#EMI purchase documentation

Explore tagged Tumblr posts

Text

#Documents required for phone EMI#Buy mobile on EMI#Phone EMI eligibility#EMI purchase documentation

0 notes

Text

A Step-by-Step Guide to Home Loan Application Processes in India

Buying a home is a dream for many people in India, and taking a home loan is often the most practical way to make this dream come true. While the process may seem complicated initially, breaking it down into simple steps can help you understand what to expect and prepare accordingly. Whether purchasing an apartment, a villa, or a plot in a large project like Godrej MSR City in Shettigere, knowing how to apply for a home loan can save time, reduce stress, and even help you get better loan terms.

Step 1: Check Your Eligibility

Before applying for a home loan, check your eligibility based on your age, income, job type, existing liabilities, and credit score. Most banks and NBFCs (Non-Banking Financial Companies) offer online eligibility calculators. A good credit score (typically 750 and above) increases your chances of approval and may help you get better interest rates.

Tip: If you're buying a plot or home in a reputed project like Godrej MSR City in Devanahalli, lenders are usually more willing to approve loans due to the builder's credibility and clear legal documentation.

Step 2: Choose the Right Lender

Compare banks and housing finance institutions based on interest rates, processing fees, prepayment terms, and customer service. Consider both fixed and floating interest rate options and choose what suits your long-term goals.

Step 3: Gather the Required Documents

Prepare the following documents before applying:

Identity Proof: PAN card, Aadhaar card, or passport

Address Proof: Utility bill, voter ID, passport

Income Proof: Salary slips (for salaried) or IT returns (for self-employed)

Bank Statements: Last 6 months' statements

Property Documents: Agreement to sell, allotment letter, or builder-buyer agreement

Employment Proof: Offer letter or employment certificate (for salaried individuals)

If you're purchasing a home in an established township like Godrej MSR City in Bangalore, the builder often assists with documentation and coordination with banks, making this step easier.

Step 4: Submit the Loan Application

You can apply online or visit the bank branch. Fill out the home loan application form and attach all necessary documents. Pay the processing fee, which typically ranges from 0.25% to 1% of the loan amount.

Step 5: Loan Processing and Verification

Once the application is submitted, the lender will verify your documents and may conduct a personal discussion to confirm your repayment ability. They will also evaluate your credit score and verify your employment and income details.

Step 6: Property Valuation and Legal Check

The bank will inspect the property to ensure it has a clear title and matches the legal and construction norms. This includes a site visit and checking RERA registration, building approvals, and sale agreements. Reputed projects like Godrej MSR City already have these legal clearances, which speed up the process.

Step 7: Loan Sanction and Offer Letter

Once everything checks out, the lender will issue a sanction letter mentioning the loan amount, interest rate, tenure, EMI, and terms. Read this carefully before accepting.

Step 8: Loan Agreement and Disbursement

After you accept the offer, the bank will ask you to sign the loan agreement. Once signed, the loan is disbursed — either in full (for ready-to-move homes) or in stages (for under-construction projects). The disbursement is often linked to construction progress if you're buying in a phased township like Godrej MSR City in Shettigere.

Bonus Tips for a Smooth Home Loan Experience

Keep Your Credit Score Healthy: Avoid delays in existing EMIs or credit card payments.

Plan Your Budget Wisely: Factor in down payment, registration charges, and interior costs.

Use Builder Tie-Ups: Many top builders, including Godrej Properties, have tie-ups with leading banks for quick processing and better rates.

Read the Fine Print: Before signing, understand prepayment, foreclosure, and late payment charges.

Conclusion

Applying for a home loan in India is a well-defined process; being prepared can make it much easier. If you are considering a home or plot in Bangalore, especially in fast-developing areas like Devanahalli and Shettigere, choosing a project like Godrej MSR City can simplify the home loan process due to its transparency, clear documentation, and builder-bank relationships.

youtube

#godrej properties#apartments#real estate#bangalore#north bangalore#Youtube#godrej msr city#godrej shettigere#godrej devanahalli#godrej msr city shettigere#godrej msr city devanahalli

2 notes

·

View notes

Text

Northern Songs & NEMS in 1969

I wrote this up to get my head around the business side of things surrounding the breakup and I thought I'd throw it up here for all you people who don't feel like wading through You Never Give Me Your Money/The Love You Make.

Brian had managed The Beatles via NEMS, which is to say that their contract was with NEMS and not Brian himself. The group didn't want to be managed by Clive Epstein and didn't care for Robert Stigwood (who had become partners with Brian, which the Beatles didn't learn till August '67) because he'd rejected them in '62. After the contract expired in September 1967, the group decided to manage themselves. NEMS was jointly managed by Clive Epstein and Robert Stigwood for a while until they split fairly amicably. Clive retained NEMS. The inheritance tax for the holding was due on March 31, 1969, and he did not have the money to pay it.

In early 1969, Clive informed The Beatles that he was looking to sell NEMS*. Paul asked the Eastmans for advice, who told him they should borrow money from EMI to buy NEMS outright. The reasoning being: after Brian's death, it came to light that NEMS was entitled to 25% of the record sales for the next nine years. Owning NEMS would mean the company could no longer claim commission from them. However, Allen Klein advised the group not to go ahead with the purchase, pointing out that the loan they took out from EMI would be difficult to repay.

Paul favoured the Eastmans as the group's managers, while the other three preferred Klein. The Eastmans had several things going against them:

They were Paul's brother and father-in-law and would therefore be biased in his favour.

They were more 'class-conscious' people, which means they owned Picassos and wore suits all the time. Paul was attracted to this kind of thing while John and George were repelled by it.

They made several tactical errors while dealing with Klein and the rest of the group.

When John Eastman, Klein and The Beatles all met for the first time to discuss the acquisition of NEMS, Eastman went in on Klein for all his crooked dealings (he had been accused of insider trading** with a company he owned and had been in trouble with the IRS for failing to file tax returns.) He must've expected Klein to fire back at him in the same fashion but, as per Peter Doggette's book, he 'calmly defused the row,' making Eastman look like a psycho and Klein a reasonable, victimised man. This basically only served to solidify the other three's (John's) support for Klein, but for the time being, they were going to try to work together: Klein was to produce a statement of The Beatles' financial situation, and the Eastmans were appointed legal advisors to Apple Corps.

The arrangement was doomed from the start because Klein wasn't exactly being cooperative with the Eastmans, sending them bundles of documents of no importance whatsoever. Things only got worse after Lee Eastman wrote Clive Epstein to suggest a meeting where they could discuss, among other things, the 'propriety' of the negotiations that Brian carried out with EMI on the group's behalf in '66. This incensed Clive, because what do you mean propriety? Are you calling my dead brother a crook? And he went off and sold Queenie Epstein's 70% stake in NEMS to a Leonard Richenberg of Triumph Investments.

As a reminder, NEMS took a 25% commission on The Beatles royalties. That company is now majority owned by Some Guy. A quarter of The Beatles' earnings are lining the pockets of Some Guy. This was a huge blow to the Eastmans. The Beatles told EMI that all their royalties (including NEMS' 25%) should be sent to their own bankers, but, confused, EMI threw up their hands and decided to withhold the money until they sorted out the issue.

We're up to about February/March 1969 now. Apple is still haemorrhaging money and The Beatles' main revenue source has been blocked off. And we haven't even gotten into the Northern Songs fiasco yet.

Note - pie charts NOT to scale!

Northern Songs went public in February 1965 to reduce its income tax burden and the 1,250,000 shares on offer sold out in sixty seconds. At the time of flotation, John, Paul, Dick James, and Charles Silver (partner of Dick James - no not that way) all had 15% stakes in the company. Dick James Music and NEMS both held 7.5% stakes, and George and Ringo each had 1.6% stakes. In June 1968, George got rid of his shares entirely which, like Ringo's, had by then whittled down to 0.8%.

The situation by 1969 was basically what you see above. As you all know, Dick James and Charles Silver sold their shares to ATV in March 1969, giving them 35% of the company and the majority stake. The Beatles and Co. could only cobble together 30%. But if they could get Consortium, a group that held a 14% stake in Northern Songs, to sell its shares to them, they could take back control of the company.

At the same time, relations within the group continued to deteriorate. The Eastmans advised Paul to not add his block of shares to John's as collateral for the loan they needed for their takeover bid and Klein offered his £750,000 worth of shares in MGM to make up for it. He also informed John that Paul had been buying more shares in Northern Songs. As things stood, John had 644,000 and Paul had 751,000.

While it was true that Paul had increased his standing in Northern Songs on advice of the Eastmans, he couldn't have bought much more than 1,000 extra shares. The real reason for the discrepancy was that part of John's stake, roughly 100,000 shares and 2% of the company in total, had been put aside for Cyn and Julian. Roughly the same distribution in shares had existed since at least 1966*** and Cyn had been allowed to retain the 2% after the divorce. But, if you take that fact out of the equation and just present the massive difference in their stakes and the fact that Paul had been buying more shares, it looks quite damning. After this meeting, John, George, and Ringo effectively banished the Eastmans from Apple.

Meanwhile, since The Beatles had already fulfilled their 1967 deal with EMI, Klein got to work on negotiating a new deal for the group with the blessings of all four Beatles.**** He also got permission from the group to go into Apple and start cutting redundancies. By the end of April, he had drawn up a three-year management contract for The Beatles to sign. The terms were:

ABKCO (company run by Allen and Betty Klein) is appointed exclusive business manager to Apple Corps on behalf of The Beatles and their companies

ABKCO recieves 20% of Apple's income before tax. The percentage would continue for any deals signed while the contract was in force, with a few exceptions. • He would not receive any percentage of The Beatles' royalties until he negotiates a new deal for the group. • He would only receive 20% of the increase royalty, not the full rate. • He could only claim 10% of the income generated by Apple Records

Apple would pay the expenses of Klein and any other ABKCO staff working on their behalf.

The four of them initially agreed to the deal. Loony Toons-type hijinks occurred when the group attempted to sign the contract. It was first brought to John. The version he signed had last minute clause added in by the group's advisors that made the document into a basis for further discussion instead of a binding deal. John showed off the signed contract to Klein, who wanted the clause removed. By this point, the guy who brought the contract to John, lawyer Peter Howard, was already on the way to George's house and discovered that he had left behind the document George needed to sign. George also wanted to phone Paul before he did, but Paul had changed his number and hadn't told anyone, so he couldn't reach him. The lawyer got George to sign a carbon copy, which was then brought to Ringo, then to John and Klein, who added their signatures.

The deal now had to be ratified by Apple's board of directors. When the Beatles later met, Paul was upset because the deal had been signed without him being notified and he thought Klein's percentage was too big. Klein told the board that ABKCO's insisted he got The Beatles' approval that day so there was no time for further negotiations.***** Paul wanted them to wait until his lawyers had drafted another agreement. However, only three directors were required to agree, so John, George, and Neil Aspinall went ahead and ratified the deal. Klein was officially the manager of John, George, and Ringo, but not Paul.

On a brighter note, the NEMS situation was finally resolved in July 1969. The arrangement was:

NEMS drops all claims of representing The Beatles.

The Beatles sell their 10% stake in NEMS.

NEMS was paid a lump sum of £750, 000 as compensation for all the money they might've made managing The Beatles up to 1972.

NEMS took 5% of The Beatles' royalties between 1972 and 1976 - the 5% of North American royalties (which comprised 75% of their global revenue) would come from Klein's commission.

Paul attempted to stage a weak protest against Klein's rule by threatening to pull out of the deal unless Klein agreed to not take any payments for negotiating the deal over the past five months. Klein confronted him at Abbey Road where he, George, and Ringo were working (John had crashed his car in Scotland) and called his bluff. Paul backed down; the deal was signed and the £1.3 million on hold from EMI was finally released.

A few months later, it looked like all the Beatles' business woes would soon be resolved: Consortium were willing to sell their shares. The Beatles sans George (missing because of Louise's brain tumour diagnosis, I assume) and Klein met on September 19 to discuss how the board of Northern Songs would look when they took control. Linda took photos to assure Consortium that The Beatles were all speaking with one voice. I assume these are the pictures:

John Eastman pushed for Paul to have the same number of votes as the other three combined, which baffled everyone - including Paul. However, it all turned out to be for nought when Consortium threw in their stake with ATV. Northern Songs was lost. The next day, the group reconvened to sign The Beatles' new contract with Capitol****** and John Lennon left The Beatles.

* Clive or someone had renamed NEMS Nemperor Holdings at this point, but I’m going to keep using NEMS because this is tedious enough without companies changing names.

** Insider trading is buying or selling a company's stock in accordance with information that is not publically available. For example:

My friends and I are betting on how many hot dogs my cousin David can eat within twenty minutes. Everyone else has to place bets based on guesses, but I know from growing up with him that Dave gets sick after eating seven hot dogs at once, and I bet accordingly.

*** Why didn't John know this? Aside from because he was paranoid, already suspicious of Paul and the Eastmans, and probably on a ridiculous cocktail of drugs, I think he might genuinely not have remembered. It's possible that his accountant called him at some point, said hey, do you want to put some shares aside for your family? And he just said yeah, went straight back to sleep, and it had slipped entirely from his mind by the time he woke up.

**** Per Klein, in the middle of negotiations John Eastman sent a message to Capitol saying that Klein does not represent Paul in any way, which was not true.

***** ABKCO was singlehandedly controlled by Allen Klein

****** A very lucrative deal. It gave them 25% of the wholesale price, a higher royalty rate than any other recording group.

#please feel free to add/correct me!#my dad saw me drawing those pie charts and asked if i was doing horoscopes. said yes cause it's easier to explain#midposts#on lawyers and managers

55 notes

·

View notes

Text

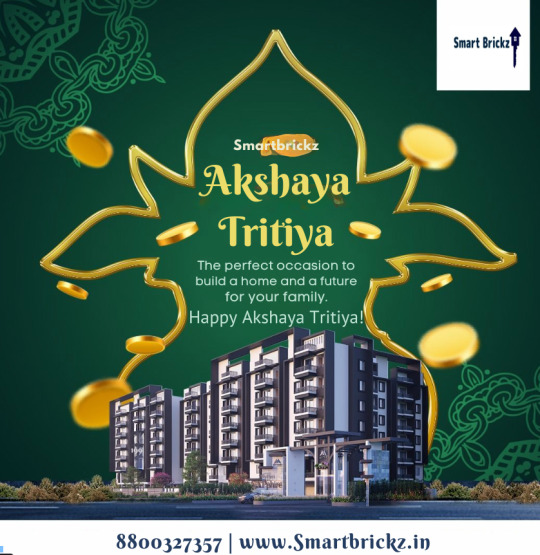

Invest Smart This Akshaya Tritiya: Secure Your Future with Freehold Plots in Noida & Greater Noida Knowledge Park 2

Akshaya Tritiya is not just a day for gold and traditional purchases; it is an opportunity to invest in assets that promise growth, prosperity, and long-term value. In 2025, one of the smartest and most secure investments you can make is in freehold property. If you’re looking for the best assets to invest in this Akshaya Tritiya, consider freehold plots in Noida and Greater Noida Knowledge Park 2, starting at an unbeatable price of just ₹28 lakh.

Akshaya Tritiya is known as an auspicious time in Indian tradition. The word “Akshaya” means never diminishing, and investments made on this day are believed to bring long-term prosperity. Traditionally, people buy gold, but in today’s time, real estate is emerging as the best asset for Akshaya Tritiya. Unlike gold, property not only retains value but also generates returns through appreciation and rental income.

Freehold property means full ownership of the land and the structure built on it. You are the absolute owner, and there are no leasehold restrictions or government interventions. This makes it a perfect choice for long-term investment.

Key advantages of freehold property:

No lease expiration

Right to sell, lease, or build as per norms

Full transferability

High resale value

When it comes to investing, location matters. Greater Noida Knowledge Park 2 is strategically located near major educational hubs, expressways, metro stations, and business districts. It offers an ideal mix of infrastructure, accessibility, and future growth potential.

Noida is also witnessing massive infrastructure developments, making it one of the most promising real estate zones in North India. Whether you’re an end user or an investor, these regions promise high appreciation value and ROI.

1. Full Ownership: You own the land entirely without any lease hassles.

2. Better Control: You can construct, modify, or resell the plot as per your vision.

3. Low Risk: No lease renewals or government complications.

4. Legal Security: RERA-approved projects, fully documented, and supported by housing finance institutions.

5. High ROI: With the area’s rapid urban development, your investment will appreciate faster.

Luxury and Affordability in One Package

Freehold plots now offer luxury amenities at a surprisingly affordable rate. Starting at ₹28 lakh, these properties come with features such as:

Gated community

CCTV surveillance

24x7 water and power supply

NPCL electricity connection

Green landscaping

Clear title and freehold registration

You get all the benefits of a luxury lifestyle, without breaking the bank.

EMI Options Make It Easier

Worried about upfront costs? Many projects offer flexible EMI plans through trusted finance partners. So, you can now own a freehold plot without putting financial pressure on yourself.

Why Freehold Plots Are the Best Assets Akshaya Tritiya 2025

Investing in a freehold plot gives you more than just land; it gives you:

Financial security

A hedge against inflation

A home or business location for the future

Peace of mind knowing it’s a legal and safe investment

As the demand for freehold plots in Greater Noida and freehold plots in Noida continues to grow, early investors will benefit from higher appreciation and better resale value.

From Instagram stories to YouTube shorts, people are sharing their success stories of buying luxury freehold plots in Noida. Influencers and real estate experts are calling this the “golden moment” to invest. Join the conversation and make your move before the prices rise.

Use trending hashtags to boost visibility:

#AkshayaTritiya2025

#FreeholdPlotsNoida

#SmartInvestment

#GreaterNoidaProperty

#PropertyDeals2025

#AkshayaTritiyaRealEstate

Final Word: Your Akshaya Tritiya Investment Awaits

Let this Akshaya Tritiya be your turning point. Step away from conventional gold and embrace the future of wealth with freehold property in Noida and Greater Noida. With the combination of prime location, affordable luxury, legal security, and high growth potential, this is truly the best time to act.

Contact us today to schedule a site visit or learn more about available plots. This festive season, don’t just celebrate — invest smartly.

📍 Location: Knowledge Park 2, Greater Noida

📞 Contact: 8800327357

🌐 Website: www.smartbrickz.in

#real estate#freehold property#freehold#property for sale#property#noida real estate#property bazar#noida plots#noida property#best location#commercial property#properties#greater noida#property management#propertyinvestment#property investment#residential property#real estate investing#realestate#homebuying

2 notes

·

View notes

Text

Need a Loan For a House:-

It is an amount borrowed by a borrower from a financial institution, such as a housing finance company, to purchase a new or resale home, construct a home, or renovate or extend an existing home. This amount is borrowed at a particular interest rate and is repaid within a particular period in small installments known as EMI (equated monthly installment)

Whoever is taking a loan for a home, we call it a mortgage loan. While taking a home loan, we can keep some things in mind. Example: -

First, you assess the condition of your house, then take the loan.

You should also keep in mind your income and expenses. How much can you borrow based on your income and current expenses?

Your credit score should also be good so that you can get a loan quickly and not face any problems.

If necessary, seek the help of a real estate agent to find a home within your budget and desired location.

Review the closing disclosure provided by the lender, which details the final terms and costs of the loan.

Sign documents: Sign the loan documents and pay any closing costs and required down payment.

Closing opening: Review the closing opening ceremony presented by the lender which details the final amount and costs of the loan..

2 notes

·

View notes

Text

Kissht - Business Loans for Startups: Fueling Innovation and Growth in Today’s Competitive Market

Kissht Reviews: In today’s hyper-competitive and innovation-driven market, startups are shaping the future. From groundbreaking tech products to revolutionary service models, entrepreneurs are continually challenging the status quo. However, even the most promising idea needs fuel to take off and that fuel is funding. Access to timely and sufficient capital is often the deciding factor between a startup’s success and stagnation. This is where business loans become crucial, offering the much-needed financial support to help startups scale and thrive.

Among the most trusted and accessible platforms for startup financing in India is Kissht. Known for its digital-first approach, easy application process, and fast loan disbursal, Kissht has emerged as a reliable financial partner for startups looking to make their mark.

The Financial Challenges Startups Face

Startups operate in a high-risk environment, especially in their early stages. They often need funds for:

Product development

Hiring skilled professionals

Marketing and brand positioning

Purchasing equipment or software

Expanding to new markets

Yet, traditional financial institutions are often hesitant to provide loans to startups due to lack of collateral, short operational history, or inconsistent cash flows.

This is where a specialized business loan from a fintech company like Kissht proves to be a game-changer.

What is a Business Loan for Startups?

A business loan for startups is a type of unsecured or secured loan offered to new businesses to help meet various operational or growth-related expenses. These loans are tailored to the dynamic needs of emerging companies, offering flexible repayment tenures, minimal documentation, and fast approval.

Kissht business loans are designed specifically with startups in mind, recognizing the unique challenges and potential of these new ventures.

Why Choose Kissht for Your Startup Business Loan?

Kissht stands out in the lending space for several reasons:

1. Easy Online Application

Startup founders are often juggling multiple responsibilities. Kissht offers a fully digital application process through its user-friendly instant loan app. Founders can apply for a loan, upload documents, and track application status all from their smartphones.

2. Quick Approval and Disbursal

Time is critical in the startup ecosystem. Kissht ensures instant personal loan approvals and fast disbursals, allowing you to take timely decisions that could determine your startup’s success.

3. Flexible EMI Options

Founders can plan their repayments using the business loan EMI calculator. This tool helps estimate monthly outflows based on loan amount, tenure, and interest rate ensuring you choose a plan that suits your cash flow.

4. Attractive Interest Rates

Kissht offers competitive business loan interest rates, making it affordable for startups to borrow and invest in their growth. Transparent pricing means there are no hidden charges or surprises.

How Kissht Loans Fuel Innovation

Startups rely heavily on innovation. A loan from Kissht can help in several ways:

A. Product Innovation

Developing a new product or enhancing an existing one often requires investment in research, tools, or specialized manpower. A Kissht loan provides the necessary funds to fuel product innovation without diluting equity.

B. Market Expansion

Breaking into a new market means spending on logistics, marketing, legal setup, and localization. With a quick personal loan from Kissht, founders can tap into new customer segments without waiting for external funding.

C. Technology Upgrades

Modern businesses depend on cutting-edge technology to stay competitive. A Kissht instant loan online enables startups to invest in new software, AI tools, or cybersecurity enhancements without straining their capital reserves.

D. Talent Acquisition

The right team can drive exponential growth. Whether it’s hiring a data scientist, a marketing expert, or a CTO, you can use a Kissht business loan to attract and retain top talent.

Beyond Business Loans: Kissht’s Broader Offerings

While Kissht is known for business loans, it also provides a wide range of financial products:

Instant personal loan: Ideal for urgent personal needs

Loan against property: For larger borrowing needs

Personal loan EMI calculator: Helps plan your repayments smartly

Apply for personal loan online with ease and transparency

The platform also ranks among the best personal loan apps in India for salaried individuals and self-employed professionals alike.

Final Thoughts

In today’s competitive landscape, startups need every possible advantage to succeed. Access to timely and flexible financing can give you the edge you need to grow faster, innovate continuously, and compete effectively. A business loan from Kissht is more than just funding, it’s a partnership that empowers you to pursue your entrepreneurial vision with confidence.

If you’re ready to scale your startup, don’t wait. Apply for a business loan today through Kissht and take the next big step in your journey.

#Kissht Fraud#Kissht Chinese#instant money#Kissht Fosun#loan app#advance loan#kissht reviews#personal loan app#Kissht Illegal#Kissht#Kissht Banned#low-interest loan#personal loan#instant loans

0 notes

Text

Why the HP Laptop Store in Jaipur Is the First Choice for Students and Professionals

Introduction

In a fast-paced city like Jaipur, where education and technology are evolving rapidly, having access to reliable and efficient laptops is a must. Whether you are a student preparing for challenging examinations or a working professional handling remote assignments, a great laptop may significantly increase your productivity. That’s where the hp laptop store in jaipur comes into the picture — giving top-notch products, skilled support, and unsurpassed service.

Wide Range of HP Laptops for Every Need

One of the major aspects of the hp laptop store in jaipur is its vast range of laptops that cater to diverse demands. From budget-friendly models for college students to high-performance PCs for designers, gamers, and corporate users – the store has something for everyone. HP's Pavilion, Envy, Spectre, and Omen series are all available under one roof, making it easy to compare and choose based on your tastes.

Genuine Products and Latest Releases

Buying from an authorized hp laptop store in jaipur ensures you get 100% genuine products with original warranties and invoices. These boutiques often obtain the latest arrivals quicker than online platforms and provide exclusive configurations and color options. Plus, as an official outlet, they maintain clear pricing and give student or festival discounts directly from HP.

Expert Guidance and Technical Support

For students and professionals who may not be tech-savvy, choosing the proper configuration can be a difficulty. Fortunately, the staff at the hp laptop store in jaipur are highly trained and offer competent guidance. They take the time to understand your requirements — whether it’s for programming, graphic designing, online classes, or business tasks — and suggest the best options accordingly. Post-purchase, the business also provides extensive after-sales service and software support.

Easy Financing and Student-Friendly Offers

Many students in Jaipur are often concerned about budget concerns. The hp laptop store in jaipur recognizes this and connects with renowned financial providers to offer convenient EMI alternatives with minimal documentation. Additionally, students can benefit from seasonal bargains, cashback promotions, and complimentary equipment like backpacks, printers, or extended warranties.

Strategic Location and Hassle-Free Experience

Located in prominent sections of Jaipur such as Tonk Road, MI Road, and Malviya Nagar, the HP stores are easily accessible and well-connected. The stores are meant to give a comfortable browsing and purchase experience, with demo machines available for hands-on testing. Customers may stroll in, try several models, examine specs, and make informed decisions without pressure.

Conclusion

With a strong reputation for quality, support, and variety, the hp laptop store in jaipur has become the go-to destination for students and professionals alike. Whether you're buying your first laptop or upgrading to a more powerful machine, these businesses offer a whole package — authenticity, expertise, price, and after-sales care. It's no surprise they are the first pick for Jaipur's tech-savvy generation.

0 notes

Text

Top Benefits of Taking a Loan Against Residential Property

In the world of personal and business finance, a Loan Against Residential Property (LAP) has emerged as one of the most effective ways to secure large funding without selling assets. As a secured loan, it allows borrowers to use their owned residential property as collateral to avail funds for a wide range of needs—from business expansion and education to medical emergencies and debt consolidation.

Here’s a detailed look at the top benefits of choosing a Loan Against Residential Property, and why it continues to be a popular option among borrowers in India.

1. Lower Interest Rates Compared to Unsecured Loans

One of the most significant advantages of a Loan Against Residential Property is the lower interest rate. Since the loan is backed by an immovable asset, the risk to the lender is lower, which translates into more competitive rates for the borrower. This is especially useful when compared to unsecured options like personal loans or credit cards, which typically carry higher interest charges.

2. High Loan Amount Eligibility

Lenders typically offer up to 60%–75% of the market value of the residential property, depending on the borrower’s profile and the lender’s internal policies. This makes it an excellent choice for those needing substantial funds. Whether you're planning a large wedding, funding higher education abroad, or expanding a business, the high loan amount provides the required financial flexibility.

3. Longer Repayment Tenure

A Loan Against Residential Property offers repayment periods of up to 15–20 years, allowing borrowers to manage EMIs without burdening their monthly budget. The extended tenure helps reduce the monthly repayment load, making it an attractive option for salaried individuals and self-employed professionals alike.

4. Utilize Idle Property for Financial Needs

Many homeowners have valuable residential properties that remain unused or generate minimal income. A Loan Against Residential Property enables you to unlock the financial value of your property without having to sell it. This way, your property continues to appreciate in value while simultaneously fulfilling your financial needs.

5. Flexible End-Use of Funds

One of the most versatile features of LAP is that there are no strict restrictions on how the loan amount is used. Borrowers can use the funds for diverse purposes—business investment, children’s education, emergency medical expenses, home renovation, or even purchasing new assets. The flexibility makes it far superior to purpose-specific loans.

6. Quick Processing and Disbursal

Modern lenders now offer faster processing and digital documentation for LAP. With proper paperwork and a clear property title, borrowers can expect loan approval and disbursal within a few working days. Some banks and NBFCs even offer doorstep service for document collection and legal verification.

7. No Need to Liquidate Investments

Instead of breaking your fixed deposits, selling shares, or redeeming mutual funds, you can opt for a Loan Against Residential Property to meet your urgent requirements. This approach ensures your investment portfolio remains intact and continues to yield returns while you fulfill your financial obligations.

8. Improved Loan Eligibility

Since the loan is secured, borrowers with average credit scores may still qualify for LAP, unlike in the case of unsecured loans where credit history plays a more significant role. Additionally, co-applicants and co-owners of the property can help boost the loan eligibility and sanctioned amount.

Final Thoughts

A Loan Against Residential Property is a smart, cost-effective financing tool that allows property owners to leverage their real estate assets without relinquishing ownership. With benefits like lower interest rates, higher loan amounts, longer repayment terms, and flexible usage, LAP stands out as one of the most dependable loan products in the Indian financial ecosystem.

Before proceeding, ensure the property has a clear title and minimal encumbrances. Comparing offers from multiple lenders and reading the fine print can help you secure the best terms for your Loan Against Residential Property.

0 notes

Text

How to Get the Best Auto Loan in East Delhi

Your Roadmap to Easy Car Financing

If you’ve been dreaming of owning a car in East Delhi, you’re not alone. With increasing traffic congestion and the need for personal mobility, more people are turning toward auto loans to make their dream ride a reality. But finding the best auto loan in East Delhi isn’t always simple—unless you know where to look.

In this blog, we’ll cover how to find the most affordable and hassle-free auto loan options, and how platforms like Finiscope can make the journey smoother.

The Rise of Car Ownership in East Delhi

East Delhi is one of the most vibrant and fast-growing areas in the capital. With expanding metro connectivity, new residential areas, and rising incomes, personal mobility is becoming more essential. As car prices continue to rise, more buyers are relying on auto loans in East Delhi to fund their purchases.

But with so many lenders, banks, and digital loan providers in the market, how do you pick the right one?

Key Features of Auto Loans in East Delhi

Here are some things to look out for when evaluating loan options:

✅ Loan Amount

Most lenders offer 85-100% of the car's on-road price. The exact percentage depends on your profile and credit history.

✅ Interest Rates

Interest rates for auto loans in East Delhi typically start from 8% per annum but may vary depending on your CIBIL score and lender policies.

✅ Tenure

You can repay your auto loan over 1 to 7 years. A longer tenure means lower EMIs, but you might pay more interest overall.

✅ Processing Time

Digital platforms have significantly cut down processing times. With the right documents, you can get approval within 24–48 hours.

How Finiscope Helps You Compare Auto Loans in East Delhi

Finiscope is a digital loan marketplace designed to simplify financial decisions for consumers. Instead of manually comparing dozens of loan offers, Finiscope allows you to view, compare, and apply for auto loans in just a few clicks.

Benefits of Using Finiscope:

🔍 Instant Loan Comparison: Side-by-side comparisons of leading lenders in East Delhi

💡 Smart Match Technology: Personalized offers based on your income, credit profile, and car model

📝 Simple Online Application: No paperwork, no bank queues—just upload and submit digitally

📞 Support at Every Step: Get free consultation and assistance from financial experts

Whether you're applying for your first car loan or refinancing an existing one, Finiscope gives you a head start with data-driven decision-making.

0 notes

Text

Using Business Loans to Manage Cash Flow During Economic Uncertainty

In today’s ever-changing business landscape, financial uncertainty has become a common challenge for entrepreneurs. Economic slowdowns, fluctuating demand, delayed payments, and inflation can strain a company’s working capital. During such periods, maintaining steady cash flow becomes critical to survival and success. One effective way to tackle this challenge is by utilizing a business loan, especially through modern platforms like Kissht that offer quick and flexible funding options like an instant business loan via a quick loan app.

1. The Importance of Cash Flow During Economic Slowdowns

Cash flow is the lifeblood of any business. It ensures that day-to-day operations continue smoothly including paying salaries, purchasing inventory, covering rent, and handling emergencies. When economic uncertainty hits, income may slow down while expenses continue.

A temporary cash flow gap, if not addressed quickly, can halt operations or force cost-cutting decisions. That’s why many business owners rely on digital lending platforms like Kissht, where they can access an instant business loan that supports ongoing financial commitments without delay.

2. Why Traditional Loans May Not Be Ideal in Uncertain Times

Traditional loans often involve lengthy paperwork, multiple in-person visits, and long processing times. During an economic downturn, business owners need quick access to capital not a prolonged application process. Moreover, some traditional lenders may tighten their lending criteria during such times.

This is where online loan app solutions stand out. Apps like Kissht offer quick loan app functionality that allows business owners to apply online and receive funds within a short period, depending on eligibility. This flexibility can be a game-changer for businesses trying to stay afloat or seize timely opportunities.

3. Kissht: A Smart Way to Apply for Instant Business Loans

Kissht is a digital platform that simplifies the borrowing process for both personal and business needs. With a user-friendly interface, minimal documentation, and transparent terms, Kissht allows business owners to apply for an instant business loan directly through a quick loan app.

You don’t need to visit a bank or go through complicated steps just download the app, upload your KYC and business details, and track your loan application in real time. This ease of access is especially helpful during uncertain financial periods when time is critical.

4. How Instant Business Loans Improve Cash Flow

An instant business loan can help your business by:

Covering urgent expenses such as rent, salaries, or vendor payments.

Supporting working capital during sales slumps or seasonal slowdowns.

Seizing short-term business opportunities (such as stocking inventory at a discount).

Avoiding delays in operations due to cash crunches.

Using a business loan calculator or a business loan EMI calculator allows you to plan repayments without overburdening your monthly budget.

5. Advantages of Using a Quick Loan App for Business Loans

Here’s how a quick loan app benefits businesses:

Accessibility: You can apply from anywhere, anytime.

Speed: Faster loan processing means quicker disbursal.

Transparency: Clear information about EMIs, repayment tenure, and documentation.

Digital Tracking: Real-time status updates reduce uncertainty.

Platforms like Kissht combine all these benefits, making the experience seamless and efficient especially useful when managing urgent financial needs.

6. Personal vs. Business Loans: Choosing the Right Option

When managing finances during uncertain times, it’s important to choose the right type of loan. A business loan is ideal for covering expenses like salaries, inventory, or marketing. If you need quick funds, applying for an instant business loan through Kissht’s quick loan app can be a smart move it’s fast, easy, and tailored for business needs.

A personal loan may help with smaller expenses but might come with higher interest rates. You can use tools like a personal loan EMI calculator to plan repayment, but it’s not always the best fit for business cash flow.

A loan against property works for large capital needs but takes longer to process and requires collateral. If time and flexibility matter, an instant business loan from Kissht is often the most practical option.

7. Tools That Help You Plan Repayments

Before applying for a loan, it’s important to calculate your EMI to understand how the loan fits into your monthly budget. You can use:

Business loan EMI calculator

Personal loan interest rate calculator

PL loan EMI calculator

These tools help you estimate monthly repayments and select the right tenure and loan amount, keeping cash flow smooth and manageable.

8. Steps to Apply for a Business Loan via Kissht

Here’s how you can apply for a business loan on Kissht in just a few steps:

Download the Kissht App from the Play Store or App Store.

Register your business or personal details.

Upload KYC and income documentation.

Choose loan type and amount e.g., instant business loan.

Submit and track your application status within the app.

This fully digital process ensures you’re not delayed by traditional paperwork or slow bank approvals perfect for managing cash flow during a financial crunch.

9. Final Thoughts

Managing cash flow during economic uncertainty is not easy but it is possible with the right financial tools. Using an instant business loan from Kissht, applied via a quick loan app, helps you bridge financial gaps without disrupting operations.

Whether you’re a small business owner, entrepreneur, or startup, platforms like Kissht provide flexible credit solutions to help you move forward with confidence even in uncertain times.

#advance loan#cash loan app#instant loan#loan app#loan apps#low-interest loan#short-term loan#quick loans#quick loan#personal loan app#online personal loans#online instant loans#instant money

1 note

·

View note

Text

Common Mistakes First-Time Homebuyers Should Avoid

Common Mistakes

Buying your first home is a big milestone—exciting, life-changing, and sometimes, a bit overwhelming. For many first-time homebuyers, the process is full of unknowns. From budgeting to finalizing the deal, there are several steps where things can go wrong. To help you avoid common pitfalls, here are the most frequent mistakes first-time buyers make—and how you can steer clear of them.

1. Not Setting a Realistic Budget

One of the most common mistakes is starting the home search without knowing how much you can afford. Many buyers fall in love with properties that are outside their budget, which can lead to financial stress later. Before house hunting, get pre-approved for a home loan and understand your total budget, including the down payment, monthly EMIs, registration charges, and maintenance fees.

Tip:

Don’t just think about the purchase price. Factor in ongoing costs like property taxes, insurance, and upkeep.

2. Skipping Home Loan Pre-Approval

Many first-time buyers begin looking at homes without consulting a bank or financial institution. This can lead to disappointment if you find a property you love but can’t secure a loan in time. A loan pre-approval gives you a clear idea of how much you can borrow and shows sellers that you're a serious buyer.

3. Not Researching the Location

Location is one of the most important aspects of buying a home. Sometimes, buyers get attracted to a beautifully designed property but ignore key location factors such as connectivity, safety, water supply, traffic congestion, or future development plans.

Tip:

Visit the neighborhood at different times of the day, talk to locals, and check nearby facilities like schools, hospitals, and markets.

4. Ignoring Additional Costs

Many first-time buyers focus only on the price of the property. However, buying a home comes with several extra costs, including stamp duty, registration charges, legal fees, home insurance, and interior work. These hidden expenses can add up quickly and impact your budget.

Tip:

Ask your real estate agent or advisor to provide a detailed breakdown of all costs involved.

5. Not Hiring a Real Estate Agent

Some first-time buyers try to do everything on their own, thinking they can save money. However, a good real estate agent can guide you through the entire process, help with paperwork, negotiations, and ensure you don’t fall for overpriced or illegal properties.

6. Overlooking Home Inspection

Many buyers skip a proper home inspection, especially when buying a ready-to-move-in or resale property. This can lead to costly repairs down the line. Always inspect the property for structural issues, plumbing, electrical systems, and overall condition.

7. Letting Emotions Take Over

It’s easy to get emotionally attached to a house, but that can cloud your judgment. Some buyers end up overpaying or compromising on critical features because they “fell in love” with the space. Always evaluate a property logically and don’t rush your decision.

8. Not Understanding the Legal Process

Many first-time buyers do not understand the legal aspects of a property deal. This can lead to delays or disputes. Ensure the property has clear legal titles, the builder has all necessary approvals, and the transaction is done with proper documentation.

Consider hiring a legal expert to review documents before making any commitments.

Bonus Tip: Use a Trusted Platform

If you’re a first-time buyer, using a reliable real estate platform like MultiOwner can make the process much smoother. MultiOwner offers verified listings, professional guidance, and ensures transparency in every transaction.

Conclusion

Buying your first home should be a happy and fulfilling experience. By avoiding these common mistakes, you can make smarter decisions, stay within budget, and find a home that’s right for you. Take your time, do your research, and don’t hesitate to seek help from professionals. The right guidance can make all the difference.

0 notes

Text

"Break the Chains: Unleash Instant Funds with IDFC First Bank Personal Loan"

When you’re chasing money, time is your enemy. Banks stall, paperwork piles up, and before you know it, your opportunity is gone. If you’re done waiting, done negotiating, and done compromising, it’s time to choose a lender that moves with the same urgency as you do. IDFC First Bank isn’t just a bank—it’s a weapon for financial speed and freedom.

No more long queues. No more excuses. Just cold, hard cash delivered fast—with IDFC First Bank Personal Loans.

Why IDFC First Bank? Because Speed and Simplicity Win

Let’s cut through the noise.

IDFC First Bank offers high-speed personal loans backed by digital innovation, flexible eligibility, and some of the most competitive interest rates in the game. This isn’t traditional banking. This is a new-age lending machine built for salaried and self-employed individuals who want money without drama.

What You Get with an IDFC First Bank Personal Loan

Loan Amounts: Up to ₹40 lakhs

Tenure Options: 6 months to 60 months

Interest Rates: Starting from 10.49% p.a.

Processing Time: As little as a few hours

Application Mode: 100% online

Collateral: None. Just your word and your income.

This is the no-nonsense way to secure funding—without begging, chasing, or compromising.

Who’s Eligible? The Rules Are Simple, and Built to Empower

To apply for an IDFC First Bank personal loan, here’s what you need:CriteriaRequirement Age 23 to 60 years Employment Salaried or self-employed Monthly Income ₹20,000 or more CIBIL Score Preferably 700+ (exceptions may apply) Location PAN-India coverage Work Experience Minimum 6 months (salaried), 2 years (self-employed)

If you’re earning steadily and have basic financial discipline, you’re already halfway there.

How to Apply for IDFC First Personal Loan Online

You want a loan. Not a lecture. Here’s the fastest path:

Visit IDFC First Bank’s digital loan platform.

Fill out the quick loan form with your basic details.

Upload your KYC documents—PAN, Aadhaar, income proof, bank statement.

Get an instant eligibility check based on your profile.

Choose your loan amount and tenure.

Accept the terms, e-sign, and wait for disbursal.

Approval can be granted within hours, and money hits your account without delay.

Interest Rates and Charges: Transparent, Sharp, and No Surprises

Fee TypeDetails Interest Rate Starting from 10.49% p.a. Processing Fee Up to 2% of loan amount Prepayment Charges Zero after lock-in period Late Payment Fee ~2% per month Foreclosure Allowed after 6 EMIs

This isn’t a “gotcha” loan. This is crystal-clear lending designed for the digitally bold and financially aware.

Who Should Use This Loan?

This loan isn’t for fence-sitters. It’s for:

Salaried professionals facing an urgent cash crunch

Self-employed entrepreneurs needing working capital

Medical emergencies that don’t wait

Big-ticket purchases or debt consolidation

Individuals rebuilding credit with reliable repayment

You don’t need a million reasons. You just need one. And IDFC First Bank delivers.

Key Advantages That Put IDFC First Bank Ahead

Hyper-fast digital approval

No branch visits, no manual delays.

Flexible repayment structure

Customize your EMI to suit your income flow.

Zero collateral

Your creditworthiness is enough.

Attractive balance transfer offers

Reduce burden by moving from high-interest loans.

High loan amounts for top-tier profiles

Get up to ₹40 lakhs with just a few clicks.

This is aggressive lending with a customer-first backbone.

Mistakes to Avoid When Applying

If you're serious about approval, don’t play loose:

Don’t lie about income or employment status.

Don’t apply with incomplete documents.

Don’t bounce EMIs—IDFC First Bank reports to credit bureaus instantly.

Don’t ignore terms. Read every clause before you sign.

Apply smart, repay smarter—and you’ll earn the trust of a lender that rewards loyalty.

Use Case: Meet Arjun, 32, Marketing Professional

Arjun needed ₹5 lakhs fast to cover a family medical emergency. Traditional banks asked for collateral or weeks of paperwork. He chose IDFC First Bank.

Applied online at 10 AM

Verified documents and got approval by 3 PM

₹5 lakhs disbursed by 6 PM the same day

That’s not just service—that’s financial firepower in real-time.

Your Game Plan: Win Big with a Personal Loan from IDFC First Bank

Compare your eligibility before applying.

Check your EMI using the loan calculator on IDFC’s portal.

Opt for auto-debit to avoid late penalties.

If your credit score is borderline, add a co-applicant.

Don't just hope for approval. Engineer your success.

Final Thoughts: Stop Waiting. Start Winning.

The old-school way of applying for loans is dead. You don’t have time to beg. You don’t have time to wait. You need money fast—and you need a lender who treats your urgency with the respect it deserves.

That lender is IDFC First Bank.

From seamless digital application to competitive interest rates and lightning-speed disbursals, this is not just a loan—it’s a solution.

0 notes

Text

Apply for Home Loan Online in 2025 – Instant Approval, Lowest Rates & Zero Income Proof Needed!

In 2025, the dream of owning a home is now more achievable than ever. With the rise of digital lending platforms and streamlined online home loan applications, you can now get your home loan approved instantly, without the hassle of heavy paperwork or long waiting times. Whether you're a salaried employee, a self-employed individual, or even someone with limited income proof, there's a solution waiting for you.

Let’s explore how to apply for a home loan online, compare top offers, understand interest rates, and know what documents are actually needed in today’s fast-paced, low-documentation era.

Why Are Home Loans Going Digital in 2025?

The shift toward digital platforms is driven by three major factors:

Ease of Application via online housing loan applications

Instant Approvals using tools like Faircent EMI Calculator and real-time eligibility checks

Fewer Documents Required, ideal for users searching home loan with minimum documentation

Platforms like Investkraft have partnered with trusted lenders to help users apply for home loans online, offering fast tracking, smart interest comparisons, and complete transparency.

Instant Home Loan Online in 2025: How It Works

Visit a Verified Portal

Select 'Apply Now for Home Loan'

Use EMI tools (like Faircent EMI Calculator) to assess repayment comfort

Submit Basic KYC & Property Details

Get Instant Approval from leading banks/NBFCs

Popular platforms like Insta Home Loan, Upwards, and Fullerton India have made this process smooth and paperless.

Documents Required for Online Home Loan Application (Minimal!)

Many users search for "documents required for home loan" and worry about long lists. But in 2025, minimal documentation is the new norm:

PAN Card & Aadhaar

Address Proof

Income Proof (optional for select lenders)

Property Documents

You can even apply for a home loan without income proof under specific low-income or no-CIBIL plans.

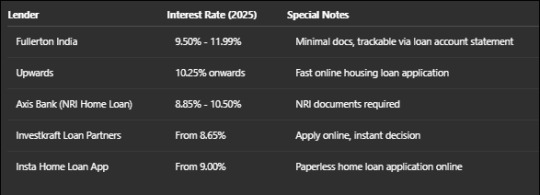

Home Loan Interest Rate Trends in 2025

Let’s break down the home loan current interest rate across popular lenders:

Always check what interest rate is being charged for your specific loan amount and profile.

What Are the Charges on Home Loan in 2025?

Before signing your loan agreement, review all charges on the home loan, including:

Processing Fee: 0.25% to 1.5%

Incidental Charges: Fees incurred due to legal, valuation, or follow-up processes

Prepayment/Foreclosure Charges: Often NIL for floating rates

Stamp Duty: As per state laws

Understanding what incidental charges are in a home loan helps avoid future disputes.

Who Can Apply for a Home Loan Online?

You are eligible if you are:

Salaried or Self-employed (even with a loan, app-based salary)

Looking for house loan app based options

Need home construction loans or a top-up loan on a home loan

Seeking investment property loan requirements

You can even check how much of a home loan you can get on a 40,000 salary using online eligibility calculators from platforms like Investkraft.

Types of Home Loans You Can Apply For

Regular Home Purchase Loan

Home Construction Loan

Plot + Construction Loan

Top-Up Loan on Existing Home Loan

NRI Home Loan

Home Loan for Investment Property

Use the home loan eligibility tools provided by your lender or platforms like Investkraft partner network to know which one fits your needs.

Benefits of Using Platforms Like Investkraft

Compare home loan offers from 30+ lenders

One-stop portal to track status, download Fullerton India loan account statement, or check reviews (Investkraft reviews)

Option to apply from anywhere via the home loan online application system

Real User Story: From ₹40K Salary to Dream Home

Ravi, a digital marketer earning ₹40,000/month, thought home ownership was a distant dream. With the help of Investkraft, he:

Used a home loan EMI calculator India tool

Found a low-interest home loan offer with minimum documentation

Got approved via online housing loan application in under 24 hours

Today, Ravi is repaying his loan comfortably using EMI auto-debit, and has even applied for a top-up loan on his home loan to renovate his kitchen.

FAQs About Online Home Loans in India (2025)

1. What are the charges for a home loan in 2025?

Ans: Expect processing fees (0.25%-1.5%), incidental charges, and stamp duty. Most lenders have NIL foreclosure charges now.

2. Can I apply for a home loan without income proof?

Ans: Yes. Several lenders offer home loans with minimum documentation or alternative income verification.

3. Which bank home loan interest is low in 2025?

Ans: Axis Bank, SBI, and partners of Investkraft currently offer competitive rates starting from 8.65%.

4. How to apply for a house loan online?

Ans: Visit a portal like Investkraft, enter your details, upload basic documents, and get pre-approved instantly.

5. What documents do NRIs need for a home loan?

Ans: Passport, visa, salary slips, NRE/NRO account proof, and property documents. See Axis Bank NRI home loan documents for the full list.

Final Thoughts: Apply Now for a Home Loan Without Stress

Whether you're a first-time buyer, an NRI investor, or looking to refinance your current home, 2025 is the best time to get your home loan approved online. With tools like Faircent EMI Calculator, apps like Insta Home Loan, and trusted portals like Investkraft, you can skip the old-school queues and submit your application from the comfort of your home.

So why wait?

Apply now for a home loan online and turn your property dream into a reality with low interest, fast approval, and zero hassle.

#online home loan application#faircent emi calculator#online housing loan application#home loan offer#investkraft loan#upwards loan interest rate#investkraft partner#fullerton india home loan interest rate#insta home loan#site:investkraft.com#what is incidental charges in home loan#home loan investment#home loan interest rate#fullerton india loan account statement#what are the charges for home loan#what interest rate#axis bank nri home loan documents#apply for house loan#mpokket loan documents#charges on home loan#home loan current interest rate#investment property loan requirements#which bank home loan interest is low#house loan app#housing home loan#home loan apply online#home loan online apply#apply for home loan online#investkraft reviews#apply now for home loan

0 notes

Text

Plots in Ramohalli for Sale: Key Factors to Consider Before Making a Purchase

Considering buying a plot at MRCL SylvanWoods in Ramohalli? It's an exciting opportunity, but making a smart move requires more than just falling for the location. You need to check many important details before signing on the dotted line. A key investment like this can pay off, but only if you do your homework. From location and legal checks to future growth potential, here's what you need to consider to make an informed choice: Plots in Ramohalli for sale.

Overview of MRCL SylvanWoods in Ramohalli

Location and Accessibility

Ramohalli is growing fast. It's well connected to Bangalore’s main hubs, making daily commute easier. The proximity to major roads, bus stops, and upcoming metro lines boosts its appeal. Plus, residents can enjoy nearby schools, hospitals, shopping malls, and retail outlets. Future infrastructure plans, like road widening and new public transport routes, will likely improve connectivity even more. Location isn’t just about convenience; it impacts property value over time.

Project Highlights and Features

SylvanWoods offers more than just land— it promotes a lifestyle. Expect large green spaces and well-planned community amenities like parks, playgrounds, walkways, and security services. The project’s developer has a strong track record with past successful ventures, which adds reliability. The plots come in various sizes, making it flexible for different budgets and needs. Prices are trending upward, reflecting high demand and the project's quality.

Market Position and Investment Potential

Real estate in Ramohalli is on the rise, with appreciation rates often surpassing 10% annually for premium plots. SylvanWoods benefits from this trend, meaning your investment could grow steadily. Many early investors share stories about significant gains within just a few years. While market fluctuations are normal, the area's future development plans suggest long-term potential for property value increases.

Factors to Consider When Buying MRCL SylvanWoods Plots

Legal Due Diligence and Documentation

Title Deeds and Ownership Rights

Always verify the property’s title deed. Ensure the seller has clear ownership rights, and no disputes exist. It's a good idea to hire a legal expert to review all documents. A clear title means no surprises later on.

Regulatory Approvals and Clearances

Check whether the project has approval from relevant authorities like the Bangalore Development Authority (BDA) or Bruhat Bengaluru Mahanagara Palike (BBMP). Confirm the land use complies with zoning rules. Without proper permissions, your investment could become risky or even illegal.

Encumbrances and Litigation Checks

Make sure the land isn't tied up by loans or legal disputes. Conduct thorough background checks to avoid future headaches. Legal experts can assist in tracing encumbrances or ongoing litigation related to the plot.

Location and Infrastructure Development

Connectivity and Accessibility

Think about how close the plots are to major roads, railway stations, or upcoming airport plans. The better the accessibility, the higher the resale value. Future infrastructure projects can turn a once-remote area into a prime locale.

Utilities and Infrastructure

Confirm that essential amenities like water, electricity, sewage, and internet are available. Location near schools, hospitals, and shopping centers adds convenience and boosts property worth.

Pricing, Payment Plans, and Financial Aspects

Current Market Pricing Trends

Compare SylvanWoods plots with similar offerings nearby. Are the prices competitive? Does the price for your chosen plot match its size, location, and features? Make sure you’re paying fair market value.

Payment Options and Financing

Many developers offer flexible plans like EMIs or bank loans. Explore options for the best interest rates and terms. Negotiating payment terms can save you money and give you more financial breathing room.

Future Growth and Resale Value

Urban Development Plans

Local government projects impact property appreciation. Upcoming roads, commercial zones, and industrial hubs can dramatically boost the value of SylvanWoods plots. Keep an eye on government schemes that support infrastructural growth.

Environmental and Sustainability Factors

Green spaces, eco-friendly designs, and sustainable development practices attract buyers and tenants alike. They also help preserve land value over time, making your investment more secure.

Resale Possibilities

Resale depends on location, demand, and market trends. A well-located plot near future developments offers better chances for quick resale. Carefully consider long-term liquidity to maximize potential returns.

Expert Insights and Real-World Examples

Real estate experts often highlight Ramohalli’s growing potential due to its connectivity and development plans. Many investors have seen good gains by investing early here. However, some buyers have faced setbacks because of overlooked legal issues or poor infrastructure analysis. The biggest lesson? Never skip thorough due diligence — it’s your best tool for safe investing.

Conclusion

Buying a plot in Ramohalli can be rewarding if you approach it wisely. Focus on verifying legal documents, understanding the location’s growth prospects, and assessing financial options. A long-term view backed by research and professional advice increases your chances of success. Whether you plan to build your dream home or invest, doing your homework now helps unlock the area’s full potential and safeguards your money. Choose smartly — your future self will thank you.

0 notes

Text

Drive Your Dream Kia in Bangalore — Naara Kia Has the Perfect Model for You!

Your Journey Starts at Naara Kia in Bangalore

Looking to upgrade your driving experience in Bangalore? Whether it’s style, safety, or innovation you're after, Naara Kia offers a full lineup of the latest Kia vehicles to match your unique needs. Conveniently located in JP Nagar, Naara Kia is more than just a car showroom, it's a one-stop destination where your dream car becomes a reality.

Visit us!

From bold SUVs to dynamic sedans, every model at Naara Kia blends advanced features with Kia’s signature performance and design. And with unmatched customer service, unbeatable pricing, and exciting offers, driving home your ideal Kia has never been easier.

Why Choose Naara Kia in Bangalore?

A Full Lineup of Latest Kia Models

Naara Kia features a wide range of vehicles, including:

Kia Seltos – Perfect for those who love bold styling and smart technology.

Kia Sonet – A compact SUV ideal for city roads with a big personality.

Kia Carens – Designed for families who want comfort, space, and safety.

Kia EV6 – Kia’s award-winning electric crossover that redefines innovation.

Whether you’re looking for your first car or upgrading to something more premium, Naara Kia has something for everyone.

Value-Driven Pricing and Offers

At Naara Kia, you’ll find:

Special launch offers on new models

Exchange bonuses for old cars

Attractive EMI and finance plans

Corporate and festive discounts

Every purchase is backed by complete transparency and tailored financing options to suit your budget.

Customer Experience You Can Trust

The team at Naara Kia believes in putting the customer first. From the moment you walk in, you’re treated to a hassle-free, informative experience. You can expect:

Detailed walkthroughs of each model

Personalized recommendations

Quick loan processing

Easy documentation

What Makes Kia Stand Out in Bangalore?

Kia has earned a strong reputation among city drivers and suburban families alike across Bangalore. Here’s why it continues to be a top choice:

Modern Design: Every Kia model boasts eye-catching styling that suits both business and family lifestyles.

Advanced Safety: With features like electronic stability control, multiple airbags, and hill-assist, Kia prioritizes your safety on every drive.

Tech Integration: From large infotainment screens to connected car technology, Kia vehicles are built for the modern driver.

Fuel Efficiency & EV Options: Whether you prefer petrol, diesel, or electric, Kia offers models designed to deliver performance without compromising mileage.

Low Maintenance Costs: Built to last, Kia cars offer reliability and efficiency, reducing the cost of ownership in the long run.

Expert Guidance Every Step of the Way

Buying a car can be overwhelming, but not at Naara Kia. The team is trained to guide you through the process from start to finish:

They help you understand every feature and match it to your real-world needs.

If you’re unsure about financing, they help you compare plans, interest rates, and approval timelines.

New to car ownership? They'll walk you through insurance, registration, service schedules, and more.

This hands-on approach ensures you feel confident and supported at every stage of your car-buying journey.

Conveniently Located in JP Nagar

Strategically located in JP Nagar, Naara Kia is easily accessible from key areas like:

Jayanagar

BTM Layout

Banashankari

Bannerghatta Road

Kanakapura Road

With a modern showroom and ample parking space, your visit is guaranteed to be convenient and welcoming.

Conclusion: Your Dream Kia Awaits

If you’re ready to elevate your driving experience, there’s no better place than Naara Kia in Bangalore. With a wide model range, expert assistance, competitive pricing, and reliable after-sales service, Naara Kia ensures you drive away not just with a car, but with confidence.

Visit Naara Kia today — your dream Kia is waiting for you in JP Nagar.

#Kia in Bangalore#Kia Showroom Bangalore#Kia Dealership Bangalore#Kia Showroom near me#Kia Dealership near me#Kia Service in Bangalore#Kia Service center near me

0 notes

Text

Easy Car Loan in Noida – Get New & Used Car Loans at Best Rates

Looking for a car loan in Noida? Get instant approval for new and used car loan in Noida with low interest rates. Apply online and drive your dream car today.

If you’re planning to buy a car and need financial support, getting a car loan in Noida is now easier than ever. Whether you’re buying a brand-new car or a second-hand vehicle, multiple loan options are available to match your needs and budget.

Car Loan in Noida – Drive Your Dream Vehicle Today

In Noida, top banks and NBFCs offer car loans with flexible EMI options, minimal paperwork, and fast approvals. If you're salaried or self-employed, you can easily qualify for a loan with basic documents like ID proof, income proof, and bank statements.

Key Features:

Loan up to 100% of on-road price

Attractive interest rates starting from 8.5%*

Tenure from 1 to 7 years

Fast disbursal and easy online application

Used Car Loan in Noida – Affordable Financing for Pre-Owned Cars

Buying a pre-owned car? A used car loan in Noida is a smart option to finance your second-hand vehicle. Most banks provide loans for used cars up to 5 years old with competitive rates and flexible terms.

Why Choose Used Car Loan?

Lower EMIs compared to new car loans

Loan available for cars up to 10 years old

Quick loan disbursal with minimal documentation

How to Apply?

You can apply online for both new and used car loan in Noida through trusted lenders. Just fill out a simple form, submit your documents, and get approval within 24–48 hours.

Conclusion:

Whether you’re purchasing your first vehicle or upgrading to a better one, getting a car loan in Noida or a used car loan in Noida is now fast, easy, and convenient. Start your journey today with the right financing partner!

0 notes