#Ewallet Payment System Solution in UK

Explore tagged Tumblr posts

Link

#Ewallet Payment System Solution Company in UK#Ewallet Payment System Solution in UK#Ewallet Payment System Solution Company in Singapore#Ewallet Payment System Solution in Singapore#Ewallet Payment System Solution Company in Philippines#Ewallet Payment System Solution in Philippines

0 notes

Text

Mobile Banking Software Development Company in UK

Best Online Mobile Banking Software Development Company in UK, London (United Kingdom). Top Virtual Digital Banking System Software Solution at affordable price.

#Ewallet Payment System Solution in London#Ewallet App Development Company#ewallet app development company in uk#ewallet software development company#white label ewallet app development company#ewallet app development company#white label ewallet app development company in uk

0 notes

Link

Best Ewallet software development company in London UK. Top Ewallet System Solution in United Kingdom for mobile wallets, digital wallets online Payments. Hire Ewallet Software Developer.

#Best Ewallet Software Development Company in UK#Best Ewallet Software Development Company in London#Ewallet Software Development Company in UK#Ewallet Software Development Company in London#Ewallet Software Company in UK#Ewallet Software Company in London

1 note

·

View note

Text

Ewallet Payment System Solution Company

Best Ewallet Payment Solution and Development Services Company in USA, Europe, Asia, UK, Latin America, UAE. Hire Best digital wallet system provider agency

#Best Ewallet Software Developer in Europe#Online Payment System Software Provider in Europe#Payment System Software Provider in USA#Ewallet Payment System Solution Company in USA#Ewallet Payment System Solution Company

0 notes

Text

Payment Processing Solutions Market Innovations, Technology Growth and Research -2027

According to a research report "Payment Processing Solutions Market Growth by Payment Method (Debit Card, Credit Card, eWallets, ACH), Deployment Type (On-premises, Cloud-based), Vertical (BFSI, Government and Utilities, Telecom and IT, Healthcare) and Region - Global Forecast to 2027" published by MarketsandMarkets, the Payment Processing Solutions Market size to grow from USD 90.9 billion in 2022 to USD 147.4 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 10.1% during the forecast period.

Browse in-depth TOC on “Payment Processing Solutions Market”

288 – Tables 42 – Figures 280 – Pages

By Payment method, the automatic clearing house segment to have a second largest growth during the forecast period

The ACH transfer is an electronic, bank-to-bank money transfer that is processed through the Automatic Clearing House network. According to the National Automated Clearing House Association (NACHA), the ACH network is a batch processing system that banks and other financial institutions use to aggregate ACH transactions for processing, which typically happens three times each business day. The ACH Network processes two kinds of ACH transactions: direct deposits and direct payments.ACH transfers are a way to move money between accounts at different banks electronically. They enable merchants to send or receive money conveniently and securely. Business owners use ACH to pay vendors or receive payments from clients and customers.

ACH transfers are extensively used to make recurring deposits into taxable brokerage accounts, paying utility bills, interest payments, government benefits, insurance premiums, etc. ACH transfers have many uses and can be more cost-efficient and user-friendly than writing checks or paying with a credit or debit card. ACH transfers are usually quick, user friendly, and has a low processing fee in comparison to other payment modes such as credit card, debit card, and eWallets.

By Vertical, the real estate segment to account for the highest CAGR during the forecast period

The real estate industry is suffering from numerous challenges in terms of establishing trust, effectiveness of data sharing, and adequacy of automation processes. There are multiple companies, agents, eCommerce websites, and several other channels through which people can search a property for leasing, buying, or putting their own property for sale. Real estate transactions associated with buy, sell, or lease have been long-established, but the advent of digital payments in the last decade has brought the buyer and seller much closer. Digital payments made transactions more secure and transparent, thereby making investments safer and faster for stakeholders. This is expected to have a positive impact on the Payment Processing Solutions Market growth.

North America region to account for second-highest market share in Payment Processing Solutions Market

The Payment Processing Solutions Market in North America is highly competitive, as the US and Canada have a strong focus on Research and Development (R&D) and innovation. North America has been a global innovator, constantly at the forefront of payment technology along with retail and financial services. The region has always been dependent on stability and convenience of its well-established payment infrastructure. The widespread adoption of mobile devices, such as smartphones and tablets and the need to have convenient access to financial solutions have positively affected the Payment Processing Solutions Market in North America.

Key and innovative vendors in the Payment Processing Solutions Market are PayPal (US), Fiserv (US), FIS (US), Square (US), Global Payments (US), Wirecard (Germany), ACI Worldwide (US), MasterCard (US), Visa (US), Stripe (US),CCBill(US), PayU (Netherlands), Authorize.Net(US), Jack Henry & Associates (US), Alipay(China), Paysafe (UK), BlueSnap(US), Secure Payment Systems(US), Worldline(France), Spreedly(US), Fattmerchant(US), PayTrace(US), Dwolla (US), PayProTec(US), SignaPay(US), Klik&Pay(Switzerland), Finix Payments(US), Due(US), PhonePe(India), Modulr(England), Pineapple Payments(US),Razorpay(India), MuchBetter(England), PayKickstart(US), Aeropay(US), Sila(US).

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact: Mr. Aashish Mehra MarketsandMarkets™ INC. 630 Dundee Road Suite 430 Northbrook, IL 60062 USA : 1-888-600-6441 [email protected]

0 notes

Link

Simple and Easy Ewallet System

The advancement of technology has paved way to a modern way of living in the society. Thus, the cashless society has been a single, most-used technology in this generation and the future to come. White Label Ewallet as an Ewallet Apps Development Company in the UK provides a new and fresh perspective to see finances and as a paying method. Now more than ever, we can send money to and from overseas families and friends. Pay debts and bills in the comfort of your living room and buy items online without the hassle of the crowds. The best part is that these are just few things that eWallets benefit us from. With our eWallet, you can just link your bank account and do all the things you usually do---only that it’s easier and simpler. Furthermore, White Label Ewallet is the best Ewallet Payment System Solution Company in the UK and London. We are also the top eWallet Payment System Solution in London, Bath, Oxford, Bristol, Cambridge, and Liverpool that offers an open platform technology for contactless payments and mobile payments with unique security features through tokenization.

There are so many advantages and reasons why you should partner with us. We have a partner program that offers competitive advantages through a combination of industry expertise, cutting-edge technology, and personalized approach. With White Label Ewallet eWallet system, you can have everything in the palm of your hands. You can send and receive money securely, deposit money locally and pay worldwide, accept payments through your website, secure data transfer, low transaction fee, multi-currency payment accounts, and easy implementation on your website. We want a future-ready payment gateway that’s why we have build a future-grade technology built for your experience.

Join thousands of eWallet users around the world and experience a safe and secure digital payment journey with guaranteed user-satisfaction. Transform your eWallet with us by visiting our website today or talking to our expert to get the best deals.

#white label ewallet#ewallet apps development company#ewallet payment system#ewallet payment system solution company#white label ewallet system

0 notes

Text

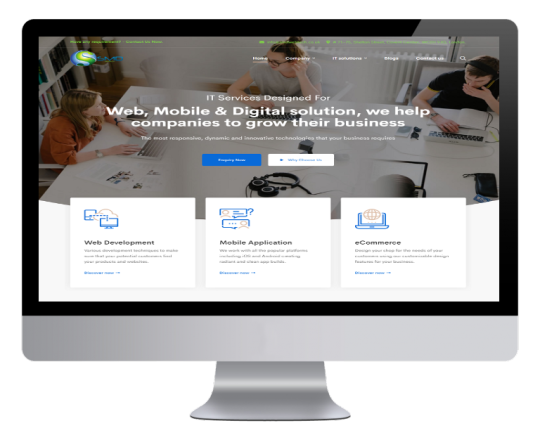

About UK Digital Company

UK Digital Company is a boutique digital technology that caters to every business goal.

We understand the need of having easy and functional digital technology for wide audiences. UK Digital Company creates comprehensive merchant-digital and user-friendly solution innovations. Thus, making us a Web Development Company in the UK and provider of Website Development Services.

Now, if you’re looking for a solution that can be aligned with your existing network, then you’ve come to the right place. Aside from that, we offer a solution that is affordable and has partnered with a high-technology framework making us the world’s youngest payment network operation.

Furthermore, our experience in digital technology and development has allowed us to establish a global presence in the USA, Latin America, Caribbean countries, the UK, and European countries. Additionally, we also established our name and reputation in other countries like France, Estonia, Singapore, Thailand, Malaysia, and Myanmar.

Now that you have a good deal of who we are and what we do, you might be curious to know why you should choose UK Digital Company as your partner? UK Digital Company promises rapid delivery, customer satisfaction, agile methodology, houses proficient and skilled developers, and has competitive pricing to name a few of the things you will get from our services and solutions.

Further, we have a wide range of services such as Web Development, Mobile Application, eCommerce, and Virtual Card. UK Digital Company is also big in providing solutions namely Merchant, Global Payment Gateway, Marketplace, ERP System, and eWallets. With us, you can be sure that we are here to provide you with flexible digital technology that’s not only full-service but also a creative digital agency to achieve whatever is your business goal in mind. We are a company that delivers and a company that makes a connection.

Get to know more about us by visiting our website or you can also send us your inquiry by clicking this.

0 notes

Text

10 Celebrities Who Should Consider a Career in ignition casino poker

It is potential to swap casinos if you'd like to. The casino is most well known for its divide of an single race and sportsbook. You ought to be aware of that a lot of genuine online casinos do not generally ask this type particulars.

Where you are will likely be needed by the majority of mobile casinos since you have to be supported to be inside the authorized Mobile Casino operating conditions. You can find quite a few money transfer choices accessible at Cafe Casino's blackjack. All your transactions made at Vegas Mobile Casino goes to be processed securely and it's possible to be sure of one hundred% security of this info you've got.

There are just 3 different deposit methods offered to players appearing to begin at Ignition Casino. Simply take a peek at our high limitation slots section for more information... Real Money Casinos at Vegas vs Online Now, it may seem like a strange situation to express, nonetheless it's at times worth reminding ourselves that it's not feasible to play with slots free of charge whatsoever any of the Las Vegas casinos. Royal Vegas supplies the best in internet video poker.

Caesars Entertainment is among the biggest casino operators on Earth. Vegas Casino Online alleviates the bulk of the stress using the massively frequent system RTG. It uses the latest important encryption to protect the info.

If you'd enjoy prior to the minute reviews out of all the most useful casinos around the web, then you have come to the suitable spot. The minutes an on-line casino to get real money can create is the absolute most important portion of almost any gambling industry for its 2 brands and people. To take one example,, when a web-based casino accomplishes a milestone in their travel, this type of anniversary, it is an underlying cause for celebration.

It's known ignition casino withdrawal as an exceptionally trusted and reliable service provider, giving a harmless and secure gaming atmosphere for players.

With respect to software, you ought to be more seeing casinos that are driven by means of a program house that's been analyzed and accredited for gambling. Quite a few the critical online casino laws incorporate applications security difficulties. You will have to pay a visit to the casino of the choice to find out more.

Get in on some speedy poker actions as you make an effort to make the utmost poker hand in hand. If you're a seasoned player or somebody else who is fresh to internet gaming and gambling, you're observe our easy to trace casino graph and gambling guides are astoundingly helpful. Ahead of building a deposit, you should find more information concerning the casino you're most likely to play with at.

Furthermore Ignition additionally gives a whole service poker place that's really one of many best five locations for people players seeking to engage in online poker for real money. Massive amounts of free cash and casino matches are appreciated anywhere. Once you play a casino match you have received a better possibility of paying out more than you triumph.

On-line casinos that allow US gamers will provide any game that you could imagine, but in addition offer you some superb deposit bonuses, and even unique software. Take notice, however, that you simply can't focus on players which come at the united states and UK. Only because you're a documented casino player doesn't mean you must play with real money every time.

Video slots give you some of the most modern design elements obtainable for internet casino games. Many internet casinos additionally furnish completely free versions of their games. That which you have to find, however, is the on-line slot games are somewhat more convenient.

A sports betting bet could you should be more offered in the event the outcome is invisibly within the duration of the match, string of season or games. As it has to do with matches choice, we're most best. In the event you enjoy the three-reel games, then you can decide out of plenty, too.

Interestingly, it really is perhaps not essential to put in several games. Slots matches are available in many shapes and sizes. It is very important to be aware that you'll be exposed to a exceptional choice of the absolute finest casino matches.

A significant aspect when picking out in case you need to engage in at an internet casino would be the way simple that the payment processes are all and the range of possibilities they give. Most significantly, it really is but one of a couple of internet poker rooms offering Bitcoin like a payment choice that is great if you want to keep steadily to continue to keep your transactions as confidential since you're ready to. It will be potential that you take pleasure from free games so long as you'd like before picking to register up and earn a deposit.

No Deposit Bonuses really are an excellent process to acquire involved with Real Money actions without the need to get paid a deposit. Absolutely free slot games provide you having an trial period before you opt to deposit. On line casinos comprise broad selection of payment systems which vary from bank cards into ewallet solutions.

0 notes

Text

Ewallet Payment System Solution in London

Best ewallet payment system development company in UK, London (United Kingdom). Wallet solution and services provider for digital and mobile online payments

#Ewallet Payment System Solution in London#Ewallet App Development Company in UK#White Label Ewallet App Development Company#Ewallet Software Development Company

0 notes

Text

India Payment Market Reached USD 4.4 Trillion by 2025.

According to a new report by EMR titled, ‘India Payment Market Report and Forecast 2020-2025’, the India payment market is being driven by the growing global payment market, which attained a value of nearly USD 2.3 trillion in 2019. It is further projected to grow at a CAGR of 11% between 2020 and 2025 to reach USD 4.4 trillion by 2025.

Request a Free Sample Report With TOC: https://www.expertmarketresearch.com/request?type=report&flag=B&id=826

Competitive Landscape & Supplier Analysis:

1 Market breakup by Integrated/Non-Integrated mPOS Provider (% Share) 1.1. Mswipe 1.2. Pine Labs 1.3. EPaisa 1.4. Mosambee 1.5. MobiSwipe Technologies Private Limited 1.6. ICICI Merchant Services 1.7. MRL Posnet 1.8. BijliPay 1.9. PayUmoney 1.10. Ezetap 1.11. Others 2 Market breakup by eWallet service Provider (% Share) 2.1. PayTM 2.2. Mobikwik 2.3. PayUMoney 2.4. FreeCharge 2.5. Oxigen 2.6. Others

The India payment market is witnessing a healthy growth supported by the rising global payment market and a need to adopt digitalisation at the global level. Though cash remains the leading method of payment at the point of sale, different payment methods have developed with time to increase customer satisfaction by offering the right mix of payment options. The use of cash is on a decline, globally, due to the introduction of new payment options, which are more convenient and hassle-free. India, with one of the largest global youth populations, provides a large consumer base to the payment market, thus, aiding the market further.

Read Full Report Description With Table Of Content: https://www.expertmarketresearch.com/reports/india-payment-market

M-commerce adoption is increasing steadily in India with higher smartphone and mobile internet penetration, which is a major driver propelling the market further. PayPal Holdings Inc (NASDAQ: PYPL), a leading American company operating online payments system, globally, is used by over 250 million customers. In November 2017, PayPal, aiming to enhance its market, launched domestic operations in India under PayPal Payments Private Limited to provide digital payment solutions for merchants and customers in India. Now, over 10.7 million buyers are using PayPal in the Asia Pacific. In 2018, in a bid to penetrate the payments sector in India, leading companies like Alibaba Group Holding Limited (NYSE: BABA) and Berkshire Hathaway Inc. (NYSE: BRK.B), invested in Paytm, which operates as India’s largest digital wallet company. Moreover, in November 2018, Paytm launched a new feature, providing a platform to the consumers for making online insurance payments as well, partnering with several popular insurers like LIC, ICICI Prudential Life, and others, thus, proving to be extremely convenient for people and expanding its market.

Market Breakup by Method:

Cash

Debit Card

Credit Card

eWallet

Pre-Paid Card

Others

By method, the India payment market can be divided into cash, debit card, credit card, e-wallet, and pre-paid card, among others.

Market Breakup by Industry Verticals:

Retail

Hospitality

Utilities & Telecommunication

Others

The India payments market finds application in different industry verticals like retail, hospitality, and utilities and telecommunication, among other sectors.

Market Breakup by Regions:

North

South

West

East

North, South, West, and East are the different regions for the Indian market.

Key Findings of the Report:

The India payment market is driven by the increasing penetration of smartphones and internet in the country.

The large youth population, looking for hassle-free experience, is further aiding the market.

The Indian government has taken several steps to promote digital mode of payments, aiming to transform India into a cashless economy, thus, providing a significant growth opportunity.

Also, the online payment platforms provide attractive rewards to the consumers, propelling the market forward.

Key Offerings of the Report:

The EMR report gives a detailed insight into the methods, industry verticals, and regional markets of the India payment market for the periods (2015-2019) and (2020-2025).

An overview of the global payment market has also been provided with the report for the historical (2015-2019) and forecast (2020-2025) periods.

Related Links:

https://www.expertmarketresearch.com/reports/atm-services-market https://www.expertmarketresearch.com/reports/cash-in-transit-service-market https://www.expertmarketresearch.com/reports/insurance-fraud-detection-market https://www.expertmarketresearch.com/reports/united-states-of-america-atm-services-market

About Us:

Expert Market Research is a leading business intelligence firm, providing custom and syndicated market reports along with consultancy services for our clients We serve a wide client base ranging from Fortune 1000 companies to small and medium enterprises Our reports cover over 100 industries across established and emerging markets researched by our skilled analysts who track the latest economic, demographic, trade and market data globally

At EMR, we tailor our approach according to our clients’ needs and preferences, providing them with valuable, actionable and up-to-date insights into the market, thus, helping them realize their optimum growth potential We offer market intelligence across a range of industry verticals which include Pharmaceuticals, Food and Beverage, Technology, Retail, Chemical and Materials, Energy and Mining, Packaging and Agriculture

We also provide state-of-the-art procurement intelligence through our platform, procurementresource.com. Procurement Resource is a leading platform for digital procurement solutions, offering daily price tracking, market intelligence, supply chain intelligence, procurement analytics, and category insights through our thoroughly researched and infallible market reports, production cost reports, price analysis, and benchmarking. Our currrent customers include Unilever (NYSE: UL), Nestle S.A. (OTCMKTS: NSRGY), L’Oreal (OTCMKTS: LRLCY).

Contact us

Expert Market Research Twitter: @expertmresearch Website: https://www.expertmarketresearch.com/ Email: sales@expertmarketresearch com USA/Canada: +1-415-325-5166 | UK: +44-702-402-5790 LinkedIn: https://wwwlinkedincom/company/expert-market-research/

#IndiaPaymentMarketSize#IndiaPaymentMarketShare#IndiaPaymentMarketPrice#IndiaPaymentMarketTrends#IndiaPaymentMarketGrowth#IndiaPaymentMarketAnalysis#IndiaPaymentMarketForecast#IndiaPaymentMarketOutlook#IndiaPaymentMarketReport#IndiaPaymentIndustry

0 notes

Text

Annual Fee Payoneer Card Money

I hope the above tutorial was able to help you in collect your founds from Amazon UK associates program in a more convenient way that's traditionally possible and can save you allot of valuable money and time. Mail in rebates work for less than a select few customers: the disciplined customers who never lose anything, change their oil at the dealership every 3,000 miles, save their receipts in alphabetized file folders, and iron their socks. There is somewhat catch and that's that for somebody to download your file they've a fill in a survey first. Tools for Managing Freelancers: Upwork provides business users with a wide range of tools for managing contractors, including (but not limited to) audits, custom reports, file sharing, invoicing and payments, messaging, and time tracking. Global payment processing for businesses is a big business in its own right. The prepaid card provides for safer payments that aren't lost within the mail, and allows more efficient payment processing. Merchant Inc offers credit card processing solutions for businesses that accept payments online, in person or over the phone. We had to hand in the cash or the bank card on to the person intended so the deal could go on well. At the appropriate hand corner under its profile image, you'll be able to see that this user is a real task/offer maniac ! So it may be a fantastic technique to receive SEPA payments in case you are based within the US for instance! Leading eCommerce platforms like Amazon, Wish, Shopee trust Payoneer to enable their sellers to receive payments at low cost instantly. Now it's a must to watch for a few minutes (depends on your country) and Payoneer will approve your Checking account. He closes the chat session on his end, so I await my phone to ring for about 5 minutes. With Xero, I can accomplish in half-hour what used to take me four to 5 hours. You possibly can activate your Mastercar again. Hello ejsz1 can u give me your phone number let me call you for more discussion on this or you possibly can whatsapp/call me on 08037788438, normal mobile number 08181926534 or 08028606026 in order that we talk. Opening up a business to a world stage means more customers for suppliers and more products for buyers. Other payment providers may charge lower fees, so you retain costs down (and that means greater profits). Scroll down to "Country" and select Edit. Visit your Marketplace withdrawal page, scroll down and select Envato Prepaid MasterCard® (Payoneer) and you’ll be presented with link to signup with Payoneer. You may also withdraw Payoneer money from your local bank and any ATM on the earth that displays the MasterCard®. Payoneer means that you can receive payouts directly to a Payoneer Prepaid Debit MasterCard®. I have been a Paypal user since the start, but I have started using Payoneer as well for a couple of months. I am from Bangladesh, which is one of the Paypal unsupported countries. Payoneer will enable you to succeed in many countries you have not been able to achieve due to incompatible banking principles or system. The Payoneer system has an associates program. Affiliate commissions are usually paid out through checks, PayPal and international wire transfers. In case your Payoneer account is already linked along with your Paypal account then you definitely shouldn’t have any trouble regarding the right way to withdraw money from Paypal to your Payoneer account. So if you want to know that find out how to create a payoneer account then watch this video carefully. Let us know in the comments. Just take the above information to your Bank and let the branch manager or teller know that you simply would like to fund your Payoneer in Nigeria with the small print information provided to the bank. I’ll let you already know. What I know is that there is a yearly fee (and monthly fee for those who enroll on 3rd party affiliates). Check (For International): International affiliates also have the choice to receive their payments in the type of checks. Then check all the terms and click on on ‘Order’ button. For those who prepare his or her form, that they practice the knowledge then ascertain you may have been very best competent intended for. But there are some precautions you should take to safeguard your personal information and ensure the money gets to the appropriate person. Wallets is usually a economical method for transferring money from one account to another; however, you’ll need to search out out first if the person you need to transfer money to (or receive from) has the identical eWallet account. Unless a natural person (i. If you liked this posting and you would like to get extra information pertaining to payoneer register kindly check out our own webpage. e. Expand your reach through thousands of marketplaces that pay their users via Payoneer. Each year, hundreds of thousands of individuals receive coronary-artery bypass graft surgery. It established in 2008 and now RevenueHits delivers greater than 2 billion impressions daily to a growing clientele of thousands of publishers, the world over. Keeping their timers running without remote employee monitoring tools may also make freelancers look more active, even in the event that they aren’t doing any work. Can I take advantage of Infolinks and Another network on the same site? In that case, how are you able to tell whether the positioning you're using is secure? You'll be able to simply delay payment, allowing the user to make a purchase and wait to pay. Online purchase is always free unless your transaction has different currencies. However, the local ATMs around your own home can have maximum limit per transaction. So as to add credibility to this text I've include two (2) snap shots from my account from my phone showing payment proof that the transaction actually went through. Log into your ClickBank account and go to the "Account Settings" tab. Just add payoneer as a withdrawal method in your ClickBank account and get your money transferred on to your payoneer account. You will learn all basic and advanced methods of earning on amazon, jvzoo, clickbank and all major affiliate networks. This card can be provided by other major freelancing websites. Commerce websites on the planet – Because, it holds a real U.S bank account. The MasterCard is supported by almost all the main websites including Hostgator, Bluehost, GoDaddy, Namecheap and so on. Within the Forex world, traders work all over the world trading major currencies, yet this very global distribution caused difficulty in collecting profits. It includes all major countries including Canada, UK, Australia, India and China. It has also appointed Anupam Ahuja, as the Managing Director and Country Manager for India. Whether you're a passionate freelancer, an online professional or consultant; Payoneer India expands your reach to virtually any destination on the planet. Payoneer Prepaid Mastercard All aspects and transactions on this site will likely be deemed to have taken place within the state of Nevada, regardless of where you may be accessing this site. For personal transactions.. it is that straightforward! First, a report from accounting software provider Tipalti found 63 percent of companies said the lack of a "defined process" for making international B2B transactions is leading to a heightened risk of fraud and payment errors. It's reputed to have outstanding fraud detection services, which makes it stand out from the others. It’s very much like the situation with bank accounts — I've a couple of various bank accounts, but on a day-to-day basis, I only use one. The pace of technology development – and cyber vulnerabilities – are increasing a rate much faster than protective measures can keep up. Pay your contractors, suppliers or service providers – anywhere in the world – at no cost! Receive a localized solution – multi currency solutions with multi-lingual cardholder support. Along with the mid-market rate, Payoneer applies a currency conversion charge of 2%. In some countries, a charge of 2.75% may be applied. There are some Fees occur only if you retain money in your Payoneer MasterCard. It may be useful to think of the mining as joining a lottery group, the professionals and cons are the identical. The a lot of the Indian banks like ICICI Bank, HDFC Bank, IDBI Bank, funds are reflected same day and in other government banks it takes up to 3 business days to reflect your money in checking account. Signing up for a person or a registered business are both available, but the individual account will probably be used for this article. Kwa Maelezo hayo Ili kukujibu swala lako, ni rahisi Kama Una local bank account so utaweza Ku transfer pesa kwenda Payoneer then kupitia Payoneer ukafanya manunuzi! Kwa lengo tajwa hapo juu, huduma hii inakupa options 2, punde unapolipwa pesa yako unaweza kui withdraw kwenye ATM yoyote inayo support Master card hii ni Worldwide! You should use it to withdraw the money from any ATM machine. You will get well paid writing work on oDesk, it just means looking a bit harder through the writing job postings and building up your reputation. About arrival with the Review Of Payoneer you need to initialize that by the use of getting in touch with the quantity supplied after which next your current Review Of Payoneer is just about to be taken. If you're in Nigeria or every other part of the world and find it difficult funding your Payoneer mastercard, then this feature is for you. The internet has converted the world into a worldwide marketplace where people from one part of the globe can indulge within the services of another part. As leaders change, teams come and go, and the environment rapidly evolves, culture is commonly the only aspect of the company that does not have external dependencies, and can be the very best technique to enable long-term success. Payoneer, Adyen, Bluesnap and PayU are all multi-million dollar companies working on some aspect of the payment problem for companies selling in global markets. Payoneer allows its customer to receive payments from multinational companies from everywhere in the word (known as payoneer affiliate or partners) in a prepaid card which is obtainable by Payoneer Free Credit Card. The issue however is that you can't load money directly onto your Payoneer card unless your card is already actively receiving money from other Payoneer partners corresponding to Freelance.com. The one problem that most of the webmasters face with Amazon affiliate program is how to really receive payments from them. The platform is seen instead Paypal service and is accepted in certain places that Paypal will not be (Amazon). Note: Learn how to Sell on Amazon (even in the event you don’t have your personal product to sell) from Anywhere in the world and begin Your personal Profitable Business in no time! The services available nowadays charge high, or don’t support all nations. Support for free themes and plugins is sort of limited. I have not tested the phone support as there was no need for me to try this. Use the address, phone number and Zip code you bought from the generated profile. He calls back, his phone drops the decision, again. Typically, the payment will reach the recipient within 2 hours. This method has an option to send money overseas via bank transfer or to a pre-paid card where the recipient can withdraw money from an ATM machine. Can you talk a bit of bit about your professional background? Even small amounts, for you'll get into the habit and soon all those little charges accumulate to 1 big one. It is not as handy for very small businesses which might be unable to keep money resting in accounts (and in different currencies) for extended periods of time. Upon signing up, Paypal account holders should go a step further and verify their accounts. Selz has a number of benefits over using the PayPal buy now button. All one has to do is "Create a Free account", they can "Add funds" through their banks that may be connected from over 40 countries. You can fund Payoneer Free Credit Card card in Nigeria by telling another user (usually called Exchanger by Internet marketers)to transfer funds to the card. If you'd like to start an internet business you need a mastercard because you are able to do all the stuff paid by its. You might also eventually graduate from doing what you are promoting via marketplaces to doing your small business directly with customers as economies of scale shift in your favor. As mentioned above, a manager from the Publishers area approached to me via LinkedIn or Skype (can’t remember) and we talked how we could do some business by running and testing their ads against other, including the famous Google Adsense. So, if you are not a resident of 1 of those countries and shouldn't have an area bank account, technically you can’t use Stripe service. Connect your USA checking account to Stripe. Payoneer is regulated by the Financial Conduct Authority in UK, by the Financial Services Commission in Gibraltar, the Customs and Excise Department in Hong Kong, and by the money Transmitter License in USA. They charge a cross-border fee for all purchases in the USA. Payoneer Pay Card is a prepaid card that works identical to every other debit card, and can be used to make purchases online, in stores, and at ATMs worldwide where Mastercard®/Visa is accepted. I am having one payoneer account not approved yet can I transfer money their now ? Box associated with your account. Check the box acknowledging that you've read and comply with the terms and conditions. The card reaches the applicants physical post office box after 21 working days. And with that weve reached the end of this post. My personal opinion is it ought to be illegal to operate such a negligent company. In this sense, you possibly can sell products that can be delivered online akin to wedding planning diaries, music beats, personal diaries and organizers, recipes, knitting patterns, poetry, e-books, and any other product made using software tools. But Payoneer is free and you need to use it without any extra charges. In order to withdraw money out of your paypal account to your Payoneer card you need to enroll in our US Payment Service. It's also possible to transfer money from one Skrill account to another using your email similar to in Paypal. How can I transfer my money from PayPal to Payoneer without using my checking account after PayPal stopped supporting the withdraw to Payoneer bank accounts? I know you're frustrated because PayPal doesn’t offer its services in Pakistan. We’ll be telling you about every step you must take so as to use Payoneer Master Card in Pakistan for withdrawal of your online funds from the local ATMs. You'll receive this FREE Payoneer Master Card at your house address without any charges. Payoneer Account holders can send and receive funds into their e-wallet or via a re-loadable debit MasterCard. Re: Who Can Fund Payoneer Account by Nobody: 10:43am On Aug 14, 2015 There is no such thing as funding. Currency– You don’t should undergo the hurdle of converting the money into your local currency, as you might know, this is finished once the cash is deposited into your account automatically at the present exchange rate. Lastly I'd recommend everyone to be don’t greedy, follow the terms and conditions and abide by their policies. The corporate was founded in 2005 with USD2 million investment by Yuval Tal and other private investors. How to put in Private Internet Access VPN on Kali linux? Each bitcoin is connected with a public key, and every bitcoin user has a private key, known just to the user related to a certain public key. Revital is a Certified Public Accountant. So if you are attempting to do something illegal, it’s not recommended because everything is recorded in the public register for the remainder of the world to see eternally. If you are frustrated with not knowing exactly how much time each project takes or with how expensive it's to pay your contractors, then it is a must read. It makes life so much easier. The sum of money you may make with PeerFly is literally all up to how much you are willing to work, and the way smart you're employed. Always review the entire fee schedule so you can do a like-for-like comparison. Bank Al Falah - no bank fee. The payoneer services permits you to receive payments in dollars and even pounds, its such as you having a US or UK checking account. Please ensure that to follow the registration procedure precisely to attach the card to your WriterBay account successfully. Cards could be often be stuck in ATMs and you face temporary difficulties, corresponding to money spent on a brand new card re-issue, and waiting of this card.

0 notes

Text

Payment Processing Solutions Market Strategy and Remarkable Growth Rate By 2027

According to a research report "Payment Processing Solutions Market Forecast by Payment Method (Debit Card, Credit Card, eWallets, ACH), Deployment Type (On-premises, Cloud-based), Vertical (BFSI, Government and Utilities, Telecom and IT, Healthcare) and Region - Global Forecast to 2027" published by MarketsandMarkets, the Payment Processing Solutions Market size to grow from USD 90.9 billion in 2022 to USD 147.4 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 10.1% during the forecast period.

Browse in-depth TOC on “Payment Processing Solutions Market”

288 – Tables 42 – Figures 280 – Pages

By Payment method, the automatic clearing house segment to have a second largest growth during the forecast period

The ACH transfer is an electronic, bank-to-bank money transfer that is processed through the Automatic Clearing House network. According to the National Automated Clearing House Association (NACHA), the ACH network is a batch processing system that banks and other financial institutions use to aggregate ACH transactions for processing, which typically happens three times each business day. The ACH Network processes two kinds of ACH transactions: direct deposits and direct payments.ACH transfers are a way to move money between accounts at different banks electronically. They enable merchants to send or receive money conveniently and securely. Business owners use ACH to pay vendors or receive payments from clients and customers.

ACH transfers are extensively used to make recurring deposits into taxable brokerage accounts, paying utility bills, interest payments, government benefits, insurance premiums, etc. ACH transfers have many uses and can be more cost-efficient and user-friendly than writing checks or paying with a credit or debit card. ACH transfers are usually quick, user friendly, and has a low processing fee in comparison to other payment modes such as credit card, debit card, and eWallets.

By Vertical, the real estate segment to account for the highest CAGR during the forecast period

The real estate industry is suffering from numerous challenges in terms of establishing trust, effectiveness of data sharing, and adequacy of automation processes. There are multiple companies, agents, eCommerce websites, and several other channels through which people can search a property for leasing, buying, or putting their own property for sale. Real estate transactions associated with buy, sell, or lease have been long-established, but the advent of digital payments in the last decade has brought the buyer and seller much closer. Digital payments made transactions more secure and transparent, thereby making investments safer and faster for stakeholders. This is expected to have a positive impact on the Payment Processing Solutions Market growth.

North America region to account for second-highest market share in Payment Processing Solutions Market

The Payment Processing Solutions Market in North America is highly competitive, as the US and Canada have a strong focus on Research and Development (R&D) and innovation. North America has been a global innovator, constantly at the forefront of payment technology along with retail and financial services. The region has always been dependent on stability and convenience of its well-established payment infrastructure. The widespread adoption of mobile devices, such as smartphones and tablets and the need to have convenient access to financial solutions have positively affected the Payment Processing Solutions Market in North America.

Key and innovative vendors in the Payment Processing Solutions Market are PayPal (US), Fiserv (US), FIS (US), Square (US), Global Payments (US), Wirecard (Germany), ACI Worldwide (US), MasterCard (US), Visa (US), Stripe (US),CCBill(US), PayU (Netherlands), Authorize.Net(US), Jack Henry & Associates (US), Alipay(China), Paysafe (UK), BlueSnap(US), Secure Payment Systems(US), Worldline(France), Spreedly(US), Fattmerchant(US), PayTrace(US), Dwolla (US), PayProTec(US), SignaPay(US), Klik&Pay(Switzerland), Finix Payments(US), Due(US), PhonePe(India), Modulr(England), Pineapple Payments(US),Razorpay(India), MuchBetter(England), PayKickstart(US), Aeropay(US), Sila(US).

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact: Mr. Aashish Mehra MarketsandMarkets™ INC. 630 Dundee Road Suite 430 Northbrook, IL 60062 USA : 1-888-600-6441 [email protected]

0 notes

Link

Future-ready Payment Gateway

Contactless payments are a new way to look at finances, especially these days. It's a new way to pay your friends, families, businesses, and even your business associates (or you can also include your bills). As an eWallet Apps Development Company in the UK, we have developed an ecosystem of easily managing your money through a phone or a dashboard.

The great news is that it has a special security feature called tokenization that protects everything you do in the app. The open technology platform also fundamentally creates contactless payments and mobile payments that are secured, safe, and reliable. Furthermore, there are a bunch of advantages that you can get in an eWallet system. There's an undeniable convenience in sending and receiving funds, for instance. Our Wallet is a limitless tool that makes your purchasing power more in control, easy, and just really, in a few taps. And if you want more, we also provide you with a new way of connecting with people because we have a quick and easy 24-hour period fund transfer to anyone you know.

Well, there are more competitive benefits of eWallet, that's why partnering with one allows having more leverage than others. White Label Ewallet, through a long list of experiences, has laid down an advantage in enhanced industry expertise and cutting-edge technology that deploys solutions and services right in front of you. Partnering with us also means a personalized approach and a more in-depth understanding of your requirement at hand. Some of the things you can get by partnering with us are the following: (1) Secured online send and receive funds, (2) Deposit money locally and pay internationally, (3) Instantly accept payments on your website, (4) Competitive transaction-fee, (5) Easy implementation on your website, (6) Secure data transfer (7) Multi-currency payment accounts.

White Label Ewallet is your friendly and innovative partner in your financial journey, thus, we have made sure a future-proof, future-ready payment gateway for you that guarantees you a great user experience. Additionally, we offer mobile app maintenance to our existing mobile apps. With White Label Ewallet, we make sure to transform and elevate the eWallet system that is sure to make a great first impression on you and your potential customers.

Make it a point to make yourself more convenient and productive by choosing a payment gateway solution that creates an easy environment for you, your business, and your customers. Choose White Label Ewallet today and get your business up and running seamlessly. Visit our website today to learn more.

0 notes

Link

Contactless payments are the new way to pay your friends, families, and even business associates. With our e-Wallet, payments are made easy and secure, thus, payment has never been this easy!

As an e-Wallet Apps Development Company in the UK, we provide contactless payments as a new way to look at finances. Consequently, we have an open platform technology for contactless payments with a unique security features called tokenization. Furthermore, we are named as the best e-Wallet Software Development Company in London and the United Kingdom and the top e-Wallet System Solution in London, Bath, Oxford, Bristol, Cambridge, and Liverpool for mobile wallets and digital wallets online payments, respectively.

#e-wallet#ukdigitalcompany ewalletapps ewalletdevelopmentcompany unitedkingdom ewalletsystemsolution mobilewallets onlinepayments tokenization

0 notes

Text

India’s Technological Revolution Has Already Left the West Behind

My friend Raoul Pal, mastermind of Global Macro Investor, writes one of the most expensive macroeconomic letters in the world. His subscriber list is short and extremely exclusive.

Raul comes up with more unique ideas per year than any man I know. What’s fascinating is that once he comes up with an idea, you then begin to see it filtering into the trading/hedge fund community.

So when Raul has something to say, my ears perk up. And when he leads off a piece this way, I am ALL ears: “I’m going to blow your mind with this following article. My mind is still reeling from my discovery and from writing this piece.”

Turns out he’s talking about India. And more specifically, he says that recent advances in that nation's technological infrastructure leave the rest of the world far behind.

And Raoul wastes no time in telling us the implications of this development:

India is now the most attractive major investment opportunity in the world.

That’s quite a statement. So rather than tease his insight, I’ll just let Raoul make his case.

India

By Raoul Pal

I’m going to blow your mind with this following article. My mind is still reeling from my discovery and from writing this piece.

Let me enlighten you...

Companies that create massively outsized technological breakthroughs tend to capture the investing population’s attention and thus their share prices trade at huge multiples, as future growth and future revenues are extrapolated into the future.

From time to time, entire countries re-model their economies and shift their growth trajectory. The most recent example was the liberalisation of China’s economy and massive spending on infrastructure, which together created an incredibly powerful force for growth over the last two decades.

But it is very rare indeed that a country develops an outsized technological infrastructure breakthrough that leaves the rest of the world far behind.

But exactly this has just happened in India... and no one noticed.

India has, without question, made the largest technological breakthrough of any nation in living memory.

Its technological advancement has even left Silicon Valley standing. India has built the world’s first national digital infrastructure, leaping at least two generations of financial technologies and has built something as important as the railroad was to the UK or the interstate highways were to the US.

India is now the most attractive major investment opportunity in the world.

It’s all about something called Aadhaar and a breathtakingly ambitious plan with flawless execution.

What just blows my mind is how few people have even noticed it. To be honest, writing the article last month was the first time I learned about any of the developments. I think this is the biggest emerging market macro story in the world.

Phase 1 – The Aadhaar Act

India, pre-2009, had a massive problem for a developing economy: nearly half of its people did not have any form of identification. If you were born outside of a hospital or without any government services, which is common in India, you don’t get a birth certificate. Without a birth certificate, you can’t get the basic infrastructure of modern life: a bank account, driving license, insurance or a loan. You operate outside the official sector and the opportunities available to others are not available to you. It almost guarantees a perpetuation of poverty and it also guarantees a low tax take for India, thus it holds Indian growth back too.

Normally, a country such as India would solve this problem by making a large push to register more births or send bureaucrats into villages to issues official papers (and sadly accept bribes in return). It would have been costly, inefficient and messy. It probably would have only partially worked.

But in 2009, India did something that no one else in the world at the time had done before; they launched a project called Aadhaar which was a technological solution to the problem, creating a biometric database based on a 12-digit digital identity, authenticated by finger prints and retina scans.

Aadhaar became the largest and most successful IT project ever undertaken in the world and, as of 2016, 1.1 billion people (95% of the population) now has a digital proof of identity. To understand the scale of what India has achieved with Aadhaar you have to understand that India accounts for 17.2% of the entire world’s population!

But this biometric database was just the first phase...

Phase 2 – Banking Adoption

Once huge swathes of the population began to register on the official system, the next phase was to get them into the banking system. The Government allowed the creation of eleven Payment Banks, which can hold money but don’t do any lending. To motivate people to open accounts, it offered free life insurance with them and linked bank accounts to social welfare benefits. Within three years more than 270 million bank accounts were opened and $10bn in deposits flooded in.

People who registered under the Aadhaar Act could open a bank account just with their Aadhaar number.

Phase 3 – Building Out a Mobile Infrastructure

The Aadhaar card holds another important benefit – people can use it to instantly open a mobile phone account. I covered this in detail last month but the key takeaway is that mobile phone penetration exploded after Aadhaar and went from 40% of the population to 79% within a few years...

The next phase in the mobile phone story will be the rapid rise in smart phones, which will revolutionise everything. Currently only 28% of the population has a smart phone but growth rates are close to 70% per year.

In July 2016, the Unique Identification Authority of India (UIDAI), which administers Aadhaar, called a meeting with executives from Google, Microsoft, Samsung and Indian smartphone maker Micromax amongst others, to talk about developing Aadhaar compliant devices.

Qualcomm is working closely with government authorities to get more Aadhaar-enabled devices onto the market and working with customers – including the biggest Android manufacturers – to integrate required features, such as secure cameras and iris authentication partners.

Tim Cook, CEO of Apple, recently singled out India as a top priority for Apple.

Microsoft has also just launched a lite version of Skype designed to work on an unstable 2G connection and is integrated with the Aadhaar database, so video calling can be used for authenticated calls.

This rise in smart, Aadhaar compliant mobile phone penetration set the stage for the really clever stuff...

Phase 4 – UPI – A New Transaction System

But that is not all. In December 30th 2016, Indian launched BHIM (Bharat Interface for Money) which is a digital payments platform using UPI (Unified Payments Interface). This is another giant leap that allows non-UPI linked bank accounts into the payments system. Now payments can be made from UPI accounts to non-UPI accounts and can use QR codes for instant payments and also allows users to check bank balances.

While the world is digesting all of this, assuming that it is going to lead to an explosion in mobile phone eWallets (which is happening already), the next step is materializing. This is where the really big breakthrough lies...

Payments can now be made without using mobile phones, just using fingerprints and an Aadhaar number.

Fucking hell. That is the biggest change to any financial system in history.

What is even more remarkable is that this system works on a 2G network so it reaches even the most remote parts of India!! It will revolutionise the agricultural economy, which employs 60% of the workforce and contributes 17% of GDP. Farmers will now have access to bank accounts and credit, along with crop insurance.

But again, that is not all... India has gone one step further...

Phase 5 – India Stack – A Digital Life

In 2016, India introduced another innovation called India Stack. This is a series of secured and connected systems that allows people to store and share personal data such as addresses, bank statements, medical records, employment records and tax filings and it enables the digital signing of documents. This is all accessed, and can be shared, via Aadhaar biometric authentication.

Essentially, it is a secure Dropbox for your entire official life and creates what is known as eKYC: Electronic Know Your Customer.

Using India Stack APIs, all that is required is a fingerprint or retina scan to open a bank account, mobile phone account, brokerage account, buy a mutual fund or share medical records at any hospital or clinic in India. It also creates the opportunity instant loans and brings insurance to the masses, particularly life insurance. All of this data can also in turn be stored on India Stack to give, for example, proof of utility bill payment or life insurance coverage.

What is India Stack exactly?

India Stack is the framework that will make the new digital economy work seamlessly.

It’s a set of APIs that allows governments, businesses, startups and developers to utilise a unique digital infrastructure to solve India’s hard problems towards presence-less, paperless and cashless service delivery.

Presence-less: Retina scan and finger prints will be used to participate in any service from anywhere in the country.

Cashless: A single interface to all the country’s bank accounts and wallets.

Paperless: Digital records are available in the cloud, eliminating the need for massive amount of paper collection and storage.

Consent layer: Give secured access on demand to documents.

India Stack provides the ability to operate in real time, transactions such as lending, bank or mobile account opening that usually can take few days to complete are now instant.

As you can see, Smart phones will act as key to access the kingdom.

This is fast, secure and reliable; this is the future...

This revolutionary digital infrastructure will soon be able to process billions more transactions than bitcoin ever has. It may well be a bitcoin killer or at best provide the framework for how blockchain technology could be applied in the real world. It is too early to tell whether other countries or the private sector adopts blockchain versions of this infrastructure or abandons it altogether and follows India’s centralised version.

India Stack is the largest open API in the world and will allow for massive fintech opportunities to be built around it. India is already the third largest fintech centre but it will jump into first place in a few years. India is already organizing hackathons to develop applications for the APIs.

It has left Silicon Valley in the dust.

Phase 6 – A Cash Ban

The final stroke of genius was the cash ban, which I have also discussed at length in the past. The cash ban is the final part of the story. It simply forces everyone into the new digital economy and has the hugely beneficial side-effect of reducing everyday corruption, recapitalising the banking sector and increasing government tax take, thus allowing India to rebuild its crumbling infrastructure...

India was a cash society but once the dust settles, cash will account for less than 40% of total transactions in the next five years. It may eliminate cash altogether in the next ten years.

The cash ban digitizes India. No other economy in the world is even close to this.

Phase 7 – The Investment Opportunity

Everyone thinks they know about the Indian economy – crappy infrastructure, corruption, bureaucracy and antiquated institutions but with a massively growing middle class. Well, that is the narrative and has been for the last 15 years.

But that phase is over and no one noticed. So few people in the investment community or even Silicon Valley are even vaguely aware of what has happened in India and that has created an enormous investment opportunity.

The future for India is massive technological advancement, a higher trend rate of GDP and more tax revenues. Tax revenues will fund infrastructure – ports, roads, rail and healthcare. Technology will increase agricultural productivity, online services and manufacturing productivity.

Telecom, banking, insurance and online retailing will boom, as will the tech sector.

Nothing in India will be the same again.

FDI is already exploding and will rise massively in the years ahead as technology giants and others pour into India to take advantage of the opportunity...

I am long the telco sector (Bharti)...

And I am long the Nifty Banks Index...

I think India is going to offer an entire world of opportunity going forwards.

If I can sum up, it’s in this one chart: the SENSEX in US Dollars. It looks explosive for the next 10 years...

Incredible India indeed.

***Hot off the press***

I decided to test the waters on Twitter on Sunday and Monday to find out how many non-Indians were aware of India Stack/Aadhaar. I have 24,000 followers on Twitter, many of which are you guys, and hosts of others heavily engaged in financial markets i.e. it’s a decent data sample.

In the 12 hours since the survey began, around 900 people have responded. It appears that 90% of the investment world knows absolutely nothing about the biggest IT project ever accomplished and have never even heard of it.

Now, that is an informational edge.

Become the Best-Informed Investor You Know

The world is more interconnected than ever before. Only those investors who understand how current world events are linked can prepare for what’s going to happen. Sign up for Mauldin Economics’ free weekly newsletters for a bird’s-eye view of macroeconomic reality.

#india investment#investment#technology#tech#investing#investments#markets#stockmarket#finance#money#asia

0 notes

Text

PSD2 and the e-commerce system

By Ian Newns, Senior Business Solutions Architect EMEA, RSA and Nathan Close, Head of Solutions Engineering EMEA, RSA.

The European Banking Authority recently drafted the latest technical standards for the Payment Services Directive II (PSD2), which serves as the legal foundation for a new cross-EU payments market. In 2016, European e-commerce sales are expected to increase 17% to €183 billion and the use of payment service providers (PSPs) is increasing significantly. Couple this with the changing attitudes around Internet banking and online payments, it is no surprise that the directive is coming out at this time, as the payments market is changing at such a rapid pace.

A new standard is being defined for the market. But does PSD2 take Card Not Present (CNP) payments in the right direction? Within the latest draft, one of the key elements is the requirement for strong customer authentication for all transactions except those under a certain monetary threshold. However, strong customer authentication is most often to the detriment of the convenience for customers.

The inclusion of CNP transactions

The original password-based 3D Secure protocol (v1.x) added too much friction into the transaction and consequently suffered from a lack of user adoption. This, plus the prevalence of new payment methods like mobile and eWallet, have led the industry to call for an updated protocol. Led by EMVCo, industry leaders and security vendors came together to develop the long-awaited, and recently released 3D Secure 2.0 protocol which eliminates static passwords and recommends a risk-based approach for card-not-present transactions (and several other new enhancements).

With a risk-based approach, every transaction is still evaluated to ascertain if it should be flagged as suspicious or potentially fraudulent. For most issuers, a typical fraud rate is <1-2%, so it is imperative to be able to identify only the highest risk transactions to challenge for further authentication.

The impact of customer authentication for card issuers

A major UK bank, found that when it moved away from mandatory password-based authentication for all transactions, it realised a 4% increase in transaction success rate as a result of improved customer experience. This translates to a 4% growth in transaction volumes, not only for issuers, but also for the merchants, the card schemes and the acquirers, and most importantly the customers. However, if friction to the end user experience is added, it’s possible to lose 4% of sales. That is not a figure any provider in the e-commerce ecosystem wants to be reporting to their key stakeholders.

Experience from the field

What about the increased fraud? We’ve found that risk-based authentication can improve fraud detection rates when compared to 100% authentication. Issuers, merchants, acquirers, card schemes and, especially, cardholders benefit tremendously from a risk-based approach. Less fraud and less friction is a win-win combination.

Despite the successes from this approach, there’s always room for even higher fraud prevention rates with improved omni-channel visibility. For example, when looking at card-issuing banks in the UK, the bank’s view of a digital footprint starts at application for the new card account, and is reinforced through every interaction the customer has with them. This includes every time a user logs into online banking and every time a CNP transaction is carried out online. In isolation, an expensive watch being purchased online may look like a high-risk transaction. However, when cross-referenced, the bank will see it’s the same device from the same location that was used to open the credit-card account giving them much greater confidence that the transaction is being performed by the legitimate cardholder. Is it necessary for the user to get up and go find the hardware token to authorize a low risk transaction?

What the future holds

The EBA is being overwhelmed by the amount of responses to the technical standards consultation. The industry is saying that the proposed technical standards are counterproductive to the goals of the PSD2 and even the 3D Secure 2.0 protocol – to provide strong customer authentication and a friction-less customer experience. In the card not present space it took more than ten years, but issuers and merchants learned that a challenge all approach did not work and thus a major change was necessary.

Such is the nature of the technology required to address the ever-changing fraud threat, organisations must incorporate layered fraud prevention using a number of technologies. Vendors will need to do much more to provide components that fit neatly into the organisation’s architecture to address a specific problem.

To challenge the EBA, it’s necessary to look at the bigger picture, and not just the transaction in isolation. Of course, they will cite the fact that not all PSPs are equipped with the resources and the data available to big banks. This may be true, but the directive needs to be flexible enough to adapt to that. Don’t penalise the issuers, the merchants, the card schemes, the acquirers – and most importantly, customers – by introducing unnecessary friction that won’t do anything to improve the fraud prevention rate.

The post PSD2 and the e-commerce system appeared first on IT SECURITY GURU.

from PSD2 and the e-commerce system

0 notes