Text

How Customer Identity Verification Protects Your Business: Aadhaar & PAN Verification

In today’s fast-paced digital landscape, ensuring the authenticity of financial transactions is paramount. As businesses strive for efficiency and security, integrating robust verification mechanisms becomes indispensable. That’s why we’re excited to announce the launch of our latest feature in RealBooks: Customer Aadhaar No. and PAN No. Verification. This innovative addition to RealBooks empowers businesses to verify the identity of their customers swiftly and securely, enhancing trust and compliance in every transaction. Why Verification Matters: In today’s digital age, where data security and regulatory compliance are of utmost importance, verifying customer identities has become increasingly crucial. Whether mandated by regulations, essential for fraud prevention, or simply to foster trust with customers, dependable verification processes are now indispensable. By seamlessly integrating Aadhaar No. and PAN No. verification in RealBooks, we’re enabling businesses to proactively ensure the authenticity of their financial transactions, empowering them to stay ahead of the curve in today’s evolving landscape. Key Benefits of Aadhaar No. and PAN No. Verification: 1. Enhanced Security: Reduced Fraud Risk: Aadhaar & PAN verification helps prevent identity theft and fraudulent transactions by ensuring the customer’s legitimacy. This significantly reduces2 the risk of fraudulent activities and identity theft.

Stronger Data Security: Verification minimizes the risk of inaccurate or fake customer data entering your system, leading to a more secure financial environment.

2. Improved Compliance: Compliance with regulatory standards is non-negotiable for businesses operating in today’s regulatory landscape. Our verification feature simplifies compliance by enabling businesses to easily verify customer identities as required by regulations. Reduced Regulatory Burden: Automating verification processes saves time and resources compared to manual verification methods, making compliance less cumbersome.

3. Trust & Transparency: Customer Confidence: Verified customer identities demonstrate your commitment to data security and financial integrity, fostering trust and confidence among your customers.

Transparency in Transactions: Verification promotes transparency in financial transactions, creating a secure environment for both businesses and customers.

How Aadhaar and PAN No. Verification Works: Our new feature allows you to seamlessly verify your Aadhaar and PAN Number in RealBooks. Here’s the process breakdown: 1. In RealBooks, go to Ledger Creation under the Accounts Menu. While creating a ledger, choose the Ledger Category as Vendor or Customer. 2. Once you are navigated to the Party info tab, the Aadhaar and PAN No. verification option will appear. You can enter the relevant details and proceed by clicking on the verify option.

Empower your business, Safeguard your Transactions: Start Verifying Today

In the dynamic realm of finance, where trust and security reign supreme, customer identity verification emerges as a cornerstone of operational integrity. With the advent of RealBooks‘ Aadhaar and PAN No. verification feature, businesses are poised to fortify their defenses against fraud while blistering compliance with regulatory mandates. As businesses navigate the complexity of today’s digital landscape, embracing robust verification mechanisms isn’t just a strategic choice – it’s a necessity for safeguarding financial integrity and fostering enduring customer relationships. Take advantage of this innovative feature today and experience the peace of mind that comes with secure, verified transactions.

Sign up for your free trial of RealBooks today and experience the peace of mind that comes with secure, verified transactions!

0 notes

Text

Unlocking Efficiency with Link ID Assignment feature in RealBooks

In the dynamic world of business, keeping track of your financial data is essential. But with countless transactions occurring daily, maintaining accuracy and organization can feel like a constant struggle. Fortunately, RealBooks offers a powerful solution: the link ID assignment feature.

What is Link ID Assignment?

Link IDs are unique identifiers assigned to individual transactions. They act like labels, enabling categorization and tracking across different transactions and reports. Think of them as serial numbers for your transactions, offering a distinct reference point.

How Link IDs Simplify Your Life

1. Enhanced Tracking and Analysis: Say goodbye to sifting through endless data. Link IDs allow you to effortlessly track specific transactions across various ledgers and reports. This means you can identify trends, patterns, and anomalies with ease, gaining valuable insights into your financial health.

2. Error-Free Organization: Tired of duplicate entries and inconsistencies? Link IDs eliminate the confusion by ensuring each transaction has a unique identity. This promotes accuracy and organization in your financial records, boosting your confidence in data-driven decisions.

3. Effortless Exception Management: Not all transactions fit neatly into predefined categories. Link IDs come to the rescue by allowing you to assign them to a dedicated "exception" category. This keeps your main ledgers clean while still providing easy access to these transactions for analysis.

How to Leverage Link IDs in RealBooks:

To Use Link Transaction Feature first enable the feature from RealBooks Configuration option.

Go to Settings => Configuration => Accounts => General => Link Transaction

Click the Toggle button to enable the Link Transaction Feature.

Next, Enable Link id feature in Ledger

For ledger new Creation enable the toggle button available in right hand side of the screen.

For existing ledgers go to edit and enable it.

That’s it now just record entries and assign link ids in transaction page.

Take Control of Your Data

Whether you're a small business owner or a large organization, the link ID assignment feature in RealBooks empowers you to take control of your financial data. With increased accuracy, organization, and reporting capabilities, you gain the insights needed to make informed decisions and drive your business forward.

So, unleash the power of link IDs today and experience the difference in your financial management journey!

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software

0 notes

Text

Beyond Troubleshooting: RealBooks Support – Your Co-Pilot in Financial Excellence

In the dynamic world of business, accounting plays a crucial role in ensuring financial stability and growth. RealBooks, a leading provider of online accounting software in India, understands this importance and has built a robust support system to assist its users every step of the way.

The Human Touch

RealBooks knows that every problem you have is different, so we give you personalized attention. Our support team is made up of experts who are ready to help you with whatever you need. Whether you're a small business owner or a big company, our goal is to make sure you have the support you need when you need it.

Operating Hours

Our support service operates during standard business hours, ensuring that you have access to assistance when most needed. We believe in quality over quantity, focusing on delivering impactful solutions during the times you're actively engaged with your accounting processes.

How It Works

Reaching out for support is a breeze. Simply dial our helpline during operating hours, and you'll be connected with a knowledgeable support representative. Alternatively, if you prefer written communication, you can also reach us via email. Our team is ready to assist with everything from software navigation to troubleshooting.

Beyond Troubleshooting

RealBooks support goes beyond just resolving issues. We view each interaction as an opportunity to empower our users. Whether you need clarification on a feature, want guidance on best practices, or seek advice on optimizing your accounting processes, our team is here to help.

Continuous Improvement

Your feedback matters. We constantly strive to enhance our support services based on user experiences and evolving needs. By listening to your suggestions and concerns, we ensure that our support system grows and adapts alongside your business.

Instant Responses for Seamless Resolution

RealBooks understands that time is of the essence in business, and delays in resolving accounting issues can have significant consequences. That's why we prioritizes instant responses to customer inquiries. Whether you reach out through phone, email, or chat, you can expect a quick and helpful response from RealBooks' support team.

Having a strong support system is like having a compass for any business, regardless of its size or stage. RealBooks is here to help you navigate the ups and downs of your financial journey. We're committed to providing you with the support you need during our regular business hours. While we might not be available around the clock, our focus on excellence during operating hours ensures that you receive the support you deserve.

Remember, at RealBooks, success is not just a destination; it's a journey we navigate together.

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software#freeaccountingsoftware#freeaccountingsoftwareinindia

0 notes

Text

Inter Branch Transactions: Everything You Need to Know

In today's interconnected business landscape, many companies operate through multiple branches or locations. While this expansion brings numerous advantages, it also creates the need for efficient and seamless transactions between these branches. This is where inter-branch transactions come into play. In this blog, we'll talk about the basics of inter-branch transactions, why they're important, and how companies can make them work better using RealBooks' simplified inter-branch transaction feature.

What is Inter Branch accounting transactions?

Inter-branch transactions, also known as inter-company transactions or branch transfers, include the transfer of goods, services, or money among various branches or locations of the same business. These transactions can take many different forms, such as the movement of inventory between branches to meet customer demand or maintain stock levels, the sharing of resources, such as staff or equipment, to increase efficiency and cut costs, and the transfer of money between branches to pay for operational costs or consolidate funds.

Challenges of managing inter-branch transactions/The Complexity of Inter-Branch Transactions

Inter-branch transactions present complex challenges for businesses, encompassing inventory management, financial reconciliation, resource allocation, and compliance with tax regulations.

Maintaining optimal inventory levels across branches while avoiding imbalances is a delicate task, as inaccurate tracking can lead to financial discrepancies and customer dissatisfaction.

Handling the financial aspects of these transactions, including cost allocation and revenue recognition, demands meticulous accounting to avoid legal and financial consequences. Efficiently allocating shared resources, such as vehicles and personnel, is essential to preventing resource shortages and operational inefficiencies.

Data security is paramount when transferring sensitive financial and inventory information, guarding against unauthorized access and data breaches. Furthermore, businesses with branches in different regions must navigate varying tax and regulatory requirements, as non-compliance can result in penalties and legal complications.

RealBooks: Your Solution for Efficient Inter-Branch Transactions

RealBooks is a cloud-based accounting software that can help organizations of all sizes to manage inter-branch transactions more efficiently and effectively. RealBooks offers a number of features that can help to address the challenges of managing inter-branch transactions, including:

Automated inter-branch transfers: Managing transactions involving multiple branches has never been easier. RealBooks simplifies the process by allowing you to create a single entry in one branch, and RealBooks takes care of the rest. This means that transactions are automatically posted across all involved branches, eliminating the need for manual entries and ensuring accuracy and efficiency in your accounting processes. With RealBooks, you can save time and reduce the chances of errors in your inter-branch transactions.

Comparative Analysis: RealBooks offers various performance reports that give you a complete overview of all your branches. These reports empower you with valuable insights, enabling you to thoroughly analyze each branch's performance. With this data at your fingertips, you can make informed, data-driven decisions that have a positive impact on your business.

Automated Branch Reconciliation:

Automatically matches and reconciles inter-branch transactions, eliminating the need for manual reconciliation processes.

Aids in Identifying and resolving discrepancies promptly, ensuring the accuracy of financial records across branches.

Reduces the time spent on reconciliation tasks, freeing up accounting staff to focus on more strategic activities.

Robust security: RealBooks takes data security seriously. It employs state-of-the-art security measures to safeguard inter-branch transactions from potential fraud and cyber threats.

In conclusion, managing inter-branch transactions is a critical aspect of running a multi-branch business efficiently. RealBooks not only simplifies the complexities associated with inter-branch transactions but also enhances overall business operations.

With RealBooks, you can achieve greater accuracy, compliance, and efficiency in managing transactions between your branches, ultimately driving your business towards greater success.

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software#accounting software for autodealers#autodealership

0 notes

Text

The Secret to Speeding up Your Accounting in RealBooks

In the fast-paced world of online accounting, where every second counts, RealBooks shortcut keys can help you save time and streamline your financial management. With these keyboard shortcuts, you can easily and quickly navigate through the software, perform tasks with ease, and master accounting tasks with lightning speed and precision.

What are the Keyboard Shortcuts in RealBooks?

RealBooks is an online accounting software that offers powerful yet simple accounting solutions. RealBooks helps you navigate your business, meet all the demands, and experience great business success. This solution has been specially designed for small, large, and medium-sized businesses with the aim of achieving accuracy in accounting and bookkeeping.

We all know how easy it is to just press Ctrl + C and Ctrl + V to copy and paste instead of using a mouse to click all these options. Similarly, shortcut keys in RealBooks help make your accounting faster and more accurate.

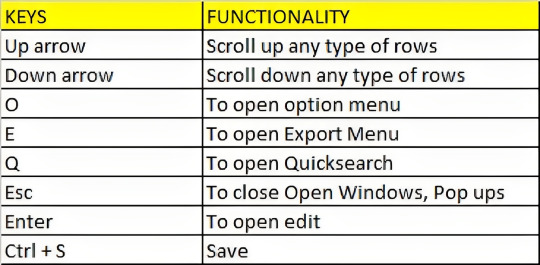

The shortcut keys in RealBooks help with voucher posting, report navigation, master creation, etc.

RealBooks Shortcut Keys

RealBooks is a highly effective accounting software used in India. It keeps thorough records of all a company's transactions for each account, helping to prevent and fix errors.

Shortcut keys in RealBooks are important because they save you time and effort. RealBooks is an excellent tool for managing businesses, maintaining your day-to-day accounts and handling GST tasks.

Common Function :

Transaction Related :

Document Related :

New Create :

From Menu Page/Dashboard :

Master Short Keys List :

Report Short Keys List :

Ledger Report Short Keys List :

Experience the future of accounting today

Ready to transform your accounting journey? Embrace the power of shortcut keys in RealBooks online accounting software. Unlock efficiency, streamline your tasks, and elevate your financial management prowess. RealBooks is not just any accounting software; it is a gateway to a more intuitive, productive, and empowered accounting experience. Try RealBooks now and witness the difference firsthand.

#accounting#online accounting software#gst accounting software in india#accounting software#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software#accounting software india

0 notes

Text

Shift your Business Gear with RealBooks Auto Dealership Accounting Software

The Indian auto sector has historically been a key determinant of the country's economic strength, generating both macroeconomic growth and technological innovation. Auto dealerships in India are faced with the problem of managing intricate financial transactions while maximizing the sector's growth potential as the automobile industry continues to prosper. A game-changer for navigating this unpredictable environment is specialist accounting software made specifically for auto dealerships. In this article, we'll look at how auto dealership accounting software, like RealBooks, gives dealerships the ability to optimize financial operations, take advantage of market trends, and embrace expansion in the booming Indian automotive sector.

The Booming Indian Automotive Industry

The Indian automotive sector stands out for its dominance in the two-wheeler market, which is supported by a growing middle class and an increasingly young population. The companies' exploration of rural markets is another factor in the sector's expansion. The demand for commercial vehicles is also being driven by the expansion of the logistics and passenger transportation sectors. With India being the world's top producer of tractors, buses, and heavy trucks, the Indian market also holds a strong position in the global economy. With a stunning 22.93 million automobiles manufactured during the fiscal year 2022, India proved its dominance in the world's automotive industry.

The Role of Auto Dealerships in the Market

Auto dealerships serve as the driving force in the Indian automotive ecosystem, seamlessly connecting manufacturers to eager consumers and igniting a whirlwind of sales. However, amidst the rapid pace of this industry, navigating the intricacies of financial management demands a powerful solution. With the rising adoption of digital technologies, the need for specialized accounting software tailored for auto dealerships has become evident.

Embracing Efficiency with Auto Dealership Accounting Software

The landscape of financial management has changed dramatically with the advent of accounting software made specifically for auto dealerships. Integrated inventory management provided by these software systems enables dealerships to manage their large vehicle inventories effectively and reduce transactional errors. Efficiency and accuracy are increased by automating the sales and purchasing processes.

Multi-location, Multi-branch, Multi-GST

The worry of handling complex accounting responsibilities across several entities could occur as your vehicle dealership expands into multiple sites and branches. But fear no more, thanks to RealBooks! Our cloud based accounting software is made to manage many branches, locations, and GST needs without any problems. You have 24/7 access to your books, giving you complete real-time knowledge of your dealership's financial situation. With our online accounting software, you can say goodbye to repeated mistakes and duplication of labor because it reduces the likelihood of discrepancies and makes inter-branch reconciliation simple. Your growth process will be easier and more effective with RealBooks than ever before.

Chassis Wise Inventory Aging

Effective inventory management is crucial for auto dealerships, and RealBooks ensures you keep on top of it with chassis-wise stock maintenance. With the use of item or item group filters, our GST accounting software enables you to view the stock age on a chassis-by-chassis basis, further segmented by date for convenience of reference. You can tailor the age breakdown to your tastes for optimum flexibility, giving you the option to see reports however suits you best. Furthermore, RealBooks goes above and beyond by offering chassis-wise stock valuation analyses, empowering you to manage your inventory with knowledge. For the best possible business performance, improve your inventory management techniques and receive exact insights into your inventory aging using RealBooks.

Automation of the Finance Commission and simplified Receipt Tracking against Delivery Order

At RealBooks, our unwavering commitment is to make your dealership's financial management effortless and efficient. With our cutting-edge features, you can now effortlessly track receipts against Delivery Orders (DO) and automate the commission calculation process. Say goodbye to manual commission entries as RealBooks auto-posts commission entries for you. Embrace a world of convenience, productivity, and way more possibilities with way less effort, all powered by RealBooks. Experience financial management like never before, so you can focus on what truly matters: driving your dealership's success.

In the ever-evolving automotive landscape, RealBooks emerges as the driving force behind your dealership's financial excellence. With our state-of-the-art accounting software tailored for auto dealerships, we empower you to streamline operations, capitalize on market opportunities, and navigate complexities effortlessly. Say goodbye to manual processes and redundant errors, as RealBooks takes the wheel, allowing you to focus on accelerating sales and unlocking your dealership's true potential.

Unlock the road to financial excellence with RealBooks, your trusted partner on the journey to success. Experience ease, efficiency, and empowerment like never before. Embrace the future of financial management in the automotive industry with RealBooks, and together, we'll steer your dealership toward a thriving and prosperous future. Let's accelerate toward success - together.

#accounting#online accounting software#accounting software#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#gst accounting software in india#multi branch accounting software#auto dealership accounting software#accounting software for auto dealerships

0 notes

Text

Unveiling the Best Accounting Software for Small Businesses in India

The Uncrowned Hero of the Indian Economy

India is one of the fastest-growing economies in the world, with approximately 630 lakh Micro, Small, and Medium Enterprises (MSMEs) registered. The MSME sector in India, which accounts for 30% of the nation’s GDP and supports over 11 crore jobs across various industries and regions, generates income at the grassroots level. (Source: Businessworld.in).

While the MSME sector in India is significant and makes up a substantial portion of the GDP, this sector has faced a number of difficulties in recent years. One of the biggest challenges micro, small, and medium enterprises (MSMEs) face is the absence of accounting automation.

RealBooks has conquered every challenge that has arisen in this sector in recent years and has become the Best Accounting Software for Small Businesses in India.

What’s preventing small businesses from thriving?

Small businesses encounter various challenges in the realm of accounting. Limited financial resources often make it difficult for them to invest in robust accounting software or hire professional accountants. Additionally, many small business owners lack formal accounting training, leading to challenges in accurately recording transactions and interpreting financial statements. Time constraints also play a role, as owners often juggle multiple responsibilities and struggle to allocate sufficient time for accounting tasks. Compliance with tax regulations and financial reporting requirements can be daunting, and cash flow management poses a constant challenge. Data security, scaling accounting processes, and making informed financial decisions are additional hurdles small businesses face.

RealBooks simplifies the MSMEs’ Accounting Victory

Today, more than ever, the importance of online accounting software cannot be overstated, and the advantages it offers are enormous.

Using RealBooks, the best accounting software for small businesses in India has a number of advantages, including these:

1. Low Upfront Costs: RealBooks understands the financial limitations of small businesses, and has designed its pricing in such a way that users can avail of monthly subscriptions as well as yearly allowing businesses to access robust accounting features without breaking the bank. RealBooks offers a cost-effective solution for the accounting needs of small businesses by eliminating high upfront costs and providing flexible subscription plans.

2. User-Friendly Interface – Designed with small business owners in mind, RealBooks prioritizes usability and simplicity, making it accessible even for users with no prior knowledge of accounting. The user-friendly interface and intuitive features allow small business owners to quickly familiarize themselves with the software and effectively manage their financial records. The software’s navigation is easy to navigate, enabling users to navigate through their financial tasks with confidence and ease.

3. Time-Saving Automation: Different accounting tasks are automated by RealBooks, which helps small business owners save valuable time. Features like automatic bank reconciliation, GST filing, e-invoice generation, and expense tracking streamline the bookkeeping process, reducing manual data entry and minimizing the risk of errors. By automating tedious tasks, RealBooks helps users to stay focused on other essential aspects of their business.

4. Compliance and Tax Support: The life of a one-man army is not easy. Learning on one end and counting days to the due date on the other end is a process that is more likely to attract errors. If you hire a skilled accountant for this, it will be a huge hit to your pocket.

RealBooks offers a range of features to simplify GST return filing and improve accuracy. With auto-generated GST reports, users can avoid data preparation and filing delays. The software integrates with the GST portal, allowing direct upload of data without the need for file conversion.

To avoid mistakes and deal with the requirement for revised returns, RealBooks provides pop-up transaction warnings and exception reports. Consolidated reporting for accounting, GST filings, and inventory make multi-branch accounting simpler.

The software stays updated with changes in the GST portal, ensuring compliance. Users can upload invoices at any time and make modifications as needed.

In case of rejected invoices, RealBooks provides invoice-wise reasons for easy correction. RealBooks aims to simplify the return filing process and contribute to accurate tax payments, serving as a partner in fulfilling tax obligations and supporting the nation.

5. Cash Flow Management: Small businesses can manage cash flow more efficiently with the help of RealBooks. It gives businesses real-time access to information about their income and outgoing costs, enabling them to manage unpaid invoices, keep track of cash flow patterns, and project future cash flow. RealBooks provides precise and current financial data to assist small businesses in making knowledgeable cash flow management decisions.

6. Data Security: RealBooks maintains a high priority on data security to protect private financial information. To guarantee the security and privacy of user data, it employs industry-standard security mechanisms, secure data encryption, and regular data backups. By tackling data security issues, RealBooks gives small businesses peace of mind that their financial information is secure.

7. Scalability and Growth: Catering to the evolving needs of growing businesses, the solution provided by RealBooks is designed to accommodate increasing transaction volumes, multiple users, and expanding business operations. With scalable features and the ability to handle growing data, it supports small businesses throughout their growth journey, ensuring seamless accounting processes.

8. Financial Insights and Reporting: Empowering small businesses with comprehensive financial insights and reporting capabilities, RealBooks offers customizable financial reports, real-time analytics, and tax reports. It enables businesses to track their performance, make informed financial decisions, and gain valuable insights into profitability, expenses, and financial trends. With RealBooks, small businesses can make data-driven decisions and enhance their financial management processes.

9. Enhancing Mobile Accounting: RealBooks mobile app revolutionizes accounting tasks for small businesses by offering a range of efficient features. The app allows users to access accounting and inventory reports on the go, and share PDF or Excel reports seamlessly. With an intuitive maker-checker tool, managers can approve transactions with a simple click on their phones. Creating invoices, recording receipts and payments can all be easily done on the app, reducing dependency on others and saving time.

With its easy-to-use interface and command centers, it makes the perfect fit for tech-savvy businesspeople. Whether you have an iOS or an Android, you can avail business insights with just a click through the RealBooks app.

Switch to RealBooks, harness the power of online accounting software, embrace simplicity, and leave behind the worries of accounting. It’s time to focus on what truly matters – nurturing your business, fueling your passion, and witnessing the extraordinary success that awaits.

RealBooks emerges as one of the best accounting software for small businesses in India and a trusted ally for small businesses, tackling the hurdles of accounting with precision and efficiency.

Choose RealBooks, your trusted financial superhero partner, and let your small business journey reach new heights. Together, we can rewrite the story of your success, one balance sheet at a time.

0 notes

Text

How Multi Branch Accounting Software Enhances Business Operations

Managing multiple branches could be very stressful and messy. Traditional accounting methods may no longer keep up with the demands of industries. However, this era offers many technologies to overcome these challenges and achieve enhanced operational efficiency. In this article, we will explore the key methods by which multi-branch accounting or branch accounting enhances business operations, from centralized branch accounting management to real-time reporting and advanced decision-making.

Centralized Financial Management: One of the primary benefits of multi-branch accounting software is the ability to centralize financial management. Instead of dealing with various accounting systems for each branch, firms may integrate their financial data on a single platform. Because all financial information is readily available in one location, this facilitates easier monitoring, analysis, and decision-making.

Simplified Reporting and Analytics: multi-branch accounting software offers sophisticated reporting and analytics. Consolidated financial reports that provide an overview of the entire firm, as well as branch-specific reports for thorough examination, can be generated by businesses. This allows management to get insights into the performance of each branch, spot trends, and make informed strategic decisions to drive growth.

Improved Cost Control: Businesses may easily manage and control expenditures across all branches using multi-branch accounting software. They can track expenses, budgets, and cash flows in real time, enabling proactive spending optimization and cost reduction. Businesses can execute cost-cutting measures that benefit the bottom line by having a thorough perspective of financial data.

Enhanced Inter-Branch Accounting: multi-branch accounting software provides easy collaboration among branches. Teams can collaborate on budgeting, forecasting, and financial planning more effectively with shared access to financial data. This supports a unified approach to financial management and stimulates cross-branch collaboration and knowledge sharing.

Boosted Compliance and Control: Compliance elements are frequently integrated into multi-branch accounting software to ensure regulatory compliance. They provide tools for managing tax obligations, providing correct financial accounts, and preserving adequate documentation. Businesses can reduce the risk of errors, penalties, and reputational harm by automating compliance operations and providing audit trails.

Multi-branch accounting software, such as RealBooks - online accounting software, has become an essential tool for businesses with many locations. This software solution provides consolidated financial administration, faster operations, real-time reporting, greater collaboration, and better financial control. Businesses can make better choices, increase efficiency, and foster growth if they have access to accurate and up-to-date financial information. Organizations may overcome the problems of managing finances across branches by using the power of multi-branch accounting software, allowing them to focus on their core activities and achieve long-term success.

#accounting#accounting software#online accounting software#cloud accounting#branch accounting software#multi branch accounting software

0 notes

Text

GST E-invoicing On An Accounting Software – How It Is Beneficial For Your Business?

Filing ‘e-way bill‘ is common on GST portals to facilitate transporting of goods from one place to another. Similarly, the GST council introduced the system of e-invoicing for specific categories of people.

E-invoicing is not a feature to generate invoices on the GST portal but it requires submitting an already generated invoice on the portal. Thus you can generate multiple reports with a one-time upload of invoice details.

RealBooks is one of the best Indian accounting software that stays up-to-date with Government mandates and provides a great platform for taxpayers to perform their e-invoicing activities. RealBooks also ensures that you can safely migrate all your data with the supported system without any change to all your archival data.

As a comprehensive accounting software in India, RealBooks offers very easy-to-use features. Some of the most notable and useful features are:

It is easier to keep track of all the entries corresponding to a particular invoice through online accounting software with the help of options like document attachment and management.

RealBooks online accounting software offers direct integration with the GST portal so that your business is always GST-compliant without any additional cost.

Being an online accounting software in India, RealBooks is easily accessible across operating systems and web browsers, allowing better remote access.

By cutting down the charges of physical resources, benefitting from online accounting software can be very cost-effective.

Data integrity enhances greatly with RealBooks accounting software which is devoid of human errors.

E-invoicing can reduce the risk of fraudulent bills, thus enhancing trust and reliability from both the supplier and buyer’s end.

Online accounting software can also help the human resources department in tracking the payroll advantages with unique tools for management.

What is e-invoicing under GST?

‘E-invoice’ generation is a process to identify and electrically authenticate B2B invoices by GST Network (GSTN) for common accessibility across the GST portal.

In this e-invoicing system, every transaction has a unique identification code by the Invoice Registration Portal (IRP) through the GST network.

From the accounting software portal, all the invoice details will be automatically transferred to both the GST portal and e-way bill portal, syncing in real time. this will eliminate the requirement for manual entry while generating part-A of the e-way bills and filling GSTR-1 returns.

What is the current system in place for issuing invoices?

Currently, businesses generate their invoices by using a variety of tools and finally uploading these invoices manually for the GSTR-1 return, instead of using single accounting software.

Once the GSTR-1 return is filled, the recipients can view the invoice information in GSTR-2A. The transporters or consignors need to generate separate e-way bills by importing these invoices in JSON or Excel, manually. Businesses can reduce their effort simply by using accounting software that offers tools for GST integration and e-invoicing.

Under the e-invoicing system now, the process of uploading and generating the invoices is the same – either by importing the Excel/JSON file or through API integration. This data seamlessly flows through the entire GST portal required at various instances of e-invoicing and filing tax returns.

How will e-invoicing benefit businesses?

E-invoicing has been introduced for the benefit of businesses, and with accounting software to automate the process, the benefits keep getting easier to grasp. The following are the advantages of using e-invoicing through GSTN:

With the help of e-invoice, a major gap in data reconciliation for GST is plugged, while noticing an absolute reduction in mismatch errors.

The data entry errors also reduce as the e-invoices generated by multiple software can be read by this online accounting software, offering integration with GST in the GST portal.

All the Concerned authorities involved in a business transaction can track the invoices prepared by the supplier in real time.

With e-invoicing, you can quickly generate genuine reports of your tax credit. All information about your business is available at the transaction level so there is less possibility of surveys and audits by the tax authorities

While filing the tax return, backward integration and automation of the process can make it very simple. Required details of the invoices can also be auto-populated in multiple returns by using RealBooks - Online Accounting Software.

How will e-invoicing curb tax evasion?

E-invoicing is very beneficial in ensuring proper tax compliance and curbing tax evasion in the following ways:

As the e-invoices are generated through the GST portal, the tax authorities have complete access to all the transactions happening in real time.

As the invoices are generated before conducting a transaction, there are fewer chances of manipulative invoices.

Since the invoices are generated through the GST portal, they have GSTIN integrated on the invoices, and there cannot be any fake tax credit claim.

In a brief conversation about RealBooks and online accounting software in India, these are the main things to know about GST e-invoicing. if you wish to learn more, visit RealBooks and sign up for our free trial to personally have an experience of this Best free accounting software

0 notes

Text

RealBooks Approval Workflow: The Hassle-free Alternative to Park & Post

Approval plays a crucial role in verifying and certifying the authenticity of any document/entry in accounting. When a document passes through hands then they have a few more error scans which lead to the least errors and add more weightage to the document.

But, isn’t the process lengthy?

Is the appropriateness of the book not suffering?

Are the customized reports accurate?

Accounting has its synonym named accuracy and when the same is getting compromised then how can an organization not suffer from the reports being inaccurate? The layered process might make a document/entry error free but it compromises the complete records as a whole if delayed.

Approval getting delayed is a basic issue that is being faced by each and every business organization on a daily basis be it a payment or receipt entry or issuing a purchase order or an invoice and it is not the fault of any specific individual. The process itself is way too stretched.

And when it comes to Park & Post feature, it might affect the accuracy of the reports, as the real-time reports will not show accurate data be it the stock, cash, or fund flow or any of the material data which eventually impacts the decision-making of a manager or the authorities.

What is the concept of Park & Post?

As the name suggests, it implies, keeping the entries parked separately till they get approved, and once approved the same shall reflect in the books of accounts. This means the unapproved entries will not have any impact on the Books. Though the feature serves as beneficial for many it has its own set of limitations.

To understand it better let’s take an example of an inward fund transfer. Here, the money has been received in the bank, but the same has not reflected in the books as it is yet not been approved.

What impact does it have on the day-to-day operations?

As we all know inflow funds play an important role in any organizations planning for outflows. If an inflow has taken place and the books are still stuck in their earlier balances, the manager will not know the exact status, and assume the shortfall in funds since he/she has planned the outflow based on the same. It is due to the park and post feature, the entry made is not showing up in the reports as they are still lying in the unapproved status.

But then what is the solution, if not park & post?

For RealBooks, the cloud accounting software, the approach of park and post is a big turndown and we are not disturbing you by serving the same. However, we do have the maker-checker concept in place, which can easily cater to the requirements. You might be into a range of questions after knowing this.

A. Will my books still be controlled? B. What about the important and material entries? C. What about external communication?

The answer is a big Yes!

Answer A: Yes your books will be controlled, even though the entries are showing up on your reports but they still can be filtered on the basis of approved and unapproved entries and you are completely in control and have knowledge of all the entries in that specific reports.

Answer B: Yes, all the material entries are safe and are completely controlled by the role-based access and approval process. Since not everything is accessible to all so it won’t set the entry process free to use on all basis.

Answer C: External communication is the most concerning part as it is the key to branding and building trust. RealBooks is protecting you by not letting Invoices, Purchase Orders, Money Receipts, Expense Vouchers, Cheque Prints, or any other externally communicative documents get printed from the software, till they are Approved. Thus, you are protected but in a user-friendly way.

This means not only the report accuracy is intact but the risk of unapproved transactions getting entered into is also eliminated.

Move towards the simpler and efficient options. Park and Post Forget the earlier accounting software of yours and switch to RealBooks, the cloud accounting software, and take your visionary organization towards a smarter and greener tomorrow.

1 note

·

View note

Text

Road to a Successful Entrepreneurship Journey

For successful entrepreneurship, financial literacy is essential for every entrepreneur. You need to understand your numbers and accounting – to understand your business better.

Successful Entrepreneurship is about making better decisions, making fewer mistakes, and hopefully turn a little cash into a lot of cash. Sometimes finance is not about money.

For example, how long will it take to get a customer to buy your product?

How much cash do you need to get to this milestone?

And how much do we spend on marketing in order to generate the revenues we’re looking for?

How long will it take to convert a prospect into a paying customer?

These are some of the questions that investors are going to ask you that you should be asking yourself that finance can help you answer.

Key areas of focus worth having in mind for successful entrepreneurship

If you are running a startup company here are some of the important areas for business owners and startups

Cash flow management is vital for successful entrepreneurship:

Most startups fail for a variety of reasons with one being the most common -running out of capital investment.

You need to be at the top of the cash flow system.

You need to know where every dime is coming in and going into.

Regardless of the brilliance of your idea, stick to your budgeting system.

Track and monitor all Spending

Being a new startup, expenses are going to come to you from all directions. So instead of hiring a full time professional to handle the books- online accounting software are a better option as it saves you much more money and time in the long run. Limit your fixed expenses like fancy office space, fully catered meals.

Remain Optimistic but be prepared for the worst

You never know what can happen when starting a business. Keep reserves- both personal and business. Sadly you can never be too prepared for these situations. It all comes down to how well you handle the pressure of these situations. Make investments even small ones count- anything is better than nothing.

Focus on Customer Acquisition

Let’s accept it- without customers, there is no business. The sooner we figure out a channel to acquire clients the faster the business starts to grow. Once the right channel is acquired, work on optimization in order to lower the cost.

Take it up step by step

Only having the dream to make a million-dollar business will not lead up to anything. Work is all that pays off. So break down the financial goals into reachable and measurable ones. Monthly, weekly or even daily revenue goals allow you to stay on track and make the adjustments necessary for constant growth. Knocking down little goals gives you the confidence to keep power through to your ultimate entrepreneur dream!

7 Key Measurables for a successful entrepreneurship

To ensure success in business and as a businessman, self-assessment is a sure recipe for success in the long run. But as digitization overtakes business organizations, business practices that included retrospection and paperwork are gradually being reduced or quantified to nil. RealBooks caters to many small organizations and hence has an in-depth understanding of its various nuances. Merely providing accounting tools to our clients isn’t our work.

We believe in acting as a friend, philosopher, and guide advising you of how you can maintain and manage your business better. A businessman’s work is never finished, he is always in a ‘work-in-progress’ mode. That’s because added with the sheer responsibility of handling financial affairs.

A businessman must introspect, plan, track, and measure the ongoing performance of finance as well as ideas through the business exchange. With our experience in building accounting software and providing accounting services to so many companies.

We have just listed a few pointers to follow, to ensure continued success at your work-place:

Quantify whatever you can for a Successful Entrepreneurship

Something that can be measured, can be achieved. If something cannot be measured, it is very difficult to understand if you have been successful at achieving it or not. Whether it is profit margins, sales, customer retention, customer satisfaction, lead conversion, salesman targets, etc. You must set targets for each and every different parameter

And only then can you measure whether you have achieved what you set out to do.

It could be as simple as – “Retain 80% of customers y-o-y / Convert 15% of all online leads / Work at profit margins of 30%”

Break One Arrow at a Time – Set Priorities

Setting targets is the easy part. And once you set out to achieve them, you would wonder which direction you should be running in. Remember, as small organizations, with limited resources, it is not possible to achieve everything. Hence, you need to create a priority list, ensure that you, and then set out to achieve what you did.

Don’t ignore financial statements

See how much money your business is generating.

With the right amount and assessment, you can continue pursuing your entrepreneurial dreams.

But before that, you need to track at regular intervals how much money is going in and out of your business?

To ensure the above, you must have a serious, detailed, and, regular look at the financial statements of your organization – balance sheets, income statements, cash flow statements, etc. in a small company to start with.

While balance sheets depict the health of your business.

The income statement helps measure the profitability of your business in a given period of time.

Also, the cash flow statement reflects how healthy your liquidity is.

Hear What Your Customers are Saying

While it is humanly impossible to keep a track of all customer mentions of your business.

You can still have an insight into the metrics through digital tools like online forums, social media mentions, and so on.

You can even record discussions surrounding your brand through various online marketing tools.

Make sure you routinely browse through the statements, figures, and trends.

This will not only help you improve but provide new ideas for business growth.

Along with this, review comments and ratings of your products/services to resolve any issues that could become an obstacle to your online reputation.

Understand the Power of Client Retention

The number one rule and formula for Successful Entrepreneurship in business are to understand client retention.

Genuine and loyal customers are the best friends for life for any organization.

These are people who generously rake in referrals, continuously contributing to gains at your business.

They increase your business prospects, so do take note of your retention rates.

Customer Retention is tougher than client acquisition since this requires your product/service to deliver day in – day out.

Also, remember, customer acquisition is much more expensive than customer retention.

Hence it’s an absolute no-brainer to focus on delivering quality to ensure happy customers who keep referring to more and more customers.

Competition is Key – Differentiate your product/service

Unlike your personal life, comparing yourself to others is welcome in the business world. If you want to climb up the ladder, you must bank on a little competitive stance to set effective goals for your business. Analyze how your product/service qualifies against its competitors when it comes to staying on top of the trends. There must be 1-2 aspects on which your product scores over the competition.

In the same way, competition might also be scoring over you in some aspects, but that’s fine! You know what your USP is market that.

Visibility is the First Step Towards Profitability and Successful Entrepreneurship

You have heard this several times – “Jo Dikhta Hai, Wo Bikta Hai”.

Nothing could be more true for your product.

Hence, ensure that your product gets maximum visibility – only then this be sold.

Once it got several sales, then automatically, you have a credible customer base, which will keep referring you and making your product and company highly profitable.

As they say in BNI, a global networking organization – Visibility + Credibility = Profitability

Depending on your budgets, you could target online and offline media platforms – Facebook, Twitter, Instagram or Advertisements, Billboards, etc.

But selecting this is a fine strategy for which you must do enough due diligence before putting the buck out.

Each rupee spent must be towards some measurable benefits either in the short term or long term.

So if you are lagging behind, it’s about time to start!

1 note

·

View note

Text

How RealBooks Online Accounting Software Is A Boon For Logistics Accounting?

How RealBooks Online Accounting Software Is A Boon For Maintaining Logistics Accounting?

One of the most fundamental aspects of any organization’s supply chain process is to maintain the logistics and accounts. Today the technology is growing rapidly, giving us digital alternatives to the traditional mediums of operations across departments. Needless to mention, the COVID-19 pandemic ushered in a digital revolution in the world when almost every organization started working remotely. Thereafter, it was quite easy to understand how technology can improve the quality of work that we do. Several online facilities including RealBooks accounting software grew in demand.

Inventory management and accounting for businesses include working with huge amounts of data where manual error can easily creep in. To avoid such discrepancies, automation and digital reliance are needed. The most ideal solution is to integrate all the major processes of the organization with cloud accounting software. That’s where RealBooks steps in.

Challenges in Logistics Management

Before we tell you more about what this accounting software can do for you, it is important to know some of the challenges that you can face in the logistics industry. Overcoming these challenges should be your priority when you are looking for the best accounting software for your enterprise.

Insufficient integration of services for networking, IT, warehousing, etc.

Manual data management and logistics accounting can be very time-consuming.

It is easier to make mistakes when working with large volumes of data, and a small error can make a big difference in the total calculation.

Delayed release of waybills and invoices due to differences in TDS rates, GSTIN compliances, and other mandates.

Lack of communication between different departments.

Continuous requirement of monitoring and feedback.

Inability to get a detailed data analytics report.

To get over all these challenges, your organization requires the best accounting software in India. And RealBooks is your go-to accounting software when you are looking forward to an all-inclusive, cloud accounting software to access from anywhere, anytime across different operating systems and devices. It offers seamless integration with logistics management software and enables you to manage your inventory easily.

Key Features of RealBooks Accounting Software:

Here are some of the significant ways in which RealBooks can help you maintain your inventory and grow your business, with its cost-effective account management solutions!

API / Excel integration with operations software

Directly import your accounts and transactions from different operations software with the help of API and Excel integration on RealBooks. Note that your operations software should have the option to export the accounts directly. You can also import your manual data present on Excel sheets to avail of automated services.

Handle multiple GSTIN and multiple locations

No more hassles of creating separate accounts for different branches and GSTIN. The centralized services of RealBooks help you easily manage all your accounts, bills, and GST compliances in one place, irrespective of your business locations and services.

Record lakhs of transactions without any slowness

Unlike traditional accounting mediums, your hardware does not dictate the functioning speed of RealBooks. As a cloud-based accounting software, it relies on your bandwidth and offers a super-smooth experience in accounting and data management, no matter how big a figure you calculate.

Decentralized accounting with centralized reporting

Being an online platform, RealBooks offers real-time consolidation of accounts across different branches of your organization. You get the flexibility to choose from various filters, be it checking the performance of one branch or looking at the centralized salary calculations of all your employees. RealBooks can give you the flexibility you never knew you needed!

With such diverse and useful features, RealBooks is indeed one of the accounting software that will offer you the best services and streamline your workflow, with the help of technology.

After all, the world is moving towards cloud computing and it is the latest tech mantra today. Leveraging on the smart engineering of RealBooks, you can:

Decrease the burden of the IT sector.

You can always use more applications and tools without worrying about the physical infrastructure when your accounting software is cloud-based.

You can easily generate accurate information on all kinds of bills and reports with a single click.

Your data is always integrated at one location virtually so you never need to worry about losing your accounts.

The biggest advantage is the increased productivity and swiftness of the business processes along with time-saving task execution.

Therefore, reliable cloud-based accounting software like RealBooks is a must-have for all enterprises to manage their logistics and stay ahead of the competition with error-free, advanced technology integration.

#accounting software#online accounting software#cloud accounting software#Best Accounting Software for GST

1 note

·

View note

Text

How RealBooks can help to Kick-Start your Accounting Online?

Accounting online and advances in technology have aided in transforming businesses and industries rapidly, over the past few years. While these transformations are evident, accountants are already using several

digital tools to optimize processes

India is still in the phase where people use papers extensively for day-to-day activities. Though there is a wave of digital transformation the adoption of the same has been slow among the people. The result is huge piles of papers that clutter our workplaces, homes, etc.

But the question is – Do we need these many papers on an everyday basis?

The answer is definitely No.

It is just that we are so used to live in space that is so cluttered that the idea of clear space or rather a paperless office has never been on our inspiration list. That is how the concept of accounting online has begun.

What is accounting online?

Accounting online is often interchangeably used with cloud accounting to denote an online accounting software. Cloud-based accounting software, web-based accounting, e-Accounting, SaaS are all also interchangeably related. Accounting online simply means using technology, tools, and techniques to make business accounting work better for you online. And keep yourself away to get rid of the paperwork and files that are unnecessarily occupying your office space. This simply means there are no files no more booklets or rough papers to manage your accounting. And you have a paperless work area where all your accounting data rests online and on the cloud. Therefore you get access to your business data anytime and anywhere and on any device directly on the go.

According to Wikipedia E-accounting or online accounting is the application of online and Internet technologies to the business accounting function.

How Accounting Online is beneficial for Businesses and Enterprises?

Most of us would here think that Why do I actually need a paperless office?

And how would it help me?

Well, most of the success guru believes that a clear and uncluttered space gives them more clarity in their thoughts and help them stay organized making them more productive. Therefore going paperless in a bigger way means saving the environment and a small contribution towards preserving our ecosystem.

But how can you achieve it?

Especially when you have been dependent on papers throghout your life.

Well even if it’s not an easy transformation, small steps towards building a paperless office can always be good to start off with.

Use Digital Devices Smartly for Accounting Online

Each one of us is surrounded by gadgets that when smartly used can reduce our consumption of paper on a daily basis. With Digital Calendars, Planners, Notes, etc. the need to physically record things is much reduced. Also, when storing data digitally the chances of your data getting lost is negligible as all the data in your gadgets are synced with your account. And that can be retrieved easily anytime and anywhere.

Adopting Accounting Online through Apps

A Cloud-Based App gives you the convenience of accessing it anytime, anywhere. Also, the data is much more secure and easily accessible. From daily accounting to daily business tasks all can be done through various cloud-based apps available online.

Some of the useful apps are :

RealBooks – A Cloud-Based Accounting Software

Google Documents – To collaborate on documents

DropBox – To share files

Especially for offices that wish to go paperless in the near future, the adoption of Cloud-Based Accounting Software is a must.

RealBooks is a GST-Ready Accounting Software online that allows its users to access it from anywhere through its desktop version as well as a mobile application. Users can easily scan and upload their important documents, bills, etc. eliminating the need to store each and every document physically with you.

The huge benefit of adopting this software is – the next time you need a particular document or invoice instead of searching your entire office for small documents you can easily find it in the software- safely stored.

Also, since Cloud-Based tools allow teams to collaborate and work on the same documents simultaneously he needs to physically download and share the documents is eliminated.

Lastly, with all the reports automatically generate, the need to physically create and present the documents to the management reduces.

Switch to Paperless Billing

You must be receiving a large number of bills, bank statements, etc. throughout the year.

Today all the companies offer a paperless option where they send e-bills and statements to your mail directly.

Switching to Electronic Documents would not only save paper but also make you more organized making it easier for you to find them even after a long time.

Accounting Online Makes Your Files Digital

Most of the offices are cluttered with a stack of files and folders – to which we keep adding more every year. The result – Cluttered spaces and finding the right documents when in need is very difficult. The solution is to simply start saving the digital version of the file. Here you need to cautious as sorting documents that need to be digitally saved would require your time and input.

Use Digital Payments

When payments are done digitally a receipt of the same is send to you electronically. This saves paper in turn helping your office turn paperless. An app like BHIM, Tez, Paytm, etc. is used to make Digital Payments in India.

Is Setting up a Paperless Office possible?

If any individual or company adopts the above-mentioned small steps, achieving a paperless office is not at all difficult. Because all the resources mentioned are easily available. The only challenge is adopting it into our lifestyle. And adopting cloud accounting software can truly make it possible.

How Accounting Online Replaces Human Accountants?

The robot revolution has indeed taken the world by storm, starting from the inanimate yet multi-functional Alexa to the more sophisticated humanoid Sophia. Even as technology grows in leaps and bounds, a big question looms in front of the financing industry.

Are robots going to replace accountants?

The best and only answer to this question is NO.

Technologies might change a process, make computing easier, but somehow the human factor cannot be eliminated. A part of the IT boom also involves blockchain, a technology powered by artificial intelligence and cloud computing. Looking at the way blockchain and cryptocurrency are evolving. It seems that accountants will be better endow when manual data entry reduces and data precision and processing speed improves.

So here is what RealBooks is looking at in terms of technological contribution.

Cloud Computing Versus Accounting

An analysis conducted by Accountant today estimated that the global market for accounting software will be valued at a whopping $11.8 billion, by the year 2026. While digitalization of the accounting industry is already certain SaaS or software-as-a-service or cloud accounting is fast finding footage as well. Internet-enabled services and virtualization helps users access financial data from anywhere. Such integrated accounting platforms are efficient and even aid in streamlining critical back-office processes across industries and businesses.

Accounting Online & Blockchain Revolutions

Blockchain does not limit to cryptocurrencies alone. In fact, blockchain was a focal point of dialog in many of the recent accounting shows and seminars. The delivery method of this single-ledger technology is rather unique. Several users from different origins can access real-time and similar information on a common platform. For example, the risk profile of a business hash-tied to the blockchain can be accessed by all the potential investors and financers, at the same time.

Any modifications performed can be visualized as soon as it has been validated. With greater security and transparency, transactions may take days, hours, minutes, or even seconds, as the case may be. Reconciliations, auditing, and compliance will all be accurate, quick, and error-free.

Accounting Online with Enhanced Automation

One of the great transformations of the accounting system is seen in the automation of manual tasks. It includes tasks such as audits, banking, payroll management, and tax preparation to name a few that will increase beyond 2020. Here too, AI plays a big role, but yet, will not be able to surpass human intelligence.

Accountants will be able to get access to real-time and verified information extracted from a number of resources. As transactional machines, computers, and along with it algorithms will become more efficient at accumulating and analyzing big data.

But, in the end, the interpretive capacity lies with humans. A machine, yet, cannot learn common sense. Accountants will be able to access rational and comparative data and apply this information to provide crucial business insights and intelligence.

In Conclusion:

Manual and transactional tasks can streamline and automate with cloud AI and blockchain while decision-making, planning, and expertise will still remain with the humans. By embracing technology, accountants can expect to see themselves as valuable business advisers in the future. The future is more assured when accountants can turn accurate data into actionable insights.

A fully automated plant developed by Tesla in California is all powered by AI robots. While this is considered revolutionary, production is significantly slowing down, because the unit could not achieve its targets. The company had to replace the robots with a specially trained staff that would manage the machines. Visibly, it just seems that humans were underestimated.

This, conclusively, goes to prove that human accountants who receive specialized tutelage will only add value to a revolution that will help build and even strengthen businesses.

1 note

·

View note

Text

The importance of Cost Auditing during Business Crisis

What is Cost Auditing?

Cost auditing usually ascertains the accuracy of cost accounting records. And it ensure that they are in conformity with cost accounting principles, plans, procedures and objectives. Cost audit aims to identify the undue wastage or losses and ensure that costing system determines the correct and realistic cost of production. Knowing the position of your company is vital for survival in the long run.

Therefore cost auditors make the necessary changes to the various financial aspects of the company. Thereby reducing cost and plans to efficiently saving money. This is one of the true things ever said.

” Never take your eyes off the cash flow because it’s the lifeblood of business ” – Richard Branson

For a business owner to be able to pay off expenses, invest in new opportunities or grow a business, a consistent revenue flow is mandatory. In fact, 82% of startups and small businesses fail due to poor cash flow management.

What is Cash flow management?

It can be defined as the process of monitoring, analyzing, and optimizing the net amount of income and expenditure of an individual or firm on a cash flow basis. Most companies view profits to benchmark their performance. But the reality is that cash flows are much more important for this size of entities. Especially when they are self-funding or a boot-strap and do not have access to external sources of funds. It’s possible your billings consistently exceed your expenses.

But if those billings are not realized in a timely manner. You cannot possibly make payments on time and can fall into a poor cash flow cycle. You need to buy a computer or some other asset and expect a significant outflow. But you have not planned the outflow since it does not show up as an expense it’s an asset. When you pay for it, you are bound to face cash flow issues as it probably consumes a significant part of your cash flows – as it is unplan ‘expense’.

It is the owner’s primary duty to ensure that the business is up and ready steadily. His aim is to ensure cost creep remains dissolved. Cost creep is when the expense of the company is continuously increasing over a period of time without the direct knowledge of the proprietor. Certain times even after being very vigilant, cost creep occurs.

To help manage such crisis, we advice you to begin with cost auditing.

Here is how you should go about with Cost Auditing

Analyze the current status:

The primary step, like in any crisis, is to observe the problem.

Take a look at your financials and analyze your costs.

Evaluate how the company is doing so far during the year.

And compare it to the initial budget and goals set during the beginning of the year.

Also, compare it with the previous year’s statistics.

Take a note of every major reason accountable for the variation in the graph.

By doing the following analyzing, one gets a clear picture of the company’s economic status.

Strategize the best solution:

For strategizing cost-cutting, first one should determine the importance of each expense and asset acquisition on the list. We can figure this out by conducting a simple exercise.

Namely, create a list of all of your costs to date with four columns for each one. Title the four columns:

Is this expense really necessary?

What would be the ROI on this expense?

Is there an alternative to this expense?

Would it be ok to omit this expense altogether?

This would definitely help you think and cut down all the secondary expenses that aren’t necessary for that instance.

Implement the new plan of action:

Once you have successfully strategized your cost-cutting, it’s now time to implement it.

Depending on the nature of the expense, some costs can cut or reduce immediately while others decrease over time.

It recommends that every business does cost auditing twice a year.

0 notes

Text

Why Embrace the Concept of Audit Trail in Bookkeeping?

A less travelled path also has footprints somewhere or the other which leads the traveller to its destination sooner or later. But what if the path is heavily travelled?

The destination might seem easy but counting and analysing each and every step might not be easy to fetch from those numerous feet. The advanced tech helps us edit anything and everything and the records of each and every edit can be fetched but need technical expertise.

Similarly, the world of bookkeeping, through accounting software, goes through several changes and edits on daily basis even after being strongly controlled through the developed technology.

But then what about the records of those changes?

According to The Indian Ministry of Company Affairs (MCA) notification dated March 24, 2021 (Companies (Accounts) Amendment Rules, 2021), for the financial year beginning on or after April 1, 2021, every company that uses accounting software to maintain its books of account shall use only Accounting Software that has a feature of recording an –

Audit Trail of each and every transaction,

Creating an edit log of each change made in books of account along with the date when such changes were made.

Ensuring that the audit trail cannot be disabled.

Current Update: The MCA has later announced that the above amendments will take effect on April 1, 2023, as per the amended provisions vide Companies (Accounts) Second Amendment Rules, 2022.

How do you as a business get benefitted from the concept of Audit Trail?

1.Compliant Books: An audit trail can help by providing evidence that your business has followed established procedures and that the books are demonstrating its compliance with regulations, laws, and industry standards further avoiding penalties and fines.

2.Transparency makes accountability easier: Trust is what every stakeholder expects the business to radiate and without crystal clear records of each and every transaction in books, the trust factor might never get room. An audit trail helps the business gain and maintain trust.

3.Fraud caught at the thought: Corrective actions come into the frame when a company can identify irregularities, anomalies, and suspicious behaviours. An audit trail can help detect and prevent fraud by providing a record of all transactions and activities.

4.Risks get managed well: Identification of potential issues is always a better option than solving it after it becomes the bone in the throat kind of problem. An audit trail helps in the identification of such risks and can also provide evidence to support insurance claims or legal disputes.

RealBooks, your compliant cloud accounting partner has always tried its best to keep the books appropriate at all times. We followed the MCA notification even before 2021 and have helped YOU keep the records of all when, what, whom and where of all transactions.

Are you yet not in the category of YOU till date??? Get RealBooks now, be the King or Queen and relax since we are the ones who will shield you from such issues.

Switch to RealBooks, the cloud accounting software, and take your visionary organization towards a smarter and greener tomorrow.

0 notes

Text

Customise your Invoice Templates like a Pro with RealBooks!

In this world of personalisation and customisation, be it product or service, everything is being customised. Even the stars are being named in your name and have turned into an asset.

Customisation is required when we are not satisfied with the general servings. In the era of advancement, we all are in a need of customised outputs in order to make our work easy and effective. We didn’t spare Stars then why to spare the invoice of ours!

You are allowed to be choosy and your choosiness will be respected when you have an accounting partner like RealBooks, who serves the book as you want it to look. Not sure about your partner of your choice but you will surely get the Tax Invoice as per your preference and requirement from our 10+ templates with multiple colour options as well.

Already a RealBooks user and want to know how?

Watch the video and get ready to customize your Invoice template right now!

youtube

And for the ones who are just seeing and are not dating us, it’s time to get RealBooks spot on and avail the 1 free user offer immediately.

Customised invoices are more presentable and professional since it has a soul as per your brand requirements. An invoice format must include all the relevant data which you find relevant and you need not to follow the generic common market format like a duckling following its mother’s tail.

Uniqueness of your brand identity reflects from all the areas and accordingly your accounting partner shall serve you uniqueness be it with the colour or the data of the invoices.

Changed nation has changed notions and we, RealBooks, your biz-teligent accounting partner follow them and try to be at par with the same.

It’s time to switch to RealBooks, the cloud accounting solution, and take your visionary organization towards a smarter and greener tomorrow.

0 notes

Text

RealBooks offers Customisable Properties at Zero Additional Cost

A restaurant with a menu completely of our wish is none other than our kitchen and such ease in your accounting preferences are being served by your own RealBooks.

Additional fields to capture details in the Voucher, Ledger or Items do not come for free since majorly all accounting software charges you for the same whereas, our business intelligent pocket friendly cloud accounting software, RealBooks, cares about your pocket and gives you a feature, customisable properties, through which you can self-customize the same without paying a single penny.