#FTC Refund Checks

Explore tagged Tumblr posts

Text

FTC Distributes $2.8 Million in Refunds to Victims of Deceptive ‘Free Trial’ Scheme

WASHINGTON, D.C. — The Federal Trade Commission (FTC) announced the distribution of more than $2.8 million in refunds to individuals misled by a fraudulent “free trial” scheme orchestrated by Apex Capital Group and its associates. This initiative marks the culmination of a legal battle that commenced in 2018, targeting deceptive marketing practices in the personal care and dietary supplement sectors.

The FTC’s 2018 complaint against Apex Capital Group, alongside Phillip Peikos, David Barnett, and various affiliated entities, unveiled a complex operation exploiting online consumers. Marketed under the guise of “free trial” offers, the products were instead sold at full price, with consumers unknowingly enrolled in ongoing subscription plans. This deceptive practice ensnared countless individuals into unauthorized financial commitments, leveraging an intricate network of shell companies and straw owners both domestically and internationally to process payments.

The fraudulent operations, which began in early 2014, saw a range of personal care items and supplements pushed onto unsuspecting consumers. The scheme persisted until November 2018, when a court order, prompted by the FTC, effectively halted the deceptive activities.

In the aftermath of this legal victory, the FTC is dispatching 153,940 refund checks to affected consumers. Each recipient is advised to cash their checks within 90 days, as indicated. This refund process is a significant step in providing restitution to those impacted by Apex Capital’s unscrupulous business practices.

#FTC Complaint#Apex Capital Group#Deceptive Practices#Free Trial Scam#Subscription Trap#Consumer Protection#Refunds#Online Fraud#Unsolicited Charges#FTC Enforcement#Phillip Peikos#David Barnett#Consumer Restitution#FTC Refund Checks#Subscription Model Fraud#Fraudulent Business Practices#Shell Companies#False Advertising#Supplement Scams#Personal Care Products Scam#Legal Action

1 note

·

View note

Text

SCAM ALERT

TLDR: If a commisioner ignores your instructions, sends you a ton of money upfront via a check asking you to deposit and send back a portion of money- DO NOT. So back in Nov 10 I got an email commission which started okay: "I hope this message finds you well. I am reaching out to you because I am impressed by your portfolio and believe your artistic style would be a fantastic fit for an upcoming project I am coordinating.

I am currently in the process of assembling a team and I need a talented illustrator to collaborate on the title, Pandemic: Precaution and Prevention. Your work stood out to me due to its vibrant colors, character choices and attention to detail.

If you are interested, I would love to discuss the project further and provide more details about the scope, timeline, and compensation. Please let me know if this opportunity aligns with your current availability and if you would be open to discussing it further.

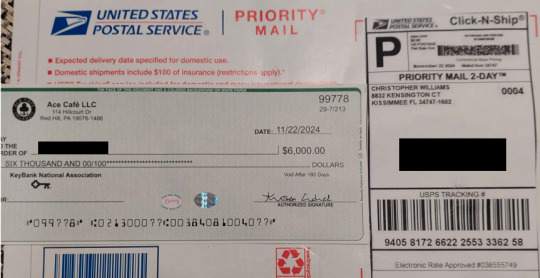

He wanted to create 6 group illustrations that would be printed and handed out for students 18-25 that would equate to $6000 at a 9 week turnaround. This raised an eyebrow but thought they were just a generous client. I gave him my procedure pipeline, starting with a min deposit upfront as a show of good faith. Also told him holidays are busy so will we start next year? He says that's fine. So far okay. "Considering the amount to be paid for the job, cashiers check or bank certified checks is our best bet. My sponsor doesn't use online payment platforms. He's an old-fashioned businessperson. The check will be issued and mailed to you and you should receive it within 5 days. Please get back to with your details in the format below:" Another raised eyebrow in this digital day and age but I've done previous freelance work that used mailed checks so I was alright with this. Only released my contact info and bank name.

Now the red flags pop up: On Nov 19 he sends this: "How are you doing today ? I'm so sorry for this, sincerely I do not find it easy to write this to you this moment , I have been so busy lately, the check is been made out for $6,000.00 which is cover for both phases. The sponsor asked for immediate refund for the 2nd phase as soon as the check clears your bank then you could proceed with the first 1-3. The 2nd phase is been postponed until further notice due to the sponsors personal issue, I will provide you the tracking information via USPS as soon as I have it so you could have it tracked yourself to know when exactly it will be delivered. My sincere apology for the inconvenience and do have a great day." So my requests were completely ignored, tells me a check is on the way with the full lump sum and I have to return half that amount. This is one method I've heard scammers get access of one's bank account with the poison check and you end up paying that half with your own actual money. Checked with friends and my own bank, sounds like a scam. Check arrives, and doing 30 minutes of Googling reveals so much warning stuff:

-So the names on the client email (Nicholas Jarry), and this name on the USPS (Christopher Williams) revealed on the first results are both famous sports players. One is a funny coincidence, two is suspicious. -quick Google of what a Keybank check is like, get an old warning about what to look for in legit checks, also tried calling Keybank on how to verify a check and explaining the scenario. -the address on the USPS belongs to a residential house that had another business also registered to it before that has gone inactive. -The Ace Cafe is real, but everything is inconsistent. The Hillcourt Dr address leads to a residential house, there is no LLC, and the logo belongs to a legit Orlando location that had closed last year and is opening in a new location, the address not matching whats on the check and names do not match either Jarry or Williams.

I've already reported this issue to the FTC and while they can't help me do anything with this particular scammer I'm now passing this around to new artists to know what to look out for when too many little suspicious things add up.

34 notes

·

View notes

Text

0 notes

Text

How to Identify and Avoid Counterfeit Auto Parts (Without Getting Scammed)

How to Identify and Avoid Counterfeit Auto Parts (Without Getting Scammed) You know that sinking feeling when your car breaks down, and you need a quick fix? The last thing you want is to slap on a cheap, fake part that fails when you least expect it. Counterfeit auto parts are everywhere—online marketplaces, shady repair shops, even some “reputable” suppliers. Here’s how to spot the fakes before they wreck your ride. The Ugly Truth About Fake Auto Parts Honestly, counterfeiters are getting scarily good at mimicking real parts. A 2023 study found that fake brake pads can look identical to OEM ones—until they crumble under pressure. These knockoffs aren’t just annoying; they’re dangerous. Think: brake failures, electrical fires, or engines seizing up mid-drive. Where Counterfeits Hide They lurk in: Too-good-to-be-true online deals (Amazon, eBay, random auto sites) Uncertified repair shops using “OEM-equivalent” parts Flea markets or roadside vendors selling “genuine” parts in plastic bags 6 Red Flags of a Counterfeit Auto Part Here’s the deal—if a part triggers two or more of these warnings, walk away. 1. Packaging That Looks… Off Real parts come in high-quality boxes with crisp logos. Fakes often have: Blurry or pixelated branding Typos (“Genuinee Parts” instead of “Genuine”) Missing holograms or security stickers 2. Suspiciously Low Prices A $20 “OEM” alternator? Yeah, no. If it’s 50% cheaper than competitors, it’s probably fake. Counterfeiters bank on your desperation to save cash. 3. Weak or Missing Documentation Legit parts include warranty cards, installation guides, or batch numbers. No paperwork? Big red flag. 4. Poor Build Quality Run your fingers over the part. Rough edges, flimsy materials, or uneven paint? Authentic parts feel sturdy—like they’ll actually last. 5. Sketchy Seller Behavior Watch for sellers who: Refuse to provide a business address Use stock photos instead of real product images Have zero negative reviews (fake accounts often inflate ratings) 6. No Brand Authentication Options Many manufacturers (like Bosch or Denso) let you verify parts via QR codes or serial numbers on their websites. No way to check? Assume it’s fake. How to Buy Real Parts (Without the Guesswork) Let’s cut through the noise. Here’s your cheat sheet for avoiding fakes: Where to Buy Why It’s Safer Dealership parts departments Direct from manufacturers, full warranties Certified online retailers (RockAuto, FCP Euro) Vetted suppliers with return policies Local mechanic shops with ASE-certified techs Reputation on the line—they won’t risk junk parts Pro Tip: Cross-Check Part Numbers Every real part has a unique ID. Google it. If the same number pulls up wildly different looking products? Something’s fishy. What to Do If You’ve Been Scammed Okay, maybe you already bought a dud. Don’t panic—here’s your game plan: Document everything: Photos of the part, receipts, seller communications. Contact the seller (politely at first—sometimes they’ll refund to avoid trouble). Report counterfeiters to the Better Business Bureau or FTC. Leave honest reviews to warn others. The Bottom Line Fake parts are like ticking time bombs—they’ll save you money today but could cost you thousands (or worse) tomorrow. Stick with trusted suppliers, trust your gut when something feels off, and remember: your car’s safety isn’t worth risking over a “bargain.” The post How to Identify and Avoid Counterfeit Auto Parts (Without Getting Scammed) appeared first on Car Accessories Blog. Car Accessories Blog

0 notes

Text

Thousands of Publishers Clearing House customers set to get refund over misleading emails, FTC says

Publishers Clearing House is known for giving money away in sweepstakes and other contests. Now it’s offering a different kind of payout — a refund for customers who may have been deceived by the direct marketing company. The Federal Trade Commission said Wednesday that the agency has mailed checks totaling over $18 million to nearly 282,000 PCH consumers who the FTC says were misled by the…

0 notes

Text

🚨 PSA: IRS Scams Are Everywhere This Tax Season! 🚨

Tax season = scammer season. Protect your info & refund! Here’s how: 💰 File Early – Beat scammers before they file a fake return in your name. 🕵 Verify Your Preparer – No PTIN? No deal. Avoid "ghost preparers." 👻 📵 IRS Won’t Call or Text – If they demand payment, it’s a SCAM. �� Secure Your Accounts – Use strong passwords & MFA. 📧 Watch for Phishing – IRS won’t email links. Don’t click! 🚫 💳 Monitor Your Finances – Check bank & credit statements. 🚫 Freeze Your Credit – Lock down your identity. 📢 Report Scams – If it seems sketchy, report it to the IRS & FTC ASAP. Scammers are getting smarter, but so are you. Stay alert & protect your money! 💰 Have you seen any tax scams? Share below! 👇 #TaxSeason #ScamAlert #IRSScams #StaySafe

0 notes

Text

#PMQs#Syria#ASTROS#AUTOS#Lookman#twitchrecap#FarmersProtest#Somme#LuigiMangione#Peppers#SaraSharif#girliv#STAGE#Dubai#PoliticsLive#ChampionsLeague#TheConservativeParty#Rashford#Duran#Badenoch#NickCandy#hatate#Assad#JustStopOil#Zagreb#Israel#Girona#DanJames#UrfanSharif#Lemina

0 notes

Text

STIPULATED ORDER FORP ERMANENT INJUNCTION AND MONETARY JUDGMENT

FINDINGS

This Court has jurisdiction over this matter.

The Complaint charges that Settling Defendants participated in deceptive and unfair acts or practices in violation of Section 5 of the FTC Act, 15 U.S.C. § 45, Section 4 of ROSCA, 15 U.S.C. § 8403, and Section 907(a) of EFTA, 15 U.S.C. § 1693e(a) and Section 1005.10(b) of Regulation E, 12 C.F.R. § 1005.10(b), in connection with the unfair and deceptive advertising, marketing, promotion, or sale of certain dietary supplements, skin creams, and other products or services through a Negative Option Feature.

Settling Defendants neither admit nor deny any of the allegations in the Complaint, except as specifically stated in this Order. Only for purposes of this action, Defendants admit the facts necessary to establish jurisdiction.

Settling Defendants waive any claim that they may have under the Equal Access to Justice Act, 28 U.S.C. § 2412, concerning the prosecution of this action through the date of this Order, and agree to bear their own costs and attorney fees.

Settling Defendants and the Commission waive all rights to appeal or otherwise challenge or contest the validity of this Order.

PROHIBITED BUSINESS ACTIVITIES

Defendants’ officers, agents, and employees, and all other persons in active concert or participation with any of them, who receive actual notice of this Order, whether acting directly or indirectly, in connection with the advertising, marketing, promotion, offering for sale, or sale of any good or service are permanently restrained and enjoined from: A. Before a consumer consents to pay for such good or service, failing to disclose, or assisting others in failing to disclose in a Clear and Conspicuous manner all material terms and conditions of any offer, including:

The total cost or price of the good or service;

The amount, timing, and manner of all fees, charges, or other amounts that a consumer will be charged or billed, including the date of the charge and whether it will be a credit card or checking account charge; and

The mechanism for consumers to stop a charge.

B. Before a consumer consents to pay for such product, service, or program, failing to disclose, or assisting others in failing to disclose in a Clear and Conspicuous manner all material terms and conditions of any refund or cancellation policy, including:

The specific steps and means by which such requests must be submitted;

The customer service telephone number or numbers that a customer must call to cancel and/or return goods or services;

The email address, web address, or street address to which such requests must be directed;

Any mechanism that customers must use to return any products, including any requirement for specific tracking methods or delivery confirmation for a package;

If there is any policy of not making refunds or cancellations, including any requirement that a product will not be accepted for return or refund unless it is unopened and in re-sellable condition, a statement regarding this policy; and

The date by which a customer is required to request a refund. C. Misrepresenting, or assisting others in misrepresenting, expressly or by implication, any fact material to consumers concerning any good or service, such as:

That the consumer will not be charged for any good or service;

That a good or service is free, risk free, a bonus, a gift, without cost, or without obligation;

That the consumer can obtain a good or service for a processing, service, shipping, handling, or administrative fee with no further obligation

1 note

·

View note

Text

How to Regain Control of Your Crypto Assets: A Guide to Recovering Lost Wallets and Reporting Scams

Cryptocurrency offers exciting opportunities, but it also comes with risks. Many people face the frustration of losing access to their wallets or falling victim to reclaim stolen crypto scams. Understanding how to recover lost bitcoin wallets, report broker scams, reclaim stolen crypto, and seek refunds can help restore your peace of mind.

Understanding Bitcoin Wallet Losses

Losing access to a bitcoin wallet can happen for several reasons:

Forgetting passwords

Losing hardware wallets

Accidental deletions

Each scenario can be distressing. However, there are steps you can take to recover your assets.

Tips for Recovering a Lost Bitcoin Wallet

Use Seed Phrases: Most wallets provide a seed phrase when you create them. This phrase can restore your wallet on a compatible platform. If you have it written down, use it.

Check Backup Locations: If you created backups, check all possible locations—cloud storage, USB drives, or even physical copies.

Seek Professional Help: If recovery seems impossible, consider contacting a recovery expert. They can assist you in navigating complex recovery processes.

Reporting Broker Scams

Scams involving cryptocurrency brokers have increased. Knowing how to identify and report these scams can protect others from similar fates.

Signs of a Scam Broker

Promises of high returns with low risk

Lack of regulatory oversight

Pressure to invest quickly

If you suspect you’ve been scammed, act fast.

How to Report a Scam Broker

Gather Evidence: Collect all relevant communication and transaction details. Screenshots and emails can serve as proof.

Report to Regulatory Bodies: In the U.S., report scams to the Federal Trade Commission (FTC) and the Commodity Futures Trading Commission (CFTC).

Contact Local Authorities: File a report with your local law enforcement. They may not recover your funds but can help track scammers.

Notify Your Bank: If you used your bank account, inform them about the scam. They may be able to assist in freezing transactions.

Reclaiming Stolen Cryptocurrency

If someone has stolen your crypto, reclaiming it can be challenging but not impossible. Here’s how to start.

Steps to Reclaim Stolen Crypto

Identify the Theft: Ensure that the transaction was unauthorized. Review your wallet history carefully.

Document Everything: Keep records of all transactions and communications related to the theft.

Contact the Exchange: If the theft occurred through an exchange, contact them immediately. Provide details about the transaction.

Report to Authorities: File a report with local law enforcement. Also, consider notifying the FBI’s Internet Crime Complaint Center (IC3).

Engage with Recovery Services: Some firms specialize in cryptocurrency recovery. They can track stolen funds and help in the recovery process.

Seeking a Refund After a Scam

If you’ve lost money due to a scam, it’s natural to want to get your money back. Here are steps to help you in that pursuit.

Steps to Seek a Refund

Document the Scam: Similar to reporting scams, gather all related evidence. This includes transaction IDs, dates, and amounts.

Contact Your Bank or Credit Card Company: If you made a payment with a credit card or bank transfer, contact your provider. They may offer chargeback options.

File Complaints: In addition to regulatory bodies, consider filing complaints with consumer protection agencies like the Better Business Bureau (BBB).

Consult Legal Professionals: If the amount is significant, consulting with a legal expert can provide guidance on possible actions.

Staying Safe in the Crypto Space

Prevention is always better than recovery. Here are some practices to enhance your security.

Security Best Practices

Use Strong Passwords: Combine letters, numbers, and symbols. Avoid common phrases.

Enable Two-Factor Authentication: This adds an extra layer of protection.

Educate Yourself on Scams: Knowledge is power. Stay updated on the latest scams in the crypto world.

Keep Software Updated: Ensure that your wallets and exchanges have the latest security patches.

Conclusion

Recovering lost bitcoin wallets, reporting broker scams, reclaiming stolen crypto, and seeking refunds can be overwhelming.

However, knowing the right steps to take can significantly improve your chances of success.

By understanding the processes involved and taking proactive measures, you can protect your assets and help others avoid similar pitfalls.

Stay informed, stay secure, and remember that you’re not alone in this journey.

1 note

·

View note

Text

RiverValleyLoans.com Pre Qualified

RiverValleyLoans.com Pre Qualified

If you took out an online payday loan from a company affiliated with AMG Services, you may be getting a check in the mail from the FTC. The $505 million the FTC is returning to consumers makes this the largest refund program the agency has ever administered.

The FTC sued AMG and Scott A. Tucker for deceptive payday lending. When consumers took out loans, AMG said they would charge a one-time finance fee. Instead, AMG made multiple illegal withdrawals from peoples’ bank accounts and charged hidden fees. As a result, people paid far more for the loans than they had agreed to.

1 note

·

View note

Text

Florida AG - FTC - Sends $540,000 to Robocall Scam Victims

Florida Attorney General Moody and the FTC send more than $540,000 to Consumers who Lost Money to Robocall Scams. TALLAHASSEE, FL (STL.News) Thursday, Florida Attorney General Ashley Moody and the Federal Trade Commission are sending more than $540,000 to consumers who fell victim to an illegal robocall scheme. Life Management Services of Orange County, LLC, and related companies tricked individuals into paying for credit card interest-rate-reduction and debt-elimination programs that rarely, if ever, provided the results as promised. The average restitution check amount that victims will be receiving is $117. Attorney General Ashley Moody said, “Hundreds of Floridians harmed by this deceptive robocall scheme will soon receive restitution through action by my Consumer Protection Division working with the FTC. Additionally, we shut down this scheme so no other Floridians could be harmed.” Attorney General Moody and the FTC send checks to more than 4,600 consumers. Recipients should cash checks within 90 days, as indicated on the check. Consumers who have questions about refunds should contact the refund administrator, JND Legal Administration, at 1- 877-381-0342 or visit the FTC website to view frequently asked questions about the refund process. Consumers will not be required to pay money or provide account information to receive a refund. According to the Florida Attorney General’s Office and the FTC’s complaint, the Life Management defendants operated an illegal robocall schemeviolatingf the FTC Act, the FTC’s Telemarketing Sales Rule, and the Florida Unfair and Deceptive Trade Practices Act. The defendants’ robocall campaign deceived consumers into paying upfront fees of $500 to $1500 for false credit card interest-rate-reduction and debt-elimination services. As a result of this joint litigation, the defendants are permanently banned from engaging in these types of practices. Additionally, the defendants must pay money and surrender a homestead property, luxury cars, watches, and other goods. As a result of the joint efforts, 383 checks totaling $49,723 will be sent to Floridians, and 4,604 checks totaling $540,353 will be sent nationwide. Report robocalls to the FTC by visiting ReportFraud.FTC.gov. Floridians can also report scams related to robocalls by filing a complaint at MyFloridaLegal.com or calling 1(866) 9NO-SCAM. Editors Question: Is anybody going to Jail? SOURCE: Florida Attorney General Read the full article

0 notes

Text

Publishers Clearing House to refund customers $18.5 million in FTC settlement for ‘deceptive’ practices

Publishers Clearing House agreed to settle a lawsuit with the Federal Trade Commission for $18.5 million, the agency said Monday.

The FTC alleged that PCH, well known for its sweepstakes, used “dark patterns” and other deceptive, unlawful business practices.

The agency also sued Amazon last week for using dark patterns relative to Prime subscriptions.

The PCH settlement money will be used to refund customers. It’s unclear how many are affected and when they might receive a refund.

Publishers Clearing House will refund $18.5 million to customers and make changes to its online business practices as part of a settlement reached with the Federal Trade Commission, the agency said Monday.

The FTC had sued the company — which runs sweepstakes contests and is well known for surprising people on their doorstep with oversized checks — for allegedly using so-called dark patterns and other deceptive consumer practices like surprise fees.

CONTINUED...

*** They sure had my dad fooled, later in his life..

0 notes

Text

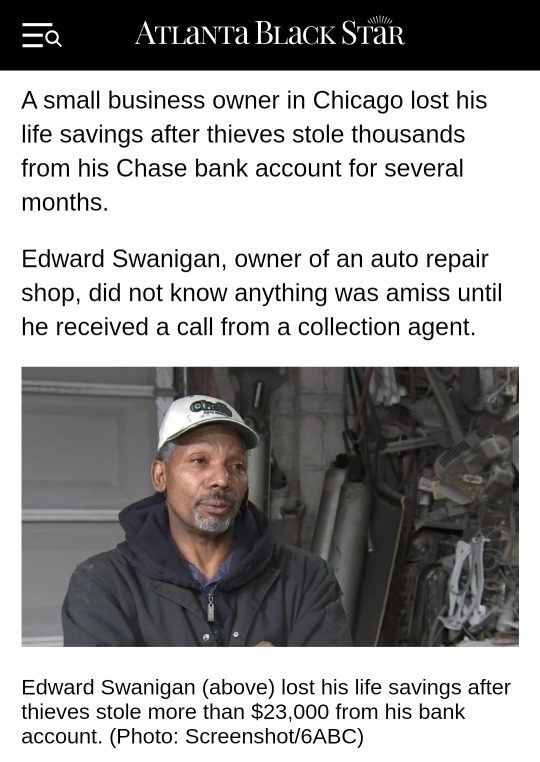

“Someone from Chase collection agent called me to collect on a $5,000 overdraft,” Swanigan recalled to 6ABC.

Somehow, the unknown culprits obtained his debit card information and began siphoning money regularly. They stole over $23,000 from his savings from locations all over the world, 6ABC reported.

“It was 2, 3, 4, 10 transactions a day. Every day of the week,” Swanigan said told the station.

Swanigan deposited money into his business account a couple times a month for over a decade. He didn’t notice the missing money because his deposit slips didn’t list a balance and he doesn’t do online banking. He received paper statements in the mail but he didn’t look at them because he assumed his money was safe.

“I just don’t have time, I mean, I know I got money in the bank,” Swanigan said. “And why do I have to check it if I feel comfortable with my money in the bank?”

To make matters worse, Chase refused to refund the money because Swanigan missed their 60-day reporting window.

“They said it took more than 60 days to report it so there is nothing they can do for me,” Swanigan told 6ABC. “What’s the sense of having your money in the bank if you can’t feel like you can sleep at night worrying that somebody isn’t going to take it?”

The Federal Trade Commission suggests customers keep a close eye on their bank information to prevent theft. This includes regularly reviewing bank statements for any differences.

“Open your monthly statements promptly and compare them to your receipts. Report mistakes or discrepancies as soon as possible,” the FTC suggested on its website.

The FTC also encouraged consumers to guard their account numbers, PIN numbers and other sensitive information. Additionally, the account owner should destroy old bank statements and cards so thieves can’t use them to steal data.

Chase confirmed to 6ABC Swanigan will not be reimbursed and added “one year passed until he notified us of unauthorized transactions.”

The FTC website states “liability depends on how quickly” the account owner reports the incident.

The incident has left Swanigan “depressed” and affects his ability to work.

“It’s hard for me now because I have no capital to work with because they took everything,” Swanigan said.

Swanigan filed reports with the police and the attorney general’s office.

1 note

·

View note

Text

Look Out for Job Scam

Hey everyone,

I just wanted to share an experience I just had that may help others.

I got an email from an "employee" at Advanced Biodesign saying they had found my resume on Indeed and wanted to do an interview for a Graphic Web Assistant. They had me contact someone named A.B.D ` M. Espinoza on Google Hangouts. I went through the process of doing an interview and the next day said they'd hire me. They then sent me a job offer to sign and then sent a "check" to buy my office suite which I deposited. I started to get a weird feeling when they wanted me to buy my equipment through a Cash App. I was desperate for a job though and went through with it, sending $400.00. Luckily either something went wrong on the app or my bank is smarter than me because the payment didn't go through and I got refunded.

Espinoza then asked me how far I was from an ATM. Since the app payment didn't work he wanted me to withdraw the money and send it. This is when my senses finally overrode my desperation. I called my bank and told them I had doubts about the check so they put a hold on it. I then told Espinoza that I wouldn't continue the process until I had verification from my bank. He got very upset about it and I even got a call from the "CEO". He was cordial at first before I started poking holes in his story. Then he got angry. I hung up on him and haven't had contact since. I just got a call today (11/27/19) from my bank that the check was fake.

Later I found out that it is a common scam to send someone a fake check to get money out of them. Because of the law, when you deposit a check, the bank is required to make those funds available to you immediately. But it takes a few days for the bank to verify the check. So, whoever sent you the check will get you to send them money either through a Cash App or some other means once you deposit it. Then a few days later, you find out the check is fake, the bank removes the funds, and now you are out the money you just sent them, plus a punishment from your bank. In my case it was only a $5.00 fee but sometimes they can also suspend your account, or remove other privileges. So if you start to suspect the check you deposited was a fake, call your bank and explain what happened. You may still get hit with a fee but you may avoid other punishments.

I got emails through the “CEO” Ismail Ceylan, I talked with A.B.D ` M. Espinoza on Google Hangouts, and I have the phone number he used. The person on the phone claimed to be Mr. Ceylan. The Cash App account they wanted me to send money to was $accountingvendor with the user name Jermain Edwards.

This has happened to other people. You can find stories of this happening to other people on Jobcase. I’d like to leave a link but I don’t want this buried by Tumblr. If you search for “Advanced Biodesign scam jobcase” there should be a result titled “Possible Scam | Jobcase”. That has some stories people have shared about the same scammer.

Right now the only money I am out is a $5.00 fee from my bank for depositing a fake check. Although I’m embarrassed I got strung along for a week and looking back it was fairly obvious. I wish I hadn’t let my desperation override my common sense. I have filed a complaint with the FTC and messaged the legitimate company that their identity is being used but he will probably get away with preying on people desperate for a job.

TL;DR: Do not do job interviews over Google Hangouts. They will do the interview, hire you, send you a fake check to buy equipment, then trick you into giving them money. Only talk to employers through means that you can verify (i.e. the number is listed on the official site or the person you are meeting with is listed as an employee for the company on the LinkedIn/Employee page on the website).

I did not even now this was a scam people pulled. Be careful out there everyone.

8 notes

·

View notes

Text

Discount Contact Lenses - How To Buy

With a contact focal point solution close by, it's conceivable to buy your contact lenses from stores, the Internet, via telephone, or via mail. On the off chance that you've for a long while been itching to change your eye shading, shading contact lenses can give postnatal depression, beautiful greens, grand hazels - even different examples and structures. You'll need to avoid potential risk to make any focal point buy protected and compelling.

youtube

In the U.S. contact focal point commercial center, 82 percent wear delicate lenses, 16 percent wear inflexible gas-penetrable and just 2 percent wear hard. Contact focal point deals are controlled by the FDA (Food And Drug Administration) and the FTC (Federal Trade Commission.)

The lapse date for your medicine is as of now set by your state requiring a one-year or two-year restoration; if your state hasn't set a base termination date, government guideline sets a one-year date except if your eye specialist decides there's a clinical explanation behind short of what one year. Unbending lenses for the most part give you all the more clear vision. Contacts accommodate phenomenal fringe vision for sports, driving, security, and performing.

Expendable lenses don't accompany directions for cleaning and purifying, while those named explicitly for arranged substitution do. Delicate lenses are easier to alter and are substantially more agreeable than unbending lenses, since they adjust to the eye and ingest and hold water. Unbending lenses don't retain synthetic compounds, dissimilar to delicate lenses which will absorb buildup from your hands like cleanser or moisturizer.

A few specialists endorse disposables as arranged substitution lenses, which are evacuated, purified, and reused before being disposed of. Individuals who have great separation vision however need assistance for perusing can get a monovision perusing focal point for one eye. While the capacity to hold water builds the oxygen porousness of delicate lenses, it expands their delicacy remainder too.

There are additionally a couple of inflexible gas penetrable lenses that are structured and affirmed for medium-term wear. With arranged substitution lenses, the specialist works out a substitution plan custom fitted to the requirements of every patient.

Any place you buy, look for quality and esteem and remember you need to give a valiant effort for your eye wellbeing. Be careful with endeavors to substitute a brand different from the one you need when buying contacts. Continuously ask what refunds are accessible.

Cautiously check to ensure the organization gives you the specific brand you requested, the name of the focal point, the force, circle, chamber, assuming any, pivot, assuming any, breadth base bend, and fringe bends, assuming any. At the point when you put in your contact focal point request, demand the maker's composed patient data for your contact lenses; it'll give you significant hazard and benefit data just as guidelines for use. At the point when you get your request, in the event that you think you've gotten an off base contact focal point, check with your primary care physician or eye care proficient immediately; don't acknowledge any substitution except if your eye care proficient endorses it.

Discounts might be accessible from the merchant, from the maker, for first-time contact focal point wearers and for people who buy lenses and get an eye test. Concentrate on esteem, not simply the cost; a great many people searching at the best cost are truly searching for the best worth. Get some information about costs at your primary care physician's office when you have your eye assessment, or during a subsequent visit after you get your medicine.

The danger of corneal ulcers for individuals who keep broadened wear lenses in medium-term is 10 to multiple times more prominent than for the individuals who utilize day by day wear lenses just while they are wakeful. Fundamental principle: never swap your contact lenses with any other person. To be certain your eyes stay solid you shouldn't organization lenses with a medicine that is terminated or load up on lenses directly before the medicine is going to lapse; it's a lot more secure to be re-checked by your eye specialist.

Microorganisms might be available in refined water, so consistently utilize business clean saline arrangements, in the event that you intend to utilize chemical tablets in water for purifications. Broadened wear unbending lenses can cause surprising, bothersome, reshaping of the cornea. On the off chance that your eyes become red or disturbed, expel the lenses promptly and talk with your primary care physician.

1 note

·

View note

Link

Uber, the self-appointed future of personal transportation, has achieved its massive growth thanks in part to an age-old trick: treating their workforce like shit. Earlier this week, the Federal Trade Commission announced that they’d be sending $20 million in refunds on Uber’s behalf to beleaguered drivers who’d been suckered into driving for the ride-sharing service through misleading claims about how financially advantageous it was to be an Uber driver.

The checks represent the culmination of a January 2017 settlement between the FTC and Uber, which resulted in a $20 million fine and tighter rules about the statements the company was allowed to make about itself. As for the specifics of what Uber did to earn such a fine, in a press release announcing the settlement, the FTC wrote:

Uber claimed on its website that uberX drivers’ annual median income was more than $90,000 in New York and over $74,000 in San Francisco. The FTC alleges, however, that drivers’ annual median income was actually $61,000 in New York and $53,000 in San Francisco. In all, less than 10 percent of all drivers in those cities earned the yearly income Uber touted. The FTC also alleges that Uber made high hourly earnings claims in job listings, including on Craigslist, but that the typical Uber driver failed to earn those advertised hourly amounts in various cities.

Additionally, the FTC found that Uber drivers who obtained loans on their cars through the company’s Vehicle Solutions Program “received worse rates on average than consumers with similar credit scores typically would obtain,” despite the company’s claims that the Vehicle Solutions Program offered more favorable terms than traditional financing options.

Per the FTC, drivers who were harmed by Uber will receive an average of $223 each. While a $20 million fine is a drop in the bucket for a company with a $62 billion valuation, and $223 a pretty crappy compensation for potentially being screwed out of tens of thousands of dollars, the very existence of these payments serves as a yet another reminder that Uber is not trying to make the world a better place. Instead, they’re trying to make the world a place where everyone has no choice but to use Uber. They attempt to pay their drivers as little as possible while simultaneously working to replace those drivers with self-driving cars (which, by the way, they may have developed with stolen trade secrets). It’s been strongly alleged they’ve used both encryption and the sorts of legal tactics you’d normally see from Saul Goodman in Breaking Bad, to obscure company activities from both regulators and law enforcement. Like, this is a company that literally had a division called Uber Hell, which was tasked with spying on the movements of Lyft drivers and using that data to steal Lyft’s business. Currently, they’re being investigated by the Equal Employment Opportunity Commission for gender discrimination in the workplace, and one of the first things their new Chief Operating Officer, Barney Hartford, made the news for was making racist comments on a conference call.

(Continue Reading)

112 notes

·

View notes