#payment solutions

Text

The Rise of Cashfree Payments: A Paradigm Shift in Financial Transactions

The way we handle financial transactions has undergone a dramatic transformation. Traditional cash payments are gradually being phased out, making way for the era of cashfree payments. With the advent of digital payment methods such as mobile payments, UPI transactions, and international payments, consumers and businesses alike are embracing the convenience and efficiency offered by cashfree solutions. In this blog post, we will explore the various facets of cashfree payments, from their advantages to common misconceptions and their potential impact on the future of finance.

2 notes

·

View notes

Text

Paypal alternative (?)

To artists doing commissions from all over the world. (or people buying them)

I don't know if this will reach anyone, but it might. I am mainly referring to people from Europe. What do you take payment through? I'm looking for an alternative to paypal, due to the unfavorable exchange rate and high fees (for me) :/

Do you have something tested and worth recommending?

2 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

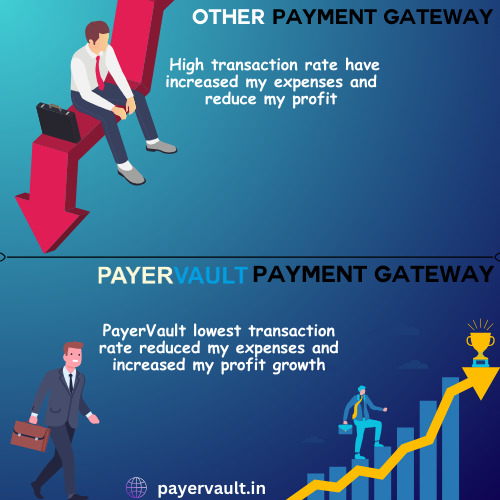

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness"

Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

2 notes

·

View notes

Text

1 note

·

View note

Text

WEX Signs Agreement with Leading Online Travel Platform Booking.com

Continuation of long-standing partnership demonstrates strength and reliability of WEX’s enterprise-grade technology platform, flexibility through co-development of proprietary travel payment solutions, geographic reach, and deep payments industry expertise

PORTLAND, Maine, April 25, 2024–(BUSINESS WIRE)–WEX (NYSE:WEX), the global commerce platform that simplifies the business of running a…

View On WordPress

0 notes

Text

A payment gateway is an important business that provides services to a variety of businesses.If you own a business, you should be familiar with the services that a payment gateway offers. Still, in this section, we discussed payment gateways in detail, their role in e-commerce, the importance of investing in payment gateways for businesses, and other related topics.

0 notes

Text

If you want to run a business *You need proper business formation. *You need Verified, Secure And Instant Payment Gateway. *You need Bank account. *You need proper add management. You need all off this. We are here to help you. We are the only one Who give you all of this in one package. We are here to solve your payment problem, We are here to solve you business problem. Visit The link https://merchantta.net/

1 note

·

View note

Text

Secure Online Payments Made Easy with OnePay

Welcome to the world of modern business, where convenience is king and adaptation is the key to success. If you're a business owner, big or small, you've probably heard about the importance of accepting card payments and processing transactions online. But what exactly does that entail? Don't worry, we're here to break it down for you in the simplest terms possible. Think of it as your trusted guide to navigating the world of payments with ease and confidence. Let's get started!

Understanding Card Payments

First things first, let's break down what card payments entail. When a customer pays with a credit or debit card, the transaction involves several steps:

Authorization: The customer swipes, inserts, or taps their card at the point of sale (POS) device or enters their card details online.

Authentication: The card issuer verifies the transaction's legitimacy and the availability of funds.

Settlement: The funds are transferred from the customer's account to the merchant's account.

Why Accept Card Payments?

Accepting card payments offers numerous benefits for your business:

Convenience: Customers prefer the ease and security of paying with cards.

Increased Sales: Studies show that businesses that accept cards typically see higher transaction volumes.

Global Reach: With online payments, you can reach customers beyond your local area or even your country.

Security: Card transactions come with built-in fraud protection, reducing the risk for both you and your customers.

Accepting Payments Online

Nowadays, having an online presence is crucial for any business. Here's how you can start accepting payments online

Choose a Payment Gateway: A payment gateway is an online service that authorizes card payments. Popular options include PayPal, Stripe, and Square.

Integrate with Your Website: Most payment gateways offer easy-to-implement plugins or APIs to seamlessly integrate with your website or e-commerce platform.

Secure Checkout: Ensure that your checkout process is secure and user-friendly to instill trust in your customers.

Stay Compliant: Familiarize yourself with relevant regulations such as PCI DSS (Payment Card Industry Data Security Standard) to protect sensitive cardholder data.

Simplifying the Process

While the technical aspects of card payments and online transactions may seem daunting, there are tools and services available to simplify the process for you:

All-in-One Solutions: Consider using platforms like Shopify or WooCommerce that provide integrated payment processing along with e-commerce functionalities.

Customer Support: Choose payment providers that offer responsive customer support to assist you whenever you encounter challenges.

Educational Resources: Take advantage of online guides, tutorials, and customer forums provided by payment service providers to learn and troubleshoot effectively.

Conclusion

Accepting card payments and processing transactions online doesn't have to be overwhelming. By understanding the basics, leveraging reliable payment gateways, and utilizing available resources, you can simplify the process and focus on growing your business. Embrace the opportunities that digital payments offer, and watch your business thrive in today's interconnected world.

1 note

·

View note

Text

📝Unlocking the Benefits of 123 Pay UPI: A Convenient and Secure Online Payment Method—

To know more ↓

1 note

·

View note

Text

Mastering Modern Payments: OnePay's Innovations in Payment Analytics, Contactless, and Mobile Payment Methods

Businesses are constantly seeking ways to optimize their payment processes, improve efficiency, and enhance customer experience. OnePay stands at the forefront of innovation, offering a comprehensive suite of features designed to revolutionize transactions. With its advanced payment analytics, seamless contactless payments, and versatile mobile payment methods, OnePay is empowering businesses to unlock valuable insights, embrace convenience, and drive success in the digital age. Let's explore how these key features are transforming the payment landscape.

Empowering Informed Decision-Making:

By leveraging advanced analytics tools, businesses can gain a deeper understanding of their payment patterns, customer behavior, and overall financial performance. OnePay's payment analytics dashboard offers real-time visibility into key metrics such as transaction volume, revenue trends, and customer demographics.

With customizable reports and interactive visualizations, businesses can analyze their data from multiple perspectives, uncovering actionable insights to drive growth and profitability.

Embracing Convenience and Safety:

OnePay's contactless payments feature allows businesses to offer customers a convenient and secure way to pay without physical contact. With contactless payments, customers can simply tap their cards or smartphones on a compatible payment terminal to complete their transactions quickly and efficiently.

Whether it's in-store, at a restaurant, or on the go, businesses can cater to the preferences of their customers and provide a seamless payment experience across various touchpoints.

Convenience at Your Fingertips:

Businesses must adapt to the evolving preferences of consumers who demand convenience and flexibility in their payment options. OnePay's mobile payment methods feature enables businesses to accept payments seamlessly via smartphones and tablets, catering to the needs of modern customers on-the-go.

With OnePay's mobile payment methods, customers can make payments quickly and securely using their mobile devices, eliminating the need for physical cards or cash. Whether it's through a dedicated mobile app, a mobile website, or a QR code scan, businesses can offer customers a variety of mobile payment options to suit their preferences.

Conclusion:

OnePay is revolutionizing the payment landscape with its advanced payment analytics, seamless contactless payments, and versatile mobile payment methods. By leveraging these key features, businesses can unlock valuable insights, enhance convenience, and drive success in the digital age.

0 notes

Text

Write Digital Checks With Ease: Guidelines and Mistakes to Avoid

New financial practices are slowly displacing older payment systems since most financial transactions in the modern digital era are online. One big change is that more and more people are paying for things with digital checks, which are sometimes called "e-checks." For business owners to be able to handle the complicated nature of modern business deals, they need to know how to write a check online. In this blog post, we'll examine the rules for writing online checks and discuss some typical errors that users make.

What are e-checks or digital checks?

Simply put, digital checks are electronic copies of paper checks that may be sent to recipients online. Online checks are less expensive and require less time and effort than traditional checks.

Tips for Writing an Online Check:

Choose Your Online Banking Platform: The first thing to do is confirm that you can access a safe online banking platform that offers services for writing digital checks. Today, the majority of banks and financial organizations provide this service. If your bank doesn't, you can explore online payment platforms that do. You can link your bank account and begin making payments after your profile is set up.

Enter Payee Information: You must ensure that the recipient's bank account number and other pertinent information are entered accurately. It is crucial to prevent mistakes to guarantee no payment delays.

Provide the Payment Amount: It is preferable to provide the payment amount in numerical format for clarity's sake. Make sure the quantity is correct by checking it twice.

Check Account Balances: Before writing a check online, check your bank account balance to ensure that you have enough money. You might have to pay overdraft fees if you don't. Additionally, there's a chance the check gets declined.

Review and Submit the Check: Before you submit the online check, you have to confirm that all the information is correct to avoid payment issues. Once you do that, you can submit the check or send it to the recipient.

Common Mistakes to Avoid:

Incorrect Payee Details: A common mistake users must correct while writing digital checks is entering inaccurate information about the recipient. Details like the payee's name and bank account number must always be accurate.

Entering the Wrong Payment Amount: If the payment amount needs to be corrected, that can cause complications. So, always ensure that the payment amount is correct.

Writing Online Checks Without Proper Account Balances: Failure to analyze your account information and balances can often lead to overdraft charges or failed transactions. To improve your online check-writing experience, always confirm enough funds in your account before making payments.

Disregarding Security Measures: Although payment platforms offer great security, users must take precautions to ensure their transactions are safe. Log into your banking account only when necessary and make sure to log out once you are done.

Conclusion:

The general guidelines provided in this blog will certainly help you understand the online check-writing process. But be sure to avoid mistakes while preparing digital checks. Assimilating to the digital era might be difficult for some, but it is never too late to learn new banking skills that will increase the accuracy and security of your financial transactions.

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

See how we boosted a leading retailer’s checkout experience by integrating Salesforce Commerce Cloud with Authorize.Net, improving payment efficiency and customer satisfaction.

0 notes

Text

The integration of Artificial Intelligence (AI) into payment solutions is revolutionizing the way transactions are processed and managed, offering

#AI in payment solutions#Ai#payment solutions#payment systems#AI-driven payment#AI in payment systems

1 note

·

View note