#Delaware business tax

Text

Navigating Delaware's Business Tax Landscape: A Comprehensive Overview

Delaware, renowned for its business-friendly environment and favorable corporate laws, is a beacon for entrepreneurs and corporations alike. One key aspect that makes the First State attractive is its approach to business taxes. In this comprehensive overview, we delve into the intricacies of business taxes in Delaware, exploring the various levies that impact corporations operating within its borders.

Understanding Delaware's Tax Climate

Delaware is often celebrated for not imposing a state-level sales tax. This unique feature has contributed to its appeal, especially for retail businesses. However, the absence of a sales tax is just one facet of Delaware's tax climate. The state relies on other revenue streams to fund public services, education, and infrastructure.

Corporate Income Tax

The Corporate Income Tax is at the forefront of Delaware's business tax structure. Corporations that operate, earn income, or are incorporated in Delaware are subject to this tax. The state employs a graduated tax rate system based on the amount of income a corporation generates. It's important to note that this tax is solely on income earned within the state's borders.

Franchise Tax

Delaware's franchise tax is another significant component of the state's revenue structure. This tax is not based on income but on the authorization to operate as a corporation in the state. Every corporation incorporated in Delaware must pay an annual franchise tax regardless of where it conducts business. The franchise tax calculation involves different methods, including the authorized shares method and the assumed par value capital method.

Property Tax Implications

Delaware's property tax landscape is diverse, with each county's approach to property assessments and tax rates. Property taxes primarily fund local services such as schools, fire departments, and law enforcement. Businesses with physical locations or real estate holdings in Delaware will be subject to property taxes, the rates of which vary across the state.

Strategic Use of Holding Companies

Delaware's tax structure has led to corporations' strategic use of holding companies. Many companies establish a presence in Delaware for its favorable laws, creating subsidiaries or holding companies that can benefit from the state's tax advantages.

Tax Credits and Incentives

Delaware actively promotes economic development through various tax credits and incentives. Businesses engaged in specific activities, such as research and development or job creation, may qualify for these incentives, providing a further layer of appeal for companies considering Delaware as their base of operations.

Compliance and Reporting Requirements

Navigating Delaware's business tax landscape requires careful attention to compliance and reporting. Corporations must file annual reports and pay their franchise taxes on time to maintain good standing with the state.

Delaware business tax balance attracts corporations and maintains essential public services. While the absence of a sales tax is a clear advantage, businesses must navigate the intricacies of the Corporate Income Tax, franchise taxes, and other potential local levies. For many corporations, the strategic benefits of operating in Delaware often outweigh the complexities of its tax system. As businesses continue to explore opportunities in this business-friendly state, a nuanced understanding of Delaware's tax landscape becomes an invaluable asset in making informed financial decisions.

0 notes

Text

There's a post from someone outside of the US about how people in the US don't put their country down and just put down their state and something about US people being US centric, and part of it has always kind of bothered me because I think that people outside of the US don't really understand how states work for us or why people think their state should be enough. Some of it is being US centric for sure, but I honestly don't think that's the main reason.

It's because the US is a bunch of countries in a trench coat. I've compared it before to the EU, and I really do think that's accurate. It's literally a union of states. Each state has it's own government and laws and we have the federal government too but day to day a lot more of your life comes down to the state laws. Your driver's license, license plate, wage and a lot of employment protect (and enforcement), vast majority of court experiences, etc all go through the state. Moving to different states can mean being subject to wildly different laws, tax rates/methods, and forms of discrimination (ie florida trying to ban queer people while other states are explicitly adding protections for them).

Like, you'll notice that streamers often tend to be clustered in certain states in the US, and a lot of that has to do with certain states not having an income tax. Depending on what state they're registered in, companies can be subject to wildly different laws. Hence why Delaware is so popular for businesses. Bankruptcy law works differently in every state.

Lawyers are licensed to practice by state, and while they can move to different states, it's difficult and depending on their area of law they may be totally out of their field. Even small states like Delaware have totally different laws from a place 15 minutes to the left like New Jersey.

The largest single state by population is California which has nearly 40 million people. That is more than the entire population of Canada. It's roughly on par with Poland. Give or take a million people.

Ohio has about 11 million people, about 1 million more than Sweden. Florida has 22 million, over double Greece's population. New York and Romania both come out to about 19 million each.

Our smallest state by population, Wyoming, which has about 500k people, still has about 200k more people than Iceland.

Fucking Russia literally does not have half the population of the US. It sits at 144 million while we're at 333 million.

To give a sense of landmass/scale, France is the largest EU state by landmass with 630k square km. Texas alone is 695k. Alaska is 1.7 million square km. The US in total is 11.3 million square km. The entire EU has 4.2 million square km.

The US is 1) fucking huge and 2) so much less cohesive than a lot of non-Americans assume.

So why would someone from the US just put down their state? For the same reason that most people from the EU don't write down "Germany in the EU". Your state is where you're actually from, the USA is the weird umbrella you live under.

#sif speaks#us politics#america#Like I don't think people not from the US understand how fucking big it is#Canada does not compare even a little bit in anything other than land mass#mexico doesn't even reach half#it's also more cohesive now than it used to be#immigration used to be done state by state too#“why is the us so fucked up” have you ever tried to get 333 million people to agree on anything#“why is the us federal government such a mess” your country doesn't even have a third of our population and not even a tenth of our landmas

169 notes

·

View notes

Text

Oversight, Judiciary, and Ways and Means Committees Release Report on Impeachment Inquiry Finding Joe Biden Has Committed Impeachable Conduct

Below are key findings from the impeachment inquiry report. The 291 page report can be found below.

From 2014 to the present, as part of a conspiracy to monetize Joe Biden’s office of public trust to enrich the Biden family, Biden family members and their associates received over $27 million from foreign individuals or entities. In order to obscure the source of these funds, the Biden family and their associates set up shell companies to conceal these payments from scrutiny. The Biden family used proceeds from these business activities to provide hundreds of thousands of dollars to Joe Biden—including thousands of dollars that are directly traceable to China. While Jim Biden claimed he gave this money to Joe Biden to repay personal loans, Jim Biden did not provide any evidence to support this claim. The Biden family’s receipt of millions of dollars required Joe Biden’s knowing participation in this conspiracy, including while he served as Vice President.

Joe Biden used his status as Vice President to garner favorable outcomes for his son’s and his business partners’ foreign business dealings. Witnesses acknowledged that Hunter Biden involved Vice President Biden in many of his business dealings with Russian, Romanian, Chinese, Kazakhstani, and Ukrainian individuals and companies. Then-Vice President Biden met or spoke with nearly every one of the Biden family’s foreign business associates, including those from Ukraine, China, Russia, and Kazakhstan. As a result, the Biden family has received millions of dollars from these foreign entities.

The Biden family leveraged Joe Biden’s positions of public trust to obtain over $8 million in loans from Democratic benefactors. Millions of dollars in loans have not been repaid and the paperwork supporting many of the loans does not exist and has not been produced to the Committees. This raises serious questions about whether these funds were provided as gifts disguised as loans.

Under the Biden Administration, the Justice Department and Federal Bureau of Investigation (FBI) afforded special treatment to President Biden’s son, Hunter Biden.Several witnesses acknowledged the delicate approach used during the Hunter Biden case, describing the investigation as “sensitive” or “significant.” Evidence shows that Department officials slow-walked the investigation, informed defense counsel of future investigative actions, prevented line investigators from taking otherwise ordinary investigative steps, and allowed the statute of limitations to expire on the most serious felony charges. These unusual—and oftentimes in the view of witnesses, unprecedented—tactics conflicted with standard operating procedures and ultimately had the effect of benefiting Hunter Biden.

The Biden Justice Department misled Congress about the independence of law enforcement entities in the criminal investigation of Hunter Biden. Biden Administration political appointees exercised significant oversight and control over the investigation of the President’s son. Witnesses described how U.S. Attorney for the District of Delaware and now-Special Counsel David Weiss, who oversaw the investigation and prosecution of Hunter Biden, had to seek (1) agreement from other U.S. Attorneys to bring cases in a district geographically distinct from his own and (2) approval from the Biden Justice Department’s Tax Division to bring specific charges or take investigative actions against Hunter Biden. Despite the clear conflict of interest, Weiss was only afforded special counsel status after the investigation came under congressional scrutiny.

The White House has obstructed the Committees’ impeachment inquiry by withholding key documents and witnesses. The White House has impeded the Committees’ investigation of President Biden’s unlawful retention of classified documents, by refusing to make relevant witnesses available for interviews and by erroneously asserting executive privilege over audio recordings from Special Counsel Hur’s interviews with President Biden. In addition, the White House is preventing the National Archives from turning over documents that are material to the Committees’ inquiry.

See report at the below link

#Joe Biden#Jill Biden#Hunter Biden#Biden Family#Biden#Corrupt#Indict#Prosecute#Incarcerate#Impeach#trump#america first#repost#ivanka#president trump#trump 2024#americans first#america#democrats#donald trump#treason#kamala harris#tim walz#harris walz 2024#Corrupted

70 notes

·

View notes

Text

Last post, with some findings that might help y'all move on too:

Disclaimer: I am not an accountant nor a tax professional. I am simply someone with an unused journalism degree who didn't need the 'goodbye youtube' video. Information is sourced from California Business Search, US Securities and Exchange Commission, and OpenCorporates

• Watcher Entertainment, Inc. was formed in 2019 in Delaware, and has a branch operating in CA. This seems to be the parent company that the trademarks (Puppet History, Watcher) belong to.

According to Forbes, "Delaware has become internationally recognized as a corporate paradise and is “home” to such famous firms as Amazon, Google, Tesla, Walmart, American Express and Disney, to name just a few. [...]

Corporations registered in Delaware that do not do business in the state do not pay corporate income tax. Delaware also does not have a sales tax, investment income taxes, inheritance taxes or personal property taxes. While companies do have to pay a franchise tax to register in Delaware, this can be pennies compared to the income tax other states would charge". They also point out that this is standard process for venture capital/angel investors. I would guess that 99% of traditional media in CA do this.

• There was a Notice of Exempt Offering of Securities filed to the SEC in 2019. The long and short of that is there were 8 investors at that point. That number is given on the filing.

• Although it appears the trio (Madej, Bergara, Lim) formed the company as directors and executive officers equally, by 2023 that wasn't the case.

As far the documents show - Shane is the Secretary, Ryan is the Chief Financial Officer and Steven is the Chief Executive Officer.

Lastly: I'm not advocating going to say anything to these people. Frankly, why bother. They've been shitheads, lots of people are in this world. But this helped me contextualise the last week and it might help you too. Stay silly :)

23 notes

·

View notes

Text

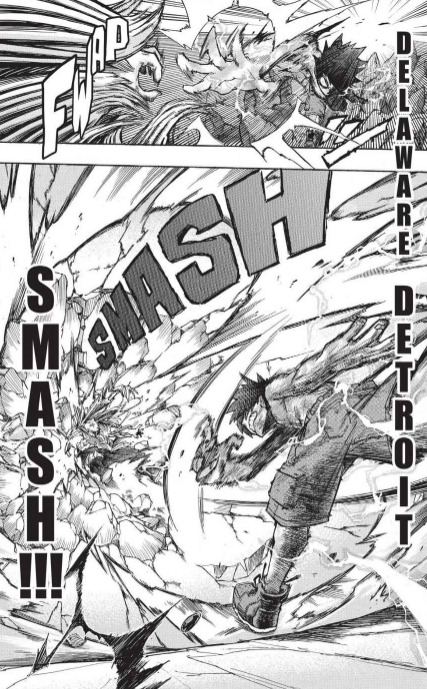

It makes sense that an attack that defies all logic is the one that isn't actually a place. (I guarantee you that there is no place called Delaware, Detroit)

And speaking of attack names, it's hilarious that Izuku's state choice for his main spin on All Might's attack names is a tax haven.

Like Detroit Smash sounds tough. Detroit's a tough place with a strong history. Delaware is where 20 businesses have the same address for the same cubicle for tax purposes. But I'm assuming Horikoshi had no idea about that and was just like Delaware is small I guess.

#bnha reread#bnha 76#bnha#midoriya izuku#all might#would be like naming an attack cayman island smash or bahamas blast or panama punch (also major tax havens)#also picked my username from this panel

26 notes

·

View notes

Text

Corporations pay their CEOs extravagantly while trying to cheat on taxes.

It would be one thing if, alongside the exorbitant executive pay, the quality of American CEO-ing was going up. But these executives are making off with bigger bags of boodle despite their persistent incompetence: Media executives keep running their businesses into the ground, tech firms are laying people off because of vibes, the planes keep nearly crashing, and examples of insane eye-popping greed—like Rite-Aid’s decision to claw back severance paid out to laid-off workers on the same day they handed their CEO a $20 million bonus—keep on coming.

So it may come as no surprise that there’s a robust connection between the overindulged CEOs and the firms that are most flagrantly dodging their fair share of taxes. For a report released Wednesday, the Institute for Policy Studies teamed up with Americans for Tax Fairness to spelunk into the balance sheets at some of America’s best-known tax scofflaws between 2018 and 2022. What they found was pretty consistent: The firms took home high profits and lavished their top executives with exorbitant pay, all while stiffing Uncle Sam.

The excess is stunning. “For over half (35) of these corporations,” the study reports, “their payouts to top corporate brass over that entire span exceeded their net tax payments.” An additional 29 firms managed this feat for “at least two of the five years in the study period.” Eighteen firms paid a grand total of zero dollars during that five-year span, 17 of which were given tax refunds. All in all, the 64 companies in the report “posted cumulative pre-tax domestic profits of $657 billion” during the study period, but “paid an average effective federal tax rate of just 2.8 percent (the statutory rate is 21 percent) while paying their executives over $15 billion.”

Which firms are the worst of the worst? You can probably guess the company that tops the list because it’s the one run by The New Republic’s 2023 Scoundrel of the Year. During the five years of the study, Tesla took home $4.4 billion in profits as CEO Elon Musk carted off $2.28 billion in stock options, which, since his 2018 payday, have ballooned to nearly $56 billion—a compensation plan so outlandish that the Delaware Court of Chancery canceled it. Tesla has, during that same period of time, paid an effective tax rate of zero percent through a combination of carrying forward losses from unprofitable years and good old-fashioned offshore tax dodging.

Elon Musk is either the world's richest or second richest person. But he still wants more. Give him credit for pathological greed.

In all fairness, Musk is not alone when it comes to enriching himself while screwing workers.

What sort of innovations have these CEOs wrought from this well-remunerated period? T-Mobile’s Mike Sievert presided over the Sprint merger that led to $23.6 million in stock buybacks and 5,000 layoffs. Netflix’s Reed Hastings poured $15 billion in profit into jacking up subscription rates. Nextera Energy has devoted $10 million in dark money in a “ghost candidate scheme” to thwart climate change candidates. Darden Restaurants has been fighting efforts to raise the minimum wage. Metlife has been diverting government money meant to fund low-cost housing into other, unrelated buckraking ventures. And some First Energy executives from the study period are embroiled in a corruption scandal that’s so massive that even Musk might find it to be beyond the pale.

These oligarchs are going to spend lavishly to elect Republicans who would give them even bigger tax breaks.

Fortunately, they can't literally buy votes. If we return to old school grassroots precinct work then we can thwart the MAGA Republican puppets of billionaire oligarchs.

One to one contact is a more important factor than TV or online ads in convincing people to vote your way. It takes more effort, but democracy was not built by slacktivism in the first place.

#corporate tax cheats#extravagant salaries for ceos#tax dodging#greed#oligarchs#tesla#elon musk#t-mobile#netflix#nextera energy#first energy#metlife#darden#maga#republicans#grassroots political work#election 2024#vote blue no matter who

13 notes

·

View notes

Text

No! Legislators should know better. The job of the county assessor is to assign a reasonable valuation for a property. Assessment is not to be used to punish people.

DJT has paid a reasonable amount of property tax on the property given the independent valuations which took into account the covenants restricting its use and occupancy as an Historical Landmark as well as those additional restrictions allowing Donald to use it as a private club or whatever.

DJT’s fraud in the New York case is that he and his organization deliberately misrepresented the nature of the covenants and restrictions when validating the property for purposes of obtaining a loan. Repeatedly. For 20+ properties.

DJT lost the Summary Jusgment because Statute and Case Law were the basis of rejecting each and every counter argument of caveat emptor his attorneys presented. Counter arguments were also denied on appeal. Twice.

Jeff Bezos could decide tomorrow that he can’t live without owning Mar-A-Lago or other Trump property and buys one for $2 billion.

It would not affect that the Trump organization committed fraud each and every time it knowingly FAILED TO DISCLOSE material facts.

If such a purchase occurred, Trump would walk away with a lot of cash but would not be able to do business in New York State.

Trump’s stupidity is that he kept ALL his properties in one New York based umbrella trust instead of incorporating separately in Delaware or in a bunch of different States. Which is how it’s the NY AG who is seizing his assets worldwide.

Not that he would have escaped litigation. All 50 States and the Federal government have these ‘blue sky laws’ like the one Trump is fighting and States/Federal are constantly prosecuting businesses for violating them.

We never hear about these cases because they just aren’t the kind of Infotainment that the Media covers…unless it’s infotainment celebrity like Trump.

25 notes

·

View notes

Text

Arthur Delaney at HuffPost:

A jury in Delaware has found the president’s son guilty of illegally owning a gun in 2018.

The government said Hunter Biden was addicted to drugs when he bought a pistol that October, and that he lied on a federal form when he checked a box saying he wasn’t an addict. Jurors agreed, and Biden now faces time behind bars.

The case has major political significance, coming as former President Donald Trump and the entire Republican Party mount an all-out assault on the U.S. justice system over its supposed “weaponization” by President Joe Biden against Trump, who faces federal charges for hoarding classified documents and trying to steal the 2020 election.

The Department of Justice has thrown the book at Hunter Biden, hitting him with illegal gun ownership charges that are rarely prosecuted as a standalone case without some other misconduct related to the firearm. The weeklong trial humiliated the first family, the guilty verdict could send the president’s son to prison, and he still faces another trial this fall for allegedly failing to pay his taxes on time.

During closing arguments on Monday, prosecutor Leo Wise reportedly gestured toward first lady Jill Biden and other members of the Biden family in the court gallery, saying: “Respectfully, none of that matters.”

Hunter Biden had originally struck a plea deal with prosecutors last year, but the agreement fell apart under questioning by District Judge Maryellen Noreika, which revealed a disagreement between Biden’s legal team and prosecutors about whether the government would still pursue other charges against Biden related to his international business deals.

So Biden pleaded not guilty, even though he didn’t deny buying the gun and he admitted in his 2021 memoir that he was constantly smoking crack cocaine around the time of the purchase. The government used the memoir to make its case, and also called to the stand Biden’s ex-wife, an ex-girlfriend, and his late brother’s widow, Hallie Biden, with whom he had a disastrous affair.

[...]

The jury found Biden guilty on three counts: lying about his drug use on a federal form used in firearm sales that he was not addicted to a controlled substance, making that same lie to a federally licensed gun dealer, and illegally possessing a firearm even though he was an addict. Biden faces a maximum possible sentence of 25 years in prison, though it’s likely he would receive a lighter sentence, and he could appeal the case.

Biden’s attorney, Abbe Lowell, said in a statement that they would “continue to vigorously pursue all the legal challenges available to Hunter.”

In a statement, Joe Biden said he loved his son and would respect the judicial process.

“I will accept the outcome of this case and will continue to respect the judicial process as Hunter considers an appeal,” he said. “Jill and I will always be there for Hunter and the rest of our family with our love and support. Nothing will ever change that.”

Hunter Biden thanked his family and friends in a statement after the verdict.

“I am more grateful today for the love and support I experienced this last week from Melissa, my family, my friends, and my community than I am disappointed by the outcome,” he said. “Recovery is possible by the grace of God, and I am blessed to experience that gift one day at a time.”

Hunter Biden, the son of President Joe Biden, has been found guilty on all three counts of illegally owning a gun.

President Biden has said that he won't pardon him.

A big difference between Democrats and the MAGA cult is that we accept the fact Hunter Biden has been charged in a court of law by a jury of his peers, while the MAGA cult (and the GOP at large) whine about Donald Trump being held accountable in a court of law.

Another big difference is that President Biden didn't interfere with the Hunter Biden trial process, unlike Trump, who did everything he could to obstruct his trial.

See Also:

MMFA: MAGA propagandists juggle conspiracy theories following Hunter Biden verdict

The Guardian: Hunter Biden found guilty on all three charges in federal gun case

Daily Kos: Hunter Biden is convicted, but the GOP is still big mad

5 notes

·

View notes

Text

LOS ANGELES (AP) — Weeks before Hunter Biden is set to stand trial on federal tax charges, the legal team for President Joe Biden's son and prosecutors will appear in a California courtroom Wednesday as the judge weighs what evidence can be presented to the jury.

Hunter Biden is accused of a scheme to avoid paying at least $1.4 million in taxes in the case headed for trial in September in Los Angeles. It's the second criminal trial in just months for the president's son, who was convicted in June of three felony charges in a separate federal case over the purchase of a gun in 2018.

Prosecutors and the defense have been fighting for weeks in court papers over what evidence and testimony jurors should be allowed to hear. Among the topics at issue is evidence related to Hunter Biden's foreign business dealings, which have been at the center of Republican investigations into the Democratic president's family.

Prosecutors say they will introduce evidence of Hunter Biden's business dealings with a Chinese energy conglomerate, as well as money he made for serving on the board of Ukrainian gas company Burisma. Prosecutors say the evidence will show Hunter Biden “performed almost no work in exchange for the millions of dollars he received from these entities.”

Special counsel David Weiss' team also plans to tell jurors about Hunter Biden's work for a Romanian businessman, who prosecutors say sought to “influence U.S. government policy” while Joe Biden was vice president.

Prosecutors want to call as a witness a Hunter Biden business associate to testify about the arrangement with the Romanian businessman, Gabriel Popoviciu, who was seeking help from U.S. government agencies to end a criminal investigation he was facing in his home country, according to prosecutors.

Hunter Biden and his business associate were concerned their “lobbying work might cause political ramifications” for Joe Biden, so the arrangement was structured in a way that “concealed the true nature of the work” for Popoviciu, prosecutors allege. Prosecutors say Hunter and two business associates split more than $3 million from Popoviciu.

The defense has said evidence about his foreign business dealings is irrelevant to the tax charges and would only confuse jurors. They have accused prosecutors of inappropriately trying to insert “extraneous, politically-charged matters" into the trial.

Hunter Biden has pleaded not guilty, and his lawyers have indicated they will argue he didn't act “willfully,” or with the intention to break the law. Pointing to Hunter Biden’s well-documented addiction struggles during those years, they've argued his drug and alcohol abuse impacted “his decision-making and judgment, such that Mr. Biden was unable to form the requisite intent to commit the crimes he has been charged with.”

Prosecutors have said that while avoiding his taxes, Hunter Biden was living an “extravagant lifestyle,” spending money on things like drugs, escorts, exotic cars and luxury hotels. The defense is urging the judge to keep those salacious allegations out of the trial.

“The Special Counsel may wish to introduce such evidence for the very reason that it is salacious and would pique the interest of the jury, but for the same reasons and because such evidence would distract the jury from the crimes charged, such information would also be highly prejudicial to Mr. Biden,” defense lawyers wrote in court papers.

Hunter Biden was supposed to plead guilty last year to misdemeanor tax offenses in a deal with prosecutors that would have allowed him to avoid prosecution in the gun case if he stayed out of trouble. But the plea deal fell apart after a Delaware federal judge raised concerns about it, and he was subsequently indicted in the two cases.

3 notes

·

View notes

Text

32 notes

·

View notes

Text

President Joe Biden’s defenders have been on a wild ride this past year. It began with them arguing that the president knew absolutely nothing about his family’s influence-peddling business to arguing that it’s no big deal that Chinese communist wire payoffs happen to have Biden’s home address listed on them.

The quality of the excuses, unsurprisingly, has been deteriorating rapidly.

They largely entail repeating the words “no” and “evidence” in a perpetual loop. But, this week, when Rep. James Comer, R-Ky., released financial records of Hunter Biden receiving two wire transfers totaling $260,000 in 2019 from Beijing with the president’s Delaware home listed as the beneficiary address, the White House jumped into action.

“Imagine them arguing that, if someone stayed at their parents’ house during the pandemic, listed it as their permanent address for work, and got a paycheck, the parents somehow also worked for the employer,” wrote White House spokesman Ian Sams. “It’s bananas. Yet this is what extreme House Republicans have sunken to.”

Speaking of bananas, the first confirmed case of COVID-19 in the United States wasn’t reported until January 2020, and shutdowns were still a year away when Hunter Biden used his dad’s house as a beneficiary address on a wire payment. According to Hunter’s own memoir, he was living in Los Angeles with his new wife at the time.

Of course, even if the pandemic had been raging by summer 2019, Hunter Biden wasn’t a college student visiting home. He was a 49-year-old who had the wherewithal to craft numerous international million-dollar deals—not to mention allegedly evade taxes, buy firearms illegally, and score crack and prostitutes.

Why would Hunter need to stay at Daddy’s house? Why do they keep talking about this grown man as if he were a toddler? For God’s sake, this is an accomplished artist whose work goes for upwards of a million dollars.

And it wasn’t a “paycheck,” but a wire transfer from a Chicom investment firm that his father repeatedly lied about to the American people.

In an October 2019 presidential debate, Joe Biden incredulously claimed that Hunter never benefited from Chinese interests: “My son has not made money in terms of this thing about, what are you talking about, China.” It was weird, even then, that Biden could make such an assertion with confidence, considering that not long before he had claimed to “never” have spoken to Hunter about his “overseas business dealings.”

Perhaps one day the president will be asked by the political media why he made this claim, and whether he knew his address was being used on Biden Inc. paperwork at the time. And while they’re at it, they could ask him whether he was at his Wilmington house in 2017 when his son threatened his Chinese partner, Henry Zhao, with the words, “I am sitting here with my father.”

Let’s also remember that not only did Joe Biden fly his son to Beijing aboard Air Force Two during an official visit in 2013 to meet with potential investors, but the vice president met Jonathan Li, whose name is on the 2019 wire transfer, for coffee. The two would talk again on the phone—probably just some “casual conversations” or “niceties about the weather.” Joe was even kind enough to write college recommendation letters for his son and daughter.

It’s a really weird coincidence that the same guy happens to have Joe Biden’s address on a wire transfer. A cynic might start to piece together these stories and come to the conclusion that there’s actually plenty of evidence the president had created the “illusion” of access to the White House on his son’s behalf—at the very least, enriching his entire family.

COPYRIGHT 2023 CREATORS.COM

The Daily Signal publishes a variety of perspectives. Nothing written here is to be construed as representing the views of The Heritage Foundation.

Have an opinion about this article? To sound off, please email [email protected] and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.

5 notes

·

View notes

Text

10 notes

·

View notes

Note

“Pleasing is a money grab from Molly Hawkins and Harry Lambert to exploit their connection to Harry styles. Look at their instagrams - this is clearly their business and I’m sure Harry probably was given 10-15% of the business for his name to be attached - but he does not care about what it sells or does. I’m just amazed at the fans who will blindly buy anything just because his name is attached.”

Can I just add something I noticed - Pleasing LLC is registered in Delaware and I thought hmmm that’s a bit strange cause like why Delaware of all places, it’s so random, you’d think it would be LA, NYC, London etc so of course I had to investigate and it turns out a lot of corporations love registering in Delaware because the state is a very business-friendly legal environment and has very lenient business taxes thanks to a loophole that allows businesses that DON’T do business in that state to not pay corporate income tax. So there you have it. If anyone wants to read further just Google why businesses register in Delaware

I'm not sure how any of it works, but companies were set up as Delaware LLCs but are based in LA. I'm sure all the loopholes are in place, though.

7 notes

·

View notes

Text

“When we first exposed, in 2018, their deals in China, their initial response was there are no deals in China. Then it became well, there might be deals in China, but Hunter Biden didn’t make any money in China. And then, of course, that. So you see this continue to erosion,”

breitbart.com

Exclusive -- Peter Schweizer: 'The Dam Is Starting to Break' on Biden Family Corruption

Hannah Bleau

4–5 minutes

“The dam is starting to break” on the Biden family corruption, multiple New York Times best-seller author Peter Schweizer said during an appearance on Breitbart News Saturday.

Schweizer, a senior contributor at Breitbart News and president of the Government Accountability Institute, spoke about the recent Hunter Biden whistleblower revelations.

“This is really, really important. The dam is starting to break — truly the first time you’ve had somebody from inside the government who has said, ‘Wait a minute, the way this is being handled is wrong,'” he said, praising the whistleblowers who could otherwise retire and have comfortable lives.

“Based on what they’ve told us, is that under ordinary circumstances, Hunter Biden would, right now, be facing indictments not only for tax evasion charges, which are felonies,” but also for violation of the Foreign Agents Registration Act (FARA), Schweizer explained.

“The U.S. Attorney in Delaware wanted to bring charges in both of those areas and was blocked by the Department of Justice (DOJ),” he said, explaining that the revelations also reveal that the DOJ not only failed to do its job but applied a different set of standards to Hunter.

“We’re gonna call the person that is the subject of the search warrant. We’re going to call their lawyer and let them know a couple of days in advance that the search is coming,” he said, speaking of the special treatment issued to Hunter Biden.

Describing it as an “enormous breakthrough,” Schweizer added, “I don’t think these whistleblowers would come forward, except for the fact that this is true, and as they said, all of this can easily be corroborated based on correspondents and based on the information that’s available.”

“It is a devastating blow, and if you look through American history — whether it’s Watergate or other scandals — oftentimes it’s a cover-up that gets them because they get arrogant. They get greedy. They think they can get away with it, and that’s usually when they get caught,” the Red-Handed: How American Elites Get Rich Helping China Win author said.

Schweizer also weighed in on the new statement issued by a White House Council spokesman, who now said President Joe Biden was never in business with his son. The author described this as the “continued erosion of their position.”

“When we first exposed, in 2018, their deals in China, their initial response was there are no deals in China. Then it became well, there might be deals in China, but Hunter Biden didn’t make any money in China. And then, of course, that. So you see this continue to erosion,” Schweizer said, also pointing to the defense of the Biden team on Hunter’s involvement with Burisma.

“The defense from the Biden team was always this was a legitimate enterprise, as Hunter is a highly trained lawyer and an international businessman. Now their position has evolved during the same time period to say, ‘Well, look, Hunter was a drug addict. He didn’t really know what he was doing. He didn’t really know what he was saying,'” he said.

“The point is, they are flipping and flopping because they know that the noose on this entire enterprise is starting to tighten. And I think that this is going to have major repercussions not just for the Biden family, but for the 2024 election,” he said, adding that he would not be shocked to see someone such as California Gov. Gavin Newsom (D) jumping into the presidential race “not just on some of the questions about where the President is mentally because of his age, but also because this scandal has legs.”

Indeed, recent surveys indicate that the American electorate view Biden himself as corrupt, “involved with his son in an illegal influence peddling scheme,” and Schweizer also pointed to that fact.

“We already see polls, Harvard Harris poll, showing a comfortable majority of Americans, including independents, fundamentally believe that he was engaged in criminal activity to aid and help his family’s business,” he added.

4 notes

·

View notes

Text

Revelations that the Trump Organization created a new company just as New York Attorney General Letitia James was about to file a lawsuit against former President Donald Trump and his business has drawn mockery online.

James' office sued Trump, the Trump Organization, senior management and other entities last month for what it alleged was "years of financial fraud to obtain a host of economic benefits." The former President is accused in the suit of falsely inflating his net worth by billions of dollars with the help of three of his children and senior Trump Organization executives in order to deceive lenders, insurers and tax authorities.

The New York Attorney General wrote in a court filing on Thursday that on the exact day the lawsuit was filed, September 21, the Trump Organization registered a new entity with the New York Secretary of State called "Trump Organization II LLC."

"That entity is a foreign corporation that was incorporated in Delaware. The Trump Organization has since refused to provide any assurance that it will not seek to move assets out of New York to evade legal accountability," James' office wrote in a release. The court filing notes that attorneys for Trump said the Trump Organization had not taken any steps to avoid potential consequences of the lawsuit.

"On the eve of this filing, counsel did offer to provide assurances and advance notice to address what were described as 'purported concerns,' but again offered no concrete mechanism to either effectuate or enforce that offer," the filing added.

The court filing's details about the almost identically named new company sparked parodies and ridicule on Twitter Thursday. One user, television producer Jonathan Goldman, wrote: "Trump Organization II is like the criminal putting on a fake mustache and thinking nobody recognizes him."

In another tweet, Goldman shared a picture of Trump with a drawn-on mustache.

"BREAKING: Trump Organization II announces its new CEO," he captioned the photo.

Heather Cox Richardson, a professor, took aim at the timing of the creation of Trump Organization II.

"I dunno, but creating 'Trump Organization II' on the same day that NYAG Letitia James sued the Trump Organization, and then continuing the same financial practices, sure sounds crimey," Richardson tweeted.

The New York Attorney General's court filing on Thursday was a motion for a preliminary injunction seeking to block what it alleged was an "ongoing fraudulent scheme" by Trump and the Trump Organization.

Writer Mike Larsen's response to the revelation centered on the name of the new business.

"On second thought, Trump Organization II might not have been the best name for the shell corporation," he tweeted.

The measures James' office is seeking to curtail the alleged continued fraud include blocking the Trump Organization from transferring any material assets to another entity without court approval, and requiring that all supporting and relevant materials are included in any new financial disclosures to banks and insurers. The office's release on Thursday also stated that James was seeking court permission to electronically serve Trump and his son, Eric Trump, "as both defendants and their counsels have refused to accept service of the complaints for almost a month."

A Trump Organization spokesperson told Newsweek in a statement back when the lawsuit was filed that it "has nothing to do with the facts or the law" and denounced it as political targeting of Trump and his company.

Newsweek has reached out to the Trump Organization for comment.

#us politics#news#donald trump#trump organization scandal#trump organization#Trump Organization II#letitia james#ag letitia james#new york#sdny#fraud#twitter#tweet#Jonathan Goldman#Heather Cox Richardson#Mike Larsen#Eric Trump#newsweek#2022#delaware

19 notes

·

View notes

Text

Early this morning, shortly after midnight, Republican Kevin McCarthy of California won enough votes to become speaker of the House of Representatives. Not since 1860, when it took 44 ballots to elect New Jersey’s William Pennington as a compromise candidate, has it taken 15 ballots to elect a speaker.

The spectacle of a majority unable to muster the votes to elect a speaker, while the Democratic opposition stayed united behind House minority leader Hakeem Jeffries (D-NY), raised ridicule across the country. McCarthy tried to put a good spin on it but inadvertently undercut confidence in his leadership when he, now the leader of the House, told reporters: “This is the great part…. Because it took this long, now we learned how to govern.”

But there is no doubt that the concessions he made to extremist Republicans to win their votes mean he has finally grasped the speaker’s gavel from a much weaker position than previous speakers. “He will have to live the entirety of his speakership in a straitjacket constructed by the rules that we’re working on now,” one of the extremist ring leaders, Matt Gaetz (R-FL) told reporters. Gaetz later explained away his willingness to accept McCarthy after vowing never to support McCarthy by saying “I ran out of things I could even imagine to ask for.”

In his acceptance speech, McCarthy first thanked the House clerk, Cheryl Johnson, who presided over the drawn-out fight. Johnson was chosen by Nancy Pelosi (D-CA) when she became speaker in 2018, and has served since 2019. Her work this week was impressive.

McCarthy promised that the Republicans recognized that their responsibility was not to themselves or their conference, but to the country, but then went on to lay out a right-wing wish list for investigations, business deregulation, and enhanced use of fossil fuels, along with attacks on immigration, “woke indoctrination” in public schools, and the 87,000 new IRS agents funded by the Inflation Reduction Act to enforce tax laws. Somewhat oddly, considering the Biden administration’s focus on China and successful start to the repatriation of the hugely important chip industry, McCarthy promised that the Republicans would essentially jump on Biden’s coattails, working to counter communist China and bring jobs home. McCarthy promised that Republicans would “be a check and provide some balance to the President’s policies.”

It was a speech that harked back to the past 40 years of Republican ideology, although he awkwardly invoked Emanuel Leutze’s heroic 1851 painting of Washington crossing the Delaware to suggest that America is a land in which “every individual is equal” and “we let everybody in the boat.” Despite the language of inclusion, just as the Republicans have since 1980, he emphasized that the Republicans would center the “hardworking taxpayer.” The Republican conference repeatedly jumped to its feet to applaud his promises, but it felt rather like listening to a cover band playing yesterday’s hits.

Immediately after his victory, McCarthy thanked the members who stayed with him through all the votes, but told reporters: “I do want to especially thank President Trump. I don’t think anybody should doubt his influence. He was with me from the beginning…. He would call me and he would call others…. Thank you, President Trump.”

Aaron Rupar of Public Notice pointed out that “McCarthy going out of his way to gush over Trump at a time when his influence is clearly diminished & political brand is more toxic to mainstream voters than ever—especially on the anniversary of the insurrection—is notable & indicative of who he'll be beholden to as speaker.”

I would go a step further and say that embracing Trump after his influence on the Republican Party has made it lose the last three elections suggests that, going forward, the party is planning either to convince more Americans to like the extremism of the MAGA Republicans—which is unlikely—or to restrict the vote so that opposition to that extremism doesn’t matter.

Yesterday, Ohio’s Republican governor, Mike DeWine, signed into law a series of changes in election law that include requiring a photo ID rather than permitting people to use other government documents or utility bills, shortening the time for returning ballots and fixing errors in them (called “curing”), prohibiting curbside voting, and limiting ballot drop boxes to one per county.

Also yesterday, a panel of three federal judges ruled that South Carolina’s First Congressional District is an unconstitutional racial gerrymander. Following the 2020 census, the Republican-dominated legislature moved 62% of the Black voters previously in that district into the Sixth District, turning what had recently been a swing district into a staunchly Republican one that Republican Nancy Mace won in November by 14 percentage points. District Judge Richard M. Gergel said: “If you see a turtle on top of a fence post, you know someone put it there…. This is not a coincidence.”

In contrast to McCarthy stood Minority Leader Jeffries, who used the ceremonial handing over of the speaker’s gavel from the Democrats to the Republicans to give a barn-burning speech. He began by praising “the iconic, the heroic, the legendary” former House speaker Nancy Pelosi as “the greatest speaker of all time,” and offering thanks to her lieutenants Steny Hoyer (D-MD) and Jim Clyburn (D-SC).

He reviewed the laws the Democrats have passed in the past two years—the American Rescue Plan, the Infrastructure Investment and Jobs Act, gun safety legislation, the CHIPS & Science Act, and the Inflation Reduction Act, among others. “It was one of the most consequential congresses in American history,” he said, accurately. He called for Democrats to continue the fight for lower costs, better paying jobs, safer communities, democracy, the public interest, economic opportunity for all, and reproductive freedom.

“As Democrats,” he said, “we do believe in a country for everyone…. We believe in a country with liberty and justice for all, equal protection under the law, free and fair elections, and yes, we believe in a country with the peaceful transfer of power.

“We believe that in America our diversity is a strength—it is not a weakness—an economic strength, a competitive strength, a cultural strength…. We are a gorgeous mosaic of people from throughout the world. As John Lewis would sometimes remind us on this floor, we may have come over on different ships but we’re all in the same boat now. We are white. We are Black. We are Latino. We are Asian. We are Native American.

“We are Christian. We are Jewish. We are Muslim. We are Hindu. We are religious. We are secular. We are gay. We are straight. We are young. We are older. We are women. We are men. We are citizens. We are dreamers.

“Out of many, we are one. That’s what makes America a great country, and no matter what kind of haters are trying to divide us, we’re not going to let anyone take that away from us, not now, not ever. This is the United States of America….

“So on this first day, let us commit to the American dream, a dream that promises that if you work hard and play by the rules, you should be able to provide a comfortable living for yourself and for your family, educate your children, purchase a home, and one day retire with grace and dignity.”

In this moment of transition, he said, the American people want to know what direction the Congress will choose. The Democrats offer their hand to Republicans to find common ground, Jeffries said, but “we will never compromise our principles. House Democrats will always put American values over autocracy…

“benevolence over bigotry, the Constitution over the cult, democracy over demagogues, economic opportunity over extremism, freedom over fascism, governing over gaslighting, hopefulness over hatred, inclusion over isolation, justice over judicial overreach, knowledge over kangaroo courts, liberty over limitation, maturity over Mar-a-Lago, normalcy over negativity, opportunity over obstruction, people over politics, quality of life issues over QAnon, reason over racism, substance over slander, triumph over tyranny, understanding over ugliness, voting rights over voter suppression, working families over the well-connected, xenial over xenophobia, ‘yes, we can’ over ‘you can't do it,’ and zealous representation over zero-sum confrontation. We will always do the right thing by the American people.”

The torch has indeed passed to a new generation, at least of Democrats. Between them and the extremists in his own ranks, McCarthy has his work cut out for him.

Heather Cox Richardson

6 notes

·

View notes