#Fibonacci extension indicator

Explore tagged Tumblr posts

Text

Hot Bulenox Discount 91%

#Fibonacci#fibonacci retracements#Fibonacci extensions#stocks trading#futures trading#currencies trading#fx trading#forex trading#commodity trading#indices trading#ETF Trading#cfd trading#spx#ndx#ftse#nifty#Sensex#trading education#cci#rsi

1 note

·

View note

Text

Exploring the Main Functions of TradingView: A Comprehensive Guide

TradingView has emerged as a leading charting platform for traders and investors, offering a wide range of functionalities that cater to various aspects of market analysis. This blog post delves into the main functions of TradingView, providing a comprehensive guide for both beginners and seasoned users.

Customizable Charts

At the heart of TradingView lies its highly customizable charts. Users can personalize their charting experience with an array of options, from selecting different chart types to adjusting timeframes for detailed analysis. The platform's flexibility allows traders to tailor their charts to fit their specific trading styles and preferences.

Technical Indicators and Drawing Tools

TradingView boasts an extensive library of technical indicators and drawing tools, enabling users to conduct in-depth technical analysis. Whether you're looking to apply moving averages, Fibonacci retracements, or trend lines, the platform provides all the necessary tools to identify potential trading opportunities and analyse market trends.

Keyboard Shortcuts

Efficiency is key in trading, and TradingView's keyboard shortcuts offer users a quick way to navigate and interact with the platform. From opening quick search with Ctrl + K to saving chart layouts with Ctrl + S, these shortcuts streamline the trading process, making it more intuitive and time-efficient.

Social Community Features

One of the unique aspects of TradingView is its robust social community. Traders can share ideas, learn from others, and network with a global community of like-minded individuals. This social aspect fosters a collaborative environment and provides a platform for traders to gain insights and perspectives from a diverse group of market participants.

Trading Platform Integration

TradingView supports integration with various trading platforms, allowing users to trade directly through the charting interface. This seamless integration simplifies the trading workflow, as traders can analyse the markets and execute trades without switching between different applications.

Alerts and Notifications

Staying informed is crucial, and TradingView's alert system ensures that users never miss important market movements. Traders can set up custom alerts based on price levels, indicators, or other criteria, receiving notifications through the platform, email, or mobile app.

Accessibility and Web-Based Platform

As a web-based platform, TradingView offers accessibility from any device with an internet connection. This means traders can access their charts and analysis tools from anywhere, at any time, without the need for downloading or installing software.

TradingView is a must-have for anyone in the financial world. It's got everything you require—from customizable charts to technical analysis tools, social networking, and seamless trading integration. Whether you're just starting out or a seasoned trader, TradingView has what it takes to elevate your market analysis and trading game.

And if you want to dive deeper into all that TradingView offers, there are guides and tutorials available to walk you through every feature and help you make the most of the platform. So, get ready to trade with confidence and make the most of your investments!

Remember, while crypto trading can offer profit opportunities, it also carries inherent risks. Proceed with caution and always prioritize protecting your investment capital.

2 notes

·

View notes

Text

Master the Markets: Best Share Market Courses in Pune & India for Technical Analysis and Option Strategies

In the current fast moving financial era, it is more important than ever to know how the stock market works. Whether you are a newcomer attempting to master the fundamentals or a seasoned trader seeking to improve your skills, taking the appropriate share market course can be the difference between success and failure. This holds particularly in cities such as Pune and Mumbai, where high-quality stock market classes are in highly demand owing to an increase in interest in wealth creation through equities, derivatives, and technical trading.

Why Choose Share Market Education?

Learning to navigate the market is not simply a matter of reading charts or keeping up with trends. It's about building a disciplined trader's mindset, risk management skills, and insight into market forces. Thorough share market training programs provide that foundation and much more. From learning fundamentals to mastering sophisticated tools, a properly structured curriculum gives you the advantage.

Best share market courses in Pune and in India today include specialized modules covering everything from:

Introduction to equities and market mechanics

Candlestick and price action analysis

Risk and money management

Trading psychology

Advanced modules such as Option Trading Strategies course and Advance Technical Analysis course

What is an Advance Technical Analysis Course About?

An Advance Technical Analysis course goes deep into market indicators, patterns, and trading systems. It prepares students to analyze price action accurately and make correct decisions using tools such as:

Fibonacci Retracements and Extensions

Elliott Wave Theory

Ichimoku Cloud Analysis

Volume and Open Interest Analysis

Advanced Charting Software (e.g., TradingView, MetaStock)

Such comprehensive training, offered at well-known stock market classes in Mumbai and Pune, keeps you ahead of the curve.

Mastering Options with a Focused Option Trading Strategies Course

Options trading is a high reward area of the market that needs to be understood in depth. A good Option Trading Strategies course teaches both the theoretical basis and actual execution of trades. Such courses typically feature:

Basics of options: calls and puts

The Greeks (Delta, Theta, Vega, Gamma)

Popular strategies such as Iron Condor, Straddles, and Spreads

Hedging techniques and risk reduction

Real market case studies and backtesting

You can find some of the finest guidance by opting for well-planned share market classes in Mumbai and Pune with a focus on theory and practice in the live market.

For more courses - https://sharemarketclasses.in/

How to Select a Good Share Market Institute

Selection of a good share market institute is key to receiving quality education. Find out the following:

Certified and experienced trainers

Practical training with market simulators

Up-to-date curriculum based on market trends

Availability of trading tools and guidance

Good student reviews and reputation in the industry

Urban cities such as Mumbai and Pune also have numerous institutes that provide exhaustive stock market classes. Whether one is a student, a professional, or retired, flexible timing and batch facility make learning feasible for all. Why Choose Stock market Classes in India?

India has become a retail trading hotspot around the world. The quality and diversity of stock market classes in India (and share market classes in India) have increased significantly over the years. Through a combination of online and offline courses, students from across the country can now benefit from high-level market training that previously was concentrated in metro cities.

Learn from the Best at eMS Stock Market Institute

If you're searching for career focused, hands on share market courses in Pune or best stock market classes in Mumbai, eMS Stock Market Institute is the place to be. With a legacy of excellence in training and guidance, eMS provides holistic programs in advance technical analysis course, option trading strategies course, and complete share market training. Whether you are embarking on the journey or aspire to be a professional trader, eMS guarantees that you possess the tools, information, and assistance necessary to succeed in the financial markets.

Are you seeking in person or online stock market classes?

#share market classes in pune#Share Market Courses In Pune#best share market courses in pune#share market classes#Best Share Market Classes In Pune

1 note

·

View note

Link

#ARKInvest#Bitcoin#Blockchain#cryptocurrency#ETFs#FinancialMarkets#institutionalinvestment#marketanalysis

0 notes

Link

#chartpatterns#FibonacciLevels#FibonacciRetracementTrading#GoldenRatio#MarketPrediction#marketvolatility#priceaction#ProfitTaking#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradeEntryPoints#TradingSignals#TradingStrategy#TrendReversal

0 notes

Text

XRP's Big Breakout Is Coming — Is Your Crypto Wallet Ready?

The cryptocurrency market never stays silent for too long — and XRP is the latest asset signaling a major move. After weeks of consolidation, XRP is building up energy that could soon explode into a significant rally.

Technical analysis based on the Elliott Wave Theory suggests that Wave 5 is approaching, potentially sending XRP’s price to an ambitious target of $5.85. As the opportunity heats up, smart investors are choosing reliable platforms like UPBonline to position themselves early and securely.

XRP's Long Consolidation: Calm Before the Storm

For months, XRP has been trading between a narrow range, frustrating traders who seek volatility. But consolidation periods are often precursors to large breakouts.

Key drivers behind XRP's sideways movement:

Regulatory uncertainties clouding the U.S. market

Ripple Labs' ongoing legal battles with the SEC

Broader crypto market hesitation in the face of macroeconomic factors

However, technical charts are now showing signs that the end of this consolidation is near, and a breakout could be imminent.

Why Wave 5 Could Be Historic for XRP

The Elliott Wave Theory is a classic method of predicting market cycles, and XRP’s current structure fits the textbook setup:

Wave 1: Initial rally

Wave 2: Corrective pullback

Wave 3: Strong surge

Wave 4: Complex correction (ongoing)

Wave 5: Final upward move — possibly the most aggressive

Analysts expect Wave 5 to push XRP toward $5.85, backed by technical indicators, Fibonacci levels, and XRP’s historical patterns.

As these signs align, investors preparing ahead with strong platforms like UPBonline could be better positioned to act quickly and securely when momentum shifts.

Technical Indicators Supporting a Breakout

Several bullish signals are flashing:

RSI levels are in oversold territory

MACD is forming a bullish crossover

Accumulation by whales is rising, indicating institutional interest

Fibonacci extensions point toward the $5.50 to $6.00 range

Moreover, XRP’s strong support around the $0.55 level has held firm, setting a foundation for an upward explosion.

With this setup, retail investors using traditional exchanges might face delays — but using agile, crypto-focused platforms like UPBonline ensures faster, smoother transactions.

Why UPBonline is the Right Choice for the Next Crypto Move

As XRP gears up for a possible surge, the importance of choosing the right trading and banking partner cannot be overstated. UPBonline offers a seamless platform for crypto banking, secure crypto payments, and instant XRP transactions.

Top reasons to choose UPBonline before the breakout:

Fast transaction speeds

High-security standards

Easy XRP management

Integrated crypto banking solutions

Professional-grade support for traders and investors

Instead of scrambling after the rally begins, UPBonline users are already positioned, ready to capitalize on XRP’s next big wave.

Conclusion: Prepare Early, Act Smart

XRP’s consolidation phase appears to be nearing its end. Technical patterns, market indicators, and broader sentiment suggest that Wave 5 could soon launch XRP toward $5.85.

In the fast-moving world of crypto, timing is everything. Choosing a powerful, reliable platform like UPBonline could make the difference between catching the breakout or missing the opportunity.

Are you ready to ride XRP’s Wave 5? Secure your position today with UPBonline and stay ahead of the market! 🚀

1 note

·

View note

Text

Advanced Technical Analysis: Pro Trading Strategies & Market Insights

Advanced Technical Analysis is designed for traders and investors who want to take their market analysis skills to the next level. This course delves deep into sophisticated trading strategies, advanced chart patterns, and complex technical indicators to enhance decision-making and maximize profitability. Learn about Elliott Wave Theory, Fibonacci extensions, Ichimoku Cloud, Volume Profile, Divergence Analysis, and Algorithmic Trading techniques. Gain insights into market psychology, risk management, and high-probability trade setups to navigate stocks, forex, and cryptocurrency markets with precision. Whether you're a seasoned trader or looking to refine your strategies, mastering advanced technical analysis will give you a competitive edge in today’s dynamic financial markets.

0 notes

Text

Pi Coin (PI) Nears Breakout — Bulls Eye Major Upside Move

Pi Coin (PI) is approaching a significant breakout, with technical indicators pointing to an imminent price surge. As the asset consolidates within a symmetrical triangle, bullish momentum continues to build, signaling potential gains for traders.

With PiWallet’s upcoming token launch in March and its beta release in April, the Pi wNetwork ecosystem is set to expand further, strengthening its DeFi and Web3 capabilities.

PI Technical Analysis — Symmetrical Triangle Breakout Ahead?

Key Takeaways:

✅ Breakout Nearing: Pi Coin consolidates within a symmetrical triangle, approaching the apex. ✅ Bullish Wave Structure: Elliott Wave analysis suggests an imminent upward continuation. ✅ Fibonacci Targets: Key resistance levels indicate potential for an extended rally.

Pi Coin’s 1-hour and 15-minute charts indicate the formation of a bullish impulse wave, signaling potential upside. RSI levels remain neutral, suggesting neither overbought nor oversold conditions, while Fibonacci extensions highlight key price targets.

📈 PI Price Analysis

Pi Coin’s symmetrical triangle pattern follows an extended impulsive wave, which suggests that the asset is preparing for the next leg up in its cycle.

🔹 Support Levels: Holding above $1.46 remains crucial for maintaining bullish momentum. 🔹 Resistance Levels: PI must break $1.64 first before targeting $1.79 — $1.87. 🔹 Breakout Probability: Strong buying pressure and PiWallet’s upcoming ecosystem expansion could support sustained bullish movement.

PIUSD

PiWallet Expansion & PiWT Token Launch

PiWallet, the first Web3 wallet on Pi Blockchain, is set to launch its beta version in April, introducing key features like:

✨ Portfolio Management ✨ DApps Browser ✨ Swap DEX ✨ DeFi Staking & Yield Farming

Additionally, PiWallet’s native token, PiWT, is launching in March on BSC before migrating to the Pi Network. This token will power staking, rewards, and liquidity within the PiWallet ecosystem, enhancing Pi Network’s growing DeFi infrastructure.

Final Thoughts — What’s Next for PI?

✅ Technical indicators favor a breakout above $1.64. ✅ Upcoming PiWallet and PiWT token launches add fundamental support. ✅ Holding above $1.50 is critical for sustained bullish momentum.

With Pi Coin nearing a breakout and PiWallet expanding its ecosystem, the next few weeks will be pivotal in shaping the future of Pi Network’s DeFi landscape.

📢 Stay tuned for updates on Pi Coin’s price action and PiWallet’s launch! 🚀

1 note

·

View note

Text

5 Key Indicators Every Trader Should Know: Essential Tools for Today's Market

The Trading Compass: Navigating India's Current Market

Hey there, fellow traders! 📈 Have you been feeling the market's unpredictability lately? You're not alone! I've been trading through this volatility too, and wanted to share some hard-earned wisdom about the technical indicators that have truly made a difference in my decision-making process.

India's market has been particularly turbulent recently, with everything from global economic shifts to domestic policy changes throwing curveballs our way. That's why having reliable tools to guide your trading decisions isn't just helpful—it's essential for survival in today's market environment.

Let me walk you through the five indicators I personally rely on every single day:

1. RSI: Your Market Mood Reader

Think of the Relative Strength Index as your market psychiatrist—it tells you when the market is getting too emotional in either direction. On a scale of 0-100, it measures whether an asset is potentially overvalued or undervalued.

I've found RSI incredibly reliable lately, especially when:

It pushes above 70, suggesting a stock might be running too hot (happening frequently in our tech sector right now)

It dips below 30, hinting at oversold conditions (I've found some great bargains in manufacturing this way)

2. MACD: Your Trend's Best Friend

Don't let the complicated name fool you! The Moving Average Convergence Divergence indicator simply helps you understand the momentum and direction of trends.

Here's how I personally use MACD in today's market:

When the MACD line crosses above the signal line, I pay attention—this bullish signal has been remarkably accurate in renewable energy stocks lately (helped me catch a 12% move just last week!)

I watch the histogram to see momentum building or fading—crucial for timing entries and exits

Zero-line crossings give me confidence about the overall trend direction—essential for my medium-term positions

3. Bollinger Bands: Your Volatility Visualizer

In times like these, understanding volatility is everything—and Bollinger Bands make it visual. They expand during chaotic periods and contract during calmer ones.

Three ways I apply Bollinger Bands in my daily trading:

Band width immediately shows me if volatility is increasing/decreasing—absolutely crucial as our markets navigate current transitions (saved me from several false breakouts recently)

I love finding mean reversion opportunities when prices touch band extremes—this strategy has been particularly profitable in FMCG stocks

After consolidation periods, decisive band breakouts often precede strong trends—I've seen this pattern repeatedly in banking stocks this year

4. VWAP: Your Institutional Edge

As algorithms dominate more trading, understanding where big money is active becomes critical. VWAP (Volume-Weighted Average Price) helps me see the true average price incorporating volume—essentially showing where institutions are likely active.

Here's how VWAP gives me an edge:

Major institutions use it for execution benchmarks, creating natural support/resistance levels

Trading above/below VWAP helps confirm my intraday bias—essential in today's quick-moving markets

I use it as an exit benchmark to improve my average performance

5. Fibonacci Retracement: Your Timeless Market Map

It amazes me that a mathematical sequence discovered centuries ago works so well in our digital markets today, but Fibonacci retracement levels consistently help identify potential turning points.

My three favorite Fibonacci applications:

The 38.2%, 50%, and 61.8% retracement levels provide amazing entry points in trends—I've used these successfully throughout this year's commodity cycles

Fibonacci extensions help me project realistic profit targets beyond previous highs/lows

When Fibonacci levels align with other indicators like RSI or MACD, the high-probability setups that emerge have dramatically improved my win rate

Bringing It All Together: The Integrated Approach

Here's what I've learned after years of trading: while each indicator offers valuable insights, the real magic happens when you combine them strategically. I don't make major trading decisions without confirmation from multiple indicators—it's like having several expert advisors all agreeing on the same trade. You can learn this strategies and how to effectively apply them by enrolling in the Stock Market Courses in Mumbai

I'd love to hear which indicators you find most helpful in your trading! Drop a comment below and let's learn from each other. Happy trading! 📊

1 note

·

View note

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw ringing in the New Year and ringing out a fabulous 2024, that the week showed some disappointment in equity markets year end and an early year rebound. Elsewhere looked for Gold ($GLD) to continue to consolidate the major move higher while Crude Oil ($USO) rose in consolidation in the lower end of a broad range. The US Dollar Index ($DXY) looked to continue the breakout higher while US Treasuries ($TLT) consolidated at 14 month lows.

The Shanghai Composite ($ASHR) looked to reverse its uptrend with a break lower while Emerging Markets ($EEM) were reversing their uptrend. The Volatility Index ($VXX) looked to remain low making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ continued to look strong on the longer timeframe. On the shorter timeframe both looked a little weaker but finding support. The $IWM was recovering, and so far, maintaining the uptrend.

The week played out with Gold moving higher in consolidation all week while Crude Oil found some strength Friday and moved to 3 month highs. The US Dollar continued to move up to a 26 month high while Treasuries resumed the move lower. The Shanghai Composite continued its short term move lower while Emerging Markets sank to a 5 month low.

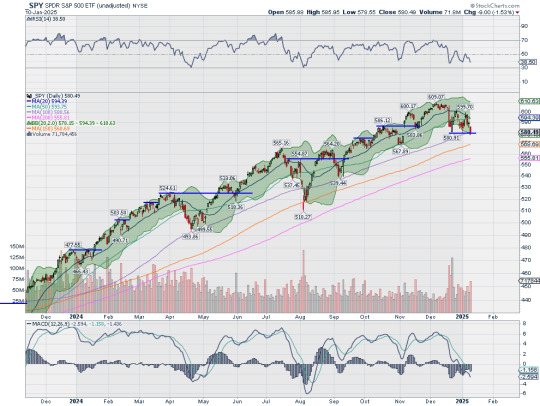

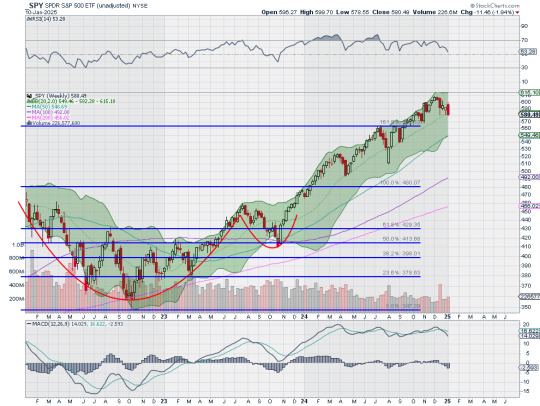

Volatility ticked higher on the week testing the 20s. This put a damper on the beginning of the year bounce in equities and they fell back. This resulted in the SPY dropping back to the November election gap, the QQQ retesting a major Fibonacci extension and the IWM nearly tagging its 200 day SMA for the first time in 13 months. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week bouncing off support at the December low on the daily chart. It continued higher Monday but could not make a higher high and fell back the rest of the week. It ended Friday at a 2 month low at the 100 day SMA and into the Election gap. The Bollinger Bands® have shifted lower on the daily chart. The RSI is dipping into bearish territory and making lower highs while the MACD is negative and falling.

The weekly chart ended with a bearish engulfing candle at the 20 week SMA. This is the first touch at the 20 week SMA in 4 months. The RSI is rolling lower toward the midline in the bullish zone with the MACD crossed down and falling but positive. There is support lower at 580 and 574.50 then 571.50 and 565.50 before 561.50 and 556.50. Resistance higher is found at 585 and 590 then 593 and 600 before 604 and 609. Pullback in Uptrend.

Heading into the January options expiry and the start of earnings season, equity markets showed some short term weakness. Elsewhere look for Gold to continue its rise in consolidation while Crude Oil consolidates in the upper half of a broad range. The US Dollar Index continues to drift to the upside while US Treasuries resume their downtrend. The Shanghai Composite looks to continue the short term move lower while Emerging Markets consolidate continue their downward reversal.

The Volatility Index looks to remain on the edge of low to slightly elevated making the path easier for equity markets to the downside. Their charts are starting to show some cracks on the weekly chart, but with the QQQ remaining strong, on the longer timeframe. On the shorter timeframe the SPY, the QQQ and the IWM all are making lower lows and looking weaking. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview January 10, 2025

1 note

·

View note

Text

Ethereum Mirrors Bitcoin’s Historic 45% Surge: An In-Depth Look at the Price Chart

Key Points

The Ethereum price surge above $3,700 sparks hope for a rally similar to Bitcoin’s 45% increase.

Analysts predict Ethereum could approach the $10,000 mark by the end of this rally.

The recent surge in the price of Ethereum (ETH) above $3,700 has sparked significant optimism.

Expectations are high for a rally that could see the price rise to $4,000 in the short term and potentially even reach a new all-time high.

Ethereum and Bitcoin: Parallel Price Movements

Interestingly, the current ETH price chart bears a striking resemblance to the Bitcoin (BTC) price chart prior to its 38% rally in November.

The three-line break chart for Ethereum, which smooths out daily price fluctuations, suggests an 8-month corrective trend has ended.

This could potentially lead to a bullish chain reaction, attracting new buyers and forcing out sellers who have been suppressing price rallies during consolidation periods.

Bitcoin demonstrated a similar breakout in mid-October, which triggered a rally that led it to a new all-time high of $73,000.

Since then, the BTC price has surged by 45%, reaching over $96,000.

Supporting Factors for Ethereum’s Bullish Outlook

The recent activity on the Ethereum network also supports the bullish outlook for ETH.

The number of “blobs” posted by layer 2 protocols on Ethereum saw a sharp increase in November, which incurs fluctuating fees paid in Ether.

These fees are burned, similar to regular transaction fees, reducing the overall supply of ETH in the market and creating an upward pressure on the Ethereum price.

Predictions for Ethereum’s Price Rally

While Ethereum has yet to cross the immediate resistance of $4,000, calls for its rally to $10,000 have already begun.

Crypto analyst Titan of Crypto suggests that the ETH price could reach new highs, potentially between $7,800 and $9,900.

Historical trends indicate a potential top near the 141.40% Fibonacci extension, which previously marked the peak in the last cycle.

If history repeats itself, some analysts believe Ethereum could approach the $10,000 mark by the end of this rally.

However, Ethereum has recently faced strong rejections at $3,700.

Thus, securing a daily close above this level is crucial to meet the immediate target of $4,000.

On the other hand, inflows into spot Ethereum ETFs have picked up pace over the last week of November, seeing more than $550 million in weekly inflows.

Last Friday, the daily inflows in spot Ethereum ETF surpassed the inflows of Bitcoin ETFs for the first time since inception.

0 notes

Text

Sui vs Solana: A Comprehensive Comparison Sui vs Solana: A Comprehensive Co- Sui vs Solana: $2.29 -Solana: A Comprehensive $188.28

-Solana: A Comprehensive $5.39 billion - A Comprehensive Compare $83.19 billion

As of November 7, 2024, Sui (SUI) is trading at approximately $2.29, while Solana (SOL) is at $188.28. Sui’s market capitalization stands at around $5.39 billion, significantly smaller than Solana’s $83.19 billion.

Technical Analysis and Short-Term Price Prediction for Sui:

Recent analyses suggest that SUI is exhibiting bullish momentum. The 50-day and 200-day moving averages are trending upward, indicating a strong trend. The Relative Strength Index (RSI) is within the neutral zone (30-70), suggesting that the price is neither overbought nor oversold.

If SUI maintains its upward momentum, it may soon rally to retest its next key barrier of $2.36, the all-time high. A successful close above this level could pave the way for SUI to target the 141.40% Fibonacci extension level at $3.15.

Comparison with Solana:

Solana has established itself as a leading blockchain with an active community and numerous successful projects. In contrast, Sui’s ecosystem is still in its early stages of development and is currently far from reaching the level of Solana.

Market Capitalization Comparison:

Currently, Solana’s market cap stands at $71.7 billion, roughly 12 times greater than Sui’s $6 billion. However, when looking at fully diluted market caps—which account for all tokens that could potentially enter circulation—Solana’s $90 billion valuation is only about four times larger than Sui’s.

Future Trends and Considerations:

Sui has shown potential with its innovative technology and rapid ecosystem expansion, making it a formidable contender in the blockchain space. While it may not immediately overtake Solana, the evolving crypto landscape could see shifts in market dynamics over time.

Investors should monitor Sui’s development progress, adoption rates, and overall market conditions to make informed decisions.

0 notes

Text

An Introduction

Welcome to the world of Alpha Fibonacci, where ancient Fibonacci wisdom built a foundation for the renowned Alpha Fibonacci Precise Trading Method. In this ebook, you’ll embark on a journey to discover the power of the Alpha Fibonacci Trading System, a revolutionary approach that has transformed the way traders navigate financial markets. Whether you’re new to trading or a professional trader, this e-book will provide you with the insights to elevate your trading game to the Alpha Precision.

Chapter 1: Introduction to Fibonacci

In this chapter, we’ll explore the fascinating origins of the Fibonacci sequence, its discovery by Leonardo of Pisa, and how these intriguing numbers appear in various aspects of nature. We’ll then delve into how the Fibonacci sequence forms the foundation for our Alpha Fibonacci Trading System, setting the stage for its application in the financial markets.

Chapter 2: Fibonacci in Trading

Here, we’ll uncover the pivotal role Fibonacci plays in trading. By comparing Fibonacci with traditional indicators, we’ll highlight its superior predictive capabilities and why it’s favored by professional traders. You’ll learn how Fibonacci levels serve as key support and resistance areas, providing a roadmap for price movement. This chapter sets the stage for understanding the core principles for precise and predictive trading.

You’ll discover the unique characteristics of Fibonacci retracement and extension levels, essential tools for identifying potential reversal points in the market. We’ll explain how these levels can be used to set entry and exit points, manage risk, and enhance your overall trading strategy. By the end of this chapter, you’ll have a solid grasp of why Fibonacci is a cornerstone of successful trading.

Chapter 3: Introduction to the Alpha Fibonacci Trading System

Now that you understand the fundamental role of Fibonacci in trading, we’ll introduce you to the Alpha Fibonacci Trading System. This chapter provides an overview of what sets this system apart from conventional trading methods. You’ll learn about its unique features, such as precision timing, adaptability to all instruments and platforms, and how it leverages the natural rhythm of the markets. By the end of this chapter, you’ll see why the Alpha Fibonacci Trading System is a game-changer for traders seeking consistent, reliable results.

Chapter 4: How Alpha Fibonacci Trading System Can Improve Your Trading

Conclusion: Embrace the Alpha Fibonacci Transformation

1.0 - A Brief History Of Fibonacci

In this chapter, we'll explore the fascinating origins of the Fibonacci sequence, its discovery by Leonardo of Pisa, and how these intriguing numbers appear in various aspects of nature. We'll then delve into how the Fibonacci sequence forms the foundation for our Alpha Fibonacci Trading System, setting the stage for its application in the financial markets .

What is important to know prior to diving into Fibonacci mathematics: math complexities are not required to apply Alpha Fibonacci but rather used as a preset settings for Precise Entries, Stops and Targets.

Fibonacci numbers were derived from an Italian mathematician Leonardo Pisano and documented initially in the 13th Century. Pisano was considered by some as the most talented Western mathematician of the Middle Ages and made many of the original contributions within complex calculations.

It was whilst journeying with his father that Pisano began to develop his mathematical skills and solve problems relating to merchant trade and price calculations. He started to observe that certain ratios of a number series can describe the natural proportions of the Universe including price data.

With this in mind Pisano devised a series of numbers that were derived by starting at 0 and 1 and then adding the two previous numbers to create the next number in the series. This series reaches all the way out to infinity and the start of the sequence looks like the following:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987 ……. and so on to infinity.

The ‘Golden Ratio’ is a term that is associated with Fibonacci and the ratio is determined by a special relationship found within the number series. After the commencement of the first few numbers there is found to be a ratio multiplier of 1.618 between each number for example:

55 x (1.618) = 89, 89 x (1.618) = 144, 144 x (1.618) = 233 and so on.

Further work has been done on the Fibonacci ratios to provide yet another sequence which is used in today’s Fibonacci Analysis. Without going too deep into the square roots, reciprocals or other mathematical formulas of these numbers the list of values which are in use are:

2.0 - Fibonacci vs Indicators TechnicaIndIndicators

Fibonacci in Trading

Fibonacci is a highly powerful natural precise predictive tool in trading when used with a proven strategy. Fibonacci cant not be placed on the charts randomly without rules and with speculative levels.Based upon mathematical concepts of the Fibonacci Sequence, nomath knowledge required to use Alpha Fibonacci correctly. Fibonacci is naturally predictive and the only tool, which can identify price entries, targets and reversals in advance of current prices. The accuracy of Fibonacci lends itself to finding precise key entries and precise key targets with retal and instituional support and resistance within the markets thus identifying precise trade entry and profit target prices.

Technical Indicators are mostly delayed with limitations in that they are often expensive, work only on certain platforms and lag behind the markets. Fibonacci Tools on the other hand are common to the vast majority of trading platforms, work on any instrument, any timeframe and are predictive in nature.

Characteristics of Alpha Fibonacci & Indicators

ALPHA FIBONACCI

INDICATORS

Naturally Predictive

Delayed

Precise

Artificial

Can be used on:

Can only be used on:

All Platforms

Specific Platforms

All Instruments

Specific Timeframes

All Timeframes

Cost can be Considerable

3.0- Introduction to the Alpha Fibonacci Trading System

The Alpha Fibonacci Trading System represents the culmination of centuries of mathematical evolution, tailored specifically for the modern trader. Developed by Alla Peters-Plocher in 2004, the system emerged from a profound understanding of Fibonacci principles and extensive market experience. Its precision was notably affirmed during the financial crisis of 2008, a time when traditional trading strategies floundered. Since 2011, traders from beginner to hedge fund manager in US and around the globe have been leveraging this Proprietary system, transforming their approach to the markets with remarkable success across all instruments and all platforms.

The Alpha Fibonacci Trading System is more than a set of tools; it's a comprehensive methodology. It adapts to all instruments and platforms, offering traders a structured approach to deciphering precise strategic market patterns. By tapping into the natural rhythm of price movements, this system allows traders to anticipate market turns with remarkable accuracy.

In the following sections, we'll explore how the Alpha Fibonacci Trading System can be integrated into your trading routine, enhancing precision, managing risk, and ultimately elevating your trading success.

Contact Fibonacci Trading Institute

If you would like to see the accuracy of Fibonacci and the FTI Method in action, then please get in touch and be welcomed as a guest in the trading room.

Contact Alla Peters- Plocher:

Phone: (925) 257-4298

Web: www.FibonacciTradingInstitute.com

0 notes

Link

#chartpatterns#IchimokuCloudTrading#KumoCloud#markettrends#marketvolatility#MomentumTrading#priceaction#ProfitTaking#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendAnalysis

0 notes

Text

Captain Faibik, a leading crypto analyst, has identified a bullish breakout for Ethena (ENA), suggesting a shift from a bearish to a bullish market trend on the 4-hour chart. The breakout from a descending channel pattern—previously signaling lower highs and lows—signals a potential trend reversal, sparking optimism for ENA's future price action. A bullish candle near the breakout peak reinforces this shift, with Fibonacci extension analysis indicating key resistance at $1.300, aligning with the 0.478 Fibonacci level. This could act as a potential price target if the bullish momentum continues.

Following the breakout, ENA’s price surged 12.45%, reaching $0.903628 and highlighting increased investor confidence. However, the analyst emphasizes the importance of ENA maintaining this breakout level; otherwise, a reversion to the bearish trend may occur.

0 notes