#ESG Performance Management

Text

“Like everything based on the writings of Karl Marx—seeing oppressors and colonial struggles everywhere—DEI was doomed to fail. The uniformity of thought known as intersectionality, fostered by DEI, meant all oppressed people must support all others who are oppressed. But that idea burst on Oct. 7 when Hamas raped, murdered and kidnapped Israelis. Many liberals, especially Jewish ones, couldn’t support genocidal “colonized” terrorists. Pop! The long march is in retreat.

By the way, ESG, or investing based on “environmental, social and governance” principles, peaked last June, when BlackRock CEO Larry Fink said he would stop using “the word ESG anymore, because it’s been entirely weaponized.” Never mind that performance of ESG funds has been sketchy and that BlackRock had been adding the label “sustainable” or “ESG” to funds and charging up to five times as much. Then a study published in December by Boston University’s Andrew Kingfound “no reliable evidence for the proposed link between sustainability and financial performance.” Pop!

Most offensive to me was DEI’s devious underlying agenda: societal design. 𝐁𝐥𝐢𝐧𝐝𝐞𝐝 𝐛𝐲 𝐟𝐚𝐧𝐚𝐭𝐢𝐜𝐚𝐥 𝐝𝐞𝐯𝐨𝐭𝐢𝐨𝐧, 𝐚𝐜𝐭𝐢𝐯𝐢𝐬𝐭𝐬 𝐰𝐞𝐫𝐞 𝐩𝐚𝐰𝐧𝐬 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐜𝐚𝐮𝐬𝐞 𝐨𝐟 𝐫𝐞𝐬𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐰𝐨𝐫𝐥𝐝 𝐢𝐧𝐭𝐨 𝐚 𝐜𝐨𝐥𝐥𝐞𝐜𝐭𝐢𝐯𝐞 𝐮𝐭𝐨𝐩𝐢𝐚 𝐭𝐨 𝐛𝐞 𝐫𝐮𝐧, 𝐨𝐟 𝐜𝐨𝐮𝐫𝐬𝐞, 𝐛𝐲 𝐩𝐫𝐨𝐠𝐫𝐞𝐬𝐬𝐢𝐯𝐞, 𝐬𝐞𝐥𝐟-𝐢𝐝𝐞𝐧𝐭𝐢𝐟𝐲𝐢𝐧𝐠 𝐞𝐥𝐢𝐭𝐞𝐬. That was the “my truth” that Ms. Gay invoked on her exit. Critical theories and Marxist techniques would take power from you and me, using big government as the enforcer.

The new societal design, embedded in DEI and ESG, envisioned idyllic communal progress. 𝐇𝐢𝐬𝐭𝐨𝐫𝐲 𝐬𝐡𝐨𝐰𝐬 𝐭𝐡𝐢𝐬 𝐧𝐞𝐯𝐞𝐫 𝐰𝐨𝐫𝐤𝐬 𝐛𝐞𝐜𝐚𝐮𝐬𝐞 𝐩𝐨𝐰𝐞𝐫 𝐜𝐨𝐫𝐫𝐮𝐩𝐭𝐬. Diversity meant ideological conformity. Equity meant discrimination. Inclusion meant blurring the sexes. Men winning women’s athletic events would be considered normal. It was all theatrics, like the tampons I’ve seen in men’s bathrooms on Ivy League campuses. Somewhere George Orwell is rolling on the floor laughing.

One goal of progressive societal design is to shrink—depopulation. Twenty-somethings now question having children. Net zero and degrowth, both World Economic Forum approved, are pushed via energy myths: carbon bad, cows bad. A plant-based chicken in every pot and two electric cars in every garage. They envy the merit-touting rich, shout “inequality” and wear “Tax the Rich” dresses. They tear down statues to erase history. How did we let this happen?

𝐖𝐡𝐢𝐥𝐞 𝐌𝐚𝐫𝐱𝐢𝐬𝐦 𝐢𝐬 𝐚 𝐦𝐞𝐚𝐧𝐬 𝐨𝐟 𝐠𝐚𝐢𝐧𝐢𝐧𝐠 𝐩𝐨𝐰𝐞𝐫 𝐭𝐨 𝐢𝐦𝐩𝐥𝐞𝐦𝐞𝐧𝐭 𝐬𝐨𝐜𝐢𝐞𝐭𝐚𝐥 𝐝𝐞𝐬𝐢𝐠𝐧, 𝐢𝐭 𝐪𝐮𝐢𝐜𝐤𝐥𝐲 𝐭𝐮𝐫𝐧𝐬 𝐚𝐮𝐭𝐡𝐨𝐫𝐢𝐭𝐚𝐫𝐢𝐚𝐧. There was very little free speech at Harvard—the Foundation for Individual Rights and Expression ranked it last of all colleges last year. Those against the societal-design agenda were shouted down. Dissent was met with accusations of privilege or cancellation. Conform or be cast out. On a larger scale, the Biden administration co-opted social media to censure opposing views.

I, like most Americans, am for diversity, but not when it’s forced or mandated. In a 2017 interview, Mr. Fink admitted BlackRock would use DEI tactics to “force behaviors” of corporations on “gender or race,” including via management compensation. Now that’s power.

𝐓𝐡𝐢𝐬 𝐩𝐨𝐰𝐞𝐫 𝐢𝐧𝐞𝐯𝐢𝐭𝐚𝐛𝐥𝐲 𝐥𝐞𝐚𝐝𝐬 𝐭𝐨 𝐚 𝐦𝐚𝐫𝐜𝐡 𝐨𝐟 𝐢𝐧𝐭𝐞𝐥𝐥𝐞𝐜𝐭𝐮𝐚𝐥 𝐜𝐨𝐫𝐫𝐮𝐩𝐭𝐢𝐨𝐧 𝐭𝐡𝐫𝐨𝐮𝐠𝐡 𝐢𝐧𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧𝐬, 𝐰𝐡𝐢𝐜𝐡 𝐰𝐞’𝐯𝐞 𝐬𝐞𝐞𝐧 𝐚𝐭 𝐇𝐚𝐫𝐯𝐚𝐫𝐝, 𝐭𝐡𝐞 𝐁𝐢𝐝𝐞𝐧 𝐚𝐝𝐦𝐢𝐧𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐞𝐥𝐬𝐞𝐰𝐡𝐞𝐫𝐞. Does national security adviser Jake Sullivan really care about equity or climate change? It polled well and put him back in power to implement his own societal design via “industrial strategy.”

𝐓𝐡𝐞 𝐠𝐨𝐨𝐝 𝐧𝐞𝐰𝐬 𝐢𝐬 𝐭𝐡𝐚𝐭 𝐞𝐜𝐨𝐧𝐨𝐦𝐢𝐜𝐬 𝐞𝐯𝐞𝐧𝐭𝐮𝐚𝐥𝐥𝐲 𝐨𝐮𝐭𝐥𝐚𝐬𝐭𝐬 𝐭𝐡𝐞 𝐜𝐨𝐧𝐭𝐫𝐨𝐥 𝐟𝐫𝐞𝐚𝐤𝐬. 𝐂𝐞𝐧𝐭𝐫𝐚𝐥 𝐩𝐥𝐚𝐧𝐧𝐢𝐧𝐠 𝐥𝐨𝐬𝐞𝐬. 𝐑𝐞𝐚𝐥 𝐥𝐢𝐟𝐞 𝐢𝐬 𝐚𝐛𝐨𝐮𝐭 𝐦𝐚𝐫𝐤𝐞𝐭𝐬 𝐭𝐡𝐚𝐭 𝐞𝐯𝐞𝐫𝐲 𝐝𝐚𝐲 𝐭𝐫𝐚𝐧𝐬𝐦𝐢𝐭 𝐭𝐫𝐢𝐥𝐥𝐢𝐨𝐧𝐬 𝐨𝐟 𝐩𝐫𝐢𝐜𝐞 𝐬𝐢𝐠𝐧𝐚𝐥𝐬 𝐨𝐟 𝐡𝐮𝐦𝐚𝐧 𝐝𝐞𝐬𝐢𝐫𝐞𝐬. Those prices inform production much better than any government bureaucrat or Harvard professor. Societal design—remember Lyndon B. Johnson’s Great Society?—requires government control. I’ll take freedom.

Preferred pronouns are fading. College admissions, and maybe hiring, based on race is illegal. DEI departments are being deconstructed. But while the DEI movement may have peaked, like that Monty Python character, it’s not dead yet. 𝐓𝐡𝐞 𝐟𝐞𝐯𝐞𝐫𝐢𝐬𝐡 𝐰𝐡𝐢𝐧𝐢𝐧𝐠 𝐨𝐟 𝐭𝐡𝐨𝐬𝐞 𝐠𝐫𝐚𝐬𝐩𝐢𝐧𝐠 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐥𝐚𝐬𝐭 𝐫𝐞𝐢𝐧𝐬 𝐨𝐟 𝐩𝐨𝐰𝐞𝐫 𝐰𝐢𝐥𝐥 𝐩𝐫𝐨𝐛𝐚𝐛𝐥𝐲 𝐠𝐞𝐭 𝐰𝐨𝐫𝐬𝐞 𝐛𝐞𝐟𝐨𝐫𝐞 𝐃𝐄𝐈 𝐞𝐯𝐞𝐧𝐭𝐮𝐚𝐥𝐥𝐲 𝐝𝐢𝐞𝐬 𝐰𝐢𝐭𝐡 𝐚 𝐰𝐡𝐢𝐦𝐩𝐞𝐫.”

— Andy Kessler//WSJ

#wsj#thank god#dei must die#regressive ideology#luxury beliefs#striver class parroting of fashionable ideas that never work for working class and poor people#plantationeering 2.0#pseudo white guilt religion#society#Utopianism#elitism#Orwellian#Cadillac communism#equality NOT equity#reality wins#human nature#control#social engineering#emotionalism#wef#world economic forum#Andy Kessler#wall streeet journal#Marxism#apparatchiks#racism in virtuous looking clothing#pseudointellectualism#dehumanizing socially regressive mindfuck#diversity equity and inclusion#dei

23 notes

·

View notes

Text

Best 10 Business Strategies for year 2024

In 2024 and beyond, businesses will have to change with the times and adjust their approach based on new and existing market realities. The following are the best 10 business approach that will help companies to prosper in coming year

1. Embrace Sustainability

The days when sustainability was discretionary are long gone. Businesses need to incorporate environmental, social and governance (ESG) values into their business practices. In the same vein, brands can improve brand identity and appeal to environmental advocates by using renewable forms of energy or minimizing their carbon footprints.

Example: a fashion brand can rethink the materials to use organic cotton and recycled for their clothing lines. They can also run a take-back scheme, allowing customers to return old clothes for recycling (not only reducing waste but creating and supporting the circular economy).

2. Leverage AI

AI is revolutionizing business operations. Using AI-fuelled solutions means that you can automate processes, bring in positive customer experiences, and get insights. AI chatbots: AI can be utilized in the form of a conversational entity to support and perform backend operations, as well.

With a bit more specificity, say for example that an AI-powered recommendation engine recommends products to customers based on their browsing history and purchase patterns (as the use case of retail). This helps to increase the sales and improve the shopping experience.

3. Prioritize Cybersecurity

Cybersecurity is of utmost important as more and more business transitions towards digital platforms. Businesses need to part with a more substantial amount of money on advanced protective measures so that they can keep sensitive data private and continue earning consumer trust. Regular security audits and training of employees can reduce these risks.

Example: A financial services firm may implement multi-factor authentication (MFA) for all online transactions, regularly control access to Internet-facing administrative interfaces and service ports as well as the encryption protocols to secure client data from cyberattacks.

4. Optimizing Remote and Hybrid Working Models

Remote / hybrid is the new normal Remote teams force companies to implement effective motivation and management strategies. Collaboration tools and a balanced virtual culture can improve productivity and employee satisfaction.

- Illustration: a Tech company using Asana / Trello etc. for pm to keep remote teams from falling out of balance. They can also organise weekly team-building activities to keep a strong team spirit.

5. Focus on Customer Experience

Retention and growth of the sales follow-through can be tied to high quality customer experiences. Harness data analytics to deepen customer insights and personalize product offers making your marketing campaigns personal: a customer support that is responsive enough can drive a great level of returning customers.

Example – For any e-commerce business, you can take user experience feedback tools to know about how your customers are getting along and make necessary changes. Custom email campaigns and loyalty programs can also be positively associated with customer satisfaction and retention.

6. Digitalization Investment

It is only the beginning of digital transformation which we all know, is key to global competitiveness. For streamlining, companies have to adopt the use advanced technologies such as Blockchain Technology and Internet of Things (IoT) in conjunction with cloud computing.

IoT example : real-time tracking and analytics to optimize supply chain management

7. Enhance Employee Skills

Develop Your Employees: Investing in employee development is key to succeeding as a business. The training is provided for the folks of various industries and so employees can increase their skills that are needed to work in a certain company. Employee performance can be enhanced by providing training programs in future technology skills and soft skills and job satisfaction.

Example: A marketing agency can host webinars or create courses to teach people the latest digital marketing trends and tools This can help to keep employees in the know which results in boosting their skills, making your campaigns successful.

8. Diversify Supply Chains

The ongoing pandemic has exposed the weaknesses of global supply chains. …diversify its supply base and promote the manufacturing of drugs in Nigeria to eliminate total dependence on a single source. In return, this approach increases resilience and reduces exposure to the risks of supply chain interruption.

- E.g., a consumer electronics company can source components from many suppliers in various regions. In so doing, this alleviates avoidable supply chain interruptions during times of political tensions or when disasters hit.

9. Make Decisions Based on Data

A business database is an asset for businesses. By implementing data, they allow you to make decisions based on the data that your analytics tools are providing. For example, sales analysis lets you track trends and better tailor your goods to the market.

Example: A retail chain can use data analytics to find out when a customer buys, and it change their purchasing policies. This can also reduce overstock and stockouts while overall, increasing efficiency.

10. Foster Innovation

Business Growth Innovation is Key A culture of creativity and experimentation should be established in companies. Funding R&D and teaming with startups can open many doors to both solve problems creatively but also tap into new markets.

Example: A software development firm could create an innovation lab where team members are freed to work on speculative projects. Moreover, work with start-ups on new technologies and solutions.

By adopting these strategies, businesses can navigate the turbulence for 2024 and roll up market — progressive.AI with an evolving dynamic market, being ahead of trends and updated is most likely will help you thrive in the business landscape.

#ai#business#business strategy#business growth#startup#fintech#technology#tech#innovation#ai in business

2 notes

·

View notes

Text

The Ultimate Guide to ESG Investing: Strategies and Benefits

Socio-economic and environmental challenges can disrupt ecological, social, legal, and financial balance. Consequently, investors are increasingly adopting ESG investing strategies to enhance portfolio management and stock selection with a focus on sustainability. This guide delves into the key ESG investing strategies and their advantages for stakeholders.

What is ESG Investing?

ESG investing involves evaluating a company's environmental, social, and governance practices as part of due diligence. This approach helps investors gauge a company's alignment with humanitarian and sustainable development goals. Given the complex nature of various regional frameworks, enterprises and investors rely on ESG data and solutions to facilitate compliance auditing through advanced, scalable technologies.

Detailed ESG reports empower fund managers, financial advisors, government officials, institutions, and business leaders to benchmark and enhance a company's sustainability performance. Frameworks like the Global Reporting Initiative (GRI) utilize globally recognized criteria for this purpose.

However, ESG scoring methods, statistical techniques, and reporting formats vary significantly across consultants. Some use interactive graphical interfaces for company screening, while others produce detailed reports compatible with various data analysis and visualization tools.

ESG Investing and Compliance Strategies for Stakeholders

ESG Strategies for Investors

Investors should leverage the best tools and compliance monitoring systems to identify potentially unethical or socially harmful corporate activities. They can develop customized reporting views to avoid problematic companies and prioritize those that excel in ESG investing.

High-net-worth individuals (HNWIs) often invest in sustainability-focused exchange-traded funds that exclude sectors like weapon manufacturing, petroleum, and controversial industries. Others may perform peer analysis and benchmarking to compare businesses and verify their ESG ratings.

Today, investors fund initiatives in renewable energy, inclusive education, circular economy practices, and low-carbon businesses. With the rise of ESG databases and compliance auditing methods, optimizing ESG investing strategies has become more manageable.

Business Improvement Strategies

Companies aiming to attract ESG-centric investment should adopt strategies that enhance their sustainability compliance. Tracking ESG ratings with various technologies, participating in corporate social responsibility campaigns, and improving social impact through local development projects are vital steps.

Additional strategies include reducing resource consumption, using recyclable packaging, fostering a diverse workplace, and implementing robust cybersecurity measures to protect consumer data.

Encouraging ESG Adoption through Government Actions

Governments play a crucial role in educating investors and businesses about sustainability compliance based on international ESG frameworks. Balancing regional needs with long-term sustainability goals is essential for addressing multi-stakeholder interests.

For instance, while agriculture is vital for trade and food security, it can contribute to greenhouse gas emissions and resource consumption. Governments should promote green technologies to mitigate carbon risks and ensure efficient resource use.

Regulators can use ESG data and insights to offer tax incentives to compliant businesses and address discrepancies between sustainable development frameworks and regulations. These strategies can help attract foreign investments by highlighting the advantages of ESG-compliant companies.

Benefits of ESG Investing Strategies

Enhancing Supply Chain Resilience

The lack of standardization and governance can expose supply chains to various risks. ESG strategies help businesses and investors identify and address these challenges. Governance metrics in ESG audits can reveal unethical practices or high emissions among suppliers.

By utilizing ESG reports, organizations can choose more responsible suppliers, thereby enhancing supply chain resilience and finding sustainable companies with strong compliance records.

Increasing Stakeholder Trust in the Brand

Consumers and impact investors prefer companies that prioritize eco-friendly practices and inclusivity. Aligning operational standards with these expectations can boost brand awareness and trust.

Investors should guide companies in developing ESG-focused business intelligence and using valid sustainability metrics in marketing materials. This approach simplifies ESG reporting and ensures compliance with regulatory standards.

Optimizing Operations and Resource Planning

Unsafe or discriminatory workplaces can deter talented professionals. A company's social metrics are crucial for ESG investing enthusiasts who value a responsible work environment.

Integrating green technologies and maintaining strong governance practices improve operational efficiency, resource management, and overall profitability.

Conclusion

Global brands face increased scrutiny due to unethical practices, poor workplace conditions, and negative environmental impacts. However, investors can steer companies towards appreciating the benefits of ESG principles, strategies, and sustainability audits to future-proof their operations.

As the global focus shifts towards responsible consumption, production, and growth, ESG investing will continue to gain traction and drive positive change.

5 notes

·

View notes

Text

Ramaswamy’s push to end climate-conscious investing

Over the years, Ramaswamy has been known for many things: founding a biotech company called Roivant Sciences; becoming a near-billionaire; and performing libertarian-themed rap songs under the stage name "Da Vek."

But recently, he’s become best known as “the right’s most prominent crusader against climate-conscious investing.” His latest mission: ensure Republican-led states pull their money from big investment firms like BlackRock that are trying (or at least claiming) to make more climate-friendly decisions, and reallocate that money to his firm, Strive Asset Management, which explicitly promises not to invest with the climate in mind.

The fossil fuel industry has wanted someone to do this for many years. As we’ve previously reported, the anti-ESG movement—which pushes corporations to reject environmentally and socially conscious investing principles—was originally created by fossil fuel industry operatives to try to delay the renewable energy transition.

The movement fizzled in the early 2000s. But it was revived in 2022, when Ramaswamy launched Strive with the help of billionaire investors Peter Thiel and Bill Ackman, as well as the same fossil fuel industry-connected group that spearheaded the original movement.

Ramaswamy has reported more than $50 million in holdings in Strive, which to date, is mostly a fund to promote fossil fuel development. As Semafor reports, the largest fund at Strive—called DRLL—“ invests in U.S. energy companies and urges them to keep drilling for oil so long as it’s profitable.”

Though Semafor describes DRLL’s holdings as “energy,” the vast majority are fossil fuels. According to Strive’s own description, 93.6 percent of DRLL’s investments are in oil, gas, and pipeline companies. These companies rank among the world’s top climate polluters.

People would not invest in these companies—much less push them to drill as much oil as humanly profitable—if they accepted the science of climate change. They would not invest if they accepted that fossil fuels are causing catastrophic planetary damage. They would not invest if they accepted that this damage cannot be stemmed without rapidly transitioning away from fossil fuels.

That’s why Ramaswamy pushes rejection of the “climate change agenda.” He says it’s because he’s not “bought and paid for.”

The reality is the complete opposite.

Denying the need for fossil fuel reduction is climate denial

Ramaswamy’s style of fossil fuel boosterism, as described by the New Republic, is on the rise in Republican circles. So as we continue to hear it, it’s important to remember two things:

If someone says climate change does not pose a massive threat to human life, economies, and ecosystems, then they are denying the science of climate change.

If someone says climate change can be effectively managed without reducing the use of fossil fuels, then they are denying the science of climate change.

Ramaswamy didn’t flat-out say that climate change is a hoax. But in the debate and in follow-up interviews, Ramaswamy made clear he doesn’t believe climate change poses a massive threat to human life, and doesn’t believe that transitioning away from fossil fuels will help.

This is an opinion he is allowed to have. But it is a rejection of the vast majority of climate science. It should be characterized as such.

3 notes

·

View notes

Text

What Is Investment Management?

Investment management, also known as asset management or fund management, is the professional management of assets (such as stocks, bonds, real estate, and other investments) on behalf of investors or clients with the goal of achieving specific financial objectives. Investment managers or fund managers use their expertise to make investment decisions and construct portfolios that align with their clients' risk tolerance, return expectations, and investment goals. Here are key aspects of investment management:

Portfolio Construction: Investment managers analyze various investment options and build portfolios that are diversified across different asset classes to manage risk. The allocation of assets in the portfolio is based on the client's investment objectives and risk tolerance. SPEED SUV

Risk Management: Managing risk is a crucial part of investment management. Managers assess the risk associated with different investments and adjust portfolios accordingly. Diversification and risk mitigation strategies are employed to minimize potential losses.

Asset Selection: Investment managers select specific securities or assets for inclusion in portfolios. This involves conducting research and analysis to identify opportunities and make informed investment choices.

Market Analysis: Investment managers closely monitor financial markets and economic trends. They use market analysis to make timely investment decisions and adjust portfolios in response to changing market conditions.

Performance Evaluation: Investment managers continuously evaluate the performance of the portfolio relative to its benchmark and client-specific goals. They may make adjustments to the portfolio to improve performance or align it with changing objectives.

Client Communication: Effective communication with clients is essential in investment management. Managers keep clients informed about their investments, provide regular reports, and discuss any changes in strategy or portfolio performance.

Regulatory Compliance: Investment managers must adhere to industry regulations and compliance standards. This includes fiduciary responsibilities to act in the best interests of clients.

Fee Structure: Investment managers typically charge fees for their services, which can vary based on the type of investment vehicle and the assets under management. Common fee structures include asset-based fees, performance fees, and hourly fees.

Investment Vehicles: Investment managers may manage a variety of investment vehicles, including mutual funds, exchange-traded funds (ETFs), separately managed accounts (SMAs), and hedge funds. Each type of vehicle has its own structure and regulatory requirements.

Ethical and Sustainable Investing: Some investment managers specialize in ethical, socially responsible, or sustainable investing, where they consider environmental, social, and governance (ESG) factors in their investment decisions.

Investment management is a profession that requires a deep understanding of financial markets, investment strategies, and risk management techniques. Many individuals and institutions, including pension funds, endowments, and individual investors, rely on investment managers to help them achieve their financial goals. These professionals play a critical role in the financial industry, helping clients grow and preserve their wealth over time.

1 note

·

View note

Text

Building a Sustainable Supply Chain Program with Data-Driven Responsible Sourcing

Building a Sustainable Supply Chain Program with Data-Driven Responsible Sourcing

Introduction: In today's business landscape, sustainability has become a key focus for companies looking to create a positive impact on the environment and society. One crucial aspect of sustainability is supply chain management, as it plays a significant role in reducing the overall environmental and social footprint of a company. In this article, we will explore how to build a robust supply chain sustainability program through data-driven responsible sourcing. By leveraging data and implementing responsible sourcing practices, companies can not only enhance their sustainability efforts but also gain a competitive edge in the market.

The Importance of Responsible Sourcing in Supply Chain Sustainability

Responsible sourcing is the process of ensuring that the materials, products, and services used in a company's supply chain are obtained from ethical and sustainable sources. It involves evaluating the environmental, social, and governance (ESG) aspects of suppliers, and making informed decisions based on that evaluation. Responsible sourcing is crucial for companies aiming to build a sustainable supply chain program, as it helps them identify and address potential environmental and social risks associated with their suppliers.

Leveraging Data for Responsible Sourcing in Supply Chain Management

Data plays a pivotal role in responsible sourcing, as it provides insights into the sustainability performance of suppliers. By leveraging data, companies can make informed decisions about which suppliers to work with and how to improve their sustainability performance. There are several ways in which data can be utilized for responsible sourcing in supply chain management:

Implementing Responsible Sourcing in Supply Chain Sustainability Programs

Implementing responsible sourcing practices requires a systematic approach that involves multiple stakeholders across the supply chain. Here are some key steps to consider when building a sustainable supply chain program with responsible sourcing:

Benefits of Implementing Responsible Sourcing in Supply Chain Management

Implementing responsible sourcing practices in supply chain management can yield several benefits for companies. Some of the key benefits include:

Building a sustainable supply chain program with data-driven responsible sourcing is critical for companies looking to enhance their sustainability performance, gain a competitive advantage, and mitigate risks. By leveraging data to ensure transparency, assess supplier performance, and drive continuous improvement, companies can create a positive impact on the environment and society, while also achieving business success. Implementing responsible sourcing practices requires a systematic approach, including clear policies, supplier engagement, collaboration with stakeholders, and a commitment to continuous improvement. By prioritizing responsible sourcing in their supply chain management, companies can contribute to a more sustainable future while reaping the benefits of improved sustainability performance, innovation opportunities, and stakeholder engagement.

2 notes

·

View notes

Text

F1 teams told they must work to improve governance and transparency

Formula One teams must do more to improve their governance and transparency if they are to embrace a sustainable future, according to new research.

The report by the Standard Ethics group has concluded that F1 teams need to make clear their position and goals on environmental, social and governance issues, with only three of the 10 on the grid currently having a publicly stated code of ethics.

“There is work to do for the governance side, this is the most important,” said Jacopo Schettini, the director of research at Standard Ethics. “It is very, very important to see a long-term commitment to sustainability. A long-term commitment comes from crucial important documents like a code of ethics or a sustainability plan or policies on specific issues.

“There were three teams with a code of ethics – McLaren, Aston Martin and Ferrari. They were talking about all major sustainability issues but I would like to see more from the other teams.”

Standard Ethics assesses companies on their performance relating to sustainability and environmental, social and governance (ESG) issues. They were not commissioned to analyse F1 teams but undertook the research independently.

In their report, teams were assessed on whether they publish a code of ethics, the quality of reporting of ESG issues, whether they have a human rights policy and whether they disclose environmental targets. They did this by analysing the information each team has published in the public domain. Schettini noted that investigating this way was a vital test of the transparency he believes is key to a positive sustainability policy.

“We analysed by what they publish,” he said. “It’s very important, the first part of sustainability is to be transparent, to inform people what you are doing about that. You should publish everything.”

Schettini acknowledged that in some areas the teams performed well. Most, the report concluded, were addressing human rights and addressing environmental targets. However outside of the three teams cited the lack of a published code of ethics and of an ESG reporting system meant governance and transparency was lacking.

“Sustainability is not just environmental topics, but also gender inequality or risk management, or health and safety. It’s a lot of issues,” Schettini said. “Having an ESG reporting system we can see what they are doing, they have to improve governance and reporting.”

Clearly, however, teams are acting positively. Mercedes have committed to fund the MSc motorsport scholarship programme with the Royal Academy of Engineering, aimed at improving diversity among motorsport engineers, part of their Ignite partnership with Lewis Hamilton. Schettini added that some teams may also have a code of ethics and ESG reporting system that was not public, but reiterated that was a part of the problem.

“Sustainability needs transparency,” he said. “Transparency and a long-term vision, give us a long-term vision. What you are thinking about sustainability and keep us updated on your goals. If you fail to meet a target we understand, you can postpone a target but it’s very important that you have a target and a roadmap.”

The group have since received feedback from several teams looking to improve their performance in future.

F1 recently published its latest report into its environmental goal of going carbon neutral by 2030, a target the sport believes it is on course to meet. However, F1’s teams are far from alone in requiring improvement.

“We do something like this, even more accurately with most leading European football teams,” said Schettini. “Last year, we discovered more or less the same approach from them, so we have seen some environmental targets but even leading football teams lack transparency.”

via Formula One | The Guardian https://www.theguardian.com/sport/formulaone

3 notes

·

View notes

Text

CSRD

In recent years, the importance of sustainability has been increasingly recognized in corporate circles. Investors, consumers, and regulators demand more transparency and accountability regarding environmental, social, and governance (ESG) practices. This shift has led to developing and adopting various sustainability reporting standards. One of the most significant recent developments in this area is the Company Sustainability Reporting Directive (CSRD).

What is CSRD?

The Corporate Sustainability Reporting Directive (CSRD) is a new regulation from the European Union (EU) to enhance the transparency and reliability of sustainability reporting and It replaces the Non-Financial Reporting Directive (NFRD) and expands the scope and depth of sustainability disclosures required from companies. CSRD is designed to improve the quality of sustainability information companies disclose, making it more comparable, consistent, and reliable. This enables stakeholders to make more informed choices based on a company's sustainability performance.

Why is CSRD Important?

The introduction of CSRD marks a significant step towards a more sustainable future. It acknowledges the growing importance of ESG factors in business operations and decision-making. By mandating more comprehensive and standardized sustainability reporting, CSRD aims to provide a clearer picture of a company's environmental and societal impact. This increased transparency is crucial for investors, patrons, and other stakeholders, increasingly considering sustainability when making investment and purchasing decisions.

Key Requirements of CSRD

CSRD introduces several critical requirements for companies. First, it expands the scope of reporting to include more companies than the previous NFRD. Approximately 50,000 companies in the EU will now be required to report on sustainability matters, compared to the 11,000 under NFRD. This includes both large firms and listed small and medium-sized enterprises (SMEs).

Second, CSRD requires companies to report on broader sustainability topics. This includes environmental and social issues and governance matters, such as business ethics and anti-corruption measures. Companies must provide detailed information on their impact on the environment, human rights, and social standards, as well as their strategies to alleviate negative impacts.

Third, CSRD introduces more rigorous assurance requirements for sustainability information. Companies will be required to obtain limited assurance on their sustainability reports, with the potential for this to move to reasonable assurance in the future. This aims to enhance the reliability and credibility of informed information.

How CSRD Impacts Businesses

The CSRD will significantly impact businesses, especially those that have yet to engage in comprehensive sustainability reporting. Companies must invest in the systems and processes necessary to collect, manage, and report on various sustainability data. This may involve implementing new technologies, such as data management and reporting software and developing internal expertise in sustainability reporting.

Additionally, the CSRD requires companies to adopt a double materiality perspective, which means they must consider both how sustainability issues affect the company and how the company's activities impact the environment and society. This approach requires a more in-depth analysis of a company's operations and value chain, including its suppliers and customers.

The Role of CSRD in Driving Sustainable Business Practices

CSRD is not just about reporting; it's about driving real change in businesses' operations. By requiring companies to disclose their sustainability impacts and strategies, CSRD encourages them to adopt more sustainable practices. This can lead to various benefits, including reduced environmental impact, improved stakeholder relations, and heightened long-term value creation.

Furthermore, CSRD can help companies align their operations with global sustainability goals, such as the United Nations Sustainable Development Goals (SDGs) and the Paris Agreement on climate change. By providing a standardized framework for reporting on sustainability performance, CSRD facilitates the integration of sustainability into business strategy and decision-making.

Preparing for CSRD Compliance

Companies need to start preparing now to comply with CSRD. This includes thoroughly assessing their current sustainability practices and reporting capabilities. Companies should identify gaps in their data collection and reporting processes and develop a plan to address them. This may involve employing new data management systems, training staff, and engaging stakeholders to understand their expectations and requirements better.

In addition, companies should stay informed about the evolving requirements of CSRD and other sustainability reporting standards. The EU is expected to issue detailed reporting standards under CSRD, providing further guidance on the required disclosures. By staying up to date with these developments, companies can ensure they are well-positioned to meet the new requirements and demonstrate their commitment to sustainability.

Conclusion

The Corporate Sustainability Reporting Directive (CSRD) represents a significant step forward in sustainability reporting. By requiring companies to provide more comprehensive and reliable information on their sustainability performance, CSRD aims to enhance transparency and accountability, helping stakeholders make more informed decisions and For businesses, CSRD presents both faces and opportunities. While compliance may require significant effort, it also offers the chance to drive positive change, improve stakeholder relations, and create long-term value. As the world moves towards a more sustainable future, CSRD will be crucial in shaping how companies report on and manage their sustainability impacts.

0 notes

Text

CMA USA Course: A Comprehensive Guide to Eligibility, Syllabus, Fees, and Career Opportunities in 2025

The Certified Management Accountant (CMA) USA certification has gained immense popularity for its global recognition and valuable opportunities in finance and management roles.

If you're preparing for the CMA USA course in 2025, this detailed guide will walk you through every aspect— from eligibility requirements to exam structure and career opportunities. By the end of this blog, you'll have a clear roadmap to navigate through your CMA USA journey.

1. What is CMA USA?

CMA USA is a globally recognized credential awarded by the Institute of Management Accountants (IMA). This certification focuses on two critical areas:

Financial Management

Strategic Management

It sets professionals apart in the accounting and finance sectors by validating expertise in financial planning, analysis, control, decision support, and professional ethics.

Why is CMA USA Important in 2025?

In 2025, the demand for certified financial professionals with advanced skills in strategic decision-making will continue to grow. CMAs often earn more than their non-certified counterparts, and they are sought after by leading organizations worldwide.

2. Eligibility Criteria for CMA USA 2025

Before diving into the CMA USA syllabus and exam structure, let’s first understand the eligibility criteria for 2025:

Education:

Bachelor’s degree from an accredited institution.

Alternatively, professional certifications like CA, CPA, or ICWA can also qualify you.

Work Experience:

2 years of relevant professional experience in management accounting or financial management. This requirement can be completed before or after passing the exams.

Membership:

You need to be a member of the Institute of Management Accountants (IMA) to enroll in the CMA USA course.

3. CMA USA Exam Structure 2025

The CMA USA exam is divided into two parts, each with a distinct focus:

Part 1: Financial Planning, Performance, and Analytics

External Financial Reporting Decisions

Planning, Budgeting, and Forecasting

Performance Management

Cost Management

Internal Controls

Technology and Analytics

Part 2: Strategic Financial Management

Financial Statement Analysis

Corporate Finance

Decision Analysis

Risk Management

Investment Decisions

Professional Ethics

Each part includes 100 multiple-choice questions (MCQs) and 2 essay-type questions. Candidates are allotted 4 hours to complete each part of the exam.

4. CMA USA Syllabus 2025 – What’s New?

The CMA USA syllabus is constantly evolving to stay relevant to the dynamic business world. In 2025, expect more emphasis on:

Data Analytics: Focus on how financial managers use big data and analytics to make decisions.

Sustainability Reporting: Due to increasing awareness of ESG (Environmental, Social, Governance) factors, professionals are required to understand the basics of sustainability reporting.

Digital Transformation: A significant part of the 2025 syllabus will cover digital technologies that impact financial processes and decision-making.

For an in-depth understanding of each section, candidates are recommended to use official IMA textbooks or resources from established coaching centers like iProledge Academy.

5. CMA USA Course Fees in 2025

The fees for the CMA USA course in 2025 are structured as follows:

IMA Membership: $250 annually

Entrance Fee: $280

Exam Fees (for both parts): $460 per part

Many CMA coaching institutes, including iProledge Academy, offer special packages that include exam preparation, mock tests, and assistance with registration. Always check for any discounts or scholarships that may be available for 2025.

6. Study Plan for CMA USA 2025

To pass the CMA USA exam in 2025, you need a solid study plan. Here’s a month-by-month guide to ensure you're well-prepared:

January to March:

Focus on understanding the basics of financial planning and analysis.

Regularly solve MCQs and past papers for Part 1.

April to June:

Start with essay-type questions for Part 1.

Review weak areas using resources from iProledge Academy.

July to September:

Move to Part 2 and focus on strategic financial management topics like risk management and investment decisions.

Take mock tests to simulate exam conditions.

October to December:

Intensive revision. Focus on time management during the exam.

Attending revision webinars and last-minute tips from coaching centers.

7. Career Opportunities After CMA USA in 2025

The CMA USA certification opens doors to lucrative careers across multiple industries. In 2025, CMAs will be in high demand for roles such as:

Financial Analyst

Risk Manager

Corporate Controller

Finance Director

Chief Financial Officer (CFO)

Countries like the USA, Canada, UK, and India offer some of the highest-paying jobs for CMA USA professionals. Employers value the strategic skills that CMAs bring, especially when it comes to financial decision-making and ethical management.

8. Top Institutes for CMA USA Coaching

Choosing the right coaching institute can make all the difference in your CMA USA journey. Here’s what you should look for:

Experienced Faculty: Instructors who are themselves certified CMAs.

Comprehensive Study Material: Ensure that the study material is up-to-date and covers the latest syllabus.

Mock Exams and Revision Sessions: The more practice, the better prepared you'll be.

Support: Institutes like iProledge Academy provide extensive student support, including doubt-clearing sessions, mentorship, and career counseling.

9. FAQs

Q1: Is CMA USA worth pursuing in 2025?

Absolutely! With its global recognition and demand in the financial and managerial sectors, CMA USA offers numerous career opportunities.

Q2: How long does it take to complete the CMA USA course?

On average, it takes about 6-12 months to complete both parts of the exam, depending on your study plan.

Q3: What’s the passing rate for CMA USA in 2025?

The global pass rate for the CMA USA exam is approximately 45-50%, making it a challenging but achievable certification with the right preparation.

0 notes

Text

Direct and Custom Indexing Approaches

Financial professionals use indexing to compile a portfolio that mirrors the performance of a specific benchmark or market index. There are two primary forms of indexing: direct indexing and custom indexing. The best approach for indexing depends on several factors, such as flexibility.

Indexing differs from other strategies, where professionals pick companies they believe will outpace the market. Instead, they focus on investing a small portion of total allocations in many companies on an index, providing diversification and broad market exposure.

With direct indexing, financial professionals purchase stocks and securities to create a portfolio that is directly proportional to the actual index. The portfolio replicates the performance of the target index, such as the Dow Jones Industrial Average or S&P 500.

Direct indexing replaces traditional formal index funds. Brokerages developed them to overcome high transactional fees, seeking to diversify holdings cost-effectively. Rather than taking separate positions in the 500 companies on the S&P 500, with their associated transaction fees, investors invested in an S&P 500 index fund.

Transaction costs have declined, and advanced computer algorithms allow investors to own and organize positions directly across index stocks without investing in an intermediary fund. Therefore, directly owning the positions confers tax benefits since investors can harvest their losses. By contrast, investors can only harvest losses when their aggregate positions veer negative at the aggregate fund level. Frequent trading can optimize the capture of tax losses, given expected equity market volatility, and boost after-tax returns by as much as two percent.

Custom indexing differs from direct indexing, which exclusively mirrors existing published indexes. The investor still owns positions directly but according to individual criteria and parameters. For example, investors weigh a custom index toward a specific asset class or size of stock and underlying company. They can also incorporate environmental, social, and governance (ESG) screens that ensure the index closely aligns with investor values. For example, investors can weigh a custom index toward renewables like wind and solar.

In addition, custom indexing tracks a specific index without employing the same index components, such as stocks. Through a custom indexing approach, the portfolio manager selects and combines a variety of bonds, equities, and other types of securities that deliver sought-after exposure to the index. Such a structure may provide tax benefits and further reduce transaction fees.

Flexibility in indexing is also important for creating exclusions at various levels. The approach makes sense for investors with significant exposure to an industry or specific stock with other investment accounts. Investors have holdings tied to specific industries. For example, some technology executives hold stock options linked to specific tech companies. In this situation, custom indexing allows investors to avoid specific company holdings or shift allocations toward other sectors while broadly following the target index.

Lastly, custom indexing enables factor-based investing approaches emphasizing stocks with specific traits, such as those with less earnings volatility or above or below-average price-to-earnings ratios. Multi-factor overlays may combine complex factors within index holdings, such as quality and value, and deliver a customized yet well-planned portfolio.

0 notes

Text

What is ESG Controversy, and How Does It Impact Business?

Social media has augmented the power multimedia coverage has over public perception. The positive aspects of this situation include a rising demand for accountability and transparent corporate communication. However, the potential misuse of modern media, third-party firms’ intelligence, and news platforms can threaten the brand you develop through fake news. For instance, an ESG controversy, whether real or not, can impact a business. And this post explains how.

What is an ESG Controversy?

An ESG controversy encompasses all events concerning actual or alleged adverse impact assessments, sustainability non-compliance, data theft, etc. The environmental, social, and governance (ESG) factors help analysts create comprehensive reports and financial disclosures, highlighting potentially controversial business aspects.

Controversial events can decrease your company’s reputation, increase legal liabilities, and alienate the stakeholders. Besides, brand-related risks have long-term consequences. Therefore, corporations leverage ESG controversy analysis to identify the activities that can undermine their strategic vision, financial performance, and stakeholder interests.

What Causes an ESG Controversy?

Advanced technology empowers today’s world, empowering researchers, non-governmental organizations (NGOs), industry bodies, regional authorities, and consumers. They can quickly investigate if a brand has engaged in ESG non-compliant activities.

Employing child labor, discriminating against employees, polluting the environment, or engaging in corruption can affect your company’s relationships. Sometimes, old norms become obsolete, and new legal frameworks replace them. However, specific organizations might miss such dynamics or willfully postpone compliance.

Through ESG consulting, businesses can acquire thematic insights into sustainability compliance and controversy exposure. Themes include energy transition, labor rights, social good, carbon emissions, and waste disposal. So, investors, authorities, businesses, NGOs, and consumers can decide which brands to support or ignore.

How Does an ESG Controversy Impact a Business?

1| It Can Discourage Investors

Ethical and impact investors want to focus on enterprises working on socio-economically beneficial projects. They also employ exclusion strategies when building portfolios based on sustainable development goals (SDGs). Investors are less likely to include a brand with a controversial background in their portfolios.

2| ESG Controversy Can Lead to Consumer Boycott

Launching a new product or service will become more challenging if a company is part of a controversy. Consumers believe in buying from brands that share their values. Suppose they learn about a brand’s ESG controversy. They will deliberately avoid its products, events, and services. Simultaneously, social media and news platforms can accelerate the brand boycott trends.

3| Legal Processes Will Impact the Business

Addressing non-compliance issues can involve fulfilling legal requirements like account audits, independent inquiries, or financial penalties. These activities can make specific business operations inefficient for a while. Otherwise, the managers might get trade restrictions for an indefinite period.

4| ESG Controversy Makes Supply Chain Management Riskier

Consider a business that procures critical components from a supplier that employs child labor and releases untreated industrial effluent into water bodies. Therefore, the brand is at risk. After all, ESG controversy analysis does not stop at the company level. It inspects whether a few supplier relations can damage your stakeholder goodwill due to questionable practices.

Steps of Controversy Monitoring and Reporting

Recognizing the vulnerable aspects across the environmental, social, and governance pillars helps companies and investors streamline risk assessment. Think of the deforestation risks that will be higher in the case of construction projects. However, water resources will be more vulnerable to pollution from the heavy chemicals industry.

Later, you want to create a consolidated statistical method to rate the adverse impact according to ESG controversy risks. It will allow companies to benchmark their compliance.

Finally, investors must determine whether they want to buy or sell an asset using the final reports. Likewise, business leaders must explore opportunities to make their organizations more resilient to controversies.

Conclusion

Several possibilities affect how everyone essential to your business development perceives you. Their faith in your brand shakes once your organization becomes the focus of global and regional media coverage for the wrong reasons.

Still, every ESG controversy analyst will follow a unique system to evaluate the risks that business leaders must mitigate to have a positive impact. As a result, corporations must select analysts with an established track record of sustainability compliance and risk assessment.

3 notes

·

View notes

Text

Real Estate Credit Investments reports annual profit uplift and 10.4% dividend (LON:RECI)

Real Estate Credit Investments Limited (LON:RECI) has announced its Annual Report and Audited Financial Statements for the year ended 31 March 2024.

Outline of the Annual Report

1. Overview and Highlights

Introduction: Overview of Real Estate Credit Investments Limited (RECI) and its market positioning as a specialist investor in UK and Western European real estate markets.

Key Figures: Net assets, NAV per share, total assets, net profit, and share price performance as of 31 March 2024.

Dividend Stability: RECI’s consistent quarterly dividends and its stable income amidst changing interest rate environments.

2. At a Glance

Investment Strategy: Details about RECI’s approach to investing in real estate debt secured by commercial or residential properties in Western Europe.

Portfolio Composition: Breakdown of the investment portfolio, including the number of positions, types of assets, geographic distribution, and yield metrics.

3. Chairman’s Statement

Performance Overview: Commentary on the company’s performance, market conditions, and strategic decisions.

Future Outlook: Insights on expected market conditions, potential interest rate changes, and the company’s preparedness for future opportunities.

4. KPIs and Financial Highlights

Key Performance Indicators (KPIs): Detailed financial metrics including NAV per share, share price, discount, leverage, earnings per share, dividends, and total NAV return.

Financial Performance: Comparative financial performance for the years ending 31 March 2023 and 2024.

5. Business and Strategy Review

Strategic Framework: Objectives, performance highlights, and strategies to exploit market opportunities and deliver stable dividends.

Portfolio Management: Overview of investment activities, repayments, dividends paid, and the composition of the investment portfolio.

6. Investment Manager’s Report

Market Analysis: Macroeconomic backdrop and its implications for real estate assets.

Investment Strategy: Approach towards senior real estate lending and management of the investment portfolio.

Performance and Outlook: Insights into the performance of the investment portfolio and future strategy to maintain and enhance returns.

7. Stakeholder Engagement

Engagement Activities: Overview of how the company engages with its stakeholders, including shareholders, service providers, and the community.

Diversity and Inclusion: Details on the company’s approach to diversity and inclusion within its governance framework.

8. Sustainability Report

ESG Integration: Description of how environmental, social, and governance (ESG) considerations are integrated into the company’s investment process.

Sustainability Initiatives: Examples of sustainable investment projects and their impact.

Cheyne’s ESG Policies: Details on the investment manager’s ESG policies and partnerships to enhance sustainability.

0 notes

Text

Welcome to Vastasys: Elevate Your Business with Dynamics 365

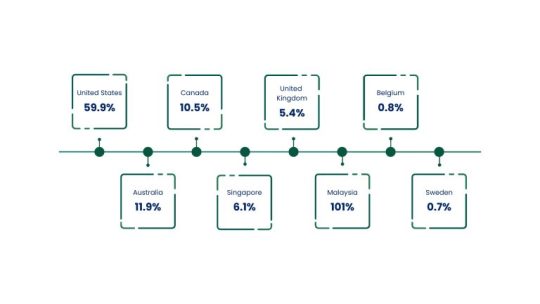

🚀At Vastasys, we specialize in harnessing the power of Microsoft Dynamics 365 to drive efficiency and growth for businesses across Canada, the US, and Europe.

Since 2013, our cost-effective solutions and expert consulting services have helped companies enhance productivity, improve customer engagement, and accelerate sales cycles. Discover how we can transform your business today!

Explore Our Dynamics 365 Solutions

Dynamics 365 for Small & Medium Businesses (SMBs) 🌟

Business Central: Streamline your operations with a unified system that integrates finance, sales, service, and operations into one seamless solution.

Ideal for SMBs looking to boost efficiency and accuracy. Explore more about our solutions and services on our website Vastasys.

Uncover Insights with Dynamics 365 Customer Insights 📊

Customer Insights: Gain a deeper understanding of customer behaviors and preferences. Use Copilot for personalized content, lead nurturing, and compliance with privacy regulations to make informed decisions.

Accelerate Sales with Dynamics 365 Sales 🚀

Sales: Enhance your sales processes with automation, real-time insights, and advanced AI. Improve customer interactions and speed up your sales cycles with our cutting-edge tools.

Transform Customer Service with Dynamics 365 🛠️

Customer Service: Deliver exceptional customer support with optimized operations and automated workflows. Empower your team to handle every customer interaction efficiently.

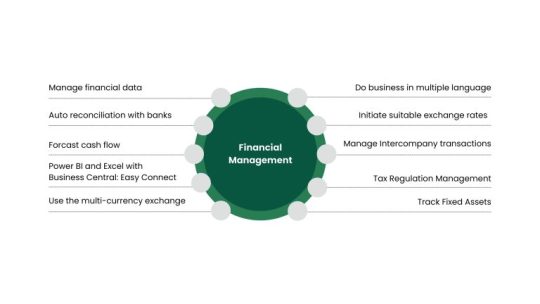

Optimize Financial Operations with Dynamics 365 Finance 💰

Finance: Automate and digitize your financial processes to boost productivity, enhance decision-making, and reduce your ESG footprint. Our solution provides comprehensive financial management.

Enhance Field Service Management with Dynamics 365 ⚙️

Field Service: Improve service delivery with AI-powered field service management. Optimize your operations and enhance the efficiency of your field service teams.

Why Choose Vastasys?

Our Cost-Effective Blended Model 💡

Benefit from our unique approach that combines onsite and offsite resources. Our blended cost model ensures:

Top-Quality Solutions

Affordable Pricing

Rapid Delivery

Smooth Communication

Dedicated Project Managers

This model delivers the best value and performance for your investment.

Our Comprehensive Service Offerings

Seamless Implementation 🚀

We offer a full suite of implementation services for Microsoft Dynamics CRM, including strategy development, data management, security, and integration with your existing systems.

Smooth Upgradation 🔄

Transition effortlessly from legacy systems to Dynamics 365. Our upgradation services ensure minimal disruption and lower maintenance costs.

Tailored Customization 🎨

Customize Dynamics 365 to fit your unique business needs. Our services include secure data transfer, custom entities, functions, workflows, and branded UI to enhance performance and scalability.

Expert Training and Support 🎓

Ensure your team is fully equipped to use Dynamics 365 with our comprehensive training and support services. We provide ongoing assistance to address any issues and maximize your investment.

Grow Your Business with Vastasys

Analyze & Design 🔍

We start by understanding your specific needs and challenges to design a solution tailored to your business goals.

Develop & Deploy ⚙️

Our development and deployment process ensures that your Dynamics 365 solution is implemented effectively and aligns with your operational requirements.

Continuous Training & Support 💬

Ongoing training and support keep your team skilled and ready to utilize Dynamics 365 efficiently, ensuring smooth operations.

Get in Touch

Address: 1001 1st St SE, Calgary AB, T2G 5G3

For more information or to schedule a consultation, visit our Contact Us page.

Explore how Vastasys can elevate your business with Microsoft Dynamics 365. Partner with us to achieve greater efficiency and success! 🌟

#Dynamics365#MicrosoftDynamics#microsoft dynamics 365 consultant#dynamics crm consulting services#dynamics 365 customer insights#microsoft dynamics 365 support services

1 note

·

View note

Text

Importance of Environmental, Social, and Governance (ESG) Criteria in Banking

Environmental, Social, and Governance (ESG) criteria have become increasingly important in the banking sector as financial institutions face growing pressure to contribute to sustainable development and ethical business practices. ESG represents a set of standards used to evaluate a company’s operations, focusing on how it impacts the environment, society, and its governance structure. For banks, integrating ESG into their practices is not only a matter of social responsibility but also a strategic move to manage risks, enhance reputation, and meet the evolving expectations of customers, regulators, and investors.

Key Reasons Why ESG Criteria are Important in Banking:

Risk Management ESG criteria help banks identify and manage potential risks associated with their lending, investment, and operational activities. For example, a bank that finances projects or businesses with poor environmental practices may face financial losses due to environmental degradation, regulatory fines, or reputational damage. By applying ESG criteria, banks can avoid financing high-risk ventures, thus protecting their assets and ensuring long-term financial stability.

Also read- freeze account ko unfreeze kaise kare

Environmental Risk: Climate change, deforestation, and pollution can have direct financial impacts on industries like agriculture, energy, and manufacturing. By incorporating environmental considerations into lending decisions, banks can minimize exposure to these risks.

Social Risk: Banks that engage in unethical lending practices or invest in companies with poor labor conditions may face public backlash, legal consequences, and reputational damage.

Governance Risk: Poor corporate governance can lead to mismanagement, corruption, or scandals, which negatively affect financial performance and customer trust.

Regulatory Compliance Governments and regulatory bodies worldwide are increasingly implementing stricter regulations related to environmental protection, human rights, and corporate governance. Banks that integrate ESG into their decision-making processes are better equipped to comply with these evolving regulations. This not only helps avoid legal penalties but also enhances a bank’s ability to operate smoothly in various regions. Adhering to ESG standards also positions banks as responsible financial actors in the eyes of regulators, investors, and customers.

Also read- account freeze kyu hota hai

Meeting Investor Expectations Investors are increasingly considering ESG factors when making investment decisions, particularly institutional investors who manage large funds. Many investment portfolios now include ESG criteria as part of their evaluation process to ensure they are supporting companies with sustainable and responsible practices. Banks that align with ESG criteria are more likely to attract capital from investors who prioritize sustainability and ethical business practices. Furthermore, banks offering ESG-focused financial products, such as green bonds or sustainability-linked loans, can tap into a growing market of impact-driven investors.

Also read- how to get noc from cyber crime

Enhancing Reputation and Brand Value Incorporating ESG criteria into banking operations can significantly enhance a bank’s reputation and brand value. Consumers, especially younger generations, prefer to engage with businesses that demonstrate social responsibility and a commitment to sustainability. By showcasing their commitment to ESG principles, banks can build stronger relationships with customers, increase brand loyalty, and differentiate themselves from competitors. A positive reputation also helps banks attract top talent, particularly employees who want to work for organizations that align with their ethical values.

Also read- bank account freeze hone par kya kare

Supporting Sustainable Economic Growth Banks play a crucial role in financing businesses and projects that drive economic development. By prioritizing ESG criteria, banks can channel capital toward projects that contribute to sustainable growth, such as renewable energy, affordable housing, and education. This not only benefits society but also creates long-term investment opportunities for banks. Additionally, financing sustainable projects can help mitigate climate-related risks and promote resilience in the global economy.

Also read- bank account freeze by cyber crime

Long-Term Financial Performance Studies have shown that companies that score high on ESG metrics tend to perform better financially over the long term. For banks, this means that financing companies with strong ESG credentials can lead to more stable and profitable relationships. Similarly, by focusing on sustainability in their own operations, banks can reduce costs related to energy consumption, waste management, and regulatory fines. Sustainable business practices often lead to higher operational efficiency, which contributes to improved financial performance.

Innovation and New Financial Products The growing demand for ESG-related investments has led banks to innovate and develop new financial products, such as green bonds, social impact bonds, and sustainability-linked loans. These products cater to investors and clients looking to make a positive environmental or social impact while generating financial returns. By developing and offering these ESG-aligned products, banks can tap into new markets, attract environmentally and socially conscious investors, and enhance their product portfolio.

Contributing to the Global Sustainability Agenda Banks that adopt ESG criteria are aligning themselves with global sustainability initiatives, such as the United Nations Sustainable Development Goals (SDGs) and the Paris Agreement on climate change. By supporting projects and companies that contribute to these goals, banks play a pivotal role in advancing global efforts to tackle pressing challenges such as poverty, inequality, and climate change. This not only helps banks align with international priorities but also opens opportunities for collaboration with governments, non-profits, and other organizations committed to sustainability.

Conclusion:

ESG criteria are critical in the modern banking landscape as they help manage risks, enhance reputation, and attract investors. By integrating environmental, social, and governance considerations into their decision-making processes, banks can foster sustainable economic growth, meet regulatory requirements, and position themselves as leaders in responsible finance. Adopting ESG practices is not just about mitigating risks; it’s about seizing opportunities to create long-term value for banks, investors, customers, and society at large.

0 notes

Text

The Power of ESG Implementation: A Guide to Sustainable Business Practices

In today's rapidly evolving business landscape, sustainability and corporate responsibility have become more than just buzzwords; they are essential components of a successful and forward-thinking strategy. Environmental, Social, and Governance (ESG) practices are at the forefront of this shift, offering companies a framework to operate responsibly while driving long-term value. In this blog, we will explore what ESG implementation entails, its benefits, and how businesses can integrate ESG principles into their operations.

What is ESG Implementation?

ESG implementation involves integrating environmental, social, and governance criteria into a company’s business strategy and operations. These criteria help companies assess their impact on the world and ensure they are operating in a manner that is not only profitable but also responsible and sustainable.

a. Environmental Criteria

Environmental criteria focus on how a company interacts with the natural world. This includes efforts to reduce carbon footprints, manage waste, conserve resources, and promote environmental stewardship. Key areas include:

Energy Efficiency: Implementing practices to reduce energy consumption and increase the use of renewable energy sources.

Waste Management: Reducing, recycling, and responsibly managing waste materials.

Resource Conservation: Minimizing the use of natural resources and supporting sustainable sourcing.

b. Social Criteria

Social criteria address how a company manages relationships with employees, suppliers, customers, and the communities in which it operates. This encompasses:

Employee Welfare: Ensuring fair labor practices, promoting diversity and inclusion, and supporting employee well-being.

Community Engagement: Contributing to local communities through philanthropy, volunteerism, and responsible business practices.

Customer Relations: Upholding ethical marketing practices and ensuring product safety and quality.

c. Governance Criteria

Governance criteria involve the structures and practices that ensure a company is run ethically and transparently. This includes:

Board Diversity and Structure: Ensuring diverse representation and effective governance on the board of directors.

Ethical Conduct: Implementing policies and practices to prevent corruption, fraud, and unethical behavior.

Transparency: Providing clear and accurate reporting on financial performance, risks, and ESG initiatives.

Benefits of ESG Implementation

Implementing ESG practices can provide a range of benefits for businesses, including:

a. Enhanced Reputation

Companies that prioritize ESG initiatives often enjoy a stronger reputation among customers, investors, and stakeholders. Demonstrating a commitment to sustainability and ethical practices can attract customers who value corporate responsibility and improve brand loyalty.

b. Risk Management

ESG implementation helps businesses identify and manage risks related to environmental regulations, social issues, and governance practices. By proactively addressing these risks, companies can mitigate potential disruptions and enhance long-term stability.

c. Competitive Advantage

A strong ESG strategy can differentiate a company from its competitors. Investors are increasingly looking for companies with robust ESG practices, and those that excel in these areas may gain a competitive edge in attracting investment and partnerships.

d. Cost Savings

Sustainable practices, such as energy efficiency and waste reduction, can lead to significant cost savings. Implementing green technologies and optimizing resource use can reduce operational expenses and improve financial performance.

e. Employee Engagement

Employees are increasingly seeking workplaces that align with their values. Companies with strong ESG practices often experience higher levels of employee satisfaction, retention, and productivity.

How to Implement ESG Practices

Integrating ESG practices into your business requires a strategic approach. Here are steps to effectively implement ESG principles:

a. Assess Current Practices

Begin by evaluating your company’s current practices and identifying areas where ESG principles can be applied. Conduct a thorough analysis of environmental impacts, social practices, and governance structures.

b. Set Clear Goals and Objectives

Establish specific, measurable goals and objectives for your ESG initiatives. These goals should align with your overall business strategy and reflect the key areas of environmental, social, and governance impact.

c. Develop an ESG Strategy

Create a comprehensive ESG strategy that outlines how you will achieve your goals. This strategy should include action plans, timelines, and responsibilities for implementing and monitoring ESG practices.

d. Engage Stakeholders

Engage with stakeholders, including employees, customers, investors, and community members, to gather input and support for your ESG initiatives. Effective communication and collaboration are essential for successful implementation.

e. Monitor and Report Progress

Regularly monitor and measure progress towards your ESG goals. Use key performance indicators (KPIs) to track performance and provide transparent reports on your achievements and areas for improvement.

f. Continuously Improve

ESG implementation is an ongoing process. Continuously review and refine your practices to address emerging trends, regulatory changes, and stakeholder expectations. Strive for continuous improvement and innovation in your ESG efforts.

Conclusion

ESG implementation is more than just a trend; it represents a fundamental shift towards responsible and sustainable business practices. By integrating environmental, social, and governance criteria into your operations, you can enhance your company’s reputation, manage risks, and drive long-term success. Embracing ESG principles not only contributes to a better world but also positions your business for growth and resilience in the modern economy. Start your ESG journey today and reap the benefits of a more sustainable and responsible approach to business.

0 notes

Text

Exploring ESG Investing with Leaders including Tereno Jason Forbes: Incorporating Environmental, Social, and Governance Factors into Investment Decisions

As financial planning becomes increasingly sophisticated, investors are seeking ways to align their portfolios with their values and principles. ESG investing, which incorporates Environmental, Social, and Governance (ESG) factors into investment decisions, has emerged as a pivotal approach for those aiming to make a positive impact while achieving financial returns. This investment strategy focuses not only on financial performance but also on how companies manage risks and opportunities related to sustainability and ethical considerations.

This blog delves into the principles of Environmental, Social, and Governance investing, exploring how environmental, social, and governance factors influence investment decisions. We will examine the benefits of integrating ESG criteria, the methodologies for evaluating Environmental, Social, and Governance performance, the challenges and opportunities within the ESG landscape, and practical steps for beginners looking to incorporate Environmental, Social, and Governance factors into their financial plans. By understanding these aspects, investors can make informed decisions that reflect both their financial goals and personal values.

Understanding ESG Criteria

ESG investing revolves around three key criteria: Environmental, Social, and Governance. The environmental aspect evaluates how a company manages its impact on the planet, including factors like carbon emissions, resource use, and waste management. Experts like Tereno Jason Forbes convey that social criteria assess a company’s relationships with employees, suppliers, customers, and communities, focusing on issues such as labor practices, human rights, and community engagement. Governance involves examining a company's leadership, executive pay, audits, and shareholder rights to ensure ethical and effective management.

Incorporating these criteria into investment decisions allows investors to support companies that align with their values and contribute positively to societal and environmental goals. This holistic approach goes beyond traditional financial metrics, providing a more comprehensive view of a company's long-term sustainability and ethical practices.

Benefits of ESG Investing

Investing with an ESG focus offers several benefits, both from an ethical and financial perspective. Ethically, Environmental, Social, and Governance investing enables individuals to support businesses that prioritize environmental protection, social responsibility, and good governance. This alignment with personal values can enhance the sense of purpose and satisfaction associated with investment decisions.

Financially, companies that adhere to strong ESG principles often demonstrate better risk management and resilience. Leadrs such as Tereno Jason Forbes emphasize that by focusing on sustainability and ethical practices, these companies may be better positioned to navigate regulatory changes, reputational risks, and market shifts. Studies have shown that Environmental, Social, and Governance investments can potentially offer competitive returns while reducing exposure to long-term risks, making them an attractive option for prudent investors.

Methodologies for Evaluating ESG Performance

Evaluating ESG performance involves various methodologies and tools designed to assess a company's adherence to environmental, social, and governance criteria. Common approaches include Environmental, Social, and Governance ratings provided by specialized agencies, which offer insights into a company's performance based on a set of standardized metrics. Industry leaders including Tereno Jason Forbes point out that these ratings can help investors identify companies that meet their ESG criteria and align with their investment goals.

Another methodology is the use of ESG-focused indices and funds, which aggregate investments based on Environmental, Social, and Governance criteria. These indices and funds provide a diversified way to invest in companies with strong ESG performance, allowing investors to gain exposure to a broad range of sustainable investments. Additionally, investors can use screening techniques to exclude companies involved in activities contrary to their values, such as tobacco or fossil fuels.

Challenges in ESG Investing

Despite its advantages, Environmental, Social, and Governance investing presents several challenges. One significant challenge is the lack of standardized ESG metrics and reporting, which can make it difficult for investors to compare and evaluate companies consistently. Variations in Environmental, Social, and Governance data collection and reporting practices can lead to discrepancies in performance assessments and investment decisions.

Another challenge, as highlighted by experts like Tereno Jason Forbes, is the potential for “greenwashing,” where companies may exaggerate or misrepresent their Environmental, Social, and Governance efforts to appear more sustainable than they are. Investors must be vigilant in their research and rely on reputable sources to ensure that their investments genuinely align with their Environmental, Social, and Governance criteria. Addressing these challenges requires diligence and a critical approach to evaluating ESG claims and performance.

Practical Steps for Beginners