product. Its DDR5 uses EUV lithography's 1αnm technology. In terms of NAND, in 2022, the company successfully developed 238-layer 4D NAND flash memory in 2023. It demonstrated its latest 300-layer 3D NAND product prototype, which is expected to be available in the 2024-2025 period.

4. Kioxia

Toshiba Memory officially changed its name to "Kioxia" on October 1, 2019, and its Chinese name is "Kioxia".

In 2007, as 2D NAND reached its scale limit, Toshiba took the lead in proposing the concept of 3D NAND structure. However, due to Toshiba's financial difficulties, this part of its core business had to be sold to a consortium led by Bain Capital, an American private equity investment company, in 2018. Toshiba only held about 40.6% of Kioxia's shares. In October 2019, the new company started afresh as Kioxia Holdings Co., Ltd.

Toshiba invented NAND flash memory in 1987. In April 2017, Kioxia's predecessor, Toshiba Memory Group, was spun off from Toshiba, creating advanced storage solutions and services that enrich people's lives and expand society's horizons. Kioxia's innovative 3D flash memory technology, BiCS FLASH™, is shaping the future storage methods for many high-density applications, including advanced smartphones, PCs, SSDs, automobiles, and data centers.

5. Western Digital Western Digital

Western Digital is a world-renowned storage manufacturer. It was founded in 1970 and is headquartered in California, USA. It has branches around the world and provides storage products to users around the world.

In 2011, Western Digital acquired Hitachi Global Storage Technologies (HGST) for US$4.3 billion, which acquired IBM's hard drive division for US$2 billion in 2002.

On October 22, 2015, Western Digital announced that it would acquire flash memory manufacturer SanDisk for US$19 billion in cash and stock. In May 2016, Western Digital completed its acquisition of Sandisk for US$16 billion. In December 2018, Western Digital officially announced that it would conduct a round of integration of its storage sub-brands. Enterprise and business-class storage product brands will abandon the HGST, SanDisk, tegile and WD brands and use the Western Digital unified brand. Including brands, the brand of consumer terminals will not change. Then Western Digital and SanDisk jointly announced that starting from January 1, 2021, the SanDisk brand will be renamed Western Digital, and the company's operating entity and brand name will be changed to "Western Digital GK" and "Western Digital Co., Ltd." On April 18, 2022, Western Digital officially released a new brand logo.

In November 2016, Western Digital and Tsinghua Unigroup established Ziguang Western Digital Company in Nanjing with a registered capital of US$158 million, of which Western Digital and Tsinghua Unigroup each hold 49% and 51% of the shares. In September 2017, Western Digital acquired Toshiba's semiconductor business for US$18.3 billion.

Now, Western Digital is preparing a new transformation plan and plans to sell its storage business to Kioxia Holdings.

According to reports, the two parties have held in-depth negotiations and plan to establish a new holding company after the merger. Western Digital will retain 50.1% of the assets, and the remaining 49.9% will be owned by Kioxia. The president of Kioxia will manage the new company's business, while the Japanese representative company will occupy the majority of the board of directors. The new company will be registered in the United States but will be headquartered in Japan and its shares will be listed on the U.S. and Tokyo stock exchanges.

If the merger is successful, the two parties will surpass South Korea's Samsung Electronics in global market share in the NAND field and amount, ranking first in the global memory market sales.

Lansheng Technology Limited, which is a spot stock distributor of many well-known brands, we have price advantage of the first-hand spot channel, and have technical supports.

Our main brands: STMicroelectronics, Toshiba, Microchip, Vishay, Marvell, ON Semiconductor, AOS, DIODES, Murata, Samsung, Hyundai/Hynix, Xilinx, Micron, Infinone, Texas Instruments, ADI, Maxim Integrated, NXP, etc

To learn more about our products, services, and capabilities, please visit our website at http://www.lanshengic.com

0 notes

Text

0 notes

Text

XPG Unveils the New XENIA 15G Gaming Laptop

XPG XENIA 15G gaming laptops

XPG, a rapidly expanding supplier of systems, parts, and accessories for gamers, pros in esports, and tech enthusiasts, introduced the newest iteration of the XPG XENIA 15G gaming laptop to global markets today. With the goal of providing gamers, developers, and content producers with an all-around performance laptop at an affordable price, XPG has worked assiduously to create a device that would satisfy all of your demands without going over budget. Nothing is too difficult for the XENIA 15G (2024).

Take on everything and everything

The result of several years of gaming laptop development is the XENIA 15G. Numerous hours of study and testing have been conducted since then in order to provide an affordable laptop for the current user. You can play anything and do everything without compromising performance thanks to a 14th Gen Intel Core i7-14700HX CPU, up to an NVIDIA GeForce RTX 4070 series GPU, high-speed ADATA DDR5 DRAM, and a 15.6″ FHD IPS 144Hz display.

Absurd Expandability

More expandability is necessary in a world where games may easily weigh over 100GB when updates and DLC are included, whole servers are powered by laptops, and users are creating and maintaining their own closed AI models. The days of considering 8GB of RAM and 100GB of storage to be sufficient for gaming are long gone. Thus, XPG designed a laptop with ongoing development and improvement in mind.

Although the XENIA 15G is shipped with a fast 1TB ADATA LEGEND 850 SSD, an astounding three SSD slots are available. That means that if you combine ADATA S70 8TB SSDs with your storage, you can simply increase its capacity to an amazing 24TB. Similar to the previous model, this one has 16GB of ADATA DDR5 DRAM that can be increased to 96GB by purchasing two ADATA DDR5 48GB modules. ideal for heavy workloads in content production and AI development.

Modifications for Geek

Many advantages of the XPG XENIA 15G may go unnoticed by the uninformed user. You can easily handle demanding work right out of the box with the powerful Intel Core i7-14700HX CPU. Remember, too, that you can obtain even more seamless, continuous performance with the 5.5GHz peak turbo capabilities. Similar to this, the GeForce RTX 40 Series laptop GPU makes use of NVIDIA’s Ada Lovelace architecture to provide complete ray tracing and AI-powered the DLSS 3, which result in a performance boost for the newest games.

Furthermore, users may bypass the integrated graphics and deliver frames straight to the display by switching between NVIDIA Optimus Hybrid Mode and Discrete Graphics Mode using the inbuilt MUX switch. Higher frame rates, more fluid gameplay, and lower latency are all made possible by this, providing the best laptop gaming experience possible.

It’s all done by the XPG XENIA 15G (2024). This laptop is capable of fulfilling the demands of a wide range of users, including avid gamers, content creators, AI developers, students, and working professionals. Thanks to its many expansion possibilities, it will continue to function well for many years to come. Utilize the XENIA 15G to work, create, and have fun with XPG.

Concerning XPG—XTREME PERFORMANCE GEAR

ADATA founded XPG to provide gamers, esports professionals, and tech enthusiasts high-performance goods. They collaborate with the gaming and esports communities to understand consumer demands to produce high-performance devices. They provide a wide variety of products, from complete systems to peripherals, systems, and components, and they design them with the highest standards of performance, stability, and dependability. Additionally, they create goods with very stylish designs that have won us several important international prizes, like Good Design and iF Design. In addition to their product line, they actively promote and fund esports teams and events throughout the world to provide the best possible extreme gaming experiences.

FAQS

Which are the possible configurations?

The CPU, GPU, RAM, and storage combinations for the XENIA 15G may be changed in a number of configurations. The official XPG website or the websites of the retailers provide the particular selections.

Is it appropriate for use in creative professional work?

Despite being mainly designed for gaming, the XENIA 15G’s potent components make it suitable for demanding creative jobs like 3D rendering and video editing. For professional work, some users may, nevertheless, prefer a display with a greater resolution.

Read more on Govindhtech.com

#xenia#XPG#XENIA15G#GamingLaptop#govindhtech#ADATA#NewsUpdate#technologynews#technology#news#technews#DDR5

0 notes

Text

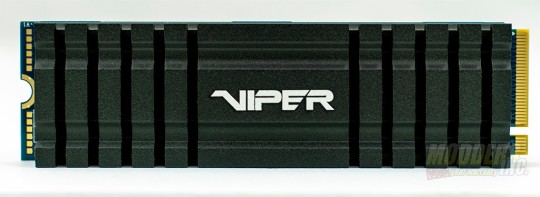

Patriot Viper VPN100 PCIe M.2 SSD Review

Before keyboards, mice and other accessories, Patriot was a flash memory based company. It originally started with RAM and then started to release USB flash drives and eventually started producing SSDs and gaming peripherals. Patriot's Viper product line is considered their top of the line products and meant for those discerning consumers that demand the best. The Viper VPN100 PCIe M.2 SSD is Patriots next entry into the M.2 PCIe drive market. The VPN100 comes in capacities from 256GB all the way to 2 TB and is covered by a 3-year warranty. This drive features a massive heatsink and the drive boasts a 3450 MB/s read speed and 3000 MB/s write speed. The VPN100 uses the latest Phison E12 controller that is PCIe Gen 3 x 4 capable and supports the latest NVMe 1.3 specification. FEATURES: • Phison E12 Controller • 2280 M.2 PCIe Gen3 x 4, NVMe 1.3 • DRAM Cache: 512MB • External Thermal sensor • Heatshield design • Extreme high performance • Operating Temperature - 0° ~ 70°C • TBW: 800TB • 4K Aligned Random Read: up to 700K IOPs • 4K Aligned Random Write: up to 480K IOPs • Sequential Read (ATTO): up to 3,300MB/s • Sequential Write (ATTO): up to 2,200MB/S • Sequential Read (CDM): up to 3,300MB/s • Sequential Write (CDM): up to 2,200MB/s • O/S Supported: Windows® 7*/8.0*/8.1/10 *May require driver Packaging Patriot's packaging for the Viper VPN100 is eye-catching. On the front of the box, there is a large graphic of the drive. The actual drive capacity is noted by a sticker also located on the front. The back fo the box contains the specifications of the drive in multiple languages. There's also a front flap that can be opened. Inside the flap, Patriot gives you some information on why the company thinks this drive is the one for you as well as goes into a little more detail on the cooling features of the drive. On the opposite side, you can get a peek at the actual drive housed in a plastic shell.

Upon opening the box, you'll be presented with a plastic shell with the Viper VPN100 drive encased within.

A Closer Look at the Patriot Viper VPN100 The most prominent feature on the drive is the large heatsink applied on top of the controller and memory ICs. The heatsink is made of aluminum and features 10 vertical slots for airflow and the Viper logo in the center.

From the side profile, you can see the heatsink is fairly tall on the Viper VPN100, measuring in at 10mm. That's great for everyone except for those that would like to put this in their laptop. In most cases, this drive won't fit.

On the back of the drive, Patriot put a sticker indicating the drive's capacity and other pertinent information. You can see here that our test sample is the 512 GB version.

After initial testing, I decided to pull the heatsink off the VPN100 to get a look at the controller and memory ICs below. The picks that come in the iFixIt kit were essential to removing the heatsink. I slid the pick between the heatsink and and the modules below it. Good lord, whatever thermal pad they used took forever to clean off from the ICs. Using some isopropyl alcohol and some elbow grease, I still wasn't able to get all of the adhesive off of the ICs. It was stuck on pretty well.

The Viper VPN100 has ICs on only one side. The controller, DRAM, and flash are all located under the heat sink.

The controller for the Viper VPN100 is the newest Phison PS5012-E12 controller. The controller is PCIe 3.0X4 with NVMe 1.3 protocol support. The E12 (non-c variant) can support up to a max capacity of 8 TB. Sequential speeds of 3200 MB/s read and 3000 MB/s write can be obtained using this controller.

Two 256GB 64-layer BICS 3D triple-level cell chips labeled TCBBG55A1 which, are manufactured by Toshiba. The write endurance is rated at 800 TB which is pretty massive for a 512 GB SSD.

Finally, the DRAM is a Nanya 512MB memory chip that is used for caching.

Test Setup & Results Component Product Name Provided By Processor Intel Core i7-8700K (Retail) Intel Motherboard Aorus Z390 Pro Gigabyte Memory G.Skill SniperX 2x8GB @ 3400MHz 16-16-16-36 (XMP) G.Skill Drive Patriot Viper VPN100 512 GB NVMe SSD, Samsung 240 EVO 256GB SSD Patriot/Samsung Video Card Zotac Geforce GTX 1080 mini Zotac Monitor BenQ EL2870U 28 inch 4K HDR Gaming Monitor 3840×2160 @ 60 Hz Case DimasTech EasyXL DimasTech Power Supply Cooler Master Silent Pro M2 1500W Cooler Master Operating System Windows 10 x64 Pro with latest patches and updates All of these tests were performed before I removed the heatsink. Additional testing was done after the heatsink was removed. The first round of benchmarks was run with an empty drive. The second round of benchmarks was run with the drive over 75% full. Each benchmark was run three times and we recorded the best overall scores for this review. There were no less than 20 minutes between each benchmark to give the drive time to cool down and rest. A quick side note. The threaded Q-depth tests on the Anvils Storage Utilities named the drive as a Toshiba drive, However, it had the correct letter and capacity. ATTO Disk Benchmark The ATTO Disk Benchmark utility was designed to measure regular disk drive performance. However, its more than capable of measuring both USB flash drive and SSD speeds as well. The utility measures disk performance rates for various sizes of files and displays the results in a bar chart showing read and write speeds at each file size. The results are displayed in megabytes per second Both the fresh out of box and the 75% capacity tests are almost identical with the 75% test just barely ahead. The ATTO tests were able to get extremely close to the manufactures advertised speeds. AS SSD Benchmark AS SSD Benchmark is a simple and portable utility which helps you measure the effectiveness and performance of any solid state (SSD) drives connected to your system. It will test “Seq”, “4K”, “4K-64Thrd” and Access Time. In the end, it will give your SSD a score. 4K tests the read/write abilities by access random 4K blocks while the Sequential test measures how fast the drive can read a 1GB file. For AS SSD, we run the SSD benchmark and the Copy Benchmark. Empty Drive: 75% Capacity The AS SSD tests came back with 2247.75 MB/s read and 1984.01 MB/s write on the empty drive for the sequential tests. 4K results were 45.63 MB/s read and 117.71 on the write and earned an overall score of 5302. The tests with the drive at 75% resulted in 2250.58 MB/s read and 1982.07 MB/s write in the sequential tests. 4K resulted in 55.40 MB/s read and 146.20 MB/s write speeds with an overall score of 5302. Each of the tests fell a bit short of the manufactures stated sequential read and write speeds. Anvil’s Storage Utilities Anvil’s Storage Utilities is a powerful performance measurement tool for both traditional hard drives and SSDs. The tool can monitor, and test read and write speeds on hard drives while also providing information from the Windows Management Instrumentation (WMI) that provides basic information about the disk and its parameters, including partitions and volumes. The ANVIL SSD benchmark resulted in sequential read speed of 3281.40 MB/s read speed and 1984.50MB/s write speeds on the fresh drive with an overall score of 15698.26. The VPN100 at 75% capacity yielded a result of 2301.12 MB/s read and 1984.50 MB/s write speeds and for the first time in our testing scored lower at 14835.12 overall. CrystalDiskMark 5.2.1 CrystalDiskMark is designed to quickly test the performance of your hard drives. Currently, the program allows to measure sequential and random read/write speeds. Crystal Disk Mark is where we see the closest sequential read and write speeds to what the manufacture published. The empty drive resulted in 3469.9 MB/s read and 2101.1 MB/s write speeds. When the drive was filled up to 75% of its total capacity, the read speed came back at 3472.0 MB/s and 2105.3 MB/s on the write speed. 4K speeds were good as well at 966.7 MB/s read and 1952.7 MB/s write on the empty drive compared to 1065.3 MB/s read and 1939.8 MB/write speed when the drive is filled to 75%. Conclusion and Final Thoughts First, let's get some additional testing out of the way. For this drive specifically, I really wondered if the heatsink was necessary. The drive is fast and from the results so far, meets the specifications listed. I reinstalled the drive in an open slot below the GPU with no heatsink installed, including the SSD covers that come with the Aorus Z390 Pro motherboard and I ran through some tests once more. The results were similar to the results that were obtained with the heatsink installed. During this test, I also pulled up AIDA 64 to monitor temperatures as the controller has a max operating temperature of 70°C. During the non-heatsink tests, I saw a max temperature of 50°C and 53°C during an extended write test using HDDTune. With the heatsink installed, I observed temperatures of 45°C during our standard test suite and an absolute max of 47°C in the extended write testing. Take into consideration these tests were performed on an open test bench and not in a standard PC case or a laptop. Even then, I would think it would be safe to say the SSD would keep temperatures down below the throttling threshold.

The Patriot Viper VPN100 is armed with the latest controller from Phison and the latest 3D NAND from Toshiba. The pairing results in great speeds for the drive. In my testing, I was able to easily eclipse 2 GB/s write speeds and 3 GB/s read speeds. I do feel the packaging on the Viper VPN100 is slightly misleading. The box does say up to 3000 MB/s write however, that's only on the 1 and 2 TB models and yet those specifications persist on the smaller capacity drives as well. You'll have to dig into the product documentation for the actual specifications. Shame on me, as I did make the fatal mistake of believing the box vs reading the product documentation when I first started testing the drive. The Viper VPN is a fast and stable drive. I continue to try to heat it up and get it to throttle but as of yet, I have been unable to do so with the heatsink off. So, if you feel like pulling that massive hunk of aluminum off, you can slide this drive into your laptop. As of this writing, the Viper VPN512 GB model can be had for $83 on Amazon with the 1TB slightly more at $145. Combine the pricing with the speeds and you've got a drive that is hard to beat. Read the full article

3 notes

·

View notes

Text

The Secrets Of Substrate-Like PCB Market 2024 In One Place - Check It Now ($2.6 Billion Market)

“Substrate-Like PCB Market by Line/Spacing (25/25 & 30/30 µm and Less than 25/25 µm), Inspection Technology (Automated Optical Inspection, Direct Imaging, Automated Optical Shaping), Application, and Geography - Global Forecast to 2023"

The substrate-like PCB market is expected to grow from USD 1.1 billion in 2018 to USD 2.6 billion by 2024, at a compound annual growth rate (CAGR) of 15.6% during the forecast period. The high adoption of SLPs by leading OEMs, surge in demand for smart consumer electronics and wearable devices, and impactful benefits of SLP are a few major factors driving the growth of the substrate-like PCB market.

Automated optical inspection (AOI) to account for largest market during forecast period

AOI is an automated vision inspection of PCB during the manufacturing process. It is used to scan the inner and outer layers of PCBs after the processes of etching and stripping. After the circuit patterns on inner layers and outer layers are formed, there may be defects on them such as open circuit, short circuit, missing copper, and excess copper. AOI systems identify defects accurately.