#FastApprovals

Explore tagged Tumblr posts

Text

PSB59: Instant Business Loans, Zero Hassle!

Why wait in long queues when you can get loan approvals in minutes? With PSB59, experience a fully digital, paperless, and hassle-free loan process.**

✅ Instant approval ✅ Loans up to ₹5 crore ✅ For MSMEs & entrepreneurs ✅ No branch visits required

#PSB59#PSBLoansin59minutes#DigitalLoans#MSMEFinance#NoQueueLoans#InstantApproval#BusinessGrowth#PaperlessLoans#ClickAndGrow#HassleFreeFinance#QuickLoans#MSMELoans#EasyFinance#GrowWithPSB59#FastApprovals#StartupFunding#EntrepreneurLife#SmallBusinessSupport#LoanMadeEasy#FinanceForGrowth#GoDigital

0 notes

Text

Fast, Sustainable Forest Clearance with Easy FC!

Tired of slow, complicated forest clearance processes?

EasyFC is here to make it simple, fast, and sustainable! 🌱✨

🌟 What EasyFC offers: ✅ Wildlife Mitigation Plans ✅ Soil and Moisture Conservation Plans ✅ Expert handling of Essential Details Sought (EDS) — no more delays! ✅ Full support from proposal to final approval

Why choose between development and conservation when you can have both? EasyFC helps businesses move forward without harming the environment.

👉 Ready for faster, hassle-free forest clearance? Let EasyFC handle it!

#ForestClearance#EasyFC#SustainableDevelopment#EcoFriendly#WildlifeProtection#EnvironmentalSolutions#GreenBusiness#NatureMatters#EcoProjects#FastApprovals

0 notes

Text

Add Digital Signature in My HRM App – Fast & Easy!

No more paperwork! With MyHRM, HR managers can now seamlessly upload employee digital signatures, eliminating manual approvals and ensuring smooth documentation. Digital signatures enhance efficiency, security, and compliance, making HR operations completely paperless.

Why Do We Need a Digital Signature?

Traditionally, HR departments relied on physical documents for approvals. Employees had to manually sign leave requests, appointment letters, and policy agreements. However, with digital transformation, these processes have shifted online.

Key Reasons for Using a Digital Signature:

✔ Paperless Documentation: No more handling stacks of paper.

✔ Mobile-Friendly Process: Employees can submit requests via their smartphones.

✔ Quick Approvals: Managers can approve documents instantly.

✔ Secure & Compliant: Digital signatures ensure authentication and prevent forgery.

✔ Future-Ready Printing: If a document needs printing later, the signature is already embedded.

With MyHRM, HR professionals can effortlessly manage digital signatures, streamlining workflows and improving compliance.

youtube

How to Upload a Digital Signature in MyHRM?

Uploading a digital signature in MyHRM is quick and straightforward. Follow these easy steps:

Step-by-Step Guide:

Open MyHRM and navigate to the Active Employees section.

Click on the employee’s profile to view details like joining date, department, and location.

Below the details, you’ll find three blue icons.

Click on the leftmost icon labeled ‘Upload Signature’.

Upload the employee’s digital signature.

✅ Once uploaded, the digital signature will be automatically applied to all HR transactions for that employee, ensuring effortless processing.

Benefits of Digital Signature in MyHRM

Embracing digital signatures within MyHRM revolutionizes HR operations. Here’s how:

1. No More Paperwork – 100% Paperless!

Forget physical forms! Employees submit digital requests, and HR processes them without needing printouts. This saves time and promotes eco-friendly practices.

2. Seamless HR Transactions

Approvals, policy acknowledgments, and offer letters are digitally signed, ensuring quick and smooth operations without delays.

3. Enhanced Security & Compliance

Digital signatures in MyHRM offer encryption and authentication, ensuring that signatures are genuine and tamper-proof.

4. Automated Integration

Once an employee’s digital signature is uploaded, it seamlessly integrates with all HR forms, including leave approvals, salary slips, and contracts.

5. Ready for Future Print Requirements

If a document needs to be printed for reference, the digital signature is already in place—no need for additional paperwork!

How Digital Signatures in MyHRM Benefit Hospitals

Hospitals deal with numerous HR documents daily. Implementing digital signatures simplifies processes, reducing administrative burden and allowing HR teams to focus on core responsibilities. MyHRM empowers hospitals by offering:

✔ Instant leave approvals – No waiting time for physical signatures.

✔ Automated appointment letters – Issue offer letters digitally.

✔ Easy policy acknowledgment – Employees digitally sign HR policies.

✔ Seamless employee onboarding – Digitally sign and store contracts.

✔ Compliance with legal standards – Ensures all documents meet industry regulations.

With MyHRM, hospitals achieve paperless HR operations, boosting efficiency while maintaining compliance.

The Future of HR Digitalization with MyHRM

In an era where digitalization is crucial, MyHRM’s digital signature feature is a game-changer for HR teams. By eliminating manual approvals and embracing paperless efficiency, hospitals and organizations can streamline HR processes effortlessly.

Key Takeaways:

🔹 Faster approvals & seamless workflows

🔹 Eco-friendly, paperless HR management

🔹 Secure, tamper-proof digital signatures

🔹 Compliance-ready documentation

🔹 Easy onboarding & employee record management

HR digitalization is no longer optional—it’s essential. With MyHRM, hospitals and businesses can embrace the future of HR automation, ensuring smooth, secure, and hassle-free employee transactions.

Get Started with Digital Signature in MyHRM Today!

Ready to digitize your HR processes? Say goodbye to paperwork and hello to seamless digital HR operations with MyHRM.

📲 Download MyHRM today and experience the power of digital signatures!

Go paperless. Go digital. Go MyHRM!

Contact Us: [email protected] / [email protected]

Call Us: +91 7356 78 9993 +91 8606 98 4841

Visit: Best Hospital management software

#MyHRM#SalaryAdvance#HRSoftware#HRAutomation#HRMS#EmployeeManagement#DigitalHR#HRTech#PaperlessHR#FastApprovals#HRProcess#SalaryRequests#EmployeeFinance#HRTransformation#HRProductivity#HRSolutions#SmartHR#EmployeeEngagement#HRSoftwareSolutions#HRTools#WorkplaceTech#SeamlessWorkflow#NoMorePaperwork#HRManagement#FastAndEasy#FutureOfHR#Youtube

0 notes

Text

🚗 Get Behind the Wheel Faster with Auto Body Plug’s Quick Approvals!🚗

At Auto Body Plug, we’re here to make car financing and leasing easy, fast, and stress-free. From lightning-fast approvals to financing plans designed to fit your lifestyle, we’re your go-to source for making car ownership simple.

✨ Why Auto Body Plug? ✅ Fast Approvals – Drive Sooner! ✅ Customizable Financing Options ✅ All Makes & Models – Find Your Match ✅ Trusted Team Ready to Help

Take the first step toward your new car today—call Auto Body Plug and make it happen!

📞: (838)-227-7584 / (838)-CAR-PLUG ✉️: [email protected] 🌐: www.autobodyplug.com 📍: 430-442 Peninsula Blvd, Hempstead, NY 11550

0 notes

Text

Affordable Financing for Essential Equipment: From Carpentry to CNC

Explore our easy equipment finance options Get ready to expand your business projects From Carpentry, Woodworking Machines to Restaurant Equipment, CNC machines and Office printers."

✅Easy Financing process. ✅ Minimum documents. ✅ Fast Approvals. ✅All credits will be reviewed. Contact us today 📞 Ph: 8554035626, 647-219-6397 ✉️ Mail: [email protected] 🌐 Website: https://cikcapital.com/cnc-machine-equipment-financing/

#EquipmentFinancing#BusinessExpansion#EasyFinanceOptions#FastApprovals#FinanceYourGrowth#EquipmentLoans#CNCFinancing#AllCreditWelcome#RestaurantEquipmentFinance#SmallBusinessLoans

0 notes

Text

Start your investment journey with Money Bag Lending Loans! Enjoy fast approvals, competitive rates, and streamlined processes to get your project underway. 📈💼

0 notes

Text

🚀 Unleash your business potential with our hassle-free Collateral-Free Loan of up to 75 Lakh! 💰 Whether you're expanding, diversifying, or need working capital, we've got you covered. Experience lightning-fast approvals and have the funds in your hands within 5 days*! ⏰💼 ✅ Business soaring for 6+ months? ✅ Have PAN, Aadhaar, and 6 months Bank statement? ✅ Possess Business Registration or GST Certificate? ✅ Proudly tied up with 19 Banking institutions. 🏦🤝 Don't hit the brakes on your dreams! Apply right away and catapult your business to unparalleled heights! 🚀🌟 📞 Dial: +91-9745454959 📧 Email: [email protected] 💬 WhatsApp: https://wa.me/919745454959 Your success story starts here! ✨

0 notes

Text

Why settle for ordinary? Drive the Peugeot 5008 Active and experience the difference!

🚘 PEUGEOT 5008 ACTIVE SUV (7 seater) AT GLACE🚘

₱1,662,187 (still negotiable)

Zero all in down payment in financing

We Accept:

- ✅ Bank P.O. & Company P.O.

- ✅ Financing

- ✅ Cash

- ✅ Transfer of Approval

For Inquiries, reservation, and more details just contact me at the below.

🧑🏻💻 Mike Pelicano

📞 09611282630/Viber

09633267078/Sms & Viber

Peugeot Quezon Avenue – Mike Pelicano

Location: 602 Quezon Avenue, Cor. Tuayan st. Brgy. Tatalon, Qc 1102 in front of Sto. Domingo church

2 notes

·

View notes

Text

Get your prescriptions approved without the wait. Choose RxBLVD for stress-free service that puts your health first.

Learn more at https://rxblvd

#healthcare#prescriptionsavings#RxBLVD#prescriptionmadeeasy#fastapproval#nomoredelays#RxSolutions#wellnesswithoutwait#modernmedicine

0 notes

Text

Personal Loan: Your Smart Solution to Financial Flexibility

In a world where financial challenges can arise unexpectedly, having access to quick and reliable funds can make all the difference. Whether it’s for a medical emergency, home renovation, wedding planning, or simply managing multiple debts, a personal loan can offer the peace of mind and freedom you need.

But before jumping in, it’s important to understand what a personal loan truly offers—and what it doesn’t. Let’s break it down in a way that’s straightforward, human, and practical.

What is a Personal Loan?

A personal loan is a fixed-amount loan offered by banks, credit unions, or online lenders that is typically unsecured—meaning you don’t need to put up collateral. Once approved, you receive a lump sum of money, which you repay in monthly installments over a set period of time, usually with a fixed interest rate.

You can use a personal loan for almost any purpose—unlike a mortgage or car loan, which must be used for specific purchases. This flexibility is what makes personal loans so popular.

When Does a Personal Loan Make Sense?

Not every financial situation calls for borrowing money. But there are certain moments when taking out a personal loan can be a smart and strategic move:

1. Debt Consolidation

If you’re juggling multiple credit card payments with high interest rates, a personal loan can combine all your debts into one monthly payment—usually at a lower rate.

2. Medical Expenses

Unexpected medical bills can be overwhelming. A personal loan can help you manage those costs without diving deep into credit card debt.

3. Home Improvements

Want to remodel your kitchen or fix that leaky roof? A personal loan offers an easy way to fund home upgrades without dipping into your savings.

4. Major Life Events

Weddings, relocations, or even a career change—life’s big moments often come with big costs. A personal loan can help you finance them smoothly.

How to Qualify for a Personal Loan

Getting approved for a personal loan depends on a few key factors:

Credit Score: Most lenders look for a credit score of 650 or above, though options exist for lower scores.

Income: Your monthly income plays a huge role in determining your loan eligibility.

Debt-to-Income Ratio: This ratio shows how much of your income is already tied up in debt. A lower ratio increases your chances.

Employment Stability: Lenders want to see that you have a consistent source of income.

Tip: Pre-qualifying with lenders can give you a sense of what kind of personal loan you might be eligible for—without impacting your credit score.

Fixed Rates, Predictable Payments

One of the best parts about a personal loan is the predictability. Fixed interest rates mean your monthly payments never change, which helps with budgeting and reduces financial stress. You know exactly how much you owe and when the loan will be fully paid off.

Unlike credit cards, where the minimum payments can stretch out for years, a personal loan comes with a clear end date.

Choosing the Right Personal Loan

Not all personal loans are created equal. To find the best fit, consider these factors:

Interest Rate: This directly affects how much you’ll pay over time.

Loan Term: Shorter terms usually mean higher monthly payments, but less interest overall.

Fees: Some lenders charge origination fees, late fees, or prepayment penalties. Always read the fine print.

Lender Reputation: Stick with reputable lenders. Online reviews and ratings can give you a clearer picture of their customer service and transparency.

Don’t rush this step. Shopping around can save you hundreds—if not thousands—over the life of your personal loan.

Myths About Personal Loans

Let’s clear up a few common misconceptions:

Myth 1: Personal Loans Are Only for People with Excellent Credit

Truth: While good credit helps, many lenders offer personal loans to those with fair or even poor credit—though rates may be higher.

Myth 2: Personal Loans Are Risky

Truth: Any form of borrowing can be risky if mismanaged. But with responsible repayment, a personal loan can actually boost your credit score.

Myth 3: It’s Better to Use a Credit Card

Truth: If you need to borrow a larger amount and want structured repayments, a personal loan often makes more sense than racking up high-interest credit card debt.

The Impact of a Personal Loan on Your Credit

A personal loan affects your credit score in multiple ways:

Application: Applying may cause a small dip due to a hard inquiry.

Credit Mix: Having a variety of credit types (loans + credit cards) can improve your score.

On-Time Payments: Timely repayments boost your creditworthiness.

Debt Levels: Consolidating high-interest debt can lower your overall utilization.

Used wisely, a personal loan can be a powerful tool to improve your credit over time.

Is a Personal Loan Right for You?

There’s no one-size-fits-all answer. But asking yourself these questions can help you decide:

Do I really need the funds?

Can I comfortably afford the monthly payments?

Am I using the loan for a sound financial purpose?

Have I compared rates and terms from multiple lenders?

If the answer to these is yes, then a personal loan could be exactly what you need to take the next step forward with confidence.

Final Word

A personal loan is more than just borrowed money—it’s a bridge to your goals, a lifeline in emergencies, and a structured way to manage financial challenges. Like any tool, its effectiveness depends on how you use it.

Take your time, weigh your options, and be honest about your financial picture. With the right approach, a personal loan can offer both relief and opportunity—without derailing your long-term plans.

If you're ready to take control of your finances, explore your personal loan options today. The right loan, at the right rate, could be the start of a smarter, stronger financial journey.

0 notes

Text

Top Reasons to Apply for an Indonesia Visa Online with VisaCollect

Indonesia is a dream destination for travellers, whether for its stunning beaches, vibrant cities, or rich cultural heritage. However, before packing your bags, securing the right visa is a crucial step.

Thanks to modern technology, applying for an Indonesian visa online has become easier and more efficient than ever.

VisaCollect, an internet-based secure visa processing system, enables easy, trouble-free application for tourists, business travellers, and digital nomads.

We will be quoting the main reasons why you need to apply for an Indonesia visa online via VisaCollect in this blog post.

1. Easy Online Application Process

Are the good old days over when visa applicants would rush to embassies, stand in long queues, and fill out page after page of forms? Not anymore with VisaCollect. With VisaCollect, you are able to apply for your Indonesia visa from anywhere across the globe—sitting at your computer or mobile phone.

Why Does This Matters?

No embassy or consulate visit necessary.

Complete the application from home.

Scan all the documents needed digitally.

This efficient process makes your visa application fast, hassle-free, and easy.

2. Rapid and Guaranteed Visa Processing

The other great benefit of using VisaCollect is the rapid turnaround time. Unlike regular visa applications that take weeks, VisaCollect guarantees you will receive your visa approval within a few business days.

What Can You Expect?

Rapid turnaround times versus standard embassy applications.

Free routine updates on your visa status.

Uncompromised and effective service to enable you to catch your travel schedules.

This makes it the best option for last-minute travellers or businesspeople who require a visa on short notice.

3. Simple Steps to Follow

It is so daunting to apply for a visa online, particularly for first-time travellers. However, VisaCollect breaks it down into easy, simple steps.

How Does It Works?

Visit the VisaCollect Website – Visit VisaCollect.

Select Your Visa Type – Select the right Indonesia visa (tourist, business, social, etc.).

Complete the Online Application – Enter your personal details, travel plans, and other vital information.

Upload Documents – Attach scanned copies of your passport, photos, and supporting documents.

Secure Payment – Pay for the visa through VisaCollect's secure payment facilities.

Get Your eVisa – Upon approval, your Indonesia visa is e-mailed to you.

This hassle-free and transparent process eliminates misunderstandings and permits a seamless application experience.

4. Secure and Safe Transactions

During the application process online for a visa, security takes utmost priority. VisaCollect protects all your personal and financial information using cutting-edge encryption and safe payment gateways.

Security Features Are:

Secure transaction encryption to guard sensitive data.

Secure online payment using secure payment gateways.

Data protection procedures for personal data confidentiality.

By employing VisaCollect, you have it easy with your Indonesia visa application, knowing that your information is in trustworthy hands.

5. 24/7 Support

Every now and then there is a question or problem with having a visa application, and having an assurance that you have a support staff you can count on is reassuring. VisaCollect offers 24/7 customer service, so help is always close at hand when you need it.

How Does VisaCollect Support You?

Live chat and email support for instant help.

Professional advice on visa requirements and document submission.

Reminders and status updates on your visa.

Whatever you wish to learn about eligibility, documentation, or processing times, VisaCollect's professional and friendly team is here for you.

6. No Embassy Visits or Standing in Long Queues

By choosing VisaCollect, you avoid the trips to the embassy and the waiting around long. This is useful especially for:

Travelers without an Indonesian embassy nearby.

Busy professionals with no time.

Travelers who desire a hassle-free experience. By applying attention online means you won't waste your valuable time and energy, and you can focus instead on planning your trip.

8. Various Visa Options to Choose From

VisaCollect provides many visa options for different purposes of travel. If you are going to Indonesia for tourism, business, visiting family or for work, you may choose the appropriate travel visa option on VisaCollect's website.

Best Indonesia Visas Available Online:

Tourist Visa – For leisure and holiday travel.

Business Visa – To attend conferences, meetings, and business travel.

Social/Cultural Visa – To visit relatives or for cultural exchange.

Work Visa – For employment in Indonesia.

When you use VisaCollect, you are provided with one-stop-shop visa services best tailored to your intention of visit.

9. Saves You Money on Travel and Documentation

Application via an embassy usually has costs incurred that do not directly add to your balance, including:

Travel to and from the embassy.

Printing and photocopying of documents.

Potential fees for services by an agent.

You can apply from home with VisaCollect, avoiding wasteful costs while receiving a hassle-free and efficient visa approval experience.

Conclusion: Why Go to VisaCollect?

An Indonesia visa application through VisaCollect online is easy, quick, safe, and dependable. For those on business, vacationing, or travelling as a digital nomad, the VisaCollect process combines an easy visa application with fast visa approval.

Takeaways:

Easy online application

Rapid visa approval processing times

Secure payment and data protection

24/7 support provided

No waiting or visiting embassies

Handled by over one thousand travellers

If you are off to Indonesia, do not get held up by visa issues. Visit us today at VisaCollect and get your Indonesia visa online in a hurry Begin your Indonesia travel with VisaCollect – smart visa application to Indonesia.

#VisaCollect#IndonesiaVisa#TravelToIndonesia#VisaApplication#HassleFreeVisa#FastApproval#EasyVisaProcess

0 notes

Text

🚨 Year-End Offer Alert! 🚨

Ready to end the financial year on a high note? Get quick and easy loans with special low-interest rates at BHS Instant Loan Solutions! Whether it’s for an emergency, education, a new car, or debt consolidation, we’ve got you covered!

Comment FYEO or DM us or Click the link below and fill the details.

Hurry, apply now at bhsinstantloans.in or call 9743739944!

#bhsinstantloansolutions#BHSInstantLoans bhsinstantloan FinancialYearEndOffer QuickLoans LowInterestLoans FastApproval TransparentLoans HassleFreeLoans

0 notes

Text

Begin your investment journey with Money Bag Lending Loans! Fast approvals, competitive rates, and streamlined processes to kickstart your project immediately. 🚀💰

0 notes

Text

🚀 Maximize Your Loan Efficiency! Get the best rates, fast approvals, and hassle-free processing with InvestKraft. Your dream loan is just a click away! 💰✨

🔗 Apply now at www.investkraft.com

#InvestKraft#SmartLoans#LoanApproval#EasyLoans#FinanceMadeSimple#LowInterestRates#FastApproval#DreamHome#FinancialFreedom#MoneyMatters

0 notes

Text

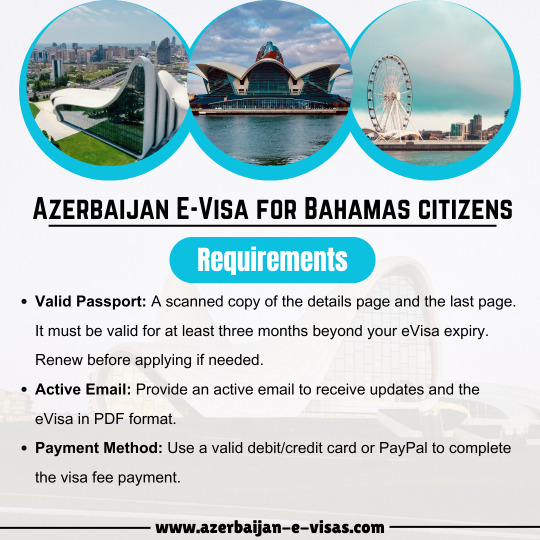

📢 Apply for your Azerbaijan e-Visa today! 🌍✨

Planning a trip to Azerbaijan? Ensure a smooth application process! ✅ Submit a scanned passport copy, provide an active email for updates, and complete the payment with a debit/credit card or PayPal. Don't wait—get your Azerbaijan eVisa hassle-free! 🛂✈

👉 Apply now and explore Azerbaijan! 🌟

#azerbaijanevisa#traveltoazerbaijan#evisaazerbaijan#visitbaku#bakutrip#exploreazerbaijan#visaonline#travelhasslefree#visitazerbaijan#azerbaijantravel#tourismazerbaijan#bakutravel#onlinevisa#easyvisa#fastapproval#azerbaijantourism#triptoazerbaijan#evisaprocess#travelsimplified#applynow

0 notes

Text

🚗 The Ultimate Luxury: Mercedes-Maybach S 680 🌟 Redefine sophistication and performance with the Mercedes-Maybach S 680. Crafted to deliver an unparalleled driving experience, this masterpiece combines cutting-edge technology with timeless elegance.

✨ Key Features: ✔ Twin-turbocharged V12 engine for unmatched power and smoothness ✔ Exquisite handcrafted interior with premium Nappa leather ✔ Advanced driver-assist features for seamless travel ✔ Panoramic roof with magic sky control for a luxurious view ✔ Exceptional sound system for an immersive audio experience ✔ Exclusive Maybach design details for superior style

⛰ $0 Down Lease or Finance Available!

Ready to experience the pinnacle of luxury? Auto Body Plug makes it easy with fast approval on car leasing and financing. Drive off in your dream car today! 📍 Location: 430-442 Peninsula Blvd, Hempstead, NY 11550 📞 Call us now: (838)-227-7584 | (838)-CAR-PLUG 🌐 Learn more: www.autobodyplug.com

0 notes