#Fintechsolutions

Explore tagged Tumblr posts

Text

Accepting Electronic Checks in Your Small Business: A Comprehensive Guide

Introduction:

In the ever-evolving landscape of business and finance, staying adaptable and responsive to emerging payment trends is crucial for the success of small businesses. One such trend that has gained traction and offers an array of benefits is the acceptance of electronic checks, commonly referred to as eChecks. If you're a small business owner looking to broaden your horizons and enhance your payment options, this comprehensive guide is here to demystify eChecks, providing insights into what they are and, most importantly, how to seamlessly integrate them into your business operations.

What is an eCheck?

An electronic check, or eCheck, is a digital version of a traditional paper check. It enables businesses and customers to conduct transactions electronically, making it a convenient and cost-effective payment method. Instead of writing a physical check, the payer enters their banking information online, and the funds are transferred directly from their bank account to the recipient's account.

Why Accept eChecks?

Cost-Effective: eChecks are often cheaper than credit card transactions because they have lower processing fees, making them an attractive option for small businesses.

Reduced Fraud Risk: Electronic checks are more secure than paper checks as they involve encryption and authentication processes, minimizing the risk of fraud.

Faster Settlement: eChecks typically clear faster than paper checks, improving your cash flow.

Convenience: eChecks are convenient for both you and your customers, as they can be processed online, reducing the need for physical paperwork.

How to Accept eChecks in Your Small Business:

Now that you understand the benefits of accepting eChecks, let's explore how to implement this payment method in your small business.

1. Choose an eCheck Service Provider:

Start by researching eCheck service providers. Look for companies that offer competitive pricing, robust security features, and user-friendly interfaces. Some popular eCheck service providers include:

Compare the fees, features, and compatibility with your existing systems to make an informed choice.

2. Set Up Your Business Account:

Once you've selected an eCheck service provider, create a business account. You'll need to provide your business information, banking details, and contact information.

3. Integrate eCheck Payment:

Depending on your chosen provider, you may need to integrate eCheck payment into your website or point-of-sale system. Many providers offer plugins or APIs to facilitate this integration. Ensure that the payment process is user-friendly and straightforward for your customers.

4. Educate Your Customers:

Inform your customers that you now accept eChecks as a payment option. Include this information on your website, invoices, and any other customer-facing materials. Provide clear instructions on how they can make payments using eChecks.

5. Test the Process:

Before fully launching eCheck payments, conduct a few test transactions to ensure everything is functioning correctly. Verify that funds are deposited into your business account as expected.

6. Monitor Transactions:

Regularly monitor your eCheck transactions and reconcile them with your accounting records. This will help you stay on top of your finances and quickly identify any discrepancies.

7. Maintain Security:

Security is paramount when dealing with electronic payments. Ensure that your eCheck service provider has robust security measures in place to protect sensitive customer data and financial information.

8. Provide Excellent Customer Support:

Offer reliable customer support for any payment-related inquiries or issues. Promptly address customer concerns to build trust and confidence in your eCheck payment process.

Conclusion:

Embracing eChecks as a payment option in your small business can enhance your payment processing capabilities, reduce costs, and improve customer satisfaction. By following these steps and choosing a reputable eCheck service provider, you can seamlessly integrate eCheck payments into your business operations and provide added convenience to your customers. Stay up to date with the latest payment

#echeck#high risk merchant account#payment processor#echecks#echeck payment processing solutions#echeck payment#credit card#merchant account#merchant services#electronic#ECheckPayments#SmallBizPayments#ElectronicChecks#PaymentProcessing#DigitalChecks#SmallBusinessFinance#SecurePayments#BusinessPayments#FintechSolutions#ConvenientPayments#MoneyManagement#PaymentSolutions#ECommercePayments#CashlessTransactions#BusinessTransactions#FinancialTech#PaymentSecurity#CustomerPayments#OnlinePayments

4 notes

·

View notes

Text

Top Money Transfer Apps USA with Lowest Fees (2025)

At present, it is very important to find a fast, safe and low cost medium for money transactions. Especially if you live in United States and transfer money inside the country or internationally, it is important to choose the right app. On this blog we will discuss some of the best Money Transfer Apps USA of 2021, which provide low cost and Real-Time Transfer.

Why use Money Transfer Apps USA?

The conventional banking system in the United States can often be slow. So the current generation is looking for Lean & Fast Financial Solutions, where mobile apps are the most popular choice. Money Transfer Apps USA is now reached in unique popularity for the following reasons:

Fasten Money Facility (Real-Time Transfer)

Minimum transfer fee

User-Friendly Interface

International transfer facility

Secure encryption system

1. Zelle-the fastest and bank-engaged app

Zelle is an app that is integrated with most banks in the United States. This is one of the fastest money sending apps to the Money Transfer Apps USA category.

Zelle’s Features:

The Real-Time Transfer Facility, that is, the recipient immediately gets the money.

No transfer fee — completely free.

Transfer can be done with mobile number or email address.

Why zelle popular:

In addition to United States, it can also be effective for those who use US-based accounts from Canada, UK or Australia.

1. What will change in these apps in the coming days?

Answer: Money Transfer Apps USA will become smarter and AI-based after 2021 and then. Fraud Detection AI, Crypto Integration, International Transfer Support and Multi-Currency Wallet will continue to increase. This will be more convenient for users.

READ MORE

#TopMoneyTransferApps#MoneyTransferUSA#LowestFees2025#TransferMoney#BestAppsUSA#MoneyTransferOptions#FinanceTips#SendMoney#SavingOnFees#CostEffectiveTransfers#FinancialApp#2025Savings#DigitalWallets#MoneyManagement#CheapTransfers#InstantMoneyTransfer#FintechSolutions#VirtualBanking#MoneyTransferGuide#BudgetSmart

0 notes

Text

💡 Smarter Payments with UPI Collection API

Upgrade your payment stack with PaySprint’s UPI Collection API. Ideal for merchants who want to save on transaction costs and offer a smoother UPI-based checkout experience.

0 notes

Text

Smart Budgeting with tech

Take control of your finances with smart tech! From AI-powered insights to automated transactions, simplify your budgeting. Set clear goals, sync securely, and make every rupee count. Your smarter financial future starts today with F2 Fintech.

"If you want to know more, click on the link below.":-

#SmartBudgeting#FintechSolutions#AIBudgeting#FinancialWellness#MoneyManagement#DigitalFinance#F2Fintech#GoalBasedBudgeting

0 notes

Text

#DigitalMicrofinance#LoanOrigination#MicrofinanceIndia#FinancialInclusion#FintechSolutions#MicrofinanceTechnology#BestMicrofinanceBankingSoftware#MicrofinanceSoftware#PaperlessLending#DigitalLendingIndia#MFIDigitalTransformation#CreditAccess#InclusiveFinance#RuralBanking#FintechIndia#LoanAutomation#MicroLoanSoftware#BankingInnovation#NBFCSoftware#GtechWebSolutions

0 notes

Text

How OCR & AI Are Automating Bank Statement Reconciliation

🚀 Say Goodbye to Manual Bank Reconciliation! 🧾💻

In today's fast-paced financial world, manual reconciliation is no longer sustainable. ⏳❌ Discover how AI 🤖 and OCR 📄 are transforming traditional processes into automated, error-free systems — saving time, reducing costs, and boosting accuracy! ✅📊

📌 In our latest blog, we dive deep into: ✨ The real cost of manual reconciliation ✨ How AI & OCR streamline financial operations ✨ The future of bank reconciliation in 2025 ✨ Real-world insights from Webelight Solutions 💼🌐

Whether you're a fintech leader, CFO, or digital transformation enthusiast — this read is for you! 📚✨

🔍 Explore the future of finance automation now 👉 https://www.webelight.com/blog/how-ocr-and-ai-are-automating-bank-statement-reconciliation-for-businesses

💬 Let's connect and discuss how we can help your business automate smarter!

#BankReconciliation#FintechSolutions#AIinFinance#OCRTechnology#DigitalTransformation#FinancialAutomation#WebelightSolutions#AI#SmartFinance#Fintech2025#EfficiencyDriven

0 notes

Text

How Online RC Verification APIs Are Transforming Vehicle Ownership Checks

In today’s fast-paced digital landscape, verifying vehicle ownership has become essential for businesses operating in sectors like fintech, insurance, logistics, car rentals, and vehicle financing. Traditional RC (Registration Certificate) verification processes are slow, manual, and often prone to errors or fraud. This is where Online RC Verification APIs step in as game changers.

Let’s explore how an RC Verification API like the one offered by Gridlines is simplifying workflows, ensuring regulatory compliance, and improving customer experience across industries.

What is RC Verification?

RC (Registration Certificate) is an official document issued by the RTO (Regional Transport Office) that certifies the ownership of a motor vehicle. Verifying this document is critical in scenarios like:

Vehicle loan disbursals

Car/bike rental sign-ups

Logistics fleet onboarding

Motor insurance issuance

Second-hand vehicle marketplaces

Manual verification of RC details can take hours or days. This delay not only impacts business efficiency but also increases the risk of onboarding fraudulent vehicles.

The Rise of Online RC Verification APIs

An Online RC Verification API allows businesses to verify vehicle registration details instantly using the vehicle registration number. With seamless integration into mobile apps or platforms, it fetches real-time data directly from government-authorized sources like Vahan.

Key details typically verified via the API include:

Owner’s name

Vehicle class and fuel type

Registration date

Engine and chassis number (partially masked)

RC status (active/scrapped/expired)

Key Benefits of RC Verification APIs

Instant Results: No more waiting for manual checks. Get verified RC data within seconds.

Compliance Made Easy: Stay aligned with KYC/AML regulations and onboarding protocols.

Reduced Fraud Risk: Ensure vehicle authenticity and detect tampering or forged documents.

Seamless Digital Journeys: Integrate into your existing app, platform, or CRM with minimal code.

Scalable for All Sizes: Whether you’re a startup or enterprise, APIs scale with your needs.

Industries Benefiting from RC Verification APIs

Fintech & NBFCs: Speed up vehicle loan approvals by verifying ownership in real-time.

Insurance Providers: Quickly validate vehicle details before policy issuance.

Car Rental & Leasing: Ensure accurate owner data to prevent misuse or theft.

Logistics & Fleet Management: Onboard new vehicles into your fleet efficiently.

Why Gridlines RC Verification API?

Gridlines offers a robust, secure, and developer-friendly RC Verification API. It provides high uptime, lightning-fast responses, and access to reliable data from official sources. With clear documentation and dedicated support, Gridlines ensures a hassle-free integration experience.

Whether you're a fintech app aiming to reduce turnaround times or an auto marketplace that needs to verify listings, Gridlines’ RC Verification API empowers your platform with the tools you need to build trust and scale faster.

Final Thoughts

In an era where speed, accuracy, and compliance are paramount, Online RC Verification APIs are indispensable tools. By automating and securing the vehicle verification process, businesses can deliver faster services, build credibility, and reduce risk.

#RCVerificationAPI#VehicleVerification#DigitalOnboarding#GridlinesAPI#FleetManagement#APIIntegration#VehicleData#FintechSolutions#OnlineKYC#RegTech

0 notes

Text

Transforming Finance with AI and Machine Learning

From automating fraud detection to hyper-personalizing customer experiences, AI and machine learning in finance are no longer futuristic—they're fundamental.

In this blog, discover: 📉 How financial institutions cut risks with predictive insights 📊 Use cases in credit scoring, trading, robo-advisors, and more 🔐 Enhanced security through AI-powered fraud analytics 📈 The strategic edge of adopting AI in modern finance systems

If you're a fintech innovator, banking strategist, or finance executive — this guide is your compass to smarter, faster, and safer financial services.

#AIinFinance#MachineLearning#FintechSolutions#SmartBanking#PredictiveAnalytics#FraudDetectionAI#CreditScoring#AIFinanceRevolution#FinancialTechnology#DataDrivenFinance#KodyTechnolab#InnovationInBanking

0 notes

Text

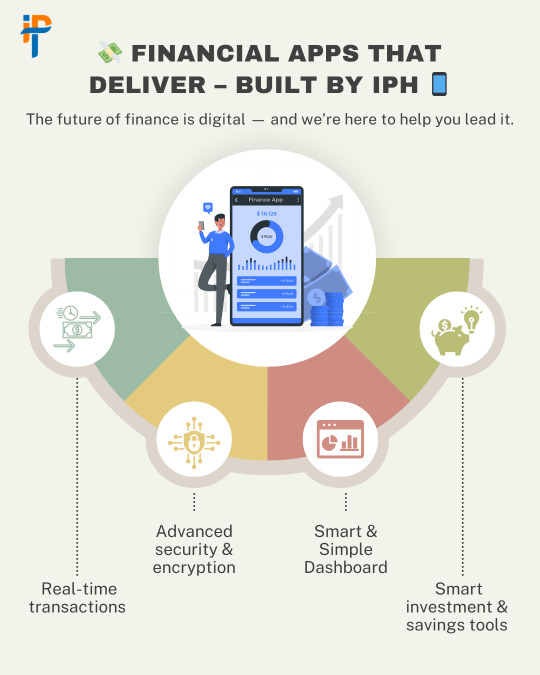

Whether you're a startup, a bank, or a fintech pioneer — IPH Technologies delivers apps people trust. 🔒 Safe. 📈 Scalable. 🌍 Global-ready. Let’s bring your financial vision to life. 👉 DM us or visit our website to get started!

We build powerful financial apps that drive real results! 📱

#IPH Technologies#FintechSolutions#FinanceApps#AppDevelopment#MobileBanking#FintechInnovation#FinanceTechnology#DigitalTransformation#FintechDevelopment

0 notes

Text

Powering Secure & Instant B2B Payments with Gridlines

In today’s fast-paced digital economy, instant, secure, and verified payments are no longer a luxury—they’re a necessity. For fintechs, NBFCs, marketplaces, and enterprises, the ability to automate business payouts without compromising on compliance or risk is crucial. That’s where Gridlines steps in—powering secure payment workflows through its advanced business verification and compliance APIs.

The Problem: Trust & Compliance Gaps in B2B Payments

B2B payment workflows often face significant hurdles—verifying the legitimacy of a vendor or seller, ensuring that payouts reach the correct bank accounts, and managing fraud risks during disbursal. Traditional KYC and KYB methods are slow, manual, and fragmented. For high-volume platforms like lending startups, gig marketplaces, or vendor-heavy enterprises, these inefficiencies are costly and dangerous.

Gridlines’ Solution: Real-Time Business Identity Verification

Gridlines offers a comprehensive API suite that enables platforms to build fully automated and compliant payment workflows. Whether you're sending payouts to vendors, disbursing loans, or onboarding new merchants, you need to verify who you're paying—instantly.

With Gridlines, you can:

Verify Udyam Registration Numbers to confirm MSME status

Cross-check PAN, GSTIN, and bank account ownership

Perform KYB (Know Your Business) checks in real-time

Ensure compliance with RBI and AML guidelines

All of this happens in seconds—giving you the confidence to release payments without manual intervention.

Key Benefits of Using Gridlines for Payments

Speed: Real-time APIs eliminate bottlenecks in disbursal.

Accuracy: Reduce payment errors and reversals with verified data.

Compliance: Stay audit-ready with in-built regulatory checks.

Scalability: Ideal for fintechs, gig platforms, and large enterprises handling bulk payouts.

Use Case Examples

NBFCs and Lending Startups: Automate business loan disbursals with verified KYB data.

Gig Marketplaces: Ensure the gig workers or vendors you pay are legitimate businesses.

E-commerce Platforms: Validate seller identity before enabling payouts.

Future-Proofing Your Payment Infrastructure

As regulatory norms tighten and fraud tactics evolve, having a future-proof and compliant payment infrastructure is a competitive advantage. Gridlines help you meet these demands while keeping the user experience frictionless.

By integrating Gridlines’ verification APIs, your platform ensures that every rupee disbursed is traceable, compliant, and secure—without slowing down operations.

Final Thoughts

Whether you're managing thousands of vendor payouts or offering instant working capital to SMEs, Gridlines is the API-first partner that enables safe, smart, and scalable payment operations. Get started with secure payment workflows that your business—and your regulators—can trust.

0 notes

Text

Boost Online Transactions with Custom Payment Gateway Solutions

Looking for secure and seamless payment integration for your website? Our expert payment gateway software development company offers end-to-end payment software development tailored to your business. Whether you're building an eCommerce platform or a service-based website, we deliver fast, secure, and scalable payment gateway software development services. From APIs to multi-currency support, our team ensures hassle-free transactions. Get a custom payment gateway for your website that enhances user trust and drives sales.

#PaymentGateway#SoftwareDevelopment#FintechSolutions#eCommerce#WebDevelopment#SecurePayments#CustomSoftware#PaymentIntegration#DigitalTransactions#InnovateMarketers

0 notes

Text

FinTech Consultancy Services – Innovative R&D Solutions for Financial Growth

Our FinTech consultancy empowers businesses with innovative research and development, custom money transfer software, and tailored financial solutions. We focus on improving efficiency, reducing costs, and keeping your business competitive in a fast-evolving financial landscape.

#FinTechConsultancy#FinancialTechnology#BusinessInnovation#MoneyTransferSoftware#RAndDServices#FinTechSolutions#ProcessOptimization#CostEffectiveSolutions#TechDrivenFinance#BusinessEfficiency#CustomSoftware#FinancialGrowth#InnovativeSolutions#DigitalFinance#SmartBusiness

0 notes

Text

#CoreBanking#RetailBanking#BankTech#DigitalBanking#BankingSoftware#FintechSolutions#CoreBankingSystems#BankTransformation#FinancialTechnology#BankingInnovation#CloudBanking#BankingAutomation#FintechMarket

0 notes

Text

The Benefits of SprintOPN for Payment Processors and Service Providers 🔧💡

For payment processors and service providers, finding a flexible, reliable solution for handling digital payments is essential. SprintOPN provides:

Secure, real-time transaction processing

Scalable APIs for payment services

Compliance with Indian financial regulations

Whether you’re processing UPI, Aadhaar-based payments (AEPS), or offering payouts, SprintOPN offers a high-performance platform to handle it all. Simplify your payment systems with SprintOPN’s easy-to-integrate APIs.

0 notes

Text

#MortgageFraud#LoanFraudDetection#FinancialSecurity#FraudPrevention#DigitalLending#LoanVerification#MortgageLending#FintechSolutions#RiskManagement#MortgageRedFlags#NBFCIndia#MicrofinanceSoftware#LatestMicrofinanceSoftware#FintechIndia#DigitalFinance#MicrofinanceSolutions#LoanProcessingSoftware#FinancialInstitutions#FraudDetectionTech

0 notes

Text

RWA Tokenization Development Company - Touch Crypto

Touch Crypto stands at the forefront of real world asset tokenization, providing specialized development services that turn tangible assets into blockchain-based investment products. Our team crafts customized platforms that ensure regulatory compliance, data integrity, and seamless asset lifecycle management. From concept to deployment, we focus on building robust digital frameworks that enable fractional ownership, automated transfers, and enhanced investor access. With Touch Crypto, institutions can confidently enter the digital asset economy and unlock new value from their physical holdings.

Explore more - https://www.touchcrypto.org/rwa-tokenization-development-company

#RWATokenization#TouchCrypto#DigitalAssets#BlockchainSolutions#AssetManagement#TokenizedAssets#Web3Innovation#FintechSolutions#SmartInvesting#RealWorldAssets

0 notes