#Employee Payroll Services

Text

Your Solution for Outsourcing Employment Payroll Management

Boost your business efficiency with TECKJOBS! Offering top-notch Outsourcing Employment Payroll Management & HR services for seamless business operations.

For more information, visit https://www.teckjobs.com/outsourcing-employment-payroll-management.php.

#Outsourcing Employment Payroll Management#hr outsourcing services#outsourcing payroll#payroll management company#hr outsourcing company#payroll outsourcing company#employee payroll services#payroll management service#outsourcing payroll management

0 notes

Link

0 notes

Text

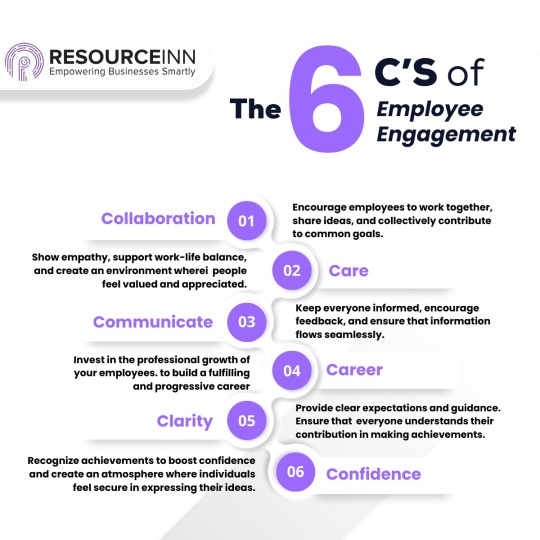

According to 𝐆𝐚𝐥𝐥𝐮𝐩'𝐬 𝐒𝐭𝐚𝐭𝐞 of the Global Workplace, only 23% of employees are actively engaged globally 📉💼

It’s more crucial than ever for organizations to reduce turnover, retain top talent, increase productivity, and build better workplace relationships. 🤝

However, it can be managed with the 𝟔𝐂𝐬 𝐨𝐟 𝐄𝐦𝐩𝐥𝐨𝐲𝐞𝐞 𝐄𝐧𝐠𝐚𝐠𝐞𝐦𝐞𝐧𝐭

1 → Collaboration

2 → Care

3 → Communicate

4 → Career

5 → Clarity

6 → Confidence

From commitment to communication, each C intertwines for workplace brilliance

(You can view more details in the infographics 📊 below)

Which of the 6 Cs of employee engagement do you struggle with the most? Share your experience with us 💬👇

2 notes

·

View notes

Text

How Outsourced HR Payroll Services Can Help You Focus on Core Business

Managing HR and payroll internally can quickly become a cumbersome task for growing businesses. As companies scale, the complexities of payroll compliance, wage calculations, tax deductions, and employee benefits multiply. This is where outsourced HR payroll services step in to save the day. By shifting these essential but time-consuming tasks to an expert provider like Ignite HCM, businesses can focus on what truly matters: driving growth, innovation, and customer satisfaction.

In this article, we’ll dive into how outsourcing HR payroll can free up valuable resources, streamline operations, and empower your business to focus on its core mission.

Introduction: The Hidden Costs of In-House Payroll

Payroll is an unavoidable aspect of any business, but managing it in-house often comes with hidden costs. From the time spent on repetitive administrative tasks to the stress of navigating compliance requirements, businesses can quickly find themselves overwhelmed. In fact, a study by the National Small Business Association found that small business owners spend an average of 5 hours per pay period handling payroll.

Every hour spent on payroll is an hour not spent on building your brand, innovating new products, or engaging with customers. Outsourcing HR payroll services not only reduces operational burdens but also allows businesses to allocate their resources more efficiently.

1. Save Time and Focus on Core Activities

Time is money in business, and payroll management can eat up a significant portion of it. From processing timesheets to filing tax documents, payroll is a complex and time-intensive task. A survey by PricewaterhouseCoopers found that nearly 40% of companies struggle with inefficient payroll processes.

When businesses outsource HR payroll services, they free up their HR teams to focus on strategic initiatives. Instead of getting bogged down in administrative tasks, they can concentrate on improving employee satisfaction, enhancing workplace culture, and driving business goals. Ignite HCM takes the heavy lifting off your hands, enabling your business to thrive.

2. Reduce Costs and Increase Operational Efficiency

Maintaining an in-house payroll department is not only time-consuming but also expensive. Between hiring payroll specialists, investing in software, and keeping up with compliance regulations, the costs can quickly add up. According to Deloitte, companies can save 20-30% of payroll costs by outsourcing.

By partnering with Ignite HCM, businesses eliminate the need for costly software licenses, reduce payroll errors, and mitigate the risk of penalties due to compliance issues. These savings can then be reinvested into core areas like product development, marketing, and business expansion.

3. Ensure Compliance and Mitigate Risk

One of the biggest challenges of handling payroll in-house is staying compliant with constantly changing tax laws, labor regulations, and benefits requirements. Failing to comply with these regulations can result in hefty fines or even legal action. A report by the IRS shows that nearly 40% of small to medium-sized businesses incur penalties related to payroll compliance errors each year.

Outsourcing payroll ensures that your business remains compliant with local, state, and federal regulations. Ignite HCM keeps up-to-date with the latest compliance changes, giving you peace of mind that your payroll is being handled correctly and in full accordance with the law. This eliminates the risk of costly mistakes and lets you focus on growing your business.

4. Boost Employee Satisfaction with Accurate Payroll

Payroll mistakes can severely damage employee trust and morale. Studies show that 49% of employees would look for a new job after experiencing two payroll errors. Timely, accurate payroll processing is essential for maintaining a motivated and engaged workforce.

When businesses outsource their payroll services to Ignite HCM, they gain access to cutting-edge technology that ensures payroll accuracy. Employees are paid on time, every time, with minimal errors—helping to foster a positive work environment. Happy employees are more productive, which directly contributes to the success of your core business.

5. Access Advanced Payroll Technology and Expertise

Outsourcing payroll doesn’t just save time and money; it also grants businesses access to advanced technology and industry experts. Payroll providers like Ignite HCM leverage modern, cloud-based systems that automate payroll tasks, ensuring real-time updates, accurate reports, and seamless integrations with other HR functions.

This expertise extends to managing complex situations like multi-state payroll, international employees, and benefits administration. By relying on an expert provider, businesses can avoid costly mistakes and benefit from the latest payroll technology, which would otherwise require significant investment.

Frequently Asked Questions About Outsourcing HR Payroll Services

Q1: Is outsourcing payroll suitable for small businesses?

Absolutely. Outsourcing payroll is not just for large corporations. Small businesses can greatly benefit from outsourcing, as it frees up time and resources, allowing them to focus on growth and core business activities.

Q2: How much time can I save by outsourcing payroll?

On average, businesses can save 5-10 hours per pay period, depending on the complexity of their payroll processes. This time can be better spent on strategic growth activities.

Q3: How do outsourced payroll services handle compliance?

Outsourced providers like Ignite HCM are experts in payroll compliance. They stay up-to-date on tax regulations and labor laws, ensuring that your business remains compliant and avoids penalties.

Q4: What cost savings can I expect from outsourcing payroll?

Businesses typically save 20-30% of payroll costs by outsourcing, as it eliminates the need for additional in-house staff and costly software investments.

Q5: Is outsourcing payroll secure?

Yes, outsourcing payroll is secure. Providers like Ignite HCM use encrypted, cloud-based systems to ensure that your data is protected, and they follow stringent security protocols to safeguard sensitive employee information.

Conclusion: Ignite Business Growth by Outsourcing Payroll

Outsourcing HR payroll services is a strategic move that allows businesses to focus on their core competencies. With Ignite HCM handling your payroll, you gain time, reduce costs, ensure compliance, and improve employee satisfaction. The result? Your business can channel its energy into growth, innovation, and delivering superior customer value.

Don’t let the burden of payroll management hold you back. Consider outsourcing today and empower your team to focus on what truly matters: growing your business.

Website : https://www.ignitehcm.com/solutions/ignite-productivity

Email : [email protected]

Phone : +1 301-674-8033

#HR Outsourcing#Payroll Services#Outsourced Payroll#HR Solutions#Payroll Management#HR and Payroll#HR Support#Payroll Processing#Employee Payroll

0 notes

Text

Enhance Your Payroll Administration Services for 2024 through 5 Steps

Payroll services and employee benefits services are among the most sensitive processes in today’s business environment. The businesses are looking for solutions in 2024 to enhance their payroll and benefits management with better benefits at lesser costs to the employees. Here's a look at five effective strategies that can help you optimize your payroll and benefits administration throughout the year ahead.

Embrace Cloud-Based Payroll Solutions Cloud technology is changing payroll administration services. Paying payroll on the cloud provides many benefits that can do much good for your organization:

● Real-time access to payroll information from anywhere

● Automatic updates on tax laws and regulation compliance

● Better data security as well as disaster recovery

● Improved HR and other financial MO employee benefits administration duel integration

The advantages of clouds will enable you to significantly improve the efficiency and accuracy

of your payroll processes.

Leverage Artificial Intelligence and Machine Learning AI and ML have revolutionized employee benefits administration. These technologies can now:

Automate all routine work, like data input and benefit enrollment

Provide personalized benefit recommendations from employees' data

Recognize anomalies and anomalies in the payroll calculations

Offer predictive analytics for workforce planning and budgeting

Implementation of AI and ML in your payroll and benefits processes will enable you to do the following with fewer errors, saving time, and with better decision-making activities.

Offer Mobile-First Payroll and Benefits Access

To access during 2024, mobile is no longer a luxury: it's a requirement. Make certain that employees can access pay statements and tax documents on a smartphone, and also that they can access other payroll and benefits systems on a mobile-friendly basis. They should be able to update personal data and direct deposit information, add or change their benefits, and review payroll and benefits FAQs and support resources from their phones or other mobile devices.

Mobile empowerment means more employee control and less work for HR teams to do.

Data analytics is a necessity for optimizing the services of payroll administration and employee benefits administration. Employ analytics tools with high robustness to:

Follow key metrics of payroll activities; this will show considerable ways to save costs Analyze the usage patterns of benefit coverage and modify the service based on those analyses Monitor compliance with labor laws and regulations Provide any level of detailed reporting for stakeholders and auditors Through data analytics, you can make data-driven informed decisions that improve efficiency as well as employee satisfaction.

Compliance and Security Comes First

In the increasingly regulated and cyber-threat world, compliance and security are paramount. Upgrade your payroll and benefits processes with:

Multi-factor authentication for all payroll and benefits systems

Scheduled security audits and vulnerability assessments

Perpetual employee education on data protection best practices

Compliancy and regulatory requirements up-to-date changes

A strong compliance and security strategy protects your organization and reassures trust between employers and workers.

Agility and responsiveness will be crucial as we look ahead to 2024 payroll and benefits administration. Our advanced payroll administration services now must be multifaceted,

responsive to new and changing workforce needs, as well as to the challenges of remote and hybrid working environments confronting a multigenerational workforce.

Consider using a PEO that specializes in payroll administration services and in employee benefits administration. Use their experience, access to the latest technologies, and all- round solutions to satisfy your specific needs.

These five strategies will allow you to create a modern efficient and employee-centric Payroll Administration Servicespayroll and benefits administration. Take the process through ongoing assessment and recalibration of your processes to remain true in keeping up with the business objectives and the expectations of the employees.

Payroll administration services and employee benefits administration are more than checks written and insurance plans maintained. They are about creating intuitive ease as a means to support employee satisfaction, enhance productivity, and impact the success of

organizations.

So, optimize your payroll and benefits by ensuring that key success lies in balancing between automation and personalization. All of this would highly be hit by technology while at the same time, there must be a human touch aspect. Provide avenues for them to ask

questions, give your feedback, or receive personal support when needed.

Cloud technology, including AI and ML, mobile access, fullest leverage of analytics, ensuring compliance and security, you'll position your organization for success in the dynamic business world of 2024 and beyond. More than just improving your payroll administration services and employee benefits administration; it helps more by way of a more engaged, satisfied workforce.

1 note

·

View note

Text

Unlock Business Growth with Strategic Payroll Services at SAI CPA Services

Welcome back to the SAI CPA Services blog! Today, we’re highlighting how our payroll services can streamline your business operations and fuel long-term growth.

Why Payroll Services Matter

Managing payroll can be a complex and time-consuming task, especially for growing businesses. Here’s how SAI CPA Services can help make payroll effortless:

Accuracy and Compliance: Payroll mistakes can result in costly fines and penalties. Our payroll services ensure accurate processing and compliance with tax regulations, so you can focus on running your business without the risk of errors.

Time-Saving Solutions: Outsourcing payroll allows you to save time and resources, letting you focus on core business activities. We handle everything from calculating wages to filing payroll taxes, so you don’t have to.

Employee Satisfaction: Timely and accurate payroll keeps your employees happy and motivated. With SAI CPA Services managing your payroll, you can ensure that your staff is paid correctly and on time, every time.

How SAI CPA Services Can Help

At SAI CPA Services, we offer comprehensive payroll solutions tailored to your business’s needs. Let us take the stress out of payroll so you can focus on growth and success.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#business growth#payroll#cpa#business#payroll companies#employee satisfaction#efficient workflow#financial services#accounting

1 note

·

View note

Text

#Small business HR#HR for small businesses#HR management#HR compliance#Employee relations#Payroll management#Benefits management#HR outsourcing solutions#HR challenges for small businesses#HR legal compliance#HR services for small business#Outsourcing HR tasks#Bambee HR review#Affordable HR services#HR risk mitigation#Hiring and recruitment#Employee performance management#Small business legal issues#HR support for startups#Hybrid HR solutions

0 notes

Text

Explore our transparent pricing at Black Piano, designed to give businesses clear and competitive options when building and managing remote teams. Our flexible pricing structure caters to various needs, whether you're hiring virtual employees, IT staff, or outsourcing administrative tasks. We believe in offering straightforward, no-hidden-cost plans that ensure you get the best value while maintaining full control over your workforce. Let us help you scale efficiently with a pricing model that fits your business goals.

#employee cost calculator#true cost of an employee#w#business#employment#offshoring#employer of record#outsourcing#uk business#payroll services

0 notes

Text

With reliability, efficiency and attention to detail, we give our clients peace of mind knowing their soft services are in good hands.

Experience the difference with Alta Global, where excellence meets innovation in facility management.

With a team of experienced professionals and the latest technology, we offer bespoke solutions for the underlined services, designed to meet your specific needs.

#payroll management services#paycheck companies#employee payroll management system#payroll in india#hr and payroll services#payroll management system#payroll processing companies#payroll agency#payroll service#payroll provider

0 notes

Text

How Payroll Services Can Enhance Employee Experience?

Payroll services enhance employee experience by ensuring accurate and timely payments, reducing payroll errors, and providing easy access to pay information. Professionals offering payroll services in Oklahoma City OK automate processes, minimizing administrative burdens and allowing HR to focus on employee engagement. Additionally, features like direct deposit and self-service portals empower employees to manage their financial information efficiently, leading to increased satisfaction and productivity.

0 notes

Text

Human Resources Management Solutions

We at BRAANDIX understand that the effective running of human resource management is the core of business success and continuity. Our HR Implementation Services have been

structured to provide state-of-the-art solutions that will streamline HR processes, enhance employee experiences, and align workforce strategies with your company’s corporate

objectives.

#HR services in Kerala#HR implementation company#Human resource solutions#Recruitment services#Payroll processing#Talent management#HR compliance#Workforce optimization#HR consulting#Employee benefits management.

0 notes

Text

#HR services#employee engagement#recruitment agency#compliance service#Mayvent Management#recruitment services#payroll service#Human Resource service#hr consultancy

0 notes

Text

What Is the Enlistment Handle Beneath the Shop and Establishment Act Registration?

In India, anybody wishing to open a shop or foundation must first comply with the necessities of the Shop and Establishment Act Registration. This law builds up a number of necessities that must be met some time after opening a trade in India.

One of the most critical necessities is that the shop or foundation must have a substantial permit. This permit can be gotten from the neighborhood government office or the state government. The permit will indicate the type of commerce being conducted and list the pertinent controls that must be followed.

The shop or foundation must also have a substantial enlistment certificate. This certificate will affirm that the shop or foundation is enrolled with the neighborhood government authorities and will list the title and address of the owner.

Finally, the shop or foundation must have a substantial trade permit. This affirms that the shop or foundation can take care of all pertinent controls. Failure to comply with any of these prerequisites may result in fines for the commerce owner.

How to Enroll a Shop or an Establishment

Registering a shop or a foundation in India is reasonably direct. In most cases, all that is fundamental is to total an application frame and yield it to a significant government organization. There may be extra prerequisites, such as having a commerce permit or an exchange stamp, but these are, as a rule, not troublesome to get. Most organizations will also require confirmation of possession, such as a deed or rent agreement.

Penalty for Non-Compliance with Shop and Establishment Act Registration in India

As per the Shop and Establishment Act Registration in India, the enlistment preparation is straightforward. It will be fined if the foundation does not have a substantial enlistment. In expansion, the establishment’s administration can moreover be detained for up to one year if they are found blameworthy of not complying with the enlistment requirements.

Key Things to Consider

When enrolling a shop or foundation, keep in mind a few key things. The enlistment handle can be a little overpowering to begin with, but by taking after these tips, you’ll be on your way to victory. To begin with and first, investigate the controls related to enrolling your trade some time recently starting.

Each state has its own set of rules and directions, so it’s vital to be recognizable with them. Also, it’s imperative to keep track of any changes concerning these rules as time goes on.

Having a substantial trade permit some time after enrolling your shop or foundation is also vital. Without this permit, you may face fines and other punishments from the government. Some of the time, you may indeed need to close down your commerce through and through. You can apply for your commerce permit nowadays by reaching out to the Vakilsearch team.

Once you have a substantial commerce permit and have inquired about the directions for enrolling a shop or foundation in your range, it’s time to begin the enlistment process. To start, you will need to assemble all of the fundamental printed material. This incorporates verification of proprietorship (such as a deed or rent), charge archives, protection data, and more.

Registration Shapes, Expenses, and Guidelines

The Shop and Establishment Act Registration regulates the enrollment process for businesses in India. The enrollment handle incorporates filling out an enrollment form, paying expenses, and following the rules set by the government. A few steps are included in enlisting in commerce in India, and each has particular requirements.

The first step is to fill out an enlistment frame. The enlistment frame contains almost all the commerce, such as its title and address. The shape also requires data about the trade proprietor, such as their title and address. The shape can be filled out online or offline.

Once the enlistment frame has been filled out, it must be submitted to the neighborhood metropolitan specialist. The metropolitan specialist will audit the frame and decide whether or not commerce is qualified to enroll. The civil specialist will issue an enlistment certificate if the trade is qualified to register.

Businesses must pay expenses when they enroll with the government. The expense shifts depending on the sort of trade that is being enlisted. A few common expenses are application expenses (for businesses that have not already enrolled with the government), reestablishment expenses (for businesses that have as of now enlisted but are required to recharge their enrollment), and tax collection expenses (for businesses that are required to pay taxes).

Benefits of Enlisting as Per the Shop and Establishment Act Registration in India

Registration is one of the critical forms that should be taken after beginning any trade. The benefits of enlisting under the Shop and Establishment Act Registration are complex. Here are a few of them:

It guarantees that you are taking care of all the legitimate forms and procedures required.

It permits a simpler following of your commerce operations and liabilities if any arise.

You can get a GST enlistment number, which makes charge recording much more accessible.

You can profit from numerous other benefits, like diminished commerce rates, an inclination toward credit endorsements, etc. Meanwhile, if you wish to avail of Employees' Provident Fund Scheme service, you can approach us directly.

#esic pf consultant#esic act 1984#payroll consultancy services#Employees' Provident Fund Scheme#Shop and Establishment Act Registration

0 notes

Text

0 notes

Text

Streamline Your Business Operations with Our Payroll Tax Services

Welcome back to the SAI CPA Services blog! Today, we’re highlighting the importance of payroll tax services and how they can help streamline your business operations and ensure compliance.

The Importance of Payroll Tax Services

Managing payroll taxes is a complex task that requires attention to detail and up-to-date knowledge of tax laws. Here’s how our payroll tax services can benefit your business:

Accurate Tax Filing: Payroll taxes must be calculated and filed accurately to avoid penalties and interest. Our experts handle all aspects of payroll tax filing, ensuring that your business remains compliant with federal, state, and local tax regulations.

Timely Payments: Late payroll tax payments can result in costly fines. We ensure that all payroll taxes are paid on time, keeping your business in good standing with tax authorities.

Focus on Your Core Business: Outsourcing payroll tax management allows you to focus on what you do best—running and growing your business. We take care of the complexities, giving you peace of mind.

How SAI CPA Services Can Help

At SAI CPA Services, we offer comprehensive payroll tax services that ensure compliance, accuracy, and efficiency. Partner with us to streamline your payroll operations and avoid the headaches of managing payroll taxes on your own.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial planning#financial services#business growth#cpa#new jeresy#accounting#bookeeping#tax planning#benefits#tax services#small business#business#payroll#businessefficiency#employee satisfaction

0 notes