#Electronic Sez

Note

You commented "we use relativistic effects to understand how Mercury is liquid", could you please explain how so? (Apologies, I don't know quite so much about chemistry in particular beyond Gen Chem)

Okay, so, all of the elements with full d orbitals experience relativistic effects to an extent. Because a full set of d orbitals is fairly small for the number of electrons in it, the electrons that go close to the nucleus experience very, very high speeds when repelling each other- close to the speed of light. Due to these high speeds, the Schrodinger equation breaks down and we have to pull out the Dirac equation. Dirac equation sez that because the electrons are moving too quickly, they'll not be able to interact with other electrons as much, and will have less solid-like behavior at the same temperature as other comparable metals. (Solids are solids because of relatively stable bonds between atoms; if the electrons can't interact for long, they can't form those stable bonds as well, or sometimes at all.)

These effects are present in all of mercury's group- zinc has a melting point of ~420 degrees C, compared to its neighbor copper, which bears one of 1085 degrees, and nickel, with one of 1455 degrees. (Scandium, furthest to the left in the d-block, has a melting point of 1541 degrees, so it's not necessarily like it's going up infinitely).

Mercury, though, because it's got the heaviest nucleus and the most electrons of the gang, accelerates its particles closest to the speed of light, and therefore has the fewest chances to interact with other atoms of mercury. Thus, melts at -40 C. Most of "why is this solid/liquid at X temperature" has to do with how strong its interactions are with other atoms; various things control this, but in metals, electron speed is a pretty notable one.

23 notes

·

View notes

Text

Why do all electric vehicle companies occupy Warehouse and Industrial space in Hosur?

With the electric buzz that has taken the nation by storm, the Government is planning to develop EV parks in the same line as SEZ and pharma parks across the country. The EV park aims to house majority original equipment manufacturers, battery manufacturers, and charging infrastructure developers at one place. With the vision to develop an entire ecosystem at one same place, the Government plans to offer plug-and-play business models to EV industries who will set up their units in these parks. One such park is located in north western districts of Tamil Nadu, just across the Karnataka border from Bengaluru, which houses a number of new-age EV companies, such as, Ather Energy, Ola Electronics, Simple Energy, among others.

The Rise of Hosur

Several factors have helped the Hosur belt boom with several big-ticket projects and investments in the region. The cluster witnessed two substantially high profile investments in the last couple of years, with Tata electronics setting up a ₹5,000-crore mobile components plant at Udhanapalli, and Ola, a ₹2,500-crore electric vehicle (EV) plant at nearby Pochampally. These massive investments triggered the new EV boom in Hosur, with EV companies preferring Hosur for putting up their manufacturing units given a competent ancillary supplier network, proximity to Bengaluru where corporate offices of these companies are located, plus amicable and skilled labour force in two-wheeler, automotive, and electronics segment.

Well-oiled Supply-chain Network

The region is equipped with a strong supply-chain ecosystem, making it easier for the companies to locally source components necessary for manufacturing and assembly. This, in turn, would help us in improving cost and time efficiency for the businesses. Moreover, companies are prompting tier-2 suppliers to move their base to Hosur area, to make smaller components in the close vicinity to further add to the efficiency.

Financial SOP and Easier Admittance

EV companies in the Hosur area are upheld by EV policy contrived by Tamil Nadu Government. The policy is drafted to support EV companies with repayment of SGST for electric vehicle producing, capital appropriation for battery fabricating, business motivation as far as repayment of EPF for a time of one year, exclusion from instalment of Electricity Tax till 2025 and 100 percent stamp obligation exception.

Proximity to Bengaluru

As most of the corporate offices are located in Bengaluru, the first preference of companies is to put up a plant within a comfortable driving distance from head office. As most of the senior employees and mid-level management sit at the head office, most of the companies want employees to be able to move between the office and the plant in an hour or so maximum. For instance, Ather Energy corporate office is located in Koramangala, which is 60 minutes away from the Ather Energy plant in Hosur. Moreover, the connection via Electronics city flyover helps cut through the traffic, which was initially the pain point of employees moving between Koramangala and Whitefield, where Ather Energy plant was located.

Availability of Land and Scalability Scope

Given the area related bottleneck in Bengaluru, it is essential for EV companies or any other manufacturing units to look into areas nearby that can accommodate projected production capacity and growth plans. Given, land investments are not made again and again, it is always advisable for the companies to take up the area based on the most optimistic business projections. With the same thought, Ather Energy Hosur plant is spread across 300,000 Sq. Ft. with capacity to produce 1,10,000 scooters annually. Ather Energy envisions that the plant will serve as Ather Energy’s national manufacturing hub, catering to demand from across the country. Moreover, the plant is nearly 10 times the capacity of the Whitefield, Bengaluru, plant.

Hosur Historic Precedence

Within the close proximity to Bengaluru, Hosur area has historically been a dominant space for two wheeler, automotive, and electronics business segments. Given that EV is primarily an amalgamation of these three segments, it is therefore a natural choice for EV companies to develop manufacturing units in the Hosur area. Moreover, with established and consistent access to power, land, and labour relevant to the industry, Hosur is the first choice of investment. Furthermore, a lot of fossil-fuelled automotive industries are also expanding into the EV segment. This has prompted an easy transition for existing automotive companies in the area. Also, as Tamil Nadu has over 800 engineering colleges, the state offers an intellectual and skilled labour pool ensuring steady stream for the workforce.

Amicable Labour and Supportive Workforce

In the area, it is widely noted that the kind of labour unrest Bengaluru witnesses is not seen in the Tamil Nadu north western districts, which are barely an hour away from each other. The most plausible reason for this could be the existential automotive businesses in the Hosur area, unlike Bengaluru, where labourers are experiencing the automotive industry for the first time. In Hosur, both industry and labour have matured, and the companies have learnt that exploitative practices are rather counter-productive. Therefore, most of the EV companies find this a huge draw in making investment decisions in the Hosur area.

Hosur Meteoric rise and the way ahead

Given the reasons above along with a network of highways facilitating logistics of movement and the welcoming policies set by the Tamil Nadu Government for automotive companies, Hosur belt is emerging as an industrial bowl for the electric vehicle manufacturers. Tata, Delta, Ola Mobility, Ather Energy, and Simple Energy are some of the big names in the electronics and electric vehicle (EV) sectors that have made Hosur and the surrounding districts their home in the past few years.

Along with growing awareness and spiralling petrol prices, the demand for EV is set to increase significantly in the coming years. As per the data, In January 2022, overall high-speed EV two-wheeler registrations rose to 27,563 units as compared to 24,725 units in December 2021. To match the rising demand, manufacturers have to up their capacity, for example Ather Energy recently commissioned its second facility in Hosur to increase its capacity from 1,20,000 units to 4,00,000 units. Ola Electric has set out to build the world’s largest EV facility with an initial annual capacity of two million units. Furthermore, TVS has also decided to invest over 1,100 crores in the area for the new EV plant. If the cards are played right, this belt could further emerge as a global player given the fast adoption of EVs, especially in the two-wheeler segment.

7 notes

·

View notes

Text

The Puck Shooter's Field Encyklopedia

Hey there, puck shooter! Below, you may find a compendium of free-to-consumer resources of multiple medias in alphabetical-ish order on various enthralling subjects. Searching for PWHL/LPHF-specific news and media? Look here!

[last updated: 05-MAR-02024]

Index:

. >> Athletics {empty}

. >> Geography {new additions!}

. >> Health, Exercise, Sports Science {new additions!}

. >> Hockey, Competition {new additions!}

. >> Hockey, Fundamentals {empty}

. >> Language {empty}

. >> Recreation {empty}

. >> Social Studies {new additions!}

. >> Miscellaneous / Uncategorized {empty}

. >> Epilogue {new additions!}

Puckey seys Note: Note what? Pucke oft’ sez: A smart person knows how to spend their time. Do w/that whatcha will.

Index:

. [Link] == weblink of unspecific origin.

. [OP Link] == weblink to original publication.

. [WP Link] == weblink to Wikipedia.

. [YT Link] == weblink to YouTube.

_# ATHLETICS #_

{empty}

_# GEOGRAPHY #_

subsections

. > PWHL Cities

. > PWHL Nations

PWHL Cities

Boston: [WP Link]

Minneapolis–Saint Paul: [WP Link]

Montréal: [WP Link]

Ottawa: [WP Link]

New York City: [WP Link]

Toronto: [WP Link]

PWHL Nations

Canada: [WP Link]

United States of America: [WP Link]

_# HEALTH, EXERCISE, SPORTS SCIENCE #_

Note well: Not a substitute for qualified medical consult; for informational purposes only.

Bipedal Gait Cycle [WP Link]

Body Schema [WP Link]

Female Athlete Triad / RED-S [WP Link]

Exercise [WP Link]

First Aid [WP Link]

Motor Control [WP Link]

Motor Learning [WP Link]

- Puck sez NB! “Knowledge of performance, knowledge of results” under §Feedback given during practice

Motor Skill [WP Link]

Motor Skill Consolidation [WP Link]

Muscles of the Human Body, Skeletal, List of [WP Link]

Muscle Architecture [WP Link]

Muscle Memory [WP Link]

Neuromechanics [WP Link]

Neuroscience Crash Course Playlist (Brain Discoveries) by TED-ED [YT Link]

Neuroscience Crash Course Playlist (Exploring the Senses) by TED-ED [YT Link]

Neuroscience Crash Course Playlist (Mind Matters) by TED-ED [YT Link]

Nutrition Science Crash Course Playlist (You Are What You Eat) by TED-ED [YT Link]

Procedural Memory [WP Link]

Psychology Crash Course Playlist (Mental Health Awareness) by TED-ED [YT Link]

Psychology Crash Course Playlist (The Way We Think) by TED-ED [YT Link]

_# HOCKEY, COMPETITION #_

Ice Hockey at the Olympic Games [WP Link]

_# HOCKEY, FUNDAMENTALS #_

{empty; proposed subsections:}

. > Skating

. > Puck, stick handling

. > Hockey Sense / IQ

. > Puck tracking

. > Goaltending

_# LANGUAGE #_

{empty}

_# RECREATION #_

{empty. what are the puck shooter’s reading, watching, listening to nowadays? send word! meanwhile, here’s wonderwall 🌱}

_# SOCIAL STUDIES #_

Living wage calculator, methodology [Link]

Media Literacy Crash Course Playlist (Hone Your Media Literacy Skills) by TED-ED [YT Link]

Universal human rights described by UN Sustainable Development Goals [Video] [Audio??] [Print]

_# MISCELLANEIOUS / UNCATEGORIUZED #_

{empty}

Think something’s missing? Comments/Questions/Feedback? Feel free to Mail in at, none other than, **foobo(alloneworld) chider1 (aht)gee, whizze… electronic-snail-mail (dawt, you get it…).

— Puckey Digest

also available via:

Medium .commahe

Substack .com,,,,,

and, ofc, TuMbLr [¿r we getting meta nao? X3c]

click here 4 a good time

[MORE AMENDMENTS COMING TO PUCK-O-PEDIA SOON! ☻]

[last updated: 05-MAR-02024]

_# EPILOGUE #_

Pucke Says! The athlete and critical problem-solver should — among other things — learn to approximate and convert units of distance, weight, and time on-the-fly, off-the-cuff, & ad-hoc. Such skills will take one far in life, and serve the athlete and problem-solver well in many contexts.

Knowledge is power; France es bacon; and, lest I forget:

[MORE AMENDMENTS COMING TO PUCK-O-PEDIA SOON! ☻]

[last updated: 05-MAR-02024]

⚘❃⚘⚜❃❁❀✿✾✽ Many Flowers 4 U~!! ✽✾✿❀❁❃⚜⚘

2 notes

·

View notes

Text

https://slnventures.com/highway-paradise/

HIGHWAY PARADISE

Commercial Land & Plots KANDUKUR SRISAILAM HIGHWAY

OPPORTUNITY TO INVEST IN HIGHWAY FACING COMMERCIAL LAND

Prop. 200ft., Highway Facing Land

5 to 40 Guntas Available

Close to Pharma City, Pharma University,Amazon Data Center

Amenities :

Pampering you with the best for a hassle-free living

NEAR @ OUR VENTURE

00 Mins to Srisailam Highway

05 Mins to Pharmacy City (19933 Acres)

10 Mins to Amazon Data Center (100 Acres)

15 Mins to Mankhal Industrial Development- 143Acrs

20 Mins to Exit-14 ORR

15 Mins to Tata Aerospace Sez Adibatla

15 Mins to Rajiv Gandhi International Airport

15 Mins to E-City (1200 Acres)

30 Mins to TCS Adibatla & Hardware Park

30 Mins to Banglore Highway

20 Mins to Ranga Reddy Collectorate

40 Mins to Gachibowli & Hitech-City

20 Mins to INDO UK 1000 Beds Hospital, Gold SEZ, Electronics Companies (Total 350 Acrs)

20 Mins to Maisigandi Temple

20 Mins to International ZOO Park (945 Acres)

Srisailam Highway to Tirupati National Highway Declared Central Government

#hyderabad#farmland#marketing#smartbusiness#plot for sale#propertyforsale#telangana#property#realestate#farmlands

2 notes

·

View notes

Text

DRR'S HAPPY RESIDENCY

DRR'S HAPPY RESIDENCY

Projects | DRR'S HAPPY RESIDENCY

Maheswaram is now the nucleus of real estate boomk of tryuly global proportiond.Set in the exponentially growing topography is the pretigious DRR's HAPPY RESIDENCY, the gateway ta a fine living and pathway to awesome returns on investment.The project from the much admired DRR GROUP features two ventures in close proximity offering premium villa plots with construction assistance.

The top end project is strategically located between the ORR and RRR adject to MAHESHWARAM,HYDERABAD-SRISAILAM HIGHWAY.The venture is flanked by a host of landmarks including the proposed MASTER PLAN, 150' Electronic city SEZ road, near Shivaganga Temple,Maheshwaram-Pulimamidi and 100' wide road corridor abutting the Electronic City SEZ.

The whole geography is being developed on a large scale replete with robust infrastructure and easy connectivity.The Pharma City near the project's location further accentuates its appreciation value.The venture is being embedded with a host of amenities and facilities which offer premium living amidst idyllic,pollution free environment.DRR's HAPPY RESIDENCY offers a distinctive value proposition that combines smart living and huge returns on investment.

#Owning a home or plots are the most desirable thing HMDA#Plots For sale At Maheswaram LP NO:338/2021 & Nandigama LP NO :02/2022#shadnagar Hyderabad#Book Your Free Site Visit Today Call : 7997 215 888#WhatsApp: wa.me/917997215888#Drrgroup#drrgroup#plots#MAHESWARAM#Hyderabad#Plots#shamshabadairport#Tukkuguda#nandigama#Shadnagar#kothur#Nandigama#PlotsForSaleInHyderabad#plotsforsale#plotsavailable#HMDAApprovedPlots#HMDA#hmdaplots#Gachibowli#Kondapur#Miyapur#Patancheru#Dilsukhnagar#Uppal#plotsforsaleinhyderabad

2 notes

·

View notes

Text

Complete F&Q All e-Invoicing Software

Q-1: What is e-Invoicing?

Answer: Electronic invoicing or e-invoicing is an invoicing process that allows other software to access invoices generated by software, eliminating the need for re-entry of data or errors. In less difficult words, it is an invoice created in a standard format, whereby the electronic information of the invoice can be shared with other people, which guarantees the compatibility of the information.

Q-2: What is the electronic invoicing process?

Answer: There aren't many changes; Companies can continue to generate their invoices from their existing software. To ensure a certain level of standardization, only one standard format is used, the e-invoicing schema. These systematic invoices are prepared by the taxpayer. When creating the invoices, you must report them to the GST Invoice Registration Portal (IRP). The portal then generates a unique invoice reference number and adds the digital signature along with the QR code to the e-invoice. The QR code contains all the information required for the electronic invoice. After this process, the electronic invoice is sent back to the taxpayer via the portal. IRP will also send a copy of the signed invoice to the seller's registered email address.

Q-3: Will the electronic invoice format be the same for all categories?

Answer: All companies/taxpayers that must pay GST must issue electronic invoices using the same scheme established by GSTN. The format has required and non-required fields. All taxpayers must complete the required fields and non-required fields are used as required.

Q-4: Is e-invoicing mandatory?

Answer: Electronic invoicing is mandatory for all companies with an annual turnover of Rs. Rs. 100 crores or more from 1st January 2021. Previously it applied to companies with a turnover above the limit of Rs. 500 million crores.

However, e-invoicing does not apply to the categories listed below, regardless of commercial invoicing, as per CBIC Notice No. 13/2020- Central Rate:

. An insurance company or a banking company or financial institution, including an NBFC

. A Freight Transport Company (GTA)

. A registered person offering passenger transportation services.

. A registered person who provides services by way of admission to the exhibition of motion pictures in multiplex services

. One SEZ unit (excluded by CBIC Report No. 61/2020 – Central Tax)

Q-5: What are the advantages of electronic invoicing?

Answer: These are some of the benefits of electronic invoicing:

. Report B2B invoices once during generation, reducing reporting in multiple formats.

. Most of the data on the GSTR-1 form can be kept ready to send while using the electronic billing system.

. E-Way invoices can also be easily created with electronic invoice data.

. There is a minimal data reconciliation between the books and the GST returns submitted.

. Real-time tracking of invoices generated by a supplier can be enabled, along with faster availability of input tax credits. It will also reduce input tax

credit verification problems.

. Better management and automation of the tax declaration process.

. Reduced fraud as tax authorities also has real-time access to data.

. Elimination of false GST invoices that are generated.

Q-6: What deliveries are currently covered by e-invoicing?

Answer: Electronic invoicing currently applies to:

. Deliveries to registrants (i.e. B2B deliveries),

. Deliveries to ZEE (with/without payment of taxes),

. Exports (with/without payment of taxes) and

exports considered,

made by the Class of Notified Taxpayers.

Q-7: How will the e-invoicing model work?

Answer: Under the e-invoicing model, companies will continue to issue invoices in their respective ERPs, as has been the case in the past. Only the standard, schema, and format for creating invoices are specified to ensure a certain level of standardization and machine-readability of these invoices. The preparation of the invoice is the responsibility of the taxpayer.

As it is generated, it must be reported to the GST Invoice Registration Portal (IRP). The IRP generates a unique invoice reference number (IRN) and adds the digital signature for the e-invoice along with the QR code. The QR code contains important parameters of the electronic invoice and sends it back to the taxpayer who created the document. The IRP also sends the signed e-invoice to the seller to the registered email id.

Q-8: What types of fields are there in an electronic invoice?

Answer: The data of the fields marked as "required" must be entered.

. A required field that has no value can be reported as null.

. Fields marked as "Optional" may or may not be filled out. They are only relevant to certain companies and only relate to certain scenarios.

. Some sections of the electronic invoice marked as "Optional" may contain mandatory fields.

For example, the E-Way Billing Details section is marked as Optional.

However, in this section, the Transport Type field is required.

Q-9: Does the e-invoice need to be signed again by the supplier?

Answer: The provisions of Rule 46 of the Central Goods and Services (CGST) Rules, 2017 apply here. According to Rule 46, the signature/digital signature of the supplier or his authorized representative is required while issuing invoices. However, a proviso to Rule 46 states that the signature/digital signature shall not be required in the case of issuance of an electronic invoice that is by the provisions of the InformationTechnology Act, 2000. Hence, it has been interpreted that in the case of e-invoices, a supplier will not be required to sign/digitally sign the document.

Q-10: What are the options for receiving electronic invoices registered in the IRP?

Answer: Several ways to record electronic invoices are provided in the Invoice Registration Portal (IRP). Some of the suggested modes are-

. Web-based,

. API based,

. Based on offline tools and

. based on GSP.

Q-11: What is the final threshold for e-invoicing?

Answer: In a bid to step up measures against tax evasion, the government announced last week that GST e-invoicing will be mandatory for companies with a turnover of more than Rs 10 crore from October 1, down from the current Rs 20 crore, which will bring in another 0.36 million businesses in digital reporting.

2 notes

·

View notes

Text

EXPORT OF SERVICES AND INVOICE FORMAT – OVERVIEW OF EXPORT OF SERVICES

The Goods and Services Tax (GST) literature provides detailed guidelines about the content of an invoice in its various notes. The ‘Export Invoice’ related to Service is also a document containing a description of the services provided by an exporter, and the amount due from the importer. Export invoicing is governed by various laws and regulations including GST regime as well as the guidelines of RBI. Export invoices are used by the governmental authorities in the assessment and calculation of taxes.

There are three types of transactions that are related to export in GST: Export under IGST, Under Bond/LUT, and Zero- rated supply.

Under the GST Law, the export of goods or services has been treated as follows.

inter-State supply and covered under the IGST Act.

‘zero rated supply’ i.e., the goods or services exported shall be relieved of GST levied upon them either at the input stage or at the final product stage.

Zero- rated supply means that the entire value chain of the supply is exempt from tax. This means that in case of zero rating, not only is the output exempt from payment of tax, but there is also no bar on taking/availing credit of taxes paid on the input side for making/providing the output supply.

The export transaction can be completed on payment of IGST that can be claimed as refund after the goods have been exported, as per the defined procedure. In the case of goods and services exported under bond or LUT, the exporter can claim a refund of accumulated ITC on account of export. The export goods are to be made under self-sealing and self-certification without any intervention of the departmental officer.

Export invoices fall under electronic invoicing system for taxpayers with aggregate Annual Turnover of more than 10 Cr from 01st October, 2022. This ceiling will be modified on a periodical basis. All supplies to SEZs (with/without payment), exports (with/without payment), deemed exports, are also currently covered under e-invoicing except those fall under exempt list with the turnover limit.

Generating the right export invoice is an important part of export services. Business needs to ensure that it complies with all regulations while issuing an export invoice to avoid any legal or financial penalties. There are no specific guidelines mentioned for the format of invoice while exporting services. Generally, export invoices for services need to contain the following details based on the available info.

Name, address, contact details and GSTIN of exporter and similar details of recipient

Invoice number and date

Details of Shipping

Type of export and total value of invoice and currency

Conversion rate from INR to applicable currency and Total Value of the Document

Taxable Value, Tax rate and Tax as applicable, if the refund is claimed and type of export is Export with Tax

HSN Code

Signature of authorized person

Shipping bill number, date and Port are not needed for Invoice related to Export of Services as per the Annexure documentation of GST.

Exporters need to submit various forms and documents to report on their export transactions to RBI pe the type of exports and need to follow RBI guidelines. If the exporter is claiming any benefits under export promotional schemes, the relevant details should be included in the invoice. DGFT is responsible for administering various export schemes.

SMART ADMIN is a cloud-based software for Office Automation. Smart Admin Tools are designed for Payroll management, Timesheet, and Project Tracking – visit SMART ADMIN for FREE Trial and Registration.

For more information visit https://www.smartadmin.co.in/

0 notes

Text

Exploring The Role of India’s Free Trade Warehousing Zone

A vital part of India's economic growth and development are its free trade and warehousing zones, often referred to as export processing zones (EPZs) or special economic zones (SEZs). To encourage exports and draw in foreign direct investment (FDI), these zones are specifically designated locations that provide a range of incentives and advantages to firms. The function of India's free trade warehousing zone and their effects on the national economy will be covered in detail in this blog article.

The purpose of the establishment of India's free trade zones in the late 1960s was to promote industrialization and exports. The government increased the size of these zones and implemented a number of incentives throughout time, including infrastructural support, duty-free imports and exports, tax holidays, and streamlined customs processes. These actions were intended to entice domestic and international businesses to establish export-oriented enterprises and invest in these zones. These zones are intended to increase exports, create jobs, and draw foreign direct investment (FDI) in the Indian setting. As a result of economic liberalisation initiatives, the idea of FTZs gained popularity in India in the early 2000s.

Duty-free imports of machinery, components, and raw materials needed to produce items intended for export are among the many important advantages of free trade zones. This has made manufacturing and assembly activities more appealing in Indian free trade zones, especially for sectors like electronics, textiles, automotive, and pharmaceuticals. Reduced manufacturing costs and increased global competitiveness can be achieved by businesses through duty-free imports. India has benefited from this by becoming a hub for manufacturing for many global companies.

The convenience of conducting business is another benefit of free trade zones. The government has taken action to lower bureaucratic barriers and streamline customs processes for companies doing business in these zones. One of the things that falls under this category is offering a one-stop shop for clearing the many licences and permissions needed to open and run a business. The time and effort needed for businesses to launch their operations has been greatly decreased by these simplified procedures, which has also improved the general ease of doing business in India.

Additionally, firms may access a variety of infrastructural services and amenities through free trade zones. Dedicated power supplies, well-maintained industrial parks, transportation systems, and operational factories are a few examples. In addition to saving setup costs, these infrastructural features provide a favourable atmosphere for operations and production. Free trade warehousing zone also frequently feature research facilities and specialised training facilities, which raise worker skill levels and foster innovation.

Bringing in foreign direct investment is one of the main goals of creating free trade zones (FDI). India has had success drawing foreign direct investment (FDI), especially in fields like information technology, pharmaceuticals, and the automobile industry. Foreign corporations find India to be an appealing investment destination because to its skilled labour force, developing economy, and vast domestic market, as well as the incentives and benefits provided by the free trade warehousing zone. This FDI infusion helps the growth of Indian industry overall by facilitating technology transfers and information exchange in addition to providing much-needed finance.

Free trade zones are advantageous to the regional economy and create job possibilities. The local populace benefits from both direct and indirect employment created by the introduction of industries inside these zones. Additionally, as these zones' businesses expand, adjacent areas' economies are stimulated, which fosters the expansion of auxiliary industries, commerce, and services. For the local people, this has a multiplier effect that leads to more job possibilities and revenue sources.

India has also used its free trade zones in recent years to support a number of industries focused on exports. For instance, the government has established special economic zones devoted to industries like electronics, textiles, jewellery and gems, and medicines.

These focused strategies not only increase exports but also support the development of these particular industries, encouraging innovation and the improvement of technology.

Free trade zones offer numerous benefits, but there have also been some drawbacks. Since businesses operating outside of the zones do not get comparable benefits, opponents contend that the incentives and perks offered within these zones create an unfair playing field. This may lead to an unbalanced pattern of growth, with the majority of economic activity concentrating in the free trade zones and the neglect of other areas. Concerns over labour conditions have also been raised in several of these zones due to claims of poor working conditions and labour exploitation. Moreover, elements like regulatory clarity, political stability, and a favourable business climate are crucial to the prosperity of free trade zones. Collaboration between local communities, companies, and the government is necessary to overcome these obstacles.

To sum up, India's free trade zones are essential for fostering economic expansion, drawing in foreign direct investment, and increasing exports. Due to the incentives and benefits provided by these zones, both domestic and foreign businesses are finding India to be a desirable place to invest. Additionally, the development of enterprises within these zones creates jobs and boosts the local economy in the surrounding areas. Nonetheless, the government must respond to the criticisms made and make sure that these zones support equitable and long-term economic growth throughout the nation. Among the many services that are provided inside India's Free Trade Zones is Onnsynex. We offer complete solutions to companies operating in these zones, and we have experience with supply chain management. Storage and distribution, logistics, and value-added services comprise Onnsynex' three main areas of expertise.

Modern facilities are available for distribution and warehousing within the free trade warehousing zone thanks to Onnsynex. Assuring effective inventory management and prompt delivery, we offer safe storage facilities for products. Advanced technologies and integrated systems in these warehouse facilities allow for real-time tracking and monitoring of items, resulting in efficient handling and reduced downtime. We provide a broad range of transport services to cater to the various demands of companies that operate in free trade zones. They provide the smooth delivery of commodities between various places by offering multimodal transportation options that include road, rail, air, and sea. Furthermore, we minimise transit times, optimise routes for transportation, and lower transportation costs thanks to our vast network and experience. Value-added services are provided by Onnsynex within the FTZs in addition to standard transportation and warehousing services. Our specialised services, which include packing, labelling, assembly, kitting, and quality control, are made to meet the unique needs of our customers. These value-added services assist companies in increasing customer happiness, streamlining processes, and improving the quality of their products.

0 notes

Text

52nd GST MEETING MINUTES 07.10.2023

Trade Facilitation measures

Amnesty scheme for appeal filing till 31st January 2024

> Who will it benefit?

Taxable persons

> who could not file an appeal against a demand order passed on or before 31st March 2023

> Whose appeal was rejected since it was not filed within the specified time limit

> How much amount to be pre- deposited?

> 12. 5% of the tax under dispute

> of which 2.5% has to be debited from electronic cash ledger

2.Taxability of Guarantees given to the banks against the credit limits / loans sanctioned by the Company

> Where the guarantee is provided by the directors :The value of the transaction to be treated as zero if there is no consideration paid by the company.

> Where corporate guarantee is provided for related persons including holding company to its subsidiary company :The taxable value of the transaction shall be 1% of such guarantee or the actual consideration whichever is higher (Sub-rule (2) in Rule 28 to be inserted for the purpose).

3.Restoration of provisional attachment of property

Proposed amendment to provide that the order passed in Form GSTR DRC -22 shall not be valid for more than one year from the date of order.

Note :No specific written order required

4. Clarification on issues related to Place of Supply

Circulars to be issued to clarify the place of supply related to i) transportation of goods, including by mail or courier, in cases where the location of supplier or the location of recipient of services is outside India; (ii) advertising services and (iii) co-location services.

5. Clarification related to export of services

> To be treated as export of services , the consideration for supply of services to be received in convertible foreign exchange or in Indian rupees wherever permitted by RBI

> Circular to be issued to clarify the admissibility of export remittances received in Special INR Vostro account, as permitted by RBI

Note : Rupee vostro accounts keeps a foreign entities holding in an Indian Bank in India Rupees and facilitate settlement of transactions in INR.

6. Supplies to Sez unit / sez development on payment of IGST and claiming of refund

Except commodities mentioned in Notification 1/ 2023 dated 31st July 2023, suppliers to Sez units / Sez developers can go for the IGST payment and refund route w.e.f 1st October 2023

Other measures pertaining to law and procedure

> Alignment of provisions of the CGST Act, 2017 with the provisions of the Tribunal Reforms Act, 2021 in respect of Appointment of President and Member of the proposed GST Appellate Tribunals – The eligibility and age criteria has now been specified.

> Amendment to Act and rules to give effect to ISD procedure

> ISD distribution procedure was made mandatory for distribution of Input Services procured by HO.

> In relation to the same amendments has been recommended in Section 2(61) , Section 20 of the CGST Act and Rule 39 of the CGST Rules.

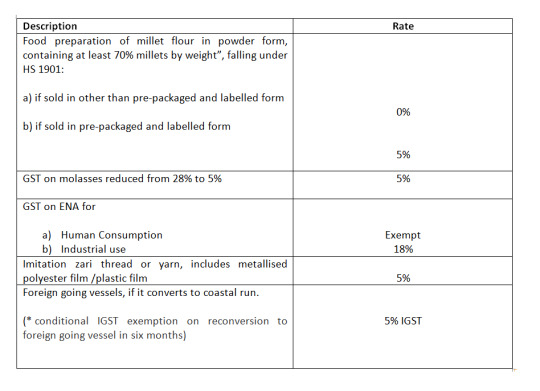

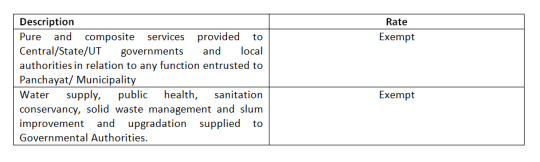

Rate Changes

1. Changes in rate of Good

2. Changes in rate of Services

0 notes

Text

How to find a suitable 3.5 BHK apartment in Sobha Neopolis in Bangalore

Finding Your Ideal 3.5 BHK Apartment in Sobha Neopolis in Bangalore

Sobha Neopolis in Bangalore, often called the Silicon Valley of India, is a bustling city with a thriving real estate market. Among the many prestigious developments in the city, Sobha Neopolis stands out as a beacon of luxury and comfort. If you are looking for a spacious and well-appointed 3.5 BHK apartment in this sought-after locality, this guide will walk you through the essential steps to find your dream home.

Sobha Neopolis in Bangalore has good connectivity to all the areas of the city through a good network of roads. It is near to both the city and the airport. It is 45 km from the airport, making it easy for business travellers. The project is in a thriving area with several IT parks, making this area a central IT hub. The project is in a location that is accessible from all areas of the city.

Many buses run from the area and connect all parts of the city. The upcoming metro will improve the transport network further and close the room to the rest of the town. The airport is near the area and is accessible through NH 44. The site has good rail connectivity through Belandur Road Station, 10 minutes from the project, and Carmelaram Station, 6.5 km from the project.

Connectivity to the railway station – The Bellandur Railway Station is 5 minutes from the project.

Some nearby IT companies to the project include SEZ, which is 8 km from the project

Eco Space Tech Park is 3 km from the project

SAP Labs is 6 km from the project

Brigade Tech Park is 5 km from the project

Some hospitals near the project include Motherhood Hospital,

Sakra World Hospital,

Columbia Asia Hospital, etc.

The Sobha Neopolis in Bangalore enclave is in the beautiful area of Panathur Road and is well-connected to the rest of Bangalore. It is in the growing east of the city. The area is one of the upcoming housing areas and is favoured by many people to live in. It is easy to reach the site from other parts of the city.

Connectivity to Airport – The distance to the airport is 45.4 kilometres. It is an area in the north that takes an hour and a half to reach.

Connectivity to Whitefield – Whitefield is also in the city’s east. It is located 9.2 kilometres away and takes 25 minutes to get there.

Connectivity to Sarjapur Road – The area is in the southeast, and the distance is 7.4 kilometres. It takes just 15 minutes to reach the place.

Connectivity to Electronic City – It is 21.4 kilometres from Electronic City. The site can be contacted via a lot of major roadways. It takes 40 minutes to get to the area.

Connectivity to MG Road – MG Road’s main work area is in the city’s heart. It is 14.9 kilometres away and can be reached by NH 44 and Old Airport Road.

The payment schedule of Sobha Neopolis in Bangalore includes the following:

Pricelist

Stamp duty is charged at 0.1% of the agreement of sale.

GST as per the prevalent rates.

Deposit and charges for utilities (at actuals).

If payment is late, extra GST is charged on interest.

Costs for registration and stamp duty.

Demand notes for price on completing building milestones.

Advance charges for maintenance with the final payment request letter and taxes.

Other applicable charges are to be paid.

The primary value has one car parking space for all 1, 3+2T, and 3-BHK. Two-car parking is for 3+HO and 4-BHK.

Deposit on electricity consumption.

Setting the Stage for Your Search:

With 78% open spaces, lush greenery, and world-class amenities, Sobha Neopolis in Bangalore offers a kaleidoscope of options. To navigate this abundance, define your priorities:

Budget: 3.5 BHK apartments’ prices vary depending on size, floor, and view. Be realistic and factor in maintenance charges and potential renovation costs.

Size & Layout: 3.5 BHKs range from 1611 to 2178 sq. ft., with study areas adding extra space. Choose a layout that suits your family dynamics and ensures optimal sunlight and ventilation.

Amenities: Sobha Neopolis in Bangalore boasts three clubhouses, swimming pools, sports facilities, and more. Prioritize amenities you’ll use to avoid paying for extras you won’t.

Location: Sobha Neopolis in Bangalore spans across two phases. Consider proximity to schools, hospitals, public transport, and your workplace for a convenient daily commute.

Exploring Your Options:

Dive into the treasure trove of resources available:

Sobha Neopolis in Bangalore Website: Browse official floor plans, price lists, and virtual tours for a holistic picture.

Online Real Estate Portals: Utilize platforms like No Broker, Housing.com, and Magic bricks to compare listings, check pricing trends, and connect with agents.

Resident Reviews: Seek insights from existing residents on community life, amenities, and maintenance through forums and social media groups.

Direct Contact: Don’t hesitate to contact the Sobha Neopolis sales team for personalized assistance and a clearer understanding of available options.

Why do you need to select Sobha Neopolis in Bangalore?

Sobha Neopolis in Bangalore is a testament to a luxurious dwelling in the heart of Bangalore. With number 2 and three-bedroom apartments designed to cater to various preferences, the venture offers a perfect combination of comfort, aesthetics, and present-day facilities. While the price of residing in Sobha Neopolis in Bangalore reflects the top-rate nature of the improvement, the investment potential and the first-rate existence guarantees to make it a compelling preference for the ones seeking to make extended-term funding in Bangalore’s actual property marketplace.

Related Links

Sobha Neopoils About

Sobha Neopolis master and floor plan

Sobha Neopolis Pricing

Sobha Neopolis Amenities

Related Links

Sobha Neopolis Best 3, 3.5BHK apartments in Bangalore

Sobha Neopolis Luxury 3,4 BHK apartments in Bangalore

Sobha Neopolis Apartments

RELATED ARTICLE

SOBHA NEOPOLIS IN BANGALORE

0 notes

Text

Navigating the GST Refund Process: A Comprehensive Guide

The Goods and Services Tax (GST) has transformed the Indian taxation landscape, introducing a unified tax system that subsumed various indirect taxes. While GST has simplified tax compliance for many businesses, the process of claiming GST refunds can be complex and often confusing. This comprehensive guide aims to demystify the GST refund process, providing a step-by-step approach to navigate the system effectively.

Understanding GST Refunds

GST refunds are primarily granted to businesses that have accumulated excess tax credit in their Electronic Credit Ledger (ECL). These credits arise when a business purchases goods or services from GST-registered suppliers and pays the applicable GST. The input tax credit on such purchases can be set off against the output tax liability generated from the sale of goods or services.

However, in certain situations, a business may have an excess balance in their ECL, indicating that they have paid more input tax than the output tax they have collected. This is where GST refunds come into play. The excess balance in the ECL can be claimed as a refund from the GST authorities.

Types of GST Refunds

There are various types of GST refunds available to businesses, each with its specific criteria and eligibility requirements. Some of the common types of GST refunds include:

Refund of excess balance in the Electronic Cash Ledger (ECL): This is the most common type of refund, where a business claims the excess input tax credit accumulated in their ECL.

Refund on account of exports without payment of tax: Exporters are eligible for a refund of the GST paid on input goods or services used for the manufacture or procurement of exported goods.

Refund on account of supplies to SEZ units: GST paid on input goods or services supplied to units located in Special Economic Zones (SEZs) can be claimed as a refund.

Refund on account of payment of tax on zero-rated supply: Businesses that have inadvertently paid GST on zero-rated supplies are eligible for a refund.

Filing a GST Refund Application

The process of filing a GST refund application is primarily online through the GST portal. The following steps outline the general process:

Log in to the GST portal using your registered GSTIN and credentials.

Navigate to the Services tab and select Refunds.

Choose the Application for Refund option.

Select the reason for refund from the available options.

Enter the tax period for which the refund is being claimed.

Fill in the refund claimed amount and provide supporting documents.

Review the application details and submit it.

Once submitted, the application will be assigned to a Refund Processing Officer (RPO) for review.

The RPO will scrutinize the application and may seek further clarifications if necessary.

Upon approval, the refund amount will be credited to the taxpayer's bank account linked to their GSTIN.

Timelines for GST Refund Processing

The time taken for processing a GST refund application can vary depending on the complexity of the claim and the workload of the RPO. However, the GST rules specify a maximum time limit of 60 days for processing refund applications.

Documents Required for GST Refund

The specific documents required for a GST refund application will depend on the type of refund being claimed. However, some common documents that may be required include:

GST registration certificate

GSTR-1 return for the relevant tax period

Copies of invoices or other supporting documents for input tax credits

Export documents (for refund on account of exports)

IEC (Importer-Exporter Code) number (for refund on account of exports)

Certificate from a Chartered Accountant (CA) or Cost and Management Accountant (CMA) in certain cases

Additional Tips for GST Refund Claims

To ensure a smooth and timely processing of your GST refund application, consider the following tips:

File your GST returns regularly and accurately.

Maintain proper records of all input tax credits and supporting documents.

File your refund application promptly within the prescribed time limit.

Submit complete and accurate information in the refund application.

Respond promptly to any queries raised by the RPO.

Seek professional assistance from a tax consultant if required.

Conclusion

The GST refund process, while not without its complexities, can be effectively navigated with proper planning and documentation. By adhering to the prescribed procedures and timelines, businesses can ensure that their legitimate refund claims are processed efficiently.

0 notes

Text

52nd GST MEETING MINUTES 07.10.2023

Trade Facilitation measures

Amnesty scheme for appeal filing till 31st January 2024

> Who will it benefit?

Taxable persons

> who could not file an appeal against a demand order passed on or before 31st March 2023

> Whose appeal was rejected since it was not filed within the specified time limit

> How much amount to be pre- deposited?

> 12. 5% of the tax under dispute

> of which 2.5% has to be debited from electronic cash ledger

2.Taxability of Guarantees given to the banks against the credit limits / loans sanctioned by the Company

> Where the guarantee is provided by the directors :The value of the transaction to be treated as zero if there is no consideration paid by the company.

> Where corporate guarantee is provided for related persons including holding company to its subsidiary company :The taxable value of the transaction shall be 1% of such guarantee or the actual consideration whichever is higher (Sub-rule (2) in Rule 28 to be inserted for the purpose).

3.Restoration of provisional attachment of property

Proposed amendment to provide that the order passed in Form GSTR DRC -22 shall not be valid for more than one year from the date of order.

Note :No specific written order required

4. Clarification on issues related to Place of Supply

Circulars to be issued to clarify the place of supply related to i) transportation of goods, including by mail or courier, in cases where the location of supplier or the location of recipient of services is outside India; (ii) advertising services and (iii) co-location services.

5. Clarification related to export of services

> To be treated as export of services , the consideration for supply of services to be received in convertible foreign exchange or in Indian rupees wherever permitted by RBI

> Circular to be issued to clarify the admissibility of export remittances received in Special INR Vostro account, as permitted by RBI

Note : Rupee vostro accounts keeps a foreign entities holding in an Indian Bank in India Rupees and facilitate settlement of transactions in INR.

6. Supplies to Sez unit / sez development on payment of IGST and claiming of refund

Except commodities mentioned in Notification 1/ 2023 dated 31st July 2023, suppliers to Sez units / Sez developers can go for the IGST payment and refund route w.e.f 1st October 2023

Other measures pertaining to law and procedure

> Alignment of provisions of the CGST Act, 2017 with the provisions of the Tribunal Reforms Act, 2021 in respect of Appointment of President and Member of the proposed GST Appellate Tribunals – The eligibility and age criteria has now been specified.

> Amendment to Act and rules to give effect to ISD procedure

> ISD distribution procedure was made mandatory for distribution of Input Services procured by HO.

> In relation to the same amendments has been recommended in Section 2(61) , Section 20 of the CGST Act and Rule 39 of the CGST Rules.

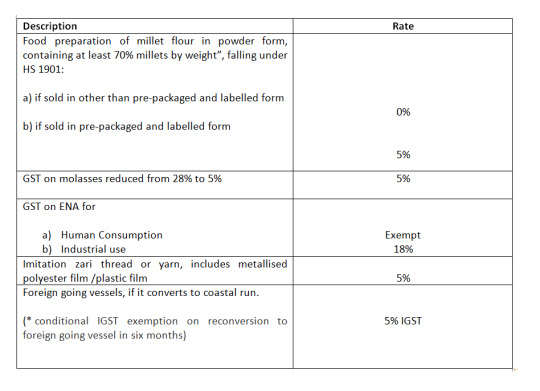

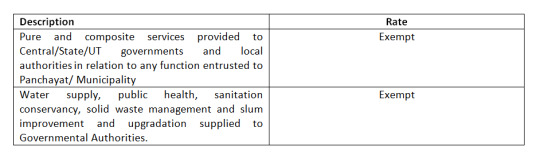

Rate Changes

1. Changes in rate of Good

2. Changes in rate of Services

0 notes

Text

The Rise of the International Trade Compliance Officer in a Post-MBA World

Introduction:

In an era marked by intricate global trade networks, the International Trade Compliance Officer stands as the guardian of regulatory integrity. As India asserts its role in the global marketplace, what does it take to excel in this critical position? Journey with us as we explore the power of an Online MBA in Logistics with Supply Chain Management for those aspiring to champion international trade compliance.

Why an MBA is Crucial for International Trade Compliance:

In-depth Regulatory Knowledge: Master international trade laws, treaties, and customs protocols across major global economies.

Strategic Decision Making: Navigate complex scenarios where trade regulations intersect with business strategies.

Ethical Leadership: Foster a culture of compliance and ethics, ensuring every trade action stands up to scrutiny.

Risk Management: Identify and address potential compliance risks before they escalate.

Trade Across Diverse Industries:

An Online MBA opens avenues in various sectors that engage in international trade:

Electronics: Ensure the smooth exchange of tech goods across borders.

Pharmaceuticals: Guarantee that medical supplies and drugs adhere to international safety and trade norms.

Agriculture: Facilitate the global movement of agricultural products, keeping in mind quotas and restrictions.

Automotive: Oversee the trade of vehicles and parts, ensuring conformity with global standards.

Challenges on the Global Stage:

International Trade Compliance Officers are tasked with managing multifaceted challenges. An MBA equips them to:

Adapt to Changing Regulations: As international treaties evolve, be prepared to quickly pivot and adapt.

Navigate Geopolitical Dynamics: Trade often gets ensnared in geopolitical tensions. The ability to strategize in such a landscape is vital.

Manage Audits and Scrutiny: Ensure that every audit is passed with flying colors and every transaction stands up to regulatory examination.

Drive Continuous Training: As rules change, so must the company's training protocols. Lead this change from the front.

Top 10 Companies in India for International Trade Compliance Officers:

Tata Consultancy Services

Infosys

Wipro

Mahindra & Mahindra Ltd.

Reliance Industries Limited

Adani Ports & SEZ

Sun Pharmaceuticals

Dr. Reddy’s Laboratories

Hindustan Unilever Ltd.

ICICI Bank

The Value of an MBA in Global Compliance:

The role of an International Trade Compliance Officer isn't merely about overseeing paperwork. It's about strategizing in a complex, ever-changing world of international norms. An Online MBA in Logistics with Supply Chain Management not only empowers with knowledge but instills a mindset to innovate and adapt.

Let ShikshaGurus help you in your Education Journey:

ShikshaGurus assists you in exploring and comparing courses from over 60 online and distance learning universities. They offer free, unbiased consultation sessions with experts to guide you in selecting the ideal educational path. Furthermore, they provide assistance in finding the best university that aligns with your budget.

Conclusion:

The International Trade Compliance Officer stands at the crossroads of business and global diplomacy. In India's quest for global economic prominence, these professionals will play an instrumental role. An Online MBA in Logistics with Supply Chain Management is more than just a degree; it's a passport to leading global trade's future. Equip yourself with this MBA and redefine international trade compliance.

0 notes

Text

HIGHWAY PARADISE

Commercial Land & Plots KANDUKUR SRISAILAM HIGHWAY

OPPORTUNITY TO INVEST IN HIGHWAY FACING COMMERCIAL LAND

Prop. 200ft., Highway Facing Land

5 to 40 Guntas Available

Close to Pharma City, Pharma University,Amazon Data Center

Amenities :

Pampering you with the best for a hassle-free living

NEAR @ OUR VENTURE

00 Mins to Srisailam Highway

05 Mins to Pharmacy City (19933 Acres)

10 Mins to Amazon Data Center (100 Acres)

15 Mins to Mankhal Industrial Development- 143Acrs

20 Mins to Exit-14 ORR

15 Mins to Tata Aerospace Sez Adibatla

15 Mins to Rajiv Gandhi International Airport

15 Mins to E-City (1200 Acres)

30 Mins to TCS Adibatla & Hardware Park

30 Mins to Banglore Highway

20 Mins to Ranga Reddy Collectorate

40 Mins to Gachibowli & Hitech-City

20 Mins to INDO UK 1000 Beds Hospital, Gold SEZ, Electronics Companies (Total 350 Acrs)

20 Mins to Maisigandi Temple

20 Mins to International ZOO Park (945 Acres)

Srisailam Highway to Tirupati National Highway Declared Central Government

#hyderabad#telangana#marketing#smartbusiness#farmland#plot for sale#propertyforsale#property#realestate#farmlands

3 notes

·

View notes

Text

Royal Car Rental Indore Call 9009191093

The Best Car Rental Company in Indore Royal Car Rental is the leading Fleet provider in Indore. We have large number of cars in our Fleet. Royal Car Rental is providing luxury car rentals India and under one roof you will find all kind of Tour and Transport related services. Our fleet includes Luxury cars like BMW, Mercedes Benz E Class, Toyota Corolla. Budget cars like Tata Indigo, Swift Dzire. Executive cars like Honda City, and we also offer MUV-SUV Rental with cars like Chevrolet, Toyota Innova, Toyota Fortuner. Our services includes Airport Pick Up & Drop Off , Railway Transfers, Diplomatic services - VIP, Dignitary & Diplomatic Client Handing, Events/ Trade Shows, car rental for - Parties & Social Events, Weddings, Festivals & other Special Occasion, Sight-seeing Tours, Day/ Weekend Trips, Award Shows & Events etc. We offer Best Services at very competitive prices. Indore is the largest city and the financial capital of Madhya Pradesh. Indore is situated on the Malwa Plateau, just south of the Satpura Range. . The city is well connected via rail, road and air. Indore has for a long time been a rail and road transportation hub. Indore being the financial capital of the Madhya Pradesh is home to the Madhya Pradesh Stock Exchange, India's third oldest stock exchange. Indore's real estate market is among the fastest growing in Central India. Therefore Indore witness many business travelers for meetings and events, held in Indore, local commute for business travelers in Indore have become very easy with Royal Car Rental providing its car rental services in Indore. There is no need for business travelers to look for public transport as we offer our car hire services at very competitive prices. We also assure you best services in Indore. Royal Car Rental Indore, also provides car rental services in major industrial areas surrounding the Indore city such as Pithampur, Indore Special Economic Zone, Sanwer Industrial belt,LaxmiBai Nagar IA, Rau IA, Bhagirathpura IA, Kali Billod IA, Ranmal Billod IA, Shivaji nagar Bhindikho IA, Hatod IA, IT Parks - Crystal IT Park, IT Park Pardeshipura, Electronic Complex, Individual SEZ such as TCS SEZ, Infosys SEZ, Impetus SEZ,etc., Diamond Park,Gems and Jewellery Park, Food Park, Apparel Park, Namkeen Cluster and Pharma Cluster. Royal Car Rental also provides car rental services for tourists visiting Indore from outstation places, Just give us a call and we will arrange the Best Car Hire service for your tour. We offer our car hire services to famous tourists destinations near Indore like Maheshwar, Mandavgarh or Mandu, Patalpani waterfall, Choral Fall, Tincha Fall , Ujjain etc.

#Tempo Traveller Rental Indore#Car Rental Indore#Car Hire Indore#Taxi In Indore#Royal Car Rental Indore

0 notes

Text

What is the process of filing a Letter of Undertaking (LUT) under Goods & Service Tax (GST)?

Introduction

All registered taxpayers who wish to export goods or services without paying IGST (Integrated Goods and Service Tax) must submit a Letter of Undertaking (LUT) in GST RFD-11 form through the GST website. This article is going to focus on “What is a Letter of Undertaking under GST?”, “Process for Filling LUT under GST,” “Documents Required for LUT under GST,” and “Eligibility requirements for Filing LUT under GST (Goods and Service Tax).

What is a Letter of Undertaking under GST?

Exporters can use a letter of undertaking to export goods or services without paying taxes. Under the new GST system, all exports are subject to IGST, which may then be reclaimed through a refund against the tax paid. By applying for a LUT (Letter of Undertaking), exporters can avoid the effort of requesting a refund and avoid the freezing of cash through tax payments.

Who is eligible to file LUT under GST?

Any exporter of goods or services who has registered for GST is required to submit a GST LUT. Exporters who have been accused of committing a crime or tax evasion totaling more than INR 250 lakhs in violation of the CGST Act, the IGST Act, 2017, or any other applicable law are disqualified from submitting a GST LUT. In this case, they would have to offer an export bond. According to the CGST Rules, 2017, any registered person may submit an export bond or LUT under GST RFD 11 without having to pay the integrated tax. They could apply for LUT if:

They want to offer goods or services to India, other nations, or SEZs (Special Economic Zones) and have registered for GST.

They wish to avoid paying the integrated tax when they sell goods.

What is the process of filing LUT under GST?

The following is the process of filing LUT under GST:

Navigate to the GST Portal and sign in using your authorized credentials.

The “USER SERVICES” drop-down menu under “SERVICE TAB” offers the option to furnish a Letter of Undertaking (LETTER OF UNDERTAKING (LUT).

You must next choose the financial year for which you want to file the letter of undertaking after choosing this option.

Next, attach a PDF of the LUT from the previous financial year, if applicable.

Next, include two witnesses’ names, addresses, and occupations.

The next step is to fill in the filing location. You can view a preview of the form after this process is finished.

The application can be signed using an electronic verification code or a recognized digital signature certificate. On the form, both options are present. The form cannot be changed after it has been signed and submitted.

What are the documents required for filing LUT?

The following documents are required for filing LUT under GST:

PAN Card of the Company

Authorized Person’s KYC

Certificate of IEC Code

Form GST RFD 11

LUT Cover Letter with an official signature serving as an acceptance request

Returned/ Canceled Cheque

How will the GST Letter of Undertaking help exporters?

The following are the benefits of GST LUT for exporters:

Regular exporters gain a lot by filing LUT electronically because doing so saves time compared to the alternative.

The applicant does not have to show up in person for approval in front of the officials. The entire process can be finished more quickly and easily.

An exporter may export products or services tax-free if they submit a LUT under the GST.

The Letter of Undertaking is effective for the whole financial year for which it was submitted.

GST filing charges are the fees incurred when individuals or businesses file their Goods and Services Tax (GST) returns with tax authorities. These charges vary based on tax laws, filing frequency, and transaction complexity, covering preparation, verification, and submission of GST returns, along with any professional services fees if needed. Staying informed and seeking professional guidance can aid in a smooth and accurate GST filing process.

Summary

LUT is necessary if you want to export goods, services, or both without paying IGST. If exporters fail to provide the LUT, they must pay IGST or release an export bond. Previously, LUT could only be delivered in person to the appropriate GST office. But in order to make the process simpler, the government has made LUT filing available online.

0 notes