#GridlinesAPI

Explore tagged Tumblr posts

Text

Skip Tracing: The Smart Way to Locate Defaulters in India’s Digital Lending Era

In the rapidly growing digital lending space, one challenge continues to haunt recovery teams and fintechs alike—how to find borrowers who’ve gone silent or vanished. Whether it’s an overdue EMI, an unresponsive customer, or a defaulted business loan, this is where skip tracing becomes indispensable.

What Is Skip Tracing?

Skip tracing is the process of locating a person whose contact details are outdated, incorrect, or intentionally masked. Traditionally used in debt recovery and investigations, today’s skip tracing has evolved into a data-driven technique powered by AI and API integrations. It’s no longer just about knocking on doors—it’s about piecing together digital breadcrumbs.

For fintechs, NBFCs, recovery agents, and legal teams, skip tracing is a critical tool for minimizing loss, speeding up resolution, and ensuring accountability in loan collections.

Why Skip Tracing Matters Today

India’s digital loan market has expanded at breakneck speed. Unfortunately, so have delinquencies. Many defaulters use burner phones, falsified documents, or simply change addresses without notice. With traditional methods falling short, automated skip tracing solutions help organizations:

Track down individuals using alternate phone numbers, email addresses, or family references

Identify recent address history through telecom, employment, or utility data

Connect multiple data points such as PAN, Aadhaar, employment, and more

Prevent fraud by flagging identity mismatches or recycled information

The ability to instantly access this information through an API can be a game changer—especially for platforms working with high application volumes or tight turnaround times.

How Gridlines Makes Skip Tracing Smarter

At Gridlines, our skip tracing solution is designed with speed, scale, and accuracy in mind. Instead of depending on manual checks or disconnected databases, we leverage a network of verified data sources and intelligent logic.

With Gridlines’ skip tracing APIs, lenders and platforms can:

Instantly fetch verified alternate contact details

Pinpoint updated addresses and employment history

Verify identity against trusted government and private data sets

Automate workflows for collections or field visits

Whether you're an NBFC handling consumer loans or a B2B platform facing commercial defaults, our API helps your operations become proactive rather than reactive.

Use Cases: Who Needs Skip Tracing?

Loan Recovery Teams: Reconnect with unreachable borrowers

Insurance Investigators: Track fraudulent claims or policyholders

Gig & Employment Platforms: Trace ex-employees or delivery partners

Legal & Compliance Teams: Serve notices or conduct due diligence

Conclusion

As digital fraud grows more sophisticated, and customers become more mobile than ever, skip tracing isn’t just a nice-to-have—it’s a must. Gridlines offers a robust, plug-and-play skip tracing API that helps you close the loop faster, reduce bad debts, and maintain compliance.Looking to modernize your collections strategy? Start with smart skip tracing from Gridlines.

#SkipTracing#DigitalLending#DebtRecovery#FintechSolutions#FraudPrevention#KYCVerification#APIIntegration#LoanCollections#GridlinesAPI#FintechIndia

0 notes

Text

Streamline MSME Verification with Gridlines' Robust API Solution

Udyam registration and Udyog Aadhaar reference are unique IDs assigned to small and medium-sized enterprises by the Ministry of MSMEs. These identifiers serve as official government recognition, verifying the legitimacy and operational status of MSMEs. Gridlines’ MSME Verification API provides instant validation of these registrations, reducing fraudulent risks and ensuring compliance with regulatory standards.

Why Gridlines

Instant MSME Validation

Enables immediate confirmation of Udyam registrations, crucial for verifying small and medium enterprise identities as recognized by the Ministry of MSMEs.

Efficient Partner Integration

Accelerates the integration of business partners or merchants, streamlining the onboarding process for better operational flow.

Regulatory Compliance Check

Assures that businesses are operating in accordance with government standards, maintaining legal and regulatory compliance.

Reliable Security Measures

Strengthens the verification process with robust security, ensuring the legitimacy of MSME merchants.

#MSMEVerification#UdyamRegistration#UdyogAadhaar#GridlinesAPI#BusinessCompliance#SecureVerification#InstantValidation#FraudPrevention#DigitalVerification#MSMESolutions#APIIntegration

0 notes

Text

How an MSME Verification API Simplifies Udyam Registration Checks Instantly

Instantly verify Udyam Registration details with Gridlines’ MSME verification API. Automate MSME onboarding, prevent fraud, and ensure KYB compliance at scale.

#MSMEVerification#UdyamRegistration#KYB#APIVerification#GridlinesAPI#FintechCompliance#BusinessVerification#FraudPrevention#DigitalOnboarding#MSMEIndia

0 notes

Text

MSME Verification API: A Smarter Way to Validate Udyam Registration

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of the Indian economy. According to the Ministry of MSME, over 1.5 crore Udyam registrations have been recorded as of 2024. As digital platforms, fintechs, and lenders increasingly work with these enterprises, verifying their legitimacy becomes a critical step—both for regulatory compliance and fraud prevention.

That’s where a MSME verification API comes in.

Why MSME Verification Is Crucial

Whether you're offering credit, onboarding sellers, or conducting KYB (Know Your Business) checks, verifying Udyam Registration ensures the business:

Is officially registered under the MSME Act

Has submitted correct business category (Micro/Small/Medium)

Provides a valid Udyam Registration Number (URN)

Matches key identity fields like PAN and Aadhaar

Manual verification through the Udyam portal is possible—but not scalable. It’s time-consuming, error-prone, and not viable when onboarding thousands of MSMEs.

What Is an MSME Verification API?

An MSME verification API allows platforms to instantly validate Udyam details in real-time by simply submitting the URN (Udyam Registration Number). It pulls data directly from government sources and returns structured, validated fields such as:

Legal business name

Udyam Registration Number

Business category (Micro/Small/Medium)

Date of registration

PAN & Aadhaar linkage

Business address

The API checks if the registration exists, matches inputs with official records, and ensures the enterprise is legitimate.

Benefits of Using Gridlines’ MSME Verification API

Gridlines’ MSME verification API simplifies the process for platforms that deal with high volumes of MSMEs. Here’s what makes it indispensable:

✅ Instant Validation: Eliminate manual lookups and delays—get real-time Udyam verification in milliseconds.

✅ Fraud Detection: Spot mismatched or fake Udyam numbers early to prevent fraud in lending or vendor onboarding.

✅ KYB Compliance: Stay compliant with RBI and fintech KYB mandates by verifying every business partner digitally.

✅ Seamless Integration: The API integrates easily into loan origination systems, onboarding flows, or marketplaces.

Use Cases Across Industries

Fintechs & NBFCs: Verify Udyam status before loan disbursal to MSMEs

Marketplaces: Onboard only genuine sellers with valid Udyam registration

Insurers: Confirm MSME eligibility for sector-specific insurance products

B2B Platforms: Build trust by validating vendor and supplier credentials

Final Thoughts

MSMEs are key players in India’s economic growth—but only when verified and trusted. By integrating a MSME verification API, platforms can automate Udyam checks, prevent fraud, and speed up onboarding without compromising compliance.

Start verifying Udyam registrations the smart way—visit Gridlines MSME API to learn more.

#MSMEVerification#UdyamRegistration#KYB#APIVerification#GridlinesAPI#FintechCompliance#BusinessVerification#FraudPrevention#DigitalOnboarding#MSMEIndia

0 notes

Text

Seamless Identity Checks with Gridlines' Voter ID Verification API

Discover how Gridlines' Voter ID Verification API streamlines digital identity checks using Election Commission records—ideal for fintechs, lenders, and onboarding platforms.

#VoterIDVerificationAPI#DigitalKYC#IdentityVerification#ElectionCommissionData#RealTimeVerification#KYCautomation#FintechAPI#OnboardingSolutions#GridlinesAPI#APIVerification

0 notes

Text

Unlock Seamless Identity Verification with Gridlines’ Voter ID Verification API

In the age of digital onboarding and instant verifications, relying on outdated or manual identity checks can severely slow down business operations. Whether you’re a fintech startup, a lending platform, or an enterprise building robust KYC workflows, verifying a user's identity in real-time is non-negotiable. This is where Gridlines’ Voter ID Verification API makes a significant difference.

Why Voter ID Matters for Identity Verification

Issued by the Election Commission of India, the Voter ID card is one of the most widely accepted government-issued identity proofs. It contains key information like the individual's name, date of birth, gender, and photograph—elements that are vital for verifying an identity. However, until recently, leveraging this database for seamless digital verification was a challenge for businesses.

Gridlines bridges this gap with its Voter ID Verification API, allowing businesses to tap into Election Commission data in a secure, compliant, and real-time manner.

What is the Voter ID Verification API?

The Voter ID Verification API by Gridlines enables instant verification of voter ID details using official government sources. It allows platforms to confirm a user’s identity by matching input details—such as voter ID number, name, or DOB—against Election Commission records.

Key Features:

Real-Time Verification: Instantly validate voter ID details within seconds.

Secure & Compliant: Fully compliant with data privacy laws and API security best practices.

High Accuracy: Reduces fraud by eliminating reliance on self-declared or manipulated ID information.

Easy Integration: Developer-friendly documentation and RESTful API support for quick implementation.

Use Cases Across Industries

Fintech & Lending: Conduct quick and reliable identity checks before loan disbursement.

Digital Onboarding: Streamline the user onboarding process for banking, insurance, and government services.

Gig Economy Platforms: Authenticate gig workers in real-time to reduce the risk of identity fraud.

E-Commerce & Delivery Platforms: Verify delivery agents or service professionals before onboarding them.

Why Choose Gridlines?

Gridlines stands out for its ecosystem of trusted, real-time verification APIs, designed for modern business needs. The Voter ID Verification API complements other services like PAN, Aadhaar Masked Verification, and Udyam Registration APIs—making it easy to build end-to-end KYC and KYB workflows.

With Gridlines, you're not just verifying identities—you’re enabling trust at scale.

Final Thoughts

As businesses shift towards digital-first customer journeys, the need for fast, accurate, and secure identity verification tools is growing exponentially. Gridlines’ Voter ID Verification API is a powerful addition to your verification stack, enabling instant and compliant identity checks via authentic government data.Start verifying smarter—explore the Voter ID Verification API today.

0 notes

Text

Secure Payments Made Simple: How Gridline's Payment APIs Enhance Transaction Safety

Discover how Gridline's real-time payment verification APIs simplify transactions, reduce fraud risks, and ensure compliance. By validating bank accounts, UPI IDs, and assets, businesses can securely manage payments, minimize errors, and boost operational efficiency. With rapid and scalable solutions, Gridlines helps organizations maintain secure, seamless, and compliant digital payment processes.

#PaymentVerification#FraudPrevention#RealTimeAPI#UPIIDVerification#BankAccountVerification#DigitalPayments#Compliance#GridlinesAPI#SecureTransactions#PaymentSecurity#IdentityAPI#BusinessAPI#AssetVerification#EmploymentVerification

0 notes

Text

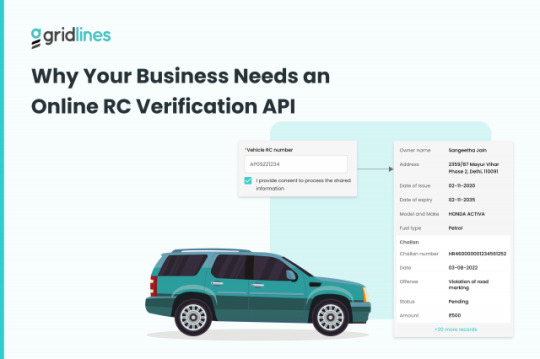

Discover how Online RC Verification APIs simplify vehicle registration checks, boost compliance, and enable faster customer onboarding. Ideal for fintech, insurance, and logistics sectors, these APIs provide real-time access to verified vehicle data, reducing fraud and streamlining digital operations

0 notes

Text

How Online RC Verification APIs Are Transforming Vehicle Ownership Checks

In today’s fast-paced digital landscape, verifying vehicle ownership has become essential for businesses operating in sectors like fintech, insurance, logistics, car rentals, and vehicle financing. Traditional RC (Registration Certificate) verification processes are slow, manual, and often prone to errors or fraud. This is where Online RC Verification APIs step in as game changers.

Let’s explore how an RC Verification API like the one offered by Gridlines is simplifying workflows, ensuring regulatory compliance, and improving customer experience across industries.

What is RC Verification?

RC (Registration Certificate) is an official document issued by the RTO (Regional Transport Office) that certifies the ownership of a motor vehicle. Verifying this document is critical in scenarios like:

Vehicle loan disbursals

Car/bike rental sign-ups

Logistics fleet onboarding

Motor insurance issuance

Second-hand vehicle marketplaces

Manual verification of RC details can take hours or days. This delay not only impacts business efficiency but also increases the risk of onboarding fraudulent vehicles.

The Rise of Online RC Verification APIs

An Online RC Verification API allows businesses to verify vehicle registration details instantly using the vehicle registration number. With seamless integration into mobile apps or platforms, it fetches real-time data directly from government-authorized sources like Vahan.

Key details typically verified via the API include:

Owner’s name

Vehicle class and fuel type

Registration date

Engine and chassis number (partially masked)

RC status (active/scrapped/expired)

Key Benefits of RC Verification APIs

Instant Results: No more waiting for manual checks. Get verified RC data within seconds.

Compliance Made Easy: Stay aligned with KYC/AML regulations and onboarding protocols.

Reduced Fraud Risk: Ensure vehicle authenticity and detect tampering or forged documents.

Seamless Digital Journeys: Integrate into your existing app, platform, or CRM with minimal code.

Scalable for All Sizes: Whether you’re a startup or enterprise, APIs scale with your needs.

Industries Benefiting from RC Verification APIs

Fintech & NBFCs: Speed up vehicle loan approvals by verifying ownership in real-time.

Insurance Providers: Quickly validate vehicle details before policy issuance.

Car Rental & Leasing: Ensure accurate owner data to prevent misuse or theft.

Logistics & Fleet Management: Onboard new vehicles into your fleet efficiently.

Why Gridlines RC Verification API?

Gridlines offers a robust, secure, and developer-friendly RC Verification API. It provides high uptime, lightning-fast responses, and access to reliable data from official sources. With clear documentation and dedicated support, Gridlines ensures a hassle-free integration experience.

Whether you're a fintech app aiming to reduce turnaround times or an auto marketplace that needs to verify listings, Gridlines’ RC Verification API empowers your platform with the tools you need to build trust and scale faster.

Final Thoughts

In an era where speed, accuracy, and compliance are paramount, Online RC Verification APIs are indispensable tools. By automating and securing the vehicle verification process, businesses can deliver faster services, build credibility, and reduce risk.

#RCVerificationAPI#VehicleVerification#DigitalOnboarding#GridlinesAPI#FleetManagement#APIIntegration#VehicleData#FintechSolutions#OnlineKYC#RegTech

0 notes

Text

Streamline Employee Verification with Gridlines’ EPFO API

In today’s digital economy, trust and speed are essential—especially when it comes to verifying employment history. Whether you're hiring, underwriting loans, or conducting background checks, outdated and manual verification processes can delay operations and introduce risks.

That’s where the Gridlines EPFO Employment History API steps in—a powerful tool that allows you to fetch verified employment data directly from India’s Employees' Provident Fund Organisation (EPFO) database. With just a few inputs, businesses can instantly access an individual's active and historical employment records, helping them make informed, risk-free decisions.

What is the EPFO API?

The EPFO (Employees' Provident Fund Organisation) is a central government body that manages retirement savings and employment contributions for salaried individuals in India. Every registered employer contributes to the EPF account, making it a reliable source for tracking employment history.

Gridlines’ EPFO API leverages this verified data source to help organizations fetch:

Current and past employers

Tenure of employment

PF account activity

UAN (Universal Account Number)-linked details

This provides an unmatched level of accuracy and transparency in employment verification—eliminating the need for lengthy document submissions or third-party calls.

How It Works

The EPFO Employment History API can be integrated into your platform in a few simple steps. By entering the UAN and mobile number (with OTP-based consent), the API pulls verified employment records in real time. The data returned is structured, secure, and instantly usable for:

HR Tech Platforms for onboarding

Lenders assessing loan eligibility

Insurance Providers verifying income sources

Background Verification Agencies streamlining checks

Benefits of Using Gridlines’ EPFO API

Instant Verification: Reduce verification time from days to seconds.

Real-Time Data: Access live, government-backed records.

Reduced Fraud Risk: Eliminate fake or misrepresented job histories.

Consent-Based: Ensures privacy with OTP-based user authentication.

Seamless Integration: Plug-and-play API fits easily into your existing tech stack.

Why Gridlines?

Gridlines combines robust data access with AI-powered insights to enable smarter decisions across fintech, HR, and compliance workflows. Its EPFO API is part of a larger suite of verification tools trusted by leading businesses for secure and scalable onboarding.

Final Thoughts

If your business depends on validating employment records—don’t rely on outdated processes. With Gridlines’ EPFO API, you gain speed, accuracy, and trust—all in real time.Explore the API and see how effortless employment history verification can be: 👉 https://gridlines.io/products/epfo-api

#EPFOAPI#EmploymentVerification#HRTech#BackgroundCheck#FintechIndia#KYCVerification#DigitalOnboarding#VerifyWithGridlines#RealTimeVerification#GridlinesAPI

0 notes

Text

Instant Identity Verification with Gridlines Voter ID Verification API

Gridlines' Voter ID Verification API offers a robust solution for verifying voter IDs, a critical document held by all Indian citizens over the age of 18. This API ensures instant validation of voter registration details, enhancing the accuracy and speed of user identity checks during onboarding. By confirming essential information such as address, age, and gender, the API reduces onboarding friction and provides a seamless experience for your users. With features like real-time voter ID validation, efficient address and age verification, and enhanced customer onboarding, the API simplifies the process while detecting potential fraud through flagging inconsistencies in voter ID information.

Choosing Gridlines means benefiting from meticulous verification of every Voter ID, ensuring trust and authenticity. The seamless API integration facilitates quick and reliable identity checks, giving you access to essential user details for a comprehensive understanding. Additionally, Gridlines' robust verification system enhances security, protecting your operations from potential fraud. Optimize your onboarding process and ensure compliance with industry standards using Gridlines' Voter ID Verification API, delivering reliability and efficiency for your user base.

#SecureOnboarding#FraudPrevention#APIIntegration#RiskManagement#GridlinesAPI#VoterID#DigitalTrust#RealTimeVerification

0 notes

Text

Protect Your Business from Fraud: Gridlines Bank Account Verification API

The Gridlines Bank Account Verification API is a powerful tool designed to protect your business from fraud by verifying bank account details submitted by users, partners, or employees. This API ensures that bank accounts are legitimate and belong to the individual at the time of onboarding, making the process seamless and efficient. Instantly confirm bank account details and existence with real-time verification, expediting customer sign-ups and enhancing risk management by providing valuable insights into customer financials. Simplify your KYC compliance effortlessly through efficient bank account checks.

Choose Gridlines for immediate confirmation of bank account details, ensuring their accuracy for real-time transactions. Our API introduces stringent security measures to mitigate the risk of fraud, facilitating smooth financial transactions and improving user experience and operational efficiency. Additionally, it ensures compliance with banking regulations, helping your business maintain high legal standards. Enhance your security measures, streamline operations, and stay compliant with the Gridlines Bank Account Verification API. Protect your business from fraud and ensure the legitimacy of bank accounts with ease.

#BankAccountVerification#FraudPrevention#SecureOnboarding#RealTimeVerification#RiskManagement#KYCCompliance#FinancialSecurity#APIIntegration#StreamlinedOnboarding#DigitalTrust#GridlinesAPI

0 notes

Text

Criminal and Court Record Verification API: Essential for Financial Institutions

Safeguard your financial transactions with Gridlines' Criminal and Court Record Verification API. Designed for banks, NBFCs, and fintech companies, our API ensures quick and thorough verification of borrowers' criminal histories.

Key Benefits:

In-Depth Verification: Conducts comprehensive checks using detailed data points like name, father's name, and addresses, ensuring a complete criminal history profile.

Instant Decision Making: Delivers 100% of criminal history checks within 45 minutes, enabling swift and informed lending decisions.

Extensive Database & Coverage: Access over 20 crore court records across India for accurate and rapid verification.

Comprehensive Reports: Provides access to FIR copies and case documents when matches are found, offering actionable insights.

Gridlines' API empowers financial institutions to reduce the risk of fraud and make reliable lending decisions. Secure your transactions today with our Criminal and Court Record Verification API.

#CCRV#CriminalRecordCheck#CourtRecordVerification#FinancialFraudPrevention#GridlinesAPI#BackgroundCheck#FintechSecurity#RiskManagement#Compliance#LendingVerification#InstantVerification#DataSecurity#FinancialServices#APIIntegration#BankingSafety

0 notes

Text

Ensure Roadworthy Rides: Gridlines Vehicle RC Verification Solutions

Gridlines offers Vehicle RC Verification APIs, providing crucial insights into vehicle legality and ownership status. As a legal requirement for all vehicles, the registration certificate (RC) holds vital information issued by regional transport offices. Our APIs enable instant verification of RC numbers during onboarding processes, ensuring vehicles are permitted on Indian roads and belong to the user. Additionally, users can verify insurance status, further enhancing compliance measures.

A variant of our API extends functionality to include traffic violation (challan) information, empowering users with comprehensive vehicle verification tools. With Gridlines Vehicle RC Verification APIs, businesses can streamline operations, mitigate risk, and prioritize safety and security.

#apis#VehicleRCVerification#RoadSafety#ComplianceMatters#GridlinesAPIs#SecureOnboarding#TrafficViolationChecks#VehicleOwnership

0 notes