#Financialforecast

Explore tagged Tumblr posts

Text

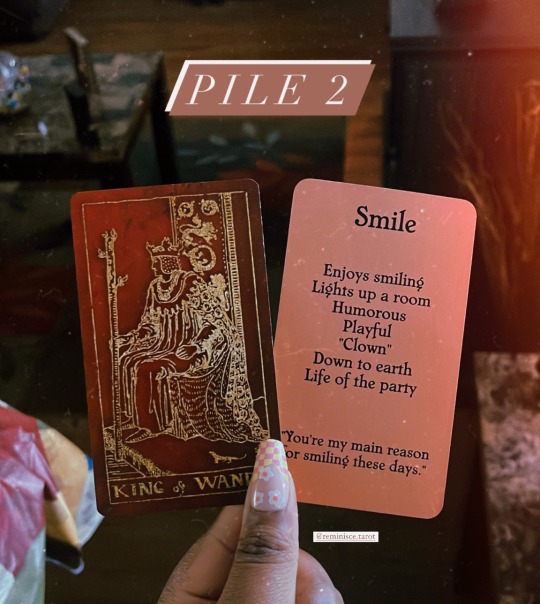

💘 What’s Coming Towards You in Love? Pick a Card 💘

Choose a pile to see what you may expect when it comes to your love life. Take what resonates; leave what doesn’t. The messages can be used upon your interpretation as well. This applies to you and the other person’s energy ~ regardless of relationship status.

Choose 1, 2, or 3

If you chose Pile 1 -

Listen to that inner voice when you are connecting with someone. Take the “Instagram filter” off someone and really see what’s happening in that moment. There’s a need for vulnerability and to take things to the heart. Does someone loves you for being you, or their own idea of you? 😘

If you chose Pile 2 -

You are clear about what you truly want from the start. You are the main attraction when you walk in the room. Smiling and laughing! Behind that smile is hiding secrets and feelings from the world. Don’t be a prisoner of your own mind. 🧡

If you chose Pile 3 -

Trust the process in your healing journey. Things are changing for the better. Life is really a roller coaster ride. If you want to make this work, keep an open mind and heart toward acceptance and love ~ nothing is really set in stone. 💘

Let me know which pile do you choose and if it resonates.

DING! DING! DING!

Financial Forecast Email Reading Special (Limited Time) 💸💰

This financial forecast reading touches upon what’s happening with your money and your career. This reading includes the HUSTLE Money/Career Advice Oracle Cards. I will send your reading through your email address. It is $10 per submission.

HOW TO SECURE YOUR SPOT ~ 💰💸

- Please include your full name and email address along with your payment via CashApp or PayPal in the notes section at checkout.

Cashapp - $KekeWin23

PayPal - @reminiscetarot

- Make sure that you are giving the correct information. If you made an error, please email me at [email protected]. Don’t forget to send me your proof of payment, your full name and email address.

Submissions will be closed on Sunday 09/10/2023.

REMINDER: Use your own interpretation of the cards and the message that I give you as well. Please be patient with my time and energy.

Look is what your reading will look like!

#spirituality#black tarot readers#dreamnreminisce#healing#reminiscetarot#tarot reader#divination#intuitive#pac#pick a card#pick an image#love reading#love#loveyourself#financialforecast#firesigns#water signs#astrology#tarot reading#oracle reading#tumblr fyp#blacktarotreaders

97 notes

·

View notes

Text

New York Stock Market Index in 2025

The New York Stock Market Index, one of the world’s leading financial markets, plays a pivotal role in global economics. Its indices, such as the Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ Composite, serve as barometers of the financial health and investor sentiment in the United States. In 2024, the performance and dynamics of these indices have garnered significant attention, not only within the U.S. but also globally, including their impact on the Indian market. This comprehensive overview explores the current state of the New York Stock Market, its live updates, and its influence on the Indian economy.

New York Stock Market Index

Key Indices and Their Performance:

NASDAQ Composite: Known for its high concentration of technology and biotech companies, the NASDAQ Composite has shown significant volatility in 2024. The performance of major tech giants and innovative startups has heavily influenced this New York stock market index.

Dow Jones Industrial Average (DJIA): The DJIA, consisting of 30 major companies, is one of the oldest and most well-known stock market indices. In 2024, the DJIA has experienced fluctuations due to various factors, including economic data releases, corporate earnings, and geopolitical events.

S&P 500: New York stock market index includes 500 of the largest companies listed on the NYSE and NASDAQ. The S&P 500 is widely regarded as one of the best representations of the U.S. stock market. Its performance in 2024 has been closely monitored, reflecting the overall economic conditions and investor confidence.

New York Stock Market Now

Current Trends and Influences:

Corporate Earnings: Quarterly earnings reports from major corporations provide insights into New York stock market now financial health and future prospects. In 2024, mixed earnings results across sectors have led to varied market reactions, with technology and healthcare sectors showing notable performances.

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation figures have a direct impact on New York stock market index performance. In 2024, the U.S. economy has shown signs of resilience with steady GDP growth, though concerns about inflation have persisted, influencing investor behavior.

Monetary Policy: The Federal Reserve’s monetary policy, including interest rate decisions and quantitative easing measures, plays a crucial role in shaping market dynamics. In 2024, the Fed’s stance on interest rates has been a focal point for investors, impacting both equity and bond markets.

Geopolitical Events: Geopolitical tensions, trade relations, and international conflicts can lead to market volatility. In 2024, events such as trade negotiations, diplomatic developments, and regional conflicts have contributed to fluctuations in the New York Stock Market Now.

New York Stock Market Live

Real-Time Updates and Market Movements:

Investor Behavior: The behavior of retail and institutional investors significantly influences New York stock market index trends. In 2024, the rise of retail investors, facilitated by online trading platforms, has added a new dimension to New York stock market index dynamics, often leading to unexpected price movements.

Market Sentiment: Real-time market sentiment, driven by news events, analyst reports, and social media trends, can cause immediate market reactions. In 2024, platforms providing live updates and market sentiment analysis have become invaluable tools for investors.

Technological Advancements: Advances in trading technology, including algorithmic trading and high-frequency trading, have increased the speed and volume of transactions. These technological developments have contributed to greater market liquidity and efficiency in 2024.

New York Stock Market Index Impact on Indian Market

Interconnected Global Economy:

Capital Flows: The interconnectedness of global financial markets means that movements in the New York Stock Market Index can influence capital flows to emerging markets, including India. In 2024, shifts in investor sentiment in the U.S. have led to changes in foreign portfolio investments in Indian equities and bonds.

Exchange Rates: The performance of the U.S. dollar, influenced by the New York Stock Market Now impacts exchange rates. In 2024, fluctuations in the dollar have affected the Indian rupee, influencing trade dynamics and foreign exchange reserves.

Commodity Prices: The U.S. stock market’s performance can impact commodity prices globally. In 2024, changes in oil prices, driven by market sentiment and economic conditions in the U.S., have had ripple effects on India’s import costs and inflation.

Sectoral Impacts:

Automotive Sector: The automotive sector, particularly electric vehicles (EVs), has seen significant developments in the U.S. market. In 2024, the growth of the EV market in the U.S. has spurred investments and innovations in India’s automotive industry, promoting sustainability and technological advancement.

Technology Sector: The technology sector’s performance in the New York Stock Market Index has direct implications for Indian IT companies, many of which derive a significant portion of their revenue from the U.S. In 2024, strong performances by U.S. tech giants have been positive for Indian tech firms.

Pharmaceutical Sector: The healthcare and pharmaceutical sectors are closely linked between the U.S. and India. In 2024, advancements and investments in U.S. biotech and pharma companies have opened opportunities for Indian counterparts, enhancing collaborations and market access.

Challenges and Opportunities

Navigating Market Volatility:

Investment Opportunities: Despite market volatility, 2024 has presented numerous investment opportunities. Sectors such as renewable energy, healthcare, and technology have shown promise, attracting both domestic and international investors.

Risk Management: Investors in both the U.S. and India need to adopt robust risk management strategies to navigate market volatility. In 2024, diversification across asset classes and geographical regions has become essential to mitigate risks associated with New York stock market index fluctuations.

Policy Responses: Government and regulatory policies play a critical role in stabilizing markets. In 2024, coordinated policy responses between the U.S. and India, focusing on trade, investment, and economic reforms, have been crucial in addressing market challenges.

CONCLUSION

The New York Stock Market Index in 2024 has been a focal point for global investors, reflecting broader economic trends, technological advancements, and geopolitical developments. Its real-time performance and market movements have had far-reaching implications, influencing not only the U.S. economy but also global markets, including India. Understanding the dynamics of the New York Stock Market Index and its interconnectedness with the Indian market is crucial for investors, policymakers, and businesses seeking to navigate the complexities of the global financial landscape in 2024.

Stay updated with ISMT latest insights New York Stock Market Index in 2024, real-time analysis New York Stock Market Now live data, expert commentary.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#financeblog#economicoutlook#marketupdate#stockpredictions#useconomy2025#wallstreet#investmentstrategies#financialforecast#nyse2025#stockmarkettrends#stockmarketindex#newyorkstockmarket

0 notes

Text

🚀📈 Neural Finance Is Redefining Stock Market Predictions!

💻 Neural finance investment platforms 🤖 are transforming how we predict 📊 stock market trends—using artificial intelligence 🧠 to uncover hidden patterns 🔍, reduce risks ⚠️, and supercharge 💥 portfolio returns 💰!

Wondering how it all works? 🧐

We explain everything: from how neural networks 🕸️ forecast market moves 🔄 to best practices for smart investing 💼.

👉 Read the full article now and stay ahead of the game! 🏁 https://thinquer.com/financial/neural-finance-investment-platforms-stock-market-predictions/

💬 Drop a comment & 📅 check back daily for more insights!

#NeuralFinance#StockMarketPredictions#AIInvesting#FintechRevolution#SmartInvesting#DeepLearning#PortfolioOptimization#QuantTrading#FinancialForecast#PredictiveAnalytics#MachineLearning#InvestmentPlatform#FinanceNews#AIDriven#StockTrends#DataScience#InvestorsCommunity#TradingTools#MarketInsights#FutureOfFinance

0 notes

Text

0 notes

Text

France Castrate Resistant Prostate Cancer Therapeutics Market Growth Projection

The image illustrates the projected growth of the France Castrate Resistant Prostate Cancer Therapeutics Market from 2022 to 2030, measured in millions of dollars (Mn). The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.1%. Starting at $280.5 Mn in 2022, the market is expected to steadily increase year by year, reaching $450.5 Mn by 2030. Each bar represents a specific year, with the corresponding value displayed above it, showcasing the progressive growth trend.

#MarketGrowth#ProstateCancer#CancerTherapeutics#France#Healthcare#FinancialForecast#CAGR#MedicalTechnology#BarGraph#MarketAnalysis#Insights10

0 notes

Link

مايكروسوفت تتوقع نموًا في الإيرادات رغم تراجع مبيعات الأجهزة في 2025 أعلنت مايكروسوفت، عبر تقريرها المالي الأخير، عن توقعاتها بنمو في الإيرادات خلال الربع الثالث من العام المالي 2025، والذي يغطي الفترة من 1 يناير إلى 30 مارس 2025. جاء هذا الإعلان على لسان آيمي هود، المديرة المالية للشركة، التي أكدت أن الشركة تتوقع تعافيًا في الأداء المالي بعد تراجع شهدته خلال الربع الماضي. وأشارت هود إلى أن هذا النمو

0 notes

Text

#BankOfAmerica#EconomicOutlook#RecessionUpdate#CEOReport#FinancialForecast#EconomicForecast#MarketTrends#BusinessNews#FinancialNews#EconomicInsights#news#ceo#success#entrepreneur#brand#marketing#business

0 notes

Text

Skyrocketing Stocks: Jaw-Dropping Predictions for the 2025 Share Market 🚀📈

Are you ready to take your investments to the next level? Buckle up, because we’re diving into the most anticipated stock market predictions for 2025. The financial landscape is set for some seismic shifts, and savvy investors need to stay ahead of the curve. Here's a deep dive into the trends and stocks that could make you a fortune in the next few years.

🌟 The Tech Titans: Dominating the Market

Technology stocks have been on a tear, and they show no signs of slowing down. By 2025, we predict that:

Artificial Intelligence (AI) companies will see unprecedented growth. Think beyond just the big names; emerging startups in AI and machine learning will offer incredible investment opportunities.

Blockchain Technology will revolutionize industries beyond cryptocurrency. Companies leveraging blockchain for supply chain management, security, and data integrity are set to soar.

Green Tech and Renewable Energy firms will be major players. With global shifts towards sustainability, stocks in solar, wind, and battery technology will be the ones to watch.

🏥 Health is Wealth: Biotech and Healthcare Surge

The pandemic has underscored the importance of healthcare innovation. Our 2025 predictions include:

Biotech Breakthroughs: Companies focusing on gene editing, personalized medicine, and biotech advancements are poised for massive growth.

Telehealth Expansion: The convenience and necessity of telehealth services will drive the growth of companies in this sector. Look for stocks that are innovating in virtual healthcare, remote diagnostics, and health monitoring.

💸 Financial Revolution: Fintech and Cryptocurrency

The financial world is undergoing a digital transformation. Key predictions for 2025 include:

Fintech Firms Flourish: Companies offering digital banking, payment solutions, and financial services will continue to disrupt traditional banking models. Stocks in this space are a must-watch.

Cryptocurrency Adoption: As cryptocurrencies gain mainstream acceptance, related stocks, including those in crypto exchanges, wallet providers, and blockchain infrastructure, will skyrocket.

🌐 Global Giants: International Market Leaders

Don't limit your portfolio to domestic stocks. Our 2025 predictions highlight the importance of international diversification:

Asian Markets: China and India will continue to be economic powerhouses. Companies in tech, manufacturing, and consumer goods from these regions will offer lucrative investment opportunities.

Emerging Markets: Countries in Southeast Asia, Africa, and Latin America are on the cusp of significant economic growth. Investing in diverse industries within these emerging markets could yield high returns.

📊 Strategy and Caution: How to Navigate 2025

While these predictions offer exciting prospects, it's crucial to approach 2025 with a strategic mindset:

Diversify Your Portfolio: Spread your investments across different sectors and regions to mitigate risk.

Stay Informed: Keep up with market trends, global news, and financial analyses to make informed decisions.

Consult Financial Advisors: Professional guidance can help tailor your investment strategy to your personal financial goals and risk tolerance.

🚀 Ready to Invest?

2025 promises to be a landmark year for the stock market. With the right strategies and a keen eye on emerging trends, you could be on the path to financial success. Don’t miss out on these investment opportunities – the time to start planning is now!

#StockMarket#MarketPredictions#2025Stocks#Investing#FinancialForecast#StockTips#MarketTrends#InvestmentStrategy#FutureStocks#BullMarket#ShareMarket#StockGrowth#MarketAnalysis#StockInvesting#FinancialGrowth#InvestmentPredictions#MarketOutlook#StockInsights#WealthBuilding#InvestSmart

0 notes

Text

Dining with Digital Gold: Adjust Your Appetite for Investment Returns! 📉🍴💰

0 notes

Text

Micron Technology Inc. Surges on Strong AI Demand Forecast

Micron Technology Inc., the leading US producer of computer memory chips, witnessed a remarkable surge in its stock value, marking its most significant gain in over a decade. This surge came in response to the company’s unexpectedly robust sales forecast, largely driven by the escalating demand for artificial intelligence (AI) hardware. Here’s a breakdown of Micron’s recent developments and its outlook:

Stellar Financial Forecast

In a statement released on Wednesday, Micron projected its fiscal third-quarter revenue to range between $6.4 billion and $6.8 billion, surpassing the average analyst estimate of $5.99 billion. Additionally, the company anticipates earnings of approximately 45 cents per share, excluding certain items, far exceeding analysts’ projections of 24 cents per share. This bullish outlook underscores Micron’s confidence in its growth trajectory amidst the evolving landscape of AI technology.

Emerging from Industry Slump

Micron Technology, alongside its competitors, navigated through one of the memory chip industry’s toughest downturns, primarily attributed to subdued demand for personal computers and smartphones. However, with the burgeoning market for AI hardware, chipmakers like Micron are poised to rebound, propelling the industry toward growth and profitability once again.

AI: A Game Changer

Sanjay Mehrotra, CEO of Micron Technology, emphasized the company’s strategic positioning to capitalize on the prolonged opportunity presented by AI. Mehrotra believes that Micron stands as one of the primary beneficiaries within the semiconductor industry, as AI continues to drive innovation and demand for advanced hardware solutions.

Micron Technology Jumps After AI Growth Helps Bolster Forecast

youtube

Innovating with High-Bandwidth Memory

Micron’s foray into high-bandwidth memory (HBM), particularly HBM3E, signals a significant step towards catering to the specialized requirements of AI-related systems. This type of memory, integral to AI accelerators such as those developed by Nvidia Corp., allows Micron to command higher prices due to its novelty and indispensability in the AI ecosystem.

Future Outlook and Expansion Plans

Looking ahead, Micron remains optimistic about the industry’s resurgence, with expectations of record sales levels by 2025. However, achieving these milestones hinges on meeting the demand for ultrafast memory, essential for AI-driven applications. Micron’s ongoing investments in new facilities across China, Japan, and India, coupled with potential expansions in the US, underscore its commitment to meeting the evolving needs of the market.

Government Support and Market Dynamics

While the US Department of Commerce announced substantial support for semiconductor giant Intel Corp., Micron remains focused on sustaining its growth momentum with ongoing investments. The company’s plans for expansion in the US are contingent upon receiving adequate support in the form of grants, tax credits, and incentives, reflecting the intricate interplay between government initiatives and private sector investments in the semiconductor industry.

In summary, Micron’s bullish outlook fueled by AI demand highlights its resilience and adaptability in an ever-changing market landscape. As the industry continues to evolve, Micron remains at the forefront, poised to capitalize on emerging opportunities and drive innovation in the realm of memory chip technology.

Curious to learn more? Explore our articles on Enterprise Wired

#microntechnology#AI#semiconductors#technews#innovations#artificialintelligence#stockmarket#investing#financialforecast#Youtube

0 notes

Text

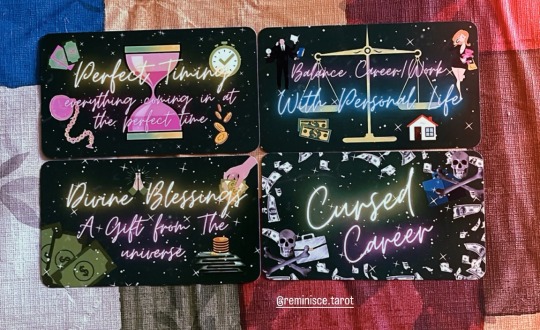

💰 Career + Finances Messages | What is Coming Towards You | Pick a Card 💰

This pick a reading touches upon what you can expect within financial/career matters and its energy surrounding it in your life. Choose a number and read the message below. Let me know if this resonates in the comments below too! ☺️

💰 Pile 1 💰

This is your year to be able to experience a level of success and abundance. I’m seeing that you are able to pay off your debt and other expenses to get yourself situated to avoid any setbacks. You have taken the time and effort to manifest your financial and career goals, and you will eventually seek those rewards soon. However, be mindful of people who may not have the best intentions for you and your money - try to be careful of giving people your ideas and money to. 🤑

💸 Pile 2 💸

You are about to enter a cycle of abundance. Don’t let failures and mistakes get the best of you - keep on trying and learn from them. Also, be aware of signing any business contracts, agreeing to certain ideas, or involving into get-rich- quick schemes that can lead to financial/legal issues. Keep your eye on the people who are around your finances as well. 💵

🤑 Pile 3 🤑

You may be involved in a career choice that is draining and stressful to you, and you are ready to move on. You are gonna be blessed very soon that all of your doubts will fade away. There’s a need for you to have faith and trust in the Universe. Try to keep the balance between your work and personal life to avoid any stress and anxiety as changes are coming to you in divine timing. 💸

I am not taking personal readings at this time. If this resonates with you, you may send a love donation through my CashApp ($KekeWin23) or PayPal ([email protected]).

Deck: HUSTLE Money/Career Advice Oracle Cards by @firewitchtarot (from Instagram)

#spirituality#dreamnreminisce#healing#reminiscetarot#black tarot readers#tarot reader#divination#intuitive#pac#spiritualhealing#financialforecast#financialfreedom#abundance#pickapile#pickacard#pickacardreading#oraclereading#intuitivehealer#divineguidance#abundance mindset#careerdevelopment#hustle

8 notes

·

View notes

Text

Bitcoin Price Prediction $300K for 2024 by Robert Kiyosaki!

Bitcoin price prediction by Robert Kiyosaki, the beloved author of “Rich Dad Poor Dad”, has once again aroused enthusiasm among Bitcoin lovers with his recent Twitter post. Due to this, there has been a stir in the entire cryptocurrency market.He boldly predicts that Bitcoin’s current growth is just the beginning, with Bitcoin potentially rising significantly to $300,000 by the end of 2024.…

View On WordPress

#2024Prediction#Bitcoin#BitcoinPrice#Cryptocurrency#FinancialForecast#Investment#MarketAnalysis#RobertKiyosaki#crypto news#cryptocurrency news predictions#Investment opportunities#latest crypto news

0 notes

Text

Unlocking Financial Wisdom: Your Guide to Expert Reports

Haynes Bookkeeping delivers expert financial reports, offering comprehensive insights into your company's fiscal health. Meticulously crafted by seasoned professionals, these reports decode complex financial jargon, providing a clear and concise overview of your business's financial performance. Trust Haynes Bookkeeping for accurate, understandable financial reports that empower you to make informed decisions and drive your company's success.

#FinancialInsights#ExpertAnalysis#StrategicPlanning#DataDrivenDecisions#FinanceMatters#InvestmentStrategies#EconomicOutlook#FinancialForecast#MarketTrends

0 notes

Text

France Cardiac Resynchronization Therapy Market Growth Projection

The image presents a bar graph depicting the projected growth of the France Cardiac Resynchronization Therapy Market from 2022 to 2030, measured in millions of dollars (Mn). The market is forecasted to expand at a compound annual growth rate (CAGR) of 4.0%. Starting at $132 Mn in 2022, the market is expected to steadily increase year by year, reaching $180.7 Mn by 2030. Each bar represents a specific year, with the corresponding value displayed above it, showing the progressive growth trajectory

#MarketGrowth#CardiacTherapy#France#Healthcare#FinancialForecast#CAGR#MedicalTechnology#BarGraph#MarketAnalysis#Insights10

0 notes

Text

𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐌𝐨𝐝𝐞𝐥𝐢𝐧𝐠 𝐟𝐨𝐫 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐋𝐨𝐚𝐧 𝐁𝐫𝐨𝐤𝐞𝐫𝐬!

In the fast paced world of commercial lending, financial modeling is no longer just a technical skill it’s a powerful strategic tool. For commercial loan brokers, it can completely transform how deals are assessed, structured, and closed. Whether you're helping a business secure funding or analyzing complex proposals, mastering financial modeling allows you to deliver more value, reduce risk, and gain trust from both clients and lenders.

What is Financial Modeling?

At its core, financial modeling is the practice of building a detailed, dynamic representation of a business’s financial situation. It involves using spreadsheets and data inputs to forecast future performance, simulate different financial outcomes, and analyze the impact of various strategic decisions. Think of it as a financial roadmap it gives clarity, insight, and direction to both brokers and borrowers.

Why It Matters for Loan Brokers:

1. Informed Decision Making Financial models allow you to evaluate a client’s financial health with precision. You can present proposals that are realistic, tailored, and backed by data. Instead of relying on surface level numbers, you’ll be able to dig deep into cash flow patterns, debt service coverage ratios, and profitability trends resulting in stronger, smarter decisions.

2. Risk Assessment & Mitigation A good financial model helps you simulate various scenarios what happens if revenue drops by 15%? What if expenses rise unexpectedly? By analyzing different what if situations, you’re able to identify and prepare for potential risks, giving you an edge in both structuring deals and advising your clients.

3. Streamlined Loan Structuring With a well built model, you can structure loans that align with the borrower’s needs while satisfying the lender’s criteria. Whether it’s determining optimal loan amounts, repayment schedules, or interest structures, financial modeling ensures you’re not guessing you’re calculating. This can lead to quicker approvals and more sustainable loan terms.

4. Increased Client Trust Clients want to work with brokers who bring insight, not just options. When you walk in with a clear, data driven model that outlines their financial position and opportunities, it builds confidence. You’re seen as a knowledgeable partner, not just a facilitator.

5. Stronger Lender Relationships Lenders appreciate brokers who come prepared. A financial model presents a professional, transparent snapshot of the borrower’s situation, reducing ambiguity and making underwriting easier. It also shows that you’ve done your homework something lenders never overlook.

Key Takeaways

Financial modeling is an essential skill for today’s commercial loan brokers. It goes beyond spreadsheets it enables you to present credible, customized loan proposals based on real data. This helps you make informed decisions, mitigate risk, and structure smarter deals. More importantly, it builds trust with clients and strengthens your relationships with lenders. In a competitive marketplace, brokers who can model effectively stand out, close faster, and grow their business more sustainably.

#CommercialLoans#FinancialModeling#LoanBrokers#BusinessGrowth#FinancialAnalysis#BrokeringSuccess#RiskManagement#ClientRelationships#CommercialLending#BusinessLoans#FinancialForecasting#DealStructuring#CashFlowModeling#FinanceStrategy#CloseMoreDeals#TrustedAdvisor#LoanOrigination#FinanceForBrokers#ProfessionalEdge#ClientSuccess

1 note

·

View note

Text

Bank of America CEO Brian Moynihan Reveals Research Team No Longer Forecasting a Recession

Brian Moynihan, CEO of Bank of America, recently suggested that the Biden administration and the Federal Reserve have successfully navigated the economy through a “soft landing” after recent inflationary pressures. He indicated that the banking giant no longer anticipates a recession for the U.S. economy.

Despite ongoing economic weaknesses, Moynihan highlighted that consumer spending remains robust, holding steady at pre-pandemic levels. "Our Bank of America Research team is excellent and no longer predicts a recession," Moynihan stated during an interview with CBS’s Margaret Brennan on "Face the Nation." He noted that this represents a significant shift from last year, when a recession was anticipated.

Moynihan observed that consumer expenditure growth has slowed to about 3% compared to the previous year. He attributed this slowdown to high interest rates, which are exerting pressure on consumers. Although spending is still occurring, it is happening at a more measured pace. "The customer is moving more slowly. Although there is money in their accounts, it is gradually being spent," Moynihan remarked. He emphasized that the Federal Reserve needs to be cautious to avoid overly dampening economic activity.

Bank of America anticipates two interest rate cuts this year—one at the Fed's next meeting and another in December—and predicts four additional rate reductions in 2025. This forecast comes after the Fed surprised markets in July by opting not to lower rates.

Regarding the anticipated rate cuts, Moynihan commented, "So we’re getting back to normal, and that’s going to take a while for people to adjust." He added that this adjustment period will affect both corporate and consumer perspectives.

Following a sharp decline in American markets after last week’s disappointing job data and the Fed's decision to hold rates steady, markets have since largely recovered. Additionally, mortgage rates have recently decreased as lenders brace for an expected Fed cut.

READ MORE

#BankOfAmerica#EconomicOutlook#RecessionUpdate#CEOReport#FinancialForecast#EconomicForecast#MarketTrends#BusinessNews#FinancialNews#EconomicInsights

0 notes