#Fake Note Checking Machines to detect Fake Notes

Explore tagged Tumblr posts

Text

PH 7x05 Reaction and Theories

This post will contain spoilers for all of PH season 7 so far from Watcher TV

Contains moments from 7x05 but also some overall notes on s7 as a whole while we theorize for the finale next week

Since a lot of the non-WTV subscribers are looking for 7x01 posts everything will be under a read more to try and avoid spoiling things and also you can filter out #Puppet History spoilers for anything I post like this

Click at your own risk!

First, not a Lore bomb but I'm giggling that 7x05 is about a jester and we learn they were chosen to perform because they could make fart jokes and the Professor calls Ryan his jester lolll

For the Lore at the end, I want to point out that they really make a point of telling us how addictive the Phorgedytol pills are and how much both Ryan and the Professor are wishing for more - I hope this isn't used against them!

they also trust Sprat enough to warn him about Elmer and the Professor says that Sprat is "really friendly" (ominous maybe?)

whoever had "Ryan tries to contact ghost!Shane via Spirit Box" on their 2025 Bingo card is correct!

this exchange between Ryan and ghost!Shane is so great lmao

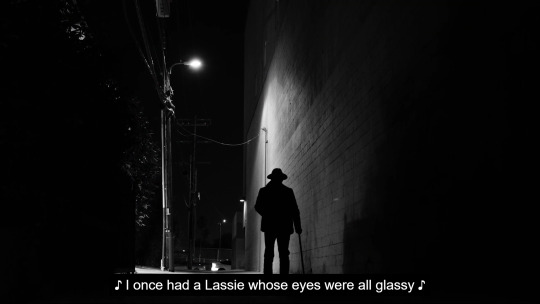

During Shane's flashback he's singing a song "I once had a Lassie whose eyes were all glassy" but I couldn't find if that song actually exists

Then we get confirmation that it was Elmer who pulled the trigger and we see him walking from beside a dumpster - aka the last known location of the substitute's hologram device :eyes emoji:

After saying how he was shot, Shane mentions running into some interesting celebrities

Past guests referenced by ghost!Shane and links to the PH episode:

Abraham Lincoln & Kate Warne - Kate was a detective who foiled an assassination attempt on Lincoln

Adolf Sax - aka the "unkillable weirdo" who lived through many things that could have killed him

Pickle Boys - they were brought back to life by Santa Claus

Seems to be a common theme about avoiding murder/death with these guests. My theory is that this is how Estranged Producer Shane Madej can still win! (come back to life)

and I want to point out again that Dr. Sprat wears triangle-shaped glasses and I can't help but feel like this is significant to 7x01 with Pythagoras and the Triangle and Reincarnation...

I think that every time we see Sprat through the season we're supposed to remember that Reincarnation is on the table

Also, Shane mentions the human participants of these episodes and not the anthropomorphized puppets (train, instrument prototype, or various guests from the xmas special). Maybe he's in a different place than purgatory, since we know that's where the puppets are or are being sent, and he's not seeing the puppets.

Now for some general notes about the season I've been rotisserie-ing in my mind the past few weeks:

7x01 Pythagoras -Themes of mysticism and reincarnation -Triangle sings that "Math will never die" and then is the first one to be sent to Purgatory by the Retirement Machine. Ironic but also perhaps foreshadowing that the machine isn't really killing them permanently?

7x02 Straw Hat Riots -Themes of violence especially against those in "other" groups -Dorothy Ruth tries to warn Ryan and the Professor

7x03 Shajar al-Durr -Pretending someone you're close to isn't dead -Dead body inside the puppet -Dino parents tricked with Liza Minnelli fake and sent through the Retirement Machine (Note: Elmer is the one supervising this usage of the machine and not Dr. Sprat, who seems to be against this part of his job)

7x04 Lisztomania -Puppet was a discarded pile of trash (a metaphor for Shane shot "like a dog in the street") when it could have been a piano for Liszt -Professor and Ryan remember what happened at the s6 wrap party

7x05 Jester -Dead body inside the puppet -Professor and Ryan contact ghost!Shane

7x06 Topic TBD -Only episode that hasn't been announced yet -Double-checked the trailer and there were no animations from 7x06 as all the ones we saw have been for the other five episodes -We know the guest will be Sara Rubin and her line from the trailer about "this is heading toward eating people" -The puppet seems to be a broken ship based on the s7 banner art on WTV with a skeleton on the bow

shots from all the animations we saw in the trailer

NOTE: All of the puppets this season have been fairly simple (triangle, hat, tent, trash, rug) compared to some of the major guest stars we've had in previous seasons (god, death, cupid, Antarctica) which I think is due to Elmer or someone else besides Shane being in charge and not really caring about who is booked for the show

But Elmer's title is Branded Content Manager, so maybe he's only working for a producer in the shadows (like the Genie perhaps?? but my money is on the Substitute)

I want to believe Sprat is a good guy, but his reluctance to retire the puppets could all be a ruse!

In 7x05 we didn't get any updates on Dorothy Ruth, and the Professor and Ryan didn't learn what the Department of Puppet Safety is really up to with the guests, so I'm interested to see how much Lore is packed into the last episode. It could be a long one!

My other PH posts about s7 are in this tag if you want to refresh your memories while we wait for 7x06

Thanks for reading! Comment or reblog with your finale theories!

20 notes

·

View notes

Note

i really love your death knight au for yakou‼️it’s super fun to read and think about

i’m just wondering about your perspective when it comes to yakou slowly putting together everything about the homunculus stuff in chapter 5. because, god, as far as i can tell that is absolute existential crisis material (like yakou figuring out he himself is a homunculus? and that his original is probably dead? like dude)

(i also imagine that the way he initially starts putting things together is like. through the whole pink blood thing. maybe yuma somehow gets (non-lethally) injured in the beginning of the chapter and sheds red blood, which leads into yakou realizing that something’s off?? don’t mind me i’m just rambling here)

There's a lot to take in when the revelation finally hits. While venturing through the abandoned village with Yuma, Yakou is mortified by the ghastly sight. Many citizens he'd known over the years, despite their passing, are husks of their former selves, mindlessly attacking him and the rookie. He fights back against them to protect Yuma, who they seem to suspiciously target more than Yakou. There's not much room to dwell on it as Makoto fires the arrow containing the threat of homunculi feasting on human flesh to survive. A pit in his stomach begins to form. While being chased down, the two fall down a cliff, both suffering some cuts and bruises. Yakou quickly takes action to clean off their blood for fear of attracting more homunculi. He takes note of the difference in their blood color, but doesn't comment on it, assuming Yuma hasn't been in the rain long enough for it to affect his body.

In the factory, Yakou confronts the zombified Hitman Zilch, newfound anger coursing through him. He wants to get back at the hitman for all the harm he caused, killing Yakou's wife and massacring the five detectives on the Amaterasu Express. Shinigami and Yuma manage to break him from his rage-induced trance, telling him Yomi and Huesca were the ones who gave the orders; he only followed their commands. Hitman Zilch confirms this during his drawn-out speech. As they discover the remains of each of the NDA detectives, Yuma immediately begins to panic. Yakou remains skeptical, trying to calm the rookie down by telling him they could be fakes. He's too deep in denial to say why.

It doesn't take long before a portion of the truth comes crashing down on him. Hearing strange noises in the freezer, Yakou instructs Yuma to stay behind so he can check. In the bone-biting cold, Yakou feasts his eyes upon the horrors of Kanai Ward. Frozen corpses are mushed into meat buns, the main food supply for the entire city's citizens. Shinigami turns away as he vomits from pure repugnance. Despite his disgusting display, he can't cough up all the lives he consumed. Exiting the freezer, Yuma rushes to him, fearful of what his chief could've seen. Yakou tells him not to worry; the bitter cold got to him, is all.

The two detectives head down into the old facility, shocked by the near cosmic terror of all the vacant pods lining the infinite walls. Holes in the ceiling reveal cloudless skies. Yuma steps into the strips of sunlight in relief, allowing himself a faint smile as he revels in what little warmth he can gain. Yakou instinctively avoids the holes, staying in the shade as he observes Yuma with sorrowful eyes. Shinigami advises her Sir to let the fledging enjoy it while it lasts.

In the bathhouse, Yuma curiously pokes and prods at the rainmaking machine while Yakou investigates. Suddenly, the rainmaker comes to a stop. Yakou and Yuma freeze up. The thick dark clouds dissipate, the blinding sun enveloping Kanai Ward. It's far from a welcoming embrace. Yakou feels his sense of self slipping away, his thoughts colliding together as a deep forgotten impulse claws up to the surface of his weakening mind. Using as much energy as he can muster, he yells at Yuma to turn the machine back on, but Yuma's anxiety flares. As he fruitless attempts to power the rainmaker, Makoto enters the building. Yuma backs up and clutches Yakou's hand, who barely clings to consciousness. When Makoto offers to help, Yuma takes his hand, allowing the three of them to connect. The rainmaker turns on, a brewing storm surrounding the city once more. Yakou regains what he had lost of himself while Shinigami recovers from her own stupor. Taking it all in is nigh impossible.

#im not the same man i was before#death knight yakou au#rain code spoilers#rain code#yakou furio#yuma kokohead

20 notes

·

View notes

Text

Why Cash Scans Are Essential for High-Volume Businesses: Preventing Fraud at Scale

In today’s fast-paced economy, large retail stores, casinos, and banks handle thousands of dollars in cash transactions every day. But with high volume comes high risk — especially from counterfeit currency. If you're an industrial business owner in the USA, the solution lies in a reliable cash scan system designed specifically for bulk operations.

Let’s explore why integrating a cash scan for large retail isn’t just a smart move — it’s a business necessity.

The High Stakes of Handling Large Cash Volumes

From payroll fraud to fake bills slipped into late-night registers, counterfeit currency can cause significant financial damage. In high-volume environments, manual detection methods fall short — not just in accuracy, but in efficiency.

Here’s what’s at risk:

Revenue Loss: Even one $100 fake note a day can add up to $36,500 a year.

Employee Error: Human verification can’t match machine consistency.

Brand Trust: Accepting counterfeit bills can hurt your credibility with customers.

That’s where the bulk bill checker comes into play.

What Is a Cash Scan and How Does It Work?

A cash scan is an automated machine that verifies currency authenticity by analyzing multiple security features such as:

UV and magnetic markings

Infrared patterns

Watermark detection

Serial number validation

When you're processing hundreds (or thousands) of bills daily, these machines offer unmatched speed and precision.

Why Large Enterprises Choose Bulk Bill Checkers

High-volume businesses can’t afford downtime, mistakes, or fraud. Here's why they trust cash scan for large retail and institutional operations:

✅ Scalability

Whether you're managing five registers or fifty, cash scans can handle the workload with no drop in performance.

✅ Accuracy at Speed

Most models process up to 1,200 bills per minute — detecting even the most convincing counterfeits.

✅ Reduced Labor Costs

Automating the validation process minimizes manual checks, reducing staff workload and operational costs.

✅ Audit-Friendly

Cash scans generate logs and reports, making reconciliation and audits easier — a major plus for banks and casinos.

Real Use Case: A Casino That Saved Thousands

A mid-size casino in Las Vegas installed a series of Lynde Ordway cash scan units across cashier desks and reported:

$9,200 in counterfeit bills intercepted in the first 60 days

20% faster shift closing times

Zero cash-handling disputes thanks to logged validation data

This real-world result showcases how the right counterfeit detector can directly impact bottom-line efficiency.

Key Features to Look For in a Counterfeit Detector

When selecting a cash scan machine, prioritize features like:

Multi-currency support

Continuous feed systems

Advanced counterfeit detection algorithms

POS system integration

Compact design for front-end counters

🔗 Explore Lynde Ordway’s Cash Scan models here — a trusted name in retail and banking equipment.

Q&A: What Business Owners Are Asking

❓ Can a cash scan detect all types of counterfeit bills?

✅ Yes. High-end models use multi-layered security checks to flag even the most sophisticated fakes.

❓ How much training is needed to use one?

✅ Minimal. Most machines are plug-and-play with intuitive interfaces.

❓ Is it suitable for small teams or just large corporations?

✅ Both. While ideal for high-volume businesses, even small teams can benefit from reduced human error and improved speed.

Final Thoughts

In a world where counterfeit currency continues to evolve, high-volume businesses can’t rely on outdated methods. A robust bulk bill checker not only detects fakes but improves efficiency, audit reliability, and peace of mind. From casinos and retailers to banks and service counters — the ROI is immediate and lasting.

✅ Call to Action

Ready to protect your profits and streamline your cash management? 👉 Contact Lynde Ordway today to get a quote or schedule a demo of our cutting-edge Cash Scan solutions tailored for your business needs.

Cash Scan

counterfeit detector

bulk bill checker

cash scan for large retail

currency validation

bill checking machine

fake currency scanner

0 notes

Text

💸 Money Counting Machine Price in Bangladesh – A Smart Tool for Smart Cash Handling

Handling large amounts of cash every day can be stressful, risky, and time-consuming—especially for business owners, retail shop managers, bank clerks, and even general users who deal with frequent cash transactions. That’s why a Money Counting Machine is no longer a luxury—it’s a necessity in today’s fast-paced economy.

If you’re wondering about the Money Counting Machine price in Bangladesh or which model is right for you, this article is designed to walk you through everything in a simple and helpful way.

🧠 What Is a Money Counting Machine?

A Money Counting Machine, also called a Currency Counting Machine or Money Counter Machine, is an automatic device used to count bundles of banknotes quickly and accurately. These machines are commonly used in shops, banks, offices, and organizations where cash flow is high.

More advanced models come with fake note detector sensors that identify counterfeit bills using UV, MG, or IR technology. This not only saves time but also protects businesses from financial losses due to fake currency.

✅ Why Do You Need One?

Manual cash counting is tiring, often inaccurate, and leaves room for human error. A single mistake in counting could cause hours of confusion and loss. Here’s why a Money Counting Machine makes life easier:

Fast Processing: Count hundreds of notes in seconds.

Accuracy Guaranteed: Avoid human errors and recounts.

Fake Note Detection: Advanced models come with built-in fake note detector systems.

Time-Saving: Automate repetitive tasks and let your staff focus on more important things.

Professional Handling: Build trust with customers and staff with transparent cash management.

🏪 Who Should Use It?

This machine is perfect for anyone who deals with cash regularly. Here's a quick list:

Retail store owners

Wholesalers and distributors

Pharmacies and supermarkets

NGOs and educational institutions

Event organizers

Fuel stations

Ticket counters

Small to medium-sized businesses

Whether your business is large or small, a Money Counting Machine simplifies the way you handle money.

🧾 Different Types of Money Counter Machines

Before you buy, it’s important to understand the different types available in the market:

1. Basic Money Counter Machines

Functions: Just count the notes.

Use case: For small shops or personal use.

Limitation: No fake note detector included.

2. Money Counting Machine with Fake Note Detector

Functions: Counts notes and detects counterfeit bills.

Ideal for: Medium-size shops, offices, clinics, etc.

Technology used: UV (ultraviolet), MG (magnetic), IR (infrared).

3. Advanced Currency Counting Machine

Functions: Mixed denomination detection, value calculation, sorting, and counterfeit check.

Ideal for: Banks, financial institutions, and high-volume businesses.

💡 What Features Should You Look For?

When buying a Money Counting Machine, make sure it has features that suit your needs:

Speed: Look for machines that can process 1,000 to 1,500 notes per minute.

Fake Note Detection: A must-have for all businesses handling cash.

Display: A large, clear LCD/LED screen helps track counts easily.

Batch Function: Great for organizing notes into specific amounts.

Add Function: Useful for totaling multiple stacks of currency.

Noise Level: Quiet machines are best for peaceful work environments.

Dust Resistance: Extends machine life and improves performance.

📌 Real-Life Use Cases

Let’s break down how various users benefit from a Money Counter Machine:

Retail Shops: No more end-of-day counting struggles. Get accurate results in minutes.

Banks: Handle large volumes of cash with confidence and speed.

Event Managers: Count ticket collections quickly and error-free.

Educational Institutions: Simplify fee collection and counting during admission seasons.

Pharmacies and Supermarkets: Deal with multiple cash counters and ensure accurate reconciliation.

💰 So, What’s the Price?

Now that you know how helpful these machines are, let’s talk about price—because that’s usually the biggest question.

Quality Money Counting Machines in Bangladesh start from ৳21,000. Yes, for just BDT 21,000, you can have a professional-grade machine with essential features like fast counting and fake note detection.

Of course, depending on the brand, functionality, and build quality, prices may vary. Higher-end models with mixed denomination recognition and automatic sorting can cost significantly more. But for most small to medium businesses, even the base models provide incredible value.

You can check out the updated pricing and compare models on Nobarun BD’s website, a trusted supplier in the Bangladeshi market.

🔍 Top Brands Available in Bangladesh

Several brands are well-known for offering reliable and durable machines:

KINGS Power

Xinda

Gold Japan

Hisense

Hitachi

These brands provide after-sales service, warranties, and great build quality—important factors when making a business investment.

📈 Money Counting Machine Price in BD: Quick Summary

In Bangladesh, Money Counting Machines come in different types based on features and usage. Below is a clear breakdown to help you choose the right one:

1. Basic Machines: These are simple machines that only count notes. They do not detect fake currency. Best for small shops or personal use. ➡️ Starting Price: Around ৳21,000

2. Mid-Range Machines: These machines come with a fake note detector. They use UV, MG, or IR technology to detect counterfeit notes. Ideal for medium-sized businesses, offices, and clinics. ➡️ Starting Price: Around ৳30,000

3. Advanced Machines: These are high-end Currency Counting Machines that can count mixed denominations, calculate totals, and detect fakes. Suitable for banks and large organizations. ➡️ Starting Price: ৳45,000 or more

🛍️ Where to Buy One?

It’s important to buy from a reliable vendor that offers genuine products, service warranty, and after-sales support. One such place is Nobarun BD, where you can explore a wide variety of machines and select the one that matches your business requirements.

Check here 👉 https://www.nobarunbd.com/money-counting-machine-price-in-bangladesh

✅ Final Thoughts

A Money Counting Machine isn’t just a gadget—it’s an investment in speed, accuracy, and peace of mind. From detecting fake notes to saving hours of manual work, this one tool can transform your business operations.

Whether you’re a retail shop owner, a banker, or someone who deals with large amounts of cash, this machine will help streamline your workflow. And with prices starting at just ৳21,000, it’s more affordable than you think.👉 Ready to make your cash management smarter? Explore the latest models today at Nobarun BD and find the perfect Money Counting Machine for your needs!

0 notes

Text

10 Qualities of the Best Dating App Development Company in 2025

The online dating industry has evolved dramatically, with millions of users turning to apps to find meaningful connections. As we move into 2025, the competition among dating apps is fiercer than ever. Whether you're an entrepreneur or a business looking to launch the next Tinder or Bumble, choosing the best dating app development company is crucial for success.

A high-quality dating app requires more than just a swipe feature—it needs advanced technology, seamless UX, robust security, and scalability. In this guide, we’ll explore the 10 essential qualities that define the top dating mobile app development companies in 2025.

1. Expertise in Dating-Specific Development

Not all app developers understand the nuances of dating platforms. The best dating app development company specializes in:

AI-Driven Matchmaking Algorithms – Smart pairing based on interests, location, and behavior.

Behavioral Analytics – Tracking user interactions to improve engagement.

Niche Dating Solutions – Catering to specific audiences (e.g., LGBTQ+, professionals, seniors).

A company with experience in dating mobile app development will know how to integrate features like video dating, voice notes, and icebreaker prompts effectively.

2. Strong Portfolio & Proven Track Record

Before hiring a development team, check their portfolio for:

Successful Dating Apps – Look for apps with high download rates and positive reviews.

Case Studies – Detailed breakdowns of how they solved challenges for previous clients.

Client Testimonials – Feedback from businesses that have worked with them.

A top-tier company will have a history of building apps that retain users and generate revenue.

3. Advanced Security & Privacy Compliance

Dating apps handle sensitive user data, making security a top priority. The best dating app development company ensures:

End-to-End Encryption – Protecting messages and personal details.

Secure Authentication – Two-factor authentication (2FA) and biometric login.

GDPR & CCPA Compliance – Adhering to global data protection laws.

Fraud Prevention – AI-powered detection of fake profiles and scams.

Without strong security measures, users will lose trust in your app.

4. AI & Machine Learning Integration

Modern dating apps rely heavily on AI for:

Smart Matching – Analyzing user behavior to suggest compatible partners.

Chatbots & Icebreakers – Helping users start conversations effortlessly.

Image Verification – Detecting fake or inappropriate profile pictures.

Predictive Analytics – Forecasting user preferences to boost engagement.

A leading dating mobile app development company will leverage AI to create a personalized and secure experience.

5. Cross-Platform Compatibility (iOS, Android & Web)

Your dating app should work flawlessly across all devices. The best developers ensure:

Responsive Design – Smooth performance on smartphones, tablets, and desktops.

Native & Hybrid App Development – Optimized speed and functionality for both iOS and Android.

Progressive Web App (PWA) Support – Allowing users to access the app via browsers.

A fragmented experience can drive users away, so cross-platform compatibility is a must.

6. Scalability & High Performance

A successful dating app grows rapidly, so your backend must handle:

Millions of Users – Cloud-based infrastructure (AWS, Google Cloud) for scalability.

Real-Time Notifications – Instant alerts for matches, messages, and updates.

Low Latency – Fast loading times even during peak traffic.

The Best Dating App Development Company builds apps that scale without crashes or slowdowns.

7. User-Centric UI/UX Design

A dating app’s design can make or break its success. Key elements include:

Swipe Mechanics – Intuitive and addictive like Tinder or Bumble.

Clean & Engaging Layouts – Easy navigation with minimal clutter.

Accessibility Features – Support for visually impaired users (voice commands, screen readers).

Dark Mode & Custom Themes – Enhancing user comfort.

A great UI/UX keeps users engaged and reduces uninstall rates.

8. Seamless Social Media & Third-Party Integrations

To enhance functionality, top developers integrate:

Social Logins – Letting users sign in via Facebook, Google, or Apple.

Spotify/Instagram Feeds – Adding personality to profiles.

Payment Gateways – For premium subscriptions and in-app purchases.

Geolocation APIs – For real-time proximity-based matches.

These integrations make the app more interactive and convenient.

9. Post-Launch Support & Continuous Updates

App development doesn’t end at launch. The best dating app development company offers:

Bug Fixes & Performance Tweaks – Resolving issues quickly.

Feature Upgrades – Adding new functionalities based on user feedback.

24/7 Technical Support – Ensuring minimal downtime.

Regular updates keep the app competitive and secure.

10. Transparent Pricing & Agile Development Process

Avoid hidden costs by choosing a company with:

Clear Pricing Models – Fixed-cost or milestone-based payments.

Agile Methodology – Regular updates and flexible adjustments.

Detailed Project Timelines – No unnecessary delays.

A transparent process ensures smooth collaboration and on-time delivery.

Final Thoughts

Launching a successful dating app in 2025 requires partnering with the best dating app development company. look for a team with expertise in dating mobile app development, a strong portfolio, AI integration, robust security, and scalable solutions.

By prioritizing these 10 qualities, you’ll ensure your app stands out in a crowded market, attracts loyal users, and achieves long-term success.

Why Choose Us for Your Dating App Development?

If you're searching for a reliable dating mobile app development partner, our team specializes in creating high-performance, secure, and engaging dating apps. With years of experience and a client-focused approach, we’re recognized as one of the best dating app development company options in 2025.

Ready to build the next big dating app? Contact us today for a free consultation!

For more information, visit us: -

Fantasy Sports App Development Company

Custom Healthcare App Development

Logistics Management Software Development

0 notes

Text

Key Features of Our OCR & Intelligent Document Processing Solution

In today’s fast-paced digital world, businesses deal with massive volumes of documents daily—invoices, contracts, receipts, and forms—that require accurate and efficient processing. Traditional manual data entry is time-consuming, error-prone, and costly. This is where an Intelligent Document Processing Solution powered by Optical Character Recognition (OCR) and Artificial Intelligence (AI) comes into play.

At GlobalNodes, we provide a cutting-edge Intelligent Document Processing Solution that automates data extraction, classification, and validation, helping businesses streamline workflows, reduce errors, and improve productivity.

In this blog, we’ll explore the key features of our OCR & Intelligent Document Processing Solution, how it works, and why it’s a game-changer for industries like finance, healthcare, logistics, and legal services.

What Is an Intelligent Document Processing Solution?

An Intelligent Document Processing Solution combines OCR, AI, and machine learning (ML) to automatically capture, classify, and extract data from structured and unstructured documents. Unlike traditional OCR, which only converts scanned text into digital format, an AI-powered document processing system understands context, validates data, and integrates seamlessly with business applications.

Why Businesses Need It

✔ Eliminates manual data entry – Reduces human errors and processing time. ✔ Improves compliance & accuracy – Ensures data consistency and regulatory adherence. ✔ Enhances operational efficiency – Automates workflows for faster decision-making. ✔ Scales with business growth – Handles increasing document volumes effortlessly.

Key Features of Our Intelligent Document Processing Solution

Our Intelligent Document Processing Solution is designed to handle diverse document types with high accuracy. Here are its standout features:

1. Advanced OCR with AI-Powered Text Recognition

Our solution uses AI-enhanced OCR to accurately extract text from scanned documents, handwritten notes, PDFs, and images. Unlike basic OCR, it: ✔ Supports multiple languages and fonts✔ Reads handwritten text with high precision✔ Processes low-quality scans and distorted documents

2. Smart Document Classification & Sorting

Not all documents are the same—invoices, contracts, and IDs require different handling. Our Intelligent Document Processing Solution automatically: ✔ Classifies documents (e.g., invoices vs. receipts) ✔ Routes them to the correct workflow✔ Identifies key fields (dates, amounts, vendor names)

3. Context-Aware Data Extraction

Traditional OCR extracts raw text, but our AI-driven solution understands context, such as: ✔ Invoice numbers & payment terms✔ Customer names & addresses✔ Contract clauses & key datesThis reduces manual corrections and speeds up processing.

4. Automated Data Validation & Error Correction

Mistakes in data entry can be costly. Our system: ✔ Cross-checks extracted data with existing databases ✔ Flags inconsistencies (e.g., mismatched invoice amounts) ✔ Suggests corrections using AI-powered validation

5. Seamless Integration with Business Systems

Our Intelligent Document Processing Solution integrates with: ✔ ERP systems (SAP, Oracle, QuickBooks)✔ Cloud storage (Google Drive, SharePoint, Dropbox)✔ CRM platforms (Salesforce, HubSpot)This ensures smooth data flow across departments.

6. AI-Powered Fraud Detection

For industries like banking and insurance, detecting fraudulent documents is critical. Our solution: ✔ Identifies forged signatures & tampered documents✔ Checks for duplicate invoices & fake IDs✔ Alerts compliance teams in real-time

7. Scalable & Cloud-Ready Deployment

Whether you need on-premise, cloud, or hybrid solutions, our system scales to meet your needs. Benefits include: ✔ High-volume processing (thousands of documents per hour) ✔ Secure cloud storage with encryption✔ API access for custom workflows

8. Customizable Workflow Automation

Every business has unique document workflows. Our solution allows: ✔ Rule-based automation (e.g., auto-approve invoices under $1,000) ✔ Human-in-the-loop validation for complex cases ✔ Custom reporting & analytics dashboards

9. Compliance & Audit Trail

For industries with strict regulations (GDPR, HIPAA, SOX), our solution provides: ✔ Full audit logs of document processing ✔ Role-based access control✔ Secure data redaction for sensitive information

10. Real-Time Analytics & Insights

Beyond extraction, our Intelligent Document Processing Solution offers: ✔ Trend analysis (e.g., peak invoice processing times) ✔ Performance metrics (accuracy rates, processing speed) ✔ Predictive analytics to optimize workflows

Industries That Benefit from Our Intelligent Document Processing Solution

🏦 Banking & Finance

✔ Automates loan applications & KYC verification ✔ Detects fraudulent transactions

🏥 Healthcare

✔ Processes patient records & insurance claims ✔ Ensures HIPAA compliance

📦 Logistics & Supply Chain

✔ Automates shipping labels & customs forms ✔ Tracks inventory via purchase orders

⚖ Legal & Compliance

✔ Extracts clauses from contracts ✔ Manages case files efficiently

📑 Government & Public Sector

✔ Digitizes citizen records ✔ Automates permit & license processing

Why Choose GlobalNodes’ Intelligent Document Processing Solution?

✅ Higher Accuracy – AI reduces errors compared to manual entry. ✅ Faster Processing – Cuts document handling time by 80% or more. ✅ Cost Savings – Reduces labor costs and operational overhead. ✅ Security & Compliance – Ensures data privacy and regulatory adherence.

Final Thoughts

Manual document processing is no longer sustainable in the digital age. Our Intelligent Document Processing Solution leverages OCR, AI, and automation to transform how businesses handle documents—improving speed, accuracy, and efficiency.Whether you’re in finance, healthcare, logistics, or legal services, our solution can be tailored to your needs

0 notes

Text

Buy Counterfeit Money

Buying Counterfeit Money Dollars | Fake Bills

Protecting yourself from Counterfeit Banknotes is crucial to avoid financial loss and legal issues. Counterfeit money refers to fake or fraudulent currency produced with the intent to deceive people into accepting it as genuine. Here are some detailed steps on how to protect yourself from Counterfeit Money:

1. Know the Features of Real Currency

Different countries have specific security features on their banknotes to distinguish them from counterfeit currency. Knowing these features is the first line of defense.

Common security features on banknotes:

Watermarks: Many currencies have watermarks that can be seen when the bill is held up to light.

Security Thread: A thin strip embedded in the paper that runs vertically through the note. It may have text, patterns, or change color.

Holograms: Some currencies use holograms that change images or colors when viewed from different angles.

Microprinting: Tiny text that is difficult to replicate, often found in the borders or in fine details of the design.

UV Ink: Under ultraviolet light, certain parts of the note may glow, revealing hidden security features.

Raised Print: Certain areas of the note, like the denomination or portrait, may feel slightly raised when touched.

Color-Shifting Ink: Some banknotes include ink that changes color when tilted.

Special Paper: Genuine notes are often printed on unique paper that may feel different from regular paper and can include embedded fibers or security threads.

2. Use Detection Tools

There are various tools you can use to help detect Counterfeit Banknotes:

- UV Light Detectors:

These lights reveal invisible features, such as UV ink or patterns that are embedded into the note and are not visible under normal lighting.

- Magnifying Glass:

Use a magnifying glass to closely inspect the microprinting and fine details on the banknote. Counterfeit bills often have blurry or imperfect details in these areas.

- Currency Detectors:

There are handheld devices that use various methods (ultraviolet light, magnetic ink detection, etc.) to identify fake hub money.

3. Examine the Bill Carefully

When you receive a bill, take a few seconds to check for the following:

Feel: The texture of a real note is different from paper or common materials. Real currency is typically printed on a special cotton or polymer-based paper that feels distinct.

Look: Compare the bill closely with a known genuine note. Check for color shifts, intricate patterns, and holographic features.

Tilt: Hold the bill at different angles and see if any holographic elements, color shifts, or watermarks become visible.

Check Serial Numbers: Counterfeit bills may have inconsistent or duplicate serial numbers. Ensure that the serial numbers are unique and match the format of the currency.

4. Know How Counterfeit Money Enters Circulation

Counterfeit money can be distributed in a variety of ways. Some of the common methods are:

Street Vendors or Unfamiliar Places: Often, counterfeit bills are passed to unsuspecting people at markets, shops, or places where transactions are rushed or informal.

Online Purchases: Counterfeit Banknotes can sometimes be hidden in packages from online sellers, especially when buying from untrustworthy or unknown sources.

ATMs and Banks: While rare, some Counterfeit Bills may be dispensed through ATMs if the machine doesn't have proper counterfeit detection mechanisms. It's important to check all cash dispensed by ATMs and banks.

Counterfeit Banknotes | Buy Fake Banknotes Online

5. What to Do If You Receive Counterfeit Money

If you receive counterfeit money, it is important to act quickly and appropriately:

- Do Not Attempt to Pass It Off: Trying to use counterfeit money, knowingly or unknowingly, is illegal and could lead to criminal charges.

- Notify Authorities: If you realize you've received a counterfeit note, contact the local police or your country's national central bank. Many countries have special units that handle counterfeit currency cases.

- Hold Onto the Bill: If possible, avoid letting the counterfeit bill out of your possession. You may need to provide it as evidence, and authorities will likely want to inspect it.

- Fill Out a Report: In some cases, if you unknowingly accepted a counterfeit bill, you'll need to fill out a report or form with local authorities or your bank. They may be able to assist you in replacing the counterfeit note, depending on the circumstances.

6. Educate Employees or Others in Your Business

If you're a business owner or in charge of a store or office where cash is exchanged frequently, ensure that your staff is trained in identifying Counterfeit Banknotes. Some key training points include:

Familiarizing employees with the security features of real currency.

Using detection tools and techniques regularly during transactions.

Setting up a policy for handling counterfeit money if it is received, including notifying managers or law enforcement.

7. Invest in High-Quality Detection Equipment

For businesses or individuals who handle large volumes of cash, investing in counterfeit detection machines can save time and reduce the risk of accepting fake currency. These machines typically detect Counterfeit Banknotes based on a variety of features, including:

Ultraviolet (UV) light

Magnetic ink

Size and dimensions

Infrared scanning

8. Know the Law

It’s important to understand the laws surrounding counterfeit currency in your country. In most places, knowingly passing counterfeit money is a criminal offense and can result in significant fines or imprisonment. Even if you unknowingly accept counterfeit money, it’s important to report it promptly to avoid potential legal complications.

9. Keep Up-to-Date with New Security Features

Banknotes and security features are regularly updated to stay ahead of counterfeiters. Keep yourself informed about any new changes to the currency in circulation, including the release of new bills or updates to security features. National central banks or mints often publish information about changes to currency.

10. Use Electronic Transactions When Possible

While cash remains a common payment method, digital transactions via credit cards, mobile payments, and bank transfers are much less likely to involve counterfeit money. Reducing the amount of cash you handle and encouraging others to use digital payments can help avoid this risk.

By following these tips and staying vigilant, you can protect yourself from counterfeit currency and minimize your risk of accepting fake bills.

1 note

·

View note

Text

Money Counting Machines: Revolutionizing Cash Handling for Modern Businesses

1. What is a Money Counting Machine?

A money counting machine is an automated device that counts paper currency quickly and accurately. Modern machines go beyond simple counting to offer advanced features counterfeit detection, mixed denomination counting, and batch processing.

These devices have become indispensable for businesses that handle large volumes of cash daily, significantly reducing the time and effort required for cash management.

Managing cash efficiently is a critical task for businesses across industries, from retail stores to financial institutions. Counting currency manually is time-consuming and prone to errors, leading to operational inefficiencies and potential financial discrepancies. Enter the money counting machine — a technological marvel designed to streamline cash handling, boost accuracy, and enhance productivity.

In this blog, we'll explore the benefits of money counting machines, their advanced features, and how they are transforming the way businesses manage their finances.

2. Why Every Business Needs a Money Counting Machine

Investing in a money counting machine offers several compelling advantages:

Increased Speed: Count hundreds or thousands of notes per minute, saving valuable time during cash reconciliation.

Unmatched Accuracy: Eliminate human errors in cash counting, ensuring accurate tallies every time.

Counterfeit Detection: Advanced models are equipped with sensors to identify fake currency instantly, protecting businesses from financial loss.

Operational Efficiency: Automate cash handling tasks, allowing staff to focus on customer service and other critical operations.

3. Key Features to Look for in a Money Counting Machine

When selecting a money counting machine, consider the following essential features:

Counting Speed: Choose a model that meets your cash handling volume requirements.

Counterfeit Detection: Look for machines with multiple detection technologies, such as UV (ultraviolet), MG (magnetic ink), and IR (infrared) sensors.

Mixed Denomination Counting: Some machines can identify and tally different denominations simultaneously.

Batch Processing: Ideal for bundling cash for deposits or storage.

Portability: Compact and lightweight models are perfect for businesses that require cash management on the go.

4. Types of Money Counting Machines

Money counting machines come in various models to cater to different business needs:

Basic Note Counters: Ideal for simple cash counting without advanced features.

Value Counting Machines: Calculate the total cash value by identifying mixed denominations.

High-Speed Counters: Handle large volumes of cash quickly, perfect for banks and large retail operations.

Portable Money Counters: Lightweight and compact models designed for mobile businesses or multi-location operations.

5. Industries That Benefit from Money Counting Machines

Money counting machines are versatile tools that add value across various industries:

Retail: Speed up end-of-day cash reconciliations and reduce errors.

Banking: Handle large volumes of currency efficiently with counterfeit detection.

Hospitality: Simplify cash management for hotels, restaurants, and event venues.

Small Businesses: Save time and improve accuracy for daily cash handling tasks.

Nonprofits: Manage donations and event collections with ease.

6. How to Maintain Your Money Counting Machine

Proper maintenance ensures the longevity and optimal performance of your machine:

Regular Cleaning: Remove dust and debris from the note feeder and sensors.

Check for Wear and Tear: Inspect rollers and belts for signs of wear.

Calibration: Ensure the machine remains accurate by periodic calibration.

Handle with Care: Transport portable machines carefully to avoid damage.

Pro Tip: Follow the manufacturer’s maintenance guidelines for the best results.

7. The ROI of Money Counting Machines

While there is an upfront cost to purchasing a money counting machine, the return on investment (ROI) is significant:

Time Savings: Faster cash handling allows employees to focus on more strategic tasks.

Error Reduction: Accurate counting minimizes financial discrepancies and potential losses.

Enhanced Security: Counterfeit detection provides peace of mind by safeguarding against fraudulent currency.

8. The Future of Money Counting Machines

As technology advances, money counting machines are becoming smarter and more efficient:

AI Integration: Machines with artificial intelligence can learn and adapt to recognize new currency designs.

Cloud Connectivity: Real-time cash data synchronization across multiple locations.

Eco-Friendly Designs: Manufacturers are incorporating sustainable materials and energy-efficient components.

These innovations are poised to make cash handling even more streamlined and secure.

9. Choosing the Right Money Counting Machine

When selecting the ideal machine for your business, consider:

Business Size: Larger operations may require high-speed models with advanced features.

Volume of Cash: Determine the average cash flow to choose a machine with the right speed and capacity.

Security Needs: Opt for models with counterfeit detection if your business handles significant cash transactions.

Conclusion

A money counting machine is a powerful tool that transforms cash management from a tedious, error-prone process into a seamless, efficient operation. Whether you're running a small business, managing a retail store, or handling large cash volumes in a bank, these machines save time, reduce errors, and enhance security.

Investing in the right money counting machine tailored to your business needs can make a world of difference in operational efficiency and accuracy.

0 notes

Text

Currency Sorter Market Growth Drivers: Automation, Technology, and Efficiency Shaping the Industry

The currency sorter market has gained significant traction over the past few years, driven by a surge in demand for automation and precision in financial operations. Currency sorters are machines designed to quickly and accurately sort banknotes based on their denomination, authenticity, and quality. These devices have become crucial in financial institutions, retail businesses, and casinos, where large volumes of cash need to be processed efficiently. The market for currency sorters is expected to continue expanding as various factors drive growth and innovation in the industry. This article explores the key market drivers shaping the future of currency sorters.

1. Increased Demand for Automation

One of the primary drivers of the currency sorter market is the growing demand for automation in financial operations. As businesses strive to enhance operational efficiency and reduce human errors, the adoption of automated solutions like currency sorters has become a priority. With the ability to process large amounts of currency rapidly and accurately, these machines minimize the need for manual labor, which can be slow and error-prone. The automation trend is particularly evident in sectors such as banking, retail, and casinos, where cash handling is frequent and needs to be precise.

2. Need for Faster Cash Processing

With the rise in cash transactions worldwide, the need for faster cash processing systems has become critical. Currency sorters play a vital role in ensuring that banknotes are sorted in a matter of seconds, saving valuable time for businesses and financial institutions. By improving speed and efficiency, currency sorters enable organizations to handle high volumes of cash without disrupting daily operations. The speed at which currency sorters work also reduces the time spent on manual counting and checking, helping businesses save on labor costs.

3. Advancements in Technology

Technological advancements have significantly influenced the growth of the currency sorter market. The integration of features like counterfeit detection, quality assessment, and currency verification has made modern currency sorters more sophisticated and reliable. These advancements ensure that businesses can not only sort currency quickly but also maintain accuracy in detecting counterfeit notes. Furthermore, continuous improvements in sensor technology, artificial intelligence, and machine learning algorithms have enhanced the capabilities of currency sorters, driving their adoption across various sectors.

4. Expansion of the Retail Sector

As the retail sector continues to grow, the demand for currency sorters has surged. Retailers, especially large chains, handle significant amounts of cash daily, making manual sorting inefficient and costly. Currency sorters provide a practical solution by automating the sorting process, allowing retailers to reduce time spent on cash handling and increase overall efficiency. Additionally, with the increasing trend of cashless payments, many retailers are focusing on improving the efficiency of cash handling systems to balance their operations. This shift is expected to continue driving demand for currency sorters.

5. Rising Security Concerns

The need for enhanced security in cash management has been another significant driver for the currency sorter market. With increasing concerns about counterfeit currency and theft, businesses are seeking advanced solutions to protect their cash handling processes. Currency sorters are equipped with sophisticated security features, such as counterfeit detection mechanisms, which help identify fake banknotes and reduce the risk of financial losses. As security concerns continue to rise, the demand for reliable and secure currency sorting solutions is expected to grow.

6. Growth of Emerging Markets

Emerging markets, particularly in Asia-Pacific and Africa, are witnessing rapid economic growth, which is driving the demand for currency sorting machines. As these regions experience an increase in the volume of cash transactions due to rising populations and expanding economies, the need for efficient cash management systems becomes more critical. Currency sorters help businesses in these emerging markets meet the growing demand for fast and accurate cash handling while minimizing operational costs. Additionally, the increased adoption of digital currencies in these regions is further accelerating the need for automated currency sorting solutions.

7. Focus on Regulatory Compliance

In many countries, financial institutions and businesses must adhere to strict regulations regarding currency handling and cash management. Compliance with these regulations is crucial to avoid penalties and maintain smooth operations. Currency sorters aid businesses in meeting regulatory requirements by ensuring that the cash they handle is properly sorted and accounted for. This compliance-driven demand for efficient cash management systems is expected to propel the growth of the currency sorter market in the coming years.

Conclusion

The currency sorter market is poised for significant growth due to several key drivers, including the demand for automation, faster cash processing, technological advancements, and enhanced security features. As businesses across various sectors recognize the benefits of currency sorters in improving operational efficiency, minimizing errors, and ensuring regulatory compliance, the market is likely to continue expanding. The evolving needs of the retail sector, the growth of emerging markets, and increasing security concerns will also play a pivotal role in shaping the future of the currency sorter market.

0 notes

Text

How Does a Cash Counting Machine Detect Counterfeit Notes?

Cash counting machines are essential tools for businesses that handle large volumes of cash, providing efficiency and accuracy in counting. One of their most critical functions is the detection of counterfeit notes. This article explores the various technologies employed by cash counting machines to identify fake currency effectively.

Detection Technologies

Cash counting machines utilize several advanced technologies to detect counterfeit notes, primarily focusing on Ultraviolet (UV) light, Magnetic (MG) detection, and Infrared (IR) detection.

Ultraviolet Detection (UV):Cash notes often contain security features that are only visible under UV light, such as non-visible ink marks. When a machine shines UV light on a note, it checks for these specific marks. If the required marks do not fluoresce, the note is flagged as counterfeit

Magnetic Detection (MG):Many currencies are printed using magnetic ink or contain magnetic threads embedded within them. Cash counting machines equipped with magnetic sensors can detect these features. The presence and correct positioning of magnetic elements help verify a note's authenticity

Infrared Detection (IR):Some advanced machines also use infrared technology to analyze the pattern and composition of the notes. This method can identify discrepancies that may indicate counterfeiting, such as incorrect printing techniques or materials.

Additional Features for Counterfeit Detection

Beyond these primary methods, cash counting machines may incorporate other features to enhance their counterfeit detection capabilities:

Dimensional Measurement: Machines can measure the dimensions and thickness of notes to ensure they conform to standard specifications. Fake notes often deviate from these measurements

Color Detection: Some models are equipped with sensors that analyze the color patterns on the currency, further ensuring authenticity based on known standards

Self-Examination Functions: Many modern cash counting machines perform self-checks to ensure all detection systems are functioning correctly before use, enhancing reliability during operation

Importance of Counterfeit Detection

The ability to detect counterfeit notes is crucial for businesses, particularly those in retail and banking sectors, where cash transactions are frequent. By employing cash counting machines with robust counterfeit detection technologies, businesses can significantly reduce the risk of financial loss due to fake currency. These machines not only save time but also enhance accuracy in cash handling processes, contributing to overall operational efficiency.

Conclusion

In summary, cash counting machines play a vital role in safeguarding businesses against counterfeit currency through sophisticated detection technologies like UV, MG, and IR methods. As counterfeiting techniques evolve, so too will the technology behind these machines, ensuring that they remain effective tools for financial security in cash-intensive environments.

#bankomatautomationprivatelimited#cash counting machine#cashdrawer#laminationmachine#papershader#billingmachine#notecountingmachine#safelocker#currencycountingmachine

1 note

·

View note

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] Product Description The CC-232 Classic is designed with a big front display that gives a clear view while using it. This in-built display contains a range of 1-999 buttons for a better user experience. Cash counting tasks for heavy-duty operations can be done with ease with the help of this machine. The machine is built to provide a hassle-free and smoother workflow. Along with being fast, the machine is equipped to provide the accuracy required for counting currencies. It effectively detects and counts old, new, fake, and real currencies with a high level of precision. The machine has a super-fast currency counting pace that helps save on time. The function of the machine is such that it exhibits counting of 1200 notes in a minute's time. The cash counting machine has a coIt that can automatically detect fake notes from the real ones. It efficiently does so with its ultraviolet and magnetic radiations for batching and adding currencies. For more convenience and ease, the machine comes with a self-check function that makes it simple to maintain. This self-examination function is a handy feature to keep the machine in a good condition. Suitable for Heavy duty operations Super fast currency counting: 1200 notes/min Supports batch function with in-built display Detects and counts both old and new currencies Has automatic count mode. Easy maintenance : Self check function [ad_2]

0 notes

Text

If you want them in quantity and especially in the long term, we can already set up a discreet appointment to produce 1 or 2 samples for you.

Which you will pass through any type of fake detector.

If you are satisfied, this would mean that our products are of high quality and can be used everywhere.

The sample is free.Live production of ready to use bank notes .

Premium quality test check ☑️ contact 👇 👇 👇

Telegram 👉 :@mr_banknotes19

0 notes

Text

Why Cash Scans Are Essential for High-Volume Businesses: Preventing Fraud at Scale

In today’s fast-paced economy, large retail stores, casinos, and banks handle thousands of dollars in cash transactions every day. But with high volume comes high risk — especially from counterfeit currency. If you're an industrial business owner in the USA, the solution lies in a reliable cash scan system designed specifically for bulk operations.

Let’s explore why integrating a cash scan for large retail isn’t just a smart move — it’s a business necessity.

The High Stakes of Handling Large Cash Volumes

From payroll fraud to fake bills slipped into late-night registers, counterfeit currency can cause significant financial damage. In high-volume environments, manual detection methods fall short — not just in accuracy, but in efficiency.

Here’s what’s at risk:

Revenue Loss: Even one $100 fake note a day can add up to $36,500 a year.

Employee Error: Human verification can’t match machine consistency.

Brand Trust: Accepting counterfeit bills can hurt your credibility with customers.

That’s where the bulk bill checker comes into play.

What Is a Cash Scan and How Does It Work?

A cash scan is an automated machine that verifies currency authenticity by analyzing multiple security features such as:

UV and magnetic markings

Infrared patterns

Watermark detection

Serial number validation

When you're processing hundreds (or thousands) of bills daily, these machines offer unmatched speed and precision.

Why Large Enterprises Choose Bulk Bill Checkers

High-volume businesses can’t afford downtime, mistakes, or fraud. Here's why they trust cash scan for large retail and institutional operations:

✅ Scalability

Whether you're managing five registers or fifty, cash scans can handle the workload with no drop in performance.

✅ Accuracy at Speed

Most models process up to 1,200 bills per minute — detecting even the most convincing counterfeits.

✅ Reduced Labor Costs

Automating the validation process minimizes manual checks, reducing staff workload and operational costs.

✅ Audit-Friendly

Cash scans generate logs and reports, making reconciliation and audits easier — a major plus for banks and casinos.

Real Use Case: A Casino That Saved Thousands

A mid-size casino in Las Vegas installed a series of Lynde Ordway cash scan units across cashier desks and reported:

$9,200 in counterfeit bills intercepted in the first 60 days

20% faster shift closing times

Zero cash-handling disputes thanks to logged validation data

This real-world result showcases how the right counterfeit detector can directly impact bottom-line efficiency.

Key Features to Look For in a Counterfeit Detector

When selecting a cash scan machine, prioritize features like:

Multi-currency support

Continuous feed systems

Advanced counterfeit detection algorithms

POS system integration

Compact design for front-end counters

🔗 Explore Lynde Ordway’s Cash Scan models here — a trusted name in retail and banking equipment.

Q&A: What Business Owners Are Asking

❓ Can a cash scan detect all types of counterfeit bills?

✅ Yes. High-end models use multi-layered security checks to flag even the most sophisticated fakes.

❓ How much training is needed to use one?

✅ Minimal. Most machines are plug-and-play with intuitive interfaces.

❓ Is it suitable for small teams or just large corporations?

✅ Both. While ideal for high-volume businesses, even small teams can benefit from reduced human error and improved speed.

Final Thoughts

In a world where counterfeit currency continues to evolve, high-volume businesses can’t rely on outdated methods. A robust bulk bill checker not only detects fakes but improves efficiency, audit reliability, and peace of mind. From casinos and retailers to banks and service counters — the ROI is immediate and lasting.

✅ Call to Action

Ready to protect your profits and streamline your cash management? 👉 Contact Lynde Ordway today to get a quote or schedule a demo of our cutting-edge Cash Scan solutions tailored for your business needs.

Cash Scan

counterfeit detector

bulk bill checker

cash scan for large retail

currency validation

bill checking machine

fake currency scanner

0 notes

Text

How Much Is a Money Counting Machine in Bangladesh? Everything You Need to Know

If you’re tired of counting cash manually, you’re not alone. Every day, countless shop owners, bankers, and small business operators in Bangladesh waste valuable time checking and rechecking currency by hand. But now, there's a better solution: the Money Counting Machine. Whether you run a store or work in a financial institution, this device can make your job faster, easier, and more secure. Want to know the Money Counting Machine price in Bangladesh? You can find updated and reliable information here.

Why You Should Use a Money Counting Machine

Manual cash counting is not only time-consuming but also prone to human error. A simple mistake in counting could lead to financial losses or trust issues in business. That’s where a Money Counter Machine can help. It automatically counts notes with accuracy and speed, reducing your workload and improving cash handling efficiency.

Whether you own a retail shop, a pharmacy, a restaurant, or work at a bank counter, this device can bring structure and peace of mind to your daily operations.

Features That Make It Worth Buying

Today’s Currency Counting Machines are loaded with features that go far beyond simple counting. Here's what you can expect:

Fast Counting Speed: Most machines can process 800–1500 notes per minute.

High Accuracy: Digital sensors ensure exact counts every time.

Fake Note Detector: Perhaps the most useful feature in Bangladesh, where counterfeit notes are a common issue.

Add & Batch Functions: Easily total your cash and create fixed-size note bundles.

Clear Display: LED or LCD screens show real-time counting info and error messages.

When choosing a Money Counting Machine with fake note detector, you get a double benefit—quick counting and security against fraud.

Types of Money Counting Machines in Bangladesh

Not all machines are built the same. Depending on your business size and cash volume, there are several types of Money Counter Machines available:

1. Basic Note Counting Machine

This is ideal for small shops or businesses. It’s budget-friendly and perfect for straightforward counting without extra features.

2. Fake Note Detector Machine

This model is equipped with UV, MG (magnetic), and IR (infrared) sensors to identify counterfeit bills. A smart investment for businesses that deal with a lot of cash daily.

3. Bundle Note Counter

Used by banks and large companies, this machine can count bound or loose bundles and is made for heavy-duty use.

4. Mixed Denomination Machine

These advanced machines detect and count notes of different denominations at once. They’re slightly more expensive but extremely useful for banks and high-volume businesses.

The Importance of Fake Note Detection

One of the biggest threats to cash-based businesses in Bangladesh is counterfeit money. The fake note detector in modern counting machines protects you from accepting false bills.

These detectors use a combination of:

UV Light: To scan the watermark and quality of the paper.

Magnetic Ink Detection: To verify the presence of magnetic features found in genuine currency.

Infrared Sensors: To detect hidden ink patterns only present in real notes.

Buying a Money Counting Machine with fake note detector ensures you won’t fall victim to currency fraud, which can harm your finances and business reputation.

Who Needs a Money Counting Machine?

You may think only banks need a Money Counting Machine, but that's not true anymore. These machines are now widely used by:

Retail Shop Owners: Manage end-of-day cash counts quickly.

Supermarkets and Department Stores: Speed up cash register operations.

Hospitals and Clinics: Handle large volumes of patient payments safely.

NGOs and Schools: Count donations or tuition fees accurately.

Banks and Financial Institutions: Handle high-volume, high-risk currency operations with safety and speed.

No matter your business type, if you're dealing with daily cash, a Currency Counting Machine is a smart investment.

💰 Money Counting Machine Price in BD: 2025 Update

Wondering about the actual Money Counting Machine price in Bangladesh? Here’s a breakdown of the most common types and their approximate price ranges so you can choose the right one based on your needs:

Bundle Note Counter Machine 👉 Price: BDT 21,000 to 30,000 ✅ Heavy-duty machines suitable for banks and large organizations that handle bulk cash.

Mixed Denomination Counting Machine 👉 Price: BDT 35,000 to 55,000+ ✅ Automatically counts and detects notes of different values. Great for banks and businesses dealing with various note types.

As you can see, the price depends on your needs. Spending a little more for extra features like fake note detection could save you big in the long run.

Trusted Brands in the Bangladeshi Market

Many brands are currently offering reliable Money Counting Machines in Bangladesh, such as:

Kington

Bill Counter

Canon

Godrej

Hitachi

These brands are known for their accuracy, durability, and smart features. Before you buy, it’s a good idea to compare models, features, and after-sales service.

Where to Buy a Money Counting Machine in Bangladesh

You’ll find these machines at electronics stores, banking equipment suppliers, and online platforms. But when shopping online, make sure the seller is trusted and provides proper warranty support.

One of the most reliable websites in Bangladesh is Nobarun BD, where you’ll find a wide range of Money Counting Machines, including models with fake note detectors. Their pricing is competitive, and they offer solid customer support—making your buying experience hassle-free.

To browse available options and get the best deals, visit Nobarun BD.

Final Thoughts

In today’s fast-paced business world, manual cash handling just doesn’t cut it. Whether you own a small shop or manage a large bank branch, a Money Counter Machine can transform your daily operations—making them quicker, safer, and more reliable.

A Currency Counting Machine saves time, reduces human errors, and helps detect fake notes before they cause losses. With options for every budget and business size, there's no reason to delay this smart investment.

So, if you're looking for the best Money Counting Machine price in Bangladesh, check out the models and offers at Nobarun BD. With their quality machines and excellent support, you're sure to find the perfect fit for your needs.

0 notes

Text

7 Essential Insights About Money Counting Machines

In today's fast-paced financial environments, efficiency and accuracy in handling cash are paramount. Businesses, whether large or small, rely on advanced tools to streamline operations, and a money counting machine is one such indispensable device. This article will delve into the key aspects of money counting machines, highlighting why they are crucial for businesses and how to choose the right one.

1. The Evolution of Money Counters

Money counters have come a long way from the simple mechanical devices of the past. Modern machines are equipped with advanced technologies, allowing them to handle large volumes of cash quickly and accurately. Today’s machines not only count notes but also detect counterfeit currency, making them essential tools in the retail and banking sectors. With the rise of digital transactions, the need for cash handling might seem reduced, but cash is still king in many parts of the world, making money counting machines relevant even today.

2. Types of Money Counting Machines

There are several types of money counting machines, each designed to meet different needs.

Basic Currency Counting Machines: These are straightforward devices that count the number of notes passed through them. They are ideal for businesses with a low risk of counterfeit currency and where speed is more important than accuracy.

Mix Value Counters: These advanced machines can count mixed denominations and calculate the total value of the notes. This feature is particularly useful for businesses that handle large amounts of cash in various denominations, ensuring that they don’t just count notes but also know their exact value.

Note Counting Machines with Counterfeit Detection: These machines not only count money but also check for counterfeit notes using UV, magnetic, or infrared technology. This is crucial for businesses in high-risk areas where counterfeit currency is more prevalent.

3. Why Businesses Need Currency Counting Machines

For any business handling cash transactions, time is money. Manually counting notes is not only time-consuming but also prone to human error. A money counting machine automates this process, significantly reducing the time spent on counting cash and minimizing errors. Moreover, the counterfeit detection feature in many machines ensures that businesses do not lose money by accepting fake notes.

4. Key Features to Look For

When choosing a money counting machine, there are several features to consider:

Counting Speed: Depending on the volume of cash handled daily, businesses should look for machines with varying counting speeds. High-speed machines are suitable for larger businesses, while smaller businesses may opt for slower, more affordable models.

Counterfeit Detection: As mentioned, this feature is crucial for businesses in areas where counterfeit currency is common. Ensure the machine uses multiple detection methods for the highest accuracy.

Hopper Capacity: This refers to the number of notes the machine can hold at once. Larger hoppers are better for businesses that need to count large amounts of cash quickly.

Noise Level: Some machines can be quite noisy, which can be a distraction in quieter office environments. Consider a machine with a lower noise output if this is a concern.

Portability: For businesses that require flexibility, portable money counting machines are available. These are lightweight and easy to transport, making them ideal for use at multiple locations.

5. The Cost Factor: What to Expect

The price of money counting machines varies significantly based on their features. Basic models can be quite affordable, but as you add more advanced features like counterfeit detection and mix value counting, the price increases. It's important to balance your budget with your needs, as investing in a more expensive machine can save you money in the long run by preventing losses from counterfeit notes and improving efficiency.

6. Maintenance and Durability

Money counting machines are robust devices, but like any equipment, they require regular maintenance to ensure longevity. Regular cleaning and calibration will keep your machine running smoothly and accurately. It's also wise to invest in a machine from a reputable brand that offers a good warranty and customer support.

7. Real-World Applications

In the retail sector, where cash transactions are frequent, a currency counting machine can save significant time during cash register closeouts. For banks and financial institutions, mix value counters ensure that large volumes of cash are processed accurately. Even small businesses can benefit, as these machines reduce the likelihood of errors and the labor costs associated with manual counting.

Conclusion Investing in a money counting machine is a smart move for any business that handles cash. With features like counterfeit detection, mix value counting, and high-speed processing, these machines streamline cash handling, improve accuracy, and protect your business from losses. Whether you run a small retail shop or a large financial institution, there's a currency counting machine tailored to your needs. By choosing the right machine, you can enhance efficiency and ensure the smooth operation of your cash-handling processes.

#cash counting#currency counting machines#money counting machine#counting machine#note counting machine#value counting machine#cash counting machine

0 notes

Text

Key Features of Our OCR & Intelligent Document Processing Solution

In today’s fast-paced digital world, businesses deal with massive volumes of documents daily—invoices, contracts, receipts, and forms—that require accurate and efficient processing. Traditional manual data entry is time-consuming, error-prone, and costly. This is where an Intelligent Document Processing Solution powered by Optical Character Recognition (OCR) and Artificial Intelligence (AI) comes into play.

At GlobalNodes, we provide a cutting-edge Intelligent Document Processing Solution that automates data extraction, classification, and validation, helping businesses streamline workflows, reduce errors, and improve productivity.

In this blog, we’ll explore the key features of our OCR & Intelligent Document Processing Solution, how it works, and why it’s a game-changer for industries like finance, healthcare, logistics, and legal services.

What Is an Intelligent Document Processing Solution?

An Intelligent Document Processing Solution combines OCR, AI, and machine learning (ML) to automatically capture, classify, and extract data from structured and unstructured documents. Unlike traditional OCR, which only converts scanned text into digital format, an AI-powered document processing system understands context, validates data, and integrates seamlessly with business applications.

Why Businesses Need It

✔ Eliminates manual data entry – Reduces human errors and processing time. ✔ Improves compliance & accuracy – Ensures data consistency and regulatory adherence. ✔ Enhances operational efficiency – Automates workflows for faster decision-making. ✔ Scales with business growth – Handles increasing document volumes effortlessly.

Key Features of Our Intelligent Document Processing Solution

Our Intelligent Document Processing Solution is designed to handle diverse document types with high accuracy. Here are its standout features:

1. Advanced OCR with AI-Powered Text Recognition

Our solution uses AI-enhanced OCR to accurately extract text from scanned documents, handwritten notes, PDFs, and images. Unlike basic OCR, it: ✔ Supports multiple languages and fonts✔ Reads handwritten text with high precision✔ Processes low-quality scans and distorted documents

2. Smart Document Classification & Sorting

Not all documents are the same—invoices, contracts, and IDs require different handling. Our Intelligent Document Processing Solution automatically: ✔ Classifies documents (e.g., invoices vs. receipts) ✔ Routes them to the correct workflow✔ Identifies key fields (dates, amounts, vendor names)

3. Context-Aware Data Extraction

Traditional OCR extracts raw text, but our AI-driven solution understands context, such as: ✔ Invoice numbers & payment terms✔ Customer names & addresses✔ Contract clauses & key datesThis reduces manual corrections and speeds up processing.

4. Automated Data Validation & Error Correction

Mistakes in data entry can be costly. Our system: ✔ Cross-checks extracted data with existing databases ✔ Flags inconsistencies (e.g., mismatched invoice amounts) ✔ Suggests corrections using AI-powered validation

5. Seamless Integration with Business Systems

Our Intelligent Document Processing Solution integrates with: ✔ ERP systems (SAP, Oracle, QuickBooks)✔ Cloud storage (Google Drive, SharePoint, Dropbox)✔ CRM platforms (Salesforce, HubSpot)This ensures smooth data flow across departments.

6. AI-Powered Fraud Detection