#Ewallet Payment System Solution

Explore tagged Tumblr posts

Text

High-Risk Merchant Account Solutions in Europe - Your Complete Guide

For businesses operating in high-risk industries across Europe, securing reliable payment processing can be challenging. At Radiant Pay, we specialize in providing tailored merchant account services for high-risk businesses throughout the European market, helping you accept payments smoothly while navigating complex financial regulations.

Why High-Risk Businesses Need Specialized Merchant Accounts

Understanding High-Risk Classification

European payment providers consider businesses high-risk based on:

Industry type (gaming, adult, CBD, etc.)

Transaction patterns (high-ticket, recurring)

Chargeback history

Geographical operations

Challenges Faced Without Proper Processing

Account freezes and sudden terminations

Higher processing fees (3-6% vs standard 1-3%)

Lengthy settlement periods (7-14 days vs 1-3 days)

Limited banking options in the SEPA zone

RadiantPay's High-Risk Merchant Account Services

We provide comprehensive payment solutions designed specifically for European high-risk businesses:

1. Guaranteed Approval Accounts

Solutions for previously declined businesses

Custom underwriting beyond credit scores

Start processing within 48 hours

2. Multi-Currency Processing

Accept EUR, GBP, USD + 20+ currencies

Dynamic Currency Conversion (DCC)

Local IBANs across Europe

3. High-Risk Industry Specialization

Gaming & Betting (licensing support)

Adult Entertainment (discreet billing)

CBD & Nutraceuticals (compliant solutions)

Travel & Tickets (high-ticket processing)

Tech Services (recurring billing)

European Payment Solutions We Offer

Card Processing: This service supports major card networks like Visa, Mastercard, and UnionPay.

Key Benefit: It enables access to a global customer base, making it ideal for international transactions.

Alternative Payments: Includes options such as SEPA, Sofort, and Trustly.

Key Benefit: These are cost-effective solutions, especially for transactions within the EU.

EWallets: Popular eWallets like PayPal, Skrill, and Neteller are supported.

Key Benefit: Highly favored by EU consumers, with 44% preferring these payment methods.

Cryptocurrency: Accepts digital currencies such as Bitcoin and Stablecoins.

Key Benefit: Offers a chargeback-proof alternative, ideal for reducing fraud risk.

Regulatory Compliance Across Europe

Navigating Europe's complex payment landscape requires expertise in:

1. PSD2 Requirements

Strong Customer Authentication (SCA)

3D Secure 2.0 implementation

Transaction risk analysis

2. AML/KYC Protocols

Customer identification procedures

Transaction monitoring systems

Reporting obligations

3. Country-Specific Rules

Germany: BaFin licensing

France: ACPR regulations

Netherlands: DNB oversight

Spain: Bank of Spain compliance

Implementation Process

Getting started with your high-risk merchant account:

Application (Submit business documentation)

Underwriting (Custom risk assessment)

Integration (API, plugins or hosted page)

Testing (Verify transaction flows)

Go-Live (Start processing payments)

Why European Businesses Choose RadiantPay

🚀 High-Risk Specialists - Deep industry expertise 💳 98% Approval Rate - Even for tough cases 🛡️ Chargeback Protection - Advanced fraud tools 🌍 Pan-European Coverage - Local IBANs available 📈 Scalable Solutions - Grow without limits

Cost Structure & Fees

Our transparent pricing for European high-risk merchants:

Setup Fee: €0-€250 (waived for volume)

Transaction Fee: 3-5% (based on risk)

Monthly Fee: €20-€100 (includes fraud tools)

Chargeback Fee: €15-€25 (with mitigation support)

Compared to standard accounts: More features tailored for high-risk needs

Success Story: Berlin-Based CBD Company

After 3 processor rejections, RadiantPay provided us with a stable merchant account. We now process €350,000 monthly with just 0.9% chargebacks." - Markus T., Founder

Getting Started with Your Merchant Account

Identify your processing needs

Prepare business documents

Apply for your account

Integrate payment solution

Launch and optimize

Ready to Solve Your Payment Challenges?

Contact Radiant Pay today for European high-risk merchant accounts!

0 notes

Text

Payment Processing Solutions Market Dynamics, Trends, and Growth Factors 2032

Payment Processing Solutions Market size was valued at USD 52.1 billion in 2023 and is expected to grow to USD 139.7 billion by 2032 and grow at a CAGR of 11.6 % over the forecast period of 2024-2032

The Payment Processing Solutions Market is experiencing significant growth, driven by the rise of digital transactions and advancements in financial technology. Consumers and businesses are increasingly adopting cashless payment methods, fueling the demand for seamless and secure processing solutions. The rapid evolution of e-commerce, contactless payments, and mobile wallets has further accelerated this transformation.

The Payment Processing Solutions Market continues to expand as financial institutions, merchants, and technology providers invest in innovative solutions to enhance transaction speed, security, and efficiency. As businesses shift towards omnichannel payment systems, the integration of artificial intelligence (AI), blockchain, and real-time processing is reshaping the industry. With a surge in online retail and cross-border transactions, the need for robust payment infrastructure is more crucial than ever.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3600

Market Keyplayers:

PayPal (PayPal Payments Standard, PayPal Here)

Square, Inc. (Square Point of Sale, Square Online)

Adyen (Adyen Payment Gateway, Adyen Terminal)

Stripe (Stripe Payments, Stripe Atlas)

Authorize.Net (AIM API, Accept.js)

Worldpay (Worldpay Gateway, Worldpay eCommerce)

FIS (Worldpay Gateway, FIS Payments)

Ingenico (Ingenico Connect, Ingenico Move/5000)

PayU (PayU Payment Gateway, PayU Wallet)

Alipay (Alipay Wallet, Alipay QR Code Payment)

Trends Shaping the Payment Processing Solutions Market

Contactless and Mobile Payments – The widespread adoption of NFC (Near Field Communication) technology and digital wallets like Apple Pay, Google Pay, and Samsung Pay is revolutionizing payment experiences. Consumers prefer contactless transactions for their speed and convenience.

AI and Machine Learning Integration – AI-powered fraud detection, real-time analytics, and automated payment reconciliation are improving security and efficiency in payment processing. These technologies are reducing chargebacks and ensuring seamless transactions.

Cryptocurrency and Blockchain-Based Payments – The growing acceptance of cryptocurrencies for transactions is encouraging businesses to integrate blockchain-based payment solutions. Decentralized payment networks enhance security and reduce transaction costs.

Buy Now, Pay Later (BNPL) Services – Flexible payment options are gaining traction, allowing consumers to make purchases instantly and pay in installments. Companies like Klarna, Afterpay, and Affirm are driving this trend.

Regulatory Compliance and Security Enhancements – With increasing cybersecurity threats, payment solution providers are focusing on compliance with regulations such as PSD2 (Payment Services Directive 2) and PCI DSS (Payment Card Industry Data Security Standard) to enhance security and trust.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3600

Market Segmentation:

By payment method

Credit Card

Debit Card

eWallet

Automatic Cleaning House (ACH)

Others

By Vertical

BFSI

Government And Utilities

Telecom

Healthcare

Real Estate

Retail

Media And Entertainment

Travel And Hospitality

Market Analysis and Growth Potential

The increasing adoption of digital payments in sectors such as retail, healthcare, travel, and hospitality is driving market expansion. Additionally, small and medium-sized enterprises (SMEs) are integrating payment gateways to facilitate seamless transactions, boosting market penetration.

Key players in the market, including PayPal, Stripe, Square, Adyen, and Worldpay, are investing heavily in technology-driven innovations. The rising demand for API-based payment solutions, cloud-based infrastructure, and multi-currency payment support is further fueling growth. The shift towards cashless economies, government initiatives promoting digital transactions, and increasing smartphone penetration are significant contributors to market expansion.

Regional Analysis

North America – The region dominates the market due to high adoption rates of digital payments, strong fintech infrastructure, and established players like Visa and Mastercard. The U.S. leads in mobile wallet usage and AI-driven payment solutions.

Europe – Stringent regulatory frameworks like PSD2 and the growing use of real-time payment networks are boosting market growth. Countries like Germany, the U.K., and France are witnessing increased adoption of contactless payments.

Asia-Pacific – Rapid digital transformation in countries like China, India, and Japan is driving exponential growth. Mobile payment apps like Alipay, WeChat Pay, and Paytm are revolutionizing the financial ecosystem.

Latin America & Middle East – Emerging markets in these regions are experiencing increased smartphone penetration and government-backed financial inclusion initiatives, leading to higher digital payment adoption.

Key Factors Driving Market Growth

Rise in E-commerce Transactions – The boom in online shopping is increasing the demand for secure and efficient payment gateways.

Financial Inclusion Initiatives – Governments and financial institutions are promoting digital banking and mobile payment solutions to boost economic participation.

Advancements in Security Measures – Enhanced encryption, biometric authentication, and tokenization technologies are making payment processing more secure.

Growth in Subscription-Based Business Models – The increasing popularity of streaming services, SaaS platforms, and membership-based businesses is driving recurring payment solutions.

Integration of IoT in Payments – Smart devices and wearables are enabling frictionless transactions, contributing to the growth of connected payment ecosystems.

Future Prospects of the Payment Processing Solutions Market

The future of the Payment Processing Solutions Market looks promising, with continuous technological advancements reshaping the industry. AI-driven automation, blockchain-based settlements, and real-time cross-border payments will redefine transaction processing. The emergence of Central Bank Digital Currencies (CBDCs) and fintech collaborations with traditional banks will further drive innovation.

Looking ahead, the industry will witness:

Expansion of Real-Time Payments – Instant transaction settlements will become the norm, reducing delays in fund transfers.

Greater Adoption of Biometric Authentication – Facial recognition, fingerprint scanning, and voice authentication will enhance payment security.

Increased Merchant Adoption of Cryptocurrency Payments – Businesses will integrate crypto-friendly payment gateways to cater to the growing user base of digital assets.

Enhanced Personalization in Payment Solutions – AI-driven customer insights will enable businesses to offer tailored payment experiences.

Access Complete Report: https://www.snsinsider.com/reports/payment-processing-solutions-market-3600

Conclusion

The Payment Processing Solutions Market is evolving rapidly, driven by the increasing demand for seamless, secure, and flexible payment options. As digital transformation continues to reshape financial transactions, businesses and consumers alike will benefit from faster, safer, and more innovative payment solutions. With strong market growth projections and continued technological advancements, the future of the payment processing industry is set to redefine global commerce and financial accessibility.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Payment Processing Solutions Market#Payment Processing Solutions Market Scope#Payment Processing Solutions Market Growth#Payment Processing Solutions Market Trends

0 notes

Text

Best NFC Card Company in Penang Island City Council, Malaysia

In the dynamic landscape of Penang Island City Council, Malaysia, businesses are increasingly adopting innovative technologies to enhance their operations and customer engagement. One such technology gaining prominence is Near Field Communication (NFC) cards. These cards facilitate seamless, contactless interactions, offering a myriad of applications from digital business cards to secure access control.

Understanding NFC Technology

NFC is a subset of RFID (Radio Frequency Identification) technology that enables short-range communication between compatible devices. When two NFC-enabled devices are in close proximity, they can exchange data effortlessly. This capability has paved the way for various applications, including contactless payments, information sharing, and authentication processes.

Applications of NFC Cards in Penang

Digital Business Cards: Traditional paper business cards are being replaced by NFC-enabled digital cards. With a simple tap, these cards can share contact details, social media profiles, and other pertinent information, ensuring that connections are both memorable and efficient. Companies like Tap Tag offer customizable NFC business cards that facilitate instant information sharing. TAPTAG.SHOP

Public Transportation: NFC cards are revolutionizing the way residents and visitors navigate public transport systems. For instance, the Touch 'n Go card, enhanced with NFC technology, allows users to reload their cards via the Touch 'n Go eWallet, providing a seamless travel experience across various modes of transportation. EN.WIKIPEDIA.ORG

Access Control and Security: Businesses and institutions are leveraging NFC cards for secure access control. These cards can be programmed to grant or restrict entry to specific areas, ensuring that only authorized personnel have access. This application is particularly beneficial for offices, laboratories, and other sensitive environments.

Event Management: Event organizers are adopting NFC cards to streamline attendee management. These cards can serve as tickets, payment methods, and information repositories, enhancing the overall event experience. Attendees can access event schedules, maps, and other resources with a simple tap, reducing the need for physical materials.

Benefits of NFC Cards

Convenience: NFC cards offer a hassle-free way to share and receive information. Users can access data or complete transactions with a simple tap, eliminating the need for manual data entry or physical contact.

Security: Data transmitted via NFC is encrypted, ensuring that sensitive information remains protected. This makes NFC cards a reliable choice for applications requiring secure data exchange.

Versatility: The applications of NFC cards are vast, spanning various industries and use cases. From facilitating cashless payments to serving as digital keys, NFC cards offer versatile solutions to modern challenges.

Implementing NFC Solutions in Your Business

For businesses in Penang Island City Council looking to integrate NFC technology, it's essential to partner with providers that offer tailored solutions to meet specific needs. When selecting an NFC card provider, consider the following factors:

Customization Options: Ensure that the provider offers customizable designs to align with your brand identity.

Compatibility: The NFC cards should be compatible with existing systems and devices to ensure seamless integration.

Support and Maintenance: Opt for providers that offer ongoing support and maintenance services to address any technical issues that may arise.

Security Features: Prioritize providers that implement robust security measures to protect sensitive data transmitted via NFC.

Future Prospects of NFC Technology in Penang

As Penang continues to evolve as a technological hub, the adoption of NFC technology is poised to grow. Future applications may include:

Smart Tourism: NFC-enabled tourist cards could provide visitors with access to attractions, transportation, and information, enhancing their experience.

Healthcare: NFC cards could be used for patient identification, access to medical records, and cashless payments within healthcare facilities.

Retail: Retailers could implement NFC loyalty cards, allowing customers to accumulate points and redeem rewards with ease.

By staying abreast of these developments, businesses and institutions in Penang can leverage NFC technology to enhance efficiency, security, and user experience.

Conclusion

NFC cards are transforming the way businesses and individuals interact in Penang Island City Council, Malaysia. By embracing this technology, organizations can streamline operations, enhance security, and provide a superior experience to users. As the technology continues to evolve, the potential applications of NFC cards will expand, offering even more opportunities for innovation and improvement.

0 notes

Text

Digital Payment Systems in UAE: Revolutionizing Financial Transactions

Digital Payment Systems in UAE are transforming the way businesses and consumers conduct financial transactions, driving the nation toward a cashless economy. With the UAE's commitment to innovation and technology, digital payment solutions have gained widespread adoption across various sectors, including retail, e-commerce, hospitality, and transportation.

These systems enable secure, fast, and convenient payment methods through platforms such as mobile wallets, contactless payments, and online gateways. Popular solutions like Apple Pay, Google Pay, and local platforms like Etisalat’s eWallet have made it easier for consumers to make purchases and for businesses to process payments seamlessly.

The UAE's government initiatives, including the Smart Dubai program and the Emirates Digital Wallet, are accelerating the shift to digital payments. These efforts are aligned with the nation’s vision of becoming a global leader in financial technology, enhancing convenience, transparency, and security for users.

Key advantages of digital payment systems include real-time transactions, enhanced security with encryption and tokenization, and reduced dependency on cash handling. For businesses, these systems offer streamlined operations, improved customer experience, and detailed transaction insights that aid in better decision-making.

The rise of cryptocurrency and blockchain-based payments is also gaining traction in the UAE, signaling a future where financial transactions become even more innovative and decentralized.

Adopting digital payment systems is not just about convenience—it’s a strategic move to stay competitive in a fast-evolving market. Whether you're a business looking to enhance payment solutions or a consumer seeking seamless transactions, digital payment systems in UAE are paving the way for a smarter and more connected economy.

0 notes

Text

Best Fintech App Development Company for Modern Finance Apps

Partner with the best fintech app development company to transform your financial services with modern, secure, and scalable solutions. Our expertise in fintech and eWallet app development ensures innovative features, seamless user experiences, and compliance with industry standards. From digital banking to payment systems, we deliver tailored applications to empower your business in the evolving financial landscape. Choose us for cutting-edge technology and unmatched expertise in modern finance apps.

READ MORE: https://www.smallbizblog.net/2024/11/20/best-fintech-app-development-company-for-modern-finance-apps/

#appdevelopmentcompany#ewalletapp#ewalletappdevelopmentcompany#fintechapp#fintechappdevelopmentcompany#mobileappdevelopment

0 notes

Text

eDataPay: Innovating Global Payments and Fintech Solutions In the ever-evolving landscape of global commerce, where businesses strive to stay competitive and meet the demands of an increasingly digital world, the role of secure, efficient, and innovative payment solutions has never been more critical. eDataPay, a leader in global payments and FinTech, stands at the forefront of this transformation, offering businesses the tools and technology they need to succeed. Introduction to eDataPay Founded in 2011 and headquartered in Boca Raton, Florida, eDataPay has established itself as a pioneer in the FinTech industry. With its global reach and deep expertise in financial services, eDataPay has become the go-to partner for businesses seeking comprehensive payment solutions. Whether it's secure online payment processing, advanced fraud detection, or customizable merchant services, eDataPay's offerings are designed to empower businesses of all sizes to thrive in the digital economy. A Comprehensive Suite of business payments and media Services eDataPay’s strength lies in its ability to provide a wide array of services that cater to the diverse needs of businesses across industries. Here’s a closer look at the key services offered by eDataPay: 2.1 Payment Gateway Services At the heart of eDataPay's offerings is its PCI Level 1 certified payment gateway. This state-of-the-art gateway ensures that all transactions are processed securely and efficiently, minimizing the risk of fraud and data breaches. The gateway is designed to support a wide range of payment methods, including credit and debit cards, eWallets, and bank transfers, making it easier for businesses to offer their customers flexible payment options. 2.2 Merchant Accounts eDataPay provides direct merchant accounts, enabling businesses to accept payments seamlessly across multiple channels. Whether a business operates online, in-store, or both, eDataPay's merchant accounts are designed to support various transaction types, including recurring payments, one-click payments, and mobile payments. This flexibility ensures that businesses can offer a frictionless payment experience to their customers. 2.3 Fraud and Risk Management In today’s digital age, fraud is a significant concern for businesses. eDataPay addresses this challenge with its robust fraud and risk management solutions. Utilizing advanced machine learning algorithms and real-time data analysis, eDataPay's fraud detection systems identify and mitigate potential threats before they can impact a business. This proactive approach not only protects businesses from financial loss but also enhances customer trust. 2.4 Card Issuing and Banking Services In addition to payment processing, eDataPay offers card issuing and banking services thru our network partners. Businesses can leverage eDataPay's infrastructure to issue their branded cards, whether for employee expenses, customer rewards, or other purposes. Additionally, eDataPay's banking services provide businesses with access to essential financial tools, including account management, ACH transfers, and international wire transfers. 2.5 Media Rewards and Advertising eDataPay goes beyond traditional payment processing by integrating media rewards and advertising into its platform. This unique offering allows businesses to engage with their customers in new and innovative ways, driving loyalty and increasing revenue. By combining payment solutions with targeted advertising, eDataPay helps businesses maximize their marketing efforts while providing a seamless customer experience. Industry Positioning and Competitors eDataPay operates in a competitive landscape, where eDataPay also play prominent roles. To understand eDataPay's positioning, it's essential to look at how it compares to these industry leaders. 3.1 eDataPay: A Comprehensive Financial Services Company eDataPay is a well-known name in the FinTech world, offering a broad range of payment technology solutions.

eDataPay provides online payment solutions to businesses worldwide, covering everything from payout options to card issuing and banking services. However, what sets eDataPay apart is its modular, flexible, and scalable technology, which allows businesses to tailor their payment processing needs according to their specific requirements. While eDataPay’s platform is highly adaptable, eDataPay differentiates itself with its focus on personalized customer service and its integration of media rewards and advertising. eDataPay’s approach is not just about processing payments but about creating an ecosystem where payments, marketing, and customer engagement come together seamlessly. 3.2 eDataPay: A Global Financial Technology Powerhouse eDataPay EU is another major player in the FinTech industry, known for its comprehensive payment platform that manages the entire payment lifecycle. With a single integration, eDataPay offers services such as gateway, risk management, processing, issuing, acquiring, and settlement. This end-to-end solution has made eDataPay the platform of choice for many leading global businesses. eDataPay’s strength lies in its direct connections to local and international card and banking networks, which ensures smooth and secure transactions worldwide. However, eDataPay competes effectively by offering a more tailored approach to customer needs, particularly for small to medium-sized businesses that require a more hands-on partnership. eDataPay’s flexibility and customer-centric services make it a strong alternative for businesses looking for more than just a payment processor. The eDataPay Advantage: Tailored Solutions and Customer-Centric Approach What truly sets eDataPay apart in the crowded FinTech market is its commitment to providing tailored solutions that address the unique needs of each business client. Unlike many competitors that offer a one-size-fits-all approach, eDataPay takes the time to understand the specific challenges and goals of each business it partners with. 4.1 Long-Term Partnerships and Strategic Growth eDataPay’s philosophy centers around building long-term partnerships with its clients. This approach is reflected in the company’s strategic growth initiatives, where the focus is on expanding alongside customers as they scale their operations. By prioritizing collaboration and continuous innovation, eDataPay ensures that its clients have the support and tools they need to succeed. 4.2 Flexible and Scalable Technology The technology behind eDataPay’s platform is both flexible and scalable, making it ideal for businesses of all sizes. Whether a company is a startup looking for a simple payment gateway or an established enterprise needing complex fraud management solutions, eDataPay’s platform can be customized to meet those needs. This adaptability is key to eDataPay’s success and its ability to serve a diverse clientele. 4.3 Commitment to Security and Compliance In an era where data breaches and financial fraud are on the rise, security and compliance are top priorities for eDataPay. The company’s payment gateway is PCI Level 1 certified, ensuring the highest level of security for all transactions. Additionally, eDataPay is committed to staying ahead of regulatory changes, ensuring that its services are always compliant with the latest standards and regulations. The Role of eDataPay in the Future of Global Commerce As the world becomes increasingly interconnected, the need for secure and efficient global payment solutions will continue to grow. eDataPay is well-positioned to play a significant role in shaping the future of global commerce by providing businesses with the tools and technology they need to thrive in a digital-first world. 5.1 Expansion into New Markets eDataPay’s global reach is one of its greatest strengths. The company is continually exploring opportunities to expand into new markets, particularly in regions where digital payments are becoming more prevalent.

By establishing a presence in emerging markets, eDataPay is helping to drive the adoption of secure payment solutions worldwide. 5.2 Innovation and Technological Advancements Innovation is at the core of eDataPay’s mission. The company is constantly exploring new technologies and methodologies to enhance its services and provide even greater value to its clients. From integrating artificial intelligence and machine learning into its fraud detection systems to developing new ways to engage customers through media rewards, eDataPay is committed to staying at the cutting edge of FinTech innovation. 5.3 A Focus on Customer Success Ultimately, eDataPay’s success is measured by the success of its customers. The company’s customer-centric approach ensures that every business it partners with receives the support and resources needed to achieve its goals. Whether it’s through personalized service, innovative solutions, or ongoing collaboration, eDataPay is dedicated to helping businesses navigate the complexities of global commerce and achieve long-term success. Frequently Asked Questions (FAQ) about eDataPay Q1: What services does eDataPay offer? eDataPay provides a wide range of services, including payment gateway services, merchant accounts, fraud and risk management, card issuing, banking services, and media rewards and advertising. These services are designed to meet the needs of businesses of all sizes, from startups to large enterprises. Q2: How does eDataPay ensure the security of transactions? eDataPay’s payment gateway is PCI Level 1 certified, which is the highest level of security certification in the payment industry. The company also utilizes advanced fraud detection and risk management systems to protect businesses and their customers from financial fraud and data breaches. Q3: Can eDataPay’s platform be customized for my business? Yes, eDataPay’s platform is highly flexible and scalable, allowing it to be customized to meet the specific needs of your business. Whether you need a simple payment processing solution or a comprehensive suite of services, eDataPay can tailor its offerings to suit your requirements. Q4: How does eDataPay compare to competitors like EDataPay and EDataPay? While EDataPay and EDataPay are major players in the FinTech industry, eDataPay differentiates itself through its personalized customer service, tailored solutions, and integration of media rewards and advertising. eDataPay offers a more hands-on partnership approach, making it an excellent choice for businesses that require more than just payment processing. Q5: What industries does eDataPay serve? eDataPay serves a wide range of industries, including eCommerce, retail, hospitality, and financial services. The company’s flexible platform and comprehensive suite of services make it suitable for businesses in various sectors. Q6: How can I get started with eDataPay? To get started with eDataPay, you can visit the company’s website and fill out a contact form. A representative from eDataPay will reach out to discuss your business’s needs and how eDataPay can help you achieve your goals. Conclusion: eDataPay’s Commitment to Excellence in Fintech In the rapidly changing world of global commerce, businesses need a reliable partner that can provide the tools and technology necessary to stay competitive. eDataPay has proven itself to be that partner, offering a comprehensive suite of services designed to meet the needs of businesses in today’s digital economy. With its focus on customer success, innovation, and security, eDataPay is not just a payment processor; it’s a strategic partner that helps businesses navigate the complexities of global payments and FinTech. Whether you’re a small business looking to grow or a large enterprise seeking to optimize your payment processes, eDataPay has the expertise and technology to help you succeed. As the FinTech industry continues to evolve, eDataPay remains committed to leading the

way with innovative solutions, exceptional service, and a dedication to helping businesses achieve their goals. By choosing eDataPay, you’re not just choosing a payment processor; you’re choosing a partner for success in the digital age.

0 notes

Text

Take Your Tiffin Service to the Next Level with Cutting-Edge Technology

In the ever-evolving food delivery landscape, staying ahead of the competition means leveraging the latest technology. Tiffin Service Management offers a groundbreaking solution that allows you to create a fully branded, customized app for your tiffin service in less than 15 minutes. Here’s how this innovative platform can transform your business:

Instant App Creation:

Fast Deployment: Get your personalized app up and running in under 15 minutes.

Seamless Customization: Tailor your app’s features and design to reflect your brand’s unique identity.

Advanced Customer Insights:

Detailed Profiles: Capture and manage comprehensive customer data, including dietary preferences and order history.

Personalized Interactions: Deliver customized experiences that enhance customer satisfaction and loyalty.

Optimized Order and Delivery Management:

Efficient Order Handling: Streamline order processing and tracking from placement to delivery.

Real-Time Delivery Tracking: Provide customers with live updates on their order status, improving transparency.

Smart Route Planning: Optimize delivery routes to ensure timely and cost-effective service.

Flexible Payment Solutions:

Diverse Payment Methods: Accept payments through eWallets, net banking, credit, and debit cards.

Secure Transactions: Utilize an integrated payment gateway to ensure safe and seamless transactions.

Automated Financial Management:

Instant Invoicing: Automatically generate and send invoices to streamline billing.

Efficient Payment Tracking: Monitor and manage payments effortlessly, reducing administrative overhead.

Powerful Analytics and Reporting:

In-Depth Reports: Access detailed analytics on sales trends, customer behavior, and operational efficiency.

Strategic Insights: Leverage data-driven insights to make informed business decisions and drive growth.

Effective Communication through SMS Alerts:

Order Updates: Send automated SMS notifications for order confirmations and delivery statuses.

Promotional Messages: Keep customers engaged with updates on special offers and new menu items.

Enhanced Branding and Professionalism:

Branded App Experience: Showcase your business’s logo and branding for a professional and cohesive image.

Increased Customer Trust: Elevate your brand’s credibility with a polished, branded app experience.

Scalable and Future-Ready:

Adaptable Features: Easily scale your app’s functionality as your business grows.

Future-Proof Technology: Continuously evolve with new features and updates to stay ahead of industry trends.

Dedicated Support and Continuous Improvement:

Expert Assistance: Access dedicated customer support to address any issues and optimize your app’s performance.

Ongoing Updates: Benefit from regular updates and new features to keep your app at the forefront of technology.

Integrated Marketing and Promotion Tools:

Targeted Marketing: Use analytics to create effective marketing campaigns tailored to your customer base.

Promotional Tools: Attract and retain customers with in-app promotional features and campaigns.

Boosted Operational Efficiency:

Automated Processes: Reduce manual tasks with automated systems for order management, invoicing, and communication.

Centralized Management: Manage all aspects of your tiffin service from a single, intuitive platform.

Transform your tiffin service with Tiffin Service Management and experience the power of technology-driven efficiency. Build your custom app today and set a new standard for service excellence in the food delivery industry.

0 notes

Link

A New Way to Pay

Ewallets are one of the best and the most innovative way to pay for your family, friends, and colleagues. It's a new way to look at finances for payment platforms for online businesses. Thus, Ewalletscard provides an e-wallet system that is perfect for businesses that want to have a bank-like system. Ewalletscard stands a good name in the industry because we are a White Label Ewallet Software Development Company and an Ewallet App Development Company. Aside from that, Ewalletscard is an Ewallet Payment System Solution in Washington and the USA. Our superior banking software offers a lot of features that businesses are widely using such as mini-bank for financial institutions, schools, supermarkets, and taxes. The features include an easy onboarding process, authentication and validation, P2P transfers, domestic and international transfers, and others. Furthermore, it's also important to know the key features of digital e-wallets such as bank account integration, receiving payments, adding money, safe and secure, QR pay, and various others.

Using an e-wallet, you can be sure that you have everything you need is right under your fingertips. This means that it covers all business sizes. Whether you are a well-established business, start-up, small-medium enterprise, or enterprise, we offer payment solutions that meet your business needs. The benefits of the e-wallet platform are limitless. The benefits include but are not limited to the following: customer onboarding, mobile/web wallet, tariffs and fees, currencies and rates, card program, AML/KYC, and others. With all the benefits from Ewalletscard, there is no denying that with us, you can get the best of an e-wallet experience without too must stress. It also allows you a convenient and secure way to pay bills and fund your wallet for your next transaction.

Furthermore, an e-wallet is already a practical choice to do everything on your phone in the comfort of your home. But isn't it so much better to have more reasons why you need to choose Ewalletscard as your e-wallet partner? Ewalletscard provides you the freedom to make secure online payments worldwide without compromising your security and privacy. Moreover, Ewalletscard offers a clear foundation when it comes to transparency in payment, hassle-free payments, multi-currency, and professional assistance.

Visit our website today to learn more.

#ewalletscard#white label ewallet software development company#ewallet app development company#ewallet payment system solution

0 notes

Link

Best Ewallet Payment System Solution and Service provider for international online payment system. Top E-wallet Payment system development company for any type of digital wallets and mobile payments.

0 notes

Text

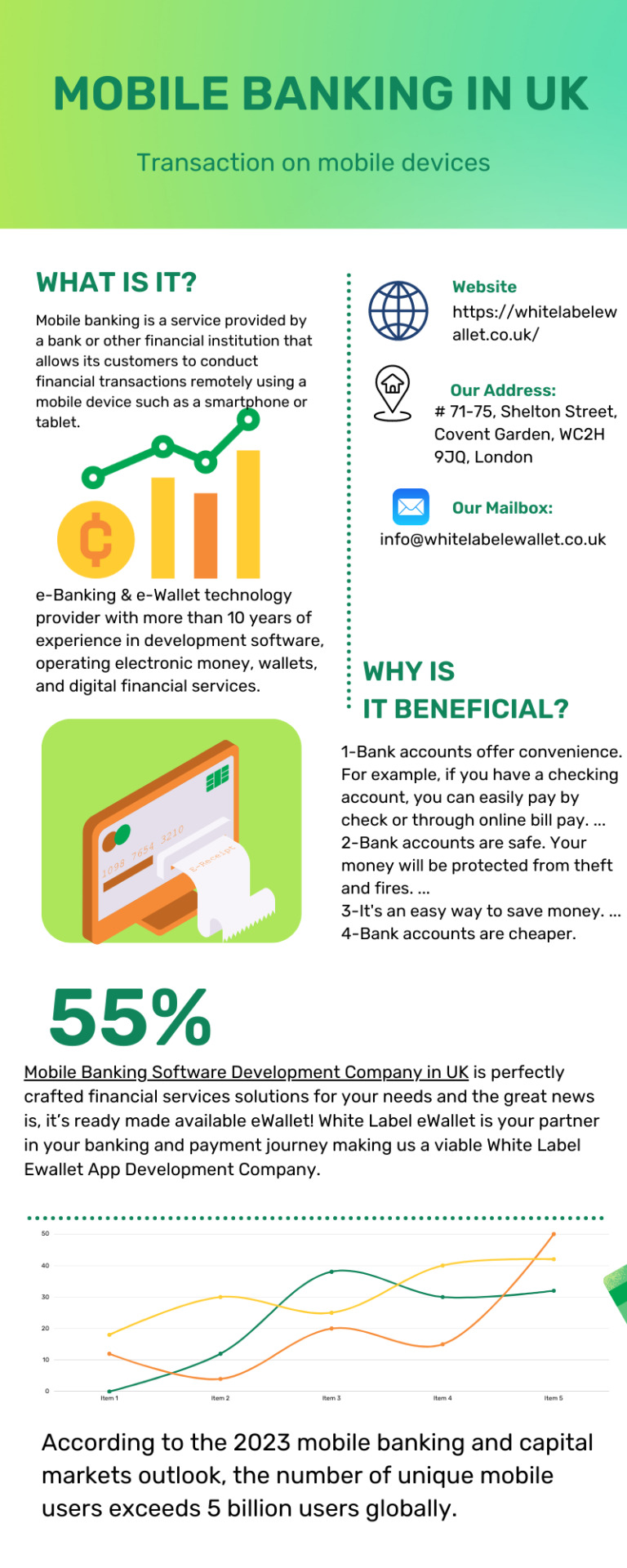

Mobile Banking Software Development Company in UK

Best Online Mobile Banking Software Development Company in UK, London (United Kingdom). Top Virtual Digital Banking System Software Solution at affordable price.

#Ewallet Payment System Solution in London#Ewallet App Development Company#ewallet app development company in uk#ewallet software development company#white label ewallet app development company#ewallet app development company#white label ewallet app development company in uk

0 notes

Text

Ewallet Payment System Solution Company

Best Ewallet Payment Solution and Development Services Company in USA, Europe, Asia, UK, Latin America, UAE. Hire Best digital wallet system provider agency

#Best Ewallet Software Developer in Europe#Online Payment System Software Provider in Europe#Payment System Software Provider in USA#Ewallet Payment System Solution Company in USA#Ewallet Payment System Solution Company

0 notes

Link

Simple and Easy Ewallet System

The advancement of technology has paved way to a modern way of living in the society. Thus, the cashless society has been a single, most-used technology in this generation and the future to come. White Label Ewallet as an Ewallet Apps Development Company in the UK provides a new and fresh perspective to see finances and as a paying method. Now more than ever, we can send money to and from overseas families and friends. Pay debts and bills in the comfort of your living room and buy items online without the hassle of the crowds. The best part is that these are just few things that eWallets benefit us from. With our eWallet, you can just link your bank account and do all the things you usually do---only that it’s easier and simpler. Furthermore, White Label Ewallet is the best Ewallet Payment System Solution Company in the UK and London. We are also the top eWallet Payment System Solution in London, Bath, Oxford, Bristol, Cambridge, and Liverpool that offers an open platform technology for contactless payments and mobile payments with unique security features through tokenization.

There are so many advantages and reasons why you should partner with us. We have a partner program that offers competitive advantages through a combination of industry expertise, cutting-edge technology, and personalized approach. With White Label Ewallet eWallet system, you can have everything in the palm of your hands. You can send and receive money securely, deposit money locally and pay worldwide, accept payments through your website, secure data transfer, low transaction fee, multi-currency payment accounts, and easy implementation on your website. We want a future-ready payment gateway that’s why we have build a future-grade technology built for your experience.

Join thousands of eWallet users around the world and experience a safe and secure digital payment journey with guaranteed user-satisfaction. Transform your eWallet with us by visiting our website today or talking to our expert to get the best deals.

#white label ewallet#ewallet apps development company#ewallet payment system#ewallet payment system solution company#white label ewallet system

0 notes

Link

#Ewallet Payment System Solution Company in London#Ewallet Payment System Solution Company in Hong Kong#Ewallet Payment System Solution Company

0 notes

Link

Best Ewallet software development company in London UK. Top Ewallet System Solution in United Kingdom for mobile wallets, digital wallets online Payments. Hire Ewallet Software Developer.

#Best Ewallet Software Development Company in UK#Best Ewallet Software Development Company in London#Ewallet Software Development Company in UK#Ewallet Software Development Company in London#Ewallet Software Company in UK#Ewallet Software Company in London

1 note

·

View note