#FinTech Trends in 2019

Explore tagged Tumblr posts

Link

Increasing adoption of mobile banking application drives the demand for global fintech market. On the basis of geography, Europe dominated the global...

0 notes

Text

In the German city of Weimar, just a few steps from Enlightenment-era literary luminary Johann Wolfgang von Goethe’s baroque residence, the Lavazza cafe seems determined to remain in the past. This cafe, like many other establishments all over the country, accepts only cash. That old-fashioned and inconvenient mode of payment is still revered in Germany. According to the latest study by Germany’s central bank, the Bundesbank, on payment behavior, Germans pay for nearly 60 percent of their purchases—both goods and services—in cash.

Germany is not the only country standing athwart the global trend toward cashless payments. In Austria, cash is so popular that the Austrian chancellor has claimed it should amount to a constitutional right. Yet in other European countries, such as the United Kingdom, cash will account for just 6 percent within a decade, and in the Netherlands only 11 percent of transactions were made in cash last year. In other bigger economies, the pace of the decline is even faster. While in China 8 percent of point-of-sale (POS) transactions were made in cash, in India, cash use has declined from 91 percent in 2019 to 27 percent in 2022.

But in Germany, an obsession with privacy, mistrust of big-tech and fintech in general, and worries about political and financial crises depleting bank balances overnight—an experience rooted in history as well as a cultural desire for control—all contribute to the country’s love for cash. Arnold, Maria, Elisabeth, and Harald, a group of middle-aged friends who refused to reveal their full names, were taking a break in Weimar from a road trip on their bicycles from Hessen in western Germany. “Nur Bares ist wahres,” said Elisabeth, which means “only cash is true” and is a famous saying in Germany that expresses more than a preference for cash. Arnold said spending in cash encouraged him to spend less and stay in control of his expenses, but more importantly it protected the details of where he was spending his money. “If you use a card, the bank knows everything about you,” he said. Harald jumped in and added that if he used digital means to pay, he would “feel surveilled.”

But as some European states, such as Sweden, go nearly cashless, with only 6 percent of transactions still settled with banknotes, how does Germany’s preference for cash impact the largest economy in Europe? Perhaps not as much as one might think.

On average, Germans carry more than 100 euros in their wallets—much more than their counterparts in many other developed nations. Since the euro was introduced, the Bundesbank has issued more cash than any other member in the 27-nation European Union, and according to the Bundesbank report, even though cash use was down from 74 percent in 2017, as high as 69 percent of respondents expressed their intention to continue to pay in cash.

Agnieszka Gehringer, a professor at Cologne University of Applied Sciences, said German fondness for cash can be understood via cultural attachment theory and behavioral factors. She explained that, culturally, cash is seen as safe by Germans. “If I have been customarily using cash as a payment method for ages and I know how it works and my data remain protected, there is no particular reason to change my habit,” she told FP.

Gehringer traced these behavioral and cultural attitudes in part to hyperinflation witnessed in the Weimar Republic in 1923, when a loaf of bread cost billions of marks; steep devaluation of the currency after World War II, which washed out nearly 90 percent of people’s savings; and the division of the country, which left the Soviet-controlled east impoverished. “This series of turbulences is considered the basis of the so-called German angst—the fear of losing control,” Gehringer said. “Beyond culture and attitude, for some others, cash is a means of self-control and self-supervision: It is more transparent and easier to track the record of personal expenditures.”

While the fear of losing everything in a quick turn of events was passed on from generation to generation, so was the positive symbolism of the Deutsche mark. Post-World War II Deutsche marks rose in value and symbolized Germany’s resurgence and prosperity. In the late 1990s, Germans reluctantly agreed to a common European currency—but perhaps only because by then Germany was among the biggest European economies and influential in European decision-making.

Another reason to avoid possession of plastic money or credit cards is the fear of debt. “Germans do not like debt,” said Doris Neuberger, head of the money and credit department at Germany’s University of Rostock. In fact, the German word for debt and guilt are derived from the same word (Schuld), and this moral charge helps produce the country’s “low debt ratio and low usage of credit cards.”

Using cash is also easy for a wide range of consumers, including the elderly, who may be unfamiliar and uncomfortable with using smartphones or keystrokes online. It’s also cheaper for retailers and end consumers on transactions under 50 euros, as the cost of holding cash is lower than the fees incurred with non-cash payments, according to the Bundesbank. But the cost of producing, storing, and transporting bank notes and coins is eventually passed on to consumers, experts say.

There are other downsides to excessive use of cash, too. According to a report by the Office of Technology Assessment at the German Bundestag, high levels of cash holdings reduce the central bank’s “monetary policy steering options,” Gehringer wrote. “Sure, holding cash has a higher hurdle to make the money available for financial investments.”

But most experts say the argument that cash exacerbates the shadow economy tends to be overstated. The Office of Technology Assessment report noted that in countries with less cash spending, such as Switzerland, the Netherlands, and France, there is less activity in the shadow economy when compared to countries such as Spain, Italy, and Greece, which have high rates of cash use. But it added that in Sweden, despite a minor role for cash, the shadow economy is “medium-sized,” while in Austria and Germany, with relatively high shares of cash transactions, the shadow sector is relatively small.

In 2019, the Bundesbank conducted a study on the extent of “illicit cash use” in Germany, in collaboration with Friedrich Schneider, a professor at the Johannes Kepler University Linz. It said that without more in-depth analysis it was “impossible to distinguish those stocks of banknotes that are being held as a store of value—and kept at home under the mattress totally legally and legitimately by every citizen—from illicit banknote stocks.” On average, a German hoards more than 1,300 euros at home or in a safe deposit box.

“Available estimates for the size of the shadow economy lie between 2 percent and 17 percent of gross domestic product,” the study said. “This range alone shows that studies of the shadow economy are subject to an above average degree of uncertainty and all results should be interpreted with care.”

“Cash does not promote a shadow economy, as it is not a cause,” Schneider, a co-author of the study, told FP. “Causes are tax burden, regulations, etc.” Schneider said the higher the tax burden, the higher the motivation to evade taxes. “If cash is completely abolished, then people find other means.” He added that earlier uses of cash were more firmly linked to tax evasion than now, when “it is very difficult to open a bank account abroad with a large cash sum of money.” Money laundering in real estate is deterred with a different set of regulations.

Neuberger claimed much more criminal activity is conducted with digital money than with cash. “Nowadays, the ideal medium for illegal drug transactions is not cash, but Amazon gift cards,” she said. “Gift tokens allow for anonymous payments anywhere in the world and, unlike cash, do not require a face-to-face transaction. The same holds for prepaid credit cards, which can be loaded with cash anonymously.”

Burkhard Balz, a member of the executive board of the Deutsche Bundesbank, told FP no initiatives have been taken by the government to discourage or disincentive the use of cash and that it is “an excellent back option should other payment methods end up temporarily out of action—because of a power outage or software error.” Regulations to limit cash use are deemed politically unpopular in Germany, especially since people and experts just don’t see any disadvantages to carrying on with folded euros in their pockets and wallets.

A digital euro, however, could reduce the costs of producing, storing, and transporting cash. It wouldn’t be tied to any intermediary banking institution—as opposed to electronic payments, which are intermediated by multiple banks—and won’t even require a bank account. Balz said the digital euro would ensure “the accessibility and usability of central bank money alongside cash in a digitized world.”

“Currently, the Eurosystem is about to conclude its two-year investigation phase on a digital euro and may move into the next phase of the project—the preparation phase,” he said, “provided that the [European Central Bank] Governing Council takes this decision in late autumn this year.”

At least some private banks believe that payments made with the digital euro could still be tracked and help with anti-money laundering regulations, but not without placing limits on the highly prized privacy of citizens. Furthermore, it could lead to a reduction in deposits to credit institutions and limit the ability of the banks to offer loans.

Online purchases rose from 6 percent in 2017 to 24 percent in 2022 amid the COVID lockdown, but neither the pandemic nor digitization so far has managed to eliminate the appeal and comfort of cash for Germans. Even though Germany’s banking industry envisages a growth of 2 percent per year in card payments, a cash decline of 3 percent a year would still mean that, in 2030, Germans will carry out at least 30 percent of transactions in cash.

17 notes

·

View notes

Text

Algorithm Trading Market Growth Analysis 2025

The global Algorithm Trading market was valued at US$ 13,523.37 million in 2023 and is anticipated to reach US$ 26,730.34 million by 2030, witnessing a CAGR of 10.58% during the forecast period 2024-2030.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/270/algorithm-trading

North American market for Algorithm Trading is estimated to increase from $ 6,319.47 million in 2023 to reach $ 12,357.44 million by 2030, at a CAGR of 10.46% during the forecast period of 2024 through 2030.

Asia-Pacific market for Algorithm Trading is estimated to increase from $ 3,179.34 million in 2023 to reach $ 6,353.80 million by 2030, at a CAGR of 10.73% during the forecast period of 2024 through 2030.

The global market for Algorithm Trading in Investment Bank is estimated to increase from $ 6,852.29 million in 2023 to $ 13,381.21 million by 2030, at a CAGR of 10.39% during the forecast period of 2024 through 2030.

The major global companies of Algorithm Trading include QuantConnect, 63 moons, InfoReach, Argo SE, MetaQuotes Software, Automated Trading SoftTech, Tethys Technology, Trading Technologies, and Tata Consultancy Services, etc. In 2023, the world's top three vendors accounted for approximately 22.52 % of the revenue.

This report aims to provide a comprehensive presentation of the global market for Algorithm Trading, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Algorithm Trading.

The Algorithm Trading market size, estimations, and forecasts are provided in terms of and revenue ($ millions), considering 2023 as the base year, with history and forecast data for the period from 2019 to 2030. This report segments the global Algorithm Trading market comprehensively. Regional market sizes, concerning products by Type, by Application, and by players, are also provided.

For a more in-depth understanding of the market, the report provides profiles of the competitive landscape, key competitors, and their respective market ranks. The report also discusses technological trends and new product developments.

The report will help the Algorithm Trading companies, new entrants, and industry chain related companies in this market with information on the revenues for the overall market and the sub-segments across the different segments, by company, by Type, by Application, and by regions.

Market Segmentation

By Company

QuantConnect

63 moons

InfoReach

Argo SE

MetaQuotes Software

Automated Trading SoftTech

Tethys Technology

Trading Technologies

Tata Consultancy Services

Exegy

Virtu Financial

Symphony Fintech

Kuberre Systems

Itexus

QuantCore Capital Management

Segment by Type

Forex Algorithm Trading

Stock Algorithm Trading

Fund Algorithm Trading

Bond Algorithm Trading

Cryptographic Algorithm Trading

Other Algorithmic Trading

Segment by Application

Investment Bank

Fund Company

By Region

North America

United States

Canada

Others

Asia-Pacific

China

Japan

South Korea

Southeast Asia

India

Rest of Asia

Europe

Germany

France

U.K.

Rest of Europe

South America

Mexico

Brazil

Argentina

Rest of South America

Middle East & Africa

Middle East

Africa

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/270/algorithm-trading

0 notes

Text

Australia Digital Banking Market Projected to Reach USD 569.81 Million by 2033

The latest report by IMARC Group, titled “Australia Digital Banking Market Size, Share, Trends and Forecast by Services, Deployment Type, Technology, Industry, and Region, 2025-2033,” offers a comprehensive analysis of the Australia digital banking market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia digital banking market size reached USD 206.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 569.81 Million by 2033, exhibiting a growth rate (CAGR) of 11.91% during 2025–2033. • Base Year: 2024 • Forecast Years: 2025–2033 • Historical Years: 2019–2024 • Market Size in 2024: USD 206.97 Million • Market Forecast in 2033: USD 569.81 Million • Market Growth Rate 2025–2033: 11.91%

Request for sample Report: https://www.imarcgroup.com/australia-digital-banking-market/requestsample

Australia Digital Banking Market Overview

The Australia digital banking market is developing rapidly as budgetary teach are centering on overhauling client experience through progressed alter. Banks are sending AI-driven improvements, versatile openness, and user-friendly meddle to streamline organizations and offer personalized keeping cash experiences. Overhauled applications and stages by and by allow reliable course, 24/7 client reinforce, and custom-made cash related things, pulling in a broader client base. These headways are arranging banks to remain competitive in a fast-evolving section, though government support and regulatory frameworks are developing secure and capable progressed overseeing an account choice.

Australia Digital Banking Market Growth Trends

The publicize is seeing enlivened allotment of AI, machine learning, and blockchain developments to move forward operational capability and security. AI-powered devices are enabling minute, personalized client natural, while biometric confirmation and multi-factor security traditions are strengthening client accept. The rise of cloud-based keeping cash stages is progressing flexibility and flexibility. In expansion, affiliations between banks and fintech firms are driving improvement and developing advantage offerings. These imaginative designs are fueling the wide affirmation and advancement of computerized overseeing an account organizations over Australia.

Australia Digital Banking Market Growth Drivers

Improvement is driven by growing customer ask for supportive, accessible, and secure keeping cash organizations. The extension of smartphones and web organize is empowering flexible and online overseeing an account allotment. Regulatory support for progressed installments and secure trades is enabling banks to contribute in advanced computerized system. Additionally, the rising slant for contactless installments and real-time budgetary organizations is boosting publicize improvement. Banks’ center on personalized client experiences and operational efficiency is progress animating the progressed keeping cash promote improvement.

Australia Digital Banking Market Segmentation:

By Services: • Transactional (cash deposits and withdrawals, fund transfers, auto-debit/auto-credit services, loans) • Non-Transactional (information security, risk management, financial planning, stock advisory)

By Deployment Type: • On-Premises • Cloud

By Technology: • Internet Banking • Digital Payments • Mobile Banking

By Industry: • Media and Entertainment • Manufacturing • Retail • Banking • Healthcare

By Region: • Australia Capital Territory & New South Wales • Victoria & Tasmania • Queensland • Northern Territory & Southern Australia • Western Australia Australia Digital Banking Market News: • In 2025, Bankwest launched a revamped banking app and website featuring enhanced interfaces, dedicated property and money tabs, 24/7 support, and upcoming virtual card services. • Also in 2025, Commonwealth Bank introduced CommBiz Gen AI, an AI-driven messaging platform for business clients developed in collaboration with AWS, enhancing personalized digital banking experiences. Key Highlights of the Report:

Market Performance (2019–2024)

Market Outlook (2025–2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization. Ask analyst for your customized sample:https://www.imarcgroup.com/request?type=report&id=35387&flag=E About Us: IMARC Group is a leading market research company providing management strategy and market research worldwide. We partner with clients across sectors and regions to identify high-value opportunities, address critical challenges, and transform businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth. Contact Us: 134 N 4th St. Brooklyn, NY 11249, USA Email: [email protected] Tel No: (D) +91 120 433 0800 United States: +1-631-791-1145

0 notes

Text

Understanding Voice-based Payments Market: Trends and Growth Drivers

The global voice-based payments market size is expected to reach USD 14.66 billion by 2030, expanding at a CAGR of 10.9% from 2022 to 2030, according to a new study conducted by Grand View Research, Inc. The growing adoption of voice commerce solutions worldwide is anticipated to drive the growth of the market. The strong emphasis payment service providers are putting on offering enhanced payment solutions also bodes well for the market growth.

According to statistics provided by the media company ComScore, approximately 50% of Google mobile searches were conducted by voice in 2020. However, a survey conducted in 2019 by fintech company Handsome and Ethik Connection, an event management company, of 120 people in France revealed that around 89% of the visually impaired people have already been the victims of errors and frauds while they were paying for services and goods. As a result, voice-based payment providers are particularly enhancing payment solutions for visually impaired people. For instance, a secure and discreet assistive technology solution offered by Thales Group and Handsome gives visually impaired people greater control over the payments they are making by vocalizing the transaction details.

The investments being raised by voice assistant solution providers are anticipated to create new opportunities for the growth of the market over the forecast period. For instance, in August 2021, Baidu Inc. announced that its artificial intelligence (AI) voice assistant, Xiaodu Technology, raised USD 5.1 billion in a Series B round. The fundraising came as the company continued to push forward with its ambitions aimed at AI chip designing and manufacturing.

The COVID-19 pandemic is expected to play a vital role in driving the growth of the voice-based payments market during the forecast period. People are particularly preferring touchless ordering and payments at fast restaurants in the wake of the pandemic, thereby opening new opportunities for the growth of the market. Touchless payments are in demand among restaurants due to their greater convenience, ordering accuracy, and reduced human contact.

Curious about the Voice-based Payments Market? Get a FREE sample copy of the full report and gain valuable insights.

Voice-based Payments Market Report Highlights

• The software segment is expected to witness the fastest growth during the forecast period. The voice payment software being introduced aggressively by some of the major companies worldwide is expected to drive the growth of the segment

• The small & medium enterprises segment is expected to witness the fastest growth during the forecast period. The growth of the segment can be attributed to the increasing number of small and medium enterprises worldwide

• The BFSI segment dominated the market in 2021. The banks are adopting voice-based payments to meet their changing customer need which is one of the major factors that propelled the market growth in 2021

• The Asia Pacific regional market is expected to witness the fastest growth during the forecast period. The growing demand for voice-enabled consumer electronics across the region is expected to play a decisive role in driving the growth of the regional market

Voice-based Payments Market Segmentation

Grand View Research has segmented the global voice-based payments market based on component, enterprise size, end-use, and region.

Voice-based Payments Component Outlook (Revenue, USD Million, 2017 - 2030)

• Software

• Hardware

Voice-based Payments Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

• Large Enterprises

• Small & Medium Enterprises

Voice-based Payments End-Use Outlook (Revenue, USD Million, 2017 - 2030)

• BFSI

• Automotive

• Healthcare

• Retail

• Government

• Others

Voice-based Payments Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o U.K.

• Asia Pacific

o China

o India

o Japan

• Latin America

o Brazil

• Middle East & Africa (MEA)

List of Key Players in the global Voice-based Payments Market

• NCR Corporation

• Amazon.com, Inc.

• PayPal

• Paysafe

• PCI Pal

• Vibepay

• Cerence

• Huawei Technologies Co., Ltd.

• Google

• Alibaba

Order a free sample PDF of the Voice-based Payments Market Intelligence Study, published by Grand View Research.

#Voice-based Payments Market#Voice-based Payments Market Analysis#Voice-based Payments Market Report#Voice-based Payments Market Size#Voice-based Payments Market Share

0 notes

Text

Abhay Bhutada’s Journey of Business Success and Social Impact

Abhay Bhutada, a member of the Poonawalla Group and the founder of the Abhay Bhutada Foundation, stands as a defining figure in India’s corporate and philanthropic landscape. Recognized as the highest-paid executive in the country for FY24, he has set new benchmarks with a total remuneration of Rs. 241.21 crore, including stock options. His impressive net worth of over Rs. 1,000 crore is a direct result of his strategic vision, relentless determination, and innovative business approach. From a small town in Maharashtra to the highest echelons of corporate leadership, his journey is one of resilience, foresight, and an unwavering commitment to excellence.

Also Read: Empowering Pune’s Students with Hands-On STEM Learning

The Journey to Financial Success

Abhay Bhutada’s story is rooted in his early years in Latur, Maharashtra, where he displayed a keen interest in finance and business. A Chartered Accountant by qualification, he was driven by a passion for innovation and technology. He identified key gaps in financial accessibility and dedicated himself to bridging them using modern solutions.

His professional journey began in 2010 when he took on the role of an SME Finance Professional at the Bank of India. This initial exposure to the banking sector allowed him to understand the complexities of financial services. With an entrepreneurial mindset shaped by his business-oriented family background, he soon ventured into consulting, assisting small and medium enterprises in securing financial support.

Determined to transform the financial landscape for MSMEs, he established TAB Capital in 2016. His fintech-driven approach redefined digital lending, making finance more accessible to small businesses. This success led to the acquisition of TAB Capital by a leading financial services group in 2019, following which he took charge as the Managing Director and CEO.

His leadership at the company marked a turning point, leading to the acquisition of a well-established financial services firm in 2021. Under his guidance, the organization reached new heights with a CRISIL AAA rating, an asset under management (AUM) of Rs. 25,000 crore, and a profit after tax (PAT) of Rs. 1,000 crore by FY2024.

Strategic Business Leadership and Growth

Abhay Bhutada has always been a forward-thinker, known for his ability to anticipate market trends and seize opportunities at the right moment. His decision to step down as Managing Director was a strategic move to focus on his broader entrepreneurial ambitions.

He plays a pivotal role in managing investments and financial strategies at the group level. His expertise in asset growth and financial planning has significantly contributed to the company’s success, reinforcing its position in the industry.

His leadership extends beyond finance and investment. Abhay is a firm believer in leveraging technology and innovation to drive business efficiency. His deep understanding of digital finance and his commitment to adopting modern financial solutions have been key to his success.

His achievements have been widely recognized, earning him prestigious accolades such as ‘Global Indian of the Year’ in 2023, ‘Young Entrepreneur of India’ in 2017, and The Economic Times’ ‘Promising Entrepreneur of India’ in 2019. His name also features in Asia One’s ‘40 Under 40 Most Influential Leaders for 2020-21.’

Also Read: A Visionary Leader Setting New Benchmarks in Wealth and Philanthropy

Wealth Creation Through Innovation and Investment

The cornerstone of Abhay Bhutada’s salary is his ability to combine strategic foresight with business innovation. His success with TAB Capital demonstrated his talent for scaling ventures efficiently and positioning them for growth.

His role at Rising Sun Holdings provides him with a larger platform to oversee investments and formulate high-value strategies. His ability to identify emerging opportunities in digital finance has played a critical role in maximizing returns and strengthening his financial standing.

Abhay believes in an adaptive approach to business. His philosophy, “Every challenge presents an opportunity to grow,” reflects his ability to navigate complex markets and maintain sustainable progress.

The Impact of the Abhay Bhutada Foundation

Beyond financial success, Abhay Bhutada is committed to creating meaningful change through philanthropy. The Abhay Bhutada Foundation is a reflection of his dedication to social welfare, focusing on education, healthcare, and sports.

One of the foundation’s flagship initiatives, ‘Learn by Doing,’ is carried out in partnership with Sakar Eduskills. Through this program, STEM kits are distributed to underprivileged students in Pune, providing them with practical learning tools such as microscopes and periscopes. This initiative fosters curiosity and hands-on scientific exploration among young learners.

Another key program is the ‘Abhay Bhutada Scholarship Program,’ which extends financial support to meritorious students from disadvantaged backgrounds. By enabling access to quality education, the foundation is helping students build brighter futures.

In the healthcare sector, the foundation actively organizes medical camps, blood donation drives, and health awareness campaigns in rural areas. These efforts aim to bridge healthcare gaps and provide essential services to underserved communities.

The foundation is also involved in supporting young athletes, ensuring that promising talent from underprivileged backgrounds receives the resources and guidance necessary to excel in their respective sports.

Also Read: What It Takes to Be Among the Highest-Paid Professionals in India

A Legacy of Business and Benevolence

Abhay Bhutada’s journey is a compelling example of how vision, hard work, and strategic planning can lead to financial success. His transformation from a determined student in Maharashtra to a top executive and philanthropist showcases the power of perseverance and informed decision-making.

While his business achievements have positioned him among India’s most successful executives, his legacy extends beyond corporate milestones. Through his philanthropic work, he is actively shaping a better future for countless individuals. His ability to channel his success into impactful initiatives underscores the true essence of leadership.

Abhay Bhutada’s story is a testament to the fact that wealth, when aligned with purpose, has the potential to drive lasting change. His influence in both the corporate world and the social sector serves as an inspiration for aspiring entrepreneurs and changemakers alike.

0 notes

Text

The Future of Finance: Key Tech Trends Reshaping Banking

Over the past decade, technological advancements have catapulted fintech from the periphery to the forefront of financial services. This rapid growth has been driven by the dynamic expansion of the banking sector, rapid digital transformation, shifting customer expectations, and the strong backing of investors and regulators. Fintech companies have fundamentally reshaped financial services with their innovative, differentiated, and customer-centric solutions, agile strategies, and cross-functional expertise.

As of July 2023, fintech firms listed on the public market reached a combined market capitalization of $550 billion, double their value from 2019. At the same time, the sector boasted more than 272 fintech unicorns, collectively valued at $936 billion, a significant increase from just 39 firms five years ago.

The growth of these strategies and the swift adoption of fintech are largely driven by their ability to address critical gaps within traditional banking. Fintech companies offer more accessible, intuitive ways for consumers to control and manage their finances, providing solutions that banks have historically overlooked. Their seamless integration into everyday life, through mobile app development and web development, has significantly elevated convenience and customer engagement.

In this blog, we will explore the groundbreaking technologies shaping the future of the financial sector. We will also provide you with the overall technology trends in the finance industry that are reinventing the industry.

Key Takeaways:

Fintech is facing an amazing innovation in the industry. People are more leaning towards easy access to applications that can be downloaded on phones or accessible on browsers.

Innovations like AI-powered apps, IoT integration, blockchain, and mobile payment systems are reshaping the finance industry.

Many digital finance companies are leveraging AI to boost customer satisfaction and improve efficiency.

Despite the growing trends towards fintech, a considerable number of customers still appreciate the availability of physical branches.

Overview of the Evolving Banking Technology Landscape

Banks face increasing pressure due to changing customer preferences, complex regulations, fintech competition, and rising liquidity costs. The digital transformation is rapidly reshaping the industry, pushing banks to adopt the latest technological innovations to stay competitive.

Simultaneously, regulators are placing greater emphasis on technological capabilities, with a focus on data enhancement and fintech integration. Deloitte highlights that banks must align these innovations with strategic planning and robust governance to meet regulatory expectations.

Below is an in-depth look at the trends, technologies, and challenges shaping the future of banking and fintech.

Digital-Only Banking: A Game Changer

Digital-only banks, or neobanks, operate exclusively through online platforms, eliminating the need for physical branches. They offer seamless digital experiences with mobile deposits, lower fees, and competitive rates.

The demand for digital banking is surging as more consumers prefer efficient, on-the-go financial solutions. According to the American Bankers Association, digital banking is now preferred by 71% of consumers, with millennials and Gen Z leading the trend.

Traditional banks are facing a decline, with over 2,555 branches closing in the U.S. in 2023 alone. This shift signifies a growing need for banks to adapt to digital demands.

Surge in Digital Payments

Digital payments have become integral to modern consumer behavior, experiencing a spike in adoption post-pandemic. McKinsey’s 2023 survey reveals over 90% of consumers now use digital payment methods.

Expanding Fintech Regulation

Fintechs are facing stricter regulations as they expand their role in delivering essential financial services. Jurisdictions worldwide are tightening rules to ensure fintech innovations align with financial stability requirements.

Navigating these complex regulations can be challenging for fintechs operating across multiple regions. A strategic partnership with an experienced fintech developer like Leobit can simplify compliance with key standards like GDPR, CCPA, and OWASP.

Generative AI: Transforming the Banking Landscape

Generative AI (GenAI) has the potential to add between $200 billion to $340 billion in value to the banking sector. GenAI automates tasks like data entry, fraud detection, credit assessments, and personalized financial advice, revolutionizing operations.

Blockchain Innovations in Banking

Blockchain technology’s decentralized ledger is revolutionizing banking by enhancing transaction security and transparency. Beyond payments, blockchain’s applications include trade finance, cross-border payments, and smart contracts, streamlining financial operations.

Real-Time Payments (RTP) on the Rise

Real-time payments (RTP) are becoming the norm due to the demand for instant settlements and cloud-based transaction solutions. The global RTP market is projected to grow at a rate of 35.5% annually, driven by technological innovations and competitive pressure.

Challenges like legacy infrastructure and fragmentation persist, prompting 77% of financial companies to consider outsourcing RTP capabilities to accelerate implementation.

Personal Finance Apps and Consumer Empowerment

Personal finance apps have seen massive growth, with users seeking tools beyond basic budgeting to include investment insights. The market is set to rise to $1.57 billion by 2025 as users prioritize apps offering personalized financial advice.

Fintechs can leverage user data from these apps to offer tailored insights, meeting the demand for more personalized financial solutions.

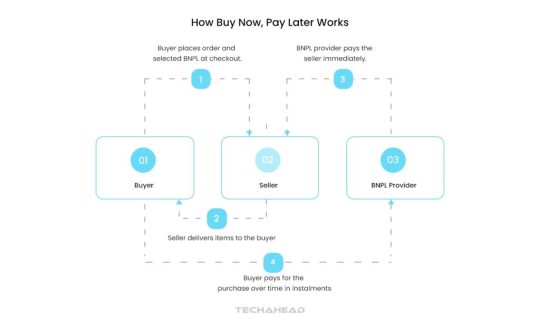

Buy Now, Pay Later (BNPL) Adoption Expands

BNPL services offer flexible payment options, rapidly gaining popularity across all age groups.

Key Technologies That Will Reinvent the Financial Industry

In the next decade, there are some technologies that will be the digital transformation within the financial industry. Technological innovation will act as the backbone of fintech, fueling the emergence of disruptive business models.

Artificial Intelligence (AI) Fuels Unprecedented Value Creation

AI is poised to unlock up to $1 trillion in annual value for global banks. Financial institutions will adopt an AI-centric strategy to counter the growing influence of tech giants on their market share. AI’s evolving capabilities will enable financial firms to harness data-driven insights and sharpen their competitive edge.

AI will facilitate automatic factor discovery, identifying key drivers of financial outperformance. This will revolutionize financial modeling, making it more precise and reliable. AI-powered knowledge graphs and graph computing will also play a critical role in analyzing intricate financial networks, revealing hidden patterns by connecting diverse data sources.

Enhanced privacy-centric data analytics will limit data usage to only essential, sanitized information for model training. Techniques like federated learning will boost security by processing data locally instead of centralizing it. Advanced encryption methods, zero-knowledge proofs and secure multi-party computations will set new benchmarks in consumer data protection.

AI’s impact will span across all functions within the financial sector. Customer-facing innovations will include personalized offerings, predictive analytics, AI-driven chatbots, automated trading, and intelligent robo-advisors. On the backend, AI will streamline processes with smarter automation, natural language processing for fraud detection, and improved data handling.

Currently, many banks use AI selectively, focusing on specific tasks. However, industry leaders are now adopting a holistic AI approach across digital operations. This strategy leverages behavioral data to gain insights, driving new opportunities in ecosystem-based financing, where banks partner with non-financial entities to deliver broader customer experiences.

The emergence of “AI-first” institutions will push operational efficiency to new levels, emphasizing extreme automation. By reducing manual tasks and enhancing decision-making through AI diagnostics, banks will optimize performance. AI-first banks will operate with the agility of digital-native companies, launching innovations within days or weeks and integrating seamlessly with external partners for holistic customer solutions.

Blockchain will Disrupt Established Financial Protocols

Blockchain and Distributed Ledger Technology (DLT) are set to revolutionize traditional financial frameworks. DLT enables secure, synchronized data sharing across multiple databases, enhancing transparency and efficiency within the financial ecosystem.

DLT systems often leverage blockchain’s cryptographic algorithms to ensure data integrity and immutability across their networks. This technology records, synchronizes, and validates transactions without a central authority, building trust among network participants.

Blockchain’s versatility in supporting ecosystem financing lies in its distributed nature, storing data in multiple locations simultaneously. With cross-chain technology advancing, blockchain interoperability will connect different protocols, streamlining operations across various sectors like payments and supply chain logistics.

Blockchain’s Role in Policy and Regulation

Governments are actively exploring blockchain for digital currency and regulatory frameworks. About 60% of central banks are studying Central Bank Digital Currencies (CBDCs), indicating a shift toward digital monetary systems.

Notable Blockchain Applications

Real-time transaction settlement: Banks now use smart contracts to streamline transaction settlements, boosting speed and accuracy. Blockchain facilitates efficient securities trading, lending, and cross-border transactions, enhancing global capital flows and reducing costs.

Digital asset support services: Investors seek DLT solutions for tokenization, cryptocurrency exchanges, and secure custody services. This includes encryption protocols like key escrow, ensuring secure digital asset management.

Authentication via zero-knowledge proofs: Blockchain enables seamless identity verification while protecting sensitive data. Customers share only necessary information, enhancing privacy in digital interactions across health and government services.

Decentralized Finance (DeFi): DeFi platforms eliminate intermediaries using deterministic smart contracts for loans, investments, and trading. These contracts reduce counterparty risks, increase market efficiency, and offer transparency in real time. DeFi’s potential to disrupt traditional value chains is reshaping the financial landscape. As regulations evolve, DeFi is set to unlock new opportunities, transforming finance through blockchain’s decentralized architecture.

Cloud Computing will Liberate Financial Services Players

Cloud computing will empower financial institutions, unlocking new efficiencies and cost-saving opportunities. By 2030, it’s expected to add over $1 trillion in EBITDA for the top 500 global companies.

Effective cloud migration enhances application development and maintenance efficiency by 38%, cuts infrastructure costs by 29%, and reduces downtime by nearly 57%. This efficiency lowers technical violation costs by 26%, boosting overall productivity and reliability.

Cloud platforms also elevate security through integrated DevOps principles. This approach embeds security throughout development, ensuring a consistent, cross-environmental tech stack, and reducing potential technical risks.

Key Cloud Service Models for Financial Institutions

Financial firms should focus on three primary cloud service models: public, hybrid, and private clouds.

Public Cloud: Owned by service providers, it offers scalable resources to various organizations, reducing infrastructure expenses.

Hybrid Cloud: Combines public and private cloud elements, ensuring flexibility and optimized performance through seamless integration.

Private Cloud: Exclusively dedicated infrastructure for individual clients, ensuring higher control, data privacy, and security.

Understanding these cloud models enables financial institutions to choose solutions that align with their specific needs and risk appetites.

IoT to Revolutionize Trust in the Financial Sector

The Internet of Things (IoT) is finally gaining momentum, significantly impacting financial systems. IoT consists of three layers: smart sensor systems, communication networks, and application support.

Components of IoT in Finance

Smart Sensor Systems: RFID labeling remains underutilized in automating asset identification and logistics. This potential automation boosts operational efficiency by streamlining inventory and supply chain processes.

Communication Networks: IoT connectivity is expanding, integrating devices across wired, wireless, and low-power wide-area networks. Technologies like Near-Field Communication (NFC) and Narrow-Band IoT enhance real-time data transmission for financial services.

Embedded Systems: Advanced embedded technologies enable intelligent object communication, paving the way for more responsive and data-driven financial operations.

ESG and IoT Being the Perfect Match

Environmental, Social, and Governance (ESG) factors now influence investment strategies and regulatory compliance. IoT plays a pivotal role in monitoring energy efficiency, essential to achieving carbon neutrality targets. Carbon trading will increasingly rely on IoT metrics, opening new financial avenues for proactive businesses.

IoT Transforming the Insurance Industry

IoT is reshaping insuretech by enabling precise risk assessment and streamlined processes. Auto insurers traditionally used general data like age and location to set premiums. Now, real-time data on driving behavior directly informs risk profiles, allowing for more tailored policy pricing.

Frequent customer interactions facilitated by IoT enhance engagement, enabling insurers to provide value-added services. This shift transforms the insurer’s role from a passive service provider to an active participant in customer journeys, improving loyalty and satisfaction.

IoT-Driven Innovation in Banking

IoT is refining risk management in banking through enhanced transparency in inventory and property financing. Integrating IoT with blockchain ensures that financial records align with real-world transactions, creating a robust trust ecosystem.

In logistics, IoT revolutionizes trade finance by enabling precise tracking of goods flow. This transparency allows banks to innovate with products like on-demand liquidity and services powered by smart contracts, reducing transaction times.

SaaS, and Serverless Architecture Lower Entry Barriers in Fintech

Current digital economy is speeding and scaling vital for new businesses striving to gain a competitive edge. Open-source software, serverless architectures, and SaaS solutions have become essential for both technology startups and traditional financial institutions in the Fintech space.

Key Benefits of SaaS and Serverless Architecture

Software-as-a-Service (SaaS): SaaS offers businesses on-demand access to software without requiring ownership or maintenance of infrastructure. This approach significantly reduces operational overhead, allowing firms to focus on core activities instead.

Serverless Architecture: By eliminating the need for physical servers, serverless setups optimize resource allocation, linking costs directly to executed code. This model promotes scalable growth, ensuring efficient performance without unnecessary expenses.

Cost Efficiency: Serverless technology minimizes expenses since billing is based on actual software usage, not continuous server operation. This flexible cost model enhances profitability by preventing idle resource waste.

No-Code/Low-Code Platforms Revolutionize Application Development

No-code development platforms (NCDPs) and low-code platforms enable both developers and non-technical users to build applications effortlessly. These platforms utilize intuitive graphical user interfaces, like drag-and-drop features, reducing reliance on traditional coding.

Technical Foundations of No-Code Platforms

Component Reuse and Assembly: NCDPs leverage component reuse principles, streamlining software engineering through pre-built modules and visual development tools.

Domain-Specific Language (DSL): These platforms use DSL to simplify coding, enhancing accessibility for non-developers while maintaining functional depth.

Design Thinking Integration: The platforms incorporate design thinking, enabling user-centric application development that aligns closely with business needs.

Cloud Integration and DevOps: No-code solutions are tied to cloud technologies and DevOps, tackling issues like scaling and high-availability environments efficiently.

Accelerating Cloud-Based Application Development

Organizations utilize NCDPs to speed up cloud application development while synchronizing technology with evolving business strategies. Automated workflows, like audit trails and document generation, ensure seamless compliance in regulated sectors.

Real-World Impact on Financial Services

For financial institutions, these platforms enable agile responses to dynamic market conditions, improving time-to-market for solutions. This capability is invaluable in sectors where speed and compliance are critical for maintaining a competitive edge.

Industry Investments in No-Code Platforms

Tech giants are heavily investing in these innovations. Google Cloud’s acquisition of AppSheet and investment in Unqork highlight the growing reliance on low-code and no-code technologies.

Unleashing R&D Capabilities

No-code/low-code platforms liberate research and development resources, allowing institutions to manage multiple projects simultaneously. This flexibility equips traditional financial firms to match the innovation pace of fintech startups.

Competitive Advantage in Digital Transformation

These platforms provide the scalability needed for enterprise-level digital transformation, bridging the gap between traditional finance and agile fintech disruptors.

Conclusion

The financial sector is undergoing a transformative shift, driven by advancements in fintech. Fintech innovations are not only redefining convenience and accessibility in financial services but also setting new standards. Like for personalized experiences and efficient operations.

By embracing emerging technologies like Generative AI, cloud computing, and blockchain, financial institutions can unlock new opportunities. The future of the finance industry lies in a seamless blend of technology-driven innovation and customer-centric strategies. With fintech leading the way in shaping a more connected, efficient, and secure financial landscape.

Source URL: https://www.techaheadcorp.com/blog/the-future-of-finance-key-tech-trends-reshaping-banking/

0 notes

Link

Increasing adoption of mobile banking application drives the demand for global fintech market. On the basis of geography, Europe dominated the global...

0 notes

Text

Green Frontier Capital’s Vision as a Climate Tech-focused Venture Capital Fund: Investing in Tomorrow

In recent years, there has been a significant increase in global focus on sustainability, particularly in the financial sector. According to PwC’s State of Climate Tech Report 2023, climate tech’s share of private market equity and grant investment rose to 11.4% in Q3 2023, showing a continuous upward trend over the past decade. The Confederation of Indian Industry (CII) projects the global sustainable finance market to grow from USD 3.6 trillion in 2021 to USD 23 trillion by 2031.

The increase in climate tech investment in India is largely fueled by electric mobility. Funding in the ‘Energy’ and ‘Mobility and Transport sectors together make up over 94% of total climate-tech investments in India from 2019 to November 2023. Transport, a major contributor to global emissions at 16.2%, is a crucial area for intervention in the fight against climate change. As consumer interest in this sector grows, so does the interest from climate VC fund and angel investors. The global EV market, valued at $plate_number_1.65 billion in 2022, is projected to grow to $1,579.10 billion by 2030. With the Indian automobile industry ranked 5th globally and expected to become 3rd by 2030, the electric mobility sector in India offers promising green investment opportunities. Green Frontier Capital’s vision is focused on harnessing these opportunities.

India’s electric vehicle (EV) industry has experienced significant growth due to government regulations, technological advancements, and changing consumer preferences. The industry is expected to achieve a compound annual growth rate (CAGR) of 49% from 2022 to 2030. India has established ambitious targets for EV sales, aiming for 30% in private cars, 70% in commercial vehicles, 40% in buses, and 80% in two- and three-wheelers by 2030, which would result in 80 million EVs on Indian roads by 2030. Green Frontier Capital has identified numerous investment opportunities in this growing sector for its investors.

Investment Opportunities in India’s EV Market

Electric Vehicle Manufacturers: Companies that manufacture electric vehicles are benefiting from the increasing demand for clean transportation solutions. Both established players and new entrants are expanding their EV portfolios. Green Frontier Capital has invested in Euler Motors, a commercial EV OEM that has a fleet of over 250 three-wheelers serving customers like Big Basket and Ecom Express. Additionally, Green Frontier Capital has made another investment in Motored, a company that manufactures electric cycles.

Ride-Hailing Services: Electrifying fleets can significantly reduce environmental impact. Green Frontier Capital has invested in BluSmart, which is India’s largest zero-emission ride-hailing service. BluSmart recently launched its EV fleet in Bengaluru.

Battery technologies and services are crucial for the adoption of electric vehicles (EVs). Green Frontier Capital has invested in Battery Smart, which is India’s largest battery-swapping network. India needs over 400,000 charging stations annually, with a projected 1.32 million by 2030. Recognizing this potential, Green Frontier Capital has also included ElectricPe, India’s leading EV charging platform, in its portfolio.

In addition, collaborations between banks, non-banking financial companies (NBFCs), and fintech start-ups are providing financing options to reduce EV purchase costs, especially for low-income individuals. Green Frontier Capital has invested in Revfin, a financing company that offers loans for EVs to individuals from low-income backgrounds.

Addressing Challenges and Mitigating Risks

India’s EV industry has great potential, but investors must know the challenges and risks. The rollout of charging infrastructure faces high capital costs, land acquisition issues, and regulatory hurdles. The regulatory landscape is constantly evolving and impacts market dynamics. Rapid technological advancements and intense competition pose risks to investors. Companies must innovate and adapt to remain competitive. Green Frontier Capital conducts thorough due diligence to identify companies with clear strategies to overcome these challenges and tap into the long-term growth potential of the EV market.

Climate Tech Investments: Combining Profit and Purpose

Investing in India’s EV industry offers financial returns and drives positive environmental and social impact. Electric vehicles produce zero tailpipe emissions, helping mitigate air pollution and reduce greenhouse gas emissions. Climate VC funds’ investments in EVs contribute to combating air pollution and fostering a future where economic growth and environmental conservation go hand-in-hand.

Tags: venture capital funds | climate investors India | vc climate tech | venture capital for startups

0 notes

Text

Music Tectonics Podcast Releases New How to Startup Episode “Startup Reality Check"

There is so much of a good thing in podcasting that much of the time we discover new podcasts from a recommendation from a friend, relative, podcast review sites like mine, and publicists. Of course, publicists has a lot of skin in the game. They're paid to push a podcast.

So when I heard from publicist Christian Harp from Rock Paper Scissors Biz, about a podcast called Music Tectonics, I certainly investigated. I found that the podcast called Music Tectonics was developed by -- you guessed it -- Rock Paper Scissors Biz.

With my skeptic sense on high alert, I listened to ten episodes of the Music Tectonics podcast and discovered that Harp was correct. It's a terrific podcast, especially for music lovers who nerd out on tech.

TheMusic Tectonics podcast, apparently known for exploring how technology is changing the way business is done in the music industry, recently released all five episodes of its new series “How To Startup.” For each installment, host Dmitri Vietze, CEO of music technology-focused PR firm Rock Paper Scissors, was joined by experts with experience in fields from licensing and publishing to law and partnerships, to break down all the necessary steps to build a successful startup.

In the first episode, “How To Startup: Is My Idea Any Good?” Dmitri Vietze and guest host Cliff Fluet, Digital Media Lawyer and Strategist, explain how to determine if your idea fixes a real problem. Vietze and Fluet discuss the importance of testing your technology through multiple channels, small and large-scale pivoting, and more. From their conversation, the duo highlights three key takeaways that can make or break a startup – going out into the industry and testing your product, researching other companies that are aiming to provide a similar solution, and consulting with industry experts.

In the second episode, “The Startup Mindset with Vicki Nauman,” Vietze and Vicki, founder and CEO of CrossBorderWorks, lay the framework for properly positioning your startup for success from the start, and what’s important to keep in mind as you develop. Together they highlight where to start, when to build a team and to what scale, how to approach funding, the importance of identifying real customers, and more.

Just released in early May, the fifth installment of the How To Startup series, has host Dmitri Vietze and guest Bob Moz, former Managing Director of Techstars Music, dissecting the recent trends and investment shifts that have been witnessed shaking up the music tech ecosystem. Together they break down the ways that accelerators and incubators along with an active presence at conferences can be vital aspects to getting your startup off the ground, and more. This episode was part of a recent Music Tectonics Seismic Activity open to all and held monthly. RSVP for the next one here.

This is how the podcast connects to the business because this miniseries represents Music Tectonics and Rock Paper Scissors’ mission to provide the music tech and business community with valuable advice and educational insights.

Founded in 1999, Rock Paper Scissors, Inc. is a music tech PR firm composed of a diverse team of communicators, creatives, and business minds. Its roster includes clients in music technology, music gear, B2B music agencies, music consumer products and apps, artist-facing and label services, music sync platforms, music AI, fintech for music, and much more.

Having written all this, you're right in demanding to know what topics are covered in Music Tectonics?

The podcast has been around since December 2018. I listened to some 2019 shows and, like many podcasts, the episodes and hosts have gotten better over time. Dimitri Vietze is an excellent host. Why is that such an important point? Because CEOs are not known for their podcast hosting talents. I liken it to authors reading their own book for the audiobook format. There are times that the author is a superb narrator, but there are many more times when the author should stick to writing instead of reading.

Vietze has strong hosting skills. He's enthusiastic, but not fake; he's articulate but not arrogant; he's funny but not trying too hard to be witty, and he's a strong interviewer with good listening skills and adept at asking follow-up questions.

An episode on March 6 spent time dissecting the TikTok / Universal Music "game of chicken," and Vietze's insights clarified the messy standoff. One of my favorite episodes is from February 28, 2024, when the guest is Jim Griffin, who talks about NIL (name, image, and likeness) for musicians and how much they are leaving on the table. If you're a budding musician, I would make this episode a must-listen.

There's no topic tangentially related to music that is off-limits on this podcast. For example, possibly my favorite episode is from October 2023 called "The Cool and Creepy History of Artist Estates."

This episode had it all -- hologram tours with deceased musicians, Elvis, the Marvin Gaye "Blurred Lines" lawsuit, and the in's and out's of an artist's estate such as publishing rights, recorded music rights and NIL.

Check out the Music Tectonics podcast for the miniseries, but I urge you to dive into their episode archives. If you're interested in the music business, music tech, and music as an artist, the podcast is certainly worth some of your ear time.

0 notes

Text

How AI-Augmented Data Management Evolves In 2024?

In today’s digitally-driven world, data reigns supreme, with its volume skyrocketing globally year after year. IDC predicts a surge from 45 zettabytes in 2019 to a staggering 175 zettabytes by 2025. This exponential growth is fueled by increased internet accessibility, widespread mobile phone usage, and the omnipresence of social media platforms. With data emerging as the linchpin of enterprise decision-making, businesses are pivoting towards a data-driven approach to navigate the dynamic tech landscape effectively.

The Evolution of Data Management:

Forrester’s report underscores the significance of data-driven strategies, showcasing businesses experiencing over 30% annual growth on average. However, the sheer abundance of data isn’t enough; effective management is paramount. Enterprises harness advanced tools and software to gather vast amounts of data. Yet, the true challenge lies in refining this raw data into actionable insights that drive business success. This necessitates a robust data management strategy encompassing collection, organization, and utilization.

The Role of Artificial Intelligence:

Artificial Intelligence (AI) emerges as a game-changer in the realm of data management, revolutionizing processes with its efficiency, accuracy, and scalability. By integrating AI throughout the data management lifecycle, organizations can streamline operations, enhance data quality, and unlock valuable insights. AI-powered tools facilitate seamless data querying, ensuring accurate results in real-time. Moreover, AI augments the productivity of data analysts and scientists, empowering them to uncover hidden insights and make informed decisions swiftly.

Impact across Industries:

AI’s transformative impact extends across diverse sectors, reshaping traditional paradigms and optimizing data management practices. In healthcare, AI-driven data management enhances patient care through personalized treatment plans and diagnostic precision. Similarly, in manufacturing, AI mitigates revenue loss by optimizing production processes and minimizing errors. Real estate firms leverage AI to analyze market trends and streamline property evaluations, while HR departments harness AI to streamline recruitment and optimize workforce management.

In the FinTech sector, AI-driven data management ensures compliance with stringent regulations and safeguards sensitive financial data against cyber threats. Across these industries, AI serves as a catalyst for innovation, driving operational efficiency, and enhancing customer experiences.

Conclusion:

As businesses navigate the digital landscape, harnessing AI for data management emerges as a strategic imperative. By leveraging AI-powered solutions, organizations can unlock the full potential of their data assets, driving growth, and fostering competitive advantage. Whether it’s streamlining operations, enhancing decision-making, or safeguarding sensitive information, AI-enabled data management is paving the way for a data-driven future. With the right approach and partners, businesses can navigate the complexities of modern data management, ensuring they stay ahead in an ever-evolving digital ecosystem.

0 notes

Text

Complete Guide to Indian Stock Market Statistics: Trends, Data & Insights

The Indian stock market is one of the fastest-growing in the world, attracting domestic and global investors. From historical trends to sectoral performance, trading volumes, and investor behavior, statistics play a crucial role in shaping investment decisions.

In this guide, we break down key stock market statistics, insights, and future trends, using real-world examples from Sensex, Nifty 50, NSE, BSE, and regulatory data from SEBI.

1. A Quick Overview of the Indian Stock Market

Key Players & Regulatory Bodies

The Indian stock market operates through two primary exchanges:

NSE (National Stock Exchange) – Largest by volume and liquidity

BSE (Bombay Stock Exchange) – Oldest stock exchange in Asia

Regulatory Authority: SEBI (Securities and Exchange Board of India) ensures transparency and investor protection.

Market Capitalization & Size

The BSE’s market capitalization hit $4.2 trillion in January 2024, making India the fifth-largest stock market globally.

Nifty 50’s average daily turnover exceeded ₹60,000 crore in 2023, indicating rising participation.

2. Historical Performance of the Indian Stock Market

Milestones & Major Market Events

1991 Economic Reforms: Post-liberalization, Sensex grew from 1,000 points (1991) to 74,000+ (2024).

Harshad Mehta Scam (1992): Exposed stock manipulation, leading to stricter SEBI regulations.

2008 Global Financial Crisis: Sensex crashed 60% from 21,000 to 8,000 but recovered by 2010.

COVID-19 Crash & Recovery: Nifty 50 dropped 39% in March 2020 but surged 140% by 2021.

Bull & Bear Market Phases

Bull Runs: 2003-2008, 2014-2018, 2020-Present

Bear Markets: 1992-1993, 2000-2001 (Dotcom Bubble), 2008-2009

🔍 Stat Check: The Indian stock market has delivered an annualized return of ~12% over the last 30 years, making it one of the best long-term investment avenues.

3. Key Indian Stock Market Indices & Their Performance

Sensex vs. Nifty 50: The Market Barometers

Sensex (BSE 30): Tracks 30 large-cap companies.

Nifty 50 (NSE): India’s broadest benchmark, representing 50 blue-chip stocks.

🔹 Sectoral Indices:

Nifty Bank: Tracks banking stocks like HDFC Bank, ICICI Bank.

Nifty IT: Includes Infosys, TCS, Wipro – surged 300% post-COVID-19.

Nifty FMCG: Tracks consumer-driven growth, led by HUL, ITC.

📈 Chart Your Market Analysis: Use Strike.money for real-time stock data, technical analysis, and market insights.

4. Trading Volume & Liquidity Trends in India

Rising Retail Participation

In 2019, NSE had ~40 million retail accounts; by 2024, this surged to 110 million.

Zerodha, Upstox, and Groww contributed to the fintech boom, increasing trading activity.

FII & DII Impact on Liquidity

Foreign Institutional Investors (FIIs) influence liquidity. In 2023, FIIs invested ₹1.71 lakh crore, driving market rallies.

Domestic Institutional Investors (DIIs), including LIC & Mutual Funds, invested ₹1.6 lakh crore in 2023.

🔹 Fun Fact: The highest-ever single-day trading volume on NSE was recorded in March 2023, at ₹2.5 lakh crore.

5. How Investors Behave in Indian Stock Markets

Retail vs. Institutional Investors

Retail investors: Prefer small-cap & mid-cap stocks, often driven by short-term gains.

Institutional investors: Focus on large-cap stocks for long-term growth.

SIP Boom in Mutual Funds

Monthly Systematic Investment Plans (SIP) inflows crossed ₹17,000 crore in 2023.

Mutual fund AUM (Assets Under Management) stands at ₹50+ lakh crore.

📊 Top Retail Holdings:

Tata Motors (Mid-cap investor favorite)

ITC (Highest retail investor base)

Reliance Industries (Largest market cap in India)

6. Best-Performing Sectors in Indian Stock Market

🔍 Sector Insights:

Nifty IT gained 300% between 2020-2022 (post-pandemic digitization).

Nifty Bank outperformed in 2023 due to strong credit growth & rising interest rates.

7. Key Stock Market Indicators Every Investor Should Track

Fundamental Ratios

P/E Ratio: Indicates valuation (Nifty 50 P/E ~22 as of 2024).

P/B Ratio: Shows asset value (Nifty 50 P/B ~4.2).

Volatility & Sentiment Indicators

India VIX: Measures market volatility. Spiked 80% during COVID-19 crash.

Moving Averages: 50-day & 200-day moving averages signal trends.

📈 Analyze Market Trends: Use Strike.money to track key indicators and optimize trading strategies.

8. How Government Policies Impact the Stock Market

Regulatory & Policy Changes

SEBI's margin rule (2021) reduced speculative trading.

Corporate tax cut (2019) boosted profits, leading to a market rally.

RBI’s interest rate hikes (2022-2023) slowed stock market growth.

🔹 Union Budget Impact:

Budget 2023’s capex push boosted infra stocks like L&T, UltraTech Cement.

Tax changes on LTCG (Long-Term Capital Gains) impact investor sentiment.

9. How Does India’s Stock Market Compare Globally?

📉 Correlation Trends:

India’s market has lower correlation with China (~0.3), higher with the US (~0.6).

Global slowdowns impact export-driven stocks (IT, Pharma).

10. Future Trends & Outlook for Indian Stock Market

🔹 Emerging Trends:

EV Stocks (Tata Motors, Ola Electric IPOs)

Green Energy (Adani Green, NTPC Renewable)

AI & Algorithmic Trading

📊 Market Projection:

India aims for a $10 trillion economy by 2035, driving corporate earnings & stock growth.

Nifty 50 is expected to reach 30,000 by 2027, based on earnings growth & macro trends.

Final Thoughts: Key Takeaways from Indian Stock Market Statistics

✅ India's stock market is resilient, delivering ~12% CAGR over 30+ years. ✅ Sensex & Nifty 50 are strong long-term indicators of market health. ✅ Retail participation & SIPs are at an all-time high. ✅ Sectoral trends indicate IT, Banking, and Green Energy as future growth areas.

📈 Track real-time market data on Strike.money and make informed decisions. 🚀

0 notes

Text

Exploring ESG Trends in the Real-time Payments Sector

The integration of ESG factors into decision-making processes and business strategies has become crucial for companies operating in the real-time payments industry. By incorporating ESG considerations, companies can enhance due diligence, make better investment decisions, and align their operations with the United Nations' Sustainable Development Goals (UN SDGs).

A quantum leap in real-time payments (RTPs) has leveraged customers, enterprises and governments to streamline payments and enhance the efficiency of the financial ecosystem. Real-time payments have made financial services attractive among millennials and the Gen Z population. The upsides of RTPs will be pronounced as policymakers, start-ups and other stakeholders emphasize the expansion of modern payments infrastructure. When compared with legacy alternatives that normally take days to reach the target, RTP has brought a tectonic shift to provide faster and more robust means of payment. It has unfolded social and economic facets that can influence stakeholders across verticals.

Industry leaders have jumped on the bandwagon to inject funds into environmental, social and governance (ESG) frameworks and policies. The year 2023 and beyond could witness real-time payments continuing disruptions. Notably, it could offset economic inefficiency with money locked up in financial systems. Cash-dominated regions are expected to invest in the advanced payment structure to help consumers gain access to financial services and help governments collect taxes and distribute benefits accurately and swiftly.

Fintechs and banks turned adversities into opportunities following the prevalence of the COVID-19 pandemic. The outbreak brought a paradigm shift in the payment landscape, bolstering the digital paymentecosystem. Companies scampered to keep up with the payment demands amidst a surge in cyber threats. Early adopters anticipate witnessing better liquidity management, enhanced communication with counterparties and seamless access to transaction data.

Environmental Perspective

Sustainable payment structure has emerged as a pressing segment amidst the soaring cost of cash management, including environmental, social and governance cost of printing notes. Payments initiated and settled instantaneously could prove to be a game-changer in the cost-effectiveness of cash management and be available 24 hours a day, 7 days a week & 365 days a year. Organizations have exhibited strong demand to boost spending on payment infrastructure. According to an FIS survey released in 2021, around 27% of organizations expect to implement RTP in the next three to five years, while 14% have already embedded the payment infrastructure.

At a time when customers of U.S. corporations are writing approximately 2.3 billion checks (equivalent to 455,000 trees) annually to pay their bills, digital payment could be a silver lining. With policymakers and global regulators pushing for a framework for reporting of climate risks, a transition from paper to digital could be a notable step toward sustainability. In April 2022, one of the largest check processors in the U.S. BNY Mellon announced a reduction in paper checks. Clients have reportedly minimized the number of checks they send to BNY Mellon for processing by 8.5% since 2019.

In May 2021, the check processing company announced the rollout of a real-time electronic bill (e-bill) and payment solution, it claims to be the first bank cashing in the RTP network to offer instant digital consumer bill pay service. Reflecting these trends, advanced economies, such as the U.S. have set an overarching goal of minimizing greenhouse gas emissions by 50%-52% by 2030. Advancements in payment systems are expected to complement these priorities.

Social Perspective

With payments becoming cashless, the road to a digital economy has become pronounced globally. Agility and being proactive on ESG have become compelling as a solid ESG proposition can be the precursor to the company’s long-term success. A buoyant ESG framework can propel employee motivation, reduce employee turnover and enhance social credibility. For instance, Mastercard alluded to the launch of four “work from elsewhere” weeks annually in its 2021 Corporate Sustainability and Diversity, Equity, and Inclusion (DEI) report.

The payment processing company joined forces with Neurodiversity in the Workplace (NITW) to roll out a Neurodiversity Hiring Pilot for the recruitment of neurodivergent candidates for full-time job opportunities. A sharpened focus on social performance has created an avenue of growth. The U.S.-based company has also set an “In Solidarity” action plan to overcome racism and is on course to bring 50 million micro and small businesses and 1 billion people into the digital ecosystem by 2025.

Businesses have also realized the need for skills renewal to leverage lucrative investment opportunities. The FIS survey asserts that around 44 percent of organizations will emphasize skills to bolster innovation. Fintech companies are investing in diversity and economic strength, especially among underbanked populations. To illustrate, in 2021, PayPal earmarked USD 535 million for racial equity and social justice and allocated USD 108 million commitment to underpin the economic empowerment of women and girls. The online payment company also furthered its social profile by enabling early wage access, financial education sessions and financial wellness grants. Companies are expected to harness the power of the ESG ecosystem to tap into the global landscape.

Is your business one of participants to the Global Real-time Payments Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Governance has become invaluable for banks to act as gatekeepers, comply with the law, make effective decisions and meet the needs of external stakeholders. Companies are gearing up to adhere to environmental laws amidst soaring sustainability concerns. High standards set by governance structure will add a fillip to the brands’ reputation and corporate culture. Sound internal governance and disclosures pertaining to the role of the Board and management in climate-related risk management and technology resiliency could reshape the industry dynamics.

Prevalence of practices, such as a diversified board of directors, ethical business practices and transparency has propelled the prominence of the ESG framework. For instance, BNY Mellon boasts of 91% board independence and 36.4% women directors (after the election of directors in 2022). Throughout the year, the senior management rendered reports and updates of the company’s environmental and sustainability programs to the Corporate Governance, Nominating and Social Responsibility (CGNSR) Committee.

Directors, venture capitalists and other stakeholders have prioritized governance, long-term business strategy and education on climate-related issues. Well-established brands have underscored monitoring board composition, risk management and diverse board structure. Akin to BNY Mellon, independent directors at Visa were pegged at 91% (as of April 2022). Besides, the payment giant has fostered its ethics & compliance program amidst a shift to a virtual business environment. Notably, Ethisphere Institute listed Visa among the world’s most ethical companies in early 2022. Embedment of ethics, compliance and transparency into management processes could further promote and bolster corporate governance.

Forward-looking companies face an uphill task that provides both challenges and opportunities to empower people, invest in a diversity workforce and protect customers from cyber threats. The projected CAGR of the real-time payments market at 34.9% through 2030 indicates a rising trend of electronic payment infrastructure.

Related Reports:

Digital Lending Industry ESG: https://astra.grandviewresearch.com/digital-lending-industry-esg-outlook

Digital Payments Industry ESG: https://astra.grandviewresearch.com/digital-payments-industry-esg-outlook

#Real-time Payments Industry ESG#Real-time Payments Industry#Real-time Payments Market#ESG Report#ESG