#False breakout filtering strategies

Explore tagged Tumblr posts

Text

Mastering Trading with the True Range Indicator: A Comprehensive Guide

Introduction In the vast and dynamic world of trading, having the right tools and indicators at your disposal can make all the difference between success and failure. One such powerful tool that has gained prominence among traders is the True Range Indicator. In this comprehensive guide, we will delve into what the True Range Indicator is, how it works, and how traders can leverage it to make…

View On WordPress

#Adaptive trading strategies#False breakout filtering strategies#False breakouts#financial market dynamics#learn technical analysis#Market Volatility#Market volatility analysis#Stop-loss and take-profit levels with True Range Indicator#Stop-Loss Orders#Take-Profit Levels#technical analysis#technical analysis tools#Trading algorithms incorporating True Range#Trading Indicators#trading systems#Trend confirmation#Trend confirmation using True Range#True Range Indicator#True Range Indicator trading strategies#Volatility Measurement#Volatility measurement in trading

0 notes

Text

Technical Analysis

Hull Moving Average: The Revolutionary Trend Following Indicator

Introduction

The Hull Moving Average (HMA) has revolutionized how traders identify and follow market trends. Developed by Alan Hull to address the lag inherent in traditional moving averages, the HMA provides a uniquely responsive yet smooth representation of price action. This comprehensive guide explores how traders can leverage this powerful indicator for enhanced trading performance.

Who Created the Hull Moving Average?

Alan Hull, an Australian mathematician and trader, developed the Hull Moving Average in 2005. Frustrated with the significant lag in traditional moving averages, Hull applied his mathematical expertise to create an indicator that could maintain smoothness while dramatically reducing delay in trend identification.

What Makes the Hull Moving Average Special?

Core Features:

Minimal lag compared to traditional MAs

Smooth price action representation

Strong trend identification capabilities

Responsive to price changes

Built-in noise reduction

Key Advantages:

Earlier trend identification

Clearer entry and exit signals

Reduced whipsaws

Superior price tracking

Versatile application across markets

Why Use the Hull Moving Average?

Primary Benefits:

Faster Signal Generation

Reduces lag by up to 60%

Earlier trend identification

Quicker response to reversals

Improved Accuracy

Reduces false signals

Smoother price tracking

Better noise filtration

Enhanced Trend Following

Clear trend direction

Strong support/resistance levels

Trend strength indication

Versatility

Multiple timeframe analysis

Various market applications

Combines well with other indicators

Where to Apply the Hull Moving Average?

Market Applications:

Futures Markets

E-mini S&P 500

Crude Oil

Gold Futures

Treasury Futures

Forex Trading

Major currency pairs

Cross rates

Exotic pairs

Stock Trading

Individual stocks

ETFs

Stock indices

When to Use the Hull Moving Average?

Optimal Market Conditions:

Trending Markets

Strong directional moves

Clear price momentum

Extended market cycles

Breakout Scenarios

Pattern completions

Support/resistance breaks

Range expansions

Volatility Transitions

Market regime changes

Volatility breakouts

Trend initiations

How to Trade with the Hull Moving Average

Basic Trading Strategies:

Trend Following Strategy

Long when price crosses above HMA

Short when price crosses below HMA

Use HMA slope for trend strength

Exit on opposite crossover

Support/Resistance Strategy

Use HMA as dynamic support/resistance

Buy bounces off HMA in uptrends

Sell rejections from HMA in downtrends

Tighter stops for counter-trend trades

Multiple HMA Strategy

Combine different period HMAs

Look for crossovers between HMAs

Use divergences between HMAs

Trade strongest signals only

Advanced Applications:

Multiple Timeframe Analysis

Higher timeframe for trend direction

Lower timeframe for entry timing

Middle timeframe for confirmation

Volatility Integration

Adjust periods based on volatility

Use ATR for stop placement

Scale positions with trend strength

Hybrid Systems

Combine with momentum indicators

Use with price patterns

Integrate with volume analysis

Risk Management Essentials

Position Sizing:

Scale with trend strength

Larger in confirmed trends

Smaller in transitions

Stop Loss Placement:

Beyond HMA level

Based on ATR multiple

At key price levels

Common Pitfalls to Avoid

1. Over-Optimization

Problem: Curve fitting periods

Solution: Use standard settings

Prevention: Test across markets

2. False Signals

Problem: Minor crossovers

Solution: Use confirmation filters

Prevention: Wait for clear signals

3. Late Exits

Problem: Giving back profits

Solution: Use trailing stops

Prevention: Honor exit rules

Real-World Performance Metrics

Typical Results:

Win Rate: 45-55% in trending markets

Risk/Reward Ratio: Best at 1:2 or higher

Average Trade Duration: 5-10 days

Maximum Drawdown: 15-20% with proper risk management

Optimizing Hull Moving Average

Parameter Settings:

Standard Period: 20-30

Aggressive: 14-18

Conservative: 35-50

Market-Specific Adjustments:

Fast Markets: Shorter periods

Slow Markets: Longer periods

Volatile Markets: Multiple confirmations

Conclusion

The Hull Moving Average represents a significant advancement in trend-following indicators. Its ability to reduce lag while maintaining smooth price action makes it an invaluable tool for both discretionary and systematic traders. When properly implemented with sound risk management principles, the HMA can provide a significant edge in futures trading.

#HullMovingAverage#TrendFollowing#FuturesTrading#TechnicalAnalysis#TradingStrategy#MarketIndicators#FinancialMarkets#TradingEducation#AlanHull#MovingAverages

3 notes

·

View notes

Text

Unlocking the Power of NinjaTrader 8 Indicators for Smarter Trading

When it comes to effective trading, having the right tools can make all the difference. NinjaTrader 8 indicators are among the most powerful tools available to traders today, offering enhanced market insights and precise signals to improve decision-making. Whether you’re a beginner or a seasoned trader, understanding and using NinjaTrader indicators effectively can significantly boost your trading performance.

What Are NinjaTrader 8 Indicators?

NinjaTrader indicators are custom-built tools that work within the NinjaTrader platform, designed to analyze market data and provide signals about price trends, momentum, volatility, and potential entry or exit points. NinjaTrader 8, the latest version of the platform, offers improved capabilities, faster processing, and more flexibility for developing and using indicators compared to its predecessors.

These indicators can range from simple moving averages and RSI (Relative Strength Index) to more advanced, proprietary indicators tailored for specific trading strategies. NinjaTrader 8 indicators allow traders to customize their charts and trading systems to better fit their style and goals.

Benefits of Using NinjaTrader 8 Indicators

Improved Accuracy

NinjaTrader indicators help filter out market noise, providing clearer signals. This precision allows traders to identify trends earlier and react quicker, reducing the chances of false entries or exits.

Customization

With NinjaTrader 8’s advanced architecture, indicators are highly customizable. Traders can adjust parameters, combine different indicators, or even develop their own to suit their unique strategies.

Versatility Across Markets

NinjaTrader indicators work seamlessly across multiple asset classes, including stocks, futures, forex, and cryptocurrencies. This versatility means traders can maintain consistency in their analysis regardless of their trade market.

Automation and Strategy Integration

Many NinjaTrader indicators integrate directly with the platform’s automated strategy builder. This feature allows traders to automate trades based on indicator signals, removing emotion from the trading process and enabling faster execution.

Popular Types of NinjaTrader indicators

Trend Indicators: Tools like moving averages, supertrends, and ADX help identify the direction and strength of price trends.

Momentum Indicators: Indicators such as RSI, Stochastics, and MACD measure the speed and magnitude of price movements.

Volatility Indicators: ATR (Average True Range) and Bollinger Bands help assess market volatility and manage risk.

Custom Renko Indicators: Specialized tools designed for Renko chart users that filter noise and provide clear trend signals.

Why Choose NinjaTrader Indicators?

NinjaTrader indicators are favored because they combine ease of use with powerful analytical features. The platform supports a large community of developers, meaning a wide range of free and paid indicators are available. NinjaTrader’s active user base also shares ideas, scripts, and improvements, keeping the ecosystem dynamic and innovative.

Using NinjaTrader 8 indicators can provide an edge by helping traders make informed decisions with real-time data and signals. Whether you want to identify breakout points, confirm trend reversals, or gauge momentum, these indicators can be invaluable in your trading toolkit.

Source: https://trandingdailynews.com/unlocking-the-power-of-ninjatrader-8-indicators-for-smarter-trading

0 notes

Text

Order Flow Trading Secrets: The Consistent Trader’s Blueprint

Order Flow Trading Secrets: The Consistent Trader’s Blueprint

Frustrated by unpredictable markets and inconsistent results? Discover Order flow trading secrets that demystify price action and help you build a clear, repeatable edge—no guesswork required.

Why Most Strategies Fail in Chaotic Markets

Nearly 80% of traders abandon their approach within a year. The problem? Overly complex systems and lagging indicators. In contrast, Order flow trading secrets offer real-time, actionable data, letting you adapt before it’s too late. Let’s explore how this clarity can change your trading game.

Decoding Order Flow: The Data Behind Every Move

Order flow trading secrets reveal the true intentions of big players by analyzing actual buy and sell orders. For example, tracking the volume at price levels can expose hidden support and resistance zones. This transparency helps you anticipate shifts, not just react to them, giving you a vital edge.

Applying Order Flow for Consistent Entries and Exits

With order flow, you can validate breakouts and filter out false signals. Studies show traders using order flow confirmation improve win rates by up to 15%. By focusing on genuine momentum, you avoid costly whipsaws and boost your trade consistency. Here’s how to use those signals for decisive action.

Simple Tools, Proven Results: Making It Work for You

No need for expensive software. Many platforms now offer basic order flow tools like volume profile or footprint charts. Even simple tape reading can uncover actionable Order flow trading secrets. Start with one tool, master it, and build from there—simplicity leads to consistent results.

Turning Insights into a Repeatable Trading System

Document your trades, focus on setups with clear order flow confirmation, and review outcomes weekly. Over 70% of consistent traders swear by journaling. It’s about refining your edge, not chasing every move. By systematizing your process, you transform insights into steady profits.

Order flow exposes real-time supply and demand shifts

Simple tools can reveal hidden market intentions

Consistency comes from clarity and disciplined execution

Order flow trading secrets turn market chaos into opportunity. Ready to reclaim your trading confidence? Start applying these principles now and watch your consistency soar.

What’s the best way to start learning order flow trading secrets?

Begin by studying volume profiles and order book data on your current platform. Focus on one tool at a time and review your trades to spot patterns in real market flow.

Can order flow trading secrets work in all markets?

Yes, order flow trading works in stocks, futures, and crypto—any market with transparent volume data. Adapt your tools to the asset you trade for best results.

Have you tried order flow trading? Share your experiences or questions below! What’s the biggest challenge you’ve faced in finding consistency? Reblog to spark the discussion.

0 notes

Text

mt4 indicator does not repaint

Introduction

https://secretindicator.com/product/powerful-true-mt4-scalping-indicator/

Telegram Channel

In the world of forex trading, accuracy and timing are critical. Many traders rely on indicators to make informed decisions, especially on platforms like MetaTrader 4 (MT4). However, one frustrating issue traders often encounter is "repainting"—when an indicator changes its past signals, giving a misleading appearance of high accuracy. That’s where non-repainting indicators come into play. These tools maintain the integrity of historical data and offer more reliable signals.

In this guide, you’ll learn:

What non-repainting indicators are

The dangers of repainting indicators

Benefits of non-repainting tools

The best non-repaint MT4 indicators

How to install and use them

Strategy examples

Tips to avoid scams

Frequently asked questions

Let’s dive deep into the power of non-repainting indicators on MT4.

Chapter 1: Understanding Repainting in MT4

What Is Repainting?

Repainting occurs when a technical indicator changes its previously plotted values based on future price action. For example, a buy signal shown at one candle might disappear or shift to another candle after new price data comes in. This makes the indicator look perfect in hindsight, but unreliable in real-time trading.

Why Is Repainting Dangerous?

False Confidence: Traders may believe an indicator is highly accurate.

Late Entries: By the time the signal stabilizes, the best entry point may have passed.

Overfitting: Repainting indicators often fit past data but fail in live markets.

Chapter 2: What Are Non-Repainting Indicators?

Definition

A non-repainting indicator is one that does not change past signals or values after the bar closes. What you see during a live trade is what you'll see in the history. This makes them ideal for real-time strategy building and backtesting.

Key Features

Signals stay the same once generated

Reliable for both scalping and swing trading

Great for automation (e.g., Expert Advisors)

Enhanced transparency and trust

Chapter 3: Benefits of Non-Repainting Indicators

1. Trustworthy Signals

Once a buy or sell signal appears, it doesn't vanish or change. Traders can act on these signals confidently.

2. Improved Strategy Development

Backtesting becomes reliable, allowing for data-driven decisions.

3. Automation Friendly

Many traders use Expert Advisors (EAs) to automate trading. Non-repainting indicators are compatible with most EAs.

4. Reduced Emotional Trading

When signals are clear and stable, traders avoid impulsive decisions based on "signal changes."

Chapter 4: Top Non-Repainting Indicators for MT4

Below are some of the best and most popular non-repaint indicators available for MetaTrader 4:

1. RSI + MA Crossover

Combines Relative Strength Index with Moving Average crossovers for early trend detection. Once a crossover is confirmed, the signal remains unchanged.

Usage: Great for trend-following strategies.

2. Super Trend Non-Repaint

Shows buy/sell signals based on volatility and trend. It is famous for its smooth entries.

Usage: Swing trading and intraday scalping.

3. BB Alert Arrows (Bollinger Band-Based)

Provides entry signals when price touches extreme Bollinger Band levels and confirms with momentum.

Usage: Volatility breakout and reversal signals.

4. MACD True

A customized MACD indicator that gives crossovers with accurate histogram momentum. No repainting ensures signals remain consistent.

Usage: Trend-following and momentum confirmation.

5. Buy Sell Magic Indicator

Offers clear arrows for buy and sell based on historical volatility, price action, and filters to avoid whipsaws.

Usage: Perfect for beginners.

Chapter 5: How to Install Non-Repaint Indicators on MT4

Step-by-Step Guide

Download the .ex4 or .mq4 file of the indicator

Open your MT4 platform

Click on File > Open Data Folder

Navigate to MQL4 > Indicators

Paste the downloaded file

Restart MT4

Drag the indicator from Navigator > Custom Indicators onto your chart

That’s it! Your non-repaint indicator is now active.

Chapter 6: Strategy Examples Using Non-Repainting Indicators

1. Scalping Strategy with Super Trend

Timeframe: M1 or M5

Indicator: Super Trend Non-Repaint

Entry: Buy when green arrow appears; sell on red

Exit: 5–10 pips target or opposite signal

Stop Loss: Recent swing high/low

2. Swing Strategy with MACD True + RSI

Timeframe: H1 or H4

Indicators: MACD True, RSI

Entry: Buy when MACD line crosses above signal + RSI > 50

Exit: Opposite crossover

Stop Loss: 30–50 pips depending on volatility

3. Bollinger Reversal Strategy

Timeframe: M15 or M30

Indicators: BB Alert Arrows + RSI

Entry: When price touches BB edge with RSI < 30 or > 70

Exit: 1:2 Risk/Reward or TP of 20 pips

Stop Loss: 10 pips

Chapter 7: Real-World Tips for Using Non-Repaint Indicators

1. Combine with Price Action

Always validate indicator signals with support/resistance or candlestick patterns.

2. Use in Confluence

No indicator is perfect. Combine 2–3 non-repaint tools to strengthen your strategy.

3. Avoid Overloading Charts

Too many indicators can clutter decision-making. Keep it clean and simple.

4. Don’t Chase Signals

Wait for confirmation candles to close. Acting too early can cost you.

Chapter 8: How to Identify a Fake Non-Repaint Indicator

Unfortunately, many online indicators claim to be non-repaint but aren't. Here’s how to avoid fakes:

Check live vs. historical behavior: Apply it to live chart and check if old signals shift.

Use Bar Replay: If available in MT5 or tradingview, simulate candle-by-candle development.

Look for Source Code Transparency: .mq4 files are editable. If only .ex4 is provided, be cautious.

Backtest with a strategy tester: MT4's Strategy Tester can expose repainting behaviors.

Read community reviews: Trusted forex forums often expose fake tools.

Chapter 9: Where to Find Free Non-Repainting Indicators

ForexFactory.com – Active community and free indicator uploads

MQL5 Market – Official marketplace; check reviews for non-repaint claims

TradingView (via MT4 ports) – Many open-source scripts

YouTube Forex Channels – Look for live testing videos

Telegram and Discord Forex Groups – Some groups share indicators for free

Important: Always scan files with antivirus tools before use.

Chapter 10: Frequently Asked Questions (FAQ)

1. Are all non-repainting indicators 100% accurate?

No. Non-repainting means the signal doesn’t change after it's printed, not that it's always right. Always use good risk management.

2. Can I use non-repaint indicators on a mobile version of MT4?

Not directly. Indicators can only be added to desktop versions. But you can receive trade alerts and monitor signals via mobile after setup.

3. Are paid non-repaint indicators better than free ones?

Not always. Some free indicators outperform expensive ones. It depends on the strategy and usage.

4. Can I automate non-repaint indicators in Expert Advisors (EAs)?

Yes. Non-repainting logic works well in automation, making it safer for bots and auto-trading scripts.

5. Do moving averages repaint?

Simple and Exponential Moving Averages do not repaint if they are based on closed candles. However, signals based on future prices or unclosed bars can appear to "repaint."

Conclusion

In forex trading, every pip matters. Using non-repainting indicators on MT4 is a game-changer for traders who value signal integrity, transparency, and strategy reliability. These indicators remove the illusion of perfect backtests and allow you to trade based on real data and solid setups.

Whether you're a scalper, swing trader, or algo enthusiast, choosing the right non-repaint tools can enhance your edge in the market. Remember, no tool is magic, but when used wisely, non-repainting indicators can become a core part of your profitable trading system.

https://secretindicator.com/product/powerful-true-mt4-scalping-indicator/

#forex factory#forex market#forex news#forex online trading#crypto#forex ea#forex broker#forex#forex indicators#forex education

0 notes

Text

Assessing the Right Time to Invest in Forex: A Comprehensive Guide

Investing in the foreign exchange (Forex) market can be highly rewarding—but only if you know when and how to enter and exit trades. This guide will walk you through the key steps to assess the optimal time to invest, including understanding trading signals, choosing the right charts, mastering entry and exit indicators, and leveraging technology to stay ahead. Whether you’re a beginner or a seasoned trader, these strategies will help you make informed, logical decisions and minimize risk.

1. Why Timing Matters in Forex Trading

The Forex market operates 24 hours a day, five days a week, with trillions of dollars changing hands daily. Given its continuous nature and high volatility, timing your trades can be the difference between healthy profits and significant losses. Entering at the wrong time may expose you to adverse currency swings, while exiting too early can prevent you from maximizing gains.

A well-timed trade allows you to:

Capitalize on momentum during strong trends

Avoid sharp reversals triggered by economic news

Reduce drawdowns and preserve capital

Improve risk-to-reward ratios on every position

By the end of this article, you’ll have a clear roadmap to pinpoint the best moments to invest and secure consistent returns.

2. Understanding Forex Trading Signals

Trading signals are alerts based on predefined criteria that suggest when to buy or sell a currency pair. They distill vast market data into actionable insights, helping traders spot opportunities without parsing every tick on the chart. Signals can be:

Technical: Generated from mathematical calculations on price and volume (e.g., Moving Averages, RSI, MACD).

Fundamental: Driven by economic events, like interest rate decisions or GDP reports.

Sentiment-based: Reflecting trader positioning and market psychology.

The key is to choose signals that align with your trading style—whether that’s scalping, day trading, swing trading, or longer-term position trading.

3. Selecting the Right Chart and Indicators

Before diving into signals, select a charting platform that offers:

Real-time data feeds for all major and minor currency pairs

Customizable timeframes (from 1-minute to monthly)

Built-in technical indicators and the ability to add custom scripts

Common Forex Charts

Line Chart: Simplest view showing closing prices.

Bar Chart: Displays open, high, low, and close (OHLC) for each period.

Candlestick Chart: Similar to bar charts, but with color-coded bodies—excellent for spotting reversal patterns.

Essential Technical Indicators

Moving Averages (MA): Identify trend direction and dynamic support/resistance.

Relative Strength Index (RSI): Measures overbought/oversold conditions.

Moving Average Convergence Divergence (MACD): Captures trend strength and momentum shifts.

Bollinger Bands: Highlight volatility and potential breakout points.

Stochastic Oscillator: Another momentum tool for spotting reversal zones.

Familiarize yourself with how each indicator behaves across different timeframes. Longer MAs smooth out noise but lag more, while shorter MAs react quickly but can generate false signals.

4. Mastering Entry Signals

An effective entry strategy combines multiple indicators to confirm a high-probability setup. Here’s a step-by-step process:

Trend Confirmation:

Use a 50-period and 200-period MA crossover to determine the primary trend (bullish when 50 above 200; bearish when below).

Momentum Filter:

Check RSI or MACD histogram for momentum alignment. For example, in an uptrend, RSI should be above 50.

Pattern Recognition:

Look for chart patterns (e.g., flags, pennants, head and shoulders) that signal continuation or reversal.

Entry Trigger:

A candlestick pattern (e.g., bullish engulfing) or a break above/below a recent swing high/low.

Volume/Volatility Check:

Confirm with volume spikes or Bollinger Band width expansion to ensure the move is supported by sufficient trading activity.

Example Entry Signal Workflow

Step 1: EUR/USD 4-hour chart shows 50 MA above 200 MA (uptrend).

Step 2: RSI sits at 55, indicating bullish momentum.

Step 3: Price consolidates in a bull flag for three candles.

Step 4: A breakout candle closes above the flag’s top—enter long.

Step 5: Volume increases by 20% above the 20-period average, confirming strength.

5. Optimizing Exit Strategies

Your exit plan is just as important as your entry. There are three common types of exits:

Fixed Stops and Profit Targets:

Predefine a stop-loss level (e.g., 30 pips) and a profit target (e.g., 60 pips) before entering. This guarantees a positive risk-to-reward ratio.

Trailing Stops:

Move your stop-loss in your favor as price advances. Many traders use a moving average or ATR-based trailing stop to capture extended moves.

Limit Exits at Key Levels:

Close positions at significant support/resistance zones or Fibonacci retracement lines.

Short-Term (Scalp/Swing) Exits

For quick trades, focus on “turning points”—repeated short-term patterns that can produce fast reversals. Monitor currency pair swings on 5- to 15-minute charts and set tight limit exits (e.g., 10–15 pips) with equally tight stops.

Real-Time Exit Signals

Many platforms offer real-time alerts—for example, if the MACD line crosses below the signal line or if price breaks below a key moving average. These can automate your exit decisions and reduce emotional bias.

6. Combining Multiple Signals for Risk Aversion

Relying on a single indicator is risky; it can generate false positives or lag behind. Instead, create a signal matrix by:

Overlaying trend, momentum, and volatility indicators

Filtering signals across multiple timeframes (e.g., align a 15-minute entry with a 1-hour trend)

Assigning weights to each signal based on reliability and recent performance

By evaluating multiple Forex signals together, you gain a holistic view of the market and can better anticipate fluctuations. This approach helps you stick to a logical mechanism rather than making random decisions under stress.

7. Leveraging Technology and Alerts

Modern Forex trading thrives on technology. With the right tools, you can analyze markets around the clock and never miss a crucial signal.

Mobile Trading Apps: Execute buy/sell orders and monitor charts on your smartphone—no physical presence required.

Automated Alert Systems: Configure alerts for when indicators meet your predefined parameters (e.g., RSI crosses below 30).

Expert Advisors (EAs): Deploy algorithmic trading systems that scan for signals and place trades automatically.

These innovations ensure that you’re always ready to act on new opportunities, whether you’re at your desk or on the go.

8. Choosing a Reliable Signal Provider

While self-generated signals are ideal, many traders supplement their strategies with professional signal services. To choose a trustworthy provider:

Check Track Record: Look for audited performance over at least six months with clear equity curves.

Read Reviews and Forums: Engage with communities on Forex forums and social media—peer feedback can be invaluable.

Compare Costs vs. Value: Free signals can be high-volume but low-quality, while paid services often offer curated, lower-frequency alerts.

Trial Periods: Opt for services that provide a trial or money-back guarantee so you can test signals risk-free.

Always cross-reference third-party signals with your own analysis to maintain control over your trades.

9. Continuous Research and Education

Forex markets evolve constantly. To stay ahead:

Read Business Newspapers and Magazines: Stay informed on macroeconomic trends that influence currency values.

Participate in Online Forums and Webinars: Exchange ideas with other traders and learn from expert lectures.

Backtest New Strategies: Use historical data and Forex software to simulate performance before risking real capital.

Maintain a Trading Journal: Record each trade’s setup, outcome, and your emotional state to refine your approach over time.

By committing to lifelong learning, you’ll adapt your system to changing market conditions and improve your win rate.

10. Conclusion: Bringing It All Together

Assessing the right time to invest in Forex isn’t about luck���it’s about systematic analysis, disciplined execution, and continuous improvement.

Understand and select the best trading signals for your style.

Choose the right charts and technical indicators.

Master robust entry and exit strategies.

Combine signals across multiple timeframes for enhanced risk aversion.

Leverage technology to automate alerts and execute trades.

Partner with a reputable signal provider, but always validate their calls.

Commit to ongoing research and education to refine your edge.

By following these steps, you’ll position yourself to make well-timed, high-probability trades that align with your goals and risk tolerance. Remember, consistency beats occasional brilliance—stick to your plan, and let your system guide you to long-term success in the Forex market. For more insights: Mastering Forex Trading Psychology: Traits, Emotions, and Mindset for Success Paperback – Large Print, May 20, 2025 by NABAL KISHORE PANDE (Author)

#Forex#TradingSignals#ForexStrategy#ForexIndicators#CurrencyTrading#InvestSmart#MarketTiming#ForexCharts#TradingPsychology#ExitStrategy

0 notes

Text

Profitable Moving Averagetrading Strategy ?

A Profitable Moving Average Trading Strategy: Simple, Smart, and Effective

In the world of trading, simplicity often beats complexity. One of the most time-tested, beginner-friendly, yet profitable methods is the Moving Average (MA) trading strategy. Moving Averages help traders smooth out price data and identify trends, making them a powerful tool in both short-term and long-term strategies. But what makes a Moving Average strategy truly profitable? Let’s dive into a unique approach that combines key indicators for high-probability trades.

The Core of the Strategy: The Golden Cross and Death Cross

A classic strategy that still delivers consistent results is based on the Golden Cross and Death Cross patterns. This strategy uses two MAs: a 50-day Simple Moving Average (SMA) and a 200-day SMA.

Golden Cross occurs when the 50-day SMA crosses above the 200-day SMA. This signals a bullish trend and a buying opportunity.

If you need any kind of information on this article related topic click here Forex EA

Death Cross happens when the 50-day SMA falls below the 200-day SMA, signaling a bearish trend and a selling opportunity.

Traders who follow this method often see consistent returns over time because it aligns trades with major market trends.

Adding a Twist: ATR for Smart Exits

To make this strategy even more effective, use the Average True Range (ATR) to determine stop-loss and take-profit levels. The ATR measures market volatility, allowing you to adapt your strategy to current conditions. For example:

Entry Rule: Buy when the Golden Cross occurs and the price is above both MAs.

Stop-Loss: Set it at 1.5 x ATR below the entry point.

Take-Profit: Set it at 3 x ATR above the entry point for a solid risk/reward ratio.

This addition ensures you're not using fixed levels that may not suit current market conditions. It allows you to tighten stops in low volatility and widen them when the market is more erratic.

Filtering False Signals: Use RSI or Volume

To avoid whipsaws and false breakouts, consider filtering entries with another indicator like the Relative Strength Index (RSI). For example:

Only take a Golden Cross trade if the RSI is above 50, confirming bullish momentum.

For Death Cross, look for RSI below 50 to confirm bearish sentiment.

Alternatively, look for increasing trading volume at the crossover point, which signals institutional interest and confirms the strength of the trend.

Backtesting and Realistic Expectations

No strategy is foolproof. Backtest your Moving Average strategy on different assets and timeframes to understand its behavior. Historically, this system performs well in trending markets, but it may produce false signals in sideways or choppy markets. That’s where using filters like RSI or ATR-based volatility rules helps improve accuracy and profitability.

Final Thoughts

The Moving Average strategy is not a “get rich quick�� method, but when combined with proper risk management, ATR-based exits, and a confirmation indicator like RSI, it becomes a robust, reliable tool. Patience, discipline, and consistency are the keys to turning this simple method into a profitable trading strategy. Whether you’re a novice or a seasoned trader, refining this classic approach can offer powerful results over the long term.

0 notes

Text

Weekly RSI Ascending/Descending (pt2)

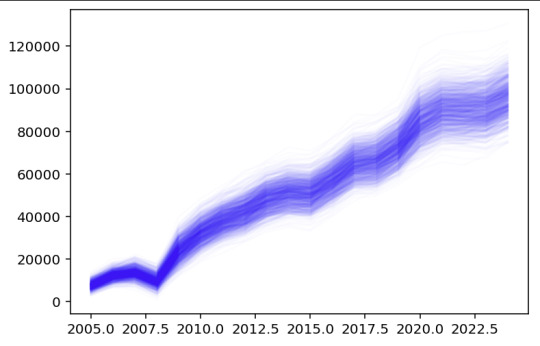

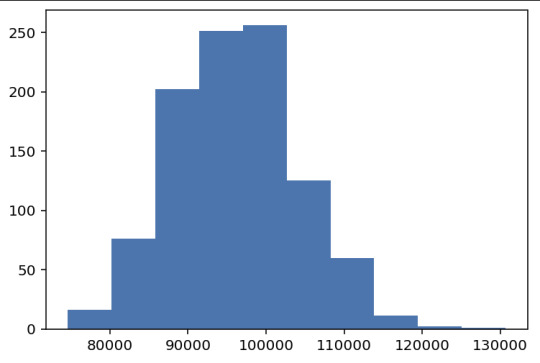

Using daily candles for better precision. A continuation of https://www.tumblr.com/patrickbatoon/772173459217383424/weekly-rsi-ascendingdescending?source=share

---

The Weekly RSI trend strategy was incredibly promising, so I wanted to take this further with more granular data. For this exploration I ended up using Daily candle data of the Russell1000 with the same timeframe of 01-JAN-2020 to 01-JAN-2025

The core strategy remains the same:

Entry: 3 consecutive increases in weekly RSI(14) using RSI-smoothed(14). For daily candles this can be computed using RSI(70) and RSI-smoothed(70).

Exit: Close < EMA20: If the close of the stock crosses below the 20-day EMA, fully exit the position.

I ended up removing the 50-week EMA filter since I found it excludes key reversals.

Broad market entry conditions as filters:

$VIX - week over week decrease. The VIX measures expected 1-year volatility as a percentage. Increases in this measure is driven by Put/Call options pricing, however its primarily associated with Put buying for downside protection

$RSP - Closeempirically found that this acts as a filter for potential key reversals and breakouts

Results:

From 01-JAN-2020 to 01-JAN-2025 it appears that the winrate is much lower than the weekly backtests suggested, but it ends up catching more false signals on the day-to-day.

Trades = 6420 Winrate = 35.72 % Total Mean = $39.84 Profitable Mean = $194.94 Upper Quartile Mean = $266.74

From 01-JAN-2020 to 01-JAN-2025

Trades = 19168 Winrate = 38.62 % Total Mean = $40.43 Profitable Mean = $177.11 Upper Quartile Mean = $257.12

---

Lastly, with the vast number of trades included in the backtest, I wanted to simulate the universe of possible outcomes through a Monte Carlo simulation. This was done by sampling 120 trades per year (10 trades per month) and determining the portfolio growth.

0 notes

Text

Best Premium TradingView Indicators for Traders to Unlock Profit Opportunities

Trading indicators play a crucial role in developing a structured and disciplined trading approach. By analyzing market data, they enable traders to make informed and strategic decisions.

TradingView, a widely used web-based platform, provides tools for charting, analyzing, and trading various financial assets, including stocks, forex, commodities, cryptocurrencies, and indices. With its hundreds of built-in technical indicators and the ability to create custom ones, TradingView is a go-to platform for traders of all levels.

Why Use TradingView Indicators?

Indicators help traders confirm trends, identify signals, and reduce the risk of false positives. By combining multiple indicators, traders can validate market directions and make smarter decisions on when to buy, sell, or hold an asset.

MiyagiTrading offers premium TradingView indicators that integrate multiple trigger conditions into a single, user-friendly toolbox. These indicators provide alerts, support backtesting, mitigate risks, and improve profitability by filtering market noise and revealing the true price trend. Say goodbye to confusion and false breakouts — with premium indicators, you’ll gain clear insights to ride trends and maximize profits.

Gain Insights into Price Momentum

MiyagiTrading’s premium TradingView indicators are designed to help traders assess market volatility and adjust their strategies accordingly. They allow you to set stop-loss levels based on market activity and identify weakening price momentum, signaling potential reversals.

Managing multiple assets across different timeframes can be overwhelming, but these indicators simplify the process by narrowing your focus to specific assets and setups that align with your trading strategy.

Spotting Opportunities with Precision

Trading indicators bring objectivity and consistency to your trading decisions, minimizing the influence of emotions. By relying on predefined signals, traders can avoid impulsive decisions and stick to their strategies.

MiyagiTrading’s premium TradingView indicators highlight potential trading opportunities by suggesting optimal entry and exit points. Automated signals further enhance efficiency by identifying trades based on preset criteria and sending timely alerts, saving traders valuable time.

Backtest Your Strategy Before Trading

Getting started with MiyagiTrading’s premium indicators on TradingView is straightforward. First, join TradingView and apply Miyagi indicators, which consolidate multiple trigger conditions into a single, easy-to-use toolbox.

With access to alerts, backtesting, and advanced analytics, you can test your strategies, refine them, and enhance your trading performance. The included TVAlertsManager makes it easy to manage alerts and test your plan to ensure its success before committing real capital.

Why Choose MiyagiTrading Premium Indicators?

MiyagiTrading offers a comprehensive suite of premium TradingView indicators tailored for traders of all levels. These tools are designed to enhance your trading strategies through high-precision alerts, robust backtesting capabilities, and advanced analytics. Whether you are a beginner or an experienced trader, MiyagiTrading has a range of paid premium indicators to take your trading to the next level.

In addition to top-tier indicators, MiyagiTrading provides comprehensive trading courses to empower traders with the knowledge and tools needed to succeed in today’s fast-paced markets. By combining expert training with premium tools, MiyagiTrading equips traders to confidently navigate the dynamic financial landscape.

Transform your trading journey with MiyagiTrading’s premium TradingView indicators and unlock new profit opportunities today!

0 notes

Text

Random Walk Index: Definition, Calculation, Trading Strategy, Advantages & Limitations

The Random Walk Index (RWI) is a technical analysis tool used in the financial markets to determine if a stock's price movement is random or part of a trend. Developed by Michael Poulos in 1997, this index helps traders and analysts discern whether a market is exhibiting a directional trend or simply fluctuating without a clear pattern. The concept of a random walk suggests that price movements are unpredictable and independent, a notion that the RWI aims to test.

Definition

The RWI is specifically designed to identify the presence of trends in market prices. A random walk implies that price changes occur without any predictable pattern, making future movements independent of past actions. In contrast, a trending market indicates that price movements follow a discernible direction. The RWI helps to measure whether the price movements over a certain period are more significant than would be expected under a random walk scenario. It essentially compares the price range of an asset to its average price movement, taking volatility into account.

Calculation

To calculate the Random Walk Index, two main values are considered: RWI High and RWI Low. These values are computed over a chosen period, commonly ranging from 2 to 7 days, to capture the extent of price changes.

RWI High: This measures the strength of upward price movements relative to the average price range. It assesses how much the current high price exceeds the previous high, factoring in market volatility.

RWI Low: This measures the strength of downward price movements. It considers the extent to which the current low price is lower than the previous low, also adjusted for volatility.

These two components provide a dual perspective on the market's behavior, indicating whether an upward or downward trend is more pronounced.

Trading Strategy

The Random Walk Index is utilized in various trading strategies, particularly for identifying trends and potential reversals. Here are some common applications:

Trend Identification:

If RWI High values are consistently higher than RWI Low values, it suggests an upward trend in the market.

Conversely, if RWI Low values are higher than RWI High values, a downward trend is indicated.

Entry and Exit Signals:

Traders may look for RWI High to exceed a certain threshold, which can signal a strong upward trend and a potential buying opportunity.

Similarly, when RWI Low surpasses a specific level, it can indicate a strong downward trend and a potential signal to sell.

Breakout Confirmation:

The RWI can confirm breakouts from consolidation patterns or trading ranges. For instance, a significant RWI reading in conjunction with a breakout suggests that the price move is likely to continue in the breakout direction.

Reducing False Signals:

The RWI is often used alongside other technical indicators, such as moving averages or oscillators, to filter out false signals and improve trading decisions.

Advantages

Clarifying Trends: The RWI is particularly effective in identifying the presence and strength of market trends, which is crucial for trend-following strategies.

Volatility Consideration: By incorporating measures of market volatility, the RWI provides a more nuanced view of price movements, helping traders understand the context of these movements.

Flexibility: The RWI can be applied to various financial instruments, including stocks, commodities, and currencies, across different time frames.

User-Friendly: Despite the technical nature of its calculations, the RWI is relatively straightforward to interpret, making it accessible to traders with different levels of experience.

Limitations

Lag in Signal: Like many indicators, the RWI can be slow to react to price changes, potentially leading to delayed signals that may miss the early part of a trend.

Risk of False Signals: In volatile or non-trending markets, the RWI might generate signals that do not accurately reflect market conditions, leading to potential trading errors.

Dependence on Volatility Measures: Since the RWI relies on volatility measures, its accuracy can be affected in markets where volatility is not a reliable indicator of price movement.

Complex Market Conditions: Interpreting the RWI requires an understanding of broader market conditions, and it is often best used in conjunction with other technical analysis tools to confirm signals.

Conclusion

The Random Walk Index is a valuable tool for traders and analysts seeking to differentiate between trending and random price movements. By evaluating the strength and direction of trends, the RWI provides critical insights into market behavior, aiding in the development of trading strategies. However, like all technical indicators, it has its limitations and should be used as part of a comprehensive analysis approach. Understanding the nuances of the RWI allows traders to harness its full potential, making informed decisions in the dynamic world of financial markets.

1 note

·

View note

Text

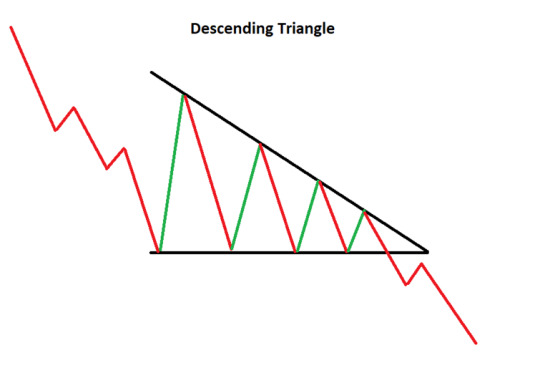

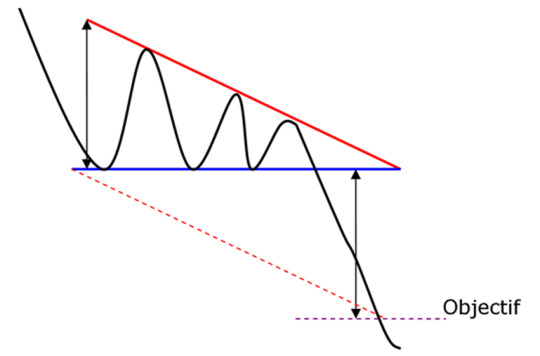

Descending Triangle

Decoding the Descending Triangle: A Technical Analysis Tool for Traders

Technical analysis is a vital tool for traders in the financial markets to make informed judgements. The descending triangle is a common chart pattern encountered by traders. This pattern has received a lot of attention because of its potential to provide useful insights about future price fluctuations. We will look at the descending triangle pattern, its properties, and how it may be used in trading techniques in this post.

Understanding the Descending Triangle:

A descending triangle is a bearish chart pattern that appears during a downtrend. It has a succession of lower highs and a horizontal support level connecting the swing lows. The descending triangle looks like a right-angled triangle, with the descending upper trend-line intersecting the horizontal support line.

The pattern denotes a period of consolidation and a conflict between buyers and sellers. Buyers are unable to drive the price higher as it approaches the horizontal support level, resulting in lower swing highs. In the meantime, sellers gain confidence and become more aggressive, perhaps leading to a collapse below the support level.

What does it tell you?

The falling triangle pattern implies a conflict between buyers and sellers, with sellers gradually gaining an advantage. Lower highs suggest that buyers are less eager to drive the price up, whilst the horizontal support level indicates that sellers are putting pressure to keep the price from rising. This tug of war frequently results in a breakout, which provides traders with significant information about probable future price movements.

How to Spot a Descending Triangle?

Identifying a falling triangle necessitates a sharp eye for chart patterns. Here are the critical steps to identifying this formation:

Downtrend: Look for a definite downtrend in the price chart, which is characterised by a series of lower lows and lower highs.

Horizontal Support: Locate a horizontal support level generated by many touches at the same price point.

Descending Trend-line: Draw a trend-line linking the lower highs to form a downward-sloping line.

If the price frequently bounces off the support level while the descending trend-line remains intact, you've most certainly spotted a descending triangle pattern.

Descending Triangle Breakout Strategy:

Trading a descending triangle pattern requires persistence, close attention to detail, and prudent risk management. Here is a detailed instruction:

Confirm the Pattern: Wait for the price to at least twice contact the horizontal support level and the falling trend-line to hold with lower highs in order to confirm the pattern.

Entry Point: When the price dips below the horizontal support level, start a short position. This breakdown suggests that purchasing demand has been outweighed by selling pressure, which could result in a further downturn.

Stop Loss: To reduce potential losses in the event of a false breakout or an unexpected reversal, set a stop-loss order above the breakout point.

Profit Target: Calculate the price objective depending on the height of the pattern. Project the distance from the highest point of the triangle to the support level downward from the breakout point.

Risk Management: Before entering a trade, calculate your risk-reward ratio to ensure that prospective earnings outweigh potential losses. Consider altering the position sizes and leverage as needed.

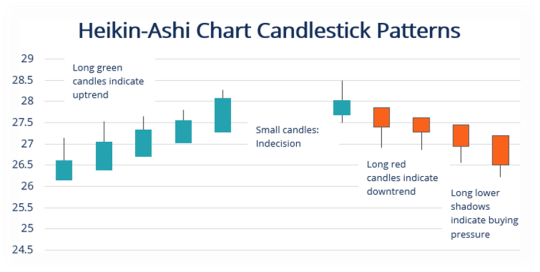

Descending Triangles with Heikin-Ashi Charts:

Heikin-Ashi charts are a sort of candlestick charting technique that includes time and volume information to create a more seamless portrayal of price patterns. Using Heikin-Ashi charts to analyze a descending triangle, traders can acquire extra information into the pattern's power.

Using modified candlestick calculations, the Heikin-Ashi approach helps to filter out noise and determine the dominant trend. When applied to descending triangles, it can assist traders more accurately detect future breakouts. A convincing bearish breakthrough on a Heikin-Ashi descending triangle chart affirms the downtrend's continuation, providing a stronger signal to go short.

Descending Triangle with Moving Averages:

Moving averages are frequently employed as technical analysis indicators to smooth out price data, spot probable trend reversals, or confirm current trends. Trading professionals frequently use moving averages to further validate the bearish character of descending triangle patterns.

Traders can see how the price responds to these trend-following indicators by superimposing moving averages on a descending triangle chart. Using a 200-day moving average along with a shorter-term moving average, like the 50-day moving average, is a typical strategy. A bearish crossover, where the shorter-term moving average crosses below the longer-term moving average, strengthens the likelihood of a downward breakout and emphasizes the descending triangle's negative bias.

Advantages and limitations of the descending triangle:

The ability of the descending triangle to offer traders with a clear and specific signal to start a short position in the market is one of its primary advantages. This pattern often suggests that the asset's price is about to break down, which can be a rewarding chance for traders who can capitalize on this movement. Furthermore, the descending triangle pattern can be utilized to identify probable price goals for the asset, which can assist traders in more efficiently planning their transactions.

It is crucial to highlight, however, that the descending triangle is not without flaws. As with all chart patterns, it is susceptible to false signals and market volatility, which can result in unanticipated price moves that contradict the pattern's predicted consequences. As a result, traders should always use caution and not base their trading decisions only on this pattern.

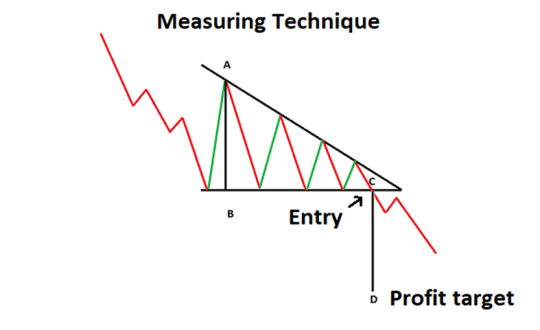

Descending triangle measuring technique:

To calculate the descending triangle pattern, traders often begin by locating the pattern's support level, which is the horizontal line connecting the asset's lowest price points. After establishing this line, traders can build a trend-line connecting the asset's declining highs. The pattern's "apex" is the point at which these two lines intersect.

Traders can compute the probable price target for the asset by measuring the distance between the support level and the apex and subtracting this number from the support level. This formula gives traders with a predicted price goal for the asset, which they can use to better plan their trades.

Conclusion:

In conclusion, the descending triangle is a negative chart pattern that can be used to forecast future price movements in financial markets. While this pattern has some positives, such as providing traders with unambiguous signals to begin short positions and identify potential price goals, it also has limitations and false signals. As a result, traders should exercise caution when making trading choices and use the descending triangle in conjunction with other technical indicators and fundamental analysis.

0 notes

Text

Order Flow Trading Secrets: The Ultimate Guide for Consistent Traders

Order Flow Trading Secrets: The Ultimate Guide for Consistent Traders Exhausted by market noise and inconsistent results? Discover Order flow trading secrets that cut through chaos, revealing a clear, data-driven path to reliable trades and lasting confidence. Why Order Flow Trading Beats Traditional Indicators Order flow trading secrets rely on real-time market data—actual buy and sell orders—rather than lagging indicators. According to CME research, over 80% of institutional traders use order flow insights. This empowers you to follow money, not just patterns. Let’s break down why this matters for consistent results. Decoding Market Intentions with Volume Analysis Volume profile analysis, a core order flow trading secret, highlights where large players enter and exit. For example, spikes in traded volume at specific prices often signal high-probability reversals or breakouts. This clarity allows you to anticipate moves before retail traders react, increasing your edge. Identifying True Support and Resistance Zones Order flow trading secrets help reveal hidden support and resistance levels by tracking real-time liquidity. Unlike static chart lines, liquidity zones adapt as markets evolve. A 2023 study found that trades executed near these zones had a 65% higher win rate. This insight keeps your strategy agile. Filtering Out Market Noise for Laser-Sharp Entries Order flow trading secrets filter the noise from news and price spikes by showing actual order imbalances. For instance, a sudden surge in aggressive buyers often forecasts an upward move. By focusing on these imbalances, you avoid false signals that plague other systems. Next, let’s explore actionable steps. Building a Simple, Repeatable Order Flow Trading System Consistency comes from a clear, proven process. Start by combining footprint charts with volume cluster analysis—two essential order flow trading secrets. Backtest your entry and exit criteria using historical order book data. Traders who did this reported a 30% reduction in whipsaw trades. Ready to take action? Order flow trading secrets reveal real market intentions Volume and liquidity zones boost precision and win rates Simple systems outperform complex strategies in the long run Unlock consistency and confidence by mastering Order flow trading secrets. Start applying these insights today for clearer, data-backed trades. Want to see the difference for yourself? What tools do I need to start using order flow trading secrets? You’ll need a trading platform with real-time order book, volume profile, and footprint chart features. Many professionals use Sierra Chart, Bookmap, or NinjaTrader for these capabilities. Is order flow trading suitable for all markets? Yes, order flow trading secrets work in futures, forex, and equities—any market with transparent order data. Liquidity and volume may vary, so adjust your strategy accordingly for best results. Have you tried order flow trading secrets? Share your experiences or questions below! Reblog if this guide helped, and tell us: What’s your biggest challenge in achieving trading consistency?

0 notes

Photo

HOW TO BUILD YOUR OWN TRADING STRATEGY?

Ask yourself who you are: scalper, day trader, medium-term trader or long-term trader and choose a timeframe – M30, hourly, daily, weekly, monthly, etc.

Decide which market conditions you will focus on. As you know, there three primary conditions: trend, range, and breakout. Each of these conditions exhibits its own market tone. As a result, a strategy that is good for trend trading can show the weak result when the market is in a range.

Choose your tools: will you use technical indicators and, if so, which ones? There are two types of strategies: indicator and no-indicator. If you prefer an indicator strategy, various technical indicators available in Metatrader will help you to identify a market’s movement. No-indicator strategies can include the analysis of candlestick patterns, chart patterns, trendlines and other elements of price action, as well as news trading.

Define the setup (required conditions) and trigger (entry rule) of your strategy.The setup is a favorable market condition, significant but not sufficient for opening the trade. It may refer to a particular location of candlesticks or indicators that you apply to a technical chart.The setup shows a favorable time for trading, but it does not point at the exact moment when you should enter it. The setup may consist of one or more filters. Filters are designed to protect traders from receiving false trading signals. However, if you apply too many filters, you risk entirely missing trading signals, so a balance between a small and a large number of filters is necessary.The second important element is a trigger. As opposed to the setup, it is a technical signal that indicates the right moment for entering the market. It is quite important to know your particular trigger to enter the market without any hesitation. It can be candlesticks, bar patterns, indicators, and oscillators.

Set the strict risk management parameters: risk/reward ratio, position size. The common ratio between potential loss and profit is 1:3. The basic rule of trading is like this: risk no more than 1-2% of deposit for 1 trade.

Choose exit rules – make a rule for Take Profit and Stop Loss orders.Not only there is an entry trigger, but an exit trigger as well. It is a moment when you understand that it is time to close your trade. The exit trigger is useful not only when you fail, but even if you have a profitable trade because a market will not be by your side forever.

Write down the rules of your strategy. Even if you are sure that you remember all steps of your strategy, it is important to write them down to not hesitate when it is time to trade.

Test your strategy on a demo account. Make a good effort: this will create a base for your success. If there are mistakes, you will be able to correct them without losing money.

Start using your strategy on live account: don’t digress from your rules but keep learning and thinking about how to make your strategy even better.

0 notes

Text

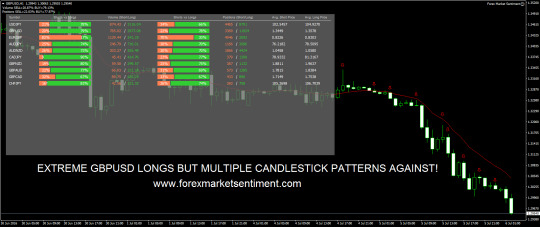

Forex Market Sentiment

New Post has been published on https://autotraffixpro.app/allenmendezsr/forex-market-sentiment/

Forex Market Sentiment

Buy Now

*Disclaimer: Box is for visualization purposes only. Forex Market Sentiment Indicator is a digital product.

With billions of dollars’ worth of forex transactions placed every single day it is clear that there are many participants in the forex market.

With such a large volume of trades taking place and the majority of them being speculative, it is very important to have an edge when trading the forex market.

Fundamental analysis can give an overview of a currency pair’s direction and technical analysis can help to spot trends and reversals.

The key thing missing is one of the most important aspects for any trading strategy which is market sentiment analysis.

Market sentiment analysis will show you how many traders are in a long position, how many traders are in a short position and the volume of these positions.

When you know what the majority of traders positions are and the amount of volume of these positions, you know what the overall sentiment is. As Forex Market Sentiment Indicator user Mirko says, “This indicator is not far to the holy grail, Thanks”!

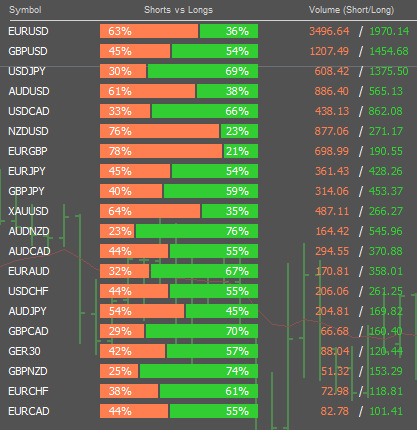

The Forex Sentiment Indicator will show you the amount of traders who are long or short and the amount of trading volume in these positions.

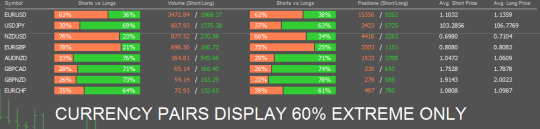

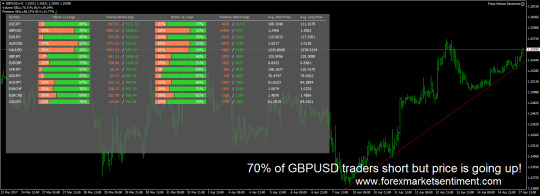

The indicator is developed for MetaTrader 4 and visually displays the market sentiment data of multiple currency pairs on one chart. With this data you can look for extreme conditions for contrarian trading signals.

The Forex Sentiment Indicator can be used stand alone or combined with any other technical and fundamental analysis. It is one piece of the puzzle to analysing the market.

The Forex Sentiment Indicator uses data collected in real time from MyFxBook which has a database with thousands of forex traders who are actively trading on real accounts. The combined trading volume of these traders is in the billions. This gives very strong data to conduct a thorough and accurate up-to-date forex market sentiment analysis with the Forex Sentiment Indicator.

MyFxBook Sentiment Statistics Summary – Huge amount of trading positions & volume.

How Does It Work?

To keep it as simple as possible, you can use the market sentiment data displayed by the forex sentiment indicator to find extremes in long or short positions and volume. When you see an extreme in either or both, you can trade against these extremes – this is known as contrarian trading. E.g. If 70% of traders and trading volume are long (buying), a contrarian trader would be looking to short (sell).

Visual display on chart

Displays all currency pairs short vs. long trading volume and total positions as figures and in a percentage.

Short vs. long volume

Displays the total size of all traders positions short and long.

Short vs. long positions

Displays how many traders are short and how many traders are long.

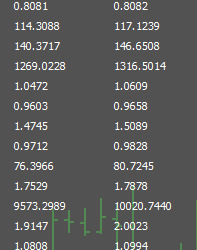

Average short/long price

Displays what the average price for all short and long positions are.

Filter by extremes

Filter display to only show currency pairs where the total volume and/or positions are extreme. You can choose the extreme, e.g. only show currency pairs where the total volume and/or long positions are greater than 70%. Both volume and positions extreme can be set to true or false.

Alerts on extremes

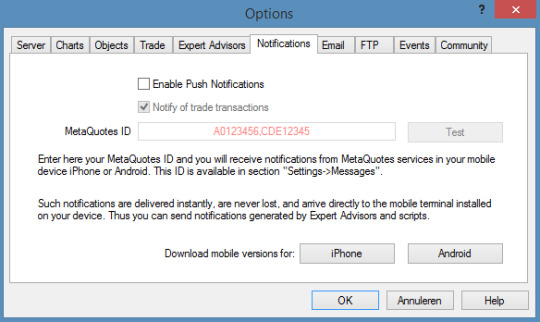

You can choose to receive a pop-up alert, email or SMS (push notification) when there is an extreme reached on any currency pair. Using alerts is useful if you do not have the time to watch charts and wait for market sentiment extremes to be reached.

Real Time Data

Forex Sentiment Indicator data is updated every 60 seconds.

Flexible

The Forex Sentiment Indicator data can be used on any currency pair and timeframe. You can use the Forex Sentiment Indicator with your own trading strategy or you can use it by itself. The main way to sentiment trade is to look for volume/position extremes and trade against them (known as contrarian trading) such as the examples below.

Forex Sentiment Contrarian Trading

If there is an extreme amount of sellers a contrarian trader can see this as a buying opportunity and if there are an extreme amount of buyers it is seen as a potential selling opportunity. Statistically speaking, 95% of traders lose so contrarian traders believe that it makes sense to go against their sentiment. In fact, according to MyFxBook data, the majority of traders are in losing positions which emphasises this.

Forex Sentiment Indicator Extremes

An extreme market sentiment can be considered anything from 70% upwards depending on the contrarian traders preference. If both the trading volume and trading positions are extreme in the same direction then this could be considered a strong contrarian trading signal. E.g. If 70% of all traders and the total volume were short then a contrarian trader would be looking to place a contrary buy trade anticipating that the market will reverse.

Forex Sentiment Indicator Reversals

You can use technical analysis indicators such as the CCI, RSI and STOCHASTICS to help identify entry points to enter against an extreme market sentiment. An extreme amount of positions and volume in one direction that has become overbought or oversold could be considered a contrarian entry against the market sentiment. If traders are buying into an overbought market or selling into an oversold market, it may reverse.

Forex Sentiment Indicator Stop Hunting

The Forex Sentiment Indicator can also identify where traders have placed there stop losses. If there is an extreme in one direction, a contrarian trader may look for a recent high or low as an area where there would be a build-up of stop losses. They would then look for the market to move rapidly against the extreme sentiment when these stop losses are triggered and other traders enter into the new market direction. Some brokers may be aware where there are a large amount of stop losses and can even move the market to trigger them.

You can also use the Forex Sentiment Indicator to show you the average prices. If the average buy or sell entry price is far from the current price then contrarian traders may expect other traders to have their stop losses hit soon or to take their profits – both which can cause a market breakout or reversal. If there is an extreme amount of sellers and the average short price is a good distance above the current price then a contrarian trader may expect them to be taking profits soon which could lead to the market reversing. If there is an extreme amount of sellers and the average short price is a good distance below the current price then a contrarian trader may expect them to be hitting their stop losses soon which could lead to the market moving up rapidly. Again, this can be combined with additional technical, fundamental and price action analysis for further confirmation.

Forex Sentiment Indicator Trend Trading

If you see the market is trending in one direction but the extreme sentiment is against the trend, this could be a sign that all of those who are against the trend may have their stop losses taken out which could move the market further into the direction of the trend. It is then possible that the trend may continue as traders add positions and volume to the trend.

Forex Sentiment Indicator Price Action Trading

When the Forex Sentiment Indicator shows extreme sentiment in one direction, contrarian traders may look for price action candlestick patterns for entry points against the extreme sentiment. Candlestick reversal patterns that are against the sentiment such as three inside/outside up, engulfing candles and hammers can give entry opportunities. You may even wish to combine the sentiment extreme and price action analysis with technical analysis using indicators for further confirmation.

You can see from the examples above how it is beneficial to know the forex market sentiment when trading. When you know what other traders are doing and where they are in the market, it can assist you in your trading. Contrarian traders do not follow the sheep, they run with the wolves, get your copy of the Forex Sentiment Indicator now! Selection of trades taken using the forex sentiment indicator:

*Disclaimer: Box is for visualization purposes only. Forex Market Sentiment Indicator is a digital product.

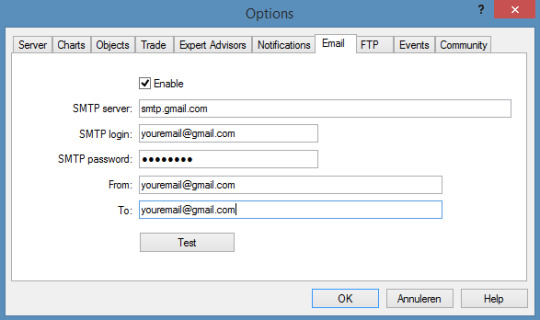

You will get the Forex Sentiment Indicator with detailed instruction manual including step by step setup instructions. Within 5 minutes you will be able to see the real time live account trading positions and volume from thousands of traders around the world from a display on your MetaTrader 4 charts. You will get unlimited license numbers for all of your trading accounts and also free lifetime updates and support.

You can setup signal alerts for market sentiment extremes and trade it stand alone or with your own preferred technical indicators, price action and fundamental analysis. It will identify what direction the market sentiment is and this can be used for contrarian trading.

It can be very beneficial to know what the market sentiment is, a contrarian trader does not want to trade with a blind fold on and hands tied behind their back! The Forex Sentiment Indicator can open a whole new sentiment perspective to the forex market and the traders who help move it in one direction or the other.

There is a minimal chance that you will not be impressed with how the Forex Sentiment Indicator can be used for contrarian trading but if it is not for you then we completely understand. If for any reason you would like to refund within 60 days of your purchase you will get your money back!

Using the Forex Sentiment Indicator can provide a new trading perspective to those who do not already use it. Do you ever wonder why forex brokers do not display market sentiment data in their feeds? Why do they hide this information from us? I think you know the answer to that. They can use the sentiment information for themselves. It’s your time to stop following the sheep and come to run with the wolves!

We will see you on the inside! Forex Sentiment Indicator Support.

Main | Terms | Privacy | Contact | Affiliates

Copyright © Forex Market Sentiment Indicator. All Rights Reserved.

ClickBank is the retailer of products on this site. CLICKBANK® is a registered trademark of Click Sales Inc., a Delaware corporation located at 1444 S. Entertainment Ave., Suite 410 Boise, ID 83709, USA and used by permission. ClickBank’s role as retailer does not constitute an endorsement, approval or review of these products or any claim, statement or opinion used in promotion of these products.

Earnings Disclaimer

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading.

All information on the forex auto millions website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold forex auto millions and any authorized distributors of this information harmless in any and all ways.

Your purchase of forex auto millions serves as your acknowledgement and representation that you have read and understand these TERMS OF USE and that you agree to be bound by such TERMS OF USE (“Agreement”). You accept that the agreement can be changed at any time and that you must comply with any changes made to the agreement.

All rights reserved. The use of this website constitutes acceptance of our user agreement and any changes made to the agreement.

Results shown on the Forex Market Sentiment website are based on historical back testing and strictly no guarantee or claims are made for future performance. You should understand the risks involved with trading before using any forex software.

0 notes

Text

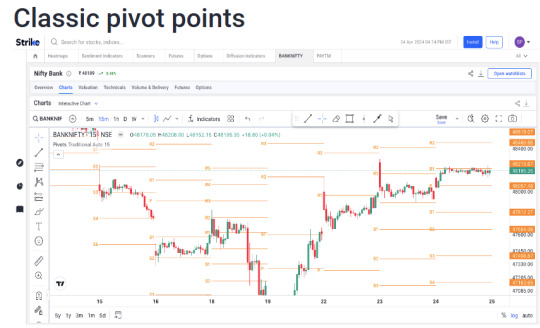

✅ Complete Guide to Pivot Points: How to Use Them in Trading Like a Pro

Ever watched the Nifty 50 bounce off a level like it had a mind of its own? Or noticed how Bank Nifty reversed direction almost perfectly from a certain price? You may be witnessing the power of Pivot Points — one of the most widely used technical tools in the trading world.

This isn't some random line drawn on a chart. Pivot Points are calculated, tested, and used by traders around the globe — from Wall Street to Dalal Street. In this guide, we’ll break down everything you need to know about pivot points, how to use them in real trading, and why even professional traders in India rely on them.

🔍 What Are Pivot Points and Why Smart Traders Use Them Daily

Pivot Points are price levels used by traders to identify potential support and resistance zones. They are derived from the previous day’s high, low, and close — which makes them highly relevant for intraday traders.

They act as psychological markers, signaling where the market could reverse or continue its trend. Originally popularized in the floor trading era of the Chicago Mercantile Exchange (CME), Pivot Points are now used globally — including by Indian traders using Strike Money, TradingView.

📉 Example: On 5th April 2024, HDFC Bank stock showed strong intraday resistance at the daily pivot of ₹1,526. The stock reversed after failing to break that level multiple times — a textbook pivot point reaction.

🧠 How Are Pivot Points Calculated? (And Yes, It’s Simple Math)

The Standard Pivot Point formula is straightforward:

Pivot Point (P) = (High + Low + Close) / 3

From this base point, we calculate:

👉 Resistance 1 (R1) = (2 × P) – Low 👉 Support 1 (S1) = (2 × P) – High

These levels are extended further to R2, R3, S2, and S3 using variations of the range (high-low). Tools like Strike Money and TradingView automate these instantly.

🧪 Real-World Insight: A 2022 research paper by the National Stock Exchange (NSE) observed that stocks tend to respect pivot levels in 68% of intraday moves across midcap and large-cap segments.

🔁 Which Type of Pivot Point Should You Use? Here's the Breakdown

✅ Standard Pivot Points – Best for beginners and general market structure ✅ Fibonacci Pivot Points – Use Fibonacci ratios (0.382, 0.618) to reflect market psychology ✅ Camarilla Pivot Points – Focus on tighter support/resistance for fast-moving stocks ✅ Woodie’s Pivot Points – Give more weight to the closing price, preferred by some day traders

📊 Use Case: During a volatile session in March 2024, Infosys Ltd reversed sharply from the Camarilla L3 level — indicating mean reversion in a ranging market.

Tools like Strike Money allow traders to select these different pivot styles seamlessly, adjusting for volatility or timeframe.

📈 Using Pivot Points in Trading: Not Just Lines, But Strategy

So how do you actually trade with pivot points? Here's how traders apply them across strategies:

🔥 Intraday Range-Bound Strategy Stocks like TCS often trade within pivot ranges during low-volatility sessions. If price hovers between S1 and R1, a range-bound strategy using RSI as confirmation works best.

💥 Breakout Strategy When Bank Nifty opens above the pivot and surges past R1, it often signals a bullish breakout. This move is usually accompanied by volume and may run till R2 or R3.

🔁 Swing Trading with Weekly Pivots Weekly pivots help spot major trend shifts. In early 2024, Reliance Industries bounced off its weekly S1 pivot level, gaining nearly 5% in the following days — ideal for swing entries.

🧠 Combine pivot points with indicators like MACD, RSI, or Moving Averages to filter false signals.

🤔 Pivot Points vs RSI, MACD & Moving Averages: What Works Best?

📍 Pivot Points help identify potential price reversal zones based on past data. 📍 RSI tells you if a stock is overbought or oversold. 📍 MACD signals momentum shifts and moving average crossovers. 📍 Moving Averages smooth out trends over time.

They all serve different purposes. But when used together, they’re powerful. For example, if ICICI Bank hits a pivot support while RSI is below 30 and MACD turns bullish — that’s a solid setup.

According to Investopedia and research by John Person, combining pivot points with momentum indicators enhances entry precision by over 30%.

⚙️ Best Tools to Use Pivot Points in Indian Markets

You don’t need to calculate pivot levels manually. Several charting platforms offer built-in indicators.

📲 Strike Money – Designed for Indian traders, this tool offers clean pivot visualizations and support for Standard, Fibonacci & Camarilla pivots.

📲 TradingView – Global charting platform with extensive pivot scripts

🧪 Tip: Use pivot points with pre-market open levels to plan your trades. Stocks like Titan and Maruti Suzuki show excellent reaction near pivot zones right from market open.

⚠️ Common Mistakes Traders Make With Pivot Points

❌ Blindly placing orders at pivot levels Just because a level is there doesn’t mean price will stop — wait for confirmation.

❌ Ignoring news events Even if a stock sits near pivot S1, a negative earnings report can send it crashing through all levels.