#DigitalLendingPlatform

Explore tagged Tumblr posts

Text

SparkLMS At OLA Tribal Lending Conference 2025

Join SparkLMS at the OLA Tribal Lending Conference 2025 to explore next-gen lending technology tailored for tribal lenders. Experience streamlined loan management, automation, and compliance solutions designed to empower your lending process. Visit our booth and discover how SparkLMS can elevate your lending operations with simplicity and control.

#loanapplicationsoftware#digitallendingsolution#automatedloanprocessing#loanoriginationsystem#bestloanmanagementsoftware#digitallendingplatform#loanportfoliomanagement#loantrackingsystem#lossystem#paydayloansoftware#triballending#olaconference#olaconference2025#sparklms#loansoftware#fintech#triballenders

0 notes

Text

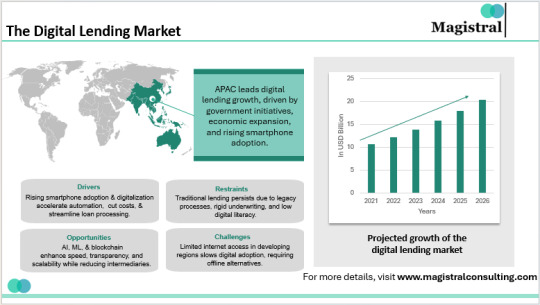

How Emerging Markets Are Driving Global Lending Services Growth

#magistralconsulting#marketsize#growthin2025#financialservices#digitallendingplatform#lendingoutsourcing#operationoutsourcing

0 notes

Text

HousingWire Recognizes Wolters Kluwer In 2024 Tech100 Mortgage Honorees List

Wolters Kluwer Compliance Solutions has been recognized with the HousingWire 2024 Tech100 Mortgage Award, showcasing its leadership and innovation in the U.S. housing economy. The award acknowledges Wolters Kluwer's commitment to advancing loan compliance technology and services across the mortgage lending process.

Simon Moir, Vice President of Banking Compliance Solutions at Wolters Kluwer, emphasized the company's dedication to enhancing its mortgage lending capabilities through strategic acquisitions, including the eOriginal® digital lending platform, and IDS compliant document generation capabilities. These efforts, combined with organic growth and ongoing product innovation, have enabled Wolters Kluwer to serve a wide range of clients, including banks, lenders, government agencies, and the secondary market.

One of Wolters Kluwer's key innovations highlighted by Moir is HMDA Wiz®, a solution within the Wiz SaaS suite that assists lenders in complying with Home Mortgage Disclosure Act (HMDA) regulations. HMDA Wiz enables lenders to import, collect, edit, and analyze data, simplifying submissions to regulators.

Additionally, Wolters Kluwer's OmniVault solution has revolutionized digital lending by providing visibility into all eVaults a lender uses in a single platform, regardless of asset type or original source. This innovation has facilitated the expansion of digital adoption to other asset classes within lenders' organizations.

Read More - https://www.techdogs.com/tech-news/business-wire/housingwire-recognizes-wolters-kluwer-in-2024-tech100-mortgage-honorees-list

#WoltersKluwer#InformationServices#ComplianceSolutions#HousingWire2024Tech100MortgageAward#DigitalLendingPlatform#HomeMortgageDisclosure

0 notes

Text

Get Fast & Affordable Loans with Achieve Personal Loans: Achieve Your Goals Today! #AchieveYourGoals #affordableloans #artificialintelligence #creditscore #customersupport #digitallendingplatform #educationalresources #fastloans #financialcounseling #financialgoals #flexiblerepaymentterms #InterestRates #loanapplicationprocess #loanrepayments #lowcreditscores #machinelearningalgorithms #originationfees #personallendingindustry #personalloans #prepaymentpenalties #technology #traditionallenders

#Business#AchieveYourGoals#affordableloans#artificialintelligence#creditscore#customersupport#digitallendingplatform#educationalresources#fastloans#financialcounseling#financialgoals#flexiblerepaymentterms#InterestRates#loanapplicationprocess#loanrepayments#lowcreditscores#machinelearningalgorithms#originationfees#personallendingindustry#personalloans#prepaymentpenalties#technology#traditionallenders

0 notes

Text

Dive into the future of finance with our in-depth analysis of the Digital Lending Platforms Market. Uncover cutting-edge technologies, key players, and market trends reshaping lending dynamics. Stay ahead in the digital lending revolution, understanding the opportunities and innovations driving this transformative market.

The global digital lending platforms market will be valued at $11.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 22.1% over the forecast period. The rising demand for digital channels, faster loan approvals and disbursements, and increased investments in emerging technologies are anticipated to drive the growth of the digital lending platforms industry.

0 notes

Link

1 note

·

View note

Link

Everyone finds themselves in a situation where dealing with a financial crisis appears to be impossible. Trending money lending apps have surpassed traditional money borrowing methods. In this article, we will go over the key points that an entrepreneur should be aware of before developing a money lending app.

#moneylendingappdevelopment#loanappdevelopment#digitallendingplatform#loanlendingappdevelopment#createamoneylendingapp#mobileappdevelopmentcompany#peertopeerlendingapp#loanlendingappdevelopmentcost#loanappbusiness#mobileappdevelopmentservices#mobileappdevelopmentcost#mobileappdevelopmentframeworks

0 notes

Photo

In your existing process of lending, do you want to explore which all processes, verifications, and analysis can be automated? Celusion’s Digital Lending platform enables swift and data-driven credit decisioning with a low-risk profile. The platform uses 3 different engines viz a rule engine that matches file parameters to product policies, a decision engine to decide risk matrix, and FOIR based on the customer’s profile and workflow engine to align credit approval policies. The system also integrates with various automated verifications and analysis to build CAM sheets. To know about these verifications, connect with us at [email protected]

0 notes

Text

SparkLMS At OLA Tribal Lending Conference 2025

At the OLA Tribal Lending Conference 2025, SparkLMS will showcase its powerful, all-in-one loan management system designed to simplify and strengthen tribal lending operations. Attendees can expect live demos of our automated workflows, borrower portal, compliance tools, and real-time reporting features.

Our team will be on-site to discuss how SparkLMS helps tribal lenders streamline origination, servicing, and collections—all while staying compliant with industry standards. Whether you're a startup or an established lender, visit our booth to see how SparkLMS can transform your lending journey with speed, transparency, and control.

#digitallendingsolution#loanapplicationsoftware#loanoriginationsystem#loanportfoliomanagement#automatedloanprocessing#digitallendingplatform#bestloanmanagementsoftware#loantrackingsystem#paydayloansoftware#lossystem

0 notes

Text

youtube

Discover how SparkLMS empowers tribal lenders with cutting-edge loan management solutions at the OLA Tribal Lending Conference 2025. Visit us to explore automation, compliance, and seamless lending workflows.

#loanapplicationsoftware#loanoriginationsystem#digitallendingsolution#automatedloanprocessing#bestloanmanagementsoftware#loanportfoliomanagement#paydayloansoftware#digitallendingplatform#loantrackingsystem#lossystem#lms#lms software#Youtube

0 notes

Text

Loan Servicing Tools: Impact on Modern Lending

Understand how advanced loan servicing platforms are reshaping lender-borrower relationships and operational efficiency.

#bestloanmanagementsoftware#digitallendingsolution#loanportfoliomanagement#loanoriginationsystem#loanapplicationsoftware#automatedloanprocessing#digitallendingplatform#loantrackingsystem#lossystem#paydayloansoftware#loan automation system#commercial loan management software#lending management system#loan decisioning software

0 notes

Text

What to Expect When Migrating to a New LMS Transitioning to a new LMS? Understand the critical challenges such as data transfer, user training, and feature adaptation before making the switch.

#digitallendingplatform#automatedloanprocessing#digitallendingsolution#loanapplicationsoftware#lossystem#loantrackingsystem#loanoriginationsystem#bestloanmanagementsoftware#paydayloansoftware#loanportfoliomanagement#loan automation system#commercial loan management software#lending management system

0 notes

Text

LMS Implementation: Challenges Every Lender Should Know A must-read for lenders! Understand the challenges of implementing loan management software and how to avoid setbacks.

#digitallendingplatform#automatedloanprocessing#loanapplicationsoftware#loanportfoliomanagement#loantrackingsystem#lossystem#paydayloansoftware#digitallendingsolution#bestloanmanagementsoftware#loanoriginationsystem#loan automation system#commercial loan management software#lending management system

0 notes

Text

How Automation in Lending Software Lowers Origination Costs Lending software helps financial institutions cut costs and speed up loan processing with AI-driven automation.

#digitallendingsolution#automatedloanprocessing#bestloanmanagementsoftware#loantrackingsystem#lossystem#loanportfoliomanagement#loanapplicationsoftware#digitallendingplatform#loanoriginationsystem#paydayloansoftware

0 notes

Text

https://www.bloglovin.com/@krishna1056/step-by-step-guide-to-implementing-a-lending-13257714

Step-by-Step Guide to Implementing a Lending CRM System for Seamless Operations Learn how to implement a Lending CRM system step-by-step to enhance borrower management, streamline workflows, and improve efficiency.

#digitallendingplatform#bestloanmanagementsoftware#automatedloanprocessing#loantrackingsystem#loanportfoliomanagement#loanoriginationsystem#loanapplicationsoftware#digitallendingsolution

0 notes

Text

What is Loan Management System Workflow? Explained in Simple Terms Learn about the key components of a loan management system workflow and how it optimizes loan processing for lenders and borrowers alike.

#digitallendingplatform#bestloanmanagementsoftware#automatedloanprocessing#loantrackingsystem#loanportfoliomanagement#loanoriginationsystem#digitallendingsolution#lossystem#paydayloansoftware#loanapplicationsoftware

0 notes