#E invoicing mandate

Explore tagged Tumblr posts

Text

Excel, Word, Access, Outlook

Previously on computer literacy: A Test For Computer Literacy

If you’re a computer programmer, you sometimes hear other programmers complain about Excel, because it mixes data and code, or about Word, because it mixes text and formatting, and nobody ever uses Word and Excel properly.

If you’re a computer programmer, you frequently hear UX experts praise the way Excel allows non-programmers to write whole applications without help from the IT department. Excel is a great tool for normal people and power users, I often hear.

I have never seen anybody who wasn’t already versed in a real programming language write a complex application in an Excel spreadsheet. I have never seen anybody who was not a programmer or trained in Excel fill in a spreadsheet and send it back correctly.

Computer programmers complain about the inaccessibility of Excel, the lack of discoverability, the mixing of code and data in documents that makes versioning applications a proper nightmare, the influence of the cell structure on code structure, and the destructive automatic casting of cell data into datatypes.

UX experts praise Excel for giving power to non-programmers, but I never met a non-programmer who used Excel “properly”, never mind developed an application in it. I met non-programmers who used SPSS, Mathematica, or Matlab properly a handful of times, but even these people are getting rarer and rarer in the age of Julia, NumPy, SymPy, Octave, and R. Myself, I have actually had to learn how to use Excel in school, in seventh grade. I suspect that half of the “basic computer usage” curriculum was the result of a lobbying campaign by Microsoft’s German branch, because we had to learn about certain features in Word, Excel, and PowerPoint on Windows 95, and non-Microsoft applications were conspicuously absent.

Visual Basic and VBS seemed like a natural choice to give power to end users in the 90s. People who had already used a home computer during the 8-bit/16-bit era (or even an IBM-compatible PC) were familiar with BASIC because that was how end-users were originally supposed to interact with their computers. BASIC was for end users, and machine code/compiled languages were for “real programmers” - BASIC was documented in the manual that came with your home computer, machine code was documented in MOS data sheets. From today’s point of view, programming in BASIC is real programming. Calling Visual Basic or .Net scripting in Excel “not programming“ misrepresents what modern programmers do, and what GUI users have come to expect after the year 2000.

Excel is not very intuitive or beginner-friendly. The “basic computer usage” curriculum was scrapped shortly after I took it, so I had many opportunities to observe people who were two years younger than me try to use Excel by experimenting with the GUI alone.

The same goes fro Microsoft Word. A friend of mine insists that nobody ever uses Word properly, because Word can do ligatures and good typesetting now, as well as footnotes, chapters, outline note taking, and so on. You just need to configure it right. If people used Word properly, they wouldn’t need LaTeX or Markdown. That friend is already a programmer. All the people I know who use Word use WYSIWYG text styling, fonts, alignment, tables, that sort of thing. In order to use Word “properly“, you’d have to use footnotes, chapter marks, and style sheets. The most “power user” thing I have ever seen an end user do was when my father bought a CD in 1995 with 300 Word templates for all sorts of occasions - birthday party invitation, employee of the month certificate, marathon completion certificate, time table, cooking recipe, invoice, cover letter - to fill in and print out.

Unlike Excel, nobody even claims that non-programmer end users do great things in Word. Word is almost never the right program when you have email, calendars, wikis, to-do lists/Kanban/note taking, DTP, vector graphics, mind mapping/outline editors, programmer’s plain text editors, dedicated novelist/screenwriting software, and typesetting/document preparation systems like LaTeX. Nobody disputes that plain text, a wiki, or a virtual Kanban board is often preferable to a .doc or .docx file in a shared folder. Word is still ubiquitous, but so are browsers.

Word is not seen as a liberating tool that enables end-user computing, but as a program you need to have but rarely use, except when you write a letter you have to print out, or when you need to collaborate with people who insist on e-mailing documents back and forth.

I never met an end user who actually liked Outlook enough to use it for personal correspondence. It was always mandated by an institution or an employer, maintained by an IT department, and they either provided training or assumed you already had had training. Outlook has all these features, but neither IT departments nor end users seemed to like them. Outlook is top-down mandated legibility and uniformity.

Lastly, there is Microsoft Access. Sometimes people confused Excel and Access because both have tables, so at some point Microsoft caved in and made Excel understand SQL queries, but Excel is still not a database. Access is a database product, designed to compete with products like dBase, Cornerstone, and FileMaker. It has an integrated editor for the database schema and a GUI builder to create forms and reports. It is not a networked database, but it can be used to run SQL queries on a local database, and multiple users can open the same database file if it is on a shared SMB folder. It is not something you can pick up on one afternoon to code your company’s billing and invoicing system. You could probably use it to catalogue your Funko-Pop collection, or to keep track of the inventory, lending and book returns of a municipal library, as long as the database is only kept on one computer. As soon as you want to manage a mobile library or multiple branches, you would have to ditch Access for a real SQL RDBMS.

Microsoft Access was marketed as a tool for end-user computing, but nobody really believed it. To me, Access was SQL with training wheels in computer science class, before we graduated to MySQL and then later to Postgres and DB2. UX experts never tout Access as a big success story in end-user computing - yet they do so for Excel.

The narrative around Excel is quite different from the narrative around Yahoo Pipes, IFTTT, AppleScript, HyperCard, Processing, or LabView. The narrative goes like this: “Excel empowers users in big, bureaucratic organisations, and allows them to write limited applications to solve business problems, and share them with co-workers.”

Excel is not a good tool for finance, simulations, genetics, or psychology research, but it is most likely installed on every PC in your organisation already. You’re not allowed to share .exe files, but you are allowed to share spreadsheets. Excel is an exchange format for applications. Excel files are not centrally controlled, like Outlook servers or ERP systems, and they are not legible to management. Excel is ubiquitous. Excel is a ubiquitous runtime and development environment that allows end-users to create small applications to perform simple calculations for their jobs.

Excel is a tool for office workers to write applications to calculate things, but not without programming, but without involving the IT department. The IT department would like all forms to be running on some central platform, all data to be in the data warehouse/OLAP platform/ERP system - not because they want to make the data legible and accessible, but because they want to minimise the number of business-critical machines and points of failure, because important applications should either run on servers in a server rack, or be distributed to workstations by IT.

Management wants all knowledge to be formalised so the next guy can pick up where you left off when you quit. For this reason, wikis, slack, tickets and kanban boards are preferable to Word documents in shared folders. The IT department calls end-user computing “rogue servers“ or “shadow IT“. They want all IT to have version control, unit tests, backups, monitoring, and a handbook. Accounting/controlling thinks end-user computing is a compliance nightmare. They want all software to be documented, secured, and budgeted for. Upper management wants all IT to be run by the IT department, and all information integrated into their reporting solution that generates these colourful graphs. Middle management wants their people to get some work done.

Somebody somewhere in the C-suite is always viewing IT as a cost centre, trying to fire IT people and to scale down the server room. This looks great on paper, because the savings in servers, admins, and tech support are externalised to other departments in the form of increased paperwork, time wasted on help hotlines, and

Excel is dominating end-user computing because of social reasons and workplace politics. Excel is not dominating end-user computing because it is actually easy to pick up for end-users.

Excel is dominating end-user computing neither because it is actually easy to pick up for non-programmers nor easy to use for end-users.

This is rather obvious to all the people who teach human-computer interaction at universities, to the people who write books about usability, and the people who work in IT departments. Maybe it is not quite as obvious to people who use Excel. Excel is not easy to use. It’s not obvious when you read a book on human-computer interaction (HCI), industrial design, or user experience (UX). Excel is always used as the go-to example of end-user computing, an example of a tool that “empowers users”. If you read between the lines, you know that the experts know that Excel is not actually a good role model you should try to emulate.

Excel is often called a “no code“ tool to make “small applications“, but that is also not true. “No Code” tools usually require users to write code, but they use point-and-click, drag-and-drop, natural language programming, or connecting boxes by drawing lines to avoid the syntax of programming languages. Excel avoids complex syntax by breaking everything up into small cells. Excel avoids iteration or recursion by letting users copy-paste formulas into cells and filling formulas in adjacent cells automatically. Excel does not have a debugger, but shows you intermediate results by showing the numbers/values in the cells by default, and the code in the cells only if you click.

All this makes Excel more like GameMaker or ClickTeam Fusion than like Twine. Excel is a tool that doesn’t scare users away with text editors, but that’s not why people use it. It that were the reason, we would be writing business tools and productivity software in GameMaker.

The next time you read or hear about the amazing usability of Excel, take it with a grain of salt! It’s just barely usable enough.

128 notes

·

View notes

Text

GST consultants in Bangalore

Hello everyone, in this post, we will talk about goods and service tax registration. This is so self-explanatory. Whoever deals with goods or services, whoever purchases goods or services, are liable to pay GST tax. There are lots of questions arising in and around about GST.

In this post, let's see very few basic questions about GST registration.

What is GST?

GST comes in the act of vanishing indirect taxes of central and state such as VAT excise duty and service tax GST, bringing in one nation one tax which is one single taxed for the entire nation.

So let's see who are eligible to get enrolled with GST so simple if you are an individual or a business who aren't dealing without who supplies goods or services are eligible to get enrolled with GST if there is a requirement or if there is a necessity to run your business only by having a GST registration you can enrol yourself by the GST registration in a voluntary basis.

Now let's see who our mandate relief should get register with GST like say, for example, you have a company, or you have a proprietorship company who supplies your goods or services in an e-commerce portal who sales your products in e-commerce portal or very mandatory to have a GST number without having a GST number, you are not supposed to run your business in any economist portal.

For example, if you are a proprietorship company or a startup company that does not turn, that means of turnover in a year or your turnover is not crossing 20 like an annum, you still need to require a GST number.

Yes, if you have a company in Karnataka, and if you are running your business out of his state, you should have a GST registration number mentioned on your invoice without having a GST number.

You should not raise any invoice apart from your state like if you have our company which runs in India. Still, your business is entirely through to a foreign country like if you export your glutes or export your service to foreign countries, it is mandatory to have a DST number. The post-registration formalities for your company may differ. However, you still have to have enrolled with a GST number and now let's see about exemption the exemption of GST registration right.

Few companies run their business only within this state. They have an exemption of GST registration until 20 lakh turnover. If you have a turnover below 20 lakh with an exemption of GST registration unless or until you do an interstate transaction, it is not required to register with GST. Still, when you start to do interstate transactions, you must get a GST registration again if you are not crossing your 20 lakh limit now.

Let's see about the benefits of GST registration. Those who have a DST number establish the company as a legal supplier of goods and services you are. You are eligible to get an input tax credit to satisfy the requirements of b2b customers and improve the business credibility.

Now let's see about post-registration formalities you are successfully enrolled with GST. What else to be done? Yes, you're not. Your role does not end with registering with GST once after registering your company with the GST registration; you have some mandatory compliance to be taken care of like you should mention your GST number in all the invoices, which hearings both in sales and purchase invoices, and you should provide a proper GST invoice to all the customers. You should file new GST in returns promptly, like based upon the turnover, the due dates may fall different. Still, you should file a GST, and also, you may say you have not made any transaction at all, but still, you have to file your new returns, which is also a mandatory thing.

salsabeelahmedandco is India Best GST consultant in Bangalore for small businesses and enterprises. Business owners in Bangalore

1 note

·

View note

Text

GSA Offer Preparations & Submission

The General Services Administration (GSA) Federal Acquisition Service (FAS) offers contract vehicles called “GSA Contracts.” Vendors who want to boost their marketing and efficiency of selling to the Government can acquire GSA Contracts. This cumbersome process is developed to frustrate, oftentimes resulting in multiple rejections.

If you have someone with federal contracting experience in-house, it's a better utilization of time and resources to outsource to a GSA Contract Specialist. This 5-part series will break down the procedure into smaller parts. This allows you to target on each part directly and hopefully gain the best understanding possible.

The Second Part of Finding a GSA Contract

The labor-intensive, heavy lifting happens in the next step: preparing what is GSA Offer and submitting. A GSA offer includes 15-30 documents, some are downloaded in the solicitation package and completed: proposal price list, a summary of the offer, commercial sales practices, and other schedule-specific documents. Additionally, there are lots of supplemental documents that really must be gathered and prepared for every single GSA offer: financials, commercial price list, contracts, and invoices, etc. Here certainly are a few details that will give you insight into the procedure as a whole.

Open rating report

The GSA wants to know what your web visitors have to state about you. So, you should submit client points of contact info to a next part service called Open Ratings. They will all be surveyed, and in the long run, a written report is likely to be generated outlining topics such as for example quality, reliability, cost, etc. In most cases, at least 5 surveys should be completed.

Digital certificate

The GSA has mandated that a person from within the company will need to have a Digital Certificate. This enables usage of the GSA's e-offer system, where modifications to GSA contracts are submitted. Digital certificates are issued by third-party vendors like ID entrust and cost around $120.

Factors/Sections

The absolute most work (by far) adopts outlining the technical details of one's company to the GSA in the format they require. With respect to the GSA Schedule you're submitting for, this really is called the “Sections” or the “Factors.” These requirements include many minor details about your company to assure the GSA that you have the capabilities to meet up the demands that federal buyers require: financial strength, manpower, internal systems, experience, quality controls, etc.

The Technical Proposal is where contracting a GSA specialist may benefit you the most. The GSA is very touchy about Scope, and one small miss-step in the Technical Proposal can unravel the whole GSA offer. There are also some very vague requirements for project details that only a specialist knows just how to answer (through trial and error themselves).

GSA Offer Submission

The GSA is as technological as any Federal Agency, and their submission system, E-Offer, is handled through the web. A Digital Certificate grants a worker or GSA specialist usage of the E-Offer takes into account a company. The upload process involves a 7-step process: Corporate Information, Negotiators, Goods/Services, Standard Responses, Solicitation Clauses, Upload Documents, Submit eOffer. Virtually anyone could handle the upload into the eOffer system. However, all information entered must completely match with the data in the document package, or the GSA offer might be rejected.

1 note

·

View note

Text

IRN Cancellation: All About E-invoice Cancellation in Details

IRN Cancellation is possible if it is done within 24 hours of submitting the invoice. In this blog, let us explore how to cancel IRN or the Invoice Reference Number that is already generated for an invoice on the Invoice Registration Portal (IRP).

In October 2020, the Government of India introduced the e-invoice mandate. Currently, the e-invoicing mandate requires all companies with an AATO of over Rs. 10 crores in a financial year to generate e-invoices under GST. They must register their invoices with an IRP like IRIS IRP.

So, what is an IRN? How is it related to the IRP? And what is the process of IRN cancellation? Let us discuss here...

What is IRN?

According to the e-invoice mandate, organizations with an AATO of over 10 crores of turnover must register their invoices with the IRP. Once the invoice is uploaded on the portal, the government assigns a unique number to the invoice. This number is called the Invoice Reference Number, or the IRN.

According to the e-invoice mandate, organizations with an AATO of over 10 crores of turnover must register their invoices with the IRP. Once the invoice is uploaded on the portal, the government assigns a unique number to the invoice. This number is called the Invoice Reference Number, or the IRN.

An e-invoice under GST, once uploaded on the IRP, is stored on the portal for 24 hours. So, if you wish to cancel your IRN, you must do it within 24 hours. But, why would a business need to cancel their e-invoice?

Reasons for IRN Cancellation

Cancellation of IRN can be needed for several reasons. Primarily, businesses cancel their IRN for the following reasons.

Buyer cancels the order

There are mistakes in the e-invoice

Incorrect entries

Duplicate entries

However, before you cancel IRN, there are a few things you must consider. Mentioning them below:

If a business, for some reason, fails to adhere to the timeline of cancelling an IRN within 24 hours, then the supplier must issue a debit or credit note. Otherwise, the supplier must edit the Form GSTR-1 and alter the corresponding details of e-invoice.

Furthermore, let’s say the e-way bill is already generated with respect to a particular IRN. It is, then, not possible to cancel that particular IRN. In such cases first need to cancel the E-way bill if possible and then only cancelation of IRN will be allowed.

If a business meets the conditions and cancels the IRN, then another IRN cannot be generated for the same invoice number.

It is also not possible to partially cancel an IRN.

For more information visit : https://einvoice6.gst.gov.in/content/irn-cancellation-all-about-e-invoice-cancellation-in-detail/

0 notes

Text

Looking for the best vendor management software?

Digitize your vendors with Bizongo's platform-led solution. Streamline your supply chain and empower vendor businesses with seamless transaction tracking. Gain visibility, eliminate delays, and make your business agile and resilient. Explore a massive embedded vendor network spanning diverse geographies and industries. Source quality products at the right time and price. Achieve 100% compliance with built-in mandates like e-invoicing and e-way bills. Experience quick onboarding, unmatched customer service, and intelligent dataflows for informed decision-making. Maximize your growth and differentiate your business with scalable vendor digitization. Get started today!

1 note

·

View note

Text

https://margcompusoft.com/m/e-invoicing-in-marg-erp-software/

How to Generate Electronic Invoicing (e-Invoicing) in Marg ERP Software

The 6th phase of e-invoicing has been announced by the CBIC, mandating businesses with a turnover of ₹5 crore or more in any financial year since 2017-18 to issue e-invoices from 1st August 2023. This move is part of the government’s efforts to shift towards a digital economy.

0 notes

Text

Best Connected Service to Generate e-Invoice in Ghaziabd

Generating and printing e-invoice is amazingly simpler with TallyPrime’s connected services. Tally being a recognized and ISO certified GSP (GST Suvidha Provider), TallyPrime directly integrates with IRP portal to seamlessly generate e-invoices.

.Auto-generate e-invoice instantly. Print IRN and QR code automatically with no changes to the invoicing process that you follow. .Flexibility to send individual/selective/ bulk invoices to IRP. .Generate e-invoice along with the e-way bill, wherever applicable. .E-Invoice report to get a bird’s-eye view on the status (generated / pending / cancelled).If you are a business with an annual turnover exceeding 5 crores, e-invoice is applicable, and you need to electronically upload all B2B and B2G invoices to the portal. You need to generate the e-invoice in the required format and upload it to the IRP portal.

e-Invoicing mandates that an invoice remains valid only if it has IRN and QR code that is authenticated by the IRP (Invoice Registration Portal). Invoicing is a key process in every business, it’s a necessity to have business management software that will help you seamlessly generate e-invoices without impacting the way you use to operate your business.

Businesses using ERP/ business management software that seamlessly connects to the IRP system via GSP, and automatically prints the QR code and IRN on the invoice, will find it easy to manage e-invoice requirements without many changes to the business process. Read to know the change in invoicing practice and things for smooth adoption of e-invoice.

0 notes

Text

GST E-invoicing On An Accounting Software – How It Is Beneficial For Your Business?

Filing ‘e-way bill‘ is common on GST portals to facilitate transporting of goods from one place to another. Similarly, the GST council introduced the system of e-invoicing for specific categories of people.

E-invoicing is not a feature to generate invoices on the GST portal but it requires submitting an already generated invoice on the portal. Thus you can generate multiple reports with a one-time upload of invoice details.

RealBooks is one of the best Indian accounting software that stays up-to-date with Government mandates and provides a great platform for taxpayers to perform their e-invoicing activities. RealBooks also ensures that you can safely migrate all your data with the supported system without any change to all your archival data.

As a comprehensive accounting software in India, RealBooks offers very easy-to-use features. Some of the most notable and useful features are:

It is easier to keep track of all the entries corresponding to a particular invoice through online accounting software with the help of options like document attachment and management.

RealBooks online accounting software offers direct integration with the GST portal so that your business is always GST-compliant without any additional cost.

Being an online accounting software in India, RealBooks is easily accessible across operating systems and web browsers, allowing better remote access.

By cutting down the charges of physical resources, benefitting from online accounting software can be very cost-effective.

Data integrity enhances greatly with RealBooks accounting software which is devoid of human errors.

E-invoicing can reduce the risk of fraudulent bills, thus enhancing trust and reliability from both the supplier and buyer’s end.

Online accounting software can also help the human resources department in tracking the payroll advantages with unique tools for management.

What is e-invoicing under GST?

‘E-invoice’ generation is a process to identify and electrically authenticate B2B invoices by GST Network (GSTN) for common accessibility across the GST portal.

In this e-invoicing system, every transaction has a unique identification code by the Invoice Registration Portal (IRP) through the GST network.

From the accounting software portal, all the invoice details will be automatically transferred to both the GST portal and e-way bill portal, syncing in real time. this will eliminate the requirement for manual entry while generating part-A of the e-way bills and filling GSTR-1 returns.

What is the current system in place for issuing invoices?

Currently, businesses generate their invoices by using a variety of tools and finally uploading these invoices manually for the GSTR-1 return, instead of using single accounting software.

Once the GSTR-1 return is filled, the recipients can view the invoice information in GSTR-2A. The transporters or consignors need to generate separate e-way bills by importing these invoices in JSON or Excel, manually. Businesses can reduce their effort simply by using accounting software that offers tools for GST integration and e-invoicing.

Under the e-invoicing system now, the process of uploading and generating the invoices is the same – either by importing the Excel/JSON file or through API integration. This data seamlessly flows through the entire GST portal required at various instances of e-invoicing and filing tax returns.

How will e-invoicing benefit businesses?

E-invoicing has been introduced for the benefit of businesses, and with accounting software to automate the process, the benefits keep getting easier to grasp. The following are the advantages of using e-invoicing through GSTN:

With the help of e-invoice, a major gap in data reconciliation for GST is plugged, while noticing an absolute reduction in mismatch errors.

The data entry errors also reduce as the e-invoices generated by multiple software can be read by this online accounting software, offering integration with GST in the GST portal.

All the Concerned authorities involved in a business transaction can track the invoices prepared by the supplier in real time.

With e-invoicing, you can quickly generate genuine reports of your tax credit. All information about your business is available at the transaction level so there is less possibility of surveys and audits by the tax authorities

While filing the tax return, backward integration and automation of the process can make it very simple. Required details of the invoices can also be auto-populated in multiple returns by using RealBooks - Online Accounting Software.

How will e-invoicing curb tax evasion?

E-invoicing is very beneficial in ensuring proper tax compliance and curbing tax evasion in the following ways:

As the e-invoices are generated through the GST portal, the tax authorities have complete access to all the transactions happening in real time.

As the invoices are generated before conducting a transaction, there are fewer chances of manipulative invoices.

Since the invoices are generated through the GST portal, they have GSTIN integrated on the invoices, and there cannot be any fake tax credit claim.

In a brief conversation about RealBooks and online accounting software in India, these are the main things to know about GST e-invoicing. if you wish to learn more, visit RealBooks and sign up for our free trial to personally have an experience of this Best free accounting software

0 notes

Text

Biden’s Blunders, From A to Z

Get Your Patriot911 E-newsletter In Your E-mail Inbox After studying my record of former President Donald Trump’s triumphs, from A to Z, nationally syndicated radio host Invoice Martinez instructed throughout one among our weekly interviews that I give President Joe Biden’s blunders the identical alphabetical remedy. Right here goes. Afghanistan’s humiliating abandonment to the Taliban, amid America’s chaotic and lethal navy withdrawal, could also be Biden’s greatest failure. Border safety has collapsed. An estimated 6.3 million unlawful aliens from not less than 172 nations have invaded America beneath Biden. A whole bunch of hundreds have obtained free bus or aircraft tickets into the homeland. Others have scored free well being care, schooling, and even Occasions Sq. resort rooms. Crime is plaguing America’s cities, mainly these run by thug-hugging Democratoc mayors and left-wing, take-a-hoodlum-to-lunch “prosecutors.” Democrat-in-Chief Biden appears to approve. Paperwork marked “categorized” surfaced within the storage of Biden’s Wilmington, Delaware, mansion (alongside his 1967 Corvette) and at Washington, D.C.’s Penn-Biden Heart, an alleged assume tank. As senator and veep, Biden lacked presidential declassification authority. Thus, Biden illegally possessed some 20 classified papers. Power dominance beneath Trump has vanished. Biden now begs Saudi Arabia and Venezuela to spice up petroleum manufacturing to compensate for his warfare on U.S. oil. Fentanyl cascades throughout the US-Mexico “border.” It's killing some 70,000 People yearly, primarily via unwitting ingestion of counterfeit prescribed drugs polluted with this lethal drug. Fentanyl poisoning has change into the No. 1 explanation for demise amongst People between ages 18 and 45. Fuel stoves are in Biden’s crosshairs, with neo-totalitarian federal scolds on the Power Division and Shopper Product Security Fee scheming to deprive People of the efficiency, consolation, and life-saving advantages of natural-gas home equipment. In contrast to electrical gear, gas-fueled gear features throughout blackouts. Hunter Biden, the president’s ne’er-do-well son and a confirmed deadbeat dad, is sinking into an ever-deepening quicksand of misdeeds, influence-peddling, and dodgy offers with international scalawags. Inflation was 1.4% yearly when Biden took workplace and triggered a tsunami of federal spending. The ensuing consumer-price spike hit 9.1% earlier than falling again to 4.9% at this time, nonetheless greater than double the Federal Reserve’s 2% goal. Justice follows two tracks: Violent leftists (Antifa, BLM) skate, whereas rightists (Jan. 6, Proud Boys) obtain jail sentences or, even worse, rot in D.C.’s jail with out prices. Keystone XL Pipeline: Killed, together with 11,000 jobs. Lynching is one thing “some folks still want to do,” Biden declared on Feb. 17. Actually? The place precisely are these white nationalists itching to hold blacks from bushes? Mandated COVID-19 vaccines compelled 8,339 young, healthy GIs out of the armed forces for refusing this experimental inoculation, the Army Occasions reviews. Information conferences are rare for Biden. Nov. 11 noticed his final solo presser, 180 days ago on Saturday. One-on-one interviews are also seldom seen beneath Biden. He granted 58 in his first two years, in comparison with Trump’s 205, Obama’s 275, and George W. Bush’s 89, per The New York Publish. Pentagon priorities beneath Biden have devolved from nationwide protection to pronouns to a frantic seek for “white nationalists,” whoever they're—and the imposition of the Inexperienced New Deal in uniform. Quotas are key to Biden’s “fairness” agenda, together with a $3.8 billion debt-relief program, completely for nonwhite farmers. Russian cyberattackers seemingly sabotaged America’s Colonial Oil Pipeline. Biden swiftly exonerated the Kremlin. He then greenlighted completion of the since-detonated Nord Stream II pipeline, which would have pumped Russian pure gasoline into Germany. Biden additionally permitted a summit with Russian dictator Vladimir Putin. These rewards for doable Russian subterfuge towards U.S. property transmitted weak spot and sure inspired Putin to invade Ukraine. Saudi Arabia and Iran now share a Beijing-brokered alliance. Trump’s technique—to isolate the ayatollahs — is kaput. Academics union boss Randi Weingarten colluded with Biden’s Facilities for Illness Management and Prevention to lock down faculties and entice children in Zoom lessons. Check scores tumbled. Ukraine has obtained $76.8 billion in support from Biden, with neither efficiency objectives nor a timetable for victory or armistice. Vice President Kamala Harris, Biden’s option to be one aorta��rush from the presidency, epitomizes overpromise and underdelivery. White Home “lids” have been known as as early as 9:00 a.m. (on April 17). When Biden plans no additional public appearances, journalists go house with out worry of lacking out. Xi Jinping has but to listen to Biden even ask about COVID-19’s origins, in line with official readouts. Such weak spot absolutely fueled the Chinese language communist dictator’s anti-dollar diplomacy, supremacy, spy balloons above U.S. navy services, unprecedented harassment of Taiwan, and different efforts to torpedo America as the planet’s main superpower. Younger People with school loans needn't repay them, due to Biden’s student-debt bailout. Biden needs to squander $400 billion to nationalize as much as $20,000 in obligations per borrower incomes as a lot as $125,000 annually. Private duty? Protecting guarantees? How quaint. Zinc is a part a part of electrical automobiles, though graphite and lithium are extra frequent parts. Whilst Biden mandates that 67% of latest vehicles be electrical by 2032, he padlocks mines whose copper and nickel are also important EV elements. Biden’s EV coverage is brain-dead. Biden’s botches defy tabulation (e.g., abortionitis, race obsession, transgender-mania hovering federal spending, swelling national debt, sagging psychological acuity, and so on.) Too dangerous English has solely 26 letters. The Day by day Sign publishes quite a lot of views. Nothing written right here is to be construed as representing the views of The Heritage Basis. Have an opinion about this text? To pontificate, please e mail [email protected] and we’ll contemplate publishing your edited remarks in our common “We Hear You” function. Keep in mind to incorporate the url or headline of the article plus your identify and city and/or state. The put up Biden’s Blunders, From A to Z appeared first on The Daily Signal. Source link Read the full article

0 notes

Photo

ZATCA Phase I made e-invoicing mandatory for all VAT-registered businesses in the Kingdom of Saudi Arabia. Phase II, which will be implemented on January 1, 2023, will mandate taxpayers to integrate their e-invoice solution provider to ZATCA via an API key.

0 notes

Photo

What is an E-invoice? - Electronically generated, verified B2B invoices for interchange between suppliers and customers are produced by the GSTN (Goods and Services Tax Network). From the point where the supplier creates the invoice until the buyer processes it, the actual practice of e-invoicing should be electronic.To ensure a decrease in GST avoidance, the idea of GST E-invoice creation was taken into consideration. Businesses with a revenue of more than INR 500 crore are mandated to provide electronic invoices under the GST regime as of October 31, 2020. However, from January 1, 2021, companies with a revenue of more than Rs 100 crore will need to provide electronic invoices.

0 notes

Text

E-invoice Printing: Process, Mandatory Fields, Modes of IRN generation

E-invoice Printing is one of the most significant aspects of e-invoicing after the mandate gets applicable to a taxpayer. Currently, the government has made e-invoicing mandatory for taxpayers with an AATO of Rs. 5 Cr. from January 1, 2023.

Under the e-invoicing mandate, the taxpayers' invoices need to be registered on the official e-invoicing portal. This portal is known as the Invoice Registration Portal (IRP) which will help taxpayers generate the invoice reference number (IRN) which will be unique for every single invoice that is being generated. E-invoice printing is one of the topics that taxpayers are most concerned about. In this article, we discuss everything related to e-invoice printing i.e. the process, mandatory and optional fields, generation etc.

E-invoice Printing - IRN & QR Code:

Under the e-invoice mandate, taxpayers will continue to generate their specific GST invoices (covered under the mandate) on their own with the help of their Accounting/Billing/ERP Systems. Once generated, the invoice data will now have to be sent to Invoice Registration Portal (IRP) if their business crosses the e-invoice turnover limit.

IRP then will verify and assign a number unique for that particular invoice using the hash algorithm under e-invoicing which is the Invoice Reference Number (IRN) along with a QR Code. QR code will be part of the signed JSON, returned by the IRP. It will be a string (not an image), which the ERP/accounting/billing software shall read and convert into QR Code image for placing on the invoice.

A B2B GST invoice will be valid only with a valid IRN. And before sharing it with the concerned parties, taxpayers need to print this IRN and QR Code on the invoice. Hence, understanding the nuances of e-invoice printing becomes important.

Mandatory fields to be printed on an invoice and an E-invoice As per Rule 46 of CGST tax rules 2017

Following fields are mandatory to be printed on the e-invoice as per Rule 46. Tax invoice referred to in section 31:

Name, address and Goods and Services Tax Identification Number of the supplier

A consecutive serial number not exceeding 16 characters, in one or multiple series, containing alphabets or numerals or special characters- hyphen or dash and slash symbolised as "-'' and "/" respectively, and any combination, unique for FY

Date of its issue

Name, address and Goods and Services Tax Identification Number or Unique Identity Number, if registered, of the recipient

Name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is Rs. 50,000/- or more

Name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is less than Rs. 50,000/- and the recipient requests that such details be recorded in the tax invoice

HSN code for goods or services

Description of goods or services

Quantity in case of goods and units or Unique Quantity Code thereof

The total value of the supply of goods or services or both

Taxable value of the supply of goods or services or both taking into account discount or abatement, if any

Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess)

Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess )

Place of supply along with the name of the State, in the case of a supply in the course of inter-State trade or commerce

Address of delivery where the same is different from the place of supply

Whether the tax is payable on reverse charge basis

Signature or digital signature of the supplier or his authorised representative

QR code, having embedded Invoice Reference Number (IRN) in it, in case invoice has been issued in the manner prescribed under sub-rule (4) of rule 48.

Read More: https://einvoice6.gst.gov.in/content/e-invoice-printing-process-mandatory-fields-modes-of-irn-generation/

1 note

·

View note

Text

myBillBook launches e-invoicing module to ease business compliance

myBillBook launches e-invoicing module to ease business compliance

With myBillBook’s e-invoicing capabilities, businesses can comply with the government’s mandate in a single click BANGALORE, India, July 21, 2022 /PRNewswire/ — FloBiz, India’s leading neobank for growing Small & Medium Businesses (SMBs), has announced the launch of its new e-invoicing service on its flagship GST invoicing and accounting product myBillBook. The newly launched service will further…

View On WordPress

0 notes

Photo

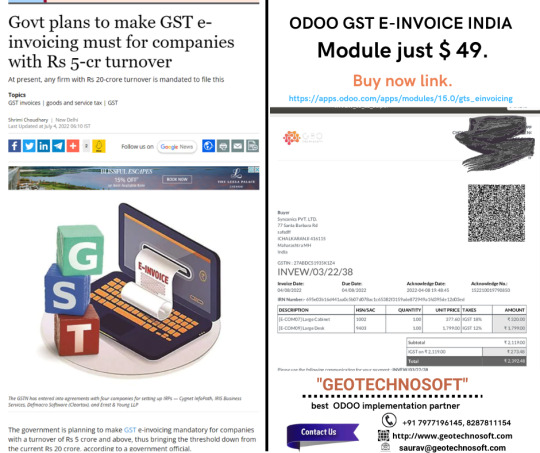

NEW UPDATE.SOON E-INVOICING will be mandated for units with ₹ 5cr turnover.

The E-invoicing system applies to the GST registered persons whose aggregate turnover in the financial year exceeds ₹ 20 cr. India’s GST Council has approved the phased implementation of e-Invoicing for reporting business-to-business (B2B) invoices using the GST system. It first started on January 1st, 2020 on a voluntary basis. The government is planning to make GST e-invoicing mandatory for companies with a turnover of ₹ 5 crore and above, thus bringing the threshold down from the current Rs 20 crore, according to a government official.

TO KNOW MORE MUST READ:https://www.linkedin.com/pulse/soon-e-invoicing-mandated-units-5cr-turnover-geo-technosoft

The big question that comes to everyone's mind is what is the solution where we can do all the processes easily. Here we are introducing our GST E-INVOICE INDIA Module where you can go throw all your query done and generate your E-INVOICE very smoothly. More than 60 customers using our E-INVOICING MODULE.We directly get all information for the GST portal to Odoo Invoice. With the full authenticity GST E-INVOICE INDIA Module where you can go throw all your query done and generate your E-INVOICE very smoothly.GEOTECHNOSOFT the best ODOO implementation partner introduces the GST E-INVOICE INDIA Module with which you can get all the processes just in a few clicks.

Buy now link. https://apps.odoo.com/apps/modules/15.0/gts_einvoicing

ODOO GST E-INVOICE INDIA Module just $ 49.

Contact us at +91 7977196145, 8287811154

Also visit:http://www.geotechnosoft.com

Skype: sauravkumar2000

0 notes