#Dynamic UPI QR Code Generator

Explore tagged Tumblr posts

Text

UPI Payment Gateway India

Empower Your Transactions with Quintus Tech: Leading Automated Payment Solution Provider in India. Discover seamless payment solutions in India with Quintus Tech – your trusted automated payment solution provider. Streamline transactions effortlessly Quintus Tech offers cutting-edge and seamless payment solutions in India, serving as your trusted automated payment solution provider. Our goal is to simplify and streamline transactions, making the payment process effortless for businesses and individuals alike. Automation, Security, User-Friendly Interface, Versatility, Integration, Customer Support, Innovation etc. Visit Our Website :- https://quintustech.in/

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions

0 notes

Text

UPI payment gateway in India

Quintus Tech provides a wide range of services including automated payment solutions in India and digital payment systems, mobile payment solutions, and UPI payment gateways. They enable businesses to easily and securely accept customer payments, settle transactions, and improve customer experience.

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business

0 notes

Text

QR Code UPI Collections, Simplified

Generate dynamic or static QR codes through the API and let your customers scan to pay in seconds. Ideal for offline businesses, delivery agents, or even customer service counters. UPI QR tech — but smart and API-driven.

0 notes

Text

What’s the Difference Between UPI QR and UPI API Collections?

UPI QR codes are static or dynamic codes used for face-to-face payments. UPI APIs, on the other hand, offer dynamic programmatic payment collection features. With a UPI API, businesses can generate QR codes, track status, automate reminders, and reconcile payments without manual intervention. APIs are more suited for scalable, automated, and integrated payment workflows across digital platforms.

0 notes

Text

Enable UPI QR Code Payments Instantly

Accept UPI payments easily via dynamic QR codes using sprintNXT. Generate QR codes for customers to scan and pay instantly—no manual entries or errors. It’s a must-have for merchants, delivery services, and mobile businesses. #QRcodeTech #InstantPayments #SmartPOS #UPIBusiness #sprintNXT

0 notes

Text

UPI Collection API Providers: Transforming Digital Payments in India

The Unified Payments Interface (UPI) has revolutionized digital transactions in India, offering a seamless and instant payment experience. To leverage the power of UPI for payment collection, businesses are turning to upi collection api provider. These APIs enable businesses to integrate UPI payment collection into their platforms, streamlining transactions and enhancing customer convenience.

The Rise of UPI and its Impact on Digital Payments

UPI has emerged as a dominant payment method in India, driven by its simplicity, speed, and security. It allows for instant fund transfers between bank accounts using mobile devices, eliminating the need for traditional payment methods. The widespread adoption of UPI has transformed the digital payment landscape, empowering businesses and consumers alike.

The Role of UPI Collection API Providers

UPI Collection API providers enable businesses to:

Integrate UPI Payment Collection: Seamlessly integrate UPI payment options into their websites and mobile applications.

Generate UPI QR Codes: Dynamically generate UPI QR codes for easy payment collection.

Automate Payment Reconciliation: Automate the process of matching payments with orders.

Offer Real-Time Payment Notifications: Provide instant payment confirmations to customers.

Key Features to Look for in a UPI Collection API Provider

Reliability and Uptime: Ensure the provider offers high uptime and reliable transaction processing.

Security: Look for providers with robust security measures to protect sensitive data.

Scalability: Choose a provider that can handle your growing transaction volume.

Ease of Integration: Opt for APIs with clear documentation and developer-friendly tools.

Comprehensive Reporting: Access detailed transaction reports for analysis and reconciliation.

Customer Support: Ensure the provider offers responsive and knowledgeable customer support.

Expanding Digital Services Beyond UPI

Beyond UPI collection, businesses are also exploring other digital services, such as Bus Booking API Provider in India and Fast Tag Payment API.

Bus Booking API Provider in India: These APIs enable businesses to integrate bus booking services into their platforms, offering customers a convenient way to book bus tickets.

Fast Tag Payment API: These APIs facilitate seamless Fast Tag payment integration, streamlining toll payments.

Cyrus Recharge: A Leading UPI Collection API Provider

Cyrus Recharge is a prominent software development and API provider in India, offering robust and reliable UPI Collection API provider solutions. Their APIs are designed to simplify payment collection and enhance customer experience. Cyrus Recharge also provides excellent solutions for Bus Booking API Provider in India and Fast Tag Payment API needs. Their commitment to security, reliability, and customer support makes them a trusted partner for businesses of all sizes.

The Importance of Seamless Integration and Security

Seamless integration of UPI Collection APIs is crucial for ensuring a smooth and efficient payment experience. Additionally, robust security measures are essential to protect sensitive financial data.

Conclusion

UPI Collection APIs are transforming digital payments in India, empowering businesses to offer seamless and convenient payment options to their customers. By partnering with a reliable provider like Cyrus Recharge, businesses can leverage the power of UPI to enhance their payment processes.

FAQs:

1. What are the advantages of using a UPI Collection API?

It enables instant and seamless payment collection.

It reduces transaction costs compared to traditional payment methods.

It enhances customer convenience and satisfaction.

It automates payment reconciliation.

2. How secure are UPI Collection API transactions?

Reputable providers implement robust security measures, including encryption and authentication.

UPI transactions are secured by multiple layers of security, including bank-level security.

It is vital that the api provider follows all NPCI guidelines.

3. Can UPI Collection APIs be integrated with e-commerce websites and mobile apps?

Yes, UPI Collection APIs can be easily integrated with e-commerce websites and mobile applications.

Most API providers offer developer-friendly tools and documentation to facilitate integration.

Most also have dedicated support teams to help with the integration.

0 notes

Text

5 Impactful Investing Opportunities in India in 2024

Investing in startups in India has emerged as a promising avenue for investors seeking high-growth opportunities and impactful returns. With a vibrant entrepreneurial ecosystem, technological innovation, and supportive government policies, India offers a conducive environment for startup investments. In this comprehensive guide, we will explore five impactful investing opportunities in India in 2024, providing insights into emerging trends, sectors, and investment strategies that have the potential to generate significant returns and drive positive societal impact.

1. Fintech Innovation:

Fintech, or financial technology, is one of the most dynamic and rapidly evolving sectors in India's startup ecosystem. With the proliferation of smartphones, internet connectivity, and digital payment infrastructure, fintech startups are revolutionizing the way people access financial services, manage their finances, and conduct transactions. Opportunities abound in areas such as digital banking, mobile payments, peer-to-peer lending, robo-advisory services, and blockchain-based solutions. Investing in fintech startups allows investors to capitalize on India's digital transformation, financial inclusion initiatives, and the transition towards a cashless economy. By supporting innovative fintech solutions, investors can drive financial empowerment, promote economic growth, and create value for underserved segments of the population.

Here's a detailed explanation of why fintech innovation is an impactful investing opportunity in India in 2024:

1. Digital Transformation of Financial Services:

Fintech startups are at the forefront of India's digital transformation journey, offering innovative solutions to meet the evolving needs of consumers and businesses in the financial services sector. With the widespread adoption of smartphones, internet banking, and digital payment platforms, fintech startups are leveraging technology to deliver seamless, accessible, and user-friendly financial services, including digital banking, mobile payments, remittances, wealth management, and insurance.

2. Financial Inclusion and Access:

Fintech innovation is driving financial inclusion and expanding access to financial services for underserved and unbanked segments of the population in India. By leveraging mobile technology, biometric authentication, and digital KYC (Know Your Customer) processes, fintech startups are overcoming traditional barriers to banking, enabling individuals and businesses in remote areas to open bank accounts, access credit, make digital payments, and manage their finances more effectively.

3. Disruption of Traditional Banking Models:

Fintech startups are disrupting traditional banking models and challenging incumbents by offering agile, customer-centric, and cost-effective alternatives to traditional banking services. Digital-only banks, peer-to-peer lending platforms, and fintech-driven lending solutions are gaining traction among tech-savvy consumers and millennials who prioritize convenience, transparency, and personalized financial services.

4. Innovation in Payment Systems:

Fintech startups are driving innovation in payment systems and reshaping the payments landscape in India. Mobile wallets, UPI (Unified Payments Interface), contactless payments, and QR code-based payment solutions have transformed the way people transact and conduct business, offering speed, security, and interoperability across different payment platforms. Fintech startups are also exploring emerging technologies such as blockchain and cryptocurrency to enable cross-border payments, reduce transaction costs, and enhance financial inclusion.

5. Wealth Management and Investment Solutions:

Fintech startups are democratizing access to wealth management and investment solutions, making it easier for individuals to invest in stocks, mutual funds, and other financial instruments. Robo-advisors, algorithmic trading platforms, and online investment platforms offer personalized investment advice, portfolio management services, and automated investment strategies tailored to individual risk profiles and investment goals.

6. Regulatory Support and Innovation Sandbox:

The Indian government and regulatory authorities have been supportive of fintech innovation, introducing policies and regulatory frameworks to promote digital payments, encourage fintech investments, and foster innovation in the financial services sector. Initiatives such as the Regulatory Sandbox Framework and the Bharat Bill Payment System (BBPS) provide a conducive environment for fintech startups to test innovative solutions, collaborate with traditional financial institutions, and scale their operations while ensuring compliance with regulatory requirements.

7. Global Expansion and Market Opportunities:

Fintech startups in India are well-positioned to expand their footprint and tap into global markets, leveraging India's strong technology talent pool, English-speaking workforce, and growing reputation as a fintech hub. With increasing investor interest, strategic partnerships, and cross-border collaborations, Indian fintech startups have the opportunity to scale their operations internationally, address global challenges, and drive financial inclusion and innovation on a global scale.

2. Healthcare Technology:

Healthcare technology, or healthtech, is experiencing unprecedented growth and innovation in India, fueled by factors such as rising healthcare costs, increasing chronic diseases, and the need for accessible and affordable healthcare solutions. Healthtech startups are leveraging technologies such as artificial intelligence, telemedicine, remote monitoring, and electronic health records to improve healthcare delivery, diagnosis, and patient outcomes. Investing in healthtech startups offers investors the opportunity to address critical healthcare challenges, enhance access to quality healthcare services, and promote preventive care and wellness. By supporting innovative healthtech solutions, investors can contribute to improved healthcare access, reduced healthcare costs, and better health outcomes for millions of people across India.

Here's a detailed explanation of why healthcare technology presents an impactful investing opportunity in India in 2024:

1. Addressing Healthcare Challenges:

India faces significant healthcare challenges, including inadequate infrastructure, shortage of healthcare professionals, uneven distribution of healthcare services, and rising disease burden. Healthtech startups are leveraging technology to address these challenges by offering innovative solutions in areas such as telemedicine, remote patient monitoring, digital diagnostics, electronic health records (EHR), and healthcare analytics. By improving access to healthcare services, enhancing diagnostic capabilities, and optimizing healthcare delivery, healthtech startups have the potential to transform India's healthcare landscape and drive positive health outcomes.

2. Telemedicine and Remote Consultations:

Telemedicine platforms allow patients to consult with healthcare providers remotely through video calls, chat sessions, and virtual consultations. These platforms enable patients to access medical advice, diagnosis, and treatment from the comfort of their homes, reducing the need for physical visits to healthcare facilities and overcoming geographical barriers to healthcare access. Telemedicine startups are leveraging artificial intelligence (AI), machine learning (ML), and data analytics to offer personalized, evidence-based healthcare recommendations and improve patient outcomes.

3. Remote Patient Monitoring and IoT Devices:

Remote patient monitoring (RPM) solutions and Internet of Things (IoT) devices enable continuous monitoring of patients' vital signs, health parameters, and medication adherence outside of traditional healthcare settings. Wearable devices, smart sensors, and mobile health apps collect real-time data on patients' health status, allowing healthcare providers to track disease progression, manage chronic conditions, and intervene proactively in case of emergencies. RPM startups are leveraging IoT technology to empower patients to take control of their health, prevent hospital readmissions, and reduce healthcare costs associated with chronic disease management.

4. Digital Diagnostics and Imaging:

Digital diagnostics startups are revolutionizing medical imaging, pathology, and diagnostic testing through the use of advanced imaging techniques, AI algorithms, and cloud-based platforms. AI-powered diagnostic tools analyze medical images, laboratory results, and patient data to detect abnormalities, identify diseases, and assist healthcare providers in making accurate diagnoses. Digital diagnostics solutions enable faster, more accurate diagnosis, reduce diagnostic errors, and improve patient outcomes by facilitating early detection and treatment of diseases such as cancer, cardiovascular disorders, and infectious diseases.

5. Electronic Health Records and Interoperability:

Electronic health records (EHR) platforms digitize patients' medical records, histories, and treatment plans, enabling secure storage, retrieval, and sharing of health information across healthcare providers and institutions. Interoperable EHR systems facilitate seamless exchange of patient data, medical histories, and diagnostic reports between hospitals, clinics, pharmacies, and laboratories, ensuring continuity of care and coordination among healthcare providers. EHR startups are leveraging blockchain technology and secure data exchange protocols to ensure patient privacy, data security, and compliance with regulatory requirements such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation).

6. Healthcare Analytics and Predictive Modeling:

Healthcare analytics startups analyze large volumes of healthcare data, including clinical records, claims data, and patient demographics, to derive actionable insights, identify trends, and optimize healthcare delivery. Predictive analytics models leverage machine learning algorithms to forecast disease outbreaks, predict patient outcomes, and optimize resource allocation in healthcare facilities. Healthcare analytics solutions enable evidence-based decision-making, resource optimization, and cost-effective healthcare delivery, leading to improved patient outcomes, reduced healthcare costs, and enhanced operational efficiency in healthcare organizations.

7. Regulatory Support and Policy Initiatives:

The Indian government and regulatory authorities have introduced policies and initiatives to support healthcare technology innovation, promote digital health adoption, and improve healthcare access and affordability. Initiatives such as the National Digital Health Mission (NDHM), Digital India Healthcare Vision, and Telemedicine Practice Guidelines provide a conducive environment for healthtech startups to develop and deploy innovative solutions, collaborate with healthcare providers, and scale their operations while ensuring compliance with regulatory requirements and quality standards.

3. Clean Energy and Sustainability:

Clean energy and sustainability have emerged as priority areas for investment in India, driven by environmental concerns, climate change mitigation efforts, and the transition towards renewable energy sources. Startups in the clean energy sector are developing innovative solutions in areas such as solar power, wind energy, energy storage, electric vehicles, and sustainable agriculture. Investing in clean energy startups allows investors to support India's renewable energy goals, reduce carbon emissions, and promote environmental sustainability. By backing innovative clean energy solutions, investors can contribute to India's energy security, create green jobs, and mitigate the adverse impacts of climate change on communities and ecosystems.

4. Edtech Revolution:

The education technology, or edtech, sector in India is undergoing a rapid transformation, driven by factors such as digitization of education, remote learning trends, and the adoption of online education platforms. Edtech startups are leveraging technology to deliver personalized, interactive, and accessible learning experiences across various subjects and skill levels. Opportunities abound in areas such as online tutoring, test preparation, skill development, vocational training, and lifelong learning. Investing in edtech startups allows investors to support inclusive and equitable education, bridge the digital divide, and empower learners of all ages to acquire knowledge and skills for personal and professional growth. By backing innovative edtech solutions, investors can contribute to India's human capital development, workforce productivity, and socio-economic progress.

5. Agritech Innovation:

Agritech, or agricultural technology, is poised for significant growth and innovation in India, driven by the need to enhance agricultural productivity, improve farmer livelihoods, and ensure food security. Agritech startups are leveraging technologies such as precision farming, IoT sensors, drones, AI-powered analytics, and supply chain optimization to address challenges across the agricultural value chain. Opportunities abound in areas such as farm management software, precision agriculture, crop monitoring, market linkages, and post-harvest management. Investing in agritech startups allows investors to support sustainable agriculture practices, increase farm efficiency, and reduce food waste. By backing innovative agritech solutions, investors can contribute to rural development, farmer prosperity, and food sustainability in India.

In conclusion, investing in startups in India presents investors with five impactful opportunities to drive positive change and achieve financial returns in 2024. By strategically allocating capital to sectors such as fintech, healthtech, clean energy, edtech, and agritech, investors can support innovative solutions, promote socio-economic development, and address pressing challenges facing India and the world. However, startup investing carries inherent risks, and investors should conduct thorough due diligence, diversify their portfolios, and seek professional advice to mitigate risks and maximize returns. With the right investment strategies, investors can play a significant role in fueling innovation, driving economic growth, and creating lasting impact through startup investments in India.

This post was originally published on: Foxnangel

#investing opportunities#startups in india#investing in startups in india#start up investment in india#startup investments#investment strategies#fintech innovations#invest in startups india#foxnangel

1 note

·

View note

Text

Dynamic UPI QR Code Generator

Those days when QR codes used to be static are over. It’s a dynamic generator that adjusts your QR code for every transaction, ensuring correctness and safety every time. You can effortlessly generate QR codes on the fly, whether you run a small or large business entity.

Just punch in the transaction amount and get an immediate one-off QR code. No more worries about updating manually or using out-of-date codes. Moreover, our system offers real-time monitoring and analytics to give you some valuable transaction insights.

Experience the convenience and efficiency of our dynamic UPI QR code generator today. Forget static ones and have a taste of streamlined payments!

visit our website - https://quintustech.in/

0 notes

Text

Payment Solution Providers in India

Empower Your Transactions with Quintus Tech: Leading Automated Payment Solution Provider in India. Discover seamless payment solutions in India with Quintus Tech – your trusted automated payment solution provider. Streamline transactions effortlessly Quintus Tech offers cutting-edge and seamless payment solutions in India, serving as your trusted automated payment solution provider. Our goal is to simplify and streamline transactions, making the payment process effortless for businesses and individuals alike. Automation, Security, User-Friendly Interface, Versatility, Integration, Customer Support, Innovation etc. Visit Our Website :- https://quintustech.in/

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions"

0 notes

Text

Automated Payment Solutions

Quintus Tech provides a wide range of services including automated payment solutions in India and digital payment systems, mobile payment solutions, and online payment gateways. They enable businesses to easily and securely accept customer payments, settle transactions, and improve customer experience.

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions

0 notes

Text

Smart UPI QR API

Generate dynamic or static UPI QR codes on the fly using this robust API. Perfect for merchants needing instant, contactless payment solutions. Supports merchant-level customizations and real-time payment tracking. Enhance user experience while keeping operations efficient and low-cost. No need for physical hardware or complex setup. https://www.sprintnxt.in/upi-collection-api.html

0 notes

Text

Collect Payments Easily with Dynamic QR Codes

Accept UPI payments via QR codes linked to virtual IDs through SprintNXT’s payment gateway. Generate unique codes per customer or order for automated reconciliation, secure transactions, and real-time payment tracking. Perfect for retail, logistics, or utility billing.

0 notes

Text

Dynamic QR by NifiPayments – Revolutionizing Real-Time Payments

In today’s fast-paced digital economy, customers expect convenience, speed, and security at every transaction. Static QR codes have played a role, but it’s time for a smarter solution — Dynamic QR codes.

With Dynamic QR by NifiPayments, businesses can now offer a more personalized, real-time payment experience that simplifies billing and enhances customer satisfaction.

💡 What is a Dynamic QR Code?

Unlike a static QR code that always carries the same fixed payment information, a Dynamic QR code is generated in real time with specific transaction details like the amount, merchant ID, invoice reference, and more.

Each scan is unique — ensuring improved security, error-free payments, and seamless tracking.

✅ Key Features of Dynamic QR by NifiPayments

🔹 Auto-Generated Per Transaction

Each QR is generated with a unique transaction ID and amount — no manual entry needed.

🔹 Error-Free Payments

No more wrong amounts or reference confusion. Customers scan and pay with confidence.

🔹 Instant Payment Confirmation

Get real-time status updates and notifications as soon as a transaction is completed.

🔹 Seamless Integration

Easily integrate with billing software, POS systems, or mobile apps.

🔹 Supports Multiple Payment Modes

Customers can pay using UPI apps, cards (via app wallets), or any QR-scanning payment method.

🎯 Perfect For:

Supermarkets & Retail Chains

Restaurants & Cafes

Delivery Services

Online & Offline Billers

Petrol Pumps

Healthcare & Clinics

Utility Bill Collection Centers

Wherever quick, one-to-one payments are needed — Dynamic QR is the smarter choice.

🔐 Security & Compliance

NifiPayments’ Dynamic QR solution follows strict security protocols and adheres to RBI and NPCI guidelines, ensuring that each payment is not only fast, but also fully secure and traceable.

🚀 Why Choose Dynamic QR by NifiPayments?

Reduce errors and improve payment accuracy

Speed up checkout and customer service

Automate transaction tracking and reconciliation

Boost your business’s digital image and convenience

Eliminate manual data entry and human error

📲 Get Started Today

Upgrade your payment experience with Dynamic QR by NifiPayments — the future-ready way to collect payments smarter, faster, and safer.

Contact us today to get a demo or integration support.

#NifiPayments #DynamicQR #SmartPayments #DigitalIndia #UPIQR #PaymentInnovation #SecureTransactions #RetailTech #InstantPayments #BusinessGrowth #UPI #RealtimePayments #QRcodePayment

0 notes

Text

Modern Retail Payments with Dynamic QR Codes

Retail businesses need faster, smarter payment solutions. SprintNXT offers dynamic and static UPI QR code generation that’s perfect for shops, invoices, and delivery use cases. Dynamic QR codes personalize the payment experience, while static ones support speed and simplicity. With SprintNXT, retailers can improve customer satisfaction and reduce cash handling overhead.

0 notes

Text

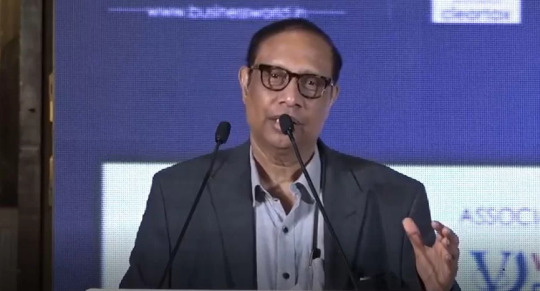

Contribution Of UPI To Making Our Future Digital Is Phenomenal - Sethurathnam Ravi

Mr. Sethurathnam Ravi throws insights into the revolution created by the UPI and the shift of India into the technological realm especially during the pandemic times. Unified Payment Interface is a digital innovation with an instant payment option developed indigenously by the National Payments Corporation of India (NPCI) and launched in 2016 in India.

According to S Ravi BSE, the popularity of UPI is evident, as it is accepted by tiny roadside shops to large brands as well as by small retailers to wholesale merchants. “The numbers speak for themselves. In the last 4 years from October 2018 to September 2022, the number of banks live on UPI has increased from 128 to 358. And the volume of the transaction has risen from 482 million to 6,781 million and transactions from Rs 74,978 crore to Rs 11,16,438 crore. This is significant proof of the success and growth of the UPI story”, Mr. Ravi adds.

The main reason for this penetration as per the analysis of Mr. Sethurathnam Ravi is that UPI accepts transactions as small as a rupee. The incentive for merchants is on account of the absence of MDR to be paid to the banks vis-à-vis card transactions and end-to-end transact ability on smartphones, wherein only a single device is required to complete a transaction, thereby making the process simplistic.

The ecosystem in which UPI thrives is also key to its success, says the expert. This includes the presence of high-speed internet in many parts of the country, technologies that power a smartphone, cloud computing and modern software engineering technologies that fulfil a transaction in a few seconds. The security of a UPI transaction is tied to the user’s authentication with a mobile phone — there is a mobile personal identification number (MPIN) for the UPI application and there is one more layer of security when the bank’s online transaction PIN is to be keyed in as part of every UPI transaction. If you block a mobile number due to theft, for example, then UPI transactions on that mobile number will also be halted.

In the words of S Ravi BSE, the NPCI has come up with multiple new innovations over the past few years: recurring payments for monthly bills, international payments, linking UPI to credit cards, 123pay … and many more features. The dynamic QR code is a great boost to security and trust because there is no risk of someone tampering with a static QR code. The merchant generates a QR code specific to that transaction amount and the customer pays through UPI by scanning the QR code”.

NPCI has partnered with entities in the USA, Japan, Singapore and Dubai to broaden base transactions abroad. Sethurathnam Ravi details. UPI is unique as it:

· It allows real-time transfer of money any time/ any day of the month and year by using a single mobile application for accessing different bank accounts.

· It is supported by the security feature of single-click 2-factor Authentication — aligned with the regulatory guidelines as well as virtual address allowing incremental security as the customer is not required to share account details.

· Payment to merchants with a single account or through Apps and thereby not relying on cash arrangement/ ATM

· It has the facility to raise grievances from the mobile App Directly

The UPI is a phenomenal Indian technological success story. The interface in a short period has facilitated Indians to move from a cash-based economy to a digital economy. Sethurathnam Ravi concludes with the exciting thought that the pandemic has taught us that the future is digital and the contribution of UPI to the cause is phenomenal.

0 notes

Text

IppoPay - A Payment aggregator with accounting software

IppoPay is a payment aggregator with accounting software and an online store targeting tier2, tier3 areas of Tamil Nadu.

We surveyed Freelancers, SMEs who all need to hire invoice software to accept payments. To manage payment details they have to use invoice software like Zoho, Quick book and have to spend around Rs. 2000 per month. Also this market was already crowded

So we made an innovation, developed the invoice software with quotation, performa & invoice to accept payments. We also provide proper accounting software, customer management with a complete book record and can track the payment details.

Though their customers pay in another mode they still can track all the payment details. We provide an android/ iOS app to handle all the payment related activities in the mobile app.

Our SaaS-based invoice software is completely free and they have to pay only when the customers pay ie transaction fee is only charged when the customer pays

Our Payment link plays an important role in the life of individuals like carpenter, plumber, electrician, etc. The only option for them to get paid is Google Pay where they cannot maintain any book record.

Businesses can manage payments and track payment details like those who have paid / not paid using our payment link and can get paid by sending the payment link via SMS, Email to their customers

Manage subscriptions; automate recurring billing, get notified for all the payment related activities with no setup fee supported by flat and unit pricing model

We analyzed small scale business individuals like milk vendors, newspaper boys, chit fund companies, etc. of tier2, tier3 cities of Tamil Nadu. Those people manage their payments only through paper. Hence we got an idea of providing them a mobile app to create a subscription plan in their language mainly Tamil.

In Tamil Nadu most of the married women are homepreneurs. To showcase their products they need an E-commerce platform, hire a development company that is too hard. Though platforms like Shopify is available still they need to pay for it.

IppoPay fills that gap and it provides online store where Homepreneurs can showcase their products and sell it using our social commerce platform

We analyzed a problem that most of the individuals have to spend time and they have to reply to their customers. So we are developing chatbot and using it they can sell their products after striking a deal with potential customers by bargaining over chat in regional language (Tamil).

We also provide UPI for retails stores to make the payment cardless. Customers can pay just by scanning the QR code. Uniqueness of IppoPay is no terminal is required. It eliminates the need for POS/ card swiping machine. Merchants can generate dynamic QR codes using our Mobile app for a particular amount. Customers can pay without entering the amount in a single tap. Push notification is received once the payment is done.

Our UPI includes Bharat QR code too. Hence the customers can use their credit card / net banking app to make payments with QR code.

Use IppoPay; manage your customers and revenue.

#payment gateway in chennai#payment solution in chennai#payment api in chennai#free invoice software in chennai#subscription software chennai#online store in chennai#social commerce in chennai

0 notes