#File 1099 MISC For 2022

Explore tagged Tumblr posts

Photo

Ready to file tax returns? File Form 1099s with Form1099Online an IRS authorized e-file provider. Our e-filing services available 24*7 to provide completely US-based customer support. File: https://www.form1099online.com/1099-forms/1099-misc-form/

#1099 MISC#IRS Form 1099 MISC#E-file 1099 MISC#File 1099 MISC Online#File 1099 MISC#File 1099 MISC For 2022#1099 MISC Form#1099 MISC 2022

0 notes

Text

About this item

You can now print to blank check stock. Customization of the check layout is "not" possible at this time. Check the Help file for additional details.

Electronic form filing for W-2, 1099-NEC and 1099-MISC is available through a third party service (there is a nominal fee for this service).

Tax forms for 2022

Includes tax tables for 2023

Support for new 1099-NEC form

#bookkeeper#easilymanageyourbusinessbybookkeeper#lowerpricebookkeeper#bookkeepeerincludingtax#bookkeeperincludingtax2023

0 notes

Text

1099-MISC tax forms for platforms and marketplaces: An introduction

A 1099-MISC form: what is it?

A tax information form called the 1099-MISC is often used to report any payments made to a contractor or service provider. This aids the IRS in keeping track of how much tax revenue contractors and independent contractors will likely generate. In contrast to regular, W-2 employees, who have their taxes routinely withheld by employers, independent contractors, who are considered to be a "business-of-one" when contracting, are responsible for managing their own taxes.

Who submits a form 1099-MISC?

The organization or business owner who pays the service provider or contractor for their services must report such payments to the IRS and submit a copy to the recipient of the payment, who may be a service provider or contractor.

The 1099-NEC will now be used by many companies who previously filed the 1099-MISC to record non-employee compensation in Box 7.

Who gets a form 1099-MISC?

Both the service provider or contractor and the IRS receive copies—either through electronic filing or print mailing—for their records. Normally, businesses are only required to submit 1099-MISCs to service providers or contractors who have received $600 or more in compensation in a calendar year and who are based in the US or are US taxpayers.

Deadlines

The IRS must receive 2022 tax forms by January 20, 2023, via Stripe 1099. By doing this, the forms will be submitted to the IRS and a copy will be mailed to the beneficiaries in time for the January 31, 2023 IRS deadline.

factors for 1099-MISC state filing

Remember that your state can additionally have specifications and distinct due dates for submitting and reporting 1099-MISCs. To find out what paper work you need to file with your state, we advise speaking with a tax advisor.

E-filing 1099-MISCs with the IRS versus mailing them

Anybody who issues more than 250 1099 forms must electronically file tax returns with the IRS. It is permitted to e-file even if fewer than 250 forms are being submitted.

Penalties:-

You may be subject to IRS fines of $50 to $280 per form if any of the following occur:

1. Don't submit an information return by the due date to the IRS.

2. Don't deliver the statement to the receiver by the due date

3. Keep your Taxpayer ID a secret (TIN)

4. Please report a false TIN.

5. Declare false information

6. When compelled to e-file with the IRS, do not do so.

If willful disrespect or neglect is proven, harsher punishments may be applied.

#form 1099#1099 nec#1099 nec form#1099 misc#1099 misc form#1099 online#1099 form online#1099 nec filing#irs 1099 form#online irs form 1099 filing#kansas#us#trending

0 notes

Text

End-of-Year Bookkeeping Tips for Your Business

Get your books in order now to enjoy a stress-free tax season and plan ahead for next year. Read these bookkeeping tips to learn more.

Late fall into early winter can be a stressful time for a business leader, especially if the holiday season is critical to your bottom line. Just when you need to amplify your focus on your day-to-day operations, you also have to get your books in order for the year’s end. That includes preparing 1099 forms, which can number in the hundreds or even thousands depending on the nature of your business. If your recordkeeping isn’t clean, you could be in for a rough time.

And messy recordkeeping could cost you more than time. It could also result in a big bill from your CPA if they have to devote many extra hours to sorting out your tax documents.

This is a great opportunity to make sure your financial data is up to date and accurate before tax season. Why? Because with reliable financial data, you’ll also gain insights that can help you strengthen your business for next year.

First Things First

Whether you’re gathering records for your CPA to prepare your tax return or for your own budgeting and forecasting purposes, there are a number of boxes that you need to check. These include:

Reviewing systems to make sure no important bookkeeping data is missing: Many companies use integrated scheduling, bill paying and bookkeeping apps. If you have data feeding into your bookkeeping system from other apps, confirm it’s all mapped correctly.

Monthly reconciliations: Resolve any discrepancies now, before dealing with additional year-end work.

Having Up-to-Date Records from Vendors and ContractorsIt can be particularly stressful to chase after required documents from outside sources when the clock is ticking toward your tax-filing deadline. Start now to make sure you have what you need, including:

As a reminder, the IRS reintroduced form 1099-NEC last year. The NEC stands for non-employee compensation, so this covers anything you paid to anyone who is not actually on staff, such as vendors and independent contractors. The filing deadline for both the IRS and payees is January 31, 2022.

Speaking of which: Make sure W-9 forms are on file for all vendors and independent contractors — and that all information such as mailing addresses is up to date.

Also, be aware that even if that vendor or contractor operates as an LLC, you might still need to send them a 1099, depending on how the LLC is set up. As a general rule, you must send a 1099-NEC to any LLC to which you paid more than $600, but you do not have to send a 1099 to an LLC — or any other vendor — that you paid via credit card.

Finally, use the revamped form 1099-MISC to report rent payments, royalties, etc.

Plan Time for Planning

At the very least, arrange to actually meet with your CPA rather than do a simple handoff of your financial records. As tax-preparation professionals, they might have valuable advice on how to reduce your tax liabilities in the future or suggest additional deductions that you might not know about.

An outsourced bookkeeping and controller services provider can also be a huge help by starting the budgeting and forecasting process even farther upstream. This can be of particular benefit now, given the disruptions that have affected just about every small business in recent years.

Depending on your type of business and any changes you made in your business model this year (e.g., launching an online retail component or adding or closing a location), you could review various metrics to get a fix on trajectory for the coming year. These include cost of goods sold, profit per project and gross profit margin. Your bookkeeping and controller services provider can help you determine which data will give you the greatest insight to help meet your business goals.

At Supporting Strategies, our experienced, U.S.-based professionals use secure, best-of-breed technology and a proven process to provide a full suite of bookkeeping and controller services. Are you ready to learn how you can move your business forward? Contact Supporting Strategies today.

0 notes

Text

The 2022 Tax Season Has Arrived!

Not sure you’ll consider this good news or not, but the Internal Revenue Service (IRS) announced it is now accepting and processing 2021 federal income tax returns. This year brings additional challenges as the agency continues to process over 24 million returns from 2020 due to coronavirus stimulus checks, scaled-up child tax credit payments and widespread staffing shortages.

The IRS expects more than 70 percent of taxpayers will get tax refunds this year. Last year, 128 million refunds were issued, with an average refund of around $2,775. More than 150 million returns are expected to be filed so don't wait to get started on yours!

Below are some key things you need to know when filing your 2021 tax return.

Changes to Tax Filing Deadline

This year, the deadline to file individual and joint 2021 tax returns is Monday, April 18, 2022. Keep in mind, not only are returns due by that date, but so is any amount owing! Taxpayers requesting an extension will have until Monday, October 17, 2020 to file. For S-Corp & LLCs/Partnerships, the filing deadline is March 15, 2022.

If for some reason you won’t be ready to file by the deadline, you can always request an extension. However, just remember that filing an extension does not mean you have more time to pay your taxes. Any tax owed is still due by the original filing deadlines.

Also – please be aware that, if you want to take advantage of the CA Passthrough Entity Tax, the full tax must be paid no later than March 15th – there are no extensions.

Accuracy is Critical to Avoid Delays

When a tax return doesn’t match up with IRS records, it’s placed in the agency’s paper processing backlog – a complex traffic jam that’s been increasingly harder to move through amid the pandemic and IRS staffing challenges. That means taxpayers are likely to encounter delays if they make a mistake when they file. Taxpayers who wait until the last-minute risk making errors, especially if their records aren’t in good order. Here are a few things to keep in mind as you begin preparing your return:

Gather all necessary records, such as W-2s, 1099s, receipts, canceled checks and other documents that support an item of income, or a deduction or credit, appearing on a tax return.

Develop a system that keeps all important information together, including a software program for electronic records or a file cabinet for paper documents in labeled folders. Having all records readily at hand makes preparing a tax return easier.

Compile all year-end income documents, such as Form 1099-MISC, Form 1099-INT, Form 1099-NEC, Form 1099-G, Form 1095-A and certain government payments like unemployment compensation or state tax refund.

Electronic Filing and Direct Deposit Are the Fastest Way to Get a Refund

Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year to avoid refund delays. If you need a tax refund quickly, save a tree and use software, a trusted tax professional like Truax or Free File on IRS.gov. For people with no tax return issues, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit.

Reconcile Advance Child Tax Credit Payments

If you received advance Child Tax Credit payments, you need to file a 2021 tax return. You’ll need to compare the advance Child Tax Credit payments that you received with the amount of the Child Tax Credit that you can properly claim on your 2021 tax return. This includes people who successfully used the Non-Filer tool in 2021. The IRS will be sending you Letter 6419 with the total amount of advance Child Tax Credit payments you received in 2021. To avoid a processing delay, you’ll need to report the total amount and should keep an eye out for your Letter 6419 before you file. If you don’t have a letter or have questions about the amount you received, you can see the total advance Child Tax Credit payment amount using your IRS Online Account.

Claim a Recovery Rebate Credit (Stimulus Payment)

Individuals who didn't qualify for the third Economic Impact Payment or didn’t receive the full amount may be eligible for the Recovery Rebate Credit based on their 2021 tax situation. Those eligible will need to file a 2021 tax return, even if they don't usually file, to claim the Recovery Rebate Credit. They will also need the total amount of their third Economic Impact Payment, including any supplemental or “plus-up” payments, to file their return accurately and avoid a processing delay. In early 2022, the IRS will send out Letter 6475 to provide the total amount of the third Economic Impact Payments that individuals received. Individuals can also get this information by logging in to their IRS Online Account.

What to do if your tax return from 2020 is still being processed.

People whose tax returns from 2020 have not yet been processed can still file their 2021 tax returns. For anyone in this group filing electronically, here’s a critical point: taxpayers need their Adjusted Gross Income, or AGI, from their most recent tax return when they file electronically. For those waiting on their 2020 tax return to be processed, make sure you enter $0 (zero dollars) for last year’s AGI on the 2021 tax return.

Unemployment Compensation is Taxable

Millions of Americans received unemployment compensation last year, and it’s fully taxable in 2021. The American Rescue Plan Act of 2021 allowed an exclusion of unemployment compensation of up to $10,200 for 2020 only. Remember for 2022, if no federal income tax is withheld from unemployment payments, it could mean an estimated tax payment should be made. For more information, review Tax Topic 418, Unemployment Compensation and Publication 525, Taxable and Nontaxable Income, on IRS.gov.

If you have any questions about completing your 2021 tax return or need additional info about the filling requirements, please CONTACT US right away. We know how stressful this time of year can be and our certified tax professionals are here to help!

0 notes

Text

Form 1099-MISC and 1099-NEC: What’s New in 2022

Let’s talk about the most fundamental and significant form that every employer and organization needs to know. Yes, you are right; we are talking about Form 1099. As you know, numerous types of 1099s are out there for reporting different incomes. Though today we only talk about Form 1099-MISC and 1099-NEC.

We will have a slight focus on the changes that have taken place in 2022. So Let’s get started.

What is Form 1099?

First, let’s start with the definition. What is Form 1099, what’s the use, and who uses this form?

I assume that you may or may not be aware of the definition. So for those of you who are not aware of the definition, let me tell you that all the 1099 forms serve the same purpose.

Form 1099 is used by taxpayers to provide information about their income to the IRS besides their salary.

Employers must fill out this form and send it to the person they have paid by the end of January or early February.

What is Form 1099-MISC and Form 1099-NEC?

Now take a look at the term Form 1099-MISC and 1099-NEC.

The term MISC defines the Miscellaneous income here. It is also known as miscellaneous information.

And this form is used to report miscellaneous compensation such as medical or healthcare payments, payments to an attorney, rents or prizes, etc. In contrast, the Form-NEC is applied to report the non-employee compensation.

The non-employee person can be a freelancer, an independent contractor, an attorney, or an accountant whose service can be used by a business or an organisation.

Do you know that before the 2020 tax year, all the non-employee compensation payments are made on Form 1099-MISC? However, now, these payments have to be reported on Form 1099-NEC.

How to file a form with the IRS?

Now let’s discuss how to file the form with the IRS and the recent updates and changes in the form 2022?

The significant change in this form is that the E-file threshold has changed. We are talking about the E-file mandate here. In general, an E-file refers to the way you file these forms with the IRS, which means how you file the form with the IRS.

I suppose for 2021, the threshold for electronic filing is 250. The Treasury Department came out with the motive to change the threshold in July; however, that was never finalized. And if you are interested in the form 1099 changes and how to file the form with the IRS - Course Ministry is conducting a webinar on its official website.

Form 1099 MISC Compliance Update for 2022: https://www.courseministry.com/product/form-1099-compliance-update-for-2022/

This webinar will provide you with extensive training on Form 1099.

You will Learn:

How and when you should reimburse the contractors.

Form W-9 and backup withholding

The $600 rule

The 1099-K Problem

What I've written above just scratches the surface. I am by no means an expert on this so Join the webinar and make the most out of the training. Reference Link : https://medium.com/@celinaisteni/form-1099-misc-and-1099-nec-whats-new-in-2022-c31a2303255b

1 note

·

View note

Text

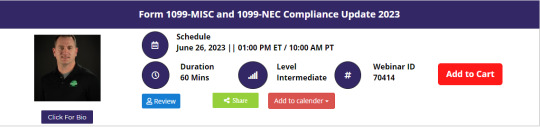

Form 1099-MISC and 1099-NEC Compliance Update 2023

This webinar will covers the latest updates businesses need to be aware of with the 1099-NEC and 1099-MISC. This includes changes in the American Rescue Plan relating to Form 1099-K, which in turn affects the 1099-NEC and 1099-MISC. We will also cover topics such as: how (or if) you report payments made to contractors through Venmo. We also cover the basics, at the beginning, such as what is a 1099, who gets a 1099, what are "medical payments" and what are "legal payments"?

Why Should You Attend

Form 1099 reporting has always been tricky, and changes in 2021 and 2022 continue to increase the reporting burden. Tucked away in the American Rescue Plan was a change to reporting on a form called a 1099-K, which has an interaction with contract labor reported on the 1099-NEC. More and more contractors are taking payment via apps such as Venmo - how are those payments reported? Or are they reported at all? These are among the things you’ll learn in this fast-paced, 1-hour webinar.

Areas Covered in the Session

» A look at the 2023 version of the 1099-NEC and 1099-MISC » What is 1099? » Who gets 1099? » When do corporations get 1099s? A review of medical payments and legal payments » How to file 1099s » Form 1099-K: updates and interactions with the 1099-NEC » Form W-9 updates and discussion » Dealing with reimbursements to contractors » Who exactly is a contractor?

Who Will Benefit » Tax preparers » HR professionals » Bookkeepers » Accountants » Business owners » Payroll Professionals To Register (or) for more details please click on the below link: https://rb.gy/j6uys/a> Email: [email protected] Tel: (989)341-8773

0 notes

Photo

Form1099Online is the best e-documenting answer for entrepreneurs, charge professionals, and bookkeepers to record Form 1099 for clients, independent companies, and more. File with us: https://www.form1099online.com/1099-forms/1099-misc-form/

#IRS Form 1099 MISC#E-file 1099 MISC#1099 MISC#1099 MISC Form#1099 MISC Box 7#MISC Form 2022#1099 MISC 2022#1099online#form1099online

0 notes

Text

The Complete Manual for IRS Filing Deadlines In 2022

Tax filing deadlines can catch you off guard if you are not prepared. Missing crucial tax deadlines can be annoying and even result in late fees.

Spend some time and add each applicable tax filing deadline to your calendar to avoid this as much as possible.

This post was created to make it simpler for you to locate and keep in mind the correct filing dates for popular IRS forms.

It also includes some practical advice for having a good tax season, whether you're a corporation or an individual taxpayer.

Things to Keep in Mind during Tax Season

There are a few additional things to think about when tax season arrives in addition to remembering to file your tax forms on the appropriate dates.

You can save time and effort by taking note of the crucial factors listed below.

Extensions of Date

If a citizen has missed the submission deadline, they are entitled to request filing date extensions.

The Internal Revenue Service (IRS) must receive your request for an extension by April 18.

You must file your tax returns by October 17 if your filing extension was allowed.

Deadline Penalties

If you file your taxes after the due date without an authorised extension, you will incur different penalties.

0.5% of each month's taxes payable to the IRS is the fine for making late tax payments.

If you file your taxes beyond the due date without getting an extension approved, the IRS may impose fines equal to 5% of the amount you owe.

The IRS may not receive your paper tax returns on the same day if you mail them to them by the deadline for paper filing.

The IRS still regards your taxes as timely filed if the paperwork were mailed on the due date.

You have until the last minute of the submission deadline to deliver your documents to the IRS via electronic filing processes.

If the details on your tax records are incorrect, you can also be subject to a penalty.

The penalty might be 20% or more of what you still owe the IRS. Visit the IRS website for further details on fines related to taxes.

Deadline for Various IRS 1099 Forms

1099 Forms

The 1099 tax documents are utilized to report various instalments made to nonemployees to the IRS.

Nonemployees are self-employed entities or consultants who aren't officially utilized by an organization.

Organizations will frequently employ nonemployees for one-off positions or administrations.

Structure 1099 NEC

The 1099-NEC form is utilized to report non-worker pay more than $600. This sum incorporates any charges, commissions, or different kinds of revenue.

Cut-off time:

Mail and E-filing: January 31, 2022

Structure 1099-MISC

The Structure 1099-MISC reports incidental help instalments and non-representative pay that the 1099-NEC doesn't cover.

Cut-off times:

Mail filing: February 28, 2022.

E-filing: Walk 3, 2022.

Structure 1099-INT

The Structure 1099-INT structure is utilized to report any interest that a citizen gets of more than $10.

Cut-off times:

Mail filing: February 28, 2022.

E-filing: Walk 31, 2022

Structure 1099-DIV

The Form 1099-DIV reports any pay non-workers acquired from profits during the fiscal year.

Cut-off times:

Mail filing: February 28, 2022.

E-filing: Walk 31, 2022.

Structure 1099-S is utilized to follow pay from land exchanges, like selling property.

Structure 1099-R reports pay got from retirement plans or annuity reserves.

Cut-off times:

Mail filing: February 28, 2022.

E-filing: Walk 31, 2022.

#form 1099#form 1099 online#file 1099 form#efile 1099 form#1099 nec#1099 nec form#1099 misc#1099 misc form#1099 div#1099 div form#1099 int#1099 int form#1099 s#1099 s form#1099 a#1099 a form#printable 1099 form#fillable 1099 form

0 notes

Text

IRS Releases Form 1040 For 2020 (Spoiler Alert: Still Not A Postcard)

New Post has been published on https://perfectirishgifts.com/irs-releases-form-1040-for-2020-spoiler-alert-still-not-a-postcard-2/

IRS Releases Form 1040 For 2020 (Spoiler Alert: Still Not A Postcard)

The Internal Revenue Service (IRS) has released the very-probably-unless-Congress-does-something-soon final version of Form 1040, U.S. Individual Income Tax Return for 2020 (downloads as a PDF). There are several notable changes to the form proposed for the tax year 2020 – the tax return that you’ll file in 2021.

Page One

Form 1040 (2020)

Identifying information. There are no real changes to the identification portion of the Form 1040: this is where you list your name, address, Social Security Number (or ITIN) and note your filing status.

Virtual currency. As expected, a question about virtual currency remains on the front of the Form 1040. A new cryptocurrency compliance measure for taxpayers was introduced in 2019 in the form of a checkbox on the top of Schedule 1, Additional Income and Adjustments to Income. Schedule 1 is used to report income or adjustments to income that can’t be entered directly on the front page of form 1040.

Crypto question on Form 1040

I noted last year that the IRS has made no secret that it believes that taxpayers are not correctly reporting cryptocurrency transactions. An IRS dive into the data showed that for the 2013 through 2015 tax years, when IRS matched data collected from forms 8949, Sales and Other Dispositions of Capital Assets, which were filed electronically, they found that just 807 individuals reported a transaction using a property description likely related to bitcoin in 2013; in 2015, the number fell to 802. This, despite a clear uptick in cryptocurrency use and trading. The IRS has made cryptocurrency compliance one of its target issues for the 2021 year, so expect this box to get a lot of scrutiny.

Standard Deductions and Dependents. This routine information and the layout remain the same (only the numbers for the standard deduction have changed: you can find those here).

Charitable contributions. As a result of the CARES Act, charitable cash contributions of up to $300 are temporarily above-the-line deductions. That means that you do not have to itemize your deductions to deduct your charitable contribution. And yes, the $300 limit is per return, so a married couple can only deduct a total of $300.

Income items. Outside of the adjustments to income, there isn’t much difference in income reconciliation. We’ll just have to get used to yet another line number for taxable income (it’s now line 15).

Page Two

Form 1040 for 2020, p2

Tax, Credits, and Deductions. One thing that jumps out immediately is that the “Federal income tax withheld from Forms W-2 and 1099” line has now been divided into separate lines (lines 25(a)-(c)) for withholding for Forms W-2, 1099, and “other forms.” This suggests an increased level of scrutiny for the self-employed and gig workers.

And keep in mind that there’s a new Form 1099 in town: Form 1099-NEC, Non-employee Compensation, will replace Form 1099-MISC for gig workers and independent contractors. You can find out more here.

You’ll also post any estimated tax payments and amounts carried forward from last year’s return (if any) on line 26. This is new and much more simple: previously, estimated tax payments were lumped in together on line 18 after you figured the amounts on Schedule 3.

Stimulus Checks. There is a separate reconciliation schedule for stimulus checks that will carry over to page two of your Form 1040. You’ll see it on line 30: Recovery rebate credit. If you didn’t receive the correct amount in your stimulus check in 2019 (for example, you made too much money in 2019 or you had a child in 2020), you’ll make those adjustments on line 30.

The instructions will include a worksheet that you can use to figure what you’re owed. The maximum credit is $1,200 ($2,400 if married filing jointly) plus $500 for each qualifying child. The instructions aren’t out just yet, but you can get a sense of what you’ll need to know by checking out the draft instructions.

Refunds. Outside of some renumbering, the refund sections have not changed.

Amount You Owe. Usually, figuring the amount you owe is pretty simple: it’s tax due less credits and payments. But there’s a new line for 2020 which notes: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for 2020. See Schedule 3, line 12e, and its instructions for details.

And yes, Schedule 3, line 12e, is new. It says: Deferral for certain Schedule H or SE filers (see instructions) That deferral? Under the CARES Act, employers may defer the deposit and payment of the employer’s portion of Social Security taxes. The deferral applies to deposits and payments of the employer’s share of Social Security tax that would otherwise be required to be made during the period beginning on March 27, 2020, and ending December 31, 2020, with half being due on December 31, 2021, and the remainder due on December 31, 2022. What does that have to do with Form 1040? The relief also applies to self-employed persons.

Other Information

IP PIN. The spot for an IP PIN isn’t new but more taxpayers may be paying attention this year since there’s an opportunity to opt-in.

Numbered and Lettered Schedules. Form 1040 still has lettered schedules (like Schedule A, Itemized deductions) and numbered schedules (like Schedule 1, Additional Income and Adjustments To Income).

New Schedule LEP. There is a new schedule: Schedule LEP, Request for Change in Language Preference. Schedule LEP allows taxpayers to state a preference to receive written communications from the IRS in a language other than English. The draft instructions suggest that you can choose from 20 languages, including French, Spanish, Japanese, and Farsi.

Form 1040-SR. For 2020, if you were born before January 2, 1956, you have the option to use Form 1040-SR, U.S. Tax Return for Seniors (downloads as PDF).

Expect more information as IRS continues to update forms for what promises to be an interesting tax season!

More from Taxes in Perfectirishgifts

0 notes

Photo

you can make your 1099 MISC tax season a little easier and even find ways to save money. With some planning and organization. Call: 316-869-0948 or https://www.form1099online.com/1099-forms/1099-misc-form/

#E-file 1099 MISC#Fillable Form 1099 MISC#1099 MISC#1099 MISC Tax Form#File 1099 MISC#MISC Form 2022

0 notes

Link

File Form 1099 MISC with form1099online.com to get faster processing and receive your evidence in mins. For E-File: https://www.form1099online.com/1099-forms/1099-misc-form/ or call 3168690948

#1099 MISC 2022#IRS Form 1099 MISC#E-file 1099 MISC#MISC Form 2022#Fillable Form 1099 MISC#1099 MISC Tax Form#1099 MISC Form

0 notes

Video

tumblr

A filer can without difficulty E-file the 1099 Misc form. If the filer uses digital submitting, then the filer should file the form by using “March 31st, 2022“ E-File MISC: https://www.form1099online.com/1099-forms/1099-misc-form/

#FillableForm1099MISC#E-file 1099 MISC#IRS Form 1099 MISC#1099 MISC#File 1099 MISC Online#1099 MISC Form#1099 MISC Tax Form#MISC Form 2022#File 1099 MISC#form1099online#1099 online#form 1099

0 notes

Video

tumblr

The form1099online.com provides you the information on The Requirements Of Fillable 1099 MISC Online Form IRS. To File: https://www.form1099online.com/1099-forms/1099-misc-form/

0 notes

Video

tumblr

The Form 1099 MISC recipient copy deadline is January 31, 2022. If you choose to file paper forms, the deadline is February 28, 2022. For More: https://www.form1099online.com

#IRS Form 1099 MISC#E-file 1099 MISC#Fillable Form 1099 MISC#1099 MISC#misc form 2022#1099 misc 2022

0 notes

Photo

E-file 2022-23 Fillable Form 1099 MISC Online to both federal & state. E-file is as low as $2.99/Form. IRS Approved. We deliver recipient copies by postal mail & online access. File 1099 MISC: https://www.form1099online.com/1099-forms/1099-misc-form/

#1099MISC#1099MISCBox7#Form1099MISC#TaxForm1099MISC#EFile1099MISCFree#IRS1099MISC#IRSForm1099MISC#Filing1099MISCWithIRS#1099MISCForm

0 notes