#ElliottWave

Explore tagged Tumblr posts

Text

EUR/USD Poised for Lift-Off: Is Wave ⑤ Now Underway?

▪️Elliott Wave analysis on the daily chart of EUR/USD shows that corrective wave (iv) has likely completed at the 38.2% retracement of wave (iii), suggesting the beginning of a bullish wave (v) targeting the 1.17 level and beyond.

▫️On the 4-hour chart, the completion of a WXY corrective structure (wave iv in green) is evident, followed by a clear impulse wave (i) and a potential shallow pullback in wave (ii), which appears near completion.

▪️The expected scenario favors the start of a new impulsive rally, supported by clean wave structure and Fibonacci symmetry.

▫️As long as 1.1065 holds, the bullish outlook remains valid, with a breakout above 1.1380 strengthening the case for a move toward 1.17+.

#forex#forextrader#elliottwave#bitcoin#investing#eurusd#cryptocurrency#elliott wave theory#business#gold

3 notes

·

View notes

Text

📊 WallStreet Pulse – Daily Dein tägliches Markt-Update für Nasdaq, S&P 500 und VIX.

🕒 Montag bis Freitag um 14:30 Uhr Präzise. Datenbasiert. Ohne Spekulation.

🎯 Was dich erwartet: – VIX: Wie sicher ist der Markt wirklich? – S&P 500: Trendverhalten & technische Trigger – NASDAQ: Ausbruch oder Korrektur? – Klare Ampellogik statt Bauchgefühl

📈 Keine Meme-Coins. Kein Hype. Nur Struktur.

⚠️ Hinweis: Alle Charts in diesem Format sind illustrativ und dienen der visuellen Erklärung. Keine Plattformdaten, keine fremden Screenshots – nur Beispielgrafiken zur Veranschaulichung.

📆 Sonntags um 20:00 Uhr: Die große Wochenschau mit Makrostruktur & Risikoanalyse.

© ChartWise Insights – durch Vernunft zum Erfolg.

#wallstreetpulse#nasdaq#sp500#vix#usmarkets#marktanalyse#chartwise#tradingupdate#technicalanalysis#elliottwave#marketstructure#dax#volatility#macroanalysis#aktienmarkt#börse#finanzmärkte#wirtschaft#marktbericht#investing

0 notes

Text

1 note

·

View note

Text

GOLD & GBPJPY

#gbpjpy#goldtrading#gold analysis#goldprice#gold#xauusdsignals#xauusd#forextrader#forex#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#eurusd#forexprofit

7 notes

·

View notes

Text

#forex#forextrader#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#eurusd#forexprofit

7 notes

·

View notes

Text

#forex#forextrader#bitcoin#elliottwave#investing#cryptocurrency#business#eurusd#finance#elliott wave theory

4 notes

·

View notes

Text

GOLD - 2 & 4 Hour

2 notes

·

View notes

Text

GBPJPY - 4Hour

#forex#forextrader#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#forexprofit#eurusd

3 notes

·

View notes

Text

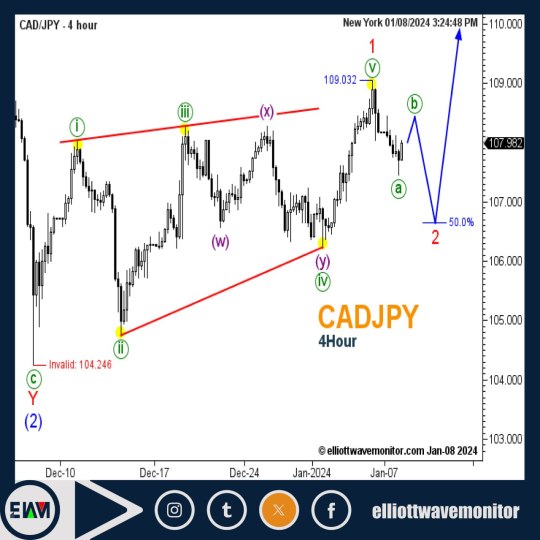

CADJPY - 4Hour

#forex#forextrader#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#eurusd#forexprofit

3 notes

·

View notes

Text

XAUUSD - 2Hour

#forex#forextrader#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#eurusd#forexprofit

3 notes

·

View notes

Text

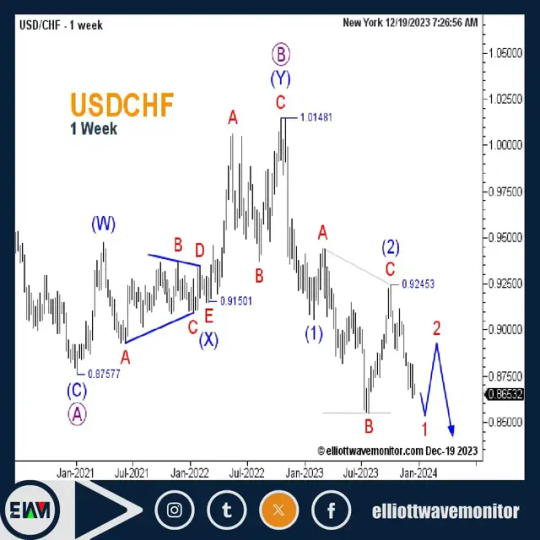

USDCHF - 1Week

#forex#forextrader#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#eurusd#forexprofit

2 notes

·

View notes

Text

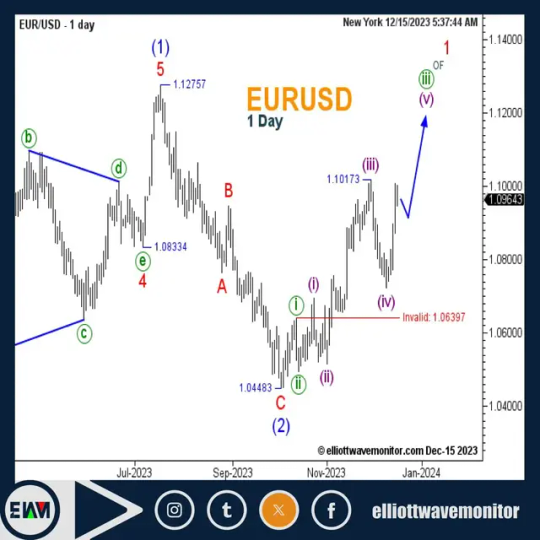

EURUSD On 1Day Time-Frame Is Currently trading in a bullish wave of wave 5 of wave 3 of wave 1 of a higher degree.

It is expected that wave 5 will continue to rise to the level of 1.10173 and then to the level of 1.12500.

This would indicate that wave 5 of wave 3 has completed and EUR/USD will begin a corrective wave 4 of wave 1 of a higher degree.

Note: Any break below the level of 1.06397 invalidates the bullish scenario.

#forex#forextrader#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#eurusd#forexprofit

2 notes

·

View notes

Text

AT&T (T) Approaches Final Wave High Before Correction Opportunity AT&T Inc. (T) is an American multinational telecommunications holding company headquartered in Dallas, Texas. It is the world’s largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S. More Information: elliottwave-forecast.com/stock…

0 notes

Text

Elliott Wave Perspective: Nvidia (NVDA) Wave 3 Close to ConclusionSince July 4, 2025, Nvidia (NVDA) has been experiencing a robust rally. The rally is unfolding as a five-wave impulse structure according to Elliott Wave analysis. This upward movement began at a low on July 4, 2025, More Information: elliottwave-forecast.com/news…

0 notes

Text

IDEX Corporation (IEX) Elliott Wave Weekly Analysis

IDEX Corporation (NYSE: IEX) is showing signs of completing its wave (2) correction within a broader bullish Elliott Wave cycle. The long-term chart highlights a strong impulsive trend that began in the early 1990s. Since then, the stock has advanced through multiple Elliott Wave degrees, forming a sustained upward structure. More Information.

0 notes