#Dave Rubin Husband and information

Explore tagged Tumblr posts

Text

In hundreds of videos since taken down by YouTube, right-wing influencers working for Tenet Media—a company the US Department of Justice alleges was financed and guided by a state-backed Russian news network—showed interest in a highly specific set of topics, according to a WIRED analysis.

Using closed captioning of the videos we downloaded before the videos were removed, we've compiled lists of terms frequently mentioned in them, along with a searchable database:

The content of these videos was described by prosecutors as “consistent” with Russia’s aim of sowing political discord in the US. Among the areas covered: free speech, illegal immigrants, diversity in video games, supposed racism toward white people, and Elon Musk.

While an indictment unsealed earlier this week does not name Tenet, WIRED and other outlets were able to identify it because prosecutors gave its motto as that of a business identified as “U.S. Company-1.” Prosecutors allege that two employees of the state-backed Russian network RT, Kostiantyn Kalashnikov and Elena Afanasyeva, who are charged with conspiracy to commit money laundering and to violate the Foreign Agents Registration Act, paid Tenet and its parent company $9.7 million to produce and distribute videos supporting Russian aims. The vast majority of that money allegedly went to Tenet’s network of popular influencers, which included Benny Johnson, Tim Pool, Dave Rubin, and Lauren Southern.

The influencers are not accused by the government of wrongdoing. Johnson, Pool, Rubin, and fellow talents Tayler Hansen and Matt Christiansen issued statements denying awareness of the alleged Russian influence scheme and portraying themselves as its victims. (They have not responded to requests for comment.) Prosecutors say that right-wing personality Lauren Chen and her husband Liam Donovan, Canadian nationals who founded Tenet—the two, who have not been charged with any crime, go unnamed in the indictment but are tied to the business through corporate records—were aware they were working with Russians and failed to register “as an agent of a foreign principal, as required by law.” The indictment alleges that the pair, who were not indicted, did not inform the influencers or other Tenet employees about the source of their funding.

Nonetheless, Afanasyeva, using fake personae, “edited, posted, and directed the posting by [Tenet] of hundreds of videos,” the indictment says. The indictment does not identify specific videos as allegedly influenced by the RT employees, but prosecutors say they were intimately involved in Tenet’s editorial process: “While the views expressed in the videos are not uniform, the subject matter and content of the videos are often consistent with the Government of Russia's interest in amplifying US domestic divisions in order to weaken US opposition to core Government of Russia interests, such as its ongoing war in Ukraine."

To determine what specifically the Russian government is alleged to have funded, WIRED downloaded the closed captioning transcripts from 405 long-form videos posted on Tenet’s YouTube channel—you can access the file here—and used natural language processing to identify common themes. These 405 video transcripts represent nearly every long-form video available on the channel. We were not able to analyze approximately 1,600 YouTube shorts before the channel was removed from the site. We analyzed the data looking for the most frequently occurring two-, three-, and four-word phrases in each video, excluding words like “um” that don’t carry much meaning. (“Um” appears in the dataset 2,340 times.)

This analysis does not show that in these videos the influencers were particularly fixated on the Ukraine war—the word “Ukraine” appears in the transcripts 67 times, about as often as “misinformation,” “Christianity,” and “Clinton.” It does show the influencers stressing highly divisive culture war topics in the videos, which carried titles like “Trans Widows Are a Thing and It’s Getting OUT OF HAND” and “Race Is Biological But Gender Isn't???” The word “trans” appears 152 times, and “transgender” 98.

Among the most common two-word phrases are “white people,” “Black people,” “civil war,” “free speech,” “Secret Service,” “illegal immigrants,” “Second Amendment,” and “Elon Musk.”

Common three-word phrases include “World War III,” “great original content,” “Black Lives Matter,” “diversity equity inclusion,” and “Sweet Baby Inc,” a reference to a Canadian consultancy focusing on diversity in video games which has been at the center of what has been called “Gamergate 2.0,” and has been targeted by right-wing culture warriors.

Among the few four-word phrases appearing multiple times: “War III around corner,” “racist towards white people,” “gay date trans woman,” and “massive attack free speech.”

In an affidavit unsealed this week in connection with the seizure of 32 domains that federal officials say were connected to a Russian propaganda campaign, the Department of Justice alleged that as part of what’s called “the Good Old USA Project,” the Russian government seeks to exploit culture war topics for its own ends, with the primary aim being the election of Donald Trump. According to the affidavit, the campaign, including the use of bots and engagement with influencers, was planned to aim at, among others, the “community of American gamers, users of Reddit and image boards, such as 4chan.” Among the narratives the campaign was designed to promote is that Republicans are “victims of discrimination of people of color.”

9 notes

·

View notes

Text

Floridumbassery

Dingbat Dave's political analysis naturally revolves around Joe Rogan clips (source: The Rubin Report on YouTube)

Well, as you might have heard, Ron DeSantis dropped out of the 2024 presidential race on Sunday. Since this piece of news is related to Florida, I figured I would go to my number one source for Florida related news; professional Ron DeSantis simp Dave Rubin.

In all seriousness, for those who don't inhabit the cartoon version of reality we call the "conservative media ecosphere", let me fill you in on Dave Rubin's connection to Ron DeSantis because it's a great example of how much of a complete moron Dave Rubin truly is.

So, Dave lives in Florida and his decision to move there was almost entirely informed by how much he liked Ron DeSantis as a governor. So naturally when Ron announced that he was running for president Dave was overjoyed and gave him his full support.

Before the Iowa Caucus, Dave, seemingly thinking he knew something that dozens of trained political analysts and my 11 year old cousin didn't, predicted that there would be a DeSantis upset in Iowa. Trump won Iowa and Dave has been coping over it on his show ever since. I give him half a month before he goes full MAGA bootlicker.

Anyway, I had been waiting for a good excuse to cover Dave again for a while and DeSantis dropping out was just the ticket. A little of this show is Dave coping and a lot of it is him running cover for some really awful people. So, let's get into it.

01:19, Dave Rubin: "OK guys, obviously there is something major to talk about, then we'll dive into a normal show and everything else, but Ron DeSantis has dropped out of the presidential race. This thing is Trumps to lose at this point, Nikki's hanging around, there's the gov who's now back in Tallahassee and we will continue to strengthen the free state of Florida."

There's a slight hint of the theme of Dave's coverage of DeSantis dropping out of the presidential race in the last part of that paragraph.

The theme is that, in what must be one of the most embarrassing rationalizations of a political loss that I have ever seen from a pundit, Dave has decided that Ron lost Iowa because he was too good.

02:25, Dave Rubin: "I just wanna say, first off, that it is always -- this is relative to Ron DeSantis and everything else in life I'd say, it's always worth fighting the good fight."

Dave has got to be the last person in the griftosphere still simping for DeSantis. You don't have political beliefs Dave, remember? That's why you sold your soul to the Koch Brothers and became a conservative media grifter. Move on man.

02:51, Dave Rubin: "I think fighting for good people and fighting for the right ideas are always worth doing and it's not just about if you get the political win or not."

"Yeah, even though he brutally lost and his entire presidential campaigns been a joke for months, DeSantis really won in a way."

Man, I thought conservatives like Dave hated participation trophies.

Also, a lot of those "right ideas" could hurt LGBTQ+ people like Dave and his husband.

The most infamous of these would be the "Don't Say Gay" Bill which is a bill that bans the teaching of sexual orientation from kindergarten through 3rd grade outright and 4th through 12 grade unless it's "expressly required by state academic standards". This bill obviously effects the safety and mental health of LGBTQ+ youths as it turns being anything but straight into a marginalized thing that isn't even allowed to be taught in schools. Studies have shown that students who go to schools that have LGBTQ+ inclusive programing report less victimization due to their sexual identity and a greater feeling of inclusivity.

Even without his bills, DeSantis has shown a disgusting homophobia streak. In a campaign video posted by DeSantis War Room on Twitter, alt-right imagery was overlayed over headlines criticizing Ron's anti-LGBTQ+ bills. It was interspersed with video of Trump (pretending) to support LGBTQ+ rights. The caption of the tweet read "To wrap up "Pride Month," let's hear from the politician who did more than any other Republican to celebrate it…" Real mask off shit.

In short, Dave Rubin is a goon who is campaigning against the rights of other people in the LGBTQ+ community and most likely his as well.

03:09, Dave Rubin: "As a Floridian, one of my concerns was 'Oh, we're gonna send our best guy who's basically done everything right in this state. This state that is a sanctuary for freedom lovers in America. We're gonna send our best guy into the chaos of the crazy machine that destroys everybody.'"

Man, the boot polish that DeSantis uses must be really tasty.

Also, Florida isn't in great shape at all under DeSantis. I already mentioned the regressive policies regarding LGBTQ+ people but here's another bad one; gun violence. A 2022 study showed that Florida has the second highest rate of fatal road rage shootings in the United States, only being beat out by Texas. As of December 14th of last year, Florida had seen 28 mass shootings. This is probably because Dave's hero Ronnie D has been working overtime to turn Florida into a gun owners paradise. In July of 2023, Florida’s government under DeSantis passed a bill that transformed Florida into a permitless carry state, essentially allowing anyone in Florida to carry a concealed weapon without a permit and or training, went into effect.

03:45, Dave Rubin: "When he announced this over the weekend I was kind of relieved."

You keep telling yourself that.

Dave reads a pro-DeSantis tweet from another guy named Dave. Dingbat Dave's in stereo.

06:32, Dave Rubin: "One of the things that I think I'll probably struggle with a little bit over the next year or so, or at least for the 10 months of this campaign is that you know how often I talk about truth on this show and how often I've said the easy thing about supporting DeSantis was, like, it's so rare that there's a politician who tells truth so you don't have to contort yourself to constantly just agree with or back or promote everything he says because your like 'oh its true, its simple, its good.' That's it."

Let's take a look at some of the things Ron has said and remember that, according to Dave, everything this guy says is true and good.

Whilst running for governor, Ron told his supporters not to "monkey this up" by voting for his opponent Andrew Gillum on FOX News. Gillum is an African-American so the likelihood that this dog whistle was a mistake is low.

He also keeps hanging out with Nazi's and racists. In 2017, Ron DeSantis spoke at an event exclusively dedicated to bashing Muslims alongside far-right commentator/likely pedophile Milo Yiannopoulos and Steve Bannon. In it, DeSantis made absolutely ridiculous and unproven claims about Barack Obama not vetting refugees. DeSantis also defended one of his supporters who said we should "bring back the hanging tree".

So yeah, "true, simple, and good". God, I hate all these people so much.

07:01, Dave Rubin: "By the way, I think that's one of the things that he suffered from as a candidate. Just kind of being good. I called it the Tim Duncan syndrome or the Tony Gwynn syndrome, I think that's what Steve Deace called it. If you're consistently batting 350, people aren't excited when you get another base hit. Tim Duncan, you win another MVP, another finals MVP, five time champ, nobody cares anymore, right. And I think DeSantis suffered from a bit of that."

So, DeSantis lost Iowa because he was so consistently good that the voters got bored of how good he is and just stopped caring. Lets be absolutely clear here, no candidate in the history of politics has ever lost because too many people liked them. That makes absolutely no sense. Also, no sports fan on the planet thinks that a players consistent success is boring!

This is the point in the episode where most viewers who are members of the reality based community would realize that this is propaganda and turn it off. But not me, let's slog onwards.

Dave decides to end all the politics talk and now it's time for him to talk about his usual "culture war" bullshit. I was mostly here for Ronnie D related cope and now that I've seen that the show gets excruciatingly boring. Dave talks about how he prefers to talk culture than politics, probably because when he talks about politics he makes himself look like a moron but I digress. He's decided to talk about a crowd of people chanting "fuck Trudeau" at a UFC match in Canada. He plays a clip of Joe Rogan reacting to said chant and then launches straight into his take.

09:46, Dave Rubin: "Again, you may not care that much about UFC. Again, I said it's not really my thing. But I'm trying to show you, when you watch newscasts and they miss all the culture stuff and you wonder 'How did Trump return?' it's because of things like this."

We live in a world with; multiple wars being waged, numerous natural and manmade disasters occurring, and an absolutely bizarre political climate. Dave Rubin's bullshit video of Joe Rogan reacting to a clip of some belligerent assholes cussing out a politician at a wrestling match is obviously low on the totem pole of stories to cover.

Half the problem here is that we don't even know if these guys chanting "fuck Trudeau" were even Canadian. A vast majority of people in that arena were there to see Sean Strickland who has made a name for himself by going on homophobic tirades and defending the trucker convoy, but I'll keep all that under my belt until later in the episode. As somebody who lives in Toronto, we are pretty liberal up here.

10:09, Dave Rubin: "He says 'I like Pierre Polivay'"

I did not misspell that, that's legitimately how Dave pronounced Pierre Poilievre's (pronounced Poly-ev) name. Dave Rubin: Master Orator strikes again.

10:15, Dave Rubin: "But the fact that thousands of people are showing up to a UFC fight to say f the prime minister of Canada, the guy who shut down the truckers and the bank accounts and all of that and was one of the worst COVID authoritarians in the entire world."

I didn't expect to have to talk about the so-called "Freedom" Convoy in a Dave freaking Rubin episode yet here we are. Man, this is a lot more local than I thought it would be.

The truckers he's talking about were a group of protestors, mainly truckers, who descended on major cities like Ottawa to protest against vaccine passports. They also blocked border crossings.

Naturally these protests went way beyond peaceful and became extremely disruptive. The border-blockades blocked off the shipment of essential goods between the US and Canada (and also were a massive pain in the ass for travelers) and the truckers in Ottawa were intentionally obtuse, they infamously honked their horns long into the night which disrupted the lives of people in the city. They even harassed people for the awful crime of.....being outside and wearing a mask. Many of the truckers displayed alt-right iconography like confederate flags and swastikas. For obvious reasons, people in cities like Ottawa legitimately starting fearing for their safety.

The Ottawa Police were actually twice as lenient to the truckers than they were with previous protest movements, and they say white privilege is a thing of the past! Trudeau eventually declared a state of emergency which allowed the RCMP to finally clear the truckers out of the city.

As for the bank accounts, they only froze the bank accounts of the protestors in Ottawa and that was after they were warned that it was going to happen. The freeze was lifted soon after.

Also, lets set the record straight here; these are the same goons who won't shut up about BLM "rioting" because of a couple of isolated incidents. Yet when a protest group of alt-right assholes barges into a city and causes actual chaos, all of a sudden they are heroes. Even if we except the false conclusion that the BLM protests were just a bunch of violent mobs, which the data has shown is false, he should be absolutely against the truckers too.

10:49, Dave Rubin: "Now, I wanna connect this to something that I think is more largely happening in the country. Like, why is it happening? Why are these people showing up to a fight to scream f the prime-minister. Well, there's a specific reason for it in this case. Over the weekend there was a press-conference for this fight and UFC middleweight champ, his name is Sean Strickland, he got into it with a reporter, a woke reporter of course, trying to get him on some past comments."

Half of this episode is Dave defending vicious homophobes. Pretty ironic since he's one of the few gay men in the griftosphere.

So, the reality of this press conference is that this reporter asked Sean to elaborate on a tweet he made in 2021. Now, before I tell you what the tweet said, this is a perfect time to illustrate how the grift works. Notice how Dave doesn't say what those past comments were nor how recently Sean made them. The impression you would get from this is that this reporter dug up some innocuous comment Sean made years ago instead of a publicly available tweet from 2021. Here's what Sean said in the tweet, I'm not typing it because I feel uncomfortable typing this unless I need to;

Yeah, some past comments alright. He's essentially equating being gay with being weak, something which Dave as a gay man shouldn't be so OK with. But Dave doesn't give a shit because defending this asshole is what all of his rightwing friends like Matt Walsh are doing and who cares about principles?

And you know what else? In the press conference Sean doubled down on that hateful rhetoric. The thing that caused Sean's tirade was Sean asking the reporter if he would be OK with having a gay son and "never having grandchildren" (as if there aren't options like adoption and surrogacy). When the reporter said yes, Sean replied by saying this;

"You’re a weak f—ing man, dude. You’re part of the f—ing problem. You elected Justin Trudeau when he seized the bank accounts. You’re just f—ing pathetic,"

Sean also had this to say about transgender people;

“Here’s the thing about Bud Light. Ten years ago, to be trans, was a mental f—ing illness. And now all of a sudden people like you have f—ing weaselled your way into the world. You are an infection. You are the definition of weakness. Everything that is wrong with the world is because of f—ing you,”

Yeah, the fact that Dave is lending his support to this bigoted asshole tells you everything you need to know about Dave's character.

Anyway, Dave plays a clip from the conference. Here's what he has to say about it.

12:22, Dave Rubin: "He's well spoken, I'll give him that much."

More than can be said for you. I find it surprising that Dave, again a gay man, isn't ticked off by Sean's bigoted ramblings. I guess money trumps morals.

12:26, Dave Rubin: "It doesn't even matter if you agree with all of the specifics and I could get into some of the nuance there, that's not really the point. The broader point is that this guy is going after the media in a very Trumpian way."

Because they pointed out that he is a bigot, this shouldn't be that hard to understand.

Also, the “nuisances”. Oh, you mean like the fact that you and your husband have two kids? The fact that this tangent is basically Sean saying he hates you for who you love? Those nuisances Dave?!?

13:15, Dave Rubin: "So the problem, of course, with the woke is that they are so fixated on these faux social issues that they actually ignore real tyranny when it comes from the real tyrants."

I don't think Dave even knows what woke means at this point. I've heard him use it to describe the people he's currently calling "tyrants" and now I guess he's using it to describe activists on the left.

Anyway, I wonder what these "faux-social issues" are? Could it be racism or transphobia? Actually legitimate social issues that the data shows are actually legitimate social issues.

Speaking of transgender people, Dave has thoughts on Sean's disgusting thoughts on them. They are also disgusting.

14:54, Dave Rubin: "Ok, again, you don't have to agree with exactly how he's saying it or anything else. But he is, like, directionally right and also it illustrates the broader point of enough people have had enough of this."

Notice how when it comes to gay people, the line is "it doesn't matter if you agree with all the specifics" whereas when it comes to trans people it's "you don't have to agree with exactly how he's saying it", implying that the transphobia is less of an issue than the cursing.

Also, a majority of the population is fine with trans people for the simple fact that they deserve the right to exist. It's just these right-wing goons who know how to scream loudly enough that they seem like the majority.

15:13, Dave Rubin: "It's like, do you think that this guy, when he was training to be a great fighter for years and years and years, thought that mostly when he would be giving press conferences before the biggest fight of his life he'd be talking about whether girls are boys and boys are girls."

Does Dave think that the reporter just asked him that question for shits and giggles? Sean got asked that question because he espoused disgusting views on the subject of LGBTQ+ rights and any journalist worth their salt would press him on that in an interview or press conference.

15:29, Dave Rubin: "Woke-ism has infected literally everything in society from the military down to the UFC and everything in between and now people have had enough."

Even going by the loose and ever changing Dave Rubin definition of "woke", the UFC is so far from woke that it isn't even funny. The president of the UFC, Dana White, is an open Trump fan for one.

Woke is just Dave Rubin's "git-r-done!"

15:40, Dave Rubin: "And again, I would connect that exactly to the rocket fuel that is behind Trump right now."

You can already sense Dave slowly switching over into MAGA bootlicker mode.

Dave plays another clip of Sean Strickland, this time he's ranting about how "the LGBTQ+ agenda" is getting into schools. Again, that LGBTQ+ agenda line the right constantly tows is a complete load of horseshit. It's like saying that eating some lettuce instantly turns you into a vegetarian. Plus, it boxes cisgender relationships in as "normal" and LGBTQ+ ones as a sort of weird lifestyle choice.

I get the sense that Sean Strickland is just a reactionary asshole trying to get attention. That tirade, plus others he's gone on in the past, are clear grabs for attention and the griftosphere has delivered that in spades. Even if, by some miracle, the UFC gets rid of him he'll probably be guaranteed a spot at the two places where reactionary grifters go when their temporary fame has died out; The Blaze Network or Charlie Kirk's show. As a result, brace yourself for the next loud bigoted statement from Sean because these types don't ever stop trying to extend their fifteen minutes of fame.

16:57, Dave Rubin: "Yeah, that's all true. Like, that is all true. Almost everyone now, not everybody but most people, especially if you're of a certain age. Like, if you're under, say, 55 you basically--no one cares about anyones sexuality anymore."

Tell that to Ben Shapiro, who is a 40 year old man who was homophobic to you directly to your face while you just sat there and took it because he's important in the griftosphere.

In all seriousness, people absolutely are bigoted towards people for their sexuality. Good examples of this would be the two guys that Dave is going on sycophantic tangents defending for the reasons we already mentioned. Outside of Sean and Ron, LGBTQ+ hate crimes are on the rise according to the FBI.

17:24, Dave Rubin: "Then they decided to push all of this in the schools relentlessly. Tell you that if you didn't want your kid learning about sex when they were in fourth grade that you're a bigot, that you're a racist."

So I guess Dave is just generally opposed to sex-ed as a whole. Yeah that tracks.

Plus, teaching kids about sexuality isn't "teaching your kid about sex". Believe it or not, you can teach a kid about being gay or trans without even bringing sex into the conversation just like how you can display straight relationships without talking about sex.

Dave plays a clip of Dana White defending what Sean Strickland stated. Dana didn't address the spirit of what the reporter was saying and just split hairs about how the guy said "you obviously give your fighters a long leash". Dave's thoughts are equally uninteresting here.

19:44, Dave Rubin: "What's really amazing is that Strickland, he's going after Bud Light. Bud Light is now one of the biggest sponsors of UFC, they gave Dana White a ton of money and suddenly Dana White is now promoting Bud Light again. So nobody is perfect in all of this but I'll certainly give Dana White credit right there for being like 'Oh, one of my guys is going after my major sponsor and I'm gonna defend his right to do it.' Isn't that seriously something?"

There's an obvious reason for this that Dave is neglecting to mention, allowing Sean to go on his deranged tirades gets eyes on the UFC.

I had never heard of Sean in my life before Friday when all of a sudden every single person on the right started talking about him. While this certainly alienates me as an audience member, I can see this tirade attracting people on the political right who agree with what Sean is saying and that means more money for Dana.

Then Dave goes into an ad pivot.

21:45, Dave Rubin: "OK, so now I wanna connect this to more widely what's going on in the culture war and what is also happening political. Because, again, these things are deeply deeply connected and if you just ignore the culture part you are always going to be in slow-motion mode. What do I always say? Truth is a time release pill these days."

Ron DeSantis wrapped himself up in the "culture war" and look where that got him. Starting to uncritically pay attention to Dave's culture war nonsense is going to put you in even greater "slow motion mode" than when you weren't. All it is is a distraction from real genuine issues.

"Don't look at the gun violence epidemic and the fact that people are dying because they can't afford healthcare, look at this transwoman on a beer can."

22:11, Dave Rubin: "So, Tiffany Justice, she is the co-founder of Moms for Liberty. I know Tiffany, I've seen her at many events, I think I've done their podcast at least once or twice."

Lets talk about Moms for Liberty because this is another group full of anti-LGBTQ+ bigots that for some reason Dave has chosen to defend. Dave seems to love people that hate him.

Moms for Liberty is a far-right "activist" group that primarily advocates for the removal of school curriculum related to racial diversity and sexual orientation. To summarize their views on the youth, their Hamilton County chapter quoted Hitler in a newsletter. Even if by some miracle they didn't realize that this was a Hitler quote, the quote "He alone, who owns the youth, gains the Future" is a horrifying representation of the reason why they do what they do. Naturally, the Southern Poverty Law Centre has designated them as an extremist group.

Their main goals seem to revolve around book banning, all whilst hypocritically saying that they believe in the Constitution. Despite claiming that they are against books with "sexual material" in them, they are all big fans of the Bible which is filled to the brim with sexual material. In case you were wondering what kinds of books they are for banning, here's a complaint one of their chapters filed against a biography of MLK Jr for being "anti-white". Anne Frank's Diary was also banned as a result of the group. Between that and the Hitler quote, I'm beginning to see a pattern here. Solidifying that pattern I just mentioned is the fact that they also have connections to an alt-right terrorist group called The Proud Boys.

As for Tiffany Justice herself, she's a complete lunatic who seems to think that yelling loudly is a substitute for having actual good points. This was exemplified when she came out against social-emotional learning.

Social-emotional learning is an educational model that aims to teach children skills such as empathy and self-awareness. Tiffany, with absolutely zero evidence, decided that this was left-wing indoctrination. Quote;

“It’s meant to replace the child’s values and morals in the home with an idea of spirituality.”

In short, teaching kids how to be a decent human being is up for debate with Moms for Liberty. This is a group full of really nasty people and if Dave had any self-respect he would be against them instead of defending them.

So, the reason that Dave is talking about this is because Tiffany recently did an interview with MSNBC's Joy Reid about book bans in schools. The resulting interview was a bizarre mess where Tiffany didn't really respond to any of Joy's points and instead screamed stupid talking points about "kids reading about anal rape". In the interview, Joy Reid came off as calm and reasonable while Tiffany came off as a dildo obsessed blithering idiot who can't argue in a way who isn't intellectually dishonest. Watch it here.

Joy also made an excellent point about how, even if certain parents are uncomfortable with sexually explicit content being taught to their children, they can opt in and opt out of their children reading it. During said moment, Joy brought up a book entitled All Boys Aren't Blue and asked Tiffany if it was her right to deny the book to children who might feel seen by the story. Since this story contained sexual assault of a minor, Tiffany distorted Joy's argument into it being her saying that children feel seen by depictions of child rape, ignoring that a lot of the book was about growing up black and queer in New Jersey and the entire book didn't revolve around the sexual abuse that the author suffered as a child. There were plenty of parts of that book that a child could relate to that don't involve the sexual assault but naturally guys like Dave Rubin and Matt Walsh don't know about that since they don't bother to look into what they are covering.

Even going off of Tiffany's insane bullshit argument, teaching kids that are the victims of sexual assault that what they went through is wrong and the tools to handle their trauma is objectively a good thing.

Anyway, sorry about the long tangent. Just had to lay out some background info. Back to Dingbat Dave.

24:24, Dave Rubin: "OK, Joy is just so absolutely unbearable that she tries to pin this down on 'you don't know the name of the main character'. She knows that it's George, she knows that it's biographical, et cetera, et cetera."

The point that Joy was making when she asked Tiffany what the main character of All Boys Aren't Blue's name was is that Tiffany and her group portray themselves as these experts on literature and why it's harmful towards minors and yet she doesn't even know the name of the person that wrote the book that she hates so much.

25:19, Dave Rubin: "Just think back to when you were in 3rd, 4th, grade, right? Think about your teacher, my third grade teacher Mrs Kachin, absolutely loved her, she read us the Secret Garden and she did all the voices, I just absolutely adored this woman--Imagine if instead of reading The Secret Garden to us, if she was reading this book about anal rape and dildos and incest and everything else."

That would be a relevant argument to make if the reason that Moms For Liberty is campaigning about this book is because it was being taught to third and fourth graders and all they wanted to do was remove it from the curriculum but that isn't what this about.

We are talking about removing this book from libraries all together. In making up this completely irrelevant example, Dave has distorted the entire story into "they were reading this story about anal rape to kids and then Moms For Liberty swooped in and saved the day" and that's simply not what happened.

All Boys Aren't Blue has been taught (and subsequently banned) in high schools and that is significantly different than grade 3 or 4. I can't find a record of this book being taught to third graders.

Dave plays another clip from the interview. Dave then reads a tweet from a guy named James Lindsay who I will probably go more in depth about if he's mentioned again more prominently in another episode. The tweet reads as follows;

"Anyone who will lie to you the way Joy Reid lies to Tiffany Justice here will kill you the second they have the clearance and need to do so."

While this may sound ridiculous to anyone in the reality-based community, Dave agrees with this.

29:34, Dave Rubin: "What do Marxist movements do? How many people have died in the name of Communism, right?"

This is ridiculous. So the left is a bunch of communists because Joy Reid pushed back on one of the leaders of a known extremist group.

Another clip from MSNBC, more stupidity from Dave.

31:19, Dave Rubin: "It's not your right to tell anyone when their children should learn about sex."

That's why schools allow parents to opt their child out of sexual education.

Ad pivot. Dave rambles about how everyone is so oppressed by the left and that's why Trump is gaining all this support. He plays a clip of the CEO of JP Morgan talking about how Democrats don't respect people who vote for Trump.

36:40, Dave Rubin: "Yeah, that's just right, that's just right. Because what's Jamie Diamond doing there? He's defending just the average American, just a mom who wants to know what her kid is learning, right? Just a person who works at a company and doesn't want to be discriminated against because they happen to be straight and white."

We already talked about how Tiffany is clearly not just some "average mom who is just concerned about her children learning about sex" so lets look at that second statement, people are being discriminated against because they are straight and white.

Well, would it surprise you to know that the data does not back that claim up? Did you know that white people make up 77% of the labor force?

Dave plays a clip of Camile Paglia being interviewed by Charlie Rose. I'm noticing something about Dave (and a lot of these grifters but Dave is particular egregious) and that is that he is basically a reactionary reaction channel. Dave doesn't really argue his points, he just plays decades old clips from the Charlie Rose Show and lets them make his argument for him.

39:19, Dave Rubin: "All she's saying in essence is the thing that, again, we all knew which is the reverse of what the woke want which is get politics, get your social agenda out of school."

It's a sad state of affairs when teaching children about sexualities outside of being straight is politicized.

39:29, Dave Rubin: "When I was growing up and I went to all public schools, and I also went to a public college, but when I went to school you learned math, you learned science, you didn't learnt that boys were girls and the rest of the nonsense."

A): Absolutely moronic characterization of transgender people.

B): Does Dave think that they've phased math and science out completely in favor of curriculum revolving around sexuality?

40:31, Dave Rubin: "You know what's not working right now? It's our border, our borders not working."

Still ranting about the border, huh? I thought it would be old by now but I'll bite.

The Biden Administration has constantly tried to compromise with the GOP on the border and yet the GOP keeps stonewalling them at every turn, this is because their goals are to limit migration entirely and restart the construction of the border wall. Also, according to data found by the Cato Institute, the situation would be exactly the same under Trump. Biden has also tried to ask for funding for the border, the right has refused to give it to him.

Dave plays a video clip from "NJEG Media" (already a huge red flag) that claims to show "African migrants" in a New York City Park. Here's what probably actually happened; some right-wing influencer who wanted attention on the griftosphere went to a park and started filming African-American homeless people. Where's the proof these people even are migrants? Odds are that they were just homeless people.

42:23, Dave Rubin: "It doesn't make you a racist to wonder why all these people are wandering through New York City to wonder 'why are all these people wandering through New York City? And what do they think? And what are their intentions? And why are they here?'"

Lets say that these migrants were white, would you be wondering the same thing? If the answer is no, yeah it's racist.

Dave plays a clip of New York City in 1945 and this is so profoundly stupid. There are so many so many systemic factors beyond "Oh, migrants are wrecking NYC" for why homelessness has spiked. For one, the cost of living is significantly higher than it was in 1945. In terms of immigration, it's harder to become a citizen of the United States than it was in 1945, thanks to the right might I add, which leads to people seeking illegal means to enter.

44:15, Dave Rubin: "That doesn't mean there aren't activist lunatics on the right but that is not the major problem at the moment."

"I should know, I've spent the entire episode defending them."

Anyway, that's enough Dave Rubin for today. The rest of the episode is just more of him reacting to clips and I'm tired of it.

Conclusion:

Outside of the Ronnie D stuff, Dave didn't cover a single important news story the entire episode. It was just him defending bigoted reactionaries and reacting to clips he found on Twitter. I forgot how Dave Rubin is basically just a reaction channel. I guess he figured out that when he talks for long periods of time without playing a clip he inevitably ends up sounding like a complete moron.

Cheers and I'll see you in the next one.

#right wing bullshit#journalism#conservative bullshit#fact checking#bad takes#conservatives#disinformation#debunking#politics#dave rubin#fuck maga#fuck the gop

0 notes

Text

Dave Rubin husband Photos Information and their life details Comedian

Dave Rubin husband Photos Information and their life details Comedian

Dave Rubin Husband

Is she married?

About Dave Rubin :

About

Humorist and host of The Rubin Report on Ora TV. He is additionally known for his radio television show on SiriusXM satellite radio.

Prior to Fame

He was a high quality comic in New York City for a long time before turning into a TV and radio character.

Incidental data

He interned at The Daily Show in the fall of 1999.

Family Life

He…

View On WordPress

0 notes

Text

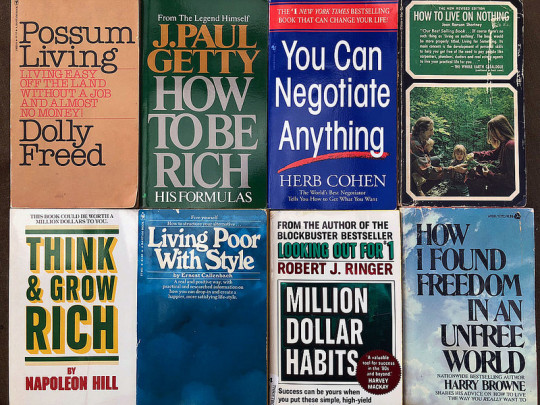

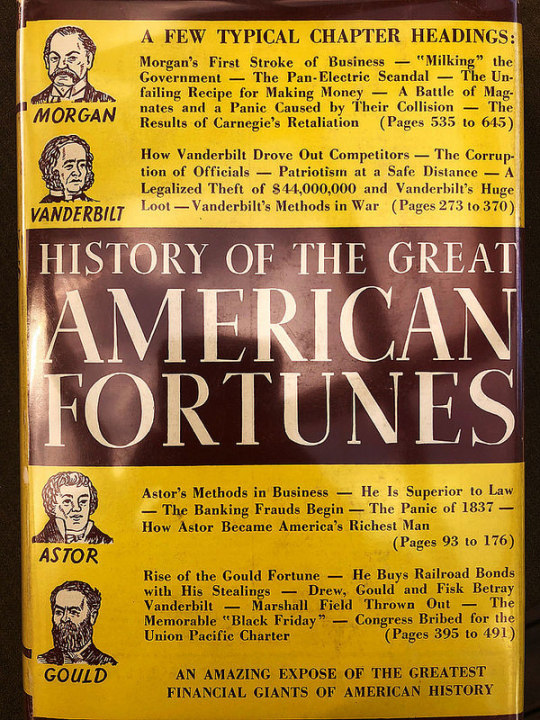

An index to every money book I've reviewed during the past twelve years

147 Shares I read a lot of money books. As a result, a large section of my large library is devoted to books about personal finance. (And if I hadn't purged hundreds of money books when I sold this site in 2009, I'd have even more books and no place to put them.) Last week, a GRS reader named Lindsay dropped a line with an interesting question: I'm really enjoying your work back at GRS, the email newsletter, and your most recent FB live video! I'm wondering: Do you have a list of all the money books you've reviewed? I've been poking around to try and find one)? As it happens, I've been wanting a list of reviews myself. I know I have a million billion different projects around here, but one that I'd like to pursue is a free nicely-formatted PDF download that compiles every review I've written. To answer Lindsay's question and to satisfy my own curiosity I sifted through the GRS archives yesterday to compile a list of every money book I've reviewed during my 12+ years at this site. In this post, I've linked to those reviews, plus I've included a short summary of each book. Note: I'm certain that about half of the reviews are missing from the archives. The folks who purchased this site from me unpublished hundreds of articles (including many book reviews, apparently) during the time they owned GRS. Those reviews still exist, and I'll eventually find them and list them here, but it's far too cumbersome to find them at the moment.

For each book below, I've included a link to Amazon. I've also assigned each a book a letter grade and, in some cases, a star . My letter grades might seem harsh. That's because I've tried to really think about these on a sort of curve, where the vast majority of books are average and only a few merit As or Fs. As a result, some important titles get average (or low) grades despite their contribution to the field. If I grade a book an A, I think it's excellent. It offers excellent advice with no real flaws.If I give a book a B, it's a good book with good advice, but something about it holds it back. Maybe it's poorly written or maybe it's off-base on a topic or two.If I give a grade of C, the book is average. That means it gives reasonable money advice in a typical way. There's nothing drastically wrong with the book, and it's worth reading.If I give a D grade, the book is flawed in some major way. It still has some value to it maybe a core concept that you can't find elsewhere but I'm hesitant to recommend this to average folks.If I give a book and F, I don't think it has any sort of value. I don't give many Fs because I think nearly every book has some nugget of wisdom in it. Note that all of my letter grades were assigned today. They're based on who I am and what I know now, not when I wrote the reviews. And they're based on how valuable the book's info will be to a modern reader. (Some money books that were awesome in 1978 haven't aged well because their advice is specific to that era.) When I've marked a book with a star , that indicates I believe regardless of my grade, the title should be considered part of a core personal-finance library. (I don't have a review of Dave Ramsey's Total Money Makeover here. If I did, it'd get a C or lower because the book's quality is mixed and it has certain drawbacks. But the book would also merit a star because it should be in any serious library of money books.) Ultimately, though, you shouldn't let the letter grades and stars guide your decision to read a book. Use my reviews instead. They're much more nuanced than an arbitrary grade. The grades are meant as a sort of quick reference. Finally, I've sorted the titles into roughly reverse-chronological order based on year of publication. I think most readers are interested in recent titles. (Because of my hiatus from money-blogging, there's a gap here between 2010 and 2016.) If, like me, you prefer older money books, you'll find them closer to the end of this list. That's enough explanation. Here then is a list of (nearly) all of the book reviews from the archives here at Get Rich Slowly!

Get Money by Kristin Wong (2018)Get Money is all about applying game-playing principles to money management. Most money books tend toward boring and stale. Not this one. Get Money is both funny and wise, packed with practical tips for how to play the game of money and win. It's a useful money manual from a favorite former GRS staff writer. [my review] BThinking in Bets: Making Smarter Decisions When You Don't Have All the Facts by Annie Duke (2018)For a long time, Ive argued that the best money books are often not about money at all. Thinking in Bets is an example of this. Duke says that there are exactly two things that determine how our lives turn out: The quality of our decisions and luck. She uses plenty of personal finance examples, but the book itself is about self-improvement. Its not specifically about personal finance, yet the info here could have a profound impact on your financial future. [my review] A-Meet the Frugalwoods: Achieving Financial Independence through Simple Living by Elizabeth Willard Thames (2018)Meet the Frugalwoods isnt a money manual. It isnt fiction. Its memoir. The book covers ten years in the lives of Liz and her husband Nate, from their post-college job-hunting experiences in Kansas to purchasing a 66-acre homestead in Vermont. Through their story, Liz shows readers its possible to move from a life of consumerism to a life built around frugality and purpose. My chief complaint? The Frugalwoods didn't achieve financial independence through frugality; they achieved it through a high income. [my review] CYou Need a Budget by Jesse Mecham (2017)You Need a Budget is a simple book, but its excellent. It doesnt try to throw the entire world of personal finance at you. Its laser-focused on one thing: building a better budget. Because Mecham has been reading and writing about budgets since 2004, hes learned a lot about what works and what doesnt. Hes constantly receiving feedback from the tens of thousands of people who follow his program. This book is a culmination of that experience, and it shows. If you need a budget, I highly recommend this book. [my review] A The Simple Path to Wealth by J.L. Collins (2016)The Simple Path to Wealth presents the advice from the author's blog in a coherent, unified package. Its an easy-to-understand primer on stock-market investing and financial independence. Although the book is intended to offer wide-ranging advice about the journey to financial freedom, I think its at its best when Collins covers retirement investing. [my review] B+ Early Retirement Extreme by Jacob Lund Fisker (2010)Imagine a personal-finance book written by a theoretical physicist. What would it be like? Full of formulas and figures, right? Well, thats what you get with Early Retirement Extreme. This feels like a book written by an engineer for other engineers. This isnt a bad thing, but it is unique. Some people will love it; others will hate it. Also, this book could use a professional editor. These caveats aside, ERE is packed with excellent information, and is one of the key books in the Financial Independence movement. [my review] B The Simple Dollar by Trent Hamm (2010)This book isnt really about personal finance. Theres personal finance in it, sure, but like Hamms blog, The Simple Dollar is about personal and professional transformation. This is a book about change. The information in the book is good, and its sure to be useful to many people, but the content is so jumbled that its difficult to see the Big Picture. [my review] C-Mind Over Money by Ted and Brad Klontz (2009)Mind Over Money wont teach you how to budget and it doesnt ever mention index funds. This isnt a book about the nuts-and-bolts of personal finance. Its a book about how we relate to money. The strength of the book isnt in the answers it provides, but in the questions it provokes. If you're looking for a book about the psychology of personal finance, this is worth reading. [my review] CEscape from Cubicle Nation by Pam Slim (2009)Escape from Cubicle Nation starts at the beginning of the entrepreneurial journey: deciding what to do with your life. Slim spends several chapters discussing how to get in touch with whats important to you. At times, this almost seems touchy-feely. Almost. Thankfully, the book packs in ton of practical info on how to start a successful small business that matches you and your lifestyle. [my review] B+The Happiness Project by Gretchen Rubin (2009)On paper, The Happiness Project may seem sort of lame. Rubin decided to spend one year consciously pursuing happiness. Each month, she tackled one specific aspect of life marriage, work, attitude, and so on and during that month, she attempted to meet a handful of related resolutions she hoped would make her happier. Fortunately, the book isnt lame. Rubins style is warm and engaging, and the material here is useful. [my review] BI Will Teach You to Be Rich by Ramit Sethi (2009)This book is great, but its not for everyone. First of all, its targeted almost exclusively at young adults. If youre under 25 and single, and if you make a decent living, this book is perfect. But if youre 45 and married with two children, and if you struggle to make ends meet, this book is less useful. That said, it's packed with solid advice, cites its sources, and provides scores of tactical tips for managing money. [my review] A- Spend Til the End by Scott Burns and Larry Kotlikoff (2008)Burns and Kotlikoff analyze dozens of hypothetical scenarios as they seek to discover which choices provide the greatest lifetime living standard per adult. Their aim is to find a way to balance today and tomorrow, to pursue what's known as consumption smoothing. Much of the books advice is geared toward those nearing retirement, but theres still plenty for readers of every age. [my review] C+Increase Your Financial IQ by Robert Kiyosaki (2008)The problem with the standard financial advice is that its bad advice. Youve been told to work hard, save money, get out of debt, live below your means, and invest in a well-diversified portfolio of mutual funds. But this advice is obsolete so argues Robert Kiyosaki in Increase Your Financial IQ. I'll be blunt: Kiyosaki is full of shit. I worry about his financial IQ. [my review] D-

The 4-Hour Workweek by Timothy Ferriss (2007)When I picked up The 4-Hour Workweek, I was worried it was some sort of get rich quick book. Ferriss makes a lot of bold promises, and some of the details along the way read like the confessions of an internet scammer. Ultimately, though, I found tons of value that I could apply to my own entrepreneurial ventures. In fact, this has become one of my most-bookmarked books of all time! An intelligent reader can easily extract a wealth of useful here, which is why it's become a modern classic. [my review] B- The Quiet Millionaire by Brett Wilder (2007)The Quiet Millionaire is different from most of the other money books I review. Though Wilder includes behavioral finance and life planning concepts, this is a numbers book. It's like a textbook for personal finance. It isnt really a book for beginners. Its targeted at folks who are out of debt and building wealth. I suspect many people will find this book boring. But then, smart personal finance is boring. [my review] BDebt Is Slavery by Michael Mihalik (2007)Debt is Slavery is a deceptively simple book. Its short. Its advice seems basic. And its self-published, so how good can it be? Well, I think its great. In fact, I found myself wishing that I had written it. Mihaliks advice is spot-on, and he covers a lot of topics that other authors shy away from, such as the effects of advertising, the weight of possessions, and the soul-sucking misery that comes from a bad job. This book may be short, but its sweet. Especially great for recent graduates, I think. [my review] B+Overcoming Underearning by Barbara Stanny (2007)Overcoming Underearning isn't what I expected it to be. When I read the title, I expected a book about how to stretch your dollars and how get more from what you do earn. This book is about asking for more, creating more, and working your way through the psychological pitfalls that lead to being satisfied with less in the first place. But the book contains few actionable steps that will help you make more money or invest well. If you need a how-to book, keep looking. If you need to get started, or are started, but have hit a wall and you dont know why, this might be the book for you. [my review] C-The Secret by Rhonda Byrne (2006)The Secret is all about the so-called Law of Attraction, which is not actually a law of anything. The Law of Attraction states that your life is a result of the things you think about. From a psychological perspective, this notion has some merit. But this book offers no evidence of any kind: no scientific discussion, no experimentation only scattered cherry-picked anecdotes. Its the worst kind of pseudo-scientific baloney. And its money advice is actively harmful rather than helpful. [my review] FThe Millionaire Maker by Loral Langmeier (2006)The Millionaire Maker attempts to codify Langemeiers proprietary Wealth Cycle Process. She believes there are better places to put your money than in mutual funds. This book is a mixed bag. While it preaches what ought to be preached, and Langemeier provides more specifics than some authors, her message sounds hollow. There is some good information here, but theres stuff that raises red flags, too. [my review] D+Work Less, Live More: The Way to Semi-Retirement by Bob Clyatt (2005)For years, Work Less, Live More has been my go-to book for info about early retirement. I give away copies several times a year. I recommend it when replying to email. I refer to it myself when I have questions. I like this book because it strikes a balance between the high-level Big Picture stuff and the low-level nitty-gritty numbers crunching. (See also: Bob Clyatt's guest post here at GRS about his life since writing the book.) [my review] A All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Tyagi (2005)This book was written by the mother-daughter team of Elizabeth Warren and Amelia Warren Tyagi. (Warren is now a U.S. Senator from Massachusetts!) The authors dont get bogged down in the details of frugality and investing. Theyre more interested in changing behavior, in fixing the big stuff. They offer a framework around which the reader can build lasting financial success. The book's advice is solid, if sometimes flawed. To me, its lasting legacy is the introduction of the Balanced Money Formula (which some now call the 50-30-20 budget), a concept I promote extensively in my public speaking gigs. [my review] B- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth by T. Harv Eker (2005)Many people would dismiss Secrets of the Millionaire Mind as useless. Theres not a lot of concrete information here about how to improve the details of your financial life. (Though the scant advice presented is sound). Instead, this book encourages readers to adopt mental attitudes that facilitate wealth. Its about changing your psychological approach to money, success, and happiness. (This book is the source of my money blueprint concept.) [my review] CMoney Without Matrimony: The Unmarried Couple's Guide to Financial Security by Sheryl Garrett and Debra Neiman (2005)As difficult as marriage and money can be, things are even tougher for unmarried couples, both gay and straight. Its difficult for these folks to get good advice in a society thats geared toward married couples. Money Without Matrimony is a great book with sound suggestions. Its non-judgmental, practical, and packed with advice. If youre in a committed unmarried relationship, I highly recommend you track down a copy. [my review] AThe Automatic Millionaire by David Bach (2005)David Bach is perhaps best known for coining the term the latte factor, a phrase that has almost become a joke in personal finance circles. Thats too bad, really, because Bach has some good ideas. And the latte factor is a marvelous concept, applicable to many people who casually spend their future a few dollars at a time. This book encourages readers to eliminate debt, to live frugally, and to pay themselves first. But the core of his book is unique: rather than develop will power and self-discipline, Bach says, why not bypass the human element altogether? Why not make your path to wealth automatic? [my review] C Luck Is No Accident: Making the Most of Happenstance in Your Life and Career by John D. Krumboltz and Al S. Levin (2004)Luck Is No Accident is a short book. Nothing in it is groundbreaking or revolutionary. Yet its common-sense wisdom is a powerful motivator. Whenever I read it, I cannot help but come away inspired, ready to make more of my situation, and to try new things. If youre the sort of person who wonders why good things only happen to other people, I encourage you to read it. [my review] B+The Random Walk Guide to Investing: Ten Rules for Financial Success by Burton Malkiel (2003)Malkiels advice can be stated in a few short sentences: Eliminate debt. Establish an emergency fund. Begin making regular investments to a diversified portfolio of index funds. Be patient. But the simplicity of his message does not detract from its value. If you want to invest but dont know where to start, pick up a copy of this book. [my review] A-

The Bountiful Container by Rose Marie Nichols McGee and Maggie Stuckey (2002)The Bountiful Container beats most gardening books hands-down in several key areas. It focuses on growing plants that give a beginning gardener the most bang for the buck, plants that are both edible and decorative and can be grown with limited space. It is splendidly organized and easy to read, and has a great index, too. And the level of detail is just right for almost any skill level, and the writing is pleasant to read and easy to understand. [my ex-wife's review] B+The Four Pillars of Investing by William Bernstein (2002)In this book, Bernstein describes how to build a winning investment portfolio. He doesnt focus on the details he tries to explain fundamental concepts so that readers will be able to make smart investment decisions on their own. The Four Pillars of Investing is challenging in places, but it provides an excellent introduction to the theory, history, psychology, and business of investing. If youre able to finish, youll have a better grasp of investing than 99% of your peers. [my review] B Why We Buy: The Science of Shopping by Paco Underhill (2000)In this book, Paco Underhill an environmental psychologist describes what he learned through years of research into consumer behavior and retail marketing. Like it or not, youre manipulated all of the time while youre shopping, and in ways you dont even suspect. But by taking Underhills lessons for marketers and flipping them around, you can make yourself immune to marketers manipulations. (Well, maybe not immune, but less likely to succumb to their ploys, anyhow.) [my review] BWhy Smart People Make Big Money Mistakes (and How to Fix Them) by Gary Belsky and Thomas Gilovich (1999)In this short book, Belsky and Gilovich catalog a menagerie of mental mistakes that cause people to spend more than they should. What might have been a boring topic becomes fascinating thanks to an engaging style and plenty of anecdotes and examples. This book covers a couple dozen psychological barriers to wealth. [my review] B+ The Millionaire Next Door by Thomas Stanley and William Danko (1998)The Millionaire Next Door has earned its place in the canon of personal-finance literature. It's built on years of research, on a body of statistics and case studies. It doesnt make hollow promises. That said, the book is a flawed classic. It offers a fascinating portrait of the wealthy, but it buries this beneath mountains of detritus. The book is poorly organized, repetitive, and dull. (The section on car-buying seems to go on forever.) A patient reader will be rewarded with a glimpse at what it takes to become a millionaire, but I cant help but feel this book could have been something more. Warning: Avoid the audiobook, which suffers even more in the tedious sections. [my review] C+ Yes, You Can Achieve Financial Independence by James Stowers (1992)Yes, You Can Achieve Financial Independence is informative without being dense. Its accessible without being condescending. Its advice is solid. The book is filled with investment advice, but it gives equal time to thrift and savings. Best of all, it asks as many questions as it provides answers. It prompts the reader to think, to evaluate his priorities. Its message is that yes, you can achieve Financial Independence, but you cant get there overnight, and you cant get there without setting goals and making sacrifices. [my review] A-How to Retire Young by Edward M. Tauber (1989)How to Retire Young is one of the oldest books Ive found on the subject of early retirement. Taubers premise is that many people can retire early if they plan and remain dedicated to the plan. I wish I could say that this is a great book. Sadly, its not. Its good (dont get me wrong), but it suffers from being first. [my review] C-Cashing In on the American Dream: How to Retire at 35 by Paul Terhorst (1988)Cashing In on the American Dream is a seminal early retirement book and its advice was spot-on for 1988. But that strength is now its weakness. Some of the advice is thirty years out of date. If you dont need specific advice but are instead interested about theory (and story), then seek out this title. (The last half of the book is filled with stories from folks who made early retirement happen.) [my review] BHow to Get Out of Debt, Stay Out of Debt, and Live Prosperously by Jerrold Mundis (1988)How to Get Out of Debt is built on the principles of Debtors Anonymous, a twelve-step program founded in 1971 to help those who struggle with compulsive debt. Mundis was himself a debtor, and he based this book on his own experience. This isnt purely theoretical information from the mind of some Wall Street finance whiz who has never struggled; this book contains real tips and real stories from real people. [my review] A- You Can Negotiate Anything by Herb Cohen (1980)Whether you like it or not, your life is filled with negotiations. You negotiate your salary, for the price of a car, for the cost of a couch. You negotiate with your wife about where to spend your summer vacation, with your husband about what color to paint the babys bedroom, with your daughter about what time she should be home from the football game. Of all the books Ive recommended at Get Rich Slowly over the years, You Can Negotiate Anything is one of the best. [my review] A How to Get Rich and Stay Rich by Fred J. Young (1979)This book is built around a single principle: Spend less than you earn and invest the difference in something that you think will increase in value and make you rich. It reads like homespun advice from your favorite uncle. While theres plenty of good advice in these pages and lots of amusing anecdotes, theres very little polish. [my review] CThe Incredible Secret Money Machine by Don Lancaster (1978)Though the title smacks of get-rich-quick schemes, The Incredible Secret Money Machine is really about starting and running a small business. To Lancaster, a money machine is any venture that generates nickels. Nickels are small streams of revenue from individual customers. If your goal is simply to earn a comfortable income for yourself by doing something you love, then this book can help you explore the idea of business ownership. Its not going to help you launch the next Google or Microsoft, though. Lancaster is all about nickels, not about dollars. [my review] C+Hard Times: An Oral History of the Great Depression by Studs Terkel (1970)In 1970, writer Studs Terkel published Hard Times: An Oral History of the Great Depression, which features excerpts from over 100 interviews he conducted with those who lived through the 1930s. Terkel spoke with all sorts of people: old and young, rich and poor, famous and not-so-famous, liberal and conservative. The book is fascinating. Its one thing to read about the Great Depression in textbooks, or to hear it used as leverage in political speeches, but its another thing entirely to read the experiences of the people who lived through it. [my review] A-

That's it! If you find any reviews I missed, let me know so that I can add them to this index. I consider this a living article. I plan to add to it with time. As I re-publish old reviews that are currently unpublished, I'll add them here. And as I write new reviews in the future, those will get added to the list too. Know of a money book that I should read and review? Drop a line to let me know! 147 Shares https://www.getrichslowly.org/money-books-index/

0 notes

Text

An index to every money book I’ve reviewed during the past twelve years

I read a lot of money books. As a result, a large section of my large library is devoted to books about personal finance. (And if I hadn’t purged hundreds of money books when I sold this site in 2009, I’d have even more books — and no place to put them.)

Last week, a GRS reader named Lindsay dropped a line with an interesting question:

“I’m really enjoying your work back at GRS, the email newsletter, and your most recent FB live video! I’m wondering: Do you have a list of all the money books you’ve reviewed? I’ve been poking around to try and find one)?”

As it happens, I’ve been wanting a list of reviews myself. I know I have a million billion different projects around here, but one that I’d like to pursue is a free nicely-formatted PDF download that compiles every review I’ve written.

To answer Lindsay’s question — and to satisfy my own curiosity — I sifted through the GRS archives yesterday to compile a list of every money book I’ve reviewed during my 12+ years at this site. In this post, I’ve linked to those reviews, plus I’ve included a short summary of each book.

Note: I’m certain that about half of the reviews are missing from the archives. The folks who purchased this site from me “unpublished” hundreds of articles (including many book reviews, apparently) during the time they owned GRS. Those reviews still exist, and I’ll eventually find them and list them here, but it’s far too cumbersome to find them at the moment.

For each book below, I’ve included a link to Amazon. I’ve also assigned each a book a letter grade and, in some cases, a star .

My letter grades might seem harsh. That’s because I’ve tried to really think about these on a sort of curve, where the vast majority of books are average and only a few merit As or Fs. As a result, some important titles get average (or low) grades despite their contribution to the field.

If I grade a book an A, I think it’s excellent. It offers excellent advice with no real flaws.

If I give a book a B, it’s a good book with good advice, but something about it holds it back. Maybe it’s poorly written or maybe it’s off-base on a topic or two.

If I give a grade of C, the book is average. That means it gives reasonable money advice in a typical way. There’s nothing drastically wrong with the book, and it’s worth reading.

If I give a D grade, the book is flawed in some major way. It still has some value to it — maybe a core concept that you can’t find elsewhere — but I’m hesitant to recommend this to average folks.

If I give a book and F, I don’t think it has any sort of value. I don’t give many Fs because I think nearly every book has some nugget of wisdom in it.

Note that all of my letter grades were assigned today. They’re based on who I am and what I know now, not when I wrote the reviews. And they’re based on how valuable the book’s info will be to a modern reader. (Some money books that were awesome in 1978 haven’t aged well because their advice is specific to that era.)

When I’ve marked a book with a star , that indicates I believe regardless of my grade, the title should be considered part of a core personal-finance library. (I don’t have a review of Dave Ramsey’s Total Money Makeover here. If I did, it’d get a C or lower because the book’s quality is mixed and it has certain drawbacks. But the book would also merit a star because it should be in any serious library of money books.)

Ultimately, though, you shouldn’t let the letter grades and stars guide your decision to read a book. Use my reviews instead. They’re much more nuanced than an arbitrary grade. The grades are meant as a sort of quick reference.

Finally, I’ve sorted the titles into roughly reverse-chronological order based on year of publication. I think most readers are interested in recent titles. (Because of my hiatus from money-blogging, there’s a gap here between 2010 and 2016.) If, like me, you prefer older money books, you’ll find them closer to the end of this list.

That’s enough explanation. Here then is a list of (nearly) all of the book reviews from the archives here at Get Rich Slowly!

Get Money by Kristin Wong (2018)

Get Money is all about applying game-playing principles to money management. Most money books tend toward boring and stale. Not this one. Get Money is both funny and wise, packed with practical tips for how to play the game of money — and win. It’s a useful money manual from a favorite former GRS staff writer. [my review] B

Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts by Annie Duke (2018)

For a long time, I’ve argued that the best money books are often not about money at all. Thinking in Bets is an example of this. Duke says that there are exactly two things that determine how our lives turn out: The quality of our decisions and luck. She uses plenty of personal finance examples, but the book itself is about self-improvement. It’s not specifically about personal finance, yet the info here could have a profound impact on your financial future. [my review] A-

Meet the Frugalwoods: Achieving Financial Independence through Simple Living by Elizabeth Willard Thames (2018)

Meet the Frugalwoods isn’t a money manual. It isn’t fiction. It’s memoir. The book covers ten years in the lives of Liz and her husband Nate, from their post-college job-hunting experiences in Kansas to purchasing a 66-acre homestead in Vermont. Through their story, Liz shows readers it’s possible to move from a life of consumerism to a life built around frugality and purpose. My chief complaint? The Frugalwoods didn’t achieve financial independence through frugality; they achieved it through a high income. [my review] C

You Need a Budget by Jesse Mecham (2017)

You Need a Budget is a simple book, but it’s excellent. It doesn’t try to throw the entire world of personal finance at you. It’s laser-focused on one thing: building a better budget. Because Mecham has been reading and writing about budgets since 2004, he’s learned a lot about what works and what doesn��t. He’s constantly receiving feedback from the tens of thousands of people who follow his program. This book is a culmination of that experience, and it shows. If you need a budget, I highly recommend this book. [my review] A

The Simple Path to Wealth by J.L. Collins (2016)

The Simple Path to Wealth presents the advice from the author’s blog in a coherent, unified package. It’s an easy-to-understand primer on stock-market investing — and financial independence. Although the book is intended to offer wide-ranging advice about the journey to financial freedom, I think it’s at its best when Collins covers retirement investing. [my review] B+

Early Retirement Extreme by Jacob Lund Fisker (2010)

Imagine a personal-finance book written by a theoretical physicist. What would it be like? Full of formulas and figures, right? Well, that’s what you get with Early Retirement Extreme. This feels like a book written by an engineer for other engineers. This isn’t a bad thing, but it is unique. Some people will love it; others will hate it. Also, this book could use a professional editor. These caveats aside, ERE is packed with excellent information, and is one of the key books in the Financial Independence movement. [my review] B

The Simple Dollar by Trent Hamm (2010)

This book isn’t really about personal finance. There’s personal finance in it, sure, but like Hamm’s blog, The Simple Dollar is about personal and professional transformation. This is a book about change. The information in the book is good, and it’s sure to be useful to many people, but the content is so jumbled that it’s difficult to see the Big Picture. [my review] C-

Mind Over Money by Ted and Brad Klontz (2009)

Mind Over Money won’t teach you how to budget and it doesn’t ever mention index funds. This isn’t a book about the nuts-and-bolts of personal finance. It’s a book about how we relate to money. The strength of the book isn’t in the answers it provides, but in the questions it provokes. If you’re looking for a book about the psychology of personal finance, this is worth reading. [my review] C

Escape from Cubicle Nation by Pam Slim (2009)

Escape from Cubicle Nation starts at the beginning of the entrepreneurial journey: deciding what to do with your life. Slim spends several chapters discussing how to get in touch with what’s important to you. At times, this almost seems touchy-feely. Almost. Thankfully, the book packs in ton of practical info on how to start a successful small business that matches you and your lifestyle. [my review] B+

The Happiness Project by Gretchen Rubin (2009)

On paper, The Happiness Project may seem sort of lame. Rubin decided to spend one year consciously pursuing happiness. Each month, she tackled one specific aspect of life — marriage, work, attitude, and so on — and during that month, she attempted to meet a handful of related resolutions she hoped would make her happier. Fortunately, the book isn’t lame. Rubin’s style is warm and engaging, and the material here is useful. [my review] B

I Will Teach You to Be Rich by Ramit Sethi (2009)

This book is great, but it’s not for everyone. First of all, it’s targeted almost exclusively at young adults. If you’re under 25 and single, and if you make a decent living, this book is perfect. But if you’re 45 and married with two children, and if you struggle to make ends meet, this book is less useful. That said, it’s packed with solid advice, cites its sources, and provides scores of tactical tips for managing money. [my review] A-

Spend ‘Til the End by Scott Burns and Larry Kotlikoff (2008)

Burns and Kotlikoff analyze dozens of hypothetical scenarios as they seek to discover which choices provide the greatest “lifetime living standard per adult”. Their aim is to find a way to balance today and tomorrow, to pursue what’s known as “consumption smoothing”. Much of the book’s advice is geared toward those nearing retirement, but there’s still plenty for readers of every age. [my review] C+

Increase Your Financial IQ by Robert Kiyosaki (2008)

The problem with the standard financial advice is that it’s bad advice. You’ve been told to work hard, save money, get out of debt, live below your means, and invest in a well-diversified portfolio of mutual funds. But this advice is obsolete — so argues Robert Kiyosaki in Increase Your Financial IQ. I’ll be blunt: Kiyosaki is full of shit. I worry about his financial IQ. [my review] D-

The 4-Hour Workweek by Timothy Ferriss (2007)

When I picked up The 4-Hour Workweek, I was worried it was some sort of “get rich quick” book. Ferriss makes a lot of bold promises, and some of the details along the way read like the confessions of an internet scammer. Ultimately, though, I found tons of value that I could apply to my own entrepreneurial ventures. In fact, this has become one of my most-bookmarked books of all time! An intelligent reader can easily extract a wealth of useful here, which is why it’s become a modern classic. [my review] B-

The Quiet Millionaire by Brett Wilder (2007)

The Quiet Millionaire is different from most of the other money books I review. Though Wilder includes behavioral finance and life planning concepts, this is a numbers book. It’s like a textbook for personal finance. It isn’t really a book for beginners. It’s targeted at folks who are out of debt and building wealth. I suspect many people will find this book boring. But then, smart personal finance is boring. [my review] B

Debt Is Slavery by Michael Mihalik (2007)

Debt is Slavery is a deceptively simple book. It’s short. Its advice seems basic. And it’s self-published, so how good can it be? Well, I think it’s great. In fact, I found myself wishing that I had written it. Mihalik’s advice is spot-on, and he covers a lot of topics that other authors shy away from, such as the effects of advertising, the weight of possessions, and the soul-sucking misery that comes from a bad job. This book may be short, but it’s sweet. Especially great for recent graduates, I think. [my review] B+

Overcoming Underearning by Barbara Stanny (2007)

Overcoming Underearning isn’t what I expected it to be. When I read the title, I expected a book about how to stretch your dollars and how get more from what you do earn. This book is about asking for more, creating more, and working your way through the psychological pitfalls that lead to being satisfied with less in the first place. But the book contains few actionable steps that will help you make more money or invest well. If you need a “how-to” book, keep looking. If you need to get started, or are started, but have hit a wall and you don’t know why, this might be the book for you. [my review] C-

The Secret by Rhonda Byrne (2006)

The Secret is all about the so-called Law of Attraction, which is not actually a law of anything. The Law of Attraction states that your life is a result of the things you think about. From a psychological perspective, this notion has some merit. But this book offers no evidence of any kind: no scientific discussion, no experimentation — only scattered cherry-picked anecdotes. It’s the worst kind of pseudo-scientific baloney. And its money advice is actively harmful rather than helpful. [my review] F