#Financial data

Explore tagged Tumblr posts

Text

Likely the horse has left the barn, but let us hope.

13 notes

·

View notes

Text

Everyone one was paid stimulus checks through the Treasury. Elon musk now has all of that banking info!!

#money#cyber security#treasury#us politics#democracy#fuck trump#fuck elongated muskrat#financial data#data breach#treason#freedom#human rights#eat the rich

8 notes

·

View notes

Text

So much fucking winning!

#economy#capitalism#late stage capitalism#data is beautiful#financial data#stock market#finance#tariffs

1 note

·

View note

Text

The Nonprofit Accounting Software Buyers Guide

Is Your Accounting Software Helping or Holding You Back?

Ask yourself: Is your accounting and financial management software truly helping your nonprofit achieve its mission, or is it creating unnecessary obstacles?

Many legacy accounting systems struggle to provide fast, reliable financial data. If this sounds familiar, it might be time to consider upgrading to a modern accounting solution.

Choosing the Right Accounting Solution for Your Nonprofit

Before making a switch, it’s essential to evaluate all available options, including on-premises, hosted, and cloud-based solutions. But how do you determine which one is best suited for your nonprofit?

No matter which solution you choose, your organization should benefit from:

Faster financial closes

Easier regulatory compliance

Reduced manual work

Real-time visibility and reporting

A reliable service level agreement

Expert Insights to Guide Your Decision

Navigating the nonprofit accounting software landscape can be challenging. Understanding the strengths and limitations of different financial management systems is crucial in making an informed decision.

This comprehensive guide explores:

Why most financial management systems fail to deliver accurate, timely financial information

Six key questions every nonprofit should ask before transitioning to a cloud-based financial solution

How evaluating software for cloud-based solutions differs from traditional systems

Find out how the right solution can streamline financial operations and support your nonprofit's mission by accessing the Nonprofit Accounting Software Buyer’s Guide.

0 notes

Text

Proper financial management is critical for both individuals and businesses aiming to achieve stability and growth. Tax and accounting services offer a comprehensive approach to managing finances effectively.

0 notes

Text

10 Essential Bookkeeping Tips To Keep Your Business Finances In Check

Introduce the importance of accurate bookkeeping for business success, emphasizing how it helps track income, manage expenses, and maintain a clear picture of financial health. Mention that whether you’re a small business owner or managing a large corporation, good bookkeeping practices are essential.

Outline:

Separate Personal and Business Finances Explain the importance of having separate accounts to avoid confusion and simplify tax time.

Track Every Expense Describe how tracking every expense, no matter how small, adds up to a more accurate financial picture.

Automate Where Possible Suggest using bookkeeping software to automate data entry and reduce human error.

Stay on Top of Invoicing Offer tips on creating a consistent invoicing system to improve cash flow.

Schedule Time for Weekly Financial Review Encourage readers to set aside time each week to review financial reports.

Keep Your Receipts Organized Provide ideas for organizing receipts digitally, making it easier for audits and tax filing.

Understand Basic Accounting Principles Briefly explain terms like debits, credits, and accrual vs. cash accounting.

Prepare for Tax Time Throughout the Year Suggest setting aside funds for taxes and keeping accurate records to ease tax season stress.

Work with a Professional Accountant Explain the benefits of working with an accountant, especially as the business grows.

Regularly Backup Financial Data: Recommend secure data backup solutions to prevent data loss.

Conclusion: Wrap up by emphasizing how consistent bookkeeping habits lead to financial clarity, better decision-making, and business growth. Encourage readers to implement these tips right away for a more organized financial future.

0 notes

Text

The Power of Data Analysis and Integration for Your Business: Why You Need to Start Now

To keep your trucking business financially healthy, it’s crucial to track revenue and expenses accurately. Data analysis helps you monitor income from various brokers and customers, and keep a close eye on every cent of your expenses. By integrating financial data from multiple sources, you get a clear picture of your cash flow, enabling you to make smart decisions. We touched on this topic once…

View On WordPress

#automated reminders#brokers#business#business operations#cash flow#cash flow management#credit reports#Creditworthiness#customers#data analysis#data integration#expense tracking#financial data#financial health#financial metrics#Freight#freight industry#Freight Revenue Consultants#income sources#logistics#operational data#payment patterns#payment terms#profitability#small carriers#strategic decisions#timely payments#track expenses#track revenue#Transportation

0 notes

Text

15 Must-Visit Sites to Follow the Latest Financial Industry Trends

Navigating the vast sea of financial information on the internet can be overwhelming. With countless websites offering insights and analyses, it's crucial to know where to turn for reliable and up-to-date financial trends. To aid in this quest, we've compiled a list of the top 15 sites that are invaluable resources for anyone looking to stay informed about the financial world.

FinChat.io: Touted as the best overall for fundamentals data, FinChat.io provides investors with extensive historical financial data and company-specific key performance indicators.

Bloomberg Businessweek: A staple in the business world, Bloomberg Businessweek delivers information and interpretation on global business events.

Reuters: Known for its speedy and accurate news reporting, Reuters is a go-to for financial professionals and casual readers alike.

Forbes: Forbes is a leading source of reliable business news and financial information, offering in-depth coverage and analysis.

Wall Street Journal — The Wall Street Journal is a must-read for its trusted news, business insights, and financial information.

Investing.com — This site provides a wealth of information, including real-time data, financial tools, and market analysis.

Kiplinger — Kiplinger is known for its practical advice on managing money and achieving financial security.

This Is Money — A comprehensive site that covers personal finance, investment news, and market trends.

The Street — The Street offers financial news, analysis, and stock market data for the savvy investor.

Financial Times — The Financial Times is internationally recognized for its authoritative news and analysis on global financial markets.

CNN Money — CNN Money is a prime destination for those looking to understand how news affects their finances.

CNBC — CNBC provides international business news coverage and real-time financial market updates.

MarketWatch: MarketWatch is a leading innovator in business news, personal finance information, and market insights.

The Economist — The Economist offers authoritative insight on international news, politics, business, finance, science, and technology.

The Motley Fool — The Motley Fool helps investors stay informed with leading insight and analysis of the stock market.

These websites are not just data sources; they are gateways to understanding the complexities of the financial markets. They offer a range of perspectives, from macroeconomic trends to individual stock analysis, making them essential tools for anyone serious about finance. Whether you're a professional investor or just starting to explore the financial landscape, these sites provide the insights needed to make informed decisions. Happy investing!

0 notes

Text

D&B Direct for Finance

Assess risk and creditworthiness in real-time

D&B Direct for Finance is an application programming interface (API) that integrates Dun & Bradstreet insight and capabilities directly into your systems and workflows and cuts through complexities to reduce friction in your overall quote-to-cash process.

0 notes

Text

Organizing Your Finances: The Importance of Financial Data Categorization

Haynes Bookkeeping Solutions offers expert financial data categorization services to help you streamline your financial management. Our dedicated team ensures that your financial data is accurately categorized, providing you with a clear overview of your finances. By categorizing your financial data, you can easily track your income, expenses, and investments, enabling you to make informed financial decisions.

0 notes

Text

Polkadot's Price Movement Indicates a Bullish Trend, Analysts Forecast an Upsurge

Polkadot (DOT) is currently experiencing a significant surge of around 16%, marking a potential shift towards a bullish trend. This positive movement is exemplified by its breakthrough of a key descending trend line, a notable indicator pointing towards a possible uptrend. Analyst Rekt Capital highlights the importance of establishing a strong foothold in the orange zone above, as failure to do so may impact the ongoing rebound trajectory illustrated by the blue path.

The chart analysis also emphasizes the relevance of specific horizontal levels that denote critical support and resistance points, playing a pivotal role in understanding DOT's price dynamics. Further insights include potential price targets and the percentage gains needed for specific milestones. Notably, the chart suggests the likelihood of a retracement following the testing of a significant resistance level, as indicated by an upward blue arrow followed by a downward red arrow.

The Fibonacci retracement levels contribute significantly to the analysis, with the 1.0 level around $7.4725 standing out. Traders closely monitor this level for potential signs of trend reversals or continuations. Additionally, the chart outlines a typical market pattern known as the "ABC" correction or "1-2-3" pattern, involving an initial uptick, a retracement, and subsequent upward movement.

As of the latest financial data, DOT's value stands at $7.22, reflecting a 1.59% increase over the past day. While this uptick supports the overall bullish sentiment, investors are advised to remain attentive to key resistance levels and potential retracements, contributing to the dynamic landscape that positions DOT as a cryptocurrency to watch in the coming days.

#Polkadot#DOT#financial data#bullish sentiment#market participants#technical analysis#key resistance levels#dynamic scenario#cryptocurrency#cryptotale

0 notes

Text

Explore 10 Company Financial Dashboards with Examples & Free Templates

This article presents a variety of financial dashboards, ranging from a CFO financial dashboard to a revenue overview and cashflow forecast. These dashboards are designed to assist you in comprehending your financial data effectively.

Among them, some serve as inspiration for crafting a personalized dashboard, while others are pre-made templates ready for immediate use. The latter enables you to effortlessly visualize your financial data within minutes. Additionally, we will guide you on automating your financial dashboard reporting, ensuring that your dashboards remain current and ready for analysis.

10 financial dashboard examples

1. SaaS financial dashboard + template

Utilize this dashboard to:

Discern the key drivers influencing financial outcomes

Identify current and potential obstacles

Examine the impact of sales on revenue generation

Monitor the evolving dynamics of revenue over time

Investigate the causes of revenue loss

Fine-tune your strategy to enhance financial performance

This dashboard is available as a free template for different apps:

Financial dashboard template for HubSpot

Financial dashboard template for Pipedrive

Financial dashboard template for Salesforce

2. Billing overview dashboard + template

Similar to contemporary financial reporting dashboards, this visually presented report is automatically updated, interactive, and conducive to analysis. It empowers you to:

Delve deeply into your data

Employ diverse filters and delve into specific details

Real-time monitoring of billing statuses

Recognition of top-performing projects and clients

Efficient billing management

Analysis of profits over time from different perspectives

This Billing overview dashboard is available as a free template.

3. CFO financial dashboard + template

Utilizing this template for a financial reporting dashboard, you can:

Track near-real-time revenue growth

Discern the top-performing products

Maintain a comprehensive record of invoices

Analyze financial data for actionable insights

Formulate data-supported projections and plan for the future

This Financial dashboard for QuickBooks is available as a free template.

4. Ecommerce financial reporting dashboard + template

Utilize this dashboard to:

Gain insights into the overall business performance of your store

Analyze and enhance order management for revenue maximization

Filter orders based on country and source

Filter orders according to their financial status (paid, pending, refunded, etc.)

Foster alignment among your finance, marketing, and sales teams to enhance overall strategy

This Ecommerce financial reporting dashboard is available as a free template.

5. Financial performance dashboard

Utilize this dashboard to:

Monitor revenue in relation to established targets

Swiftly observe shifts in growth trends

Compare actual revenue to your projections

Assess overall financial health at a glance

This dashboard was built in Tableau by MergeYourData and designed to serve as a cockpit, giving several graphs and multiple scorecards presenting various aspects of financial performance.

6. Cashflow tracking dashboard

With this dashboard, you can:

Track the dynamics of cashflow over time

Visualize the contribution of various products to cashflow (annual/monthly subscriptions)

Identify trends and patterns

Perform time-over-time analysis

This type of dashboard example is a Cashflow report built in PowerBI.

7. MRR breakdown dashboard

With this dashboard, you can:

Monitor and analyze Monthly Recurring Revenue (MRR) data

Uncover trends and significant factors impacting MRR

Perform month-over-month comparison analysis

Keep tabs on crucial metrics like churn or reactivation

Extract valuable insights to integrate into your strategy

Incorporate financial analytics into your regular processes

You can check this example of MRR breakdown dashboard for a better understanding.

8. Product revenue dashboard

Utilize this product Key Performance Indicator (KPI) dashboard to:

Monitor and analyze product revenue

Effectively manage churn

Gain deeper insights into Monthly Recurring Revenue (MRR) trends

Conduct financial analysis related to product performance

9. Daily cashflow forecast dashboard + template

With this template, you can:

Create forecasts for various time frames

Perform cashflow analysis

Develop strategies to attain the projected outcomes

Make well-informed decisions

This Ecommerce financial reporting dashboard is available as a free template.

10. High-level revenue and profit dashboard

Utilize this dashboard to:

Monitor essential metrics such as total revenue, gross profit margin, net profit margin, and more

Track month-to-month variations

Access the latest financial data around the clock

Maximize decision speed with effective financial dashboards. These dashboards serve diverse purposes, acting as reporting tools, KPI monitoring cockpits, and data analysis instruments. To be genuinely effective, a dashboard must be tailored to specific goals and audience preferences and live auto-updating with interactive features like filters and drill-downs. Including only relevant metrics, an excellent financial dashboard becomes a powerful tool for decision-makers, facilitating KPI monitoring, process control, progress tracking, and more.

This article showcases examples of automated finance dashboards with real-time data, providing actionable insights and encouraging a data-driven approach. Apart from financial, click here to learn how to build other types of SaaS dashboards and unlock your data’s full potential for informed decision-making.

#dashboards#dashboard templates#data analytics#data visualization#reporting#finance#financial data analytics#financial dashboards#financial reporting#financial data

0 notes

Text

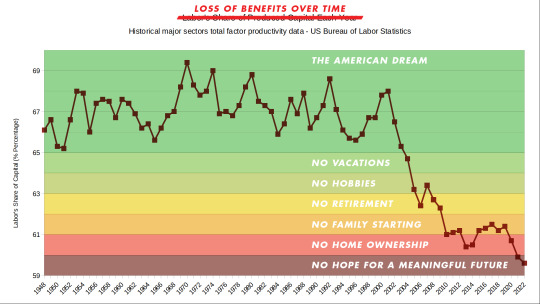

One more way to frame our current reality. But go ahead and tell me the economy is strong one more time.

#economy#capitalism#data is beautiful#financial data#late stage capitalism#no vacations#no hobbies#no retirement#no family#no home#no hope#the American dream#people die in the margins

5 notes

·

View notes

Text

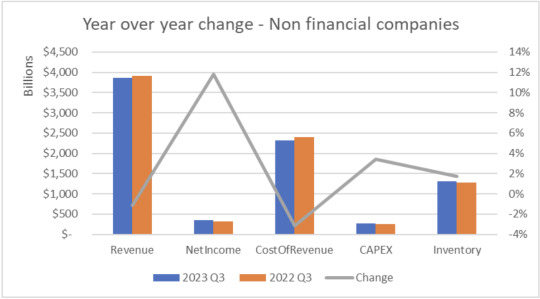

The Calcbench Q3 Quarterly Wrap-Up

Good news for analysts everywhere just before the Thanksgiving holiday: Calcbench has released its Q3 2023 Wrap-Up, so you have something to read surreptitiously on your phone while the in-laws gripe about politics.

We release our wrap-ups at the end of every earnings season (you probably figured out that part already) to study broad trends in revenue, net income, capital spending, and other important metrics. This quarter’s report tallies up the data for more than 3,300 non-financial firms — not quite every filer that’s out there, but more than enough to give us a sense of this quarter’s corporate performance.

Most notably, we saw an 11.8 percent increase in net income compared to the year-earlier period. That compares to more modest increases in capital expenditures (up 3.4 percent) and inventory (up 1.7 percent), and overall revenue actually edged downward by 1.1 percent. See Figure 1, below.

(To be clear, all firms included in this report filed earnings for Q3 in both 2023 and 2022, for the most apples-to-apples comparison.)

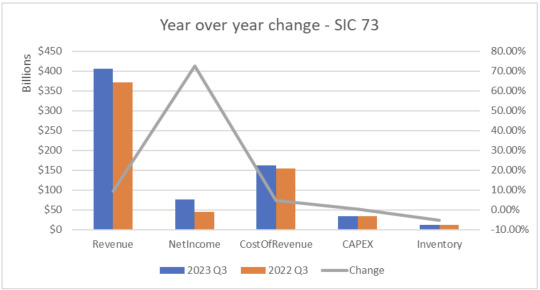

The Q3 Wrap-Up also examines three specific sectors: retail, software, and chemicals, to get a sense of how performance varied from one sector to another.

Sometimes that performance varied by a lot. The 230 companies in our retail group, for example, reported a year-over-year jump in net income of 148.4 percent, while capital expenditures dropped 11.2 percent. Various specific companies had equally impressive numbers. Walmart ($WMT) revenue rose 5 percent; Amazon.com ($AMZN) net income jumped from $2.9 billion to $9.9 billion.

Meanwhile, the software sector saw year-over-year revenue rise 9.5 percent, while net income rose 72.7 percent — led, not surprisingly, by tech giants such as Facebook ($META), Google ($GOOG), and Microsoft ($MSFT), which all reported multi-billion dollar increases in profit. See Figure 2, below.

The highlights in this report are a great place to start when analyzing Q3, but they certainly do not tell individual stories of specific companies. For example, Berkshire Hathaway ($BRKA) reported a year-over-year revenue of $16.3 billion (yay!) and a decrease in net income of $9.8 billion (yuck). To find out more about the specific companies you follow, you’ll need to do more digging and reading in the footnote disclosures.

For example, did you know Berkshire reported investment losses of $24.1 billion in the quarter? We did, because our Interactive Disclosure tool lets you dig into the footnotes and bring those important kernels of insight to the surface in short order.

Try Calcbench’s suite of products to get more data and details yourself!

0 notes

Text

Interoperability in healthcare refers to the seamless exchange and use of health information between different systems, applications, and stakeholders. It enables disparate healthcare systems to communicate and share vital patient data in a standardized and meaningful way.

0 notes

Text

Tips to Manage Liquidity Risk in Today’s Environment

With changing economic trends, technology growth, the rise of AI, and social media, banks need to effectively predict and track their capital inflows and outflows to minimise capital loss. One of the best ways to prevent loss and closure is by closely monitoring the liquidity risk factor of the bank.

The banks’ liability gap, which is measured as a difference between the asset maturity term and the liability overdue, helps banks detect if they have to be worried about a liquidity risk.

Students of accounting and finance need to be aware of the nuances of the liquidity risk factor to reduce its impact on banking operations. It will not only help them perform well in the Certified Management Accounting exam but also secure lucrative jobs in the financial crisis management department of the banking sector. In this regard, pursuing account-related courses in Ahmedabad will prove beneficial to CMA exam aspirants and other finance students.

Here are some tips for banks to monitor and minimise their liquidity risk:

Banks need to have a contingency funding plan to handle a liquidity shortfall

A strategic contingency plan will help banks foresee unfavourable situations and develop fail-safe plans to tackle them. Often known as a backup plan, a contingency funding plan (CFP) and its components will help banks function normally even during crises.

A contingency plan also gives the bank the requisite confidence to return to its normal state despite encountering undesirable situations like a cash crunch.

One of the most important aspects of a contingency funding plan is to identify key risks and rank them according to their level of importance. After this, the CFP team will need to recognise and allocate resources for the different crises. A detailed plan comprising risk factors and resources should be mapped and shared with all the relevant stakeholders.

Revamp the banks’ stress testing techniques to match technology growth

Many stress testing techniques of banks are designed for offline banking transactions only. But, owing to the growth of technology, the social media scare can lead even a healthy, functioning bank to fail with online transactions and fund transfers. Hence, the stress testing techniques should factor in the worst-case scenarios and help detect bank vulnerabilities in the age of growing social media and artificial intelligence use.

Effectively manage solvency and liquidity buffer

Solvency, which is the bank’s ability to handle long-term liabilities with ease, needs to factor in its close connection with the liquidity buffer. When banks are leaning towards solvency, their liquidity buffer can be on the lower end. But regular measures to determine the banks standing on the solvency spectrum are important. If the bank is leaning towards insolvency, then having cash reserves in the form of a liquidity buffer is essential. The rate of insolvency of rural banks tends to be higher than that of urban banks, on account of the many concessions offered to the rural sector. So, such banks need to closely monitor insolvency and manage their liquidity buffer accordingly.

Monitor the risks encountered by funding

Another important facet of liquidity risk management is incorporating it into the banking institutions’ key executive decisions and plans. In many situations, banks fail to take into account the liquidity risk while formulating the interest rates on loans for different sectors.

By knowing how much money is allocated to equity, core deposits, and wholesale funds, a bank can predict the fund recovery rate. Also, by knowing the history of depositors and their behaviours, the cash inflow and cash outflow of the bank can be determined.

Leverage the power of financial data

Data analytics can help banks manage liquidity risk very effectively. By forecasting and recognising cash flow patterns using financial data analytics tools, banks can invest in assets that have the least risk and maximum returns. For instance, the influence of demand and pricing on cash flow can be effectively determined using the power of data mining and analytics.

Data analytics not only predicts financial data but also helps optimise the working capital of the bank. Working capital is the difference between current assets and liabilities. Optimising the capital available with the bank for regular operations will help it minimise cash deficits effectively.

Additionally, the power of data analytics can also be used to monitor indicators of liquidity risk like the liability gap, liquidity fund reserve, stress tests, and others. This will further help banks mitigate liquidity risk and focus on improving banking opportunities.

Final Word

Though technology growth can sometimes be a deterrent for banking operations that are more built for brick-and-mortar banking operations, keeping up with technology and data will help a bank survive in the modern world where everything and everyone is dominated by artificial intelligence.

As a result, students who are pursuing different financial courses, like account-related courses in Ahmedabad, need to be on par with the varied financial trends of liquidity risk management if they want to have a successful career in banking.

0 notes